Exhibit 99.3

You have a friend hereTM

Value-based strategy. People-centered approach.

“Building meaningful relationships with our customers has made us the strong bank we are today.”

-Chairman and CEO George Gleason

In 1979, George Gleason had a vision to create a bank where people would genuinely want to do business. And today, that bank not only exists, it’s nationally recognized for providing safe, sound and secure banking solutions and customer service unmatched in the market place.

From the beginning, Mr. Gleason has instilled a personal commitment to excellence, fair dealing and exceptional customer service, and

has built his team with individuals having the same mindset. The philosophy has always been to do what’s best for the customer; first by listening to and understanding their needs, and then by helping them find the best financial solutions.

This values-based strategy influences all the Bank’s decisions and has kept Bank of the Ozarks strong throughout the financial crisis of the mid- to late 2000s.

The Bank’s goal is not necessarily to be the largest financial institution – but to simply be the best one. Regardless of organizational size, we will always be deeply committed to developing friendships with our customers and relationships with the communities we serve. Our success is built upon our exceptional service to every customer, large and small – and we will keep that truth in focus as we build on our past.

1903

Newton County Bank chartered in Jasper, Arkansas

1937

Bank of Ozark chartered in Ozark, Arkansas

1979

Gleason purchases Bank of Ozark

1983

Gleason purchases Newton County Bank; assumes charter

1994

With five offices, launches de novo branching plan; changes name to Bank of the Ozarks

1995

Relocates headquarters to Little Rock, Arkansas

1997

Bank of the Ozarks, Inc., holds initial public stock offering (OZRK)

1998

Begins Central Arkansas expansion

2002

Becomes $1 billion organization based on assets

2003

Celebrates 100th anniversary

2004

Pushes de novo expansion into Texas with three offices

2005

Becomes $2 billion organization based on assets

2006

Opens 11 new offices, a Company record

2008

Becomes $3 billion organization based on assets

Opens new headquarters in Little Rock, Arkansas

2009

Named second- and third-best performing bank in America by ABA Banking Journal and U.S. Banker

2010

Named second-best performing bank in America by Bank Director magazine

George Gleason named Community Banker of the Year by American Banker magazine

2011 & 2012

Named best performing bank in America by ABA Banking Journal

2012

Named best performing regional bank in America by SNL Financial

2013 & 2014

Named best performing bank in America by Bank Director

2015

Named best performing regional bank in America by SNL Financial

This Transition Is All About People—A Powerful Union Of Two Community Bank Teams.

Carefully Considered

Well Thought-Out

Customer Friendly

Shareholder Friendly

Employee Friendly

A Union Of Two Companies Striving For Excellent Results And Excellent Growth

Hard Work

A Focus on Every Detail

A Consistent Pursuit of Excellence

The goal is not to be good; not even great; but truly excellent in every respect!

Disciplined and Smart Growth

“Good enough is never good enough

if we can do any better.”

“Getting it right “ is important to many people.

The Mission Statement

Our mission is to be the best banking organization in each of the markets we serve as determined by our customers, shareholders, employees and regulators.

We strive to be the best bank for customers by offering a broad array of banking products and services at competitive prices and with the highest quality of personal service.

We strive to be the best bank for shareholders by maximizing long-term value through strong year-to-year growth in assets, loans, deposits and net income while maintaining profit margins, asset quality and operating efficiency more favorable than industry averages.

We strive to be the best bank for our employees by providing favorable compensation and benefits, opportunities for growth and advancement, a share in the success of the company, and a positive workplace and culture.

We strive to be the best bank for regulators by adhering to safe, sound and prudent banking practices, striving to comply with all applicable laws and regulations, and giving appropriate attention to capital adequacy, asset quality, management, earnings, liquidity and market sensitivity.

Excellence Recognized

Community Banker of the Year:

American Banker, December 2010

Ranked top performing bank:

ABA Banking Journal, April 2011

Ranked top performing bank:

ABA Banking Journal, April 2012

Ranked top performing Regional bank:

SNL Financial, April 2012

Ranked top performing bank:

Bank Director Magazine, August 2013

You have a friend here®

Ranked top performing bank:

Bank Director Magazine, August 2014

Ranked top performing bank:

SNL Financial, April 2015

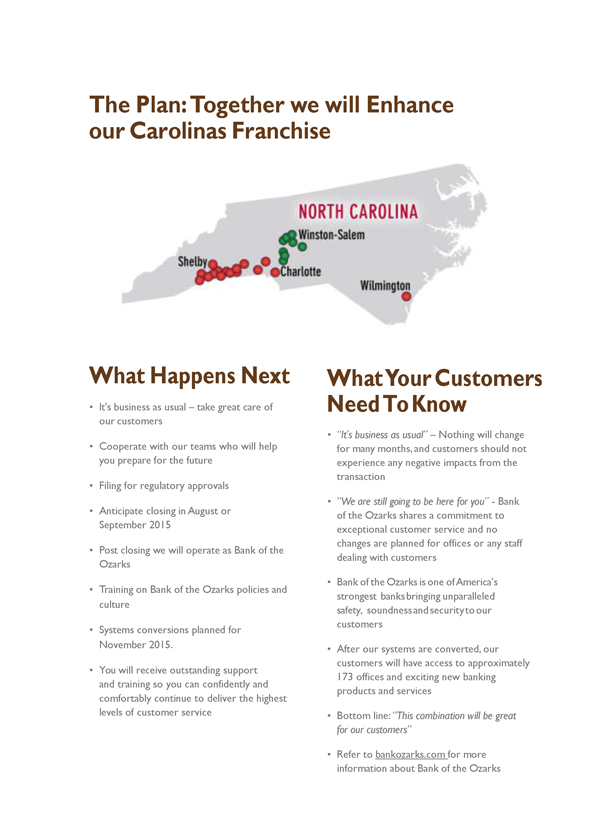

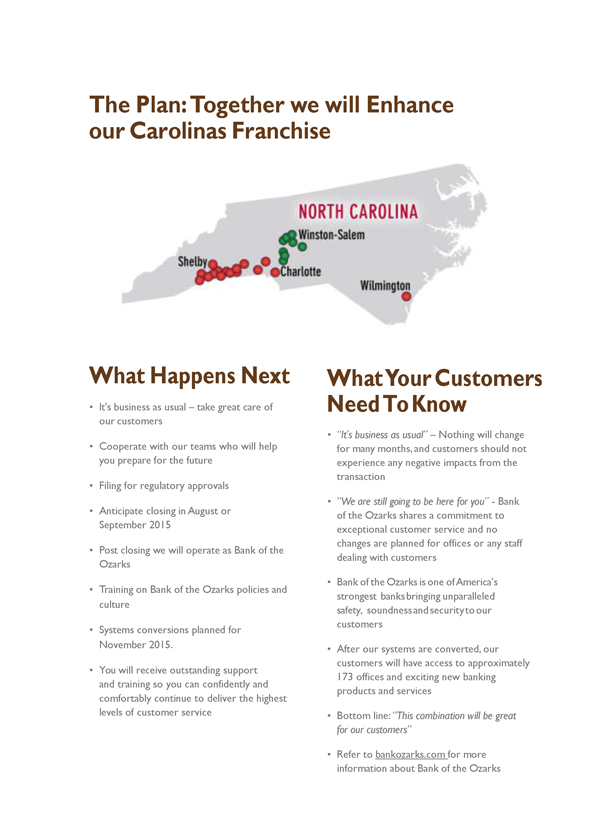

The Plan: Together we will Enhance our Carolinas Franchise

What Happens Next

It’s business as usual – take great care of our customers

Cooperate with our teams who will help you prepare for the future

Filing for regulatory approvals

Anticipate closing in August or September 2015

Post closing we will operate as Bank of the Ozarks

Training on Bank of the Ozarks policies and culture

Systems conversions planned for November 2015.

You will receive outstanding support and training so you can confidently and

comfortably continue to deliver the highest levels of customer service

What Your Customers Need To Know

“It’s business as usual” – Nothing will change for many months, and customers should not experience any negative impacts from the transaction

“We are still going to be here for you”—Bank of the Ozarks shares a commitment to exceptional customer service and no changes are planned for offices or any staff dealing with customers

Bank of the Ozarks is one of America’s strongest banks bringing unparalleled safety, soundness and security to our customers

After our systems are converted, our customers will have access to approximately 173 offices and exciting new banking products and services

Bottom line: “This combination will be great for our customers”

Refer to bankozarks.com for more information about Bank of the Ozarks

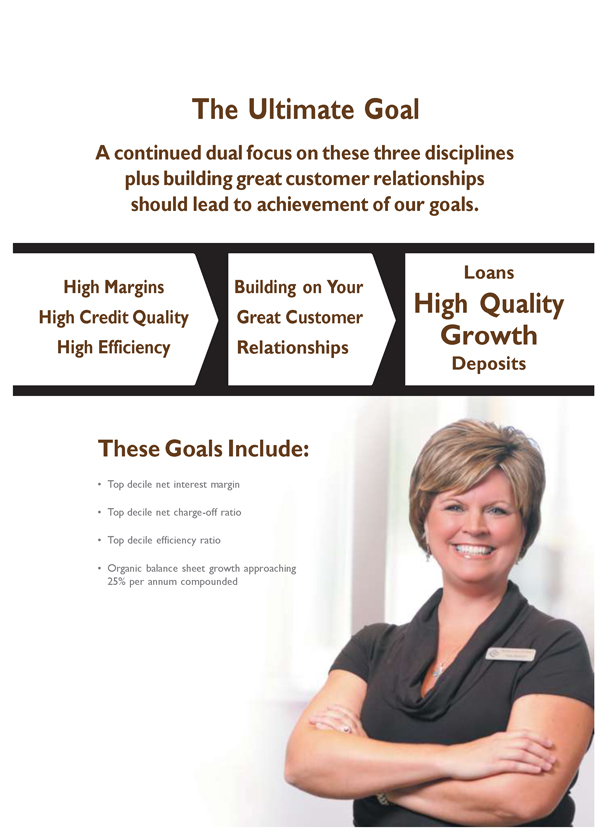

The Ultimate Goal

A continued dual focus on these three disciplines plus building great customer relationships should lead to achievement of our goals.

High Margins High Credit Quality

High Efficiency

Building on Your Great Customer Relationships

Loans

High Quality Growth

Deposits

These Goals Include:

Top decile net interest margin

Top decile net charge-off ratio

Top decile efficiency ratio

Organic balance sheet growth approaching 25% per annum compounded

Answers to Questions You May Have

Bank of the Ozarks, Inc., the holding company for Bank of the Ozarks, and Bank of the Carolinas Corporation, the holding company for Bank of the Carolinas, announced on May 6, 2015 that

the two companies entered into a definitive agreement and plan of merger and reorganization. The transaction is expected to close during the third quarter of 2015. The combined companies and banks will operate as Bank of the Ozarks, Inc. and Bank of the Ozarks.

What should I know about this merger?

Bank of the Carolinas and Bank of the Ozarks are working closely to make this transition as seamless and smooth as possible.

All deposit account types and account numbers will remain the same and customers will continue to use their existing checks, ATM/debit cards and online and mobile banking/bill pay services and make loan payments as usual.

At this time, no changes to banking hours, policies, products, interest rates, staff, and, most importantly, the banking culture are expected. It’s business as usual.

Bank of the Carolinas will retain its name until the transaction is officially completed, which is expected to be during the third quarter of 2015. At that time all locations will operate under the Bank of the Ozarks name.

Bank of the Carolinas employees and customers will still originate accounts using Bank of the Carolinas products and services until the Bank of the Carolinas and Bank of the Ozarks operating systems are combined, which is currently planned for Mid-November 2015. There will be a period of time from the closing of the transaction in the third

quarter of 2015 until the operating systems are combined in Mid-November 2015, when the former Bank of the Carolinas offices will operate as Bank of the Ozarks, but continue to offer the former Bank of the Carolinas’ products and services.

Do customers need to do anything about their account(s)?

There is no need to do anything. Customers can continue banking exactly as they have been. Customers can continue to access their money by writing checks, using ATM and debit cards and/or online and mobile banking. Checks drawn on Bank of the

Carolinas will continue to be accepted. Loan payments should also continue to be made as usual.

Customers of both banks can expect to have a high level of convenience and customer service and expanded banking locations once the transaction is officially completed and banking systems are combined.

Advance notice will be given to customers prior to any material change to

their account(s).

Will customers’ checking/savings/CD account(s) number change?

All account numbers will remain the same at this time. If any changes to account numbers are required in the future, we will communicate such changes to any affected customers well in advance of those changes.

What about direct deposits/Social Security?

Current arrangements for direct deposit(s), including Social Security checks, will continue as normal without interruption.

What about online banking access?

Bank of the Carolinas customers will continue to access online banking through bankofthecarolinas.com and no changes to online services will occur until the banking systems are combined.

Are deposits still safe?

Yes! Deposits with Bank of the Carolinas and Bank of the Ozarks are safe, sound and readily accessible. All deposit accounts, which include checking, savings, money market, CDs and retirement accounts, will become Bank of the Ozarks accounts, regardless of the amount, upon closing of the transaction, which is expected to be in the third quarter of 2015.

Why did Bank of the Carolinas and Bank of the Ozarks decide to merge?

The merger brings together two banks committed to excellence for their customers, shareholders and employees. The combined bank’s increased lending capacity, expanded footprint and combined capabilities position it well to continue meeting the needs and growing expectations of customers, shareholders and employees.

How will the merger impact customers?

The combined bank’s increased lending capacity, expanded footprint and combined technology capabilities will allow us to give our customers better access to the financial resources and the state-of-the-art technology they need to be successful.

What will be the name of the new bank?

Upon closing, Bank of the Carolinas will adopt the Bank of the Ozarks name and the holding company will be Bank of the Ozarks, Inc.

When will the merger be official? How will customers be notified?

The transaction is expected to close in the third calendar quarter of 2015 following the receipt of all customary regulatory approvals and the approval of Bank of the Carolinas Corporation’s shareholders. All customers will be notified in writing and online at closing.

Should customers expect any changes to the personalized customer service and banking experience they currently enjoy?

Bank of the Ozarks and Bank of the Carolinas share a commitment to serving customers with excellence, and customers can expect this to continue.

Will there be any new products or offerings as a result of the combined bank?

The combined banks create a stronger organization with the capital, funding, infrastructure and leadership to support continued expansion of products and services, giving our customers access to excellent banking products and technology.

Will any banking offices be consolidated?

No, we do not plan to consolidate any banking offices.

Should we slow down our business development activities?

Bank of the Carolinas and Bank of the Ozarks have achieved outstanding growth. We have expectations for continued growth and expansion as we move forward together. The staff of both banks will continue to strive to develop new business and customer relationships.

What’s the benefit to the bank given our recent track record of strong growth?

The merger will expand our loan platform for continued growth and increase our legal lending limit as well as expand our scale and footprint.

Can we expect any changes to our culture?

Our culture will continue to flourish in the way we interact with customers, operate in our communities and invest for the future. Both Bank of the Carolinas and Bank of the Ozarks share a focus on driving continued, meaningful growth and delivering excellent, personalized customer service that has been a hallmark of both companies over the years.

What should I do if someone from the media contacts me?

Employees, officers and directors who are not authorized spokespersons should refer all requests to Susan Blair, Executive Vice President, Bank of the Ozarks. Susan can be reached at (501) 978-2217 or sblair@bankozarks.com. If for any reason Susan is not

available, please take a message (name, publication, contact information) and forward it to her.

Who should I talk to with questions?

You should direct any questions or concerns to your direct supervisor.

Where will our official bank headquarters be?

The combined bank’s official headquarters will be in Little Rock, Arkansas.

For more information about Bank of the Ozarks, please visit bankozarks.com.

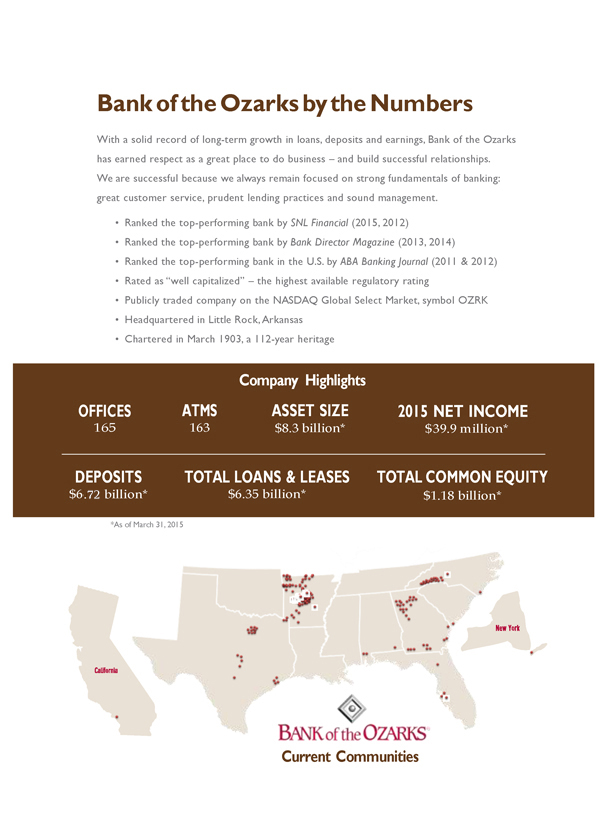

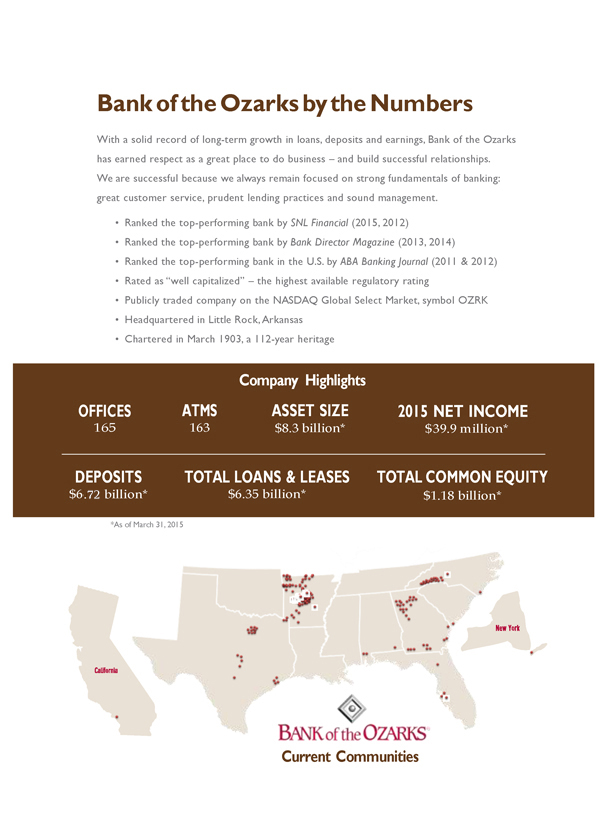

Bank of the Ozarks by the Numbers

With a solid record of long-term growth in loans, deposits and earnings, Bank of the Ozarks has earned respect as a great place to do business – and build successful relationships.

We are successful because we always remain focused on strong fundamentals of banking: great customer service, prudent lending practices and sound management.

Ranked the top-performing bank by SNL Financial (2015, 2012)

Ranked the top-performing bank by Bank Director Magazine (2013, 2014)

Ranked the top-performing bank in the U.S. by ABA Banking Journal (2011 & 2012)

Rated as “well capitalized” – the highest available regulatory rating

Publicly traded company on the NASDAQ Global Select Market, symbol OZRK

Headquartered in Little Rock, Arkansas

Chartered in March 1903, a 112-year heritage

*As of March 31, 2015

OFFICES

165

Company Highlights

ATMS ASSET SIZE

163$8.3 billion*

2015 NET INCOME

$139.9 million*

DEPOSITS

$5.05 billion*

TOTAL LOANS & LEASES

$6.35 billion*

TOTAL COMMON EQUITY

$1.18 billion*

Current Communities

ADDITIONAL INFORMATION

This communication is being made in respect of the proposed merger transaction involving Bank of the Ozarks, Inc. (the “Company”) and Bank of the Carolinas Corporation (“BCAR”). This communication does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval. The Company will file with the Securities and Exchange Commission (“SEC”) a registration statement on Form S-4 that will include a prospectus of the Company and a proxy statement of BCAR. The Company also plans to file other documents with

the SEC regarding the proposed merger transaction. BCAR will mail the final proxy statement/prospectus (the “Merger Proxy Statement”) to its shareholders. The Merger Proxy Statement will contain important information about the Company, BCAR, the proposed merger and related matters. BEFORE MAKING ANY VOTING OR INVESTMENT DECISION, INVESTORS ARE URGED TO READ THE MERGER PROXY STATEMENT AND ANY OTHER RELEVANT DOCUMENTS CAREFULLY IN THEIR ENTIRETY BECAUSE THEY CONTAIN IMPORTANT INFORMATION ABOUT

THE PROPOSED TRANSACTION. The Merger Proxy Statement, as well other filings containing information about the Company and BCAR will be available without charge at the SEC’s Internet site (http://www.sec.gov). Copies of the Merger Proxy Statement and the filings that are incorporated by reference in the Merger Proxy Statement can also be obtained, when available, without charge from the Company’s website (http://www.bankozarks.com) under the Investor Relations tab and on BCAR’s investor relations website (http://www.investor.bankofthecarolinas.com).

The Company and BCAR and their respective directors, executive officers and certain other members of management and employees may be deemed “participants” in the solicitation of proxies from BCAR’s shareholders in connection with the merger transaction. You can find information about the directors and executive officers of the Company in its Annual Report on Form 10-K for the year ended December 31, 2014 and in its definitive proxy statement as filed with the SEC on February 27, 2015 and March 25, 2015, respectively. You can find information about the executive officers and directors of BCAR in its Annual Report on Form 10-K for the year ended December 31, 2014 as filed with the SEC on March 31, 2015.

CAUTION ABOUT FORWARD-LOOKING STATEMENTS

This communication contains certain forward-looking information about the Company and BCAR that is intended to be covered by the safe harbor for “forward-looking statements” provided by the Private Securities Litigation Reform Act of 1995. All statements other than statements of historical fact are forward-looking statements. In some cases, you can identify forward-looking statements by words such as “may,” “hope,” “will,” “should,” “expect,” “plan,” “anticipate,” “intend,” “believe,” “estimate,” “predict,” “potential,” “continue,” “could,” “future” or the negative of those terms or other words of similar meaning. These forward-looking statements include, without limitation, statements relating to the terms and closing of the proposed transaction between the Company and BCAR, the proposed impact of the merger on the Company’s financial results, including any expected increase in the Company’s book value and tangible book value per share and any expected impact on diluted earnings per common share, acceptance by BCAR’s customers of the Company’s products and services, the opportunities to enhance market share in certain markets, market acceptance of the Company generally in new markets, and the integration of BCAR’s operations. You should carefully readforward- looking statements, including statements that contain these words, because they discuss the future expectations or state other“forward-looking” information about the Company and BCAR. A number of important factors could cause actual results or events to differ materially from those indicated by such forward-looking statements, many of which are beyond the parties’ control, including the parties’ ability to consummate the transaction or satisfy the conditions to the completion of the transaction, including the receipt of shareholder approval, the receipt of regulatory approvals required for the transaction on the terms expected or on the anticipated schedule; the parties’ ability to meet expectations regarding the timing, completion and accounting and tax treatments of the transaction; the possibility that any of the anticipated benefits of the proposed merger will not be realized or will not be realized within the expected time period; the risk that integration of BCAR’s operations with those of the Company will be materially delayed or will be more costly or difficult than expected; the failure of the proposed merger to close for any other reason; the effect of the announcement of the merger on employee and customer relationships and operating results (including, without limitation, difficulties in maintaining relationships with employees and customers); dilution caused by the Company’s issuance of additional shares of its common stock in connection with the merger; the possibility that the merger may be more expensive to complete than anticipated, including as a result of unexpected factors or events; general competitive, economic, political and market conditions and fluctuations; and the other factors described in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2014 and in its most recent Quarterly Reports on Form 10-Q filed with the SEC, or described in BCAR’s Annual Report on Form 10-K for the fiscal year ended December 31, 2014 and in its most recent Quarterly Reports on Form 10-Q filed with the SEC. The Company and BCAR assume no obligation to update the information in this communication, except as otherwise required by law. Readers are cautioned not to place undue reliance on these forward-looking statements that speak only as of the date hereof.

Member FDIC. © Copyright 2014 Bank of the Ozarks

bankozarks.com