Exhibit 99.02

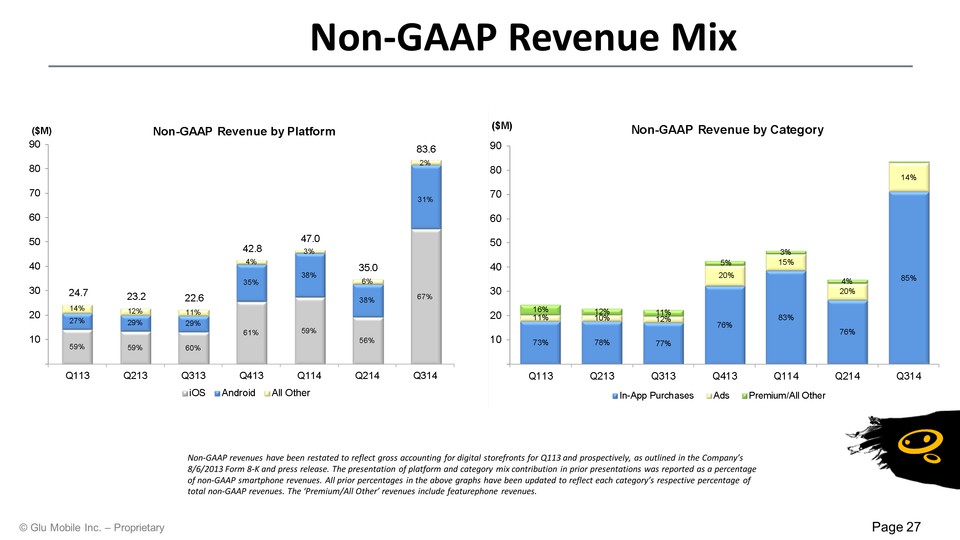

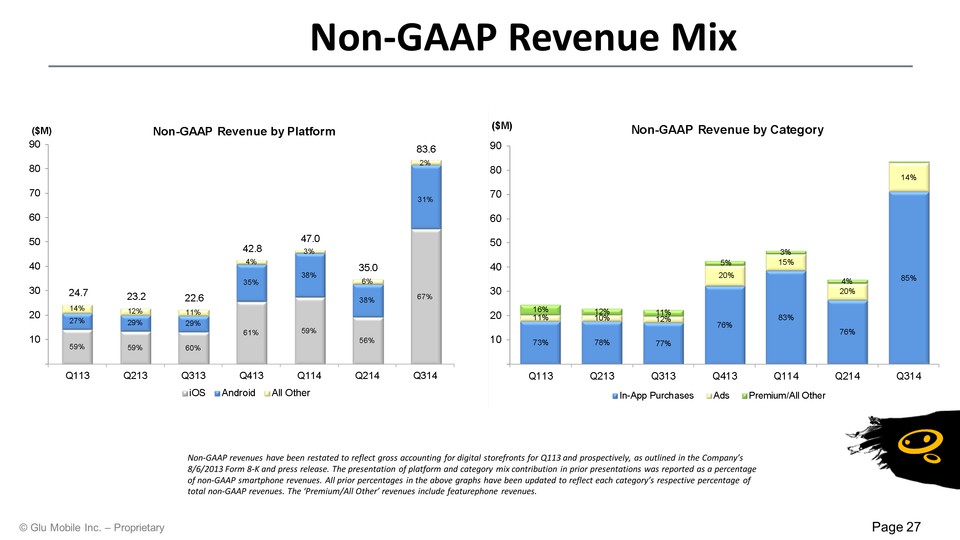

Non-GAAP Revenue Mix Page 27 Non-GAAP revenues have been restated to reflect gross accounting for digital storefronts for Q113 and prospectively, as outlined in the Company’s 8/6/2013 Form 8-K and press release. The presentation of platform and category mix contribution in prior presentations was reported as a percentage of non-GAAP smartphone revenues. All prior percentages in the above graphs have been updated to reflect each category’s respective percentage of total non-GAAP revenues. The ‘Premium/All Other’ revenues include featurephone revenues.

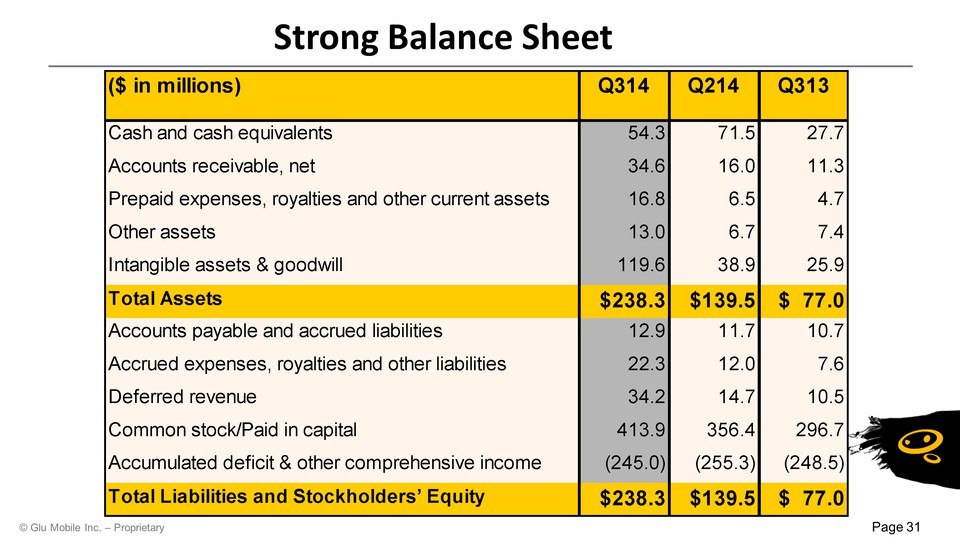

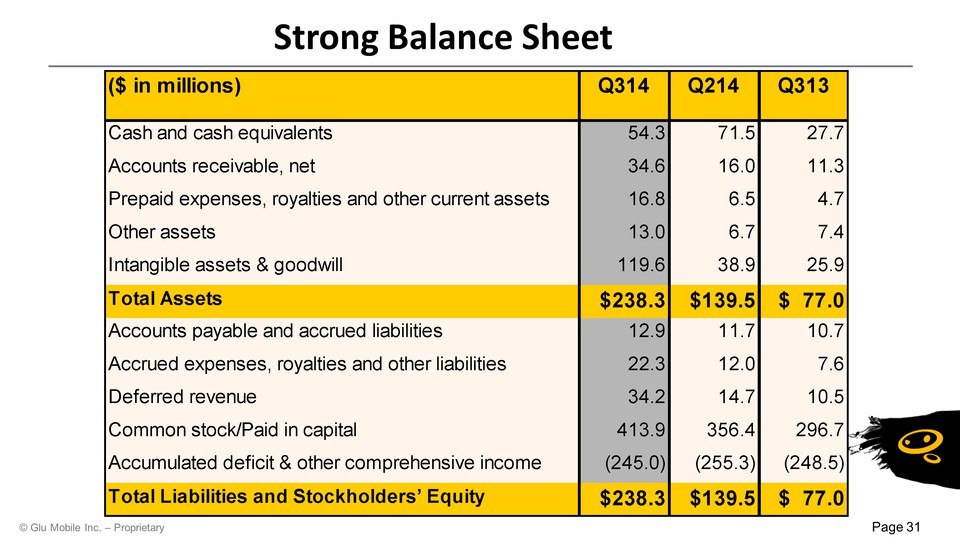

Strong Balance Sheet Page 31

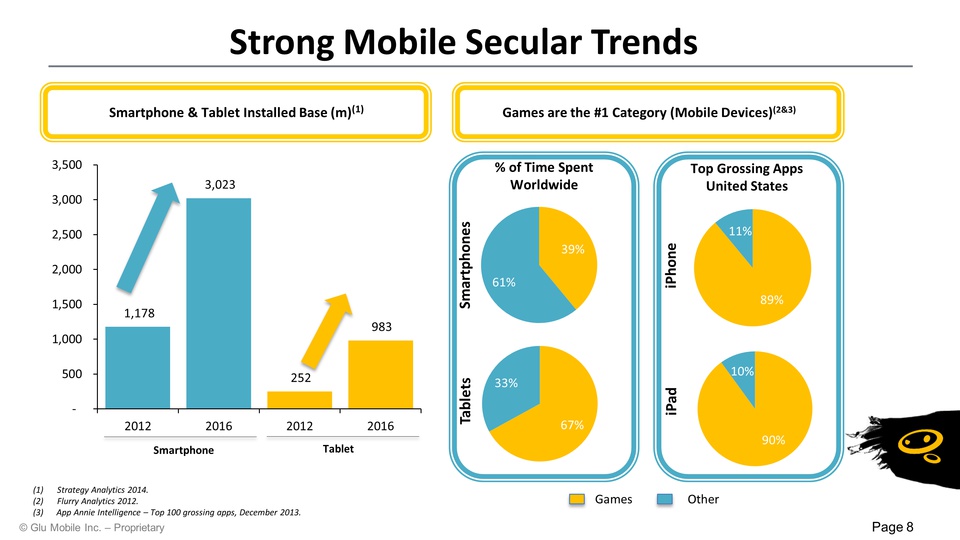

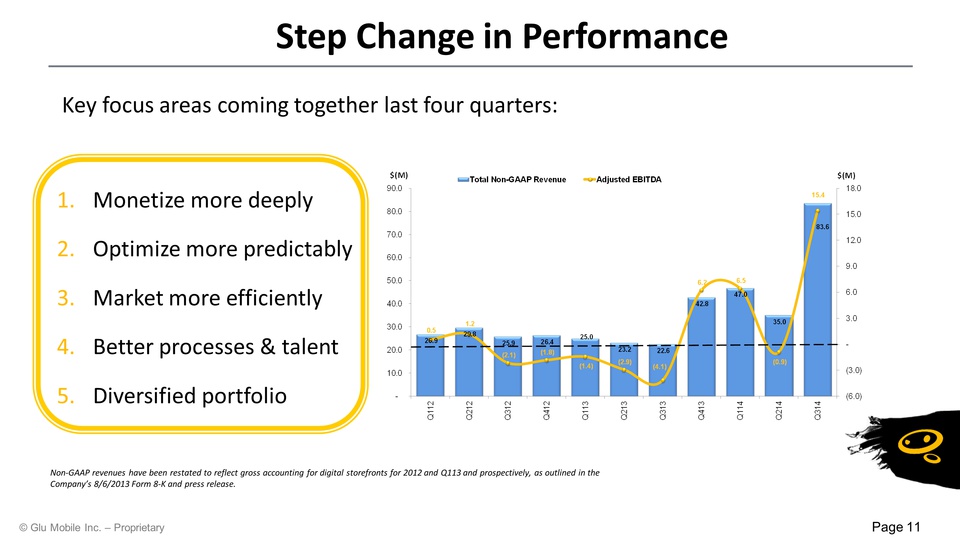

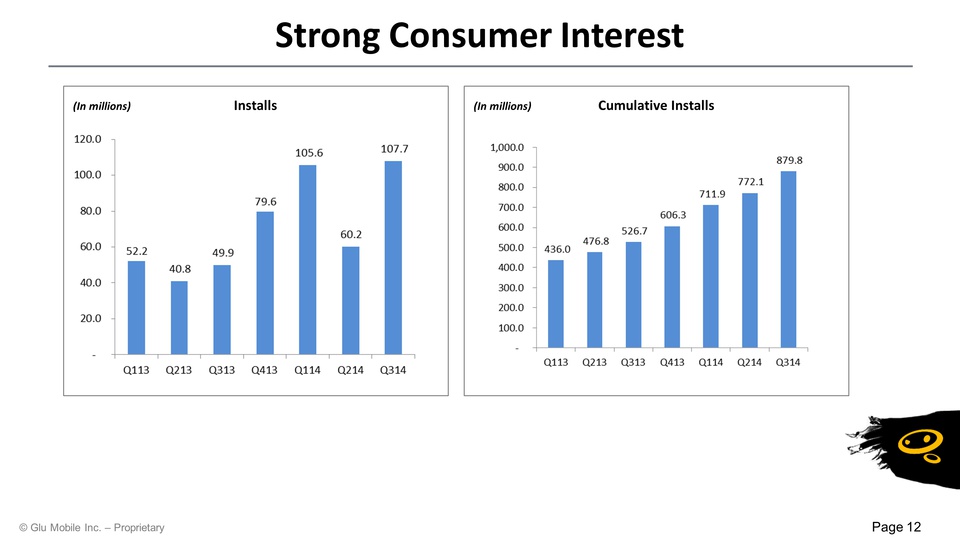

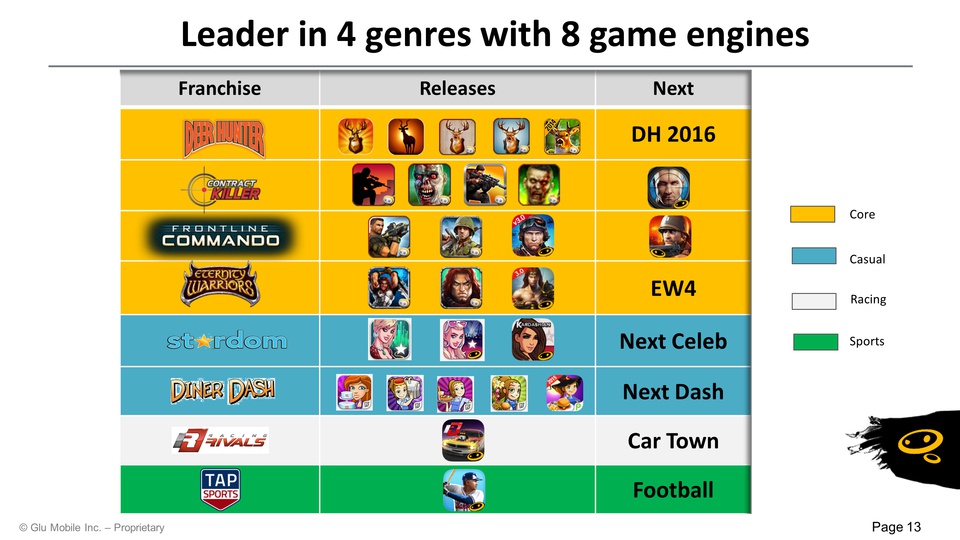

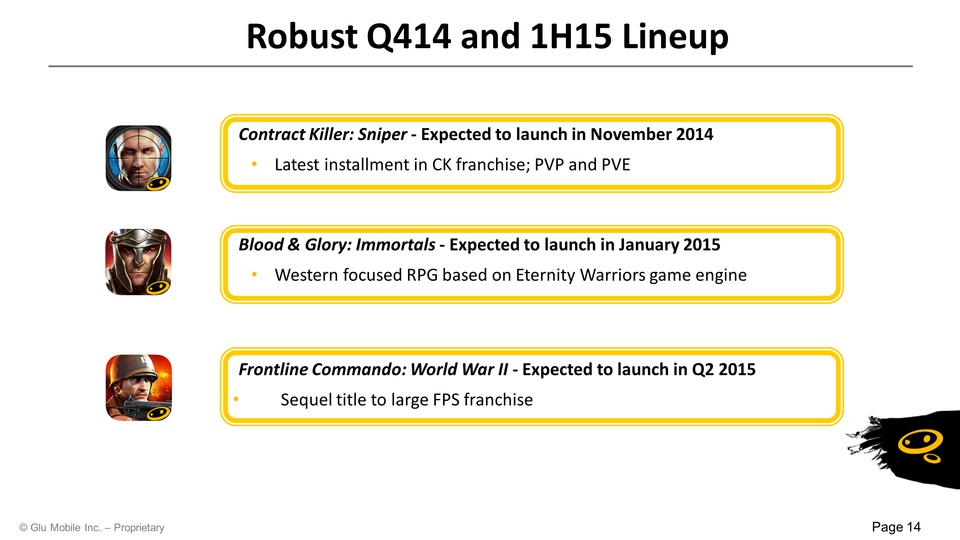

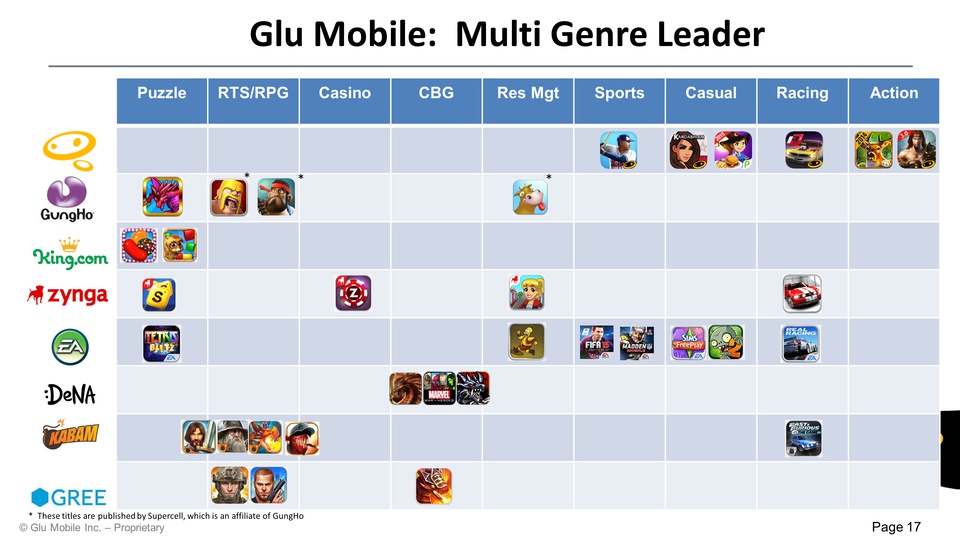

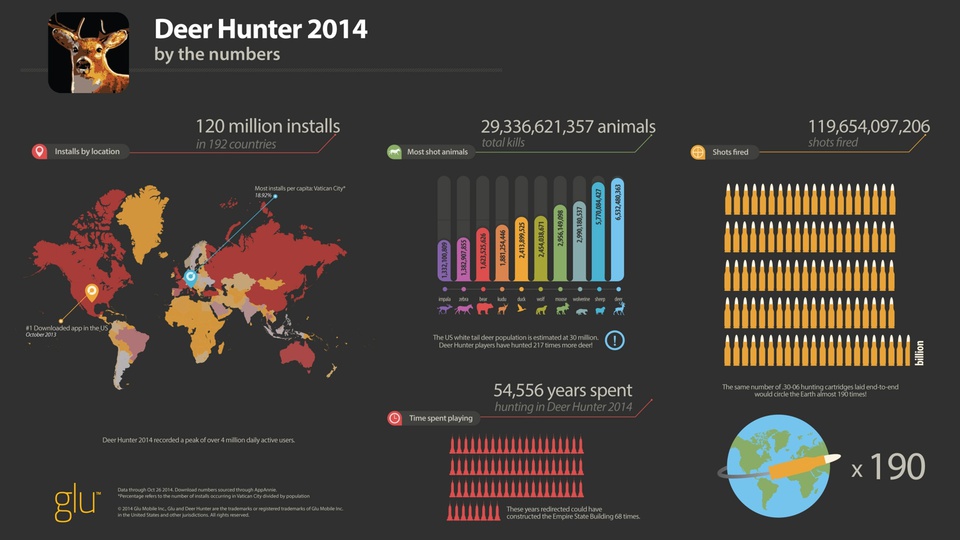

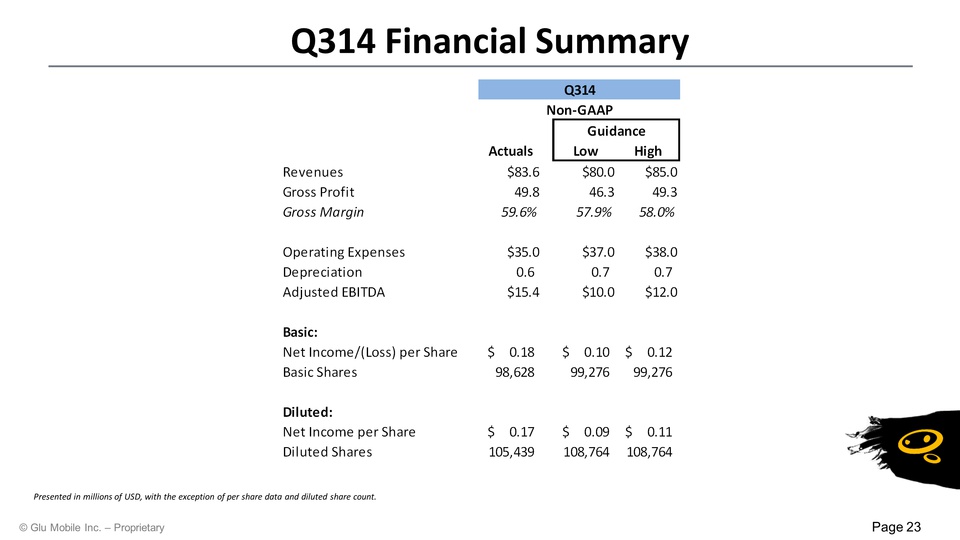

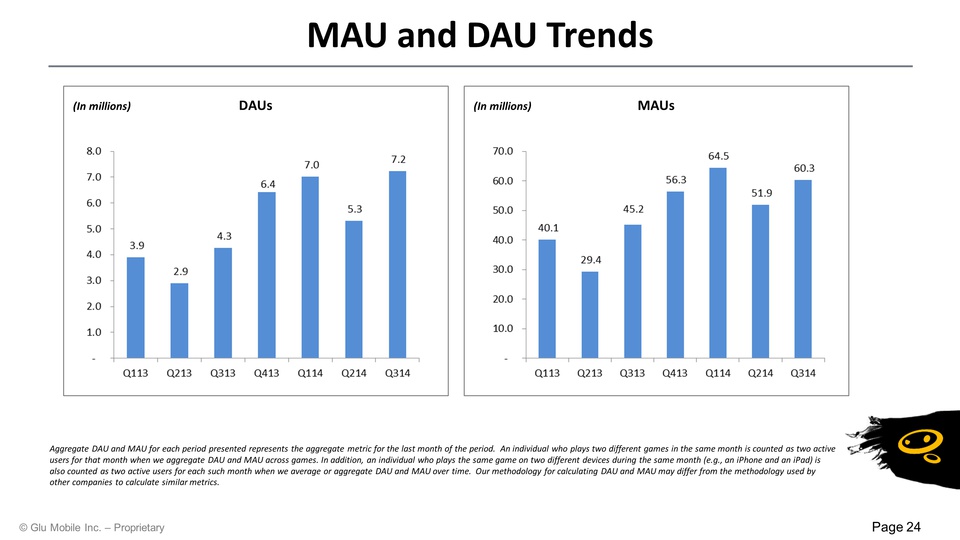

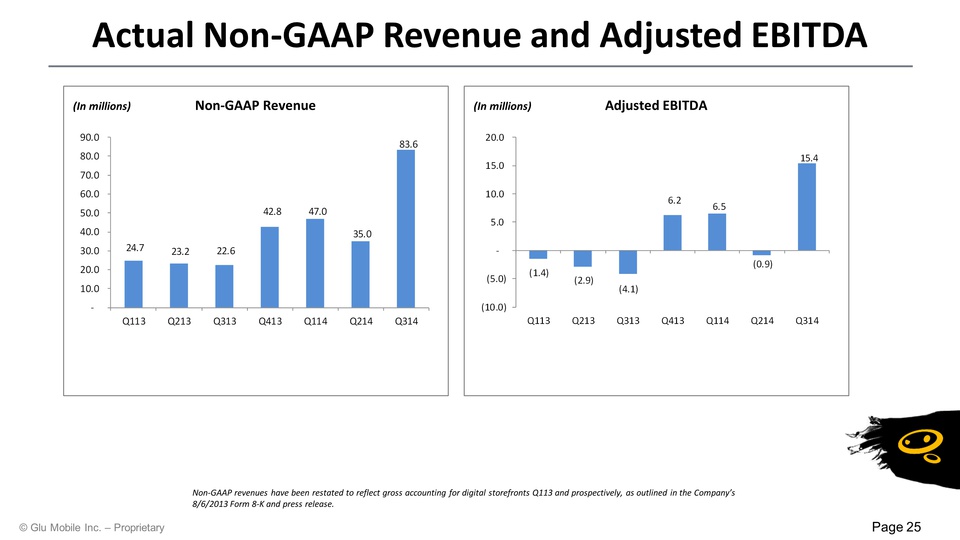

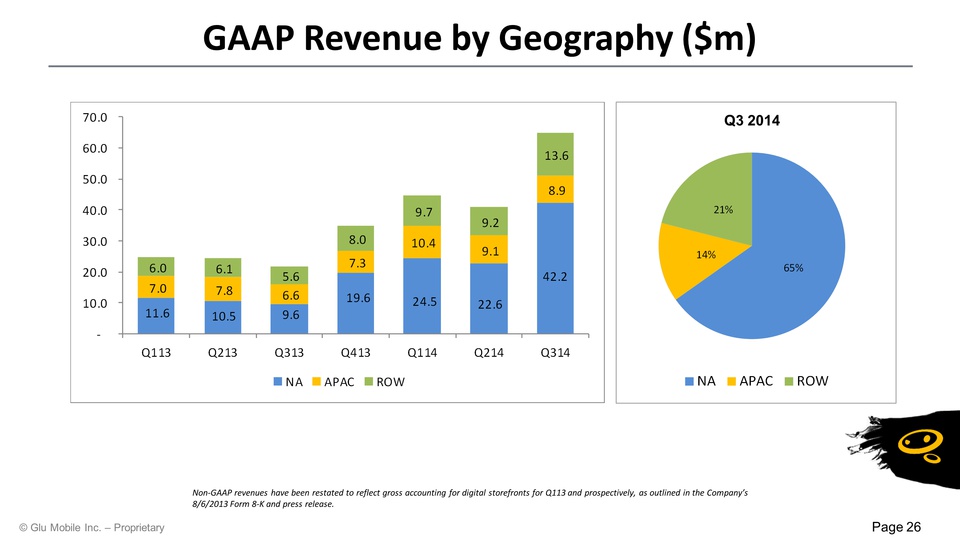

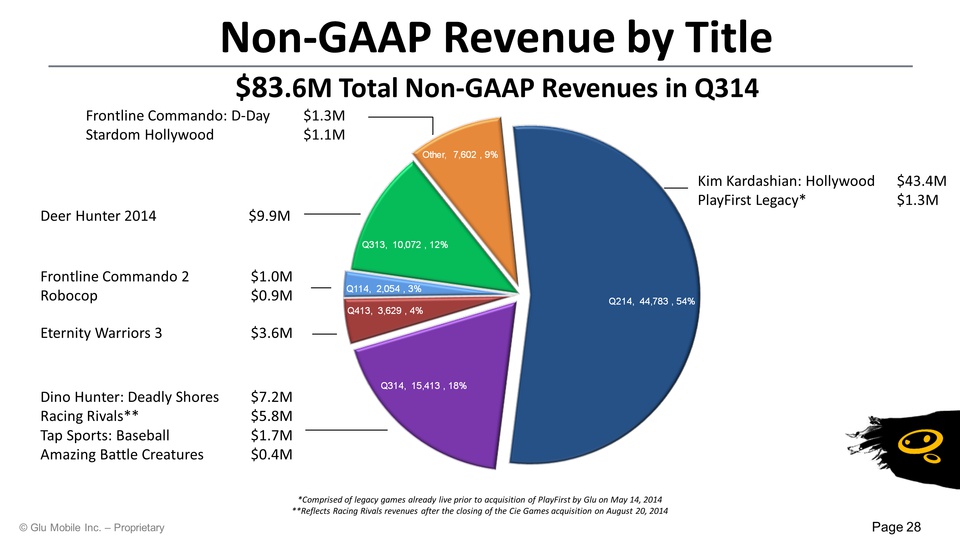

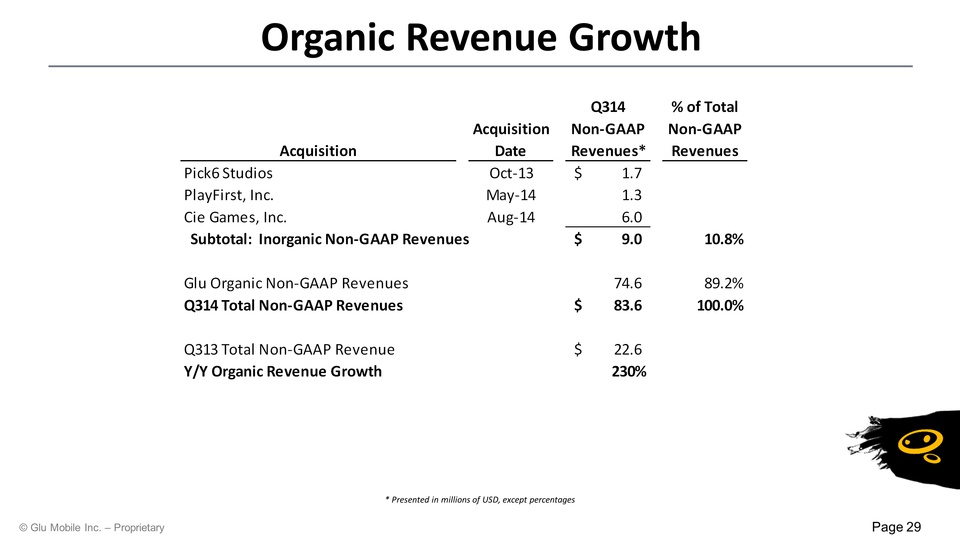

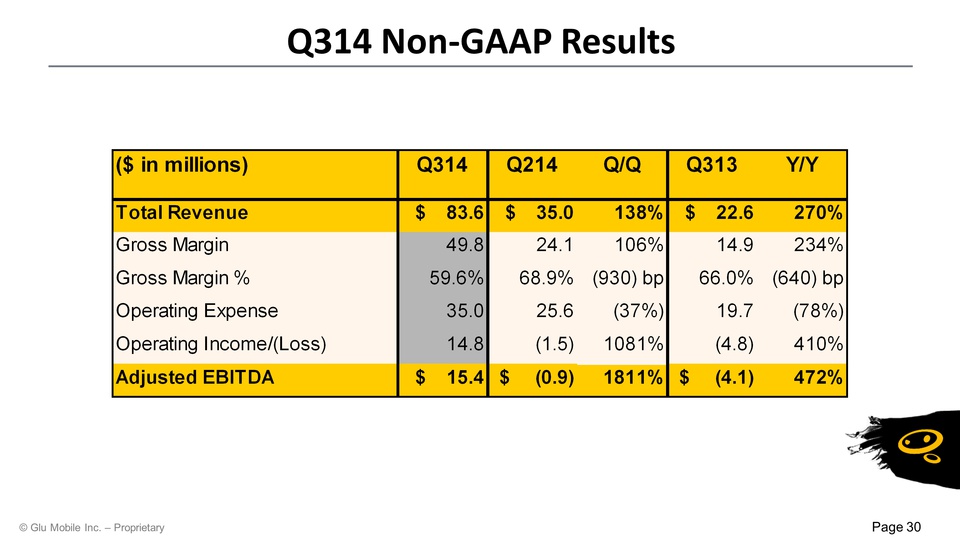

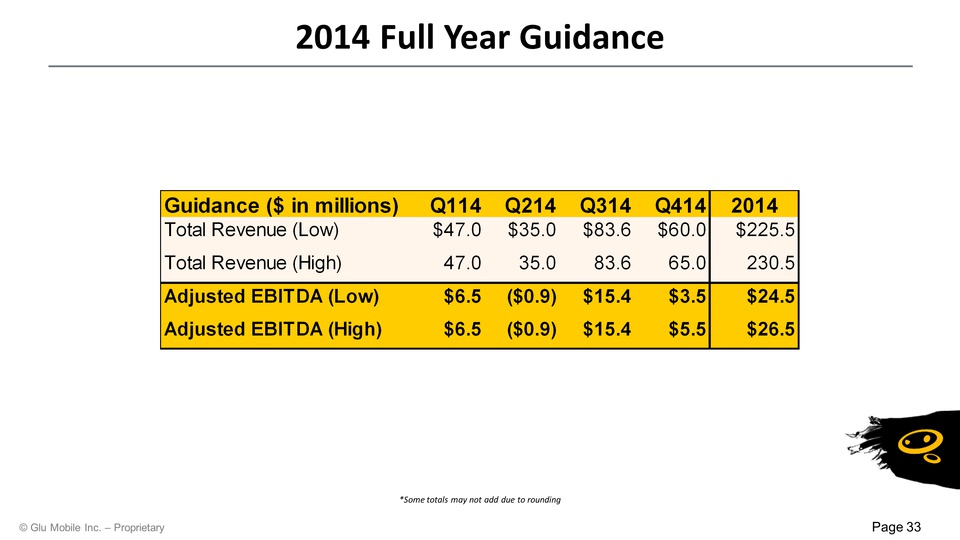

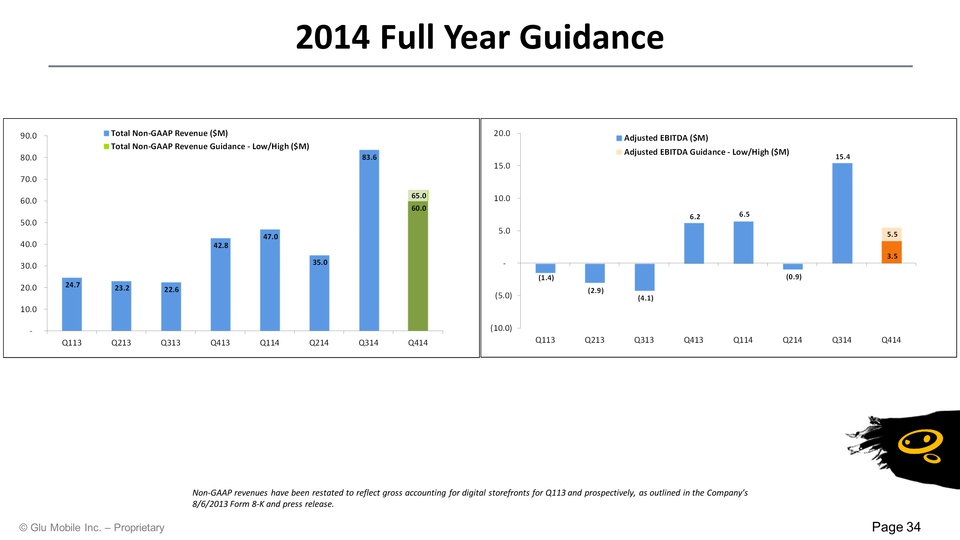

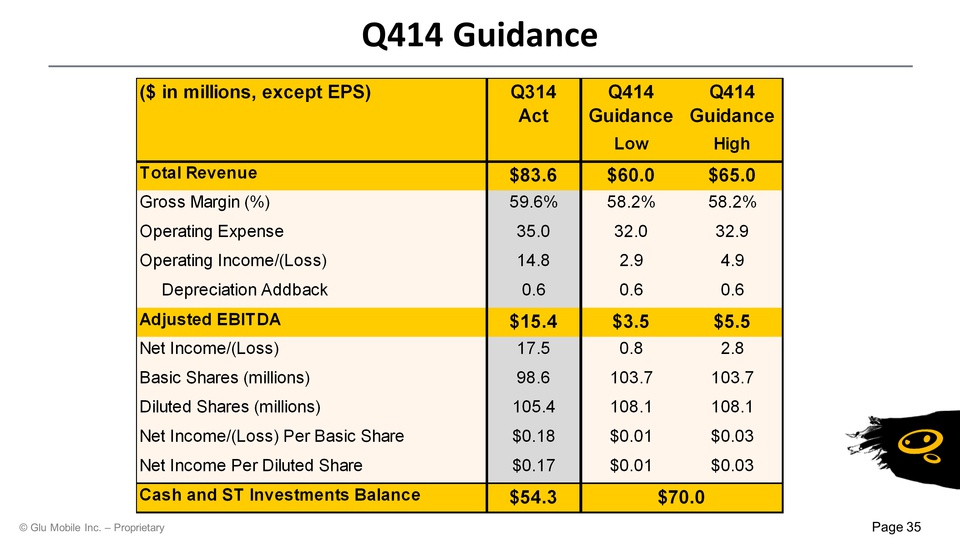

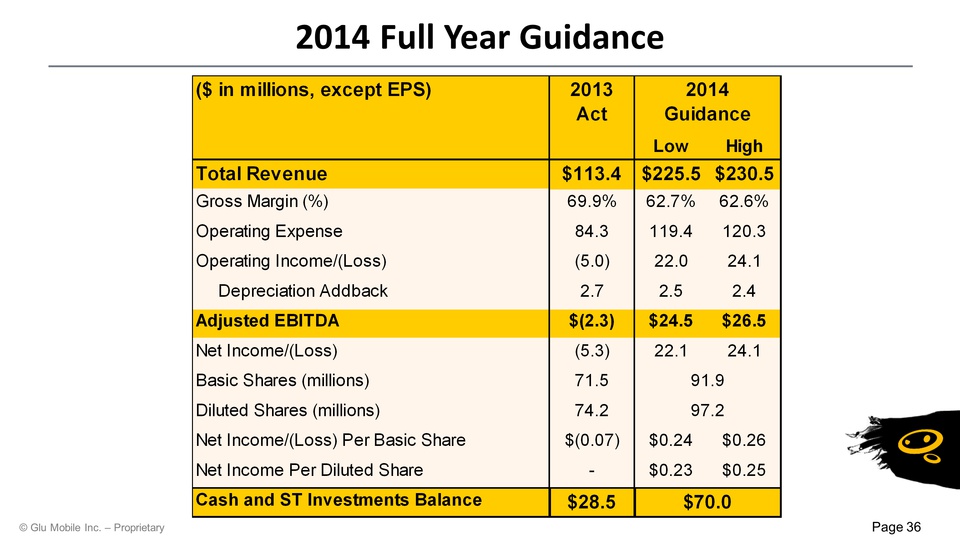

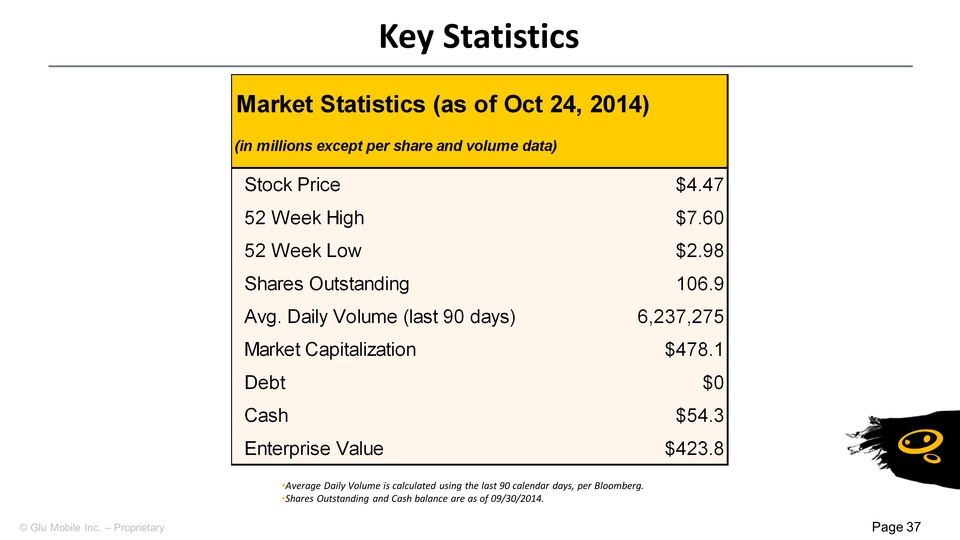

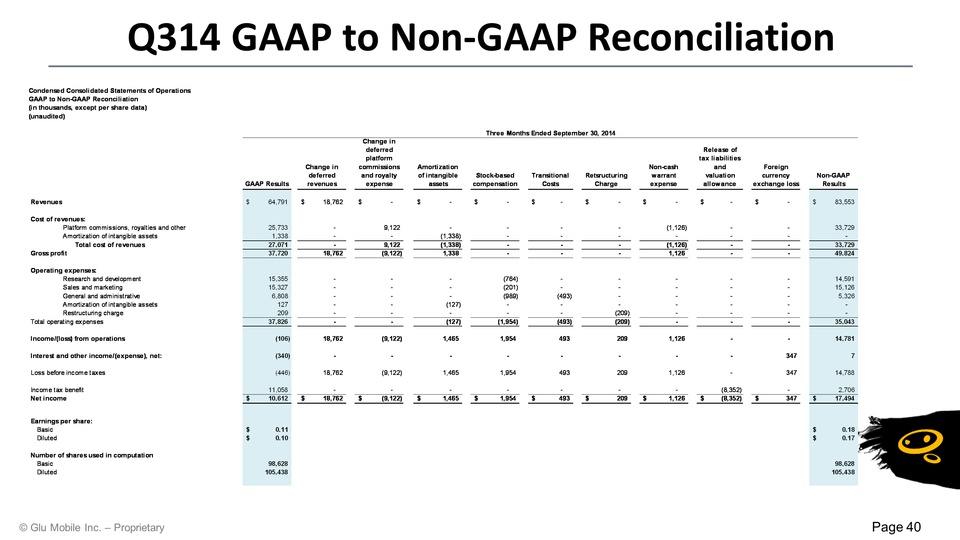

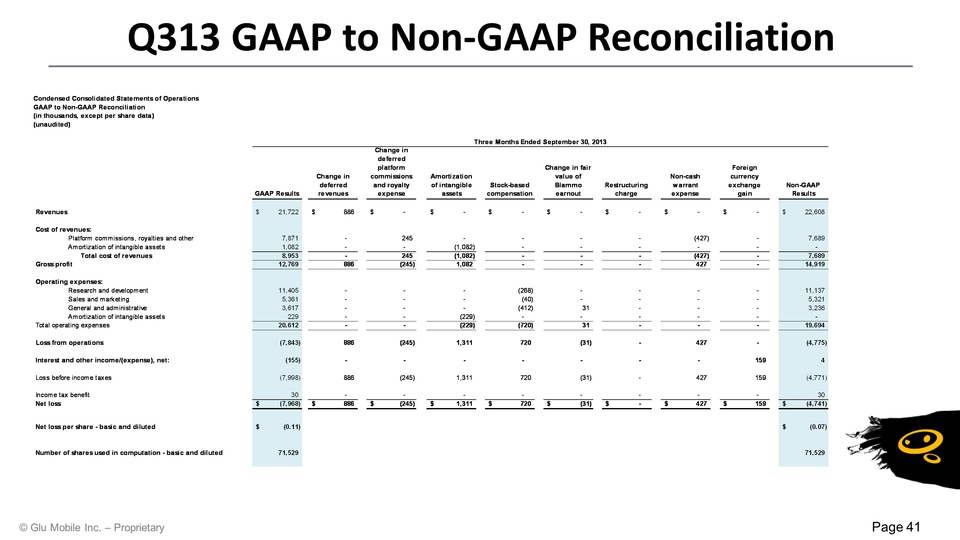

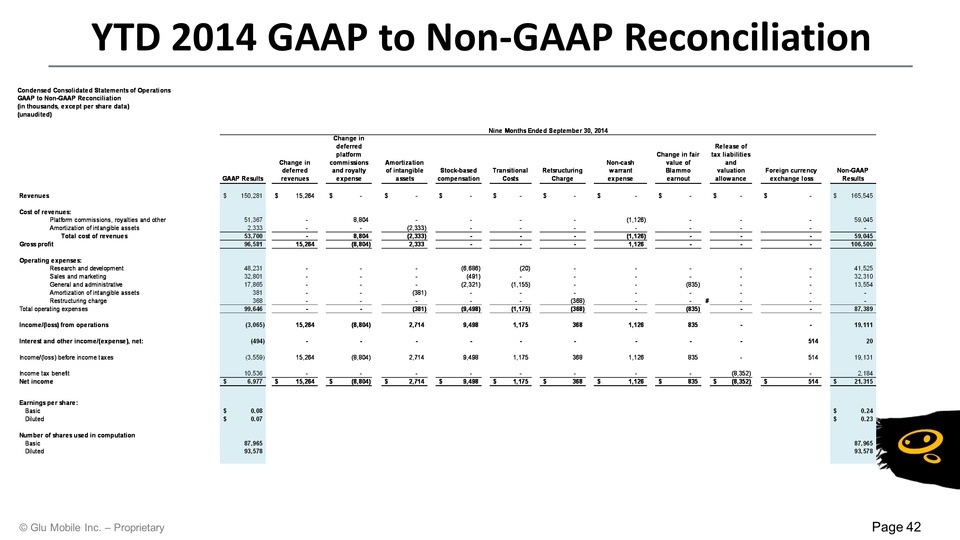

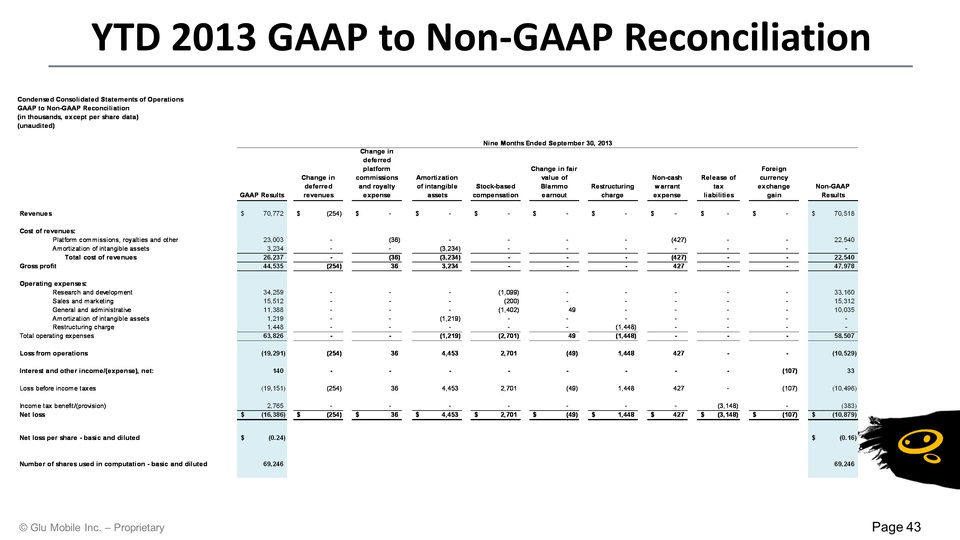

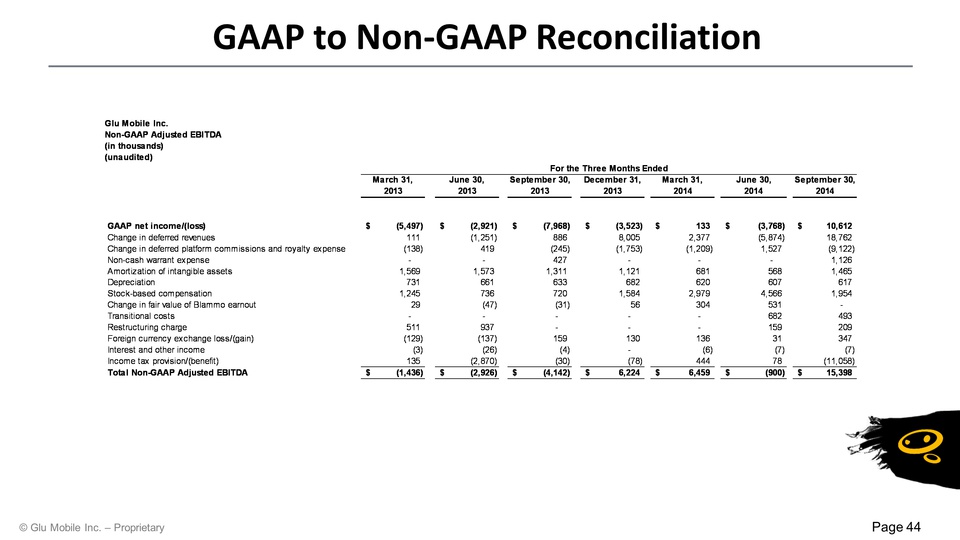

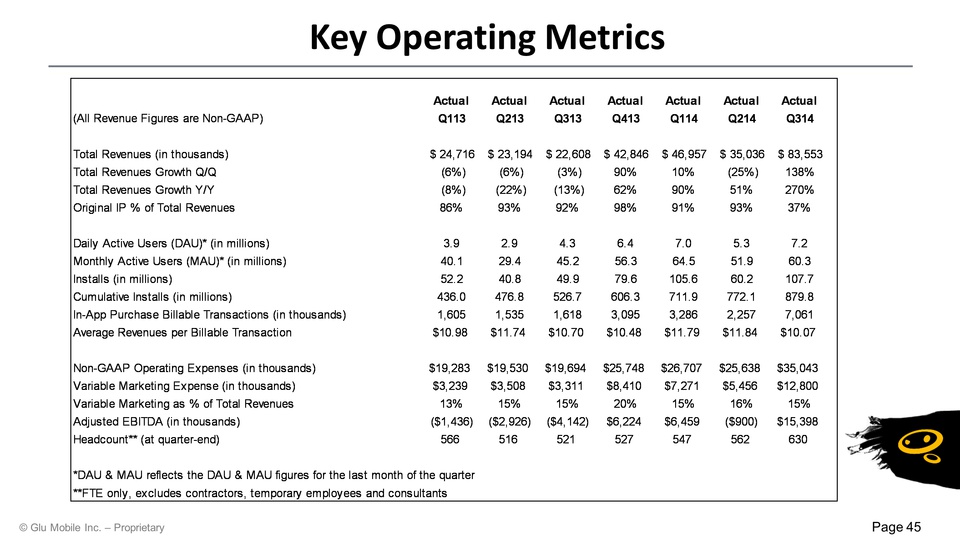

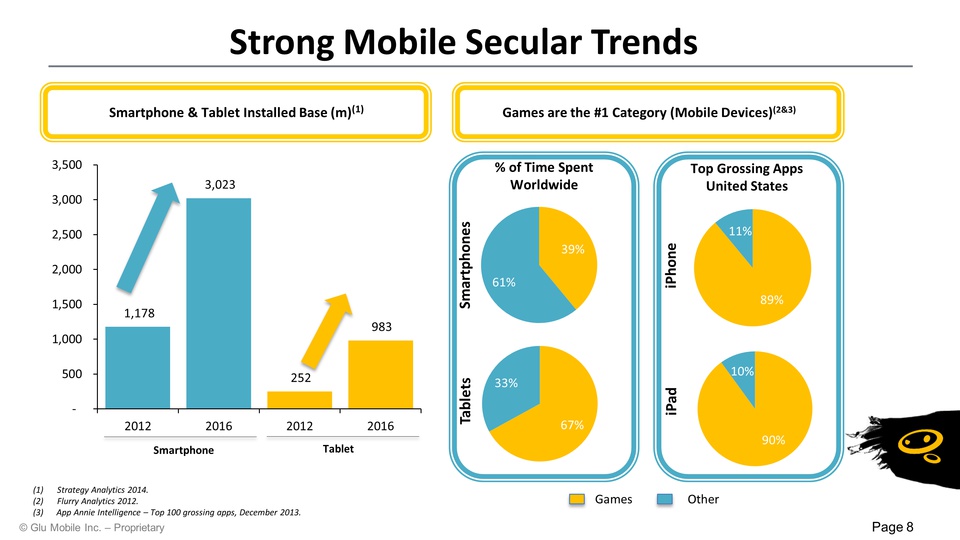

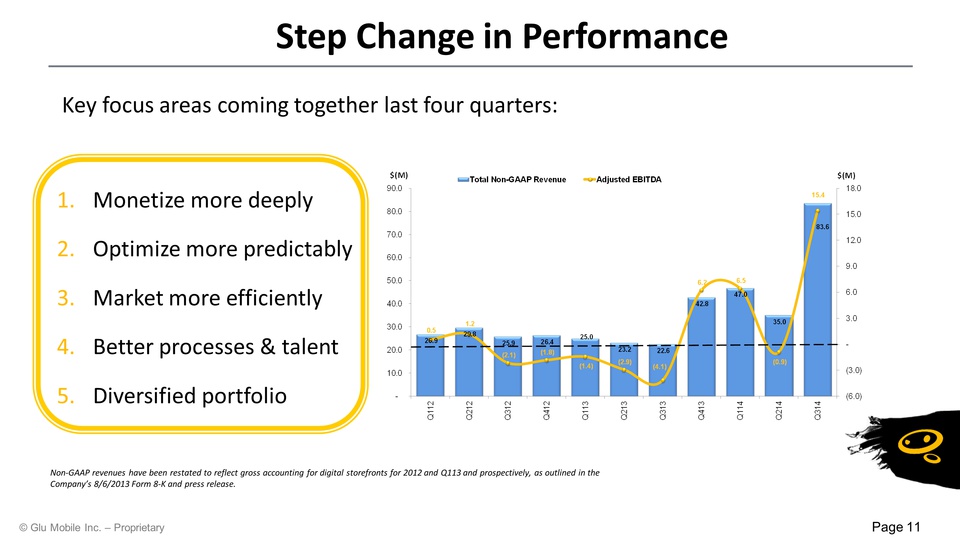

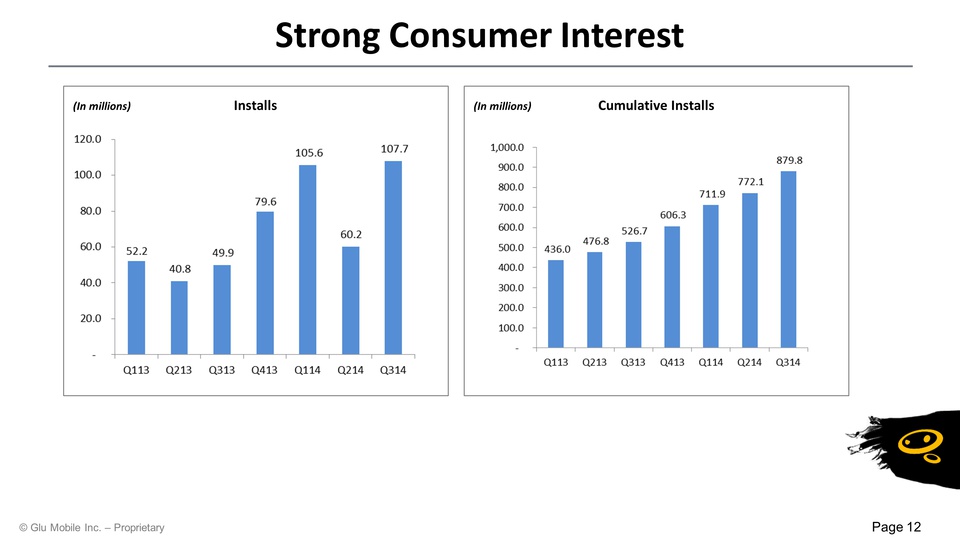

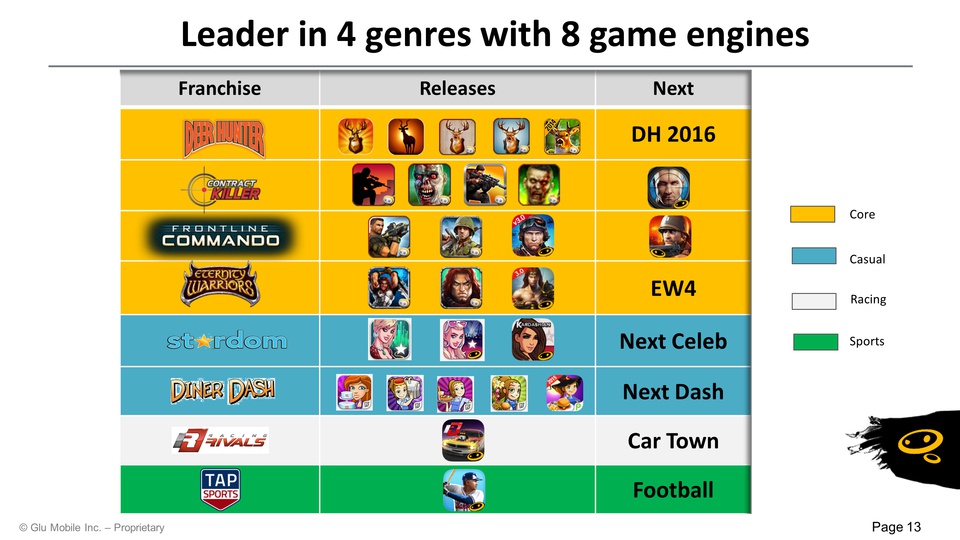

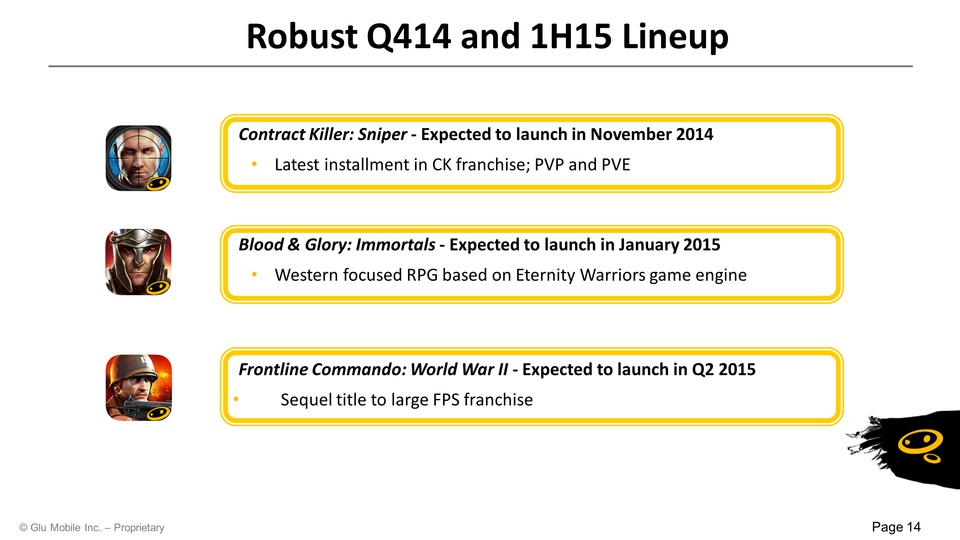

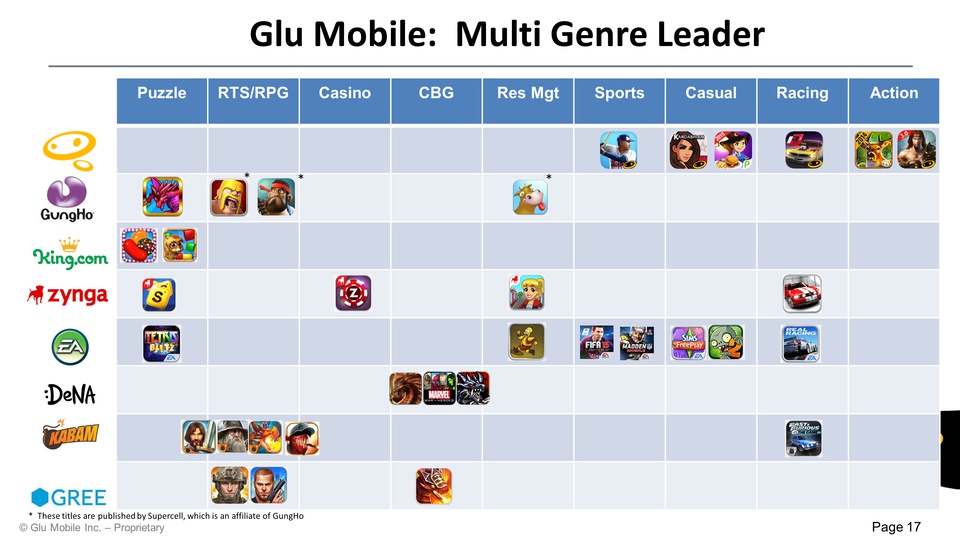

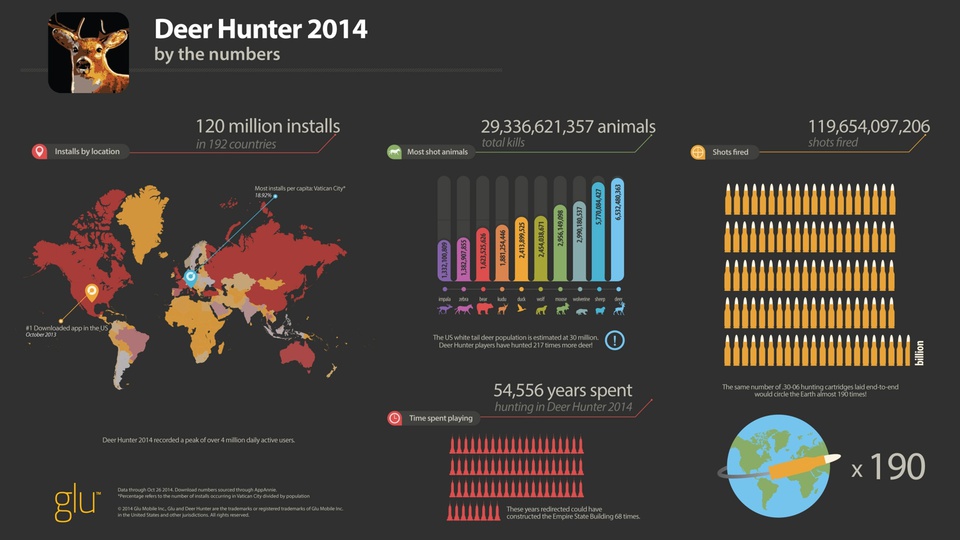

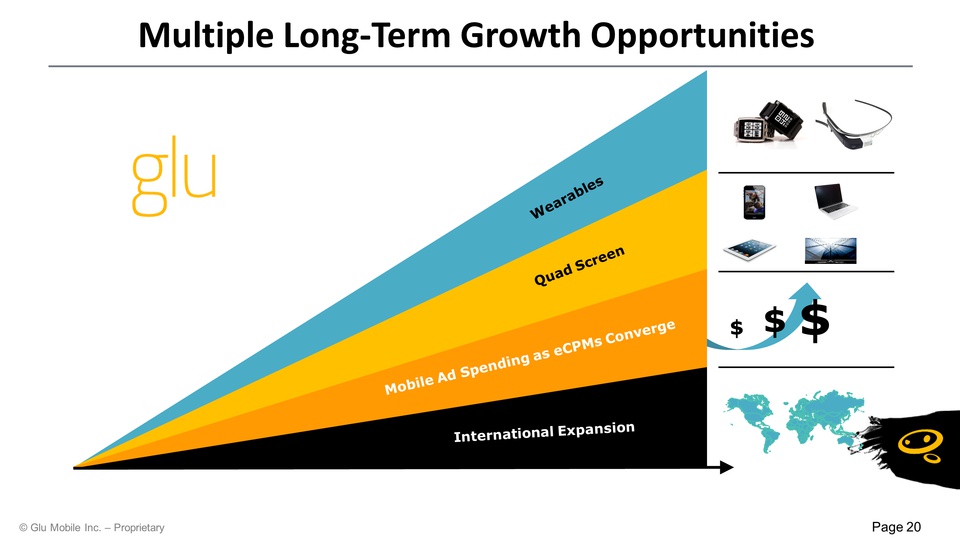

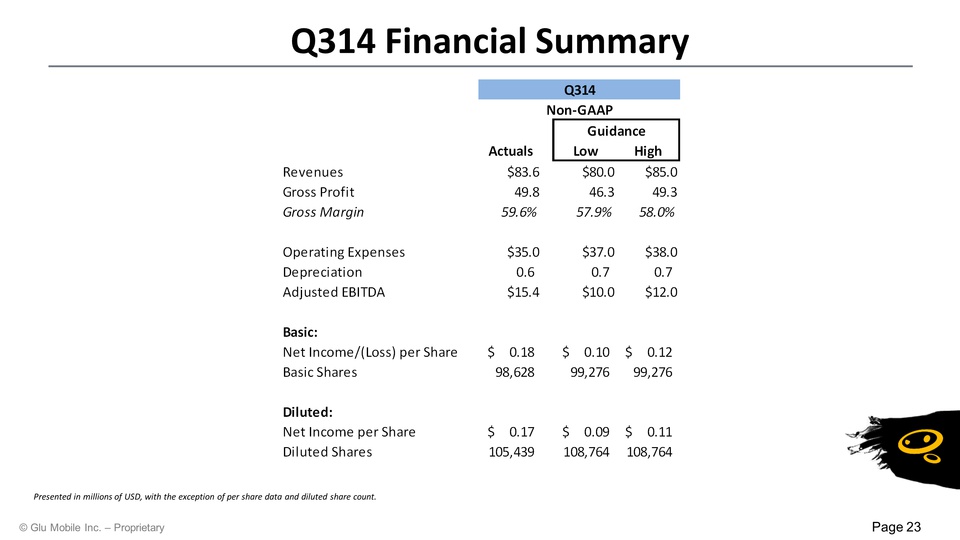

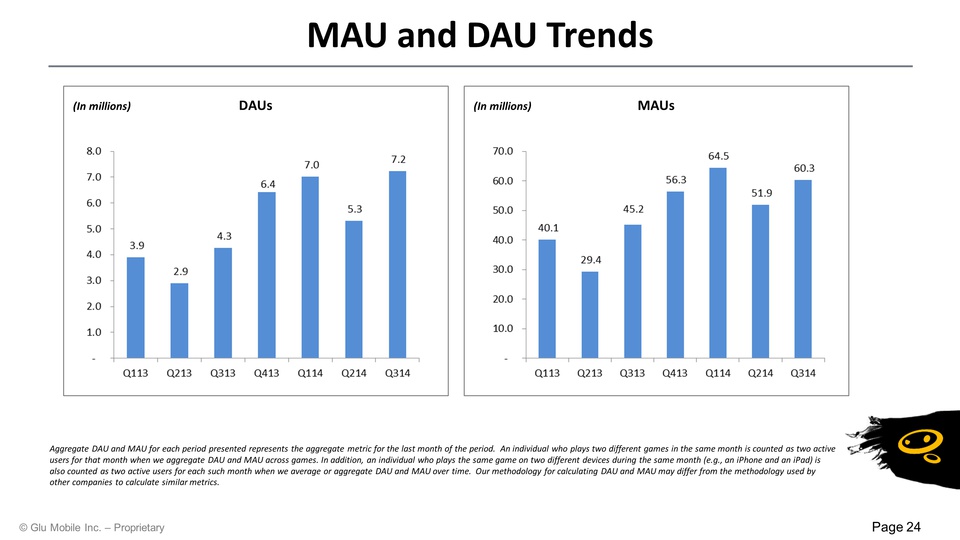

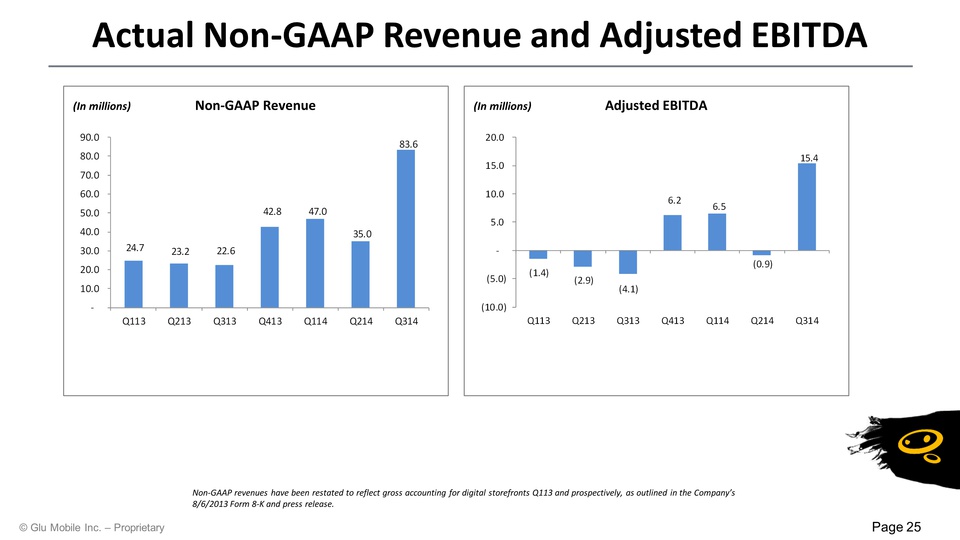

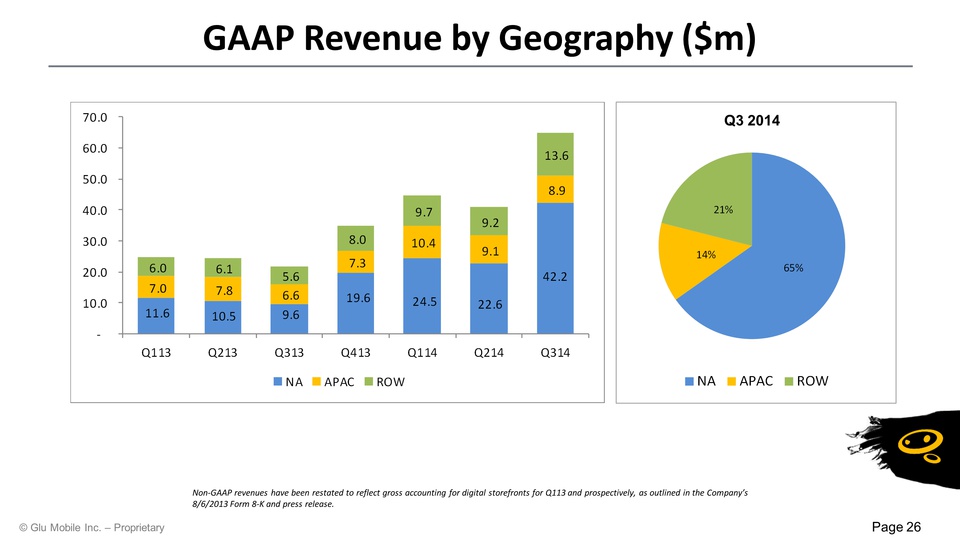

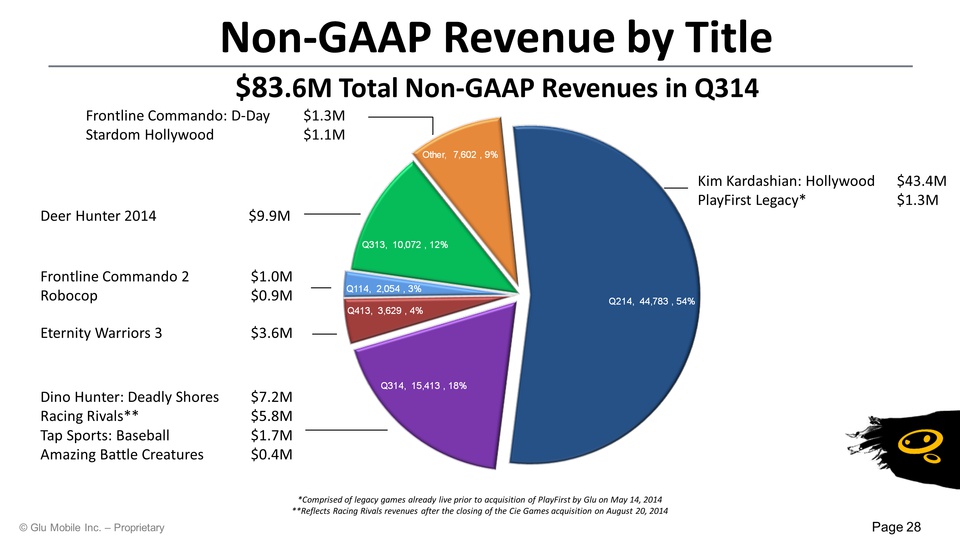

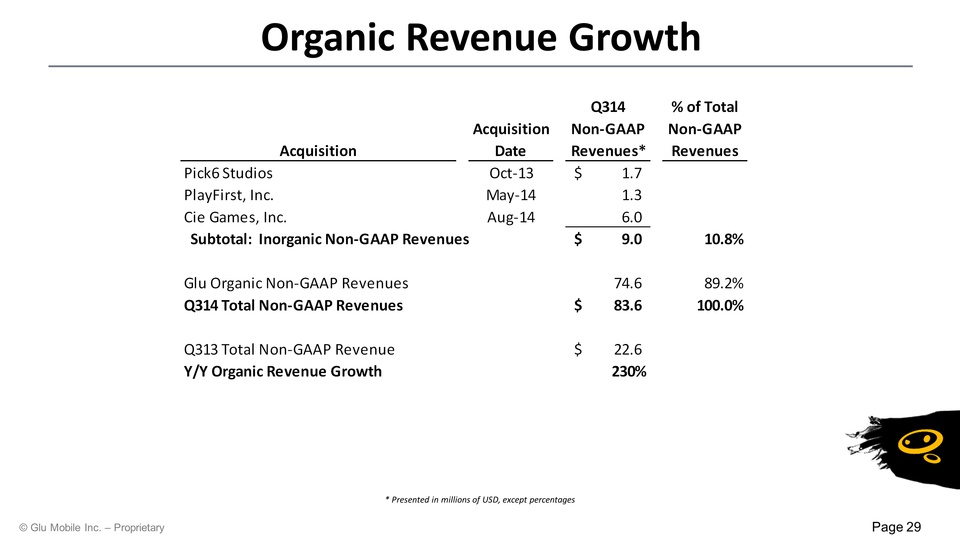

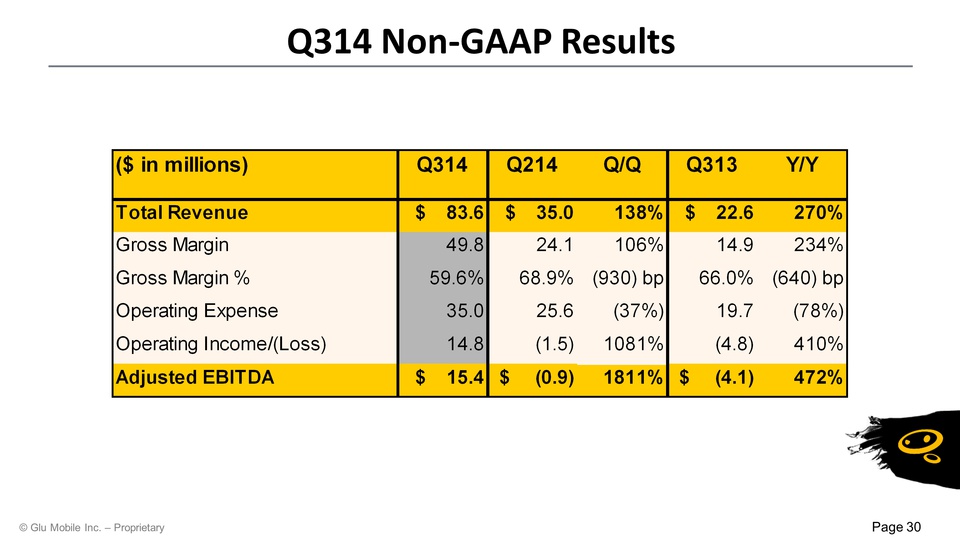

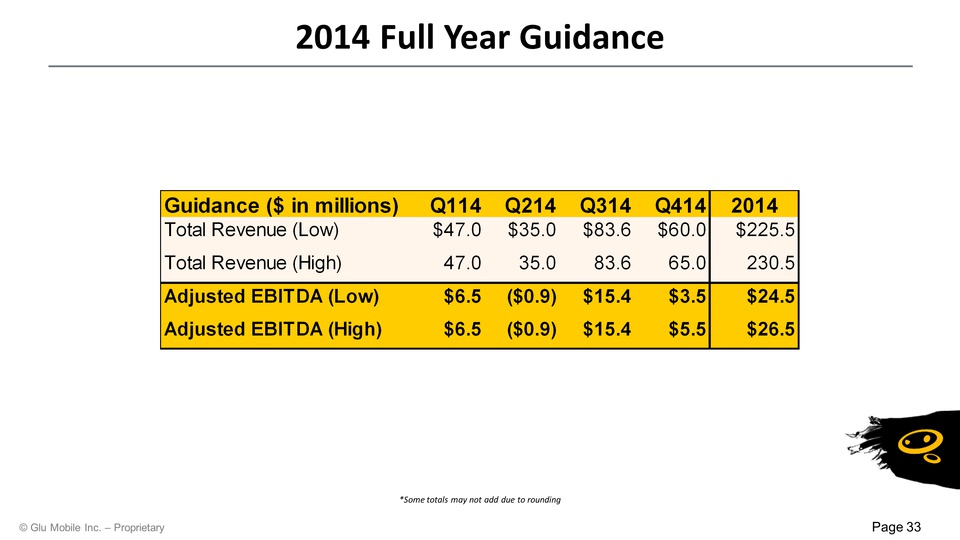

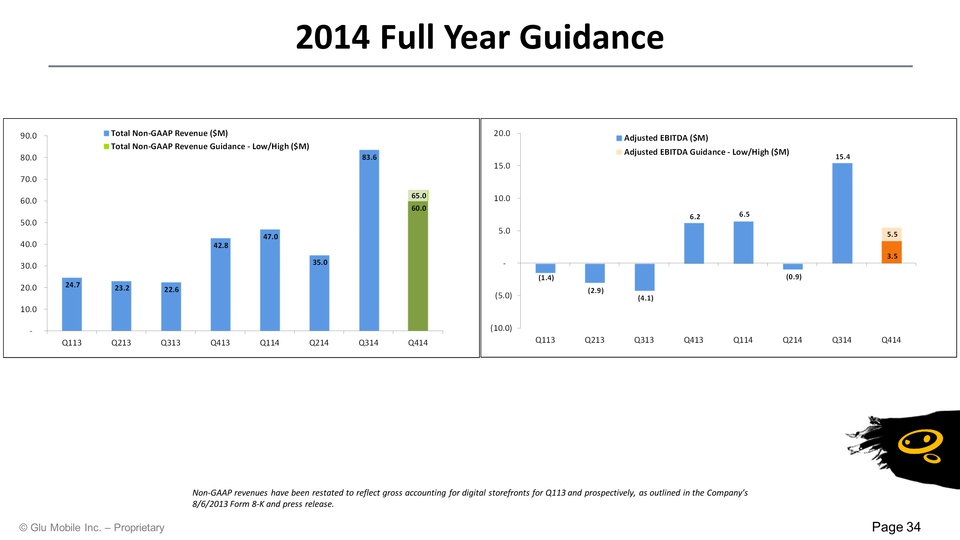

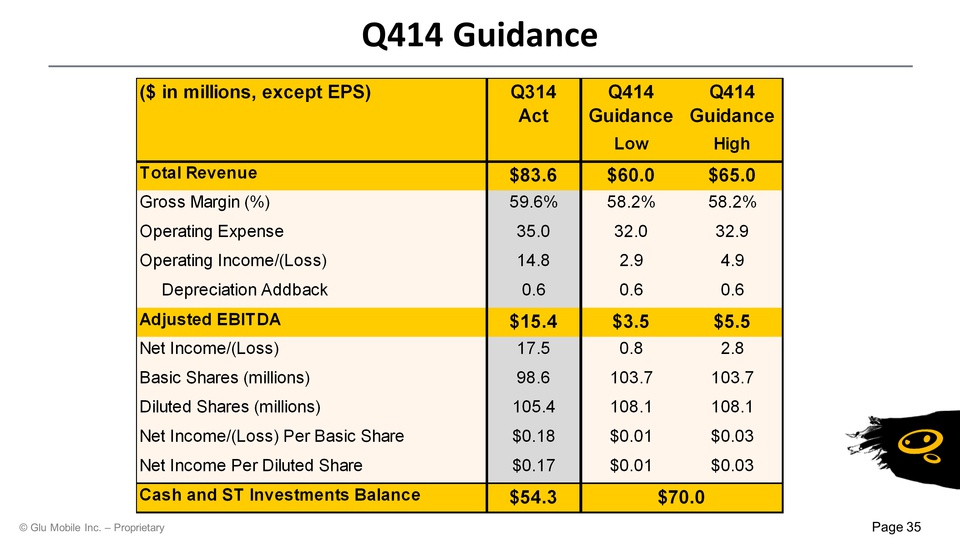

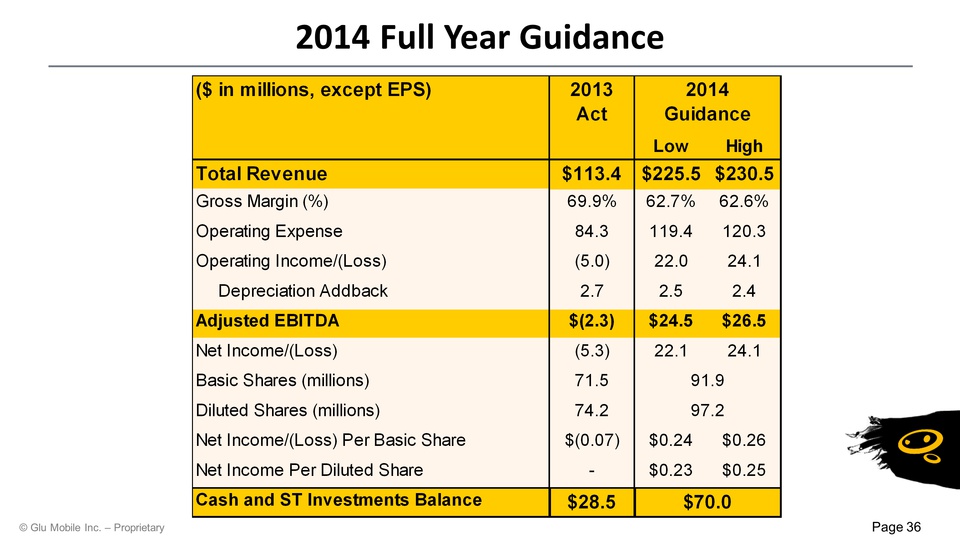

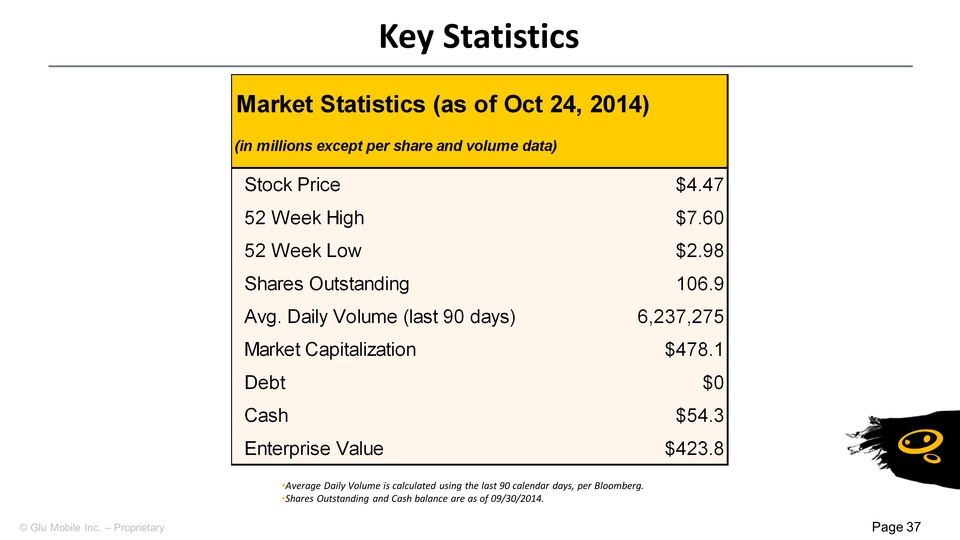

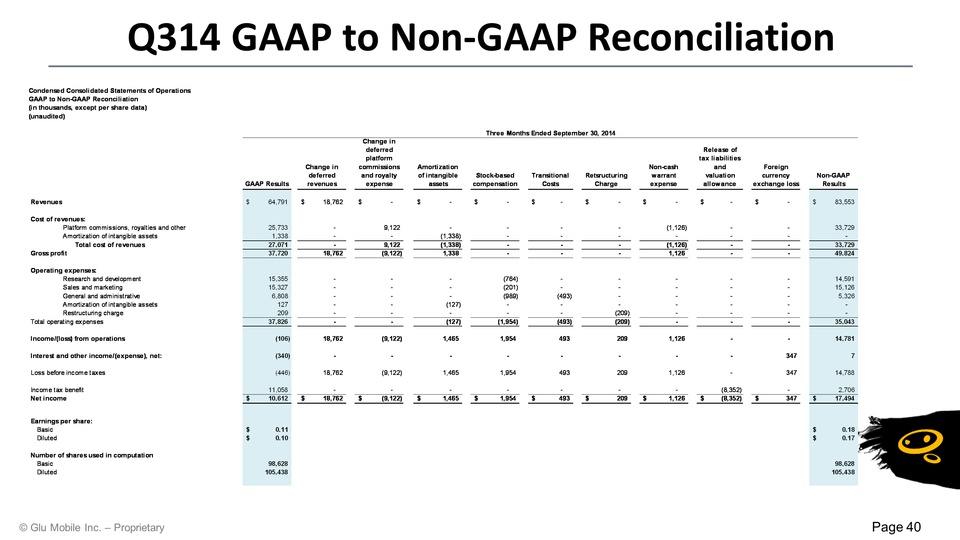

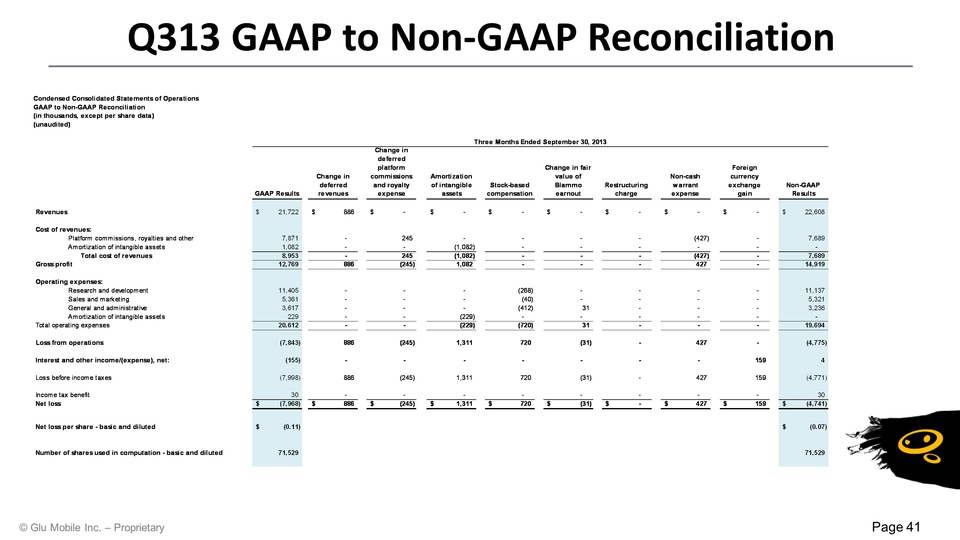

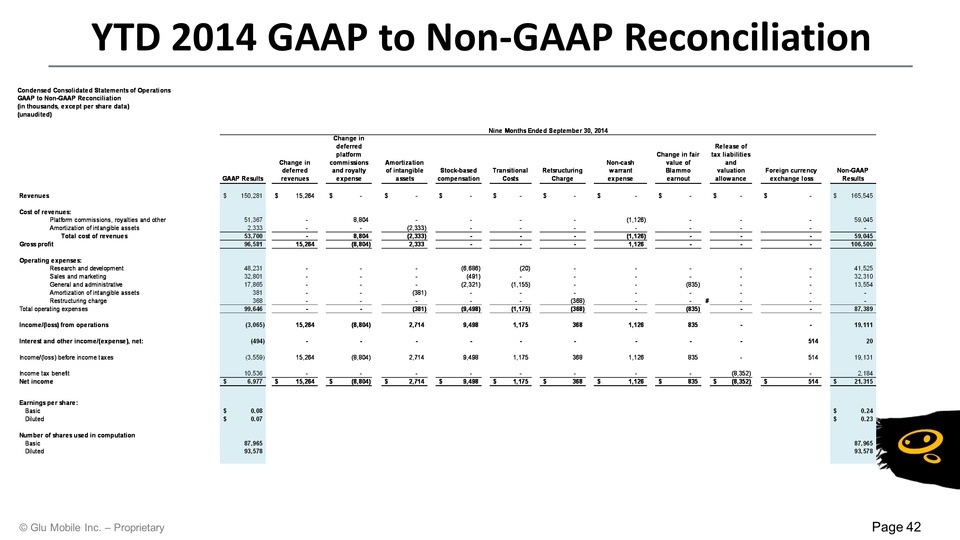

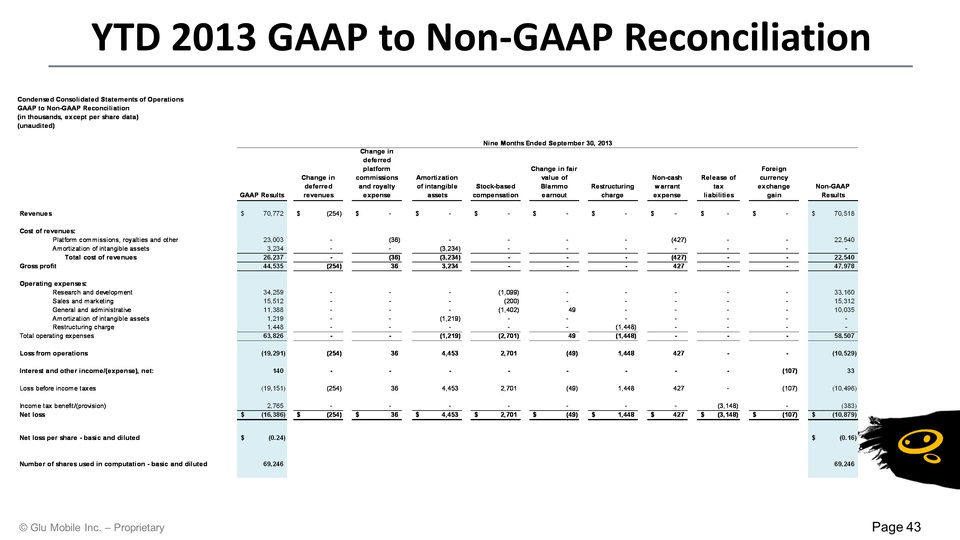

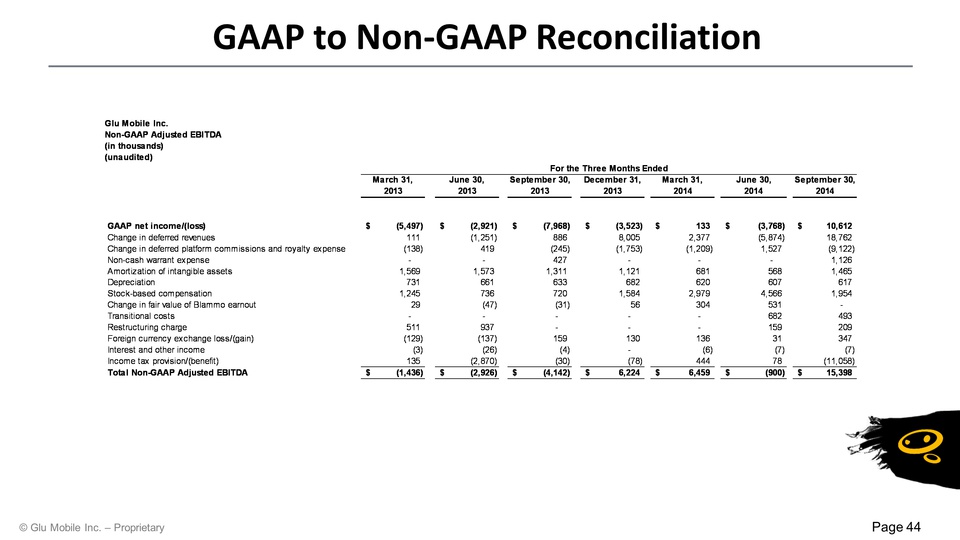

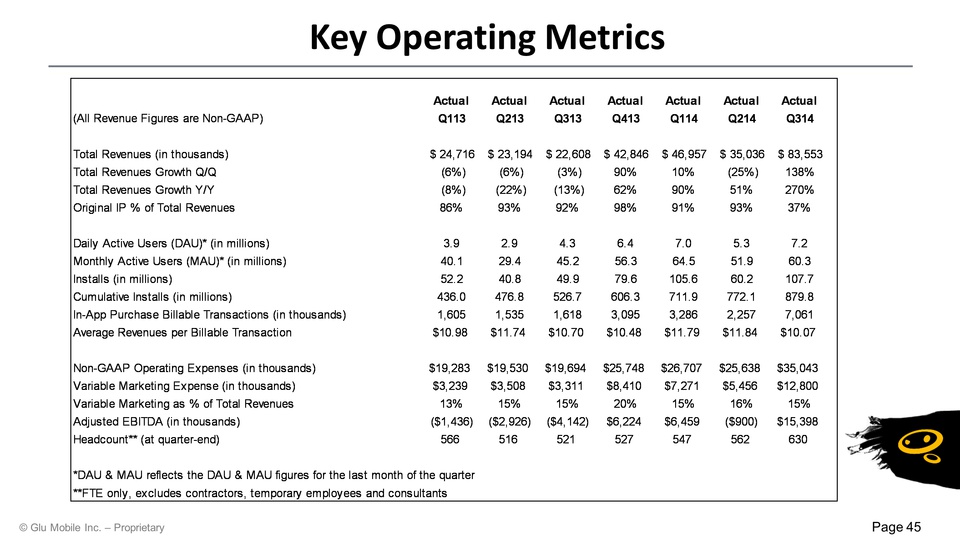

Slide: 1 Title: Glu Mobile Q314 Earnings Call October 29, 2014 Page 1 Slide: 2 Title: Safe Harbor Statement This presentation contains "forward-looking" statements including: Glu is benefitting from strong mobile secular trends in the installed base for smartphones and tablets and the popularity of games among all apps; our expected strong Q4-2014 and 2015 title slate; that Glu has an expanding global presence, particularly in APAC; the expected next title releases for each of our franchises; Glu’s expected Q4-2014 and H1-2015 title lineup and the expected launch dates for these titles; Glu has multiple growth opportunities through international expansion, wearables, the quad screen future and mobile ad spending; that we have a growing and engaged installed base; and our Q4-2014 and full year 2014 guidance. These forward-looking statements are subject to material risks and uncertainties that could cause actual results to differ materially from those in the forward-looking statements. Investors should consider important risk factors, which include: consumer demand for smartphones, tablets and next-generation platforms does not grow as significantly as we anticipate or that we will be unable to capitalize on any such growth; the risk that we do not realize a sufficient return on our investment with respect to our efforts to develop free-to-play games for smartphones and tablets, the risk that we do not maintain our good relationships with Apple and Google; the risk that our development expenses for games for smartphones are greater than we anticipate; the risk that our recently and newly launched games are less popular than anticipated; the risk that our newly released games will be of a quality less than desired by reviewers and consumers; the risk that the mobile games market, particularly with respect to social, free-to-play gaming, is smaller than anticipated; risks related to the restatement of certain of our historical financial statements and other risks detailed under the caption "Risk Factors" in our Form 10-Q filed with the Securities and Exchange Commission on August 11, 2014 and our other SEC filings. You can locate these reports through our website at http://www.glu.com/investors.These "forward-looking" statements are based on estimates and information available to us on October 29, 2014 and we are under no obligation, and expressly disclaim any obligation, to update or alter our forward-looking statements whether as a result of new information, future events or otherwise. Page 2 Slide: 3 Title: Use of Non-GAAP Financial Measures Page 3 Glu uses in this presentation certain non-GAAP measures of financial performance. The presentation of these non-GAAP financial measures is not intended to be considered in isolation from, as a substitute for, or superior to, the financial information prepared and presented in accordance with GAAP, and may be different from non-GAAP financial measures used by other companies. In addition, these non-GAAP measures have limitations in that they do not reflect all of the amounts associated with Glu's results of operations as determined in accordance with GAAP. The non-GAAP financial measures used by Glu include non-GAAP revenues, non-GAAP smartphone revenues, non-GAAP freemium revenues, non-GAAP cost of revenues, non-GAAP gross profit, non-GAAP gross margin, non-GAAP operating expenses, non-GAAP operating margin, non-GAAP net income/(loss), non-GAAP net income/(loss) per share, Adjusted EBITDA and Adjusted EBITDA margin. These non-GAAP financial measures exclude the following items from Glu's unaudited consolidated statements of operations: Change in deferred revenues and deferred cost of revenues;Amortization of intangible assets; Non-cash warrant expense;Stock-based compensation expense; Restructuring charges; Change in fair value of Blammo earnout; Transitional costs; Release of tax liabilities and valuation allowance; andForeign currency exchange gains and losses primarily related to the revaluation of assets and liabilities. In addition, Glu has included in this presentation “Adjusted EBITDA” figures which are used to evaluate Glu’s operating performance and is defined as non-GAAP operating income/(loss) excluding depreciation. Adjusted EBITDA margin is defined as Adjusted EBITDA divided by non-GAAP revenue.Glu believes that these non-GAAP financial measures, when taken together with the corresponding GAAP financial measures, provide meaningful supplemental information regarding Glu's performance by excluding certain items that may not be indicative of Glu's core business, operating results or future outlook. Glu's management uses, and believes that investors benefit from referring to, these non-GAAP financial measures in assessing Glu's operating results, as well as when planning, forecasting and analyzing future periods. These non-GAAP financial measures also facilitate comparisons of Glu's performance to prior periods. For a reconciliation of these non-GAAP financial measures to their most directly comparable GAAP financial measures, please refer to the tables at the end of this presentation. Slide: 4 Title: Executive Summary Page 4 Slide: 5 Title: Great IP + Advanced Monetization Engine + Compelling Gameplay Page 5 Slide: 6 Strong Q3 Revenue and Adjusted EBITDA Results2014 Guidance = Our Strongest Year in HistoryBenefitting from Strong Secular Global Mobile GrowthSeasoned Management TeamDiversified Portfolio of Franchises Strong Q4 & 2015 Title Roadmap Investment Highlights Page 6 Slide: 7 Title: Upward Step Change Q3 2014 results strongest in Glu’s history:Q314 non-GAAP revenue of $83.6M; 270% growth year over yearAdjusted EBITDA margin of 18.4%2014 guidance strongest in Glu’s history:2014 non-GAAP revenue guidance – 99% to 103% growth year over year11% Adjusted EBITDA margin at the high-end of guidance Page 7 Slide: 8 Page 8 Strategy Analytics 2014.Flurry Analytics 2012.(3) App Annie Intelligence – Top 100 grossing apps, December 2013. Title: Strong Mobile Secular Trends (Gp:) Smartphone & Tablet Installed Base (m)(1) (Gp:) Games are the #1 Category (Mobile Devices)(2&3) Smartphone Tablet % of Time Spent Worldwide Top Grossing AppsUnited States Smartphones Tablets iPhone iPad Games Other Slide: 9 Title: Glu: Global Leader In Mobile Gaming Page 9 Pure-play mobile gaming companyDeeply aligned with mobile ecosystem (iOS & Android)Expanding global presence, particularly APAC13 year history, 7 on NASDAQ630+ employees in major sites: San Francisco, CABellevue, WA,Long Beach, CAToronto, CanadaMoscow, RussiaBeijing, China Hyderabad, India Slide: 10 Title: Seasoned Management Team Page 10 Pres. of Pub.Chris Akhavan6 Quarters CFO & COOEric R. Ludwig39 Quarters CEONiccolo de Masi19 Quarters Slide: 11 Other Placeholder: Key focus areas coming together last four quarters:Monetize more deeplyOptimize more predictablyMarket more efficientlyBetter processes & talent Diversified portfolio Title: Step Change in Performance Page 11 Non-GAAP revenues have been restated to reflect gross accounting for digital storefronts for 2012 and Q113 and prospectively, as outlined in the Company’s 8/6/2013 Form 8-K and press release. Slide: 12 Strong Consumer Interest Page 12 (In millions) Installs (In millions) Cumulative Installs Slide: 13 Title: Leader in 4 genres with 8 game engines Page 13 Core Casual Racing Sports Slide: 14 Title: Robust Q414 and 1H15 Lineup Page 14 Other Placeholder: Contract Killer: Sniper - Expected to launch in November 2014Latest installment in CK franchise; PVP and PVEBlood & Glory: Immortals - Expected to launch in January 2015Western focused RPG based on Eternity Warriors game engineFrontline Commando: World War II - Expected to launch in Q2 2015Sequel title to large FPS franchise Slide: 15 Other Placeholder: Closed the acquisition of Cie Games on August 20, 2014Cie Games developed the current leading mobile racing gameAggregate consideration of $80.3m, comprised of $50.8m* of Glu common stock and $29.5m of cash, net of Cie Games’ transaction expensesCie Games was Adjusted EBITDA accretive in its first quarter of consolidation into GluCie Games has been fully integrated into Glu’s publishing and G&A teams Title: Cie Games Acquisition * Based on issuance of 9,998,886 shares of GLUU common stock using GLUU closing price on August 20, 2014 Page 15 Slide: 16 Page 16 Slide: 17 Title: Glu Mobile: Multi Genre Leader Page 17 * These titles are published by Supercell, which is an affiliate of GungHo * * * Slide: 18 Page 18 Slide: 19 Title: Placeholder Slide Page 19 Slide: 20 Multiple Long-Term Growth Opportunities Page 20 International Expansion Mobile Ad Spending as eCPMs Converge Quad Screen Wearables Opportunity / Revenue / Value Time $ $ $ Slide: 21 Title: Financial Overview Page 21 Slide: 22 Growing & Engaged Installed BaseDiversified Portfolio of FranchisesCost-Effective Customer AcquisitionLong Tail Games Provide Significant VisibilityStrong Top Line Growth Financial Investment Highlights Page 22 Slide: 23 Q314 Financial Summary Page 23 Presented in millions of USD, with the exception of per share data and diluted share count. Slide: 24 MAU and DAU Trends Page 24 Aggregate DAU and MAU for each period presented represents the aggregate metric for the last month of the period. An individual who plays two different games in the same month is counted as two active users for that month when we aggregate DAU and MAU across games. In addition, an individual who plays the same game on two different devices during the same month (e.g., an iPhone and an iPad) is also counted as two active users for each such month when we average or aggregate DAU and MAU over time. Our methodology for calculating DAU and MAU may differ from the methodology used by other companies to calculate similar metrics. (In millions) DAUs (In millions) MAUs Slide: 25 Actual Non-GAAP Revenue and Adjusted EBITDA Page 25 Non-GAAP revenues have been restated to reflect gross accounting for digital storefronts Q113 and prospectively, as outlined in the Company’s 8/6/2013 Form 8-K and press release. (In millions) Non-GAAP Revenue (In millions) Adjusted EBITDA Slide: 26 GAAP Revenue by Geography ($m) Page 26 Non-GAAP revenues have been restated to reflect gross accounting for digital storefronts for Q113 and prospectively, as outlined in the Company’s 8/6/2013 Form 8-K and press release. Q3 2014 Slide: 27 Title: Non-GAAP Revenue Mix Page 27 Non-GAAP revenues have been restated to reflect gross accounting for digital storefronts for Q113 and prospectively, as outlined in the Company’s 8/6/2013 Form 8-K and press release. The presentation of platform and category mix contribution in prior presentations was reported as a percentage of non-GAAP smartphone revenues. All prior percentages in the above graphs have been updated to reflect each category’s respective percentage of total non-GAAP revenues. The ‘Premium/All Other’ revenues include featurephone revenues. Slide: 28 Title: Non-GAAP Revenue by Title Kim Kardashian: Hollywood $43.4MPlayFirst Legacy* $1.3M $83.6M Total Non-GAAP Revenues in Q314 Deer Hunter 2014 $9.9M Dino Hunter: Deadly Shores $7.2MRacing Rivals** $5.8MTap Sports: Baseball $1.7MAmazing Battle Creatures $0.4M Eternity Warriors 3 $3.6M Page 28 Frontline Commando: D-Day $1.3MStardom Hollywood $1.1M Frontline Commando 2 $1.0MRobocop $0.9M *Comprised of legacy games already live prior to acquisition of PlayFirst by Glu on May 14, 2014**Reflects Racing Rivals revenues after the closing of the Cie Games acquisition on August 20, 2014 Slide: 29 Page 29 Organic Revenue Growth * Presented in millions of USD, except percentages Slide: 30 Title: Q314 Non-GAAP Results Page 30 Slide: 31 Title: Strong Balance Sheet Page 31 Slide: 32 Title: Guidance Page 32 Slide: 33 2014 Full Year Guidance Page 33 *Some totals may not add due to rounding Slide: 34 2014 Full Year Guidance Page 34 Non-GAAP revenues have been restated to reflect gross accounting for digital storefronts for Q113 and prospectively, as outlined in the Company’s 8/6/2013 Form 8-K and press release. Slide: 35 Q414 Guidance Page 35 Slide: 36 2014 Full Year Guidance Page 36 Slide: 37 Title: Key Statistics Page 37 Average Daily Volume is calculated using the last 90 calendar days, per Bloomberg.Shares Outstanding and Cash balance are as of 09/30/2014. Slide: 38 Benefitting from Strong Secular Global Mobile GrowthLeader in Mobile GamingDiversified Portfolio of FranchisesStrong 2014 & 2015 Title SlateFinancials Benefitting from Significant Investments Investment Highlights Page 38 Slide: 39 Title: Non-GAAP Reconciliations Page 39 Slide: 40 Page 40 Q314 GAAP to Non-GAAP Reconciliation Slide: 41 Title: Q313 GAAP to Non-GAAP Reconciliation Page 41 Slide: 42 Page 42 YTD 2014 GAAP to Non-GAAP Reconciliation Slide: 43 Title: YTD 2013 GAAP to Non-GAAP Reconciliation Page 43 Slide: 44 Title: GAAP to Non-GAAP Reconciliation Page 44 Slide: 45 Title: Key Operating Metrics Page 45