UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-21910

Claymore Exchange-Traded Fund Trust 2

(Exact name of registrant as specified in charter)

| | |

| 2455 Corporate West Drive, Lisle, IL | | 60532 |

| (Address of principal executive offices) | | (Zip code) |

Nicholas Dalmaso,

2455 Corporate West Drive, Lisle, IL 60532

(Name and address of agent for service)

Registrant’s telephone number, including area code: (630) 505-3700

Date of fiscal year end: August 31

Date of reporting period: August 31, 2007

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. Section 3507.

| Item 1. | Reports to Stockholders. |

The registrant’s annual report transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940, as amended (the “Investment Company Act”), is as follows:

www.claymore.com

… your road to the LATEST,

most up-to-date INFORMATION about the

Claymore Exchange-Traded Fund Trust 2

Contents

The shareholder report you are reading right now is just the beginning of the story. Online at www.claymore.com, you will find:

| | • | | Daily and historical fund pricing, fund returns, portfolio holdings and characteristics, and distribution history. |

| | • | | Investor guides and fund fact sheets. |

| | • | | Regulatory documents including a prospectus and copies of shareholder reports. |

Claymore Securities is constantly updating and expanding shareholder information services on each Fund’s website, in an ongoing effort to provide you with the most current information about how your Fund’s assets are managed, and the results of our efforts. It is just one more small way we are working to keep you better informed about your investment.

2 | Annual Report | August 31, 2007

Claymore Exchange-Traded Fund Trust 2

Dear Shareholder |

As Investment Adviser, Claymore Advisors, LLC (“Claymore”) is delighted to present the first annual shareholder report for three of our newly launched exchange-traded funds (“ETFs” or “Funds”). This report covers performance of these Funds from their inception through August 31, 2007.

Two of these ETFs commenced operations on March 1, 2007. They are:

| | • | | Claymore/Robeco Developed International Equity ETF (ticker: “EEN”) |

| | • | | Claymore/Robeco Developed World Equity ETF (ticker: “EEW”) |

The third Fund commenced operations on May 14, 2007. It is:

| | • | | Claymore S&P Global Water Index ETF (ticker: “CGW”) |

The investment objective of each Fund is to seek investment results that correspond generally to the performance, before each Fund’s fees and expenses, of its respective underlying index as named in its prospectus.

Claymore is committed to providing investors with innovative index-strategy-driven investment solutions. Accordingly, in addition to these three global-themed ETFs, during the last 12 months we have launched six other global-themed ETFs and 25 domestic-equity oriented ETFs as of August 31, 2007. Claymore has partnered with a diverse group of index providers to create some of the most distinctive ETFs currently available. The index providers design indices using defined selection methodologies in the creation of their indices. Unlike ETFs that track traditional indices representing broad market participation, the indices that many of Claymore’s ETFs track seek to capture the investment potential of unique strategies. We believe that a strategy-driven, quantitative process provides a disciplined investment approach offering the potential for superior performance over market cycles.

To learn more about the performance of each ETF, we encourage you to read the Management Discussion of Fund Performance section of the report, which begins on page 4.

|

| Sincerely, |

|

|

| Nicholas Dalmaso |

| Chief Executive Officer |

| Claymore Exchange-Traded Fund Trust 2 |

Annual Report | August 31, 2007 | 3

Claymore Exchange-Traded Fund Trust 2

Management Discussion of Fund Performance |

EEN | Claymore/Robeco Developed International Equity ETF

Fund Overview

The Claymore/Robeco Developed International Equity ETF (the “Fund”) seeks investment results that correspond generally to the performance, before the Fund’s fees and expenses, of an equity index called the Robeco Developed International Equity Index (the “Index”). The Fund will normally invest at least 90% of its total assets in equities that comprise the Index and in American depositary receipts (“ADRs”) based on the securities in the Index. The Fund generally will invest in all of the stocks comprising the Index in proportion to their weightings in the Index. Claymore Advisors, LLC, the Fund’s investment adviser (the “Investment Adviser”), seeks a correlation over time of 95% or better between the Fund’s performance and the performance of the Index.

Index constituents are selected from a universe of equities listed on international developed market exchanges. “Developed markets” are countries whose economies have high income levels, strong legal protection and sophisticated stock exchanges. The current list of international developed markets consists of Australia, Austria, Belgium, Denmark, Finland, France, Germany, Hong Kong, Ireland, Italy, Japan, Netherlands, New Zealand, Norway, Portugal, Singapore, Spain, Sweden, Switzerland, and the United Kingdom. The Index is comprised of, at any given time, between 100-200 stocks, selected based on liquidity, ease of trading, valuation and momentum measures and other criteria. The companies in the Index are selected and weighted using a proprietary methodology developed by Robeco Investment Management, Inc. (the “Index Provider”).

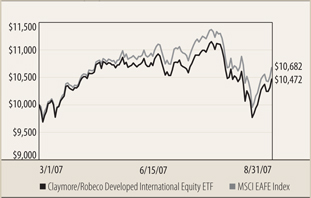

Fund Performance

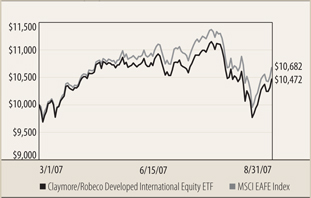

This report discusses an abbreviated annual fiscal period from the Fund’s inception date of March 1, 2007, through August 31, 2007.

On a market price basis, the Fund generated a total return of 4.97%, representing a change in market price to $25.35 on August 31, 2007, from $24.15 at inception. On a net asset value (“NAV”) basis, the Fund generated a total return of 4.72%, representing a change in NAV to $25.29 on August 31, 2007, from $24.15 at inception. At the end of the period the Fund’s shares were trading at a market price premium to NAV, which is to be expected from time to time. However, the Investment Adviser believes that large discounts or premiums to the NAV of the shares should not be sustained.

For index and broad market comparison purposes, the Index returned 5.49% and the Morgan Stanley Capital International Europe, Australasia and Far East Index (the “MSCI EAFE Index”) returned 7.27% for the same period. The MSCI EAFE Index is an unmanaged capitalization-weighted index that tracks international stock performance in the 21 developed markets of Europe, Australasia and the Far East. The index is calculated using closing local market prices and translated into US dollars using the London close foreign exchange rates. It is not possible to invest directly in an index.

Economic and Market Overview

The global economy continues to expand at or somewhat above its longer-term trend. Economies in Europe have been strong, and inflation remains modest. Asian economic growth has been driven by improving domestic demand, especially in China and India, and by export gains. Rates of resource utilization have increased, and energy prices have risen during 2007, heightening inflation risks. To guard against overly rapid growth, many central banks have moved toward mildly restraining monetary policies. In response to stronger growth and tighter monetary policies, real interest rates have risen and risk premiums have increased. Nonetheless, real interest rates remain modest by historical standards. Economic growth in Europe and Asia has reduced the reliance of the global economy on domestic demand in the U.S.

Trends in world stock markets have been generally positive during 2007; the strongest was China, up more than 50% from the end of 2006 through August 2007. European markets were up modestly, while the Japanese market was down somewhat during the first eight months of 2007.

Performance Attribution

The Fund’s strongest gains from the inception date of March 1, 2007, through August 31, 2007, were in the consumer goods sector, followed by the industrials and oil & gas sectors. Positioning in the financials and health care sectors detracted from performance. Holdings that contributed most to performance include Finnish mobile telephone producer Nokia OYJ, Japanese electronic game maker Nintendo Co. Ltd., and German automobile manufacturer Volkswagen AG (1.8%, 1.8% and 1.1% of total investments, respectively, as of 8/31/07). Holdings that detracted from performance include Swiss semiconductor producer Micronas Semiconductor Holding AG (not in the portfolio as of 8/31/07), global health care group GlaxoSmithKline PLC (not in the portfolio as of 8/31/07), and Japanese financial services firm Mitsubishi UFJ Financial Group Inc. (1.3% of total investments as of 8/31/07).

4 | Annual Report | August 31, 2007

Claymore Exchange-Traded Fund Trust 2 | Management Discussion of Fund Performance continued

EEW | Claymore/Robeco Developed World Equity ETF

Fund Overview

The Claymore/Robeco Developed World Equity ETF (the “Fund”) seeks investment results that correspond generally to the performance, before the Fund’s fees and expenses, of an equity index called the Robeco Developed World Equity Index (the “Index”). The Fund will normally invest at least 90% of its total assets in equities that comprise the Index and in American depositary receipts (“ADRs”) based on the securities in the Index. The Fund generally will invest in all of the stocks comprising the Index in proportion to their weightings in the Index. Claymore Advisors, LLC, the Fund’s investment adviser (the “Investment Adviser”), seeks a correlation over time of 95% or better between the Fund’s performance and the performance of the Index.

Index constituents are selected from a universe of equities listed on global developed market exchanges. Global developed markets are countries whose economies have high income levels, strong legal protection and sophisticated stock exchanges, including the U.S. and Canada. The current list of global developed markets consists of Australia, Austria, Belgium, Canada, Denmark, Finland, France, Germany, Hong Kong, Ireland, Italy, Japan, Netherlands, New Zealand, Norway, Portugal, Singapore, Spain, Sweden, Switzerland, the United Kingdom, and the U.S. The Robeco Developed World Equity Index is comprised of, at any given time, between 110-210 stocks, selected based on liquidity, ease of trading, valuation and momentum measures and other criteria. The companies in the Index are selected and weighted using a proprietary methodology developed by Robeco Investment Management, Inc. (the “Index Provider”).

Fund Performance

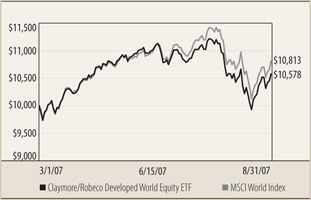

This report discusses an abbreviated annual fiscal period from the Fund’s inception date of March 1, 2007, through August 31, 2007.

On a market price basis, the Fund generated a total return of 6.53%, representing a change in market price to $25.78 on August 31, 2007, from $24.20 at inception. On a net asset value (“NAV”) basis, the Fund generated a total return of 5.78%, representing a change in NAV to $25.60 on August 31, 2007, from $24.20 at inception. At the end of the period the Fund’s shares were trading at a market price premium to NAV, which is to be expected from time to time. However, the Investment Adviser believes that large discounts or premiums to the NAV of the shares should not be sustained.

For index and broad market comparison purposes, the Index returned 6.54% and the Morgan Stanley Capital International World Index (the “MSCI World Index”) returned 6.99% for the same period. The MSCI World Index is an unmanaged, capitalization weighted measure of global stock markets, including the United States, Canada, Europe, Australia and the Far East. The index is calculated using closing market prices and converted to US dollars using the London close foreign exchange rates. It is not possible to invest directly in an index.

Economic and Market Overview

The global economy continues to expand at or somewhat above its longer-term trend. Economies in Europe have been strong, and inflation remains modest. Asian economic growth has been driven by improving domestic demand, especially in China and India, and by export gains. Rates of resource utilization have increased, and energy prices have risen during 2007, heightening inflation risks. To guard against overly rapid growth, many central banks have moved toward mildly restraining monetary policies. In response to stronger growth and tighter monetary policies, real interest rates have risen and risk premiums have increased. Nonetheless, real interest rates remain modest by historical standards. Economic growth in Europe and Asia has reduced the reliance of the global economy on domestic demand in the U.S.

Trends in world stock markets have been generally positive during 2007; the strongest was China, up more than 50% from the end of 2006 through August 2007. European markets were up modestly, while the Japanese market was down somewhat during the first eight months of 2007.

Performance Attribution

The Fund’s strongest gains from the Fund’s inception date of March 1, 2007, through August 31, 2007, were in the oil & gas sector, followed by the technology sector. Positioning in the financials and telecommunications sectors detracted from performance. Holdings that contributed most to performance include Japanese electronic game maker Nintendo Co. Ltd. and two U.S.-based integrated oil companies, Exxon Mobil Corporation and Chevron Corporation (0.9%, 2.5% and 1.4% of total investments, respectively, as of 8/31/07). Holdings that detracted include mortgage insurer MGIC Investment Corporation, Japanese financial services firm Mitsubishi UFJ Financial Group Inc. and global health care group GlaxoSmithKline PLC (0.3%, 1.0% and 0.1% of total investments, respectively, as of 8/31/07).

Annual Report | August 31, 2007 | 5

Claymore Exchange-Traded Fund Trust 2 | Management Discussion of Fund Performance continued

CGW | Claymore S&P Global Water Index ETF

Fund Overview

The Claymore S&P Global Water Index ETF (the “Fund”) seeks investment results that correspond generally to the performance, before the Fund’s fees and expenses, of an equity index called the S&P Global Water Index (the “Index”). The Index is comprised of 50 equity securities selected, based on investment and other criteria, from a universe of companies listed on global developed market exchanges. Specifically, all or any subset of the following countries/regions are currently considered to be developed markets – Austria, Australia, Belgium, Canada, Denmark, Finland, France, Germany, Greece, Hong Kong, Ireland, Italy, Japan, Netherlands, New Zealand, Norway, Portugal, Singapore, Spain, Sweden, Switzerland, United Kingdom and the U.S. The companies in the universe are selected using criteria as identified by Standard & Poor’s, a division of The McGraw-Hill Companies, Inc. (“S&P”). The Fund will normally invest at least 90% of its total assets in common stock and ADRs that comprise the Index. The Fund generally will invest in all of the stocks comprising the Index in proportion to their weightings in the Index. Claymore Advisors, LLC, the Fund’s investment adviser (the “Investment Adviser”), seeks a correlation over time of 95% or better between the Fund’s performance and the performance of the Index.

The S&P Global Water Index is comprised of 50 stocks selected based on the relative importance of the global water industry within the company’s business model. The Index is designed to have a balanced representation from different segments of the water industry consisting of the following two clusters: 25 water utilities and infrastructure companies (water supply, water utilities, waste water treatment, water, sewer and pipeline construction, water purification, water well drilling, water testing) and 25 water equipment and materials companies (water treatment chemicals, water treatment appliances, pumps and pumping equipment, fluid power pumps and motors, plumbing equipment, totalizing fluid meters and counting devices) based upon Standard & Poor’s Capital IQ (“CIQ”) industry classification. To ensure investability, a developed market listing and a minimum market capitalization of at least $250 million are required.

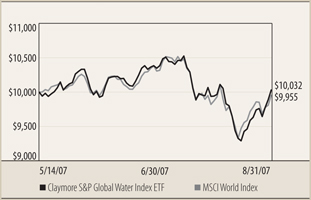

Fund Performance

This report discusses an abbreviated annual fiscal period from the Fund’s inception date of May 14, 2007, through August 31, 2007.

On a market price basis, the Fund generated a total return of 1.41%, representing a change in market price to $25.13 on August 31, 2007, from $24.78 at inception. On a net asset value (“NAV”) basis, the Fund generated a total return of 0.32%, representing a change in NAV to $24.86 on August 31, 2007, from $24.78 at inception. At the end of the period the Fund’s shares were trading at a market price premium to NAV, which is to be expected from time to time. However, the Investment Adviser believes that large discounts or premiums to the NAV of the shares should not be sustained.

For index and broad market comparison purposes, the Index returned 0.54% and the Morgan Stanley Capital International World Index (the “MSCI World Index”) returned 1.25% for the same period. The MSCI World Index is an unmanaged, capitalization weighted measure of global stock markets, including the United States, Canada, Europe, Australia and the Far East. The index is calculated using closing market prices and converted to US dollars using the London close foreign exchange rates. It is not possible to invest directly in an index.

Economic and Market Overview

The global economy continued to expand at or somewhat above its longer-term trend during 2007. Economies in Europe have been strong, and inflation remains modest. Asian economic growth has been driven by improving domestic demand, especially in China and India, and by export gains. Rates of resource utilization have increased, and energy prices have risen during 2007, heightening inflation risks. To guard against overly rapid growth, many central banks have moved toward mildly restraining monetary policies. In response to stronger growth and tighter monetary policies, real interest rates have risen and risk premiums have increased. Nonetheless, real interest rates remain modest by historical standards. Economic growth in Europe and Asia has reduced the reliance of the global economy on domestic demand in the U.S.

Trends in world stock markets have been generally positive during 2007; the strongest was China, up more than 50% from the end of 2006 through August 2007. European markets were up modestly, while the Japanese market was down somewhat during the first eight months of 2007.

Performance Attribution

Most of the Fund’s investments are categorized in four industry sectors: basic materials, industrials, utilities and financials. Since the Fund’s inception date of May 14, 2007, through August 31, 2007, basic materials and industrials contributed to performance, while utilities and financials detracted. Holdings that contributed strongly to performance include Companhia de Saneamento Basico do Estado de Sao Paulo, a Brazilian provider of water and sewage services; Danaher Corp., a producer of industrial water treatment solutions and other products; and Kurita Water Industries Ltd., a Japanese provider of water treatment services (2.4%, 4.4% and 3.7% of long-term investments, respectively). Positions that detracted from performance include Ciba Specialty Chemicals, a Swiss manufacturer of products used for water treatment; Veolia Environnement S.A., a French environmental services company; and Mueller Water Products, which manufactures water infrastructure and flow control products (1.7%, 10.1% and 1.3% of long-term investments, respectively).

6 | Annual Report | August 31, 2007

Claymore Exchange-Traded Fund Trust 2 | Management Discussion of Fund Performance continued

Risks and Other Considerations

The views expressed in this report reflect those of the portfolio managers and Claymore only through the report period as stated on the cover. These views are subject to change at any time, based on market and other conditions and should not be construed as a recommendation of any kind. The material may also contain forward looking statements that involve risk and uncertainty, and there is no guarantee they will come to pass.

This information does not represent an offer to sell securities of the Funds and it is not soliciting an offer to buy securities of the Funds. There can be no assurance that the Funds will achieve their investment objectives.

An investment in the Funds is subject to certain risks and other considerations that include, but are not limited to:

Investment Risk. This includes the risk of the possible loss of the entire principal amount that you invest.

Equity Risk. This includes the risk that the value of the securities held by the Funds will fall due to general market and economic conditions, perceptions regarding the industries in which the issuers of securities held by the Funds participate, or factors relating to specific companies in which the Funds invest.

Foreign Investment Risk. The Fund’s investments in non-U.S. issuers may involve unique risks compared to investing in securities of U.S. issuers, including, among others, less market liquidity, generally greater market volatility than U.S. securities and less complete financial information than for U.S. issuers. In addition, adverse political, economic or social developments could undermine the value of the Fund’s investments or prevent the Fund from realizing the full value of its investments. Financial reporting standards for companies based in foreign markets differ from those in the United States. Finally, the value of the currency of the country in which the Fund has invested could decline relative to the value of the U.S. dollar, which may affect the value of the investment to U.S. investors. In addition, the underlying issuers of certain depositary receipts, particularly unsponsored or unregistered depositary receipts, are under no obligation to distribute shareholder communications to the holders of such receipts, or to pass through to them any voting rights with respect to the deposited securities.

Replication Management Risk. Unlike many investment companies, the Funds are not “actively” managed. Therefore, the Funds won’t necessarily sell a stock because the stock’s issuer was in financial trouble unless that stock is removed from the Index.

Non-Correlation Risk. The Funds’ returns may not match the returns of the indices. For example, the Funds incur operating expenses not applicable to the indices, and incur costs in buying and selling securities, especially when rebalancing the Funds’ holdings to reflect changes in the composition of the indices.

Issuer-Specific Changes Risk. Investments in non-U.S. issuers may involve unique risks, including, among others, greater market volatility than U.S. securities and less complete financial information than for U.S. issuers.

Non-Diversified Fund Risk. The Funds are considered non-diversified and can invest a greater portion of assets in securities of individual issuers than a diversified fund. As a result, changes in the market value of a single investment could cause greater fluctuations in share price than would occur in a diversified fund.

Micro-, Small- and Medium-Sized Company Risk. Investing in securities of micro-, small-and medium-capitalization companies involves greater risk than investing in more established companies. These companies’ stocks may be more volatile and less liquid than those of more established companies.

Industry Risk. While the Funds do not concentrate in any industry, to the extent that the Funds’ focus their investments in a particular industry or group of related industries, the NAV of the Funds will be more susceptible to factors affecting that industry or sector.

There can be no assurance that the requirements of the AMEX necessary to maintain the listing of the Funds will continue to be met or will remain unchanged.

The Claymore S&P Global Water Index ETF is also subject to risks of concentrating in the water industry. Adverse developments in the water industry may significantly affect the value of the securities held by the Fund. Companies involved in the water industry are subject to environmental considerations, taxes, government regulation, price and supply fluctuations, competition and water conservation.

In addition to the risks described, there are certain other risks related to investing in the Funds. These risks are described further in the Prospectus and Statement of Additional Information.

Annual Report | August 31, 2007 | 7

Claymore Exchange-Traded Fund Trust 2

Fund Summary & Performance | As of August 31, 2007 (unaudited)

EEN | Claymore/Robeco Developed International Equity ETF

| | | | |

Fund Statistics | | | |

Share Price | | $ | 25.35 | |

Net Asset Value | | $ | 25.29 | |

Premium/Discount to NAV | | | 0.24 | % |

Net Assets ($000) | | $ | 5,108 | |

Total Returns

| | | |

(Inception 3/01/07) | | Since Inception | |

Claymore/Robeco Developed International Equity ETF | | | |

NAV | | 4.72 | % |

Market | | 4.97 | % |

| | | |

Robeco Developed International Equity Index | | 5.49 | % |

| | | |

Performance data quoted represents past performance, which is no guarantee of future results, and current performance may be lower or higher than the figures shown. For the most recent month-end performance figures, please visit www.claymore.com. The investment return and principal value of an investment will fluctuate with changes in market conditions and other factors so that an investor’s shares, when redeemed, may be worth more or less than their original cost.

Since inception returns assume a purchase of the ETF at the initial share price of $24.15 for share price returns or initial net asset value (NAV) of $24.15 per share for NAV returns. Returns for periods of less than one year are not annualized.

The Fund’s total annual operating expense ratio was estimated at 0.74%, per the prospectus, gross of any fee waivers or expense reimbursements. The Fund’s expense ratio for its initial fiscal year is based on an assumed average asset level of $100 million. If assets are lower than $100 million, the expense ratio will be higher due to the inclusion of offering costs during the first twelve months of operations. If average assets of the Fund exceed $100 million during the Fund’s first twelve months, the expense ratio may be lower. In the Financial Highlights section of this Annual Report, the Fund’s annualized net operating expense ratio was determined to be 1.32% while the Fund’s annualized gross operating expense ratio was determined to be 3.35%. There is a contractual fee waiver currently in place for this Fund through December 31, 2009 to the extent necessary in keeping the Fund’s operating expense ratio from exceeding 0.65% of average net assets per year. Some expenses fall outside of this expense cap and actual expenses will be higher than 0.65%. Without this expense cap, actual returns would be lower.

| | | |

Country Breakdown | | % of Long Term

Investments | |

Japan | | 22.8 | % |

United Kingdom | | 22.0 | % |

Germany | | 9.3 | % |

France | | 8.5 | % |

Switzerland | | 6.3 | % |

Netherlands | | 5.3 | % |

Australia | | 5.1 | % |

Italy | | 4.3 | % |

Spain | | 3.2 | % |

Finland | | 2.7 | % |

Sweden | | 2.7 | % |

Belgium | | 2.3 | % |

Hong Kong | | 1.7 | % |

Denmark | | 1.4 | % |

Singapore | | 1.2 | % |

Norway | | 0.9 | % |

Portugal | | 0.3 | % |

| | | |

Portfolio Breakdown | | % of Net Assets | |

Financials | | 28.2 | % |

Consumer Discretionary | | 13.0 | % |

Information Technology | | 9.5 | % |

Materials | | 9.1 | % |

Industrials | | 7.4 | % |

Energy | | 7.3 | % |

Consumer Staples | | 7.1 | % |

Telecommunication Services | | 6.6 | % |

Health Care | | 5.6 | % |

Utilities | | 5.1 | % |

| | | |

Total Investments | | 98.9 | % |

Other Assets in excess of Liabilities | | 1.1 | % |

| | | |

Net Assets | | 100.0 | % |

| | | |

| | | |

Top Ten Holdings | | % of Long Term

Investments | |

BP PLC | | 2.3 | % |

Nestle SA | | 2.1 | % |

Vodafone Group PLC | | 2.0 | % |

Nintendo Co. Ltd. | | 1.8 | % |

Nokia OYJ | | 1.8 | % |

E.ON AG | | 1.6 | % |

Royal Bank of Scotland Group PLC | | 1.5 | % |

Royal Dutch Shell PLC - Class B | | 1.5 | % |

Allianz SE | | 1.4 | % |

ENI SpA | | 1.4 | % |

Portfolio breakdown is as a percentage of net assets. Holdings and country breakdowns are as a percentage of long-term investments. Both are subject to change daily. For more current Fund information, please visit www.claymore.com. The above summaries are provided for informational purposes only, and should not be viewed as recommendations.

Performance of a $10,000 Investment

This graph compares a hypothetical $10,000 investment in the Fund, made at its inception, with a similar investment in the MSCI EAFE Index. Results include the reinvestment of all dividends and capital gains. Past performance is no guarantee of future results. The MSCI EAFE Index is a free float-adjusted market capitalization index that is designed to measure developed market equity performance, excluding the U.S. & Canada. It is not possible to invest directly in the MSCI EAFE Index. Investment return and principal value will fluctuate with changes in market conditions and other factors and fund shares, when redeemed, may be worth more or less than their original investment.

Index data source: Bloomberg

8 | Annual Report | August 31, 2007

Claymore Exchange-Traded Fund Trust 2 | Fund Summary & Performance (unaudited) continued

EEW | Claymore/Robeco Developed World Equity ETF

| | | | |

Fund Statistics | | | |

Share Price | | $ | 25.78 | |

Net Asset Value | | $ | 25.60 | |

Premium/Discount to NAV | | | 0.70 | % |

Net Assets ($000) | | $ | 15,412 | |

Total Returns

| | | |

(Inception 3/01/07) | | Since Inception | |

Claymore/Robeco Developed World Equity ETF | | | |

NAV | | 5.78 | % |

Market | | 6.53 | % |

| | | |

Robeco Developed World Equity Index | | 6.54 | % |

| | | |

Performance data quoted represents past performance, which is no guarantee of future results, and current performance may be lower or higher than the figures shown. For the most recent month-end performance figures, please visit www.claymore.com. The investment return and principal value of an investment will fluctuate with changes in market conditions and other factors so that an investor’s shares, when redeemed, may be worth more or less than their original cost.

Since inception returns assume a purchase of the ETF at the initial share price of $24.20 for share price returns or initial net asset value (NAV) of $24.20 per share for NAV returns. Returns for periods of less than one year are not annualized.

The Fund’s total annual operating expense ratio was estimated at 0.74%, per the prospectus, gross of any fee waivers or expense reimbursements. The Fund’s expense ratio for its initial fiscal year is based on an assumed average asset level of $100 million. If assets are lower than $100 million, the expense ratio will be higher due to the inclusion of offering costs during the first twelve months of operations. If average assets of the Fund exceed $100 million during the Fund’s first twelve months, the expense ratio may be lower. In the Financial Highlights section of this Annual Report, the Fund’s annualized net operating expense ratio was determined to be 0.98% while the Fund’s annualized gross operating expense ratio was determined to be 2.20%. There is a contractual fee waiver currently in place for this Fund through December 31, 2009 to the extent necessary in keeping the Fund’s operating expense ratio from exceeding 0.65% of average net assets per year. Some expenses fall outside of this expense cap and actual expenses will be higher than 0. 65%. Without this expense cap, actual returns would be lower.

| | | |

Country Breakdown | | % of Long Term

Investments | |

United States | | 47.4 | % |

United Kingdom | | 10.1 | % |

Japan | | 9.7 | % |

Canada | | 4.5 | % |

Germany | | 4.5 | % |

France | | 4.3 | % |

Italy | | 2.4 | % |

Switzerland | | 2.2 | % |

Sweden | | 2.1 | % |

Australia | | 2.0 | % |

Netherlands | | 1.9 | % |

Finland | | 1.9 | % |

Hong Kong | | 1.7 | % |

Singapore | | 1.5 | % |

Spain | | 1.0 | % |

Norway | | 0.8 | % |

Austria | | 0.7 | % |

Denmark | | 0.7 | % |

Belgium | | 0.4 | % |

Portugal | | 0.1 | % |

Bermuda | | 0.1 | % |

South Africa | | 0.0 | % |

| | | |

Portfolio Breakdown | | % of Net Assets | |

Financials | | 24.6 | % |

Information Technology | | 12.8 | % |

Consumer Discretionary | | 11.5 | % |

Health Care | | 11.3 | % |

Energy | | 10.4 | % |

Industrials | | 8.8 | % |

Materials | | 6.5 | % |

Consumer Staples | | 5.6 | % |

Utilities | | 4.1 | % |

Telecommunication Services | | 3.9 | % |

| | | |

Total Investments | | 99.5 | % |

Other Assets in excess of Liabilities | | 0.5 | % |

| | | |

Net Assets | | 100.0 | % |

| | | |

| | | |

Top Ten Holdings | | % of Long Term

Investments | |

Exxon Mobil Corp. | | 2.5 | % |

Chevron Corp. | | 1.4 | % |

International Business Machines Corp. | | 1.4 | % |

Pfizer, Inc. | | 1.4 | % |

Intel Corp. | | 1.3 | % |

Nokia OYJ | | 1.3 | % |

Altria Group, Inc. | | 1.3 | % |

Hewlett-Packard Co. | | 1.2 | % |

JPMorgan Chase & Co. | | 1.2 | % |

E.ON AG | | 1.2 | % |

Portfolio breakdown is as a percentage of net assets. Holdings and country breakdown are as a percentage of long-term investments. Both are subject to change daily. For more current Fund information, please visit www.claymore.com. The above summaries are provided for informational purposes only, and should not be viewed as recommendations.

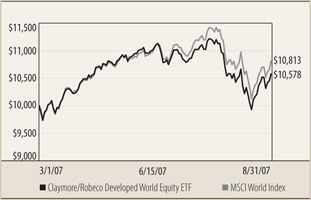

Performance of a $10,000 Investment

This graph compares a hypothetical $10,000 investment in the Fund, made at its inception, with a similar investment in the MSCI World Index. Results include the reinvestment of all dividends and capital gains. Past performance is no guarantee of future results. The MSCI World Index is a free float-adjusted market capitalization index that is designed to measure global developed market equity performance of the 23 developed market country indices of Europe, Australasia, the Far East, the United States, and Canada. It is not possible to invest directly in the MSCI World Index. Investment return and principal value will fluctuate with changes in market conditions and other factors and fund shares, when redeemed, may be worth more or less than their original investment.

Index data source: Bloomberg

Annual Report | August 31, 2007 | 9

Claymore Exchange-Traded Fund Trust 2 | Fund Summary & Performance (unaudited) continued

CGW | Claymore S&P Global Water Index ETF

| | | | |

Fund Statistics | | | |

Share Price | | $ | 25.13 | |

Net Asset Value | | $ | 24.86 | |

Premium/Discount to NAV | | | 1.09 | % |

Net Assets ($000) | | $ | 253,545 | |

Total Returns

| | | |

(Inception 5/14/07) | | | |

Claymore S&P Global Water ETF | | | |

NAV | | 0.32 | % |

Market | | 1.41 | % |

| | | |

S&P Global Water Index | | 0.54 | % |

| | | |

Performance data quoted represents past performance, which is no guarantee of future results, and current performance may be lower or higher than the figures shown. For the most recent month-end performance figures, please visit www.claymore.com. The investment return and principal value of an investment will fluctuate with changes in market conditions and other factors so that an investor’s shares, when redeemed, may be worth more or less than their original cost.

Since inception returns assume a purchase of the ETF at the initial share price of $24.78 for share price returns or initial net asset value (NAV) of $24.78 per share for NAV returns. Returns for periods of less than one year are not annualized.

The Fund’s total annual operating expense ratio was estimated at 0.90%, per the prospectus, gross of any fee waivers or expense reimbursements. The Fund’s expense ratio for its initial fiscal year is based on an assumed average asset level of $100 million. If assets are lower than $100 million, the expense ratio will be higher due to the inclusion of offering costs during the first twelve months of operations. If average assets of the Fund exceed $100 million during the Fund’s first twelve months, the expense ratio may be lower. In the Financial Highlights section of this Annual Report, the Fund’s annualized net operating expense ratio was determined to be 0.72% while the Fund’s annualized gross operating expense ratio was determined to be 0.83%. There is a contractual fee waiver currently in place for this Fund through December 31, 2009 to the extent necessary in keeping the Fund operating expense ratio from exceeding 0.65% of average net assets per year. Some expenses fall outside of this expense cap and actual expenses will be higher than 0.65%. Without this expense cap, actual returns would be lower.

| | | |

Country Breakdown | | % of Long-Term

Investments | |

United States | | 29.4 | % |

France | | 19.9 | % |

Japan | | 16.0 | % |

United Kingdom | | 12.9 | % |

Italy | | 5.3 | % |

Finland | | 4.9 | % |

Brazil | | 2.4 | % |

Spain | | 2.4 | % |

China | | 2.3 | % |

Switzerland | | 1.7 | % |

Singapore | | 1.3 | % |

Canada | | 1.0 | % |

Austria | | 0.3 | % |

Cayman Islands | | 0.2 | % |

| | | |

Portfolio Breakdown | | % of Net Assets | |

Utilities | | 45.9 | % |

Industrials | | 41.2 | % |

Materials | | 10.1 | % |

Financials | | 0.3 | % |

Consumer Discretionary | | 0.3 | % |

| | | |

Total Long-Term Investments | | 97.8 | % |

Short-Term Investments | | 0.2 | % |

Other Assets in excess of Liabilities | | 2.0 | % |

| | | |

Net Assets | | 100.0 | % |

| | | |

| | | |

Top Ten Holdings | | % of Long-Term

Investments | |

Veolia Environnement SA | | 10.1 | % |

Suez SA | | 9.8 | % |

Mitsubishi Heavy Industries Ltd. | | 6.4 | % |

United Utilities PLC | | 4.9 | % |

ITT Corp. | | 4.6 | % |

Danaher Corp. | | 4.4 | % |

Kubota Corp. | | 3.9 | % |

Kurita Water Industries Ltd. | | 3.7 | % |

Pentair, Inc. | | 3.5 | % |

Nalco Holding Co. | | 3.4 | % |

Portfolio breakdown is as a percentage of net assets. Country breakdown and holdings are as a percentage of long-term investments. All are subject to change daily. For more current Fund information, please visit www.claymore.com. The above summaries are provided for informational purposes only, and should not be viewed as recommendations.

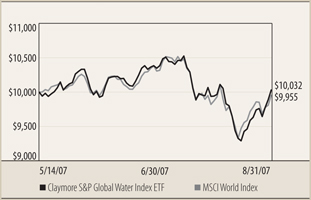

Performance of a $10,000 Investment

This graph compares a hypothetical $10,000 investment in the fund, made at its inception, with a similar investment in the MSCI World Index. Results include the reinvestment of all dividends and capital gains. Past performance is no guarantee of future results. The MSCI World Index is a free float-adjusted market capitalization index that is designed to measure global developed market equity performance of the 23 developed market country indices of Europe, Australasia, the Far East, the United States and Canada. It is not possible to invest directly in the MSCI World Index. Investment return and principal value will fluctuate with changes in market conditions and other factors and fund shares, when redeemed, may be worth more or less than their original investment.

Index data source: Bloomberg

10 | Annual Report | August 31, 2007

Claymore Exchange-Traded Fund Trust 2

Overview of Fund Expenses | As of August 31, 2007 (unaudited)

As a shareholder of Claymore/Robeco Developed International Equity ETF; Claymore/Robeco Developed World Equity ETF; or Claymore S&P Global Water Index ETF, you incur advisory fees and other Fund expenses. The expense examples below are intended to help you understand your ongoing costs (in dollars) of investing in the Funds and to compare these costs with the ongoing costs of investing in other mutual funds.

The example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period ended 8/31/07.

Actual Expense

The first line of the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line of the table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing cost of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads) or contingent deferred sales charges. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | | | | | | | | | | | |

| | | Beginning

Account

Value | | Ending

Account

Value | | Annualized

Expense

Ratio for the

period ended | | | Expenses Paid During Period1 |

| | | 3/1/07 | | 8/31/07 | | 8/31/07 | | | 3/01/07 - 8/31/07 |

Claymore/Robeco Developed International Equity ETF3 | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | $ | 1,047.12 | | 1.32 | % | | $ | 6.81 |

Hypothetical (5% annual return before expenses) | | | 1,000.00 | | | 1,018.55 | | 1.32 | % | | | 6.72 |

Claymore/Robeco Developed World Equity ETF3 | | | | | | | | | | | | |

Actual | | | 1,000.00 | | | 1,057.84 | | 0.98 | % | | | 5.08 |

Hypothetical (5% annual return before expenses) | | | 1,000.00 | | | 1,020.27 | | 0.98 | % | | | 4.99 |

| | | | | | | | | | | | |

| | | Beginning

Account

Value | | Ending

Account

Value | | Annualized

Expense

Ratio for the

period ended | | | Expenses Paid During Period2 |

| | | 5/14/07 | | 8/31/07 | | 8/31/07 | | | 5/14/07 - 8/31/07 |

Claymore S&P Global Water Index ETF3 | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | $ | 1,003.23 | | 0.72 | % | | $ | 2.17 |

Hypothetical (5% annual return before expenses)4 | | | 1,000.00 | | | 1,021.58 | | 0.72 | % | | | 3.67 |

1 | Expenses are calculated using the annualized expense ratio. This represents the ongoing expenses of the Fund as a percentage of net assets for the period March 1, 2007 (commencement of investment operations) to August 31, 2007. Expenses are calculated by multiplying the Fund’s annualized expense ratio by the average account value over the period; then multiplying that result by 184/365 (to reflect the since inception period). |

2 | Expenses are calculated using the annualized expense ratio. This represents the ongoing expenses of the Fund as a percentage of net assets for the period May 14, 2007 (commencement of investment operations) to August 31, 2007. Expenses are calculated by multiplying the Fund’s annualized expense ratio by the average account value over the period; then multiplying that result by 110/365. |

3 | The expense ratios reflect an expense waiver. Please see the Notes to Financial Statements for more information. |

4 | Hypothetical expenses reflect ongoing expenses for a full six month period as opposed to the shorter since inception period. |

Assumes all dividends and distributions were reinvested.

Annual Report | August 31, 2007 | 11

Claymore Exchange-Traded Fund Trust 2

Portfolio of Investments | August 31, 2007

EEN | Claymore/Robeco Developed International Equity ETF

| | | | | |

Number

of Shares | | Description | | Value |

| | Total Investments - 98.8% | | | |

| | Common Stocks - 97.9% | | | |

| | Australia - 5.0% | | | |

| 2,241 | | Australia & New Zealand Banking Group Ltd. | | $ | 52,854 |

| 1,357 | | BHP Billiton Ltd. | | | 42,415 |

| 1,302 | | Commonwealth Bank of Australia | | | 58,417 |

| 521 | | Macquarie Bank Ltd. | | | 31,069 |

| 2,871 | | PaperlinX Ltd. | | | 7,895 |

| 94 | | Santos Ltd. | | | 1,013 |

| 1,351 | | Stockland | | | 9,441 |

| 66 | | Westfield Group | | | 1,124 |

| 2,407 | | Westpac Banking Corp. | | | 53,263 |

| | | | | |

| | | | | 257,491 |

| | | | | |

| | Belgium - 2.2% | | | |

| 13 | | Barco NV | | | 1,234 |

| 272 | | Belgacom SA | | | 11,925 |

| 263 | | Delhaize Group | | | 25,739 |

| 241 | | Groupe Bruxelles Lambert SA | | | 28,495 |

| 367 | | KBC Groep NV | | | 46,039 |

| 5 | | Omega Pharma SA | | | 441 |

| | | | | |

| | | | | 113,873 |

| | | | | |

| | Denmark - 1.4% | | | |

| 500 | | Jyske Bank (a) | | | 37,241 |

| 200 | | Topdanmark A/S (a) | | | 32,208 |

| | | | | |

| | | | | 69,449 |

| | | | | |

| | Finland - 2.7% | | | |

| 2,726 | | Nokia OYJ | | | 89,821 |

| 1,333 | | Orion OYJ - Class B | | | 31,783 |

| 965 | | Stora Enso OYJ | | | 17,207 |

| | | | | |

| | | | | 138,811 |

| | | | | |

| | France - 8.4% | | | |

| 6 | | Accor SA | | | 515 |

| 540 | | Bouygues | | | 42,557 |

| 928 | | Business Objects SA (a) | | | 40,850 |

| 416 | | Cap Gemini SA | | | 26,938 |

| 702 | | Cie Generale d’Optique Essilor International SA | | | 42,635 |

| 6 | | Gecina SA | | | 985 |

| 308 | | Peugeot SA | | | 26,243 |

| 732 | | Publicis Groupe | | | 31,653 |

| 822 | | Sanofi-Aventis | | | 67,146 |

| 10 | | Suez SA | | | 569 |

| 502 | | Technip SA | | | 40,096 |

| 109 | | Total SA | | | 8,210 |

| 179 | | Unibail-Rodamco | | | 43,131 |

| 28 | | Valeo SA | | | 1,358 |

| 1,346 | | Vivendi | | | 55,066 |

| | | | | |

| | | | | 427,952 |

| | | | | |

| | Germany - 8.3% | | | |

| 336 | | Allianz SE | | | 72,061 |

| 433 | | BASF AG | | | 57,335 |

| 677 | | Commerzbank AG | | | 27,771 |

| 457 | | Deutsche Bank AG | | | 56,463 |

| 471 | | E.ON AG | | | 79,073 |

| 298 | | Muenchener Rueckversicherungs AG | | | 51,504 |

| 455 | | ThyssenKrupp AG | | | 26,610 |

| 259 | | Volkswagen AG | | | 53,527 |

| | | | | |

| | | | | 424,344 |

| | | | | |

| | Hong Kong - 1.7% | | | |

| 900 | | Hang Seng Bank Ltd. | | | 14,117 |

| 7,000 | | HongKong Electric Holdings | | | 35,104 |

| 3,500 | | Swire Pacific Ltd. - Class A | | | 38,696 |

| | | | | |

| | | | | 87,917 |

| | | | | |

| | Italy - 4.2% | | | |

| 5,166 | | Enel SpA | | | 53,383 |

| 2,033 | | ENI SpA | | | 70,340 |

| 1,648 | | Fiat SpA | | | 43,809 |

| 10,503 | | Telecom Italia SpA | | | 23,554 |

| 2,883 | | UniCredito Italiano SpA | | | 24,721 |

| | | | | |

| | | | | 215,807 |

| | | | | |

| | Japan - 22.5% | | | |

| 400 | | Alps Electric Co. Ltd. | | | 4,690 |

| 1,000 | | Asahi Kasei Corp. | | | 7,506 |

| 200 | | Astellas Pharma, Inc. | | | 9,265 |

| 300 | | Canon, Inc. | | | 17,133 |

| 5,000 | | Central Glass Co. Ltd. | | | 25,752 |

| 612 | | Circle K Sunkus Co. Ltd. | | | 9,857 |

| 500 | | Daito Trust Construction Co. Ltd. | | | 23,595 |

| 1 | | East Japan Railway Co. | | | 7,963 |

| 300 | | Fanuc Ltd. | | | 29,168 |

| 1,000 | | FUJIFILM Holdings Corp. | | | 43,480 |

| 3,000 | | Fujitsu Ltd. | | | 20,472 |

| 3,000 | | Hitachi Ltd. | | | 19,359 |

| 9 | | Japan Tobacco, Inc. | | | 49,925 |

| 7 | | KDDI Corp. | | | 54,048 |

| 1,500 | | Komatsu Ltd. | | | 46,198 |

| 3,000 | | Matsushita Electric Industrial Co. Ltd. | | | 52,280 |

| 7,000 | | Mitsubishi Materials Corp. | | | 38,891 |

| 7 | | Mitsubishi UFJ Financial Group, Inc. | | | 67,032 |

| 6 | | Mizuho Financial Group, Inc. | | | 37,942 |

| 2,100 | | Namco Bandai Holdings, Inc. | | | 30,418 |

| 200 | | Nintendo Co. Ltd. | | | 92,654 |

| 2,000 | | Nippon Oil Corp. | | | 16,857 |

| 7,000 | | Nippon Steel Corp. | | | 49,036 |

See notes to financial statements.

12 | Annual Report | August 31, 2007

Claymore Exchange-Traded Fund Trust 2 | Portfolio of Investments continued

EEN | Claymore/Robeco Developed International Equity ETF (continued)

| | | | | |

Number

of Shares | | Description | | Value |

| | Japan (continued) | | | |

| 2,000 | | Nisshin Steel Co. Ltd. | | $ | 8,006 |

| 2,000 | | NOK Corp. | | | 38,735 |

| 7 | | NTT Data Corp. | | | 33,818 |

| 2,000 | | Sanwa Shutter Corp. | | | 11,698 |

| 100 | | Shin-Etsu Chemical Co. Ltd. | | | 7,229 |

| 1,100 | | Sony Corp. | | | 52,953 |

| 8,000 | | Sumitomo Metal Industries Ltd. | | | 40,512 |

| 2,000 | | Sumitomo Metal Mining Co. Ltd. | | | 39,684 |

| 300 | | Suzuken Co. Ltd. | | | 9,912 |

| 2,000 | | Taisho Pharmaceutical Co. Ltd. | | | 39,080 |

| 400 | | Takeda Pharmaceutical Co. Ltd. | | | 27,330 |

| 7,000 | | Teijin Ltd. | | | 34,965 |

| 400 | | TIS, Inc. | | | 8,627 |

| 400 | | Tokyo Electric Power Co., Inc. (The) | | | 10,491 |

| 2,000 | | Toyo Suisan Kaisha Ltd. | | | 34,939 |

| | | | | |

| | | | | 1,151,500 |

| | | | | |

| | Netherlands - 5.3% | | | |

| 1,430 | | ABN AMRO Holding NV | | | 66,535 |

| 380 | | ASML Holding NV (a) | | | 11,257 |

| 511 | | Heineken NV | | | 32,379 |

| 803 | | Koninklijke DSM NV | | | 41,084 |

| 3,046 | | Royal KPN NV | | | 47,504 |

| 2,255 | | STMicroelectronics NV | | | 39,287 |

| 1,013 | | Unilever NV - CVA | | | 30,975 |

| | | | | |

| | | | | 269,021 |

| | | | | |

| | Norway - 0.9% | | | |

| 1,200 | | Norsk Hydro ASA | | | 44,520 |

| | | | | |

| | Portugal - 0.3% | | | |

| 1,067 | | Portugal Telecom SGPS SA | | | 14,633 |

| | | | | |

| | Singapore - 1.2% | | | |

| 2,000 | | ComfortDelgro Corp., Ltd. | | | 2,559 |

| 3,000 | | Fraser and Neave Ltd. | | | 9,765 |

| 1,000 | | Haw Par Corp. Ltd. | | | 5,250 |

| 1,000 | | Keppel Corp. Ltd. | | | 8,400 |

| 10,000 | | Neptune Orient Lines Ltd. | | | 32,157 |

| 2,000 | | SMRT Corp. Ltd. | | | 2,284 |

| | | | | |

| | | | | 60,415 |

| | | | | |

| | Spain - 3.1% | | | |

| 1,392 | | Banco Santander S.A. | | | 25,429 |

| 667 | | Endesa SA | | | 36,272 |

| 700 | | Gas Natural SDG SA | | | 37,293 |

| 1,432 | | Gestevision Telecinco SA | | | 38,067 |

| 5,204 | | Iberia Lineas Aereas de Espana | | | 23,695 |

| | | | | |

| | | | | 160,756 |

| | | | | |

| | Sweden - 2.7% | | | |

| 175 | | Hennes & Mauritz AB - Class B | | | 9,871 |

| 200 | | Hoganas AB - Class B | | | 5,735 |

| 3,000 | | Nordea Bank AB | | | 45,733 |

| 1,200 | | Skandinaviska Enskilda Banken AB - Class A | | | 36,238 |

| 1,400 | | Svenska Handelsbanken AB - Class A | | | 38,923 |

| | | | | |

| | | | | 136,500 |

| | | | | |

| | Switzerland - 6.3% | | | |

| 2,387 | | ABB Ltd. | | | 58,672 |

| 930 | | Credit Suisse Group | | | 60,766 |

| 243 | | Nestle SA | | | 105,683 |

| 52 | | Rieter Holding AG | | | 27,715 |

| 49 | | Swatch Group AG | | | 14,670 |

| 185 | | Zurich Financial Services AG | | | 52,937 |

| | | | | |

| | | | | 320,443 |

| | | | | |

See notes to financial statements.

Annual Report | August 31, 2007 | 13

Claymore Exchange-Traded Fund Trust 2 | Portfolio of Investments continued

EEN | Claymore/Robeco Developed International Equity ETF (continued)

| | | | | |

Number

of Shares | | Description | | Value |

| | United Kingdom - 21.7% | | | |

| 1,842 | | 3i Group PLC | | $ | 39,198 |

| 731 | | Anglo American PLC | | | 41,934 |

| 1,220 | | AstraZeneca PLC | | | 60,167 |

| 1,087 | | Berkeley Group Holdings PLC | | | 35,234 |

| 2,052 | | Bovis Homes Group PLC | | | 31,829 |

| 10,322 | | BP PLC | | | 116,071 |

| 3,571 | | British Airways PLC (a) | | | 30,558 |

| 1,715 | | British Land Co. PLC - REIT | | | 44,728 |

| 6,464 | | BT Group PLC | | | 41,168 |

| 2,440 | | Daily Mail & General Trust - Class A | | | 33,393 |

| 1,252 | | Davis Service Group PLC | | | 14,912 |

| 1,543 | | Hammerson PLC - REIT | | | 41,331 |

| 740 | | Home Retail Group | | | 6,183 |

| 1,009 | | International Power PLC | | | 8,232 |

| 460 | | Invensys PLC | | | 3,171 |

| 1,691 | | J Sainsbury PLC | | | 18,896 |

| 744 | | Land Securities Group PLC - REIT | | | 27,192 |

| 5,368 | | Lloyds TSB Group PLC | | | 59,010 |

| 3,173 | | Marks & Spencer Group PLC | | | 40,001 |

| 144 | | Next PLC | | | 5,609 |

| 2,866 | | Rolls-Royce Group PLC | | | 29,540 |

| 6,583 | | Royal Bank of Scotland Group PLC | | | 76,284 |

| 1,926 | | Royal Dutch Shell PLC - Class B | | | 75,133 |

| 1,520 | | Schroders PLC | | | 40,593 |

| 5,467 | | Stagecoach Group PLC | | | 24,480 |

| 325 | | Travis Perkins PLC | | | 11,701 |

| 1,714 | | Unilever PLC | | | 54,036 |

| 30,842 | | Vodafone Group PLC | | | 99,411 |

| | | | | |

| | | | | 1,109,995 |

| | | | | |

| | Total Common Stocks - 97.9% | | | |

| | (Cost - $4,978,043) | | | 5,003,427 |

| | | | | |

| | Preferred Stock - 0.9% | | | |

| | Germany – 0.9% | | | |

| 366 | | Volkswagen AG | | | |

| | (Cost - $30,644) | | | 45,829 |

| | | | | |

| | Total Investments - 98.8% | | | |

| | (Cost - $5,008,687) | | | 5,049,256 |

| | Other Assets in Excess of Liabilities - 1.2% | | | 58,873 |

| | | | | |

| | Net Assets - 100.0% | | $ | 5,108,129 |

| | | | | |

AG – Stock Corporation

REIT – Real Estate Investment Trust

OYJ – Public Traded Company

PLC – Public Limited Company

SA – Corporation

SpA – Limited Share Corporation

| (a) | Non-Income producing security. |

See notes to financial statements.

14 | Annual Report | August 31, 2007

Claymore Exchange-Traded Fund Trust 2 | Portfolio of Investments continued

EEW | Claymore/Robeco Developed World Equity ETF

| | | | | |

Number

of Shares | | Description | | Value |

| | Common Stocks - 99.5% | | | |

| | Austria - 0.7% | | | |

| 1,634 | | Wiener Staedtische Versicherung AG | | $ | 112,313 |

| | | | | |

| | Australia - 2.0% | | | |

| 1,518 | | Amcor Ltd. | | | 9,386 |

| 5,220 | | Coca-Cola Amatil Ltd. | | | 40,386 |

| 2,106 | | Commonwealth Bank of Australia | | | 94,490 |

| 768 | | Goodman Fielder Ltd. | | | 1,625 |

| 1,904 | | Santos Ltd. | | | 20,524 |

| 6,126 | | Westpac Banking Corp. | | | 135,560 |

| | | | | |

| | | | | 301,971 |

| | | | | |

| | Belgium - 0.4% | | | |

| 724 | | Omega Pharma SA | | | 63,858 |

| | | | | |

| | Bermuda - 0.1% | | | |

| 87 | | Ingersoll-Rand Co. Ltd. - Class A | | | 4,518 |

| | | | | |

| | Canada - 4.5% | | | |

| 340 | | Alcan, Inc. | | | 33,507 |

| 2,675 | | Bank of Nova Scotia | | | 132,100 |

| 2,325 | | EnCana Corp. | | | 136,025 |

| 962 | | Fording Canadian Coal Trust | | | 31,656 |

| 1,641 | | George Weston Ltd. | | | 111,070 |

| 5,377 | | Methanex Corp. | | | 120,263 |

| 2,175 | | Royal Bank of Canada | | | 111,726 |

| 372 | | Teck Cominco Ltd. - Class B | | | 15,825 |

| | | | | |

| | | | | 692,172 |

| | | | | |

| | Denmark - 0.7% | | | |

| 1,475 | | Jyske Bank A/S (a) | | | 109,861 |

| | | | | |

| | Germany - 4.4% | | | |

| 1,429 | | Arcandor AG | | | 38,962 |

| 1,158 | | BASF AG | | | 153,334 |

| 1,061 | | Deutsche Bank AG | | | 131,088 |

| 1,053 | | E.ON AG | | | 176,782 |

| 377 | | Muenchener Rueckversicherungs AG | | | 65,158 |

| 583 | | Volkswagen AG | | | 120,488 |

| | | | | |

| | | | | 685,812 |

| | | | | |

| | Finland - 1.9% | | | |

| 5,942 | | Nokia OYJ | | | 195,787 |

| 3,195 | | Orion OYJ - Class B | | | 76,179 |

| 744 | | Stora Enso OYJ - Class R | | | 13,267 |

| | | | | |

| | | | | 285,233 |

| | | | | |

| | France - 4.3% | | | |

| 573 | | Bouygues | | | 45,158 |

| 2,736 | | Business Objects SA (a) | | | 120,437 |

| 155 | | Cie Generale d’Optique Essilor International SA | | | 9,414 |

| 361 | | Gecina SA | | | 59,287 |

| 1,917 | | Sanofi-Aventis | | | 156,592 |

| 528 | | Technip SA | | | 42,173 |

| 1,637 | | Thales SA | | | 92,948 |

| 3,367 | | Vivendi | | | 137,748 |

| | | | | |

| | | | | 663,757 |

| | | | | |

| | Hong Kong - 1.7% | | | |

| 2,000 | | Cheung Kong Holdings Ltd. | | | 29,423 |

| 7,800 | | Hang Seng Bank Ltd. | | | 122,351 |

| 10,000 | | Swire Pacific Ltd. - Class A | | | 110,559 |

| | | | | |

| | | | | 262,333 |

| | | | | |

| | Italy - 2.4% | | | |

| 12,965 | | Enel SpA | | | 133,973 |

| 4,178 | | Fiat SpA | | | 111,065 |

| 56,194 | | Telecom Italia SpA | | | 126,018 |

| | | | | |

| | | | | 371,056 |

| | | | | |

| | Japan - 9.6% | | | |

| 6,000 | | Central Glass Co. Ltd. | | | 30,902 |

| 6 | | Central Japan Railway Co. | | | 67,291 |

| 2,500 | | FUJIFILM Holdings Corp. | | | 108,700 |

| 24 | | Japan Tobacco, Inc. | | | 133,132 |

| 19 | | KDDI Corp. | | | 146,702 |

| 8,000 | | Matsushita Electric Industrial Co. Ltd. | | | 139,413 |

| 16 | | Mitsubishi UFJ Financial Group, Inc. | | | 153,216 |

| 5,800 | | NamCo Bandai Holdings, Inc. | | | 84,012 |

| 9,000 | | NEC Corp. | | | 42,471 |

| 300 | | Nintendo Co. Ltd. | | | 138,981 |

| 19,000 | | Nippon Steel Corp. | | | 133,097 |

| 27 | | NTT Data Corp. | | | 130,440 |

| 41 | | NTT DoCoMo, Inc. | | | 62,606 |

| 200 | | Shin-Etsu Chemical Co. Ltd. | | | 14,459 |

| 5,000 | | Sumitomo Metal Industries Ltd. | | | 25,320 |

| 1,200 | | Suzuken Co. Ltd. | | | 39,650 |

| 2,000 | | Toyo Suisan Kaisha Ltd. | | | 34,939 |

| | | | | |

| | | | | 1,485,331 |

| | | | | |

| | Netherlands - 1.9% | | | |

| 1,798 | | ABN AMRO Holding NV | | | 83,657 |

| 170 | | Heineken NV | | | 10,772 |

| 2,332 | | Koninklijke DSM NV | | | 119,312 |

| 3,626 | | Royal KPN NV | | | 56,550 |

| 1,443 | | STMicroelectronics NV | | | 25,140 |

| | | | | |

| | | | | 295,431 |

| | | | | |

See notes to financial statements.

Annual Report | August 31, 2007 | 15

Claymore Exchange-Traded Fund Trust 2 | Portfolio of Investments continued

EEW | Claymore/Robeco Developed World Equity ETF (continued)

| | | | | |

Number

of Shares | | Description | | Value |

| | Norway - 0.8% | | | |

| 650 | | Norsk Hydro ASA | | $ | 24,115 |

| 6,500 | | Orkla ASA | | | 105,391 |

| | | | | |

| | | | | 129,506 |

| | | | | |

| | Portugal - 0.1% | | | |

| 1,504 | | Portugal Telecom SGPS SA | | | 20,626 |

| | | | | |

| | Singapore - 1.5% | | | |

| 24,000 | | Fraser and Neave Ltd. | | | 78,120 |

| 2,000 | | Haw Par Corp. Ltd. | | | 10,500 |

| 1,000 | | Keppel Corp. Ltd. | | | 8,400 |

| 32,000 | | Neptune Orient Lines Ltd. | | | 102,901 |

| 1,000 | | Singapore Airlines Ltd. | | | 12,469 |

| 18,000 | | SMRT Corp. Ltd. | | | 20,554 |

| | | | | |

| | | | | 232,944 |

| | | | | |

| | South Africa - 0.0% | | | |

| 1 | | Mondi Ltd. | | | 10 |

| | | | | |

| | Spain - 1.0% | | | |

| 1,300 | | Gas Natural SDG SA | | | 69,259 |

| 2,827 | | Gestevision Telecinco SA | | | 75,151 |

| 2,056 | | Iberia Lineas Aereas de Espana | | | 9,361 |

| | | | | |

| | | | | 153,771 |

| | | | | |

| | Sweden - 2.1% | | | |

| 8,000 | | Nordea Bank AB | | | 121,954 |

| 2,900 | | Skandinaviska Enskilda Banken AB - Class A | | | 87,574 |

| 5,200 | | SKF AB - Class B | | | 106,071 |

| 100 | | Svenska Handelsbanken AB - Class A | | | 2,780 |

| | | | | |

| | | | | 318,379 |

| | | | | |

| | Switzerland - 2.2% | | | |

| 1,982 | | ABB Ltd. | | | 48,718 |

| 1,086 | | Credit Suisse Group | | | 70,959 |

| 49 | | Nestle SA | | | 21,311 |

| 575 | | Sonova Holding AG | | | 50,823 |

| 60 | | Swatch Group AG | | | 17,963 |

| 465 | | Zurich Financial Services AG | | | 133,058 |

| | | | | |

| | | | | 342,832 |

| | | | | |

| | United Kingdom - 10.0% | | | |

| 2,344 | | Anglo American PLC | | | 134,463 |

| 10,391 | | British Airways PLC (a) | | | 88,919 |

| 2,809 | | British Energy Group PLC | | | 26,261 |

| 4,651 | | British Land Co. PLC - REIT | | | 121,300 |

| 294 | | Daily Mail & General Trust - Class A | | | 4,024 |

| 9,372 | | Davis Service Group PLC | | | 111,627 |

| 880 | | GlaxoSmithKline PLC | | | 22,986 |

| 115 | | Hammerson PLC - REIT | | | 3,080 |

| 6,344 | | Home Retail Group PLC | | | 53,008 |

| 1,846 | | International Power PLC | | | 15,061 |

| 696 | | J Sainsbury PLC | | | 7,777 |

| 6,953 | | Lloyds TSB Group PLC | | | 76,434 |

| 4,057 | | London Stock Exchange Group PLC | | | 111,782 |

| 6,780 | | Marks & Spencer Group PLC | | | 85,472 |

| 10,798 | | Mondi PLC | | | 106,613 |

| 14,595 | | Royal Bank of Scotland Group PLC | | | 169,126 |

| 4,306 | | Royal Dutch Shell PLC - Class B | | | 167,976 |

| 44 | | SABMiller PLC | | | 1,207 |

| 3,085 | | Schroders PLC | | | 82,387 |

| 1,530 | | Stagecoach Group PLC | | | 6,851 |

| 1,065 | | Tomkins PLC | | | 5,129 |

| 4,394 | | Unilever PLC | | | 138,527 |

| | | | | |

| | | | | 1,540,010 |

| | | | | |

| | United States - 47.2% | | | |

| 6,403 | | ADC Telecommunications, Inc. (a) | | | 117,175 |

| 2,590 | | Aetna, Inc. | | | 131,857 |

| 64 | | Aflac, Inc. | | | 3,412 |

| 1,956 | | Allstate Corp. (The) | | | 107,091 |

| 1,647 | | Alltel Corp. | | | 112,424 |

| 2,793 | | Altria Group, Inc. | | | 193,862 |

| 1,655 | | Amazon.Com, Inc. (a) | | | 132,251 |

| 2,286 | | American International Group, Inc. | | | 150,876 |

| 702 | | Apple, Inc. (a) | | | 97,213 |

| 118 | | Avis Budget Group, Inc. (a) | | | 2,739 |

| 1,840 | | Biogen Idec, Inc. (a) | | | 117,429 |

| 1,352 | | Boeing Co. | | | 130,738 |

| 829 | | Career Education Corp. (a) | | | 24,621 |

| 1,741 | | CBS Corp. - Class B | | | 54,859 |

| 2,524 | | Chevron Corp. | | | 221,506 |

| 626 | | Cigna Corp. | | | 32,352 |

| 1,941 | | Citigroup, Inc. | | | 90,994 |

| 698 | | Discover Financial Services (a) | | | 16,152 |

| 519 | | Eastman Kodak Co. | | | 13,842 |

| 4,321 | | Electronic Data Systems Corp. | | | 98,908 |

| 1,803 | | Expedia, Inc. (a) | | | 53,820 |

| 2,302 | | Express Scripts, Inc. (a) | | | 126,034 |

| 4,406 | | Exxon Mobil Corp. | | | 377,726 |

| 1,826 | | FirstEnergy Corp. | | | 112,189 |

| 719 | | General Mills, Inc. | | | 40,178 |

| 753 | | Goldman Sachs Group, Inc. (The) | | | 132,535 |

| 3,877 | | Halliburton Co. | | | 134,105 |

| 3,799 | | Hewlett-Packard Co. | | | 187,481 |

| 2,130 | | HJ Heinz Co. | | | 96,042 |

| 7,803 | | Intel Corp. | | | 200,927 |

| 1,836 | | International Business Machines Corp. | | | 214,243 |

| 2,508 | | International Paper Co. | | | 88,056 |

| 1,562 | | Invitrogen Corp. (a) | | | 121,680 |

| 4,158 | | JPMorgan Chase & Co. | | | 185,114 |

| 3,079 | | Juniper Networks, Inc. (a) | | | 101,361 |

See notes to financial statements.

16 | Annual Report | August 31, 2007

Claymore Exchange-Traded Fund Trust 2 | Portfolio of Investments continued

EEW | Claymore/Robeco Developed World Equity ETF (continued)

| | | | | |

Number

of Shares | | Description | | Value |

| | Unitied States (continued) | | | |

| 1,095 | | Kroger Co. (The) | | $ | 29,105 |

| 1,580 | | Lehman Brothers Holdings, Inc. | | | 86,631 |

| 450 | | Lennar Corp. - Class A | | | 12,721 |

| 207 | | Liberty Media Corp. - Series A (a) | | | 22,561 |

| 1,312 | | Lockheed Martin Corp. | | | 130,072 |

| 1,838 | | Marathon Oil Corp. | | | 99,050 |

| 51 | | Mastercard, Inc. - Class A | | | 6,986 |

| 2,935 | | McDonald’s Corp. | | | 144,549 |

| 1,960 | | McKesson Corp. | | | 112,132 |

| 1,042 | | MedCo Health Solutions, Inc. (a) | | | 89,039 |

| 3,381 | | Merck & Co., Inc. | | | 169,625 |

| 1,755 | | Merrill Lynch & Co., Inc. | | | 129,343 |

| 1,762 | | MGIC Investment Corp. | | | 53,142 |

| 69 | | Microsoft Corp. | | | 1,982 |

| 1,406 | | Morgan Stanley | | | 87,692 |

| 687 | | National Oilwell Varco, Inc. (a) | | | 87,936 |

| 362 | | Novellus Systems, Inc. (a) | | | 9,908 |

| 181 | | NVR, Inc. (a) | | | 101,270 |

| 989 | | Occidental Petroleum Corp. | | | 56,066 |

| 351 | | Pactiv Corp. (a) | | | 10,267 |

| 619 | | Parker Hannifin Corp. | | | 66,524 |

| 8,370 | | Pfizer, Inc. | | | 207,911 |

| 751 | | PG&E Corp. | | | 33,419 |

| 1,518 | | Prudential Financial, Inc. | | | 136,286 |

| 748 | | Public Service Enterprise Group, Inc. | | | 63,573 |

| 481 | | Raytheon Co. | | | 29,505 |

| 1,132 | | Rockwell Automation, Inc. | | | 79,761 |

| 1,619 | | Safeco Corp. | | | 93,934 |

| 601 | | Sara Lee Corp. | | | 9,989 |

| 651 | | Sears Holdings Corp. (a) | | | 93,458 |

| 1,752 | | Sprint Nextel Corp. | | | 33,148 |

| 1,517 | | Sunoco, Inc. | | | 110,953 |

| 3,950 | | Texas Instruments, Inc. | | | 135,248 |

| 7,195 | | Time Warner, Inc. | | | 136,561 |

| 1,275 | | UnitedHealth Group, Inc. | | | 63,763 |

| 1,888 | | Valero Energy Corp. | | | 129,347 |

| 3,383 | | Walt Disney Co. (The) | | | 113,669 |

| 2,106 | | Washington Mutual, Inc. | | | 77,332 |

| 1,827 | | WellPoint, Inc. (a) | | | 147,238 |

| 2,552 | | Xerox Corp. (a) | | | 43,716 |

| | | | | |

| | | | | 7,267,204 |

| | | | | |

| | Total Investments - 99.5% | | | |

| | (Cost - $14,877,412) | | | 15,338,928 |

| | Other Assets in excess of Liabilities - 0.5% | | | 73,201 |

| | | | | |

| | Net Assets - 100.0% | | $ | 15,412,129 |

| | | | | |

ASA – Stock Company

AG – Stock Corporation

REIT – Real Estate Investment Trust

OYJ – Public Traded Company

PLC – Public Limited Company

SA – Corporation

SpA – Limited Share Corporation

| (a) | Non-income producing security. |

See notes to financial statements.

Annual Report | August 31, 2007 | 17

Claymore Exchange-Traded Fund Trust 2 | Portfolio of Investments continued

CGW | Claymore S&P Global Water Index ETF

| | | | | |

Number of Shares | | Description | | Value |

| | Common Stocks - 97.8% | | | |

| | Austria - 0.3% | | | |

| 41,360 | | Christ Water Technology AG (a) | | $ | 780,919 |

| | | | | |

| | Brazil - 2.4% | | | |

| 123,555 | | Cia de Saneamento Basico do Estado de Sao Paulo - ADR (a) | | | 6,057,902 |

| | | | | |

| | Canada - 1.0% | | | |

| 250,651 | | GLV, Inc., Class A (a) | | | 2,558,993 |

| | | | | |

| | Cayman Islands - 0.2% | | | |

| 15,108 | | Consolidated Water Co, Inc. | | | 445,837 |

| | | | | |

| | China - 2.3% | | | |

| 5,834,000 | | Guangdong Investment Ltd. (Hong Kong) | | | 3,658,994 |

| 3,218,000 | | Tianjin Capital Environmental Protection | | | 2,084,317 |

| | | | | |

| | | | | 5,743,311 |

| | | | | |

| | Finland - 4.8% | | | |

| 261,913 | | Kemira OYJ | | | 6,319,838 |

| 152,453 | | Uponor OYJ | | | 5,848,381 |

| | | | | |

| | | | | 12,168,219 |

| | | | | |

| | France - 19.4% | | | |

| 426,849 | | Suez SA | | | 24,288,591 |

| 325,214 | | Veolia Environnement SA | | | 24,951,630 |

| | | | | |

| | | | | 49,240,221 |

| | | | | |

| | Italy - 5.2% | | | |

| 220,505 | | ACEA SpA | | | 4,010,051 |

| 753,677 | | ASM SpA | | | 4,453,998 |

| 57,983 | | Acegas-APS SpA | | | 629,596 |

| 1,037,252 | | Hera SpA | | | 4,150,190 |

| | | | | |

| | | | | 13,243,835 |

| | | | | |

| | Japan - 15.6% | | | |

| 1,256,000 | | Kubota Corp. | | | 9,730,302 |

| 303,700 | | Kurita Water Industries Ltd. | | | 9,222,482 |

| 38,000 | | Maezawa Kyuso Industries Co., Ltd. | | | 673,683 |

| 2,600,000 | | Mitsubishi Heavy Industries Ltd. | | | 15,903,033 |

| 650,000 | | Mitsubishi Rayon Co., Ltd. | | | 4,138,377 |

| | | | | |

| | | | | 39,667,877 |

| | | | | |

| | Singapore - 1.3% | | | |

| 1,272,000 | | Hyflux Ltd. | | | 2,203,754 |

| 1,091,000 | | Sinomem Technology Ltd. | | | 959,404 |

| | | | | |

| | | | | 3,163,158 |

| | | | | |

| | Spain - 2.4% | | | |

| 165,093 | | Sociedad General de Aguas de Barcelona SA, Class A | | | 6,009,184 |

| | | | | |

| | Switzerland - 1.6% | | | |

| 75,497 | | Ciba Specialty Chemicals AG | | | 4,130,060 |

| | | | | |

| | United Kingdom - 12.6% | | | |

| 281,813 | | Kelda Group PLC | | | 4,956,713 |

| 529,578 | | Northumbrian Water Group PLC | | | 3,693,247 |

| 361,758 | | Pennon Group PLC | | | 4,389,045 |

| 245,166 | | Severn Trent PLC | | | 6,750,084 |

| 867,798 | | United Utilities PLC | | | 12,112,701 |

| | | | | |

| | | | | 31,901,790 |

| | | | | |

| | United States - 28.7% | | | |

| 19,406 | | American States Water Co. | | | 757,998 |

| 136,231 | | Aqua America, Inc. | | | 3,264,095 |

| 55,588 | | Arch Chemicals, Inc. | | | 2,408,072 |

| 28,554 | | Badger Meter, Inc. | �� | | 896,310 |

| 19,998 | | California Water Service Group | | | 774,523 |

| 140,206 | | Danaher Corp. | | | 10,888,398 |

| 79,098 | | Flow International Corp. (a) | | | 649,395 |

| 64,459 | | Flowserve Corp. | | | 4,603,017 |

| 50,523 | | Franklin Electric Co., Inc. | | | 2,085,589 |

| 91,342 | | IDEX Corp. | | | 3,513,927 |

| 168,921 | | ITT Corp. | | | 11,484,939 |

| 16,192 | | Layne Christensen Co. (a) | | | 799,399 |

| 296,956 | | Mueller Water Products, Inc., Class B | | | 3,251,668 |

| 341,804 | | Nalco Holding Co. | | | 8,545,100 |

| 233,453 | | Pentair, Inc. | | | 8,668,110 |

| 20,180 | | Pico Holdings, Inc. (a) | | | 887,920 |

| 93,621 | | Roper Industries, Inc. | | | 5,925,273 |

| 17,812 | | SJW Corp. | | | 611,130 |

| 21,745 | | Southwest Water Co. | | | 303,995 |

| 71,417 | | Watts Water Technologies, Inc., Class A | | | 2,529,590 |

| | | | | |

| | | | | 72,848,448 |

| | | | | |

| | Total Long-Term Investments - 97.8% | | | |

| | (Cost $253,940,161) | | | 247,959,754 |

| | | | | |

| | | | | | |

Principal

Amount | | Description | | Value |

| | | Short-Term Investments - 0.2% | | | |

| | | U.S. Government and Agency Securities - 0.2% | | | |

| $ | 455,000 | | Federal Home Loan Bank Discount Note, yielding 4.10%, | | | |

| | | maturing 9/04/07 | | | |

| | | (Cost $454,845) | | | 455,000 |

| | | | | | |

| | | Total Investments - 98.0% | | | |

| | | (Cost $254,395,006) | | | 248,414,754 |

| | | Other Assets in excess of Liabilities - 2.0% | | | 5,130,189 |

| | | | | | |

| | | Net Assets - 100.0% | | $ | 253,544,943 |

| | | | | | |

ADR – American Depositary Receipt

AG – Stock Corporation

OYJ – Public Traded Company

PLC – Public Limited Company

SA – Corporation

SpA – Limited Share Company

| (a) | Non-income producing security. |

See notes to financial statements.

18 | Annual Report | August 31, 2007

Claymore Exchange-Traded Fund Trust 2

Statement of Assets and Liabilities | August 31, 2007

| | | | | | | | | | |

| | | Claymore/Robeco

Developed

International

Equity ETF | | Claymore/Robeco

Developed World

Equity ETF | | Claymore S&P

Global Water

Index ETF | |

Assets | | | | | | | | | | |

Investments in securities, at value | | $ | 5,049,256 | | $ | 15,338,928 | | $ | 248,414,754 | |

Foreign currency, at value | | | — | | | 18,549 | | | 83,812 | |

Cash | | | 11,592 | | | — | | | 62,041 | |

Receivables: | | | | | | | | | | |

Fund shares sold | | | — | | | — | | | — | |

Dividends | | | 12,303 | | | 26,446 | | | 249,099 | |

Investments sold | | | 1,408 | | | 2,270 | | | 4,937,313 | |

Due from Adviser | | | 71,122 | | | 69,342 | | | – | |

Other assets | | | 40,094 | | | 40,160 | | | 50,084 | |

| | | | | | | | | | |

Total assets | | | 5,185,775 | | | 15,495,695 | | | 253,797,103 | |

| | | | | | | | | | |

Liabilities | | | | | | | | | | |

Custodian bank | | | 7,628 | | | 4,821 | | | — | |

Payables: | | | | | | | | | | |

Investments purchased | | | 1,379 | | | 10,333 | | | 12,076 | |

Administration fee payable | | | 174 | | | 352 | | | 5,448 | |

Offering costs payable | | | — | | | — | | | 41,396 | |

Accrued advisory fees | | | — | | | — | | | 86,480 | |

Accrued expenses | | | 68,465 | | | 68,060 | | | 106,760 | |

| | | | | | | | | | |

Total liabilities | | | 77,646 | | | 83,566 | | | 252,160 | |

| | | | | | | | | | |

Net Assets | | $ | 5,108,129 | | $ | 15,412,129 | | $ | 253,544,943 | |

| | | | | | | | | | |

Composition of Net Assets | | | | | | | | | | |

Paid-in capital | | $ | 4,902,384 | | $ | 14,672,527 | | $ | 258,915,459 | |

Undistributed net investment income (loss) | | | 119,839 | | | 156,964 | | | 751,169 | |

Net realized gain (loss) on investments and currency transactions | | | 45,269 | | | 120,710 | | | (137,407 | ) |

Net unrealized appreciation (depreciation) on investments and currency translation | | | 40,637 | | | 461,928 | | | (5,984,278 | ) |

| | | | | | | | | | |

Net Assets | | $ | 5,108,129 | | $ | 15,412,129 | | $ | 253,544,943 | |

| | | | | | | | | | |

Shares oustanding ($0.01 par value with unlimited amount authorized) | | | 202,000 | | | 602,000 | | | 10,200,000 | |

Net Asset Value | | $ | 25.29 | | $ | 25.60 | | $ | 24.86 | |

| | | | | | | | | | |

Investments in securities, at cost | | $ | 5,008,687 | | $ | 14,877,413 | | $ | 254,395,006 | |

| | | | | | | | | | |

Foreign currency, at cost | | $ | — | | $ | 10,203 | | $ | 83,812 | |

| | | | | | | | | | |

See notes to financial statements.