|

Exhibit 99.1

|

OPENING VIDEO

Agenda

8:30 AM 9:00 AM 9:15 AM 9:30 AM 10:05 AM

Overview Brand & Platform Retail C2C & C2B Break

& WU 2020 Consumer

Strategy Insights

Odilon Almeida &

Hikmet Ersek Libby Chambers David Thompson Jean Claude Farah

10:25 AM 10:45 AM 11:00 AM 11:20 AM 11:55 AM

wu.com & Business Financial Q&A Closing

Digital C2C Solutions Overview & Remarks

Capital Allocation

Khalid Fellahi Kerry Agiasotis Raj Agrawal Hikmet Ersek

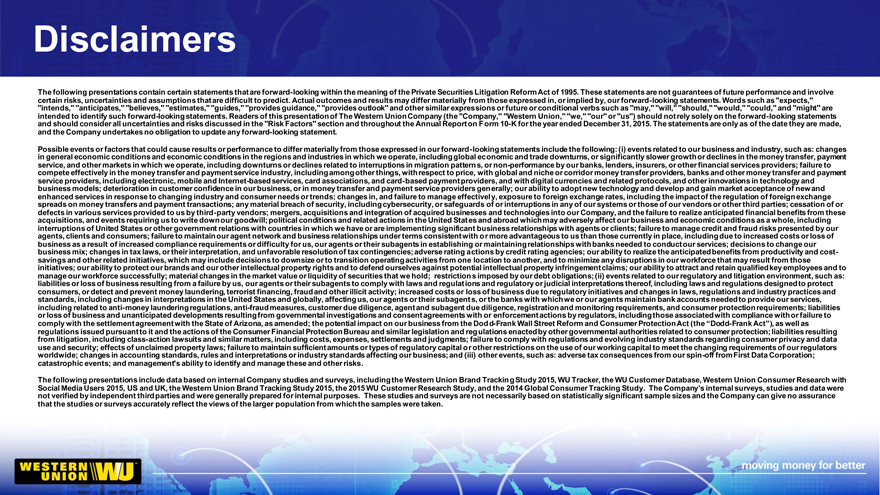

Disclaimers

The following presentations contain certain statements that are forward-looking within the meaning of the Private Securities Litigation Reform Act of 1995. These statements are not guarantees of future performance and involve certain risks, uncertainties and assumptions that are difficult to predict. Actual outcomes and results may differ materially from those expressed in, or implied by, our forward-looking statements. Words such as “expects,” “intends,” “anticipates,” “believes,” “estimates,” “guides,” “provides guidance,” “provides outlook” and other similar expressions or future or conditional verbs such as “may,” “will,” “should,” “would,” “could,” and “might” are intended to identify such forward-looking statements. Readers of this presentation of The Western Union Company (the “Company,” “Western Union,” “we,” “our” or “us”) should not rely solely on the forward-looking statements and should consider all uncertainties and risks discussed in the “Risk Factors” section and throughout the Annual Report on Form 10-K for the year ended December 31, 2015. The statements are only as of the date they are made, and the Company undertakes no obligation to update any forward-looking statement.

Possible events or factors that could cause results or performance to differ materially from those expressed in our forward-looking statements include the following: (i) events related to our business and industry, such as: changes in general economic conditions and economic conditions in the regions and industries in which we operate, including global economic and trade downturns, or significantly slower growth or declines in the money transfer, payment service, and other markets in which we operate, including downturns or declines related to interruptions in migration patterns, or non-performance by our banks, lenders, insurers, or other financial services providers; failure to compete effectively in the money transfer and payment service industry, including among other things, with respect to price, with global and niche or corridor money transfer providers, banks and other money transfer and payment service providers, including electronic, mobile and Internet-based services, card associations, and card-based payment providers, and with digital currencies and related protocols, and other innovations in technology and business models; deterioration in customer confidence in our business, or in money transfer and payment service providers generally; our ability to adopt new technology and develop and gain market acceptance of new and enhanced services in response to changing industry and consumer needs or trends; changes in, and failure to manage effectively, exposure to foreign exchange rates, including the impact of the regulation of foreign exchange spreads on money transfers and payment transactions; any material breach of security, including cybersecurity, or safeguards of or interruptions in any of our systems or those of our vendors or other third parties; cessation of or defects in various services provided to us by third-party vendors; mergers, acquisitions and integration of acquired businesses and technologies into our Company, and the failure to realize anticipated financial benefits from these acquisitions, and events requiring us to write down our goodwill; political conditions and related actions in the United States and abroad which may adversely affect our business and economic conditions as a whole, including interruptions of United States or other government relations with countries in which we have or are implementing significant business relationships with agents or clients; failure to manage credit and fraud risks presented by our agents, clients and consumers; failure to maintain our agent network and business relationships under terms consistent with or more advantageous to us than those currently in place, including due to increased costs or loss of business as a result of increased compliance requirements or difficulty for us, our agents or their subagents in establishing or maintaining relationships with banks needed to conduct our services; decisions to change our business mix; changes in tax laws, or their interpretation, and unfavorable resolution of tax contingencies; adverse rating actions by credit rating agencies; our ability to realize the anticipated benefits from productivity and cost-savings and other related initiatives, which may include decisions to downsize or to transition operating activities from one location to another, and to minimize any disruptions in our workforce that may result from those initiatives; our ability to protect our brands and our other intellectual property rights and to defend ourselves against potential intellectual property infringement claims; our ability to attract and retain qualified key employees and to manage our workforce successfully; material changes in the market value or liquidity of securities that we hold; restrictions imposed by our debt obligations; (ii) events related to our regulatory and litigation environment, such as: liabilities or loss of business resulting from a failure by us, our agents or their subagents to comply with laws and regulations and regulatory or judicial interpretations thereof, including laws and regulations designed to protect consumers, or detect and prevent money laundering, terrorist financing, fraud and other illicit activity; increased costs or loss of business due to regulatory initiatives and changes in laws, regulations and industry practices and standards, including changes in interpretations in the United States and globally, affecting us, our agents or their subagents, or the banks with which we or our agents maintain bank accounts needed to provide our services, including related to anti-money laundering regulations, anti-fraud measures, customer due diligence, agent and subagent due diligence, registration and monitoring requirements, and consumer protection requirements; liabilities or loss of business and unanticipated developments resulting from governmental investigations and consent agreements with or enforcement actions by regulators, including those associated with compliance with or failure to comply with the settlement agreement with the State of Arizona, as amended; the potential impact on our business from the Dodd-Frank Wall Street Reform and Consumer Protection Act (the “Dodd-Frank Act”), as well as regulations issued pursuant to it and the actions of the Consumer Financial Protection Bureau and similar legislation and regulations enacted by other governmental authorities related to consumer protection; liabilities resulting from litigation, including class-action lawsuits and similar matters, including costs, expenses, settlements and judgments; failure to comply with regulations and evolving industry standards regarding consumer privacy and data use and security; effects of unclaimed property laws; failure to maintain sufficient amounts or types of regulatory capital or other restrictions on the use of our working capital to meet the changing requirements of our regulators worldwide; changes in accounting standards, rules and interpretations or industry standards affecting our business; and (iii) other events, such as: adverse tax consequences from our spin-off from First Data Corporation; catastrophic events; and management’s ability to identify and manage these and other risks.

The following presentations include data based on internal Company studies and surveys, including the Western Union Brand Tracking Study 2015, WU Tracker, the WU Customer Database, Western Union Consumer Research with Social Media Users 2015, US and UK, the Western Union Brand Tracking Study 2015, the 2015 WU Customer Research Study, and the 2014 Global Consumer Tracking Study. The Company’s internal surveys, studies and data were not verified by independent third parties and were generally prepared for internal purposes. These studies and surveys are not necessarily based on statistically significant sample sizes and the Company can give no assurance that the studies or surveys accurately reflect the views of the larger population from which the samples were taken.

WU 2020: LEADING IN CROSS-BORDER, CROSS-CURRENCY MONEY MOVEMENT

Maintain leadership in traditional retail money transfer

Extend leadership in company branded digital money transfer

Leverage platform to serve new use cases and customer segments

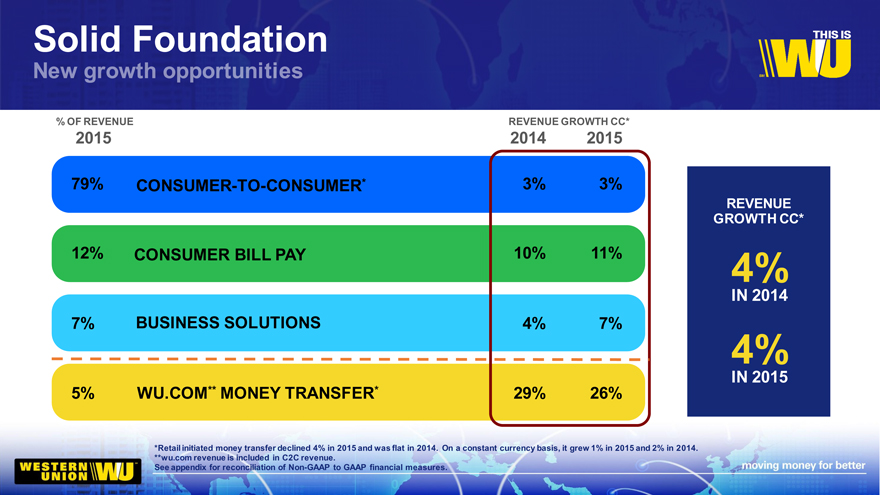

Solid Foundation

% OF REVENUE REVENUE GROWTH CC*

2015 2014 2015

79% CONSUMER-TO-CONSUMER* 3% 3%

REVENUE

GROWTH CC*

12% CONSUMER BILL PAY 10% 11% 4%

IN 2014

7% BUSINESS SOLUTIONS 4% 7%

4%

IN 2015

5% WU.COM** MONEY TRANSFER* 29% 26%

*Retail initiated money transfer declined 4% in 2015 and was flat in 2014. On a constant currency basis, it grew 1% in 2015 and 2% in 2014.

**wu.com revenue is included in C2C revenue.

See appendix for reconciliation of Non-GAAP to GAAP financial measures.

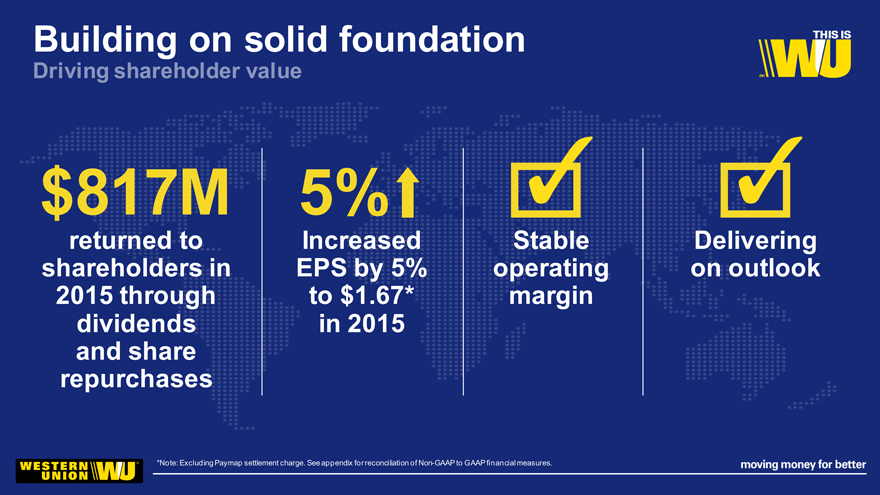

Building on solid foundation

$817M 5%

returned to Increased Stable Delivering

shareholders in EPS by 5% operating on outlook

2015 through to $1.67* margin

dividends in 2015

and share

repurchases

*Note: Excluding Paymap settlement charge. See appendix for reconciliation of Non-GAAP to GAAP financial measures.

BUSINESS IN

COUNTRIES

AND TERRITORIES

+

RETAIL LOCATIONS

ATMS & KIOSKS

ACCOUNTS

BRAND AWARENESS

90% 95% 95%

USA UK

EUROPE 93%

GERMANY 100%

99%

FRANCE PHILLIPPINES

94%

SAUDI

96% 99%

AUSTRALIA

100% ITALY 99% MEXICO INDIA

90%

AFRICA

Source: 2014 Western Union Brand Tracking StudyBase: *Migrant International Money Transfer Senders / **International Money Transfer Receivers (all category users)

CURRENCIES AVAILABLE

CORRIDORS

CONSUMERS

World Class Management Team

HIKMET ERSEK RAJ AGRAWAL LIBBY CHAMBERS DAVID THOMPSON ODILON ALMEIDA JEAN CLAUDE FARAH RICHARD WILLIAMS

President, CEO EVP and CFO EVP, Chief Strategy and EVP, Chief Technology Officer EVP and President Americas EVP and President EVP and Chief Human

Product Officer Global Operations and and European Union Middle East, Africa, Resources Officer

Technology (GO-Tech) Asia, Eastern Europe & CIS

JOHN R. DYE JACQUELINE D. KERRY AGIASOTIS KHALID FELLAHI MOLLY SHEA SCOTT COAD CHRISTINA HAMILTON

EVP, General Counsel MOLNAR President, Western Union SVP and GM, SVP, and GM, Chief Transformation Vice President, Chief of

and Secretary SVP, Chief Business Solutions WU Digital WU Digital Officer Staff, Office of the CEO

Compliance Officer

World Class Board of Directors

Hikmet Ersek Jack M. Greenberg

Frances Fragos Solomon D. Trujillo

Townsend

Betsy D. Holden

Martin I. Cole

Robert W. Selander

Michael A. Miles, Jr.

Roberto G. Mendoza

Jeffrey A. Joerres

Richard A. Goodman

Linda Fayne Levinson

TO BE THE LEADER IN CROSS-BORDER, CROSS-CURRENCY MONEY MOVEMENT

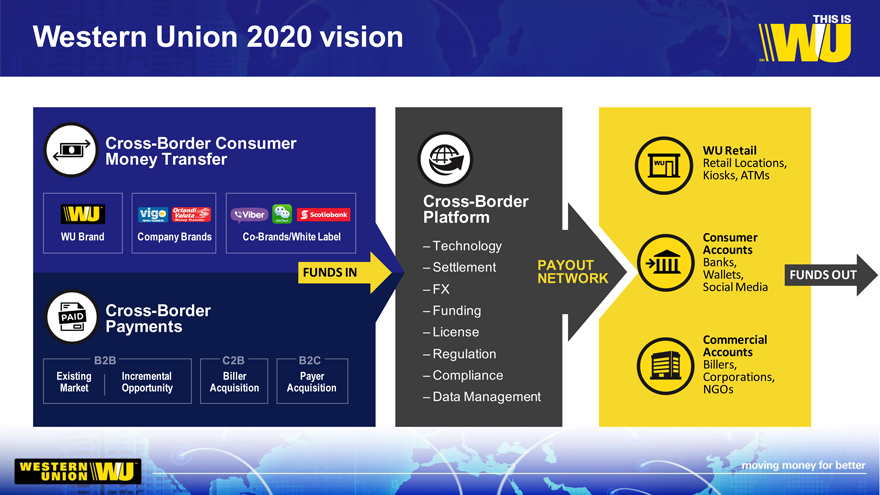

Western Union 2020 vision

Cross-Border Consumer

Money Transfer

Cross-Border

Platform

– Technology

– Settlement PAYOUT

FUNDS IN NETWORK

–FX

Cross-Border – Funding

Payments – License

– Regulation

– Compliance

– Data Management

WU Retail

Retail Locations,

Kiosks, ATMs

Consumer

Accounts

Banks,

Wallets, FUNDS OUT

Social Media

Commercial

Accounts

Billers,

Corporations,

NGOs

Leadership in digital

~$50M

INCREASE IN

REVENUE

~$300M

2015 REVENUE

$177M

REVENUE* $39M

wu. money com/mobile transfer 2015 REVENUE $ 4M

REVENUE**

*12 months ended 9/30/15 **12 months ended 3/30/15

WU 2020: New growth opportunities

Use case Product Channel Distribution Brand Operations

FROM ONE… TO MANY…

Remittance support Support • Urgent • Gifting • Goods/services • Tourism

C2C C2C • B2B • B2C • C2B

Retail • Web • Mobile • Social Media

Retail focus Bank Accounts • ATMs/Kiosk • Cards

Agent-centric WU.com • Agents • Partners

Western Union brand

Operating model Operational options for greater flexibility and efficiency

WU 2020: LEADING IN CROSS-BORDER, CROSS-CURRENCY MONEY MOVEMENT

Maintain leadership in traditional retail money transfer

Extend leadership in company branded digital money transfer

Leverage platform to serve new use cases and customer segments

CUSTOMER VOICES

1

EVP, Chief Strategy and Product Officer

Meeting the needs of many customer segments

“Core” retail consumers KEY REASONS FOR SENDING:

Gifting Emergency Support

– C2C cash send market expected to grow low single digits in coming years*

– Trust, speed, and location are key elements for this segment

*SOURCE: WU 2014 Global Consumer Tracking Study, Nielsen; McKinsey Payments Map

Digital consumers

Payments for Gifting Support

goods/service

– C2C digital send market expected to grow 20%+ in coming years*

– Over 1 billion bank accounts can accept a money transfer from WU

MILLENNIALS

REPRESENT 35

**

46%+ COUNTRIES LIVE ON

WU DIGITAL

CUSTOMER WU.COM BASE

*SOURCE: McKinsey Payments Map

**SOURCE: WU 2014 Global Consumer Tracking Study, Nielsen

Social media consumers KEY REASONS FOR SENDING:

Bill/payback Sharing Gifting Support

– Future growth opportunity, driven by smart phone adoption and desire for immediacy

– WU Connect is a leading solution for social media platforms

Viber (+600 million users)

WeChat (+500 million users)

Others in pipeline

SMEs with expanding cross-border needs

– SMEs need straightforward and trusted

support for sending and receiving

payments across borders

– WUBS can help SMEs manage payment

risk, cash flow, and currency exposure

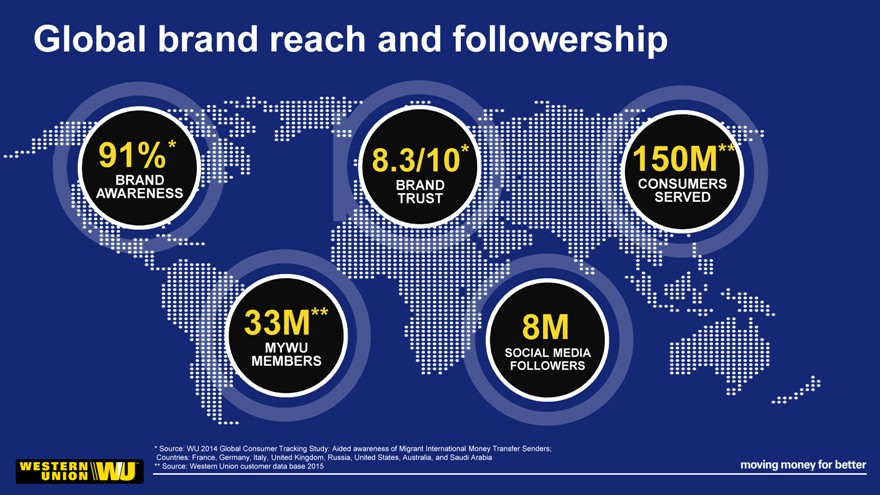

Global brand reach and followership

91%* 8.3/10* 150M**

BRAND BRAND CONSUMERS

AWARENESS TRUST SERVED

33M** 8M

MYWU SOCIAL MEDIA

MEMBERS FOLLOWERS

* Source: WU 2014 Global Consumer Tracking Study: Aided awareness of Migrant International Money Transfer Senders;

Countries: France, Germany, Italy, United Kingdom, Russia, United States, Australia, and Saudi Arabia

** Source: Western Union customer data base 2015

Customers tell us our brand is about…

And a confident new visual identity…

HISTORICAL LOGOS NEW LOGOS & VISUAL IDENTITY

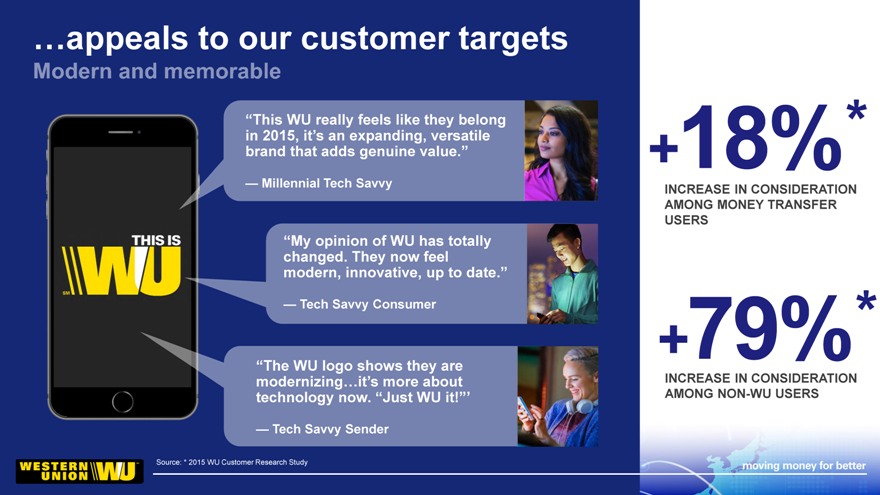

…appeals to our customer targets

“This WU really feels like they belong

in 2015, it’s an expanding, versatile *

brand that adds genuine value.” +

— Millennial Tech Savvy INCREASE IN CONSIDERATION

AMONG MONEY TRANSFER

USERS

“My opinion of WU has totally

changed. They now feel

modern, innovative, up to date.”

— Tech Savvy Consumer *

+

“The WU logo shows they are

modernizing…it’s more about INCREASE IN CONSIDERATION

technology now. “Just WU it!”’ AMONG NON-WU USERS

— Tech Savvy Sender

Source: * 2015 WU Customer Research Study

New look is effective in retail and digital formats

RETAIL DIGITAL MOBILE KIOSK/ATMs SOCIAL

INTEGRATION

Brand integrates well with others, and enhances trust

Consumer propensity to send international money transfer

via Social Media/Messaging platform when sent by WU

+56%* +43%*

+67%* +76%*

*Source: Western Union Consumer Research with Social Media users 2015, US and UK

Positioning the brand for businesses and their needs

Positioning the brand for businesses and their needs

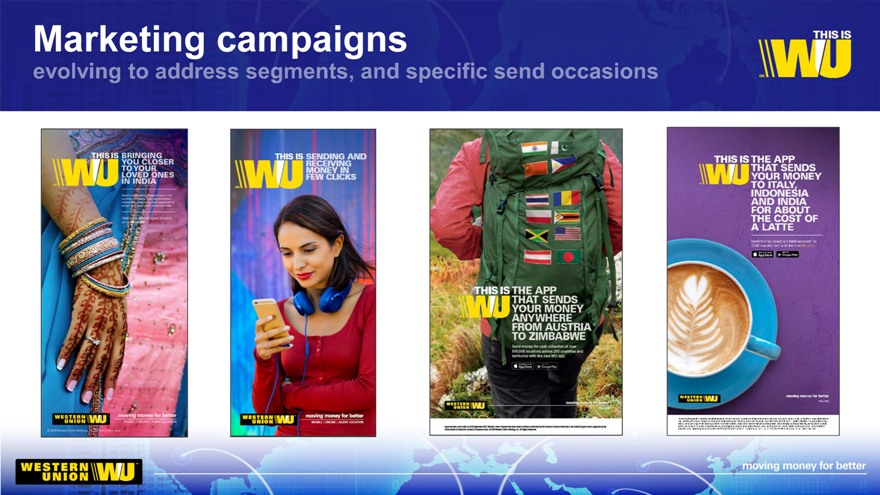

Marketing campaigns

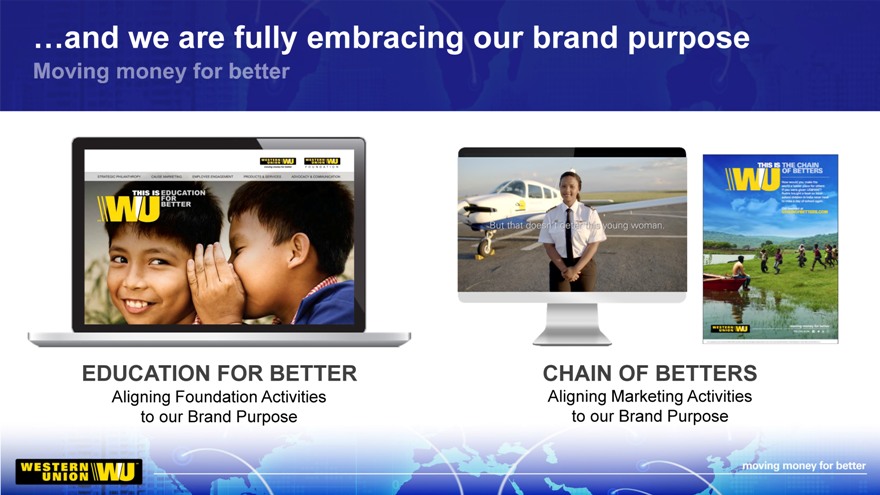

…and we are fully embracing our brand purpose

EDUCATION FOR BETTER CHAIN OF BETTERS

Aligning Foundation Activities Aligning Marketing Activities

to our Brand Purpose to our Brand Purpose

THIS IS DAVID THOMPSON

EVP, Chief Technology Officer

Global Operations and

Technology (GO-Tech)

Cross Border Platform

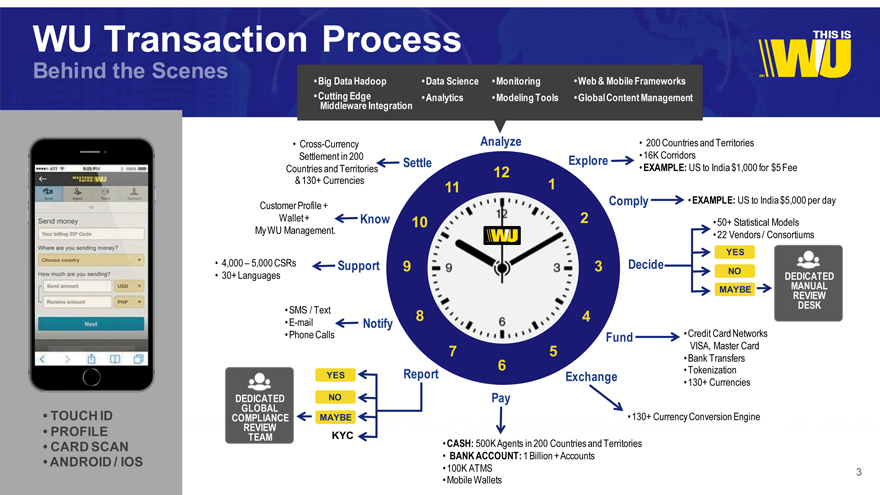

WU Transaction Process

Behind the Scenes

TOUCH ID

PROFILE

CARD SCAN

ANDROID / IOS

Big Data Hadoop Data Science Monitoring Web & Mobile Frameworks

Cutting Edge Analytics Modeling Tools Global Content Management

Middleware Integration

Cross-Currency Analyze 200 Countries and Territories

Settlement in 200 Settle Explore 16K Corridors

Countries and Territories 12 EXAMPLE: US to India $1,000 for $5 Fee

& 130+ Currencies 11 1

Customer Profile + Comply

Wallet + Know 10 2

My WU Management.

EXAMPLE: US to India $5,000 per day

50+ Statistical Models

22 Vendors / Consortiums

YES

4,000 – 5,000 CSRs Support 9 3 Decide NO

30+ Languages DEDICATED

MAYBE MANUAL

REVIEW

SMS / Text 8 4 DESK

E-mail Notify

Phone Calls Fund Credit Card Networks

YES Report Exchange Tokenization

130+ Currencies

DEDICATED NO Pay

GLOBAL

COMPLIANCE MAYBE 130+ Currency Conversion Engine

REVIEW

TEAM KYC CASH: 500K Agents in 200 Countries and Territories

BANK ACCOUNT: 1 Billion + Accounts

100K ATMS 3

Mobile Wallets

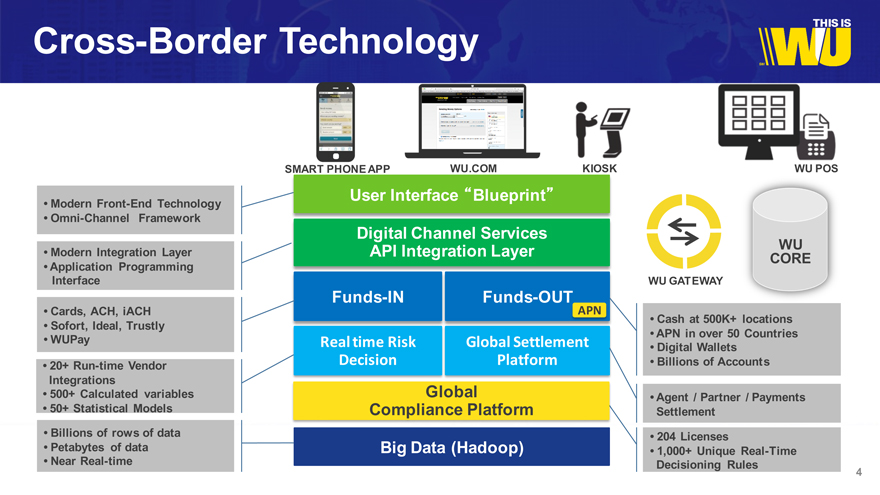

Cross-Border Technology

Modern Front-End Technology

Omni-Channel Framework

Modern Integration Layer

Application Programming

Interface

Cards, ACH, iACH

Sofort, Ideal, Trustly

WUPay

20+ Run-time Vendor Integrations

500+ Calculated variables

50+ Statistical Models

Billions of rows of data

Petabytes of data

Near Real-time

SMART PHONE APP KIOSK

User Interface “Blueprint”

Digital Channel Services

API Integration Layer

Funds-IN Funds-OUT

APN

Real time Risk Global Settlement

Decision Platform

Global

Compliance Platform

Big Data (Hadoop)

WU POS

WU CORE

WU GATEWAY

Cash at 500K+ locations

APN in over 50 Countries

Digital Wallets

Billions of Accounts

Agent / Partner / Payments

Settlement

204 Licenses

1,000+ Unique Real-Time

Decisioning Rules 4

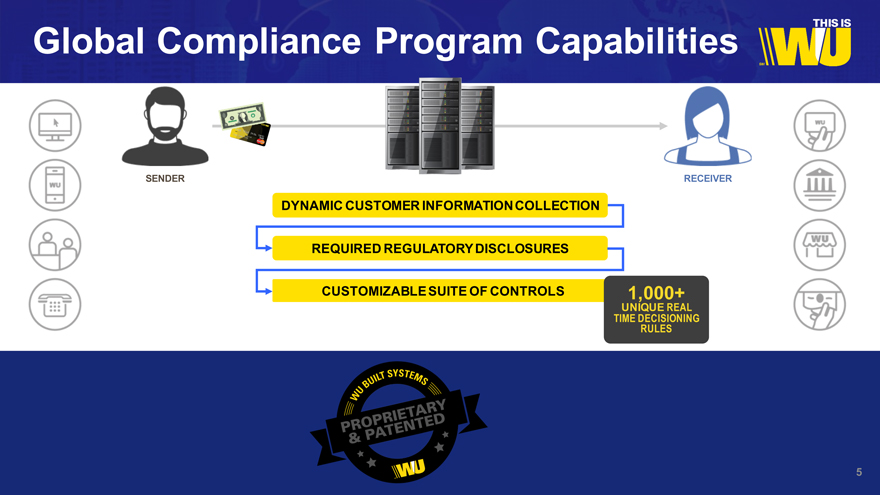

Global Compliance Program Capabilities

SENDER RECEIVER

DYNAMIC CUSTOMER INFORMATION COLLECTION

REQUIRED REGULATORY DISCLOSURES

CUSTOMIZABLE SUITE OF CONTROLS 1,000+

UNIQUE REAL

TIME DECISIONING

RULES

A LEADING

TECHNOLOGY

AND OPERATIONS

ORGANIZATION

MROC

Mexico

LAROC

Costa Rica

EUROC

Lithuania

AROC

Philippines

~2,200

DEDICATED

COMPLIANCE PROFESSIONALS

REAL-TIME

RESPONSE

WITHIN MILLISECONDS

1,000

REAL-TIME

DECISIONING

RULES

31

TRANSACTIONS

PER SECOND

EVP and President Middle East, Africa, Asia Pacific, Eastern Europe and CIS

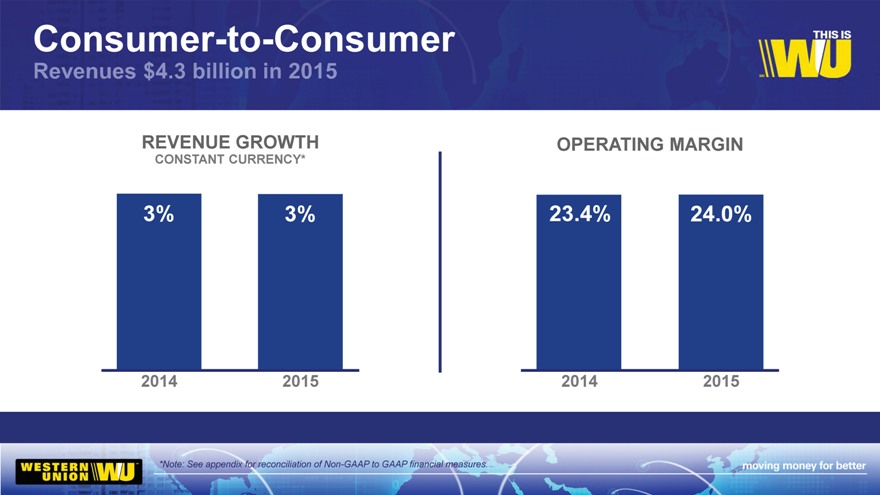

Consumer-to-Consumer

REVENUE GROWTH OPERATING MARGIN

CONSTANT CURRENCY*

3% 3% 23.4% 24.0%

2014

2015

2014

2015

*Note: See appendix for reconciliation of Non-GAAP to GAAP financial measures.

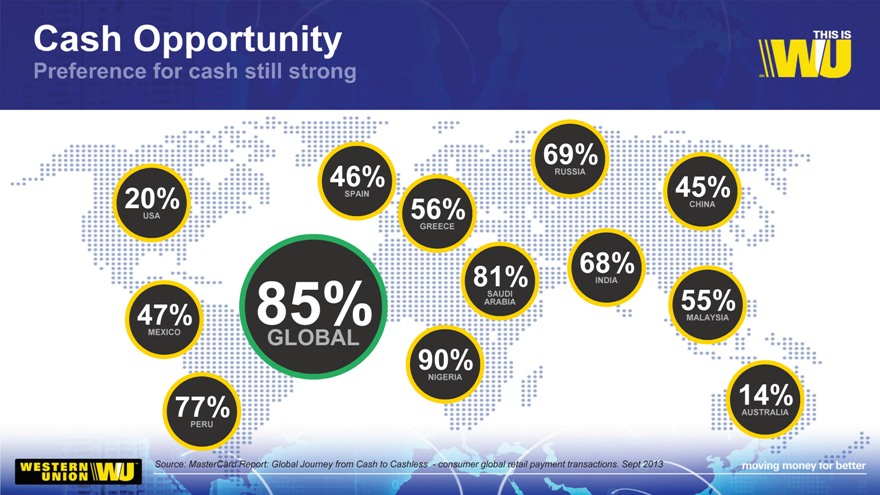

Cash Opportunity

69%

RUSSIA

46% SPAIN 45%

20% CHINA

USA 56%

GREECE

68%

81% INDIA

SAUDI

ARABIA 55%

47% 85% MALAYSIA

MEXICO GLOBAL

90%

NIGERIA

14%

77% AUSTRALIA

PERU

Source: MasterCard Report: Global Journey from Cash to Cashless—consumer global retail payment transactions. Sept 2013

Retail: Our foundation for growth

500K+

Retail: Our foundation for growth AGENT LOCATIONS

Global cross-border funds-in and funds out network

Easy access

Money-in-minutes*

Appeal to cash-centric customers

* | | Service subject to local availability |

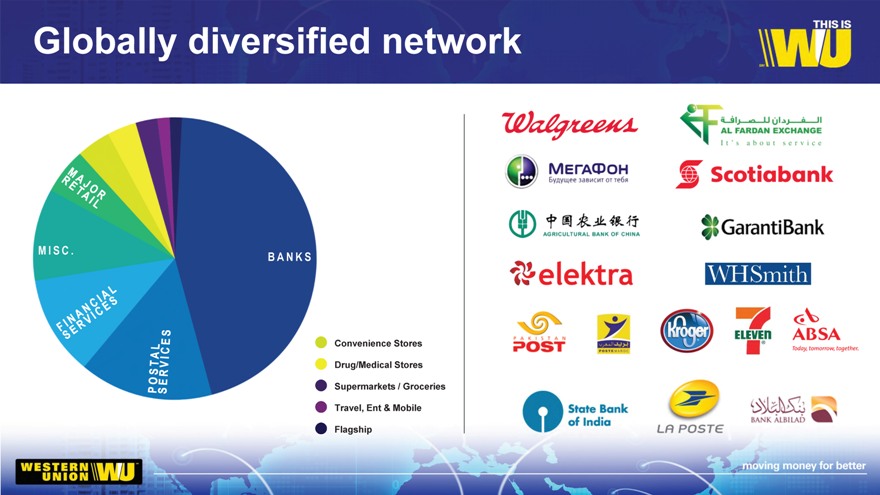

Globally diversified network

M I S C .

B A N K S

Convenience Stores Drug/Medical Stores Supermarkets / Groceries Travel, Ent & Mobile Flagship

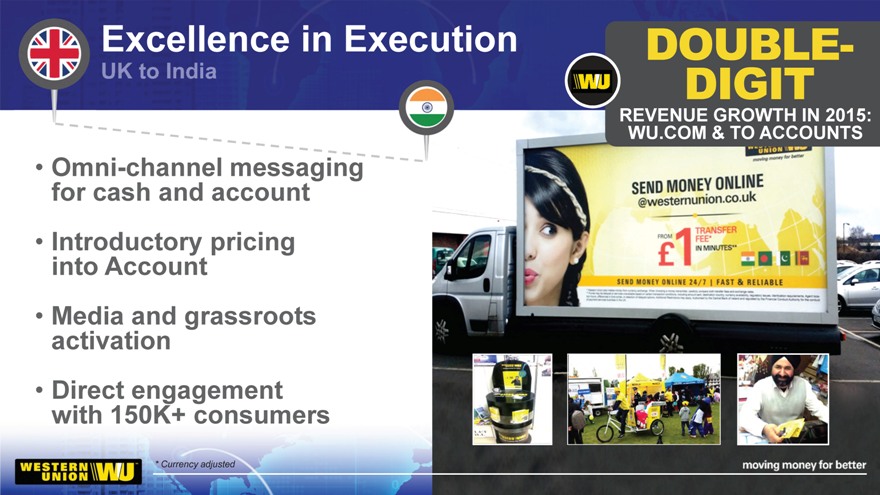

Excellence in Execution DOUBLE-

DIGIT

REVENUE GROWTH IN 2015: WU.COM & TO ACCOUNTS

Excellence in Execution DOUBLE-

DIGIT

REVENUE GROWTH IN 2015: WU.COM & TO ACCOUNTS

Omni-channel messaging for cash and account

Introductory pricing into Account

Media and grassroots activation

Direct engagement with 150K+ consumers

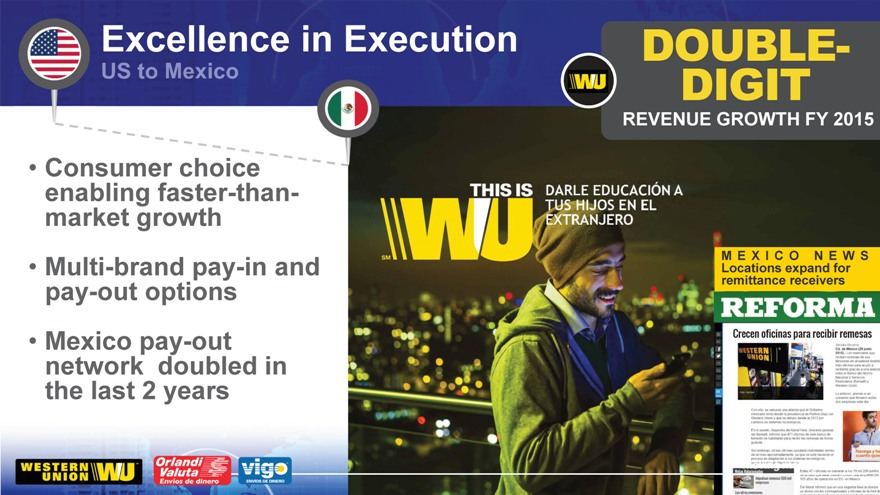

Excellence in Execution

Consumer choice enabling faster-than-market growth

Multi-brand pay-in and pay-out options

Mexico pay-out network doubled in the last 2 years

DOUBLE-DIGIT

REVENUE GROWTH FY 2015

M E X I C O N E W S Locations expand for remittance receivers

Capitalizing on an opportunity

Approximately 300 workers’ facilities visited

Majority Asian population

Detailed mapping and activation

Over 180 promoters and brand ambassadors

150K

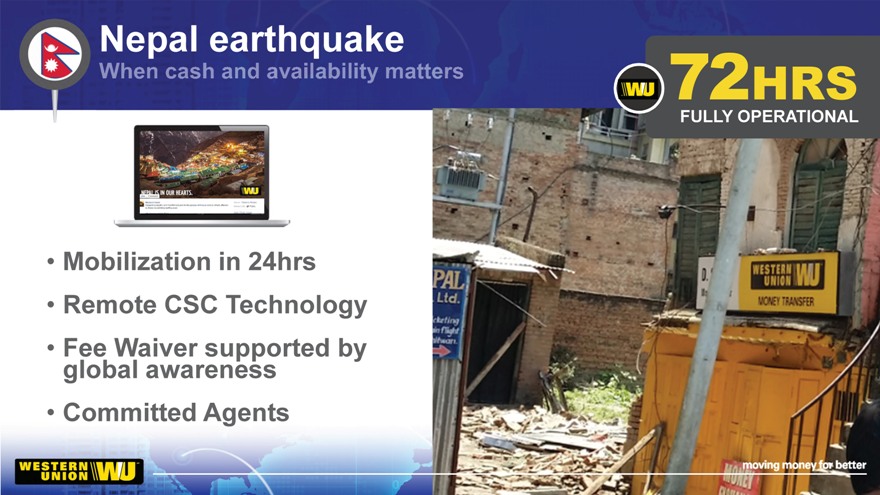

Nepal earthquake

Mobilization in 24hrs

Remote CSC Technology

Fee Waiver supported by global awareness

Committed Agents

72HRS

FULLY OPERATIONAL

Continuing the path of growth

Building our global funds in/out capabilities

Capitalization on global diaspora trends

Enhancing our customer experience

EVP and President Americas and European Union

In an evolving financial services world

REAL TIME GREATER RELIABILITY MULTIPLE ACCESSIBILITY

PRICE CHECK CONTROL CHANNELS

WU delivers:

16K+

CORRIDORS

Platform for cross border MT growth

Channel choice linking digital and cash

200 countries and territories

Our customers:

We are meeting our evolving

customer needs Support Gifting Urgent Good & Services Business Travel & Tourism

by linking cash and digital

Digitizing the retail experience

100K+

KIOSKS/ATMS

700 locations Approx. 8,000 5,000 units

locations

Top French FY’15: 36%

cities Q4’15: 155% trx growth

trx growth

High traffic

locations

15

Excellence in Execution

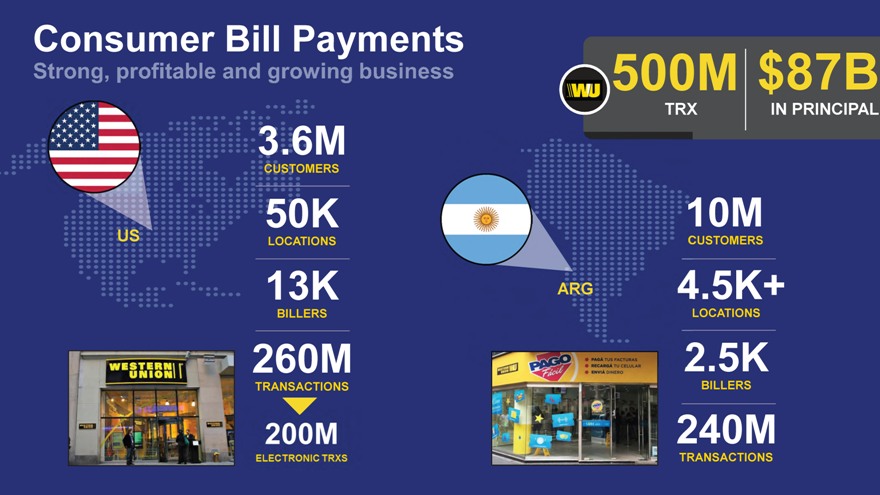

Consumer Bill Payments

500M $87B

TRX IN PRINCIPAL

3.6M

CUSTOMERS

50K 10M

US LOCATIONS USTOMERS

13K ARG .5K+

BILLERS LOCATIONS

260M 2.5K

TRANSACTIONS BILLERS

240M

TRANSACTIONS

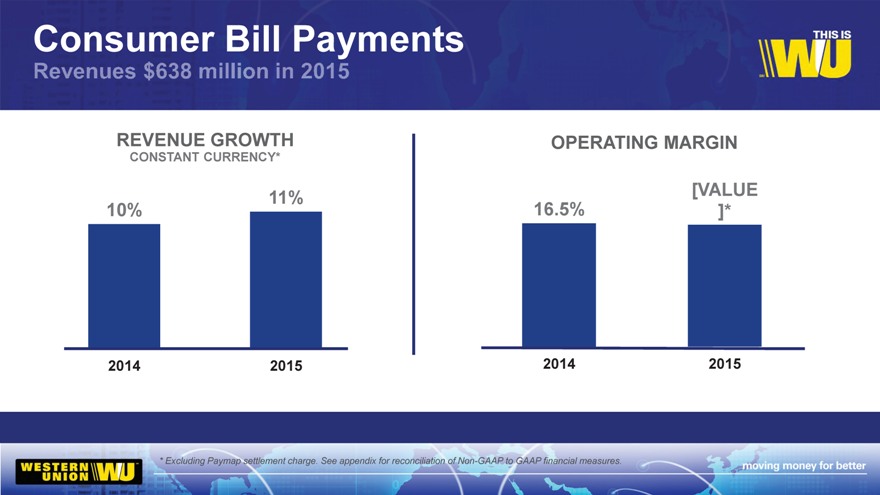

Consumer Bill Payments

REVENUE GROWTH OPERATING MARGIN

CONSTANT CURRENCY*

11% [VALUE

10% 16.5% ]*

2014 2015 2014 2015

* | | Excluding Paymap settlement charge. See appendix for reconciliation of Non-GAAP to GAAP financial measures. |

Consumer Bill Payments

CHANNELS FEATURES

WALK-IN EBILL

MOBILE VOICE ACTIVATION

INTERNET DYNAMIC MESSAGING

CALL CENTER NEW TECH DEVICE

New New New Payment

Billers Partners Methods

TESTIMONIAL VIDEO

20

SVP and GM, WU Digital

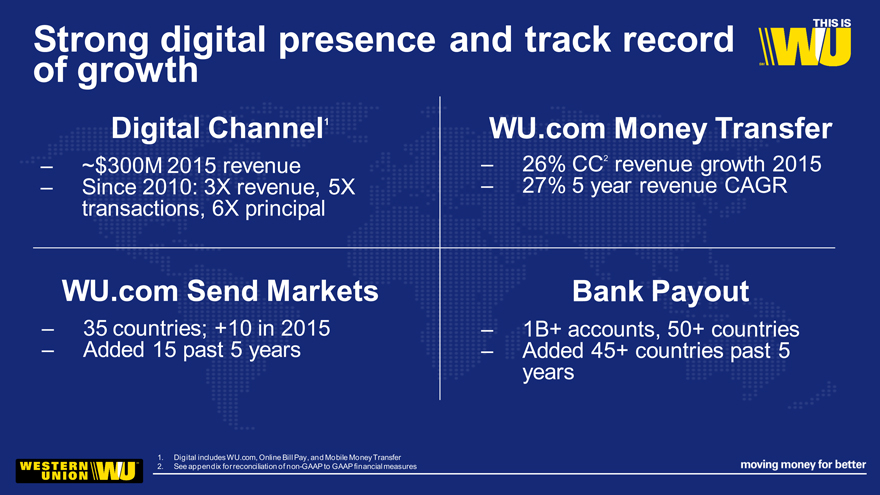

Strong digital presence and track record

of growth

Digital Channel1 WU.com Money Transfer

? ~$300M 2015 revenue ? 26% CC2 revenue growth 2015

? Since 2010: 3X revenue, 5X ? 27% 5 year revenue CAGR

transactions, 6X principal

WU.com Send Markets Bank Payout

? 35 countries; +10 in 2015 ? 1B+ accounts, 50+ countries

? Added 15 past 5 years ? Added 45+ countries past 5

years

1. Digital includes WU.com, Online Bill Pay, and Mobile Money Transfer

2. See appendix for reconciliation of non-GAAP to GAAP financial measures

Where WU plays in digital C2C

USE CASES

Support

Consumers

– Different from retail base

Digital C2C Market More affluent Gifting

Fast growing category within More banked

the remittance industry1 More tech savvy

Emergency

– Largely incremental

1. WU 2014 Global Consumer Tracking Study, Nielsen; McKinsey Payments Map

Key capabilities driving growth

Pay In

Mobile

– 3+ million downloads1 – Cash in 200+ markets

+ – Bank in 50+ markets

– Rating from customers2

– Mobile Wallet in

– Top 20 app in “Finance“3 10+ markets

1. App Annie.com.

2. 4-star+ rating for both U.S. iOS and Android apps as of Dec 31, 2015.

3. AppAnnie.com, Downloads Rank average for U.S. Android and iPhone apps for Oct 2015 through Jan 2016.

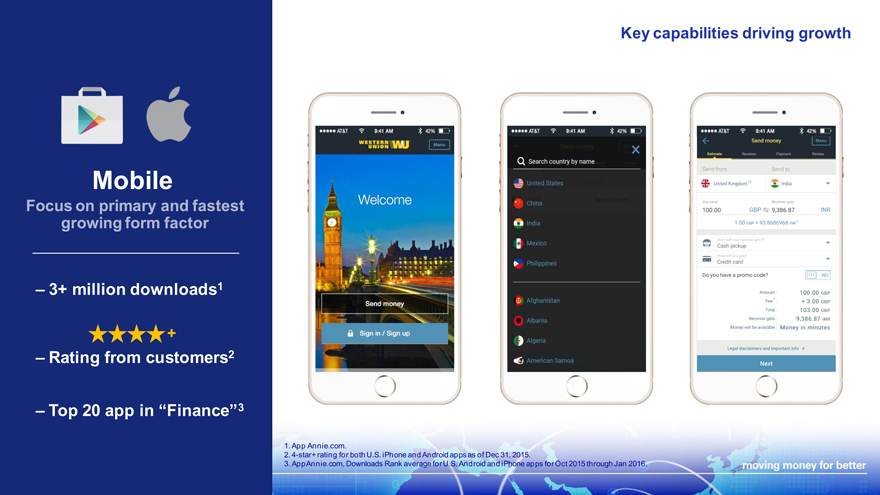

Key capabilities driving growth

Mobile

– 3+ million downloads1

+

– Rating from customers2

– Top 20 app in “Finance“3

1. App Annie.com.

2. 4-star+ rating for both U.S. iPhone and Android apps as of Dec 31, 2015.

3. AppAnnie.com, Downloads Rank average for U.S. Android and iPhone apps for Oct 2015 through Jan 2016.

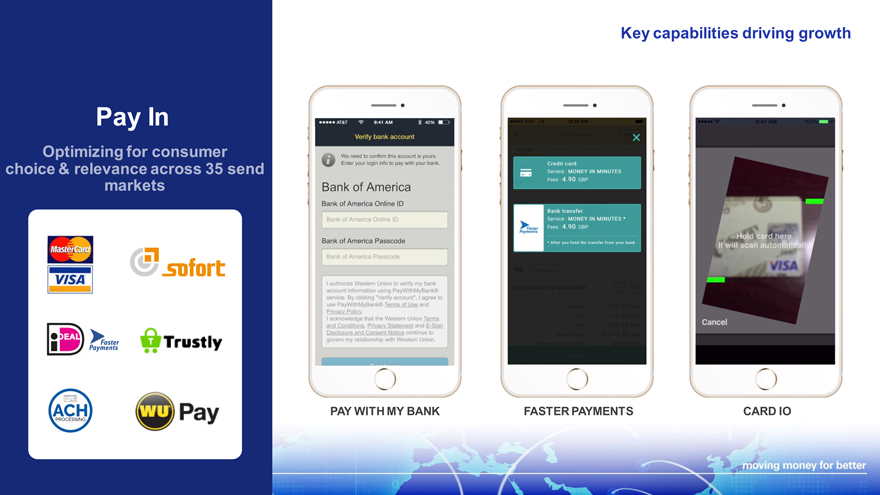

Key capabilities driving growth

Pay In Optimizing for consumer choice & relevance across 35 send markets

PAY WITH MY BANK FASTER PAYMENTS CARD IO

Key capabilities driving growth

India Direct to Bank Send

Pay Out

– Cash in 200+ markets

– Bank in 50+ markets

Sent: 4:41 EDT Received: 4:47 EDT

– Mobile Wallet in 10+ markets

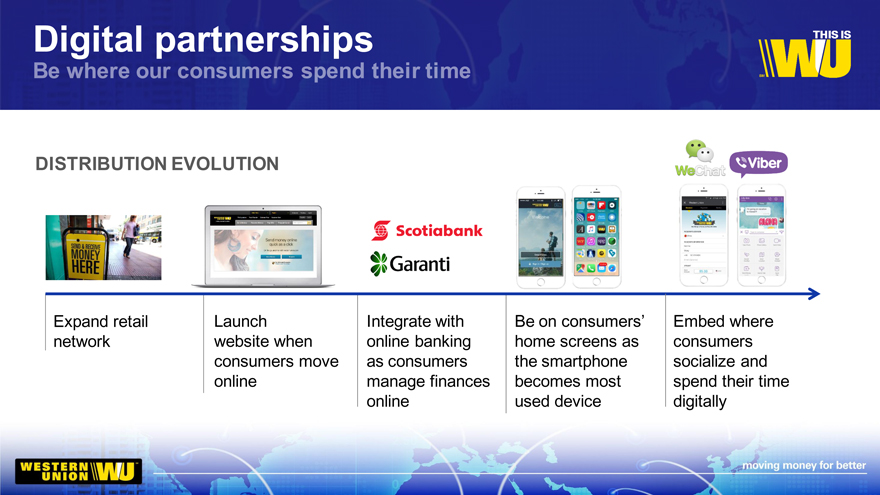

Digital partnerships

DISTRIBUTION EVOLUTION

Expand retail Launch Integrate with Be on consumers’ Embed where

network website when online banking home screens as consumers

consumers move as consumers the smartphone socialize and

online manage finances becomes most spend their time

online used device digitally

Digital partnerships: WU Connect

Multi- WU Opportunity

Currency

FX Trusted money transfer

Funds one tap away

In/Out

New customer segments

Potential Partner Universe

Risk Large digital audiences:

Management

messaging apps, social

media, telcos

Partner Value Proposition

Compliance Engagement, loyalty,

differentiation

Cross-

Settlement Border Send Monetization

Money

THIS IS KERRY AGIASOTIS

President, Western Union Business Solutions

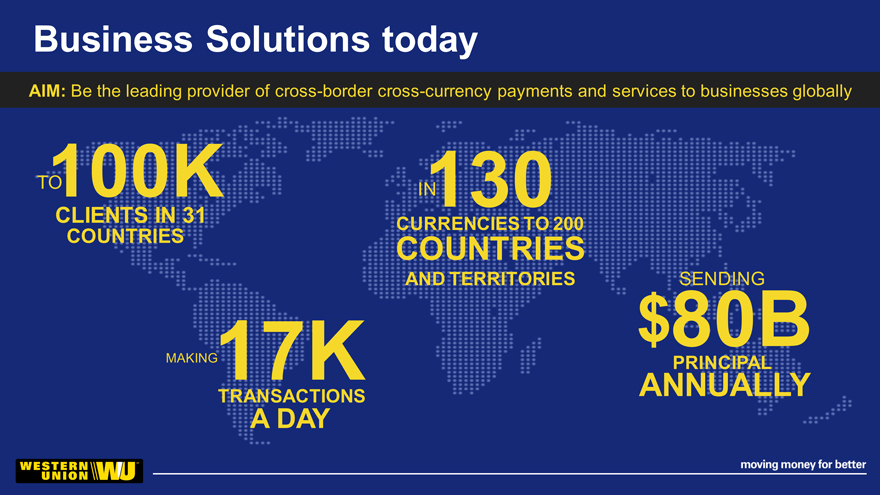

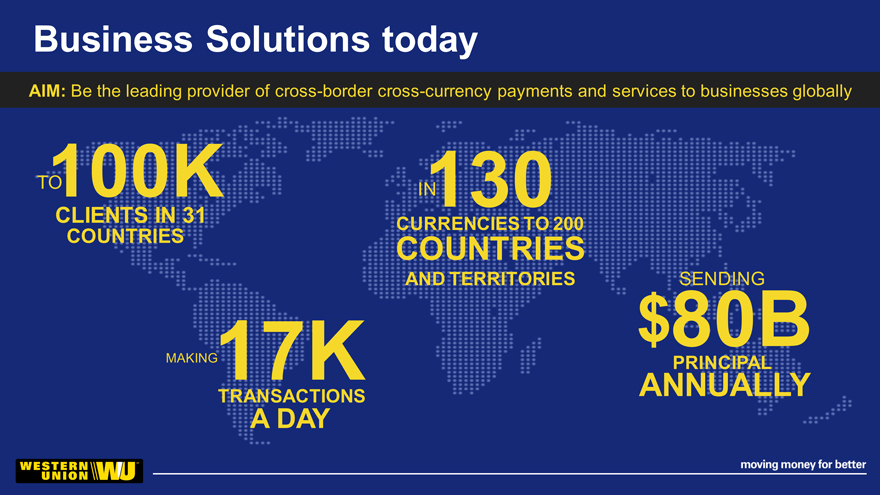

Business Solutions today

AIM: Be the leading provider of cross-border cross-currency payments and services to businesses globally

TO

100K

CLIENTS IN 31

COUNTRIES

130

CURRENCIES TO 200

COUNTRIES

AND TERRITORIES

17K

MAKING

TRANSACTIONS

A DAY

SENDING

$ 80B

PRINCIPAL

ANNUALLY

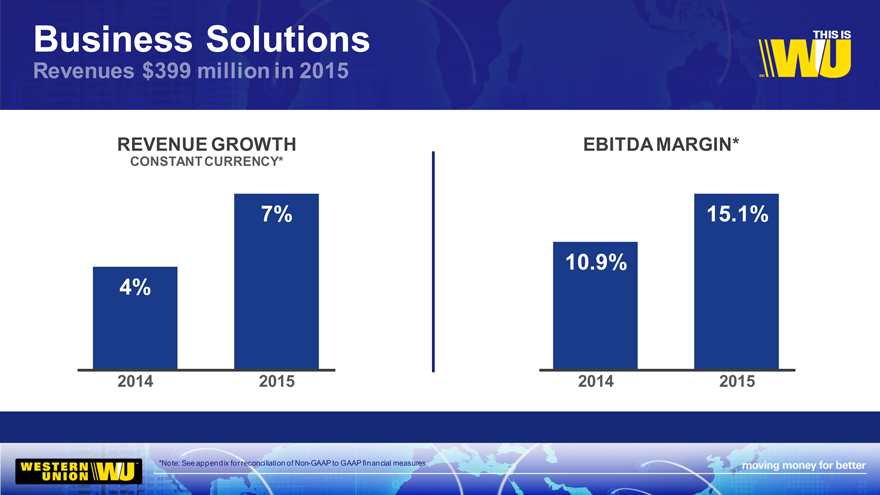

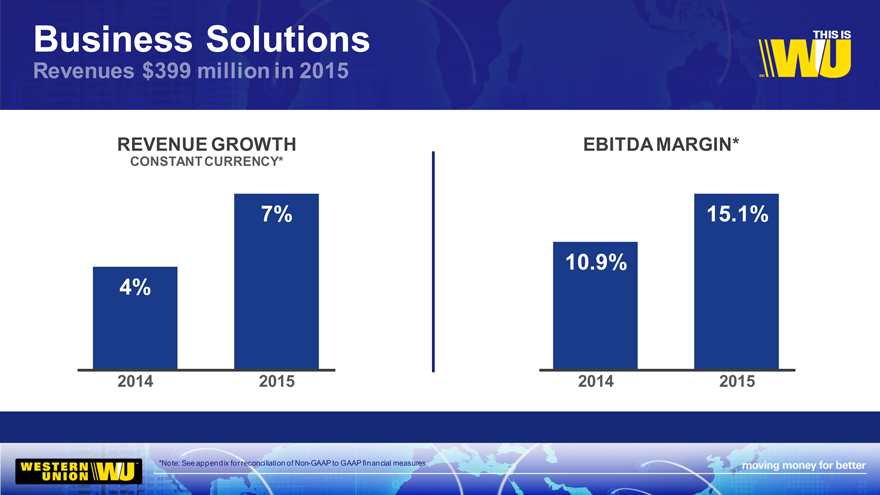

Business Solutions

Revenues $399 million in 2015

REVENUE GROWTH

CONSTANT CURRENCY*

7%

4%

2014 2015

EBITDA MARGIN*

15.1%

10.9%

2014 2015

*Note: See appendix for reconciliation of Non-GAAP to GAAP financial measures.

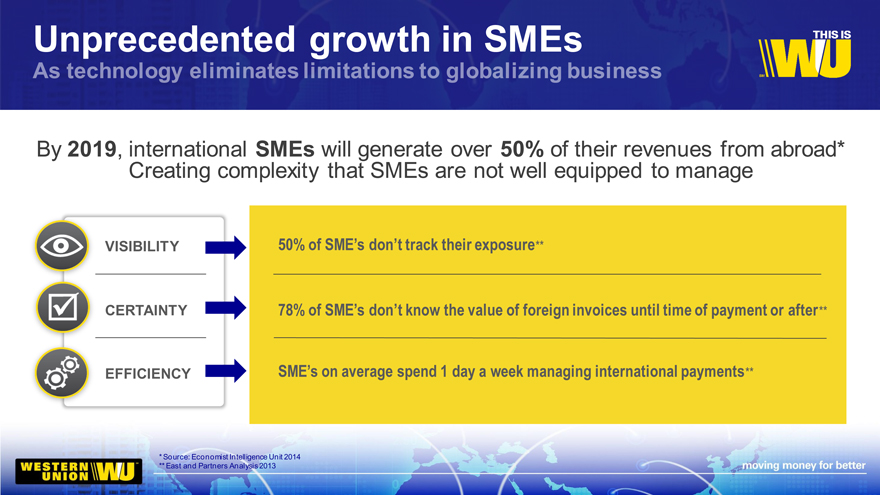

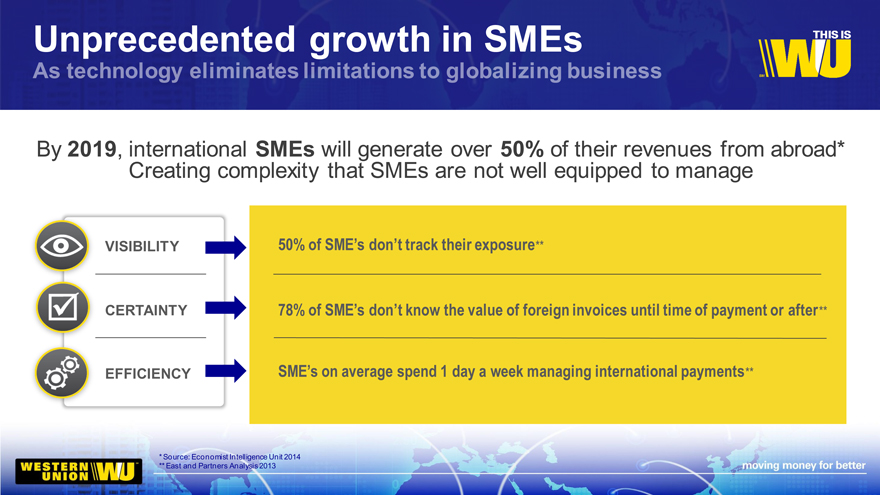

Unprecedented growth in SMEs

By 2019, international SMEs will generate over 50% of their revenues from abroad*

Creating complexity that SMEs are not well equipped to manage

VISIBILITY 50% of SME’s don’t track their exposure**

CERTAINTY 78% of SME_s don_t know the value of foreign invoices until time of payment or after**

EFFICIENCY SME_s on average spend 1 day a week managing international payments**

Source: Economist Intelligence Unit 2014

East and Partners Analysis 2013

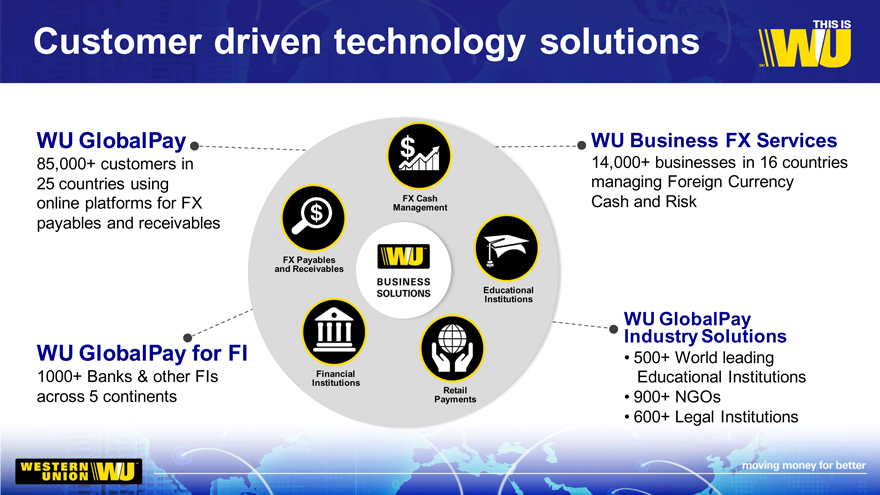

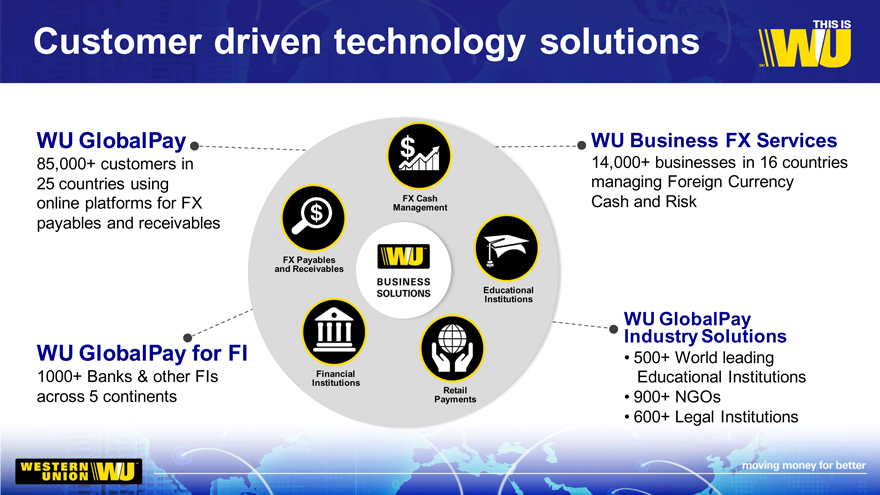

Customer driven technology solutions

WU GlobalPay WU Business FX Services

85,000+ customers in 14,000+ businesses in 16 countries

25 countries using managing Foreign Currency

online platforms for FX FX Cash Cash and Risk

Management

payables and receivables

FX Payables

and Receivables

Educational

Institutions

WU GlobalPay

Industry Solutions

WU GlobalPay for FI 500+ World leading

1000+ Banks & other FIs Institutions Financial Educational Institutions

across 5 continents Payments Retail 900+ NGOs

600+ Legal Institutions

Customer success

“I can set profit margins and budgets more

effectively.” – Jo Sujana, Director, Gideon

Services Inc.

SOLUTION:

GlobalPay

BUSINESS NEEDS

Streamlined solution for capturing and managing foreign invoices and sales orders

Greater visibility and management of fx exposures

Reduction in the time & effort to manage international payments and receipts

Customer success

_Providing international services has helped us increase client retention and wallet share and has had a positive impact to our non-interest income. Sudhir Dole, MD & CEO, ICICI Bank UK PLC._

[Graphic Appears Here]

SOLUTION:

GlobalPay FI

BUSINESS NEEDS

White labelled International Payments platform to integrate into their core banking system

Partner with ability to meet rapidly changing regulatory requirements through a robust and adaptable compliance program

Partner for joint go-to-market efforts

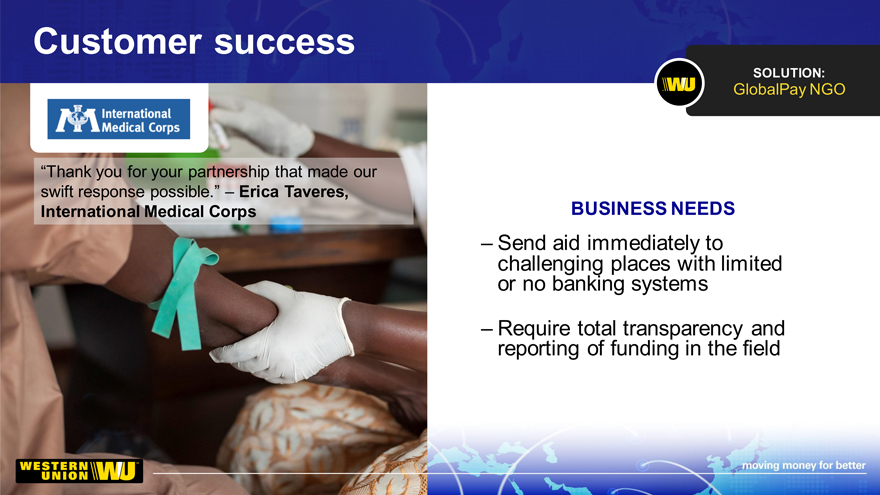

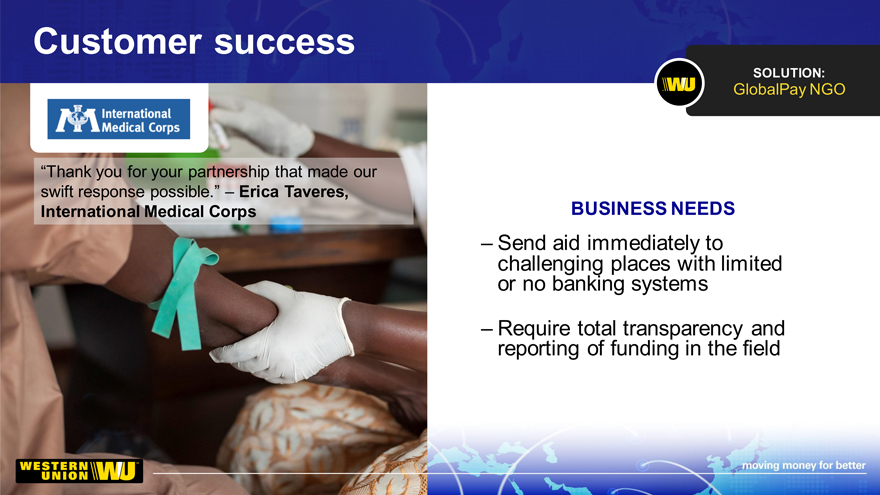

Customer success

SOLUTION:

GlobalPay Education

“WUBS provides improved controls to BUSINESS NEEDS

better manage these special payments

and allows us to save money and – Ability to simplify international

valuable time.” – Nancy Majerek, student payments via local

Treasury Manager, University of payment options

Notre Dame

– Enable full reconciliation of

incoming payments from

international students

– Ability to facilitate international AP

payments through a single platform

[Graphic Appears Here]

Customer success

_Thank you for your partnership that made our swift response possible. Erica Taveres,

International Medical Corps

[Graphic Appears Here]

SOLUTION:

GlobalPay NGO

BUSINESS NEEDS

Send aid immediately to challenging places with limited or no banking systems

Require total transparency and reporting of funding in the field

NGO GLOBALPAY VIDEO

10

Business Solutions future growth

Further leveraging core assets of WU presents additional

future growth opportunities in the B2B and B2C arenas

FUTURE OPPORTUNITY

MASS PAYMENTS

GEOGRAPHIC EXPANSION

INTERNATIONAL

TRADE RECEIVABLES

This is RAJ AGARWAL

EVP and CFO

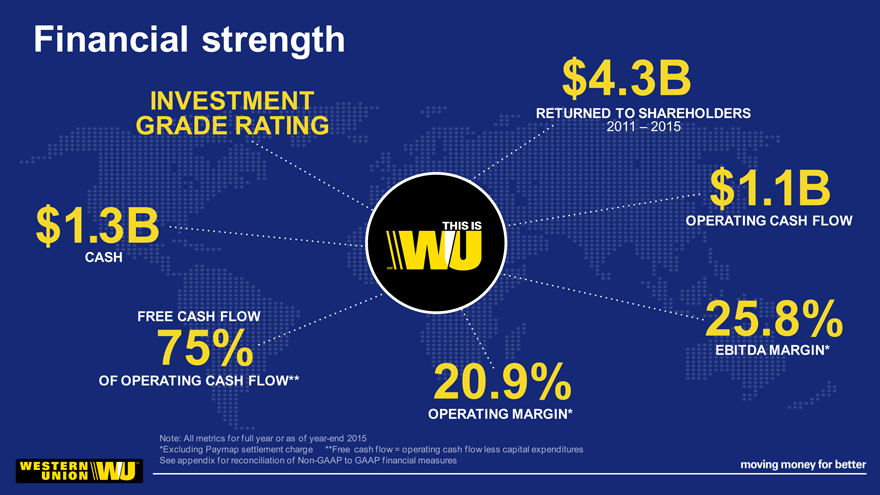

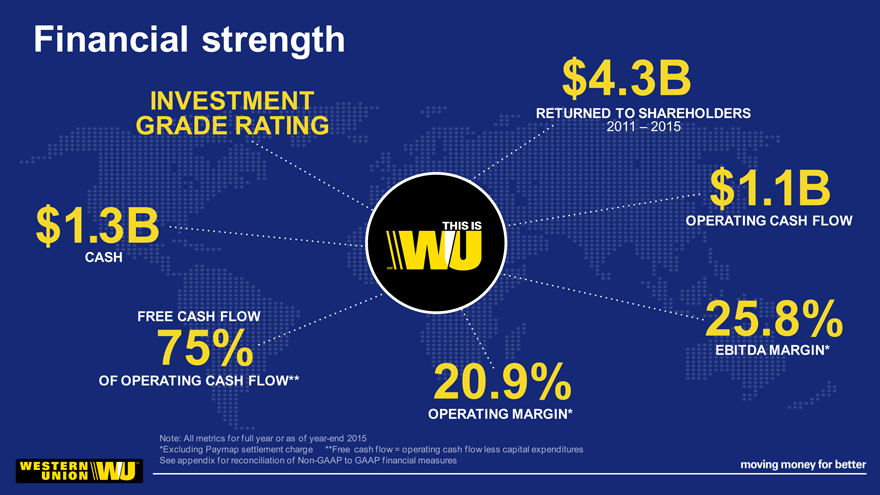

Financial strength

INVESTMENT

$4.3B

RETURNED TO SHAREHOLDERS

GRADE RATING

2011 – 2015

$1.1B

$1.3B

OPERATING CASH FLOW

CASH

FREE CASH FLOW

25.8%

75%

EBITDA MARGIN*

OF OPERATING CASH FLOW**

20.9%

OPERATING MARGIN*

Stable operating margins

Currency driving recent fluctuations

OPERATING MARGIN

20.0%

20.3%

20.9%*

~20%

2013 2014 2015 2016

OUTLOOK

CURRENCY IMPACT VS. PRIOR YEAR 0.4% (~1.0%)

*Excluding Paymap settlement charge. See appendix for reconciliation of Non-GAAP to GAAP financial measures.

Stable operating margins

MARGIN IMPACT 2014 – 2016

+ Cost savings initiatives, other

efficiencies, FX hedges

– IT investment, compliance

investment, stronger dollar

Operating margins

Operating leverage from revenue growth

C2C commission rate

Compliance

Marketing

40% 45% 3.6% 3.8%

FIXED COSTS OF REVENUES OF REVENUES

Note: 2015 percentages

Operating margins

Cost savings Currency/ New

initiatives hedges businesses

– Models still

HEDGES evolving

$32M MINIMIZE

NEAR-TERM – IT investment

INCREMENTAL FX IMPACTS ON – Incremental

SAVINGS 2015 PROFIT revenue is key

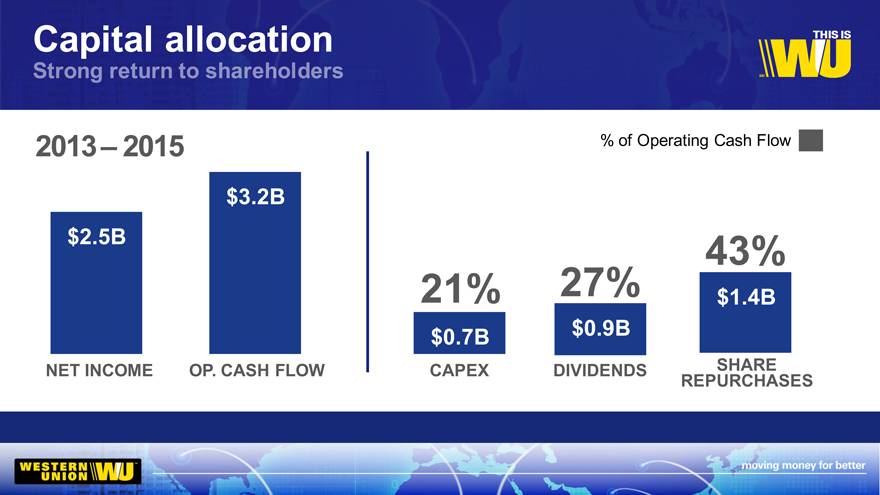

Capital allocation

Reinvest in business

CAPITAL SPENDING

4%

OF REVENUES 2013 – 2015

Return to shareholders

– Balanced payout between dividends and share repurchases

– Maintain investment grade rating

Strategic M&A

– Evaluate opportunities in cross-border money movement

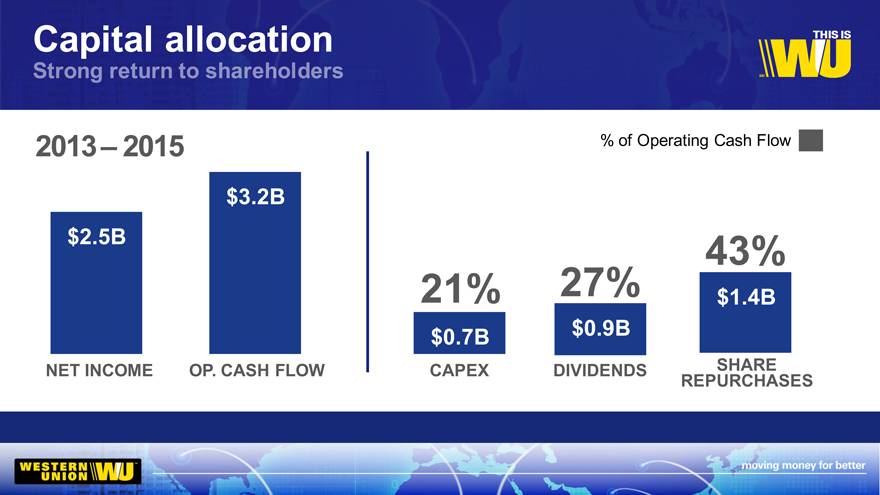

Capital allocation

2013 – 2015 % of Operating Cash Flow

$3.2B

$2.5B 43%

21% 27% $1.4B

$0.7B $0.9B

NET INCOME OP. CASH FLOW CAPEX DIVIDENDS SHARE

REPURCHASES

Capital allocation

QUARTERLY DIVIDEND LEVELS

$0.16

$0.155

$0.125

$0.10

$0.08

$0.07

$0.06

1Q 2010

4Q 2010

2Q 2011

1Q 2012

4Q 2012

1Q 2015

1Q 2016

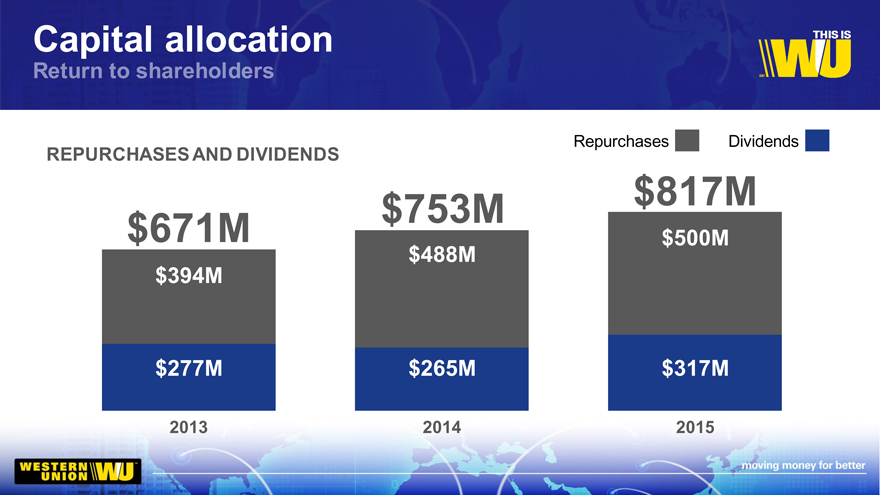

Capital allocation

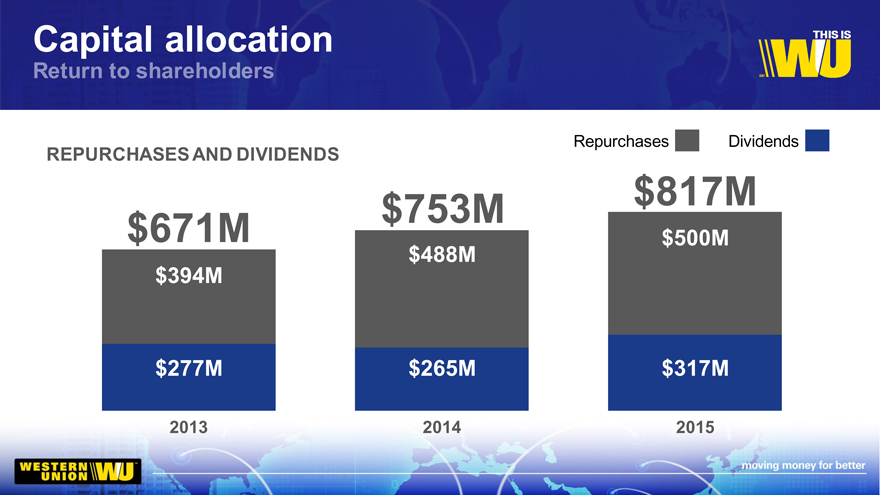

Repurchases Dividends

REPURCHASES AND DIVIDENDS

$753M $817M

$671M $500M

$488M

$394M

$277M

$265M

$317M

2013

2014

2015

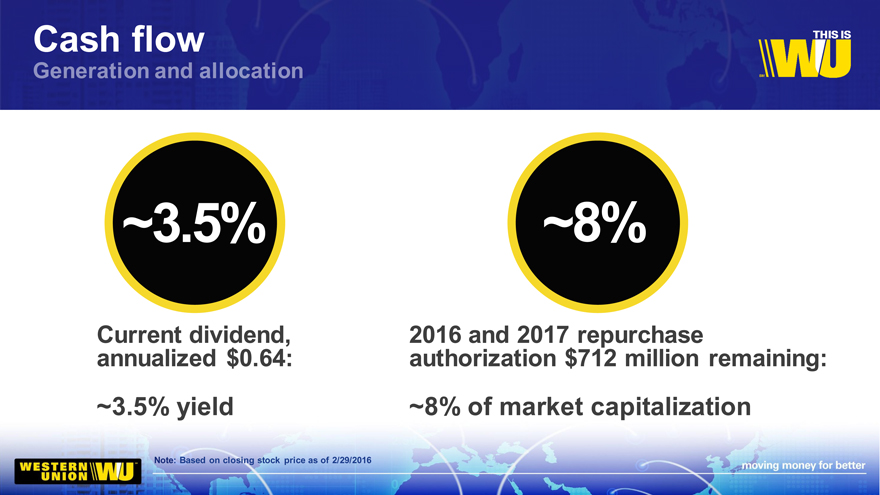

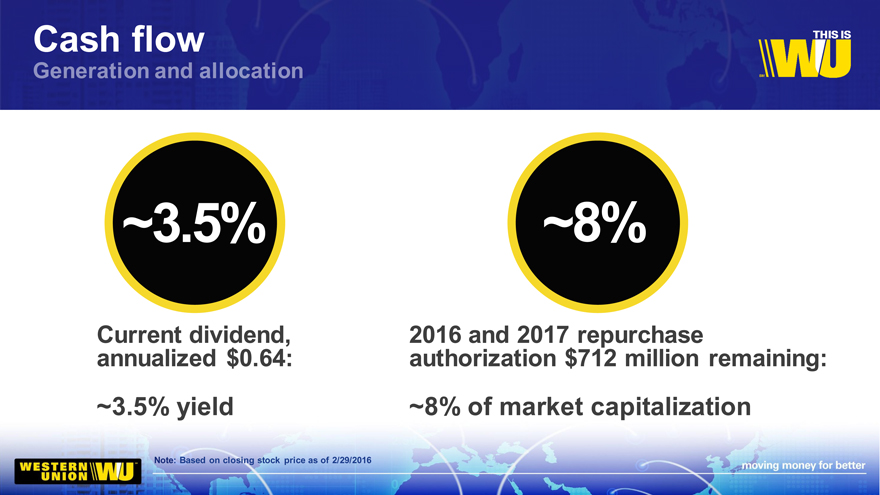

Cash flow

~3.5%

~8%

Current dividend, 2016 and 2017 repurchase

annualized $0.64: authorization $712 million remaining:

~3.5% yield ~8% of market capitalization

Note: Based on closing stock price as of 2/29/2016

Solid core business generating

strong cash flow combined with strong balance sheet

– Provides flexibility for – Allows for continued

growth investments high returns of cash

flow to shareholders

Non GAAP Measures

Western Union’s management believes the non-GAAP financial measures presented provide meaningful supplemental information regarding our operating results to assist management, investors, analysts, and others in understanding our financial results and to better analyze trends in our underlying business, because they provide consistency and comparability to prior periods.

These non-GAAP financial measures include revenue change constant currency adjusted; operating income margin, excluding Paymap settlement agreement; EBITDA margin; adjusted EBITDA margin, excluding Paymap settlement agreement; diluted earnings per share, excluding Paymap settlement agreement; Consumer-to-Consumer segment revenue change constant currency adjusted; Consumer-to-Consumer segment retail initiated money transfer revenue change, constant currency adjusted; Consumer-to-Consumer segment westernunion.com region revenue change constant currency adjusted; Consumer-to-Business segment revenue change constant currency adjusted; Consumer-to-Business segment adjusted operating income margin, excluding Paymap settlement agreement; Business Solutions segment revenue change constant currency adjusted; and Business Solutions segment EBITDA margin. Constant currency results assume foreign revenues are translated from foreign currencies to the U.S. dollar, net of the effect of foreign currency hedges, at rates consistent with those in the prior year.

A non-GAAP financial measure should not be considered in isolation or as a substitute for the most comparable GAAP financial measure. A non-GAAP financial measure reflects an additional way of viewing aspects of our operations that, when viewed with our GAAP results and the reconciliation to the corresponding GAAP financial measure, provide a more complete understanding of our business. Users of the financial statements are encouraged to review our financial statements and publicly-filed reports in their entirety and not to rely on any single financial measure. A reconciliation of non-GAAP financial measures to the most directly comparable GAAP financial measures is included below. All adjusted year-over-year changes were calculated using prior year reported amounts. Amounts included below are in millions, unless indicated otherwise.

Reconciliation of Non GAAP Measures

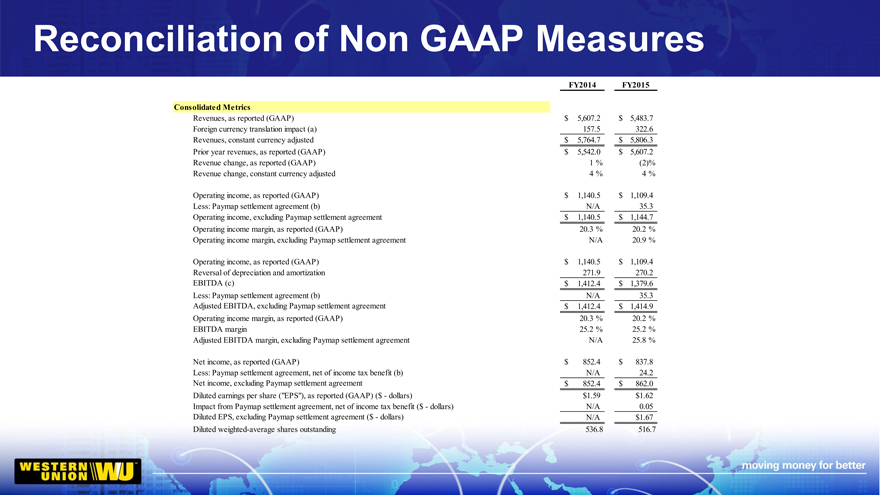

FY2014 FY2015

Consolidated Metrics

Revenues, as reported (GAAP) $ 5,607.2 $ 5,483.7

Foreign currency translation impact (a) 157.5 322.6

Revenues, constant currency adjusted $ 5,764.7 $ 5,806.3

Prior year revenues, as reported (GAAP) $ 5,542.0 $ 5,607.2

Revenue change, as reported (GAAP) 1 % (2)%

Revenue change, constant currency adjusted 4 % 4 %

Operating income, as reported (GAAP) $ 1,140.5 $ 1,109.4

Less: Paymap settlement agreement (b) N/A 35.3

Operating income, excluding Paymap settlement agreement $ 1,140.5 $ 1,144.7

Operating income margin, as reported (GAAP) 20.3 % 20.2 %

Operating income margin, excluding Paymap settlement agreement N/A 20.9 %

Operating income, as reported (GAAP) $ 1,140.5 $ 1,109.4

Reversal of depreciation and amortization 271.9 270.2

EBITDA (c) $ 1,412.4 $ 1,379.6

Less: Paymap settlement agreement (b) N/A 35.3

Adjusted EBITDA, excluding Paymap settlement agreement $ 1,412.4 $ 1,414.9

Operating income margin, as reported (GAAP) 20.3 % 20.2 %

EBITDA margin 25.2 % 25.2 %

Adjusted EBITDA margin, excluding Paymap settlement agreement N/A 25.8 %

Net income, as reported (GAAP) $ 852.4 $ 837.8

Less: Paymap settlement agreement, net of income tax benefit (b) N/A 24.2

Net income, excluding Paymap settlement agreement $ 852.4 $ 862.0

Diluted earnings per share (“EPS”), as reported (GAAP) ($—dollars) $1.59 $1.62

Impact from Paymap settlement agreement, net of income tax benefit ($—dollars) N/A 0.05

Diluted EPS, excluding Paymap settlement agreement ($—dollars) N/A $1.67

Diluted weighted-average shares outstanding 536.8 516.7

Reconciliation of Non GAAP Measures

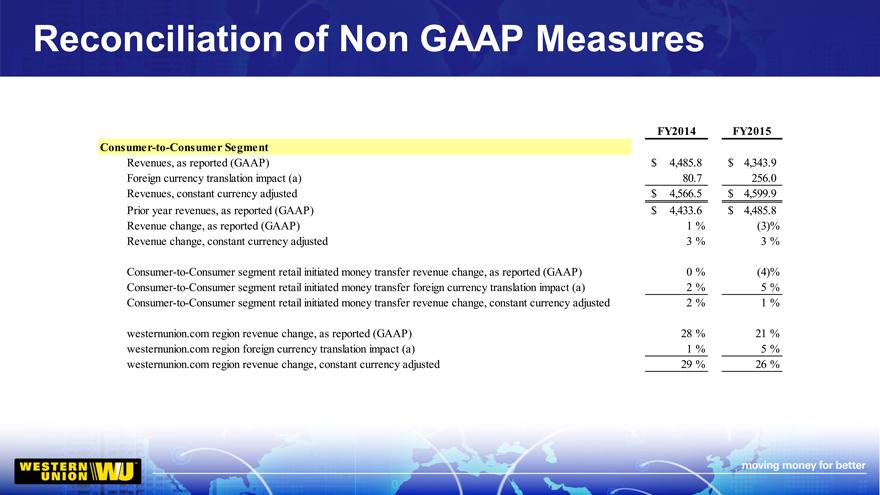

FY2014 FY2015

Consumer-to-Consumer Segment

Revenues, as reported (GAAP) $ 4485, .8 $ 4,343.9

Foreign currency translation impact (a) 80.7 256.0

Revenues, constant currency adjusted $ 4,566.5 $ 4,599.9

Prior year revenues, as reported (GAAP) $ 4,433.6 $ 4,485.8

Revenue change, as reported (GAAP) 1 % (3)%

Revenue change, constant currency adjusted 3 % 3 %

Consumer-to-Consumer segment retail initiated money transfer revenue change, as reported (GAAP) 0 % (4)%

Consumer-to-Consumer segment retail initiated money transfer foreign currency translation impact (a) 2 % 5 %

Consumer-to-Consumer segment retail initiated money transfer revenue change, constant currency adjusted 2 % 1 %

westernunion.com region revenue change, as reported (GAAP) 28 % 21 %

westernunion.com region foreign currency translation impact (a) 1 % 5 %

westernunion.com region revenue change, constant currency adjusted 29 % 26 %

Reconciliation of Non GAAP Measures

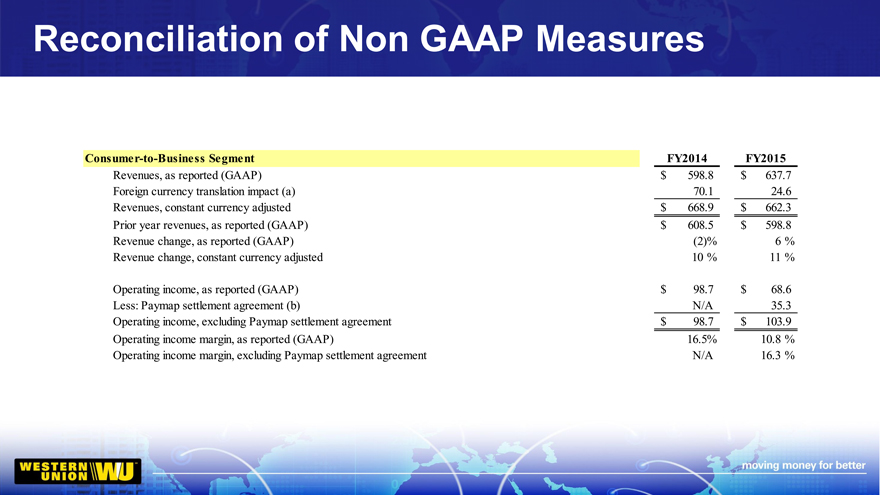

Consumer-to-Business Segment FY2014 FY2015

Revenues, as reported (GAAP) $ 598.8 $ 637.7

Foreign currency translation impact (a) 70.1 24.6

Revenues, constant currency adjusted $ 668.9 $ 662.3

Prior year revenues, as reported (GAAP) $ 608.5 $ 598.8

Revenue change, as reported (GAAP) (2)% 6 %

Revenue change, constant currency adjusted 10 % 11 %

Operating income, as reported (GAAP) $ 98.7 $ 68.6

Less: Paymap settlement agreement (b) N/A 35.3

Operating income, excluding Paymap settlement agreement $ 98.7 $ 103.9

Operating income margin, as reported (GAAP) 16.5% 10.8 %

Operating income margin, excluding Paymap settlement agreement N/A 16.3 %

Reconciliation of Non GAAP Measures

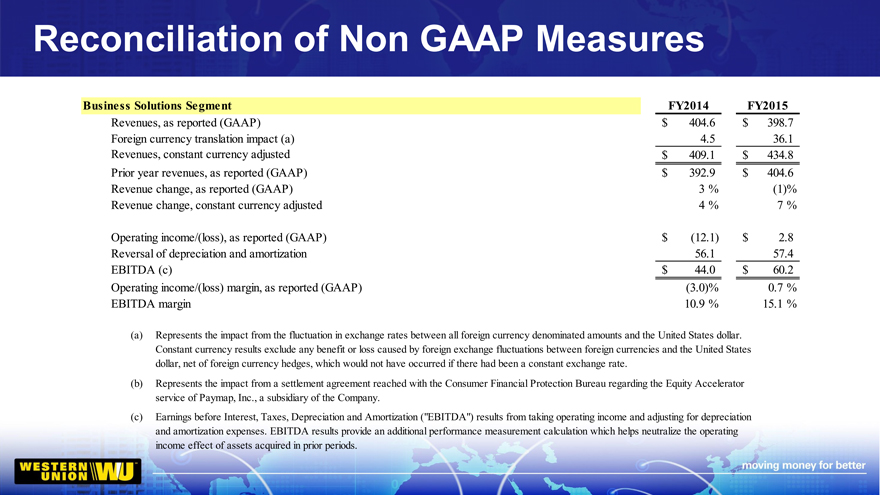

Business Solutions Segment FY2014 FY2015

Revenues, as reported (GAAP) $ 404.6 $ 398.7

Foreign currency translation impact (a) 4.5 36.1

Revenues, constant currency adjusted $ 409.1 $ 434.8

Prior year revenues, as reported (GAAP) $ 392.9 $ 404.6

Revenue change, as reported (GAAP) 3 % (1)%

Revenue change, constant currency adjusted 4 % 7 %

Operating income/(loss), as reported (GAAP) $ (12.1) $ 2.8

Reversal of depreciation and amortization 56.1 57.4

EBITDA (c) $ 44.0 $ 60.2

Operating income/(loss) margin, as reported (GAAP) (3.0)% 0.7 %

EBITDA margin 10.9 % 15.1 %

(a) Represents the impact from the fluctuation in exchange rates between all foreign currency denominated amounts and the United States dollar. Constant currency results exclude any benefit or loss caused by foreign exchange fluctuations between foreign currencies and the United States dollar, net of foreign currency hedges, which would not have occurred if there had been a constant exchange rate.

(b) Represents the impact from a settlement agreement reached with the Consumer Financial Protection Bureau regarding the Equity Accelerator service of Paymap, Inc., a subsidiary of the Company.

(c) Earnings before Interest, Taxes, Depreciation and Amortization (“EBITDA”) results from taking operating income and adjusting for depreciation and amortization expenses. EBITDA results provide an additional performance measurement calculation which helps neutralize the operating income effect of assets acquired in prior periods.