AmTrust Financial

Exhibit 99.1

Forward Looking Statements

This presentation may include forward-looking statements. These forward-looking

statements include comments with respect to our objectives and strategies, and the

results of our operations and business.

By their nature, however, these forward-looking statements involve numerous

assumptions, risks, uncertainties and opportunities, both general and specific. The

risk exists that these statements may not be fulfilled. Investors should not place

undue reliance on these forward-looking statements as a number of factors could

cause future company results to differ materially from these statements.

Potential risks and uncertainties include effects of government regulation, the

outcome of our efforts to manage growth, the extent to which our premium rates and

reserves are adequate, the extent of availability of reinsurance on favorable terms,

changes in our financial ratings, the outcome of our efforts to enter our new specialty

middle-market property and casualty segment, ability to retain and recruit key

executives and other key personnel and changes in general economic conditions,

including inflation and other factors.

When relying on forward-looking statements to make decisions, investors should

carefully consider the aforementioned factors as well as other uncertainties and

events including those discussed in the “Forward-Looking Statements” and “Risk

Factors” sections of the prospectus.

2

Who We Are

Multinational specialty property and casualty insurance company

NASDAQ ticker symbol “AFSI”

Inside ownership 57%

“A-” rating from A.M. Best

We focus on underserved, niche markets:

Low hazard

Predictable

Non-catastrophic

Low volatility

High ROE business model (22.7% annualized for Q1 2008)

3

Company Financial Highlights

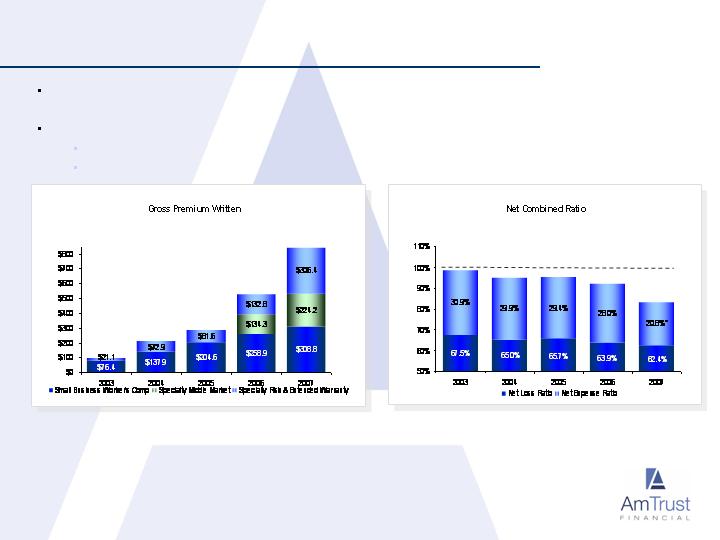

Gross Premium Written

Net Income from

Continuing Operations

$97.5

$210.9

$526.0

$286.1

$839.4

$286.1

$210.9

$97.5

$89.8

$89.3

$57.7

$51.9

$87.8

$47.9

$189.7

$234.8

$22.3

$21.5

$17.5

$25.7

All graphs represent figures in millions

4

Business Overview

$89.3 MM GPW in Q1 2008

$308.8 MM GPW in 2007

$87.8 MM

$306.4 MM

$57.7 MM

$224.2 MM

Specialty Middle-Market P&C

Insurance

Specialty Risk and Extended

Warranty

Small Business Workers’

Compensation

Mix of Business

US only (40 states and DC)

Main Street small businesses

Low-hazard

Typically underserved

by larger carriers

Europe, US

Warranty coverage for selected

consumer and commercial goods

55% of GPW in 2007 was written

outside US

US only (nationwide)

Low hazard

Specialty commercial programs

with MGAs

5

Small Business Workers’ Compensation

Target Customers

Low to mid hazard small

businesses

Restaurants

Retail

Average annual premium

less than $5,000

Average 6 employees

Competitors include

state funds and

regional carriers

AmTrust Approach

Cost efficient expense

control

Paperless proprietary

underwriting system

Risks individually

underwritten

Prompt response to

agents and insureds

9,000 active agents

Result

$89.3 MM GPW Q1 2008

$308.8 MM GPW in 2007

Historically high retention and

renewal rates (over 80%)

Historical organic premium

growth of over 15% annually

Combined ratio of 76.3% for

Q1 2008

Combined ratio of 81.7%

for 2007

We focus on low hazard small businesses

6

Specialty Risk and Extended Warranty

We provide extended warranties for a wide range

of consumer and commercial goods

Target Customers

Manufacturers and retailers

of consumer and

commercial goods

Benefit from profit center

or cost reduction

Low-hazard

Non-catastrophic

Covered products include

yellow goods and laptops

AmTrust Approach

Extensive front-end

diligence and actuarial

review for each new

product and client

Develop customized and

strictly defined policy forms

that fit the needs of the client

Proactively managing

claims and adjusting

premiums if needed

Result

$87.8 MM GPW in Q1 2008

$306.4 MM GPW in 2007

Cost effective for

warranty buyer

Europe (55% of GPW

for 2007)

Combined ratio of 71.9% for

Q1 2008

Combined ratio of 80.8%

for 2007

7

Specialty Middle Market P&C

Target Customers

Retail, wholesale, service

operations

Workers’ compensation

General liability

Commercial auto liability

Distributed through

wholesalers with geographic

and product expertise

AmTrust Approach

Extensive front-end

diligence and actuarial

review for each new

product and client

Develop customized and

strictly defined policy forms

that fit the needs of the client

Leverage proprietary

technology systems to

process business efficiently

MGA shares in the

underwritten risk

Result

$57.7 MM GPW in Q1 2008

$224.2 MM GPW in 2007

Diverse book of commercial

program business

Combined ratio of 86.4% for Q1

2008

Combined ratio of 90.1%

for 2007

Expansion of workers’ comp, general liability &

commercial auto and property coverage

8

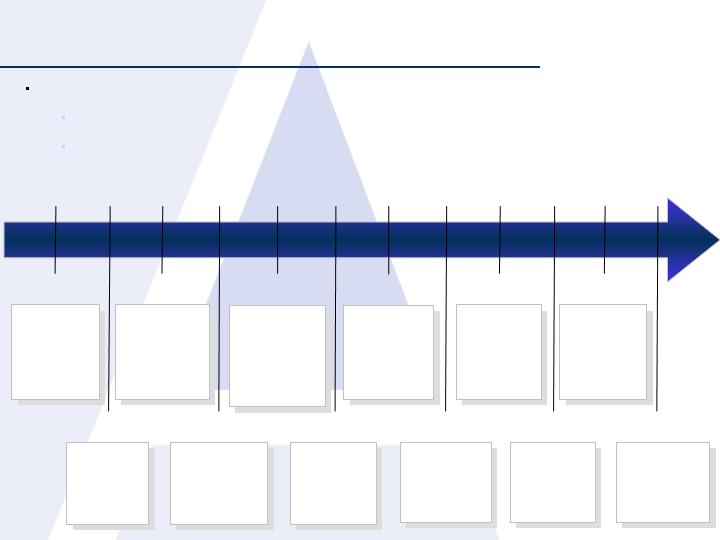

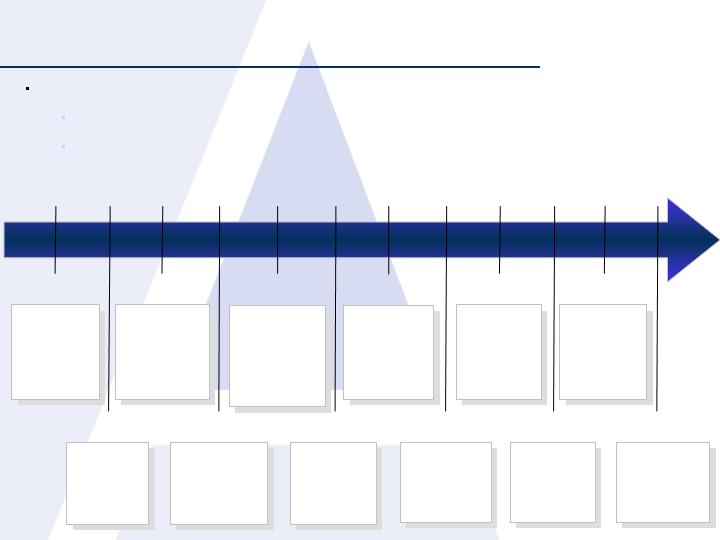

Since 1998, we have grown our business organically and through:

Key hires of underwriting teams in the US and Europe

Opportunistic renewal rights transactions and acquisitions

History of Disciplined Growth

Dec.

2002

Princeton Insurance

Company

Total book

of business:

Approximately

$111 MM

Renewal

Rights

Early

2003

Hired specialty

risk and extended

warranty insurance

team in London

Key Hires

Dec.

2003

The Covenant Group

Total book

of business:

Approximately

$62 MM

Renewal

Rights

Dec.

2005

Alea US

Small-, Middle-market

P&C book

Total book of business:

Approximately

$360 MM through

9/30/05

Renewal

Rights

May

2006

Renewal

Rights

Muirfield Underwriters

Total book

of business:

Approximately

$60 MM

June

2006

Shell

Acquisition

Acquisition of Wesco

Insurance Co. (WIC),

from HSBC

Insurance Co.,

an affiliate of HIG

Feb.

2006

Raised ~$166 MM

to finance acquisition

of renewal rights

of Alea and fund

growth in existing

businesses

144A Offering

April

2007

Acquisition of IGI

Group, Ltd.

Acquisition

June

2007

Reinsurance

Agreement

40% quota-share

reinsurance

agreement with

Maiden Insurance Co.

Sep.

2007

Associated Industries

Insurance

Services, Inc.

Acquisition

June

2008

Renewal

Rights

Closed Unitrin, Inc.

transaction

Total book of business:

Approximately $165 MM

2006

Aug.

2004

Associated Industries

Insurance Company

Total book

of business:

Approximately $100 MM

Renewal

Rights

9

Maiden Transaction Rationale

Long-term capital partner for future growth

Organic growth

Acquisition of additional books of business

Higher ROE

Ability to write additional premium on existing capital base

Ceding commission on reinsured premium

Accretive to earnings per share

$0.43 operating earnings per basic share in 1st quarter 2008 vs.

$0.29 in 1st quarter 2007

10

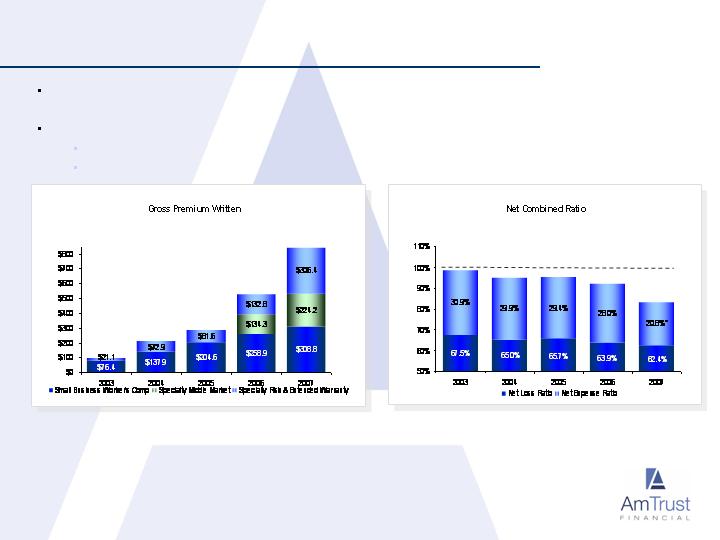

Financial Performance

$97.5

$210.9

$526.0

91.9%

95.1%

94.8%

98.4%

We produce an underwriting profit by having consistent loss ratios and focusing on expenses

As our premium has grown, we have:

Increased our operating leverage – Combined ratio 77.2% for Q1 2008 vs. 89.1% for Q1 2007

Decreased our expense ratio – ER 20.5% Q1 2008 vs. 26.3% for Q1 2007

$286.1

$839.4

83.2%

* Q1 2008 expense ratio without Maiden Insurance ceding commission revenue would have been 24.9%

11

Recent Financial Results

Summary Income Statement

($ in millions)

Gross Premium Written

Net Premium Written

Net Premium Earned

Fee Income

2006

$526.1

436.3

329.0

12.4

2007

$839.4

419.9

444.2

20.4

Q1 2008

Net Investment Income and Realized Gains

Loss and LAE Expense

Acquisition Expense

Salaries and G&A Expense

Operating Income from Continuing Operations

Income Tax Expense

Net Income from Continuing Operations

Annualized ROE from Net Income from Continuing Operations

Net Loss Ratio

Net Expense Ratio

Net Combined Ratio

42.4

210.1

43.3

49.1

70.9

17.8

$48.9

21.3%

63.9%

28.0%

91.9%

55.5

277.0

74.2

77.4

130.8

36.7

$90.1

24.7%

62.4%

20.8%

83.2%

Ceding Commission

-

59.1

* Q1 2008 expense ratio without Maiden Insurance ceding commission revenue would have been 24.9%

Earnings per Basic Share

$0.86

$1.49

$234.8

117.4

97.4

6.3

8.3

55.2

18.3

21.9

29.2

7.3

$22.3

22.7%

56.6%

20.5%*

77.2%

20.2

$0.37

12

Recent Financial Position

Balance Sheet Highlights

($ in millions except for book value per share)

Cash and Investments

Reinsurance Recoverable

Premiums Receivable, Net

Other

Loss and LAE Reserve

Unearned Premium Reserve

(1)

Junior Subordinate Debentures

Other

Shareholders' Equity

Total Liabilities and Shareholders' Equity

1.

Trust Preferred Securities

Book Value Per Share

12/31/06

$824.2

44.1

147.8

207.6

$1,223.7

295.8

323.2

82.5

181.7

883.2

340.5

$1,223.7

12/31/07

$1,289.6

281.9

257.8

493.5

$2,322.8

775.4

527.8

123.7

505.5

1,932.4

390.4

$2,322.8

$5.68

3/31/08

$1,464.0

320.2

296.8

527.5

$2,608.6

786.1

570.3

123.7

717.9

2,198

394.9

$2,608.6

$6.51

$6.60

13

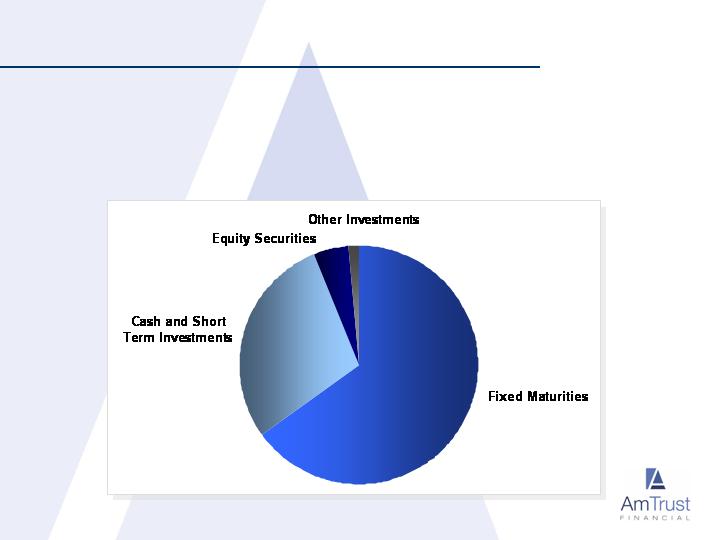

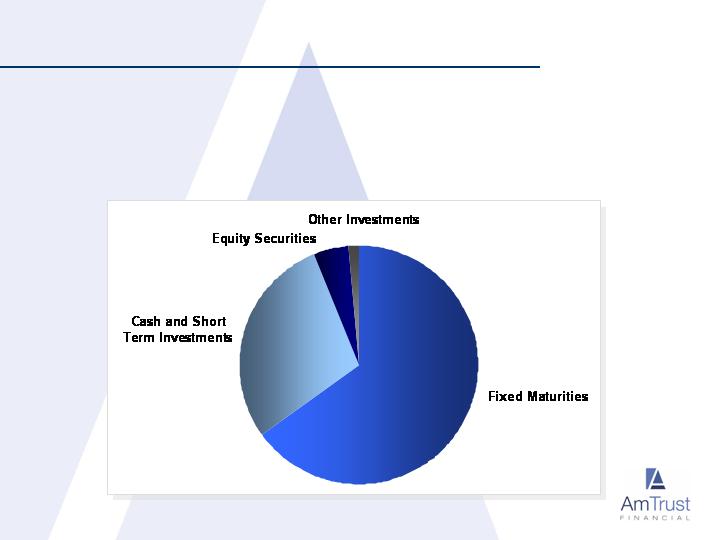

Investment Portfolio

5%

29%

65%

1%

Total invested assets as of 3/31/08 - $1.5 Billion

56.4% of fixed maturities are rated AAA or US Government and Agencies

90% of fixed maturities are rated A or better

No exposure to sub-prime

14

Business Model

Continue to deliver 20%+ ROE through:

Focus on underwriting profit:

Economies of scale

Lower expense ratio

20.5% net expense ratio for Q1 2008

Disciplined pricing and risk selection

56.6% net loss ratio for Q1 2008

Proprietary technology platform designed to process small policies

Effective tax rate less than 30%

15

AmTrust Financial