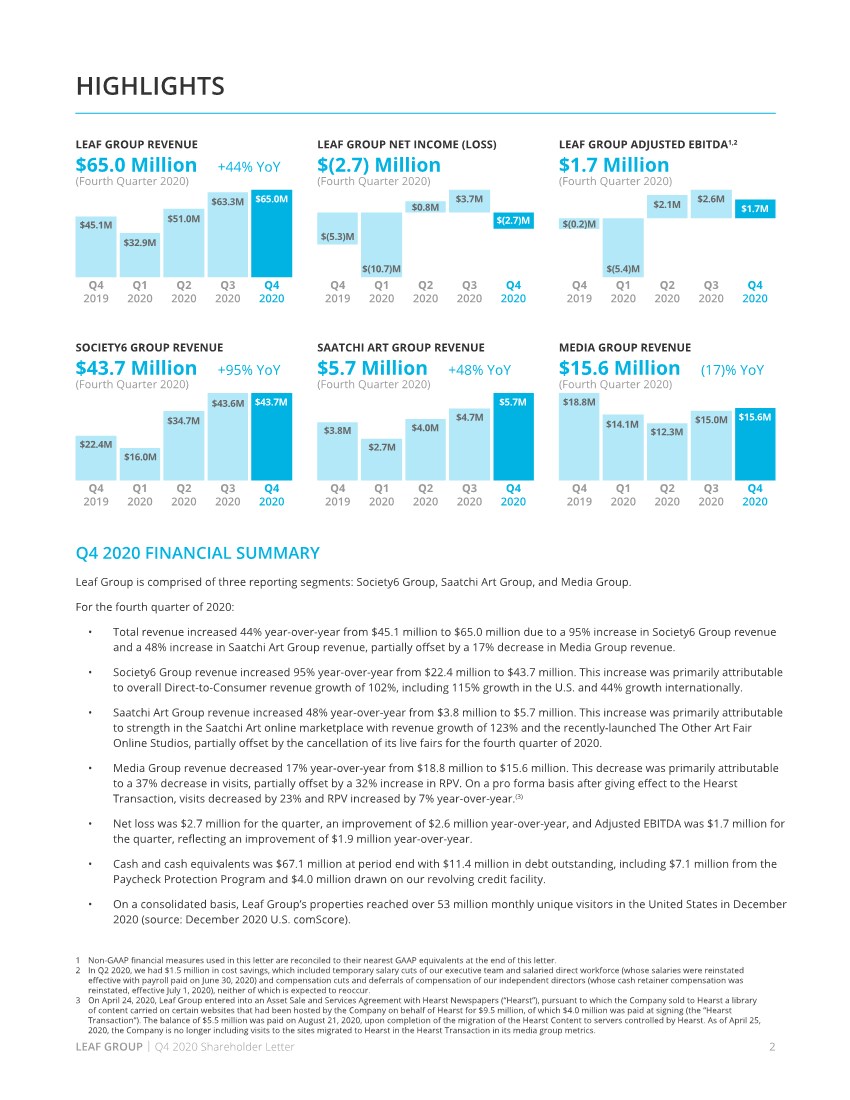

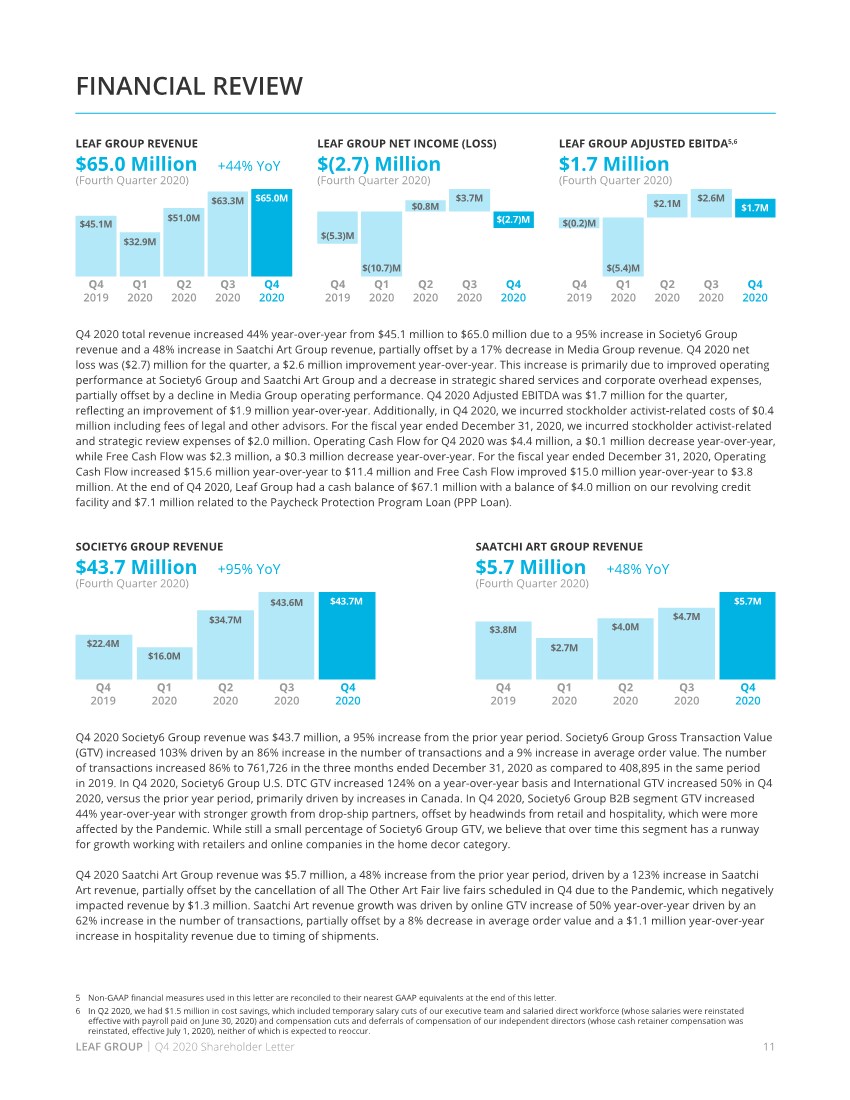

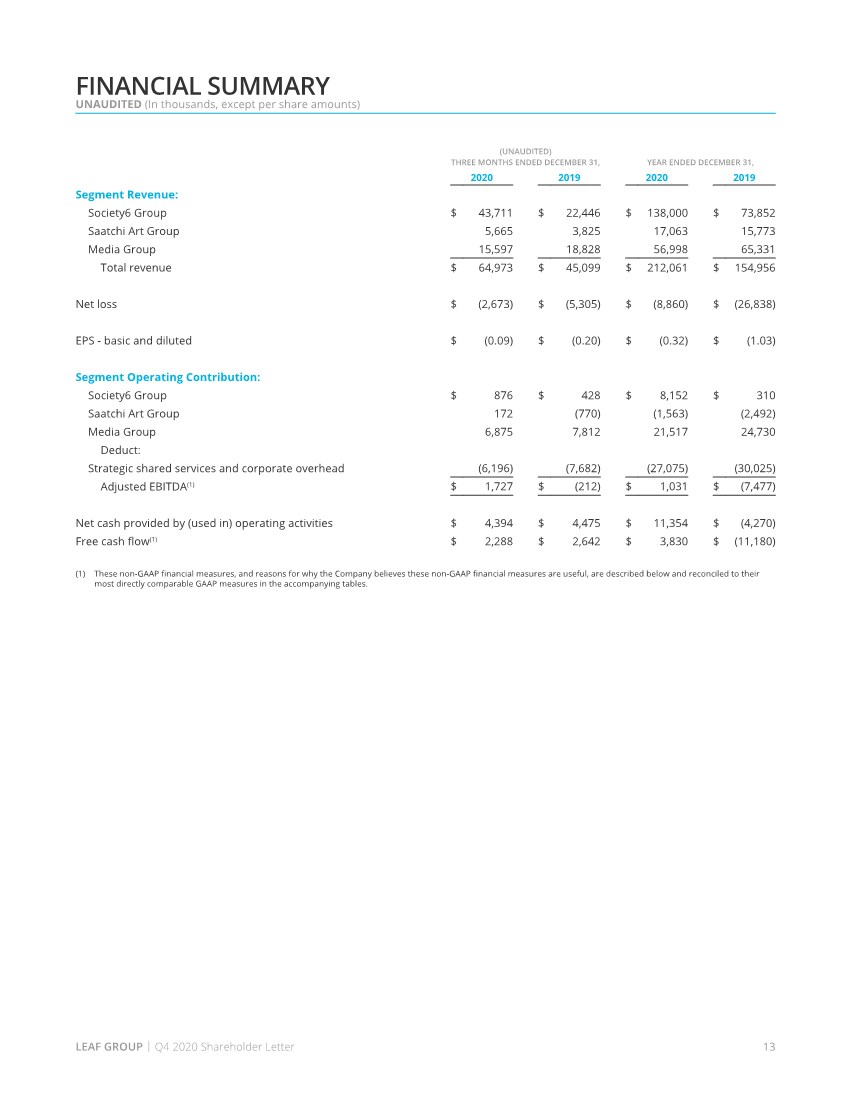

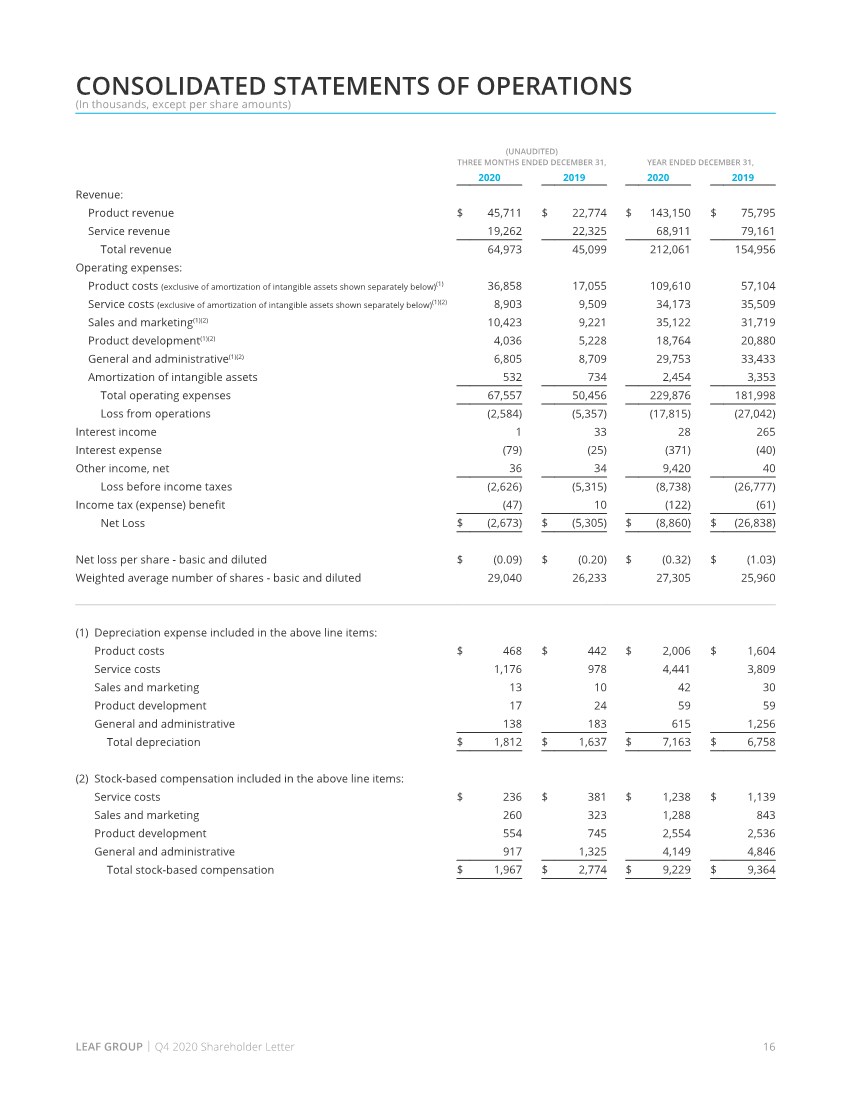

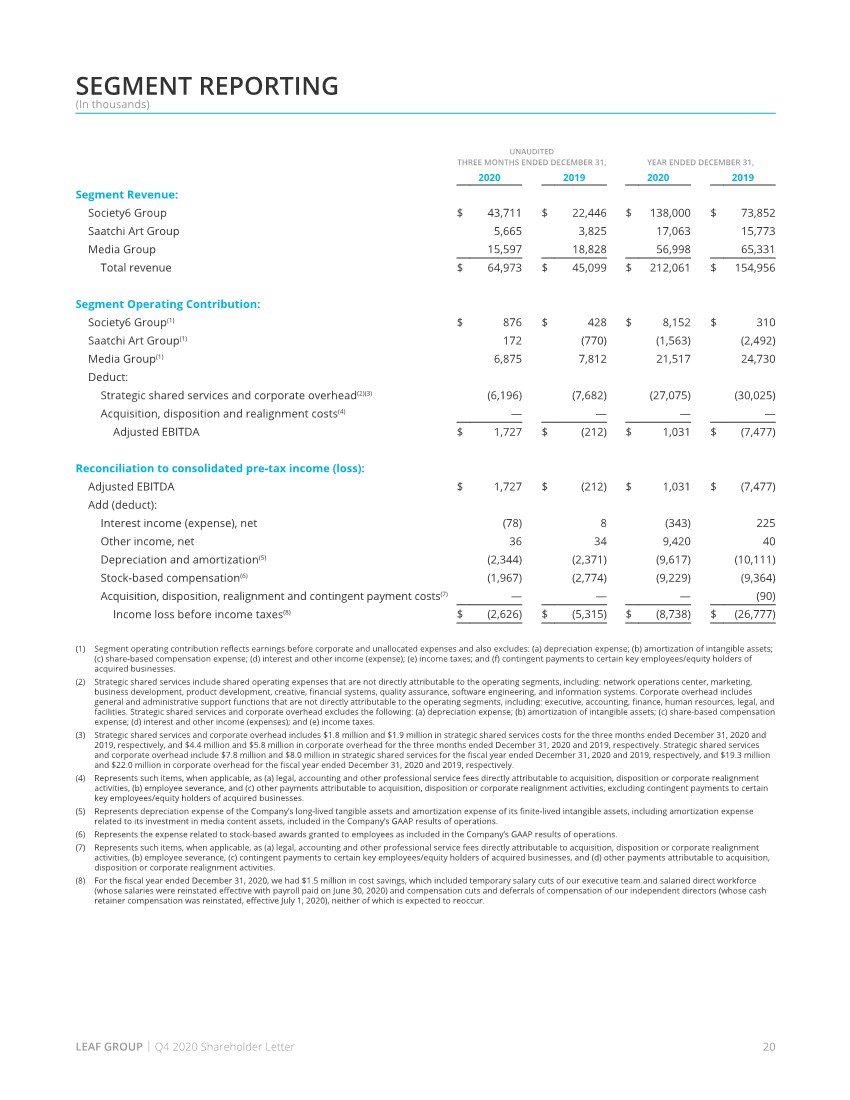

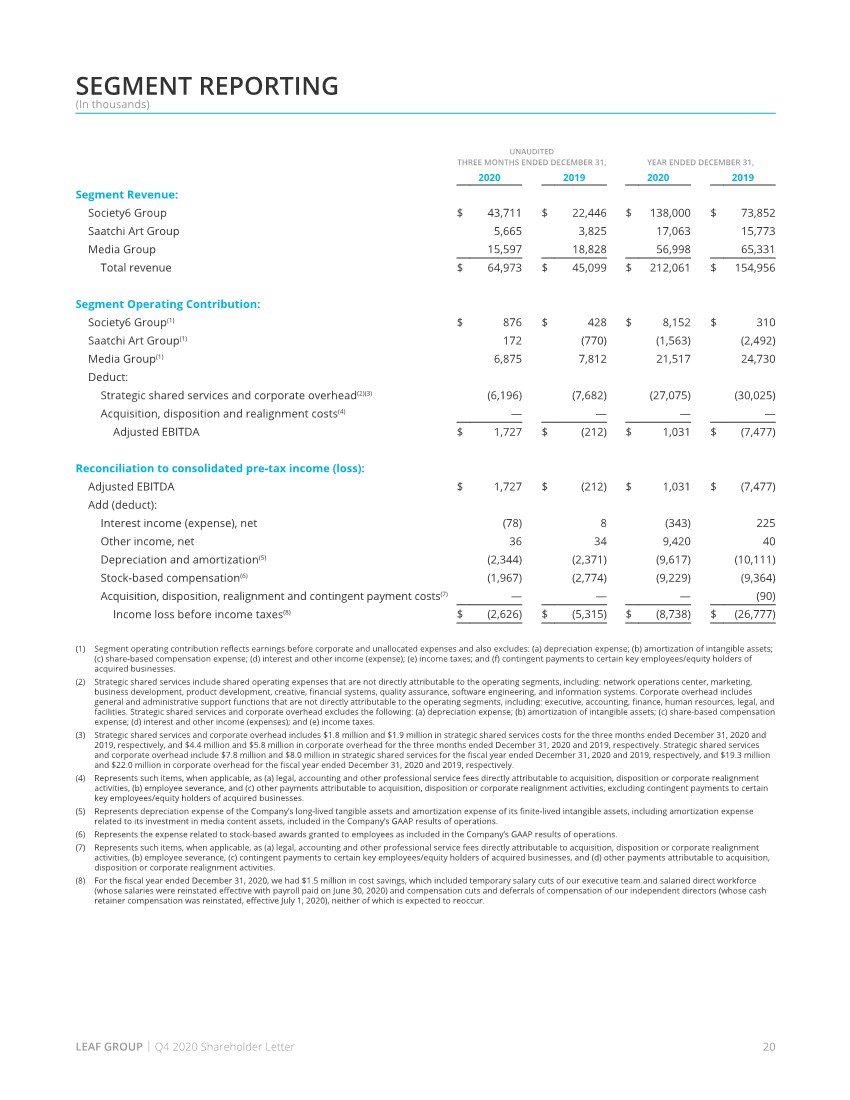

| 20 LEAF GROUP | Q4 2020 Shareholder Letter (1) Segment operating contribution reflects earnings before corporate and unallocated expenses and also excludes: (a) depreciation expense; (b) amortization of intangible assets; (c) share-based compensation expense; (d) interest and other income (expense); (e) income taxes; and (f) contingent payments to certain key employees/equity holders of acquired businesses. (2) Strategic shared services include shared operating expenses that are not directly attributable to the operating segments, including: network operations center, marketing, business development, product development, creative, financial systems, quality assurance, software engineering, and information systems. Corporate overhead includes general and administrative support functions that are not directly attributable to the operating segments, including: executive, accounting, finance, human resources, legal, and facilities. Strategic shared services and corporate overhead excludes the following: (a) depreciation expense; (b) amortization of intangible assets; (c) share-based compensation expense; (d) interest and other income (expenses); and (e) income taxes. (3) Strategic shared services and corporate overhead includes $1.8 million and $1.9 million in strategic shared services costs for the three months ended December 31, 2020 and 2019, respectively, and $4.4 million and $5.8 million in corporate overhead for the three months ended December 31, 2020 and 2019, respectively. Strategic shared services and corporate overhead include $7.8 million and $8.0 million in strategic shared services for the fiscal year ended December 31, 2020 and 2019, respectively, and $19.3 million and $22.0 million in corporate overhead for the fiscal year ended December 31, 2020 and 2019, respectively. (4) Represents such items, when applicable, as (a) legal, accounting and other professional service fees directly attributable to acquisition, disposition or corporate realignment activities, (b) employee severance, and (c) other payments attributable to acquisition, disposition or corporate realignment activities, excluding contingent payments to certain key employees/equity holders of acquired businesses. (5) Represents depreciation expense of the Company’s long-lived tangible assets and amortization expense of its finite-lived intangible assets, including amortization expense related to its investment in media content assets, included in the Company’s GAAP results of operations. (6) Represents the expense related to stock-based awards granted to employees as included in the Company’s GAAP results of operations. (7) Represents such items, when applicable, as (a) legal, accounting and other professional service fees directly attributable to acquisition, disposition or corporate realignment activities, (b) employee severance, (c) contingent payments to certain key employees/equity holders of acquired businesses, and (d) other payments attributable to acquisition, disposition or corporate realignment activities. (8) For the fiscal year ended December 31, 2020, we had $1.5 million in cost savings, which included temporary salary cuts of our executive team and salaried direct workforce (whose salaries were reinstated effective with payroll paid on June 30, 2020) and compensation cuts and deferrals of compensation of our independent directors (whose cash retainer compensation was reinstated, effective July 1, 2020), neither of which is expected to reoccur. SEGMENT REPORTING (In thousands) UNAUDITED THREE MONTHS ENDED DECEMBER 31, YEAR ENDED DECEMBER 31, 2020 2019 2020 2019 Segment Revenue: Society6 Group $ 43,711 $ 22,446 $ 138,000 $ 73,852 Saatchi Art Group 5,665 3,825 17,063 15,773 Media Group 15,597 18,828 56,998 65,331 Total revenue $ 64,973 $ 45,099 $ 212,061 $ 154,956 Segment Operating Contribution: Society6 Group(1) $ 876 $ 428 $ 8,152 $ 310 Saatchi Art Group(1) 172 (770) (1,563) (2,492) Media Group(1) 6,875 7,812 21,517 24,730 Deduct: Strategic shared services and corporate overhead(2)(3) (6,196) (7,682) (27,075) (30,025) Acquisition, disposition and realignment costs(4) — — — — Adjusted EBITDA $ 1,727 $ (212) $ 1,031 $ (7,477) Reconciliation to consolidated pre-tax income (loss): Adjusted EBITDA $ 1,727 $ (212) $ 1,031 $ (7,477) Add (deduct): Interest income (expense), net (78) 8 (343) 225 Other income, net 36 34 9,420 40 Depreciation and amortization(5) (2,344) (2,371) (9,617) (10,111) Stock-based compensation(6) (1,967) (2,774) (9,229) (9,364) Acquisition, disposition, realignment and contingent payment costs(7) — — — (90) Income loss before income taxes(8) $ (2,626) $ (5,315) $ (8,738) $ (26,777) |