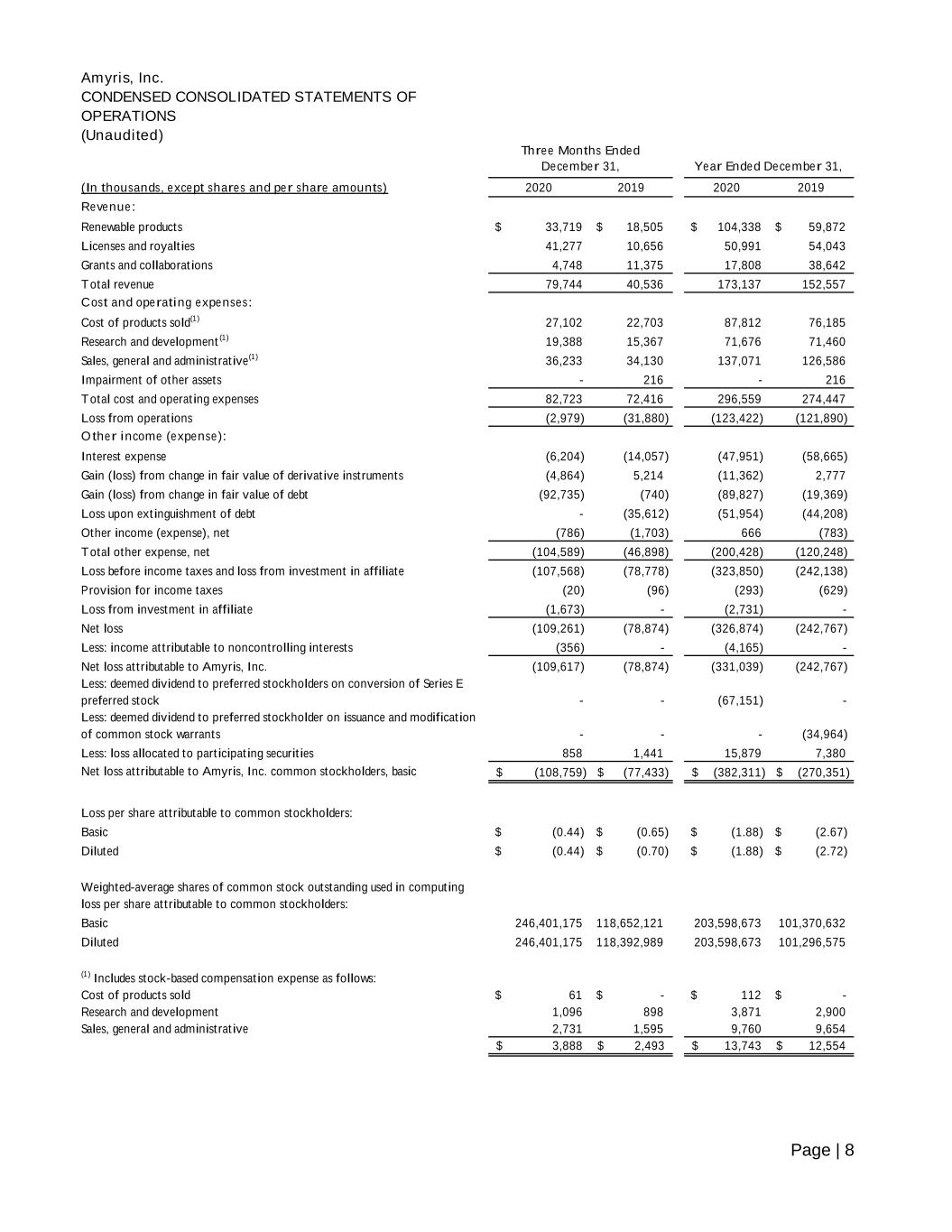

Page | 1 FOR IMMEDIATE RELEASE AMYRIS, INC. REPORTS FOURTH QUARTER AND FULL YEAR 2020 FINANCIAL RESULTS Record Q4 and Full Year Product Revenue Expanded Product Gross Margins and Positive Q4 Adjusted EBITDA Emeryville, CA – March 2, 2021 – Amyris, Inc. (Nasdaq: AMRS), a leading synthetic biotechnology company active in the Clean Health and Beauty markets through its consumer brands, today announced financial results for its fourth quarter and full year ended December 31, 2020. "2020 was a year of transformative execution for Amyris," said John Melo, President and Chief Executive Officer of Amyris. "We delivered the third consecutive quarter of record Product sales revenue in Q4 while also expanding Product gross margins. We continued to see strong growth with our Consumer brands and delivered Q4 Consumer revenue equivalent to the entire year 2019. This revenue and margin growth combined with the completion of the strategic transaction resulted in positive adjusted EBITDA in the quarter.” Mr. Melo added, “The Amyris team made significant progress in 2020 on our strategic initiatives. We delivered six new ingredients at scale, completed a successful $200 million equity financing and significantly reduced our total debt. With the momentum in our product revenue we believe that we are well positioned to continue to drive sector leading growth into the future. We expect 2021 to be another record year with underlying total revenue in the $240 million range and reported total revenue of around $400 million, when including the potential impact of the strategic transactions. With our business momentum and these transactions, we expect to deliver full year 2021 positive adjusted EBITDA.” Q4 2020 Financial Highlights Record sales revenue of $80 million nearly doubled versus the prior year quarter. Record Product revenue of $35 million increased 71% compared to the prior year quarter driven by a record quarter for Consumer which, with $17 million in revenue and 161% growth, delivered as much revenue in Q4 as the entire year 2019. Ingredients revenue of $18 million grew 29%. Q4 revenue included $40 million for the Farnesene strategic transaction. Gross margin of 66% improved from 56% in the prior year quarter and increased $30 million year- over-year. Product-related gross margin grew $6 million versus the prior year quarter with the remaining $24 million primarily attributable to the year-over-year impact from strategic transactions. Cash operating expense of $50 million increased by $5 million or 10% versus the prior year quarter, primarily due to marketing investments in our consumer brands and new R&D programs. Adjusted EBITDA was positive $1 million and improved $26 million year-over-year due to higher revenue, improved Product gross margins, and income from the Q4 strategic transaction.

Page | 2 GAAP net earnings were -$109 million due mostly to -$98 million of unfavorable mark-to-market non-cash adjustments related to changes in the fair value of debt and derivatives. GAAP EPS of -$0.44 basic improved from -$0.65 basic in the prior year quarter. Adjusted net earnings of -$7 million improved $34 million compared to the prior year quarter. Adjusted EPS of -$0.03 compared with -$0.34 for Q4 2019. Debt of $171 million was significantly reduced by $127 million from $297 million in the prior year quarter resulting in reduced interest expense of $6 million or 56% compared to the prior year quarter. Full Year 2020 Financial Highlights Record sales revenue of $173 million grew 13% versus the prior year. Record Product revenue of $112 million increased 72% versus the prior year driven by record Consumer revenue and record Ingredients growth, up 197% and 26% respectively. Gross margin of 56% improved $11 million compared to the prior year. Product-related gross margin grew $37 million year-over-year, with a $23 million improvement from Consumer and a $14 million increase from Ingredients. 2019 saw higher income from Collaboration and transactions resulting in a year-over-year variance of -$26 million. Cash operating expense of $181 million decreased by $1 million or 1% compared to the prior year primarily due to decreases in G&A and R&D expenses partly offset by increases in marketing expenses to support consumer brands growth. Adjusted EBITDA of -$95 million improved $8 million compared to the prior year, primarily due to higher revenue and improved gross margins. GAAP net earnings were -$382 million due mostly to -$232 million of mark-to-market non-cash adjustments related to changes in the fair value of debt and derivatives, extinguishment of debt and deemed dividends. GAAP EPS of -$1.88 basic improved from -$2.67 basic in the prior year. Adjusted net earnings of -$151 million improved $16 million compared to 2019. Adjusted EPS of -$0.74 compared with -$1.65 for the prior year. Q4 2020 and Full Year Sales Revenue 1 Other: Q4 includes $8.7m Vitamin E transaction (2019), $6.6m Lavvan collaboration revenue (2019) and $40m Farnesene transaction (2020). Full Year: $49.1m Vitamin E transaction (2019), $18.3m Lavvan collaboration revenue (2019), $4.8m Vitamin E transaction (2020) and $40m Farnesene transaction (2020). (In millions) 2020 2019 YoY % 2020 2019 YoY % Consumer 17.3 6.6 161% 51.6 17.4 197% Ingredients 17.7 13.8 29% 60.0 47.5 26% Product 35.0$ 20.4$ 71% 111.6$ 64.9$ 72% Collaborations & Grants 4.7 4.8 -1% 16.7 20.3 -18% Underlying Total 39.7$ 25.2$ 58% 128.3$ 85.2$ 51% Other 1 40.0 15.3 161% 44.8 67.4 -34% Reported Total 79.7$ 40.5$ 97% 173.1$ 152.6$ 13% December 31, Three Months Ended Twelve Months Ended December 31,

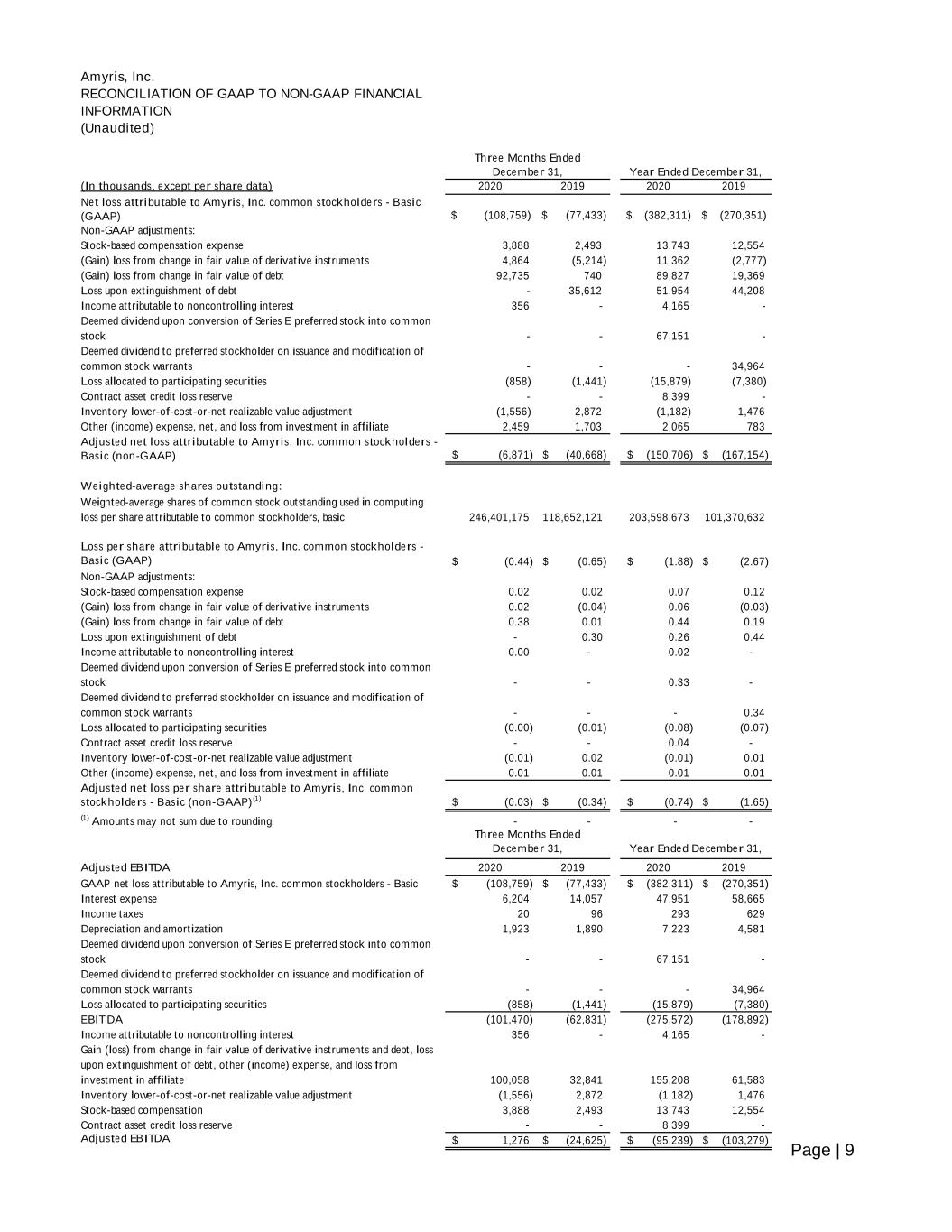

Page | 3 Full Year 2021 Outlook Underlying total revenue (Product, Collaboration & Grants) expected to be in the $240 million range. Reported total revenue expected to be around $400 million. Phasing of Underlying total revenue expected to be 35% H1 and 65% H2 to reflect a continued quarter-on-quarter growth trajectory and the addition of new brands. Debt per end of 2020 of $171 million expected to reduce further to below $100 million by Q3 2021. Strategic transactions expected to be mostly accretive to revenue and earnings resulting in positive full year adjusted EBITDA. The company may update its full year 2021 outlook following completion of the strategic transactions. Strategic Highlights 1. High growth consumer brands: industry-leading growth Recent progress: o Biossance® / SuperOrdinary partnership for China launch. First order shipped in Q4. Upcoming milestones: o Q1 2021 acquisition of Costa Brazil luxury clean beauty brand. o Q3 2021 launch of Rose Inc. clean beauty color cosmetics brand. o Q3 2021 launch of JVN clean haircare brand. o Q2 2021 launch of Terasana brand for acne and other clean skincare treatments. 2. Scientific and commercial collaboration: fast time from lab to industrial scale Recent progress: o Launched six new ingredients, exceeding 2020 goal of two to three. o Sold out first commercial production of Cannabigerol (CBG) from fermentation, understood to be largest fermentation-based CBG production in the sector to-date. o Expanded collaboration with DSM on Human Milk Oligosaccharides (HMO). Upcoming milestone: o Amryis/IDRI RNA COVID-19 vaccine platform advancing to phase 1 clinical trial. o Closing collaboration with one of the world’s leading meat producers for zero carbon protein production. 3. Supply chain optimization: enhanced product margins Recent progress: o Received Bonsucro certification for sustainable sugarcane production. o Ranked among world’s top social and environmental impact companies by Real Leaders®. Upcoming milestones: o Construction of Brazil plant targeted for Q4 2021 completion. o Publication of first ESG report. 4. Improved balance sheet, earnings and cash flow: financial foundation for success Recent progress: o Strong Consumer and Ingredients revenue growth and improved margin profile. o Generated $47 million from warrants conversion from December 2020 to March 2021. o Debt as of March 1, 2021 reduced to below $150 million. o Closed first strategic transaction in Q4 valued at $50 million; $30 million received in Q4, $10 million to be received in Q1 2021, the remainder in milestone payments. Upcoming milestone: o Two additional strategic transactions expected to close and deliver an anticipated total value of $500 million for all three transactions combined.

Page | 4 FINANCIAL RESULTS AND NON-GAAP INFORMATION To supplement our financial results and guidance presented in accordance with U.S. generally accepted accounting principles (GAAP), we use certain non-GAAP financial measures that we believe are helpful in understanding our financial results. These non-GAAP financial measures are among the factors management uses in planning and forecasting future periods. These non-GAAP financial measures also facilitate management’s internal comparisons to Amyris’s historical performance as well as comparisons to the operating results of other companies. Management believes these non-GAAP financial measures, when considered together with financial information prepared in accordance with GAAP, can enhance investors’ and analysts’ abilities to meaningfully compare our results from period to period, identify operating trends in our business, and track and model our financial performance. In addition, our management believes that these non-GAAP financial measures allow for greater transparency into the indicators used by management to understand and evaluate our business and make operating decisions. Non-GAAP financial information is not prepared under a comprehensive set of accounting rules, and therefore, should only be read in conjunction with financial information reported under GAAP in order to understand Amyris’s operating performance. A reconciliation of the non-GAAP financial measures presented in this release to the most directly comparable GAAP financial measure, is provided in the tables attached to this press release. Our Non-GAAP financial measures include the following: Adjusted net income (loss) is calculated as GAAP net income/loss excluding stock-based compensation expense, gain/loss from change in fair value of derivatives, gain/ loss from changes in the fair value of debt, losses upon debt extinguishment, income attributable to noncontrolling interest, deemed dividends to preferred stockholders, contract asset credit loss reserve, loss allocated to participating securities, contract asset credit loss reserve, inventory lower of cost or net realizable value adjustments, and other income/expense and income/loss attributable to noncontrolling interest. Adjusted EPS is calculated by dividing Non-GAAP net income (loss) by the weighted average shares, basic outstanding for the period. Non-GAAP Gross Margin (Gross Margin) is calculated as GAAP revenues divided by non-GAAP cost of products sold (which excludes other costs/provisions, inventory lower of cost or net realizable value adjustments, excess capacity, stock-based compensation expense, depreciation and amortization). Non-GAAP Cash Operating Expense is calculated as GAAP Operating Expense minus non-cash stock-based compensation, depreciation and amortization and contract asset credit loss reserve. EBITDA is calculated as GAAP net loss less interest, expense, income tax expense, depreciation and amortization, deemed dividends to preferred stockholders, and loss allocated to participating securities. Adjusted EBITDA is calculated as EBITDA less income attributable to noncontrolling interest, gain/loss from change in fair value of derivatives, gain/loss from changes in the fair value of debt, loss upon debt extinguishment, other income/expense, loss from investment in affiliate, income attributable to non-controlling interest, inventory lower of cost or net realizable value adjustments, stock-based compensation expense, and contract asset credit loss reserve. Conference Call Amyris will host its fourth quarter and full year 2020 conference call today at 9:00 am ET (6:00 am PT) to discuss its financial results and provide a business and financial update. Live audio webcast/conference call:

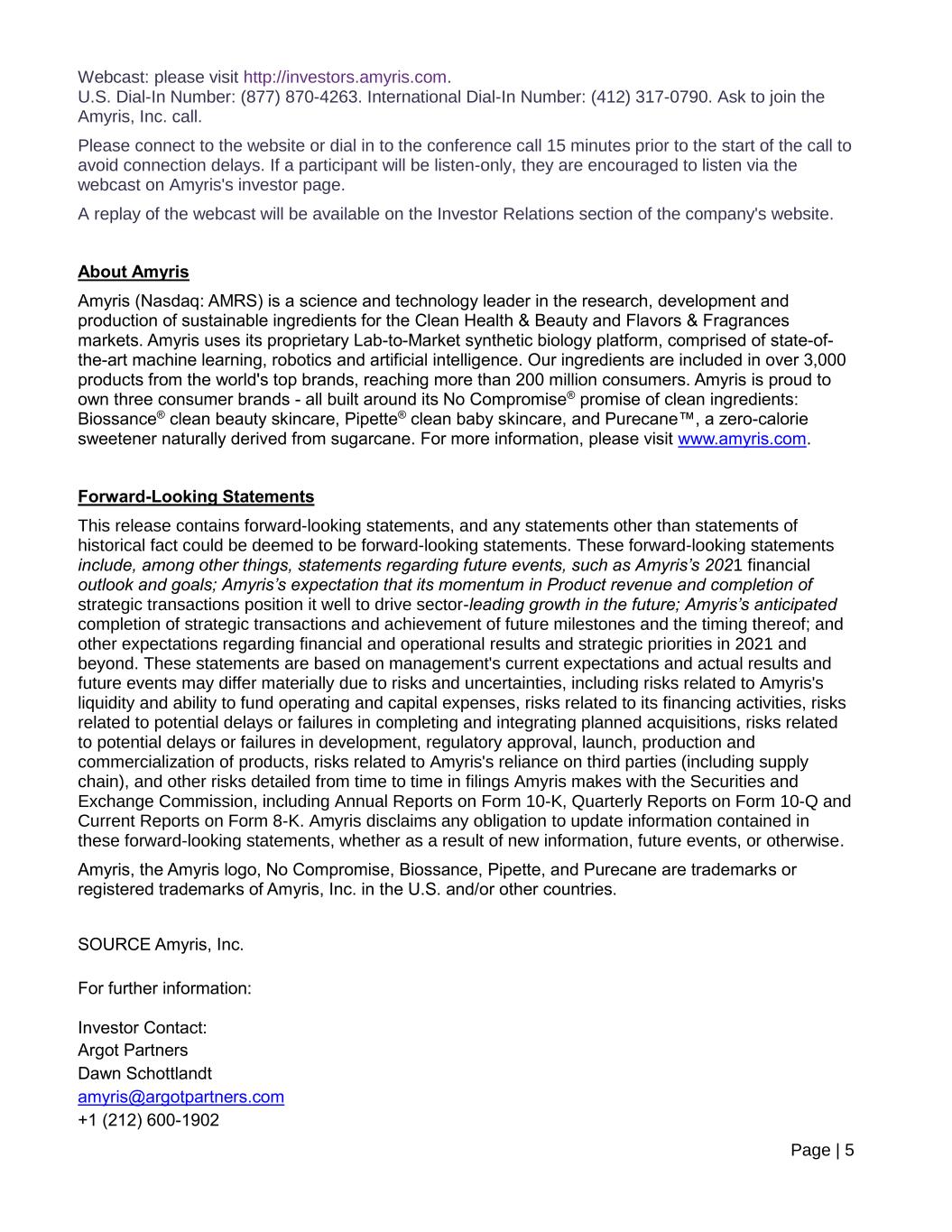

Page | 5 Webcast: please visit http://investors.amyris.com. U.S. Dial-In Number: (877) 870-4263. International Dial-In Number: (412) 317-0790. Ask to join the Amyris, Inc. call. Please connect to the website or dial in to the conference call 15 minutes prior to the start of the call to avoid connection delays. If a participant will be listen-only, they are encouraged to listen via the webcast on Amyris's investor page. A replay of the webcast will be available on the Investor Relations section of the company's website. About Amyris Amyris (Nasdaq: AMRS) is a science and technology leader in the research, development and production of sustainable ingredients for the Clean Health & Beauty and Flavors & Fragrances markets. Amyris uses its proprietary Lab-to-Market synthetic biology platform, comprised of state-of- the-art machine learning, robotics and artificial intelligence. Our ingredients are included in over 3,000 products from the world's top brands, reaching more than 200 million consumers. Amyris is proud to own three consumer brands - all built around its No Compromise® promise of clean ingredients: Biossance® clean beauty skincare, Pipette® clean baby skincare, and Purecane™, a zero-calorie sweetener naturally derived from sugarcane. For more information, please visit www.amyris.com. Forward-Looking Statements This release contains forward-looking statements, and any statements other than statements of historical fact could be deemed to be forward-looking statements. These forward-looking statements include, among other things, statements regarding future events, such as Amyris’s 2021 financial outlook and goals; Amyris’s expectation that its momentum in Product revenue and completion of strategic transactions position it well to drive sector-leading growth in the future; Amyris’s anticipated completion of strategic transactions and achievement of future milestones and the timing thereof; and other expectations regarding financial and operational results and strategic priorities in 2021 and beyond. These statements are based on management's current expectations and actual results and future events may differ materially due to risks and uncertainties, including risks related to Amyris's liquidity and ability to fund operating and capital expenses, risks related to its financing activities, risks related to potential delays or failures in completing and integrating planned acquisitions, risks related to potential delays or failures in development, regulatory approval, launch, production and commercialization of products, risks related to Amyris's reliance on third parties (including supply chain), and other risks detailed from time to time in filings Amyris makes with the Securities and Exchange Commission, including Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q and Current Reports on Form 8-K. Amyris disclaims any obligation to update information contained in these forward-looking statements, whether as a result of new information, future events, or otherwise. Amyris, the Amyris logo, No Compromise, Biossance, Pipette, and Purecane are trademarks or registered trademarks of Amyris, Inc. in the U.S. and/or other countries. SOURCE Amyris, Inc. For further information: Investor Contact: Argot Partners Dawn Schottlandt amyris@argotpartners.com +1 (212) 600-1902

Page | 6 Amyris, Inc. Peter DeNardo investor@amyris.com +1 (510) 740-7481 Media Contact: Amyris, Inc. Beth Bannerman Chief Engagement & Sustainability Officer bannerman@amyris.com +1 (510) 914-0022 ### Financial Tables Follow

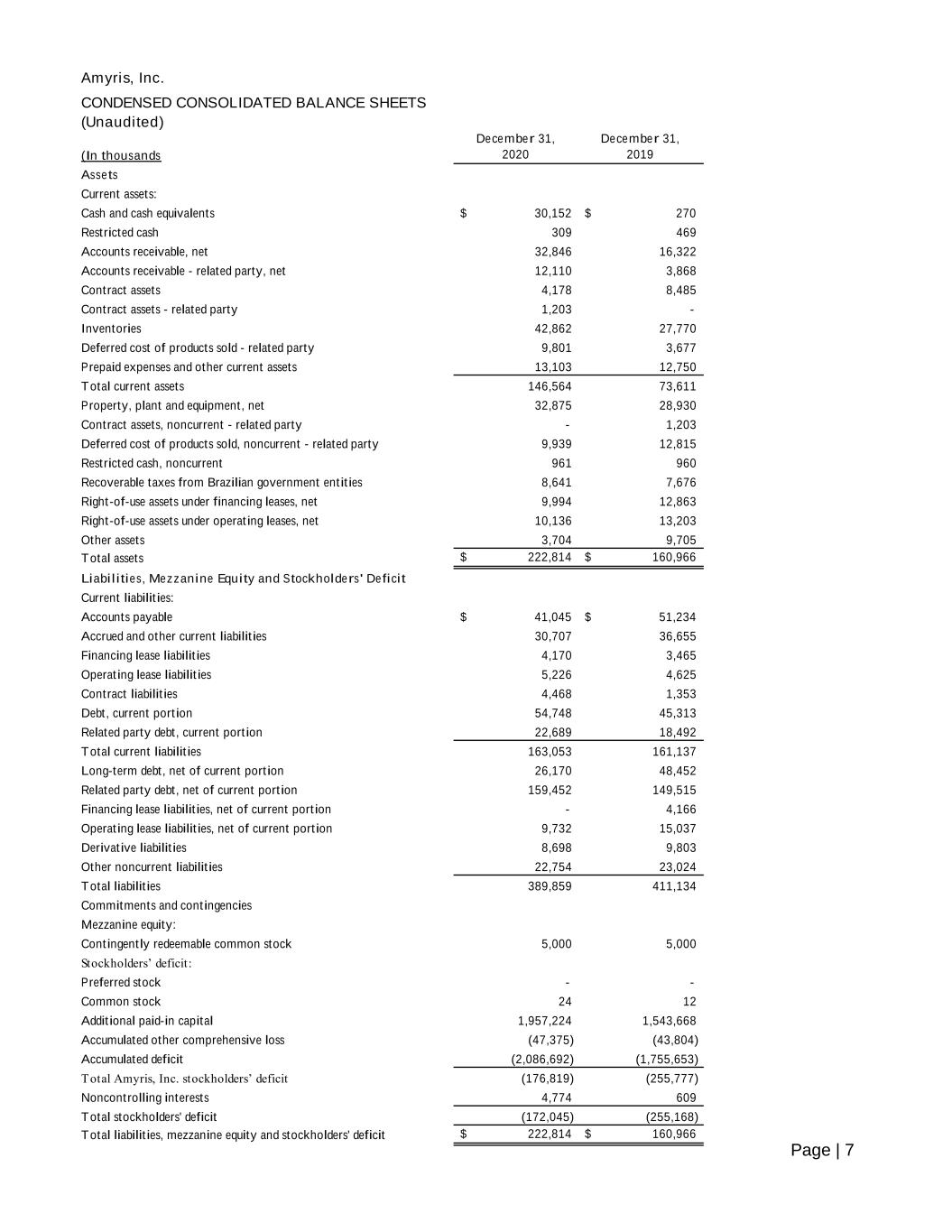

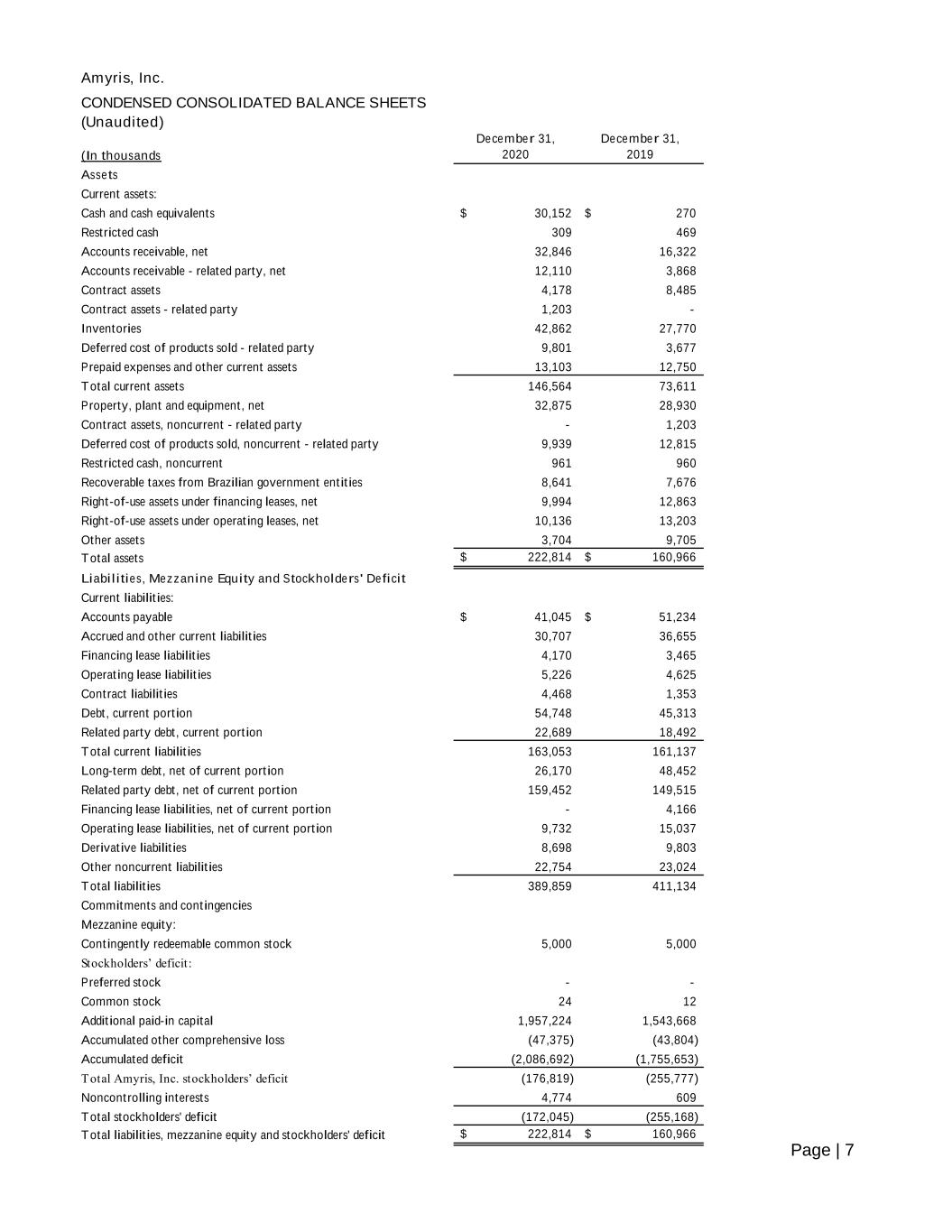

Page | 7 Amyris, Inc. CONDENSED CONSOLIDATED BALANCE SHEETS (Unaudited) (In thousands December 31, 2020 December 31, 2019 Assets Current assets: Cash and cash equivalents $ 30,152 $ 270 Restricted cash 309 469 Accounts receivable, net 32,846 16,322 Accounts receivable - related party, net 12,110 3,868 Contract assets 4,178 8,485 Contract assets - related party 1,203 - Inventories 42,862 27,770 Deferred cost of products sold - related party 9,801 3,677 Prepaid expenses and other current assets 13,103 12,750 Total current assets 146,564 73,611 Property, plant and equipment, net 32,875 28,930 Contract assets, noncurrent - related party - 1,203 Deferred cost of products sold, noncurrent - related party 9,939 12,815 Restricted cash, noncurrent 961 960 Recoverable taxes from Brazilian government entities 8,641 7,676 Right-of-use assets under financing leases, net 9,994 12,863 Right-of-use assets under operating leases, net 10,136 13,203 Other assets 3,704 9,705 Total assets $ 222,814 $ 160,966 Liabilities, Mezzanine Equity and Stockholders' Deficit Current liabilit ies: Accounts payable $ 41,045 $ 51,234 Accrued and other current liabilit ies 30,707 36,655 Financing lease liabilit ies 4,170 3,465 Operating lease liabilit ies 5,226 4,625 Contract liabilit ies 4,468 1,353 Debt, current portion 54,748 45,313 Related party debt, current portion 22,689 18,492 Total current liabilit ies 163,053 161,137 Long-term debt, net of current portion 26,170 48,452 Related party debt, net of current portion 159,452 149,515 Financing lease liabilit ies, net of current portion - 4,166 Operating lease liabilit ies, net of current portion 9,732 15,037 Derivative liabilit ies 8,698 9,803 Other noncurrent liabilit ies 22,754 23,024 Total liabilit ies 389,859 411,134 Commitments and contingencies Mezzanine equity: Contingently redeemable common stock 5,000 5,000 Stockholders’ deficit: Preferred stock - - Common stock 24 12 Additional paid-in capital 1,957,224 1,543,668 Accumulated other comprehensive loss (47,375) (43,804) Accumulated deficit (2,086,692) (1,755,653) Total Amyris, Inc. stockholders’ deficit (176,819) (255,777) Noncontrolling interests 4,774 609 Total stockholders' deficit (172,045) (255,168) Total liabilit ies, mezzanine equity and stockholders' deficit $ 222,814 $ 160,966

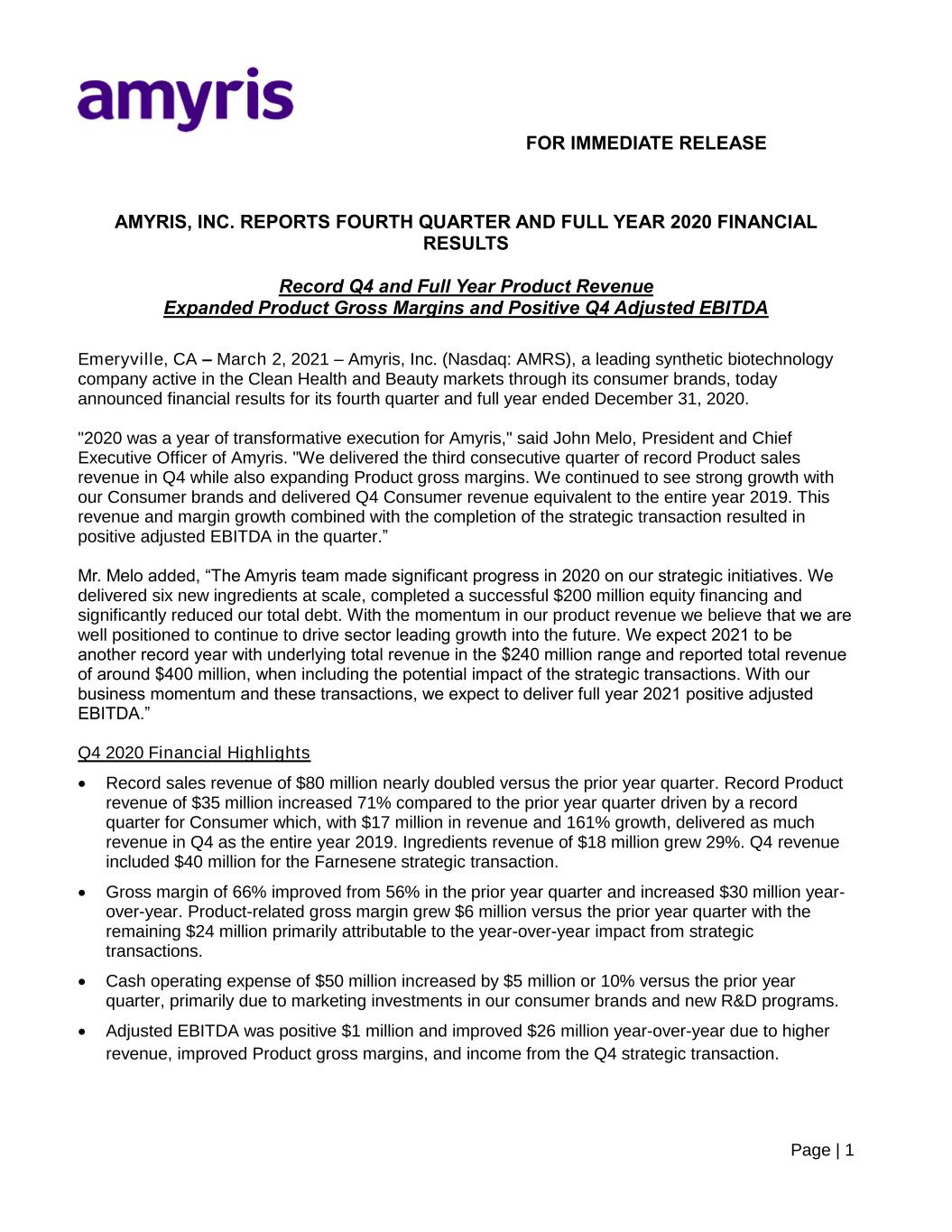

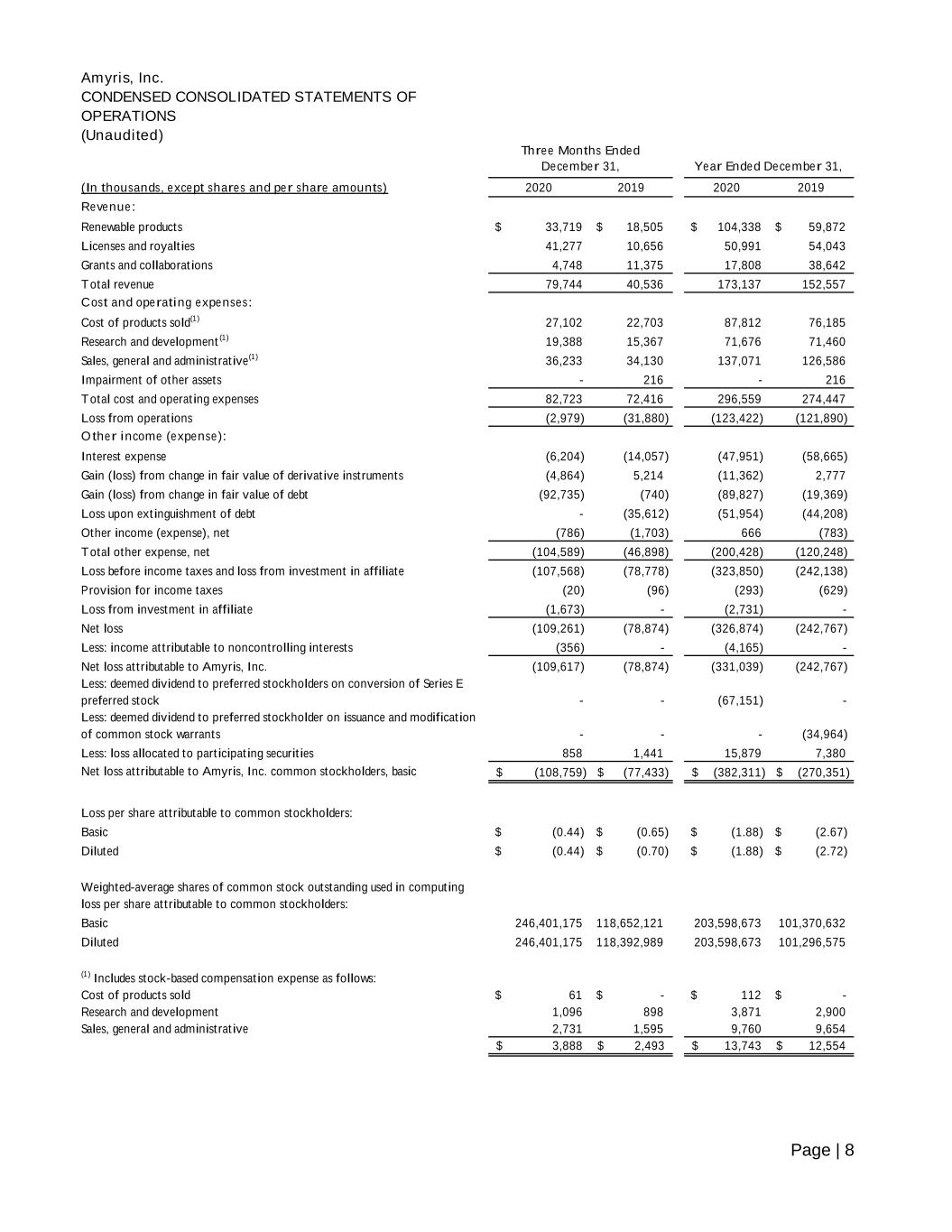

Page | 8 Amyris, Inc. CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS (Unaudited) Three Months Ended December 31, Year Ended December 31, (In thousands, except shares and per share amounts) 2020 2019 2020 2019 Revenue: Renewable products $ 33,719 $ 18,505 $ 104,338 $ 59,872 Licenses and royalties 41,277 10,656 50,991 54,043 Grants and collaborations 4,748 11,375 17,808 38,642 Total revenue 79,744 40,536 173,137 152,557 Cost and operating expenses: Cost of products sold (1) 27,102 22,703 87,812 76,185 Research and development (1) 19,388 15,367 71,676 71,460 Sales, general and administrative (1) 36,233 34,130 137,071 126,586 Impairment of other assets - 216 - 216 Total cost and operating expenses 82,723 72,416 296,559 274,447 Loss from operations (2,979) (31,880) (123,422) (121,890) O ther income (expense): Interest expense (6,204) (14,057) (47,951) (58,665) Gain (loss) from change in fair value of derivative instruments (4,864) 5,214 (11,362) 2,777 Gain (loss) from change in fair value of debt (92,735) (740) (89,827) (19,369) Loss upon extinguishment of debt - (35,612) (51,954) (44,208) Other income (expense), net (786) (1,703) 666 (783) Total other expense, net (104,589) (46,898) (200,428) (120,248) Loss before income taxes and loss from investment in affiliate (107,568) (78,778) (323,850) (242,138) Provision for income taxes (20) (96) (293) (629) Loss from investment in affiliate (1,673) - (2,731) - Net loss (109,261) (78,874) (326,874) (242,767) Less: income attributable to noncontrolling interests (356) - (4,165) - Net loss attributable to Amyris, Inc. (109,617) (78,874) (331,039) (242,767) Less: deemed dividend to preferred stockholders on conversion of Series E preferred stock - - (67,151) - Less: deemed dividend to preferred stockholder on issuance and modification of common stock warrants - - - (34,964) Less: loss allocated to participating securities 858 1,441 15,879 7,380 Net loss attributable to Amyris, Inc. common stockholders, basic (108,759)$ (77,433)$ (382,311)$ (270,351)$ Loss per share attributable to common stockholders: Basic $ (0.44) $ (0.65) $ (1.88) $ (2.67) Diluted $ (0.44) $ (0.70) $ (1.88) $ (2.72) Weighted-average shares of common stock outstanding used in computing loss per share attributable to common stockholders: Basic 246,401,175 118,652,121 203,598,673 101,370,632 Diluted 246,401,175 118,392,989 203,598,673 101,296,575 (1) Includes stock-based compensation expense as follows: Cost of products sold $ 61 $ - $ 112 $ - Research and development 1,096 898 3,871 2,900 Sales, general and administrative 2,731 1,595 9,760 9,654 3,888$ 2,493$ 13,743$ 12,554$

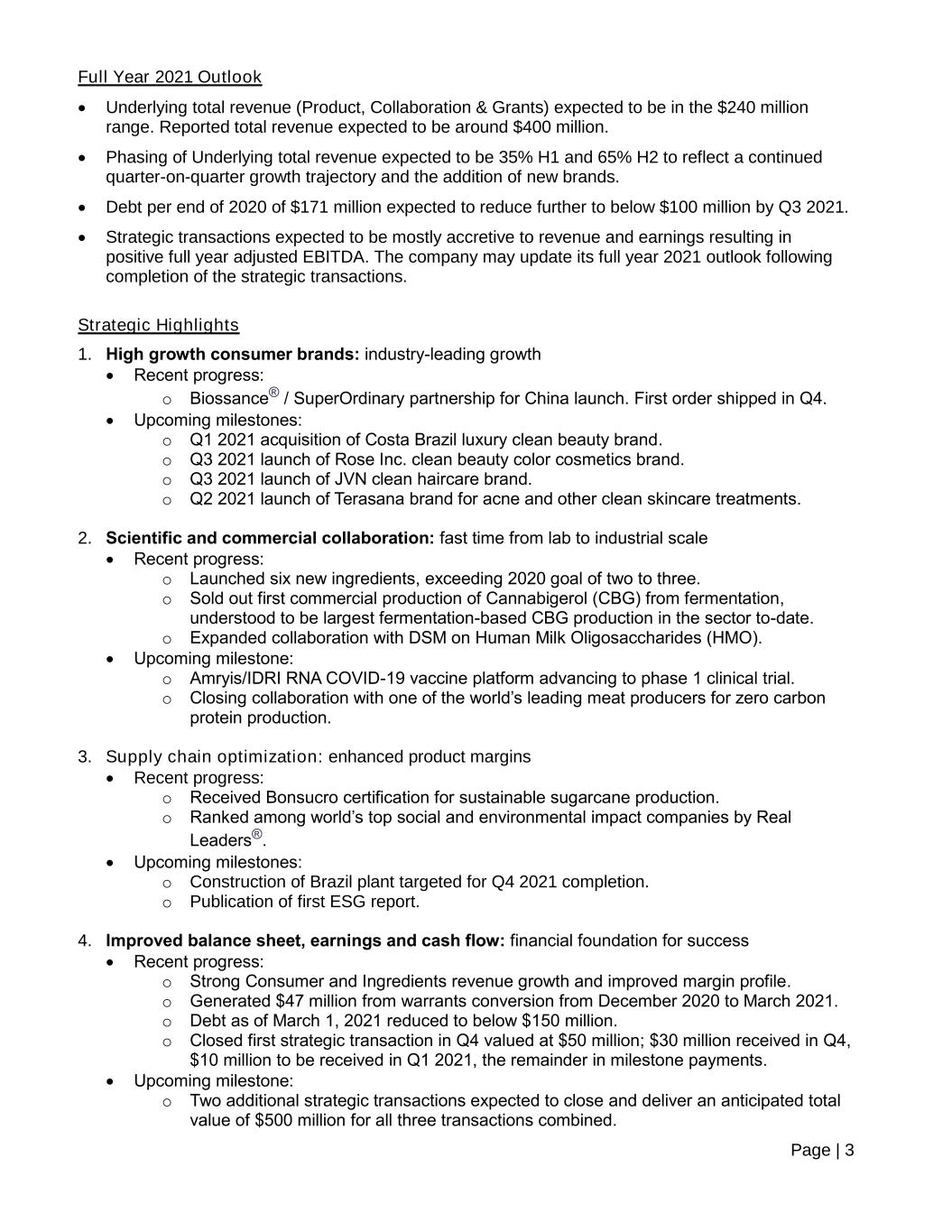

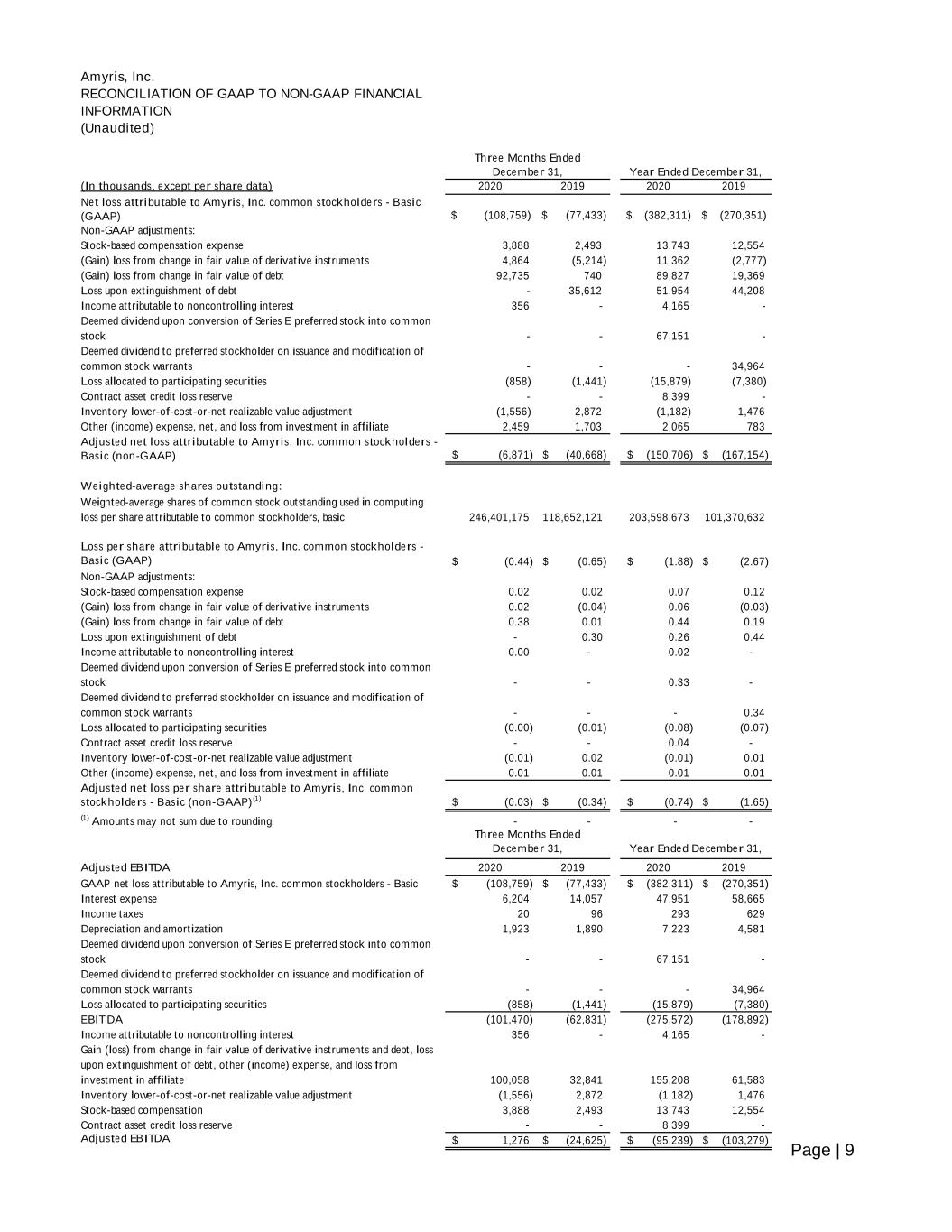

Page | 9 Amyris, Inc. RECONCILIATION OF GAAP TO NON-GAAP FINANCIAL INFORMATION (Unaudited) (In thousands, except per share data) 2020 2019 2020 2019 Net loss attributable to Amyris, Inc. common stockholders - Basic (GAAP) $ (108,759) $ (77,433) $ (382,311) $ (270,351) Non-GAAP adjustments: Stock-based compensation expense 3,888 2,493 13,743 12,554 (Gain) loss from change in fair value of derivative instruments 4,864 (5,214) 11,362 (2,777) (Gain) loss from change in fair value of debt 92,735 740 89,827 19,369 Loss upon extinguishment of debt - 35,612 51,954 44,208 Income attributable to noncontrolling interest 356 - 4,165 - Deemed dividend upon conversion of Series E preferred stock into common stock - - 67,151 - Deemed dividend to preferred stockholder on issuance and modification of common stock warrants - - - 34,964 Loss allocated to participating securities (858) (1,441) (15,879) (7,380) Contract asset credit loss reserve - - 8,399 - Inventory lower-of-cost-or-net realizable value adjustment (1,556) 2,872 (1,182) 1,476 Other (income) expense, net, and loss from investment in affiliate 2,459 1,703 2,065 783 Adjusted net loss attributable to Amyris, Inc. common stockholders - Basic (non-GAAP) (6,871)$ (40,668)$ (150,706)$ (167,154)$ Weighted-average shares outstanding: Weighted-average shares of common stock outstanding used in computing loss per share attributable to common stockholders, basic 246,401,175 118,652,121 203,598,673 101,370,632 Loss per share attributable to Amyris, Inc. common stockholders - Basic (GAAP) (0.44)$ (0.65)$ (1.88)$ (2.67)$ Non-GAAP adjustments: Stock-based compensation expense 0.02 0.02 0.07 0.12 (Gain) loss from change in fair value of derivative instruments 0.02 (0.04) 0.06 (0.03) (Gain) loss from change in fair value of debt 0.38 0.01 0.44 0.19 Loss upon extinguishment of debt - 0.30 0.26 0.44 Income attributable to noncontrolling interest 0.00 - 0.02 - Deemed dividend upon conversion of Series E preferred stock into common stock - - 0.33 - Deemed dividend to preferred stockholder on issuance and modification of common stock warrants - - - 0.34 Loss allocated to participating securities (0.00) (0.01) (0.08) (0.07) Contract asset credit loss reserve - - 0.04 - Inventory lower-of-cost-or-net realizable value adjustment (0.01) 0.02 (0.01) 0.01 Other (income) expense, net, and loss from investment in affiliate 0.01 0.01 0.01 0.01 Adjusted net loss per share attributable to Amyris, Inc. common stockholders - Basic (non-GAAP) (1) (0.03)$ (0.34)$ (0.74)$ (1.65)$ (1) Amounts may not sum due to rounding. - - - - Three Months Ended December 31, Year Ended December 31, Adjusted EBITDA 2020 2019 2020 2019 GAAP net loss attributable to Amyris, Inc. common stockholders - Basic (108,759)$ (77,433)$ (382,311)$ (270,351)$ Interest expense 6,204 14,057 47,951 58,665 Income taxes 20 96 293 629 Depreciation and amortization 1,923 1,890 7,223 4,581 Deemed dividend upon conversion of Series E preferred stock into common stock - - 67,151 - Deemed dividend to preferred stockholder on issuance and modification of common stock warrants - - - 34,964 Loss allocated to participating securities (858) (1,441) (15,879) (7,380) EBITDA (101,470) (62,831) (275,572) (178,892) Income attributable to noncontrolling interest 356 - 4,165 - Gain (loss) from change in fair value of derivative instruments and debt, loss upon extinguishment of debt, other (income) expense, and loss from investment in affiliate 100,058 32,841 155,208 61,583 Inventory lower-of-cost-or-net realizable value adjustment (1,556) 2,872 (1,182) 1,476 Stock-based compensation 3,888 2,493 13,743 12,554 Contract asset credit loss reserve - - 8,399 - Adjusted EBITDA 1,276$ (24,625)$ (95,239)$ (103,279)$ Year Ended December 31, Three Months Ended December 31,

Page | 10 Amyris, Inc. RECONCILIATION OF GAAP TO NON-GAAP FINANCIAL INFORMATION (Unaudited) Three Months Ended December 31, Year Ended December 31, (In thousands) 2020 2019 2020 2019 Revenue (GAAP and non-GAAP) 79,744$ 40,536$ 173,137$ 152,557$ Cost of products sold (GAAP) 27,102$ 22,703$ 87,812$ 76,185$ Other costs/provisions (1,190) (1,972) (10,128) (5,895) Inventory lower-of-cost-or-net realizable value adjustment 1,556 (2,872) 1,182 (1,476) Excess capacity (284) 275 (855) (1,155) Stock-based compensation expense (61) - (112) - Depreciation and amortization (393) (258) (1,239) (753) Cost of products sold (non-GAAP) 26,730$ 17,876$ 76,660$ 66,906$ Adjusted gross profit (non-GAAP) 53,014$ 22,660$ 96,477$ 85,651$ Gross margin % 66% 56% 56% 56% Research and development expense (GAAP) 19,388$ 15,367$ 71,676$ 71,460$ Stock-based compensation expense (1,096) (898) (3,871) (2,900) Depreciation and amortization (1,279) (1,330) (5,042) (2,670) Research and development expense (non-GAAP) 17,013$ 13,139$ 62,763$ 65,890$ Sales, general and administrative expense (GAAP) 36,233$ 34,130$ 137,071$ 126,586$ Stock-based compensation expense (2,731) (1,595) (9,760) (9,654) Depreciation and amortization (251) (303) (942) (1,157) Contract asset credit loss reserve - - (8,399) - Sales, general and administrative expense (non-GAAP) 33,251$ 32,232$ 117,970$ 115,775$ Cash operating expense 50,264$ 45,371$ 180,733$ 181,665$