- WU Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

CORRESP Filing

The Western Union Company (WU) CORRESPCorrespondence with SEC

Filed: 8 Sep 23, 12:00am

September 8, 2023

Via EDGAR

Securities and Exchange Commission

100 F Street, N.E.

Washington, DC 20549-7010

Attention: Keira Nakada

Rufus Decker

Re: The Western Union Company

Form 10-K for the Fiscal Year Ended December 31, 2022

Filed February 23, 2023

Item 2.02 Form 8-K Dated July 26, 2023

File No. 001-32903

Ladies and Gentlemen:

On behalf of The Western Union Company, a Delaware corporation (“Western Union” or “Company”), we are writing in response to the comments contained in the comment letter dated September 5, 2023 (the “Comment Letter”) of the staff (the “Staff”) of the Securities and Exchange Commission (the “Commission”) with respect to the Company’s (i) Annual Report on Form 10-K for the year ended December 31, 2022 (the “Form 10-K”), and (ii) Current Report on Form 8-K dated July 26, 2023 (the “Form 8-K”). For the convenience of the Staff’s review, we have set forth each comment contained in the Comment Letter along with the response of the Company.

Form 10-K for the Fiscal Year Ended December 31, 2022

Consolidated Financial Statements

Consolidated Statements of Cash Flows, page 72

RESPONSE:

The Company respectfully acknowledges the Staff’s comment.

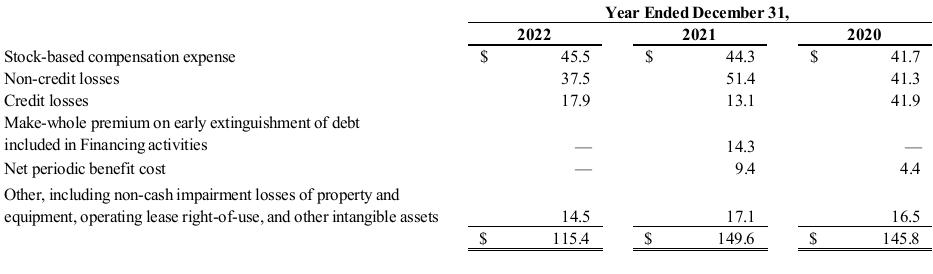

The quantified breakout of the other non-cash items, net line is presented below (in millions). The Company considers individual line items quantitatively material if they exceed 10% of total cash flows from operating activities, which the Company believes is similar and analogous to other financial statement disaggregation requirements in Regulation S-X 5-03(b). None of the below items, on an absolute basis, met this materiality guideline in any of the respective years, and thus, the Company did not present these items separately. In addition, stock-based compensation expense, credit and non-credit losses, the make-whole premium on early extinguishment of debt, and net periodic benefit cost were disclosed and discussed in Notes 17, 8, 16, and 12, respectively, to the consolidated financial statements.

The Company will continue to review individual components of its other non-cash items, net and will present any individual material items separately in its cash flows from operating activities in future filings. The Company will also continue to provide further breakdowns of reconciling item categories that are believed to be meaningful, in accordance with ASC 230-10-45-29.

Item 2.02 Form 8-K Dated July 26, 2023

Exhibit 99.1

RESPONSE:

The Company respectfully acknowledges the Staff’s comment and will reconcile its Adjusted EBITDA to net income in future filings, presenting and discussing net income margin whenever Adjusted EBITDA margin is also presented or discussed.

*****

If you have any questions regarding the foregoing or the Company’s filings, please contact the undersigned at (720) 332-5711.

Very truly yours,

/s/ Darren A. Dragovich

Darren A. Dragovich

Vice President and Secretary

The Western Union Company

cc: Devin McGranahan

Matt Cagwin

Mark Hinsey

Benjamin Adams

Sonia Barros, Sidley Austin LLP

Ernst & Young LLP