UNITED STATESSECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

REGISTRATION STATEMENT UNDER

THE SECURITIES ACT OF 1933

CYBRA CORPORATION

(Exact name of registrant as specified in charter)

New York State or Other Jurisdiction of Incorporation | | 7372 Primary Standard Classification Code Number | | 13-3303290 IRS Employee I.D. Number |

ONE EXECUTIVE BLVD.

YONKERS, NEW YORK 10701

(914) 963-6600

(Address and telephone number of principal executive offices)

ONE EXECUTIVE BLVD.

YONKERS, NEW YORK 10701

(914) 963-6600

(Address and telephone number of principal place of business)

HAROLD L. BRAND

PRESIDENT

ONE EXECUTIVE BLVD.

YONKERS, NEW YORK 10701

(914) 963-6600

(Name, address and telephone number of agent for service)

Copies of all communications to be sent to:

LAW OFFICES OF THOMAS G. AMON

500 FIFTH AVENUE

SUITE 1650

NEW YORK, NY 10110

Tel. (212) 810-2430

Fax. (212) 810-2427

APPROXIMATE DATE OF COMMENCEMENT OF PROPOSED SALE TO THE PUBLIC: As soon as practicable after the effective date of this Registration Statement

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If delivery of the prospectus is expected to be made pursuant to Rule 434, check the following box. o

Calculation of Registration Fee

Title of each class of securities to be registered | Amount to be registered | Proposed maximum offering price per share (1) | Proposed maximum aggregate offering price | Amount of registration fee |

Common Stock, par value $.001 per share | 6,500,000 (2) | $0.50 | $3,250,000 | $347.75 |

Common Stock, par value $.001 per share | 7,500,000 (3) | $.50 | $3,750,000 | $401.25 |

Common Stock, par value $.001 per share | 1,826,000 (4) | $.50 | $913,000 | $97.96 |

We are registering for resale certain shares of common stock owned by selling shareholders of CYBRA Corporation.

| (1) | Offering price computed in accordance with Rule 457(c). The price of $0.50 is a fixed price at which the selling stockholders identified herein may sell their shares until such time as a market develops for the Company’s shares. If a market develops, the shares may be sold at prevailing market prices or privately negotiated prices. |

| (2) | Includes 5,000,000 of the shares of common stock, par value $0.001 per share, of the registrant (the “Common Stock”) which may be issued upon conversion of convertible debentures sold by the Company in a private placement which closed on April 10, 2006, as more fully described herein (the “Private Placement”) as well as an additional 1,500,000 shares which are being registered to cover anti-dilution obligations of the parties. |

| (3) | Represents shares of Common Stock underlying Class A and Class B Warrants issued in the Private Placement. |

| (4) | Represents shares of common stock sold to three individuals in a private placement. |

Registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

CYBRA Corporation

15,826,000 Shares of Common Stock

By means of this prospectus, certain selling shareholders are offering to sell up to 15,826,000 shares of common stock of CYBRA Corporation , Inc. par value $.001 per share underlying debentures and warrants owned by them. The Shares which may be sold will initially be sold at a fixed price of $0.50 per share until such time as a market develops for the Company's shares. If a market develops, the shares may be sold at prevailing market prices or privately negotiated prices.

CYBRA will not receive any proceeds from the sale of the Common Stock which are being registered pursuant hereto. CYBRA will pay the expenses of this offering. There is no underwriter and proceeds to the selling shareholders are expected to be $3,250,000 if the debentures are converted and all shares of Common Stock underlying the debentures offered hereunder are sold. CYBRA will receive proceeds from the sale of the Common Stock underlying the warrants, if such warrants are exercised.

These securities are speculative and involve a high degree of risk. For a description of certain important factors that should be considered by prospective investors, SEE "RISK FACTORS" BEGINNING ON PAGE 8 OF THIS PROSPECTUS.

Neither the Securities and Exchange Commission (the “SEC”) nor any state securities commission has approved or disapproved of these securities or passed upon the accuracy or adequacy of this prospectus. Any representation to the contrary is a criminal offense.

Our common stock is not traded on any national exchange and the securities being offered hereby are not listed on any national securities exchange or the NASDAQ Stock Market. The Company intends to apply for listing of its shares on the OTC:BB as soon as practical.

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

The date of this prospectus is September _____, 2006

TABLE OF CONTENTS

| | PAGE |

| | |

| Prospectus Summary | 5 |

| | |

| The Offering | 6 |

| | |

| Summary Financial Data | 6 |

| | |

| Risk Factors | 7 |

| | |

| Use of Proceeds | 13 |

| | |

| Determination of Offering Price | 13 |

| | |

| Dilution | NA |

| | |

| Selling Shareholders | 13 |

| | |

| Plan of Distribution | 16 |

| | |

| Legal Proceedings | 18 |

| | |

| Management | 18 |

| | |

| Principal Stockholders and Holdings of Management | 20 |

| | |

| Description of Securities | 22 |

| | |

| Interest of Named Experts and Counsel | 23 |

| | |

| Experts | 23 |

| | |

| Indemnification | 24 |

| | |

| Business | 24 |

| | |

| Where You Can Find More Information | 33 |

| | |

| Management’s Discussion and Analysis and Plan of Operation | 33 |

| | |

| Description of Property | 35 |

| | |

| Certain Relationships and Related Transactions | 36 |

| | |

| Market for Common Stock | 36 |

| | |

| Executive Compensation | 37 |

| | |

| Financial Statements and Notes to Financial Statements | F-1 |

| | |

| Changes in and Disagreements with Accountants | NA |

PROSPECTUS SUMMARY

This summary highlights information contained elsewhere in this prospectus and does not contain all of the information you should consider before investing in our Common Stock. While we have highlighted what we believe are the key aspects of our business and this offering, you should read the entire prospectus carefully, especially the risks of investing in our Common Stock discussed under "Risk Factors" beginning on page 7.

CYBRA CORPORATION

Founded in 1985 and headquartered in Yonkers, New York, CYBRA Corporation is a developer and distributor of bar code and RFID1 software for IBM’s i5 and iSeries (formerly known as the AS/400 computer systems. The Company’s flagship product is sold under the MarkMagicTM brand.

MarkMagicTM Bar Code and RFID Software allows users to design virtually any type of bar coded document — such as labels, forms, RFID tags, tickets, and magnetic stripe plastic cards — on any i5 terminal, or PC connected to an i5. MarkMagic also prints documents containing barcodes and RFID tags for a variety of applications, such as, supply chain shipping and inventory control. Certified ServerProven by IBM, MarkMagicTM can be used with any of the thousands of application software packages that run on the IBM i5. MarkMagicTM supports virtually any thermal bar code label printer; RFID smart label encoders from Monarch, Printronix, and Zebra; dot matrix printers; all IBM AFP/IPDS and Hewlett Packard type laser printers; and plastic ID Card printers. In addition, all printers are supported over wireless networks.

With a simple, uniform interface, MarkMagicTM lets businesses design and print bar code labels, RFID tags, electronic forms, and other media, using live data, with little or no programming necessary. MarkMagicTM currently addresses the IBM i5 market. We believe that the i5 market will continue to provide us with a solid revenue source for many years to come. In order to broaden the i5, CYBRA plans to migrate MarkMagicTM to other computing platform such as Windows, Unix and Linus. The migration process in on schedule for completion in 2007. CYBRA plans to migrate MarkMagicTM to other computing platforms by 2007.

MarkMagicTM Version 5.1, which contains RFID support and an enhanced document designer, was officially launched in October 2004. CYBRA’s leading customers operate in a diverse group of industries including: Apparel, Automotive, Consumer Goods, Health, Manufacturing, Retail, and Software.

CYBRA’s fundamental strategy has been to establish partnerships that embed MarkMagicTM in leading Manufacturing, Supply Chain and Warehouse Management software products.

The Company is currently developing new software that would enable it to be a leading supplier of bar code and RFID solutions across all computing platforms by enhancing RFID capabilities and services and transitioning its software base to an open computing model.

CYBRA utilizes a direct sales model in the U.S. and operates through resellers internationally.

The Company maintains its executive offices at One Executive Blvd., Yonkers, NY 10701. Its telephone number is (914) 963-6600. CYBRA’s website address is www.cybra.com.

1. Short for Radio Frequency Identification, RFID is a technology similar to bar code identification. Unlike bar codes, RFID tags can be detected by radio receivers without being “seen” as long as they are within range of a specialized radio receiver. The E-Z Pass toll collection system is an example of RFID technology. CYBRA’s technology is not used in the E-Z Pass toll collection system.

THE OFFERING

By means of this prospectus, certain holders of convertible debentures and warrants of CYBRA Corporation are offering to sell, upon conversion of the debentures and exercise of the warrants up to 14,000,000 shares of Common Stock underlying these debentures and warrants. In this prospectus, we refer to these persons as the selling stockholders or the selling shareholders. As of April 1, 2006, we had 10,956,000 shares of Common Stock issued and outstanding. The number of outstanding shares does not give effect to shares which may be issued pursuant to the exercise and/or conversion of options, warrants and convertible debt securities previously issued.

CYBRA will not receive any proceeds from the sale of the shares by the selling holders of Common Stock underlying the debentures. The Company will receive proceeds from the exercise of any of the warrants.

The purchase of the securities offered by this prospectus involves a high degree of risk. Risk factors include the lack of revenues, a history of loss and the need for additional capital. SEE THE "RISK FACTORS" section of this prospectus for additional risk factors.

SUMMARY FINANCIAL DATA

The financial data presented below should be read in conjunction with the more detailed financial statements and related notes included elsewhere in this prospectus, along with the section entitled “Management's Discussion and Analysis and Plan of Operations.”

Results of Operations:

Income Statement Data:

| | Year Ended December 31, 2005 | Year Ended December 31, 2004 | Six Months Ended June 30, 2006 | Six Months Ended June 30, 2005 |

| Sales | $1,778,895 | $1,804,178 | $787,878 | $805,545 |

| Gross Profit | 1,097,632 | 907,515 | 406,839 | 503,774 |

| General, Selling, and Administrative Expenses | 957,684 | 953,320 | 567,944 | 454,825 |

| Other income (expense) | (3,741) | (1,042) | (23,902) | (1,959) |

| Net Profit/(Loss) | 408,143 | (53,417) | (83,139) | 30,634 |

Balance Sheet Data:

| | As of December 31, 2005 | As of June 30, 2006 |

| Current Assets | $418,591 | $2,161,558 |

| Total Assets | 654,615 | 2,984,710 |

| Current Liabilities | 984,391 | 1,119,812 |

| Total Liabilities | 984,391 | 3,224,756 |

| Working Capital (Deficit) | (565,800) | 1,041,746 |

| Stockholders’ Deficit | (329,776) | (240,046) |

FORWARD-LOOKING STATEMENTS

Statements contained in this prospectus include "forward-looking statements", which involve known and unknown risks, uncertainties and other factors which could cause actual financial or operating results, performances or achievements expressed or implied by such forward-looking statements not to occur or be realized. These forward-looking statements generally are based on our best estimates of future results, performances or achievements, based upon current conditions and assumptions. Forward-looking statements may be identified by the use of forward-looking terminology such as "may," "can," "could," "project," "expect," "believe," "plan," "predict," "estimate," "anticipate," "intend," "continue," "potential," "would," "should," "aim," "opportunity" or similar terms, variations of those terms or the negative of those terms or other variations of those terms or comparable words or expressions. These risks and uncertainties include, but are not limited to:

| | · | general economic conditions in both foreign and domestic markets, |

| | · | cyclical factors affecting our industry, |

| | · | lack of growth in our industry, |

| | · | our ability to comply with government regulations, |

| | · | a failure to manage our business effectively and profitably, and |

| | · | our ability to sell both new and existing products and services at profitable yet competitive prices. |

You should carefully consider these risks, uncertainties and other information, disclosures and discussions which contain cautionary statements identifying important factors that could cause actual results to differ materially from those provided in the forward-looking statements. CYBRA Corporation undertakes no obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. The securities being offered hereby are highly speculative and prospective investors should consider, among other things, the following factors related to our business, operations and financial position.

RISK FACTORS

There are numerous and varied risks, known and unknown, that may prevent us from achieving our goals, including those described below. The risks described below are not the only ones we will face. Additional risks not presently known to us or that the Company currently deems immaterial may also impair our financial performance and business operations. If any of these risks actually occurs, our business, financial condition or results of operations may be materially adversely affected. In such case, the trading price of our Common Stock could decline, and you may lose all or part of your investment. Before making any investment decision, you should also review and consider the other information set forth in this Memorandum and the exhibits thereto.

WE HAVE HAD LIMITED REVENUES THUS FAR.

To date, we have had limited revenues. We had revenues of $1,804,178 and $1,778,895, in fiscal years 2004 and 2005, respectively. In fiscal year 2004, we had a loss of $53,417 and in fiscal year 2005, we had net income of $408,143. For the three months ended March 31, 2006, we had a loss of $43,373. Because we are subject to all risks inherent in a business venture, it is not possible to predict whether we will continue to be profitable.

Accordingly, it is not possible to predict whether or not our current and proposed activities will be sufficiently profitable. Prospective purchasers should bear in mind that, in light of the risks and contingencies involved, no assurance can be given that we will ever generate enough revenue to offset expenses or to generate a return on invested capital. There is no guarantee of our successful, profitable operation. Our failure to achieve or maintain profitability can be expected to have a material adverse effect on our business, financial condition, results of operations and future business prospects.

WE MAY EXPERIENCE SIGNIFICANT FLUCTUATIONS IN OUR OPERATING RESULTS AND RATE OF GROWTH AND MAY NOT BE PROFITABLE IN THE FUTURE.

Our results of operations may fluctuate significantly due to a variety of factors, many of which are outside of our control and difficult to predict. The following are some of the factors that may affect us from period to period and may affect our long-term financial performance:

| · | our ability to retain and increase revenues associated with customers and satisfy customers’ demands; |

| · | our ability to be profitable in the future; |

| · | our investments in longer-term growth opportunities; |

| · | our ability to expand our marketing network, and to enter into, maintain, renew and amend strategic alliance arrangements on favorable terms; |

| · | changes to offerings and pricing by us or our competitors; |

| · | fluctuations in the size of our customer base, including fluctuations caused by marketing efforts and competitors’ marketing and pricing strategies; |

| · | the effects of commercial agreements and strategic alliances and our ability to successfully integrate them into our business; |

| · | technical difficulties, system downtime or interruptions; |

| · | the effects of litigation and the timing of resolutions of disputes; |

| · | the amount and timing of operating costs and capital expenditures; |

| · | changes in governmental regulation and taxation policies; |

| · | events, such as a sustained decline in our stock price, that cause us to conclude that goodwill or other long-term assets are impaired and for which a significant charge to earnings is required; and |

| · | changes in, or the effect of, accounting rules, on our operating results, including new rules regarding stock-based compensation. |

THE MARKET FOR RFID SERVICES MAY NOT DEVELOP AS ANTICIPATED, WHICH WOULD ADVERSELY AFFECT OUR ABILITY TO EXECUTE OUR BUSINESS STRATEGY.

The success of our RFID offerings depends on growth in the number of RFID users, which in turn depends on wider public acceptance of RFID software solutions. The RFID market is in its early stages and may not develop as rapidly as is expected. Potential new users may view RFID as unattractive relative to traditional bar code products for a number of reasons, including implementation, procurement , integration and supply costs, greater technical complexity, immature technology, consumer privacy concerns, or the perception that the performance advantage for RFID is insufficient to justify the increased costs. There is no assurance that RFID will ever achieve broad user acceptance.

WE MAY NOT SUCCESSFULLY ENHANCE EXISTING OR DEVELOP NEW PRODUCTS AND SERVICES IN A COST-EFFECTIVE MANNER TO MEET CUSTOMER DEMAND IN THE RAPIDLY EVOLVING MARKET FOR RFID SOFTWARE SERVICES.

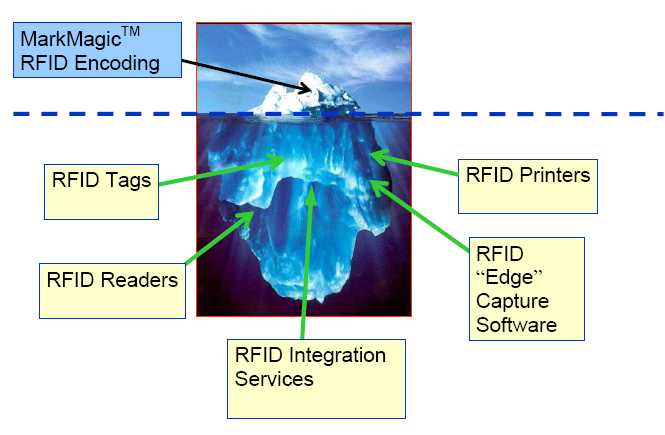

The market for bar code and RFID software solutions is characterized by rapidly changing technology, evolving industry standards, changes in customer needs and frequent new product introductions. We are currently focused on enhancing our RFID encoding capabilities through an improved user interface, wider printer type coverage, and supporting other computing platforms beyond the iSeries. In addition to improving our software for encoding RFID, we are also focused on acquiring RFID “edge” technology for the acquisition of RFID data, as well as RFID system integration capabilities, Our future success will depend, in part, on our ability to use leading technologies effectively, to continue to develop our technical expertise, to enhance our existing services and to develop new services that meet changing customer needs on a timely and cost-effective basis. We may not be able to adapt quickly enough to changing technology, customer requirements and industry standards. If we fail to use new technologies effectively, to develop our technical expertise and new services, or to enhance existing services on a timely basis, either internally or through arrangements with third parties, our product and service offerings may fail to meet customer needs, which would adversely affect our revenues and prospects for growth.

We have spent and will continue to spend significant resources enhancing our existing capabilities and developing, implementing and launching our RFID products. We believe RFID software solutions represents a significant growth opportunity. However, losses are expected to result in the early stages until a sufficient number of customers are added whose recurring revenues, net of recurring costs, more than offset sales, marketing and other expenses incurred to add additional customers.

RFID solutions may have technological problems or may not be accepted by customers. To the extent we pursue commercial agreements, acquisitions and/or strategic alliances to facilitate new product activities, the agreements, acquisitions and/or alliances may not be successful. If any of this were to occur, it could damage our reputation, limit our growth, negatively affect our operating results and harm our business.

WE MAY NOT BE ABLE TO RAISE SUFFICIENT CAPITAL TO SUCCESSFULLY OPERATE OR EXPAND OUR BUSINESS.

While management believes our current finances will enable us to implement our plans and satisfy our estimated financial needs for at least the next 12 months, such belief cannot give rise to an assumption that cost estimates are accurate or that we will in fact have sufficient working capital for the foreseeable future.

Our continued operations after such period will depend upon the availability of cash flow from operations and/or our ability to raise additional funds through various financing methods. If sales or revenues do not meet expectations, or cost estimates for development and expansion of business prove to be inaccurate, we will require additional funding. If additional capital cannot be obtained, we may have to delay or postpone acquisitions, development or other expenditures which can be expected to harm our competitive position, business operations and growth potential. There can be no assurance that cash flow from operations will be sufficient to fund our financial needs, or if such cash flow is not sufficient, that additional financing will be available on satisfactory terms, if at all. Changes in capital markets and the cost of capital are unpredictable. Any failure to obtain such financing, or obtaining financing on unfavorable terms, can be expected to have a material adverse effect on our business, financial condition, results of operations and future business prospects.

INTENSE COMPETITION COULD REDUCE MARKET SHARE AND HARM FINANCIAL PERFORMANCE.

The market for bar code and RFID encoding software is emerging, intensely competitive and characterized by rapid technological change.

Bar code and RFID software companies compete for customers based on industry experience, know-how, technology and price, with the dominant providers conducting extensive advertising campaigns to capture market share. Many of our competitors have (i) greater financial, technical, engineering, personnel and marketing resources; (ii) longer operating histories; (iii) greater name recognition; and (iv) larger consumer bases. These advantages afford our competitors the ability to (a) offer greater pricing flexibility, (b) offer more attractive incentive packages to encourage resellers to carry competitive products, (c) negotiate more favorable distribution contracts with resellers and (d) negotiate more favorable contracts with suppliers. We believe additional competitors may be attracted to the market, including IBM, Sun Microsystems, Microsoft, and HP. We also believe existing competitors are likely to continue to expand their offerings.

Current and prospective competitors include many large companies that have substantially greater market presence and greater financial, technical, marketing and other resources than we have. We compete directly or indirectly with the following categories of companies:

| · | Unix/Linux/Windows Label Software |

| · | Unix/Linux/Windows Forms Software |

After the initial purchase, most CYBRA customers choose a yearly recurring service plan. In addition, on an on-going basis, many CYBRA customers make continued purchases of items such as add-on software options, bar code hardware, bar code supplies, training and services.

As competition in the bar code and RFID market continues to intensify, competitors may continue to merge or form strategic alliances that would increase their ability to compete with us for customers. These relationships may negatively impact our ability to form or maintain our own strategic relationships and could adversely affect our ability to expand our customer base. Because we operate in a highly competitive environment, the number of customers we are able to add may decline, the cost of acquiring new customers through our own sales and marketing efforts may increase.

Our ability to compete effectively in the bar code and RFID services industry will depend upon our ability to (i) continue to provide high quality products and services at prices competitive with, or lower than, those charged by its competitors and (ii) develop new and innovative products and services. There can be no assurance that competition from existing or new competitors or a decrease in prices by competitors will not have a material adverse effect on our business, financial condition and results of operations, or that we will be able to compete successfully in the future.

WE MAY NOT BE ABLE TO KEEP UP WITH RAPID TECHNOLOGICAL AND OTHER CHANGES.

The industry in which we compete is characterized, in part, by rapid growth, evolving industry standards, significant technological changes and frequent product enhancements. These characteristics could render existing systems and strategies obsolete, and require us to continue to develop and implement new products and services, anticipate changing customer demands and respond to emerging industry standards and technological changes. We intend to evaluate these developments and others that may allow us to improve service to our customers. However, no assurance can be given that we will be able to keep pace with rapidly changing customer demands, technological trends and evolving industry standards. The failure to keep up with such changes is likely to have a material adverse effect on our business, long term growth prospects and results of operations.

WE ARE DEPENDENT ON STRATEGIC RELATIONSHIPS.

Our business, in part, is dependent upon current relationships and those we intend to develop with suppliers, distributors and resellers in various markets and other third parties. The failure to develop or maintain these relationships could result in a material adverse effect on our financial condition and results of operations. CYBRA’s key distributors and resellers are Manhattan Associates, SSA Global, Apparel Business Systems, and Vormittag Associates.

RELIANCE UPON THIRD-PARTY SUPPLIERS FOR COMPONENTS MAY PLACE US AT RISK OF INTERRUPTION OF SUPPLY OR INCREASE IN COSTS.

We rely on third-party suppliers for certain hardware and software necessary for our services and we do not have any long-term supply agreements. Although we believe we can secure other suppliers, we expect that the deterioration or cessation of any relationship would have a material adverse effect, at least temporarily, until the new relationships are satisfactorily in place. CYBRA’s primary suppliers are: Paxar/Monarch (bar code and RFID printers and printing supplies), Psion Teklogix (bar scanners and wireless equipment), ScanSource (wholesale distributors), Blue Star (wholesale distributors), Nimax (wholesale distributors). Adverse affects could limit our ability to fill customer orders for bar code and RFID hardware and supplies, resulting in potential loss of revenues and loss of goodwill. Replacing any one supplier could take weeks.

ONGOING SUCCESS AND OUR ABILITY TO COMPETE DEPEND UPON HIRING AND RETENTION OF KEY PERSONNEL.

Success will be dependent to a significant degree upon the involvement of current management, especially Harold Brand, our President. These individuals have critical industry experience and relationships upon which we rely. The loss of services of any of our key personnel could divert time and resources, delay the development of our business and negatively affect our ability to sell our services or execute our business. In addition, we will need to attract and retain additional talented individuals in order to carry out our business objectives. The competition for such persons is intense and there are no assurances that these individuals will be available. Such problems might be expected to have a material adverse impact on our financial condition, results of current operations and future business prospects.

WE ARE SUBJECT TO CONTROL BY OFFICERS AND MANAGEMENT AND THERE COULD BE CONFLICTS OF INTEREST WITH MANAGEMENT WHICH MAY BE ADVERSE TO YOUR INTERESTS.

Management of CYBRA currently beneficially owns approximately 80% of the voting shares of CYBRA Corporation. Assuming all debentures are converted and warrants exercised, management would own approximately 41% of the voting shares. As a result, management possesses meaningful influence and control over the Company, and may be able to control and direct the Company’s affairs, including the election of directors and approval of significant corporate transactions for the foreseeable future.

A conflict of interest may arise between our management's personal pecuniary interest and its fiduciary duty to our stockholders. Conflicts of interest create the risk that management may have an incentive to act adversely to the interests of other investors. Such influence may not necessarily be consistent with the interests of our other stockholders.

DIRECTOR AND OFFICER LIABILITY IS LIMITED.

As permitted by New York law, the certificates of incorporation of CYBRA limits the personal liability of directors to the fullest extent permitted by the provisions of New York Business Corporation Law. As a result of our charter provision and New York law, stockholders may have limited rights to recover against directors for breach of fiduciary duty.

IF WE RAISE ADDITIONAL FUNDS THROUGH THE ISSUANCE OF EQUITY SECURITIES, OR DETERMINE IN THE FUTURE TO REGISTER ADDITIONAL COMMON STOCK, YOUR PERCENTAGE OWNERSHIP WILL BE REDUCED, YOU WILL EXPERIENCE DILUTION WHICH COULD SUBSTANTIALLY DIMINISH THE VALUE OF YOUR STOCK AND SUCH ISSUANCE MAY CONVEY RIGHTS, PREFERENCES OR PRIVILEGES SENIOR TO YOUR RIGHTS WHICH COULD SUBSTANTIALLY DIMINISH YOUR RIGHTS AND THE VALUE OF YOUR STOCK.

CYBRA Corporation may issue additional shares of Common Stock for various reasons and may grant additional stock options to employees, officers, directors and third parties. If CYBRA Corporation determines to register for sale to the public additional shares of Common Stock or other debt or equity securities in any future financing or business combination, a material amount of dilution can be expected to cause the market price of the Common Stock to decline. One of the factors which generally affects the market price of publicly traded equity securities is the number of shares outstanding in relationship to assets, net worth, earnings or anticipated earnings. Furthermore, the public perception of future dilution can have the same effect even if actual dilution does not occur.

In order for CYBRA Corporation to obtain additional capital or complete a business combination, it may find it necessary to issue securities, including but not limited to debentures, options, warrants or shares of preferred stock, conveying rights senior to those of the holders of Common Stock. Those rights may include voting rights, liquidation preferences and conversion rights. To the extent senior rights are conveyed, the value of the Common Stock can be expected to decline.

THE EXISTENCE OF OUTSTANDING WARRANTS MAY HARM OUR ABILITY TO OBTAIN ADDITIONAL FINANCING AND THEIR EXERCISE WILL RESULT IN DILUTION TO YOUR INTERESTS.

We have outstanding 7,500,000 warrants to purchase an aggregate of 7,500,000 shares of Common Stock. Each of the Class A and Class B Warrants is exercisable for up to five years from date of issue at an exercise price of $.75 per share (Class A Warrants) and $1.75 per share (Class B Warrants). The holder of a warrant may not exercise a warrant, if , after giving effect to such issuance after exercise, such holder would beneficially own more than 4.99% of the Company’s outstanding shares. The warrants contain standard anti-dilution provisions in the event of stock divided, splits or other dilutive transactions. While these warrants are outstanding, our ability to obtain future financing may be harmed. Upon exercise of these warrants, dilution to your ownership interests will occur as the number of shares of Common Stock outstanding increases.

PENNY STOCK REGULATIONS MAY IMPOSE CERTAIN RESTRICTIONS ON MARKETABILITY OF THE COMPANY’S SECURITIES.

If the Common Stock begins trading following effectiveness of this registration statement, we will be subject to rules pertaining to “penny stocks”. The SEC has adopted regulations which generally define a “penny stock” to be any equity security that has a market price (as defined) of less than $5.00 per share or an exercise price of less than $5.00 per share, subject to certain exceptions. It is unlikely our shares will have a market price of or greater than $5.00 per share. As a result, the Company’s Common Stock will be subject to rules that impose additional sales practice requirements on broker-dealers who sell such securities to persons other than established clients and “accredited investors”. For transactions covered by these rules, the broker-dealer must make a special suitability determination for the purchase of such securities and have received the purchaser's written consent to the transaction prior to the purchase. Additionally, for any transaction involving a penny stock, unless exempt, the rules require the delivery, prior to the transaction, of a risk disclosure document mandated by the SEC relating to the penny stock market. The broker-dealer must also disclose the commission payable to both the broker-dealer and the registered representative, current quotations for the securities and, if the broker-dealer is the sole market maker, the broker-dealer must disclose this fact and the broker-dealer's presumed control over the market. Finally, monthly statements must be sent disclosing recent price information for the penny stock held in the account and information on the limited market in penny stocks. Consequently, the “penny stock” rules may restrict the ability of broker-dealers to sell shares of the Company’s Common Stock and may affect the ability of investors to sell such shares of Common Stock in the secondary market and the price at which such investors can sell any of such shares.

Investors should be aware that, according to the SEC, the market for penny stocks has suffered in recent years from patterns of fraud and abuse. Such patterns include:

| · | control of the market for the security by one or a few broker-dealers that are often related to the promoter or issuer; |

| · | manipulation of prices through prearranged matching of purchases and sales and false and misleading press releases; |

| · | “boiler room” practices involving high pressure sales tactics and unrealistic price projections by inexperienced sales persons; |

| · | excessive and undisclosed bid-ask differentials and markups by selling broker-dealers; and |

| · | the wholesale dumping of the same securities by promoters and broker-dealers after prices have been manipulated to a desired level, along with the inevitable collapse of those prices with consequent investor losses. |

The Company’s management is aware of the abuses that have occurred historically in the penny stock market.

USE OF PROCEEDS

Proceeds from this offering of Common Stock underlying the convertible debentures will inure directly to the selling shareholders hereunder. CYBRA Corporation will not receive any proceeds from the sale of the Common Stock underlying the convertible debentures by the shareholders whose shares are being registered pursuant hereto. The Company will receive proceeds of any exercise of the warrants, the underlying shares of which are also being registered hereby.

DETERMINATION OF OFFERING PRICE

The fixed per share offering price of $.50 per share is the price per share at which the selling shareholders identified herein may sell their shares until such time as a market develops for the Company’s shares. This price was chosen based on the last completed offering price of Common Stock to accredited investors pursuant to an exempt private placement. There is no relationship between this price and our assets, earnings, book value or any other objective criteria of value.

CYBRA Corporation intends to apply to the NASD over-the-counter bulletin board for the quotation of the Common Stock upon becoming a reporting entity under the Securities Exchange Act of 1934, as amended (the "1934 Act"). If the Common Stock becomes so traded and a market for the stock develops, the actual price of stock will be determined by prevailing market prices at the time of sale or by private transactions negotiated by the selling shareholders. The offering price would thus be determined by market factors and the independent decisions of the selling shareholders.

SELLING SHAREHOLDERS

This prospectus relates to the sale by certain of the debenture and warrant holders of CYBRA Corporation of the shares underlying convertible debentures and warrants issued in a private offering for cash. The convertible debentures and warrants were issued to a group of accredited investors on April 10, 2006 in a private placement which was exempt from registration under the Securities Act of 1933, by virtue of Section 4(2) thereunder.

CYBRA Corporation will not receive any proceeds from the sale of the shares underlying the convertible debenture by the selling shareholders. The Company may receive proceeds from the exercise of the warrants. The selling shareholders may resell the shares they acquire by means of this prospectus from time to time in the public market. The costs of registering the shares offered hereby are being paid by CYBRA Corporation Although these shares are being registered for possible resale by the shareholders listed below, there is no guarantee that any shareholder will reach agreement with any buyer as to the price of each share, as exhibited by the bid and ask any applicable exchange should the Company, in the future list its shares. The following table identifies the selling shareholders and the shares that are being offered for sale by the selling shareholders.

Mssrs. Sholom Babad and Sam Rothman acted as finders in connection with the placement of the debentures and warrants for which they received a fee consisting of $250,000, which was invested in debentures. Mssrs. Babad and Rothman also loaned an aggregate of $181,000 to the Company in order to facilitate the repurchase of preferred shares from Paxar Americas, Inc. (f/k/a Monarch Marking Systems, Inc.). See “Description of Securities”. Mr. Rothman’s son, Matt Rothman, is a designee to the Board of Directors. See “Management - Directors to be Appointed."

Investor Donna Meyer Reich is the wife of Sheldon Reich the Company’s Vice President of Marketing, and Samuel Akivah Reich is his brother.

NAME AND ADDRESS (1) | SHARES UNDERLYING DEBENTURES (1) | SHARES UNDERLYING CLASS A AND CLASS B WARRANTS | OTHER SHARES TO OWNED PRIOR TO OFFERING | PERCENTAGE OF SHARES OWNED PRIOR TO THE OFFERING | PERCENTAGE OF SHARES TO BE OWNED AFTER OFFERING |

| Otto Weingarten | 650,000 | 750,000 | - | | 0.00% |

| Martin Thaler | 312,000 | 360,000 | - | | 0.00% |

Sivan Industries, Inc. (2) 520 West Nyack Road West Nyack, NY 10994 | 260,000 | 300,000 | - | | 0.00% |

| Lee Grohman | 260,000 | 300,000 | - | | 0.00% |

Endeavor Management Inc. (3) c/o Endeavor Advisors Ltd. 46 Yermeyahu Street Jerusalem, Israel | 130,000 | 150,000 | - | | 0.00% |

| Joseph Sprung | 208,000 | 240,000 | - | | 0.00% |

Tayside Trading Ltd. (4) c/o Pines 32/2 Ezrat Torah Street Jerusalem, Israel 95320 | 130,000 | 150,000 | - | | 0.00% |

| Rafael Katzenstein | 130,000 | 150,000 | - | | 0.00% |

| Sara Katz | 260,000 | 300,000 | - | | 0.00% |

Joseph Hoch c/o AV Properties 400 Kelby Street, 11 th Floor Ft. Lee, NJ 07024 | 130,000 | 150,000 | - | | 0.00% |

Bernard Englard c/o AV Properties 400 Kelby Street, 11 th Floor Ft. Lee, NJ 07024 | 130,000 | 150,000 | - | | 0.00% |

Ellis International Ltd. (5) c/o SDC Capital 20 East Sunrise Highway, Suite 302 Valley Stream, NY 11581 | 325,000 | 375,000 | - | | 0.00% |

Brio Capital (6) 10 East 40th Street, 22nd Floor New York, NY 10016 | 195,000 | 225,000 | - | | 0.00% |

Fagey Steinberg 6 Langeries Drive Monsey, NY 10952 | 260,000 | 300,000 | - | | 0.00% |

| Sharei Chaim AT | 195,000 | 225,000 | | | 0.00% |

Alpha Capital A.G. (7) Pradafant 7 9490 Furstentums Vaduz, Lichtenstein | 1,040,000 | 1,200,000 | - | | 0.00% |

Designs by FMC, Inc. (8) 1533 60th Street Brooklyn, NY 11219 | 260,000 | 300,000 | - | | 0.00% |

| 260,000 | 300,000 | 166,000 | | 0.00% |

United Ten Foundation, Inc. (10) 385 Troutman Street, #100 Brooklyn, NY 11237 | 260,000 | 300,000 | - | | 0.00% |

Sholom Chaim Babad (11) 128 Hadassah Lane Lakewood, NJ 08701 | 130,000 | 150,000 | 830,000 | | 0.00% |

Sam Rothman (12) 13 Valencia Drive Monsey, NY 10952 | 130,000 | 150,000 | 830,000 | | 0.00% |

Donna Meyer Reich 4901 Henry Hudson Parkway, #8D Bronx, NY 10471 | 260,000 | 300,000 | - | | 0.00% |

Samuel Akivah Reich 301 Darby Street, Unit 5 Bar Beach NSW 2300, Australia | 260,000 | 300,000 | - | | 0.00% |

| Theodore Katzenstein | 65,000 | 75,000 | - | | 0.00% |

| Saul Perlmutter | 130,000 | 150,000 | - | | 0.00% |

| Tova Weisz & Jessica Weisz | 130,000 | 150,000 | - | | 0.00% |

TOTAL | 8,326,000 | 7,500,000 | | | |

(1) All shareholders purchased convertible debentures and warrants of CYBRA Corporation for cash in a private placement exempt from the registration requirements of the Securities Act of 1933, as amended (the "1933 Act"), in April 2006. Represents 130% of shares underlying Debentures. In connection with the private placement, the company agreed to file a registration statement covering 130% of the registrable securities (shares underlying the convertible debentures and warrants) in order to account for possible dilution of the number of registrable shares.

(2) The natural person exercising voting and investment rights over the securities owned by SiVan Industries is Mr. Chaim Breuer, 520 West Nyack Road, West Nyack, NY 10954.

(3) The natural person exercising voting and investment rights over the securities owned by Endeavor Management, Inc. is Mr. Shmuli Margulies, 46 Yermeyahu Street, Jerusalem, Israel.

(4) The natural person exercising voting and investment rights over the securities owned by Tayside Trading Ltd, is Mr. Esriel Pines, 32/2 Ezrat Torah Street, Jerusalem, Israel 95320.

(5) The natural person exercising voting and investment rights over the securities owned by Ellis International Ltd, is Mr. Wilhelm Ungar, c/o SDC Capital, 20 East Sunrise Highway, Suite 302, Valley Stream, NY 11581.

(6) The natural person exercising voting and investment rights over the securities owned by Brio Capital is Mr. Shaye Hirsch, 10 East 40th Street, 22nd Floor, New York, NY 10116,

(7) The natural person exercising voting and investment rights over the securities owned by Alpha Capital A.G. is Mr. Konrad Ackerman, Pradafant 7, 9490 Furstentums,Vaduz, Lichtenstein.

(8) The natural person exercising voting and investment rights over the securities owned by Designs by FMC, Inc. is William Nussen, 1533 60th Street, Brooklyn, NY 11219.(9) Includes share underlying $100,000 convertible debentures and an additional 166,000 shares purchased in a private placement.

(10) The natural person exercising voting and investment rights over the securities owned by United Ten Foundation, Inc. is Abraham J. Hoffman, 385 Troutman Street, #100, Brooklyn, NY 11237.

(11) Includes 130,000 shares underlying convertible debentures issued as a finder’s fee in connection with the Private Placement and 830,000 shares of common stock purchased in a private transaction.

(12) Includes 130,000 shares underlying convertible debentures issued as a finder’s fee in connection with the Private Placement and 830,000 shares of common stock purchased in a private transaction.

PLAN OF DISTRIBUTION\

Each Selling Stockholder (the “ Selling Stockholders”) of the common stock (“ Common Stock”) of CYBRA Corporation, a New York corporation (the “ Company”) and any of their pledgees, assignees and successors-in-interest may, from time to time, sell any or all of their shares of Common Stock on the Trading Market or any other stock exchange, market or trading facility on which the shares are traded or in private transactions. These sales may be at fixed or negotiated prices until such time that a market develops for the Company’s shares, such shares shall be made at a fixed price of $.50 per share. A Selling Stockholder may use any one or more of the following methods when selling shares:

| · | ordinary brokerage transactions and transactions in which the broker-dealer solicits purchasers; |

| · | block trades in which the broker-dealer will attempt to sell the shares as agent but may position and resell a portion of the block as principal to facilitate the transaction; |

| · | purchases by a broker-dealer as principal and resale by the broker-dealer for its account; |

| · | an exchange distribution in accordance with the rules of the applicable exchange; |

| · | privately negotiated transactions; |

| · | settlement of short sales entered into after the effective date of the registration statement of which this prospectus is a part; |

| · | broker-dealers may agree with the Selling Stockholders to sell a specified number of such shares at a stipulated price per share; |

| · | a combination of any such methods of sale; |

| · | through the writing or settlement of options or other hedging transactions, whether through an options exchange or otherwise; or |

| · | any other method permitted pursuant to applicable law. |

The Selling Stockholders may also sell shares under Rule 144 under the Securities Act of 1933, as amended (the “Securities Act”), if available, rather than under this prospectus.

Broker-dealers engaged by the Selling Stockholders may arrange for other brokers-dealers to participate in sales. Broker-dealers may receive commissions or discounts from the Selling Stockholders (or, if any broker-dealer acts as agent for the purchaser of shares, from the purchaser) in amounts to be negotiated, but, except as set forth in a supplement to this Prospectus, in the case of an agency transaction not in excess of a customary brokerage commission in compliance with NASDR Rule 2440; and in the case of a principal transaction a markup or markdown in compliance with NASDR IM-2440.

In connection with the sale of the Common Stock or interests therein, the Selling Stockholders may enter into hedging transactions with broker-dealers or other financial institutions, which may in turn engage in short sales of the Common Stock in the course of hedging the positions they assume. The Selling Stockholders may also sell shares of the Common Stock short and deliver these securities to close out their short positions, or loan or pledge the Common Stock to broker-dealers that in turn may sell these securities. The Selling Stockholders may also enter into option or other transactions with broker-dealers or other financial institutions or the creation of one or more derivative securities which require the delivery to such broker-dealer or other financial institution of shares offered by this prospectus, which shares such broker-dealer or other financial institution may resell pursuant to this prospectus (as supplemented or amended to reflect such transaction).

The Selling Stockholders and any broker-dealers or agents that are involved in selling the shares may be deemed to be “underwriters” within the meaning of the Securities Act in connection with such sales. In such event, any commissions received by such broker-dealers or agents and any profit on the resale of the shares purchased by them may be deemed to be underwriting commissions or discounts under the Securities Act. Each Selling Stockholder has informed the Company that it does not have any written or oral agreement or understanding, directly or indirectly, with any person to distribute the Common Stock. In no event shall any broker-dealer receive fees, commissions and markups which, in the aggregate, would exceed eight percent (8%).

The Company is required to pay certain fees and expenses incurred by the Company incident to the registration of the shares. The Company has agreed to indemnify the Selling Stockholders against certain losses, claims, damages and liabilities, including liabilities under the Securities Act.

Because Selling Stockholders may be deemed to be “underwriters” within the meaning of the Securities Act, they will be subject to the prospectus delivery requirements of the Securities Act. In addition, any securities covered by this prospectus which qualify for sale pursuant to Rule 144 under the Securities Act may be sold under Rule 144 rather than under this prospectus. Each Selling Stockholder has advised us that they have not entered into any written or oral agreements, understandings or arrangements with any underwriter or broker-dealer regarding the sale of the resale shares. There is no underwriter or coordinating broker acting in connection with the proposed sale of the resale shares by the Selling Stockholders.

We agreed to keep this prospectus effective until the earlier of (i) the date on which the shares may be resold by the Selling Stockholders without registration and without regard to any volume limitations by reason of Rule 144(e) under the Securities Act or any other rule of similar effect or (ii) all of the shares have been sold pursuant to the prospectus or Rule 144 under the Securities Act or any other rule of similar effect. The resale shares will be sold only through registered or licensed brokers or dealers if required under applicable state securities laws. In addition, in certain states, the resale shares may not be sold unless they have been registered or qualified for sale in the applicable state or an exemption from the registration or qualification requirement is available and is complied with.

Under applicable rules and regulations under the Exchange Act, any person engaged in the distribution of the resale shares may not simultaneously engage in market making activities with respect to the Common Stock for the applicable restricted period, as defined in Regulation M, prior to the commencement of the distribution. In addition, the Selling Stockholders will be subject to applicable provisions of the Exchange Act and the rules and regulations thereunder, including Regulation M, which may limit the timing of purchases and sales of shares of the Common Stock by the Selling Stockholders or any other person. We will make copies of this prospectus available to the Selling Stockholders and have informed them of the need to deliver a copy of this prospectus to each purchaser at or prior to the time of the sale.

CYBRA Corporation has advised the selling shareholders that in the event of a “distribution” of the shares owned by the selling shareholders, such selling shareholders, any “affiliated purchasers”, and any broker/dealer or other person who participates in such distribution may be subject to Rule 102 under the 1934 Act until their participation in that distribution is completed. Rule 102 makes it unlawful for any person who is participating in a distribution to bid for or purchase stock of the same class as is the subject of the distribution. A "distribution" is defined in Rule 102 as an offering of securities "that is distinguished from ordinary trading transactions by the magnitude of the offering and the presence of special selling efforts and selling methods”. CYBRA has also advised the selling shareholders that Rule 101 under the 1934 Act prohibits any "stabilizing bid" or "stabilizing purchase" for the purpose of pegging, fixing or stabilizing the price of the common stock in connection with this offering.

LEGAL PROCEEDINGS

CYBRA is not a party to any legal proceedings nor is any of their property the subject of any proceeding, nor are they aware of any proceedings pending or of any actions that might give rise to any such proceedings.

MANAGEMENT

Directors and Executive Officers

Set forth below are the present directors and executive officers of the Company. Note that there are no other persons who have been nominated to become directors nor are there any other persons who have been chosen to become executive officers. There are no arrangements or understandings between any of the directors, officers and other persons pursuant to which such person was selected as a director or an officer. Directors are elected to serve until the next annual meeting of stockholders and until their successors have been elected and have qualified. Officers are appointed to serve until the meeting of the Board of Directors following the next annual meeting of stockholders and until their successors have been elected and qualified.

Name | Age | Present Position and Offices | Term of Office |

| | | | |

| Harold Brand | 56 | President, Chairman of the Board and Chief Financial Officer | 21 Years |

| | | | |

| Sheldon Reich | 49 | Vice President Marketing and Director | 17 Years |

| | | | |

| Chuck Roskow | 35 | Branch Manager | 1 Year |

| | | | |

| Robert J. Roskow | 63 | Vice President Sales and Director | 12 Years |

| | | | |

| Brian H. Caughel | 44 | Strategic Alliance Executive | 5 Months |

| | | | |

| Steven D. Orlando | 45 | Director of Programming | 2 Months |

| | | | |

Robert Roskow is Chuck Roskow’s father. None of the other directors or officers is related to any other director or officer of the Company.

Set forth below are brief accounts of the business experience during the past five years of each director and executive officer of the Company.

Harold Brand is a founder of CYBRA and has been its President, Chairman of the Board and Chief Financial Officer since 1985. He is responsible for managing the operation, monitoring its performance, and planning and overseeing R&D projects. Mr. Brand developed much of CYBRA’s proprietary technology. Prior to founding CYBRA, Mr. Brand was the Vice President of Personnel Systems at Manufacturers Hanover Trust Company (currently JP Morgan Chase Bank), a New York City money center bank, where he managed a multimillion dollar annual budget and a staff of 25 professionals. A highly rated speaker at IBM technical conferences, Mr. Brand holds a Masters of Science degree in Computer Science from Rutgers University in New Brunswick, New Jersey.

Sheldon Reich has been Vice President of Marketing and a Director of the Company since 1989. He has expertise in the creative application of Auto ID technology. In April 2004, Mr. Reich was selected by IBM to design their infrastructure solution for enabling RFID wireless inventory systems. He is responsible for CYBRA’s advertising, promotion, trade shows, public relations, and direct mail activities. Prior to joining CYBRA, Mr. Reich held the position of Copy Director at Bantam Doubleday Dell publishing. He developed business-to-business marketing programs for such clients as: NYNEX, AT&T Microelectronics, and Philips Information Systems. A frequent speaker at industry conferences and user group meetings, Mr. Reich, holds a Bachelor of Arts degree in Linguistics from the State University of New York at Stony Brook.

Chuck Roskow heads CYBRA’s West Seneca, New York, a suburb of Buffalo branch office and is chiefly responsible for pre-sales and post-sales support of CYBRA Corporation’s software products. He joined the Company in 1994 as an Account Manager and became Customer Support Manager in 1997 to 2005, when he became Branch Manager. Acting in a sales engineering capacity, Mr. Roskow is CYBRA’s OEM customer’s primary point of contact and manages the end user support effort. Previously, as a CYBRA marketing representative, Mr. Roskow tripled sales in his territory. Before joining CYBRA, he was the owner and proprietor of Just Belts, a martial art belt manufacturer, which he built from a standing start to profitability and sale to new owners in 18 months. Mr. Roskow holds a Bachelor of Science degree in Business Administration from the State University of New York College at Fredonia.

Bob Roskow has been Vice President of Sales and a Director since 1994. He is also founder of Profit Horizons, Inc., a sales consultancy. Mr. Roskow provides his services to the Company through this consulding company. The terms of his consultancy require Mr. Roskow to provide at least three days of service per month and he currently spends approximately 90% of his working time on Company business. He brings to CYBRA more than 30 years of high technology marketing experience with the IBM Corporation. Mr. Roskow’s marketing achievements with IBM were rewarded with membership in 17 100% clubs and three Golden Circles, which signified reaching the top 3% of sales professionals in the company. One of the Chief Architects of IBM’s Business Partner Program, Mr. Roskow has consulted to more than 50 IBM Business Partners with annual sales ranging from $200,000 to $50 million in revenues. Bob was a New Business Executive with IBM for the four years prior to his retiring in 1992.

Brian Caughel’s joined CYBRA as Strategic Alliance Executive in February 2006. Prior to that, from January 2000 to December 2005, he was National Director of Sales Engineers at Iona Technologies, a public vendor in enterprise integration sector, for over five years. His main responsibility is to form strategic alliances with software vendors that require auto-id capabilities within their applications. Target applications are ERP, Warehouse Management, and Supply Chain Management Software. Mr. Caughel has over twenty years of experience in software development, sales and management roles, in the areas of integration middleware, application development tools and software/systems development solutions. Prior to joining CYBRA, Mr. Caughel was the National Director of Sales Engineers at IONA Technologies, where he built a team from six to over forty pre-sales engineers responsible for selling software integration solutions. During his six year tenure at IONA, the company achieved record sales exceeding $100M, and a stock price of over $100/share. Brian has a Bachelor of Arts degree from Brown University in Providence, Rhode Island. He is based out of CYBRA's West Seneca, New York branch office.

Steven Orlando joined the Company as Director of Programming in May 2006. Prior to that he was Project Coordinator for Information Builders, a private business intelligence software development company, from April 1989 to July 2005. From August 2005 to November he was Director of Application Engineering for Schoolnet, Inc., a software manufacturer based in Chicago, IL, and from January 2006 to May 2006 he was Senior Director of Technology for Authentidate Holdings, Inc., a digital signature and time stamping reseller backed by the U.S. Postal Service. He is responsible for all R&D projects at CYBRA. He has over twenty years of experience in system architecture, design and software engineering in a commercial software product development environment. Early in his career he worked on the development of RACF, IBM's access control product for the MVS operating system. Mr. Orlando’s main experience was as project manager for Information Builders, Inc. a premier Business Intelligence Software vendor. Steven has extensive experience managing technology projects and has a deep background in Web applications including Java, SQL and XML on a diverse range of computing platforms. Mr. Orlando holds a B.A. degree in Computer Science from the New York University Courant Institute of Mathematical Sciences. He has also served as a lecturer at NYU on Information Security, Advanced Java, C and C++ Programming.

No officer or director has, during the past five years, been involved in (a) any bankruptcy petition filed by or against any business of which such person was a general partner or executive officer either at the time of the bankruptcy or within two years prior to that time, (b) any conviction in a criminal proceeding or being subject to a pending criminal proceeding (excluding traffic violations and other minor offenses), (c) any order, judgment, or decree, not subsequently reversed, suspended or vacated, of any court of competent jurisdiction, permanently or temporarily enjoining, barring, suspending or otherwise limiting his involvement in any type of business, securities or banking activities or (d) a finding by a court of competent jurisdiction (in a civil action), the Commission or the Commodity Futures Trading Commission to have violated a federal or state securities or commodities law, and the judgment has not been reversed, suspended, or vacated.

Due to the early stage nature of the business of CYBRA Corporation, it does not have an audit committee, nor has its board of directors or the board of directors of CYBRA Corporation, deemed it necessary to have an audit committee financial expert. Within 12 months following effectiveness of this registration statement, CYBRA Corporation expects to have several committees in place, including a compensation, budget and audit committee. At such time, CYBRA Corporation intends to have a member of the Board of Directors that meets the qualifications for an audit committee financial expert.

EXECUTIVE COMPENSATION

Directors are not compensated in their roles as directors. Directors are reimbursed, however, for reasonable expenses incurred on behalf of the Company. During 2005 and through the date hereof, Mr. Brand has received an aggregate of approximately $271,000 in compensation. Effective April 30, 2006, the Company entered into a five-year Employment Agreement with Mr. Brand, with base salary set at $ 180,000 per annum. No other executive officer, other than Mr. Brand, received salary and bonus in excess of $100,000 during 2005 and the current year.

The following table sets forth all the compensation earned by the person serving as the Chief Executive Officer (Named Executive Officer) and each other executive officer whose aggregate compensation was in excess of $100,000 during the fiscal years ended December 31, 2005, 2004 and 2003 and the current fiscal year.

SUMMARY COMPENSATION TABLE

| | | | | | | | | | | Long Term | |

| | | Annual Compensation(1) | | | | | | Compensation Awards | |

| Name and Principal | | Fiscal | | | | | | Other | | Securities | | All Other | |

| Position | | Year | | Salary | | Bonus | | Annual Compensation (1) | | Underlying Options | | Compensation | |

| | | | | | | | | | | | | | |

| Harold Brand | | | 12/31/05 | | $ | 178,567 | | | — | | | | | | -0- | | $ | −−−−− | |

| Chairman and Chief | | | 12/31/04 | | $ | 165,814 | | | | | | | | | -0- | | $ | −−−−− | |

| Executive Officer | | | 12/31/03 | | $ | 161,897 | | | | | | | | | -0- | | $ | −−−−− | |

| | | | | | | | | | | | | | | | | | | | |

(1) The amounts reflected in the above table do not include any amounts for perquisites and other personal benefits extended to the named Executive Officer. Inasmuch as the aggregate amount of such compensation (consisting of payment of an auto lease and associated costs) did not exceed the lesser of $50,000 or 10% of the total annual salary reported.

Advisory Board

CYBRA Corporation’s Advisory Board consists of executive officers, as well as two outside advisors.

Gary L. Horning, Vice President of Marketing, Bar code and RFID Solutions Division at Paxar Corporation. Paxar is one of the leading providers of identification solutions to the retail and apparel industry worldwide. Prior to joining Paxar six years ago, Gary was Vice President of Strategic Marketing and Investor Relations, and member of the executive management team at The Santa Cruz Operation, a $200M software company located in Santa Cruz, CA. Earlier in his career, Mr. Horning spent twenty years at NCR Corporation, with a wide range of roles including: VP of Channel and Partnership Relationships for the Teradata Division, AVP of Strategic Planning and Product Line Management, Director of Product Management Processes and Education/Training, Strategic Major Accounts Sales Manager, and Product Line Manager. Gary holds MBA and BS degrees from Wright State University.

Dr. Shlomo Kalish, a CYBRA founder, is an Israeli based technology investor. In 1994, Dr. Kalish founded The Jerusalem Global Group, a technology focused investment house, and in 1999 he founded Jerusalem Global Ventures, a venture capital firm managing $120M. Jerusalem Global Ventures invests in seed and early-stage communications, information technology and life sciences companies. From 1997 to 1999, Dr. Kalish served as a General Partner of Concord (K.T.) Ventures I, LP, a leading Israeli venture capital fund, where he was responsible for the investments in Oridion Medical and Oren Semiconductors. Dr. Kalish frequently appears in the media and has been featured on the cover of Upside Magazine. He has also been cited in The Wall Street Journal, Dow Jones, Business Week and other business publications. Dr. Kalish holds a Ph.D. in Operations Research from MIT, a M.Sc. from the Sloan School of Management at MIT and a B.Sc. from Tel Aviv University. From 1970 to 1975 Dr. Kalish served in the Israeli Air Force as a fighter pilot. Dr. Kalish is active on the boards of many non-profit organizations and academic institutions, including Shalom Beineinu, a charitable organization of which he is Chairman; the Board of Governors of Bar Ilan University; the Board of Governors of the Technion and The Jerusalem College of Technology. Dr. Kalish serves on the board of Saifun Semiconductors — selected by Globes, an Israeli business journal, as one of Israel's most successful startups, Valor Computerized systems, as well as a number of JGV's portfolio companies.

Directors to be Appointed

The Company agreed, in connection with the Private Placement, to allow the purchasers of Debentures to appoint two members to its Board of Directors. The following individuals have been chosen by the Purchasers to join the Board of Directors after the Effective Date of this Registration Statement:

Jonathan Rubin

Jonathan Rubin, age 36, is an experienced small businessperson, having run his own businesses for the past five years. Mr. Rubin is a partner in the Jefferson Title Agency which is licensed in several states. He is a seasoned real estate professional, with extensive experience in numerous areas of the real estate field, including, management, brokerage, title and finance. Mr. Rubin is active in the Lakewood NJ community, where he manages a free loan society, and sits on the Township Rent Control Board, the Board of Congregation Ohr Meir and other community involvement.

Matt Rothman

Matt Rothman, age 28, is the owner of MorFra Designs, a wholesale jewelry company supplying retailers and catalog companies throughout the U.S. MorFra specializes in cubic zirconia silver jewelry. Prior to the formation of MorFra in 2003, Mr. Rothman was for 1 year, vice president - sales at Designs by FMC, Inc., a manufacturer and distributor of gold and silver jewelry, selling to large retail chains, through catalogues and various cable television channels. Mr. Rothman also serves as a consultant to Global Equities, a real estate investment company with interests in residential and commercial real estate.

Matt Rothman is the son of Samuel Rothman, an investor in the Company and an investor and control person in Global Equities. Mssrs. Rothman and Rubin were chosen to represent the purchaser of the debentures based upon (i) their business acumen and experience; (ii) their relationship to and interest in the Company and (iii) their availability and proximity to the Company's headquarters.

PRINCIPAL STOCKHOLDERS AND HOLDINGS OF MANAGEMENT

The following table sets forth certain information regarding the beneficial ownership of the Common Stock as of the date of this registration statement, but not as adjusted to reflect the sale of the securities offered hereby, by (i) each person who is known by CYBRA Corporation to own beneficially more than 5% of the outstanding Common Stock; (ii) each of the officers and directors of CYBRA Corporation; and (iii) officers and directors of CYBRA Corporation as a group:

Name and Address of Beneficial Owner | Number of Shares Beneficially Owned(1) | Percentage of Shares Beneficially Owned(2) |

| | | |

Harold Brand c/o CYBRA Corporation One Executive Blvd. Yonkers, NY 10701 | 7,438,460 | 67.9% |

Robert Roskow c/o CYBRA Corporation One Executive Blvd. Yonkers, NY 10701 | 531,200 | 4.8% |

Shlomo Kalish c/o CYBRA Corporation One Executive Blvd. Yonkers, NY 10701(3) | 443,220 | 4.0% |

Chuck Roskow c/o CYBRA Corporation 1050 Union Road, Suite 2

Box #10

West Seneca, NY 14224 | 273,900 | 2.5% |

Sheldon Reich c/o CYBRA Corporation One Executive Blvd. Yonkers, NY 10701 | 443,220 | 4.0% |

Sam Rothman c/o CYBRA Corporation One Executive Blvd. Yonkers, NY 10701 | 830,000 | 7.6% |

Sholom Chaim Babad c/o CYBRA Corporation One Executive Blvd. Yonkers, NY 10701 | 830,000 | 7.6% |

All Officers and Directors as a Group (4 persons) | 8,686,780 | 79.3% |

____________________

| (1) | All shares are owned directly by the named individuals. |

| (2) | Based upon 10,956,000 shares issued and outstanding. Does not include 857 shares of Series A and Series B preferred stock which were repurchased by the Company from Paxar Americas, Inc. (f/k/a Monarch Marking Systems, Inc.) in September 2005. In the summer of 2005, Monarch approached the Company and asked that its investment in the Company, which was made in 1997 be reduced or retired. Monarch agreed to do so at a significant discount if the transaction could be completed by the end of 2005. The transaction closed in October 2005. Funds were provided, in part, to the Company by Mssrs. Rothman and Babad by means of a bridge loan which was repaid out of the proceeds of the debenture placement. |

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

Two shareholders of the Company, Sholom Chaim Babad and Sam Rothman acted as finders in the Private Placement and were paid a 10% fee which they converted in Debentures and Warrants. They will also be entitled to receive as additional fees, 5% of any cash received by the Company upon the exercise of Warrants. In addition, Mssrs Babad and Rothman loaned $151,000 to the Company in 2005, and an additional $19,000 in the first quarter of 2006, the proceeds of which were used to redeem Preferred Stock owned by a third party. This loan, together with interest, was repaid out of the proceeds of the Private Placement.

The Company agreed, in connection with the Private Placement, to allow the purchasers of Debentures to appoint two members to its Board of Directors. Jonathan Rubin and Matt Rothman have been chosen by the Purchasers to join the Board of Directors after the Effective Date of this Registration Statement.

DESCRIPTION OF SECURITIES

General

CYBRA Corporation is currently authorized to issue 100,000,000 shares of common stock, $.001 par value, and 2,000 shares of preferred stock, having such rights, designations and privileges as the Board of Directors may establish from time to time. There are 10,956,000 shares of Common Stock outstanding, and no shares of preferred stock outstanding, as of the date of this prospectus. 857 shares of Series A and Series B preferred stock were repurchased by the Company from Paxar Americas, Inc. (f/k/a Monarch Marking Systems, Inc.) ("Monarch") in September 2005. In the summer of 2005, Monarch approached the Company and asked that its investment in the Company, which was made in 1997 be reduced or retired. Monarch agreed to do so at a significant discount if the transaction could be completed by the end of 2005. The transaction closed in October 2005. Funds were provided, in part, to the Company by Mssrs. Rothman and Babad by means of a bridge loan which was repaid out of the proceeds of the debenture placement.

Common Stock

Holders of Common Stock are entitled to one vote for each share held of record on each matter submitted to a vote of shareholders. Holders of Common Stock are entitled to receive ratably such dividends as may be declared by the Board of Directors out of funds legally available therefor, as well as any distributions to the shareholders and, in the event of liquidation, dissolution or winding up of the Company, are entitled to share ratably in all assets of the Company remaining after satisfaction of all liabilities. Holders of the Common Stock have no conversion, redemption or preemptive rights or other rights to subscribe for additional shares. The outstanding shares of Common Stock are, and the shares of Common Stock issuable hereunder upon conversion of the debentures and exercise of the warrants, will be, validly issued, fully paid and non-assessable.

Private Placement of Convertible Debentures

Effective April 10, 2006, the Company sold $2,500,000 of its 8% convertible debentures due April 10, 2009 (the “Debentures”) to a group of twenty-five accredited investors. Each subscriber to Debentures also received Class A common stock purchase warrants (the “Class A Warrants”) and Class B common stock purchase warrants (the “Class B Warrants”).

Each Class A Warrants entitles the holder to purchase that number of shares of the Company’s Common Stock equal to one half of the underlying shares issuable upon conversion of the Debenture purchased by the holder. The exercise price of the Class A Warrant is $0.75 subject to anti-dilution and other adjustments provide for in the Class A Warrant. Any unexercised Class A Warrants expire on April 10, 2011. At any time after the Common Stock of the Company is registered under Section 12 of the Exchange Act, the holder of the Class A Warrant shall not have the right to exercise any portion of the Class A Warrant to the extent that after giving effect to such exercise such holder (together with such holder’s affiliates) would beneficially own more than 4.99% of the Company’s Common Stock immediately following such exercise.

Each Class B Warrants permits the holder thereof to purchase one share of Common Stock of the Company at an exercise price of $1.25 per share. The Class B Warrants contain anti-dilution and restriction on sale provisions which are similar to the Class A Warrants.

The Debentures mature on April 10, 2009, bear interest at the rate 8% per annum, payable semi-annually on June 30th and December 31st, beginning on the second such date after the original Issue Date, on each Conversion Date, on each Optional Redemption Date, on each Mandatory Conversion Date and at Maturity.

The Debentures are convertible into shares of Common Stock of the Company at a conversion price of $0.50. The conversion price is adjustable in certain circumstances to protect the holder thereof from dilutive events. At any time after the Common Stock is registered under Section 12 of the Exchange Act, the Company shall not effect any conversion of the Debenture, and the holder shall have no right to effect such a conversion, if, after giving effect to such conversion, the holder (together with the holder’s affiliates) would beneficially own in excess of 4.99% the number of shares of Common Stock outstanding after giving effect to such conversion.

At any time after April 10, 2006, the Company has the right to redeem some or all of the Debentures for the sum of (i) 120% of the principal amount of the Debenture the outstanding, accrued but unpaid interest, and all other amounts then due with respect to the Debentures. In addition, provided the underlying securities have been registered, and certain other conditions are met, the Company has the option to compel a conversion on the first business day after any consecutive ten-day trading period during which the closing price of the Company’s Common Stock is more than 150% of the Conversion Price.