SCHEDULE 14A INFORMATION

PROXY STATEMENT PURSUANT TO SECTION 14(a)

OF THE SECURITIES EXCHANGE ACT OF 1934

Filed by the Registrant ☒ Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ | Preliminary Proxy Statement | |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| ☒ | Definitive Proxy Statement | |

| ☐ | Definitive Additional Materials | |

| ☐ | Soliciting Material under Rule 14a-12 | |

Fidelity Rutland Square Trust II

(Name of Registrant as Specified In Its Charter)

Payment of Filing Fee (Check the appropriate box):

| ☒ | No fee required. | |||

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

| (1) | Title of each class of securities to which transaction applies:

| |||

| (2) | Aggregate number of securities to which transaction applies:

| |||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11:

| |||

| (4) | Proposed maximum aggregate value of transaction:

| |||

| (5) | Total Fee Paid:

| |||

| ☐ | Fee paid previously with preliminary materials. | |||

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

| (1) | Amount Previously Paid:

| |||

| (2) | Form, Schedule or Registration Statement No.:

| |||

| (3) | Filing Party:

| |||

| (4) | Date Filed:

| |||

IMPORTANT

Proxy Materials

PLEASE CAST YOUR VOTE NOW

Strategic Advisers® Core Fund, Strategic Advisers® Core Income Fund, Strategic Advisers® Emerging Markets Fund, Strategic Advisers® Fidelity® Core Income Fund, Strategic Advisers® Fidelity® Emerging Markets Fund, Strategic Advisers® Fidelity® International Fund, Strategic Advisers® Fidelity® U.S. Total Stock Fund, Strategic Advisers® Growth Fund, Strategic Advisers® Income Opportunities Fund, Strategic Advisers® International Fund, Strategic Advisers® Short Duration Fund, Strategic Advisers® Small-Mid Cap Fund, Strategic Advisers® Tax-Sensitive Short Duration Fund, Strategic Advisers® Value Fund

Dear Shareholder:

As a shareholder of one or more of the Strategic Advisers funds named above, you have the opportunity to voice your opinion on the matters that affect investments in your Fidelity managed account. This package contains information about the proposals and materials to use when casting your vote.

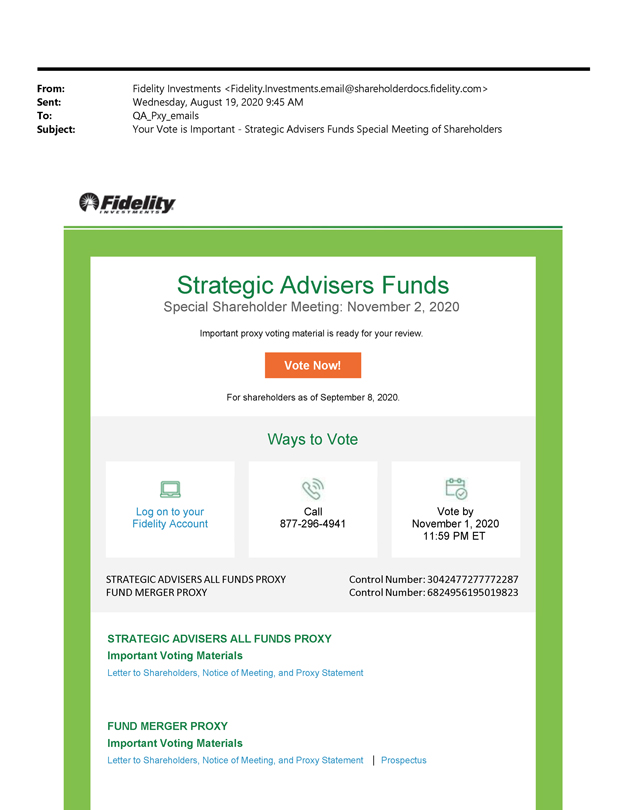

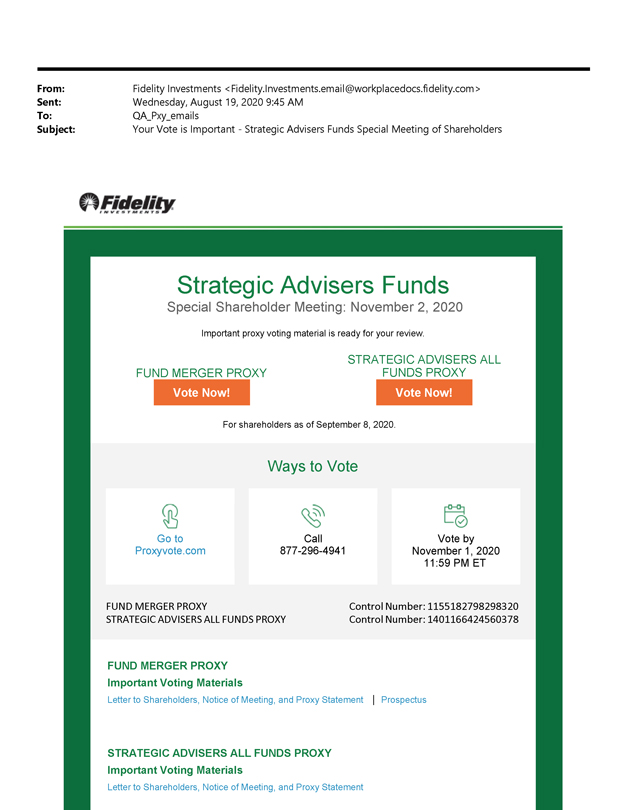

A special meeting of shareholders will be held on November 2, 2020.

To help you better understand the different proposals, we have included a Q&A as well as the complete proxy statement, which describes each proposal in greater detail. Please know that each proposal was carefully reviewed by each fund’s Board of Trustees (most of whom are not affiliated with Fidelity and are responsible for protecting your interests as a shareholder). The Trustees believe these proposals are in your best interests as a shareholder and recommend that you vote for the proposals.

Everything you need is enclosed. To cast your vote in advance of the meeting, simply visit the website indicated on your proxy card(s) and follow the online instructions. You may also vote by touch-tone telephone by calling the toll-free number printed on your proxy card(s) and following the recorded instructions. You may cast your vote by telephone or through the internet up until 11:59 p.m. ET, on November 1, 2020. In addition, you may vote by completing and signing each enclosed proxy card(s) and mailing it in the enclosed postage-paid envelope.

Your vote is important, no matter how large or small your holdings may be. Please vote on important proposals that affect the funds you hold. It’s quick and easy.

If you have any questions before you vote, please contact us at 800-544-3455. We’ll be glad to help you get your vote in quickly. Thank you for your participation.

Sincerely,

Robert A. Lawrence

Chairman of the Board

Q&A: A summary to help you understand and vote on the proposals

Please read the complete proxy statement enclosed.

What am I being asked to vote on?

You are being asked to vote on the following proposals, depending on the funds in which you are invested (a listing of funds applicable to each proposal is included on pages 1-2 of the enclosed proxy statement):

| 1. | To elect a Board of Trustees. |

| 2. | To approve the conversion of a fundamental investment policy to a non-fundamental investment policy. |

| 3. | To approve a sub-advisory agreement among Strategic Advisers LLC (Strategic Advisers), FIL Investment Advisors (FIA), and Fidelity Rutland Square Trust II (the trust) and a sub-subadvisory agreement between FIA and FIL Investment Advisors (UK) Limited (FIA (UK)). |

| 4. | To approve a sub-advisory agreement among Strategic Advisers, Geode Capital Management, LLC (Geode), and the trust. |

| 5. | To approve a sub-subadvisory agreement between FIAM LLC (FIAM) and FMR Investment Management (UK) Limited (FMR UK). |

| 6. | To approve a sub-subadvisory agreement between FIAM and Fidelity Management & Research (Hong Kong) Limited (FMR H.K.). |

| 7. | To approve a sub-subadvisory agreement between FIAM and Fidelity Management & Research (Japan) Limited (FMR Japan). |

Questions on Proposal 1

What role does the Board play?

The Trustees serve as representatives of the funds’ shareholders. Members of the Board are fiduciaries and have an obligation to serve the best interests of shareholders. In addition, the Trustees review fund performance, oversee fund activities, consider fund policy changes and review contractual arrangements with companies that provide services to the funds.

What is the affiliation of the Board and Fidelity?

The Board has nominated seven individuals to serve as trustees for your funds. There are two “interested” and five “independent” trustee nominees. Trustees are determined to be “interested” by virtue of, among other things, their affiliation with the funds, Strategic Advisers, or other entities under common control with Strategic Advisers. Interested trustees are compensated by Strategic Advisers or an affiliate. Independent trustees have no affiliation with Strategic Advisers and are compensated by the funds. Trustee compensation information for each fund covered by the proxy is included in the proxy statement.

The Board of Trustees has unanimously approved the proposal and recommends that you vote to approve it.

Questions on Proposals 2

Why am I being asked to approve the conversion of a fundamental investment policy to a non-fundamental investment policy?

When a policy is fundamental, it requires both board and shareholder approval to change. A non-fundamental policy can be changed by board vote alone.

When a policy can only be changed with shareholder approval, it is difficult and costly for a fund to update and revise its policy, if and when needed, such as when market conditions change. Converting to a non-fundamental policy provides greater flexibility to react to market changes in a timely and cost-effective manner.

Will the conversion from a fundamental to a non-fundamental policy change how the funds are managed?

No, there are no plans to change the way any fund is currently managed.

The Board of Trustees has unanimously approved the proposal and recommends that you vote to approve it.

Questions on Proposals 3 through 7

Why am I being asked to approve new sub-advisory and sub-subadvisory agreements?

The primary purpose of proposals 3 through 7 is to provide additional investment flexibility to Strategic Advisers to allocate assets to FIA or Geode, for FIA to allocate assets to FIA (UK), or for FIAM to allocate assets to FMR UK, FMR H.K. or FMR Japan, as applicable, consistent with each fund’s investment objective and strategies, as disclosed in each fund’s registration statement.

What role do sub-advisers and sub-subadvisers play in managing the funds?

As each fund’s adviser, Strategic Advisers has overall responsibility for directing the fund’s investments and is authorized, in its discretion, to grant investment management authority over an allocated portion of the fund’s assets to a sub-adviser. Subject to Board oversight, Strategic Advisers has the

ultimate responsibility to oversee each fund’s sub-advisers and recommend their hiring, termination and replacement. Under its respective sub-advisory agreement and subject to the supervision of the Board of Trustees, each sub-adviser directs the investment of its allocated portion of the fund’s assets in accordance with the fund’s investment objective, policies and limitations. In certain arrangements, a sub-adviser retains an affiliate to serve as a sub-subadviser to the fund. The sub-subadviser may provide investment research and advice to the sub-adviser and/or may be granted authority to manage all or a portion of the fund’s assets that were allocated by Strategic Advisers to the sub-adviser, as applicable. The sub-adviser, and not the fund, pays the sub-subadviser under each sub-subadvisory agreement.

How will the proposed sub-advisory or sub-subadvisory agreements affect the day-to-day management of the funds?

If the proposed sub-advisory and sub-subadvisory agreements are approved by shareholders, there will be no change to the portfolio management team at Strategic Advisers currently responsible for allocating assets of each fund among various sub-advisers and/or underlying mutual funds. Strategic Advisers, as each fund’s adviser, will continue to direct the investments of each fund, consistent with each fund’s investment objective, policies and limitations, as disclosed in each fund’s registration statement.

Strategic Advisers initially does not intend to allocate assets to each sub-adviser under the proposed sub-advisory agreements discussed within proposals 3 and 4 but may do so in the future. FIAM initially does not intend to allocate assets to any of the proposed sub-subadvisers, except to FMR UK with respect to the Strategic Advisers® Core Fund, but FIAM may do so in the future.

Will fund expenses increase if the proposed sub-advisory and sub-subadvisory agreements are approved?

As mentioned above, Strategic Advisers initially does not intend to allocate assets to each sub-adviser under the proposed sub-advisory agreements discussed within proposals 3 and 4 but may do so in the future. Therefore, total annual operating expenses for funds affected by proposals 3 and 4 will not initially change as a result of the approval of each proposed sub-advisory agreement.

To illustrate the potential effect of approving each proposed sub-advisory agreement for proposals 3 and 4, the tables in Appendix I of the proxy statement compare current expenses to possible future expenses using a hypothetical maximum allocation under each proposed sub-advisory agreement. Based on the hypothetical maximum allocations to the proposed mandate, and further assuming that assets were shifted from the lowest-priced comparable manager, Strategic Advisers estimates total annual operating expenses for Strategic Advisers Fidelity U.S. Total Stock Fund and Strategic Advisers Small-Mid Cap Fund, Strategic Advisers Emerging Markets Fund may increase by 0.02%, 0.03% and 0.03%, respectively, as outlined in Appendix I of the proxy statement.

For proposals 5 through 7, FIAM, not the applicable fund, will compensate the proposed sub-subadvisers under the sub-subadvisory agreements. Accordingly, there is no anticipated effect on the applicable fund’s management fee or total annual operating expenses.

The Board of Trustees has unanimously approved each proposal and recommends that you vote to approve it.

General Questions on the Proxy

Who bears the expenses associated with this proxy solicitation?

As is typically the case with fund proposals intended to benefit existing shareholders, the expenses associated with (i) preparing this proxy statement, its enclosures, and all solicitations; and (ii) reimbursing brokerage firms and others for their reasonable expenses in forwarding solicitation materials to the beneficial owners of shares, will be borne by each fund, except for the Strategic Advisers Core Fund.

Strategic Advisers Core Fund’s expenses in connection with preparing this proxy statement and its enclosures and all solicitations will be borne by Strategic Advisers under the fund’s management contract, which obligates Strategic Advisers to pay certain fund-level operating expenses. Strategic Advisers will reimburse brokerage firms and others for their reasonable expenses in forwarding solicitation materials to the beneficial owners of shares.

What do I need to do?

How many votes am I entitled to cast?

As a shareholder, you are entitled to one vote for each dollar of net asset value you own of each of the funds on the record date. The record date is September 8, 2020.

How do I vote my shares?

You can vote your shares by visiting the website indicated on your proxy card(s) and following the online instructions. You may also vote by touch-tone telephone by calling the toll-free number printed on your proxy card(s) and following the recorded instructions. You may cast your vote by telephone or through the internet up until 11:59 p.m. ET, on November 1, 2020. In addition, you may vote by completing and signing each enclosed proxy card(s) and mailing it in the enclosed postage-paid envelope.

If you need any assistance or have any questions regarding the proposals or how to vote your shares, please contact us at 800-544-3455.

How do I sign the proxy card?

| Individual Accounts: | Shareholders should sign exactly as their name appears on the account registration shown on the card. | |

| Joint Accounts: | Either owner may sign, but the name of the person signing should conform exactly to one of the names shown in the registration. | |

| All Other Accounts: | The person signing must indicate his or her capacity. For example, a trustee for a trust or other entity should sign, “Ann B. Collins, Trustee.” | |

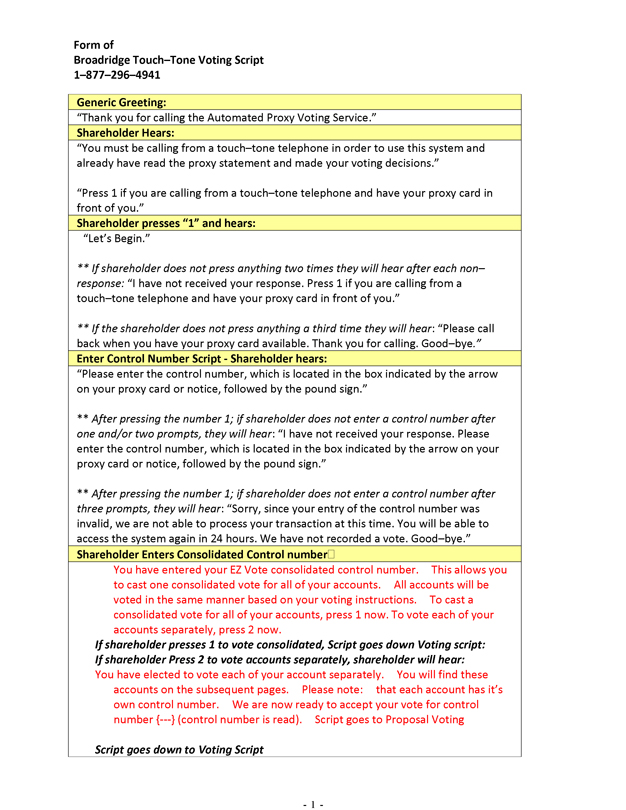

Who is Broadridge Financial Solutions, Inc. (Broadridge)?

Broadridge is a third-party proxy vendor that Fidelity has hired to call shareholders and record proxy votes. In order to hold a shareholder meeting, a quorum must be reached. If a quorum is not attained, the meeting may adjourn to a future date. Fidelity attempts to reach shareholders via multiple mailings to remind them to cast their vote. As the meeting approaches, phone calls may be made to clients who have not yet voted their shares so that the shareholder meeting does not have to be postponed.

Voting your shares immediately will help minimize additional solicitation expenses and prevent the need to make a call to you to solicit your vote.

In light of Covid-19 (coronavirus), will Fidelity consider the possibility of changing the meeting date, or having a remote shareholder meeting?

Although we intend to hold the meeting in person, we are actively monitoring the coronavirus and may need to adjust our plans. We are sensitive to the public health and travel concerns our shareholders may have and the protocols that federal, state, and local governments may impose. As a result, the date, time, location or means of conducting the meeting may change. In the event of such a change, the funds will post an announcement online at www.proxyvote.com/proxy and file the announcement on the Securities and Exchange Commission’s (“SEC”) EDGAR system, among other steps, but may not deliver additional soliciting materials to shareholders or otherwise amend the funds’ proxy materials. Although no decision has been made, the funds may consider imposing additional procedures or limitations on meeting attendees or conducting the meeting as a “virtual” shareholder meeting through the internet or other electronic means in lieu of an in-person meeting, subject to any restriction imposed by applicable law. Please monitor the website at www.proxyvote.com/proxy for updated information. If you are planning to attend the meeting, please check the website one week prior to the meeting date. As always, we encourage you to vote your shares prior to the meeting.

Remember, the above is only a summary of the proposals. Please read the proxy statement for complete details on the proposals.

| RSSAI-PXL-0920 1.9899676.100 |

Important Notice Regarding the Availability of Proxy Materials for the

Shareholder Meeting to be held on

November 2, 2020

The Letter to Shareholders, Notice of Meeting, and Proxy Statement are available at www.proxyvote.com/proxy

STRATEGIC ADVISERS® CORE FUND

STRATEGIC ADVISERS® CORE INCOME FUND

STRATEGIC ADVISERS® EMERGING MARKETS FUND

STRATEGIC ADVISERS® FIDELITY® CORE INCOME FUND

STRATEGIC ADVISERS® FIDELITY® EMERGING MARKETS FUND

STRATEGIC ADVISERS® FIDELITY® INTERNATIONAL FUND

STRATEGIC ADVISERS® FIDELITY® U.S. TOTAL STOCK FUND

STRATEGIC ADVISERS® GROWTH FUND

STRATEGIC ADVISERS® INCOME OPPORTUNITIES FUND

STRATEGIC ADVISERS® INTERNATIONAL FUND

STRATEGIC ADVISERS® SHORT DURATION FUND

STRATEGIC ADVISERS® SMALL-MID CAP FUND

STRATEGIC ADVISERS® TAX-SENSITIVE SHORT DURATION FUND

STRATEGIC ADVISERS® VALUE FUND

FUNDS OF

FIDELITY RUTLAND SQUARE TRUST II

245 Summer Street, Boston, Massachusetts 02210

1-800-544-3455

NOTICE OF SPECIAL MEETING OF SHAREHOLDERS

NOTICE IS HEREBY GIVEN that a Special Meeting of Shareholders (the Meeting) of Fidelity Rutland Square Trust II (the trust) will be held at an office of the trust, 245 Summer Street, Boston, Massachusetts 02210 (at the corner of Summer Street and Dorchester Avenue, next to Boston’s South Station) on November 2, 2020, at 8:00 a.m. Eastern Time (ET).

The purpose of the Meeting is to consider and act upon the following proposals and to transact such other business as may properly come before the Meeting or any adjournments thereof.

| 1. | To elect a Board of Trustees. |

| 2. | For shareholders of certain funds to approve the conversion of a fundamental investment policy to a non-fundamental investment policy. |

| 3. | For shareholders of Strategic Advisers® Small-Mid Cap Fund and Strategic Advisers® Fidelity® U.S. Total Stock Fund to approve sub-advisory agreements among Strategic Advisers LLC (Strategic Advisers), FIL Investment Advisors (FIA), and the trust and sub-subadvisory agreements between FIA and FIL Investment Advisors (UK) Limited (FIA (UK)). |

| 4. | For shareholders of Strategic Advisers® Emerging Markets Fund to approve a sub-advisory agreement among Strategic Advisers, Geode Capital Management, LLC (Geode), and the trust. |

| 5. | For shareholders of certain funds to approve sub-subadvisory agreements between FIAM LLC (FIAM) and FMR Investment Management (UK) Limited (FMR UK). |

| 6. | For shareholders of certain funds to approve sub-subadvisory agreements between FIAM and Fidelity Management & Research (Hong Kong) Limited (FMR H.K.). |

| 7. | For shareholders of certain funds to approve sub-subadvisory agreements between FIAM and Fidelity Management & Research (Japan) Limited (FMR Japan). |

The Board of Trustees has fixed the close of business on September 8, 2020 as the record date for the determination of the shareholders of each of the funds entitled to notice of, and to vote at, such Meeting and any adjournments thereof.

By order of the Board of Trustees,

CHRISTINA H. LEE

Secretary

September 8, 2020

Your vote is important – please vote your shares promptly.

Shareholders are invited to attend the Meeting in person. Admission to the Meeting will be on a first-come, first-served basis and will require picture identification. Shareholders arriving after the start of the Meeting may be denied entry. Cameras, cell phones, recording equipment and other electronic devices will not be permitted. Fidelity reserves the right to inspect any persons or items prior to admission to the Meeting.

Any shareholder who does not expect to attend the Meeting is urged to vote using the touch-tone telephone or internet voting instructions that follow or by indicating voting instructions on the enclosed proxy card, dating and signing it, and returning it in the envelope provided, which needs no postage if mailed in the United States. In order to avoid unnecessary expense, we ask your cooperation in responding promptly, no matter how large or small your holdings may be. If you wish to wait until the Meeting to vote your shares, you will need to request a paper ballot at the Meeting in order to do so.

INSTRUCTIONS FOR EXECUTING PROXY CARD

The following general rules for executing proxy cards may be of assistance to you and help avoid the time and expense involved in validating your vote if you fail to execute your proxy card properly.

| 1. | Individual Accounts: Your name should be signed exactly as it appears in the registration on the proxy card. |

| 2. | Joint Accounts: Either party may sign, but the name of the party signing should conform exactly to a name shown in the registration. |

| 3. | All other accounts should show the capacity of the individual signing. This can be shown either in the form of the account registration itself or by the individual executing the proxy card. For example: |

REGISTRATION | VALID SIGNATURE | |||||||

| A. | 1) | ABC Corp. | John Smith, Treasurer | |||||

| 2) | ABC Corp. | John Smith, Treasurer | ||||||

| c/o John Smith, Treasurer | ||||||||

| B. | 1) | ABC Corp. Profit Sharing Plan | Ann B. Collins, Trustee | |||||

| 2) | ABC Trust | Ann B. Collins, Trustee | ||||||

| 3) | Ann B. Collins, Trustee | Ann B. Collins, Trustee | ||||||

| u/t/d 12/28/78 | ||||||||

| C. | 1) | Anthony B. Craft, Cust. | Anthony B. Craft | |||||

| f/b/o Anthony B. Craft, Jr. | ||||||||

| UGMA | ||||||||

INSTRUCTIONS FOR VOTING BY TOUCH-TONE TELEPHONE OR THROUGH THE INTERNET

| 1. | Read the proxy statement, and have your proxy card or notice handy. |

| 2. | Call the toll-free number or visit the web site indicated on your proxy card. |

| 3. | Enter the number found in the box on the front of your proxy card. |

| 4. | Follow the recorded or on-line instructions to cast your vote up until 11:59 p.m. ET on November 1, 2020. |

PROXY STATEMENT

SPECIAL MEETING OF SHAREHOLDERS OF

FIDELITY RUTLAND SQUARE TRUST II

STRATEGIC ADVISERS® CORE FUND

STRATEGIC ADVISERS® CORE INCOME FUND

STRATEGIC ADVISERS® EMERGING MARKETS FUND

STRATEGIC ADVISERS® FIDELITY® CORE INCOME FUND

STRATEGIC ADVISERS® FIDELITY® EMERGING MARKETS FUND

STRATEGIC ADVISERS® FIDELITY® INTERNATIONAL FUND

STRATEGIC ADVISERS® FIDELITY® U.S. TOTAL STOCK FUND

STRATEGIC ADVISERS® GROWTH FUND

STRATEGIC ADVISERS® INCOME OPPORTUNITIES FUND

STRATEGIC ADVISERS® INTERNATIONAL FUND

STRATEGIC ADVISERS® SHORT DURATION FUND

STRATEGIC ADVISERS® SMALL-MID CAP FUND

STRATEGIC ADVISERS® TAX-SENSITIVE SHORT DURATION FUND

STRATEGIC ADVISERS® VALUE FUND

TO BE HELD ON NOVEMBER 2, 2020

This Proxy Statement is furnished in connection with a solicitation of proxies made by, and on behalf of, the Board of Trustees of Fidelity Rutland Square Trust II (the trust) to be used at the Special Meeting of Shareholders of the above-named funds (the funds) and at any adjournments thereof (the Meeting), to be held on November 2, 2020 at 8:00 a.m. Eastern Time (ET) at 245 Summer Street, Boston, Massachusetts 02210, an office of the trust and Strategic Advisers LLC (Strategic Advisers), the funds’ investment adviser.

Shareholders of Strategic Advisers® Core Fund, Strategic Advisers® Growth Fund, and Strategic Advisers® Value Fund will also participate in the Meeting to vote on certain other proposals that are included in a notice and proxy statement mailed separately to such shareholders.

The purpose of the Meeting is set forth in the accompanying Notice. The solicitation is being made primarily by the mailing of Notice of Internet Availability of Proxy Materials and the distribution of this Proxy Statement and the accompanying proxy card on or about September 8, 2020.

The following table summarizes the proposals applicable to each fund:

| Proposal Number | Proposal Description | Applicable Funds | Page Number | |||

| 1. | To elect a Board of Trustees. | All Funds | 5 | |||

| 2. | To convert a fundamental investment policy to a non-fundamental investment policy. | Strategic Advisers® Core Fund, Strategic Advisers® Core Income Fund, Strategic Advisers® Emerging Markets Fund, Strategic Advisers® Fidelity® International Fund, Strategic Advisers® Growth Fund, Strategic Advisers® Income Opportunities Fund, Strategic Advisers® International Fund, Strategic Advisers® Short Duration Fund, Strategic Advisers® Small-Mid Cap Fund, Strategic Advisers® Tax-Sensitive Short Duration Fund, Strategic Advisers® Value Fund | 8 | |||

| 3. | To approve a sub-advisory agreement among Strategic Advisers LLC (Strategic Advisers), FIL Investment Advisors (FIA), and the trust and a sub-subadvisory agreement between FIA and FIL Investment Advisors (UK) Limited (FIA (UK)) with respect to FIA’s Small Cap America strategy. | Strategic Advisers® Fidelity® U.S. Total Stock Fund, Strategic Advisers® Small-Mid Cap Fund | 10 | |||

| 4. | To approve a sub-advisory agreement among Strategic Advisers, Geode Capital Management, LLC (Geode), and the trust with respect to Geode’s Enhanced Emerging Markets Small Cap strategy. | Strategic Advisers® Emerging Markets Fund | 12 | |||

1

| Proposal Number | Proposal Description | Applicable Funds | Page Number | |||

| 5. | To approve a sub-subadvisory agreement between FIAM LLC (FIAM) and FMR Investment Management (UK) Limited (FMR UK). | Strategic Advisers® Core Fund, Strategic Advisers® Core Income Fund, Strategic Advisers® Emerging Markets Fund, Strategic Advisers® Fidelity® International Fund, Strategic Advisers® Growth Fund, Strategic Advisers® Income Opportunities Fund, Strategic Advisers® International Fund, Strategic Advisers® Short Duration Fund, Strategic Advisers® Small-Mid Cap Fund, Strategic Advisers® Value Fund | 14 | |||

| 6. | To approve a sub-subadvisory agreement between FIAM and Fidelity Management & Research (Hong Kong) Limited (FMR H.K.). | Strategic Advisers® Core Fund, Strategic Advisers® Core Income Fund, Strategic Advisers® Emerging Markets Fund, Strategic Advisers® Fidelity® International Fund, Strategic Advisers® Growth Fund, Strategic Advisers® Income Opportunities Fund, Strategic Advisers® International Fund, Strategic Advisers® Short Duration Fund, Strategic Advisers® Small-Mid Cap Fund, Strategic Advisers® Value Fund | 15 | |||

| 7. | To approve a sub-subadvisory agreement between FIAM and Fidelity Management & Research (Japan) Limited (FMR Japan). | Strategic Advisers® Core Fund, Strategic Advisers® Core Income Fund, Strategic Advisers® Emerging Markets Fund, Strategic Advisers® Fidelity® International Fund, Strategic Advisers® Growth Fund, Strategic Advisers® Income Opportunities Fund, Strategic Advisers® International Fund, Strategic Advisers® Short Duration Fund, Strategic Advisers® Small-Mid Cap Fund, Strategic Advisers® Value Fund | 16 | |||

Supplementary solicitations may be made by mail, telephone, facsimile, electronic means or by personal interview by representatives of the trust. In addition, Broadridge Financial Solutions, Inc. (Broadridge) may be paid on a per-call basis to solicit shareholders by telephone on behalf of the funds in the trust. The funds may also arrange to have votes recorded by telephone. Broadridge may be paid on a per-call basis for vote-by-phone solicitations on behalf of the funds. The approximate anticipated total cost of these services is detailed in Appendix A.

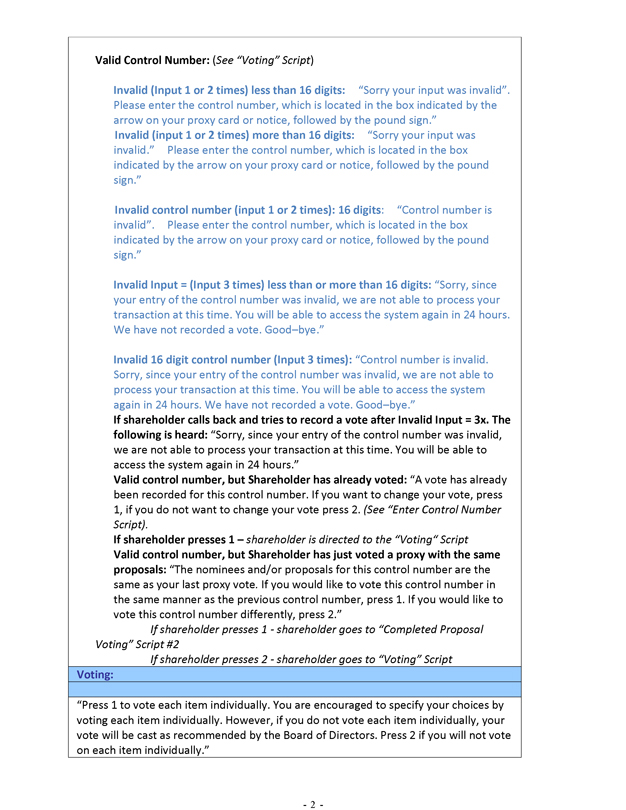

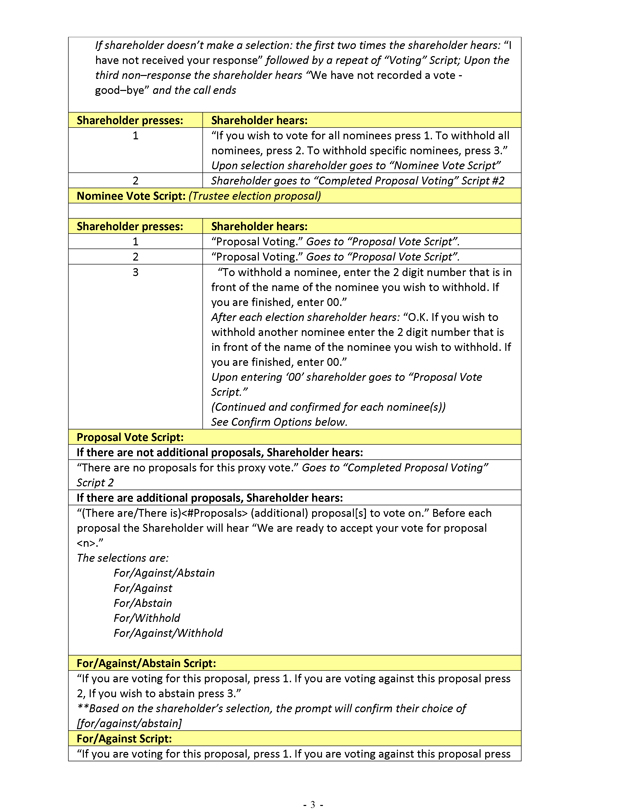

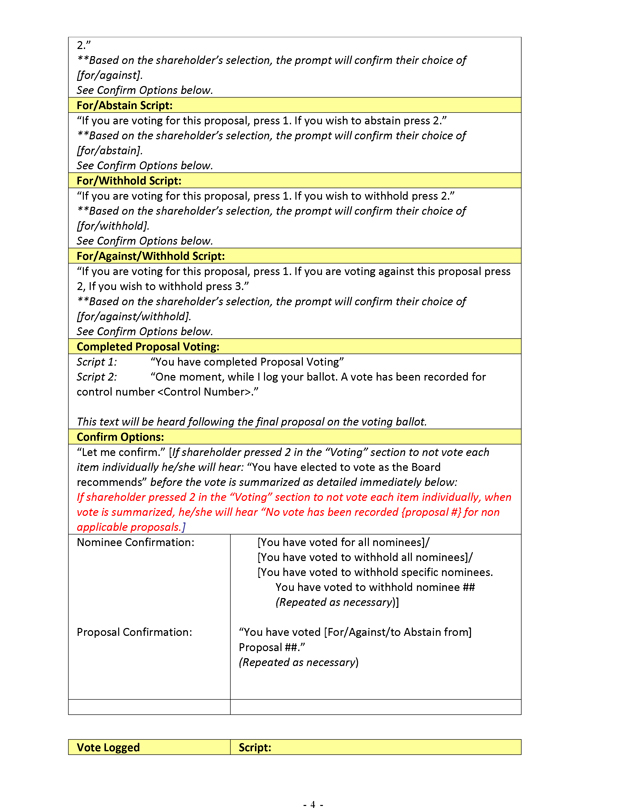

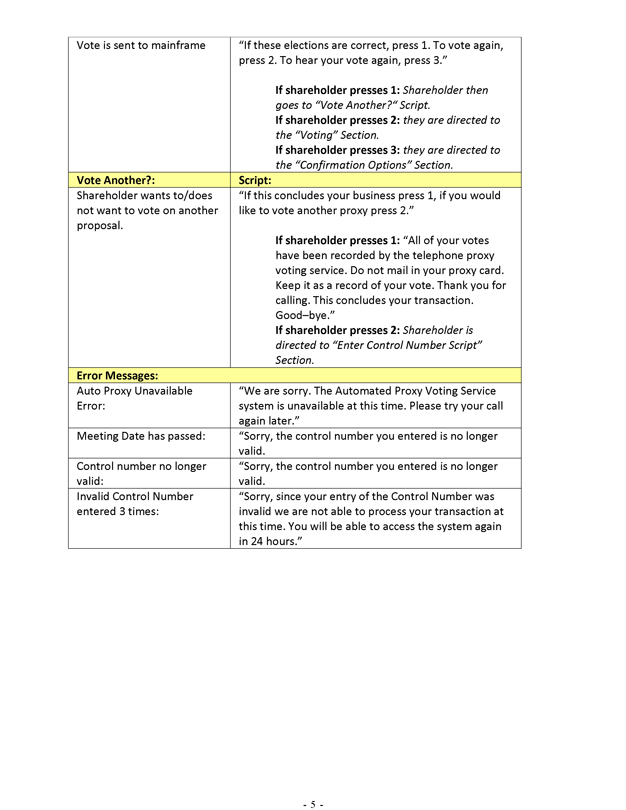

If the funds record votes by telephone or through the internet, they will use procedures designed to authenticate shareholders’ identities, to allow shareholders to authorize the voting of their shares in accordance with their instructions, and to confirm that their instructions have been properly recorded. Proxies voted by telephone or through the internet may be revoked at any time before they are voted at the Meeting.

Some shareholders will not automatically receive a copy of this entire Proxy Statement in the mail, but will instead receive a notice that informs them of how to access all of the proxy materials on a publicly available website (commonly referred to as “notice and access”). Shareholders who receive such a notice will not be able to return the notice to have their vote recorded. However, they can access the proxy materials at www.proxyvote.com/proxy to vote eligible shares or may use the instructions on the notice to request a paper or email copy of the proxy materials at no charge.

Except for Strategic Advisers® Core Fund, the expenses associated with: (i) preparing this Proxy Statement, its enclosures, and all solicitations; and (ii) reimbursing brokerage firms and others for their reasonable expenses in forwarding solicitation material to the beneficial owners of shares, will be borne by each fund.

Strategic Advisers® Core Fund’s expenses in connection with preparing this Proxy Statement and its enclosures and all solicitations will be borne by Strategic Advisers under the fund’s management contract, which obligates Strategic Advisers to pay certain fund level expenses. Strategic Advisers will reimburse brokerage firms and others for their reasonable expenses in forwarding solicitation material to the beneficial owners of shares.

If the enclosed proxy is executed and returned, or an internet or telephonic vote is delivered, that vote may nevertheless be revoked at any time prior to its use by written notification received by the trust, by the execution of a later-dated proxy, by the trust’s receipt of a subsequent valid internet or telephonic vote, or by attending the Meeting and voting in person.

All proxies solicited by the Board of Trustees that are properly executed and received by the Secretary prior to the Meeting, and are not revoked, will be voted at the Meeting. Shares represented by such proxies will be voted in accordance with the instructions thereon. If no specification is made on a properly executed proxy, it will be voted FOR the matters specified on the proxy. All shares that are voted and votes to ABSTAIN will be counted towards establishing a quorum, as will broker non-votes. (Broker non-votes are shares for which (i) the beneficial owner has not voted and (ii) the broker holding the shares does not have discretionary authority to vote on the particular matter.)

2

With respect to fund shares held in Fidelity® individual retirement accounts (IRA) (including Traditional, Rollover, SEP, SARSEP, Roth and SIMPLE IRAs), the IRA Custodian will vote those shares for which it has received instructions from shareholders only in accordance with such instructions. If Fidelity® IRA shareholders do not vote their shares, the IRA Custodian will vote their shares for them, in the same proportion as other Fidelity® IRA shareholders have voted.

With respect to Proposal 1, one-third of the trust’s outstanding voting securities entitled to vote constitutes a quorum for the transaction of business at the Meeting. With respect to Proposals 2, 3, 4, 5, 6, and 7, one-third of the aggregate number of the relevant fund’s outstanding voting securities entitled to vote constitutes a quorum for the transaction of business at the Meeting. If a quorum is not present at the Meeting, or if a quorum is present at the Meeting but sufficient votes to approve one or more of the proposed items are not received, or if other matters arise requiring shareholder attention, the persons named as proxy agents may propose one or more adjournments of the Meeting to permit further solicitation of proxies. Any such adjournment will require the affirmative vote of a majority of those shares present at the Meeting or represented by proxy. When voting on a proposed adjournment, the persons named as proxy agents will vote FOR the proposed adjournment all shares that they are entitled to vote with respect to each item, unless directed to vote AGAINST an item, in which case such shares will be voted AGAINST the proposed adjournment with respect to that item. A shareholder vote may be taken on one or more of the items in this Proxy Statement prior to such adjournment if sufficient votes have been received and it is otherwise appropriate.

Information regarding the number of shares of each fund issued and outstanding as of June 30, 2020, is included in Appendix B.

To the knowledge of the trust, as of June 30, 2020, the nominees, Trustees, and officers of the trust and the funds owned, in the aggregate, less than 1% of each fund’s outstanding shares.

To the knowledge of the trust, no shareholder owned of record or beneficially more than 5% of the outstanding shares of each fund on that date as of June 30, 2020.

Certain shares are registered to Strategic Advisers or a Strategic Advisers affiliate. To the extent that Strategic Advisers or another entity or entities of which FMR LLC is the ultimate parent has discretion to vote, these shares will be voted at the Meeting FOR each proposal. Otherwise, these shares will be voted in accordance with the plan or agreement governing the shares. Although the terms of the plans and agreements vary, generally the shares must be voted either (i) in accordance with instructions received from shareholders or (ii) in accordance with instructions received from shareholders and, for shareholders who do not vote, in the same proportion as certain other shareholders have voted.

Certain shareholders of Fidelity® Wealth Services (FWS) have elected Strategic Advisers as agent to receive proxy voting materials for non-Fidelity and Fidelity® Funds held in their FWS accounts. For Fidelity® Funds, such shareholders have instructed Strategic Advisers to vote proxies of a Fidelity® Fund in the same proportion as the vote of all other holders of such Fidelity® Fund.

Certain funds and accounts that are managed by Strategic Advisers or its affiliates (including funds of funds) invest in other funds and may at times have substantial investments in one or more funds. Although these funds generally intend to vote their shares of underlying funds using echo voting procedures (that is, in the same proportion as the holders of all other shares of the particular underlying fund), they reserve the right, on a case-by-case basis, to vote in another manner, which may include voting all shares as recommended by the Board.

Shareholders of record at the close of business on September 8, 2020 will be entitled to receive notice of and to vote at the Meeting. Each such shareholder will be entitled to one vote for each dollar of net asset value held on that date, with fractional dollar amounts entitled to a proportional fractional vote.

We intend to hold the Meeting in person as set forth in this Proxy Statement. However, we are actively monitoring the coronavirus (COVID-19); we are sensitive to the public health and travel concerns our shareholders may have and the protocols that federal, state, and local governments may impose. As a result, the date, time, location or means of conducting the Meeting may change. In the event of such a change, the funds will post an announcement online at www.proxyvote.com/proxy and file the announcement on the Securities and Exchange Commission’s (“SEC”) EDGAR system, among other steps, but may not deliver additional soliciting materials to shareholders or otherwise amend the funds’ proxy materials. Although no decision has been made, the funds may consider imposing additional procedures or limitations on Meeting attendees or conducting the Meeting as a “virtual” shareholder meeting through the internet or other electronic means in lieu of an in-person meeting, subject to any restrictions imposed by applicable law. Please monitor the website at www.proxyvote.com/proxy for updated information. If you are planning to attend the Meeting, please check the website one week prior to the Meeting date. As always, we encourage you to vote your shares prior to the Meeting.

For a free copy of each fund’s annual and/or semiannual reports, call 1-800-544-3455, visit Fidelity’s web site at www.fidelity.com, or write to Fidelity Distributors Company LLC (FDC) at 100 Salem Street, Smithfield, Rhode Island 02917.

VOTE REQUIRED: Approval of Proposal 1 requires the affirmative vote of a plurality of the shares of the entire trust voted in person or by proxy at the Meeting. Approval of Proposals 2 through 7 requires the affirmative vote of a “majority of the outstanding voting securities” of the appropriate fund. Under the Investment Company Act of 1940 (1940 Act), the vote of a “majority of the outstanding voting securities” means the affirmative vote of the lesser of (a) 67% or more of the voting securities present at the Meeting or represented by proxy if the holders of more than 50% of the outstanding voting securities are present or represented by proxy or (b) more than 50% of the outstanding voting securities. With respect to Proposals 2 through 7, votes to ABSTAIN and broker non-votes will have the same effect as votes cast AGAINST the Proposal. With respect to Proposal 1, votes to ABSTAIN and broker non-votes will have no effect.

3

SYNOPSIS OF PROPOSALS

The following is a summary of the Proposals contained in this Proxy Statement. Shareholders should read the entire Proxy Statement carefully for more complete information.

What proposals am I being asked to vote on and what is the primary purpose of the proposals?

As more fully described in each Proposal section below, shareholders of each fund are being asked to elect a Board of Trustees (Proposal 1) and shareholders of certain funds are being asked to approve the conversion of fundamental investment policies to non-fundamental investment policies (Proposal 2), sub-advisory agreements with FIA and sub-subadvisory agreements between FIA and FIA (UK) (Proposal 3), a sub-advisory agreement with Geode (Proposal 4), and sub-subadvisory agreements between FIAM and each of FMR UK (Proposal 5), FMR H.K. (Proposal 6), and FMR Japan (Proposal 7) (Proposed Sub-Advisers and Proposed Sub-Subadvisers, respectively). Shareholders of record as of the close of business on September 8, 2020 will be entitled to vote at the Meeting.

The primary purpose of Proposal 2 is to convert the fundamental investment policy of certain funds to non-fundamental. A fundamental policy requires both board and shareholder approval to change, whereas a non-fundamental policy can be changed by board vote alone. This conversion would bring the funds in line with industry practice as well as with the practices of certain other Fidelity® funds and could potentially avoid entirely, or reduce, future proxy costs and provide greater flexibility for evolution over time. There is no present intention to change the way in which any fund is currently managed if the proposal is approved.

The primary purpose of Proposals 3-7 is to facilitate approval by shareholders of sub-advisory agreements and/or sub-subadvisory agreements with the Proposed Sub-Advisers and/or Sub-Subadvisers on behalf of the applicable fund to allocate a portion of the fund’s assets to the Proposed Sub-Adviser and/or Sub-Subadvisers, if needed. If the proposed agreements are approved, Strategic Advisers initially does not intend to allocate assets to any of the Proposed Sub-Advisers but may do so in the future. FIAM initially does not intend to allocate assets to any of the Proposed Sub-Subadvisers, except to FMR UK with respect to the Strategic Advisers® Core Fund, but may do so in the future.

What are the potential expense impacts of Proposals 3 through 7?

As discussed in the Proxy Statement, Strategic Advisers initially does not intend to allocate assets to any of the Proposed Sub-Advisers in Proposals 3 and 4 but may do so in the future. Therefore, total annual operating expenses for funds impacted by Proposals 3 and 4 will not initially change as a result of the approval of the new agreements with the Proposed Sub-Advisers. However, to illustrate the potential impact of approving each proposal, the tables in Appendix I of the Proxy Statement compare current expenses to possible future expenses using a hypothetical maximum allocation to each Proposed Sub-Adviser under each proposal, which assumes that assets were shifted from the lowest-priced comparable manager. The table below summarizes a hypothetical expense increase for Proposals 3 and 4 from the tables in Appendix I of the Proxy Statement.

| Sub-Advisory Agreement Proposals | |||||||||||||||

| Proposal 3 – FIA1 | Proposal 4 – Geode | ||||||||||||||

| Fund | Proposal # | Possible Future Expense Impact | Proposal # | Possible Future Expense Impact | ||||||||||||

| Strategic Advisers® Fidelity® U.S. Total Stock Fund | 3 | +0.02 | % | N/A | N/A | |||||||||||

| Strategic Advisers® Small-Mid Cap Fund | 3 | +0.03 | % | N/A | N/A | |||||||||||

| Strategic Advisers® Emerging Markets Fund | N/A | N/A | 4 | +0.03 | % | |||||||||||

| 1 | Proposal 3 also includes request for approval of sub-subadvisory agreements between FIA and FIA (UK). FIA, not the applicable fund, will compensate FIA (UK) under the proposed sub-subadvisory agreements. Accordingly, there is no anticipated effect of these sub-subadvisory arrangements on the applicable fund’s management fee or total net expenses. |

For Proposals 5 through 7, FIAM, not the applicable fund, will compensate the Proposed Sub-Subadvisers under the sub-subadvisory agreements. Accordingly, there is no anticipated effect on the applicable fund’s management fee or total net expenses if FIAM allocates assets to any of the Proposed Sub-Subadvisers. FIAM initially does not intend to allocate assets to any of the Proposed Sub-Subadvisers, except to FMR UK with respect to the Strategic Advisers® Core Fund, but may do so in the future.

4

TO ELECT A BOARD OF TRUSTEES

The purpose of this proposal is to elect a Board of Trustees. Pursuant to the provisions of the Trust Instrument of the trust, the Trustees have determined that the number of Trustees shall be fixed at 7 upon election of the Trustee nominees listed below. It is intended that the enclosed proxy will be voted for the following nominees unless such authority has been withheld in the proxy.

Appendix C shows the composition of the Board of Trustees of the trust and the length of service of each Trustee. All nominees are currently Trustees or Advisory Board Members of the trust and have served in that capacity continuously since originally elected or appointed. Certain nominees were previously elected by shareholders to serve as Trustees of the trust, while other nominees were initially appointed by the Trustees and have not yet been elected by shareholders. With respect to the nominees not previously elected by shareholders, a third-party search firm retained by the Independent Trustees identified Heidi L. Steiger and Christine Marcks as candidates, and an executive officer of Strategic Advisers or an affiliate identified Charles S. Morrison as a candidate. The Governance and Nominating Committee has recommended all Independent Trustee candidates.

In the election of Trustees, those nominees receiving the highest number of votes cast at the Meeting, provided a quorum is present, shall be elected. A nominee shall be elected immediately upon shareholder approval. The election of the nominees will result in a board comprised of 7 Trustees.

Except for Ms. Marcks, each of the nominees currently oversees as Trustee 14 funds. Ms. Marcks is currently an Advisory Board Member of 14 funds. If elected, each nominee will oversee 14 funds upon effectiveness of their election.

The nominees you are being asked to elect as Trustees of the funds are as follows:

Interested Nominees*:

Correspondence intended for each Interested Nominee (that is, the nominees that are interested persons (as defined in the Investment Company Act of 1940, as amended (1940 Act)) may be sent to Fidelity Investments, 245 Summer Street, Boston, Massachusetts 02210.

Name, Year of Birth; Principal Occupations and Other Relevant Experience**

Robert A. Lawrence (1952)

Year of Election or Appointment: 2016

Trustee

Chairman of the Board of Trustees

Mr. Lawrence also serves as Trustee of other funds. Previously, Mr. Lawrence served as a Member of the Advisory Board of certain funds. Prior to his retirement in 2008, Mr. Lawrence served as Vice President of certain Fidelity® funds (2006-2008), Senior Vice President, Head of High Income Division of Fidelity Management & Research Company (investment adviser firm, 2006-2008), and President of Fidelity Strategic Investments (investment adviser firm, 2002-2005).

Charles S. Morrison (1960)

Year of Election or Appointment: 2020

Trustee

Mr. Morrison also serves as Trustee of other funds. Previously, Mr. Morrison served as President (2017-2018) and Director (2014-2018) of Fidelity SelectCo, LLC (investment adviser firm), President of Fidelity Management & Research Company (FMR) (investment adviser firm, 2016-2018), a Director of Fidelity Investments Money Management, Inc. (investment adviser firm, 2014-2018), President, Asset Management (2014-2018), Trustee of the Fidelity Equity and High Income Funds (283 funds as of December 2018) (2014-2018), and was an employee of Fidelity Investments. Mr. Morrison also previously served as Vice President of Fidelity’s Fixed Income and Asset Allocation Funds (2012-2014), President, Fixed Income (2011-2014), Vice President of Fidelity’s Money Market Funds (2005-2009), President, Money Market Group Leader of FMR (2009), and Senior Vice President, Money Market Group of FMR (2004-2009). Mr. Morrison also served as Vice President of Fidelity’s Bond Funds (2002-2005), certain Balanced Funds (2002-2005), and certain Asset Allocation Funds (2002-2007), and as Senior Vice President (2002-2005) of Fidelity’s Bond Division.

| * | Determined to be an “Interested Nominee” by virtue of, among other things, his affiliation with the trust or various entities under common control with Strategic Advisers. |

| ** | The information includes each nominee’s principal occupation during the last five years and other information relating to the experience, attributes, and skills relevant to each nominee’s qualifications to serve as a Trustee, which led to the conclusion that the nominee should serve as a Trustee for each fund. |

Independent Nominees:

Correspondence intended for each Independent Nominee (that is, the nominees that are not interested persons (as defined in the 1940 Act)) may be sent to Fidelity Investments, P. O. Box 55235, Boston, Massachusetts 02205-5235.

5

Name, Year of Birth; Principal Occupations and Other Relevant Experience*

Peter C. Aldrich (1944)

Year of Election or Appointment: 2006

Trustee

Mr. Aldrich also serves as Trustee of other funds. Mr. Aldrich is a Director of the U.S. Core Property Fund (and, previously, other funds) of BlackRock Realty Group (2006-present). Previously, Mr. Aldrich served as a Managing Member of Poseidon, LLC (foreign private investment, 1998-2004), and Chairman and Managing Member of AEGIS, LLC (foreign private investment, 1997-2004). Mr. Aldrich previously was a founder, Chief Executive Officer, and Chairman of AEW Capital Management, L.P. (then “Aldrich, Eastman and Waltch, L.P.”). Mr. Aldrich also served as a Director of LivelyHood, Inc. (private corporation, 2013-2020), a Trustee for the Fidelity Rutland Square Trust (2005-2010), a Director of Zipcar, Inc. (car sharing services, 2001-2009) and as Faculty Chairman of The Research Council on Global Investment of The Conference Board (business and professional education non-profit, 1999-2004). Mr. Aldrich is a Member Emeritus of the Board of Directors of the National Bureau of Economic Research, the Board of Trustees of the Museum of Fine Arts Boston and the Board of Overseers of the Massachusetts Eye and Ear Infirmary.

Mary C. Farrell (1949)

Year of Election or Appointment: 2013

Trustee

Ms. Farrell also serves as Trustee of other funds. Ms. Farrell is a Director of the W.R. Berkley Corporation (insurance provider) and President (2009-present) and Director (2006-present) of the Howard Gilman Foundation (charitable organization). Previously, Ms. Farrell was Managing Director and Chief Investment Strategist at UBS Wealth Management USA and Co-Head of UBS Wealth Management Investment Strategy & Research Group (2003-2005). Ms. Farrell also served as Investment Strategist at PaineWebber (1982-2000) and UBS PaineWebber (2000-2002). Ms. Farrell serves as Chairman of the Board of Trustees of Yale-New Haven Hospital and Vice Chairman of the Yale New Haven Health System Board and previously served as Trustee on the Board of Overseers of the New York University Stern School of Business.

Karen Kaplan (1960)

Year of Election or Appointment: 2006

Trustee

Ms. Kaplan also serves as Trustee of other funds. Ms. Kaplan is Chairman (2014-present) and Chief Executive Officer (2013-present) of Hill Holliday (advertising and specialized marketing). Ms. Kaplan is a Director of The Michaels Companies, Inc. (specialty retailer, 2015-present), Member of the Board of Governors of the Chief Executives’ Club of Boston (2010-present), Member of the Executive Committee of the Greater Boston Chamber of Commerce (2006-present), Advisory Board Member of the National Association of Corporate Directors Chapter (2012-present), Member of the Board of Trustees of the Post Office Square Trust (2012-present), Trustee of the Brigham and Women’s Hospital (2016-present), Overseer of the Boston Symphony Orchestra (2014-present), Member of the Board of Directors of The Advertising Council, Inc. (2016-present), Member of the Ron Burton Training Village Executive Board of Advisors (2018-present), Member of the Executive Committee of The Ad Council, Inc. (2019-present), and Member of the Board of Directors of The Ad Club of Boston (2020-present). Previously, Ms. Kaplan served as an Advisory Board Member of Fidelity Rutland Square Trust (2006-2010), a member of the Clinton Global Initiative (2010-2015), Director of DSM (dba Delta Dental and DentaQuest) (2004-2014), Formal Appointee of the 2015 Baker-Polito Economic Development Council, Director of Vera Bradley Inc. (designer of women’s accessories, 2012-2015), Member of the Board of Directors of the Massachusetts Conference for Women (2008-2015), Member of the Board of Directors of Jobs for Massachusetts (2012-2015), President of the Massachusetts Women’s Forum (2008-2010), Treasurer of the Massachusetts Women’s Forum (2002-2006), and Vice Chair of the Board of the Massachusetts Society for the Prevention of Cruelty to Children (2003-2010).

Christine Marcks (1955)

Year of Election or Appointment: 2019

Member of the Advisory Board

Ms. Marcks also serves as a Member of the Advisory Board of other funds. Prior to her retirement, Ms. Marcks served as Chief Executive Officer and President – Prudential Retirement (2007-2017) and Vice President for Rollover and Retirement Income Strategies (2005-2007), Prudential Financial, Inc. (financial services). Previously, Ms. Marcks was Senior Vice President and Head of Financial Horizons (2002-2004) and Vice President, Strategic Marketing (2000-2002) of Voya Financial (formerly ING U.S.) (financial services), held numerous positions at Aetna Financial Services (financial services, 1987-2000) and served as an International Economist for the United States Department of the Treasury (1980-1987). Ms. Marcks also serves as a member of the Board of Trustees, Audit Committee and Benefits & Operations Committee of the YMCA Retirement Fund (2018-present), a non-profit organization providing retirement plan benefits to YMCA staff members, and as a member of the Board of Trustees of Assumption College (2019-present).

6

Name, Year of Birth; Principal Occupations and Other Relevant Experience*

Heidi L. Steiger (1953)

Year of Election or Appointment: 2017

Trustee

Ms. Steiger also serves as Trustee of other funds. Ms. Steiger serves as Managing Partner of Topridge Associates, LLC (consulting, 2005-present), a member of the Advisory Board of the joint degree program in Global Luxury Management at North Carolina State University (Raleigh, NC) and Skema (Paris) (2018-present), a Non-Executive Director of CrowdBureau Corporation (financial technology company and index provider, 2018-present), a member of the Board of Directors (2013-present) and Chair of the Audit Committee and member of the Membership and Executive Committees (2017-present) of Business Executives for National Security (nonprofit), and member of the Board of Directors Chair of the Remuneration Committee of Imagine Intelligent Materials Limited (2019-present) (technology company). Previously, Ms. Steiger served as a member of the Global Advisory Board and Of Counsel to Signum Global Advisors (international policy and strategy, 2018-2020), Eastern Region President of The Private Client Reserve of U.S. Bancorp (banking and financial services, 2010-2015), Advisory Director of Berkshire Capital Securities, LLC (financial services, 2009-2010), President and Senior Advisor of Lowenhaupt Global Advisors, LLC (financial services, 2005-2007), and President and Contributing Editor of Worth Magazine (2004-2005) and held a variety of positions at Neuberger Berman Group, LLC (financial services, 1986-2004), including Partner and Executive Vice President and Global Head of Private Asset Management at Neuberger Berman (1999-2004). Ms. Steiger also served as a member of the Board of Directors of Nuclear Electric Insurance Ltd (insurer of nuclear utilities, 2006-2017), a member of the Board of Trustees and Audit Committee of the Eaton Vance Funds (2007-2010), a member of the Board of Directors of Aviva USA (formerly AmerUs) (insurance, 2004-2014), and a member of the Board of Trustees and Audit Committee and Chair of the Investment Committee of CIFG (financial guaranty insurance, 2009-2012), and a member of the Board of Directors of Kin Group Plc (formerly, Fitbug Holdings) (health and technology, 2016-2017).

| * | The information above includes the nominee’s principal occupation during the last five years and other information relating to the experience, attributes, and skills relevant to the nominee’s qualifications to serve as a Trustee, which led to the conclusion that the nominee should serve as a Trustee for each fund. |

As of June 30, 2020, the nominees, Trustees, and officers of the trust and the funds owned, in the aggregate, less than 1% of each fund’s outstanding shares.

During the period March 1, 2019 through June 30, 2020, no transactions were entered into by Trustees and the nominees as Trustee of the trust involving more than 1% of the voting common, non-voting common and equivalent stock, or preferred stock of FMR LLC.

Christine Marcks, a nominee for election as a Trustee, held various positions at Prudential Financial, Inc. and its subsidiaries (Prudential) from 2005 to 2017. In connection with her prior employment at Prudential, Ms. Marcks received as part of her annual compensation restricted stock and employee stock options. During the past five years, the number and aggregate value of shares of Prudential stock held by Ms. Marcks varied but at no time exceeded $4 million. Ms. Marcks disposed of the last of her Prudential stock on May 26, 2020. Prudential Financial, Inc. is the parent holding company of PGIM, Inc., sub-adviser to Strategic Advisers® Core Income Fund and Strategic Advisers® Income Opportunities Fund.

If elected, the Trustees will hold office without limit in time except that (a) any Trustee may resign; (b) any Trustee may be removed by written instrument, signed by at least two-thirds of the number of Trustees prior to such removal; (c) any Trustee who requests to be retired or who has become incapacitated by illness or injury may be retired by written instrument signed by a majority of the other Trustees; and (d) any Trustee may be removed at any special meeting of shareholders by a two-thirds vote of the outstanding voting securities of the trust. In case a vacancy shall for any reason exist, the remaining Trustees will fill such vacancy by appointing another Trustee, so long as, immediately after such appointment, at least two-thirds of the Trustees have been elected by shareholders. If, at any time, less than a majority of the Trustees holding office has been elected by the shareholders, the Trustees then in office will promptly call a shareholders’ meeting for the purpose of electing a Board of Trustees. Otherwise, there will normally be no meeting of shareholders for the purpose of electing Trustees. Advisory Board Members hold office without limit in time except that any Advisory Board Member may resign or may be removed by a vote of a majority of the Trustees at any regular meeting or any special meeting of the Trustees.

Appendix D sets forth the number of Board and Standing Committee meetings held during each fund’s last fiscal year and a list of each fund’s fiscal year end. Following the election, it is expected that the trust’s Board will include two interested Trustees and five Independent Trustees, and will meet at least four times a year at regularly scheduled meetings. For additional information about the committees of the funds’ Trustees, refer to the section entitled “Board Structure and Oversight Function and Standing Committees of the Trust’s Current Trustees.”

The dollar range of equity securities beneficially owned as of June 30, 2020 by each Trustee in each fund and in all funds in the aggregate within the same fund family overseen or to be overseen by the nominee is included in Appendix E.

Trustee compensation information for each fund covered by this proxy is included in Appendix F.

The Board of Trustees recommends that shareholders vote FOR Proposal 1.

7

TO CONVERT A FUNDAMENTAL INVESTMENT POLICY TO A NON-FUNDAMENTAL INVESTMENT POLICY

Strategic Advisers® Core Fund, Strategic Advisers® Core Income Fund, Strategic Advisers® Emerging Markets Fund, Strategic Advisers® Fidelity® International Fund, Strategic Advisers® Growth Fund, Strategic Advisers® Income Opportunities Fund, Strategic Advisers® International Fund, Strategic Advisers® Short Duration Fund, Strategic Advisers® Small-Mid Cap Fund, Strategic Advisers® Tax-Sensitive Short Duration Fund, Strategic Advisers® Value Fund

The investment policy for each fund set forth in Appendix G (Policy) is “fundamental,” meaning that it may only be changed by a vote of shareholders of the fund. Each such Policy sets forth the fund’s investment objective. The Board of Trustees recommends that shareholders approve the proposal to make each Policy non-fundamental.

Because each fund’s Policy can only be changed with shareholder approval, it can be difficult, expensive and time consuming for a fund to revise its Policy, if and when needed, such as when market conditions change. If approved, this change will allow the Board of Trustees to change each fund’s Policy without the delay and expense of a shareholder vote. If in the future the Board of Trustees approves a change to a fund’s Policy, shareholders would receive notice of such change and the fund’s prospectus would be updated accordingly. If this proposal is approved, shareholders will not have the right to vote on any future change to a fund’s Policy. Converting each Policy to non-fundamental would bring the funds in line with industry practice as well as with the practices of certain other Fidelity® funds and could potentially avoid entirely, or reduce, future proxy costs and provide greater flexibility for evolution over time. There is no present intention to change the way in which any fund is currently managed if the proposal is approved.

Conclusion. The Board of Trustees has concluded that the proposal will benefit each fund and its shareholders. The Trustees recommend voting FOR the proposal. If the conversion of the Policy from fundamental to non-fundamental is approved by a fund’s shareholders, the change will take effect in conjunction with the fund’s next annual prospectus revision. If Proposal 2 is not approved by a fund’s shareholders, the Policy will remain a fundamental policy for that fund.

8

PROPOSALS 3-7

TO APPROVE SUB-ADVISORY AND SUB-SUBADVISORY AGREEMENTS ON BEHALF OF CERTAIN FUNDS

As the funds’ investment adviser, Strategic Advisers is responsible for implementing each fund’s investment strategies and directing the investments of each fund. See “Management Contracts with Strategic Advisers” section for additional information regarding the services provided by Strategic Advisers to the funds. Pursuant to an exemptive order granted to the trust by the Securities and Exchange Commission (SEC) on November 28, 2006 (SEC Order), Strategic Advisers employs a so-called “manager of managers” structure to manage the funds by allocating some or all of the assets of each fund to one more sub-advisers who manage a portion of the fund’s assets pursuant to separate investment strategies reflected in sub-advisory agreements approved by the Trustees. Information regarding each fund’s currently approved sub-advisers and sub-subadvisers (if applicable), including their principal business address, the date of each sub-advisory and sub-subadvisory agreement, the date each agreement was last submitted to shareholders, and the date on which the agreement was last approved by the Trustees, is listed in Appendix H. Additional information regarding each of the existing sub-advisers is available in each fund’s prospectus and statement of additional information (SAI), which are available at www.fidelity.com. It is not possible to predict the extent to which Strategic Advisers may allocate assets of a fund to any particular sub-adviser and one or more sub-advisers may not be allocated any assets of a fund at any given time or from time to time.

The SEC Order allows the Trustees, subject to certain conditions, to appoint new unaffiliated sub-advisers and approve their respective sub-advisory agreements on behalf of the funds without requiring a shareholder vote. The conditions of the SEC Order require shareholder approval of any sub-advisory and sub-subadvisory agreements with affiliated sub-advisers and sub-subadvisers and in other instances when the conditions of the SEC Order cannot be satisfied. FMR UK, FMR H.K., and FMR Japan (Proposals 5-7) are indirect wholly owned subsidiaries of FMR LLC, the parent company of Strategic Advisers. In addition, certain other conditions within the SEC Order prevent its use with respect to FIA and FIA (UK) (Proposal 3) and Geode (Proposal 4). As such, shareholder approval is required in order for each of the agreements discussed below to take effect.

Conclusion. The Board of Trustees, including the Independent Trustees, has unanimously approved, and recommends that shareholders of each fund approve, each of the proposed sub-advisory and sub-subadvisory agreements in Proposals 3-7 below. The Board of Trustees believes that the approval of each sub-advisory and sub-subadvisory agreement is in the best interest of each fund’s shareholders because such approval will provide additional investment strategies should Strategic Advisers decide to allocate assets to any of the Proposed Sub-Advisers and Sub-Subadvisers, if needed, consistent with each fund’s investment objective.

If shareholders do not approve a proposal, the Board of Trustees and Strategic Advisers will evaluate other options for obtaining the desired investment strategies, which may include allocating assets to one or more existing sub-advisers and/or approving new sub-advisory agreements consistent with the terms of the SEC Order, if needed.

9

SUB-ADVISORY AGREEMENTS WITH FIA AND SUB-SUBADVISORY AGREEMENTS BETWEEN FIA AND FIA (UK)

Strategic Advisers® Fidelity® U.S. Total Stock Fund and Strategic Advisers® Small-Mid Cap Fund

The primary purpose of Proposal 3 is to facilitate approval by shareholders of sub-advisory agreements with FIA and sub-subadvisory agreements between FIA and FIA (UK) on behalf of both of the above-mentioned funds, which will provide Strategic Advisers with additional investment strategies to allocate a portion of a fund’s assets to FIA and for FIA (UK) to provide investment management and/or advice to FIA, if needed (the “Proposed Agreements”). The approval of the Proposed Agreements will not result in any changes to the portfolio management team at Strategic Advisers currently responsible for allocating assets of each fund among various sub-advisers and/or underlying mutual funds or each fund’s investment objective and principal investment strategies. If Strategic Advisers were to allocate assets to FIA pursuant to the Proposed Agreements, FIA would exercise investment management authority with respect to the portion of fund assets allocated to FIA and, if needed, FIA (UK) would provide investment management and/or advice to FIA in accordance with such fund’s investment objective, policies and limitations, as disclosed in each fund’s prospectus and SAI, subject to supervision of Strategic Advisers and oversight by the Trustees. Additional information regarding the investment strategy to be utilized by FIA under each of the proposals is provided in the table below.

| Proposal | Strategy | Description | ||

| 3. | Small Cap America | A bottom-up, high conviction approach to investing in high quality small and mid-cap opportunities primarily in the U.S. with a long-term investment horizon. |

If the Proposed Agreements are approved, Strategic Advisers initially does not intend to allocate assets to FIA but may do so in the future. Therefore, total annual operating expenses will not initially change as a result of the approval of each Proposed Agreement. However, to illustrate the potential impact of approving each Proposed Agreement, the tables in Appendix I compare current expenses to possible future expenses using a hypothetical maximum allocation under each Proposed Agreement. Based on the hypothetical maximum allocations to the proposed mandate, and further assuming that assets were shifted from the lowest-priced comparable manager, Strategic Advisers estimates that total annual operating expenses for Strategic Advisers® Fidelity® U.S. Total Stock Fund and Strategic Advisers® Small-Mid Cap Fund may increase by 0.02% and 0.03% respectively, as outlined in Appendix I.

You are being asked to vote separately on Proposal 3, solely with respect to the fund(s) that you own.

Activities and Management of FIA and FIA (UK)

FIL Limited, a Bermuda company formed in 1968, is a privately owned investment management company and the ultimate parent company of FIA and FIA (UK). Various trusts for the benefit of the Johnson family, including Abigail P. Johnson, own, directly or indirectly, more than 25% of the voting common stock of FIL Limited. At present, the primary business activities of FIL Limited and its subsidiaries are the provision of investment advisory and related services to non-U.S. Companies and private accounts investing in securities throughout the world.

FIA provides research and investment recommendations with respect to companies based outside of the United States for certain funds for which affiliates of Strategic Advisers act as investment adviser. They may also provide investment advisory services. FIA focuses primarily on companies based in Hong Kong, Australia, New Zealand, and Southeast Asia (other than Japan). FIA (UK) focuses primarily on companies based in the U.K. and Europe.

The Directors of FIA are Paras Anand, Matthew Heath, Allan Pelvang, Neal Turchairo and Deborah Speight as Alternate Director to Messrs. Pelvang and Turchiaro. The principal executive officers of FIA are Rohit Mangla, Chief Compliance Officer; Elizabeth Hickmott, Assistant Secretary; Liana Pui Man Chenug, SFC Emergency Contact Person and Compliant Officer; Michael Ng, SFC Emergency Contact Person and Compliant Officer; and Rosalie Powell, Company Secretary. The principal business address of each of the Directors and officers is Pembroke Hall, 42 Crow Lane, Pembroke HM 19, Bermuda.

The Directors of FIA (UK) are Maria Abbonizio, Victoria Kelly, Andrew McCaffery, and Dominic Rossi. FIL Administration Ltd. serves as the Company Secretary. The principal business address of each of the Directors and officers is Oakhill House, 130 Tonbridge Road, Hildenborough, TN11 9DZ, United Kingdom.

Material Terms of Proposed Agreements

The terms of the Proposed Agreements with FIA for each fund in Proposal 3 are identical to each other. The terms of each Proposed Agreement in Proposal 3 between FIA and FIA (UK) are identical to each other. The following summary of material terms of the Proposed Agreements with FIA and between FIA and FIA (UK) is qualified in its entirety by reference to the forms of the Proposed Agreements attached in Exhibit 1.

Sub-Advisory Services. Pursuant to the Proposed Agreements with FIA, if Strategic Advisers were to allocate all or a portion of a fund’s assets to FIA, FIA would provide a program of continuous investment management for the portion of each fund’s assets allocated to it in accordance with that fund’s investment objective and policies as stated in the fund’s Registration Statement, and such

10

other limitations as the trust, each fund, the Trustees, or Strategic Advisers may impose. FIA would also vote each fund’s proxies in accordance with the sub-adviser’s proxy voting policies as approved by the Board. FIA’s investment authority includes authority to invest and reinvest the assets of each fund allocated to it by selecting the securities, instruments, repurchase agreements, financial futures contracts, options and other investments and techniques that the Fund may purchase, sell, enter into or use.

Pursuant to the Proposed Agreements between FIA and FIA (UK), FIA may request that FIA (UK) provide non-discretionary investment advice to FIA with respect to all or a portion of each fund’s assets allocated to FIA pursuant to the Proposed Agreements between Strategic Advisers and FIA. Such advice may include factual information, research reports and investment recommendations, as requested by FIA. If requested by FIA, FIA (UK) may also provide discretionary investment management services with respect to all or a portion of the assets allocated to FIA in accordance with the investment objective, policies and limitations stated in each fund’s Registration Statement.

Sub-Advisory Fee Rates. Under the terms of the Proposed Agreements with FIA, for providing investment management services to the fund, Strategic Advisers will pay FIA sub-advisory fees based on the net assets of the portion of the fund managed by FIA. Strategic Advisers, and not the funds, will pay FIA out of its management fees, subject to the fee schedule below:

| Proposal: | Fee Schedule: | |

| 3. | Rate – Small Cap America | |

0.65% (65 basis points) of the first $100 million in assets 0.60% (60 basis points) on the next $100 million in assets | ||

| 0.50% (50 basis points) on any amount in excess of $200 million in assets | ||

| 3. | Rate – FIA (UK) | |

| FIA, not Strategic Advisers or the funds, will pay sub-subadvisory fees to FIA (UK) | ||

The assets of all registered investment companies managed by Strategic Advisers and sub-advised by FIA within the same investment strategy are aggregated for purposes of calculating the effective fee rate to be paid to FIA on behalf of each applicable fund.

Duration. If approved by shareholders, each Proposed Sub-Advisory and Sub-Subadvisory Agreement would take effect on or about the first day following shareholder approval and would continue in force for a term of two years, and from year to year thereafter, as long as its continuance was approved at least annually by (i) the vote, cast in person at a meeting called for the purpose, of a majority of the Independent Trustees and (ii) the vote of either a majority of the Trustees or the vote of a majority of the outstanding shares of the applicable fund.

The Proposed Agreements could be transferred to a successor of FIA without resulting in a termination and without shareholder approval, as long as the transfer would not constitute an assignment under applicable securities laws and regulations. The Proposed Sub-Advisory Agreements would be terminable on 60 days’ written notice by the trust or Strategic Advisers and on 90 days’ written notice by FIA. The Proposed Sub-Subadvisory Agreements would be terminable by Strategic Advisers, FIA, FIA (UK) or the Fund at any time on 60 days’ written notice. Each of the Proposed Agreements would terminate automatically in the event of its assignment.

Board Approval of Proposed Agreements with FIA and FIA (UK). The factors the Board considered in approving the Proposed Agreements are discussed in Appendix K.

Conclusion. The Board of Trustees has concluded that the proposal will benefit Strategic Advisers® Fidelity® U.S. Total Stock Fund and Strategic Advisers® Small-Mid Cap Fund and their shareholders. The Trustees recommend voting FOR the proposal.

11

SUB-ADVISORY AGREEMENT WITH GEODE

Strategic Advisers® Emerging Markets Fund

The primary purpose of Proposal 4 is to facilitate approval by shareholders of a sub-advisory agreement with Geode on behalf of Strategic Advisers® Emerging Markets Fund, which will provide additional investment strategies should Strategic Advisers determine to allocate a portion of the fund’s assets to Geode, if needed (the “Proposed Agreement”). The approval of the Proposed Agreement will not result in any changes to the portfolio management team at Strategic Advisers currently responsible for allocating assets of the fund among various sub-advisers and/or underlying mutual funds or the fund’s investment objective and principal investment strategies. If Strategic Advisers were to allocate assets to Geode pursuant to the Proposed Agreement, Geode would exercise investment management authority with respect to the portion of fund assets allocated to Geode in accordance with the fund’s investment objective, policies and limitations, as disclosed in the fund’s prospectus and SAI, subject to supervision of Strategic Advisers and oversight by the Trustees. Additional information regarding the investment strategy to be utilized by Geode under the proposal is provided in the table below.

| Proposal | Strategy | Description | ||

| 4. | Enhanced Emerging Markets Small Cap | The Enhanced Emerging Markets Small Cap strategy seeks to outperform the MSCI Emerging Markets Small-Cap Index by, in general, quantitatively evaluating factors such as historical valuation, growth, profitability, and other factors. |

If the Proposed Agreement is approved, Strategic Advisers initially does not intend to allocate assets to Geode but may do so in the future. Therefore, total annual operating expenses will not initially change as a result of the approval of the Proposed Agreement. However, to illustrate the potential impact of approving the Proposed Agreement, the table in Appendix I compares current expenses to possible future expenses using a hypothetical maximum allocation under the Proposed Agreement. Based on the hypothetical maximum allocations to the proposed mandate, and further assuming that assets were shifted from the lowest-priced comparable manager, Strategic Advisers estimates that total annual operating expenses for the fund may increase by 0.03%, as outlined in Appendix I.

Activities and Management of Geode

Geode, a registered investment adviser, is a subsidiary of Geode Capital Holdings LLC. Geode and Geode Capital Holdings LLC have principal offices at 100 Summer Street, 12th Floor, Boston MA, 02110. Geode was founded in January 2001 to develop and manage quantitative investment strategies and to provide advisory and sub-advisory services. Additional information regarding other registered investment companies for which Geode serves as sub-adviser with similar investment objectives as the investment strategy Geode would utilize on behalf of the fund in Proposal 4 is included in Appendix J.

The Directors of Geode are Philip L. Bullen, Michael Even, Caleb Loring, III, Franklin Corning Kenly, Arlene Rockefeller, Eric Roiter, Thomas Sprague, and Jennifer Uhrig. The principal executive officers of Geode are Vincent C. Gubitosi, President & Chief Investment Officer; Jeffrey S. Miller, Chief Operating Officer; Joseph Ciardi, Chief Compliance Officer; Sorin Codreanu, Chief Financial Officer and Treasurer; and Matt Nevins, General Counsel and Secretary. The principal business address of each of the Directors of Geode is 100 Summer Street, 12th Floor, Boston MA, 02110.

Shares of Geode Capital Holdings LLC are owned primarily by officers and senior employees of Fidelity and members of their families through partnerships and trusts for their benefit. Edward C. Johnson 3d, Abigail P. Johnson and members of their families indirectly own a majority of the shares through an irrevocable voting trust for their benefit administered by a trustee who is not an interested person of Fidelity or the Johnson family.

Material Terms of Proposed Agreements

The following summary of material terms of the Proposed Agreement is qualified in its entirety by reference to the form of the Proposed Agreement attached in Exhibit 2.