Exhibit 99.1

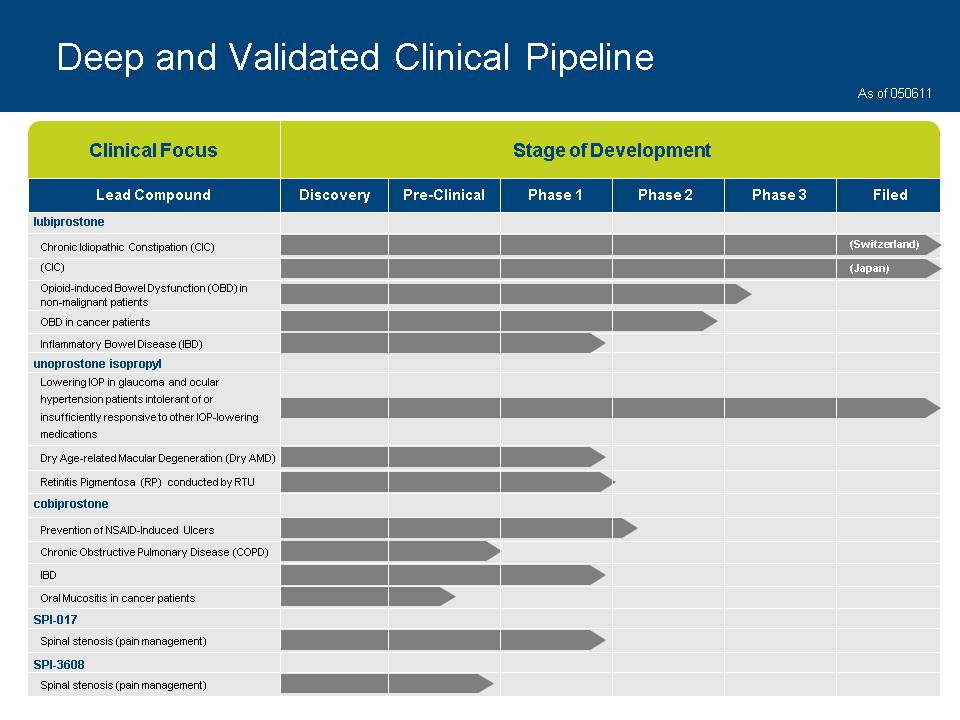

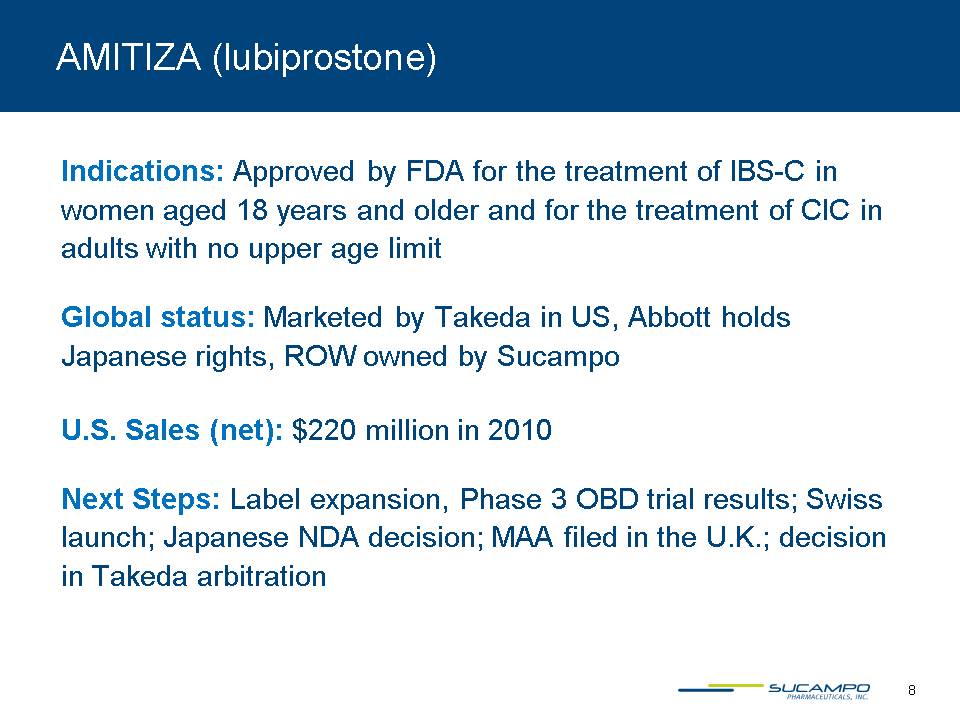

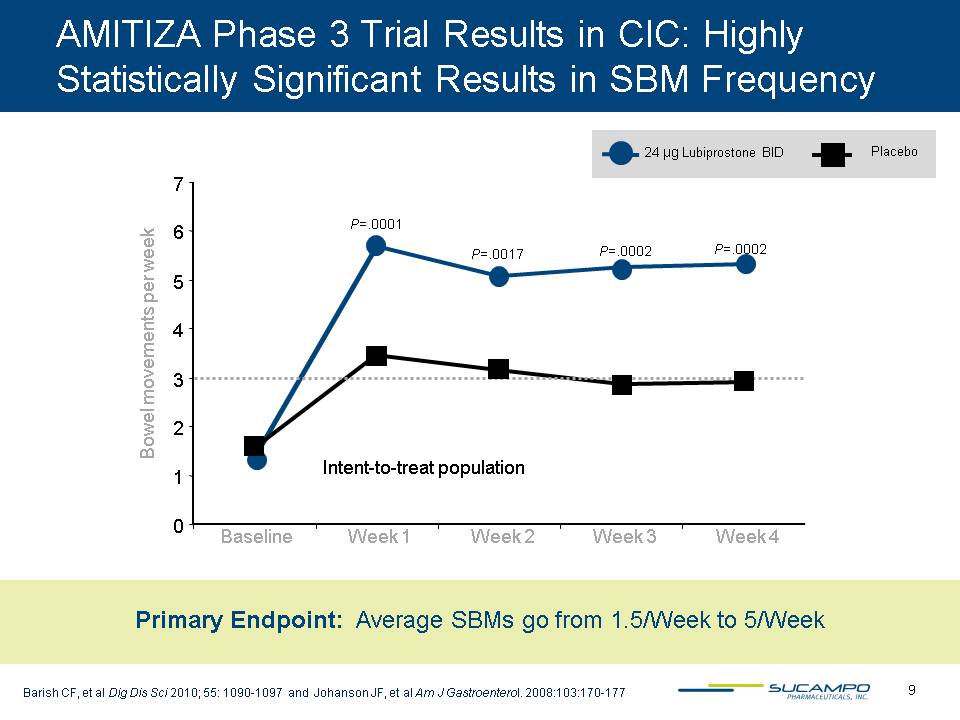

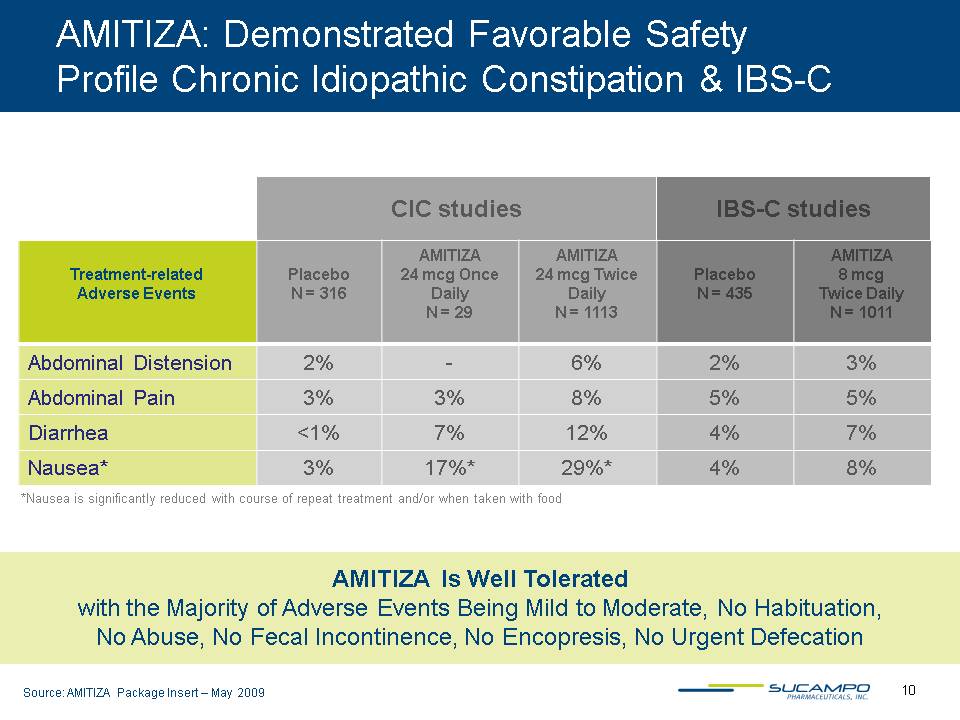

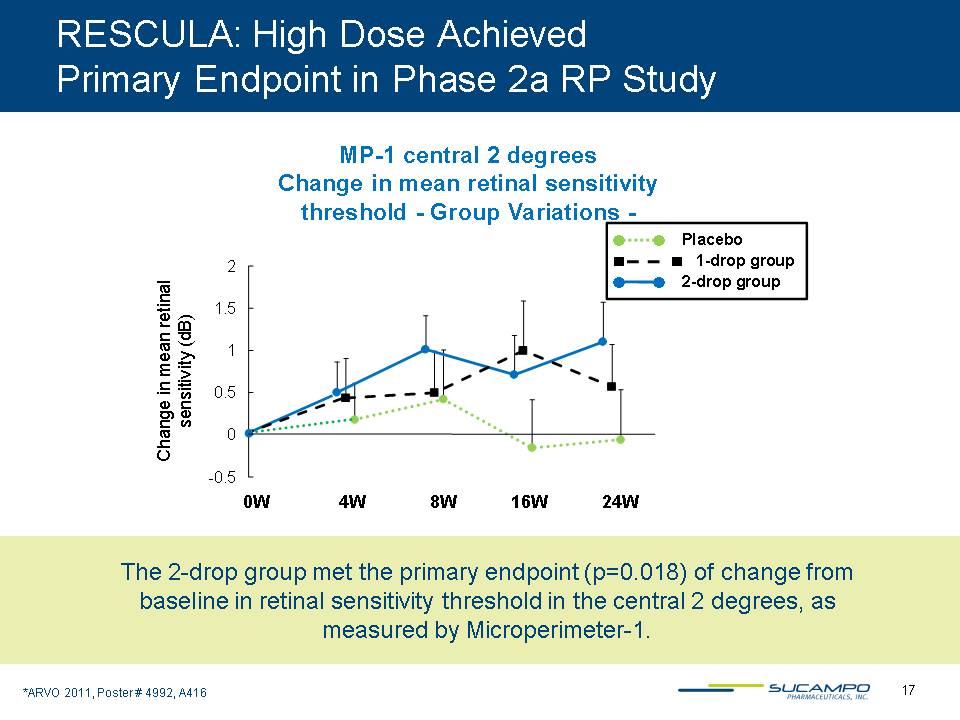

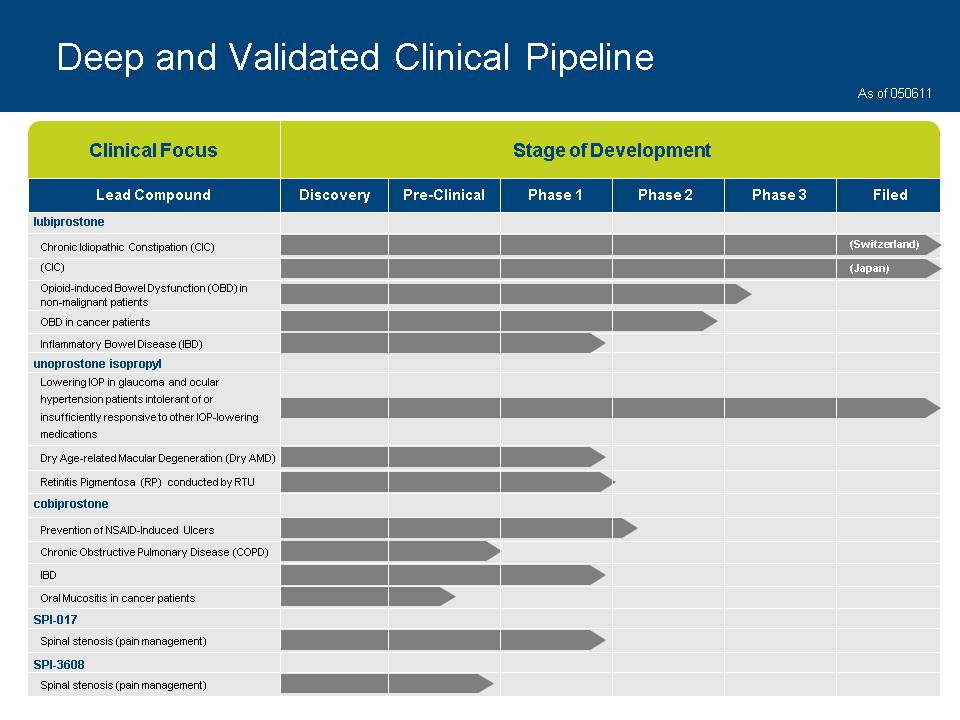

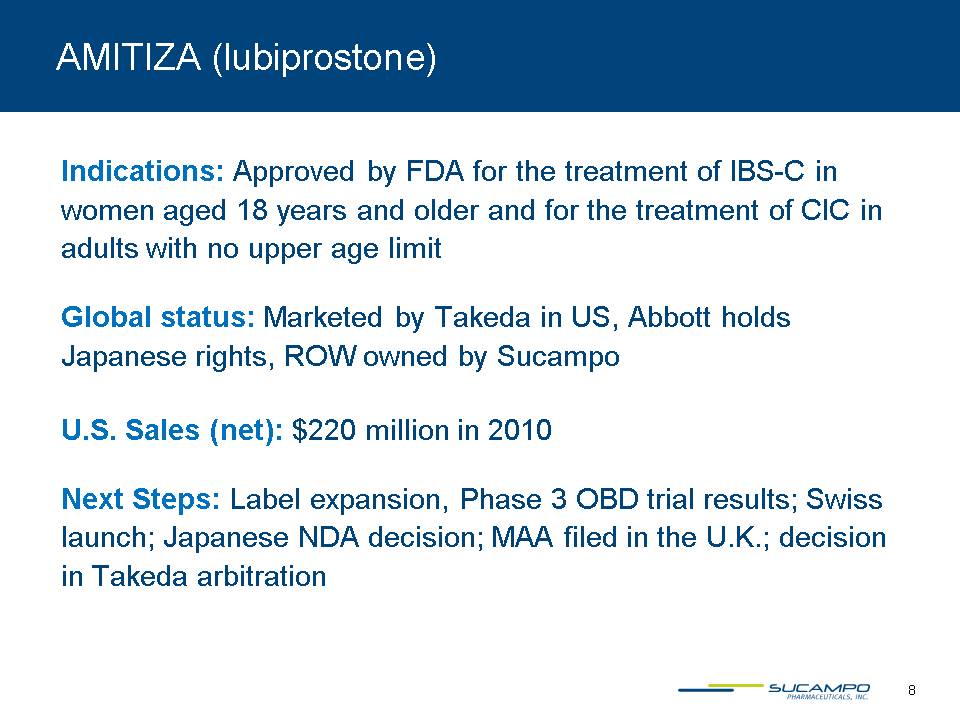

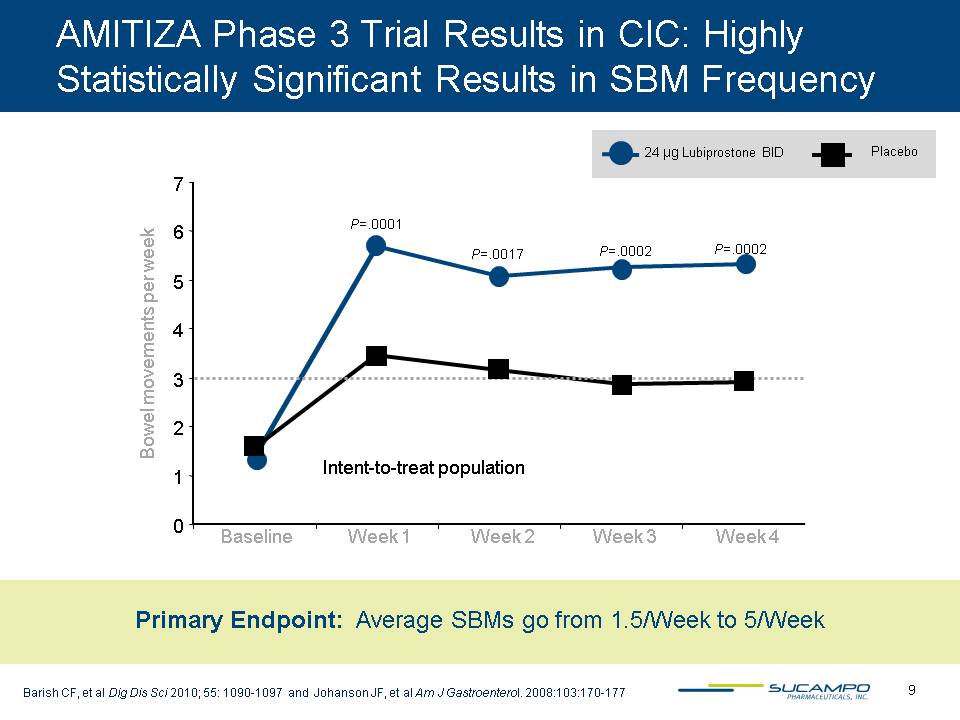

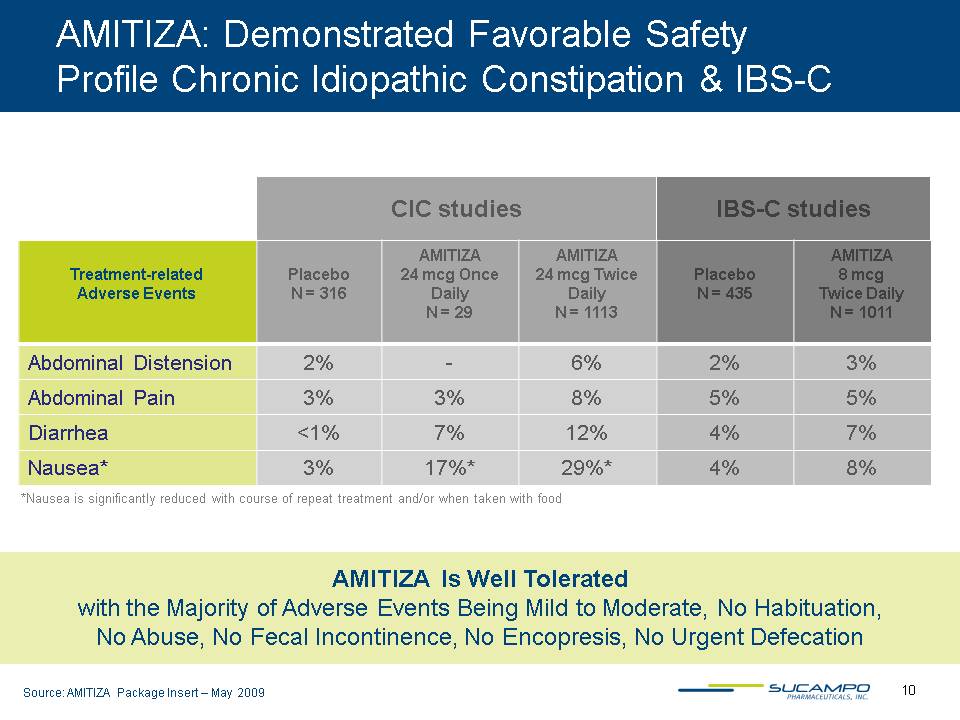

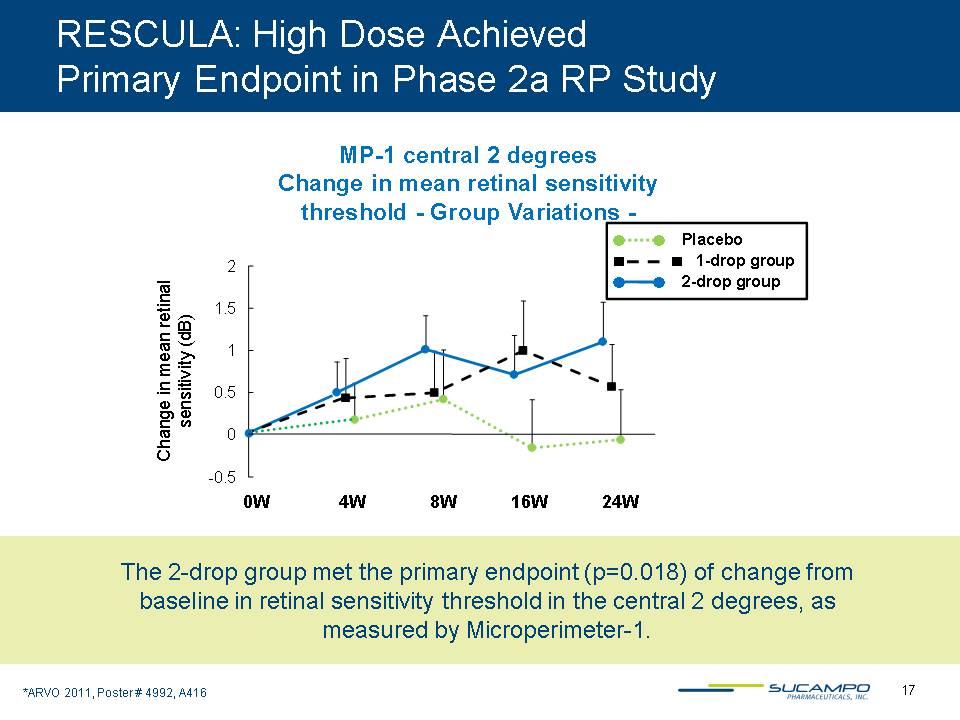

1 1 Corporate Update Applying scientific and medical leadership in prostonesto develop and commercialize therapeutics for an aging population As of September 23, 2011 2 Forward-Looking Statements Forward-looking statements contained in this presentation are based on Sucampo’sassumptions and expectations concerning future events. They are subject to significant business, economic and competitive risks and uncertainties that could cause actual results to differ materially from those reflected in the forward-looking statements. Sucampo’sforward-looking statements could be affected by numerous foreseeable and unforeseeable events and developments such as regulatory delays, the failure of clinical trials, the inability to fund drug development initiatives, competitive products and other factors identified in the “Risk Factors” section of Sucampo’sAnnual Report on Form 10-K and other periodic reports filed with the Securities and Exchange Commission. While Sucampo may elect to update these statements at some point in the future Sucampo specifically disclaims any obligation to do so, whether as a result of new information, future events or otherwise. In light of the significant uncertainties inherent in the forward-looking information in this presentation, you are cautioned not to place undue reliance on these forward-looking statements. 3 Sucampo Investment Highlights Proven technology: Leadership in prostones --key ion channel activators, with validated clinical utility Commercial products focused on large patient populations: AMITIZA®approved in the U.S. and RESCULA® was approved in the U.S. and 45 countries Clinical expansion: AMITIZA label expansion strategies underway in the U.S., Europe and Asia; RESCULA label expansion strategies underway in the U.S. and Europe Robust pipeline: Revenue stream fueling advances in proprietary prostone-based portfolio 4 Prostones Class of compounds derived from naturally occurring functional fatty acids with wound healing properties Selectively activate ion channels that modulate key pathways Metabolize quickly into inactive form -useful for localized effect in specific organs Broad and validated therapeutic applicability -can be targeted to induce specific pharmacological effects 5 ProstonesModulate Fundamental Physiologic Pathways Potassium and chloride ion channel activators Vast therapeutic targeting potential .GI .Ophthalmology .CV .Oncology .Urology .CNS .Pulmonary 6 Deep and Validated Clinical Pipeline As of 050611 Clinical FocusStage of Development Lead Compound DiscoveryPre-ClinicalPhase 1 lubiprostone unoprostoneisopropyl cobiprostone SPI-017 Chronic Idiopathic Constipation (CIC) (CIC) Opioid-induced Bowel Dysfunction (OBD) in non-malignant patients OBD in cancer patients Inflammatory Bowel Disease (IBD) Phase 2 Phase 3Filed Lowering IOP in glaucoma and ocular hypertension patients intolerant of or insufficiently responsive to other IOP-lowering medications Dry Age-related Macular Degeneration (Dry AMD) Retinitis Pigmentosa (RP) conducted by RTU Prevention of NSAID-Induced Ulcers Chronic Obstructive Pulmonary Disease (COPD) IBD Oral Mucositisin cancer patients Spinal stenosis (pain management) SPI-3608 Spinal stenosis (pain management) (Japan) (Switzerland) 7 AMITIZA (lubiprostone) 8 AMITIZA (lubiprostone) Indications: Approved by FDA for the treatment of IBS-C in women aged 18 years and older and for the treatment of CIC in adults with no upper age limit Global status: Marketed by Takeda in US, Abbott holds Japanese rights, ROW owned by Sucampo U.S. Sales (net): $220 million in 2010 Next Steps: Label expansion, Phase 3 OBD trial results; Swiss launch; Japanese NDA decision; MAA filed in the U.K.; decision in Takeda arbitration 9 BarishCF, et al Dig Dis Sci2010; 55: 1090-1097 and JohansonJF, et al Am J Gastroenterol. 2008:103:170-177 24 µg LubiprostoneBIDPlacebo P=.0001 P=.0017 P=.0002 P=.0002 Intent-to-treat population 0 1 2 3 4 5 6 7 Baseline Week 1Week 2 Week 3Week 4 Bowel movements per week AMITIZA Phase 3 Trial Results in CIC: Highly Statistically Significant Results in SBM Frequency Primary Endpoint: Average SBMs go from 1.5/Week to 5/Week 10 AMITIZA: Demonstrated Favorable Safety ProfileChronicIdiopathic Constipation & IBS-C Treatment-related Adverse Events Placebo N = 316 AMITIZA 24 mcg Once Daily N = 29 AMITIZA 24 mcg Twice Daily N = 1113 Placebo N = 435 AMITIZA 8 mcg Twice Daily N = 1011 Abdominal Distension 2% - 6% 2% 3% Abdominal Pain 3% 3% 8% 5% 5% Diarrhea <1% 7% 12% 4% 7% Nausea* 3% 17%* 29%* 4% 8% *Nausea is significantly reduced with course of repeat treatment and/or when taken with food CIC studies IBS-C studies AMITIZA Is Well Tolerated with the Majority of Adverse Events Being Mild to Moderate, No Habituation, No Abuse, No Fecal Incontinence, No Encopresis, No Urgent Defecation Source: AMITIZA Package Insert –May 2009 11 Growth Strategy: AMTIZA in OBD Campaign of three phase 3 trials of AMITIZA for the treatment opioid-induced bowel dysfunction (OBD) Reported positive results of AMITIZA phase 3 trial (OBD0631) at DDW 2010 Patients taking lubiprostoneachieved a statistically significant (p=0.02) greater increase in the mean number of SBMs per week in 8 of the 12 weeks of the trial as compared to placebo patients The percentage of patients who achieved a SBM within 24 hours and 48 hours was significantly higher with lubiprostoneas compared to placebo (p=0.0126 at 24 hours, and p=0.0360 at 48 hours) Statistical significance was achieved for the overall change from baseline in constipation-associated symptom secondary endpoints *Sucampo press release, Jan. 7, 2011 12 AMTIZA Expansion Strategy Well Underway Third phase 3 trial of AMITIZA for the treatment of OBD fully enrolled Trial design .Primary endpoint: change from baseline in SBM frequency at Week 8 without reduction in dose of study pain medication .Randomized, placebo-controlled, multi-center trial .Almost the same protocol as used in the successful phase 3 trial (OBD0631) reported at DDW 2010, except exclusion of patients on methadone .One 24-mcg gel capsule of lubiprostoneor placebo twice each day .12 week treatment period .Permitted concomitant pain medications include fentanyl, morphine and oxycontinbut exclude methadone .Enrolled more than 420 patients in the U.S. and Europe Sucampo and Takeda will share trial costs equally Top-line phase 3 results expected by year-end 2011 *Sucampo press release, Jan. 7, 2011 and Aug. 4, 2011 13 Terms of Sucampo’sAMITIZA Agreement with Takeda Takeda shall exert best efforts to promote, market, and sell AMITIZA and to maximize net sales revenue in the U.S. and Canada Sucampo’stiered royalty rate: 18% to 26% of annual net sales Sucampo earned $20 million in upfront and $130 million in development milestone payments, as of June 30, 2011 We are disappointed by our partner’s performance Arbitration hearing set for December 2011 but it is not known if the arbitration will remain on schedule or how long thereafter the arbitration proceedings will conclude 14 AMITIZA Japanese Strategy Sucampo granted Abbott exclusive rights to commercialize AMITIZA in Japan for CIC and right of first refusal for additional indications in Japan If successfully developed, Sucampo will supply finished product to Abbott Sucampo has received a total of $22.5 million in upfront and milestone payments from Abbott, as of June 30, 2011 Sucampo designed and managed the recently reported successful phase 3 efficacy trial and long-term safety trial in Japanese CIC patients NDA submitted September 2010 Next Steps: Japanese regulatory decision 15 RESCULA Compound: Unoprostoneisopropyl Indication: FDA approved for the lowering of lowering of intraocular pressure (IOP) in open-angle glaucoma and ocular hypertension in patients who are intolerant of or insufficiently responsive to other IOP-lowering medications Global status: Updating US label via sNDA; conducting trials to drive label expansion in dry AMD; reactivating and updating licenses in EU Upcoming Milestones: Data from exploratory dry AMD trial; sNDAfor glaucoma indication in US 16 RESCULA: Broad Therapeutic Potential A unique mechanism of action Rescula(unoprostoneisopropyl) activates Maxi K (BK) channels in neurons and contractile cells* Lowers IOP by increased outflow of aqueous humor through trabecular meshwork and uveoscleralpathway** Increases both retinal and choroidalcomponents of ocular blood flow to optic nerve*** -exploring AMD potential Maintains visual field in glaucoma patients; inhibits apoptosis of retinal neurons and ischemia-induced degeneration of optic nerve fibers in non-clinical studies**** * Yu DY et al. Invest OphthalmolVis Sci. 1994;35:4087-4099. Kern TS. ExpDiabetes Res. 2007;2007:95013. Hardy P et al. Prostaglandins LeukotEssentFatty Acids. 2005;72(5):301-325. ** AlmA et al. ExpEye Res. 2009;88:760-768. TorisCB et al. Arch Ophthalmol. 2004;122:1782-1787. LlobetA et al. News PhysiolSci.2003;18:205-209 *** Kojima S et al. Nippon GankaBakkaiZasshi. 1997:101;605-610. MakimotoY et al. JpnJ Ophthalmol. 2002;46:31- 35. Kimura I et al. JpnJ Ophthalmol. 2005;49:287-293 **** Sugiyama T et al. Arch Ophthalmol. 2009;127:454-459 17 MP-1 central 2 degreesChange in mean retinal sensitivity threshold -Group Variations - Mean+S.E. -0.500.511.52UF-021 1.2.. UF-021 1.1.. ..... ...+S.E. -0.500.511.52Change in mean retinal sensitivity (dB) ..Placebo ¦¦¦1-drop group ..2-drop group0W 4W 8W 16W 24WRESCULA: High Dose Achieved Primary Endpoint in Phase 2a RP Study The 2-drop group met the primary endpoint (p=0.018) of change from baseline in retinal sensitivity threshold in the central 2 degrees, as measured by Microperimeter-1. *ARVO 2011, Poster # 4992, A416 18 RESCULA: Exploring Potential with Phase 2a Study in Dry AMD Purpose: to study choroidalblood flow following administration of unoprostoneisopropyl vs. placebo Design: .A single-center, double-masked, randomized, placebo-controlled study in 28 dry AMD patients .Administer two doses (Day 1 and 8); 14 day follow-up period .Choroidalblood flow measured by laser dopplerflowmetry Study initiated in May 2011, expecting results in late 2011 19 RESCULA Current Status Awaiting FDA label with language based on current scientific understanding Was approved in 45 countries for glaucoma and ocular hypertension and is still approved in Japan Reactivating and updating licenses in E.U. and Switzerland Data from exploratory clinical study in dry AMD patients available 4Q 2011 20 R&D Candidates Cobiprostone .Phase 2 for prevention of NSAID-induced gastric ulcers .Preclinical studies for oral mucositis .Preclinical studies for COPD SPI-3608 .Preclinical development for pain associated with spinal stenosis Additional prostones in preclinical development generated by Sucampo’s proven technology platform Generating additional pipeline candidates through Numab AG collaboration 21 (In millions, except per share data) 2010* 2011* (6 months) Product Royalty Revenue $40.3 $20.2 R&D Revenue* $16.5 $3.7 Total Revenue $61.9 $26.2 Net Income/(Loss) ($2.7) ($15.9) Earnings Per Share (diluted) ($0.07) ($0.38) Cash, Restricted Cash and Investments $123.9** $109.0*** * Results for 2010 and 2011 are consolidated to reflect the acquisition of Sucampo AG in Dec 2010 ** At Dec. 31, 2010, Sucampo had $44.4 million in long-term debt and $19.5 million in short-term debt *** At June 30, 2011, Sucampo had $45.5 million in long-term debt and $19.5 million in short-term debt Key Financials 22 2011 Milestones . Completion of enrollment into third phase 3 clinical trial of lubiprostonefor OBD during third quarter . Submit a Marketing Approval Application (MAA) for lubiprostonefor CIC in the United Kingdom . Integrate Sucampo AG into corporate structure to achieve operational efficiencies afforded by our December 2010 acquisition of it .Gain approval of a commercially viable label (sNDA) for RESCULA to support a re-launch in the U.S. for the approved indication of lowering of intraocular pressure (IOP) in open-angle glaucoma and ocular hypertension in patients who are intolerant of or insufficiently responsive to other IOP-lowering medications .Make substantial progress towards successfully resolving our dispute with our U.S. partner (Takeda) 23 Sucampo Investment Highlights Proven technology: Leadership in prostones --key ion channel activators, with validated clinical utility Commercial products focused on large patient populations: AMITIZA is approved in the U.S. and RESCULA was approved in the U.S. and 45 countries Clinical expansion: AMITIZA label expansion strategies under way in the U.S., Europe and Asia; RESCULA label expansion strategies underway in the U.S. and Europe Robust pipeline: Revenue stream fueling advances in proprietary prostone-based portfolio 24 24 Corporate Update Applying scientific and medical leadership in prostonesto develop and commercialize therapeutics for an aging population