UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant x Filed by a Party other than the Registrant ¨

Check the appropriate box:

| | | | |

| ¨ | | Preliminary Proxy Statement |

| |

| ¨ | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| |

| x | | Definitive Proxy Statement |

| |

| ¨ | | Definitive Additional Materials |

| |

| ¨ | | Soliciting Material pursuant to §240.14a-12 |

|

| BANK OF THE CAROLINAS CORPORATION |

| (Name of Registrant as Specified in Its Charter) |

|

|

| (Name of person(s) filing proxy statement, if other than the registrant) |

|

| Payment of Filing Fee (Check the appropriate box): |

| |

| x | | No fee required. |

| |

| ¨ | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | |

| | (1) | | Title of each class of securities to which the transaction applies: |

| | | | |

| | (2) | | Aggregate number of securities to which the transaction applies: |

| | | | |

| | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

| | | | |

| | (4) | | Proposed maximum aggregate value of transaction: |

| | | | |

| | (5) | | Total fee paid: |

| | |

| | | | |

| | | | |

| |

| ¨ | | Fee paid previously with preliminary materials. |

| |

| ¨ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 240.0-11 and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | |

| | (1) | | Amount Previously Paid: |

| | | | |

| | (2) | | Form, Schedule or Registration Statement No.: |

| | | | |

| | (3) | | Filing Party: |

| | | | |

| | (4) | | Date Filed: |

| | | | |

135 BOXWOOD VILLAGE DRIVE

MOCKSVILLE, NORTH CAROLINA 27028

NOTICEOF ANNUAL MEETINGOF SHAREHOLDERS

The 2013 Annual Meeting of Shareholders of Bank of the Carolinas Corporation will be held at 2:00 p.m. EDT on Thursday, June 13, 2013, at the Davie County Public Library located at 371 North Main Street, Mocksville, North Carolina.

The purposes of the meeting are:

| | 1. | Election of Directors. To elect 9 directors for one-year terms; |

| | 2. | Advisory Vote on Executive Compensation. To vote on a non-binding, advisory proposal to endorse and approve compensation paid or provided to our executive officers and our executive compensation policies and practices; |

| | 3. | Ratification of Independent Accountants. To vote on a proposal to ratify the appointment of Turlington and Company, L.L.P., as our independent accountants for 2013; and |

| | 4. | Other Business. To transact any other business properly presented for action at the Annual Meeting. |

At the Annual Meeting, you may cast one vote for each share of our common stock you held of record on April 25, 2013, which is the “Record Date” for the meeting.

You are invited to attend the Annual Meeting in person. However, if you are the record holder of your shares of our common stock, we ask that you appoint the Proxies named in the enclosed proxy statement to vote your shares for you by signing and returning the enclosed proxy card or following the instructions in the proxy statement to appoint the Proxies by Internet, even if you plan to attend the Annual Meeting. If your shares are held in “street name” by a broker or other nominee, only the record holder of your shares may vote them for you, so you should follow your broker’s or nominee’s directions and give it instructions as to how it should vote your shares. Doing that will help us ensure that your shares are represented and that a quorum is present at the Annual Meeting. Even if you sign a proxy card or appoint the Proxies by Internet, you may still revoke that appointment later or attend the Annual Meeting and vote in person.

This notice and the enclosed proxy statement and form of appointment of proxy are being mailed to our shareholders on or about May 15, 2013.

|

| By Order of the Board of Directors |

|

|

Stephen R. Talbert President and Chief Executive Officer |

YOURVOTEISIMPORTANT. WHETHERYOUOWNONESHAREORMANY,YOURPROMPT

COOPERATIONINVOTINGYOURSHARESISAPPRECIATED.

TABLEOF CONTENTS

135 BOXWOOD VILLAGE DRIVE

MOCKSVILLE, NORTH CAROLINA 27028

PROXY STATEMENT

ANNUAL MEETINGOF SHAREHOLDERS

General

This proxy statement is dated May 15, 2013, and is being furnished to our shareholders by our Board of Directors in connection with our solicitation of appointments of proxies in the form of the enclosed proxy card for use at the 2013 Annual Meeting of our shareholders and at any adjournments of the meeting. The Annual Meeting will be held at the Davie County Public Library located at 371 North Main Street, Mocksville, North Carolina, at 2:00 p.m. EDT on June 13, 2013.

In this proxy statement, the terms “you,” “your” and similar terms refer to the shareholder receiving it. The terms “we,” “us,” “our” and similar terms refer to Bank of the Carolinas Corporation. Our banking subsidiary, Bank of the Carolinas, is referred to as the “Bank.”

IMPORTANT NOTICE REGARDINGTHE AVAILABILITYOF PROXY MATERIALSFORTHE

SHAREHOLDER MEETINGTOBE HELDON JUNE 13, 2013:

Copies of this proxy statement and our 2012 Annual Report on Form 10-K are available at

www.proxyvote.com

Proposals to be Voted on at the Annual Meeting

At the Annual Meeting, record holders of our common stock will consider and vote on proposals to:

| | • | | elect 9 directors for one-year terms (see “Proposal 1: Election of Directors” on page 5); |

| | • | | approve a non-binding, advisory resolution to endorse and approve compensation paid or provided to our executive officers and our executive compensation policies and practices (see “Proposal 2: Advisory Vote on Executive Compensation” on page 33); |

1

| | • | | ratify the appointment of Turlington and Company, L.L.P., as our independent accountants for 2013 (see “Proposal 3: Ratification of Appointment of Independent Accountants” on page 35); and |

| | • | | transact any other business properly presented for action at the Annual Meeting. |

Our Board of Directors recommends that you vote “FOR” the election of each of the 9 nominees for director named in this proxy statement and “FOR” Proposals 2 and 3.

How You Can Vote at the Annual Meeting

Record Holders. If your shares of our common stock are held of record in your name, you can vote at the Annual Meeting in one of the following ways:

| | • | | you can attend the Annual Meeting and vote in person; |

| | • | | you can sign and return the proxy card enclosed with this proxy statement and appoint the “Proxies” named below to vote your shares for you at the meeting, or you can validly appoint another person to vote your shares for you; or |

| | • | | you can appoint the Proxies to vote your shares for you by going to the Internet websitewww.proxyvote.com. When you are prompted for your “control number,” enter the number printed on the enclosed proxy card, and then follow the instructions provided. You may appoint the Proxies by Internet only until 11:59 p.m. EDT on June 12, 2013, which is the day before the Annual Meeting date. If you appoint the Proxies by Internet, you need not sign and return a proxy card. You will be appointing the Proxies to vote your shares on the same terms and with the same authority as if you marked, signed and returned a proxy card. The authority you will be giving the Proxies is described below and in the proxy card enclosed with this proxy statement. |

Shares Held in “Street Name.” Only the record holders of shares of our common stock or their appointed proxies may vote those shares. As a result, if your shares of our common stock are held for you in “street name” by a broker or other nominee, then only your broker or nominee (i.e. the record holder) may vote them for you, or appoint the Proxies to vote them for you, unless you make arrangements for your broker or nominee to assign its voting rights to you or for you to be recognized as the person entitled to vote your shares. You will need to follow the directions your broker or nominee provides you and give it instructions as to how it should vote your shares by completing and returning to it the voting instruction sheet you received with your copy of our proxy statement (or by following any directions you received for giving voting instructions electronically). Brokers and other nominees who hold shares in street name for their clients typically have the discretionary authority to vote those shares on “routine” matters when they have not received instructions from beneficial owners of the shares. However, they may not vote those shares on non-routine matters (including the election of directors) unless their clients give them voting instructions. To ensure that shares you hold in street name are represented at the Annual Meeting and voted in the manner you desire,it is important that you instruct your broker or nominee as to how it should vote your shares.

2

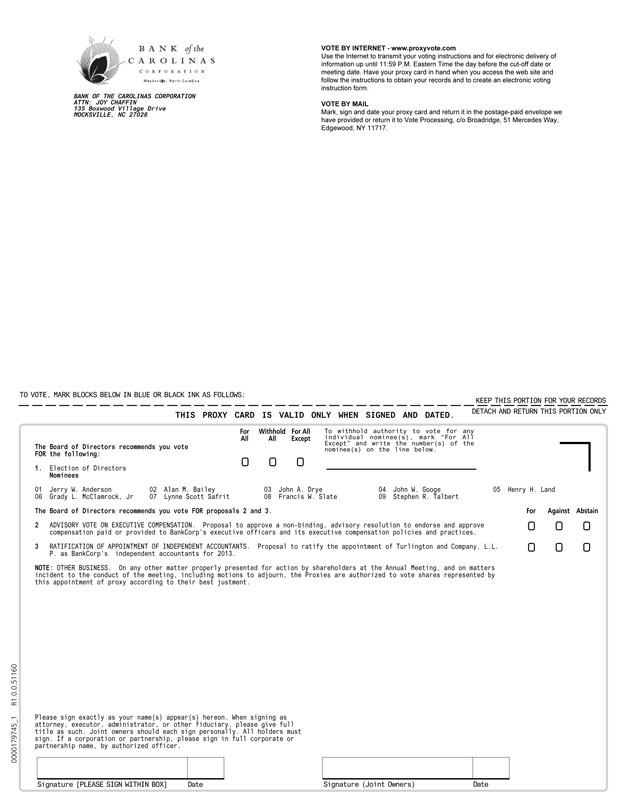

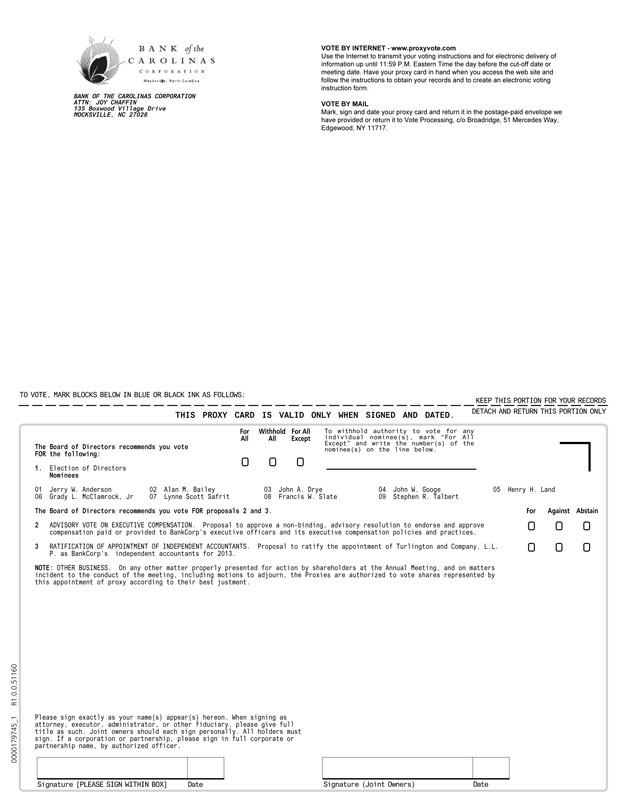

Solicitation and Voting of Proxy Cards

If you are the record holder of your shares of our common stock, a proxy card is included with this proxy statement that provides for you to name three of our directors, Stephen R. Talbert, John A. Drye and Grady L. McClamrock, Jr., or any substitutes appointed by them, individually and as a group, to act as your “Proxies” and vote your shares at the Annual Meeting. We ask that you sign and date your proxy card and return it in the enclosed envelope, or follow the instructions above for appointing the Proxies by Internet, so that your shares will be represented at the meeting.

If you sign a proxy card and return it so that we receive it before the Annual Meeting, or you appoint the Proxies by Internet, the shares of our common stock that you hold of record will be voted by the Proxies according to your instructions. If you sign and return a proxy card or appoint the Proxies by Internet, but you do not give any voting instructions, then the Proxies will vote your shares“FOR” the election of each of the 9 nominees for director named in Proposal 1 below and“FOR” Proposals 2 and 3 discussed in this proxy statement. If, before the Annual Meeting, any nominee named in Proposal 1 becomes unable or unwilling to serve as a director for any reason, your proxy card or Internet appointment will give the Proxies discretion to vote your shares for a substitute nominee named by our Board of Directors. We are not aware of any other business that will be brought before the Annual Meeting other than the election of directors and Proposals 2 and 3 described in this proxy statement, but, if any other matter is properly presented for action by our shareholders, your proxy card or Internet appointment will authorize the Proxies to vote your shares according to their best judgment. The Proxies also will be authorized to vote your shares according to their best judgment on matters incident to the conduct of the meeting, including motions to adjourn the meeting.

If you are a record holder of your shares and you do not return a proxy card or appoint the Proxies by Internet, the Proxies will not have authority to vote for you and your shares will not be represented or voted at the Annual Meeting unless you attend the meeting in person or validly appoint another person to vote your shares for you.

Revocation of Proxy Cards; How You Can Change Your Vote

Record Holders. If you are the record holder of your shares and you sign and return a proxy card or appoint the Proxies by Internet and later wish to change the voting instructions or revoke the authority you gave the Proxies, you can do so before the Annual Meeting by taking the appropriate action described below.

To change the voting instruction you gave the Proxies:

| | • | | you can sign a new proxy card, dated after the date of your original proxy card, which contains your new instructions and submit it to us so that we receive it before the voting takes place at the Annual Meeting; or |

3

| | • | | if you appointed the Proxies by Internet, you can go to the same Internet website you used to appoint the Proxies (www.proxyvote.com) before 11:59 p.m. EDT on June 12, 2013 (the day before the Annual Meeting), enter your control number (printed on the enclosed proxy card), and then change your voting instructions. |

The Proxies will follow the last voting instructions they receive from you before the Annual Meeting.

To revoke your proxy card or your appointment of the Proxies by Internet:

| | • | | you can give our Corporate Secretary a written notice, before the voting takes place at the Annual Meeting, that you want to revoke your proxy card or Internet appointment; or |

| | • | | you can attend the Annual Meeting and notify our Corporate Secretary that you want to revoke your proxy card or Internet appointment and vote your shares in person. Simply attending the Annual Meeting alone, without notifying our Corporate Secretary, will not revoke your proxy card or Internet appointment. |

Shares Held in “Street Name.” If your shares are held in “street name” and you want to change the voting instructions you have given to your broker or other nominee, you must follow your broker’s or nominee’s directions.

Expenses and Method of Solicitation

We will pay all costs of soliciting proxy cards and Internet appointments for the Annual Meeting, including costs of preparing and mailing this proxy statement. We are requesting that banks, brokers and other custodians, nominees and fiduciaries forward copies of our proxy solicitation materials to their principals and request their voting instructions, and we will reimburse those persons for their expenses in doing so. In addition to solicitation by mail and the Internet, the Bank’s and our directors, officers and employees may solicit proxy cards personally or by telephone or other methods of communication, but they will not receive any additional compensation from us for doing so.

In connection with the solicitation of proxy cards and Internet appointments for the Annual Meeting, we have not authorized anyone to give you any information, or make any representation, that is not contained in this proxy statement. If anyone gives you any other information or makes any other representation to you, you should not rely on it as having been authorized by us.

Record Date and Voting Securities

The close of business on April 25, 2013, is the “Record Date” we are using to determine which shareholders are entitled to receive notice of and to vote at the Annual Meeting and how many shares they are entitled to vote. Our voting securities are the 3,895,840 shares of our common stock that were outstanding on the Record Date. You must have been a record holder of our common stock on that date in order to vote at the meeting.

4

Quorum and Voting Procedures

A quorum must be present for business to be conducted at the Annual Meeting. For all matters to be voted on at the meeting, a quorum will consist of a majority of the outstanding shares of our common stock. Shares represented in person or by proxy at the meeting will be counted for the purpose of determining whether a quorum exists. Once a share is represented for any purpose at the meeting, it will be treated as present for quorum purposes for the remainder of the meeting and for any adjournments. If you return a valid proxy card, appoint the Proxies by Internet or attend the meeting in person, your shares will be counted for purposes of determining whether there is a quorum, even if you abstain or instruct the Proxies to abstain from voting on one or more matters. Broker “non-votes” also will be counted in determining whether there is a quorum. Broker “non-votes” will occur if your shares are held by a broker and are voted on one or more matters at the meeting, but they are not voted by the broker on a “non-routine” matter (such as the election of directors) because you have not given the broker voting instructions on that matter. If your shares are represented at the meeting with respect to any matter voted on, they will be treated as present with respect to all matters voted on, even if they are not voted on all matters.

You may cast one vote for each share of our common stock you held of record on the Record Date on each director to be elected and on each other matter voted on by shareholders at the Annual Meeting. You may not cumulate your votes in the election of directors.

Vote Required for Approval

Our directors are elected by a plurality of the votes cast in elections. In the election of directors at the Annual Meeting, the 9 nominees receiving the highest numbers of votes will be elected. For Proposals 2 and 3 to be approved, the number of votes cast in favor of each proposal must exceed the number of votes cast against it. So long as a quorum is present, abstentions and broker non-votes will have no effect in the voting for directors or on Proposals 2 and 3.

PROPOSAL 1: ELECTIONOF DIRECTORS

General

Our Bylaws provide that:

| | • | | our Board of Directors consists of not less than 5 nor more than 18 members, and our Board is authorized to set and change the actual number of our directors from time to time within those limits; and |

| | • | | our directors are elected each year at our Annual Meeting for terms of one year, or until their successors have been duly elected and qualified. |

5

Our Board has set the number of our directors at 9 for the year following the Annual Meeting, and our shareholders will elect 9 directors at the Annual Meeting.

Nominees

Based on the recommendation of our Corporate Governance Committee, the 9 persons named in the table below (each of whom currently serves as a director) have been nominated by our Board of Directors for election at the Annual Meeting as directors for one-year terms. The following table lists information about each nominee, including a description of his or her principal occupation and business experience.

| | | | | | |

Name and Age | | Positions with Us and the Bank(1) | | Year

First

Elected(2) | | Principal Occupation and Business Experience |

Jerry W. Anderson (73) | | Director | | 1998 | | Partner, Anderson Aggregates, LLC (land clearing) since 1999; previously, President, Anderson Chip & Pulpwood, Inc., from 1986 until its merger with Anderson Aggregates in 1999 |

| | | |

Alan M. Bailey (72) | | Director | | 1998 | | Private investor; previously, owner and operator, 801 Shell Service (gasoline station) |

| | | |

John A. Drye (49) | | Director | | 2002 | | Partner, Central Carolina Insurance Agency (general insurance agency) |

| | | |

John W. Googe (88) | | Director | | 2001 | | President and Chief Executive Officer, Flex-Pay Business Services, Inc. (payroll services) (1996–2012); Director, Flight Op (aircraft charter) (2008–present); Manager, Coliseum Drive Association (real estate) (2005–present); Manager, Southeastern Pension Co. (pension record keeping) (2009–present) |

| | | |

Henry H. Land (71) | | Director | | 2002 | | Retired; previously, Partner, McClary, Stocks, Smith, Land & Campbell, P.A., Certified Public Accountants (1988–2006) |

| | | |

Grady L. McClamrock, Jr. (60) | | Director | | 2001 | | Attorney; owner, Grady L. McClamrock, Jr., J.D., P.A. (law firm) |

| | | |

Lynne Scott Safrit (54) | | Director | | 2002 | | President and Chief Operating Officer, Castle & Cooke North Carolina, LLC (property management and development) |

| | | |

Francis W. Slate (90) | | Director; Chairman of the Board of Directors | | 1998 | | Mayor, Town of Mocksville; retired General Surgeon, Mocksville Surgical Associates, P.A. |

6

| | | | | | |

Name and Age | | Positions with Us and

the Bank(1) | | Year

First

Elected(2) | | Principal Occupation and Business Experience |

Stephen R. Talbert (67) | | Director; Vice Chairman of the Board of Directors; President and Chief Executive Officer | | 2002 | | Officer of the Bank; previously, President and Chief Executive Officer of BOC Financial Corp and its bank subsidiary from 1986 until their merger with the Bank in 2001 |

| (1) | Listings of the members of certain committees of our Board are contained below under the heading “Committees of Our Board.” |

| (2) | “Year first elected” refers to the year in which each individual first became a director of the Bank. Each nominee first became our director at the time we were incorporated during 2006 as the Bank’s holding company. Messrs. Drye, Land and Talbert and Ms. Safrit previously served as directors of BOC Financial Corp and were appointed as directors of the Bank following our merger with that company on December 31, 2001. |

Our Board of Directors recommends that you vote “FOR” each of the 9 nominees named above.

The 9 nominees receiving the highest numbers of votes will be elected.

Factors Bearing on Qualifications of Directors and Nominees

The experience, qualifications, attributes, skills and other factors that lead our Board to conclude that each of our directors listed in the table above should serve, or continue to serve, as a director are described below.

Jerry W. Anderson

| | • | | Thorough understanding of our culture, values, and goals derived from service as our director since 1998 |

| | • | | Owner/operator of Anderson Aggregates; in business for over 40 years |

| | • | | Board experience for over 25 years with Energy United |

| | • | | Active in civic clubs in Davie County |

| | • | | Over 40 years operating a business in Davie County leads to a thorough understanding of the banking needs of small business owners |

Alan M. Bailey

| | • | | Thorough understanding of our culture, values and goals derived from service as our director since 1998 |

| | • | | Owner/operator of 801 Shell Service and Bailey’s Auto Sales for over 30 years |

7

| | • | | Graduate of NC Bank Directors’ College 1998 |

| | • | | Well respected in the business community of Davie County as his family has been in business for over 100 years |

| | • | | Understands the banking and business needs of small business owners |

John A. Drye

| | • | | Thorough understanding of our culture, values and goals derived from service as our director since 2002 |

| | • | | Over 20 years experience in the insurance industry as partner of a property/casualty insurance agency |

| | • | | Furman University, BA, graduated 1986; University of Georgia, MBA, concentration in finance and risk management, graduated 1988; Chartered Property and Casualty Underwriter 1997; Certified Builders Insurance Agent 2008 |

| | • | | Active involvement in church and civic clubs of Rowan County |

| | • | | Good understanding of the banking needs of small businesses in Rowan and Cabarrus Counties |

John W. Googe

| | • | | Thorough understanding of our culture, values and goals derived from service as our director since 2001 |

| | • | | Over 40 years professional experience, served as President and COO of a public company |

| | • | | Guilford College, Economics degree, graduated 1950; Chartered Life Underwriter 1960 |

| | • | | Past service on other public company boards of directors |

| | • | | Mr. Googe has started and sold 18 different companies; this gives him a great understanding of the banking needs in many different industries; he is also well-respected in the Winston-Salem business community |

Henry H. Land

| | • | | Thorough understanding of our culture, values and goals derived from service as our director since 2002; currently serves as Chairman of and financial expert for the Audit Committee |

8

| | • | | East Carolina University, AB degree in Business Administration; CPA certification in 1969 from state of North Carolina |

| | • | | Extensive experience in financial accounting and reporting with large industrial corporation |

| | • | | Public accounting experience with various small - to medium-size privately owned businesses |

| | • | | Able to identify the financial needs of small- and mid-size businesses in our market area |

Grady L. McClamrock, Jr.

| | • | | Thorough understanding of our culture, values and goals derived from service as our director since 2001. |

| | • | | North Carolina State University, Construction Engineering degree 1974; Wake Forest Law School, JD degree 1977 |

| | • | | Significant business skills developed through owning and managing law practice |

| | • | | Visible and active as a community leader serving on various boards within our market area |

| | • | | Able to identify with the financial needs of small- and mid-size businesses in our market area |

Lynne Scott Safrit

| | • | | Thorough understanding of our culture, values and goals derived from service as our director since 2002 |

| | • | | Substantial experience in commercial real estate with more than 15 years as president of a national real estate development company |

| | • | | Catawba College, BA Cum Laude 1980; UNCC, MA 1981 |

| | • | | Graduate of NC Advanced Bank Directors’ College 2003 |

| | • | | Very active in many civic and professional organizations; currently serving on the Board of Trustees of Catawba College and President of the Board of Directors of the Cabarrus County Economic Development Corp. |

9

| | • | | Member of the Catawba College Business Hall of Fame |

| | • | | Able to identify with the financial needs of small- and mid-size businesses in our market area |

Francis W. Slate

| | • | | Thorough understanding of our culture, values and goals derived from service as our director since 1998 |

| | • | | Over 32 years experience in healthcare as a general surgeon |

| | • | | University of Cape Town, M. B. Ch. B degree 1947 (South African equivalent of M.D.) New York University Postgraduate Medical School 1952–1953; George Washington University Medical School residency in General Surgery 1953–1956 |

| | • | | Very active in medical community and as a community leader serving 12 years as Davie County Commissioner; Mocksville Town Commissioner for 10 years; Mayor of Mocksville for 15 years |

| | • | | Able to identify with the financial needs of small- and mid-size businesses in our market area |

Stephen R. Talbert

| | • | | Thorough understanding of our culture, values and goals derived from 41 years experience in the banking industry and service as a director since 2002; currently serves as our Vice Chairman, President and Chief Executive Officer |

| | • | | Experience as President and Chief Executive Officer of Bank of the Carolinas until its merger with Bank of Davie in 2001 |

| | • | | Catawba College, BA degree in Business Administration 1966 |

| | • | | Very active in local community serving on many boards including NorthEast Medical Center Foundation, Trinity Lutheran Church, and Catawba College Board of Visitors |

| | • | | Able to identify with the financial needs of small- and mid-size businesses in our market area |

CORPORATE GOVERNANCE

Our Board of Directors adopted Corporate Governance Guidelines during February 2010 that describe principles and practices the Board will follow carrying out its responsibilities. Together with our Bylaws, the Guidelines establish various processes related to the structure and leadership of our Board and the governance of our corporation, including certain of the matters described below.

10

Director Independence

Determination of Independent Directors. Each year our Board of Directors reviews transactions, relationships and other arrangements involving our directors and determines which of the directors the Board considers to be “independent.” In making those determinations, the Board applies the independence criteria contained in the listing requirements of The Nasdaq Stock Market. Although the Company’s common stock is no longer listed on The Nasdaq Stock Market, the Board continues to use Nasdaq’s definition of independence in determining whether or not a director or nominee for director is independent.

The Board has directed our Audit Committee to assess each outside director’s independence and report its findings to the Board in connection with the Board’s annual determinations, and to monitor the status of each director on an ongoing basis and inform the Board of changes in factors or circumstances that may affect a director’s ability to exercise independent judgment.

The following table lists our current directors and nominees for election as directors at the Annual Meeting, who our Board believes were, during their terms of office, and will be, if elected, “independent” directors under Nasdaq’s criteria:

| | | | |

| Jerry W. Anderson | | John W. Googe | | Lynne Scott Safrit |

| Alan M. Bailey | | Henry H. Land | | Francis W. Slate |

| John A. Drye | | Grady L. McClamrock, Jr. | | |

In addition to the specific Nasdaq criteria, in determining the independence of each director the Board considers whether it believes transactions that are disclosable in our proxy statements as “related person transactions,” or any other transactions, relationships, arrangements or factors, could impair a director’s ability to exercise independent judgment. In its determination that the directors named above are independent, those other factors considered by the Committee and the Board included (1) the Bank’s lending relationships with directors who are loan customers; (2) services provided to the Bank by Mr. Googe’s firm in connection with payroll processing and administration services relating to the Bank’s 125 Plan (none of which were provided during 2012), and (3) legal services that Mr. McClamrock provides from time to time in connection with matters involving such things as loan closings or collections. In the case of Mr. McClamrock, the Board concluded that he is independent under Nasdaq’s criteria, but that he may not serve on our Audit Committee.

Executive Sessions of Independent Directors. Our independent directors meet separately, without management and non-independent directors being present, in conjunction with each regular meeting of our Board and, at their discretion, they may hold separate meetings other than in conjunction with Board meetings. During 2012, the independent directors met twelve times in executive session.

Lead Independent Director. Under our Corporate Governance Guidelines, if the Chairman elected by our Board is not an independent director, then our independent directors will designate a separate “Lead Independent Director.” Even if the Chairman is an independent director, our independent directors still may, at their option, designate a Lead Independent Director. Francis W. Slate currently serves as our Lead Independent Director.

11

Under our Corporate Governance Guidelines, the duties of our Lead Independent Director include:

| | • | | convening and presiding at executive sessions and separate meetings of our independent directors, and serving as the liaison between the independent directors and our Chairman and management; |

| | • | | consulting with the Chairman and management regarding concerns of our independent directors and matters discussed, decisions reached, or suggestions made, at executive sessions and separate meetings of independent directors; |

| | • | | consulting with the Chairman regarding the schedule, agenda, and information for Board meetings; |

| | • | | consulting with the Chairman with respect to consultants who may report directly to the Board; |

| | • | | consulting with the Chairman and management as to the quality, quantity, and timeliness of information provided to the Board by management; |

| | • | | being available, as appropriate, for communications with our shareholders; and |

| | • | | such other duties and authority as is described elsewhere in the Corporate Governance Guidelines and as the Board may from time to time determine. |

A special meeting of the Board will be called at the Lead Independent Director’s request. Also, while our Chairman sets the agenda for each Board meeting, a matter will be placed on the agenda for any regular or special Board meeting at the Lead Independent Director’s request.

Board Leadership Structure

Our Board annually elects a Chairman whose duties are described in our Bylaws, and it performs its oversight role through various committees, which are appointed by the Board based on the recommendation of its independent Corporate Governance Committee and which may be established as separate committees of our Board or as joint committees of our and the Bank’s Boards. The Board may select any of its members as its Chairman, and it has no formal policy as to whether our Chief Executive Officer will serve as Chairman or whether any other director, including a non-employee or independent director, may be elected to serve as Chairman.

At present, the positions of Chief Executive Officer and Chairman are held by different persons. At this time, the Board has determined that separating these roles and having an independent director serve as Chairman of the Board is in the best interests of our shareholders. The Board believes this division of responsibility facilitates communication between the Board and executive management and is appropriate, given the legal and regulatory requirements applicable to us.

12

Additionally, as described below under the heading “Committees of Our Board,” all matters pertaining to executive compensation and the selection of nominees for election as directors are subject to the review and recommendation of the Board’s Corporate Governance Committee, which is made up of independent directors. Our Corporate Governance Guidelines provide that:

| | • | | all outside directors have full access to any member of management and to our and the Bank’s independent auditors and internal auditors for the purpose of understanding issues relating to our business; |

| | • | | our management will arrange for our outside advisors to be made available for discussions with the Board, a Board committee, our independent directors as a group, or individual directors; and |

| | • | | the Board, each Board committee, and our independent directors as a group, in each case by a majority vote, have the authority to retain independent advisors from time to time, at our expense, and separate and apart from our regular advisors. |

Our Board believes that the provisions described above enhance the effectiveness of our independent directors and provide for a leadership structure that is appropriate for a company our size.

Board’s Role in Risk Management

Risk is inherent in any business, and, as is the case with other management functions, our senior management has primary responsibility for managing the risks we face. However, as a financial institution, our business involves financial risks that do not exist, or that are more extensive than the risks that exist, in some other types of businesses. We are subject to extensive regulation that requires us to assess and manage those risks, and during their periodic examinations our regulators assess our performance in that regard. As a result, our Board is actively involved in overseeing our risk management programs.

The Board administers its oversight function primarily through committees, which may be established as separate or joint committees of our and/or the Bank’s Boards. Those committees include our Audit Committee, Risk Oversight Committee, and Corporate Governance Committee (which serves as a compensation and nominations committee). The Board approves and periodically reviews the Bank’s operating policies and procedures, and it has adopted a Risk Management Policy, which provides for the establishment of a risk management program and standards to identify, measure, monitor and control risks inherent in our business. The Risk Management Policy provides that our management is responsible for developing and implementing our risk management program and that the Board’s Risk Oversight Committee should provide independent and objective oversight of that program.

13

We have engaged the firm of Elliott Davis, PLLC, to perform our internal audit function. Elliott Davis makes reports directly to the Audit Committee regarding our internal audit function, and our independent accountants are hired by and make reports directly to that Committee with respect to the audit of our financial statements and internal control matters. Separate from the internal and independent audit functions, we have a Risk Management Department, which is administered by our Chief Risk Officer. That department’s functions include monitoring and assessing business risks, including those associated with credit, interest rate, liquidity, market, operational, legal and reputation matters, as well as the Bank’s information security and compliance functions. Our Chief Risk Officer works directly with senior management in the various departments of the Bank and makes reports directly to the Risk Oversight Committee regarding internal risk management and regulatory issues (including issues raised during internal or external reviews or examinations regarding control deficiencies and recommendations), and he is a member of our Asset / Liability Management Committee, which is made up of senior officers of the Bank and which also reports to the Risk Oversight Committee. He also works directly with our Corporate Governance Committee in its periodic reviews of our and the Bank’s compensation plans to ensure continued oversight and mitigation of risk within our compensation practices and that (1) arrangements in which our senior executive officers participate do not encourage those officers to take unnecessary and excessive risks that threaten the value of our company, and (2) arrangements in which employees participate do not encourage the manipulation of our reported earnings to enhance the compensation of any employees.

We believe the Board’s involvement in our risk management results in Board committees that are more active than those of corporations that are not financial institutions or that are not regulated as extensively as financial institutions. We believe this committee activity enhances our Board’s effectiveness and leadership structure by providing opportunities for non-employee directors to become familiar with the Bank’s critical operations and actively involved in the Board’s oversight role with respect to risk management, as well as its other oversight functions.

Attendance by Directors at Meetings

Board of Directors Meetings. Our Board of Directors and that of the Bank hold regular monthly meetings, and, from time to time, they also hold special meetings. During 2012, our Board met sixteen times and the Board of Directors of the Bank met eighteen times. Each of our current directors attended 75% or more of the aggregate number of meetings of the Boards and any committees on which he or she served, with the exception of Lynne Scott Safrit.

Annual Meetings. Attendance by our directors at Annual Meetings of our shareholders gives directors an opportunity to meet, talk with and hear the concerns of shareholders who attend those meetings. It also gives those shareholders access to our directors that they may not have at any other time during the year. Our Board of Directors recognizes that directors have their own business interests and are not our employees, and that it is not always possible for them to attend Annual Meetings. However, our Board’s policy is that attendance by directors at our Annual Meetings is beneficial to us and to our shareholders and that our directors are strongly encouraged to attend each Annual Meeting whenever possible. All of our directors then in office attended our last Annual Meeting which was held during June 2012.

14

Communications with Our Board

Our Board of Directors encourages our shareholders to communicate with it regarding their concerns and other matters related to our business, and the Board has established a process by which you may send written communications to the Board or to one or more individual directors. You may address and mail your communication to our Corporate Secretary at:

Bank of the Carolinas Corporation

Attention: Corporate Secretary

135 Boxwood Village Drive

Mocksville, North Carolina 27028

You also may send communications by e-mail todirectors@bankofthecarolinas.com, with an attention line to the Corporate Secretary. You should indicate whether your communication is directed to the entire Board of Directors, to a particular committee of the Board or its Chairman, or to one or more individual directors. All communications will be reviewed by our Corporate Secretary and, with the exception of communications our Corporate Secretary considers unrelated to our or the Bank’s business, forwarded to the intended recipients. Copies of communications from a customer of the Bank relating to a deposit, loan or other financial relationship or transaction also will be forwarded to the head of the department or division that is most closely associated with the subject of the communication.

Code of Ethics

Our Board of Directors has adopted a Code of Ethics which applies to our directors and executive officers, including our principal financial officer, and, among other things, is intended to promote:

| | • | | honest and ethical conduct; |

| | • | | ethical handling of actual or apparent conflicts of interest between personal and professional relationships; |

| | • | | full, fair, accurate, timely and understandable disclosure in reports and documents that we file with the Securities and Exchange Commission and in other public communications we make; |

| | • | | compliance with governmental laws, rules and regulations; |

| | • | | prompt internal reporting of violations of the Code to the Board’s Audit Committee; and |

| | • | | accountability for adherence to the Code. |

15

A copy of the Code is posted on the Bank’s Internet website atwww.bankofthecarolinas.com. Illegal or unethical behavior, violations of the Code, or accounting or auditing concerns may be reported, anonymously or otherwise, to the Chairman of our Audit Committee addressed as follows:

Henry H. Land

Post Office Box 166

Kannapolis, NC 28082

COMMITTEESOF OUR BOARD

General

Our and the Bank’s Board of Directors have two independent, standing committees that assist the Boards in oversight and governance matters. They are the Audit Committee and the Corporate Governance Committee. The Corporate Governance Committee serves as both a nominations committee and a compensation committee. Each of those Committees operates under a written charter approved by our Board that sets out the Committee’s composition, authority, duties and responsibilities. We believe that each member of those Committees is an “independent director” as that term is defined by Nasdaq’s listing standards. Although the Company’s common stock is no longer listed on The Nasdaq Stock Market, the Board of Directors continues to use Nasdaq’s definition of independence in determining whether or not a director is independent. Current copies of the charters of those Committees are posted on the Bank’s Internet website atwww.bankofthecarolinas.com. Also, among other committees, the Boards have an Executive Committee and a Risk Oversight Committee, each of which includes both independent directors and a management director. The current members of the Audit Committee and Corporate Governance Committee are listed in the following table, and the function of and other information about each of the Committees mentioned above is described in the following paragraphs.

| | |

Audit Committee | | Corporate Governance Committee |

| |

Henry H. Land—Chairman Jerry W. Anderson Alan M. Bailey Lynne Scott Safrit Francis W. Slate | | John A. Drye—Chairman Alan M. Bailey John W. Googe Grady L. McClamrock, Jr. |

Audit Committee

Function. Our Audit Committee is a joint committee of our and the Bank’s Boards of Directors. Under its charter, the Committee is responsible for:

| | • | | appointing our independent accountants and approving their compensation and the terms of their engagement; |

| | • | | approving services proposed to be provided by the independent accountants; and |

| | • | | monitoring and overseeing the quality and integrity of our accounting and financial reporting process and systems of internal controls. |

16

The Committee reviews various reports from our independent accountants (including its annual audit report on our consolidated financial statements), financial reports we file under the Securities Exchange Act of 1934, and reports of examinations by our regulatory agencies, and it generally oversees our internal audit program. Also, as described above under the caption “Director Independence,” our Board has directed the Audit Committee to monitor and make annual reports regarding the independence of our directors. The Committee met ten times during 2012.

Audit Committee Financial Expert. Mr. Land, the Chairman of the Audit Committee, is a certified public accountant with over forty years of accounting experience, including approximately twenty years in public accounting. Our Board of Directors believes that Mr. Land is an “audit committee financial expert” as that term is defined by rules of the Securities and Exchange Commission.

Audit Committee Report

Our management is responsible for our financial reporting process, including our system of internal controls and disclosure controls and procedures, and for preparing our consolidated financial statements in accordance with accounting principles generally accepted in the United States of America. Our independent accountants are responsible for auditing those financial statements. The Audit Committee oversees and reviews those processes. In connection with its responsibilities, the Audit Committee reviews and evaluates, then discusses with our management, internal audit personnel, and our independent accountants:

| | • | | the plan for, and our independent accountants’ report on, each audit of our financial statements; |

| | • | | our financial disclosure documents, including all financial statements and reports filed with the Securities and Exchange Commission or sent to our shareholders; |

| | • | | changes in our accounting practices, principles, controls, methodologies or financial statements, and significant developments in accounting rules; and |

| | • | | the adequacy of our internal accounting controls and accounting, financial and auditing personnel, and the establishment and maintenance of an environment that promotes ethical behavior. |

In connection with the preparation and audit of our consolidated financial statements for 2012, the Audit Committee has:

| | • | | reviewed our audited consolidated financial statements for 2012 and discussed them with management; |

| | • | | discussed with our independent accountants the matters required to be discussed by AU Section 380,Communication with Audit Committees; |

17

| | • | | received written disclosures and a letter from our independent accountants required by the independence standards of the Public Company Accounting Oversight Board (PCAOB Rule 3526); and |

| | • | | discussed the independence of our independent accountants with the accountants. |

Based on the above reviews and discussions, the Audit Committee recommended to our Board of Directors that the audited consolidated financial statements be included in our 2012 Annual Report on Form 10-K as filed with the Securities and Exchange Commission.

Members of the Audit Committee who participated in the reviews and discussions described above pertaining to the preparation and audit of our consolidated financial statements for 2012 are named below.

The Audit Committee:

| | | | | | | | |

| Henry H. Land | | Jerry W. Anderson | | Alan M. Bailey | | Lynne S. Safrit | | Francis W. Slate |

Corporate Governance Committee

Function. Our Corporate Governance Committee is a joint committee of the Bank’s and our Boards. Under its charter, the Committee acts as our Board’s nominations committee and as the compensation committee of both Boards. Also, as described below under the heading “Transactions with Related Persons,” the Board has directed the Committee to review and approve certain transactions, arrangements or relationships with the Bank in which any of our related persons has a material interest. The Committee met six times during 2012.

Nominations Committee Functions. Among its other duties and responsibilities assigned from time to time by the Board, the Corporate Governance Committee functions as a nominations committee of our Board by identifying individuals who are qualified to become directors and recommending candidates to the Board for selection as nominees for election as directors at our Annual Meetings and for appointment to fill vacancies on the Board.

The Committee’s charter and our Corporate Governance Guidelines provide for the Committee annually to recommend individuals who have the qualities expected of all directors, including personal and professional integrity, sound judgment, business acumen, and the time, ability and commitment to make a constructive and meaningful contribution to the Board, and who, with other members of the Board, will be effective in collectively serving the long-term interests of our shareholders. Candidates also must satisfy applicable requirements of state and federal banking regulators, and the Committee may develop other criteria or minimum qualifications for use in identifying and evaluating candidates. The Board makes all final decisions regarding nominations. In identifying candidates to be recommended to the Board of Directors from time to time, the Committee considers incumbent directors and candidates suggested by our management, other directors and our shareholders. The Committee has not used

18

the services of a third-party search firm. Shareholders who wish to recommend candidates to the Committee should send their recommendations in writing to:

Corporate Governance Committee

Bank of the Carolinas Corporation

Attention: Corporate Secretary

135 Boxwood Village Drive

Mocksville, North Carolina 27028

Each recommendation should be accompanied by the following:

| | • | | the full name, address and telephone number of the person making the recommendation, and a statement that the person making the recommendation is a shareholder of record (or, if the person is a beneficial owner of our shares but not a record holder, a statement from the record holder of the shares verifying the number of shares beneficially owned), and a statement as to whether the person making the recommendation has a good faith intention to continue to hold those shares through the date of our next Annual Meeting; |

| | • | | the full name, address and telephone number of the candidate being recommended, information regarding the candidate’s beneficial ownership of our equity securities and any business or personal relationship between the candidate and the person making the recommendation, and an explanation of the value or benefit that the person making the recommendation believes the candidate would provide as a director; |

| | • | | a statement signed by the candidate that he or she is aware of and consents to being recommended to the Committee and will provide information the Committee may request in connection with its evaluation of candidates; |

| | • | | a description of the candidate’s current principal occupation, business or professional experience, previous employment history, educational background, and any particular skills, experience or areas of particular expertise; |

| | • | | information about any business or personal relationships between the candidate and any of our or the Bank’s customers, suppliers, vendors, competitors, directors or officers, affiliated companies, or other persons with any special interest regarding our company or affiliated companies, and any transactions between the candidate and our company or affiliated companies; and |

| | • | | any additional information about the candidate that would be required to be included in our proxy statement pursuant to the SEC’s Regulation 14A (including without limitation information about legal proceedings in which the candidate has been involved within the past ten years). |

In order to be considered by the Committee in connection with its recommendations of candidates for selection as nominees for election at an Annual Meeting, a shareholder’s recommendation must be received by the Committee not later than the 120th day prior to the first anniversary of the date our proxy statement was first mailed to our shareholders in conjunction with our preceding year’s Annual Meeting. Recommendations submitted by shareholders other than in accordance with these procedures will not be considered by the Committee.

19

The Committee will evaluate candidates recommended by shareholders in a manner similar to its evaluation of other candidates. The Committee considers the overall composition of the Board in light of our current and future needs and will select candidates to be recommended to the Board of Directors each year based on its assessment of, among other things: (1) business, professional, personal and educational background, experience and expertise, (2) community leadership; (3) independence; (4) potential contributions to the Board that are unique; (5) knowledge of our company and the Bank and our respective operations; (6) personal financial interest in our and the Bank’s long-term growth, stability, and success; (7) the performance and past and future contributions of our current directors, and the value of continuity and prior Board experience; (8) the existence of one or more vacancies on the Board; (9) the need for a director possessing particular attributes, experience or expertise; (10) the role of directors in the Bank’s business development activities; (11) diversity; and (12) other factors that it considers relevant, including any specific qualifications the Committee adopts from time to time.

The Committee and our Board recognize the benefits derived from a Board composed of individuals who bring different attributes, experiences, and perspectives to the Board’s deliberations. However, they do not consider diversity for the sake of diversity to be a basis for the nomination, election or appointment of a director, and they have not adopted any written or mandatory diversity policy or criteria applicable to the director nominations process. In evaluating and selecting nominees, diversity is one of the multiple factors considered by the Committee and the Board. For these purposes, they consider diversity to encompass a variety of characteristics of candidates, including, by way of example, business and professional experience, academic background, geographic location within our banking markets, gender and race.

The Corporate Governance Committee recommended to our Board of Directors that the 9 incumbent directors listed above under the heading “Proposal 1: Election of Directors” be nominated for re-election at the Annual Meeting for new one-year terms.

Compensation Committee Functions. The Corporate Governance Committee also functions as a compensation committee of our and the Bank’s Boards and reviews and provides overall guidance to the Boards with respect to our executive and director compensation and benefit programs. It makes recommendations to the Boards regarding:

| | • | | cash and other compensation paid or provided to our and the Bank’s Chief Executive Officer and other executive officers; |

| | • | | the adoption of new compensation or benefit plans, or changes in existing plans, under which compensation or benefits are or will be paid or provided to those executive officers; |

20

| | • | | cash and other compensation paid or provided to other officers and employees, either individually or in the aggregate, as the Boards request; and |

| | • | | compensation paid to our directors. |

The Committee, along with our Chief Risk Officer, periodically reviews our and the Bank’s compensation plans to determine whether there are potential areas of risk that reasonably could be expected to have a material adverse effect on our business and financial results and to ensure continued oversight and mitigation of risk within our compensation practices. In particular, in connection with our participation in the U.S. Department of the Treasury’s TARP Capital Purchase Program, the Committee is required to meet with our Chief Risk Officer each six months to review and discuss our compensation arrangements to ensure that arrangements in which our senior executive officers participate do not encourage those officers to take unnecessary and excessive risks that threaten the value of our company, and that arrangements in which employees in general participate do not encourage the manipulation of our reported earnings to enhance the compensation of any employees.

In performing its duties, the Committee may, if it considers it appropriate, delegate any of its responsibilities to a subcommittee. However, any subcommittee must be composed entirely of independent directors. The Committee is authorized to conduct investigations and to request and consider any information (from management or otherwise) that it believes is necessary, relevant or helpful in its deliberations and in making its recommendations. It may rely on information provided by management without further verification. However, under its charter, when the Committee takes an action, it should exercise independent judgment on an informed basis and in a manner it considers to be in the best interests of our shareholders. In matters related to the compensation of executive officers other than our Chief Executive Officer, the Committee considers information provided by our Chief Executive Officer about the individual performance of those other officers and his recommendations as to their compensation. After receiving the Committee’s recommendations, the Board makes all final decisions regarding compensation matters.

The Committee may retain the services of outside counsel or consultants, at our or the Bank’s expense, and on terms (including fees) that it approves. However, during 2012, the Committee did not use the services of any outside consultant.

Risk Oversight Committee

Our Risk Oversight Committee is a committee of the Bank’s Board of Directors. Under its charter, and as discussed above under the caption “Board’s Role in Risk Management,” the Committee’s function is to provide oversight of our risk management program with a focus on major risks inherent in the ongoing operation of the Bank, including risks associated with credit, interest rate, liquidity, market, operational, legal and reputation matters. Our Asset Liability Management Committee, which is made up of members of our senior management, as well as our Chief Risk Officer, makes reports directly to the Committee.

21

The Committee’s charter provides that its membership will include not less than three non-employee directors who will be appointed by our Corporate Governance Committee. The Risk Oversight Committee met four times during 2012.

Executive Committee

Under North Carolina banking law, the Bank’s Board is required to appoint an executive committee which has such duties and powers as are provided for in the Bank’s Bylaws or in applicable banking regulations and which must meet at least once during any month in which the Bank’s Board does not meet. Our Executive Committee is a joint committee of our and the Bank’s Boards of Directors. Under our and the Bank’s Bylaws, and subject to limitations imposed under North Carolina law or by the Boards, the Committee is authorized to exercise all the powers of the Boards in the management of our and the Bank’s affairs when the Boards are not in session. The Committee did not meet during 2012.

EXECUTIVE OFFICERS

We consider our three officers listed below to be our executive officers.

Stephen R. Talbert,age 67, serves as our and the Bank’s Vice Chairman, President, and Chief Executive Officer. He joined the Bank on December 31, 2001, in connection with the Bank’s acquisition of BOC Financial Corp. Previously, he had served as Chairman, President and Chief Executive Officer of BOC Financial Corp since its organization during 1998, and in the same positions with that company’s bank subsidiary or its predecessor since 1971. He served as the Bank’s Chairman and Executive Vice President from 2002 to 2004 and has been Vice Chairman since 2004. Prior to being appointed President and Chief Executive Officer, Mr. Talbert served as our Interim Chief Executive Officer from August to September 2010.

George E. (“Ed”) Jordan,age 54, was appointed to serve as Chief Operating Officer of the Bank on November 24, 2010. Mr. Jordan previously served as the Bank’s Executive Vice President since January 2008 and, in that position, supervised the Bank’s financial services, marketing and sales functions and served as regional executive for the Bank’s offices located in Stokes, Forsyth, Davidson and Randolph Counties. Prior to that, he served as the Bank’s President and Chief Operating Officer from May 2004 to January 2008. Prior to his employment with the Bank, Mr. Jordan was employed by Wachovia Bank for 24 years where his positions included supervisory responsibility over city executives for several of that bank’s Triad area offices and service as that bank’s Senior Vice President and Business Banking Sales Director with responsibilities for middle market lending.

Harry E. Hill,age 67, was elected as the Bank’s Executive Vice President during January 2001. He was employed by our organizing group during 1998 and became Senior Vice President of the Bank when it began operations during 1998, and he currently functions as the Bank’s business development officer in Davie County. Previously, he served as Vice President of Southern National Bank and its successor, Branch Banking & Trust Company, in Welcome, North Carolina, from 1994 to 1998, and as Business Development Officer of Davidson Savings Bank from 1992 to 1994.

22

EXECUTIVE COMPENSATION

Summary

The following table shows the cash and certain other compensation paid or provided to or deferred by the named executive officers for 2012 and 2011. Our executive officers are compensated by the Bank for their services as its officers, and they receive no separate salaries or other cash compensation from us for their services as our officers.

SUMMARY COMPENSATION TABLE

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Name and Principal Position(1) | | Year | | | Salary(2) | | | Bonus | | | Stock

Awards | | | Option

Awards | | | Non-Equity

Incentive Plan

Compensation | | | All Other

Compensation(3) | | | Total | |

Stephen R. Talbert Vice Chairman, President and Chief Executive Officer | |

| 2012

2011 |

| | $

| 228,463

192,230 |

| |

| -0-

-0- |

| |

| -0-

-0- |

| |

| -0-

-0- |

| |

| -0-

-0- |

| | $

| 4,439

8,135 |

| | $

| 232,902

200,365 |

|

George E. Jordan Executive Vice President and Chief Operating Officer | |

| 2012

2011 |

| | $

| 169,714

155,632 |

| |

| -0-

-0- |

| |

| -0-

-0- |

| |

| -0-

-0- |

| |

| -0-

-0- |

| | $

| 1,428

2,876 |

| | $

| 171,142

158,508 |

|

Harry E. Hill Executive Vice President | |

| 2012

2011 |

| | $

| 155,314

150,000 |

| |

| -0-

-0- |

| |

| -0-

-0- |

| |

| -0-

-0- |

| |

| -0-

-0- |

| | $

| 4,832

6,695 |

| | $

| 160,146

156,695 |

|

| (1) | Mr. Talbert served as a member of our Board of Directors during 2012 and 2011. Mr. Talbert received no additional compensation for his service as a director. |

| (2) | Reflects total salary paid by the Bank each year, including the amount of salary deferred at each officer’s election under our Section 401(k) plan. |

| (3) | The following table describes each officer’s “Other Compensation” for 2012: |

| | | | | | | | | | | | |

Description | | Mr.

Talbert | | | Mr.

Jordan | | | Mr.

Hill | |

The Bank’s contributions for the officers’ accounts under our Section 401(k) plan | | | -0- | | | | -0- | | | | -0- | |

Our estimated aggregate incremental cost related to personal benefits received during 2012(a) | | | $4,439 | | | | $1,428 | | | | $4,832 | |

| | | | | | | | | | | | |

Total | | | $4,439 | | | | $1,428 | | | | $4,832 | |

| (a) | Our executive officers receive, or we may treat them as receiving, various non-cash personal benefits. During 2012, the personal benefits received by the named officers included: |

| | • | | for Mr. Talbert, an automobile allowance and the Bank’s payment of club dues; |

| | • | | for Mr. Jordan, an automobile allowance; and |

| | • | | for Mr. Hill, an automobile allowance and the Bank’s payment of club dues. |

We also provide our officers with group life, health, medical and other insurance coverages that are generally available on the same basis to all salaried employees. The cost of that insurance is not included in the table.

23

Employment Agreement

Mr. Jordan is employed by the Bank under an employment agreement. The agreement has a “rolling” term of employment of three years that, at the end of each year, is extended by one additional year. On May 17, 2018, the term becomes a fixed three years expiring at the close of business on May 17, 2021. If Mr. Jordan remains employed by the Bank after May 17, 2021, his employment will be on an “at will” basis. The agreement also provides for:

| | • | | an annual base salary (which is subject to review and periodic increase by the Bank’s Board) of $135,678; and |

| | • | | the right to participate in bonus or incentive plans and other benefits made available by the Bank to its executive officers. |

The Bank may terminate the agreement at any time for cause. Subject to certain limitations, the agreement provides for payments and benefits to be provided to Mr. Jordan and limits his ability to compete against the Bank after a termination of his employment under various circumstances (including a termination following a change in control of the Company or the Bank). Those provisions, and the limitations on their operation, are described below under the caption “Potential Payments Upon Termination of Employment or a Change in Control.”

Plan-Based Awards

We maintain two arrangements under which awards may be granted from time to time to our officers and employees. They are our:

| | • | | Omnibus Equity Plan, under which stock options, restricted stock awards, and performance share awards may be granted; and |

| | • | | Annual Management Incentive Compensation Plan, under which additional cash compensation may be paid each year based on the extent to which corporate and individual goals or other performance criteria are met or satisfied for the year. |

Stock-Based Awards. Our shareholders approved the Omnibus Equity Plan at our 2007 Annual Meeting to replace both our Employee Stock Option Plan and Director Stock Option Plan which had been in effect since 1998 and under which we had granted options from time to time to our officers, employees and directors to purchase shares of our common stock. Those old plans have expired.

Under the new plan, awards may be granted to officers and employees consisting of either:

| | • | | Incentive stock options; |

| | • | | Non-qualified stock options; |

| | • | | Restricted stock awards; or |

| | • | | Performance share awards. |

As described under the caption “Director Compensation,” the Omnibus Equity Plan also authorizes the grant of non-qualified stock options and restricted stock awards to our non-employee directors.

A stock option gives the officer or employee to whom it is granted the right to buy shares of our common stock during a stated period of time (ordinarily ten years) at a fixed price per share equal to the fair market value of our stock on the date the option is granted. Options generally are granted to officers and employees on terms that provide for them to “vest,” or become exercisable, at intervals as to portions of the shares they cover based on a vesting

24

schedule, and they do not include any performance-based conditions. They generally terminate immediately on the date of, or after a stated number of days following, the termination of an employee’s employment. Options granted to officers and employees may be “incentive stock options” that qualify for special tax treatment under the Internal Revenue Code, or they may be “non-qualified stock options” that do not qualify for that special tax treatment. We expect that options granted in the future to officers and employees under the Omnibus Equity Plan will be incentive stock options.

Restricted stock awards are conditional grants of shares of our common stock that are subject to forfeiture if specified conditions (usually the officer’s or employee’s continued performance) are not satisfied by the end of a specified restriction period. When an award is granted, the shares are issued and, if we pay dividends on our common stock during the restriction period, the officer or director would receive those dividends on the shares covered by his award at the same rate and on the same basis as they are paid to our other shareholders. However, the shares may not be sold or transferred until the restriction period ends. In most cases the restrictions lapse over time as to portions of the shares according to a “vesting” schedule. If the officer’s employment terminates for any reason prior to the end of the restriction period, he forfeits all unvested shares. As the restrictions expire, the shares become “vested” and are released to the officer.

Performance share awards are awards of shares of our common stock that may be earned based on performance objectives or criteria specified at the time the awards are granted. Like restricted stock awards, performance shares would be granted subject to conditions that must be satisfied before the officer or employee will own the shares outright. However, performance shares would be earned only to the extent that performance criteria are met by the end of a measurement period, while restricted stock awards usually are granted subject only to the condition of continued employment. Also, performance shares would not actually be issued until the end of the measurement period during which the performance criteria must be met, while restricted shares generally are issued at the time awards are granted and become unrestricted at the end of the restriction period.

The exercise price of stock options, and the other terms of options and stock awards, are determined by our Board, based on the recommendation of the Corporate Governance Committee, at the time they are granted.

The following table sets forth information regarding vested and unvested stock options granted to the named executive officers and outstanding as of December 31, 2012.

OUTSTANDING EQUITY AWARDSAT FISCAL YEAR-END

| | | | | | | | | | | | | | | | |

Name | | Number of

securities

underlying

unexercised options

exercisable | | | Number of

securities

underlying

unexercised options

unexercisable | | | Option Exercise

Price | | | Option Expiration

Date | |

George E. Jordan | | | 6,000 | | | | -0- | | | $ | 10.92 | | | | June 23, 2014 | |

25

Cash Incentive Awards. Our Board first adopted our Management Incentive Compensation Plan during 2007. Under the plan, our executive officers and other employees chosen to participate each year may earn additional cash compensation based on the extent to which:

| | • | | Our pre-tax profits (before any deduction for the expense of payments under the plan) exceed a threshold amount set by the Board; and |

| | • | | Other individual goals (which vary for different participants or groups of participants) set by the Board are achieved. |

The plan contemplates that each year our Board will set the maximum award each participant may receive for that year (stated as a percentage of his or her base salary). No cash awards are paid unless our pre-tax, pre-incentive profits for that year exceed a minimum amount set by the Board. Subject to the extent to which individual goals set by the Board for each participant are met, the maximum incentive awards may be paid if our pretax, pre-incentive profits reach a higher target level set by the Board.

During April 2009, we became a participant in the U.S. Department of the Treasury’s TARP Capital Purchase Program. Under rules adopted by Treasury under the Emergency Economic Stabilization Act of 2008 that apply to participants in that program, and with limited exceptions, we are prohibited from paying or accruing any bonus, retention award or incentive compensation to our most highly compensated employee. Also, in connection with any bonuses or incentive compensation, we are required to implement provisions to “clawback” payments to our senior executive officers and our next 20 highest paid employees if any of the criteria on which those payments are based are later found to have been inaccurate.

Like most financial institutions, our financial performance has been negatively affected by the economy and by reduced real estate values in our banking markets, and increased levels of non-performing loans, loan charge-offs and provisions to our allowance for loan losses. Our Board chose not to implement the plan in 2012. As a result, none of our officers and employees were eligible to receive any cash awards under the plan, and no such awards were paid in 2012.

Potential Payments Upon Termination of Employment or a Change of Control

The terms of Mr. Jordan’s employment agreement provide for him to receive payments and benefits if his employment is terminated under various circumstances or following a change in control of the Company or the Bank. However, during April 2009, we became a participant in the U.S. Department of the Treasury’s (“Treasury”) TARP Capital Purchase Program (the “CPP”). Under rules adopted by Treasury under the Emergency Economic Stabilization Act of 2008, as amended by the American Recovery and Reinvestment Act of 2009, that apply to CPP participants (the “CPP Rules”), we believe we are prohibited from paying severance, “golden parachute,” or other such payments to any of our senior executive officers, or to certain of our other employees, in connection with any termination of their employment for any reason while we remain a CPP participant, other than payments relating to services already performed or benefits already accrued.

In addition to the CPP Rules, the Bank is subject to a Consent Order issued by the Federal Deposit Insurance Corporation (the “FDIC”) and the North Carolina Office of the Commissioner of Banks (the “Commissioner”), effective April 17, 2011. Under the terms of the Consent Order, the Bank may not pay bonuses or any form of payment outside the ordinary course of business resulting in a reduction of capital without the prior written approval of the FDIC and the Commissioner.

26

As a result of the CPP Rules and the terms of the Consent Order, notwithstanding the terms of Mr. Jordan’s employment agreement, we believe that no severance or golden parachute payments would have been made to him by the Bank if his employment had terminated on December 31, 2012.

In the event our participation in the CPP ceases and the Consent Order is lifted or modified, payments to Mr. Jordan under his employment agreement would no longer be prohibited. Under Mr. Jordan’s employment agreement, if his employment is terminated by the Bank without cause, or if he terminates his own employment for “good reason” (as defined below), he will continue to receive salary payments from the Bank for the unexpired term of the agreement. “Good reason” will exist if, without Mr. Jordan’s consent:

| | • | | his base salary is materially reduced; |

| | • | | his duties or responsibilities are materially reduced such that he no longer serves as an executive officer; |

| | • | | he is required to transfer his offices more than 50 miles from his principal work location; or |

| | • | | the Bank materially breaches any of the terms of the agreement. |

The Agreement also provides that if, within 24 months following a change in control of the Company or the Bank, Mr. Jordan’s employment is terminated by the Bank or its successor without cause, or a “termination event” (as defined below) occurs and he voluntarily terminates his own employment within 90 days, then, in lieu of other termination payments provided for in the agreement, he will receive a lump-sum payment equal to 2.99 multiplied by his annual base salary in effect at the time the change in control becomes effective or at the time his employment terminates, whichever is greater. A “termination event” will occur under Mr. Jordan’s agreement if, following a change in control of the Company or the Bank: