Earnings webcast �and conference call Third Quarter 2022 Nov 1, 2022 Exhibit 99.2

Brad Windbigler Head of Treasury and Investor Relations

Safe Harbor This presentation contains certain statements that are forward-looking within the meaning of the Private Securities Litigation Reform Act of 1995. These statements are not guarantees of future performance and involve certain risks, uncertainties, and assumptions that are difficult to predict. Actual outcomes and results may differ materially from those expressed in, or implied by, our forward-looking statements. Words such as "expects," "intends," "targets," "anticipates," "believes," "estimates," "guides," "provides guidance," "provides outlook," “projects,” “designed to,” and other similar expressions or future or conditional verbs such as "may," "will," "should," "would," "could," and "might" are intended to identify such forward-looking statements. Readers of this press release of The Western Union Company should not rely solely on the forward-looking statements and should consider all uncertainties and risks discussed in the Risk Factors section and throughout the Annual Report on Form 10-K for the year ended December 31, 2021. The statements are only as of the date they are made, and the Company undertakes no obligation to update any forward-looking statement. Possible events or factors that could cause results or performance to differ materially from those expressed in our forward-looking statements include the following: (i) events related to our business and industry, such as: changes in general economic conditions and economic conditions in the regions and industries in which we operate, including global economic downturns and trade disruptions, or significantly slower growth or declines in the money transfer, payment service, and other markets in which we operate, including downturns or declines related to interruptions in migration patterns or other events, such as public health emergencies, epidemics, or pandemics, such as COVID-19, civil unrest, war, terrorism, natural disasters, or non-performance by our banks, lenders, insurers, or other financial services providers; failure to compete effectively in the money transfer and payment service industry, including among other things, with respect to price or customer experience, with global and niche or corridor money transfer providers, banks and other money transfer and payment service providers, including digital, mobile and internet-based services, card associations, and card-based payment providers, and with digital currencies and related exchanges and protocols, and other innovations in technology and business models; geopolitical tensions, political conditions and related actions, including trade restrictions and government sanctions, which may adversely affect our business and economic conditions as a whole, including interruptions of United States or other government relations with countries in which we have or are implementing significant business relationships with agents, clients, or other partners; deterioration in customer confidence in our business, or in money transfer and payment service providers generally; failure to maintain our agent network and business relationships under terms consistent with or more advantageous to us than those currently in place; our ability to adopt new technology and develop and gain market acceptance of new and enhanced services in response to changing industry and consumer needs or trends; mergers, acquisitions, and the integration of acquired businesses and technologies into our Company, divestitures, and the failure to realize anticipated financial benefits from these transactions, and events requiring us to write down our goodwill; decisions to change our business mix; changes in, and failure to manage effectively, exposure to foreign exchange rates, including the impact of the regulation of foreign exchange spreads on money transfers and payment transactions; changes in tax laws, or their interpretation, any subsequent regulation, and potential related state income tax impacts, and unfavorable resolution of tax contingencies; any material breach of security, including cybersecurity, or safeguards of or interruptions in any of our systems or those of our vendors or other third parties; cessation of or defects in various services provided to us by third-party vendors; our ability to realize the anticipated benefits from restructuring-related initiatives, which may include decisions to downsize or to transition operating activities from one location to another, and to minimize any disruptions in our workforce that may result from those initiatives; failure to manage credit and fraud risks presented by our agents, clients, and consumers; adverse rating actions by credit rating agencies; our ability to protect our trademarks, patents, copyrights, and other intellectual property rights, and to defend ourselves against potential intellectual property infringement claims; our ability to attract and retain qualified key employees and to manage our workforce successfully; material changes in the market value or liquidity of securities that we hold; restrictions imposed by our debt obligations; (ii) events related to our regulatory and litigation environment, such as: liabilities or loss of business resulting from a failure by us, our agents, or their subagents to comply with laws and regulations and regulatory or judicial interpretations thereof, including laws and regulations designed to protect consumers, or detect and prevent money laundering, terrorist financing, fraud, and other illicit activity; increased costs or loss of business due to regulatory initiatives and changes in laws, regulations and industry practices and standards, including changes in interpretations, in the United States and abroad, affecting us, our agents or their subagents, or the banks with which we or our agents maintain bank accounts needed to provide our services, including related to anti-money laundering regulations, anti-fraud measures, our licensing arrangements, customer due diligence, agent and subagent due diligence, registration and monitoring requirements, consumer protection requirements, remittances, and immigration; liabilities, increased costs or loss of business and unanticipated developments resulting from governmental investigations and consent agreements with or enforcement actions by regulators; liabilities resulting from litigation, including class-action lawsuits and similar matters, and regulatory enforcement actions, including costs, expenses, settlements, and judgments; failure to comply with regulations and evolving industry standards regarding consumer privacy, data use, the transfer of personal data between jurisdictions, and information security, including with respect to the General Data Protection Regulation in the European Union and the California Consumer Privacy Act; failure to comply with the Dodd-Frank Wall Street Reform and Consumer Protection Act, as well as regulations issued pursuant to it and the actions of the Consumer Financial Protection Bureau and similar legislation and regulations enacted by other governmental authorities in the United States and abroad related to consumer protection and derivative transactions; effects of unclaimed property laws or their interpretation or the enforcement thereof; failure to maintain sufficient amounts or types of regulatory capital or other restrictions on the use of our working capital to meet the changing requirements of our regulators worldwide; changes in accounting standards, rules and interpretations, or industry standards affecting our business; (iii) other events, such as catastrophic events; and management’s ability to identify and manage these and other risks. 3

Devin McGranahan Chief Executive officer

“Evolve 2025” Strategy Corridor and community customer acquisition Improved customer and agent omni-channel experiences Network optimization Digital first customer experiences Scalable marketing driven customer acquisition Retail to digital escalator Digital first customer experiences Remittance-led offering Expanded set of accessible products and services Best-in-class platforms Increased self-service for customers and agents Automated operational processes Retail as gateway to western Union Accelerate digital deliver accessible financial services Drive customer experience and operational excellence 5

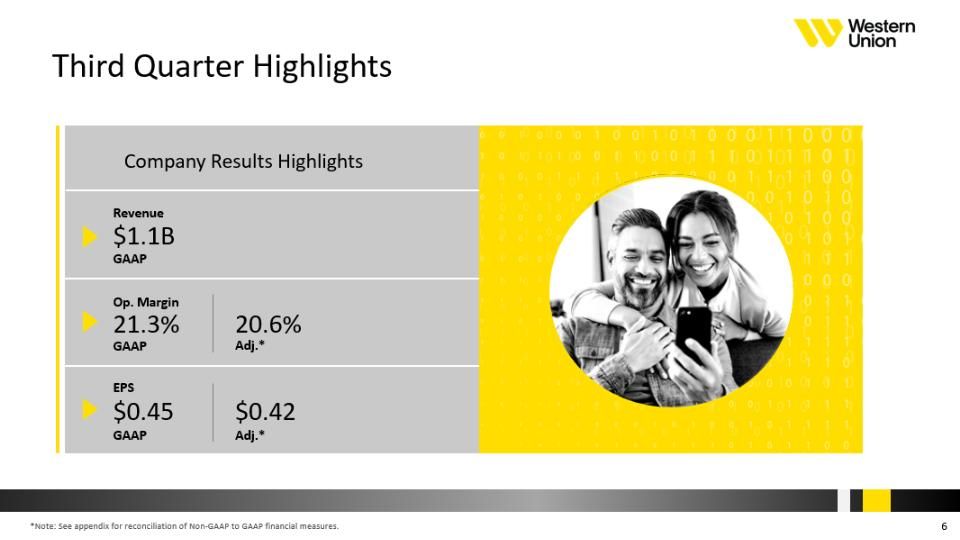

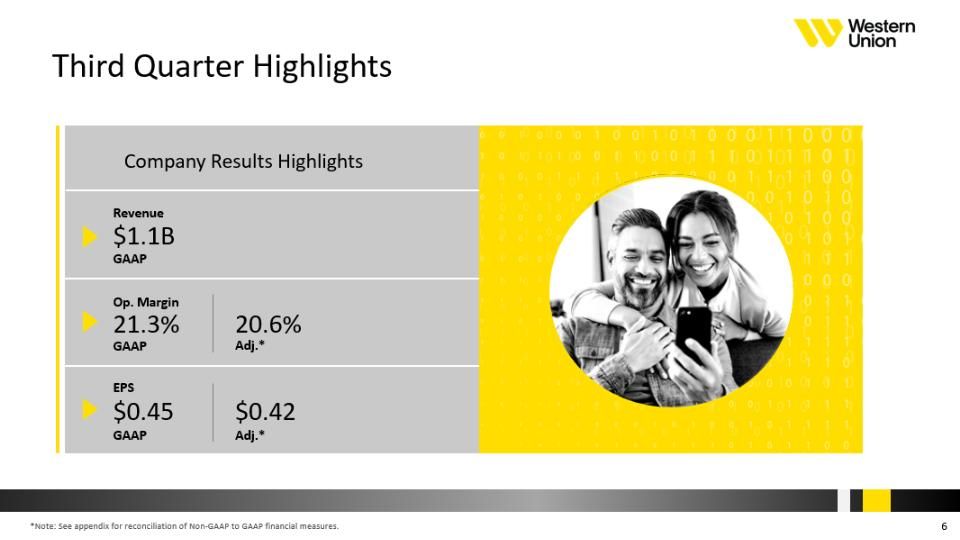

Third Quarter Highlights Company Results Highlights Revenue $1.1B GAAP Op. Margin 21.3% GAAP 20.6% Adj.* EPS $0.45 GAAP $0.42 Adj.* *Note: See appendix for reconciliation of Non-GAAP to GAAP financial measures. 6

Marketing Program to Improve Acquisition Acquisition offers optimized media spend rapid issue resolution diaspora level marketing 7

Ecosystem Strategy Senders save spend transfer receivers 8

Matt Cagwin Interim chief financial officer 9

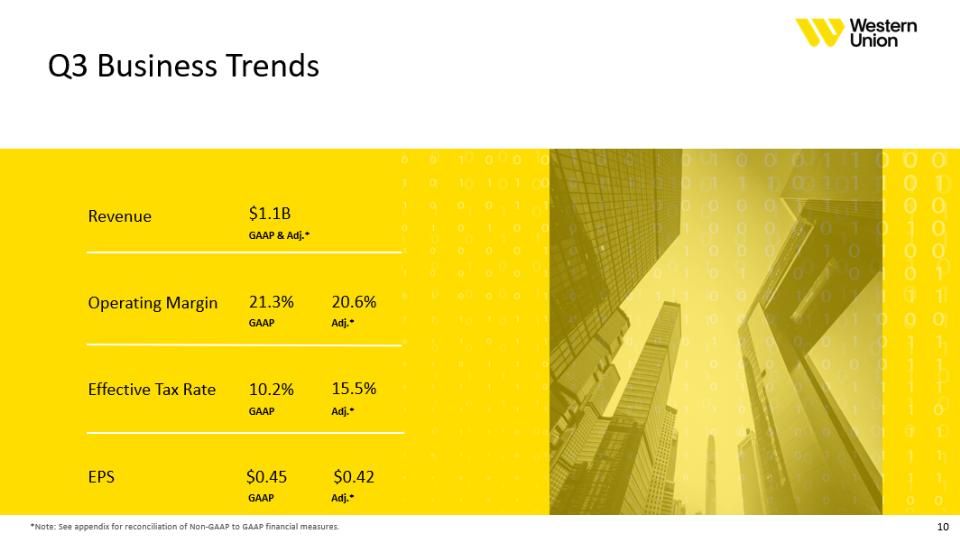

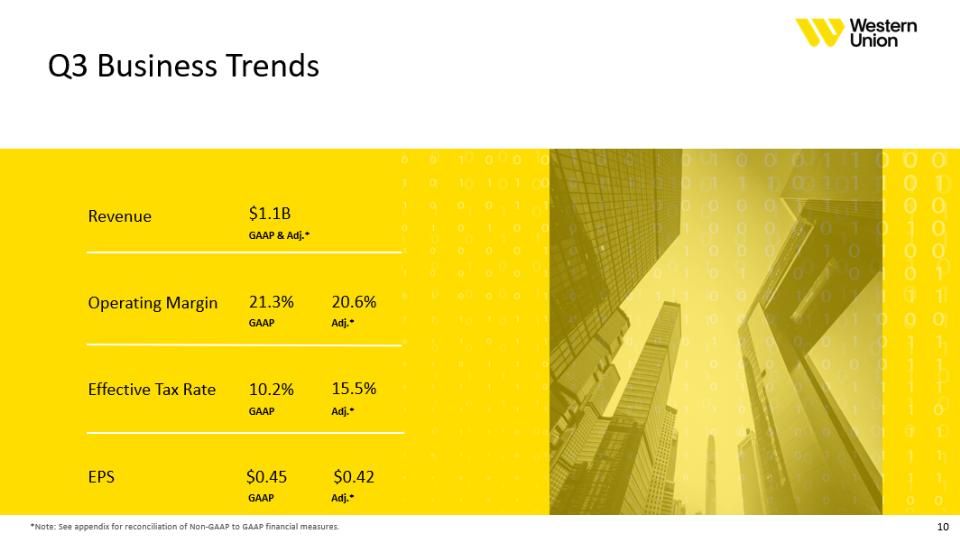

Q3 Business Trends Revenue Operating Margin Effective Tax Rate EPS $1.1B GAAP & Adj.* 21.3% 20.6% GAAP Adj.* $0.45 $0.42 GAAP Adj.* *Note: See appendix for reconciliation of Non-GAAP to GAAP financial measures. 10

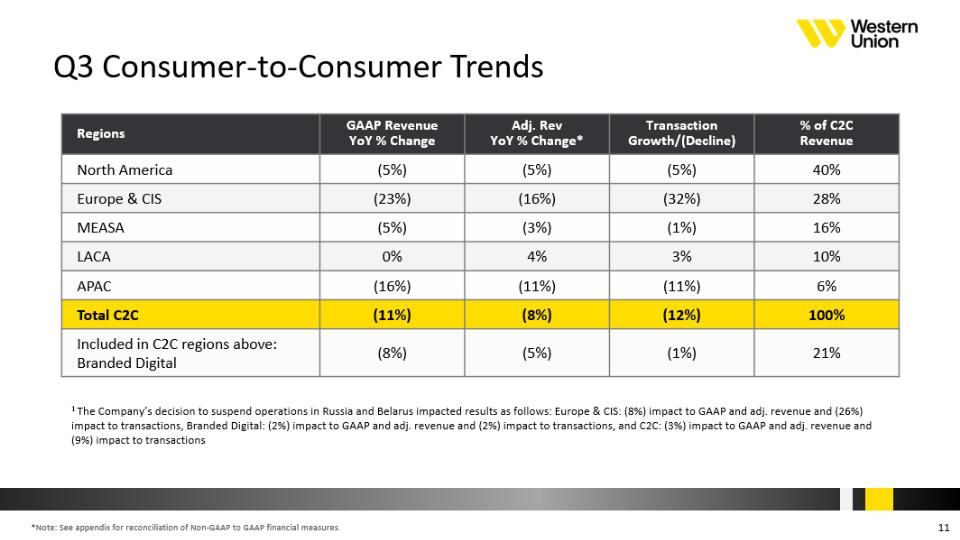

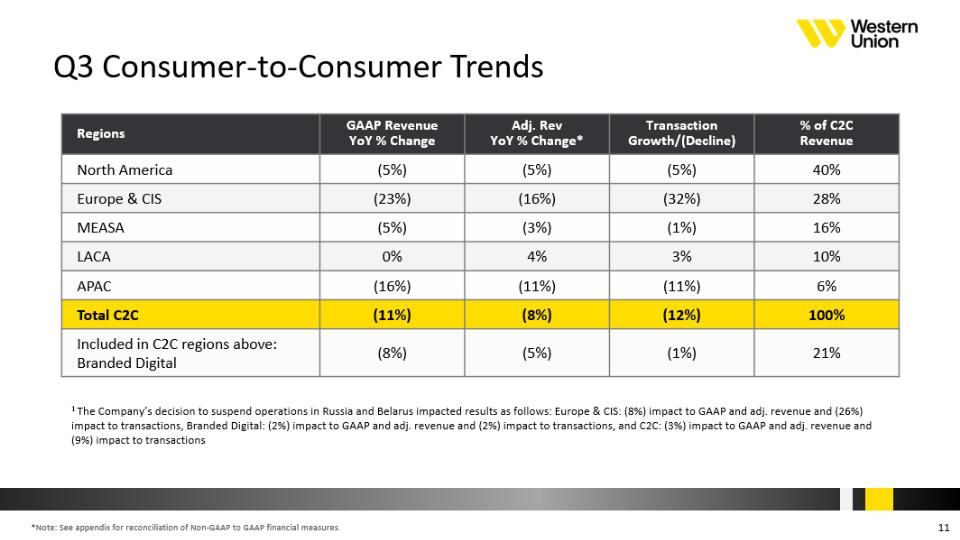

Regions GAAP Revenue YoY % Change Adj. Rev YoY % Change* Transaction Growth/(Decline) % of C2C Revenue North America (5%) (5%) (5%) 40% Europe & CIS (23%) (16%) (32%) 28% MEASA (5%) (3%) (1%) 16% LACA 0% 4% 3% 10% APAC (16%) (11%) (11%) 6% Total C2C (11%) (8%) (12%) 100% Included in C2C regions above: Branded Digital (8%) (5%) (1%) 21% 1 The Company’s decision to suspend operations in Russia and Belarus impacted results as follows: Europe & CIS: (8%) impact to GAAP and adj. revenue and (26%) impact to transactions, Branded Digital: (2%) impact to GAAP and adj. revenue and (2%) impact to transactions, and C2C: (3%) impact to GAAP and adj. revenue and (9%) impact to transactions *Note: See appendix for reconciliation of Non-GAAP to GAAP financial measures. 11

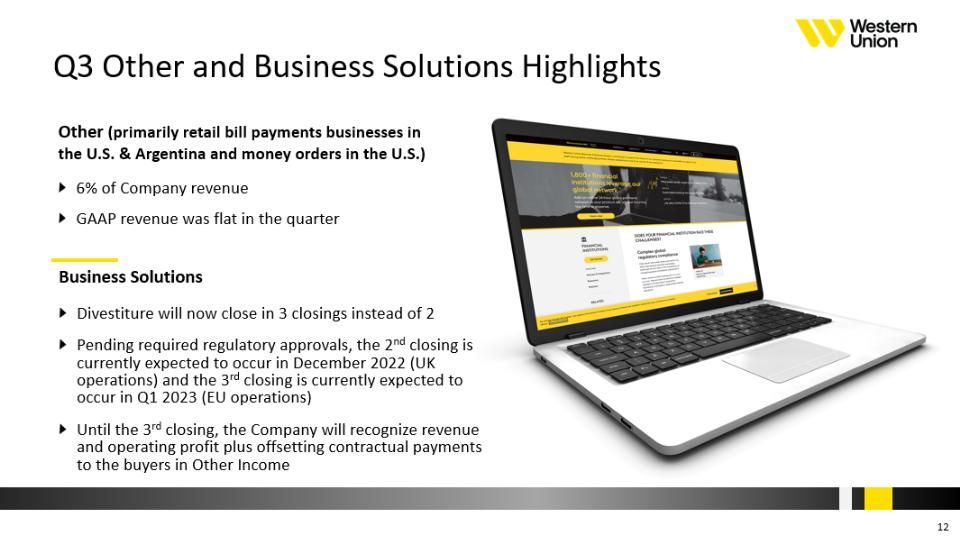

Q3 Other and Business Solutions Highlights Other (primarily retail bill payments businesses in the U.S. & Argentina and money orders in the U.S.) 6% of Company revenue GAAP revenue was flat in the quarter Business Solutions Divestiture will now close in 3 closings instead of 2 Pending required regulatory approvals, the 2nd closing is currently expected to occur in December 2022 (UK operations) and the 3rd closing is currently expected to occur in Q1 2023 (EU operations)Until the 3rd closing, the Company will recognize revenue and operating profit plus offsetting contractual payments to the buyers in Other Income 12

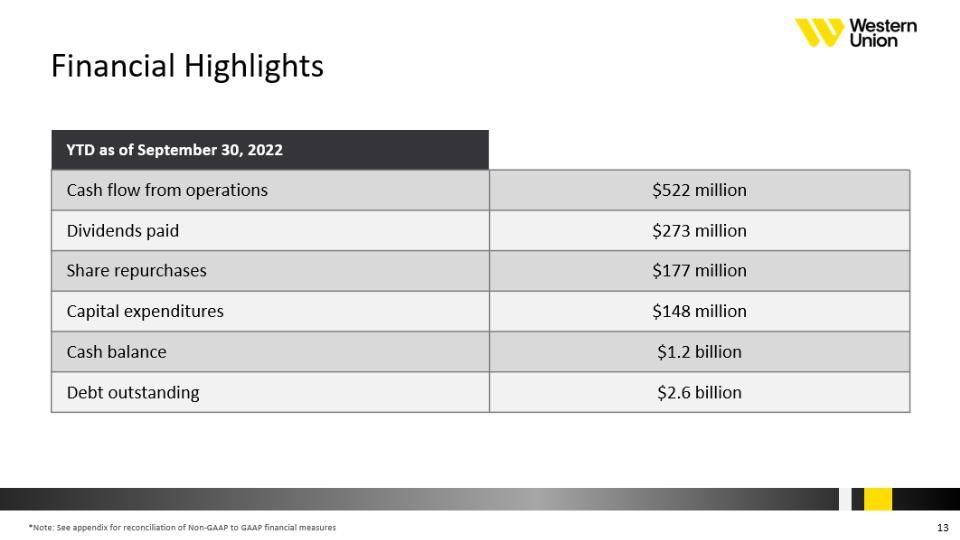

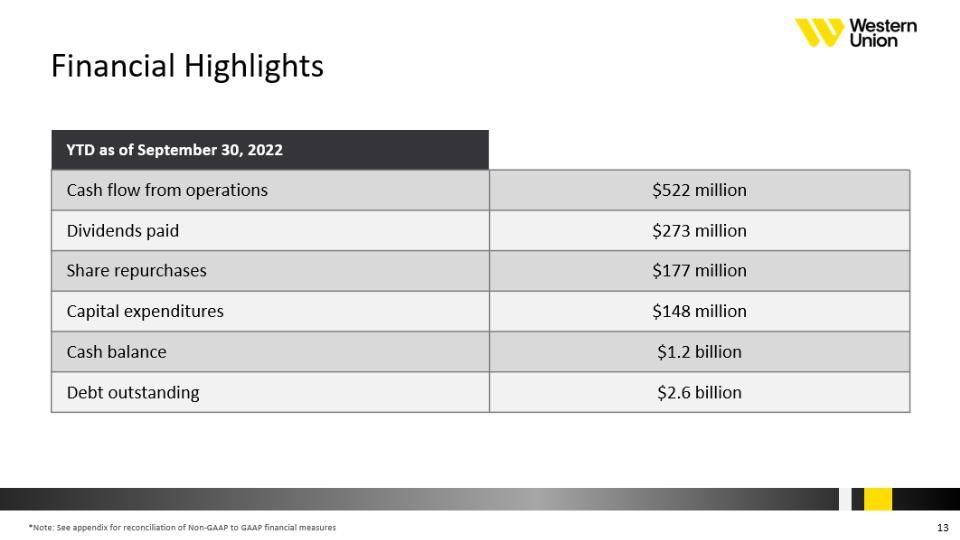

Financial Highlights YTD as of September 30, 2022 Cash flow from operations $522 million Dividends paid $273 million Share repurchases $177 million Capital expenditures $148 million Cash balance $1.2 billion Debt outstanding $2.6 billion *Note: See appendix for reconciliation of Non-GAAP to GAAP financial measures 13

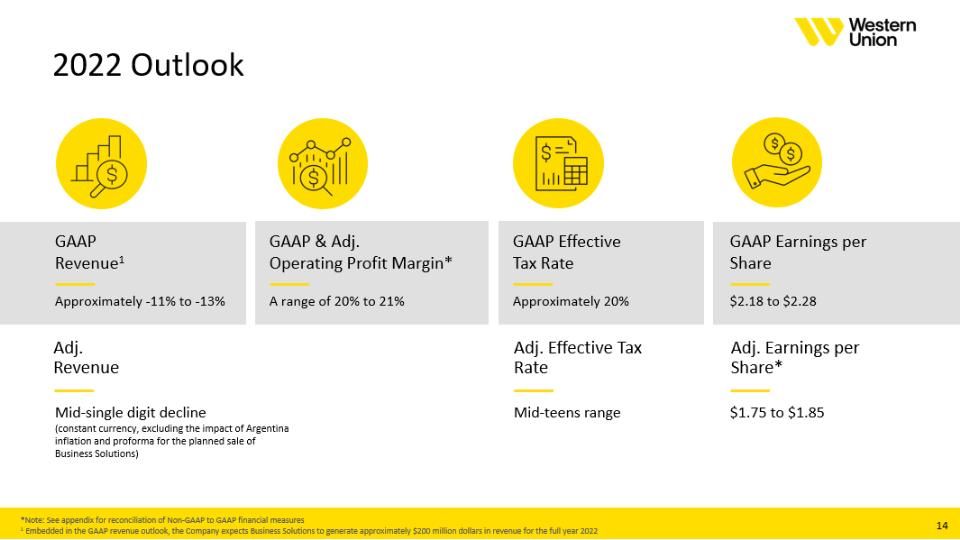

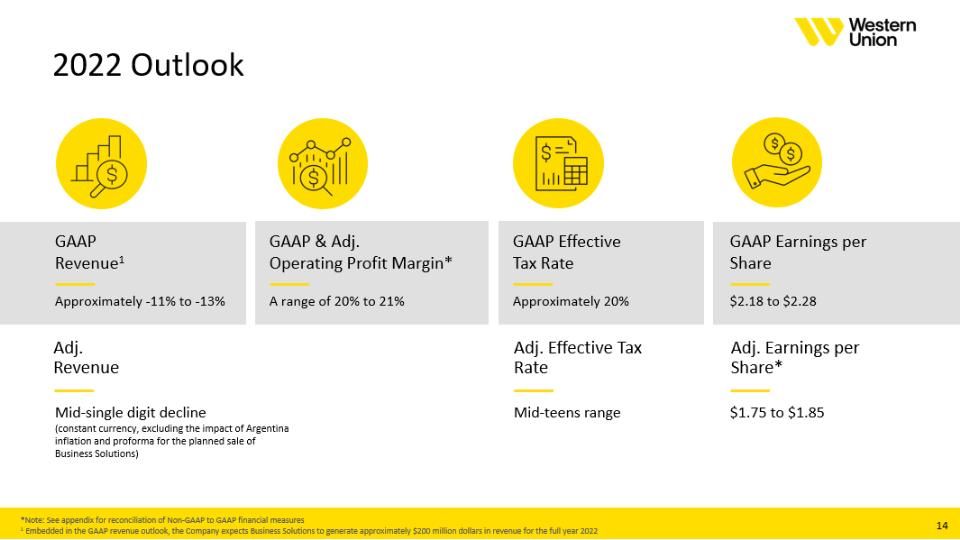

2022 Outlook GAAP Revenue1 Approximately -11% to -13% GAAP & Adj.Operating Profit Margin* GAAP Effective Tax Rate GAAP Earnings per Share A range of 20% to 21% Approximately 20% $2.18 to $2.28 Adj. Revenue Mid-single digit decline (constant currency, excluding the impact of Argentina inflation and proforma for the planned sale of Business Solutions) Adj. Effective Tax Rate Mid-teens range Adj. Earnings per Share* $1.75 to $1.85 *Note: See appendix for reconciliation of Non-GAAP to GAAP financial measures 1 Embedded in the GAAP revenue outlook, the Company expects Business Solutions to generate approximately $200 million dollars in revenue for the full year 2022 14

Questions & Answers 15

Appendix Third Quarter 2022 Earnings Webcast and Conference Call

Key Statistics and Reconciliation of Non-GAAP Measures Western Union presents a number of non-GAAP financial measures because management believes that these metrics provide meaningful supplemental information in addition to the GAAP metrics and provide comparability and consistency to prior periods. Constant currency results assume foreign revenues are translated from foreign currencies to the U.S. dollar, net of the effect of foreign currency hedges, at rates consistent with those in the prior year. We have also included non-GAAP measures below that remove certain impacts of Business Solutions, in order to provide a more meaningful comparison of results from continuing operations. A non-GAAP financial measure should not be considered in isolation or as a substitute for the most comparable GAAP financial measure. A non-GAAP financial measure reflects an additional way of viewing aspects of our operations that, when viewed with our GAAP results and the reconciliation to the corresponding GAAP financial measure, provide a more complete understanding of our business. Users of the financial statements are encouraged to review our financial statements and publicly-filed reports in their entirety and not to rely on any single financial measure. A reconciliation of non-GAAP financial measures to the most directly comparable GAAP financial measures is included below. Amounts included below are in millions, unless indicated otherwise. 17 Western Union

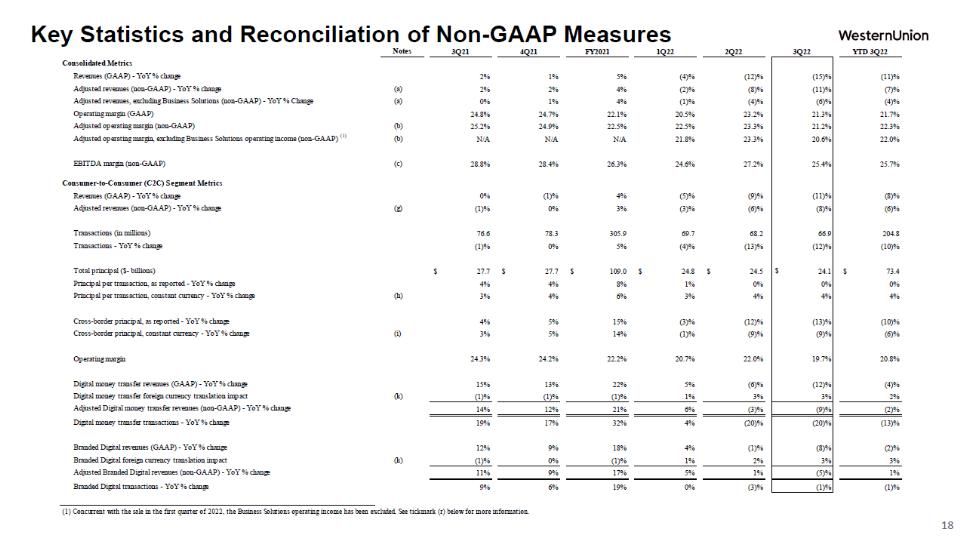

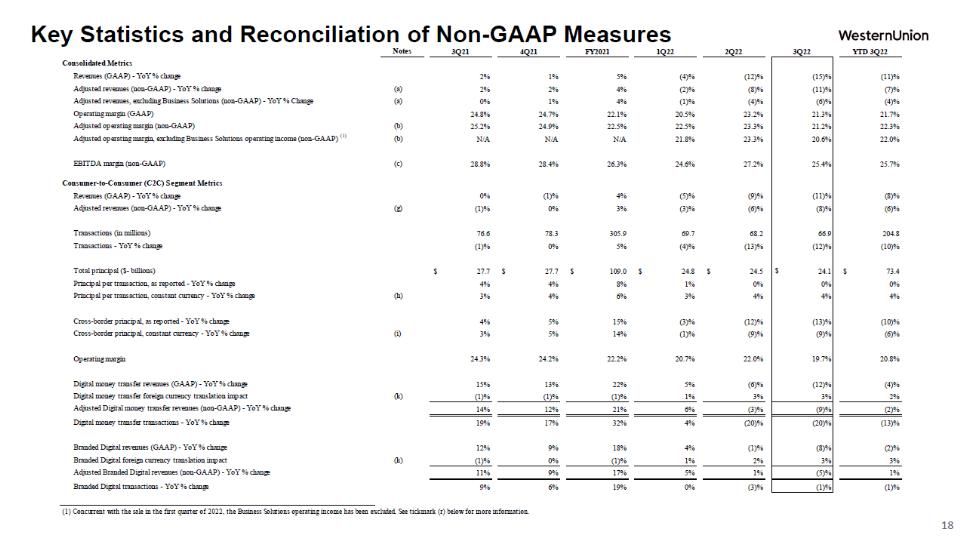

Key Statistics and Reconciliation of Non-GAAP Measures Notes* 3Q21 4Q21 FY2021 1Q22 2Q22 3Q22 YTD 3Q22 Consolidated Metrics Revenues (GAAP) - YoY % change 2% 1% 5% (4)% (12)% (15)% (11)% Adjusted revenues (non-GAAP) - YoY % change (a) 2% 2% 4% (2)% (8)% (11)% (7)% Adjusted revenues, excluding Business Solutions (non-GAAP) - YoY % Change (a) 0% 1% 4% (1)% (4)% (6)% (4)% Operating margin (GAAP) 24.8% 24.7% 22.1% 20.5% 23.2% 21.3% 21.7% Adjusted operating margin (non-GAAP) (b) 25.2% 24.9% 22.5% 22.5% 23.3% 21.2% 22.3% Adjusted operating margin, excluding Business Solutions operating income (non-GAAP) (1) (b) N/A N/A N/A 21.8% 23.3% 20.6% 22.0% EBITDA margin (non-GAAP) (c) 28.8% 28.4% 26.3% 24.6% 27.2% 25.4% 25.7% Consumer-to-Consumer (C2C) Segment Metrics Revenues (GAAP) - YoY % change 0% (1)% 4% (5)% (9)% (11)% (8)% Adjusted revenues (non-GAAP) - YoY % change (g) (1)% 0% 3% (3)% (6)% (8)% (6)% Transactions (in millions) 76.6 78.3 305.9 69.7 68.2 66.9 204.8 Transactions - YoY % change (1)% 0% 5% (4)% (13)% (12)% (10)% Total principal ($- billions) $ 27.7 $ 27.7 $ 109.0 $ 24.8 $ 24.5 $ 24.1 $ 73.4 Principal per transaction, as reported - YoY % change 4% 4% 8% 1% 0% 0% 0% Principal per transaction, constant currency - YoY % change (h) 3% 4% 6% 3% 4% 4% 4% Cross-border principal, as reported - YoY % change 4% 5% 15% (3)% (12)% (13)% (10)% Cross-border principal, constant currency - YoY % change (i) 3% 5% 14% (1)% (9)% (9)% (6)% Operating margin 24.3% 24.2% 22.2% 20.7% 22.0% 19.7% 20.8% Digital money transfer revenues (GAAP) - YoY % change (hh) 15% 13% 22% 5% (6)% (12)% (4)% Digital money transfer foreign currency translation impact (k) (1)% (1)% (1)% 1% 3% 3% 2% Adjusted Digital money transfer revenues (non-GAAP) - YoY % change (hh) 14% 12% 21% 6% (3)% (9)% (2)% Digital money transfer transactions - YoY % change 19% 17% 32% 4% (20)% (20)% (13)% Branded Digital revenues (GAAP) - YoY % change (gg) 12% 9% 18% 4% (1)% (8)% (2)% Branded Digital foreign currency translation impact (k) (1)% 0% (1)% 1% 2% 3% 3% Adjusted Branded Digital revenues (non-GAAP) - YoY % change (gg) 11% 9% 17% 5% 1% (5)% 1% Branded Digital transactions - YoY % change (gg) 9% 6% 19% 0% (3)% (1)% (1)% 18

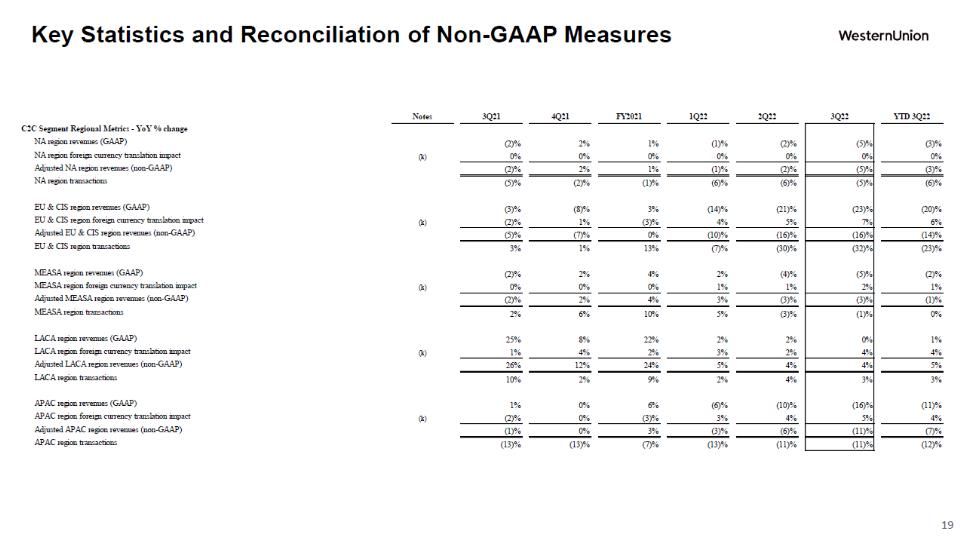

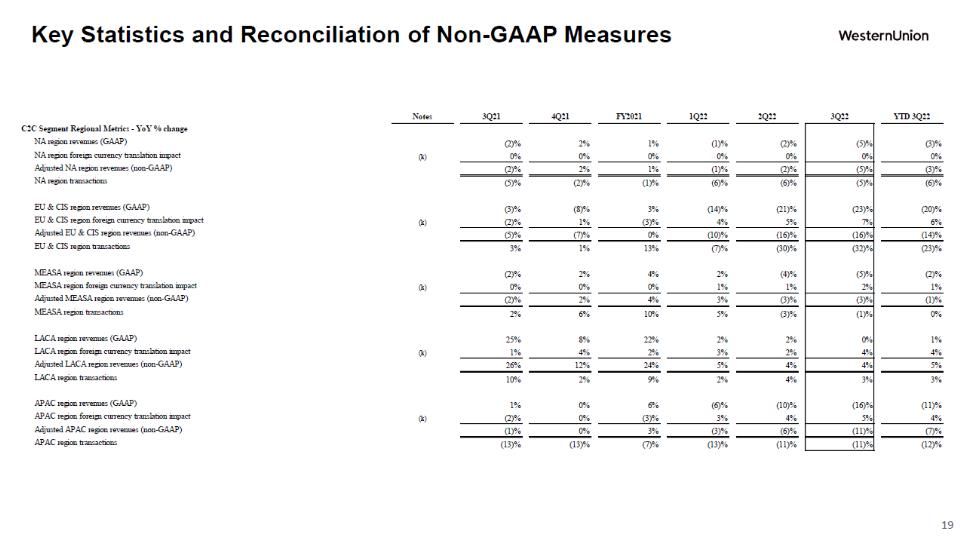

Key Statistics and Reconciliation of Non-GAAP Measures Notes* 3Q21 4Q21 FY2021 1Q22 2Q22 3Q22 YTD 3Q22 C2C Segment Regional Metrics - YoY % change NA region revenues (GAAP) (aa), (bb) (2)% 2% 1% (1)% (2)% (5)% (3)% NA region foreign currency translation impact (k) 0% 0% 0% 0% 0% 0% 0% Adjusted NA region revenues (non-GAAP) (aa), (bb) (2)% 2% 1% (1)% (2)% (5)% (3)% NA region transactions (aa), (bb) (5)% (2)% (1)% (6)% (6)% (5)% (6)% EU & CIS region revenues (GAAP) (aa), (cc) (3)% (8)% 3% (14)% (21)% (23)% (20)% EU & CIS region foreign currency translation impact (k) (2)% 1% (3)% 4% 5% 7% 6% Adjusted EU & CIS region revenues (non-GAAP) (aa), (cc) (5)% (7)% 0% (10)% (16)% (16)% (14)% EU & CIS region transactions (aa), (cc) 3% 1% 13% (7)% (30)% (32)% (23)% MEASA region revenues (GAAP) (aa), (dd) (2)% 2% 4% 2% (4)% (5)% (2)% MEASA region foreign currency translation impact (k) 0% 0% 0% 1% 1% 2% 1% Adjusted MEASA region revenues (non-GAAP) (aa), (dd) (2)% 2% 4% 3% (3)% (3)% (1)% MEASA region transactions (aa), (dd) 2% 6% 10% 5% (3)% (1)% 0% LACA region revenues (GAAP) (aa), (ee) 25% 8% 22% 2% 2% 0% 1% LACA region foreign currency translation impact (k) 1% 4% 2% 3% 2% 4% 4% Adjusted LACA region revenues (non-GAAP) (aa), (ee) 26% 12% 24% 5% 4% 4% 5% LACA region transactions (aa), (ee) 10% 2% 9% 2% 4% 3% 3% APAC region revenues (GAAP) (aa), (ff) 1% 0% 6% (6)% (10)% (16)% (11)% APAC region foreign currency translation impact (k) (2)% 0% (3)% 3% 4% 5% 4% Adjusted APAC region revenues (non-GAAP) (aa), (ff) (1)% 0% 3% (3)% (6)% (11)% (7)% APAC region transactions (aa), (ff) (13)% (13)% (7)% (13)% (11)% (11)% (12)% 19

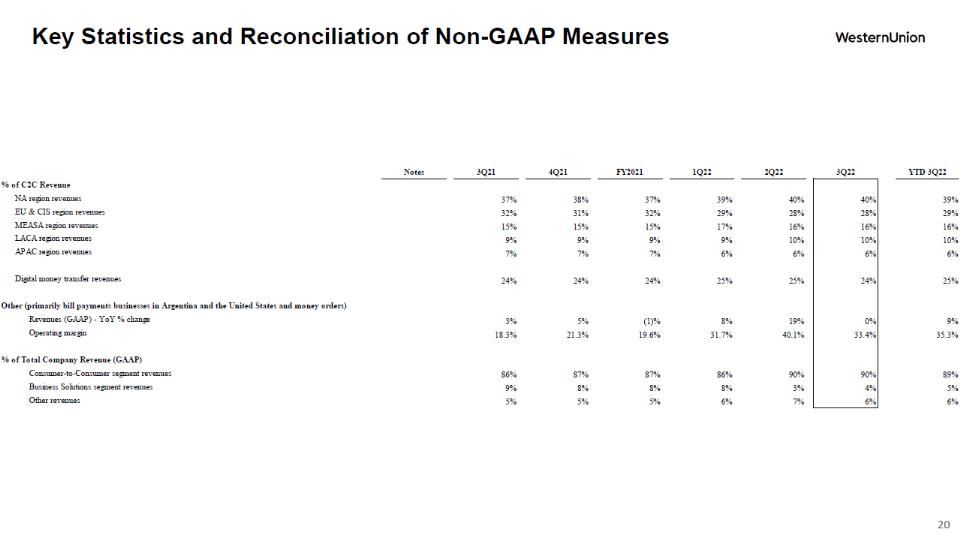

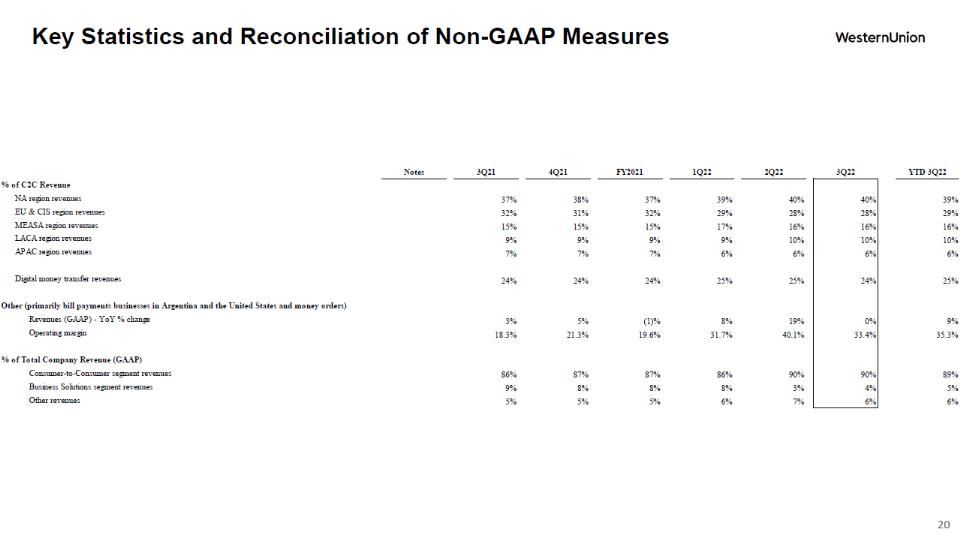

Key Statistics and Reconciliation of Non-GAAP Measures Notes* 3Q21 4Q21 FY2021 1Q22 2Q22 3Q22 YTD 3Q22 % of C2C Revenue NA region revenues (aa), (bb) 37% 38% 37% 39% 40% 40% 39% EU & CIS region revenues (aa), (cc) 32% 31% 32% 29% 28% 28% 29% MEASA region revenues (aa), (dd) 15% 15% 15% 17% 16% 16% 16% LACA region revenues (aa), (ee) 9% 9% 9% 9% 10% 10% 10% APAC region revenues (aa), (ff) 7% 7% 7% 6% 6% 6% 6% Digital money transfer revenues (aa) 24% 24% 24% 25% 25% 24% 25% Other (primarily bill payments businesses in Argentina and the United States and money orders) Revenues (GAAP) - YoY % change 3% 5% (1)% 8% 19% 0% 9% Operating margin 18.3% 21.3% 19.6% 31.7% 40.1% 33.4% 35.3% % of Total Company Revenue (GAAP) Consumer-to-Consumer segment revenues 86% 87% 87% 86% 90% 90% 89% Business Solutions segment revenues 9% 8% 8% 8% 3% 4% 5% Other revenues 5% 5% 5% 6% 7% 6% 6% Western union 20

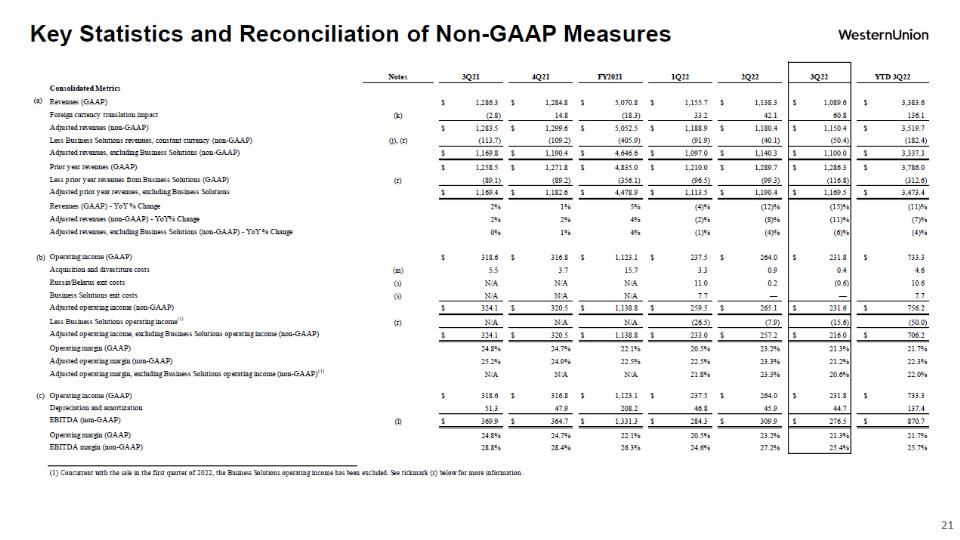

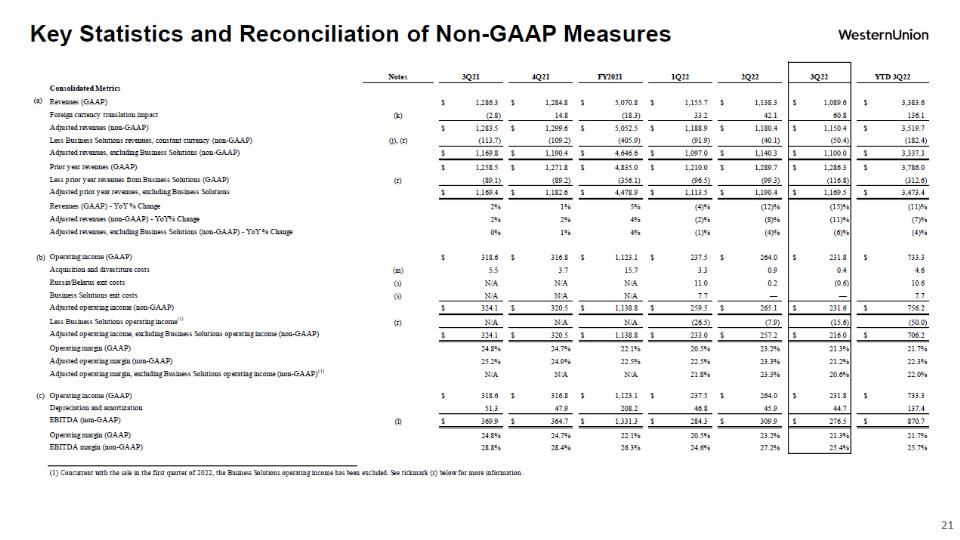

Notes 3Q21 4Q21 FY2021 1Q22 2Q22 3Q22 YTD 3Q22 Consolidated Metrics (a) Revenues (GAAP) $ 1,286.3 $ 1,284.8 $ 5,070.8 $ 1,155.7 $ 1,138.3 $ 1,089.6 $ 3,383.6 Foreign currency translation impact (k) (2.8) 14.8 (18.3) 33.2 42.1 60.8 136.1 Adjusted revenues (non-GAAP) 1,283.5 1,299.6 5,052.5 1,188.9 1,180.4 1,150.4 3,519.7 Less Business Solutions revenues, constant currency (non-GAAP) (j), (r) (113.7) (109.2) (405.9) (91.9) (40.1) (50.4) (182.4) Adjusted revenues, excluding Business Solutions (non-GAAP) $ 1,169.8 $ 1,190.4 $ 4,646.6 $ 1,097.0 $ 1,140.3 $ 1,100.0 $ 3,337.3 Prior year revenues (GAAP) $ 1,258.5 $ 1,271.8 $ 4,835.0 $ 1,210.0 $ 1,289.7 $ 1,286.3 $ 3,786.0 Less prior year revenues from Business Solutions (GAAP) (r) (89.1) (89.2) (356.1) (96.5) (99.3) (116.8) (312.6) Adjusted prior year revenues, excluding Business Solutions $ 1,169.4 $ 1,182.6 $ 4,478.9 $ 1,113.5 $ 1,190.4 $ 1,169.5 $ 3,473.4 Revenues (GAAP) - YoY % Change 2% 1% 5% (4)% (12)% (15)% (11)% Adjusted revenues (non-GAAP) - YoY% Change 2% 2% 4% (2)% (8)% (11)% (7)% Adjusted revenues, excluding Business Solutions (non-GAAP) - YoY % Change 0% 1% 4% (1)% (4)% (6)% (4)% Notes 3Q21 4Q21 FY2021 1Q22 2Q22 3Q22 YTD 3Q22 Consolidated Metrics cont. (b) Operating income (GAAP) $ 318.6 $ 316.8 $ 1,123.1 $ 237.5 $ 264.0 $ 231.8 $ 733.3 Acquisition and divestiture costs (m) 5.5 3.7 15.7 3.3 0.9 0.4 4.6 Russia/Belarus exit costs (s) N/A N/A N/A 11.0 0.2 (0.6) 10.6 Business Solutions exit costs (s) N/A N/A N/A 7.7 — — 7.7 Adjusted operating income (non-GAAP) $ 324.1 $ 320.5 $ 1,138.8 $ 259.5 $ 265.1 $ 231.6 $ 756.2 Less Business Solutions operating income(1) (r) N/A N/A N/A (26.5) (7.9) (15.6) (50.0) Adjusted operating income, excluding Business Solutions operating income (non-GAAP) $ 324.1 $ 320.5 $ 1,138.8 $ 233.0 $ 257.2 $ 216.0 $ 706.2 Operating margin (GAAP) 24.8% 24.7% 22.1% 20.5% 23.2% 21.3% 21.7% Adjusted operating margin (non-GAAP) 25.2% 24.9% 22.5% 22.5% 23.3% 21.2% 22.3% Adjusted operating margin, excluding Business Solutions operating income (non-GAAP)(1) N/A N/A N/A 21.8% 23.3% 20.6% 22.0% (c) Operating income (GAAP) $ 318.6 $ 316.8 $ 1,123.1 $ 237.5 $ 264.0 $ 231.8 $ 733.3 Depreciation and amortization 51.3 47.9 208.2 46.8 45.9 44.7 137.4 EBITDA (non-GAAP) (l) $ 369.9 $ 364.7 $ 1,331.3 $ 284.3 $ 309.9 $ 276.5 $ 870.7 Operating margin (GAAP) 24.8% 24.7% 22.1% 20.5% 23.2% 21.3% 21.7% EBITDA margin (non-GAAP) 28.8% 28.4% 26.3% 24.6% 27.2% 25.4% 25.7% Key Statistics and Reconciliation of Non-GAAP Measures 21 Western Union

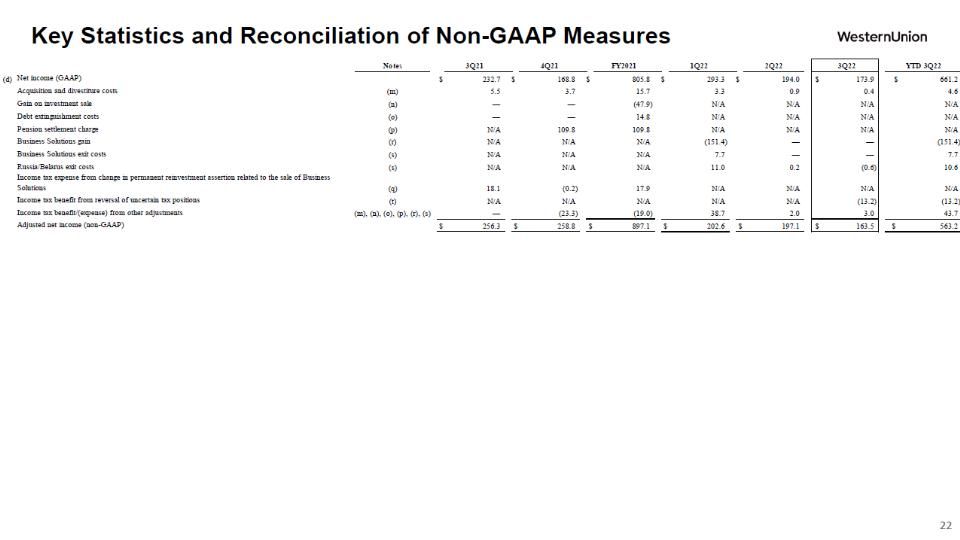

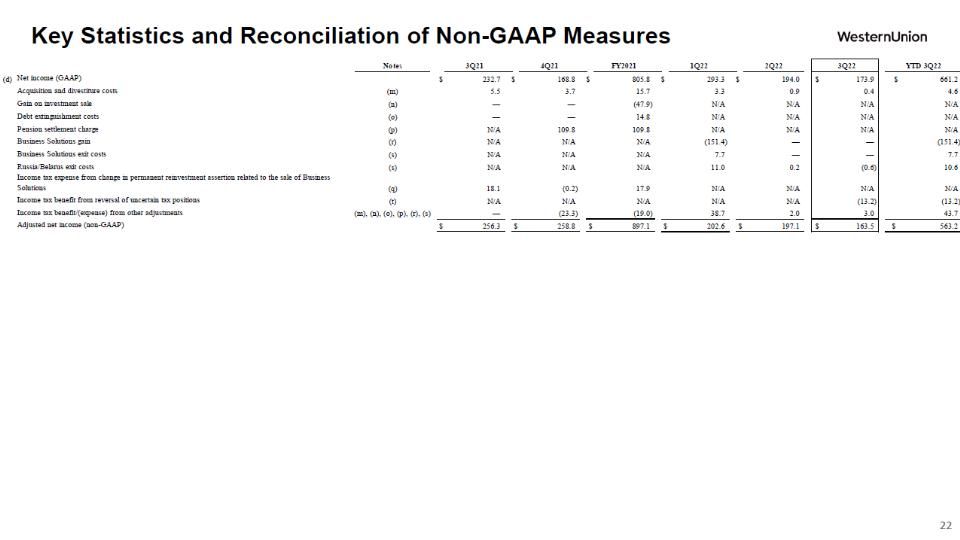

Notes 3Q21 4Q21 FY2021 1Q22 2Q22 3Q22 YTD 3Q22 (d) Net income (GAAP) $ 232.7 $ 168.8 $ 805.8 $ 293.3 $ 194.0 $ 173.9 $ 661.2 Acquisition and divestiture costs (m) 5.5 3.7 15.7 3.3 0.9 0.4 4.6 Gain on investment sale (n) — — (47.9) N/A N/A N/A N/A Debt extinguishment costs (o) — — 14.8 N/A N/A N/A N/A Pension settlement charge (p) N/A 109.8 109.8 N/A N/A N/A N/A Business Solutions gain (r) N/A N/A N/A (151.4) — — (151.4) Business Solutions exit costs (s) N/A N/A N/A 7.7 — — 7.7 Russia/Belarus exit costs (s) N/A N/A N/A 11.0 0.2 (0.6) 10.6 Income tax expense from change in permanent reinvestment assertion related to the sale of Business Solutions (q) 18.1 (0.2) 17.9 N/A N/A N/A N/A Income tax benefit from reversal of uncertain tax positions (t) N/A N/A N/A N/A N/A (13.2) (13.2) Income tax benefit/(expense) from other adjustments (m), (n), (o), (p), (r), (s) — (23.3) (19.0) 38.7 2.0 3.0 43.7 Adjusted net income (non-GAAP) $ 256.3 $ 258.8 $ 897.1 $ 202.6 $ 197.1 $ 163.5 $ 563.2 Key Statistics and Reconciliation of Non-GAAP Measures 22

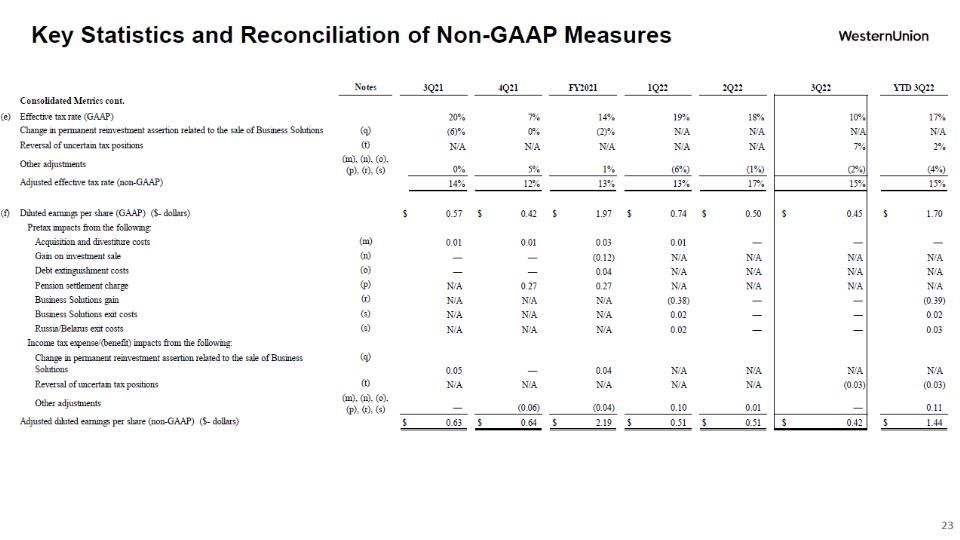

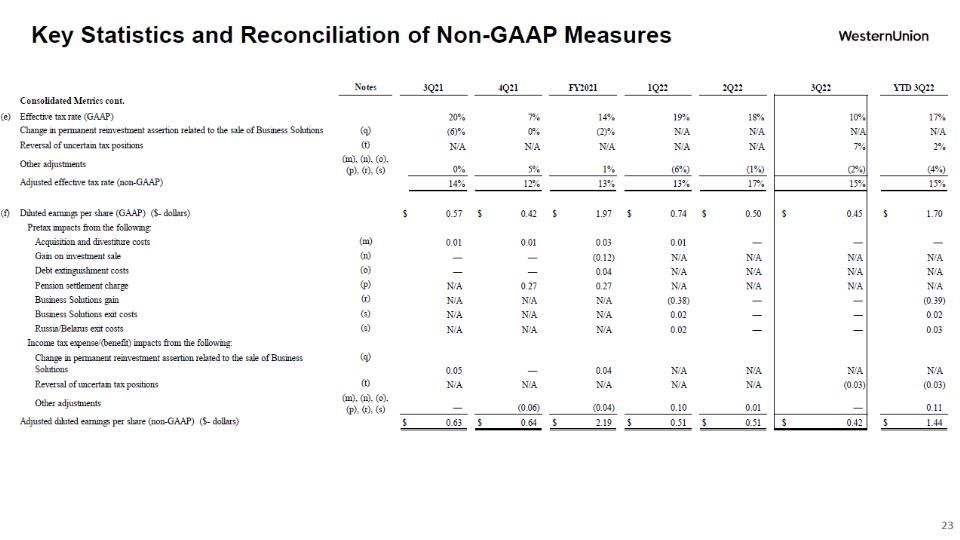

Notes 3Q21 4Q21 FY2021 1Q22 2Q22 3Q22 YTD 3Q22 Consolidated Metrics cont. (e) Effective tax rate (GAAP) 20% 7% 14% 19% 18% 10% 17% Change in permanent reinvestment assertion related to the sale of Business Solutions (q) (6)% 0% (2)% N/A N/A N/A N/A Reversal of uncertain tax positions (t) N/A N/A N/A N/A N/A 7% 2% Other adjustments (m), (n), (o), (p), (r), (s) 0% 5% 1% (6%) (1%) (2%) (4%) Adjusted effective tax rate (non-GAAP) 14% 12% 13% 13% 17% 15% 15% (f) Diluted earnings per share (GAAP) ($- dollars) $ 0.57 $ 0.42 $ 1.97 $ 0.74 $ 0.50 $ 0.45 $ 1.70 Pretax impacts from the following: Acquisition and divestiture costs (m) 0.01 0.01 0.03 0.01 — — — Gain on investment sale (n) — — (0.12) N/A N/A N/A N/A Debt extinguishment costs (o) — — 0.04 N/A N/A N/A N/A Pension settlement charge (p) N/A 0.27 0.27 N/A N/A N/A N/A Business Solutions gain (r) N/A N/A N/A (0.38) — — (0.39) Business Solutions exit costs (s) N/A N/A N/A 0.02 — — 0.02 Russia/Belarus exit costs (s) N/A N/A N/A 0.02 — — 0.03 Income tax expense/(benefit) impacts from the following: Change in permanent reinvestment assertion related to the sale of Business Solutions (q) 0.05 — 0.04 N/A N/A N/A N/A Reversal of uncertain tax positions (t) N/A N/A N/A N/A N/A (0.03) (0.03) Other adjustments (m), (n), (o), (p), (r), (s) — (0.06) (0.04) 0.10 0.01 — 0.11 Adjusted diluted earnings per share (non-GAAP) ($- dollars) $ 0.63 $ 0.64 $ 2.19 $ 0.51 $ 0.51 $ 0.42 $ 1.44 Key Statistics and Reconciliation of Non-GAAP Measures 23

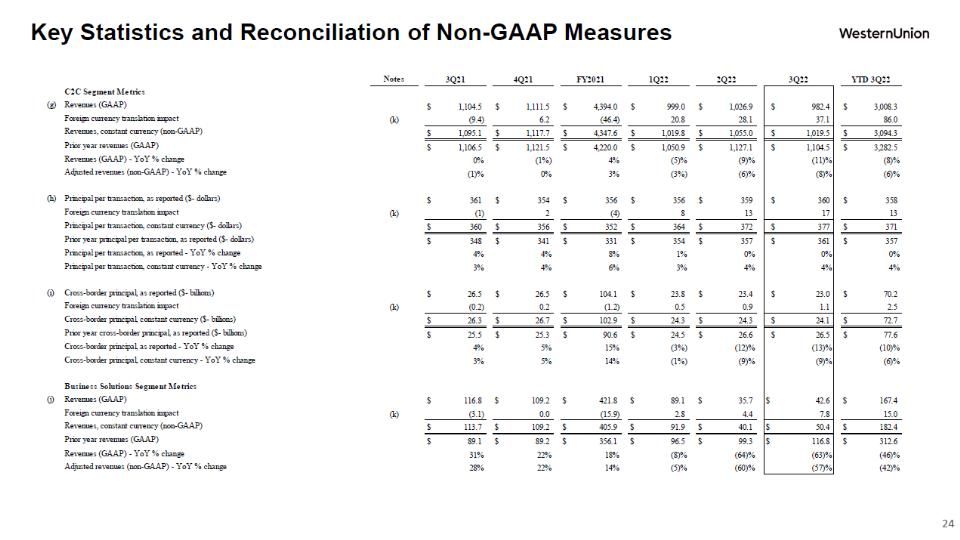

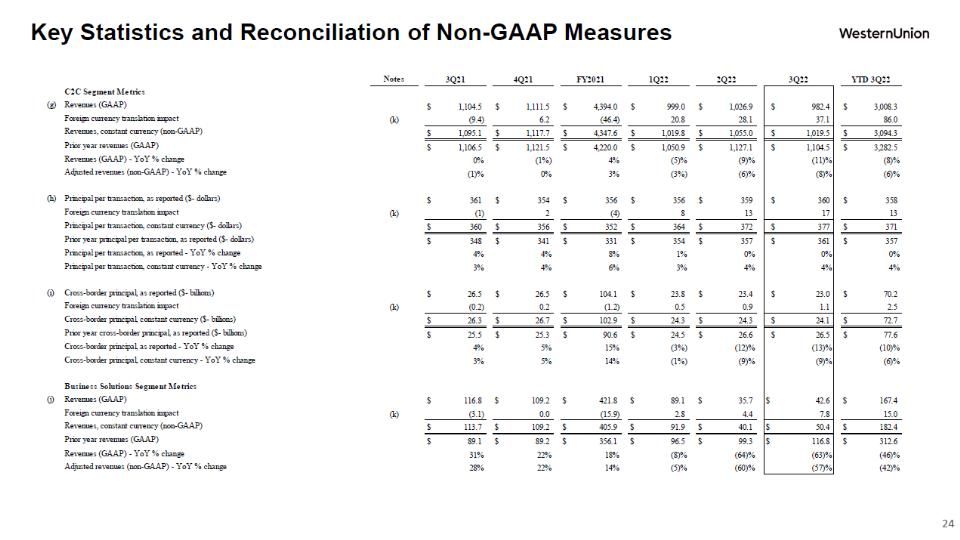

Notes 3Q21 4Q21 FY2021 1Q22 2Q22 3Q22 YTD 3Q22 C2C Segment Metrics (g) Revenues (GAAP) $ 1,104.5 $ 1,111.5 $ 4,394.0 $ 999.0 $ 1,026.9 $ 982.4 $ 3,008.3 Foreign currency translation impact (k) (9.4) 6.2 (46.4) 20.8 28.1 37.1 86.0 Revenues, constant currency (non-GAAP) $ 1,095.1 $ 1,117.7 $ 4,347.6 $ 1,019.8 $ 1,055.0 $ 1,019.5 $ 3,094.3 Prior year revenues (GAAP) $ 1,106.5 $ 1,121.5 $ 4,220.0 $ 1,050.9 $ 1,127.1 $ 1,104.5 $ 3,282.5 Revenues (GAAP) - YoY % change 0% (1)% 4% (5)% (9)% (11)% (8)% Adjusted revenues (non-GAAP) - YoY % change (1)% 0% 3% (3)% (6)% (8)% (6)% (h) Principal per transaction, as reported ($- dollars) $ 361 $ 354 $ 356 $ 356 $ 359 $ 360 $ 358 Foreign currency translation impact (k) (1) 2 (4) 8 13 17 13 Principal per transaction, constant currency ($- dollars) $ 360 $ 356 $ 352 $ 364 $ 372 $ 377 $ 371 Prior year principal per transaction, as reported ($- dollars) $ 348 $ 341 $ 331 $ 354 $ 357 $ 361 $ 357 Principal per transaction, as reported - YoY % change 4% 4% 8% 1% 0% 0% 0% Principal per transaction, constant currency - YoY % change 3% 4% 6% 3% 4% 4% 4% (i) Cross-border principal, as reported ($- billions) $ 26.5 $ 26.5 $ 104.1 $ 23.8 $ 23.4 $ 23.0 $ 70.2 Foreign currency translation impact (k) (0.2) 0.2 (1.2) 0.5 0.9 1.1 2.5 Cross-border principal, constant currency ($- billions) $ 26.3 $ 26.7 $ 102.9 $ 24.3 $ 24.3 $ 24.1 $ 72.7 Prior year cross-border principal, as reported ($- billions) $ 25.5 $ 25.3 $ 90.6 $ 24.5 $ 26.6 $ 26.5 $ 77.6 Cross-border principal, as reported - YoY % change 4% 5% 15% (3)% (12)% (13)% (10)% Cross-border principal, constant currency - YoY % change 3% 5% 14% (1)% (9)% (9)% (6)% Business Solutions Segment Metrics (j) Revenues (GAAP) $ 116.8 $ 109.2 $ 421.8 $ 89.1 $ 35.7 $ 42.6 $ 167.4 Foreign currency translation impact (k) (3.1) 0.0 (15.9) 2.8 4.4 7.8 15.0 Revenues, constant currency (non-GAAP) $ 113.7 $ 109.2 $ 405.9 $ 91.9 $ 40.1 $ 50.4 $ 182.4 Prior year revenues (GAAP) $ 89.1 $ 89.2 $ 356.1 $ 96.5 $ 99.3 $ 116.8 $ 312.6 Revenues (GAAP) - YoY % change 31% 22% 18% (8)% (64)% (63)% (46)% Adjusted revenues (non-GAAP) - YoY % change 28% 22% 14% (5)% (60)% (57)% (42)% Key Statistics and Reconciliation of Non-GAAP Measures 24

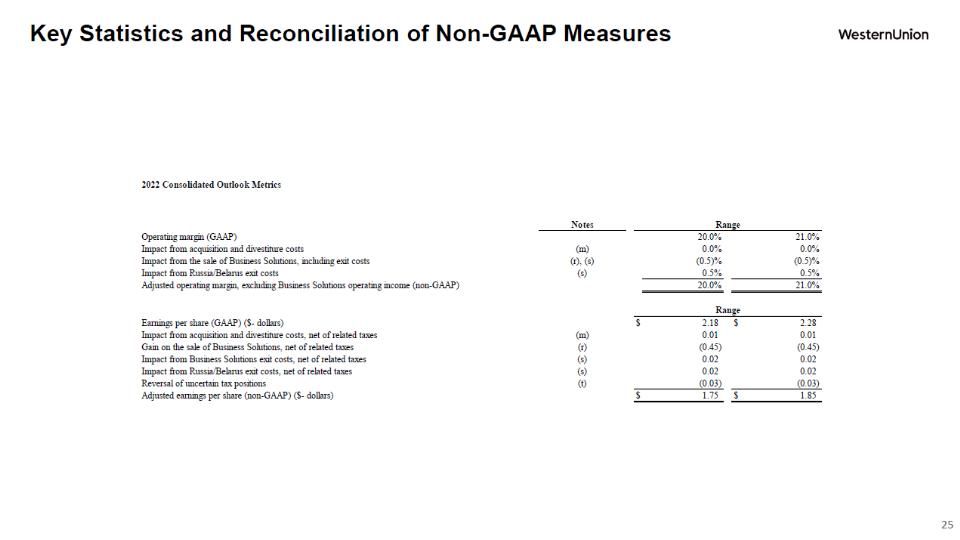

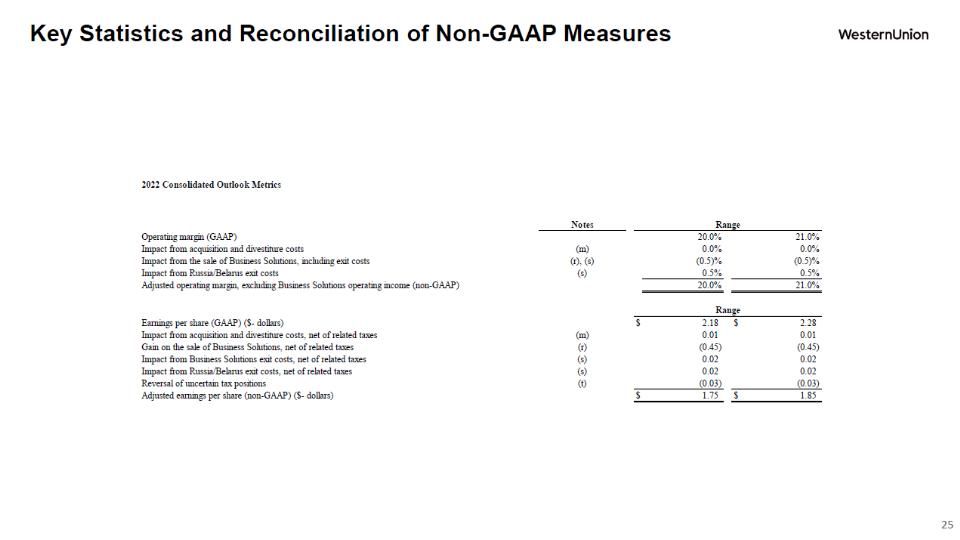

2022 Consolidated Outlook Metrics Notes Range Operating margin (GAAP) 20.0% 21.0% Impact from acquisition and divestiture costs (m) 0.0% 0.0% Impact from the sale of Business Solutions, including exit costs (r), (s) (0.5)% (0.5)% Impact from Russia/Belarus exit costs (s) 0.5% 0.5% Adjusted operating margin, excluding Business Solutions operating income (non-GAAP) 20.0% 21.0% Range Earnings per share (GAAP) ($- dollars) $ 2.18 $ 2.28 Impact from acquisition and divestiture costs, net of related taxes (m) 0.01 0.01 Gain on the sale of Business Solutions, net of related taxes (r) (0.45) (0.45) Impact from Business Solutions exit costs, net of related taxes (s) 0.02 0.02 Impact from Russia/Belarus exit costs, net of related taxes (s) 0.02 0.02 Reversal of uncertain tax positions (t) (0.03) (0.03) Adjusted earnings per share (non-GAAP) ($- dollars) $ 1.75 $ 1.85 Key Statistics and Reconciliation of Non-GAAP Measures 25

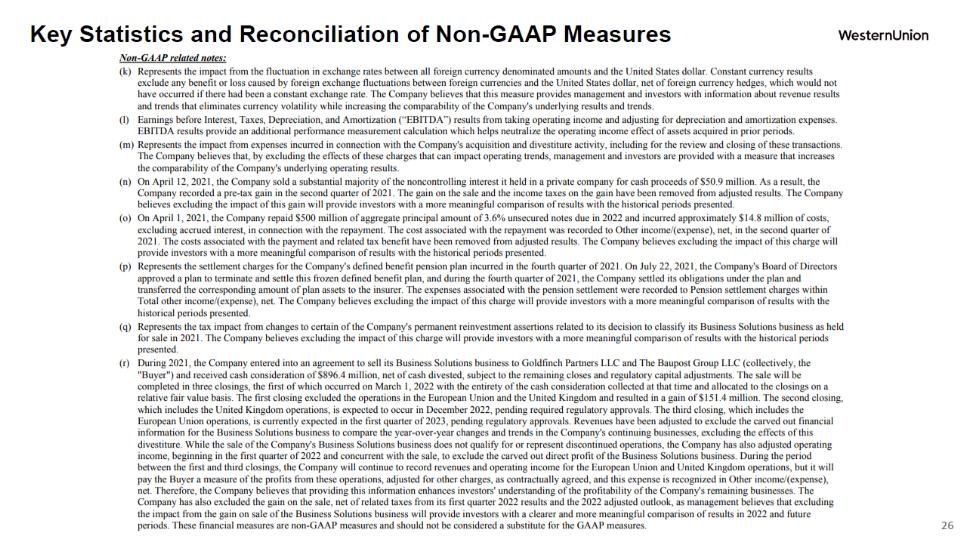

Key Statistics and Reconciliation of Non-GAAP Measures Non -GAAP related twits' (k) Represents the impact from the fluctuation in exchange rates between all foreign currency denominated amounts and the United States dollar. Constant currency results exclude any benefit or loss caused by foreign exchange fluctuations between foreign currencies and the United States dollar, net of foreign currency hedges. which would not have occurred if there had been a constant exchange rate. The Company believes that this measure provides management and investors with information about revenue results and trends that eliminates currency volatility while increasing the comparability of the Company's underlying results and trends. 01 Earnings before Interest, Taxes. Deprecation, and Amortization ("EIlITDA') results from taking operating Income and adjusting for depreciation and amortization expenses. EBITDA results provide an additional performance measurement calculation which helps neutralize the operating income effect of assets acquired in prior periods. (m) Represents the impact from expenses incurred in connection with the Company's acquisition and divestiture activity, including for the review and closing of these transactions. The Company believes that, by excluding the effects of these charges that can impact operating trendx management and investors are provided with a measure that increases the comparability of the Company's underlying operating results (o) On April 12, 2021, the Company sold a substantial majority of the noncontrolling interest it held in a private company for cash proceeds of $50.9 million. As a result, the Company recorded a pretax gain in the second quarter of 2021. The gain on the sale and the income taxes on the gain have been removed from adjusted results. The Company believes excluding the impact of this gain will provide investors with a more meaningful comparison of results with the historical periods presented. (o) On April 1. 2021. the Company repaid 5500 million of aggregate principal amount of 3.6% unsecured notes due in 2022 and incurred approximately 514.8 million of costs. excluding accrued interest, in connection with the repayment. The cost associated with the repayment was recorded to Other incomoTexpense). net, in the second quarter of 2021. The coats associated with the payment and related tax benefit have been removed from adjusted results. The Company believes excluding the impact of this charge will provide investors with a more meaningful comparison of results with the historical periods presented. (p) Represents the settlement charges for the Company, defined benefit pension plan incurred in the fourth quarter of 2021. On July 22. 2021. the Company's Board of Directors approved a plan to terminate and settle this frozen defined benefit plan, and during the fourth quarter of 2021. the Company settled its obligations under the plan and transferred the corresponding amount of plan assets to the insurer. The expenses associated with the pension settlement were recorded to Pension settlement charges within Tout other income(expense), net. The Company believes excluding the impact of this charge will provide investors with a more meaningful comparison of results with the historical periods presented. (q) Represents the tax impact from changes to certain of the Company's permanent reinvestment assertions related to its decision to classify its Business Solutions business as held for sale in 2021. The Company believes excluding the impact of this charge will provide investors with a more meaningful companson of results with the historical periods presented. (r) During 2021. the Company entered into an aim-meat to sell its liminess Solutions business to Goldfinch Partners 1.I.0 and The Baupost Group LTC (collectively. the "Buyer) and received cash consideration of 5896.4 million, net of cash divested, subject to the remaining closes and regulatory capital adjustments. The sale will be completed in three closings, the first of which occurred on March 1. 2022 with the entirety of the cash consideration collected at that time and allocated to the closings on a relative fair value basis. The first closing excluded the operations in the European Union and the United Kingdom and resulted in a gain of 5151.4 million. The second closing, which includes the United Kingdom operations, is expected to occur in December 2022, pending required regulatory approvals. The third closing, which includes the European Union operations, is currently expected in the first quarter of 2023, pending regulatory approvals. Revenues have been adjusted to exclude the carved out financial information for the Business Solutions business to compare the yearsover•year changes mid trends in the Company's continuing businesses, excluding the effects of this divestiture. While the sale of the Company's Business Solutions business does not qualify for or represent discontinued operations, the Company has also adjusted operating income. beginning in the first quarter of 2022 and concurrent with the sale, to exclude the caned out direct profit of the Business Solutions business. During the period between the first and third closings, the Company will continue to record revenues and operating income for the European Union and United Kingdom operations, but it will pay the Buyer a measure of the profits from these operations, adjusted for other charges, as contractually agreed. and this expense is recognized in Other insvimei(expaise net. Therefore, the Company believes that providing this information enhances investors' understanding of the profitability of the Company's remaining businesses. The Company has also excluded the gain on the sale, net of related taxes from its first quarter 2022 results and the 2022 adjusted outlook, as management believes that excluding the impact from the gain on sale of the Business Solutions busmen will provide inventors with a clearer and more meaningful comparison of results in 2022 and future periods. 'These financial measures are non'GAAP measures and should not be considered a substitute for the GAAP measures. 26 Western Union

(s) Represents the exit costs intuited in connection with the divestiture of the Business Solutions business and the suspension of operations in Russia and Belarus, primarily related to severance and non-cash impairments of property and equipment, an operating lease right-of-use asset, and other intangible assets. While certain of the expenses are identifiable to the Company's segments. the expenses are not included in the measurement of segment operating income provided to the Chief Operating Decision Maker for purposes of performance assessment and resource allocation. These expenses are therefore excluded from the Company's segment operating income results. These expenses have been excluded from operating income, the effective tax rate, and diluted earnings per share. net of related taxes. Additionally, the outlook metrics have been adjusted to exclude these costs, net of related taxes where applicable. The Company believes that, by excluding the effects of these charges that can impact operating trends, management and investors are provided with a measure that increases the comparability of the Company's underlying operating results. (t) Represents non-cash reversals of significant uncertain tax positions. The Company believes excluding these reversals provides a more meaningful comparison of results to the historical periods presented. Key Statistics and Reconciliation of Non-GAAP Measures 27 western union

Thank You Western Union