UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

| | |

Investment Company Act file number | | 811-21908 |

The Blue Fund Group

|

| (Exact name of registrant as specified in charter) |

| | |

| 590 Madison Avenue, 21st Floor, New York, NY | | 10022 |

| (Address of principal executive offices) | | (Zip code) |

Citi Fund Services Ohio Inc., 3435 Stelzer Road, Columbus, OH 43219

|

| (Name and address of agent for service) |

Registrant’s telephone number, including area code: 877-490-2583

Date of fiscal year end: December 31, 2007

Date of reporting period: December 31, 2007

| Item 1. | Reports to Stockholders. |

Table of Contents

The Blue Fund Group

Letter to Shareholders (Unaudited)

December 31, 2007

Dear Shareholder:

On October 17, 2006, we launched The Blue Large Cap Fund and The Blue Small Cap Fund (the “Funds”). December 31, 2007 thus marks the end of our first full year. We are very pleased to present you with the annual report for The Blue Fund Group, including perspectives on the Funds for the year just ended. This report includes financial statements and portfolio holdings for the Funds.

In the second half of 2007, domestic equity markets were marked by tremendous volatility and decidedly mixed performance. The financial sector was hit especially hard, as revelations over collateralized debt obligations and other financial instruments led to significant write-downs and analyst downgrades. Moreover, the impact of this turmoil was felt more acutely amongst small capitalization stocks, with the Russell 2000® Index closing out 2007 down 1.57% while the S&P 500 Index was up 5.49% for the same period.

Given this market environment, and our slight overweighting of financial sector holdings, it will come as no surprise that both The Blue Large Cap Fund and The Blue Small Cap Fund underperformed in relation to their broad based market indexes, the S&P 500® and Russell 2000®, respectively. Detailed performance for the each fund is available on the fund performance pages in this annual report.

Both The Blue Large Cap Fund and The Blue Small Cap Fund invest in companies that both “act blue” and “give blue”. We build our portfolios on core progressive values like environmental sustainability, community participation, and respect for human rights. Then we go a step further, investing only in those companies whose political contributions demonstrate a sincere commitment to those values.

We believe The Blue Fund Group can be as successful as the movement that we build together, as shareholders and activists. Through careful, ethical portfolio management, we are working to earn your confidence.

|

| Sincerely, |

|

|

| Daniel de Faro Adamson |

| President |

| | |

| 1 | | The Blue Fund : Invested in Meaningful Change |

The Blue Fund Group

The Blue Large Cap Fund

Fund Performance (Unaudited)

December 31, 2007

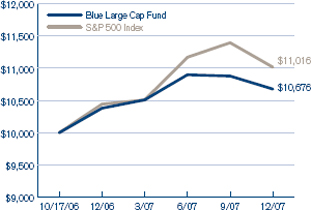

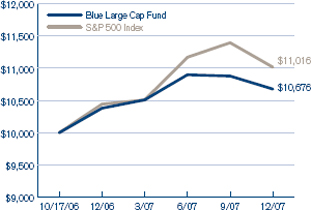

Return of a $10,000 investment as of December 31, 2007

This chart assumes an initial hypothetical investment of $10,000 made on October 17, 2006. Total Return is based on net change in net asset value assuming reinvestment of distributions. Returns shown on this page include the reinvestment of all dividends and other distributions.

Average Annual Total Return as of December 31, 2007*

| | | | | | |

| | | | | | Since Inception | |

| | |

| | | 1 Year | | | (10/17/06) | |

The Blue Large Cap Fund | | 2.36 | % | | 5.57 | % |

S&P 500 Index | | 5.49 | % | | 8.36 | % |

Expense Ratio | | 1.50% | |

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. Total return figures include change in share price, reinvestment of dividends and capital gains. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed may be worth more or less than the original cost. To obtain performance information current to the most recent month end, please visit our website at www.bluefund.com.

The Investment Adviser has agreed, in a separate Fee Waiver and Expense Limitation Agreement, to waive a portion of its fee for the first five years of operation of The Blue Large Cap Fund to the extent necessary to cap overall expenses of The Blue Large Cap Fund at 1.50%.

Investment performance reflects voluntary fee waivers in effect from inception, which may be discontinued at any time. Without these fee waivers, the performance would have been lower. This information is included in the most current prospectus available to current and prospective shareholders of the Fund.

*Returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The returns for certain periods reflect fee waivers and/or reimbursements in effect for that period; absent fee waivers and reimbursements, performance would have been lower.

The Standard & Poor’s 500 Index (“S&P 500”) is an unmanaged index of 500 selected common stocks most of which are listed on the New York Stock Exchange. The index is heavily weighted toward stocks with large market capitalizations and represents approximately two-thirds of the total market value of all domestic common stocks.

The above referenced index does not reflect the deduction of fees or taxes associated with a mutual fund, such as investment management and fund accounting fees. Investors cannot invest directly in an index.

| | | | |

| | Annual Report : December 31, 2007 | | 2 |

The Blue Fund Group

The Blue Small Cap Fund

Fund Performance (Unaudited)

December 31, 2007

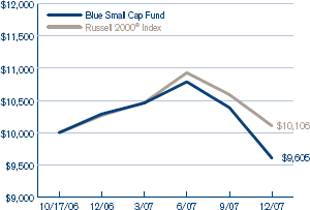

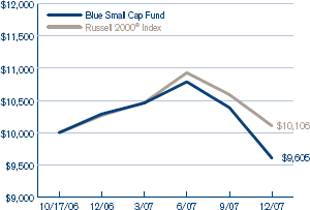

Return of a $10,000 investment as of December 31, 2007

This chart assumes an initial hypothetical investment of $10,000 made on October 17, 2006. Total Return is based on net change in net asset value assuming reinvestment of distributions. Returns shown on this page include the reinvestment of all dividends and other distributions.

Average Annual Total Return as of December 31, 2007*

| | | | | | |

| | | | | | Since Inception | |

| | |

| | | 1 Year | | | (10/17/06) | |

The Blue Small Cap Fund | | -6.66 | % | | -3.29 | % |

Russell 2000® Index | | -1.57 | % | | 0.88 | % |

Expense Ratio | | 1.75% | |

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. Total return figures include change in share price, reinvestment of dividends and capital gains. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed may be worth more or less than the original cost. To obtain performance information current to the most recent month end, please visit our website at www.bluefund.com.

The Investment Adviser has agreed, in a separate Fee Waiver and Expense Limitation Agreement, to waive a portion of its fee for the first five years of operation of The Blue Small Cap Fund to the extent necessary to cap overall expenses of The Blue Small Cap Fund at 1.75%.

Investment performance reflects voluntary fee waivers in effect from inception, which may be discontinued at any time. Without these fee waivers, the performance would have been lower. This information is included in the most current prospectus available to current and prospective shareholders of the Fund.

*Returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The returns for certain periods reflect fee waivers and/or reimbursements in effect for that period; absent fee waivers and reimbursements, performance would have been lower.

The Russell 2000® Index is an unmanaged index that measures the performance of the small-cap segment of the U.S. equity universe. The Russell 2000® Index is a subset of the Russell 3000® Index representing 10% of the total market capitalization of the index. It includes approximately 2,000 of the smallest securities based on a combination of their market cap and current index membership.

The above referenced index does not reflect the deduction of fees or taxes associated with a mutual fund, such as investment management and fund accounting fees. Investors cannot invest directly in an index.

| | |

| 3 | | The Blue Fund: Invested in Meaningful Change |

The Blue Fund Group

Summary of Portfolio Investments (Unaudited)

As of December 31, 2007

The Large Cap Fund

| | | |

Portfolio Diversification | | Percentages of Total

Net Assets | |

Information Technology | | 21.7 | % |

Consumer Discretionary | | 21.3 | % |

Financials | | 16.3 | % |

Consumer Staples | | 6.9 | % |

Utilities | | 6.7 | % |

Health Care | | 5.1 | % |

Industrials | | 3.9 | % |

Retail REITs | | 2.7 | % |

Advertising | | 1.2 | % |

Telecommunications Services | | 0.9 | % |

Office REITs | | 0.7 | % |

Diversified REITs | | 0.7 | % |

The Small Cap Fund

| | | |

Portfolio Diversification | | Percentage of Total

Net Assets | |

Information Technology | | 23.8 | % |

Consumer Discretionary | | 14.1 | % |

Financials | | 11.8 | % |

Health Care | | 11.4 | % |

Consumer Staples | | 3.9 | % |

Utilities | | 3.4 | % |

Industrials | | 3.0 | % |

Materials | | 2.7 | % |

Retail REITs | | 1.7 | % |

Energy | | 1.5 | % |

Specialized REITs | | 1.1 | % |

Mortgage REITs | | 1.0 | % |

Diversified REITs | | 0.7 | % |

Telecommunication Services | | 0.6 | % |

Office REITs | | 0.4 | % |

Residential REITs | | 0.1 | % |

Percentages above are based upon net assets.

See notes to financial statements.

| | | | |

| | Annual Report : December 31, 2007 | | 4 |

The Blue Fund Group

The Blue Large Cap Fund

Schedule of Portfolio Investments

December 31, 2007

| | | | | |

Shares | | Security Description | | Value |

| | COMMON STOCKS (88.1%): | | | |

| | Advertising (1.2%): | | | |

| 100 | | Monster Worldwide, Inc.* | | $ | 3,240 |

| 200 | | Omnicom Group, Inc. | | | 9,506 |

| | | | | |

| | | | | 12,746 |

| | | | | |

| | Consumer Discretionary (21.3%): | | | |

| 134 | | Avery Dennison Corp. | | | 7,121 |

| 226 | | Bed Bath & Beyond, Inc.* | | | 6,642 |

| 577 | | CBS Corp., Class B | | | 15,723 |

| 351 | | Coach, Inc.* | | | 10,734 |

| 1,289 | | CVS Caremark Corp. | | | 51,238 |

| 100 | | Family Dollar Stores, Inc. | | | 1,923 |

| 200 | | Gannett Co., Inc. | | | 7,800 |

| 707 | | Gap, Inc. (The) | | | 15,045 |

| 37 | | Harman International Industries, Inc. | | | 2,727 |

| 100 | | Hasbro, Inc. | | | 2,558 |

| 379 | | Interpublic Group of Cos., Inc. (The)* | | | 3,074 |

| 100 | | Liz Claiborne, Inc. | | | 2,035 |

| 351 | | Mattel, Inc. | | | 6,683 |

| 324 | | McGraw-Hill Cos., Inc. (The) | | | 14,194 |

| 314 | | NIKE, Inc., Class B | | | 20,171 |

| 100 | | Polo Ralph Lauren Corp. | | | 6,179 |

| 600 | | Staples, Inc. | | | 13,842 |

| 670 | | Starbucks Corp.* | | | 13,715 |

| 190 | | Starwood Hotels & Resorts Worldwide, Inc. | | | 8,366 |

| 66 | | V.F. Corp. | | | 4,532 |

| 93 | | Whole Foods Market, Inc. | | | 3,794 |

| 200 | | Wyndham Worldwide Corp. | | | 4,712 |

| | | | | |

| | | | | 222,808 |

| | | | | |

| | Consumer Staples (6.9%): | | | |

| 153 | | Clorox Co. (The) | | | 9,971 |

| 401 | | Colgate-Palmolive Co. | | | 31,262 |

| 387 | | Costco Wholesale Corp. | | | 26,997 |

| 89 | | Estee Lauder Cos., Inc. (The), Class A | | | 3,881 |

| | | | | |

| | | | | 72,111 |

| | | | | |

| | Diversified REIT’s (0.7%): | | | |

| 87 | | Vornado Realty Trust | | | 7,652 |

| | | | | |

| | Financials (16.3%): | | | |

| 633 | | Bank of New York Mellon Corp. | | | 30,865 |

| 200 | | CB Richard Ellis Group, Inc., Class A* | | | 4,310 |

| 375 | | E*TRADE Financial Corp.* | | | 1,331 |

| 57 | | Fannie Mae | | | 2,279 |

| 500 | | Freddie Mac | | | 17,035 |

| 245 | | H&R Block, Inc. | | | 4,550 |

| 487 | | Lehman Brothers Holdings, Inc. | | | 31,869 |

| 134 | | M&T Bank Corp. | | | 10,930 |

| 500 | | Marsh & McLennan Cos., Inc. | | | 13,235 |

| 675 | | Progressive Corp. (The) | | | 12,933 |

| 400 | | Sovereign Bancorp, Inc. | | | 4,560 |

| 298 | | State Street Corp. | | | 24,198 |

| 500 | | Western Union Co. | | | 12,140 |

| | | | | |

| | | | | 170,235 |

| | | | | |

| | Health Care (5.1%): | | | |

| 244 | | Forest Laboratories, Inc.* | | | 8,894 |

| 200 | | Genzyme Corp.* | | | 14,888 |

| 388 | | Stryker Corp. | | | 28,991 |

| | | | | |

| | | | | 52,773 |

| | | | | |

| | Industrials (3.9%): | | | |

| 310 | | Danaher Corp. | | | 27,199 |

| 88 | | L-3 Communications Holdings, Inc. | | | 9,323 |

| 100 | | Pall Corp. | | | 4,032 |

| | | | | |

| | | | | 40,554 |

| | | | | |

| | Information Technology (21.7%): | | | |

| 519 | | Adobe Systems, Inc.* | | | 22,177 |

| 270 | | Altera Corp. | | | 5,216 |

| 493 | | Apple, Inc.* | | | 97,653 |

| 111 | | Applera Corp. - (Applied Biosystems Group) | | | 3,765 |

| 500 | | Automatic Data Processing, Inc. | | | 22,265 |

| 164 | | Citrix Systems, Inc.* | | | 6,234 |

| 241 | | Electronic Arts, Inc.* | | | 14,077 |

| 42 | | Google, Inc., Class A* | | | 29,042 |

| 200 | | IAC/InterActiveCorp* | | | 5,384 |

| 100 | | Parametric Technology Corp.* | | | 1,785 |

| 300 | | Paychex, Inc. | | | 10,866 |

| 90 | | QUALCOMM, Inc. | | | 3,542 |

| 159 | | SanDisk Corp.* | | | 5,274 |

| | | | | |

| | | | | 227,280 |

| | | | | |

| | Office REITs (0.7%): | | | |

| 85 | | Boston Properties, Inc. | | | 7,804 |

| | | | | |

| | Retail REITs (2.7%): | | | |

| 265 | | Kimco Realty Corp. | | | 9,646 |

| 216 | | Simon Property Group, Inc. | | | 18,762 |

| | | | | |

| | | | | 28,408 |

| | | | | |

| | Telecommunication Services (0.9%): | | | |

| 86 | | ADC Telecommunications, Inc.* | | | 1,337 |

| 100 | | CenturyTel, Inc. | | | 4,146 |

| 100 | | Ciena Corp.* | | | 3,411 |

| | | | | |

| | | | | 8,894 |

| | | | | |

| | Utilities (6.7%): | | | |

| 222 | | Consolidated Edison, Inc. | | | 10,845 |

| 369 | | FPL Group, Inc. | | | 24,970 |

| 82 | | Integrys Energy Group, Inc. | | | 4,239 |

| 302 | | PG&E Corp. | | | 13,013 |

| 277 | | Sempra Energy | | | 17,141 |

| | | | | |

| | | | | 70,208 |

| | | | | |

| | Total Investments | | | |

| | (Cost $925,883)(a) — 88.1% | | | 921,473 |

| | Other assets in excess of liabilities—11.9% | | | 124,317 |

| | | | | |

| | NET ASSETS — 100.0% | | $ | 1,045,790 |

| | | | | |

Percentages indicated are based on net assets.

| * | Non-income producing security. |

| (a) | See notes to financial statements for tax unrealized appreciation (depreciation) of securities. |

REIT—Real Estate Investment Trust.

See notes to financial statements.

| | |

| 5 | | The Blue Fund : Invested in Meaningful Change |

The Blue Fund Group

The Blue Small Cap Fund

Schedule of Portfolio Investments

December 31, 2007

| | | | | |

Shares | | Security Description | | Value |

| | COMMON STOCKS (81.2%): | | | |

| | Consumer Discretionary (14.1%): | | | |

| 106 | | 1-800-FLOWERS.COM, Inc., Class A* | | $ | 925 |

| 80 | | 99 Cents Only Stores* | | | 637 |

| 34 | | AMERCO* | | | 2,233 |

| 165 | | Ameristar Casinos, Inc. | | | 4,544 |

| 37 | | Audiovox Corp.* | | | 459 |

| 220 | | Blockbuster, Inc.* | | | 858 |

| 130 | | Bright Horizons Family Solutions, Inc.* | | | 4,490 |

| 233 | | Buckle, Inc. (The) | | | 7,689 |

| 33 | | Build-A-Bear Workshop, Inc.* | | | 460 |

| 385 | | Callaway Golf Co. | | | 6,711 |

| 171 | | Charming Shoppes, Inc.* | | | 925 |

| 14 | | Cherokee, Inc. | | | 452 |

| 38 | | Conn’s, Inc.* | | | 650 |

| 22 | | CoStar Group, Inc.* | | | 1,039 |

| 20 | | Courier Corp. | | | 660 |

| 18 | | CRA International, Inc.* | | | 857 |

| 59 | | Dover Motorsports, Inc. | | | 386 |

| 42 | | Electro Rent Corp. | | | 624 |

| 121 | | Entravision Communications Corp.* | | | 947 |

| 37 | | Ethan Allen Interiors, Inc. | | | 1,054 |

| 78 | | Gray Television, Inc. | | | 626 |

| 50 | | Great Wolf Resorts, Inc.* | | | 491 |

| 37 | | Gymboree Corp. (The)* | | | 1,127 |

| 63 | | Interface, Inc. | | | 1,028 |

| 40 | | K-Swiss, Inc., Class A | | | 724 |

| 33 | | Kenneth Cole Productions, Inc. | | | 577 |

| 44 | | Kimball International, Inc., Class B | | | 603 |

| 56 | | Knoll, Inc. | | | 920 |

| 22 | | Lifetime Brands, Inc. | | | 286 |

| 82 | | Lin TV Corp., Class A* | | | 998 |

| 35 | | Marcus Corp. (The) | | | 541 |

| 31 | | Monarch Casino & Resort, Inc.* | | | 746 |

| 44 | | MTR Gaming Group, Inc.* | | | 299 |

| 37 | | Overstock.com, Inc.* | | | 575 |

| 155 | | Pinnacle Entertainment, Inc.* | | | 3,652 |

| 23 | | Pre-Paid Legal Services, Inc.* | | | 1,273 |

| 46 | | Priceline.com, Inc.* | | | 5,284 |

| 56 | | Progressive Gaming International Corp.* | | | 139 |

| 113 | | Radio One, Inc.* | | | 268 |

| 49 | | Scholastic Corp.* | | | 1,710 |

| 62 | | Select Comfort Corp.* | | | 435 |

| 93 | | Sotheby’s | | | 3,543 |

| 104 | | Spanish Broadcasting System, Inc., Class A* | | | 192 |

| 39 | | Stamps.com, Inc.* | | | 475 |

| 13 | | Steinway Musical Instruments, Inc. | | | 358 |

| 24 | | Steven Madden Ltd.* | | | 480 |

| 53 | | Tenneco, Inc.* | | | 1,382 |

| 53 | | Warnaco Group, Inc. (The)* | | | 1,844 |

| 181 | | World Wrestling Entertainment, Inc. | | | 2,672 |

| | | | | |

| | | | | 69,848 |

| | | | | |

| | Consumer Staples (3.9%): | | | |

| 47 | | AFC Enterprises, Inc.* | | | 532 |

| 5 | | Arden Group, Inc., Class A | | | 774 |

| 22 | | Boston Beer Co., Inc., Class A (The)* | | | 828 |

| 47 | | Elizabeth Arden, Inc.* | | | 957 |

| 36 | | Green Mountain Coffee Roasters, Inc.* | | | 1,465 |

| 45 | | Hain Celestial Group, Inc. (The)* | | | 1,440 |

| 37 | | Haverty Furniture Cos., Inc., Class A | | | 333 |

| 21 | | IHOP Corp. | | | 768 |

| 30 | | J & J Snack Foods Corp. | | | 938 |

| 37 | | Landry’s Restaurants, Inc. | | | 729 |

| 12 | | Maui Land & Pineapple Co.* | | | 349 |

| 29 | | Movado Group, Inc. | | | 733 |

| 73 | | National Beverage Corp. | | | 587 |

| 18 | | NBTY, Inc.* | | | 493 |

| 65 | | New York & Co., Inc.* | | | 415 |

| 669 | | Revlon, Inc.* | | | 790 |

| 85 | | Source Interlink Cos., Inc.* | | | 245 |

| 50 | | Stein Mart, Inc. | | | 237 |

| 23 | | Syms Corp. | | | 347 |

| 57 | | Systemax, Inc. | | | 1,158 |

| 102 | | Triarc Cos., Inc. | | | 894 |

| 49 | | United Natural Foods, Inc.* | | | 1,554 |

| 27 | | WD-40 Co. | | | 1,025 |

| 35 | | West Marine, Inc.* | | | 314 |

| 18 | | Weyco Group | | | 495 |

| 32 | | Zumiez, Inc.* | | | 780 |

| | | | | |

| | | | | 19,180 |

| | | | | |

| | Diversified REITs (0.7%): | | | |

| 6 | | Alexander’s, Inc.* | | | 2,119 |

| 77 | | Investors Real Estate Trust | | | 691 |

| 61 | | Lexington Realty Trust | | | 887 |

| | | | | |

| | | | | 3,697 |

| | | | | |

| | Energy (1.5%): | | | |

| 30 | | Carrizo Oil & Gas, Inc.* | | | 1,642 |

| 61 | | Encore Acquisition Co.* | | | 2,036 |

| 22 | | Gulf Island Fabrication, Inc. | | | 698 |

| 60 | | Harvest Natural Resources, Inc.* | | | 750 |

| 24 | | MGE Energy, Inc. | | | 851 |

| 18 | | Petroleum Development Corp.* | | | 1,064 |

| 141 | | Plug Power, Inc.* | | | 557 |

| | | | | |

| | | | | 7,598 |

| | | | | |

| | Financials (11.8%): | | | |

| 94 | | Advance America Cash Advance Centers, Inc. | | | 955 |

| 116 | | Apollo Investment Corp. | | | 1,978 |

| 22 | | ASTA Funding, Inc. | | | 582 |

| 22 | | Bancorp, Inc. (The)* | | | 296 |

| 27 | | Bank of the Ozarks, Inc. | | | 707 |

| 30 | | Bankrate, Inc.* | | | 1,443 |

| 42 | | BankUnited Financial Corp., Class A | | | 290 |

| 17 | | Capital Corp. of the West | | | 330 |

See notes to financial statements.

| | | | |

| | Annual Report : December 31, 2007 | | 6 |

The Blue Fund Group

The Blue Small Cap Fund

Schedule of Portfolio Investments, continued

December 31, 2007

| | | | | |

Shares | | Security Description | | Value |

| | COMMON STOCKS, continued: | | | |

| | Financials, continued: | | | |

| 18 | | Capitol Bancorp Ltd. | | $ | 362 |

| 79 | | Cathay General Bancorp | | | 2,093 |

| 360 | | Centerline Holding Co. | | | 2,743 |

| 35 | | Central Pacific Financial Corp. | | | 646 |

| 20 | | City Holding Co. | | | 677 |

| 42 | | Cohen & Steers, Inc. | | | 1,259 |

| 32 | | Coinstar, Inc.* | | | 901 |

| 34 | | Community Bank System, Inc. | | | 676 |

| 81 | | Crawford & Co., Class B* | | | 336 |

| 8 | | Doral Financial Corp.* | | | 144 |

| 81 | | eSPEED, Inc., Class A* | | | 915 |

| 12 | | Farmers Capital Bank Corp. | | | 324 |

| 77 | | First Acceptance Corp.* | | | 325 |

| 23 | | First Bancorp | | | 434 |

| 35 | | First Cash Financial Services, Inc.* | | | 514 |

| 45 | | First Financial Bancorp | | | 513 |

| 27 | | First Indiana Corp. | | | 864 |

| 19 | | FirstFed Financial Corp.* | | | 681 |

| 190 | | Fremont General Corp.* | | | 665 |

| 52 | | Frontier Financial Corp. | | | 966 |

| 78 | | Great Southern Bancorp, Inc. | | | 1,713 |

| 27 | | Heartland Financial USA, Inc. | | | 501 |

| 9 | | Imperial Capital Bancorp, Inc. | | | 165 |

| 23 | | Independent Bank Corp. | | | 626 |

| 34 | | Irwin Financial Corp. | | | 250 |

| 98 | | LaBranche & Co., Inc.* | | | 494 |

| 27 | | Macatawa Bank Corp. | | | 232 |

| 61 | | MCG Capital Corp. | | | 707 |

| 13 | | Mercantile Bank Corp. | | | 201 |

| 42 | | Nara Bancorp, Inc. | | | 490 |

| 44 | | National Financial Partners Corp. | | | 2,007 |

| 146 | | NewAlliance Bancshares, Inc. | | | 1,682 |

| 40 | | Oriental Financial Group, Inc. | | | 536 |

| 34 | | Presidential Life Corp. | | | 595 |

| 24 | | PrivateBancorp, Inc. | | | 784 |

| 38 | | ProAssurance Corp.* | | | 2,087 |

| 38 | | Prosperity Bancshares, Inc. | | | 1,117 |

| 176 | | Provident Financial Services, Inc. | | | 2,538 |

| 84 | | R&G Financial Corp., Class B* | | | 89 |

| 29 | | Resource America, Inc., Class A | | | 425 |

| 31 | | Rockville Financial, Inc. | | | 378 |

| 54 | | Santander Bancorp | | | 468 |

| 17 | | Suffolk Bancorp | | | 522 |

| 40 | | SVB Financial Group* | | | 2,016 |

| 30 | | TierOne Corp. | | | 664 |

| 16 | | Tompkins Financial Corp. | | | 621 |

| 148 | | United Bankshares, Inc. | | | 4,147 |

| 67 | | Universal American Financial Corp.* | | | 1,714 |

| 38 | | Virginia Commerce Bancorp, Inc.* | | | 446 |

| 189 | | W Holding Co., Inc. | | | 229 |

| 30 | | Wintrust Financial Corp. | | | 994 |

| 143 | | Zenith National Insurance Corp. | | | 6,396 |

| | | | | |

| | | | | 58,453 |

| | | | | |

| | Health Care (11.4%): | | | |

| 22 | | Advisory Board Co. (The)* | | | 1,412 |

| 73 | | Align Technology, Inc.* | | | 1,218 |

| 217 | | Alkermes, Inc.* | | | 3,383 |

| 60 | | Allscripts Healthcare Solutions, Inc.* | | | 1,165 |

| 16 | | Analogic Corp. | | | 1,084 |

| 54 | | Arena Pharmaceuticals, Inc.* | | | 423 |

| 21 | | Bio-Reference Laboratories, Inc.* | | | 686 |

| 30 | | Chemed Corp. | | | 1,676 |

| 163 | | Cubist Pharmaceuticals, Inc.* | | | 3,343 |

| 52 | | Cypress Bioscience, Inc.* | | | 574 |

| 25 | | Datascope Corp. | | | 910 |

| 111 | | Durect Corp.* | | | 714 |

| 52 | | Enzo Biochem, Inc.* | | | 662 |

| 80 | | eResearch Technology, Inc.* | | | 946 |

| 97 | | Exelixis, Inc.* | | | 837 |

| 91 | | Idenix Pharmaceuticals, Inc.* | | | 246 |

| 53 | | Illumina, Inc.* | | | 3,141 |

| 136 | | Incyte Corp.* | | | 1,367 |

| 33 | | Integra LifeSciences Holdings* | | | 1,384 |

| 38 | | Inverness Medical Innovation, Inc.* | | | 2,135 |

| 120 | | Isis Pharmaceuticals, Inc.* | | | 1,890 |

| 18 | | Kensey Nash Corp.* | | | 539 |

| 39 | | LifeCell Corp.* | | | 1,681 |

| 57 | | Mannkind Corp.* | | | 454 |

| 58 | | Medicines Co. (The)* | | | 1,111 |

| 83 | | Medicis Pharmaceutical Corp., Class A | | | 2,156 |

| 37 | | Medis Technologies, Inc.* | | | 571 |

| 32 | | Molina Healthcare, Inc.* | | | 1,238 |

| 51 | | Momenta Pharmaceuticals, Inc.* | | | 364 |

| 211 | | Monogram Biosciences, Inc.* | | | 306 |

| 74 | | NPS Pharmaceuticals, Inc.* | | | 283 |

| 60 | | Nuvelo, Inc.* | | | 110 |

| 56 | | Odyssey HealthCare, Inc.* | | | 619 |

| 20 | | Palomar Medical Technologies, Inc.* | | | 306 |

| 40 | | Par Pharmaceutical Cos., Inc.* | | | 960 |

| 37 | | Pharmion Corp.* | | | 2,326 |

| 95 | | QIAGEN N.V.* | | | 2,000 |

| 66 | | Regeneron Pharmaceuticals, Inc.* | | | 1,594 |

| 48 | | Renovis, Inc.* | | | 145 |

| 158 | | Sunrise Senior Living, Inc.* | | | 4,847 |

| 50 | | TriZetto Group, Inc.* | | | 868 |

| 26 | | United Therapeutics Corp.* | | | 2,539 |

| 21 | | Vital Images, Inc.* | | | 379 |

| 15 | | Vital Signs, Inc. | | | 767 |

| 77 | | Zymogenetics, Inc.* | | | 899 |

| | | | | |

| | | | | 56,258 |

| | | | | |

See notes to financial statements.

| | |

| 7 | | The Blue Fund : Invested in Meaningful Change |

The Blue Fund Group

The Blue Small Cap Fund

Schedule of Portfolio Investments, continued

December 31, 2007

| | | | | |

Shares | | Security Description | | Value |

| | COMMON STOCKS, continued: | | | |

| | Industrials (3.0%): | | | |

| 56 | | ABM Industries, Inc. | | $ | 1,142 |

| 51 | | Advanced Energy Industries, Inc.* | | | 667 |

| 46 | | Apogee Enterprises, Inc. | | | 787 |

| 23 | | Clean Harbors, Inc.* | | | 1,189 |

| 67 | | Comfort Systems USA, Inc. | | | 856 |

| 20 | | Gehl Co.* | | | 321 |

| 26 | | Greenbrier Cos., Inc. (The) | | | 579 |

| 34 | | Griffon Corp.* | | | 423 |

| 29 | | HEICO Corp. | | | 1,580 |

| 40 | | Hudson Highland Group, Inc.* | | | 336 |

| 34 | | Intevac, Inc.* | | | 494 |

| 22 | | Kadant, Inc.* | | | 653 |

| 50 | | Korn/Ferry International* | | | 941 |

| 29 | | McGrath Rentcorp | | | 747 |

| 41 | | Mobile Mini, Inc.* | | | 760 |

| 22 | | Noble International Ltd. | | | 359 |

| 55 | | Simpson Manufacturing Co., Inc. | | | 1,462 |

| 30 | | Tennant Co. | | | 1,329 |

| | | | | |

| | | | | 14,625 |

| | | | | |

| | Information Technology (23.8%): | | | |

| 526 | | 3Com Corp.* | | | 2,378 |

| 42 | | Actel Corp.* | | | 574 |

| 34 | | Advent Software, Inc.* | | | 1,839 |

| 152 | | American Reprographics Co.* | | | 2,505 |

| 53 | | American Superconductor Corp.* | | | 1,449 |

| 34 | | Arbitron, Inc. | | | 1,413 |

| 37 | | Argon ST, Inc.* | | | 687 |

| 260 | | Atheros Communications* | | | 7,940 |

| 39 | | Audible, Inc.* | | | 348 |

| 516 | | Axcelis Technologies, Inc.* | | | 2,374 |

| 23 | | Badger Meter, Inc. | | | 1,034 |

| 350 | | Blackbaud, Inc. | | | 9,814 |

| 358 | | Brightpoint, Inc.* | | | 5,499 |

| 255 | | CMGI, Inc.* | | | 3,338 |

| 272 | | CNET Networks, Inc.* | | | 2,486 |

| 208 | | Cogent, Inc.* | | | 2,319 |

| 59 | | Concur Technologies, Inc.* | | | 2,136 |

| 45 | | Diodes, Inc.* | | | 1,353 |

| 53 | | Ditech Networks, Inc.* | | | 184 |

| 64 | | Echelon Corp.* | | | 1,321 |

| 261 | | Entegris, Inc.* | | | 2,252 |

| 78 | | FalconStor Software, Inc.* | | | 878 |

| 73 | | FormFactor, Inc.* | | | 2,416 |

| 26 | | Forrester Research, Inc.* | | | 729 |

| 739 | | Gemstar-TV Guide International, Inc.* | | | 3,518 |

| 52 | | GSI Commerce, Inc.* | | | 1,014 |

| 86 | | iGATE Corp.* | | | 728 |

| 200 | | Informatica Corp.* | | | 3,604 |

| 90 | | infoUSA, Inc. | | | 804 |

| 59 | | InPhonic, Inc.* | | | 1 |

| 69 | | Interwoven Software, Inc.* | | | 981 |

| 119 | | Ionatron, Inc.* | | | 340 |

| 104 | | iPass, Inc.* | | | 422 |

| 29 | | Itron, Inc.* | | | 2,783 |

| 57 | | j2 Global Communications, Inc.* | | | 1,207 |

| 57 | | Jupitermedia Corp.* | | | 218 |

| 110 | | Kopin Corp.* | | | 348 |

| 47 | | L-1 Identity Solutions, Inc.* | | | 844 |

| 30 | | LodgeNet Entertainment Corp.* | | | 523 |

| 60 | | Magma Design Automation, Inc.* | | | 733 |

| 35 | | Mercury Computer Systems, Inc.* | | | 564 |

| 15 | | MicroStrategy, Inc., Class A* | | | 1,426 |

| 105 | | Midway Games, Inc.* | | | 290 |

| 175 | | Move, Inc.* | | | 429 |

| 30 | | MTS Systems Corp. | | | 1,280 |

| 224 | | Nuance Communications, Inc.* | | | 4,184 |

| 27 | | OSI Systems, Inc.* | | | 715 |

| 139 | | Palm, Inc. | | | 881 |

| 95 | | Parametric Technology Corp.* | | | 1,696 |

| 44 | | PDF Solutions, Inc.* | | | 396 |

| 57 | | Pegasystems, Inc | | | 680 |

| 99 | | Power-One, Inc.* | | | 395 |

| 57 | | Presstek, Inc.* | | | 292 |

| 47 | | Progress Software Corp.* | | | 1,583 |

| 307 | | Quantum Corp.* | | | 826 |

| 214 | | RealNetworks, Inc.* | | | 1,303 |

| 48 | | Renanissance Learning, Inc. | | | 672 |

| 143 | | Sapient Corp.* | | | 1,260 |

| 59 | | SiRF Technology Holdings, Inc.* | | | 1,483 |

| 22 | | Supertex, Inc.* | | | 688 |

| 520 | | Sycamore Networks, Inc.* | | | 1,997 |

| 290 | | Tibco Software, Inc.* | | | 2,340 |

| 75 | | United Online, Inc. | | | 887 |

| 51 | | Universal Display Corp.* | | | 1,054 |

| 239 | | UTStarcom, Inc.* | | | 657 |

| 131 | | ValueClick, Inc.* | | | 2,869 |

| 136 | | Varian, Inc.* | | | 8,881 |

| 59 | | VASCO Data Security International, Inc.* | | | 1,647 |

| 68 | | Vicor Corp. | | | 1,060 |

| 37 | | Virage Logic Corp.* | | | 309 |

| | | | | |

| | | | | 118,078 |

| | | | | |

| | Materials (2.7%): | | | |

| 42 | | American Vanguard Corp. | | | 729 |

| 351 | | Beacon Roofing Supply, Inc.* | | | 2,955 |

| 31 | | Ceradyne, Inc.* | | | 1,455 |

| 156 | | Hercules, Inc. | | | 3,019 |

| 23 | | Minerals Technologies, Inc. | | | 1,540 |

| 57 | | Myers Industries, Inc. | | | 825 |

| 35 | | Schnitzer Steel Industries, Inc., Class A | | | 2,419 |

| 38 | | Symyx Technologies, Inc.* | | | 292 |

| | | | | |

| | | | | 13,234 |

| | | | | |

See notes to financial statements.

| | | | |

| | Annual Report : December 31, 2007 | | 8 |

The Blue Fund Group

The Blue Small Cap Fund

Schedule of Portfolio Investments, continued

December 31, 2007

| | | | | |

Shares | | Security Description | | Value |

| | COMMON STOCKS, continued: | | | |

| | Mortgage REITs (1.0%): | | | |

| 66 | | Anthracite Capital, Inc. | | $ | 478 |

| 30 | | Gramercy Capital Corp. | | | 729 |

| 128 | | MFA Mortgage Investments, Inc. | | | 1,184 |

| 50 | | Newcastle Investment Corp. | | | 648 |

| 69 | | NorthStar Realty Finance Corp. | | | 616 |

| 10 | | NovaStar Financial, Inc.* | | | 29 |

| 32 | | RAIT Financial Trust | | | 276 |

| 30 | | Redwood Trust, Inc. | | | 1,027 |

| | | | | |

| | | | | 4,987 |

| | | | | |

| | Office REITs (0.4%): | | | |

| 74 | | Maguire Properties, Inc. | | | 2,181 |

| | | | | |

| | Residential REITs (0.1%): | | | |

| 29 | | Sun Communities, Inc. | | | 611 |

| 46 | | Tarragon Corp.* | | | 69 |

| | | | | |

| | | | | 680 |

| | | | | |

| | Retail REITs (1.7%): | | | |

| 37 | | Acadia Realty Trust | | | 948 |

| 42 | | Glimcher Realty Trust | | | 600 |

| 47 | | Kite Realty Group Trust | | | 718 |

| 142 | | Pennsylvania Real Estate Investment Trust | | | 4,214 |

| 27 | | Ramco-Gershenson Properties Trust | | | 577 |

| 36 | | Tanger Factory Outlet Centers, Inc | | | 1,357 |

| | | | | |

| | | | | 8,414 |

| | | | | |

| | Specialized REITs (1.1%): | | | |

| 46 | | Hersha Hospitality Trust | | | 437 |

| 66 | | LaSalle Hotel Properties | | | 2,105 |

| 38 | | LTC Properties, Inc. | | | 952 |

| 68 | | OMEGA Healthcare Investors, Inc. | | | 1,091 |

| 66 | | U-STORE-IT Trust | | | 605 |

| | | | | |

| | | | | 5,190 |

| | | | | |

| | Telecommunication Services (0.6%): | | | |

| 505 | | Charter Communications, Inc., Class A* | | | 591 |

| 132 | | Citadel Broadcasting Corp. | | | 272 |

| 60 | | Emmis Communications Corp., Class A* | | | 231 |

| 46 | | Entercom Communications Corp., Class A | | | 630 |

| 78 | | Syniverse Holdings, Inc.* | | | 1,215 |

| | | | | |

| | | | | 2,939 |

| | | | | |

| | Utilities (3.4%): | | | |

| 118 | | Integrys Energy Group, Inc. | | | 6,099 |

| 32 | | New Jersey Resources Corp. | | | 1,601 |

| 32 | | Northwest Natural Gas Co. | | | 1,557 |

| 34 | | South Jersey Industries, Inc. | | | 1,227 |

| 28 | | UIL Holdings Corp. | | | 1,035 |

| 156 | | WGL Holdings, Inc. | | | 5,110 |

| | | | | |

| | | | | 16,629 |

| | | | | |

| | Total Investments | | | |

| | (Cost 442,929)(a) — 81.2% | | | 401,991 |

| | Other assets in excess of liabilities — 18.8% | | | 93,202 |

| | | | | |

| | NET ASSETS — 100.0% | | $ | 495,193 |

| | | | | |

Percentages indicated are based on net assets.

| * | Non-income producing security. |

| (a) | See notes to financial statements for tax unrealized appreciation (depreciation) of securities. |

REIT—Real Estate Investment Trust.

See notes to financial statements.

| | |

| 9 | | The Blue Fund : Invested in Meaningful Change |

The Blue Fund Group

Statements of Assets and Liabilities

December 31, 2007

| | | | | | | | |

| | | THE BLUE

LARGE CAP FUND | | | THE BLUE

SMALL CAP FUND | |

Assets: | | | | | | | | |

Investments, at value (cost $925,883 and $ 442,929) | | $ | 921,473 | | | $ | 401,991 | |

Cash | | | 105,807 | | | | 114,565 | |

Dividend income receivable | | | 1,184 | | | | 429 | |

Receivable for investments sold | | | 22,932 | | | | — | |

Receivable from Investment Adviser | | | 38,430 | | | | 918 | |

Prepaid expenses | | | 16,427 | | | | 11,615 | |

| | | | | | | | |

Total Assets | | | 1,106,253 | | | | 529,518 | |

| | |

Liabilities: | | | | | | | | |

Accrued expenses and other payables: | | | | | | | | |

Administration | | | 986 | | | | 392 | |

Accounting | | | 1,074 | | | | 520 | |

Chief Compliance Officer | | | 4,254 | | | | 1,996 | |

Distribution | | | 234 | | | | 107 | |

Transfer agent | | | 7,092 | | | | 5,590 | |

Custodian | | | 4,329 | | | | 4,673 | |

Trustee | | | 10,272 | | | | 4,714 | |

Other | | | 32,222 | | | | 16,333 | |

| | | | | | | | |

Total Liabilities | | | 60,463 | | | | 34,325 | |

| | | | | | | | |

Net Assets | | $ | 1,045,790 | | | $ | 495,193 | |

| | | | | | | | |

Composition of Net Assets: | | | | | | | | |

Capital | | $ | 1,050,898 | | | $ | 541,734 | |

Undistributed net investment loss | | | — | | | | — | |

Accumulated net realized losses from investment transactions | | | (698 | ) | | | (5,603 | ) |

Unrealized depreciation from investments | | | (4,410 | ) | | | (40,938 | ) |

| | | | | | | | |

Net Assets | | $ | 1,045,790 | | | $ | 495,193 | |

| | | | | | | | |

Shares Outstanding (no par value, unlimited number of authorized shares) | | | 100,680 | | | | 53,809 | |

| | | | | | | | |

Net Asset Value, Offering and Redemption Price per share | | $ | 10.39 | | | $ | 9.20 | |

| | | | | | | | |

See notes to financial statements.

| | | | |

| | Annual Report : December 31, 2007 | | 10 |

The Blue Fund Group

Statements of Operations

For the year ended December 31, 2007

| | | | | | | | |

| | | THE BLUE

LARGE CAP FUND | | | THE BLUE

SMALL CAP FUND | |

Investment Income: | | | | | | | | |

Dividends | | $ | 13,347 | | | $ | 6,770 | |

| | | | | | | | |

Total Investment Income | | | 13,347 | | | | 6,770 | |

| | |

Expenses: | | | | | | | | |

Investment Adviser | | | 10,165 | | | | 6,486 | |

Administration | | | 45,001 | | | | 35,000 | |

Distribution | | | 2,541 | | | | 1,297 | |

Accounting | | | 48,229 | | | | 52,871 | |

Audit | | | 21,351 | | | | 10,923 | |

Legal | | | 68,958 | | | | 36,496 | |

Chief Compliance Officer | | | 44,991 | | | | 24,176 | |

Custodian | | | 18,518 | | | | 18,616 | |

Transfer Agent | | | 42,978 | | | | 33,793 | |

Trustee | | | 39,598 | | | | 21,159 | |

Offering | | | 28,251 | | | | 28,251 | |

Other | | | 48,759 | | | | 37,276 | |

| | | | | | | | |

Total expenses before fee reductions | | | 419,340 | | | | 306,344 | |

| | | | | | | | |

Fees reduced/reimbursed by the Investment Adviser | | | (402,620 | ) | | | (296,403 | ) |

Custody earnings credit | | | (1,448 | ) | | | (858 | ) |

| | | | | | | | |

Net Expenses | | | 15,272 | | | | 9,083 | |

| | | | | | | | |

Net Investment Loss | | | (1,925 | ) | | | (2,313 | ) |

| | | | | | | | |

Realized and Unrealized Gains (Losses) from Investments: | | | | | | | | |

Realized gains from investment transactions | | | 25,021 | | | | 13,916 | |

Change in unrealized depreciation from investments | | | (17,729 | ) | | | (49,372 | ) |

| | | | | | | | |

Net realized/unrealized gains from investments | | | 7,292 | | | | (35,456 | ) |

| | | | | | | | |

Change in net assets resulting from operations | | $ | 5,367 | | | $ | (37,769 | ) |

| | | | | | | | |

See notes to financial statements.

| | |

| 11 | | The Blue Fund : Invested in Meaningful Change |

The Blue Fund Group

Statements of Changes in Net Assets

| | | | | | | | | | | | | | | | |

| | | THE BLUE

LARGE CAP FUND | | | THE BLUE

SMALL CAP FUND | |

| | | For the year

ended

December 31,

2007 | | | For the period

ended

December 31,

2006(a) | | | For the year

ended

December 31,

2007 | | | For the period

ended

December 31,

2006(a) | |

CHANGE IN NET ASSETS: | | | | | | | | | | | | | | | | |

Operations: | | | | | | | | | | | | | | | | |

Net investment income (loss) | | $ | (1,925 | ) | | $ | 54 | | | $ | (2,313 | ) | | $ | (177 | ) |

Realized gains from investment transactions | | | 25,021 | | | | 1,470 | | | | 13,916 | | | | 4,227 | |

Change in unrealized appreciation/depreciation from investments | | | (17,729 | ) | | | 13,319 | | | | (49,372 | ) | | | 8,434 | |

| | | | | | | | | | | | | | | | |

Change in net assets resulting from operations | | | 5,367 | | | | 14,843 | | | | (37,769 | ) | | | 12,484 | |

| | | | | | | | | | | | | | | | |

Distributions to Shareholders: | | | | | | | | | | | | | | | | |

Capital Gains | | | (25,318 | ) | | | — | | | | (21,256 | ) | | | — | |

Return of Capital | | | — | | | | — | | | | (368 | ) | | | — | |

| | | | | | | | | | | | | | | | |

Total Distributions to shareholders | | | (25,318 | ) | | | — | | | | (21,624 | ) | | | — | |

| | | | | | | | | | | | | | | | |

Capital Transactions: | | | | | | | | | | | | | | | | |

Proceeds from shares issued | | | 1,142,633 | | | | 519,037 | | | | 367,124 | | | | 521,031 | |

Dividends reinvested | | | 24,718 | | | | — | | | | 21,217 | | | | — | |

Cost of shares redeemed | | | (585,440 | ) | | | (50,050 | ) | | | (317,220 | ) | | | (50,050 | ) |

| | | | | | | | | | | | | | | | |

Change in net assets from capital share transactions | | | 581,911 | | | | 468,987 | | | | 71,121 | | | | 470,981 | |

| | | | | | | | | | | | | | | | |

Change in net assets | | | 561,960 | | | | 483,830 | | | | 11,728 | | | | 483,465 | |

| | | | |

Net Assets: | | | | | | | | | | | | | | | | |

Beginning of period | | | 483,830 | | | | — | | | | 483,465 | | | | — | |

| | | | | | | | | | | | | | | | |

End of period | | $ | 1,045,790 | | | $ | 483,830 | | | $ | 495,193 | | | $ | 483,465 | |

| | | | | | | | | | | | | | | | |

Share Transactions: | | | | | | | | | | | | | | | | |

Issued | | | 106,087 | | | | 51,268 | | | | 34,621 | | | | 51,743 | |

Reinvested | | | 2,368 | | | | — | | | | 2,281 | | | | — | |

Redeemed | | | (54,290 | ) | | | (4,753 | ) | | | (30,005 | ) | | | (4,831 | ) |

| | | | | | | | | | | | | | | | |

Change in shares | | | 54,165 | | | | 46,515 | | | | 6,897 | | | | 46,912 | |

| | | | | | | | | | | | | | | | |

Undistributed net investment income (loss) | | $ | — | | | $ | 54 | | | $ | — | | | $ | — | |

| | | | | | | | | | | | | | | | |

| (a) | Fund commenced operations on October 2, 2006. |

See notes to financial statements.

| | | | |

| | Annual Report : December 31, 2007 | | 12 |

The Blue Fund Group

Financial Highlights

Selected data for a share outstanding throughout the period indicated.

| | | | | | | | | | | | | | | | |

| | | THE BLUE

LARGE CAP FUND | | | THE BLUE

SMALL CAP FUND | |

| | | For the

year ended

December 31,

2007 | | | For the

period ended

December 31,

2006(a) | | | For the

year ended

December 31,

2007 | | | For the

period ended

December 31,

2006(a) | |

Net Asset Value, Beginning of Period | | $ | 10.40 | | | $ | 10.00 | | | $ | 10.31 | | | $ | 10.00 | |

| | | | | | | | | | | | | | | | |

Investment Operations: | | | | | | | | | | | | | | | | |

Net investment income (loss) | | | (0.02 | ) | | | — | (d) | | | (0.04 | ) | | | — | (d) |

Net realized and unrealized gains (losses) from investments and securities sold short | | | 0.27 | | | | 0.40 | | | | (0.65 | ) | | | 0.31 | |

| | | | | | | | | | | | | | | | |

Total from investment operations | | | 0.25 | | | | 0.40 | | | | (0.69 | ) | | | 0.31 | |

| | | | | | | | | | | | | | | | |

Distributions: | | | | | | | | | | | | | | | | |

Return of Capital | | | — | | | | — | | | | — | (d) | | | — | |

Net realized gains from investments and futures | | | (0.26 | ) | | | — | | | | (0.42 | ) | | | — | |

| | | | | | | | | | | | | | | | |

Total Distributions | | | (0.26 | ) | | | — | | | | (0.42 | ) | | | — | |

| | | | | | | | | | | | | | | | |

Net Asset Value, End of Period | | $ | 10.39 | | | $ | 10.40 | | | $ | 9.20 | | | $ | 10.31 | |

| | | | | | | | | | | | | | | | |

Total Return(b) | | | 2.36 | % | | | 3.79 | %* | | | (6.66 | )% | | | 2.89 | %* |

| | | | |

Ratios/Supplementary Data: | | | | | | | | | | | | | | | | |

Net assets at end of period (000’s) | | $ | 1,046 | | | $ | 484 | | | $ | 495 | | | $ | 483 | |

Ratio of net expenses to average net assets after voluntary and contractual waivers and reimbursements(c) | | | 1.50 | % | | | 1.50 | % | | | 1.75 | % | | | 1.75 | % |

Ratio of net investment income (loss) to average net assets(c) | | | (0.19 | )% | | | 0.06 | % | | | (0.44 | )% | | | (0.18 | )% |

Ratio of expenses to average net assets before voluntary and contractual waivers and reimbursements(c) | | | 41.19 | % | | | 104.44 | % | | | 58.92 | % | | | 99.32 | % |

Portfolio turnover | | | 45 | % | | | 20 | % | | | 53 | % | | | 18 | % |

| (a) | Fund commenced operations on October 2, 2006. |

| (b) | Not annualized for periods less than one year. |

| (c) | Annualized for periods less than one year. |

| (d) | Amount less than $0.005. |

| * | Represents performance beginning on the first day of security trading (October 17, 2006). Total return from commencement of offering of shares was 4.00% and 3.10% for the Large Cap and Small Cap Funds, respectively. |

See notes to financial statements.

| | |

| 13 | | The Blue Fund : Invested in Meaningful Change |

The Blue Fund Group

Notes to Financial Statements

December 31, 2007

1. ORGANIZATION

The Blue Fund Group (the “Trust”) was organized as a Massachusetts business trust under the laws of the State of Massachusetts on May 11, 2006. The Trust is a diversified, open-end investment company registered under the Investment Company Act of 1940, as amended (the “1940 Act”). The Trust is authorized to issue an unlimited number of shares, which are units of beneficial interest with no par value. The Trust currently offers shares of two series, each with its own investment strategy and risk/reward profile: The Blue Large Cap Fund (“Large Cap”) and The Blue Small Cap Fund (“Small Cap”), (individually a “Fund”, collectively the “Funds”).

Under the Funds’ organizational documents, its officers and trustees are indemnified against certain liabilities arising out of the performance of their duties to the Funds. In addition, in the normal course of business, the Funds enter into contracts with vendors and others that provide general indemnification. The Funds maximum exposure under these arrangements is unknown, as this would involve future claims that may be made against the Funds.

2. SIGNIFICANT ACCOUNTING POLICIES

The following is a summary of significant accounting policies followed by the Funds in the preparation of its financial statements. The policies are in conformity with accounting principles generally accepted (“GAAP”) in the United States of America. The preparation of financial statements requires management to make estimates and assumptions that may affect the reported amounts of income and expenses, assets and liabilities and disclosure of contingent assets and liabilities at the dates of the financial statement. Actual results could differ from those estimates.

Securities Valuation: The value of each equity security is based either on the last sale price on a national securities exchange, or in the absence of recorded sales, at the closing bid prices on such exchanges, or at the quoted bid price in the over-the-counter market. Equity securities traded on the NASDAQ stock market are valued at the NASDAQ official closing price.

Securities or other assets for which market quotation are not readily available (e.g., an approved pricing service does not provide a price, a furnished price is an error, certain stale prices, or an event occurs that materially affects the furnished price) are valued at fair value as determined in good faith by the Investment Advisor under the direction of the Board of Trustees.

Security Transactions and Related Income: Changes in holdings of portfolio securities shall be reflected no later than the first calculation on the first business day following the trade date. However, for financial reporting purposes, portfolio securities transactions are reported on trade date. Interest income is recognized on the accrual basis and includes, where applicable, the amortization or accretion of a premium or discount. Dividend income is recorded on the ex-dividend date. Gains or losses realized on sales of securities are determined by comparing the identified cost of the security lot sold with the net sales proceeds.

Expenses: Expenses directly attributable to a Fund are charged to the Fund, while expenses attributable to more than one series of the Trust are allocated among the respective series based on relative net assets or another appropriate basis.

Organization and Offering Expenses: All costs incurred by the Trust in connection with the organization of the Funds, principally professional fees and printing, were paid on behalf of the Trust by Blue Investment Management, LLC and will not be borne by the Funds.

Costs incurred in connection with the offering and initial registration of the Trust are amortized on a straight-line basis over the first twelve months after the commencement of operations. Offering expenses in 2007 totaled $28,251 and $28,251 for the Large Cap and Small Cap, respectively.

Dividends to Shareholders: Dividends from net investment income, if any, are declared and paid annually by the Funds. Dividends from net realized gains, if any, are declared and distributed at least annually by the Funds. Dividends to shareholders are recorded on the ex-dividend date.

The amounts of dividends from net investment income and distributions from net realized gains are determined in accordance with federal income tax regulations, which may differ from GAAP. These “book/tax” differences are either considered temporary or permanent in nature. To the extent these differences are permanent in nature, such amounts are reclassified within the composition of net assets based on their tax-basis treatment; temporary differences do not require reclassification. As of December 31, 2007, $1,871 of net investment loss in the Large Cap Fund has been reclassified to accumulated undistributed net realized gains. As of December 31, 2007, $2,313 of net investment loss in the Small Cap Fund has been reclassified to accumulated undistributed net realized gains and paid-in capital.

Federal Income Taxes: It is the policy of each Fund to qualify as a regulated investment company by complying with the provisions available to certain investment companies, as defined in applicable sections of the Internal Revenue Code, and to make distributions of net investment income and realized capital gains sufficient to relieve it from all, or substantially all, federal income taxes.

| | | | |

| | Annual Report : December 31, 2007 | | 14 |

The Blue Fund Group

Notes to Financial Statements, continued

December 31, 2007

Recently Issued Accounting Pronouncements: Effective June 29, 2007 the fund adopted Financial Accounting Standards Board (FASB) Interpretation No. 48 (FIN 48), “Accounting for Uncertainty in Income Taxes”, a clarification of FASB Statement No. 109, “Accounting for Income Taxes”. FIN 48 establishes financial reporting rules regarding recognition and measurement of tax positions taken or expected to be taken on a tax return. FIN 48 was applied to all open tax years as of the effective date. The adoption of FIN 48 had no impact on the fund’s net assets or results of operations.

As of and during the period ended December 31, 2007, the fund did not have a liability for any unrecognized tax benefits. The fund recognizes interest and penalties, if any, related to unrecognized tax benefits as income tax expense in the statement of operations. During the period, the fund did not incur any interest or penalties. The fund is not subject to examination by U.S. federal tax authorities for tax years before 2006.

In September 2006, the FASB issued Statement on Financial Accounting Standards (“SFAS”) No. 157, “Fair Value Measurements.” This standard establishes a single authoritative definition of fair value, sets out a framework for measuring fair value and requires additional disclosures about fair value measurements. SFAS No. 157 applies to fair value measurements already required or permitted by existing standards. SFAS No. 157 is effective for financial statements issued for fiscal years beginning after November 15, 2007 and interim periods within those fiscal years. The changes to current accounting principles generally accepted in the United States of America from the application of this Statement relate to the definition of fair value, the methods used to measure fair value, and the expanded disclosures about fair value measurements. As of December 31, 2007, the Fund does not believe the adoption of SFAS No. 157 will impact the financial statement amounts; however, additional disclosures may be required about the inputs used to develop the measurements and the effect of certain of the measurements on changes in net assets for the period.

3. INVESTMENT ADVISORY FEE AND OTHER TRANSACTIONS WITH AFFILIATES

Investment Adviser: Blue Investment Management, LLC (the “Investment Adviser”) serves as the investment adviser to each Fund. Under the terms of the investment advisory agreement, the Investment Adviser is entitled to receive fees computed daily and paid monthly at an annual rate of 1.00% and 1.25% of average net assets for the Large Cap and Small Cap Funds, respectively.

Under the terms of the five-year fee waiver and expense limitation agreement, the Investment Adviser has contractually agreed to limit the expenses to the extent that the Funds total annual operating expenses (not including brokerage commissions, hedging transaction fees, and other investment related costs, extraordinary, non-recurring and certain other unusual expenses such as litigation expenses and other extraordinary legal expenses, securities lending fees and expenses and transfer taxes) exceed 1.50% and 1.75% for the Large Cap and Small Cap Funds, respectively. The Investment Adviser is entitled to recoup amounts previously waived or reimbursed within 3 years of the month the initial waiver or reimbursement took place provided that by recouping payments the Investment Adviser does not force the Funds to exceed their current expense limitation agreements.

The amounts available for future recoupments and their expiration dates are as follows:

| | | | | | |

Fund | | 2009 | | 2010 |

| Large Cap Fund | | $ | 89,094 | | $ | 402,620 |

| Small Cap Fund | | | 93,123 | | | 296,403 |

Administrator: Citi Fund Services Ohio, Inc. (the “Administrator” or “Citi”), a wholly-owned subsidiary of Citi, Inc., serves as administrator of the Trust. The Trust and the Administrator have entered into a Master Services Agreement, under which the Administrator provides the Trust with administrative services, including day-to-day administration of matters necessary to each Fund’s operations, maintenance of records and the books of the Trust, preparation of reports and assistance with compliance monitoring of the Fund’s activities. Under the terms of the Master Services Agreement, the Administrator is entitled to receive an annual asset-based fee for administration and fund accounting of 13 basis points (0.13%) on the first $250 million in aggregate net assets of all Funds; 10 basis points (0.10%) of aggregate net assets of all Funds from over $250 million to $500 million; 7.5 basis points (0.075%) of aggregate net assets of all Funds in excess of $500 million. The annual asset-based fee is subject to an annual minimum equal to $82,500 for the first Fund plus $67,500 for the second Fund and $82,500 for each Fund in excess of two Funds. Under the Master Services Agreement, Citi also serves as transfer agent and dividend disbursing agent to the Funds. Citi is entitled to receive an annual per-account fee for such services that is applied to each shareholder account on Citi’s transfer agency system, subject to an annual minimum of $17,000 per class. For providing Administration, Fund Accounting and Transfer Agency fees to the Trust, Citi is entitled to an annual minimum fee of $165,000.

Certain officers of the Trust are affiliated with the Administrator. With the exception of the Chief Compliance Officer (as noted below), none of these individuals receives a fee from the Trust for serving as an officer.

| | |

| 15 | | The Blue Fund : Invested in Meaningful Change |

The Blue Fund Group

Notes to Financial Statements, continued

December 31, 2007

Chief Compliance Officer: Citi also provides certain compliance services to the Trust pursuant to a Compliance Services Agreement. For its services, Citi receives an annual fee for the first year of $65,000, plus reimbursement for actual out-of-pocket expenses incurred while providing services to the Trust. This fee increases by $10,000 per year for years two and three of this agreement.

Distributor: The Trust has retained Foreside Distribution Services Limited Partnership (the “Distributor”), a wholly-owned subsidiary of Foreside Distribution Services Limited Partnership and an affiliate of the Administrator, to serve as principal underwriter for the shares of the Funds, pursuant to a Distribution Agreement between the Distributor and the Adviser. Fees for such distribution services are paid to the Distributor by the Adviser.

Distribution Plan: Each Fund has adopted a Distribution Plan, pursuant to Rule 12b-1 under the 1940 Act (the “Distribution Plan”). Pursuant to the Distribution Plan, each Fund will pay up to 0.25% of its average daily net assets to pay for distribution related expenses. The Distribution Plan provides that the Funds pay the Distributor and other organizations for distributing such classes of shares, for advertising and marketing and for providing certain services to shareholders of the respective class of shares.

4. PURCHASES AND SALES OF SECURITIES:

Purchases of and proceeds from sales, excluding short-term securities, for the Fund for the period ended December 31, 2007.

| | | | | | |

Fund | | Purchases | | Sales |

Large Cap Fund | | $ | 920,006 | | $ | 406,221 |

Small Cap Fund | | | 252,042 | | | 240,673 |

5. FEDERAL INCOME TAX INFORMATION:

At December 31, 2007, the cost, gross unrealized appreciation and gross unrealized depreciation on securities, for federal income tax purposes, were as follows:

| | | | | | | | | | | | | | |

| | | Tax Cost | | Tax Unrealized

Appreciation | | Tax Unrealized

(Depreciation) | | | Net Unrealized

(Depreciation) | |

| | | | | |

Large Cap Fund | | $ | 925,883 | | $ | 140,810 | | $ | (145,220 | ) | | $ | (4,410 | ) |

Small Cap Fund | | | 442,929 | | | 45,663 | | | (86,601 | ) | | | (40,938 | ) |

For the year ended December 31, 2007, the elections to defer post October losses were as follows:

| | | |

Large Cap Fund | | $ | 982 |

Small Cap Fund | | $ | 5,603 |

The tax character of distributions paid during the period ended December 31, 2007 was as follows:

| | | | | | | | | | | | | | | |

| | | Ordinary

Income | | Net Long-Term

Capital Gains | | Total Taxable

Distributions | | Tax Return of

Capital | | Total Distributions

Paid1 |

| | | | | |

Large Cap Fund | | $ | 25,298 | | $ | 20 | | $ | 25,318 | | $ | — | | $ | 25,318 |

Small Cap Fund | | | 21,253 | | | 3 | | | 21,256 | | | 368 | | | 21,624 |

There were no distributions paid during the period ended December 31, 2006.

As of December 31, 2007 the components of accumulated earnings/(deficit) on a tax basis was as follows:

| | | | | | | | | | | | | | | | | | | | | |

| | | Undistributed

Ordinary

Income | | Undistributed

Long-Term

Capital Gains | | Accumulated

Earnings | | Accumulated

Capital and

Other Losses | | | Net Unrealized

(Depreciation) | | | Total

Accumulated

Deficit | |

Large Cap Fund | | $ | 284 | | $ | — | | $ | 284 | | $ | (982 | ) | | $ | (4,410 | ) | | $ | (5,108 | ) |

Small Cap Fund | | | — | | | — | | | — | | | (5,603 | ) | | | (40,938 | ) | | | (46,541 | ) |

1 | Total distributions paid may differ from the amount reported in the Statement of Changes in Net Assets because for tax purposes distributions are recognized when actually paid. |

| | | | |

| | Annual Report : December 31, 2007 | | 16 |

The Blue Fund Group

Notes to Financial Statements, continued

December 31, 2007

6. SUBSEQUENT EVENT

On February 12, 2008, the Board of Trustees authorized Management to begin liquidation proceedings for The Blue Small Cap Fund. Effective March 3, 2008, no further purchase orders for The Blue Small Cap Fund will be accepted. Management has begun evaluating the procedures necessary for a smooth and orderly liquidation of the Fund. It is anticipated that the Fund will be liquidated on or before April 30, 2008. As a result, The Blue Small Cap Fund changed its basis of accounting from the going concern basis to the liquidation basis effective February 12, 2008.

| | |

| 17 | | The Blue Fund : Invested in Meaningful Change |

The Blue Fund Group

Report of Independent Registered Public Accounting Firm

December 31, 2007

To The Shareholders and

Board of Trustees of

The Blue Fund Group

We have audited the accompanying statements of assets and liabilities, including the schedules of investments, of The Blue Fund Group, comprising The Blue Large Cap Fund and The Blue Small Cap Fund (the “Funds”), as of December 31, 2007, and the related statements of operations for the year then ended and changes in net assets and the financial highlights for each of the two periods then ended. These financial statements and financial highlights are the responsibility of the Funds’ management. Our responsibility is to express an opinion on these financial statements and financial highlights based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. Our procedures included confirmation of securities owned as of December 31, 2007 by correspondence with the Funds’ custodian. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements and financial highlights referred to above present fairly, in all material respects, the financial positions of each of the funds constituting The Blue Fund Group, as of December 31, 2007, the results of their operations for the year then ended, and the changes in their net assets and their financial highlights for each of the two periods then ended, in conformity with accounting principles generally accepted in the United States of America.

As discussed in Note 6 to the financial statements, the Board of Trustees of The Blue Fund Group approved the liquidation of The Blue Small Cap Fund on February 12, 2008. As a result, The Blue Small Cap Fund changed its basis of accounting from the going concern basis to the liquidation basis effective February 12, 2008.

COHEN FUND AUDIT SERVICES, LTD.

Westlake, Ohio

February 29, 2008

| | | | |

| | Annual Report : December 31, 2007 | | 18 |

The Blue Fund Group

Additional Information (Unaudited)

December 31, 2007

EXPENSE COMPARISON

As a shareholder of the Funds, you incur ongoing costs, including management fees; distribution fees; and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Funds and to compare these costs with the ongoing costs of investing in other mutual funds.

The examples are based on an investment of $1,000 invested at the beginning of the period and held for the entire period from July 1, 2007 through December 31, 2007.

Actual Expenses

The table below provides information about actual account values and actual expenses. You may use the information below, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the table under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

| | | | | | | | | | | | |

| | | Beginning

Account Value

7/1/07 | | Ending

Account Value

12/31/07 | | Expense Paid

During Period*

7/1/07 - 12/31/07 | | Expense Ratio

During Period

7/1/07 - 12/31/07 | |

Large Cap Fund | | $ | 1,000.00 | | $ | 979.60 | | $ | 7.48 | | 1.50 | % |

Small Cap Fund | | | 1,000.00 | | | 890.30 | | | 8.34 | | 1.75 | % |

| * | Expenses are equal to the average account value times the Fund’s annualized expense ratio multiplied by the actual number of days in the most recent fiscal half-year divided by the number of days in the period. |

Hypothetical Example for Comparison Purposes

The table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds.

| | | | | | | | | | | | |

| | | Beginning

Account Value

7/1/07 | | Ending

Account Value

12/31/07 | | Expense Paid

During Period*

7/1/07 - 12/31/07 | | Expense Ratio

During Period

7/1/07 - 12/31/07 | |

Large Cap Fund | | $ | 1,000.00 | | $ | 1,017.64 | | $ | 7.63 | | 1.50 | % |

Small Cap Fund | | | 1,000.00 | | | 1,016.38 | | | 8.89 | | 1.75 | % |

| * | Expenses are equal to the average account value times the Funds’ annualized expense ratio multiplied by the number of days in the most recent fiscal half-year divided by the number of days in the fiscal year. |

| | |

| 19 | | The Blue Fund : Invested in Meaningful Change |

The Blue Fund Group

Additional Information, continued

December 31, 2007

Supplemental Tax Information

For corporate shareholders, the following percentage of the total ordinary income dividends paid during the fiscal year ended December 31, 2007 qualifies for the corporate dividends received deduction as follows:

| | | |

| | | Dividends Received Deduction | |

Large Cap Fund | | 50.67 | % |

Small Cap Fund | | 27.68 | % |

For the fiscal year ended December 31, 2007, the qualified dividend income payments were as follows:

| | | |

| | | Amount |

Large Cap Fund | | $ | 11,631 |

Small Cap Fund | | | 5,999 |

The Funds designate the following amounts as long-term capital gain distributions qualifying for the maximum 15% income tax rate for individuals:

| | | |

| | | Amount |

Large Cap Fund | | $ | 20 |

Small Cap Fund | | | 3 |

This report is for the information of the shareholders of The Blue Fund. Its use in connection with any offering of the Funds’ shares is authorized only in case of concurrent or prior delivery of the Funds’ current prospectus.

Statement Regarding Availability of Quarterly Portfolio Schedule

The Funds file complete schedules of portfolio holdings for each Fund with the Securities and Exchange Commission (the “Commission”) for the first and third quarters of each fiscal year on Form N-Q. The Funds’ Forms N-Q are available on the Commission’s website at http://www.sec.gov. The Funds’ Form N-Q may be reviewed and copied at the Commission’s Public Reference Room in Washington, D.C., and information on the operation of the Public Reference Room may be obtained by calling 800-SEC-0330; and the Funds make the information on Form N-Q available upon request without charge.

Statement Regarding Availability of Proxy Voting Record

A description of the policies and procedures that the Funds use to determine how to vote proxies relating to the portfolio securities is available without charge, upon request, by calling 1-877-490-2583 or on the Securities and Exchange Commission’s website at http://www.sec.gov. A copy of the Fund’s voting record for the 12-month period ending June 30, 2007 will be available at the SEC’s website at www.sec.gov.

| | | | |

| | Annual Report : December 31, 2007 | | 20 |

The Blue Fund Group

Trustees and Officers (Unaudited)

December 31, 2007

TRUSTEES:

| | | | | | | | |

Name, Address, and Age | | Position(s)

Held with

Funds | | Term of Office and

Length of Time Served | | Principal Occupation(s) During Past 5 Years | | Other Directorships

Held by Trustee |

Joseph J. Andrew, 47 3435 Stelzer Road Columbus, Ohio 43219 | | Trustee (1) | | Since inception of the Trust and until a successor is elected and qualified | | Partner, Sonnenschein, Nath & Rosenthal LLP, September 2004-Present; Partner, McDermott Will & Emery LLP, February 2003-September 2004; Partner, Cadwalader, Wickersham & Taft LLP, May 2001-February 2003; Chairman, Democratic National Committee, February 1999-May 2001 | | None |

(1) Mr. Andrew is a member of Blue Investment Management, LLC, Investment Adviser to the Funds. |

DISINTERESTED TRUSTEES: |

| | | | |

Rachel Kleinfeld, 30 3435 Stelzer Road Columbus, Ohio 43219 | | Trustee | | Since inception of Trust and until a successor is elected and qualified | | Director, Truman National Security Project, October 2004-Present; Senior Consultant, Booz Allen Hamilton, September 2002-May 2003; Consultant, World Bank, June 2001-September 2002 | | None |

| | | | |

Dmitri Mehlhorn, 34 3435 Stelzer Road Columbus, Ohio 43219 | | Trustee | | Since inception of Trust and until a successor is elected and qualified | | Director, Gerson Lehrman Group, October 2003-Present; Counsel, Director of Strategy, O’Melveny & Myers, August 2001-September 2003 | | None |

| | | | |

Paul S. Feinberg, 63 3435 Stelzer Road Columbus, Ohio 43219 | | Trustee | | Since July 17, 2006 and until a successor is elected and qualified | | Executive Vice President and General Counsel, CitiStreet Associates LLC, July 1990-December 2005 | | CitiStreet Associates LLC, CitiStreet Equities LLC, CitiStreet Financial Services LLC, CitiStreet Funds Management LLC, and CitiStreet Retirement Services LLC, each prior to January 2000- September 2005 |

PRINCIPAL OFFICERS: |

| | | | |

Daniel Adamson, 30 3435 Stelzer Road Columbus, Ohio 43219 | | Chief Executive Officer | | Since inception of Trust and until a successor is elected and qualified | | Chief Executive Officer, Blue Investment Management, LLC - February 2006 through present; Consultant, McKinsey & Company - 3 years; Senior Associate, Trireme Partners - one year; University endowment - one year | | |

| | | | |

Aaron Masek, CPA, 33 3435 Stelzer Road Columbus, OH 43219 | | Treasurer, Principal Accounting and Financial Officer | | Since inception of Trust and until a successor is elected and qualified | | Senior Vice President, Citi Fund Services Ohio, Inc. (formerly BISYS Fund Services, Ohio, Inc.) since 2005 and has been employed by Citi in various other roles since 1997. | | |

| | | | |

Eric Phipps, 35 3435 Stelzer Road Columbus, OH 43219 | | Chief Compliance Officer | | Since July 17, 2006 and until a successor is elected and qualified | | Vice President and Chief Compliance Officer; Citi Fund Services Ohio, Inc. (formerly BISYS Fund Services, Ohio, Inc.) since June 2006; Director

- Compliance, Citi Fund Services Ohio, Inc.

- December 1995 through October 2004; Staff

Accountant, Securities and Exchange Commission

- October 2004 through May 2006. | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | |

| 21 | | The Blue Fund : Invested in Meaningful Change |

INVESTMENT ADVISOR

Blue Investment Management, LLC

888 16th Street NW, Suite 800

Washington, D.C. 20006

ADMINISTRATOR AND TRANSFER AGENT

Citi Fund Services, Inc.

3435 Stelzer Road

Columbus, Ohio 43219

DISTRIBUTOR

Foreside Distribution Services, L.P.

3435 Stelzer Road

Columbus, Ohio 43219

CUSTODIAN

The Bank of New York

P.O. Box 11555

New York, New York 10286-1555

COUNSEL

Day Pitney LLP

One International Place

Boston, Massachussetts 02110

INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

Cohen Fund Audit Services, Ltd.

800 Westpoint Parkway, Suite 1100

Westlake, Ohio 44145

For additional information, call 1-877-490-2583.

This material must be preceded or accompanied by a current prospectus.

| | |

| | www.bluefund.com |

| |

| | BLUE-AR 0308 |

(a) The registrant has adopted a code of ethics that applies to the registrant’s principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions. This code of ethics is included as an Exhibit.

(b) During the period covered by the report, with respect to the registrant’s code of ethics that applies to its principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions; there have been no amendments to, nor any waivers granted from, a provision that relates to any element of the code of ethics definition enumerated in paragraph (b) of this Item 2. Effective February 12, 2008, Douglas (Buck) Owen replaced Daniel de F. Adamson as President of The Blue Fund Group.

| Item 3. | Audit Committee Financial Expert. |

3(a)(1) The registrant’s board of directors has determined that the registrant does not have an audit committee financial expert serving on its audit committee.

3(a)(2) There is not an audit committee financial expert serving on its audit committee.

3(a)(3) The Audit Committee does not currently have any members who believe that they qualify as an “audit committee financial expert.” The Audit Committee is confident, however, that its current membership is fully capable of carrying out and fulfilling the responsibilities of being members of the Audit Committee. The Audit Committee currently has no plans to recruit an additional member who would qualify as an “audit committee financial expert”, but will periodically review whether the addition of a member with such qualifications is necessary for the Audit Committee to discharge its responsibilities.

| Item 4. | Principal Accountant Fees and Services. |

| | | | | | |

| | | 2007 | | 2006 |

Audit Fees | | $ | 28,250 | | $ | 28,575 |

Audit-Related Fees | | $ | 0 | | | N/A |

Tax Fees | | $ | 3,000 | | $ | 3,000 |

All Other Fees | | $ | 0 | | | N/A |

[Disclose the audit committee’s pre-approval policies and procedures described in paragraph (c)(7) of Rule 2-01 of Regulation S-X.]

[(e) If any of the services were NOT pre-approved, but otherwise approved by the audit committee, disclose the percentage of each category above.]

[(f) If greater than 50 percent, disclose the percentage of hours expended on the principal accountant’s engagement to audit the registrant’s financial statements for the most recent fiscal year that were attributed to work performed by persons other than the principal accountant’s full-time, permanent employees.]

[(g) Disclose the aggregate non-audit fees billed by the registrant’s accountant for services rendered to the registrant, and rendered to the registrant’s investment adviser (not including any sub-adviser whose role is primarily portfolio management and is subcontracted with or overseen by another investment adviser), and any entity controlling, controlled by, or under common control with the adviser that provides ongoing services to the registrant, were $11,000 and $0 for each of the last two fiscal years of the registrant.]

[(h) Disclose whether the registrant’s audit committee of the board of directors has considered whether the provision of nonaudit services that were rendered to the registrant’s investment adviser (not including any subadviser whose role is primarily portfolio management and is subcontracted with or overseen by another investment adviser), and any entity controlling, controlled by, or under common control with the investment adviser that provides ongoing services to the registrant that were not pre-approved pursuant to paragraph (c)(7)(ii) of Rule 2-01 of Regulation S-X is compatible with maintaining the principal accountant’s independence.]

| Item 5. | Audit Committee of Listed Registrants. |

Not applicable.

| Item 6. | Schedule of Investments. |

Not applicable.

| Item 7. | Disclosure of Proxy Voting Policies and Procedures for Closed-End Management Investment Companies. |

Not applicable.

| Item 8. | Portfolio Managers of Closed-End Management Investment Companies. |

Not applicable.