Exhibit 1

Let’s Put the “Trust” Back Into AmTrust : Vote Against the Zyskind / Karfunkel Squeeze Out! May 2018 Prepared by Icahn Capital LP

ICAHN CAPITAL L.P. 2 SECURITY HOLDERS ARE ADVISED TO READ THE PROXY STATEMENT AND OTHER DOCUMENTS RELATED TO THE SOLICITATION OF PROXIES BY CARL C . ICAHN AND HIS AFFILIATES FROM THE STOCKHOLDERS OF AMTRUST FINANCIAL SERVICES, INC. FOR USE AT THE SPECIAL MEETING OF STOCKHOL DER S OF AMTRUST FINANCIAL SERVICES, INC. WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION, INCLUDING INFORMATION RELATING TO THE PARTICIPANTS IN SUCH PROXY SOLICITATION. WHEN COMPLETED, A DEFINITIVE PROXY STATEMENT AND A FORM OF PROXY WILL BE MAILED TO STOCKHOLDERS OF AMTRUST FINANCIAL SERVICES, INC. AND WILL ALSO BE AVAILABLE AT NO CHARGE AT THE SECUR ITI ES AND EXCHANGE COMMISSION'S WEBSITE AT HTTP://WWW.SEC.GOV OR UPON REQUEST OF OUR PROXY SOLICITOR, HARKINS KOVLER, LLC, BY TELEP HON E AT +1 (212) 468 - 5380 OR BY EMAIL AT AFSI@HARKINSKOVLER.COM. INFORMATION RELATING TO THE PARTICIPANTS IN SUCH PROXY SOLICITATION IS CONTAINED IN THE PRELIMINARY PROXY STATEMENT FILED ON SCHEDULE 14A, BY CARL ICAHN AND HIS AFFILIATES WITH THE SECURITIES AND EXCHANGE COMMISSION ON MAY 17, 2018 (THE “SCHEDULE 14A”). EXCEPT AS OTHERWISE DISCLOSED IN THE SCHEDULE 14A, THE PARTICIPANTS HA VE NO INTEREST IN AMTRUST FINANCIAL SERVICES, INC. OTHER THAN THROUGH THE BENEFICIAL OWNERSHIP OF SHARES OF COMMON STOCK, PAR VALUE $0 .01 PER SHARE, OF AMTRUST FINANCIAL SERVICES, INC. THIS PRESENTATION CONTAINS OUR CURRENT VIEWS ON THE HISTORICAL PERFORMANCE OF AMTRUST AND ITS CURRENT MANAGEMENT AND DIRECTOR S, THE VALUE OF AMTRUST SECURITIES, THE CONSIDERATION TO BE RECEIVED BY AMTRUST SHAREHOLDERS IN THE TRANSACTION AND CERTAIN ACTI ONS THAT AMTRUST’S BOARD MAY TAKE TO ENHANCE THE VALUE OF ITS SECURITIES. OUR VIEWS ARE BASED ON OUR OWN ANALYSIS OF PUBLICLY AVAILABLE INFORMATION AND ASSUMPTIONS WE BELIEVE TO BE REASONABLE. THERE CAN BE NO ASSURANCE THAT THE INFORMATION WE CONSIDER ED AND ANALYZED IS ACCURATE OR COMPLETE. SIMILARLY, THERE CAN BE NO ASSURANCE THAT OUR ASSUMPTIONS ARE CORRECT. AMTRUST’S ACTUAL PERFORMANCE AND RESULTS MAY DIFFER MATERIALLY FROM OUR ASSUMPTIONS AND ANALYSIS. WE HAVE NOT SOUGHT, NOR HAVE WE RECEIVED, PERMISSION FROM ANY THIRD - PARTY TO INCLUDE THEIR INFORMATION IN THIS PRESENTATION. ANY SUCH INFORMATION SHOULD NOT BE VIEWED AS INDICATING THE SUPPORT OF SUCH THIRD PARTY FOR THE VIEWS EXPRESSED HEREIN. OUR VIEWS AND OUR HOLDINGS OF AMTRUST SHARES COULD CHANGE AT ANY TIME. WE MAY SELL ANY OR ALL OF OUR HOLDINGS OR INCREASE OUR HOLDINGS BY PURCHASING ADDITIONAL SECURITIES. WE MAY TAKE ANY OF THESE OR OTHER ACTIONS REGARDING AMTRUST WITHOUT UPDATING TH IS PRESENTATION OR PROVIDING ANY NOTICE WHATSOEVER OF ANY SUCH CHANGES (EXCEPT AS OTHERWISE REQUIRED BY LAW). THIS PRESENTATION IS NOT A RECOMMENDATION OR SOLICITATION TO BUY OR SELL ANY SECURITIES. FORWARD - LOOKING STATEMENTS: Certain statements contained in this presentation are forward - looking statements including, but not limited to, statements that are predications of or indicate future events, trends, plans or objectives. Undue reliance should not be placed on such statements because, by their nature, they are subject to known and un kno wn risks and uncertainties. Forward - looking statements are not guarantees of future performance or activities and are subject to many risks and uncertainties. Due to such risks and unc ert ainties, actual events or results or actual performance may differ materially from those reflected or contemplated in such forward - looking statements. Forward - looking statements can be ide ntified by the use of the future tense or other forward - looking words such as “believe,” “expect,” “anticipate,” “intend,” “plan,” “estimate,” “should,” “may,” “will,” “objective,” “pr ojection,” “forecast,” “management believes,” “continue,” “strategy,” “position” or the negative of those terms or other variations of them or by comparable terminology. Important factors that could cause actual results to differ materially from the expectations set forth in this presentation i ncl ude, among other things, the factors identified in AmTrust’s public filings, including the public filings related to the going - private transaction. Such forward - looking statements should th erefore be construed in light of such factors, and the Participants are under no obligation, and expressly disclaim any intention or obligation, to update or revise any forward - lookin g statements, whether as a result of new information, future events or otherwise, except as required by law. Disclaimer

ICAHN CAPITAL L.P. 3 About Us CARL C. ICAHN • Famed Activist Investor and Proponent of Shareholder Rights • Five decades on Wall Street identifying poor corporate governance and effecting change in the boardroom • Responsible for creating hundreds of billions of dollars of shareholder value over the last 40+ years at a large number of companies, including (just to name a few): • Apple (improved capital allocation) • eBay (spun off PayPal) • Forest Labs (sold to Actavis) • Motorola (split up and sold to Google) • ImClone (sold to Eli Lilly) • Kerr McGee (sold to Anadarko) • AmTrust’s largest shareholder outside of the Karfunkel / Zyskind family • Owns approximately 9.4% of the outstanding shares (including shares underlying forward contracts) • Championing the fight against the conflicted board at the behest of other shareholders • Small investment for the firm but with important implications for corporate governance

ICAHN CAPITAL L.P. 4 COMPANY OVERVIEW 5 EXECUTIVE SUMMARY 6 TRUE VALUE 7 WHY ARE WE AGAINST THE TRANSACTION? 12 FAIRNESS OPINION ERRORS 15 DELAWARE LITIGATION 17 Table of Contents

ICAHN CAPITAL L.P. 5 Valuation: Share Price (5/21/18) $13.84 Shares Outsanding 196.4 Market Value $2,718 + Net Debt $844 + Preferred & Minority $1,089 Enterprise Value $4,650 2017 Year ended: Gross Written Premiums $8,435 Net Earned Premiums $5,056 EPS (diluted) ($2.23) Book Value per Share $14.48 Tangible Book Value per Share $9.89 • AmTrust (NASDAQ:AFSI) was founded in 1998 by the Karfunkel brothers to provide niche specialty and warranty insurance. • The Company has grown quickly through an aggressive acquisition strategy and reached gross written premiums of over $8 billion in 2017. • The Karfunkel family and, by way of marriage, the Zyskind family, continue to own a controlling interest in the company, holding approximately 55% of voting shares. • The family also appears to control the board with several members in leadership positions, including the current Chairman and CEO, Barry Zyskind . Founded in 1998 by Michael and George Karfunkel , AmTrust has grown to 7,000 employees serving 70 countries through almost 10,000 retail and wholesale agents. The Company offers a range of commercial P&C products for small and midsized customers, including workers' compensation, auto and general liability, workplace and agricultural coverage, and extended service/warranty coverage of consumer and commercial goods. The company also writes a smaller amount of personal auto reinsurance. Company Overview Workers Compensation $1,789 Warranty $971 Commercial Auto, Liability & Damage $512 Other Liability $368 Medical Malpractice $207 Other $1,209 2017 Net Premiums Earned: ($’s in millions) Business Description:

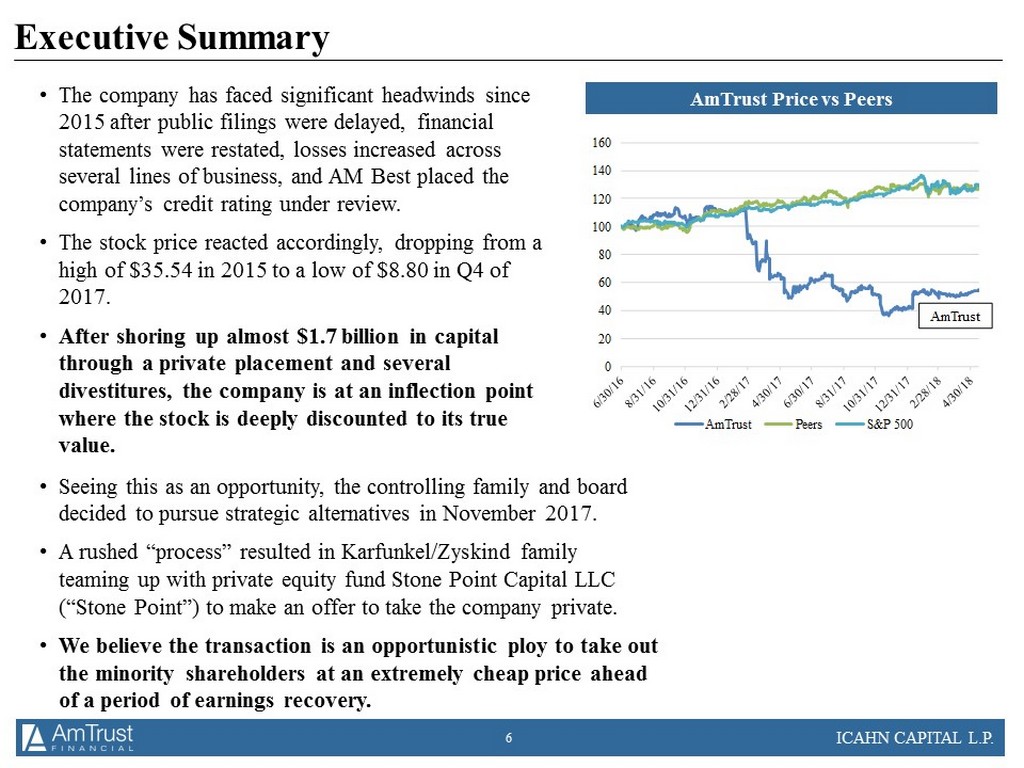

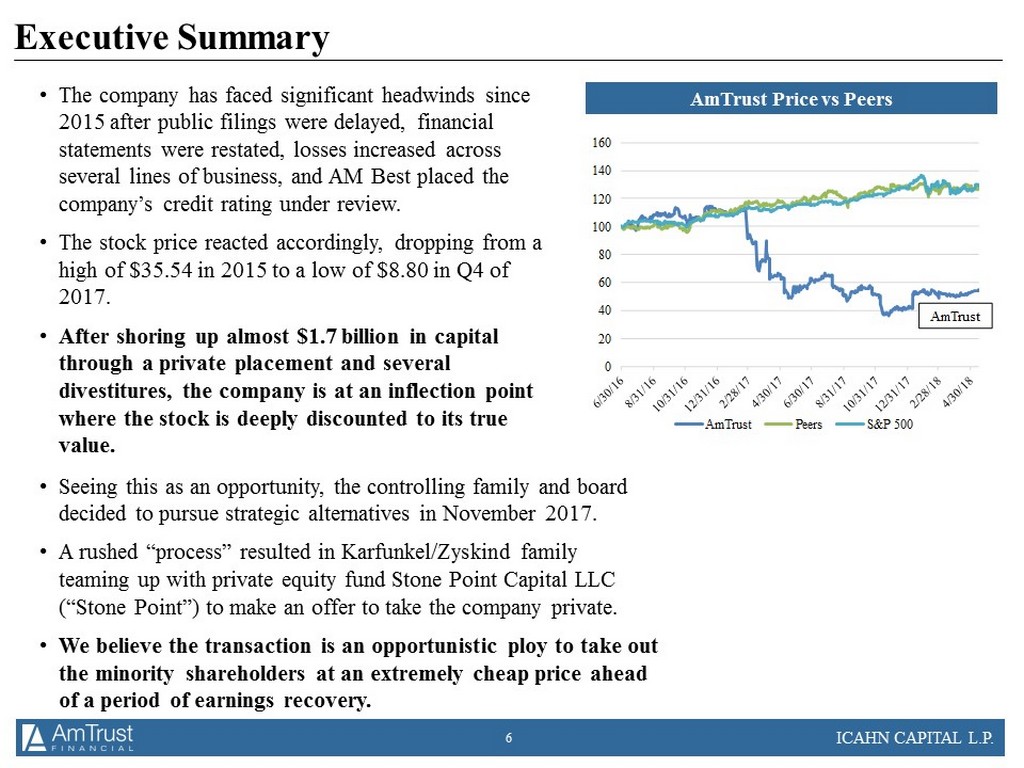

ICAHN CAPITAL L.P. 6 0 20 40 60 80 100 120 140 160 AmTrust Peers S&P 500 AmTrust • The company has faced significant headwinds since 2015 after public filings were delayed, financial statements were restated, losses increased across several lines of business, and AM Best placed the company’s credit rating under review. • The stock price reacted accordingly, dropping from a high of $35.54 in 2015 to a low of $8.80 in Q4 of 2017. • After shoring up almost $1.7 billion in capital through a private placement and several divestitures, the company is at an inflection point where the stock is deeply discounted to its true value. Executive Summary AmTrust Price vs Peers • Seeing this as an opportunity, the controlling family and board decided to pursue strategic alternatives in November 2017. • A rushed “process” resulted in Karfunkel / Zyskind family teaming up with private equity fund Stone Point Capital LLC (“Stone Point”) to make an offer to take the company private. • We believe the transaction is an opportunistic ploy to take out the minority shareholders at an extremely cheap price ahead of a period of earnings recovery.

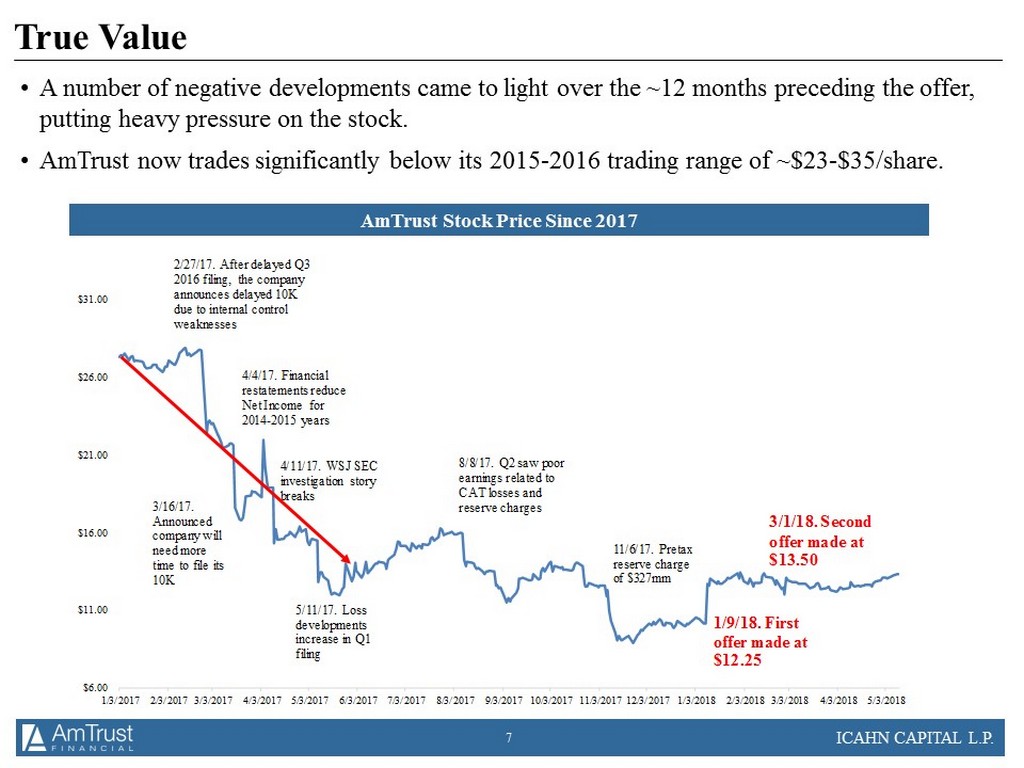

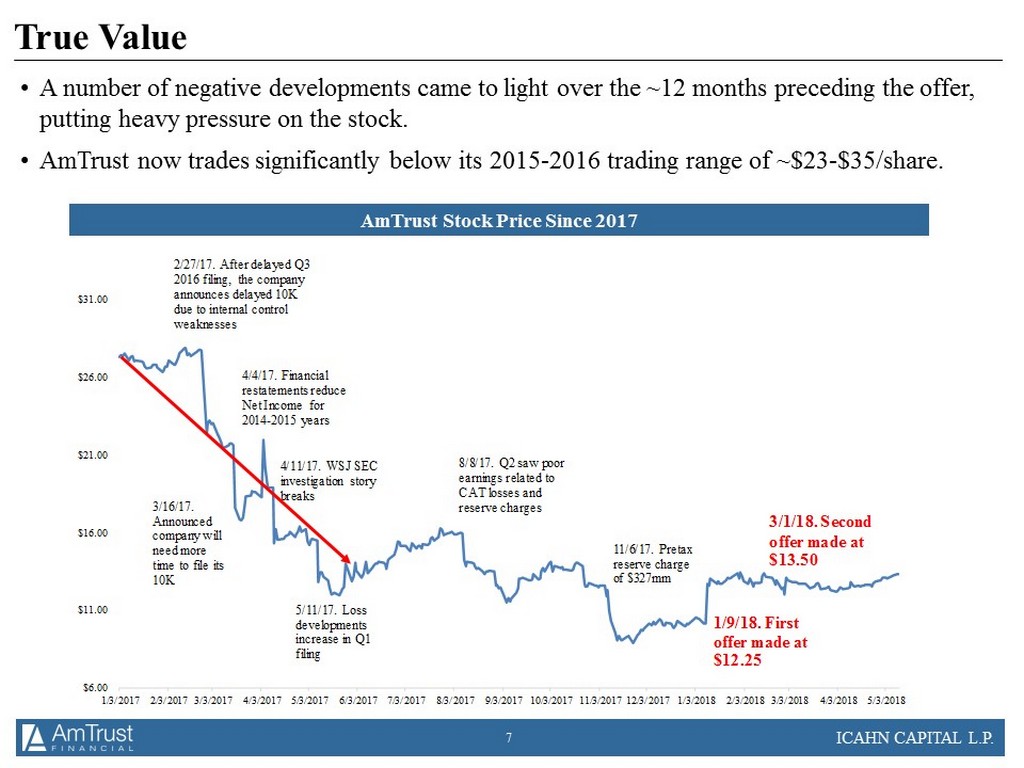

ICAHN CAPITAL L.P. 7 $6.00 $11.00 $16.00 $21.00 $26.00 $31.00 1/3/2017 2/3/2017 3/3/2017 4/3/2017 5/3/2017 6/3/2017 7/3/2017 8/3/2017 9/3/2017 10/3/2017 11/3/2017 12/3/2017 1/3/2018 2/3/2018 3/3/2018 4/3/2018 5/3/2018 2/27/17. After delayed Q3 2016 filing, the company announces delayed 10K due to internal control weaknesses 3/16/17. Announced company will need more time to file its 10K 4/11/17. WSJ SEC investigation story breaks 4/4/17. Financial restatements reduce Net Income for 2014 - 2015 years 5/11/17. Loss developments increase in Q1 filing 8/8/17. Q2 saw poor earnings related to CAT losses and reserve charges 11/6/17. Pretax reserve charge of $327mm 1/9/18. First offer made at $12.25 3/1/18. Second offer made at $13.50 • A number of negative developments came to light over the ~12 months preceding the offer, putting heavy pressure on the stock. • AmTrust now trades significantly below its 2015 - 2016 trading range of ~$23 - $35/share. True Value AmTrust Stock Price Since 2017

ICAHN CAPITAL L.P. 8 • Despite these recent recent challenges, AmTrust has historically led the industry in Loss Ratio, Combined Ratio and premium growth. 83% 74% 80% 85% 89% 89% 91% 91% 92% 94% 82% 83% 84% 86% 99% 97% 94% 95% 94% 96% 100% 70% 75% 80% 85% 90% 95% 100% 105% 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 AmTrust Combined Ratio vs Peers AmTrust Peers AmTrust 10 Yr Average 86.9% (pre - 2017) Peer 10 Yr Average 91.2% (pre - 2017) 113% (1%) 31% 30% 39% 37% 60% 56% 14% 16% 8% 1% 0% (3%) 7% 10% 11% 12% 3% 0% 6% (10%) 0% 10% 20% 30% 40% 50% 60% 70% 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 AmTrust Net Premiums Earned YoY% vs Peers AmTrust Peers AmTrust 10 Yr Average 28.9% Peer 10 Yr Average 4.7% Not only is AmTrust in - line with its peers in Combined ratio, it has blown the group away in terms of annual growth True Value Note: peer group consists of same companies utilized by Deutsche Bank in its Fairness Opinion: AFG, ARGO, AIZ, AMSF, CNA, EIG , J RVR, MKL, NAVG, PRA, SIGI, THG and WRB.

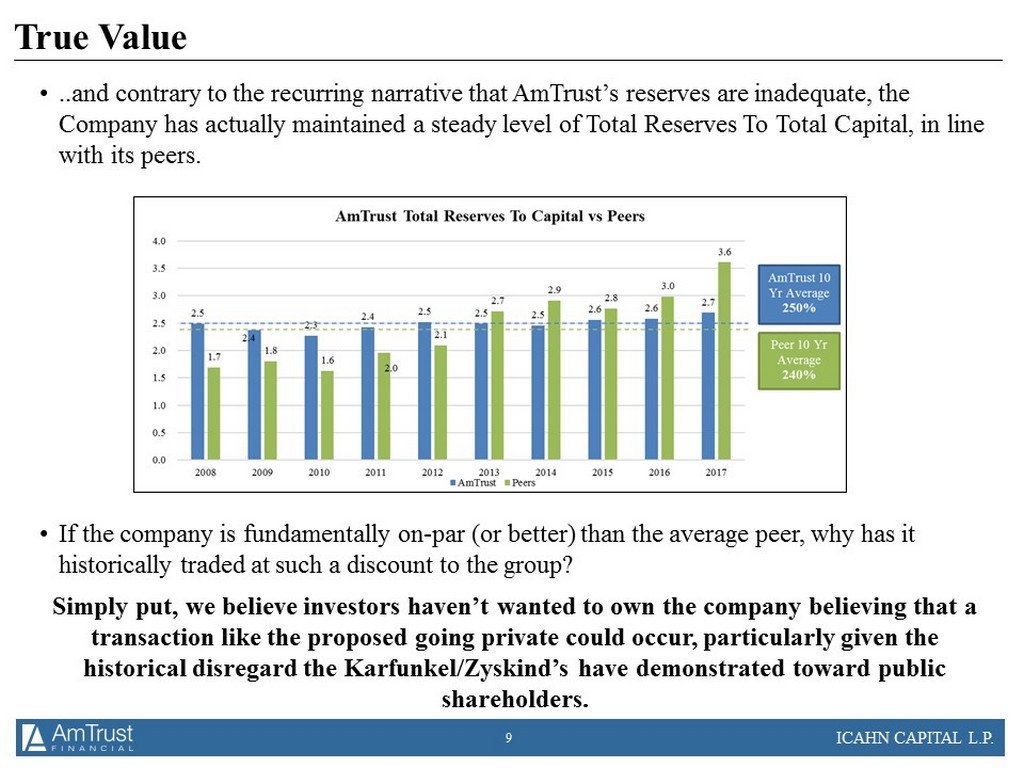

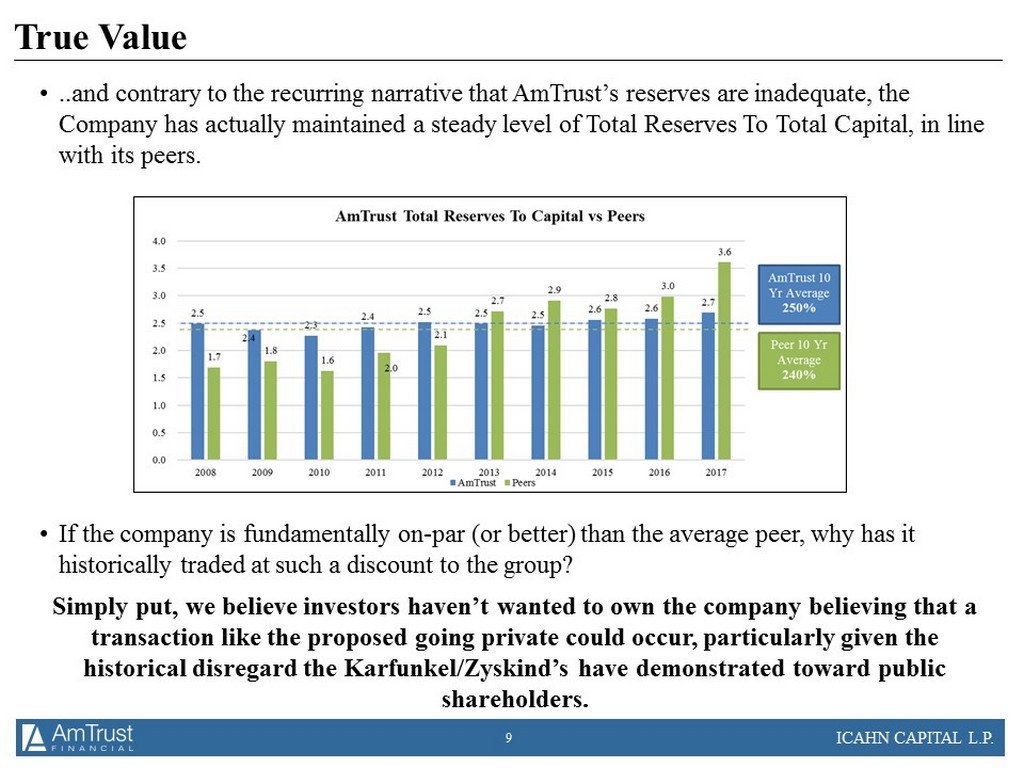

ICAHN CAPITAL L.P. 9 • ..and contrary to the recurring narrative that AmTrust’s reserves are inadequate, the Company has actually maintained a steady level of Total Reserves To Total Capital, in line with its peers. • If the company is fundamentally on - par (or better) than the average peer, why has it historically traded at such a discount to the group? Simply put, we believe investors haven’t wanted to own the company believing that a transaction like the proposed going private could occur, particularly given the historical disregard the Karfunkel / Zyskind’s have demonstrated toward public shareholders. True Value

ICAHN CAPITAL L.P. 10 Low High Average Management Long-Term Target ROE 12.0% 15.0% 13.5% x Book Value Per Share (3/31/18) $14.48 $14.48 $14.48 = Earnings Per Share $1.74 $2.17 $1.95 x AmTrust Historical Earnings Multiple (2) 8.5x 11.0x 9.9x = Equity Value Per Share $14.77 $23.89 $19.33 or x Peer Historical Earnings Multiple (2) 16.0x 20.0x 18.2x = Equity Value Per Share $27.80 $43.44 $35.62 • ...but we believe that with truly independent board oversight management would be held accountable and replaced, and we believe the stock would trade much closer to its peer group resulting in a long - term price from $20 to $35 per share. Our view is supported by the chart below, which is largely based on management and it’s advisors valuation work. • Management’s long - term target ROE shown below implies an EPS of $1.95 per share. In addition, even Deutsche Bank projects EPS near $2.00 per share within five years (1) . True Value AmTrust P/E Valuation “Our overall financial objective is to produce a return on equity of 12.0% - 15.0% over the long - term.” - Q1 2018 10Q (1) Per Deutsche Banks Fairness Opinion Special Committee Case Projections. (2) AmTrust and Peer earnings multiple ranges based on 3, 5 and 10 year historical multiples. Data from Bloomberg.

ICAHN CAPITAL L.P. 11 “Our overall financial objective is to produce a return on equity of 12.0% - 15.0% over the long - term.” - Q1 2018 10Q pg 34 ~1.8x ~2.2x • And building upon Deutsche Bank’s ROE vs P/BVPS chart, AmTrust should trade at 1.8x - 2.2x Book Value (implying a price of $26.06 to $31.86 per share (1) ). • While the transaction represents only 0.93x Book Value (1) . (1) Based on book value at March 31, 2018 of $14.48 per share. (2) Based Deutsche Banks February 28, 2018 Presentation to the Special Committee, modified to show managements long term ROE tar gets. True Value ROE vs P/BVPS Analysis (1) ..as such, we are Strongly Against the transaction at the rock bottom price of $13.50/share.

ICAHN CAPITAL L.P. 12 • The Karfunkel - Zyskind /Stone Point group are offering to buy the company at the bottom of the market . • The purported “premium” is based on recent stock price performance following a disastrous and admittedly transitional year . • The board rushed into the deal without a proper market check . • The Special Committee’s rationale is weak , including: (a)The controlling family will not entertain other suitors, and (b)No other buyers approached them . • Deutsche Bank’s Fairness Opinion to the Special Committee contains numerous flaws . • Deutsche Bank is inherently conflicted due to its contingent fee structure. • Deutsche Bank’s independence of the Company and the purchaser group is questionable. (1) • Buyout group understood that the deal price was low and even attempted to negotiate a walk - away right if too many shareholders demanded appraisal rights. • Certain “Independent” directors on the Special Committee serve on boards of other Karfunkel controlled companies. (2) • The controlling family has a history of related party transactions with the company. • Special Committee originally demanded $17.50 , but allowed the controlling family to push them all the way down to $13.50. • In the two trading days after our public statements “against” the transaction, over 12 million shares traded between $13.58 - $14.32 . Why Are We Against The Transaction? Offer Price: $13.50 per share Transaction Value: $2.7 billion Initial Public Proposal: Jan 9, 2018 at $12.25 per share 52 - Week High/Low: $16.37/$8.80 Premium to Unaffected Price (1/9/18): 33% Premium to 90 Day VWAP: 22% Discount to 2017 Average Price: (12%) Discount to 52 - Week High: (18%) Discount to Special Committee Proposed Price of $17.50: (23%) Karfunkel / Zyskind Ownership: Increases from 55% to 70% Special Committee Advisor: Deutsche Bank Special Committee Counsel: Willkie Farr Breakup Fee For Benefit of the Family: $33 million plus expenses Reverse Breakup Fee: None Transaction Summary (1) Chuck Davis, the CEO of Stone Point, currently sits on Deutsche Bank’s Advisory Board and Celeste Guth , Co - Head of FIG at Deutsche Bank is the lead banker on the engagement, but from 1986 to 2015 she worked directly for Chuck Davis (CEO of Stone Point) at Goldman. We believe other of her colleagues at Goldman during this time period included Stephen Friedman and Nicolas Zerbib , both of whom sit with Chuck Davis on Stone Point’s investment committee. (2) Donald Decarlo serves as a Director of National General Holdings Corp., a company formed by the Karfunkel family in 2007 and >40% owned by Leah Karfunkel .

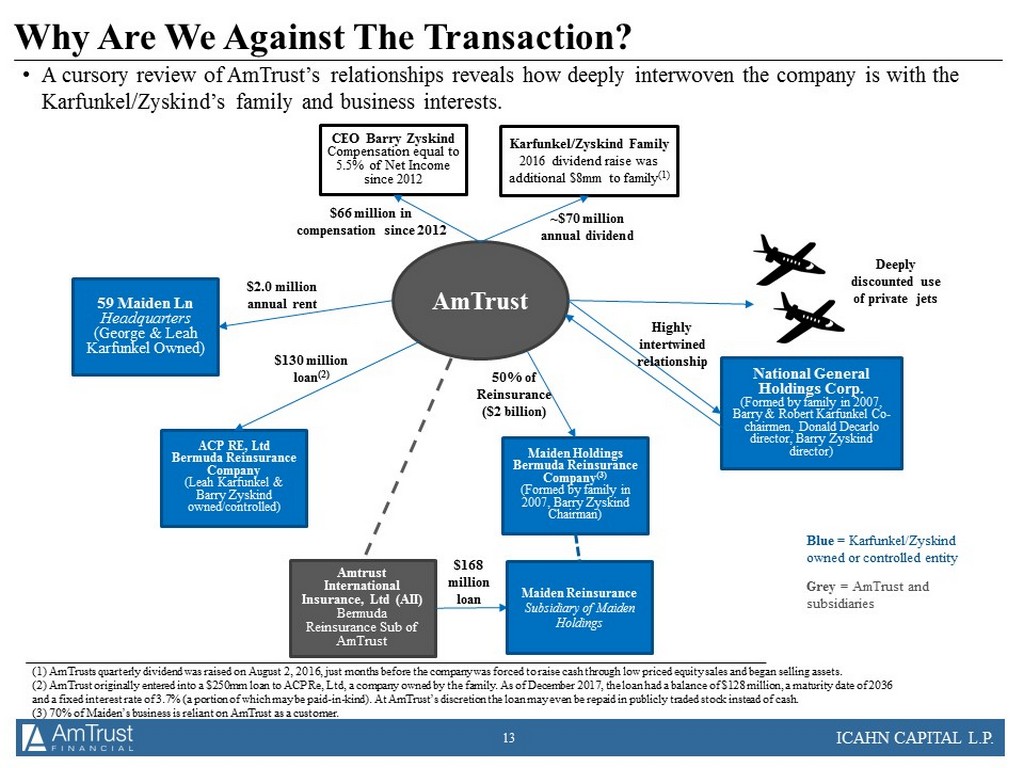

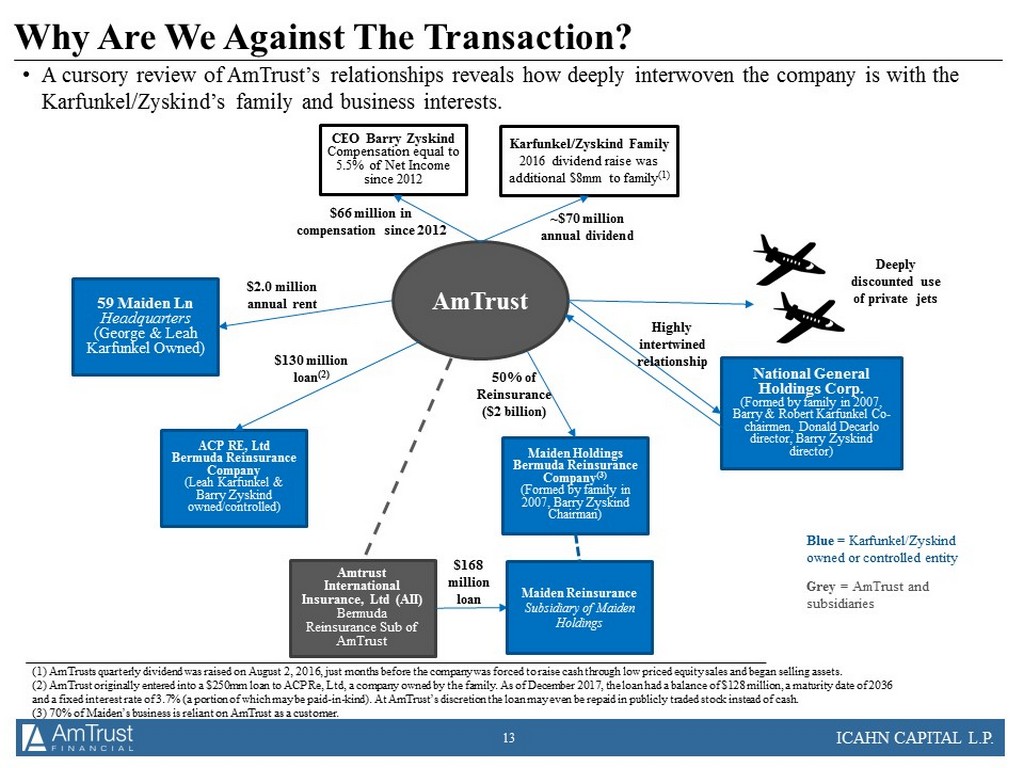

ICAHN CAPITAL L.P. 13 • A cursory review of AmTrust’s relationships reveals how deeply interwoven the company is with the Karfunkel / Zyskind’s family and business interests. Why Are We Against The Transaction? (1) AmTrusts quarterly dividend was raised on August 2, 2016, just months before the company was forced to raise cash through low priced e qu ity sales and began selling assets. (2) AmTrust originally entered into a $250mm loan to ACP Re, Ltd, a company owned by the family. As of December 2017, the loan had a bala nc e of $128 million, a maturity date of 2036 and a fixed interest rate of 3.7% (a portion of which may be paid - in - kind). At AmTrust’s discretion the loan may even be repaid in publicly traded stock instead of cash. (3) 70% of Maiden’s business is reliant on AmTrust as a customer. Blue = Karfunkel / Zyskind owned or controlled entity Grey = AmTrust and subsidiaries 59 Maiden Ln Headquarters (George & Leah Karfunkel Owned) AmTrust ACP RE, Ltd Bermuda Reinsurance Company (Leah Karfunkel & Barry Zyskind owned/controlled) Maiden Holdings Bermuda Reinsurance Company (3) (Formed by family in 2007, Barry Zyskind Chairman) Amtrust International Insurance, Ltd (AII) Bermuda Reinsurance Sub of AmTrust $168 million loan Maiden Reinsurance Subsidiary of Maiden Holdings $130 million loan (2) $2.0 million annual rent 50% of Reinsurance ($2 billion) National General Holdings Corp. (Formed by family in 2007, Barry & Robert Karfunkel Co - chairmen, Donald Decarlo director, Barry Zyskind director) Highly intertwined relationship Deeply discounted use of private jets CEO Barry Zyskind Compensation equal to 5.5% of Net Income since 2012 Karfunkel / Zyskind Family 2016 dividend raise was additional $8mm to family (1) ~$70 million annual dividend $66 million in compensation since 2012

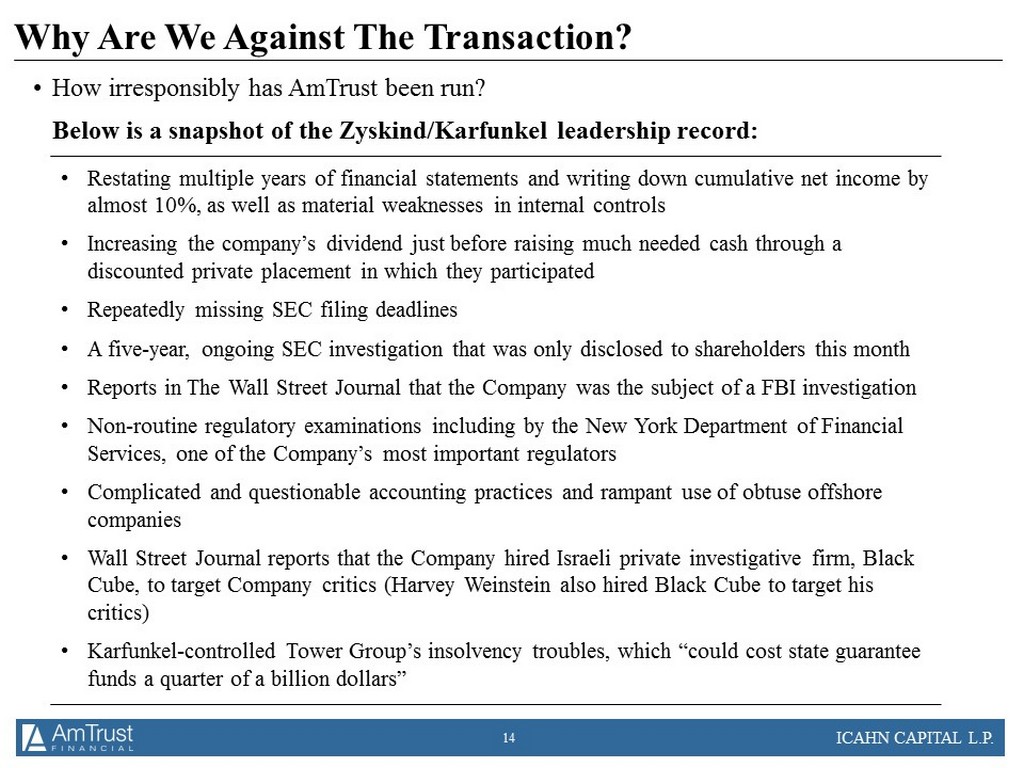

ICAHN CAPITAL L.P. 14 • How irresponsibly has AmTrust been run? Below is a snapshot of the Zyskind / Karfunkel leadership record: • Restating multiple years of financial statements and writing down cumulative net income by almost 10%, as well as material weaknesses in internal controls • Increasing the company’s dividend just before raising much needed cash through a discounted private placement in which they participated • Repeatedly missing SEC filing deadlines • A five - year, ongoing SEC investigation that was only disclosed to shareholders this month • Reports in The Wall Street Journal that the Company was the subject of a FBI investigation • Non - routine regulatory examinations including by the New York Department of Financial Services, one of the Company’s most important regulators • Complicated and questionable accounting practices and rampant use of obtuse offshore companies • Wall Street Journal reports that the Company hired Israeli private investigative firm, Black Cube, to target Company critics (Harvey Weinstein also hired Black Cube to target his critics) • Karfunkel - controlled Tower Group’s insolvency troubles, which “could cost state guarantee funds a quarter of a billion dollars” Why Are We Against The Transaction?

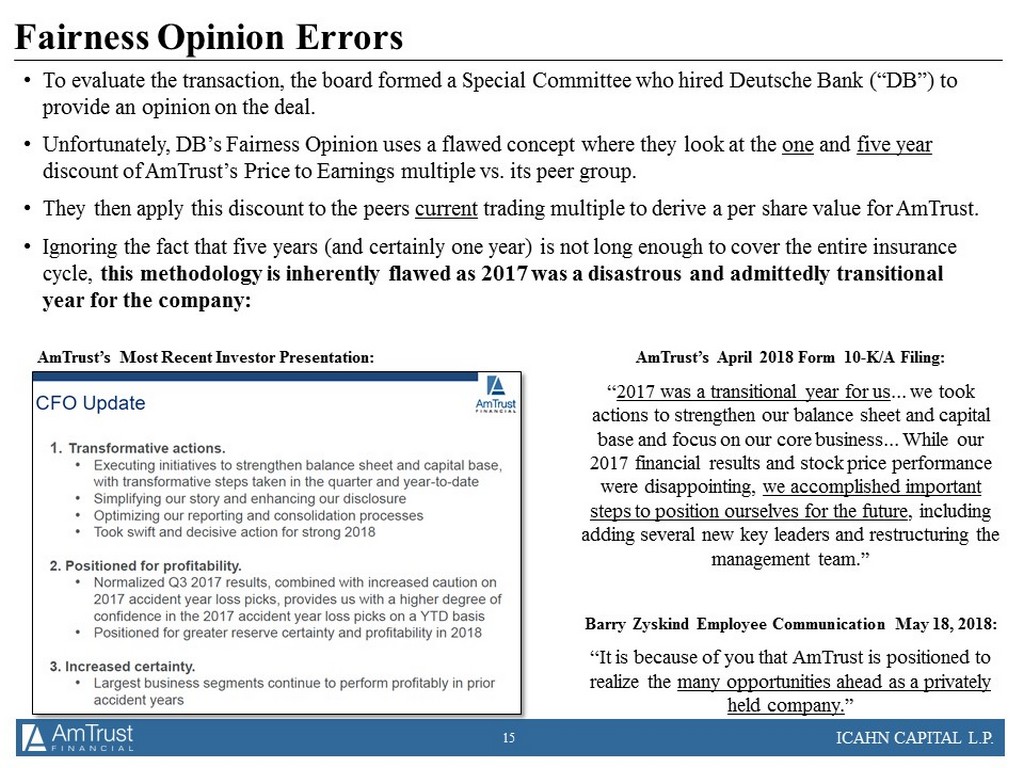

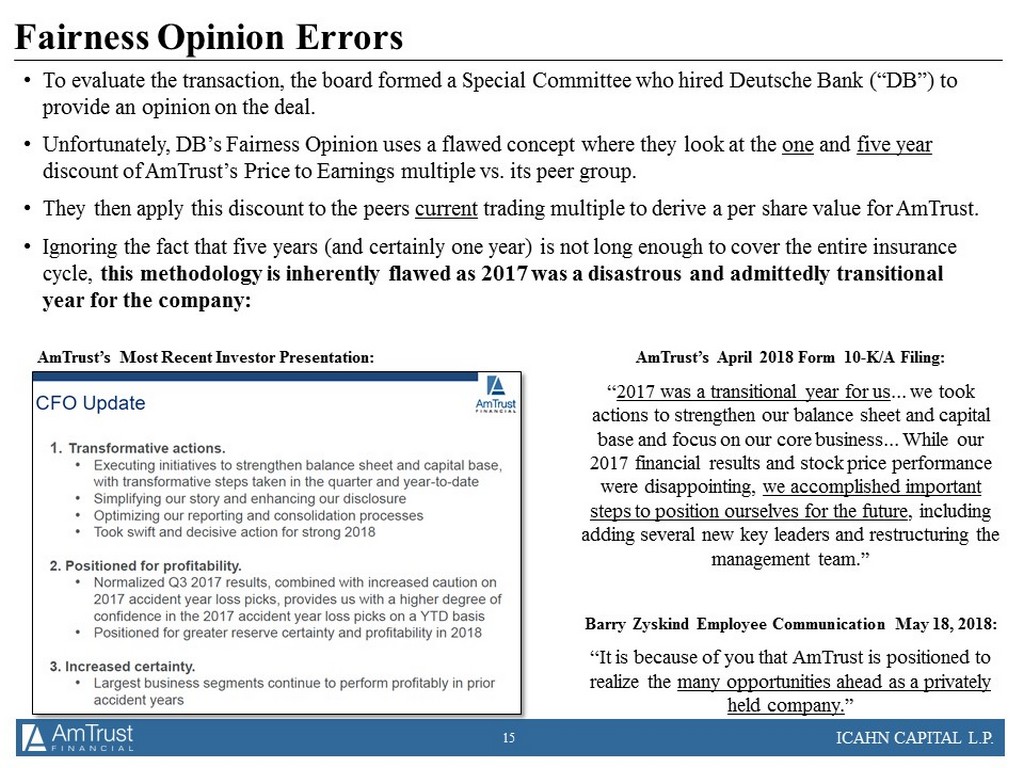

ICAHN CAPITAL L.P. 15 • To evaluate the transaction, the board formed a Special Committee who hired Deutsche Bank (“DB”) to provide an opinion on the deal. • Unfortunately, DB’s Fairness Opinion uses a flawed concept where they look at the one and five year discount of AmTrust’s Price to Earnings multiple vs. its peer group. • They then apply this discount to the peers current trading multiple to derive a per share value for AmTrust . • Ignoring the fact that five years (and certainly one year) is not long enough to cover the entire insurance cycle, this methodology is inherently flawed as 2017 was a disastrous and admittedly transitional year for the company: Fairness Opinion Errors AmTrust’s Most Recent Investor Presentation: AmTrust’s April 2018 Form 10 - K/A Filing: “ 2017 was a transitional year for us ... we took actions to strengthen our balance sheet and capital base and focus on our core business... While our 2017 financial results and stock price performance were disappointing, we accomplished important steps to position ourselves for the future , including adding several new key leaders and restructuring the management team.” Barry Zyskind Employee Communication May 18, 2018: “It is because of you that AmTrust is positioned to realize the many opportunities ahead as a privately held company. ”

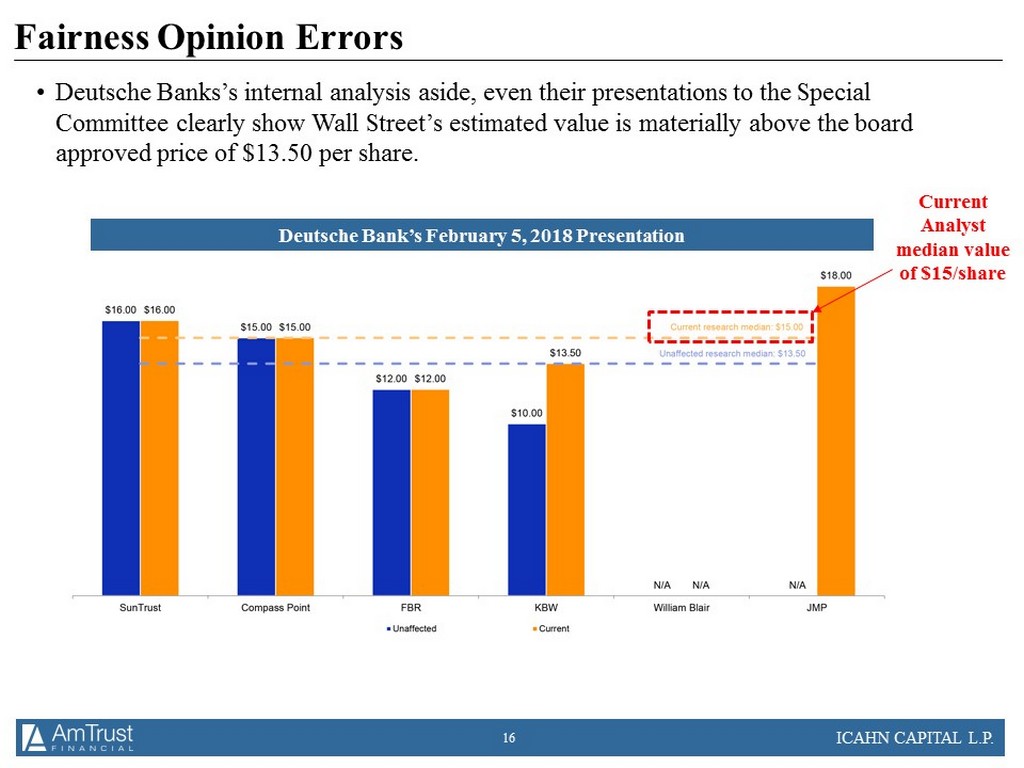

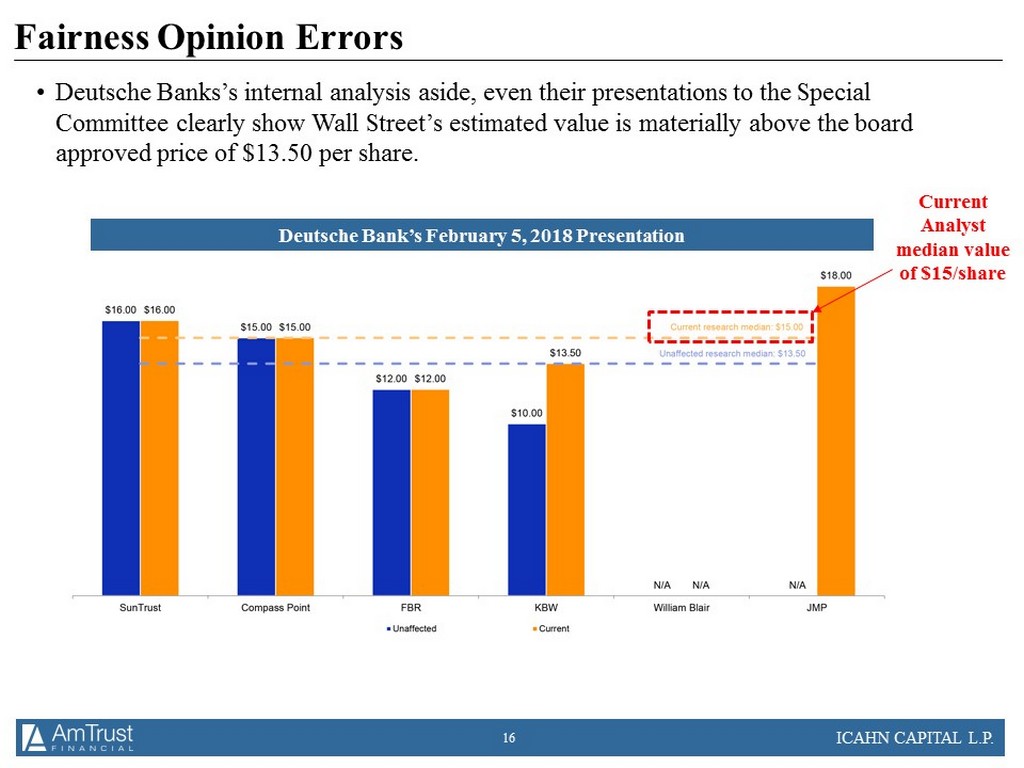

ICAHN CAPITAL L.P. 16 • Deutsche Banks’s internal analysis aside, even their presentations to the Special Committee clearly show Wall Street’s estimated value is materially above the board approved price of $13.50 per share. Fairness Opinion Errors Deutsche Bank’s February 5, 2018 Presentation Current Analyst median value of $15/share

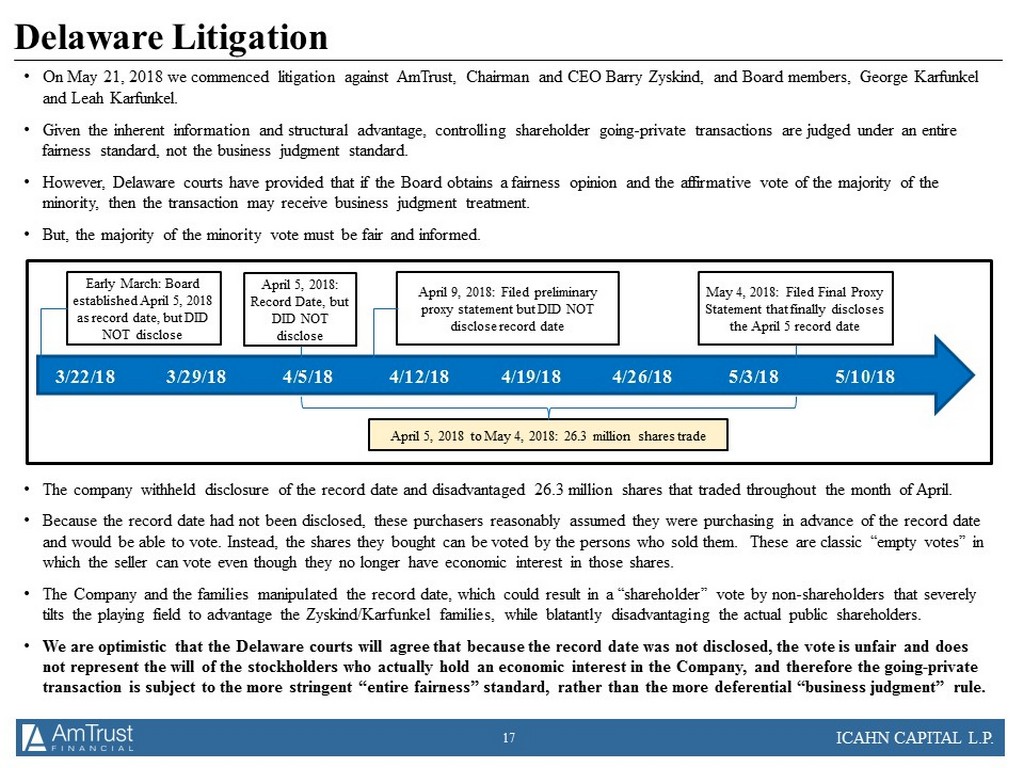

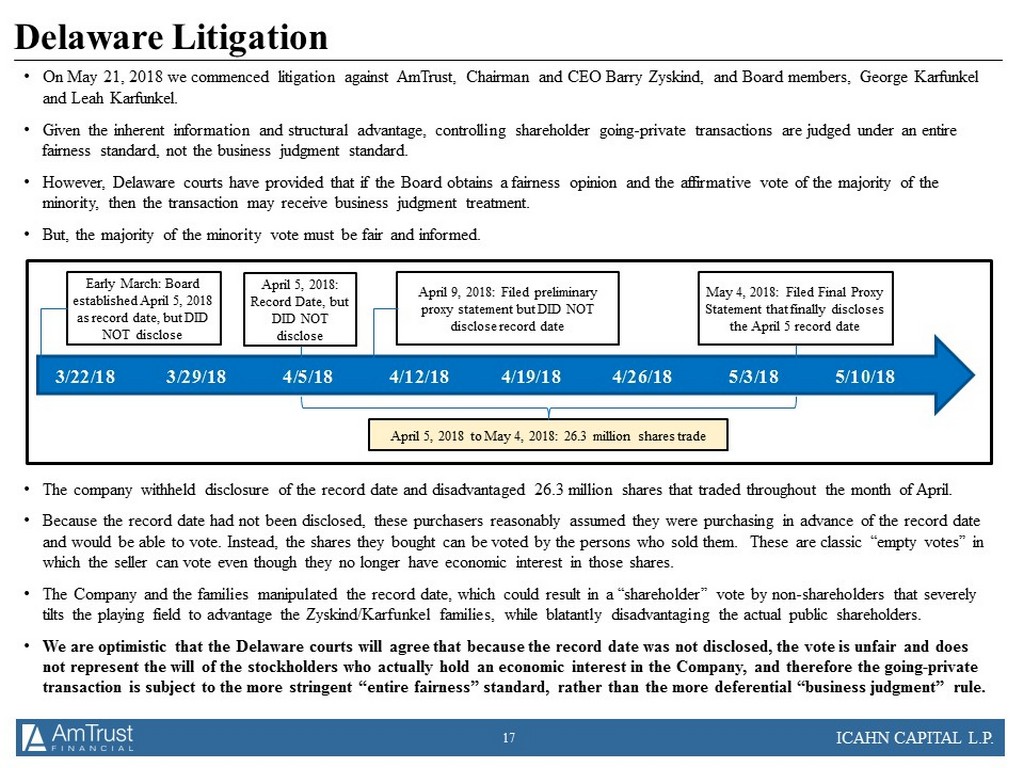

ICAHN CAPITAL L.P. 17 • On May 21, 2018 we commenced litigation against AmTrust , Chairman and CEO Barry Zyskind , and Board members, George Karfunkel and Leah Karfunkel . • Given the inherent information and structural advantage, controlling shareholder going - private transactions are judged under an entire fairness standard, not the business judgment standard. • However, Delaware courts have provided that if the Board obtains a fairness opinion and the affirmative vote of the majority of the minority, then the transaction may receive business judgment treatment. • But, the majority of the minority vote must be fair and informed. • The company withheld disclosure of the record date and disadvantaged 26.3 million shares that traded throughout the month of Apr il. • Because the record date had not been disclosed, these purchasers reasonably assumed they were purchasing in advance of the re cor d date and would be able to vote. Instead, the shares they bought can be voted by the persons who sold them. These are classic “emp ty votes” in which the seller can vote even though they no longer have economic interest in those shares. • The Company and the families manipulated the record date, which could result in a “shareholder” vote by non - shareholders that se verely tilts the playing field to advantage the Zyskind / Karfunkel families, while blatantly disadvantaging the actual public shareholders. • We are optimistic that the Delaware courts will agree that because the record date was not disclosed, the vote is unfair and doe s not represent the will of the stockholders who actually hold an economic interest in the Company, and therefore the going - privat e transaction is subject to the more stringent “entire fairness” standard, rather than the more deferential “business judgment” ru le. Delaware Litigation Early March: Board established April 5, 2018 as record date, but DID NOT disclose April 5, 2018: Record Date, but DID NOT disclose April 9, 2018: Filed preliminary proxy statement but DID NOT disclose record date April 5, 2018 to May 4, 2018: 26.3 million shares trade May 4, 2018: Filed Final Proxy Statement that finally discloses the April 5 record date 3/22/18 3/29/18 4/5/18 4/12/18 4/19/18 4/26/18 5/3/18 5/10/18

ICAHN CAPITAL L.P. 18 The Special Meeting of Shareholders called to consider and act on the Zyskind / Karfunkel Squeeze - Out is scheduled for June 4 . Your vote is important. Vote AGAINST the Zyskind / Karfunkel Squeeze - Out at AmTrust today! If you have any questions, please contact the following individuals: Vote AGAINST the Transaction Harkins Kovler , LLC Banks and Brokers Call: +1 (212) 468 - 5380 All Others Call Toll - Free: +1 (800) 339 - 9883 Email: afsi@harkinskovler.com Icahn Capital LP Susan Gordon +1 (212) 702 - 4309