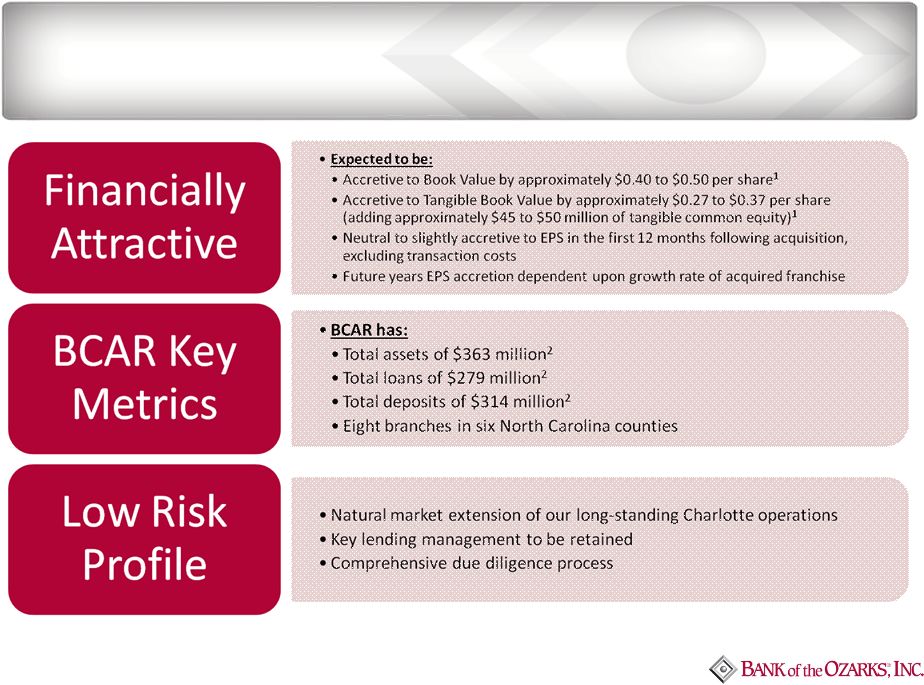

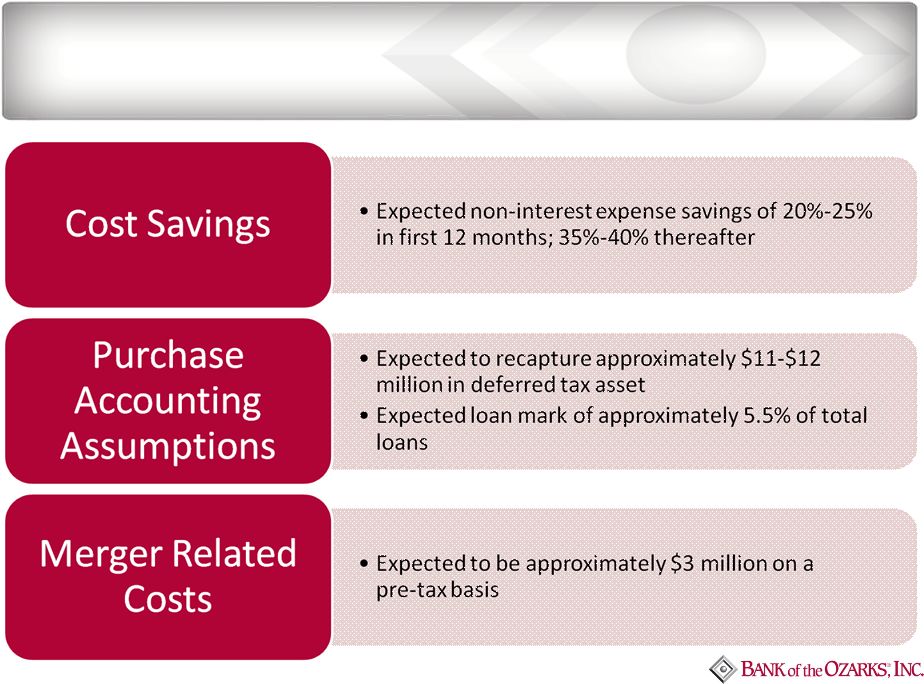

Forward Looking Information CAUTION ABOUT FORWARD-LOOKING STATEMENTS This communication contains certain forward-looking information about Bank of the Ozarks, Inc. (the “Company”) and Bank of the Carolinas Corporation (“BCAR”) that is intended to be covered by the safe harbor for “forward-looking statements” provided by the Private Securities Litigation Reform Act of 1995. All statements other than statements of historical fact are forward-looking statements. In some cases, you can identify forward-looking statements by words such as “may,” “hope,” “will,” “should,” “expect,” “plan,” “anticipate,” “intend,” “believe,” “estimate,” “predict,” “potential,” “continue,” “could,” “future” or the negative of those terms or other words of similar meaning. These forward-looking statements include, without limitation, statements relating to the terms and closing of the proposed transaction between the Company and BCAR, the proposed impact of the merger on the Company’s financial results, including any expected increase in the Company’s book value and tangible book value per share and any expected impact on diluted earnings per common share, acceptance by BCAR’s customers of the Company’s products and services, the opportunities to enhance market share in certain markets, market acceptance of the Company generally in new markets, and the integration of BCAR’s operations. You should carefully read forward-looking statements, including statements that contain these words, because they discuss the future expectations or state other “forward-looking” information about the Company and BCAR. A number of important factors could cause actual results or events to differ materially from those indicated by such forward-looking statements, many of which are beyond the parties’ control, including the parties’ ability to consummate the transaction or satisfy the conditions to the completion of the transaction, including the receipt of shareholder approval, the receipt of regulatory approvals required for the transaction on the terms expected or on the anticipated schedule; the parties’ ability to meet expectations regarding the timing, completion and accounting and tax treatments of the transaction; the possibility that any of the anticipated benefits of the proposed merger will not be realized or will not be realized within the expected time period; the risk that integration of BCAR’s operations with those of the Company will be materially delayed or will be more costly or difficult than expected; the failure of the proposed merger to close for any other reason; the effect of the announcement of the merger on employee and customer relationships and operating results (including, without limitation, difficulties in maintaining relationships with employees and customers); dilution caused by the Company’s issuance of additional shares of its common stock in connection with the merger; the possibility that the merger may be more expensive to complete than anticipated, including as a result of unexpected factors or events; general competitive, economic, political and market conditions and fluctuations; and the other factors described in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2014 and in its most recent Quarterly Reports on Form 10-Q filed with the SEC, or described in BCAR’s Annual Report on Form 10-K for the fiscal year ended December 31, 2014 and in its most recent Quarterly Reports on Form 10-Q filed with the SEC. The Company and BCAR assume no obligation to update the information in this communication, except as otherwise required by law. Readers are cautioned not to place undue reliance on these forward-looking statements that speak only as of the date hereof. ADDITIONAL INFORMATION This communication is being made in respect of the proposed merger transaction involving the Company and BCAR. This communication does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval. The Company will file with the Securities and Exchange Commission (“SEC”) a registration statement on Form S-4 that will include a prospectus of the Company and a proxy statement of BCAR. The Company also plans to file other documents with the SEC regarding the proposed merger transaction. BCAR will mail the final proxy statement/prospectus (the “Merger Proxy Statement”) to its shareholders. The Merger Proxy Statement will contain important information about the Company, BCAR, the proposed merger and related matters. BEFORE MAKING ANY VOTING OR INVESTMENT DECISION, INVESTORS ARE URGED TO READ THE MERGER PROXY STATEMENT AND ANY OTHER RELEVANT DOCUMENTS CAREFULLY IN THEIR ENTIRETY BECAUSE THEY CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION. The Merger Proxy Statement, as well other filings containing information about the Company and BCAR will be available without charge at the SEC’s Internet site (http://www.sec.gov). Copies of the Merger Proxy Statement and the filings that are incorporated by reference in the Merger Proxy Statement can also be obtained, when available, without charge from the Company’s website (http://www.bankozarks.com) under the Investor Relations tab and on BCAR’s investor relations website (http://www.investor.bankofthecarolinas.com). The Company and BCAR and their respective directors, executive officers and certain other members of management and employees may be deemed “participants” in the solicitation of proxies from BCAR’s shareholders in connection with the merger transaction. You can find information about the directors and executive officers of the Company in its Annual Report on Form 10-K for the year ended December 31, 2014 and in its definitive proxy statement as filed with the SEC on February 27, 2015 and March 25, 2015, respectively. You can find information about the executive officers and directors of BCAR in its Annual Report on Form 10-K for the year ended December 31, 2014 as filed with the SEC on March 31, 2015. |