UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

[X] ANNUAL REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year endedApril 30, 2009

[ ] TRANSITION REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from ________________ to________________

Commission file number000-52393

BIOSHAFT WATER TECHNOLOGY, INC.

(Exact name of registrant as specified in its charter)

| Nevada | 98-049003 |

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

| | |

| 1 Orchard Drive, Suite 220, Lake Forest CA | 92630 |

| (Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code(949) 748-8050

Securities registered under Section 12(b) of the Act:

| None | N/A |

| Title of each class | Name of each exchange on which registered |

Securities registered under Section 12(g) of the Act:

Common Stock, $0.001 par value

(Title of class)

Indicate by checkmark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes [ ] No [X]

Indicate by checkmark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act.

Yes [ ] No [X]

Indicate by checkmark whether the registrant has (1) filed all reports required to be filed by Section 13 or 15(d) of the

Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was

required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes [X] No [ ]

- ii -

Indicate by checkmark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this

chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy

or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form

10-K. [ ]

Indicate by checkmark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer,

or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer" and "smaller reporting

company" in Rule 12b-2 of the Exchange Act.

| Large accelerated filer [ ] | (Do not check if a smaller | Accelerated filer [ ] |

| Non-accelerated filer [ ] | reporting company) | Smaller reporting company [X] |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act).

Yes [X] No [ ]

State the aggregate market value of the voting and non-voting common equity held by non-affiliates computed by

reference to the price at which the common equity was last sold, or the average bid and asked price of such common

equity, as of the last business day of the registrant’s most recently completed second fiscal quarter: $12,950,000

based on a price of $0.37 per share, being the price the common equity was last sold as of the last day of the

registrant’s most recently cpmleted second fisal quarter.

APPLICABLE ONLY TO REGISTRANTS INVOLVED IN BANKRUPTCY

PROCEEDINGS DURING THE PAST FIVE YEARS:

Indicate by check mark whether the registrant has filed all documents and reports required to be filed by Section 12, 13

or 15(d) of the Securities Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by

a court.

Yes [ ] No [ ]N/A

(APPLICABLE ONLY TO CORPORATE REGISTRANTS)

Indicate the number of shares outstanding of each of the registrant’s classes of common stock, as of the latest practicable

date. 90,000,000 shares of common stock as of August 13, 2009.

DOCUMENTS INCORPORATED BY REFERENCE

List hereunder the following documents if incorporated by reference and the Part of the Form 10-K (e.g., Part I, Part II, etc.)

into which the document is incorporated: (1) any annual report to security holders; (2) any proxy or information statement;

and (3) any prospectus filed pursuant to Rule 424(b) or (c) of the Securities Act of 1933. The listed documents should be

clearly described for identification purposes (e.g., annual report to security holders for fiscal year ended December 24, 1980).

Not Applicable

3

Available Information

Our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and all amendments to those reports that we file with the Securities and Exchange Commission, or SEC, are available at the SEC's public reference room at 100 F Street, N.E., Washington, D.C. 20549. The public may obtain information on the operation of the public reference room by calling the SEC at 1-800-SEC-0330. The SEC also maintains a website at www.sec.gov that contains reports, proxy and information statements and other information regarding reporting companies.

TABLE OF CONTENTS

4

PART I

Forward Looking Statements.

This annual report contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. These statements relate to future events or our future financial performance. In some cases, you can identify forward-looking statements by terminology such as "may", "should", "expects", "plans", "anticipates", "believes", "estimates", "predicts", "potential" or "continue" or the negative of these terms or other comparable terminology. These statements are only predictions and involve known and unknown risks, uncertainties and other factors, including the risks in the section entitled "Risk Factors" and the risks set out below, any of which may cause our or our industry’s actual results, levels of activity, performance or achievements to be materially different from any future results, levels of activity, performance or achievements expressed or implied by these forward-looking statements. These risks include, by way of example and not in limitation:

the uncertainty that we will not be able to successfully identify and evaluate a suitable business opportunity;

risks related to the large number of established and well-financed entities that are actively seeking suitable business opportunities;

risks related to the failure to successfully management or achieve growth of a new business opportunity; and

other risks and uncertainties related to our business strategy.

This list is not an exhaustive list of the factors that may affect any of our forward-looking statements. These and other factors should be considered carefully and readers should not place undue reliance on our forward-looking statements.

Forward looking statements are made based on management’s beliefs, estimates and opinions on the date the statements are made and we undertake no obligation to update forward-looking statements if these beliefs, estimates and opinions or other circumstances should change. Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity, performance or achievements. Except as required by applicable law, including the securities laws of the United States, we do not intend to update any of the forward-looking statements to conform these statements to actual results.

Our financial statements are stated in United States dollars and are prepared in accordance with United States generally accepted accounting principles.

In this annual report, unless otherwise specified, all dollar amounts are expressed in United States dollars and all references to "common stock" refer to the common shares in our capital stock.

As used in this annual report, the terms "we", "us", "our" and "Digital Valleys" mean Digital Valleys Corp., unless otherwise indicated.

ITEM 1. BUSINESS

Item 1. Description of Business.

This annual report contains forward-looking statements as that term is defined in Section 27A of the United States Securities Act of 1933 and Section 21E of the Securities and Exchange Act of 1934. These statements relate to future events or our future financial performance. In some cases, you can identify forward-looking statements by terminology such as "may", "should", "expects", "plans", "anticipates", "believes", "estimates", "predicts", "potential" or "continue" or the negative of these terms or other comparable terminology. These statements are only predictions and involve known and unknown risks, uncertainties and other factors, including the risks in the section

5

entitled "Risk Factors", that may cause our or our industry’s actual results, levels of activity, performance or achievements to be materially different from any future results, levels of activity, performance or achievements expressed or implied by these forward-looking statements.

Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity, performance or achievements. Except as required by applicable law, including the securities laws of the United States, we do not intend to update any of the forward-looking statements to conform these statements to actual results.

Our financial statements are stated in United States dollars and are prepared in accordance with United States generally accepted accounting principles.

In this annual report, unless otherwise specified, all dollar amounts are expressed in United States dollars. All references to "CDN$" refer to Canadian dollars and all references to "common shares" refer to the common shares in our capital stock.

As used in this annual report, the terms "we", "us", "our", and "Bioshaft" mean Bioshaft Water Technology, Inc., unless otherwise indicated.

General

We were incorporated on March 8, 2006, under the laws of the State of Nevada as "Pointstar Entertainment Corp". Effective September 28, 2007, we completed a merger with our subsidiary, "Bioshaft Water Technology, Inc.", also a Nevada corporation. As a result, we changed our name from "Pointstar Entertainment Corp." to "Bioshaft Water Technology, Inc.". Effective September 28, 2007, our trading symbol on the OTC Bulletin Board was changed to "BSHF".

Our principal executive offices are located atOrchard Drive, Suite 220, Lake Forest CA and our telephone number is (949) 748-8050.

Current Business

During the period from our incorporation until September 18, 2007, we were in the process of establishing ourselves as a company that sought to obtain distribution rights for television programming and movies from film studios, television network companies, and independent production houses. However, we were not successful in implementing our business plan and we therefore considered various alternatives to ensure the viability and solvency of our company.

On August 14, 2007, Imad Kamel Yassine replaced Altaf Alimohamed as one of our directors. Subsequent to his appointment, Mr. Yassine focused his efforts on the identification of business alternatives and additional financing.

On September 18, 2007, we entered into an asset purchase agreement with Hans Bio Shaft Limited and Hassan Hans Badreddine, pursuant to which we acquired from Hans Bio Shaft U.K. Patent GB2390365 titled "Waste Water Treatment Plant and Method" and related United States and European patent applications for the design of a certain waste water treatment plant system. In consideration for the U.K. patent and related United States and European patent applications, we issued to Dr. Badreddine, the principal shareholder of Hans Bio Shaft, 27,000,000 restricted common shares of our common stock. In addition to the common shares, we paid Dr. Badreddine, a cash consideration in the amount of $750,000.

Furthermore, pursuant to the asset purchase agreement with Hans Bio Shaft and Dr. Badreddine, we agreed to pay Dr. Badreddine additional amounts of up to $1,750,000 on the following terms:

| | (a) | $750,000 upon the due execution and delivery, within 90 days from the closing of the transactions contemplated under the asset purchase agreement, of contracts for the purchase of the waste water plant system in the aggregate amount of $6,000,000; and |

6

| | (b) | $1,000,000 upon the due execution and delivery, within 180 days from closing of the transactions contemplated under the asset purchase agreement, of additional contracts for the purchase of the waste water plant system in the aggregate amount of $10,000,000. |

Subsequently, by written consent resolution of our directors effective March 12, 2008, we agreed to extend the date set out in paragraph (a) above to 365 days and the date set out in paragraph (b) above to 365 days. Neither target has been met and no new extension has been negotiated with Dr. Badreddine.

Pursuant to the asset purchase agreement with Hans Bio Shaft and Dr. Badreddine, on August 2, 2007, we closed a private placement consisting of 3,000,000 units of our securities at a price of $0.50 per unit for aggregate proceeds of $1,500,000. Each unit consisted of: (a) one common share; (b) one common share purchase warrant entitling the holder thereof to purchase one common share for a period of twenty-four months commencing from the closing of the private placement at an exercise price of $0.55 per common share; and (c) one common share purchase warrant entitling the holder thereof to purchase one common share for a period of thirty-six months commencing from the closing of the Private Placement at an exercise price of $0.60 per common share. We issued the units to a non-U.S. person (as that term is defined in Regulation S of the 1933 Act) in an offshore transaction relying on Regulation S and/or Section 4(2) of the 1933 Act.

Furthermore, pursuant to the asset purchase agreement with Hans Bio Shaft and Dr. Badreddine, our directors passed resolutions, whereby Dr. Badreddine was appointed as our president and a director as of September 18, 2008, and our corporate name was changed from "Pointstar Entertainment Corp." to "Bioshaft Water Technology, Inc.", effective September 28, 2008.

With the completion of the asset purchase agreement, we changed our business to the business of designing and manufacturing domestic waste water treatment plant systems, using our patented Hans BioShaft unit – the Hans BioShaft System. We are currently engaged in a specific branch of waste water treatment known as domestic waste or sewage treatment. In the future, we plan to expand into the treatment of industrial waste.

On January 31, 2008, we entered into a teaming agreement with Rapid Impact Compaction Contracting LLC (RIC), a company based in Dubai, UAE. The agreement provides the basis for our company and RIC to jointly pursue sewage treatment projects in the Gulf Region, with exclusivity as to association in the UAE. Pursuant to the agreement with RIC, we will perform engineering and manufacturing services, provide our sewage treatment systems, supervise installation, start-up and commissioning thereof and assist RIC over a five-year period to develop a division within RIC that specializes in sewage treatment plants using our patented Hans BioShaft technology. RIC will sell, install and handle all construction matters, provide office space, in-country transportation and assist with business development. We will pay a commission payment to RIC of 5% of the contract value of sewage treatment plant contracts in respect of the Hans BioShaft technology.

On February 11, 2008, we entered into a license agreement with FPS International (FPS) based in the Kuwait. FPS was established in 1977 and is a leading provider in the Middle East of products and services for the water, oil and gas industries.

Pursuant to the license agreement with FPS, we will license the Hans BioShaft System to FPS for marketing and distribution in the Arab Gulf Countries Council and Egypt. In consideration for the grant of the license, FPS will pay our company a royalty based on FPS’ annual gross revenues from the Hans BioShaft System, subject to a minimum annual royalty payment of $500,000.

Due to lack of payments of these royaly fees, the Licencing Agreement with FPS is terminated along with our relationship with FPS.

Our company has been chosen by the Mace group, a project management company with offices in Dubai, to bid on the Al Barari housing development in Dubai, UAE. The successful bidder will be required to install a waste water treatment plant capable of treating 32,000,000 cubic meters per day of tertiary and sewage.

We are in the process of bidding on the project as requested by the Mace group, a project management company with offices in Dubai.

7

The Al Barari development is being developed by Al Barari Development Company, a company founded by Mr. Zaal Mohamed Zaal in 2005 to provide high net worth individuals with innovative housing. Al Barari Development’s mission is to continuously raise the benchmark of the quality of property development in the UAE. through the development of eco-friendly sustainable communities and the implementation and utilization of new standards in estate planning, environment controls, and ongoing quality driven management.

Pursuant to a draft project construction contract between FPS International (FPS) and the municipality of Baghdad, the Hans BioShaft System has been selected as the technology for 13 domestic waste water treatment plants in the municipality of Baghdad in Iraq. The contract between FPS and the municipality of Baghdad is valued at $56 million and manufacturing, construction and installation of the plants by FPS is expected to begin in late-2008.

As at April 30, 2008, the Company has impaired the value of our patent to a nominal amount.

On August 11, 2008, we entered into a loan agreement with Premier Financial and Marketing Co. Ltd., in respect of the loan in the amount of $500,000 at the rate of interest of 15% per annum payable in full on August 11, 2009. The loan is to be used for general working capital purposes.

On November 11, 2008 we completed an sales agreement with RIC for a demo plant in Dubai, UAE. On July 14, 2009 completed the installation and commissioning the plant. This plant is for demo purposes. RIC paid 50% of the $100,000 cost.

On Dec 3, 2008 we received an order and down payment for a plant in Jeddah, Saudi Arabia. On June 24, 2009 we completed the installation and commissioning of the plant sold in Jeddah, Saudi Arabia.

On February 10, 2009. we received our United States Patent from the United States Patent and Trademark Office for our wastewater treatment plant and method. The patent number is 7,488,413. The we currently hold a patent in the United Kingdom as well and we have filed a PCT application as well.

On February 27, 2009 we entered into a loan agreement with Imad Yassine, in respect of the loan in the amount of $75,000 at the rate of interest of 10% per annum payable in full on February 27, 2010. The loan is to be used for general working capital purposes.

On March 6, 2009 we entered into a loan agreement with Premier Financial and Marketing Co. Ltd., in respect of the loan in the amount of $25,000 at the rate of interest of 15% per annum payable in full on March 6, 2010. The loan is to be used for general working capital purposes

On April 15, 2009 we have completed the installation and commissioning of a pilot plant for the city of Wayne, Nebraska. If the test results are approved they will allow us to bid on a larger project to upgrade their existing municipal plant.

Principal Products

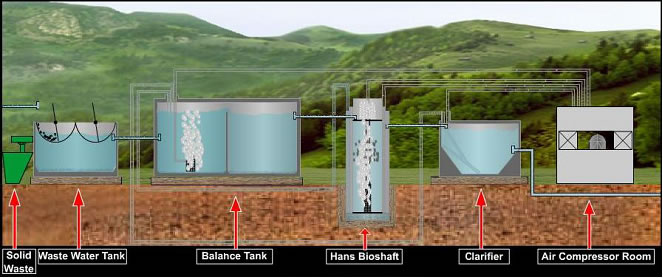

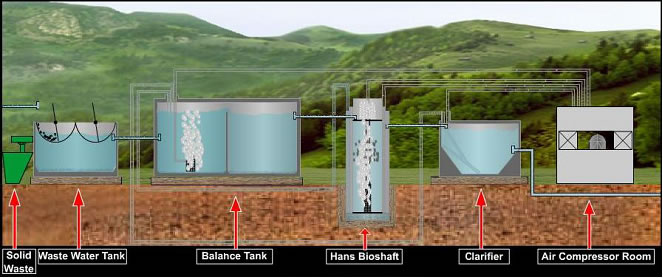

Our principal product is a domestic waste water treatment plant system. To date, there are currently 30 domestic waste water plants in use worldwide that use the BioShaft technology. This system is made using our patented Hans BioShaft unit. Hans BioShaft unit works by emulating and accelerating a natural process found in rivers. The waste water treatment plant system for which we use our Hans BioShaft unit is called the "Hans BioShaft System". The Hans BioShaft System comprises four treatment phases with Hans BioShaft unit being used in the second treatment phase. The four treatment phases are:

| | (a) | Mechanical/Primary Treatment Phases (Pre-treatment phase) which includes: |

| | | | |

| | | • | Delivery to the treatment |

| | | • | Screening and maceration |

| | | | |

| | (b) | Biological/Secondary Treatment Phase which includes: |

| | | | |

| | | • | Balance Tank (Aeration) |

8

| | | • | Hans BioShaft units |

| | | • | Clarification |

| | | | |

| | (c) | Tertiary Treatment Phase which includes: |

| | | | |

| | | • | Effluent disinfection |

| | | | |

| | (d) | Sludge Treatment which includes: |

| | | | |

| | | • | Biomass collecting tank (only for larger capacities >10,000 m3/day) |

Figure 1

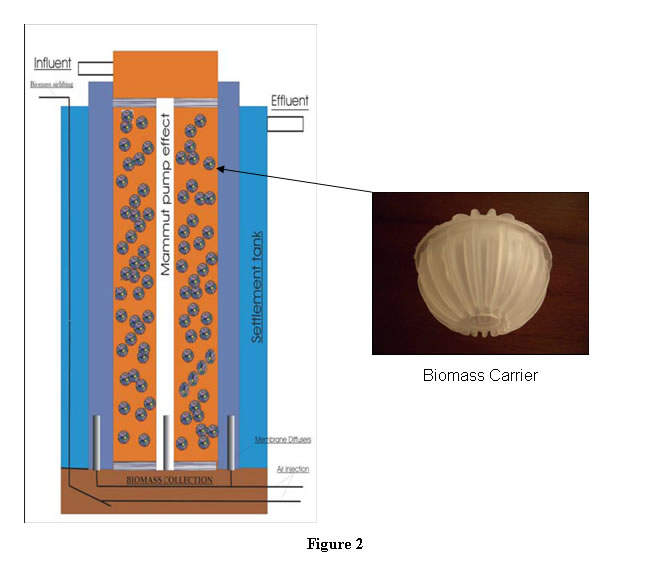

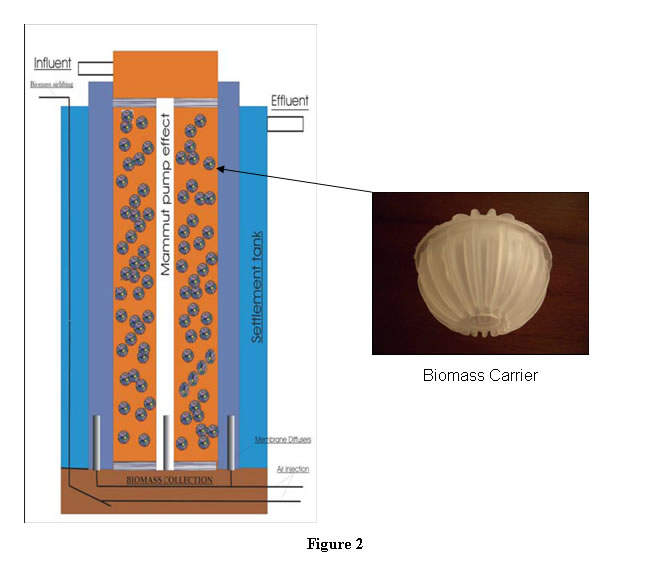

The Hans BioShaft System is an attached growth process for the biological treatment of the human (domestic) waste water. It is known that conventional suspended growth process requires large aeration and sedimentation volumes. These volumes can be reduced significantly with use of biomass carriers which have a high specific surface area. The application of a large number of biomass carriers instead of sedimentation by surface aeration has a positive effect on the efficiency and size of the required equipment.

The waste water enters the Hans BioShaft unit (see Figure 2) where it flows through the biological aeration filter chamber which contains the hollow plastic media (biomass carriers). Anoxic decomposition takes place on the inner surface (hollow area) of the biomass carrier, while on the outside, corrugated surface, the process is aerobic. This ensures a high level of sewage purification at fast speed.

9

The oxygen demand for the decomposition process is provided by the central air lift aerator. The air is supplied by a compressor and is dispersed by a special maintenance free membrane diffuser providing an enormous number of micro bubbles which saturate the sewage with oxygen and simultaneously force the sewage up to the surface. This oxygen rich fluid then passes back down through the aeration chamber in intimate contact with the carriers. Because the biomass carriers have a relative density less than unity they will always try to rise toward the surface, but are constantly forced downward under the pressure of the aerated sewage. These two forces ensure that there is constant upward and downward motion of the carriers within the aeration chamber.

Collision between the carriers will occur which will remove the excess microbial biomass by means of down current. This self-cleaning feature will protect the biological filter against any possible clogging, and makes the unit virtually maintenance free.

Treated water flows to final sedimentation compartment in the Hans BioShaft unit where suspended particles sink down to the bottom of the tank. This active biomass is then transferred back to the balance tank at periodic intervals by the airlift system which eliminates the need for sludge pumps.

Purified water rises up the outer compartment of the Hans BioShaft unit to the outlet and flows to the clarifier tank for final settlement and polishing before discharge. Any remaining biomass will settle to the bottom of the clarifier tank and will be periodically airlifted back to the balance tank.

10

Odors are eliminated due to the absorption of large quantities of oxygen in the system which converts odorous gases into dissolved chemicals.

On January 7, 2008, we launched a new product line of packaged domestic wastewater treatment systems ideal for emergency situations such as sewage overflow, system failure, natural disasters and military uses.

The new Hans BioShaft Packaged system is mobile and delivered ready for immediate installation. It is a pre-engineered, standard, packaged system designed as a complete domestic wastewater solution. The Hans BioShaft Packaged System is a compact and economic alternative that provides customers with a quick means of installation and commissioningin the event of a sewage emergency situation. The United States has many aging and overburdened sewage systems which result in regular sewage overflows and the Hans BioShaft Packaged System was designed for these emergency situations and can handle from 5000 up to 30,000 gallons per day.

As of the date hereof, we have not announced any new products or services which have not been disclosed herein.

According to the Environmental Protection Agency’s own numbers, annual sewer overflows are staggering. For combined sewer systems, EPA estimates that 850 billion gallons of raw or partially treated sewage is discharged annually into local waters.

For separate sanitary sewer systems, the EPA estimates that between 23,000 and 75,000 sanitary sewage overflows occur per year in the United States, discharging a total volume of three to ten billion gallons per year. These discharges, laden with potentially harmful chemicals, pathogens, viruses, and bacteria, often wind up in local rivers and streams, city streets, parks, or in unfortunate cases, directly into peoples’ homes.

The Market

Our market for the Hans BioShaft System encompasses both the municipal and private sectors. We will make direct sales calls to private contractors and industrial companies. For municipal projects, it will be necessary to assign a local agent or who is familiar with the market and the environmental government entities. This effort will also be supported with trade shows, sales brochures, website and online marketing.

The potential market segments are:

- Middle East;

- United States;

- Central and Eastern Europe; and

- Asia.

Middle East Market Segment

Initially, we will target waste water operators of municipalities, land developers, and private enterprises in the Middle East and then move into international markets. Currently the countries in the Middle East are encountering severe water shortages, resulting from population growth caused by rapid economic development. We believe that, as water demand increases in the region, water efficiency will need to be improved in all sectors, including the agriculture sector, which is a major consumer of water in the Middle East.

United States Market Segment

We are headquartered in Lake Forest, California and we plan to focus on the United States market.

We believe the market trends in the United States favor us, particularly because we have many qualities that differentiate us from the competition, such as rapid manufacturing, lower costs, less space requirements and less odor emission. We believe the high costs for fresh water and tough discharge standards in the United States are forcing industries to seek cost effective methods to treat waste water and reuse it.

Central and Eastern European Market Segment

11

We plan to target the Central and Eastern European market segment. One of the biggest drivers in this steadily growing market is the European Union directive for candidate countries. European Union funding aims at assisting new member and candidate countries to improve the waste water infrastructure in their regions.

We believe that this market is very price sensitive, giving us a competitive advantage. The choice of treatment processes is often based on price. Price is more important in this market then the long term benefits of advanced treatment systems. Furthermore the low price equipment vendors in South Eastern Europe are offering stiff competition to suppliers coming in from the mature western markets. The key to success here is to adopt innovative pricing strategies such as Build Own Operate. The Build Own Operate method is expected to allow us to create cash flows for many years and secure positive income for our company.

We also plan to establish local partnerships and concentrate on niche regional markets such as treatment plants for smaller communities.

Asian Market Segment

We plan to target several countries in Asia, especially China and the Philippines.

In the Philippines market, we believe there is a large market for water and waste water treatment products and equipment and we expect it to grow over the next few years. We believe the best opportunities for U.S. exporters are products for municipal water systems.

The Philippine water and waste water problems can be attributed to staggering population growth and industrialization. The result of this is a booming market for water and waste water treatment products and equipment.

There are no restrictions on imports waste water treatment products and equipment. Tariff rates imposed on most waste water equipment range from 5% to 10%.

The other major market in Asia is the Chinese market. Currently, the percentage of foreign capital in the waste water treatment industry in China is low because of low level of Chinese government investment, lack of sewage standards, lack of sewage drainage networks, low sewage treatment prices.

However, in the coming years we expect the Chinese market to evolve and we believe that we can compete in this growing market due to the size of the market and close proximity of our manufacturing facilities, which are expected to be near Shanghai.

Competition

We believe the driving forces in the waste water treatment industry to be technology and the overall cost of the treatment system. Some important industry trends that we are currently well positioned for are a shift toward nonchemical and multi-barrier treatment and the use of package plants for smaller communities.

While there are many competitors providing waste water treatment systems, our major competitors are Zenon and Smith & Loveless. Smith & Loveless, in particular, has a technology called the membrane bio reactor. Even though there are many alternative technologies for sewage treatment, two major competing technologies for our Hans BioShaft System are the traditional technologies such as activated sludge and membrane reactor treatments.

We expect competition to become increasingly intensified in the future and there is no assurance that we can keep pace with the intense competition in this market. Many of our competitors have significantly greater brand recognition, customer bases, operating histories and financial and other resources. In addition, many companies have expanded the size of their operations by acquiring other complementary companies to form advantageous strategic alliances. Many of our competitors offer less effective but similar services at less cost than us and have the financial resources to create more attractive pricing.

The system we bring to the market has not been introduced previously. Because engineering professionals are generally cautious about recommending new products to the market if not familiar with them, we may have difficulties in gaining market share.

12

Our revenues are not dependent on one or a few major customers.

Raw Materials

We are not dependent on any one supplier for our raw materials.

Sales and Marketing

Initially, we intend to target waste water operators of municipalities, land developers, and private enterprises in the Middle East and then move into international markets. We will attempt to reach these segments through traditional marketing methodologies. These methodologies include attendance at business specific conferences, direct mailings of brochures, warm and cold calling, website and e-commerce approaches and advertisements in trade publications.

Besides direct sales effort to large users of our products, a major element of our marketing efforts will be to develop a network of 4 strategic alliances with several types of companies, including:

- contractors that specialize in the construction of water treatment plants;

- engineering firms that work with municipalities;

- firms that specialize in Build Own Operate project utilities;

- Chinese manufacturers that we can outsource to.

Our marketing strategy will be to position ourselves as differentiated sewage treatment system provider. The primary goal of all marketing efforts will be to communicate these potential benefits to potential customers.

The sales strategy is to focus first on meeting the increased demand from our Middle East clients with whom Dr. Badreddine has established relationships for larger orders. These clients are critical to our ability to acquire additional accounts. Secondly we will focus on increasing the volume to the Middle East market. When we have reached maximum sales to existing channels we can then shift the majority of our focus to securing additional regions using our innovative contract pricing techniques such as Build Own Operate. This sales strategy is to concentrate on that segment of the market that can be most easily captured by our company.

Government Regulation

We will be required to comply with all regulations, rules and directives of governmental authorities and agencies applicable to the sale and use of our product in the jurisdictions where our products are sold.

In the United States, the sale and provision of on-site commercial and domestic waste water treatment devices is regulated at the state level through product registration, advertising restrictions, water testing, product disclosure and other regulations specific to the water treatment industry. In addition, municipal governments such as cities and counties frequently can require more stringent regulation. The United States Environmental Protection Agency is generally not involved in the regulation of waste water treatment devices with flow rates less than 1,000 gallons per day. In some cases, industrial, municipal, and other facilities must obtain certain permits from governmental authorities.

Federal agencies such as the United States Environmental Protection Agency, state agencies such as the Department of Health Services of various states, and local agencies such as regional pollution control boards, all have an interest in the quality of water discharged from sanitary sewer treatment plants. At a minimum, sewer treatment plants must protect the health and welfare of the local population by ensuring that raw or primary treated waste water does not contaminate the local potable water supply. At a maximum, some agencies must treat all inflows to tertiary standards, and then pump all treated water out of the drainage basin so that no effluent ever drains to a water supply.

Regulating agencies can compel sewer treatment enterprises to construct improvements to their plants by requiring higher standards in effluent quality. If not in compliance with regulations, sewer enterprises may be subject to heavy fines. Regulation is therefore often the driving force behind increasing sewer treatment costs in the United States, and is directly linked to the high cost of constructing or expanding a sewer treatment facility.

13

Intellectual Property

We own the inventions covered by United Kingdom Patent GB2390365 titled "WASTE WATER TREATMENT PLANT AND METHOD". On February 10, 2009. we received our United States Patent from the United States Patent and Trademark Office for our wastewater treatment plant and method. The patent number is 7,488,413. We also acquired the following related patent applications from Hans Bio Shaft Limited under the Asset Purchase Agreement and the Patent Assignment Agreement:

- PCT international patent application PCT/GB04/00002 (publication WO2005066081);

- European patent application EP20040700280 (publication EP1711440)

however, although related, these patent applications are not linked by priority to our U.K. patent.

We intend to require our customers to enter into confidentiality and nondisclosure agreements before we disclose any sensitive aspects of our technologies or strategic plans, and we intend in the future to enter into proprietary information agreements with employees and consultants. Despite our efforts to protect our proprietary rights, unauthorized parties may attempt to copy or otherwise obtain and use our technology. It is difficult to monitor unauthorized use of technology, particularly in foreign countries where the laws may not protect our proprietary rights as fully as laws in the United States and the United Kingdom. In addition, our competitors may independently develop technology similar to ours. Our precautions may not prevent misappropriation or infringement of our intellectual property.

No assurance can be given that any patents based on pending patent applications or any future patent applications by us, or any future licensors, will be issued, that the scope of any patent protection will exclude competitors or provide competitive advantages to us, that any of the provisional patent applications that have been or may be issued to us or our licensors will be held valid if subsequently challenged or that others will not claim rights in or ownership of the provisional patent applications and other proprietary rights held or licensed by us. Furthermore, there can be no assurance that others have not developed or will not develop similar products, duplicate any of our technology or design around our patent or any patents that may be issued to us or our licensors.

Our success will also depend in part on our ability to commercialize our technology without infringing the proprietary rights of others. We have not conducted freedom of use patent searches and no assurance can be given that patents do not exist or could not be filed which would have an adverse affect on our ability to market our technology or maintain our competitive position with respect to our technology. If our technologies or subject matter are claimed under other existing United States or foreign patents or are otherwise protected by third party proprietary rights, we may be subject to infringement actions. In such event, we may challenge the validity of such patents or other proprietary rights or we may be required to obtain licenses from such companies in order to develop, manufacture or market our technology. There can be no assurances that we will be able to obtain such licenses or that such licenses, if available, may be obtained on commercially reasonable terms. Furthermore, the failure to either develop a commercially viable alternative or obtain such licenses may result in delays in marketing our technology or the inability to proceed with the development, manufacture or sale of products requiring such licenses, which may have a material adverse effect on our business, financial condition and results of operations. If we are required to defend ourselves against charges of patent infringement or to protect our proprietary rights against third parties, substantial costs will be incurred regardless of whether we are successful. Such proceedings are typically protracted with no certainty of success. An adverse outcome could subject us to significant liabilities to third parties and force us to curtail or cease our development and commercialization of our technology.

We have not spent any money on research and development activities during the last two fiscal years.

Employees

The Company has retained 4 consultants including its President, COO and Vice President of Operations.

14

ITEM 1A. RISK FACTORS

Much of the information included in this annual report includes or is based upon estimates, projections or other "forward looking statements". Such forward looking statements include any projections or estimates made by us and our management in connection with our business operations. While these forward-looking statements, and any assumptions upon which they are based, are made in good faith and reflect our current judgment regarding the direction of our business, actual results will almost always vary, sometimes materially, from any estimates, predictions, projections, assumptions or other future performance suggested herein.

Such estimates, projections or other "forward looking statements" involve various risks and uncertainties as outlined below. We caution the reader that important factors in some cases have affected, and in the future could materially affect, actual results and cause actual results to differ materially from the results expressed in any such estimates, projections or other "forward looking statements".

Risks Related to Our Business

We have a history of losses and no revenues, which raise substantial doubt about our ability to continue as a going concern.

From inception to April 30, 2009, we have incurred aggregate net losses of $16,125,371 from operations. We can offer no assurance that we will ever operate profitably or that we will generate positive cash flow in the future. In addition, our operating results in the future may be subject to significant fluctuations due to many factors not within our control, such as the unpredictability of when customers will order products, the size of customers’ orders, the demand for our products, and the level of competition and general economic conditions.

Our company’s operations will be subject to all the risks inherent in the establishment of a developing enterprise and the uncertainties arising from the absence of a significant operating history. No assurance can be given that we may be able to operate on a profitable basis.

Due to the nature of our business and the early stage of our development, our securities must be considered highly speculative. We have not realized a profit from our operations to date and there is little likelihood that we will realize any profits in the short or medium term. Any profitability in the future from our business will be dependent upon the successful commercialization or licensing of our core products, which themselves are subject to numerous risk factors as set forth below.

We expect to continue to incur development costs and operating costs. Consequently, we expect to incur operating losses and negative cash flows until our products gain market acceptance sufficient to generate a commercially viable and sustainable level of sales, and/or additional products are developed and commercially released and sales of such products made so that we are operating in a profitable manner. Our history of losses and no revenues raise substantial doubt about our ability to continue as a going concern.

We have had negative cash flows from operations since inception. We will require significant additional financing, the availability of which cannot be assured, and if our company is unable to obtain such financing, our business may fail.

To date, we have had negative cash flows from operations and have depended on sales of our equity securities and debt financing to meet our cash requirements. We may continue to have negative cash flows. We have estimated that we will require approximately $3,410,000 to carry out our business plan for the next twelve months. There is no assurance that actual cash requirements will not exceed our estimates. We will require additional financing to finance working capital and pay for operating expenses and capital requirements until we achieve a positive cash flow.

Our ability to market and sell our waste water treatment plant system will be dependent upon our ability to raise significant additional financing. If we are unable to obtain such financing, we will not be able to fully develop our business. Specifically, we will need to raise additional funds to:

15

- support our planned growth and carry out our business plan;

- protect our intellectual property;

- hire top quality personnel for all areas of our business;

- address competing technological and market developments; and

- market and develop our technologies.

We may not be able to obtain additional equity or debt financing on acceptable terms as required. Even if financing is available, it may not be available on terms that are favorable to us or in sufficient amounts to satisfy our requirements. Any additional equity financing may involve substantial dilution to our then existing shareholders. If we require, but are unable to obtain, additional financing in the future, we may be unable to implement our business plan and our growth strategies, respond to changing business or economic conditions, withstand adverse operating results and compete effectively. More importantly, if we are unable to raise further financing when required, we may be forced to scale down our operations and our ability to generate revenues may be negatively affected.

We have a limited operating history and if we are not successful in continuing to grow our business, then we may have to scale back or even cease our ongoing business operations.

We have no history of revenues from operations and have no significant tangible assets. We have yet to generate positive earnings and there can be no assurance that we will ever operate profitably. We have only recently completed our acquisition of the U.K. patent in respect to the Hans BioShaft System and our company has limited operating history in the business of designing and manufacturing domestic waste water treatment plant system. Accordingly, we must be considered in the development stage. Our success is significantly dependent on a successful commercialization of our waste water treatment plant system. Our operations will be subject to all the risks inherent in the establishment of a developing enterprise and the uncertainties arising from the absence of a significant operating history. We may be unable to develop a useful waste water treatment system or achieve commercial acceptance of our waste water treatment plant system or operate on a profitable basis. We are in the development stage and potential investors should be aware of the difficulties normally encountered by enterprises in the development stage. If our business plan is not successful, and we are not able to operate profitably, investors may lose some or all of their investment in our company.

If we fail to effectively manage the growth of our company and the commercialization of our products and technology, our future business results could be harmed and our managerial and operational resources may be strained.

As we proceed with the commercialization of our products, technologies and the expansion of our marketing and commercialization efforts internationally, we expect to experience significant growth in the scope and complexity of our business. We will need to add staff to market our services, manage operations, handle sales and marketing efforts and perform finance and accounting functions. We anticipate that we will be required to hire a broad range of additional personnel in order to successfully advance our operations. This growth is likely to place a strain on our management and operational resources. The failure to develop and implement effective systems, or to hire and retain sufficient personnel for the performance of all of the functions necessary to effectively service and manage our potential business, or the failure to manage growth effectively, could have a material adverse effect on our business and financial condition.

We do not have the ability to manufacture our product on a commercial scale and will need to rely on third-party manufacturers and other third parties for production of our products, and our dependence on these manufacturers may impair the development of our product candidates.

Currently, we do not have the ability to internally manufacture our product on a commercial scale. We are in the process of identifying manufacturers for long-term supply contracts of components and subassemblies of our product. There are several potential manufacturers capable of manufacturing components and subassemblies for our waste water treatment plant system. There can be no assurance that we will be able to successfully negotiate long-term agreements with any of such potential manufacturers at a reasonable price and on other acceptable terms.

If our third-party manufacturers fail to deliver our products on a timely basis, with sufficient quality, and at commercially reasonable prices, we may be required to delay, suspend or otherwise discontinue development and production of our product. While we may be able to identify replacement third-party manufacturers or develop our

16

own manufacturing capabilities for our product, this process would likely cause a delay in the availability of our product and an increase in costs. We may also be required to enter into long-term manufacturing agreements that contain exclusivity provisions and/or substantial termination penalties. In addition, third-party manufacturers may have a limited number of facilities in which our product can be produced, and any interruption of the operation of those facilities due to events such as equipment malfunction or failure or damage to the facility by natural disasters could result in the cancellation of shipments, loss of product in the manufacturing process or a shortfall in available product.

We depend upon a number of third party suppliers for component parts for our products, and any disruption from such suppliers could prevent us from delivering our products to our customers within required timeframes or at scheduled prices, which could result in order cancellations and a decline in sales.

We assemble our products using materials and components procured from a number of third-party suppliers. If we fail to maintain our relationships with these suppliers, we may be unable to assemble our products or our products may be available only at a higher cost or after a long delay. We may be unable to obtain comparable materials and components from alternative suppliers. Our failure to obtain components that meet our quality, quantity, technological and cost requirements in a timely manner may interrupt or impair our ability to assemble our products or it may increase our manufacturing cost. We may be unable to identify new suppliers or qualify their products for use on our production lines in a timely manner and on commercially reasonable terms. Any of these factors could prevent us from delivering our products to our customers within required timeframes, and we may experience order cancellations which would adversely affect our business operations.

We may lose our competitiveness if we are not able to protect our proprietary technology and intellectual property rights against infringement, and any related litigation may be time-consuming and costly.

Our success and ability to compete depends to a significant degree on our proprietary technology. If any of our competitors copy or otherwise gain access to our proprietary technology or develop similar technologies independently, we may not be able to compete as effectively. The measures we have implemented to protect our proprietary technology and other intellectual property rights are currently based upon a combination of a patent, patent applications and trade secrets. These measures, however, may not be adequate to prevent the unauthorized use of our proprietary technology and our other intellectual property rights. Our pending patent applications may not result in the issuance of any patents or any issued patents that will offer protection against competitors with similar technology. Further, the laws of foreign countries may provide inadequate protection of such intellectual property rights. We may need to bring legal claims to enforce or protect such intellectual property rights. Any litigation, whether successful or unsuccessful, may result in substantial costs and a diversion of our company’s resources. In addition, notwithstanding our rights to our intellectual property, other persons may bring claims against us alleging that we have infringed on their intellectual property rights or claims that our intellectual property rights are not valid. Any claims against us, with or without merit, could be time consuming and costly to defend or litigate, divert our attention and resources, result in the loss of goodwill associated with our business or require us to make changes to our technology.

The manufacture, use or sale of our waste water treatment plant system may infringe on the patent rights of others, and we may be forced to litigate if an intellectual property dispute arises.

If we infringe or are alleged to have infringed another party’s patent rights, we may be required to seek a license, defend an infringement action or challenge the validity of the patents in court. Patent litigation is costly and time consuming. We may not have sufficient resources to bring these actions to a successful conclusion. In addition, if we do not obtain a license, do not successfully defend an infringement action or are unable to have infringed patents declared invalid, we may:

- incur substantial monetary damages;

- encounter significant delays in marketing our waste water treatment plant system;

- be unable to conduct or participate in the manufacture, use or sale of our waste water treatment plant system;

- lose patent protection for our inventions and products; or

- find that our patents are unenforceable, invalid, or have a reduced scope of protection.

17

Parties making such claims may be able to obtain injunctive relief that could effectively block our ability to further develop or commercialize our waste water treatment plant system in United States, Central and Eastern Europe, Asia and Middle East and could result in the award of substantial damages. Defense of any lawsuit or failure to obtain any such license could substantially harm our company. Litigation, regardless of outcome, could result in substantial cost to and a diversion of efforts by our company.

Because our waste water treatment plant system has not been accepted as a recognized form of waste water treatment, we face significant barriers to acceptance of our services.

Our waste water treatment plant system has not been fully utilized in any particular market. The use of equipment such as ours is a relatively new form of waste water treatment. Traditionally, these services are provided through other treatment methodologies, such as chemicals or other aeration methods. Accordingly, we face significant barriers to overcome the consumer preferences of traditionally used treatment programs for the type of waste water treatment products and services that we offer.

Market acceptance of our products and services will depend in large part upon our ability to demonstrate the technical and operational advantages and cost effectiveness of our products and services as compared to alternative, competing products and services, and our ability to train customers concerning the proper use and application of our products. There can be no assurance that our products and services will achieve a level of market acceptance that will be profitable for us.

Our waste water treatment plant system may not achieve market acceptance at a level necessary for us to operate successfully.

Our waste water treatment plant system may not achieve market acceptance at a level necessary to enable production at a reasonable cost, to support the required sales and marketing effort, to effectively service and maintain, and to support continuing research and development costs. In addition, our waste water treatment plant system may:

- be difficult or overly expensive to produce;

- fail to achieve performance levels expected by customers;

- have a price level that is unacceptable in our targeted industries; or

- be precluded from commercialization by the proprietary rights of others or other competitive forces.

We cannot assure you that we will be able to successfully manufacture and market our waste water treatment plant system on a timely basis, achieve anticipated performance levels or throughputs, gain and maintain industry acceptance of our waste water treatment plant system or develop a profitable business. The failure to achieve any of these objectives would have a material adverse effect on our business, financial condition and results of operations.

Because we face intense competition from larger and better-established companies that have more resources than we do, we may be unable to implement our business plan or increase our revenues.

The market for our waste water treatment products and services is intensely competitive and highly fragmented. Many of these competitors may have longer operating histories, greater financial, technical and marketing resources, and enjoy existing name recognition and customer bases. New competitors may emerge and rapidly acquire significant market share. In addition, new technologies likely will increase the competitive pressures we face. Competitors may be able to respond more quickly to technological change, competitive pressures, or changes in consumer demand. As a result of their advantages, our competitors may be able to limit or curtail our ability to compete successfully.

In addition, many of our large competitors may offer customers a broader or superior range of services and technologies. Some of our competitors may conduct more extensive promotional activities and offer lower commercialization and licensing costs to customers than we do, which could allow them to gain greater market share or prevent us from establishing and increasing our market share. Increased competition may result in significant price competition, reduced profit margins or loss of market share, any of which may have a material adverse effect on our ability to generate revenues and successfully operate our business. Our competitors may develop technologies superior to those that our company currently possess. In the future, we may need to decrease our prices if our competitors lower their prices. Our competitors may be able to respond more quickly to new or changing

18

opportunities, technologies and customer requirements. Such competition will potentially affect our chances of achieving profitability, and ultimately affect our ability to continue as a going concern.

If product liability lawsuits are successfully brought against us, we will incur substantial liabilities and may be required to limit commercialization of our products.

We face an inherent business risk of exposure to product liability claims in the event that an individual is harmed because of the failure of our products to function properly. If we cannot successfully defend ourselves against the product liability claim, we will incur substantial liabilities. Regardless of merit or eventual outcome, liability claims may result in:

- decreased demand for our products;

- injury to our reputation;

- costs of related litigation;

- substantial monetary awards to plaintiffs;

- loss of revenues; and

- the inability to commercialize our technologies.

We currently carry no product liability insurance. Although we expect to obtain product liability insurance coverage in connection with the commercialization of our products, such insurance may not be available on commercially reasonable terms or at all, or such insurance, even if obtained, may not adequately cover any product liability claim. A product liability or other claim with respect to uninsured liabilities or in excess of insured liabilities could have a material adverse effect on our business and prospects.

Products which incorporate our waste water treatment technology will be subject to extensive regulation, which can be costly and time-consuming and could subject us to unanticipated delays or prevent us from obtaining the required approvals to commercialize our products.

Before we can market and sell products which incorporate our waste water treatment technology in the United States and abroad, extensive regulatory testing, inspection and approvals may be required. The regulatory process can be costly and time consuming. Our products which incorporate the waste water treatment technology may not receive necessary regulatory approval. Even if these products receive approval, the approval process might delay marketing and sale of our products, which may lead to a failure to meet our sales projections.

We will be subject to laws, regulations and other procedures with respect to government procurement.

Because we plan to sell some of our products to government agencies, we will be subject to laws, regulations and other procedures that govern procurement and contract implementation by those agencies. These agencies are likely to impose vendor qualification requirements, such as requirements with respect to financial condition, insurance and history. We have limited experience with government procurement and cannot assure you that we will be able to meet existing or future procurements laws, regulations and procedures or that we will be able to qualify as a vendor.

Substantially all of our assets and a majority of our directors and officers are outside the United States, with the result that it may be difficult for investors to enforce within the United States any judgments obtained against us or any of our directors or officers.

Although we are organized under the laws of the State of Nevada, United States, a majority of our directors and our officers are nationals and/or residents of countries other than the United States, and all or a substantial portion of such persons’ assets are located outside the United States. As a result, it may be difficult for investors to enforce judgments against us that are obtained in the United States in any action, including actions predicated upon civil liability provisions of federal securities laws. In addition, as the majority of our assets are located outside of the United States, it may be difficult to enforce United States bankruptcy proceedings against us. Under bankruptcy laws in the United States, courts typically have jurisdiction over a debtor’s property, wherever it is located, including property situated in other countries. Courts outside of the United States may not recognize the United States bankruptcy court’s jurisdiction. Accordingly, you may have trouble administering a United States bankruptcy case involving a Nevada company as debtor with most of its property located outside the United States. Any orders or judgments of a bankruptcy court obtained by you in the United States may not be enforceable.

19

Our by-laws contain provisions indemnifying our officers and directors against all costs, charges and expenses incurred by them.

Our by-laws contain provisions with respect to the indemnification of our officers and directors against all expenses, liability and loss (including attorneys’ fees, judgments, fines and amounts paid or to be paid in settlement) reasonably incurred or suffered by him or her in connection with any action, suit or proceeding to which they were made parties by reason of his or her being or having been one of our directors or officers.

Currency translation and transaction risk may negatively affect our net sales, cost of sales and gross margins, and could result in exchange losses.

Although our reporting currency is the United States dollar, we intend to conduct our business and incur costs in the local currency of the other countries in which we intend to operate. Changes in exchange rates between foreign currencies and the United States dollar could affect our net sales and cost of sales figures, and could result in exchange losses. In addition, we incur currency transaction risk whenever we enter into either a purchase or a sales transaction using a dollar currency other than the United States.

Risks Related to Our Common Stock

A decline in the price of our common stock could affect our ability to raise further working capital, it may adversely impact our ability to continue operations and we may go out of business.

A prolonged decline in the price of our common stock could result in a reduction in the liquidity of our common stock and a reduction in our ability to raise capital. Because we may attempt to acquire a significant portion of the funds we need in order to conduct our planned operations through the sale of equity securities, a decline in the price of our common stock could be detrimental to our liquidity and our operations because the decline may cause investors to not choose to invest in our stock. If we are unable to raise the funds we require for all of our planned operations, we may be forced to reallocate funds from other planned uses and may suffer a significant negative effect on our business plan and operations, including our ability to develop new products and continue our current operations. As a result, our business may suffer and not be successful and we may go out of business. We also might not be able to meet our financial obligations if we cannot raise enough funds through the sale of our common stock and we may be forced to go out of business.

If we issue additional shares in the future, it will result in the dilution of our existing shareholders.

We are authorized to issue up to 300,000,000 shares of common stock and 25,000,000 preferred shares with a par value of $0.001. Our board of directors may choose to issue some or all of such shares to acquire one or more businesses or to provide additional financing in the future. The issuance of any such shares will result in a reduction of the book value and market price of the outstanding shares of our common stock. If we issue any such additional shares, such issuance will cause a reduction in the proportionate ownership and voting power of all current shareholders. Further, such issuance may result in a change of control of our company.

Trading of our stock may be restricted by the Securities Exchange Commission’s penny stock regulations, which may limit a stockholder’s ability to buy and sell our stock.

The Securities and Exchange Commission has adopted regulations which generally define "penny stock" to be any equity security that has a market price (as defined) less than $5.00 per share or an exercise price of less than $5.00 per share, subject to certain exceptions. Our securities are covered by the penny stock rules, which impose additional sales practice requirements on broker-dealers who sell to persons other than established customers and "accredited investors". The term "accredited investor" refers generally to institutions with assets in excess of $5,000,000 or individuals with a net worth in excess of $1,000,000 or annual income exceeding $200,000 or $300,000 jointly with their spouse. The penny stock rules require a broker-dealer, prior to a transaction in a penny stock not otherwise exempt from the rules, to deliver a standardized risk disclosure document in a form prepared by the Securities and Exchange Commission, which provides information about penny stocks and the nature and level of risks in the penny stock market. The broker-dealer also must provide the customer with current bid and offer quotations for the penny stock, the compensation of the broker-dealer and its salesperson in the transaction and monthly account statements showing the market value of each penny stock held in the customer’s account. The bid

20

and offer quotations, and the broker-dealer and salesperson compensation information, must be given to the customer orally or in writing prior to effecting the transaction and must be given to the customer in writing before or with the customer’s confirmation. In addition, the penny stock rules require that prior to a transaction in a penny stock not otherwise exempt from these rules, the broker-dealer must make a special written determination that the penny stock is a suitable investment for the purchaser and receive the purchaser’s written agreement to the transaction. These disclosure requirements may have the effect of reducing the level of trading activity in the secondary market for the stock that is subject to these penny stock rules. Consequently, these penny stock rules may affect the ability of broker-dealers to trade our securities. We believe that the penny stock rules discourage investor interest in and limit the marketability of our common stock.

FINRA sales practice requirements may also limit a stockholder’s ability to buy and sell our stock.

In addition to the "penny stock" rules described above, the Financial Industry Regulatory Authority (FINRA), formerly the National Association of Securities Dealers or NASD, has adopted rules that require that in recommending an investment to a customer, a broker-dealer must have reasonable grounds for believing that the investment is suitable for that customer. Prior to recommending speculative low priced securities to their non-institutional customers, broker-dealers must make reasonable efforts to obtain information about the customer’s financial status, tax status, investment objectives and other information. Under interpretations of these rules, the FINRA believes that there is a high probability that speculative low priced securities will not be suitable for at least some customers. The FINRA requirements make it more difficult for broker-dealers to recommend that their customers buy our common stock, which may limit your ability to buy and sell our stock and have an adverse effect on the market for our shares.

21

ITEM 2. PROPERTIES.

Executive Offices

We do not own any real property. We currently maintain our corporate office at 1 Orchard Drive, Suite 220, Lake Forest CA 92630. We pay monthly rent of $2,058 for use of this space. This space is sufficient until we commence full operations.

ITEM 3. LEGAL PROCEEDINGS.

We know of no material, active, or pending legal proceeding against our company, nor are we involved as a plaintiff in any material proceeding or pending litigation there such claim or action involves damages for more than 10% of our current assets. There are no proceedings in which any of our company’s directors, officers, or affiliates, or any registered or beneficial shareholders, is an adverse party or has a material interest adverse to our company’s interest.

ITEM 4. SUBMISSION OF MATTERS TO A VOTE OF SECURITY HOLDERS.

No matters were submitted to a vote of our security holders during the fourth quarter of fiscal 2009.

PART II

ITEM 5. MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES.

Market for Securities

Our common stock is quoted on the OTC Bulletin Board under the stock symbol "BSHF". We do not have any common stock subject to outstanding options or warrants and there are no securities outstanding that are convertible into our common stock.

The following quotations obtained from Yahoo.com reflect the high and low bids for our common stock based on inter-dealer prices, without retail mark-up, mark-down or commission an may not represent actual transactions.

The high and low bid prices of our common stock for the periods indicated below are as follows:

| National Association of Securities Dealers OTC Bulletin Board |

| Quarter Ended | High | Low |

| April 30, 2009 | $0.74 | $0.17 |

| January 31, 2009 | $0.41 | $0.16 |

| October 31, 2008 | $1.16 | $0.26 |

| July 31, 2008 | $3.26 | $0.80 |

| April 30, 2008 | $2.65 | $1.20 |

| January 31, 2008 | $2.05 | $1.40 |

| October 31, 2007 | $2.13 | $1.60 |

Holders of our Common Stock

On August 13, 2009 the shareholders’ list of our common stock showed 16 registered shareholder and 90,000,000 shares outstanding.

Dividend Policy

We have not paid any cash dividends on our common stock and have no present intention of paying any dividends on the shares of our common stock. Our future dividend policy will be determined from time to time by our board of directors.

ITEM 6. SELECTED FINANCIAL DATA.

Not Applicable.

ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

The following discussion should be read in conjunction with our audited financial statements and the related notes that appear elsewhere in this annual report. The following discussion contains forward-looking statements that reflect our plans, estimates and beliefs. Our actual results could differ materially from those discussed in the forward looking statements. Factors that could cause or contribute to such differences include those discussed below and elsewhere in this annual report.

22

Our consolidated financial statements are stated in United States dollars and are prepared in accordance with United States generally accepted accounting principles.

The following discussion should be read in conjunction with our financial statements and the related notes that appear elsewhere in this annual report. The following discussion contains forward-looking statements that reflect our plans, estimates and beliefs. Our actual results could differ materially from those discussed in the forward looking statements. Factors that could cause or contribute to such differences include those discussed below and elsewhere in this annual report, particularly in the section entitled "Risk Factors" beginning on page 10 of this annual report.

Our consolidated audited financial statements are stated in United States dollars and are prepared in accordance with United States generally accepted accounting principles.

Plan of Operation

Over the next twelve months ending April 30, 2010, we plan to:

| | (a) | penetrate the waste water treatment industry worldwide by stressing the cost advantages and space saving capabilities of the Hans BioShaft System; |

| | | |

| | (b) | build up a network of strategic alliances with several types of companies, including contractors that specialize in the construction of water treatment plants, engineering firms that work with municipalities and firms that specialize in "build own operate" project utilities; |

| | | |

| | (c) | form a partnership with a Chinese manufacturer that we can outsource to, and fabricate up to 2 Hans BioShaft units per month within the first 3 months; |

| | | |

| | (d) | implement our pilot project in Southern California where we will setup and operate a packaged unit in order to complete the municipal permitting process for the California commission on environmental quality; and |

| | | |

| | (e) | fill the positions of Chief Executive Officer, Chief Financial Officer, Vice President of Marketing and three sales engineers. |

Other than as disclosed herein, we do not have any definite plans for product research and development for the next 12 months.

Other than as disclosed herein, we do not expect to purchase or sell any plant and significant equipment for the next 12 months.

Cash Requirements

Over the next 12 months ending April 30, 2010, we anticipate that we will incur the following operating expenses totaling approximately $600,000 in implementing our new business plan of designing and manufacturing domestic waste water treatment plant system as follows:

| Expenses | Estimated Cost |

Marketing/Promotion

Officer and Employee Compensation

Rent and Utilities

General and Administrative | $ 35,000

$ 450,000

$ 30,000

$ 85,000 |

| Total | $ 600,000 |

Year Ended April 30, 2009

23

| | 2009 | 2008 |

Revenue

Cost of sales

Operating Expenses

Interest and Dividend Income | $ 50,000

50,000

832,923

1,315 | $ -

-

15,190,723

8,591 |

| Net Loss | $ 903,433 | $ 15,182,132 |

Revenue and Expenses

| | Year Ended April 30, |

| 2009 | 2008 |

General and Administrative

Depreciation and amortization

Impairment of assets

Stock based compensation expense | $ 760,776

14,537

-

57,611 | $ 744,372

1,785,688

12,483,903

176,760 |

| Net Loss from operations | $ 832,923 | $ 15,190,723 |

Total operating expenses during the year ended April 30, 2009 decreased as compared to the comparative period in 2008 because the company did not impair its assets in the current year. .

Liquidity and Financial Condition

Working Capital

| | At April 30, |

| 2009 | 2008 |

Current assets

Current liabilities | $ 140,496

998,351 | $ 85,876

108,137 |

| Working capital (deficit) | $ (857,855) | $ (22,261) |

Cash Flows

| | Year Ended April 30, |

| 2009 | 2008 |

Net cash flows used in operating activities

Net cash flows used in investing activities

Net cash flows provided by financing activities | $ 600,330

54,310

600,000 | $ 646,185

791,356

1,500,000 |

| Net increase (decrease) in cash during period | (54,640) | $ 62,459 |

Capital Expenditures

Other than as required under the terms of the Asset Purchase Agreement with Hans Bio Shaft Limited and Dr. Badreddine, as of September 18, 2007, we do not have any material commitments for capital expenditures and management does not anticipate that we will spend additional material amounts on capital expenditures in the near future.

24

Employees

Other than as disclosed herein, we have no plans to significantly change our number of employees for the next 12 months.

Off-Balance Sheet Arrangements

There are no off-balance sheet arrangements that have or are reasonably likely to have a current or future effect on our financial condition, changes in financial condition, revenues or expenses, results of operations, liquidity, capital expenditures or capital resources that is material to investors.

Application of Critical Accounting Estimates

Our financial statements have been prepared in accordance with the U.S. GAAP. Because a precise determination of many assets and liabilities is dependent upon future events, the preparation of financial statements for a period necessarily involves the use of estimates which have been made using careful judgment.

The financial statements have, in management’s opinion, been properly prepared within reasonable limits of materiality and within the framework of significant accounting policies.

ITEM 8. FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA.

F-1