UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

| x ANNUAL REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT |

| OF 1934 FOR THE YEAR ENDED APRIL 30, 2008 |

Commission file number 000-52813

SNOWDON RESOURCES CORPORATION

(Exact name of registrant as specified in its charter)

NEVADA

(State or other jurisdiction of incorporation or organization)

789 West Pender Street, Suite 1010

Vancouver, British Columbia

Canada V6C 1H2

(Address of principal executive offices, including zip code.)

(604) 606-7979

(telephone number, including area code)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

YES ¨ NOx

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act:

YES ¨ NOx

Indicate by check mark whether the registrant(1) has filed all reports required by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 day.YESx NO ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulations S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy ir information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K.¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 if the Exchange Act.

| Large Accelerated filer | ¨ | Accelerated filer | ¨ |

| Non-accelerated filer | ¨ | Smaller reporting company | x |

| (Do not check if a smaller reporting company) | | |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act).YESx NO ¨

State the aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was sold, or the average bid and asked price of such common equity, as of July 11, 2008: $550,000.

TABLE OF CONTENTS

| | | Page |

| |

| | PART I | |

| Item 1. | Description of Business. | 3 |

| Item 1A. | Risk Factors. | 20 |

| Item 1B. | Unresolved Staff Comments. | 20 |

| Item 2. | Properties. | 20 |

| Item 3. | Legal Proceedings. | 21 |

| Item 4. | Submission of Matters to a Vote of Security Holders. | 21 |

| |

| | PART II | |

| Item 5. | Market Price for the Registrant’s Common Equity, Related Stockholders Matters | |

| | and Issuer Purchases of Equity Securities. | 21 |

| Item 6. | Selected Financial Data. | 22 |

| Item 7. | Management’s Discussion and Analysis of Financial Condition and Results of | |

| | Operation. | 22 |

| Item 7A. | Quantitative and Qualitative Disclosures About Market Risk. | 25 |

| Item 8. | Financial Statements and Supplementary Data. | 25 |

| Item 9. | Changes in and Disagreements With Accountants on Accounting and Financial | |

| | Disclosure. | 39 |

| |

| | PART III | |

| Item 9A. | Controls and Procedures. | 39 |

| Item 9B. | Other Information. | 41 |

| Item 10. | Directors and Executive Officers, Promoters and Control Persons. | 41 |

| Item 11. | Executive Compensation. | 45 |

| Item 12. | Security Ownership of Certain Beneficial Owners and Management. | 47 |

| Item 13. | Certain Relationships and Related Transactions, and Director Independence. | 49 |

| Item 14. | Principal Accounting Fees and Services. | 49 |

| |

| | PART IV | |

| Item 15. | Exhibits and Financial Statement Schedules. | 50 |

-2-

PART I

ITEM 1. DESCRIPTION OF BUSINESS

General

We were incorporated on March 1, 2006 and our fiscal year end is April 30. Our administrative office is located at 789 West Pender Street, Suite 1010, Vancouver, British Columbia, Canada V6C 1H2, which is also our mailing address. Our telephone number is (604) 606-7979, and our registered statutory office is located at 6100 Neil Road, Suite 500, Reno, Nevada 89544.

We are an exploration stage mining company. We have no ore bodies. We intend to prospect for uranium on our one property which now contains twelve claims. We acquired five claims on April 1, 2006 from Maggie-May Minerals, Inc. which is not affiliated with us. The claims were re-staked in March, 2008 and increased to a total of twelve.

Claims

The following is a list of the claims which we own as filed with Bureau of Land Management, hereinafter the “BLM,” showing the claim number, name of claims, date of location and date of expiration for claim. All claims are located in Gila County, Arizona.

| AMC # | Claim Name | Date of Location | Date of Expiration |

| |

| Original Claims – now superseded: | |

| 370254 | CR # 1 | November 26, 2005 | n/a |

| 370255 | CR # 2 | November 26, 2005 | n/a |

| 370256 | CR # 4 | November 26, 2005 | n/a |

| 370257 | CR # 8 | November 26, 2005 | n/a |

| 370258 | CR # 10 | November 26, 2005 | n/a |

| |

| Current Claims: | | |

| 390227 | CR # 1 | February 28, 2008 | September 1, 2009 |

| 390228 | CR # 2 | February 28, 2008 | September 1, 2009 |

| 390229 | CR # 3 | February 28, 2008 | September 1, 2009 |

| 390230 | CR # 4 | February 28, 2008 | September 1, 2009 |

| 390231 | CR # 5 | February 28, 2008 | September 1, 2009 |

| 390232 | CR # 6 | February 28, 2008 | September 1, 2009 |

| 390233 | CR # 7 | February 28, 2008 | September 1, 2009 |

| 390234 | CR # 8 | February 28, 2008 | September 1, 2009 |

| 390235 | CR # 9 | February 28, 2008 | September 1, 2009 |

| 390236 | CR # 10 | February 28, 2008 | September 1, 2009 |

| 390237 | CR # 11 | February 28, 2008 | September 1, 2009 |

| 390238 | CR # 12 | February 28, 2008 | September 1, 2009 |

-3-

Each claim measures 600 feet by 1,500 feet and covers 20 acres. Total land position is 240 acres.

In order to keep claims in good standing, a claim maintenance fee in the amount of US$125.00 per claim must be paid by to the BLM each year on or before September 1 and there is no grace period. The claim maintenance fees due no later than September 1, 2008 were paid in July, 2008. We will not cause the claims to expire as a result of not paying the required maintenance fees, provided that mineralized material is found. In the event that our exploration program does not locate mineralization of interest, we will allow claims to expire and cease operations.

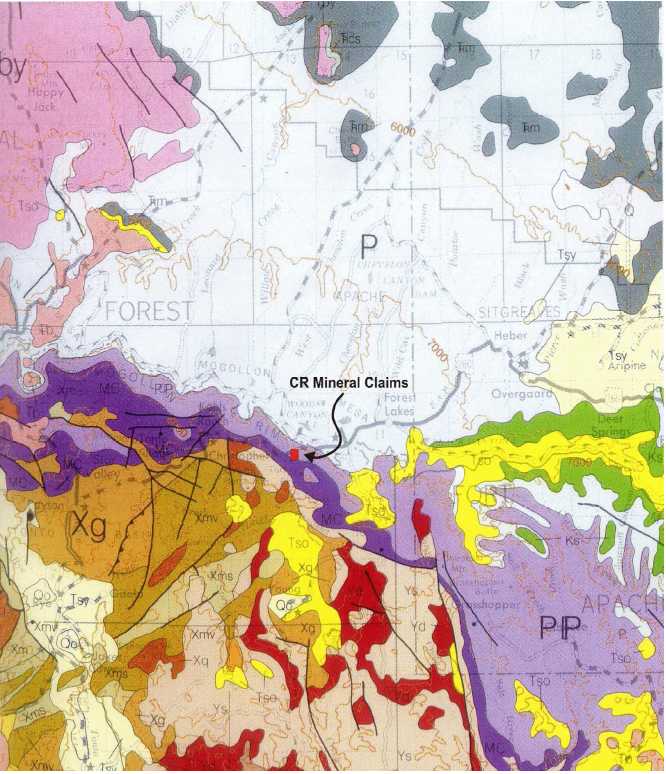

The property was as selected based on research of documented occurrences of uranium mineralization in Arizona and because mineralization has been located on other properties nearby, which are underlain by the same lithology. At the adjacent Promontory Butte deposit, important host rocks for radioactive material include siltstones and conglomerates containing abundant carbonaceous material, representing mostly fossilized plants, is thought to have deposited along ancient stream channels. We do not claim to have an ore body. No mineralized material has been discovered on our property. A Radon survey was completed on the CR mineral claims during June, 2008 and is described below.

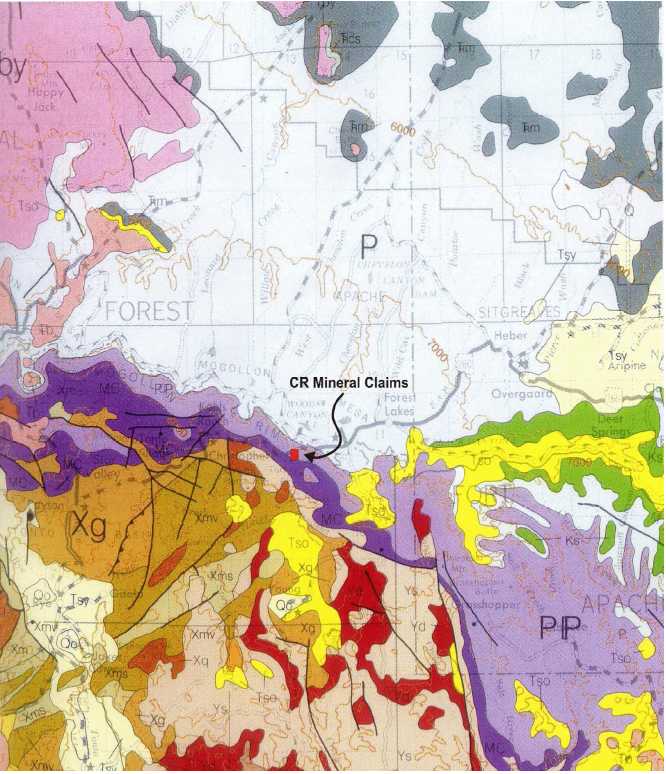

Location and Access

The twelve CR Mineral Claims are located approximately 30 miles east of Payson, Arizona in Township 11 north, Range 13 East, sections 34 & 35, Gila County, Arizona. The Claim Block is situated within the Mogollon Slope region on the southwestern edge of the Colorado Plateau geologic province in the east-central Arizona region. The edge of the physiographic Colorado Plateau is a dissected scarp known as the Mogollon Rim. The Mogollon Rim is both a structurally and topographically high which creates a regional drainage divide. The waters to the north traverse to the Colorado River and the waters to the south flow to the Gila River system. Elevations on the property range from about 6,200 to 6,450 feet.

The CR claims may be accessed from Payson, Arizona by traveling east on Arizona State highway 260 for approximately 30 miles to the Colcord Road junction, then travel about 1 mile southeast on Colcord Road to the claim boundary. There are several dirt roads that traverse the property in a northerly direction.

The terrain on the property is moderate with south dipping slopes and pine trees as the predominant vegetation. The property is typically snow free which provides a 12 month work season. The claims are outlined on the following topographical and geological maps of the area.

-4-

MAP 1

-5-

MAP 2

-6-

MAP LEGEND

Property Geology

The CR Claim block is underlain by the Pennsylvanian Horquilla Formation which is a carbonate sequence that forms ledges and slopes. The strata within the Horquilla consist of cyclically interbedded fossiliferous limestone and minor terrigenous mudstone and siltstone. The frequency and thickness of the clastic beds increase upward into the Pennsylvanian-Permian Earp Formation.

The Horquilla Formation began with the eastward transgression of the sea from the Cordilleran geosynclines into a restricted embayment. The sea advanced over a relatively flat surface formed partly by karst topography at the top of the Redwall Limestone. Thin sheets of gravel, composed of chert and flint pebbles, and in some instances contains brachiopods or other marine fossils was spread over the area followed by layer of mud, silt and carbonate deposits.

-7-

The Naco Group (uranium enriched) is predominately a marine sequence of interbedded limestones and shales that grades laterally in the Lower Supai Formation of Late Pennsylvanian–Early Permian age. It was deposited during a marine transgression over a karst surface developed on the Mississippian Redwall Limestone. There are three members in the Naco Group. The lowermost member is typically a basal reddish-brown cherty mudstone, siltstone, or conglomerate with the source of material from the solution of the Redwall Limestone and followed by stratified mudstone, siltstone and sandstone. The middle member consists of richly fossiliferous resistant limestone and interbedded with purple shales and siltstones. The upper member consists of a succession of reddish-brown clastics and interbedded limestone produced by the interfingering of marine units and continental margin and terrestrial redbeds of the south-eastward building of the Supai delta.

Mineralization

The origin of the uranium that occurs in the Colcord Road region are directly related to sandstone lenses of stream origin in beds of late Paleozoic age coincidental with the evolutionary development of land plants. The uranium deposits are tabular peneconcordant types that are enveloped in rock formations with reduced geochemical characteristics. The sandstone is pale gray and white and contains coalified plant fossils and finely disseminated pyrite. The associated mudstones are gray or green and also contain disseminated pyrite.

The uranium deposits are in the sandstone lenses interbedded with mudstone that formed in intermontane basins on broad alluvial plains or fans. The host sandstone ranges from fine to coarse grained and in places it is conglomeratic with a dominantly quartzose composition. The uranium beds have a gentle dip which may have resulted from either stream gradient or slight tectonic tilting. The uranium deposits formed at shallow or moderate depths. Within the Colcord Road area the peneconcordant uranium deposits are associated with plant debris and are light colored containing pyrite in shale (mudstone). The clastic rocks have been deposited in fluvial environments and are stratigraphically controlled. The mineralization is digenetic related to the migration of ground waters. The source of the uranium is believed to be the Precambrian rocks to the south. The uranium is associated with copper and not vanadium. The primary mineralization is characterized by metallic sulfides and uranium and in most instances it is a uraninite in coalified material.

The uranium mineralization in the Colcord Road area is estimated to occur about 700 feet above the Redwall Limestone. The uranium beds seem to be in one prominent zone of conglomerates and related cross-stratified sandstone and shales laced with carbonized and coalified plant debris within a fluvial complex. The fluvial complex displays a progressive northward shift of channel deposits with pebbles grading to inclined siltstones-claystones on the south sides of channels. Studies have shown the current within the stream channels was flowing in an easterly direction and are point-bar deposits. The channel complex is blanketed by a gray-green shale bed that contains abundant thin carbonized plant remains. The horizons are several feet thick and usually contain thin coaly units.

Uraninite, a variety of pitchblende, is the only uranium-bearing mineral reported in the area. The pitchblende occurs as sperulites and as a replacement of wood fragments. The uraninite occurs in concentrated layers and is disseminated in the fine-grained, gray siltstone and the limestone conglomerate. Drill results in the nearby Promontory Butte area indicate the uranium bearing minerals are concentrated in a horizon that includes the gray siltstone and the limestone conglomerate and appear to have a concordant 10 degree dip to the southeast. A large percentage of the uranium mineralization occurs as a direct replacement of wood fragments. In some instances, the pitchblende was deposited in a mamillary or nodular form around the periphery of existing crystals.

-8-

History of Previous Work

To date, the only evidence to indicate previous work includes shallow prospects and cuts. Several roads and clearings may have been part of exploratory drilling efforts, however this has not been confirmed. Available literature does indicate that anomalous radioactivity was recognized in the immediate vicinity during the course of regional stream sediment surveys and airborne radiometric work conducted by the Atomic Energy Commission and/or Department of Energy, in the time period between the 1950 to late 1970. A thorough study of all references related to the CR property has not been attempted.

Radon Survey

The possibility of using radon measurement as a uranium prospecting technique was first suggested in 1927. Radon, being a noble gas does not combine with other element which facilitates its free migration through pore spaces in rock and soil and its dispersion over considerable distances by groundwater and surface water. Radon occurs naturally as three isotopes with mass numbers 222, 220, and 219 which are member of the 238U, 232Th and 235U decay series. After formation by radioactive decay, a radon atom diffuses through the enclosing mineral and diffuses through the ground air or groundwater present in pore spaces. In arid areas with little or no topsoil there is almost complete continuity between ground and atmospheric air and comes under the influence of meteorological variables. Low barometric pressure and strong winds tend to draw ground air out of the pore spaces and fractures of the near surface layers, thus reducing the radon concentration within them causing an upward movement of gas from depth. Calm conditions on the other hand reduce the rate of radon escape to atmosphere and result in a build up within the ground. Rainfall also restricts the upward flow of radon but has varying effects depending upon the soil profiles. Where soil is absent the rain water penetrates deeply and seals off the pore spaces in depth, producing a temporary reduction in near surface radon concentration. It is therefore emphasized that radon prospecting is part of a dynamic system depending upon a number of variables and the interpretation of the data must consider all the radon characteristics and geological environment of the survey area.

A radon survey was completed for Snowdon Resources Corporation on the CR Mineral Claims during June, 2008 by GeoXplor Corp., under the supervision of John Rud, Geologist, M.Sc. The theory of GeoXplor Corp’s radon soil surveys are based on the element radon which is a radioactive daughter product of uranium decay. Radon is produced by the radioactive decay of radium, a product of uranium and thorium decay in rocks and soils. Theoretically, radon-222 concentrations in soil should be directly related to the uranium content of the minerals in the soil and rocks. Radon is a daughter product of uranium-238 and a non-reactive, highly mobile gas that migrates away from the site of its uranium parent by diffusion and advection along joints, faults, and intergranular permeable pathways.

The magnitude of a radon anomaly associated with a parent concentration of uranium will be due to the size and grade of the parent body. Dispersion and dilution along the pathways to the surface increase the size of the radon footprint but also reduce the magnitude. The location of the anomaly relative to the uranium body will be strongly influenced by the orientation of the pathways to the surface.

The radon survey utilizes a system that measures the radon by an ion chamber with electrically charged Teflon, called an electret, located inside an electrically conducting plastic chamber of known air volume. The electrets serve as a source of high voltage needed for the chamber to operate as an ion chamber. It also serves as a sensor for the measurement of ionization in air. The ions produced inside the sensitive

-9-

volume of the chamber are collected by the electrets causing a depletion of charge. The measurement of the depleted charge during the exposure period is a measure of integrated ionization during the measurement period. The electrets charge is read before and after the exposure using a specially built non-contact electret voltage reader.

The CR mineral claim uranium radon survey consisted of 645 stations with 585 filtered radon readings. The minimum reading was –0.71 dV and a maximum reading of 36.67 dV. The mean value was 11.61 dV with a midrange reading of 17.98 dV.

The gridding was completed by Kriging on a point basis with a standard deviation of 4.92 dV. The grid consisted of 10 lines on 100 meter spacing with station readings on 20 meter intervals for a lineal distance of 12,000 meters that covered an area of 1.08 square kilometers.

Conclusions of the Radon survey were as follows:

The CR mineral claims are underlain by a red to purple fine grained sandstone and gray limestone and dolomite of the Horquilla Formation. Available literature indicates that anomalous radioactivity in the immediate vicinity of the CR claims was reported by the Atomic Energy Commission, Department of Energy and Arizona Bureau of Geology Publications.

The Radon Survey defined several radon anomalies in the southern region of the CR mineral claim radon survey grid. The anomalies have a southeast trend which coincides with the regional trend of the uranium enriched channels in the nearby Promontory Butte/Mogollon Rim area. Field verification of the radon anomalies was completed by utilizing a RS230 Spectrometer which indicated gamma reading of 200 cps (2X background) in the area of the defined radon anomalies.

Recommendations were made to complete the following drill holes to determine the size, depth and grade of the uranium channel mineralization. The recommended drill holes to complete the first phase of a drilling program are as follows:

| Drill Hole | UTM East | UTM North |

| |

| DH #1 | 503600 | 94600 |

| DH #2 | 503950 | 94500 |

| DH #3 | 503440 | 94400 |

| DH #4 | 503360 | 94300 |

Our Proposed Exploration Program

We will be prospecting for uranium with the goal of identifying mineralized material. Mineralized material is a mineralized body which has been delineated by appropriate spaced drilling or underground sampling to support sufficient tonnage and average grade of metals to justify removal.

We have completed the Radon survey as described above. Four recommended drill sites have been identified, and will form the first phase of a drilling program. The Radon survey was more extensive than originally contemplated and allowed us to replace certain previously planned exploration steps. Those were, establishing a survey grid, geological mapping of the rock structures, soil sampling and analysis, a

-10-

radiometric survey, and a magnetometer survey. Total cost previously estimated for these steps together with the Radon survey was $74,450. The Radon survey and related consulting work that replaced those steps cost approximately $67,000.

At present, our property should be considered undeveloped raw land. Work to date has only included the staking of twelve contiguous lode claims, the required filing with both county and federal agencies and the radon survey as described. Maintenance fees due to the BLM for claims held are due on or before September 1 every year. For the CR claims, this maintenance fee amounts to $1,500 in total.

The following is our plan and milestones for exploration:

Phase 2

1. We will submit a Plan of Operation to the Tonto National Forest Service to conduct a drill program. Approval can take up to six months.

2. If our submission is approved, we will proceed with a reverse circulation drilling program at the locations recommended in the Radon survey report. This program will consist of 4 vertical holes drilled to a depth of 300 feet. The cost is estimated to be approximately $25,000 and the time involved is estimated to be 10 days.

3. As the drill holes are completed, a radiometric, down-hole probe will be immediately inserted in the holes to measure gamma ray counts. Cost is estimated to be approximately $6,000.

4.Administration and supervision by the field geologist during the drilling program and for the radiometric measurements is estimated to cost approximately $10,000.

5. Reclamation work cost is estimated to be approximately $10,000 and time involved is estimated to be 4 days. A refundable bond payment for reclamation work will need to be posted and is expected to be approximately $15,000.

Uranium in General

Background

The primary use of uranium oxide (“U3O8” or “uranium”) is as a fuel for nuclear power generation. The market for uranium has historically been prone to extreme high and low commodity prices. Commercial demand for uranium began to grow dramatically in the early 1970s as significant numbers of new orders were made for nuclear reactors, but at that time, uranium prices were severely depressed. In January 1973, the price for uranium was US$5.95 per pound (US$13.12 per kilogram). Uranium production began to exceed demand in anticipation of projected reactor construction at that time. The spot uranium price increased significantly and the price reached a peak of nearly US$43.40 per pound (US$95.68 per kilogram) in June 1978. However, the financial impact of retrofitting reactors under construction, the need for approved and anticipated new reactors to meet new environmental regulations, and public fears concerning the Thre e Mile Island, Pennsylvania event in 1979, resulted in many planned and ordered reactors being cancelled throughout the world. Although the demand for uranium continued to grow in France and Japan, the level of demand did not reach the levels originally predicted and by 1984, a surplus inventory of uranium existed.

-11-

Demand for Uranium

U3O8 is the primary material fabricated into fuel for nuclear power plants worldwide. Through the process of nuclear fission, the uranium isotope U235 undergoes a nuclear reaction where its nucleus is split into smaller particles. The reaction releases a significant amount of heat which may be used for electricity generation. Minor amounts of uranium are also used as a feedstock for over 200 private nuclear reactors operated for research purposes and for production of isotopes for medical and industrial end uses.

The demand for U3O8 is directly linked to electrical generation by nuclear power plants. Annual fuel consumption by western nations has increased from approximately 73 million pounds of U3O8 in 1980 to approximately 160 million pounds of U3O8 in 2005. The cost structure of nuclear power generation, which has higher capital costs and lower fuel costs than most other forms of power generation, requires nuclear plants to be kept operating at high capacities in order to achieve optimal economics. As a result, nuclear generation provides baseload electrical power making the demand for uranium fuel more predictable than most other fuels. Demand forecasts for uranium depend largely on forecasts of installed and operable nuclear power generation capacity, regardless of economic fluctuations or the demand for other forms of power.

World net electricity consumption is expected to nearly double over the next two decades, according to the United States Energy Information Administration’s International Energy Outlook 2004 reference case forecast. Total demand for electricity is projected to increase on average by 2.3% per year from 13,290 billion kilowatt hours in 2001 to 23,072 billion kilowatt hours in 2025. This projection assumes that developing countries in Asia, including China and India, will continue their current economic expansion with overall gross domestic product (“GDP”) growth of 5% annually over the period. The rate of economic growth of China and India is approximately 2% greater than the average global GDP growth rate. The energy demand accompanying economic growth in Asia is expected to double over the next two decades and account for 40% of the total increase in projected world energy consumption over that period.

The World Nuclear Association (the “WNA”) reported that worldwide uranium fuel consumption attributed to fuel reactors in 2004 was 173 million pounds. The 2003 Nuclear Energy Agency/Organization for Economic Cooperation and Development Red Book projects that demand will increase to between 191 and 224 million pounds of U3O8 by 2020, representing an annual growth rate of between 0.6% and 1.7% .

According to the WNA, as of August 2005, there were a total of 440 operable commercial nuclear power plants globally with an aggregate installed generating capacity of 367,684 megawatts requiring 178 million pounds of U3O8 per year. These commercial nuclear plants are currently supplying approximately 16% of the world’s power requirements. Worldwide, an additional 23 commercial nuclear power plants, representing 17,431 megawatts of electricity, are under construction. Finland, France, Russia, China, India, Pakistan and Japan have plans to build new reactors, in addition to those now under construction. New construction is currently centered in Asia. In China, nine operating reactors account for approximately 1% of all power generation in that country. China currently has two reactors under construction and it has been reported that it is planning to build another eight reactors in the near future.

-12-

Significant increases in the cost of producing electricity due to escalating oil, coal, and natural gas prices, as well as global warming concerns are increasing international interest in nuclear power and bringing demand for uranium to new levels. The need for security of supply and protection against the rapidly rising cost of energy is also one of the arguments being made by advocates in favor of using nuclear power.

Countries which have turned away from nuclear power in the past, such as Italy and Turkey, are now reconsidering the nuclear option. Other countries such as Sweden and Belgium are reviewing earlier decisions to phase out nuclear power plants. The Labour Party in the United Kingdom, under Prime Minister Tony Blair, as recently as July 2005, has made public comments indicating the real possibility of launching new nuclear power programs.

In the United States, which is the largest producer of nuclear power in the world, the nuclear industry is extremely active. US reactors have improved operating efficiencies to greater than 90%. Thirty-three reactors have been granted 20-year license extensions by the Nuclear Regulatory Commission since 2000. License extension applications have been filed for an additional 16 reactors, and 25 more reactors are expected to file for license extensions within the next six years. NuStart Energy Development, LLC, a consortium of eight companies including utilities and design groups, is participating in a 50-50 cost sharing program that is part of the United States Department of Energy’s Nuclear Power 2010 initiative, a program designed to commence construction of a new nuclear plant in the US by that date.

On August 8, 2005, President George W. Bush signed into law The Energy Policy Act of 2005 (the “Energy Act”), which incorporates a wide range of measures that support today’s operating nuclear plants and provide important incentives to build new nuclear plants, including:

| * | production tax credits, loan guarantees and risk protection for companies pursuing the first new reactors; |

| |

| * | an extension of the Price-Anderson Act, an insurance framework for protecting the public in the event of a nuclear incident; and |

| |

| | * | authorization of funding for nuclear energy research and development, as well as funding to build an advanced hydrogen cogeneration reactor in the State of Idaho. |

| |

We believe that the Energy Act is a positive step taken by President George W. Bush to reach the goal of generating sufficient quantities of electricity to meet growing demand, but without emitting pollutants or greenhouse gases.

Supply of Uranium

Uranium production has fallen below reactor demands and consumption for almost 20 years. In October 2004, the WNA announced that current production from uranium mines was only providing 55% of the world’s demand. Nuclear utilities around the world consumed approximately 173 million pounds of uranium in 2004, while world mine production was only 105 million pounds.

-13-

Since 1985, the world uranium industry has experienced continued consolidation and reduction due to a market oversupplied with government and utility inventories. Utility deregulation during this period motivated nuclear utilities to consume or dispose of large inventories that had been built up during the 1970s. National governments, recognizing the commercial nature of nuclear electrical generation, made decisions to dispose of strategic stockpiles of uranium. As the economic polices of the former Soviet Union began changing in the late 1980s, large quantities of uranium that had been mined during the Cold War began flowing into the world market. In February 1993, the US and Russia entered into an agreement (the “HEU Agreement”) to manage the disposition of highly enriched uranium (“HEU”) derived from the dismantlement of Russian nuclear warheads. Under the HEU Agreement, over a term of 20 years, weapons-derived HE U was to be diluted in Russia and delivered into the US as low enriched uranium (“Disarmament Uranium”), suitable for use in nuclear power plants. Disarmament Uranium scheduled for delivery during this period represented approximately 400 million pounds of natural uranium as U3O8. These alternate sources of supply overwhelmed the market, keeping prices well below most producers’ costs.

The shortfall in supply over the past two decades has been met by above-ground material derived from previously-mined uranium, including (i) highly-enriched fissionable material from nuclear weapons blended with low enriched uranium, which supplies approximately 11% of world demand; (ii) reprocessed uranium and plutonium derived from used reactor fuel; (iii) depleted uranium enrichment tails, which are re-enriched and added to the fuel mix used by some utilities in Europe and which supply approximately 6% to 8% of world demand; and (iv) excess inventories held by utilities, producers, other fuel cycle participants, and governments. According to The Nuclear Review, excess inventories are now estimated to be less than 100 million pounds. Inventories have been drawn down, on average, by 35 to 40 million pounds annually over the last decade. If mine production continues at current volumes, the current excess inventory is expected to cover t he production shortfall for three years or less.

In March 1999, Cameco Corporation (“Cameco”), COGEMA Mining, Inc. and RWE NUKEM, Inc. (collectively, the “Western Companies”) and Techsnabexport (“Tenex”) entered into an agreement (the “HEU Feed Agreement”) that provided for the sale and disposition of Disarmament Uranium. Tenex, the Russian agent, modified the HEU Feed Agreement with the Western Companies in 2004 allowing it to retain approximately seven million pounds of uranium per year for its own needs commencing in 2008. The Western Companies had previously assumed that such amount of uranium would be available to them. Russia provides fuel to Russian-designed reactors around the world, which require twice as much U3O8 as Russia produces. In addition, Russia is proceeding with an ambitious domestic nuclear expansion program which will make this shortfall in U3O8 supply even more pronounced. Furthermore, Russia has indicated that it may not renew the HEU Feed Agreement when it expires in 2013.

Historically, the abundance of above-ground materials not only caused existing higher-cost suppliers to be driven out of business, but new mines were also discouraged from starting and exploration was neglected. Currently, the absence of new production sources and depletion of uranium stockpiles has raised concerns about a looming shortage of uranium. Management of High Plains believes that over the next 10 years there will be a shortfall of uranium of as much as 90 million pounds per year. In the event that Russia does not renew the HEU Feed Agreement and world consumption of uranium continues to increase, new sources of uranium must be found. World mine production needs to expand significantly after 2005 to meet current and estimated future consumption.

-14-

Critical considerations in evaluating the potential for new supplies are lead times and capital costs required to obtain permits and develop new uranium production. The lead time for most new production facilities from discovery to production has historically been approximately 10 to 20 years due to environmental challenges and the technical difficulties inherent in uranium mining. Higher prices for uranium are expected to induce new capacity and projects previously deferred will be reviewed. This process will be underpinned by new investment in the segment. Uranium mine production must increase to meet future demand. We believe that the shorter lead time for developing and obtaining permits for their ISL properties in the US creates a competitive advantage for us.

Supply Deficit

The uranium supply deficit has been caused by an oversupply of cheap uranium inventories that have taken 20 years to consume. The depressed prices resulted in the development of a limited number of deposits around the world and uranium exploration effectively ceased. Although exploration has increased recently with the rise in uranium demand and pricing, the discovery of uranium deposits, approval by applicable regulatory authorities, and progression to production can take an exploration company at least four years to achieve and in most cases, a decade or longer.

Each year since 1989, the consumption of uranium has exceeded primary production by a substantial margin. In 2004, global demand for uranium was approximately 173 million pounds while global production was 105 million pounds. The supply shortage of approximately 70 million pounds has been accommodated by sales from existing inventories, former stockpiles stored in Russia and recycling programs. Uranium held in inventories is being drawn down by 35 to 40 million pounds per year and The Nuclear Review publication estimates that global excess inventories are less than 100 million pounds.

In summary, the uranium market will face a growing supply deficit until new mines produce sufficient quantities of uranium to meet the growing demand from the increasing number of operating reactors. Recent decreases in inventory levels, the recognition by Russia of its own internal need for uranium supply (which has resulted in Russia becoming a net importer of uranium), and the construction of approximately 40 new commercial reactors over the next 10 to 15 years will exacerbate this shortfall.

Uranium Producers

The uranium production industry is highly concentrated with a small number of companies operating in relatively few countries. According to the WNA, in 2004, four major uranium producers accounted for approximately 67% of uranium production in the world. The top 10 uranium producing companies control 88% of world uranium production. State-owned firms in Russia, Kazakhstan, Uzbekistan and Ukraine accounted for 23% of the world’s uranium production. The Canadian uranium industry has been the leading supplier of uranium in recent years with production of 30.2 million pounds U3O8 in 2004, representing nearly 30% of world production.

| Entity Share of World 2004 | | |

| Uranium Production | | |

| Cameco Corporation | 19.9 | % |

| Areva (COGEMA) | 19.6 | % |

| Rio Tinto | 18.7 | % |

| WMC Resources Ltd. | 9.0 | % |

| TOTAL | 67.2 | % |

-15-

Production of uranium in the US has declined to approximately 2.3 million pounds in 2004 from 43.7 million pounds in 1980, while US demand for uranium is currently over 55 million pounds. This demand and supply imbalance is significant and President George W. Bush has recently stated publicly that energy supply including uranium is a key strategic issue for the US.

Our principal competitors are uranium exploration and pre-production companies, including: Energy Metals Corp., Strathmore Minerals Corp., Uranium Resources, Inc., Everest Exploration, Inc., Rio Grande Resources Corporation and Cotter Corporation who are also active in securing uranium property interests throughout the United States. We believe that our focused geographic strategy and experienced team position us well among these competitors.

Pricing of Uranium

The vast majority of uranium is sold by producers under long-term contracts, hence the spot market for uranium is limited. There is no publicly quoted futures market for uranium. Term contracts typically provide for deliveries to begin one to three years after execution and generally run for several years. Market participants rely on multiple published price opinions based on historical data and market sentiment. Contract uranium prices are established by a number of methods, including base price levels adjusted by inflation indices, reference prices (multiple published spot price opinions as well as long-term reference prices) and annual price negotiations. Many contracts also contain minimum and maximum prices and other negotiated adjustments which effect the price ultimately paid. Prices under uranium supply contracts are usually confidential.

Utilities also acquire uranium by way of spot and near-term purchases from producers and traders. Spot market purchases usually have delivery dates within one year of the purchase. Traders generally source their uranium from organizations holding excess inventory including utilities, producers and governments. We estimate that the spot market volume in 2004 was about 20 million pounds, which was consistent with the volume over the last eight or nine years and represented approximately 12% of demand.

The spot price of U3O8 currently lags the long-term price by approximately US$1.00 to US$2.00 per pound. This difference reflects the increased premium to secure a long-term supply in a tightening market. We believe that this gap between long-term and short-term prices may put additional upward pressure on the spot price to the extent that material potentially available for spot sales is diverted to the long-term market.

The Uranium Production Process

Uranium ore is mined in one of the three ways depending on the characteristics of the deposit. First, uranium deposits close to the surface can be recovered using an open pit mining method. Second, higher-grade, deeper deposits can be mined using conventional underground mining methods. Third, if ground conditions are appropriate, ISL can be used. ISL tends to be a lower cost mining method for deeper or lower grade deposits. We expect to recover uranium by ISL. ISL can partially offset the effect of lower grade deposits and we are of the view that generally, in the US it is easier and faster to obtain a permit to engage in ISL mining than to use conventional mining methods.

-16-

The ISL Process

In the case of ISL mining technology, an oxygen-rich leaching solution is injected through wells drilled into the deposit. The solution changes the pH level of the groundwater to mildly alkaline in a uranium-bearing aquifer and with added oxygen, creates an environment in which the uranium dissolves. The groundwater is then pumped to the surface and treated to recover the uranium. After the uranium has been extracted, the groundwater is pumped back into the aquifer. ISL mining technology was developed for uranium approximately 35 years ago and accounted for approximately 21% of the world’s uranium production in 2004 and accounts for approximately 85% of all uranium recovered in the US (see Table I). The principal advantages of the ISL mining process over open pit and conventional underground mining processes include safer operations, low capital and operating costs, and minimal environmental impact. The ISL mining technology minimi zes disturbance of the land’s surface as there are no open pit excavations or underground shafts, and the ore body is not exposed to employees or the atmosphere. Additionally, ISL mining technology does not produce large volumes of waste and tailings. All operator activity occurs on the surface with little dust generation as the processing plant does not require crushing or grinding facilities. On completion of uranium recovery, wells can be plugged from top to bottom with concrete and capped, process facilities removed and the land surface rehabilitated with little or no evidence of uranium recovery activities.

ISL mining technology is typically carried out where the uranium mineralization is located in unconsolidated sands, sandstone or permeable rocks situated between impermeable strata and below the water table in an ore zone chemically suited for leaching. Countries with suitable deposits currently being mined using ISL include the United States, Australia, Kazakhstan and Uzbekistan. In the United States, ISL is considered to be the most cost effective and environmentally acceptable method of mining. Other advantages of ISL mining technology include fewer regulatory requirements in obtaining a mining permit and significantly lower capital and reclamation costs compared to traditional mining methods.

In the US, the most active areas with potential for near-term production growth are those with ISL targets located throughout the western United States and Texas. There are currently producing ISL and conventional mines in Wyoming and Texas operated by other companies, thus a regulatory regime for uranium ISL mining in these jurisdictions has already been developed.

The Nuclear Fuel Cycle

The nuclear fuel cycle begins with uranium’s transformation from ore in the ground into nuclear fuel and ultimately ends with the disposal of waste products from the reactor. After initial extraction from the deposit, the uranium ore is transported to a mill for processing. The first step in milling is to crush the ore and treat it with acid to separate the uranium metal from rock. The net result of leaching is an 80-90% U3O8 concentrate, also known as “yellowcake”. U3O8 is the uranium product sold on the market. Following milling, the U3O8 is converted to uranium hexafluoride (“UF6”) and then enriched by heating it above 56 degrees Celsius to create a gas, in which the uranium attains a workable form. Enriched UF6 is then converted to uranium dioxide (“UO2”) powder and formed into pellets, which are encased in thin metal tubes to form fuel rods. The fuel rods are grouped into fuel assemblies, which fo rm the core of the reactor. Inside the reactor, uranium isotope U235 fissions, or splits, produce a massive amount of heat that is used to generate steam that drives turbines and creates electricity. A 1,000 megawatt reactor needs about 75 tons of low-enriched uranium to produce approximately seven billion kilowatt hours of electricity each year.

-17-

Once the fuel is consumed, it is removed from the reactor and stored on-site for a number of years while its radioactivity and heat subside. After a period of storage, the highly radioactive residue produced can be separated and packaged for either chemical reprocessing to recover any residual uranium or byproduct plutonium, which are useful sources of energy, or stored without chemical treatment for up to 50 years to allow the radioactivity to diminish. Depending on the design of the disposal facility, the spent fuel may be recovered again or will be encapsulated in sturdy, leach-resistant containers and permanently placed deep underground, where it originated, thus completing the cycle.

Government Regulation

Our mineral exploration program is subject to the regulations of the Bureau of Land Management.

The prospecting on the property is provided under the existing 1872 Mining Law and all permits for exploration and testing must be obtained through the local Bureau of Land Management (BLM) office of the Department of Interior. Obtaining permits for minimal disturbance as envisioned by this exploration program will require making the appropriate application and filing of the bond to cover the reclamation of the test areas. From time to time, an archeological clearance may need to be contracted to allow the testing program to proceed.

Rental Fee Requirement

The Federal government's Continuing Act of 2002 extends the requirement of rental or maintenance fees in place of assessment work for filing and holding mining claims with the BLM. All claimants must pay a yearly maintenance fee of $125 per claim for all or part of the mining claim assessment year. The fee must be paid at the State Office of the Bureau of Land Management by September 1 of each year. We have paid this fee through September 1, 2009. The assessment year ends on noon of September 1 of each year. The initial maintenance fee is paid at the time the Notice of Location is filed with the BLM and covers the remainder of the assessment year in which the claim was located. There are no exemptions from the initial fee. Some claim holders may qualify for a Small Miner Exemption waiver of the maintenance fee for assessment years after the year in which the claim was located. We do not qualify for a Small Miner Exemption. The following sets forth the BLM fee schedule:

| Fee Schedule* (per claim) |

| Location Fee | $ | 30 |

| Maintenance Fee. | $ | 125 |

| Service Charges | $ | 10 |

| Transfer Fee | $ | 5 |

| Proof of Labor | $ | 5 |

| Notice of Intent to Hold | $ | 5 |

| Transfer of Interest | $ | 5 |

| Amendment | $ | 5 |

| Petition for Deferment of Assessment Work | $ | 25 |

| Notice of Intent to Locate on Stock Raising Homestead land | $ | 25 |

| * Fee schedule reflects increases of July 2004 and July 2005. |

-18-

The BLM regulations provide for three types of operations on public lands: 1. Casual Use level, 2. Notice level and 3. Plan of Operation level.

| 1. | Casual Use means activities ordinarily resulting in no or negligible disturbance of the public lands or resources. Casual Use operations involve simple prospecting with hand tools such as picks, shovels, and metal detectors. Small-scale mining devices such as dry washers having engines with less than 10 brake-horsepower are allowed, provided they are fed using only hand tools. Casual Use level operations are not required to file an application to conduct activities or post a financial guarantee. |

| |

| 2. | Notice level operations include only exploration activities in which five or less acres of disturbance are proposed. Presently, all Notice Level operations require a written notice and must be bonded for all activities other than reclamation. |

| |

| 3. | Plans of Operation activities include all mining and processing (regardless of the size of the proposed disturbance), plus all other activities exceeding five acres of proposed public land disturbance. |

|

Operators are encouraged to conduct a thorough inventory of the claim to determine the full extent of any existing disturbance and to meet with field office personnel at the site before developing an estimate. The inventory should include photographs taken "before" and "after" any mining activity.

If an operator constructs access or uses an existing access way for an operation and would object to BLM blocking, removing, or claiming that access, then the operator must post a financial guarantee that covers the reclamation of the access.

Concurrence by the BLM for occupancy is required whenever residential occupancy is proposed or when fences, gates, or signs will be used to restrict public access or when structures that could be used for shelter are placed on a claim. It is the claimant's responsibility to prepare a complete notice or plan of operators.

Mining Claims On State Land

The Arizona law authorizing location of claims on State Lands was repealed in 1998. Acquisition of mineral rights on Arizona trust land can only be accomplished by application for a prospecting permit, mineral lease, or lease of common variety materials.

We are in compliance with all laws and will continue to comply with the laws in the future. We believe that compliance with the laws will not adversely affect our business operations.

We are responsible to provide a safe working environment, not disrupt archaeological sites, and conduct our activities to prevent unnecessary damage to the property.

-19-

We will secure all necessary permits for exploration and, if development is warranted on the property, will file final plans of operation before we start any mining operations. At this point, a permit from the BLM would be required. Also, we would be required to comply with the laws of the state of Arizona and federal regulations. We anticipate no discharge of water into active stream, creek, river, lake or any other body of water regulated by environmental law or regulation. No endangered species will be disturbed. Restoration of the disturbed land will be completed according to law. All holes, pits and shafts will be sealed upon abandonment of the property. It is difficult to estimate the cost of compliance with the environmental law since the full nature and extent of our proposed activities cannot be determined until we start our operations and know what that will involve from an environmental standpoint.

Exploration stage companies have no need to discuss environmental matters, except as they relate to exploration activities. The only "cost and effect" of compliance with environmental regulations in the State of Arizona is returning the surface to its previous condition upon abandonment of the property. We will only be using "non-intrusive" exploration techniques and will not leave any indication that a sample was taken from the area.

Employees and Employment Agreements

At present, we have no full-time employees. Our officers and directors are part-time and each will devote about 10 hours or 25% of their time per week to our operation. Our officers and directors do not have employment agreements with us. We presently do not have pension, health, annuity, insurance, stock options, profit sharing or similar benefit plans; however, we may adopt plans in the future. There are presently no personal benefits available to our officers and directors. Our officers and directors will handle our administrative duties.

ITEM 1A. RISK FACTORS.

We are a smaller reporting company as defined by Rule 12b-2 of the Exchange Act and are not required to provide the information required under this item.

ITEM 1B. UNRESOLVED STAFF COMMENTS.

We are a smaller reporting company as defined by Rule 12b-2 of the Exchange Act and are not required to provide the information required under this item.

ITEM 2. PROPERTIES.

Claims

The following is a list of the claims which we own as filed with Bureau of Land Management, hereinafter the “BLM,” showing the claim number, name of claims, date of location and date of expiration for claim. All claims are located in Gila County, Arizona.

-20-

| AMC # | Claim Name | Date of Location | Date of Expiration |

| |

| 390227 | CR # 1 | February 28, 2008 | September 1, 2009 |

| 390228 | CR # 2 | February 28, 2008 | September 1, 2009 |

| 390229 | CR # 3 | February 28, 2008 | September 1, 2009 |

| 390230 | CR # 4 | February 28, 2008 | September 1, 2009 |

| 390231 | CR # 5 | February 28, 2008 | September 1, 2009 |

| 390232 | CR # 6 | February 28, 2008 | September 1, 2009 |

| 390233 | CR # 7 | February 28, 2008 | September 1, 2009 |

| 390234 | CR # 8 | February 28, 2008 | September 1, 2009 |

| 390235 | CR # 9 | February 28, 2008 | September 1, 2009 |

| 390236 | CR # 10 | February 28, 2008 | September 1, 2009 |

| 390237 | CR # 11 | February 28, 2008 | September 1, 2009 |

| 390238 | CR # 12 | February 28, 2008 | September 1, 2009 |

ITEM 3. LEGAL PROCEEDINGS.

We are not presently a party to any litigation.

ITEM 4. SUBMISSION OF MATTERS TO A VOTE OF SECURITY HOLDERS.

During the year ended April 30, 2008, there were no matters submitted to a vote of our shareholders.

PART II

ITEM 5. MARKET PRICE FOR THE REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITYSECURITIES.

Our shares may be traded on the Bulletin Board operated by the Federal Industry Regulatory Authority under the symbol “SWDO.” To date there has been no trading activity.

Holders

There are fifty-six holders of record for our common stock. 5,000,000 shares are held by Woodburn Holdings, Ltd., a corporation owned and controlled by Robert M. Baker, an officer and director. 5,000,000 shares are held by West Peak Ventures of Canada Limited, a corporation owned and controlled by Timothy Brock. The remaining 5,500,000 shares are held by 54 other persons, none of which hold 5% or more of the total outstanding shares.

Status of our public offering

On June 14, 2007, the Securities and Exchange Commission declared our Form SB-2 Registration Statement effective, file number 333-134943, permitting us to offer up to 10,000,000 shares of common stock at $0.10 per share. There was no underwriter involved in our public offering. On March 10, 2008, we completed an initial public offering, selling 5,500,000 common shares at a price of $0.10 per share for total proceeds of $550,000.

-21-

Dividends

We have not declared any cash dividends, nor do we intend to do so. We are not subject to any legal restrictions respecting the payment of dividends, except that they may not be paid to render us insolvent. Dividend policy will be based on our cash resources and needs and it is anticipated that all available cash will be needed for our operations in the foreseeable future.

Section 15(g) of the Securities Exchange Act of 1934

Our shares are covered by section 15(g) of the Securities Exchange Act of 1934, as amended that imposes additional sales practice requirements on broker/dealers who sell such securities to persons other than established customers and accredited investors (generally institutions with assets in excess of $5,000,000 or individuals with net worth in excess of $1,000,000 or annual income exceeding $200,000 or $300,000 jointly with their spouses). For transactions covered by the Rule, the broker/dealer must make a special suitability determination for the purchase and have received the purchaser's written agreement to the transaction prior to the sale. Consequently, the Rule may affect the ability of broker/dealers to sell our securities and also may affect your ability to sell your shares in the secondary market.

Section 15(g) also imposes additional sales practice requirements on broker/dealers who sell penny securities. These rules require a one page summary of certain essential items. The items include the risk of investing in penny stocks in both public offerings and secondary marketing; terms important to in understanding of the function of the penny stock market, such as “bid” and “offer” quotes, a dealers “spread” and broker/dealer compensation; the broker/dealer compensation, the broker/dealers duties to its customers, including the disclosures required by any other penny stock disclosure rules; the customers rights and remedies in causes of fraud in penny stock transactions; and, the NASD's toll free telephone number and the central number of the North American Administrators Association, for information on the disciplinary history of broker/dealers and their associated persons.

Securities authorized for issuance under equity compensation plans

We do not have any equity compensation plans and accordingly we have no securities authorized for issuance thereunder.

ITEM 6. SELECTED FINANCIAL DATA.

We are a smaller reporting company as defined by Rule 12b-2 of the Exchange Act and are not required to provide the information required under this item.

ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS.

This section of this report includes a number of forward-looking statements that reflect our current views with respect to future events and financial performance. Forward-looking statements are often identified by words like: believe, expect, estimate, anticipate, intend, project and similar expressions, or words which, by their nature, refer to future events. You should not place undue certainty on these forward-looking statements, which apply only as of the date of this report. These forward-looking statements are subject to certain risks and uncertainties that could cause actual results to differ materially from historical results or our predictions.

-22-

We are a start-up, exploration stage corporation and have not yet generated or realized any revenues from our business operations.

In their report on our fiscal year ended April 30, 2007, our auditors issued a going concern opinion. That means that there was substantial doubt that we could continue as an on-going business for the next twelve months unless we obtained additional capital to pay our bills. This is because we have not generated any revenues and no revenues are anticipated until we begin removing and selling minerals. Accordingly, we must raise cash from sources other than the sale of minerals found on the property. We believe that the $550,000 raised in our public offering in March, 2008 has provided certainty, for the current year at least, that we have the ability to continue as a going concern. Ultimately, our success or failure will be determined by what we find under the ground. The next phase of our exploration program requires approximately $66,000, of which $15,000 is a refundable bond. With cash being in excess of current liabilities at April 30, 2008 by approximately $463,000, we are well funded for the immediate future. If we find mineralized material and it is economically feasible to remove the mineralized material, we will attempt to raise additional money through a subsequent private placement, public offering or through loans.

We will be conducting research in the form of exploration of the property. Our exploration program is explained in as much detail as possible in the business section of this report. We are not going to buy or sell any plant or significant equipment during the next twelve months. We will not buy any equipment until have located a body of ore and we have determined it is economical to extract the ore from the land.

We do not intend to interest other companies in the property if we find mineralized materials. We intend to try to develop the reserves ourselves.

We do not intend to hire any employees at this time. All of the work on the property will be conducted by unaffiliated, independent contractors. The independent contractors will be responsible for surveying, geology, engineering, exploration, and excavation. The geologists will evaluate the information derived from the exploration and excavation and the engineers will advise us on the economic feasibility of removing the mineralized material.

Milestones

Phase 1 of our exploration program, consisting of the Radon survey as described above, has been completed. Four recommended drill sites have been identified, and will form the first phase of a drilling program.

The following are our milestones:

Phase 2

| 1. | We will submit a Plan of Operation to the Tonto National Forest Service to conduct a drill program. Approval can take up to six months. |

| |

| 2. | If our submission is approved, we will proceed with a reverse circulation drilling program at the locations recommended in the Radon survey report. This program will consist of 4 vertical holes drilled to a depth of 300 feet. The cost is estimated to be approximately $25,000 and the time involved is estimated to be 10 days. |

|

-23-

| 3. | As the drill holes are completed, a radiometric, down-hole probe will be immediately inserted in the holes to measure gamma ray counts. Cost is estimated to be approximately $6,000. |

| |

| 4. | Administration and supervision by the field geologist during the drilling program and for the radiometric measurements is estimated to cost approximately $10,000. |

| |

| 5. | Reclamation work cost is estimated to be approximately $10,000 and time involved is estimated to be 4 days. A refundable bond payment for reclamation work will need to be posted and is expected to be approximately $15,000. |

|

Limited Operating History; Need for Additional Capital

There is limited historical financial information about us upon which to base an evaluation of our performance. We are an exploration stage corporation and have not generated any revenues from operations. We cannot guarantee we will be successful in our business operations. Our business is subject to risks inherent in the establishment of a new business enterprise, including limited capital resources, possible delays in the exploration of our properties, and possible cost overruns due to price and cost increases in services.

We have no assurance that future financing will be available to us on acceptable terms. If financing is not available on satisfactory terms, we may be unable to continue, develop or expand our operations. Equity financing could result in additional dilution to existing shareholders.

Results of Operations

From Inception on March 1, 2006 to April 30, 2008

We acquired one property containing five claims. We re-staked those claims in February, 2008 and added a further seven contiguous claims, for a total of twelve claims covering 240 acres. We have no revenue and have incurred a net loss from inception to April 30, 2008 of $43,125 as a result of staking costs, a mineral claim payment, accounting and legal expenses and office and sundry costs. Office and sundry costs were higher in 2008 ($4,572) than in 2007 ($2,962) primarily due to transfer agent fees in connection with our public offering. Professional fees increased (2008: $27,772 compared to 2007: $9,858) for the same reason, as well as due to timing of year end audit fees for 2007. Project development costs in 2008 of $10,781 (2007: $Nil) were for re-staking the CR claims.

From inception on March 1, 2006 to the point that funds were available in March, 2008 as a result of our initial public offering, we were funded by loans from Woodburn Holdings Ltd. a corporation controlled by Robert Baker, our secretary, and from West Peak Ventures Canada Limited, a corporation controlled by Timothy Brock, one of our shareholders. These loans have been used for the original mineral claim fee, to re-stake the property, to incorporate us, for legal and accounting expenses, and office and sundry costs. The balance of those loans at April 30, 2008 was $66,258 (2007: $33,233). The advances are not evidenced by any written documentation and do not accrue interest. In July, 2008, $18,512 was repaid to West Peak Ventures of Canada Limited.

-24-

Liquidity and Capital Resources

As of the date of this report, we have yet to generate any revenues from our business operations.

We issued 10,000,000 shares of common stock pursuant to the exemption from registration contained in section 4(2) of the Securities Act of 1933. This was accounted for as a purchase of shares of common stock.

On June 14, 2007, the Securities and Exchange Commission declared our Form SB-2 Registration Statement effective, file number 333-134943, permitting us to offer up to 10,000,000 shares of common stock at $0.10 per share. There was no underwriter involved in our public offering. On March 10, 2008, we completed an initial public offering, selling 5,500,000 common shares at a price of $0.10 per share for total proceeds of $550,000.

As of April 30, 2008, our total assets were $531,283, comprised entirely of cash, and our total liabilities were $67,428.

ITEM 7A. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK.

We are a smaller reporting company as defined by Rule 12b-2 of the Exchange Act and are not required to provide the information required under this item.

ITEM 8. FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA.

| REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM | F-1 |

| FINANCIAL STATEMENTS | |

| Balance Sheets | F-2 |

| Statements of Operations | F-3 |

| Statements of Cash Flows | F-4 |

| Statement of Stockholders’ Equity (Deficiency) | F-5 |

| NOTES TO FINANCIAL STATEMENTS | F-6 |

-25-

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Stockholders and Directors of

SNOWDON RESOURCES CORPORATION

(An Exploration Stage Company)

We have audited the accompanying balance sheets of Snowdon Resources Corporation (An Exploration Stage Company) as of April 30, 2008 and 2007, and the related statements of operations, cash flows, and stockholders’ equity (deficiency) for the years ended April 30, 2008 and 2007, and for the cumulative period from inception (March 1, 2006) to April 30, 2008. These financial statements are the responsibility of the Company's management. Our responsibility is to express an opinion on these financial statements based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform an audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements referred to above present fairly, in all material respects, the financial position of the Company as of April 30, 2008 and 2007, and the results of its operations and its cash flows for the years ended April 30, 2008 and 2007, and for the cumulative period from inception (March 1, 2006) to April 30, 2008 in conformity with United States generally accepted accounting principles.

The Company is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. Our audit included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Company’s internal control over financial reporting. Accordingly, we express no such opinion.

| Vancouver, Canada | MORGAN & COMPANY |

| | |

| August 11, 2008 | Chartered Accountants |

| | |

F-1

-26-

SNOWDON RESOURCES CORPORATION

(An Exploration Stage Company)

BALANCE SHEETS

(Stated in U.S. Dollars)

| | | April 30 | | | April 30 | |

| | | 2008 | | | 2007 | |

| |

| ASSETS | | | | | | |

| |

| Current | | | | | | |

| Cash | $ | 531,283 | | $ | 213 | |

| |

| LIABILITIES | | | | | | |

| |

| Current | | | | | | |

| |

| Accounts payable and accrued liabilities | $ | 1,170 | | $ | 10,000 | |

| Due to related parties (Note 4) | | 66,258 | | | 33,233 | |

| | | 67,428 | | | 43,233 | |

| |

| STOCKHOLDERS’ EQUITY (DEFICIENCY) | | | | | | |

| |

| Capital Stock(Note 6) | | | | | | |

| Authorized: | | | | | | |

| 100,000,000 common shares with a par value of $0.00001 per share | | | | | | |

| 100,000,000 preferred shares with a par value of $0.00001 per share | | | | | | |

| (none issued) | | | | | | |

| |

| Issued and outstanding: | | | | | | |

| 15,500,000 common shares at April 30, 2008 | | 155 | | | 100 | |

| 10,000,000 common shares at April 30, 2007 | | | | | | |

| |

| Additional Paid-in Capital | | 549,945 | | | - | |

| |

| Deficit Accumulated During The Exploration Stage | | (86,245 | ) | | (43,120 | ) |

| | | 463,855 | | | (43,020 | ) |

| |

| | $ | 531,283 | | $ | 213 | |

The accompanying notes are an integral part of these financial statements.

F-2

-27-

SNOWDON RESOURCES CORPORATION

(An Exploration Stage Company)

STATEMENTS OF OPERATIONS

(Stated in U.S. Dollars)

| | | | | | | | | Cumulative Period | |

| | | | | | | | | From Inception | |

| | | Years Ended April 30 | | | (March 1, 2006) To | |

| | | 2008 | | | 2007 | | | April 30, 2008 | |

| |

| Revenue | $ | - | | $ | - | | $ | - | |

| |

| Expenses | | | | | | | | | |

| Project development | | 10,781 | | | - | | | 10,781 | |

| Professional fees | | 27,772 | | | 9,858 | | | 57,630 | |

| Mineral claim payment | | - | | | - | | | 10,000 | |

| Office and sundry | | 4,572 | | | 2,962 | | | 7,834 | |

| | | 43,125 | | | 12,820 | | | 86,245 | |

| |

| Net Loss For The Period | $ | (43,125 | ) | $ | (12,820 | ) | $ | (86,245 | ) |

| |

| |

| Basic And Diluted Loss Per Common | | | | | | | | | |

| Share | $ | 0.00 | | $ | 0.00 | | | | |

| |

| |

| Weighted Average Number Of Common | | | | | | | | | |

| Shares Outstanding | | 10,390,710 | | | 10,000,000 | | | | |

The accompanying notes are an integral part of these financial statements.

F-3

-28-

| SNOWDON RESOURCES CORPORATION |

| (An Exploration Stage Company) |

| |

| STATEMENTS OF CASH FLOWS |

| (Stated in U.S. Dollars) |

| |

| |

| | | | | | | | | Cumulative Period | |

| | | | | | | | | From Inception | |

| | | Years Ended April 30 | | | (March 1, 2006) To | |

| | | 2008 | | | 2007 | | | April 30, 2008 | |

| Cash Used In Operating Activities | | | | | | | | | |

| Net loss for the period | $ | (43,125 | ) | $ | (12,820 | ) | $ | (86,245 | ) |

| Net changes in non-cash operating working | | | | | | | | | |

| capital items: | | | | | | | | | |

| Accounts payable and accrued liabilities | | (8,830 | ) | | - | | | 1,170 | |

| | | (51,955 | ) | | (12,820 | ) | | (85,075 | ) |

| Cash Flows From Financing Activities | | | | | | | | | |

| Issue of share capital | | 550,000 | | | - | | | 550,100 | |

| Advances from related parties | | 33,025 | | | 11,902 | | | 66,258 | |

| | | 583,025 | | | 11,902 | | | 616,358 | |

| |

| Increase (Decrease) In Cash | | 531,070 | | | (918 | ) | | 531,283 | |

| |

| Cash, Beginning Of Period | | 213 | | | 1,131 | | | - | |

| |

| Cash, End Of Period | $ | 531,283 | | $ | 213 | | $ | 531,283 | |

| |

| Supplemental Information | | | | | | | | | |

| Cash Activities: | | | | | | | | | |

| Interest paid | $ | - | | $ | - | | $ | - | |

| Income taxes paid | $ | - | | $ | - | | $ | - | |

The accompanying notes are an integral part of these financial statements.

F-4

-29-

| SNOWDON RESOURCES CORPORATION |

| (An Exploration Stage Company) |

| STATEMENT OF STOCKHOLDERS’ EQUITY (DEFICIENCY) |

| (Stated in U.S. Dollars) |

| PERIOD FROM INCEPTION (MARCH 1, 2006) TO APRIL 30, 2008 |

| | | | | | | | | | | |

| | | | | | | DEFICIT | | | | |

| | NUMBER | | | | | ACCUMULATED | | | | |

| | OF | ADDITIONAL | | | DURING THE | | | | |

| | COMMON | PAID-IN | PAR | EXPLORATION | | | | |

| | SHARES | CAPITAL | VALUE | STAGE | | | TOTAL | |

| | | | | | | | | | | | |

| Beginning balance, March 1, 2006 | - | $ | - | $ | - | $ | - | | $ | - | |

| March 22, 2006 – Shares issued for cash at | | | | | | | | | | | |

| $0.00001 | 10,000,000 | | - | | 100 | | - | | | 100 | |

| | | | | | | | | | | | |

| Net loss for the period | - | | - | | - | | (30,300 | ) | | (30,300 | ) |

| | | | | | | | | | | | |

| Balance, April 30, 2006 | 10,000,000 | | - | | 100 | | (30,300 | ) | | (30,200 | ) |

| | | | | | | | | | | | |

| Net loss for the year | - | | - | | - | | (12,820 | ) | | (12,820 | ) |

| | | | | | | | | | | | |

| Balance, April 30, 2007 | 10,000,000 | | - | | 100 | | (43,120 | ) | | (43,020 | ) |

| | | | | | | | | | | | |

| April 4, 2008 – Shares issued for cash at | | | | | | | | | | | |

| $0.10 | 5,500,000 | | 549,945 | | 55 | | - | | | 550,000 | |

| | | | | | | | | | | | |

| Net loss for the year | - | | - | | - | | (43,125 | ) | | (43,125 | ) |

| | | | | | | | | | | | |

| Balance, April 30, 2008 | 15,500,000 | $ | 549,945 | $ | 155 | $ | (86,245 | ) | $ | 463,855 | |

The accompanying notes are an integral part of these financial statements.

F-5

-30-

SNOWDON RESOURCES CORPORATION

(An Exploration Stage Company)

NOTES TO FINANCIAL STATEMENTS

April 30, 2008 and 2007

(Stated in U.S. Dollars)

| 1. | NATURE OF OPERATIONS |

| |

| | Organization |

| |

| | Snowdon Resources Corporation (“the Company”) was incorporated in the State of Nevada, U.S.A., on March 1, 2006. |

| |

| | Exploration Stage Activities |

| |

| | The Company has been in the exploration stage since its formation and has not yet realized any revenues from its planned operations. It is primarily engaged in the acquisition and exploration of mining claims. Upon location of a commercial mineable reserve, the Company expects to actively prepare the site for its extraction and enter a development state. |

| |

| |

| 2. | SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES |

| |

| | The financial statements of the Company have been prepared in accordance with generally accepted accounting principles in the United States of America. Because a precise determination of many assets and liabilities is dependent upon future events, the preparation of financial statements for a period necessarily involves the use of estimates which have been made using careful judgment. Actual results may vary from these estimates. |

| |

| | The financial statements have, in management’s opinion, been properly prepared within reasonable limits of materiality and within the framework of the significant accounting policies summarized below: |

| |

| | a) | Exploration Stage Enterprise |

| |

| | | The Company’s financial statements are prepared using the accrual method of accounting and according to the provisions of Statement of Financial Accounting Standards No. 7 (“SFAS No. 7”), “Accounting and Reporting for Development Stage Enterprises,” as it devotes substantially all of its efforts to acquiring and exploring mineral properties. Until such properties are acquired and developed, the Company will continue to prepare its financial statements and related disclosures in accordance with entities in the exploration stage. |

| |

F-6

-31-

SNOWDON RESOURCES CORPORATION

(An Exploration Stage Company)

NOTES TO FINANCIAL STATEMENTS

April 30, 2008 and 2007

(Stated in U.S. Dollars)

| 2. | SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (Continued) |

| |

| | b) | Cash |

| |

| | | Cash consists of cash on deposit with high quality, major financial institutions, and to date the Company has not experienced losses on any of its balances. The carrying amounts approximated fair market value due to the liquidity of these deposits. However, funds on deposit at this financial institution exceed federally incurred insurance limits. Accordingly, the Company is at risk for the excess over these limits by approximately $522,000 at April 30, 2008. |

| |

| | c) | Mineral Property Acquisition Payments |

| |

| | | The Company expenses all costs incurred on mineral properties to which it has secured exploration rights prior to the establishment of proven and probable reserves. If and when proven and probable reserves are determined for a property and a feasibility study prepared with respect to the property, then subsequent exploration and development costs of the property will be capitalized. |

| |