Exhibit (c)(13)

Deutsche Bank Corporate & Investment Bank Project Pine Fairness Committee discussion materials June 6, 2018 Deutsche Bank Securities Inc., a subsidiary of Deutsche Bank AG, conducts investment banking and securities activities in the United States.

Contents Section 1 Situation update 1 2 Summary of financial projections 6 3 Valuation summary 8 Deutsche Bank Corporate & Investment Bank

Deutsche Bank Corporate & Investment Bank Section 1 Situation update

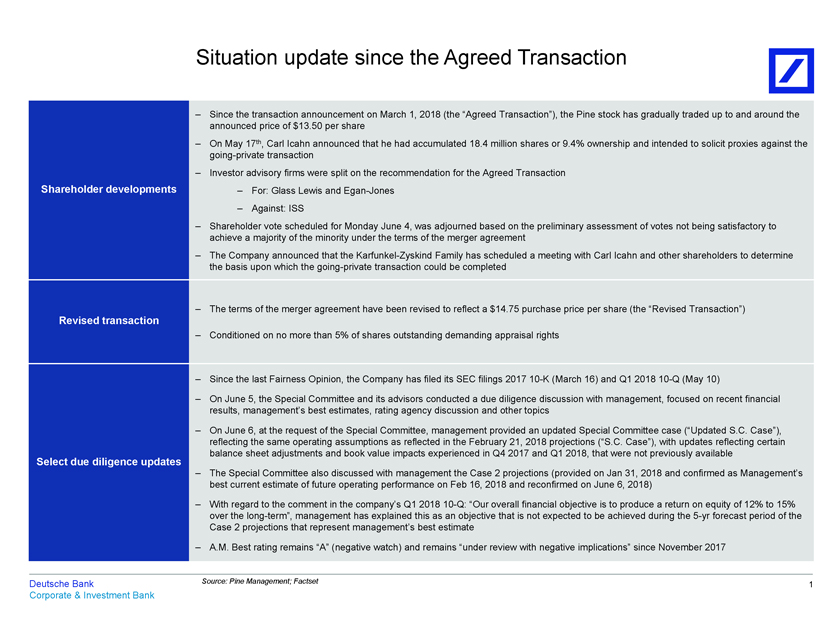

Situation update since the Agreed Transaction – Since the transaction announcement on March 1, 2018 (the “Agreed Transaction”), the Pine stock has gradually traded up to and around the announced price of $13.50 per share – On May 17th, Carl Icahn announced that he had accumulated 18.4 million shares or 9.4% ownership and intended to solicit proxies against the going-private transaction – Investor advisory firms were split on the recommendation for the Agreed Transaction Shareholder developments – For: Glass Lewis and Egan-Jones – Against: ISS – Shareholder vote scheduled for Monday June 4, was adjourned based on the preliminary assessment of votes not being satisfactory to achieve a majority of the minority under the terms of the merger agreement – The Company announced that the Karfunkel-Zyskind Family has scheduled a meeting with Carl Icahn and other shareholders to determine the basis upon which the going-private transaction could be completed – The terms of the merger agreement have been revised to reflect a $14.75 purchase price per share (the “Revised Transaction”) Revised transaction – Conditioned on no more than 5% of shares outstanding demanding appraisal rights – Since the last Fairness Opinion, the Company has filed its SEC filings 201710-K (March 16) and Q1 201810-Q (May 10) – On June 5, the Special Committee and its advisors conducted a due diligence discussion with management, focused on recent financial results, management’s best estimates, rating agency discussion and other topics – On June 6, at the request of the Special Committee, management provided an updated Special Committee case (“Updated S.C. Case”), reflecting the same operating assumptions as reflected in the February 21, 2018 projections (“S.C. Case”), with updates reflecting certain Select due diligence updates balance sheet adjustments and book value impacts experienced in Q4 2017 and Q1 2018, that were not previously available – The Special Committee also discussed with management the Case 2 projections (provided on Jan 31, 2018 and confirmed as Management’s best current estimate of future operating performance on Feb 16, 2018 and reconfirmed on June 6, 2018) – With regard to the comment in the company’s Q1 201810-Q: “Our overall financial objective is to produce a return on equity of 12% to 15% over the long-term”, management has explained this as an objective that is not expected to be achieved during the5-yr forecast period of the Case 2 projections that represent management’s best estimate – A.M. Best rating remains “A” (negative watch) and remains “under review with negative implications” since November 2017 Deutsche Bank Source: Pine Management; Factset 1 Corporate & Investment Bank

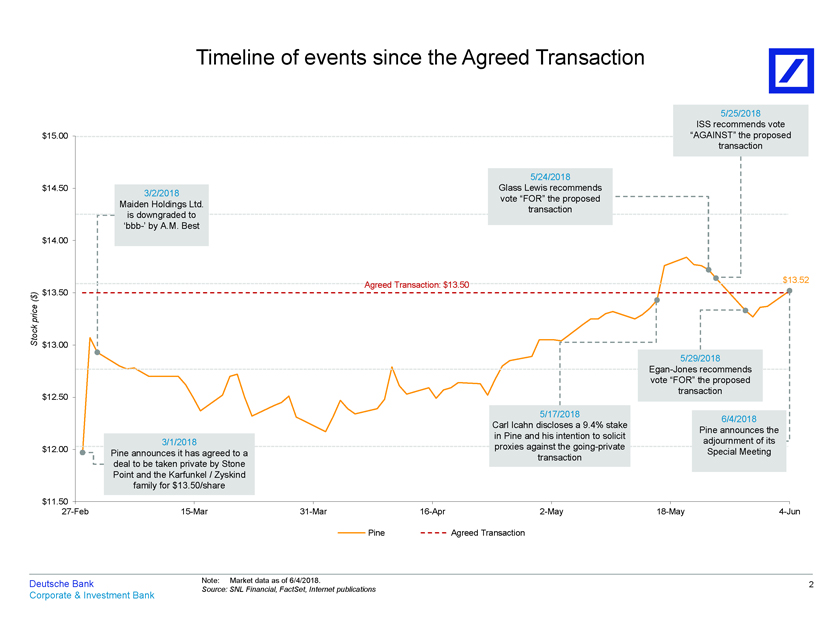

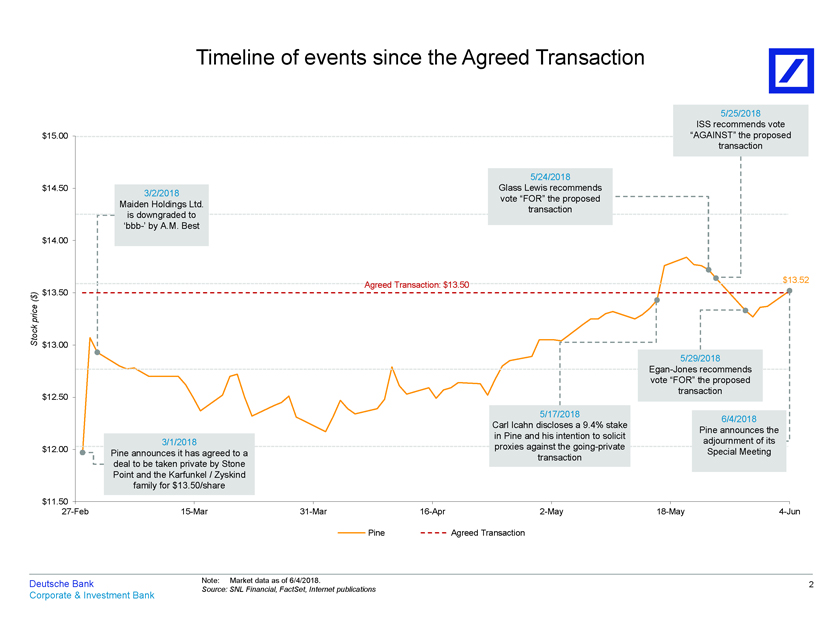

Timeline of events since the Agreed Transaction 5/25/2018 ISS recommends vote $15.00 “AGAINST” the proposed transaction 5/24/2018 $14.50 Glass Lewis recommends 3/2/2018 vote “FOR” the proposed Maiden Holdings Ltd. transaction is downgraded to ‘bbb-’ by A.M. Best $14.00 $13.52 Agreed Transaction: $13.50 $ ) $13.50 ( price oc k S t $13.00 5/29/2018 Egan-Jones recommends vote “FOR” the proposed transaction $12.50 5/17/2018 6/4/2018 Carl Icahn discloses a 9.4% stake Pine announces the in Pine and his intention to solicit 3/1/2018 adjournment of its $12.00 proxies against the going-private Pine announces it has agreed to a Special Meeting transaction deal to be taken private by Stone Point and the Karfunkel / Zyskind family for $13.50/share $11.5027-Feb15-Mar31-Mar16-Apr2-May18-May4-Jun Pine Agreed Transaction Deutsche Bank Note: Market data as of 6/4/2018. 2 Source: SNL Financial, FactSet, Internet publications Corporate & Investment Bank

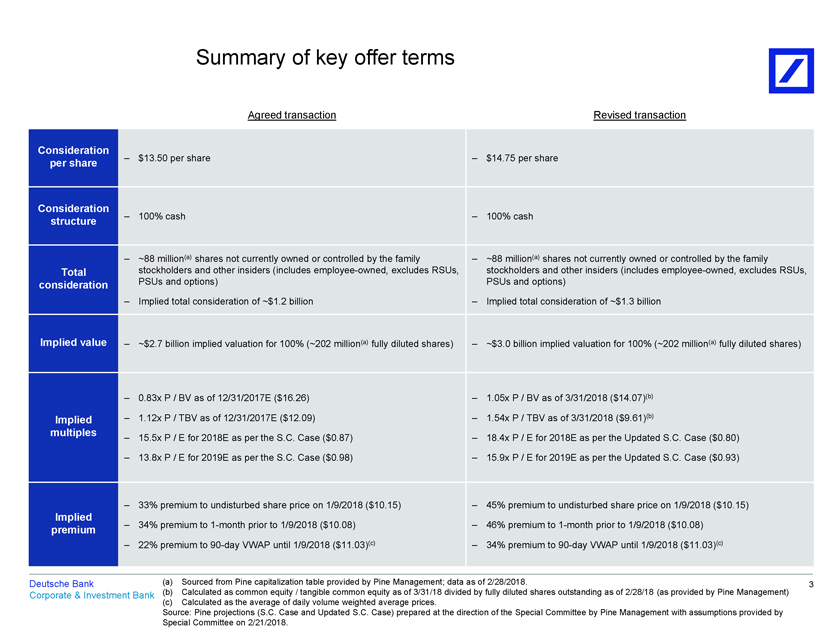

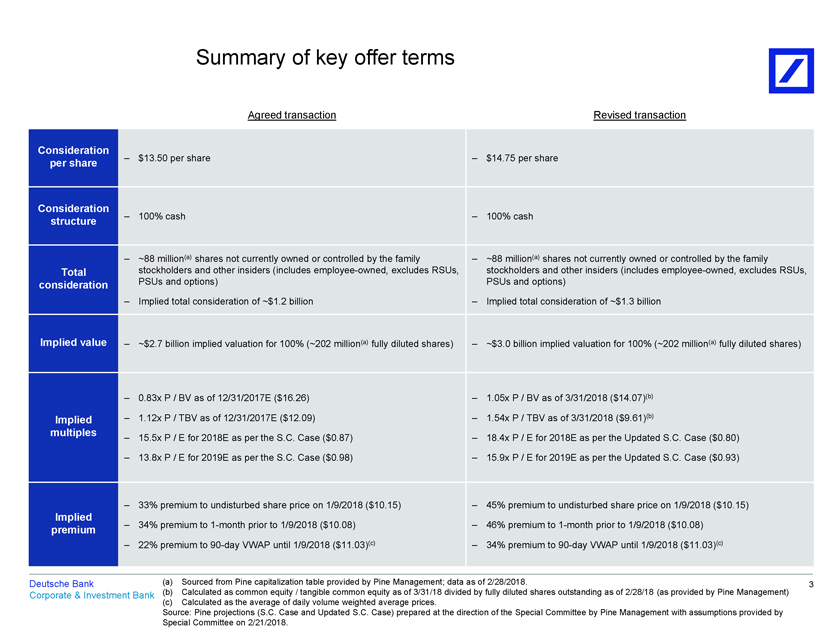

Summary of key offer terms Agreed transaction Revised transaction Consideration – $13.50 per share – $14.75 per share per share Consideration – 100% cash – 100% cash structure – ~88 million(a) shares not currently owned or controlled by the family – ~88 million(a) shares not currently owned or controlled by the family Total stockholders and other insiders (includes employee-owned, excludes RSUs, stockholders and other insiders (includes employee-owned, excludes RSUs, consideration PSUs and options) PSUs and options) – Implied total consideration of ~$1.2 billion – Implied total consideration of ~$1.3 billion Implied value – ~$2.7 billion implied valuation for 100% (~202 million(a) fully diluted shares) – ~$3.0 billion implied valuation for 100% (~202 million(a) fully diluted shares) – 0.83x P / BV as of 12/31/2017E ($16.26) – 1.05x P / BV as of 3/31/2018 ($14.07)(b) Implied – 1.12x P / TBV as of 12/31/2017E ($12.09) – 1.54x P / TBV as of 3/31/2018 ($9.61)(b) multiples – 15.5x P / E for 2018E as per the S.C. Case ($0.87) – 18.4x P / E for 2018E as per the Updated S.C. Case ($0.80) – 13.8x P / E for 2019E as per the S.C. Case ($0.98) – 15.9x P / E for 2019E as per the Updated S.C. Case ($0.93) – 33% premium to undisturbed share price on 1/9/2018 ($10.15) – 45% premium to undisturbed share price on 1/9/2018 ($10.15) Implied – 34% premium to1-month prior to 1/9/2018 ($10.08) – 46% premium to1-month prior to 1/9/2018 ($10.08) premium – 22% premium to90-day VWAP until 1/9/2018 ($11.03)(c) – 34% premium to90-day VWAP until 1/9/2018 ($11.03)(c) Deutsche Bank (a) Sourced from Pine capitalization table provided by Pine Management; data as of 2/28/2018. 3 Corporate & Investment Bank (b) Calculated as common equity / tangible common equity as of 3/31/18 divided by fully diluted shares outstanding as of 2/28/18 (as provided by Pine Management) (c) Calculated as the average of daily volume weighted average prices. Source: Pine projections (S.C. Case and Updated S.C. Case) prepared at the direction of the Special Committee by Pine Management with assumptions provided by Special Committee on 2/21/2018.

Deutsche Bank Corporate & Investment Bank Section 2 Summary of financial projections

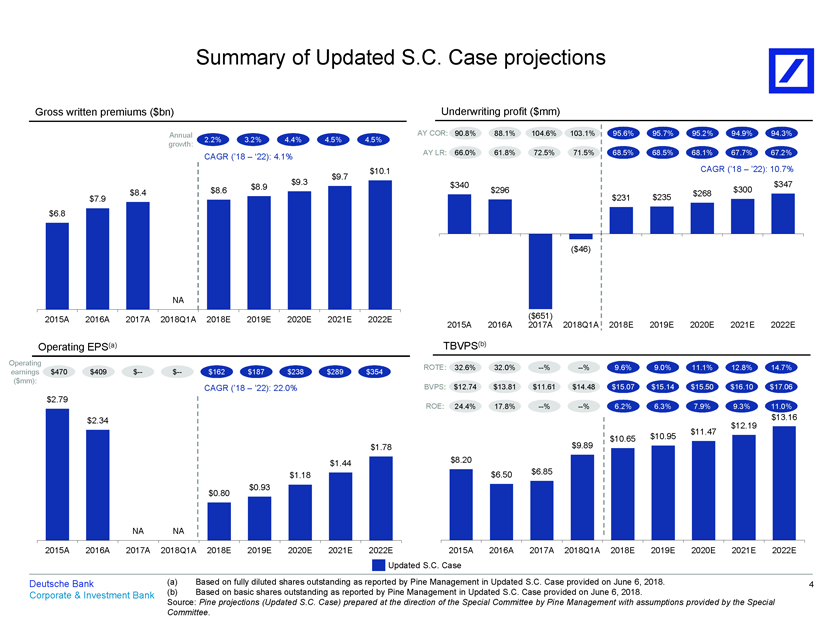

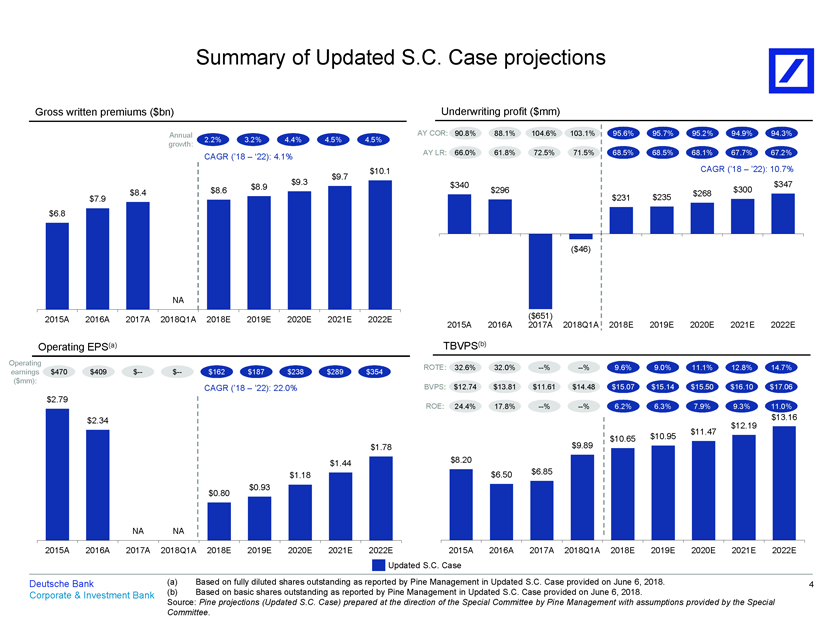

Summary of Updated S.C. Case projections Gross written premiums ($bn) Underwriting profit ($mm) Annual 2.2% 3.2% 4.4% 4.5% 4.5% AY COR: 90.8% 88.1% 104.6% 103.1% 95.6% 95.7% 95.2% 94.9% 94.3% growth: AY LR: 66.0% 61.8% 72.5% 71.5% 68.5% 68.5% 68.1% 67.7% 67.2% CAGR (’18 – ‘22): 4.1% $9.7 $10.1 CAGR (’18 – ’22): 10.7% $9.3 $340 $347 $8.6 $8.9 $296 $300 $8.4 $268 $7.9 $231 $235 $6.8 ($46) NA 2015A 2016A 2017A 2018Q1A 2018E 2019E 2020E 2021E 2022E ($651) 2015A 2016A 2017A 2018Q1A 2018E 2019E 2020E 2021E 2022E Operating EPS(a) TBVPS(b) Operating ROTE: 32.6% 32.0% —% —% 9.6% 9.0% 11.1% 12.8% 14.7% earnings $470 $409 $— $— $162 $187 $238 $289 $354 ($mm): CAGR (’18 – ’22): 22.0% BVPS: $12.74 $13.81 $11.61 $14.48 $15.07 $15.14 $15.50 $16.10 $17.06 $2.79 ROE: 24.4% 17.8% —% —% 6.2% 6.3% 7.9% 9.3% 11.0% $2.34 $13.16 $12.19 $11.47 $10.65 $10.95 $1.78 $9.89 $1.44 $8.20 $1.18 $6.50 $6.85 $0.93 $0.80 NA NA 2015A 2016A 2017A 2018Q1A 2018E 2019E 2020E 2021E 2022E 2015A 2016A 2017A 2018Q1A 2018E 2019E 2020E 2021E 2022E Updated S.C. Case Deutsche Bank (a) Based on fully diluted shares outstanding as reported by Pine Management in Updated S.C. Case provided on June 6, 2018. 4 Corporate & Investment Bank (b) Based on basic shares outstanding as reported by Pine Management in Updated S.C. Case provided on June 6, 2018. Source: Pine projections (Updated S.C. Case) prepared at the direction of the Special Committee by Pine Management with assumptions provided by the Special Committee.

Deutsche Bank Corporate & Investment Bank Section 3 Valuation summary

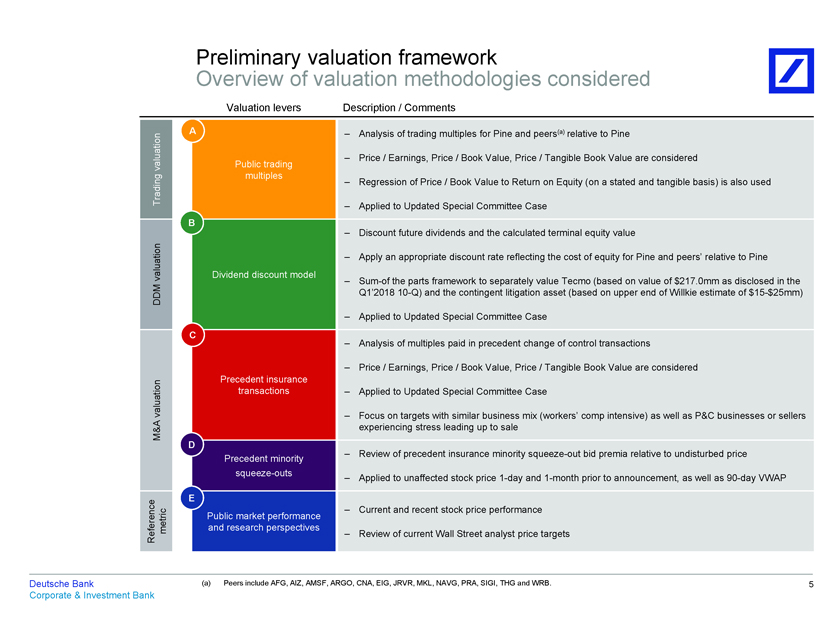

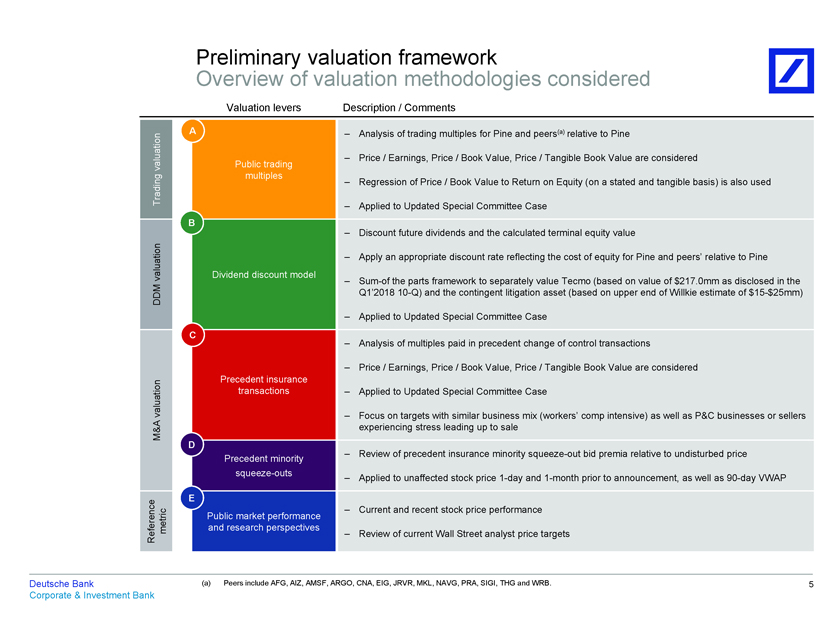

Preliminary valuation framework Overview of valuation methodologies considered Valuation levers Description / Comments A Analysis of trading multiples for Pine and peers(a) relative to Pine Price / Earnings, Price / Book Value, Price / Tangible Book Value are considered valuation Public trading multiples Trading Regression of Price / Book Value to Return on Equity (on a stated and tangible basis) is also used Applied to Updated Special Committee Case B Discount future dividends and the calculated terminal equity value Apply an appropriate discount rate reflecting the cost of equity for Pine and peers’ relative to Pine valuation Dividend discount modelSum-of the parts framework to separately value Tecmo (based on value of $217.0mm as disclosed in the DDM Q1’201810-Q) and the contingent litigation asset (based on upper end of Willkie estimate of$15-$25mm) Applied to Updated Special Committee Case C Analysis of multiples paid in precedent change of control transactions Price / Earnings, Price / Book Value, Price / Tangible Book Value are considered Precedent insurance valuation transactions Applied to Updated Special Committee Case Focus on targets with similar business mix (workers’ comp intensive) as well as P&C businesses or sellers M&A experiencing stress leading up to sale D Review of precedent insurance minoritysqueeze-out bid premia relative to undisturbed price Precedent minoritysqueeze-outs Applied to unaffected stock price1-day and1-month prior to announcement, as well as90-day VWAP E Current and recent stock price performance Public market performance ference metric and research perspectives Re Review of current Wall Street analyst price targets Deutsche Bank (a) Peers include AFG, AIZ, AMSF, ARGO, CNA, EIG, JRVR, MKL, NAVG, PRA, SIGI, THG and WRB. 5 Corporate & Investment Bank

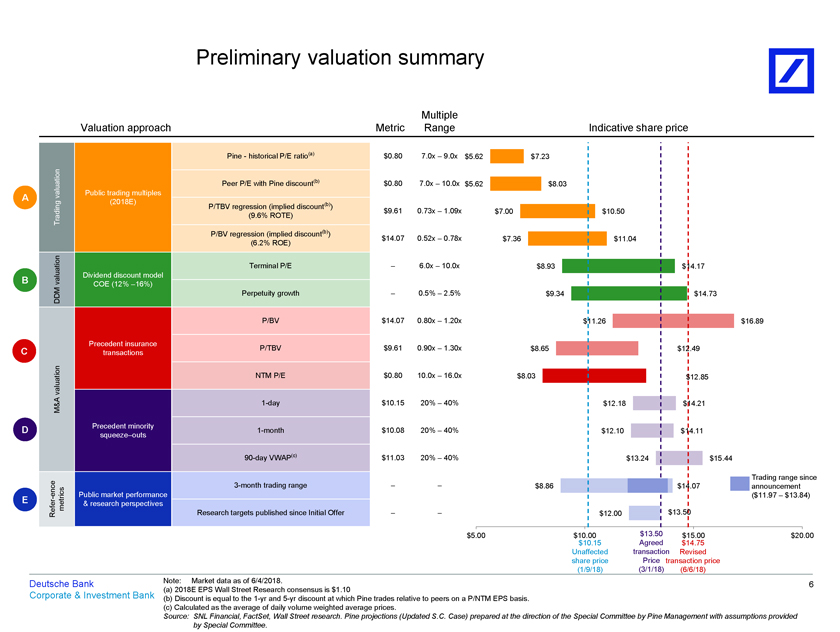

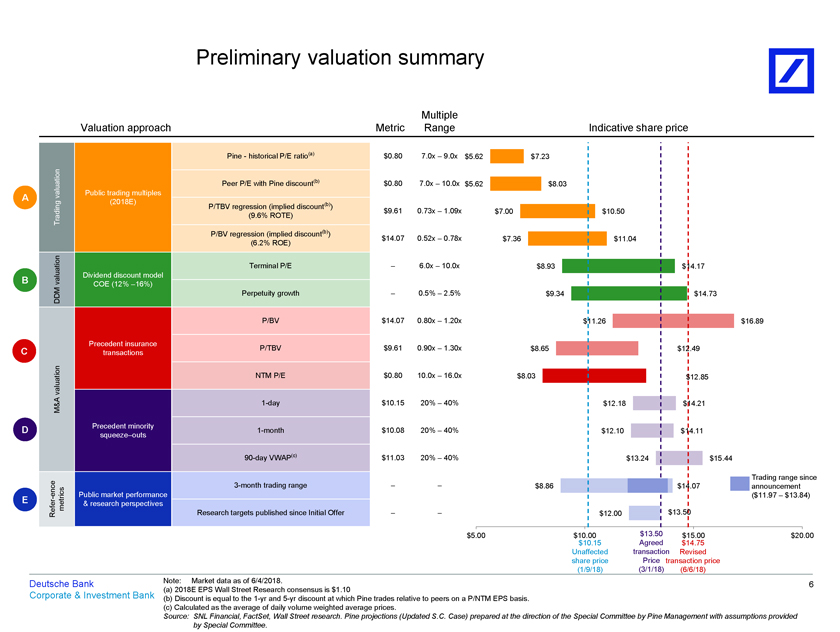

Preliminary valuation summary Multiple Valuation approach Metric Range Indicative share price Pine—historical P/E ratio(a) $0.80 7.0x – 9.0x $5.62 $7.23 Peer P/E with Pine discount(b) $0.80 7.0x – 10.0x $5.62 $8.03 valuation Public trading multiples A (2018E) P/TBV regression (implied discount(b)) $9.61 0.73x – 1.09x $7.00 $10.50 Trading (9.6% ROTE) P/BV regression (implied discount(b)) $14.07 0.52x – 0.78x $7.36 $11.04 (6.2% ROE) Terminal P/E – 6.0x – 10.0x $8.93 $14.17 Dividend discount model B valuation COE (12% –16%) DDM Perpetuity growth – 0.5% – 2.5% $9.34 $14.73 P/BV $14.07 0.80x – 1.20x $11.26 $16.89 Precedent insurance C P/TBV $9.61 0.90x – 1.30x $8.65 $12.49 transactions valuation NTM P/E $0.80 10.0x – 16.0x $8.03 $12.85 M&A1-day $10.15 20% – 40% $12.18 $14.21 Precedent minority D1-month $10.08 20% – 40% $12.10 $14.11 squeeze–outs90-day VWAP(c) $11.03 20% – 40% $13.24 $15.44 Trading range since ence3-month trading range – – $8.86 $14.07 announcement—rics Public market performance ($11.97 – $13.84) E met & research perspectives Refer Research targets published since Initial Offer – – $12.00 $13.50 $5.00 $10.00 $13.50 $15.00 $20.00 $10.15 Agreed $14.75 Unaffected transaction Revised share price Price transaction price (1/9/18) (3/1/18) (6/6/18) Deutsche Bank Note: Market data as of 6/4/2018. 6 (a) 2018E EPS Wall Street Research consensus is $1.10 Corporate & Investment Bank (b) Discount is equal to the1-yr and5-yr discount at which Pine trades relative to peers on a P/NTM EPS basis. (c) Calculated as the average of daily volume weighted average prices. Source: SNL Financial, FactSet, Wall Street research. Pine projections (Updated S.C. Case) prepared at the direction of the Special Committee by Pine Management with assumptions provided

5-year stock price performance $40.00 $35.00 $30.00 ) 90.3% pric e Pine $25.00 69.3% to ed a s $20.00 e b ( r ice p r k $15.00 Stoc $13.52 (9.5%) $10.00 $10.15 (32.1%) January 9, 2018: Stone Point and $5.00 Family make an offer to acquire outstanding shares of common stock for $12.25/share (“Initial Offer”) $0.00 2013 2014 2015 2016 2017 2018 AmTrust Peers S&P 500 Deutsche Bank Note: Market data as of 6/4/2018. Peers include AFG, AIZ, AMSF, ARGO, CNA, EIG, JRVR, MKL, NAVG, PRA, SIGI, THG and WRB. 7 Source: SNL Financial, Factset Corporate & Investment Bank

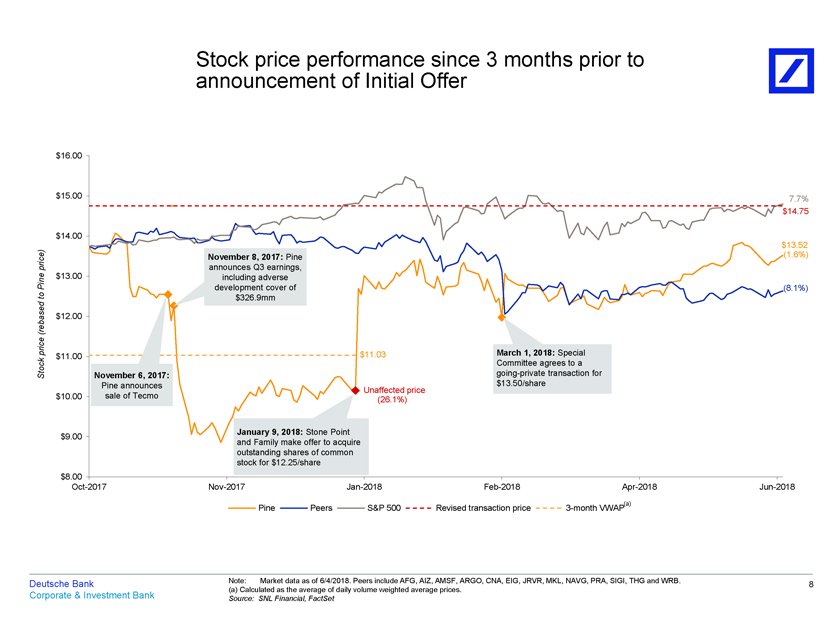

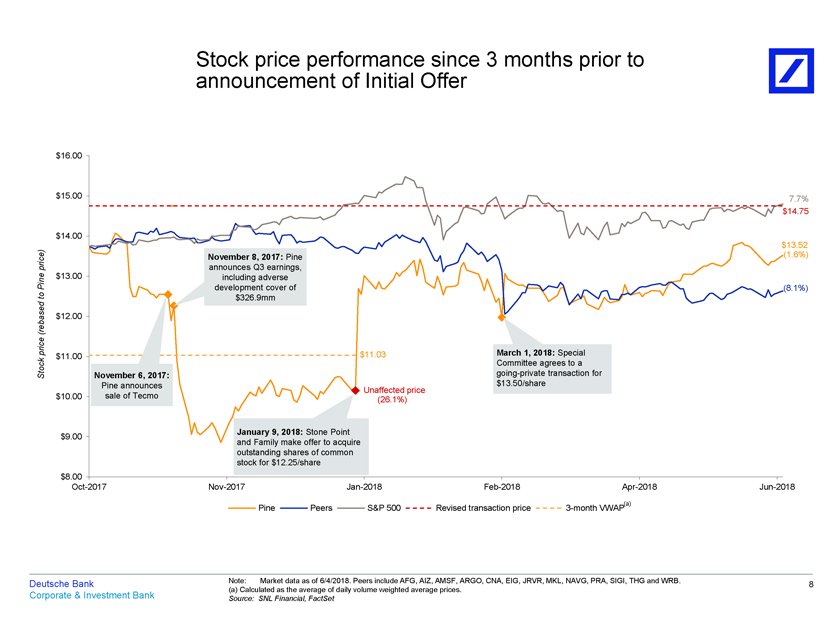

Stock price performance since 3 months prior to announcement of Initial Offer $16.00 $15.00 7.7% $14.75 $14.00 $13.52 ) e November 8, 2017: Pine (1.6%) r ic announces Q3 earnings, p Pine $13.00 including adverse development cover of (8.1%) to $326.9mm e d ba s $12.00 r e ( p rice $11.00 $11.03 March 1, 2018: Special k c Committee agrees to a Sto November 6, 2017: going-private transaction for Pine announces Unaffected price $13.50/share $10.00 sale of Tecmo (26.1%) January 9, 2018: Stone Point $9.00 and Family make offer to acquire outstanding shares of common stock for $12.25/share $8.00Oct-2017Nov-2017Jan-2018Feb-2018Apr-2018Jun-2018 (a) Pine Peers S&P 500 Revised transaction price3-month VWAP Deutsche Bank Note: Market data as of 6/4/2018. Peers include AFG, AIZ, AMSF, ARGO, CNA, EIG, JRVR, MKL, NAVG, PRA, SIGI, THG and WRB. 8 (a) Calculated as the average of daily volume weighted average prices. Corporate & Investment Bank Source: SNL Financial, FactSet

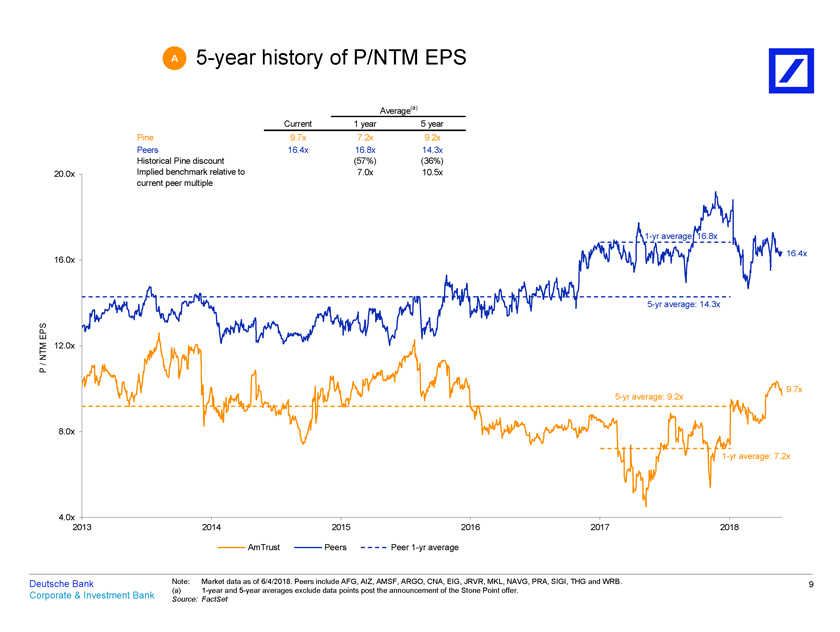

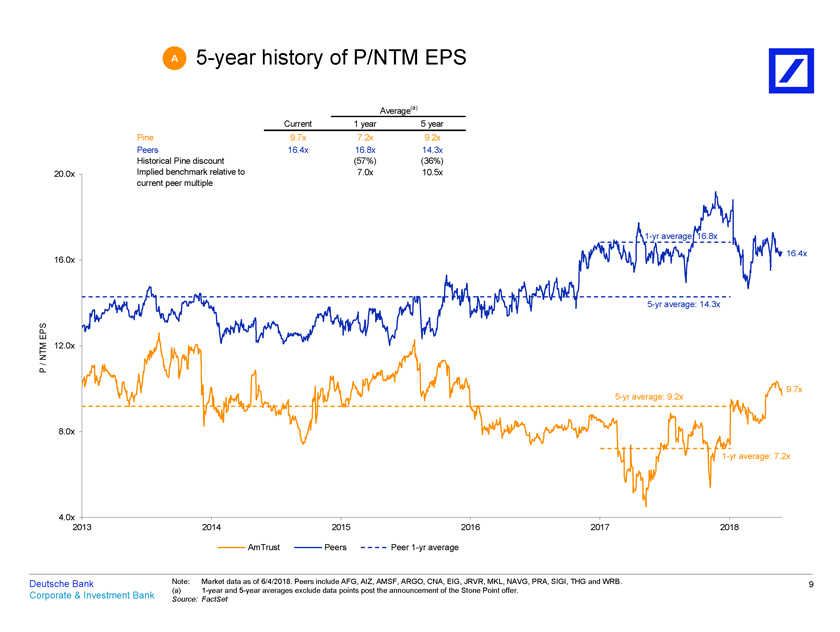

A5-year history of P/NTM EPS Average(a) Current 1 year 5 year Pine 9.7x 7.2x 9.2x Peers 16.4x 16.8x 14.3x Historical Pine discount (57%) (36%) 20.0x Implied benchmark relative to 7.0x 10.5x current peer multiple1-yr average: 16.8x 16.4x 16.0x5-yr average: 14.3x P S E TM 12.0x N / P5-yr average: 9.2x 9.7x 8.0x1-yr average: 7.2x 4.0x 2013 2014 2015 2016 2017 2018 AmTrust Peers Peer1-yr average Deutsche Bank Note: Market data as of 6/4/2018. Peers include AFG, AIZ, AMSF, ARGO, CNA, EIG, JRVR, MKL, NAVG, PRA, SIGI, THG and WRB. 9 (a)1-year and5-year averages exclude data points post the announcement of the Stone Point offer. Corporate & Investment Bank Source: FactSet

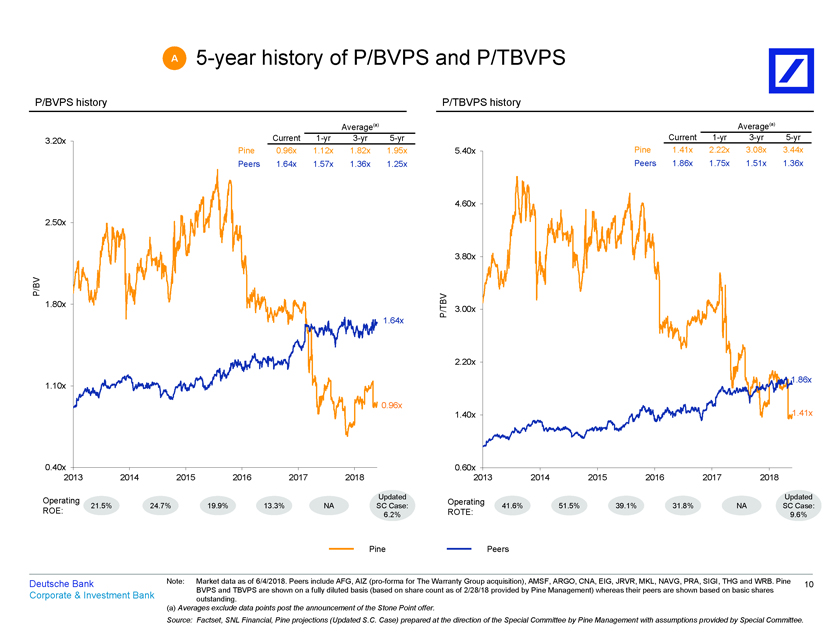

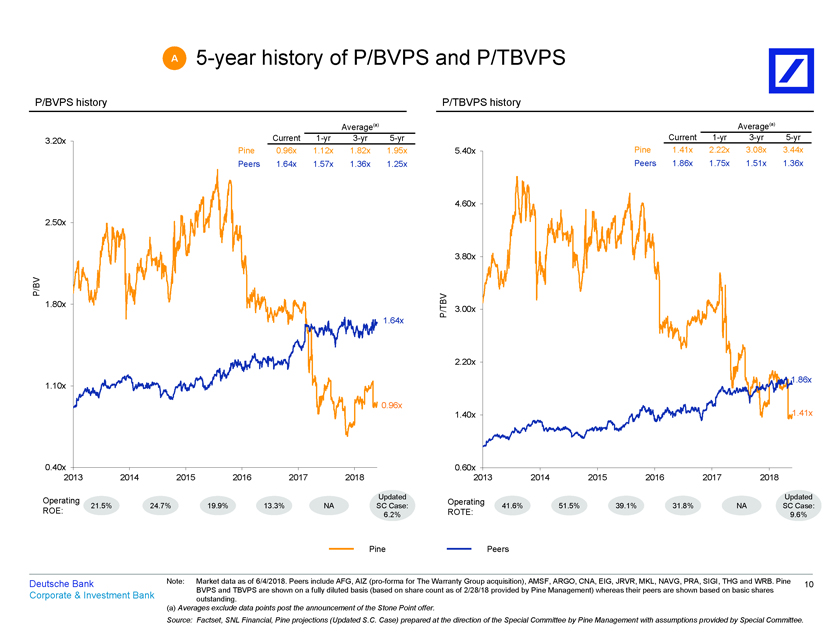

A5-year history of P/BVPS and P/TBVPS P/BVPS history P/TBVPS history Average(a) Average(a) 3.20x Current1-yr3-yr5-yr Current1-yr3-yr5-yr Pine 0.96x 1.12x 1.82x 1.95x 5.40x Pine 1.41x 2.22x 3.08x 3.44x Peers 1.64x 1.57x 1.36x 1.25x Peers 1.86x 1.75x 1.51x 1.36x 4.60x 2.50x 3.80x P/BV V 1.80x TB P / 3.00x 1.64x 2.20x 1.86x 1.10x 0.96x 1.41x 1.40x 0.40x 0.60x 2013 2014 2015 2016 2017 2018 2013 2014 2015 2016 2017 2018 Operating Updated Updated Operating 21.5% 24.7% 19.9% 13.3% NA SC Case: 41.6% 51.5% 39.1% 31.8% NA SC Case: ROE: ROTE: 6.2% 9.6% Pine Peers Deutsche Bank Note: Market data as of 6/4/2018. Peers include AFG, AIZ(pro-forma for The Warranty Group acquisition), AMSF, ARGO, CNA, EIG, JRVR, MKL, NAVG, PRA, SIGI, THG and WRB. Pine 10 BVPS and TBVPS are shown on a fully diluted basis (based on share count as of 2/28/18 provided by Pine Management) whereas their peers are shown based on basic shares Corporate & Investment Bank outstanding. (a) Averages exclude data points post the announcement of the Stone Point offer. Source: Factset, SNL Financial, Pine projections (Updated S.C. Case) prepared at the direction of the Special Committee by Pine Management with assumptions provided by Special Committee.

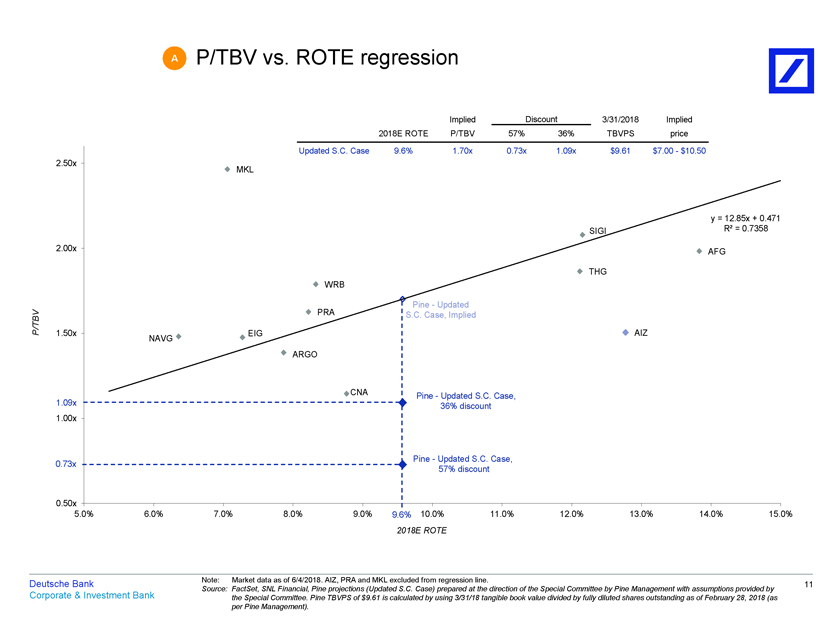

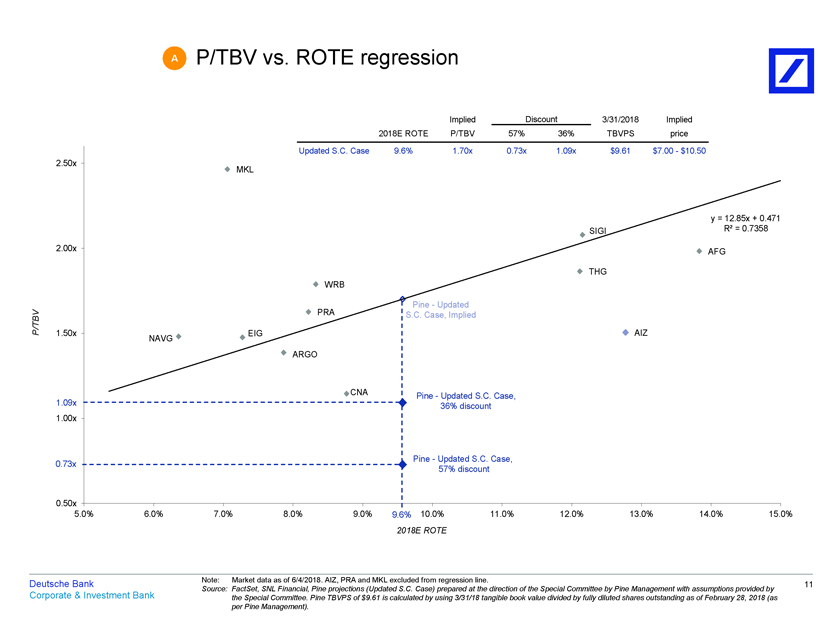

A P/TBV vs. ROTE regression Implied Discount 3/31/2018 Implied 2018E ROTE P/TBV 57% 36% TBVPS price Updated S.C. Case 9.6% 1.70x 0.73x 1.09x $9.61 $7.00—$10.50 2.50x MKL y = 12.85x + 0.471 SIGI R² = 0.7358 2.00x AFG THG WRB PRA Pine—Updated /TBV S.C. Case, Implied P 1.50x EIG AIZ NAVG ARGO CNA Pine—Updated S.C. Case, 1.09x 36% discount 1.00x Pine—Updated S.C. Case, 0.73x 57% discount 0.50x 5.0% 6.0% 7.0% 8.0% 9.0% 9.6% 10.0% 11.0% 12.0% 13.0% 14.0% 15.0% 2018E ROTE Deutsche Bank Note: Market data as of 6/4/2018. AIZ, PRA and MKL excluded from regression line. 11 Source: FactSet, SNL Financial, Pine projections (Updated S.C. Case) prepared at the direction of the Special Committee by Pine Management with assumptions provided by Corporate & Investment Bank the Special Committee. Pine TBVPS of $9.61 is calculated by using 3/31/18 tangible book value divided by fully diluted shares outstanding as of February 28, 2018 (as per Pine Management).

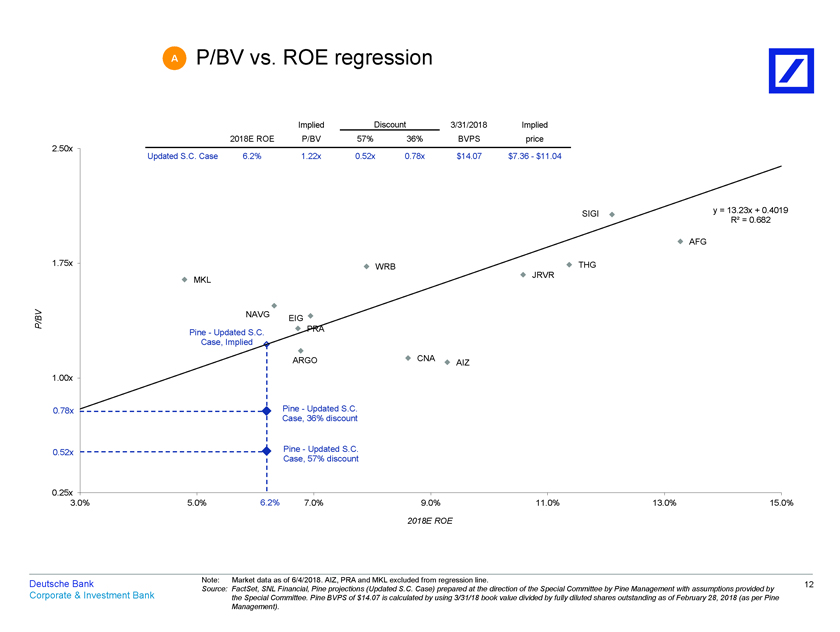

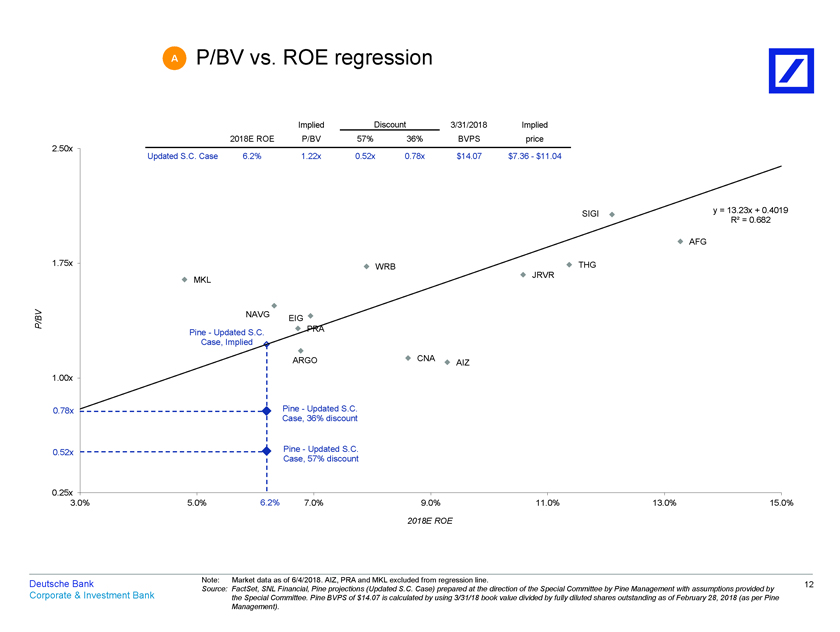

A P/BV vs. ROE regression Implied Discount 3/31/2018 Implied 2018E ROE P/BV 57% 36% BVPS price 2.50x Updated S.C. Case 6.2% 1.22x 0.52x 0.78x $14.07 $7.36—$11.04 SIGI y = 13.23x + 0.4019 R² = 0.682 AFG 1.75x WRB THG JRVR MKL P/BV NAVG EIG Pine—Updated S.C. PRA Case, Implied ARGO CNA AIZ 1.00x 0.78x Pine—Updated S.C. Case, 36% discount 0.52x Pine—Updated S.C. Case, 57% discount 0.25x 3.0% 5.0% 6.2% 7.0% 9.0% 11.0% 13.0% 15.0% 2018E ROE Deutsche Bank Note: Market data as of 6/4/2018. AIZ, PRA and MKL excluded from regression line. 12 Source: FactSet, SNL Financial, Pine projections (Updated S.C. Case) prepared at the direction of the Special Committee by Pine Management with assumptions provided by Corporate & Investment Bank the Special Committee. Pine BVPS of $14.07 is calculated by using 3/31/18 book value divided by fully diluted shares outstanding as of February 28, 2018 (as per Pine Management).

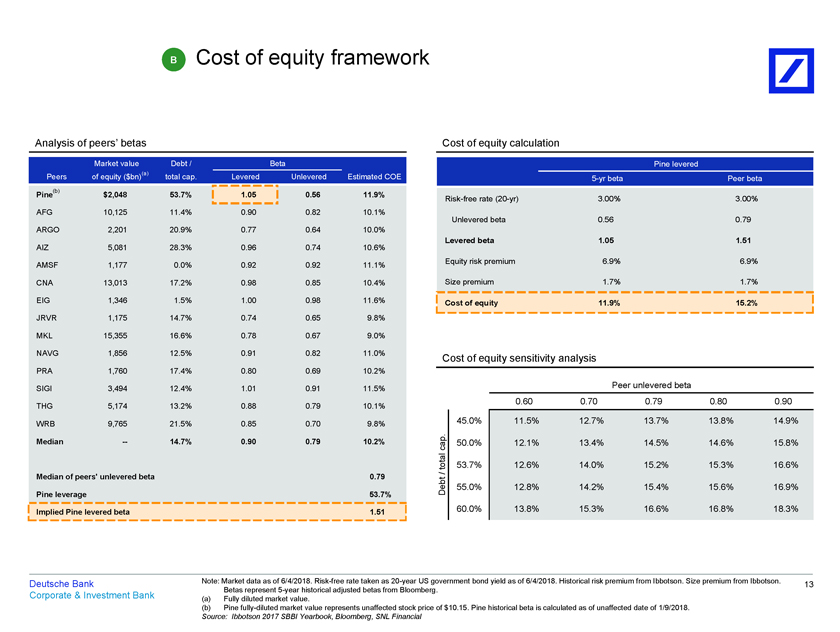

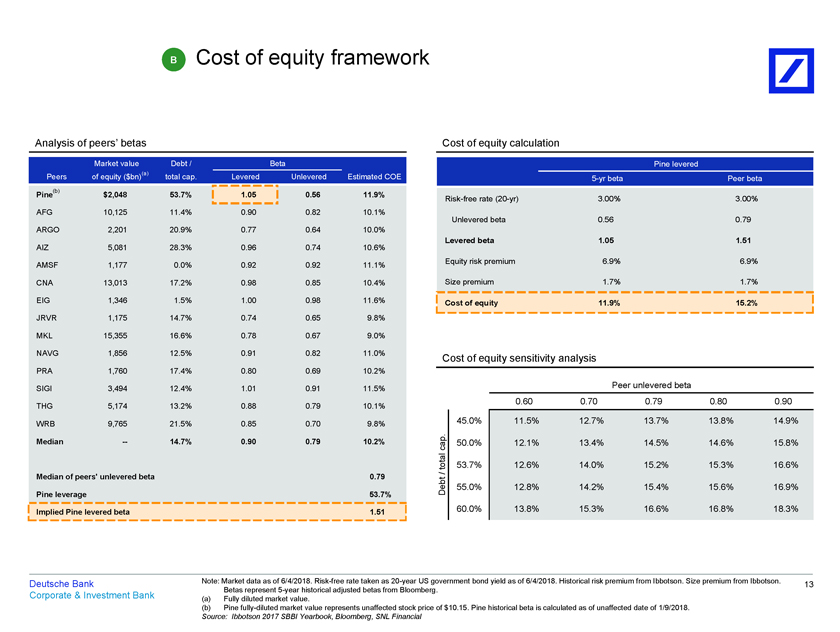

B Cost of equity framework Analysis of peers’ betas Cost of equity calculation Market value Debt / Beta Pine levered Peers of equity ($bn)(a) total cap. Levered Unlevered Estimated COE5-yr beta Peer beta (b) Pine $2,048 53.7% 1.05 0.56 11.9% Risk-free rate(20-yr) 3.00% 3.00% AFG 10,125 11.4% 0.90 0.82 10.1% Unlevered beta 0.56 0.79 ARGO 2,201 20.9% 0.77 0.64 10.0% AIZ 5,081 28.3% 0.96 0.74 10.6% Levered beta 1.05 1.51 Equity risk premium 6.9% 6.9% AMSF 1,177 0.0% 0.92 0.92 11.1% CNA 13,013 17.2% 0.98 0.85 10.4% Size premium 1.7% 1.7% EIG 1,346 1.5% 1.00 0.98 11.6% Cost of equity 11.9% 15.2% JRVR 1,175 14.7% 0.74 0.65 9.8% MKL 15,355 16.6% 0.78 0.67 9.0% NAVG 1,856 12.5% 0.91 0.82 11.0% Cost of equity sensitivity analysis PRA 1,760 17.4% 0.80 0.69 10.2% SIGI 3,494 12.4% 1.01 0.91 11.5% Peer unlevered beta 0.60 0.70 0.79 0.80 0.90 THG 5,174 13.2% 0.88 0.79 10.1% WRB 9,765 21.5% 0.85 0.70 9.8% 45.0% 11.5% 12.7% 13.7% 13.8% 14.9% . Median — 14.7% 0.90 0.79 10.2% cap 50.0% 12.1% 13.4% 14.5% 14.6% 15.8% l tota 53.7% 12.6% 14.0% 15.2% 15.3% 16.6% / Median of peers’ unlevered beta 0.79 Pine leverage 53.7% Debt 55.0% 12.8% 14.2% 15.4% 15.6% 16.9% Implied Pine levered beta 1.51 60.0% 13.8% 15.3% 16.6% 16.8% 18.3% Deutsche Bank Note: Market data as of 6/4/2018. Risk-free rate taken as20-year US government bond yield as of 6/4/2018. Historical risk premium from Ibbotson. Size premium from Ibbotson. 13 Betas represent5-year historical adjusted betas from Bloomberg. Corporate & Investment Bank (a) Fully diluted market value. (b) Pine fully-diluted market value represents unaffected stock price of $10.15. Pine historical beta is calculated as of unaffected date of 1/9/2018. Source: Ibbotson 2017 SBBI Yearbook, Bloomberg, SNL Financial

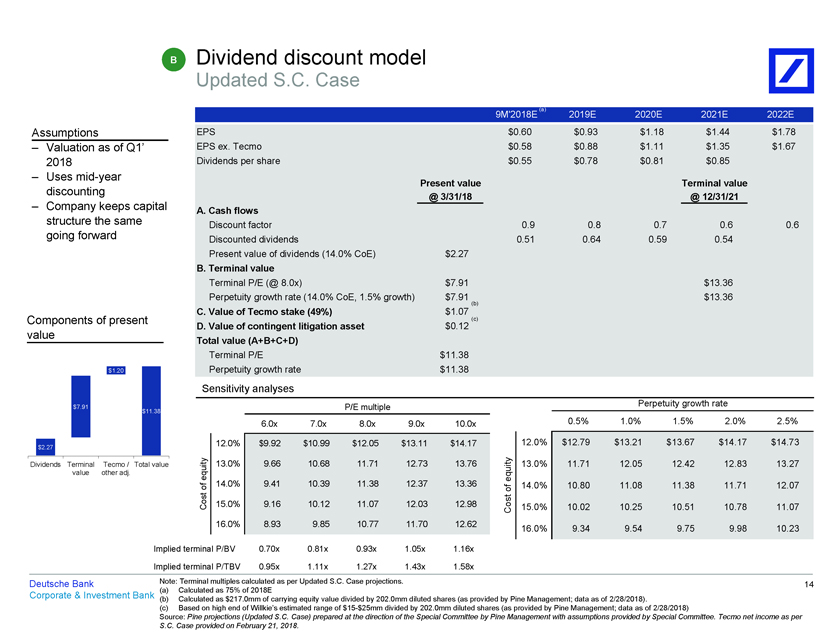

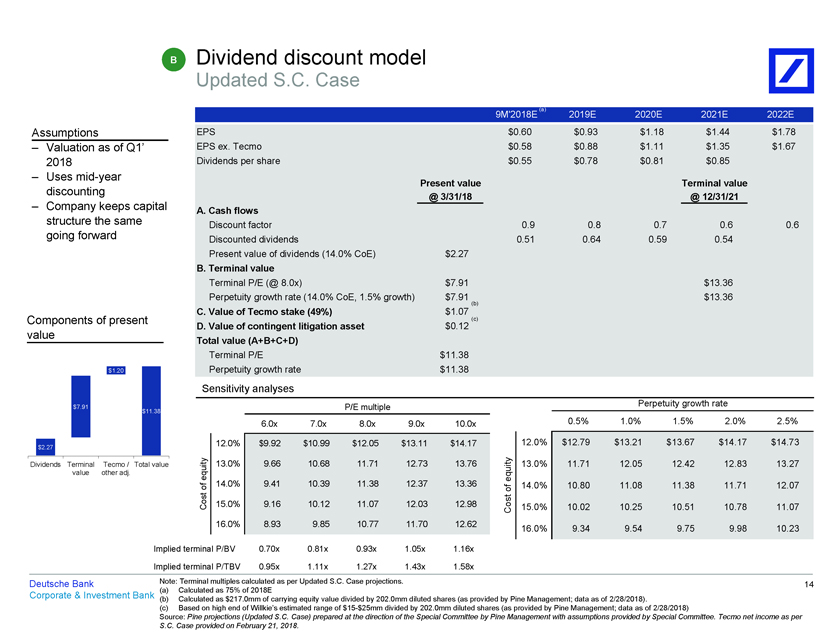

B Dividend discount model Updated S.C. Case (a) 9M’2018E 2019E 2020E 2021E 2022E Assumptions EPS $0.60 $0.93 $1.18 $1.44 $1.78 – Valuation as of Q1’ EPS ex. Tecmo $0.58 $0.88 $1.11 $1.35 $1.67 2018 Dividends per share $0.55 $0.78 $0.81 $0.85 – Usesmid-year Present value Terminal value discounting – Company keeps capital @ 3/31/18 @ 12/31/21 A. Cash flows structure the same Discount factor 0.9 0.8 0.7 0.6 0.6 going forward Discounted dividends 0.51 0.64 0.59 0.54 Present value of dividends (14.0% CoE) $2.27 B. Terminal value Terminal P/E (@ 8.0x) $7.91 $13.36 Perpetuity growth rate (14.0% CoE, 1.5% growth) $7.91 (b) $13.36 C. Value of Tecmo stake (49%) $1.07 Components of present D. Value of contingent litigation asset $0.12 (c) value Total value (A+B+C+D) Terminal P/E $11.38 $1.20 Perpetuity growth rate $11.38 Sensitivity analyses $7.91 P/E multiple Perpetuity growth rate $11.38 $11.38 6.0x 7.0x 8.0x 9.0x 10.0x $11.38 0.5% 1.0% 1.5% 2.0% 2.5% 12.0% $9.92 $10.99 $12.05 $13.11 $14.17 12.0% $12.79 $13.21 $13.67 $14.17 $14.73 $2.27 Dividends Terminal Tecmo / Total value 13.0% 9.66 10.68 11.71 12.73 13.76 13.0% 11.71 12.05 12.42 12.83 13.27 value other adj. equity equity of 14.0% 9.41 10.39 11.38 12.37 13.36of 14.0% 10.80 11.08 11.38 11.71 12.07 st st Co 15.0% 9.16 10.12 11.07 12.03 12.98 Co 15.0% 10.02 10.25 10.51 10.78 11.07 16.0% 8.93 9.85 10.77 11.70 12.62 16.0% 9.34 9.54 9.75 9.98 10.23 Implied terminal P/BV 0.70x 0.81x 0.93x 1.05x 1.16x Implied terminal P/TBV 0.95x 1.11x 1.27x 1.43x 1.58x Deutsche Bank Note: Terminal multiples calculated as per Updated S.C. Case projections. 14 (a) Calculated as 75% of 2018E Corporate & Investment Bank (b) Calculated as $217.0mm of carrying equity value divided by 202.0mm diluted shares (as provided by Pine Management; data as of 2/28/2018). (c) Based on high end of Willkie’s estimated range of$15-$25mm divided by 202.0mm diluted shares (as provided by Pine Management; data as of 2/28/2018) Source: Pine projections (Updated S.C. Case) prepared at the direction of the Special Committee by Pine Management with assumptions provided by Special Committee. Tecmo net income as per S.C. Case provided on February 21, 2018.

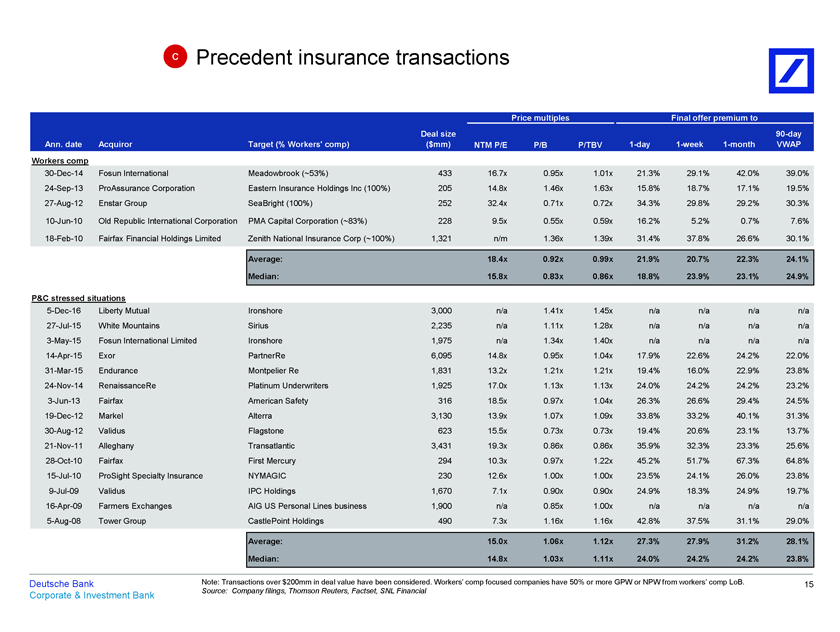

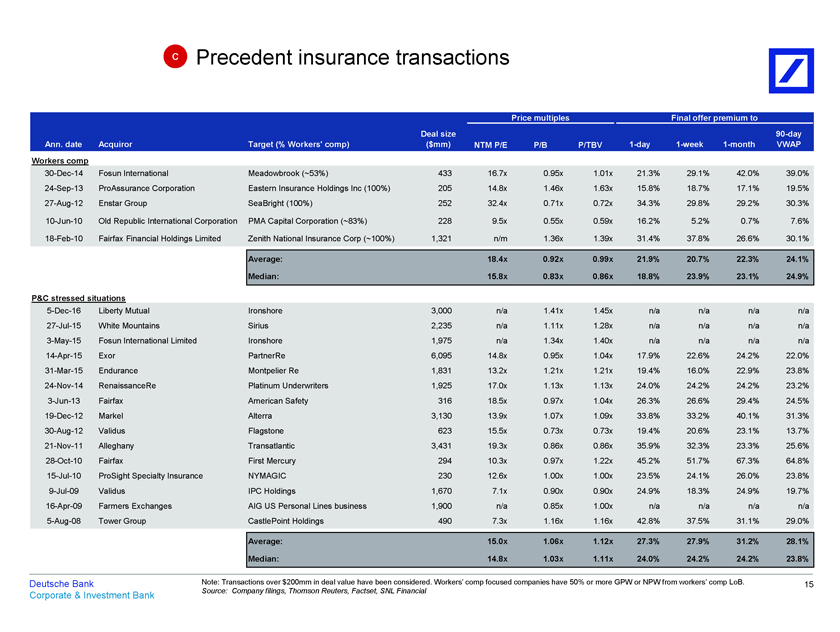

C Precedent insurance transactions Price multiples Final offer premium to Deal size90-day Ann. date Acquiror Target (% Workers’ comp) ($mm) NTM P/E P/B P/TBV1-day1-week1-month VWAP Workers comp30-Dec-14 Fosun International Meadowbrook (~53%) 433 16.7x 0.95x 1.01x 21.3% 29.1% 42.0% 39.0%24-Sep-13 ProAssurance Corporation Eastern Insurance Holdings Inc (100%) 205 14.8x 1.46x 1.63x 15.8% 18.7% 17.1% 19.5%27-Aug-12 Enstar Group SeaBright (100%) 252 32.4x 0.71x 0.72x 34.3% 29.8% 29.2% 30.3%10-Jun-10 Old Republic International Corporation PMA Capital Corporation (~83%) 228 9.5x 0.55x 0.59x 16.2% 5.2% 0.7% 7.6%18-Feb-10 Fairfax Financial Holdings Limited Zenith National Insurance Corp (~100%) 1,321 n/m 1.36x 1.39x 31.4% 37.8% 26.6% 30.1% Average: 18.4x 0.92x 0.99x 21.9% 20.7% 22.3% 24.1% Median: 15.8x 0.83x 0.86x 18.8% 23.9% 23.1% 24.9% P&C stressed situations5-Dec-16 Liberty Mutual Ironshore 3,000 n/a 1.41x 1.45x n/a n/a n/a n/a27-Jul-15 White Mountains Sirius 2,235 n/a 1.11x 1.28x n/a n/a n/a n/a3-May-15 Fosun International Limited Ironshore 1,975 n/a 1.34x 1.40x n/a n/a n/a n/a14-Apr-15 Exor PartnerRe 6,095 14.8x 0.95x 1.04x 17.9% 22.6% 24.2% 22.0%31-Mar-15 Endurance Montpelier Re 1,831 13.2x 1.21x 1.21x 19.4% 16.0% 22.9% 23.8%24-Nov-14 RenaissanceRe Platinum Underwriters 1,925 17.0x 1.13x 1.13x 24.0% 24.2% 24.2% 23.2%3-Jun-13 Fairfax American Safety 316 18.5x 0.97x 1.04x 26.3% 26.6% 29.4% 24.5%19-Dec-12 Markel Alterra 3,130 13.9x 1.07x 1.09x 33.8% 33.2% 40.1% 31.3%30-Aug-12 Validus Flagstone 623 15.5x 0.73x 0.73x 19.4% 20.6% 23.1% 13.7%21-Nov-11 Alleghany Transatlantic 3,431 19.3x 0.86x 0.86x 35.9% 32.3% 23.3% 25.6%28-Oct-10 Fairfax First Mercury 294 10.3x 0.97x 1.22x 45.2% 51.7% 67.3% 64.8%15-Jul-10 ProSight Specialty Insurance NYMAGIC 230 12.6x 1.00x 1.00x 23.5% 24.1% 26.0% 23.8%9-Jul-09 Validus IPC Holdings 1,670 7.1x 0.90x 0.90x 24.9% 18.3% 24.9% 19.7%16-Apr-09 Farmers Exchanges AIG US Personal Lines business 1,900 n/a 0.85x 1.00x n/a n/a n/a n/a5-Aug-08 Tower Group CastlePoint Holdings 490 7.3x 1.16x 1.16x 42.8% 37.5% 31.1% 29.0% Average: 15.0x 1.06x 1.12x 27.3% 27.9% 31.2% 28.1% Median: 14.8x 1.03x 1.11x 24.0% 24.2% 24.2% 23.8% Deutsche Bank Note: Transactions over $200mm in deal value have been considered. Workers’ comp focused companies have 50% or more GPW or NPW from workers’ comp LoB. 15 Corporate & Investment Bank Source: Company filings, Thomson Reuters, Factset, SNL Financial

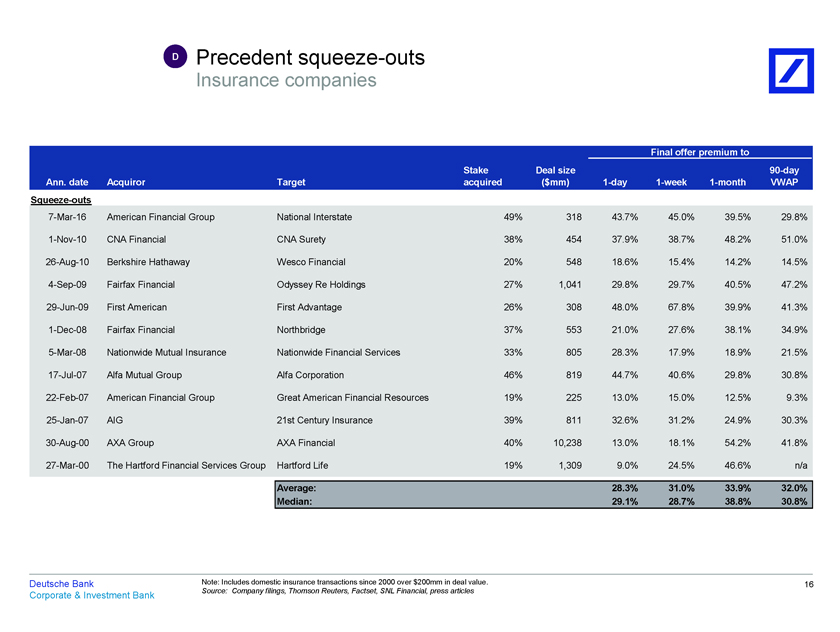

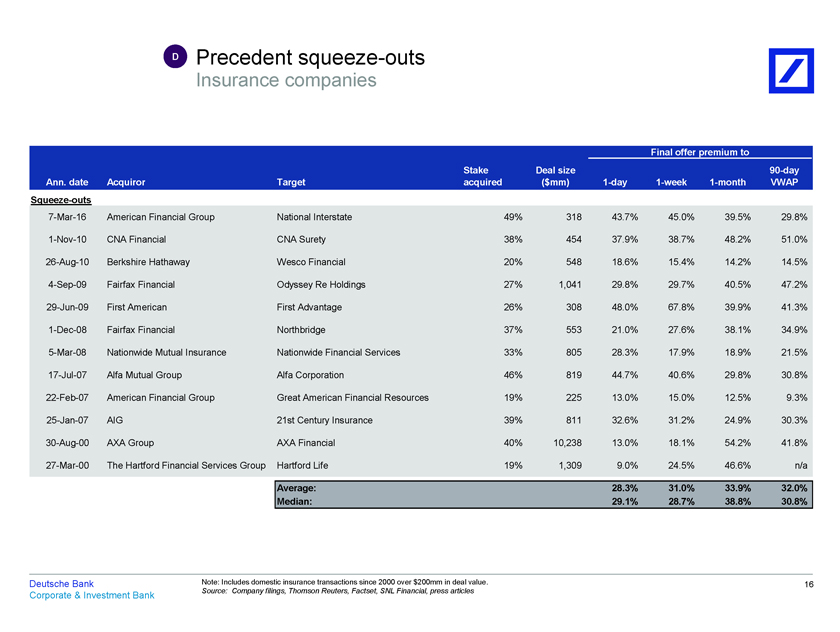

D Precedentsqueeze-outs Insurance companies Final offer premium to Stake Deal size90-day Ann. date Acquiror Target acquired ($mm)1-day1-week1-month VWAPSqueeze-outs7-Mar-16 American Financial Group National Interstate 49% 318 43.7% 45.0% 39.5% 29.8%1-Nov-10 CNA Financial CNA Surety 38% 454 37.9% 38.7% 48.2% 51.0%26-Aug-10 Berkshire Hathaway Wesco Financial 20% 548 18.6% 15.4% 14.2% 14.5%4-Sep-09 Fairfax Financial Odyssey Re Holdings 27% 1,041 29.8% 29.7% 40.5% 47.2%29-Jun-09 First American First Advantage 26% 308 48.0% 67.8% 39.9% 41.3%1-Dec-08 Fairfax Financial Northbridge 37% 553 21.0% 27.6% 38.1% 34.9%5-Mar-08 Nationwide Mutual Insurance Nationwide Financial Services 33% 805 28.3% 17.9% 18.9% 21.5%17-Jul-07 Alfa Mutual Group Alfa Corporation 46% 819 44.7% 40.6% 29.8% 30.8%22-Feb-07 American Financial Group Great American Financial Resources 19% 225 13.0% 15.0% 12.5% 9.3%25-Jan-07 AIG 21st Century Insurance 39% 811 32.6% 31.2% 24.9% 30.3%30-Aug-00 AXA Group AXA Financial 40% 10,238 13.0% 18.1% 54.2% 41.8%27-Mar-00 The Hartford Financial Services Group Hartford Life 19% 1,309 9.0% 24.5% 46.6% n/a Average: 28.3% 31.0% 33.9% 32.0% Median: 29.1% 28.7% 38.8% 30.8% Deutsche Bank Note: Includes domestic insurance transactions since 2000 over $200mm in deal value. 16 Corporate & Investment Bank Source: Company filings, Thomson Reuters, Factset, SNL Financial, press articles

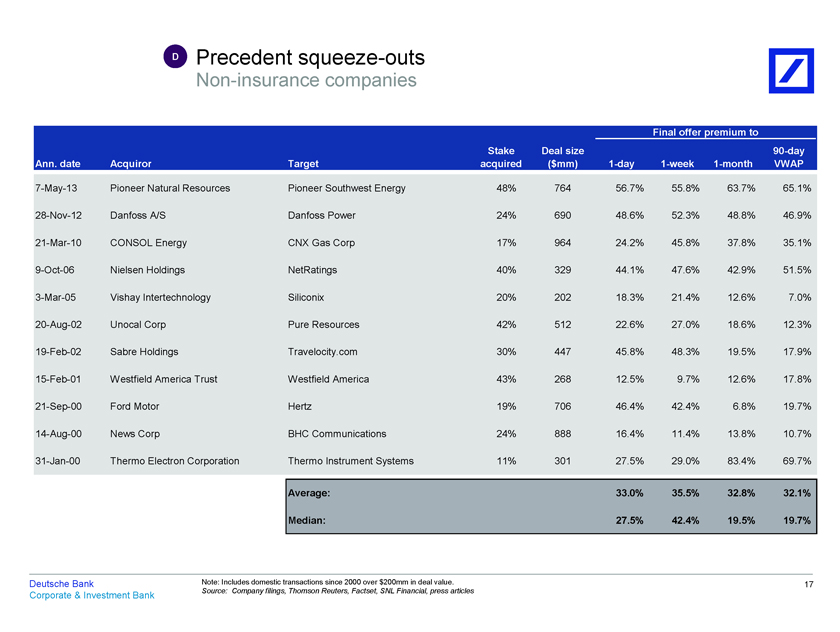

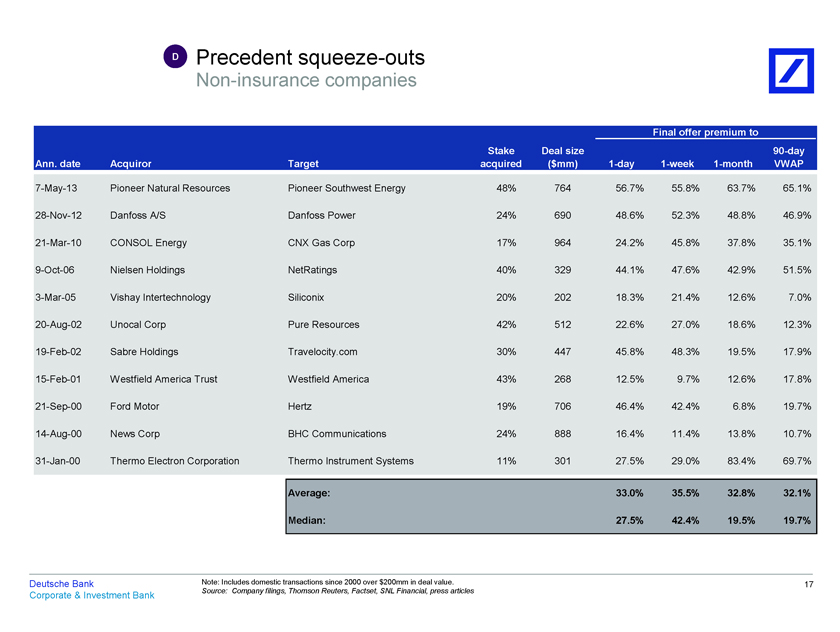

D Precedentsqueeze-outsNon-insurance companies Final offer premium to Stake Deal size90-day Ann. date Acquiror Target acquired ($mm)1-day1-week1-month VWAP7-May-13 Pioneer Natural Resources Pioneer Southwest Energy 48% 764 56.7% 55.8% 63.7% 65.1%28-Nov-12 Danfoss A/S Danfoss Power 24% 690 48.6% 52.3% 48.8% 46.9%21-Mar-10 CONSOL Energy CNX Gas Corp 17% 964 24.2% 45.8% 37.8% 35.1%9-Oct-06 Nielsen Holdings NetRatings 40% 329 44.1% 47.6% 42.9% 51.5%3-Mar-05 Vishay Intertechnology Siliconix 20% 202 18.3% 21.4% 12.6% 7.0%20-Aug-02 Unocal Corp Pure Resources 42% 512 22.6% 27.0% 18.6% 12.3%19-Feb-02 Sabre Holdings Travelocity.com 30% 447 45.8% 48.3% 19.5% 17.9%15-Feb-01 Westfield America Trust Westfield America 43% 268 12.5% 9.7% 12.6% 17.8%21-Sep-00 Ford Motor Hertz 19% 706 46.4% 42.4% 6.8% 19.7%14-Aug-00 News Corp BHC Communications 24% 888 16.4% 11.4% 13.8% 10.7%31-Jan-00 Thermo Electron Corporation Thermo Instrument Systems 11% 301 27.5% 29.0% 83.4% 69.7% Average: 33.0% 35.5% 32.8% 32.1% Median: 27.5% 42.4% 19.5% 19.7% Deutsche Bank Note: Includes domestic transactions since 2000 over $200mm in deal value. 17 Corporate & Investment Bank Source: Company filings, Thomson Reuters, Factset, SNL Financial, press articles

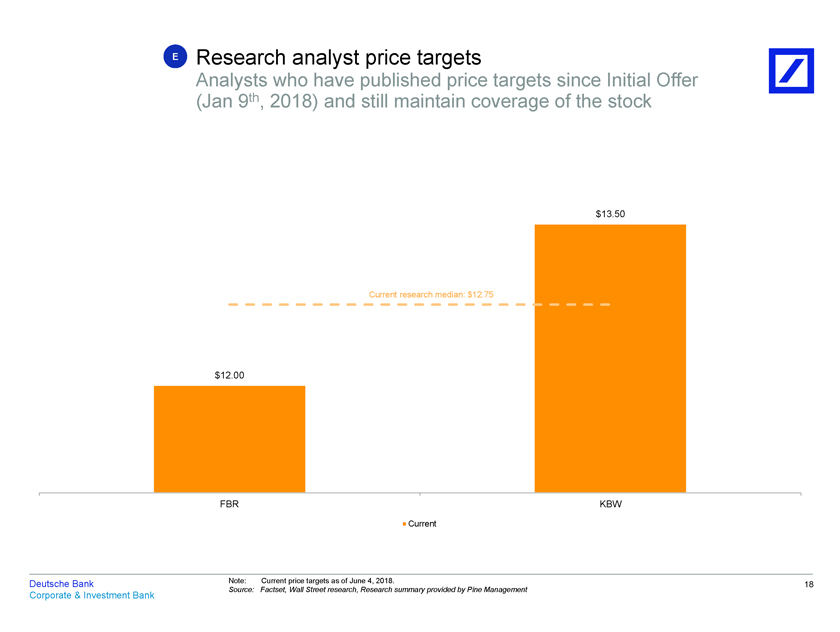

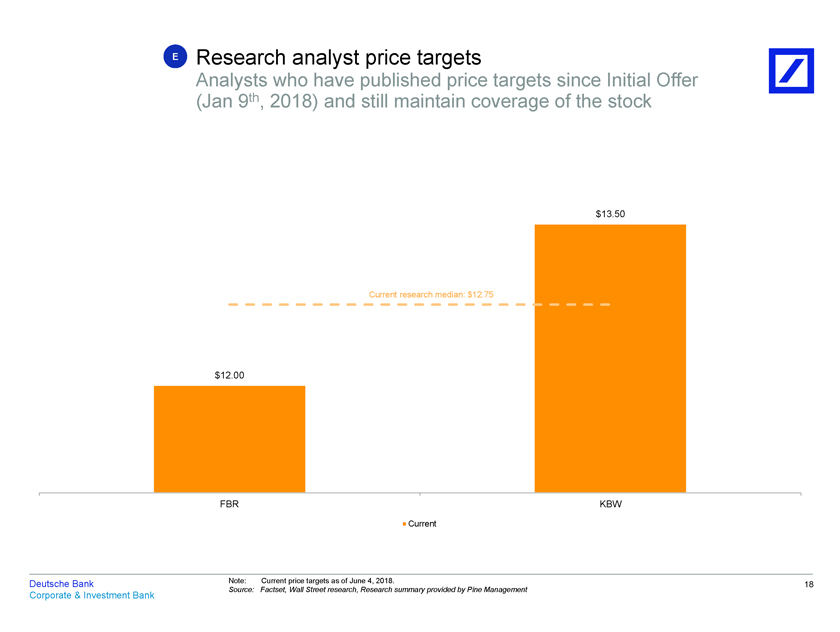

E Research analyst price targets Analysts who have published price targets since Initial Offer (Jan 9th, 2018) and still maintain coverage of the stock $13.50 Current research median: $12.75 $12.00 FBR KBW Current Deutsche Bank Note: Current price targets as of June 4, 2018. 18 Source: Factset, Wall Street research, Research summary provided by Pine Management Corporate & Investment Bank

“IMPORTANT: This presentation (the “Presentation”) has been prepared by Deutsche Bank’s investment banking department for the benefit and internal use of the recipient (the “Recipient”) to whom it is addressed. Neither Deutsche Bank AG New York Branch, Deutsche Bank Trust Company Americas (“DBTCA”) nor any of their banking affiliates is responsible for the obligations of Deutsche Bank Securities Inc. or any U.S. Broker-dealer affiliate. Unless specified otherwise, deposit products are provided by DBTCA, Member FDIC. The Recipient is not permitted to reproduce in whole or in part the information provided in this Presentation (the “Information”) or to communicate the Information to any third party without our prior written consent. No party may rely on this Presentation without our prior written consent. Deutsche Bank and its affiliates, officers, directors, employees and agents do not accept responsibility or liability for this Presentation or its contents (except to the extent that such liability cannot be excluded by law). This Presentation is (i) for discussion purposes only; and (ii) speaks only as of the date it is given, reflecting prevailing market conditions and the views expressed are subject to change based upon a number of factors, including market conditions and the Recipient’s business and prospects. The Information, whether taken from public sources, received from the Recipient or elsewhere, has not been verified and Deutsche Bank has relied upon and assumed without independent verification, the accuracy and completeness of all information which may have been provided directly or indirectly by the Recipient. No representation or warranty is made as to the Information’s accuracy or completeness and Deutsche Bank assumes no obligation to update the Information. The Presentation is incomplete without reference to, and should be viewed solely in conjunction with, the oral briefing provided by Deutsche Bank. The analyses contained in the Presentation are not, and do not purport to be, appraisals of the assets, stock, or business of the Recipient. The Information does not take into account the effects of a possible transaction or transactions involving an actual or potential change of control, which may have significant valuation and other effects. The Presentation is not exhaustive and does not serve as legal, accounting, tax, investment or any other kind of advice. This Presentation is not intended to provide, and must not be taken as, the basis of any decision and should not be considered as a recommendation by Deutsche Bank. Recipient must make its own independent assessment and such investigations as it deems necessary. In preparing this presentation Deutsche Bank has acted as an independent contractor and nothing in this presentation is intended to create or shall be construed as creating a fiduciary or other relationship between the Recipient and Deutsche Bank.” Deutsche Bank Corporate & Investment Bank