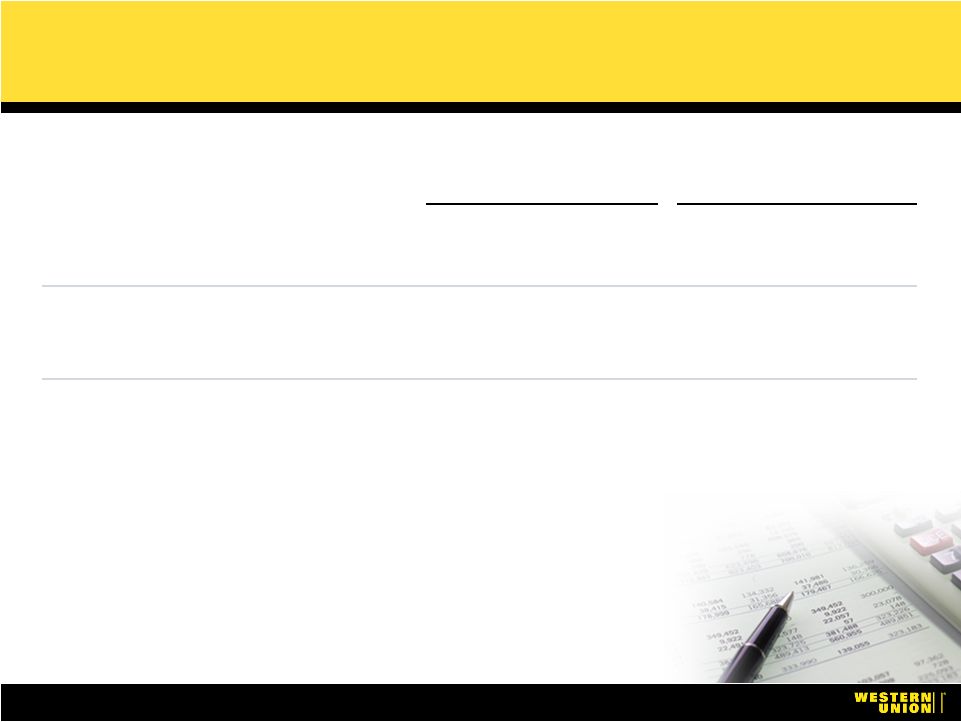

35 Key Financial Assumptions Assumptions FY 2007 FY 2006 Six Months June 30, 2006 2007 adversely impacted by spin expenses, interest expense, and changes in working capital ~ $0.9B ~ $1.0B $0.5B Cash Flow from Operating Activities Investments in the business $200M - $250M $200M - $225M $114M Capital Expenditures No material impact from FIN 48 32% - 33% 32% - 33% 32% Tax Rate New debt structure offset by cash balances ($115M) – ($135M) $25M – $35M $41M Net interest income, interest expense, and other Euro at 1.28 and hedges re-designated as cash flow hedges $0 ($20M) – ($30M) ($31M) Derivative (losses) / gains and FX effect on notes receivable from affiliates (FAS 133) Spin costs represents estimated incremental costs associated with operating as a stand-alone company. (A) $0M - $10M $65M - $75M $15M - $20M $20M - $25M $2M $0 Spin Expenses Non-recurring Ongoing (A) Spin expenses represent estimated incremental expenses associated with operating as a stand-alone company. Ongoing spin expenses relate to staffing additions and related costs to replace First Data support, corporate governance, information technology, corporate branding and global affairs, benefits and payroll administration, procurement, and other expenses related to being a stand-alone company. Non-recurring spin expenses relate to recruiting and relocation expenses associated with hiring key senior management positions new to our company, other employee compensation expenses and temporary labor used to develop ongoing processes. See reconciliation to Operating Income (GAAP) in Appendix. |