101 South Queen Street Martinsburg, West Virginia 25401 (304) 263-0836 7000 Hampton Center, Suite K Morgantown, West Virginia 26505 (304) 285-2500 333 West Vine Street, Suite 1700 Lexington, Kentucky 40507-1639 (859) 252-2202 | 600 Quarrier Street Charleston, West Virginia 25301 Post Office Box 1386 Charleston, West Virginia 25325-1386 (304) 347-1100 www.bowlesrice.com | 480 West Jubal Early Drive Suite 130 Winchester, Virginia 22601 (540) 723-8877 5th Floor, United Square 501 Avery Street Parkersburg, West Virginia 26101 (304) 485-8500 |

Amy J. Tawney Telephone — (304) 347-1123 Facsimile — (304) 343-3058 | November 13, 2007 | E-Mail Address: atawney@bowlesrice.com |

Mr. H. Christopher Owings Assistant Director United States Securities & Exchange Commission Division of Corporation Finance 100 F Street, NE Mail Stop 3561 Washington, DC 20549-3561 | VIA FEDERAL EXPRESS |

| | | Amendment No. 5 to Registration Statement on Form SB-2 File No. 333-141010 |

Dear Mr. Owings:

On behalf of MH&SC, Incorporated (“MH&SC”), we hereby submit the following responses to your comment letter dated August 31, 2007.

MH&SC, Inc. Consolidated Financial Statements, page F-19

Notes to Consolidated Financial Statements, page F-25

Note 2 - Summary of Significant Accounting Policies, page F-25

Goodwill and Other Intangible Assets, page F-28

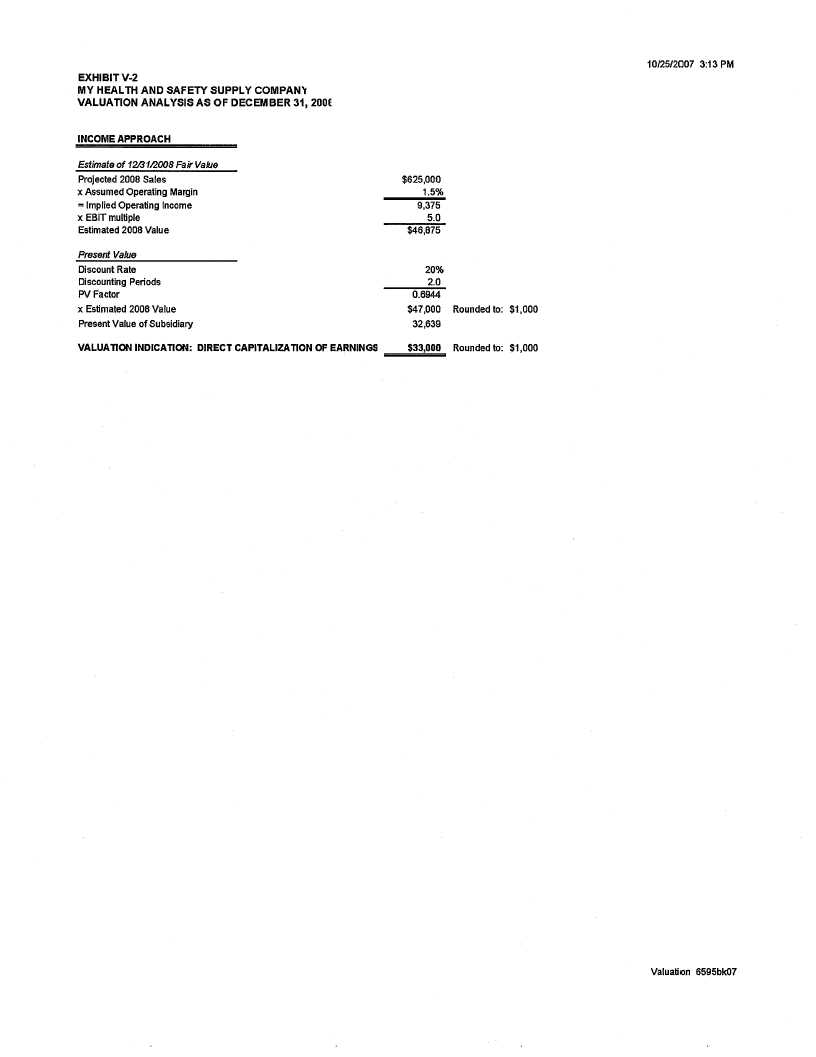

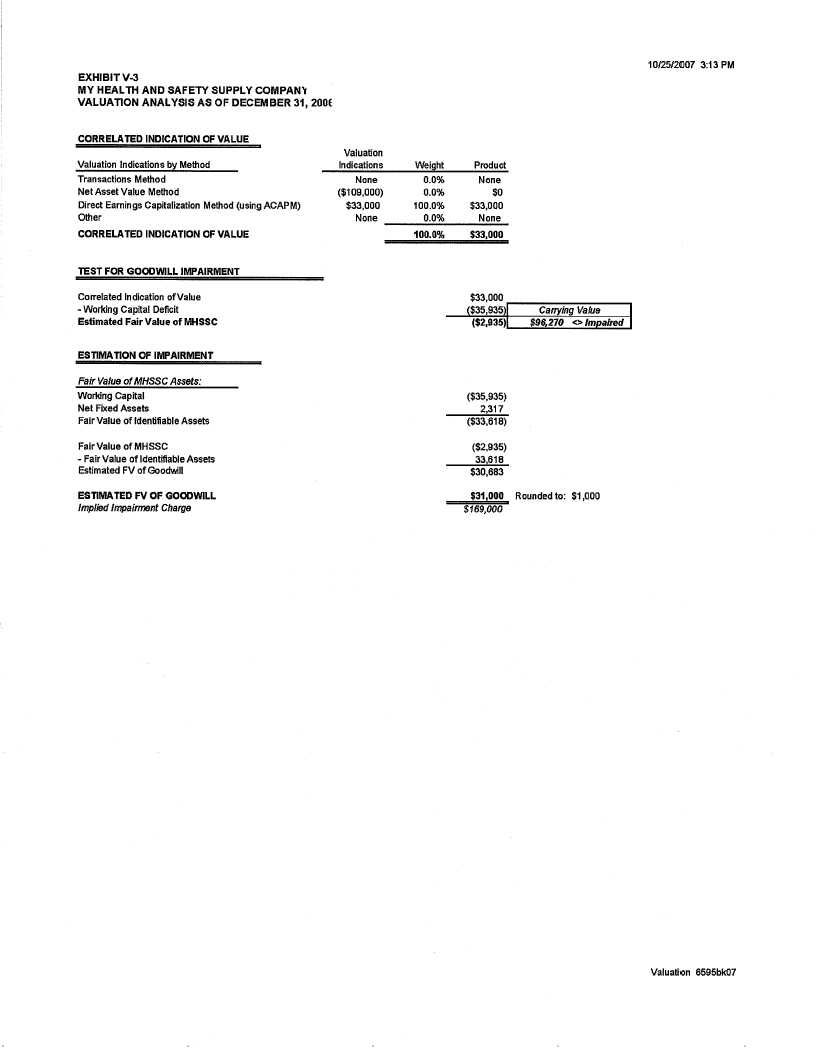

1. We reviewed your response to our prior comment 1 that you valued My Health & Safety Supply Company using one year of anticipated gross margin. We are not in a position to agree that your methodology results in an amount that approximates fair value. Please tell us your basis in GAAP for using this methodology rather than the present value of estimated futures cash flows, which is often viewed as the best available technique if quoted market prices are not available. Please tell us your basis for using only one year of anticipated operating results. Please be advised that future cash flows should take into account other factors outside of gross margin such as selling, general and administrative costs and capital expenditures required to execute your business plan. Please revise your fair value calculation and the impairment amount as necessary. Refer to paragraphs 23 through 25 of SFAS No. 142 and FASB Statement of Concepts 7.

H. Christopher Owings

Assistant Director

United States Securities & Exchange Commission

November 13, 2007

Page 2

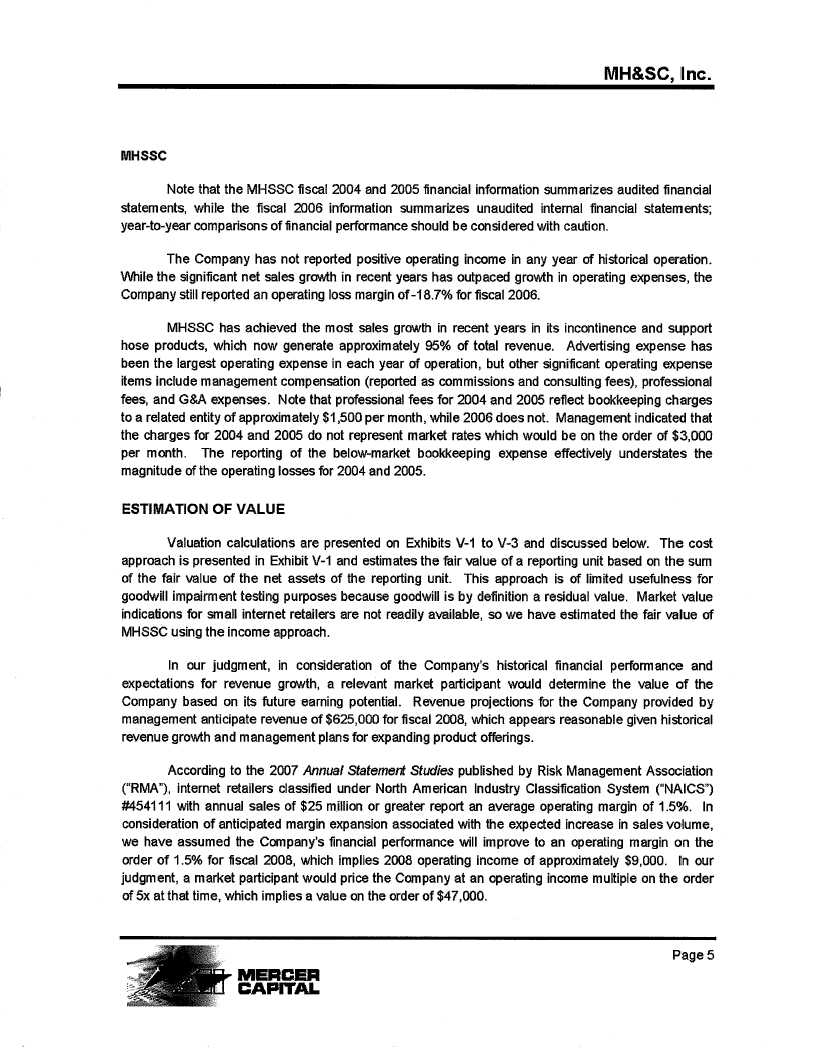

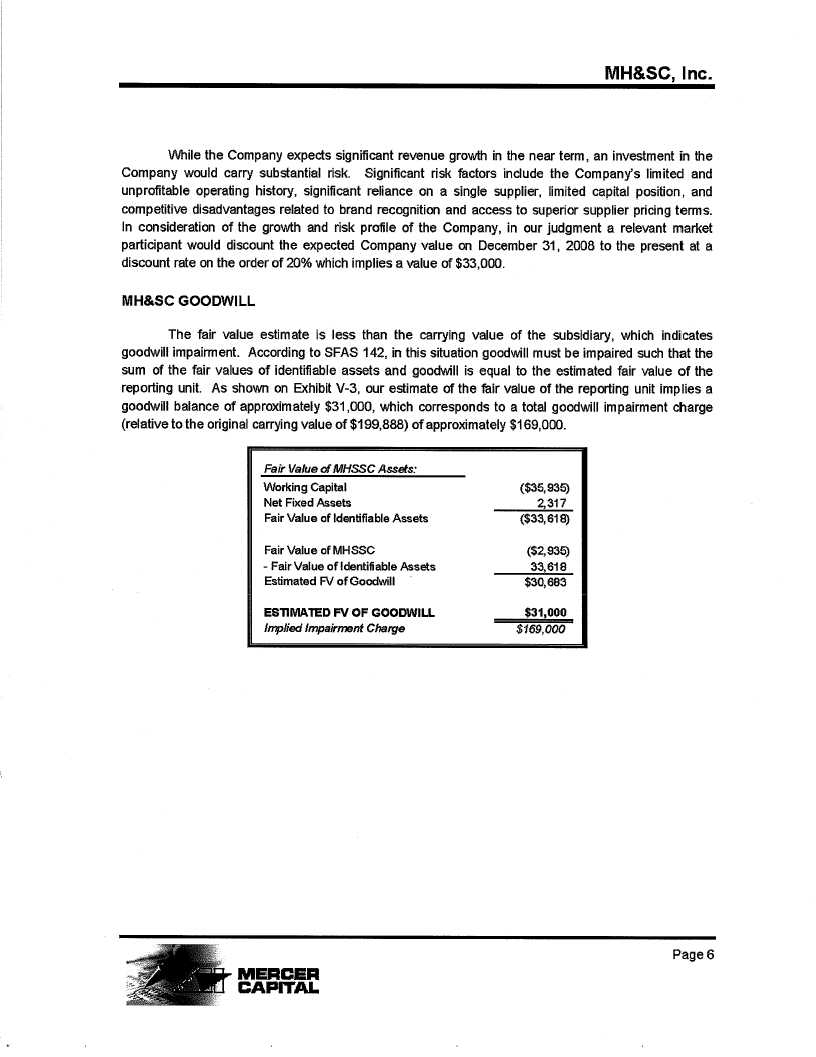

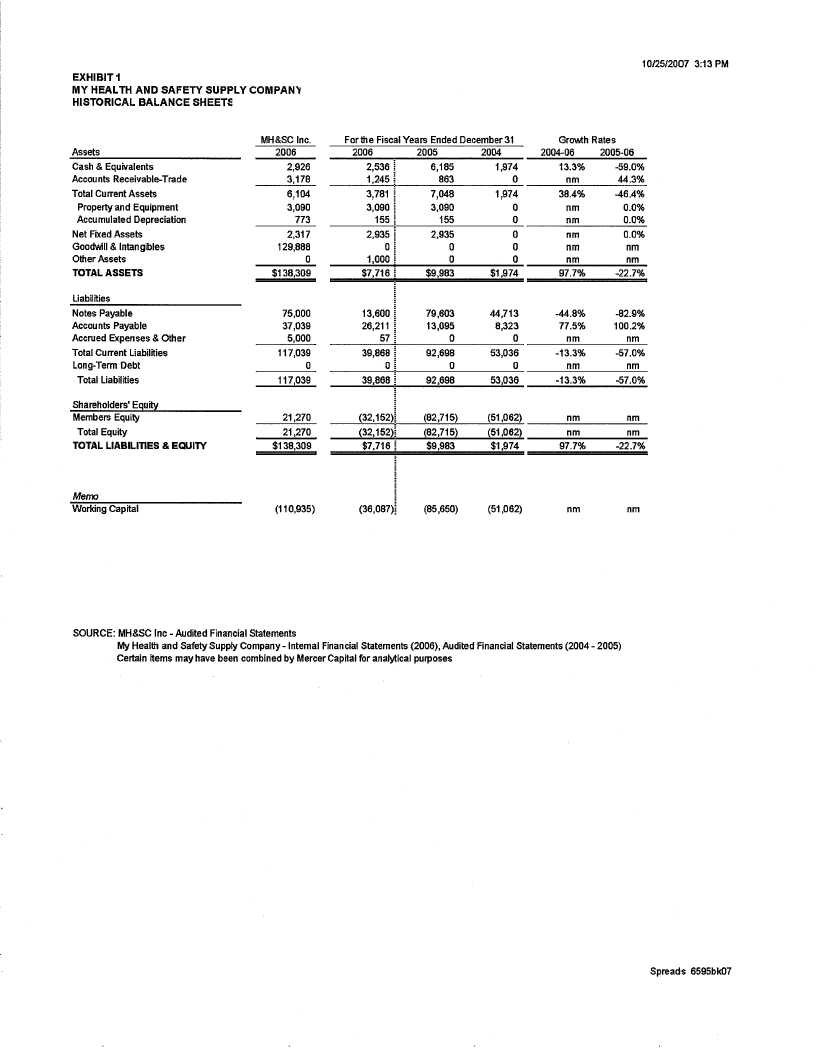

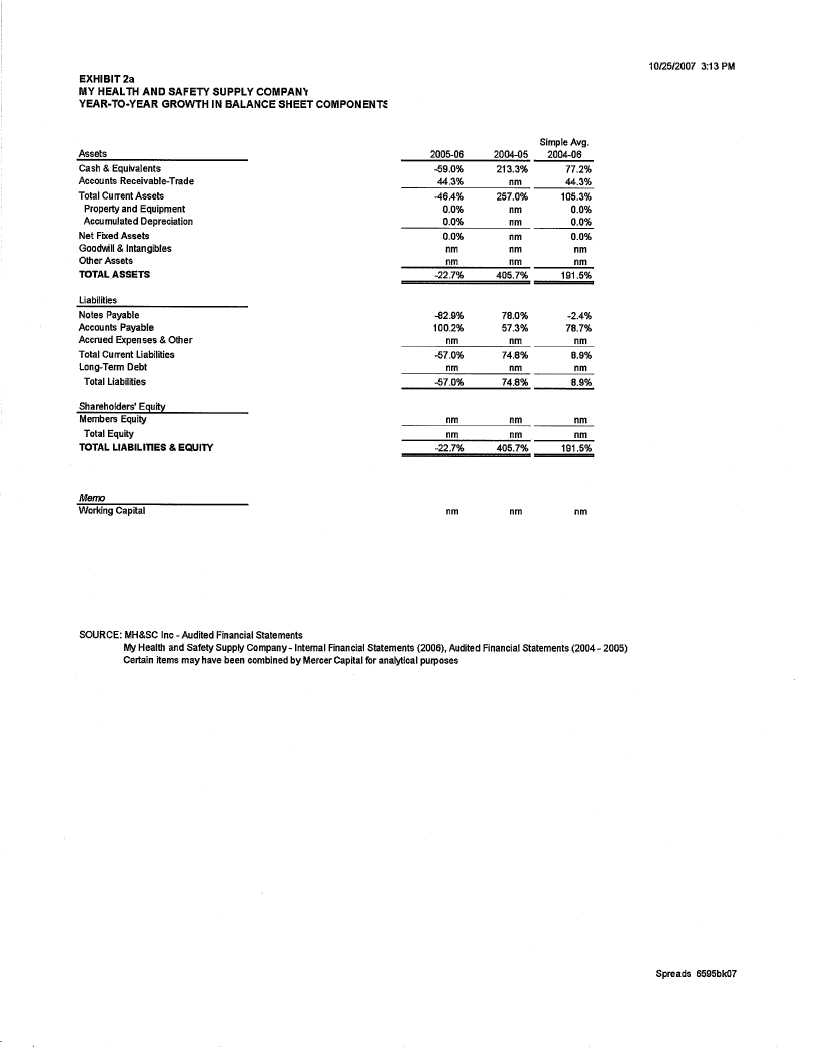

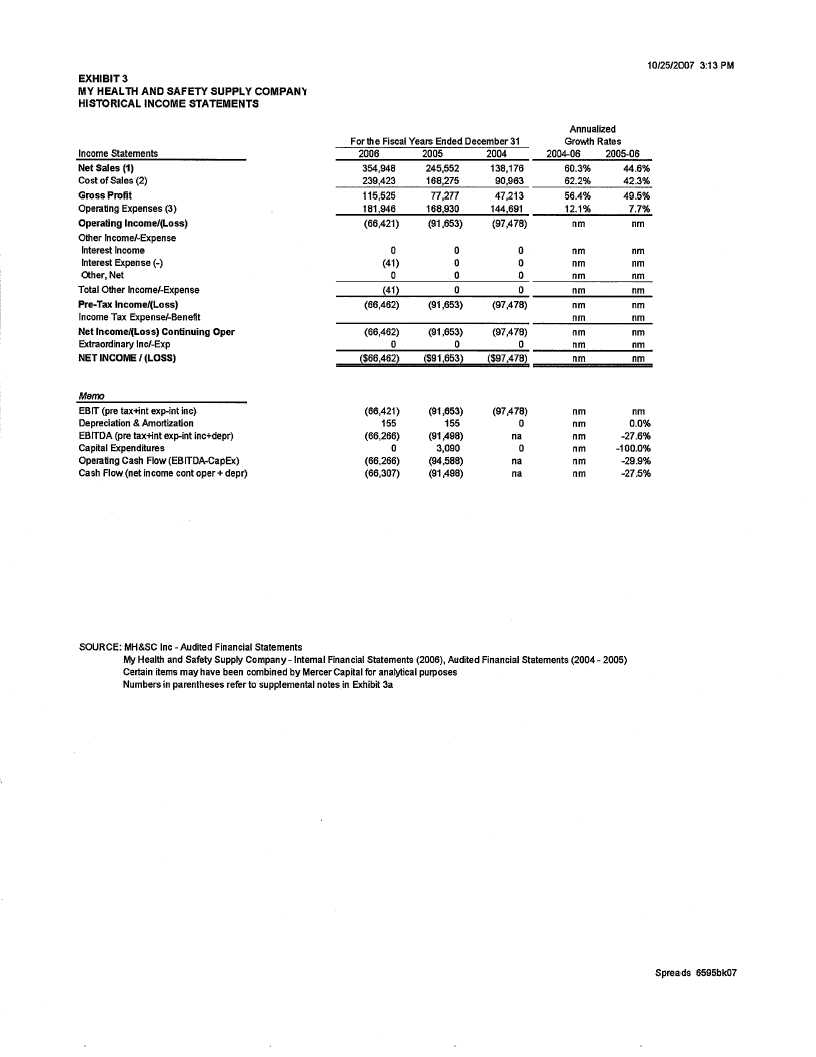

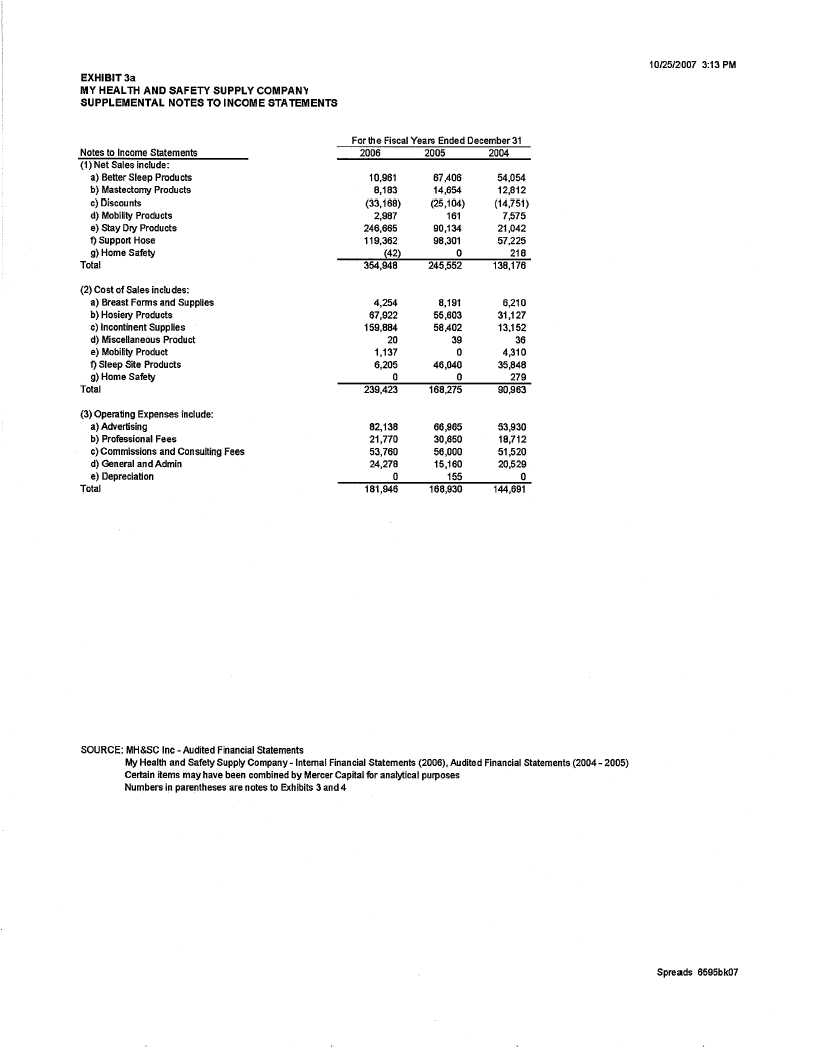

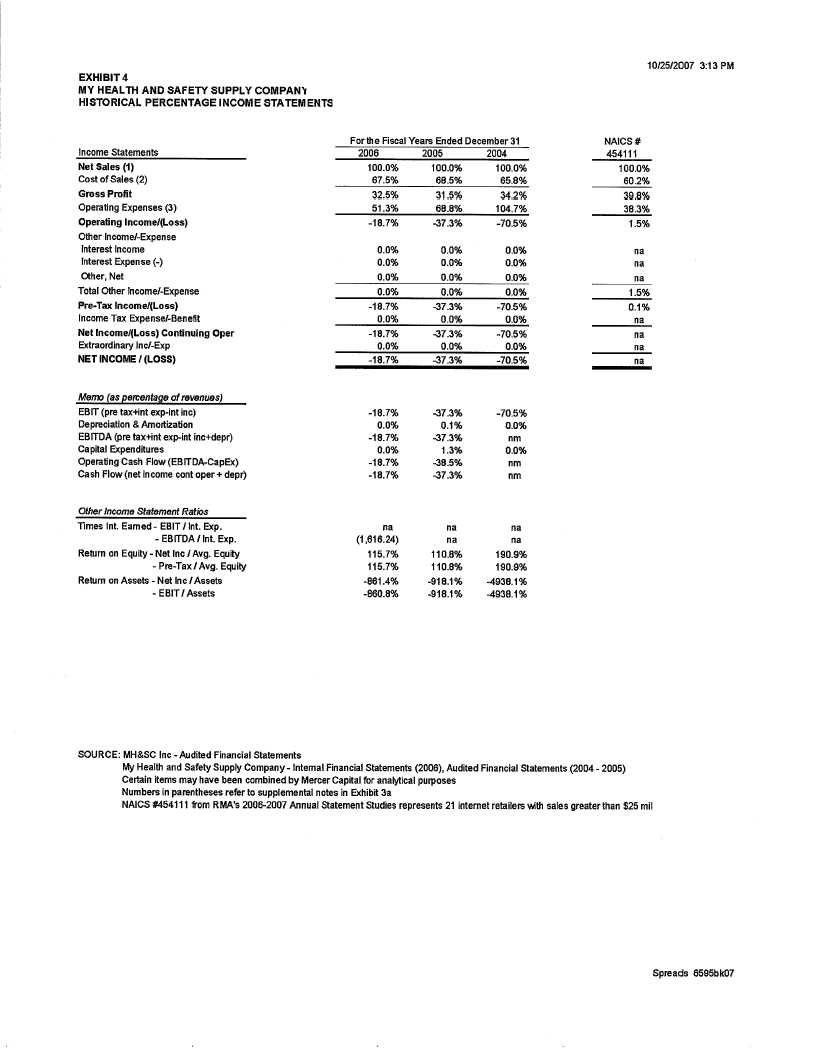

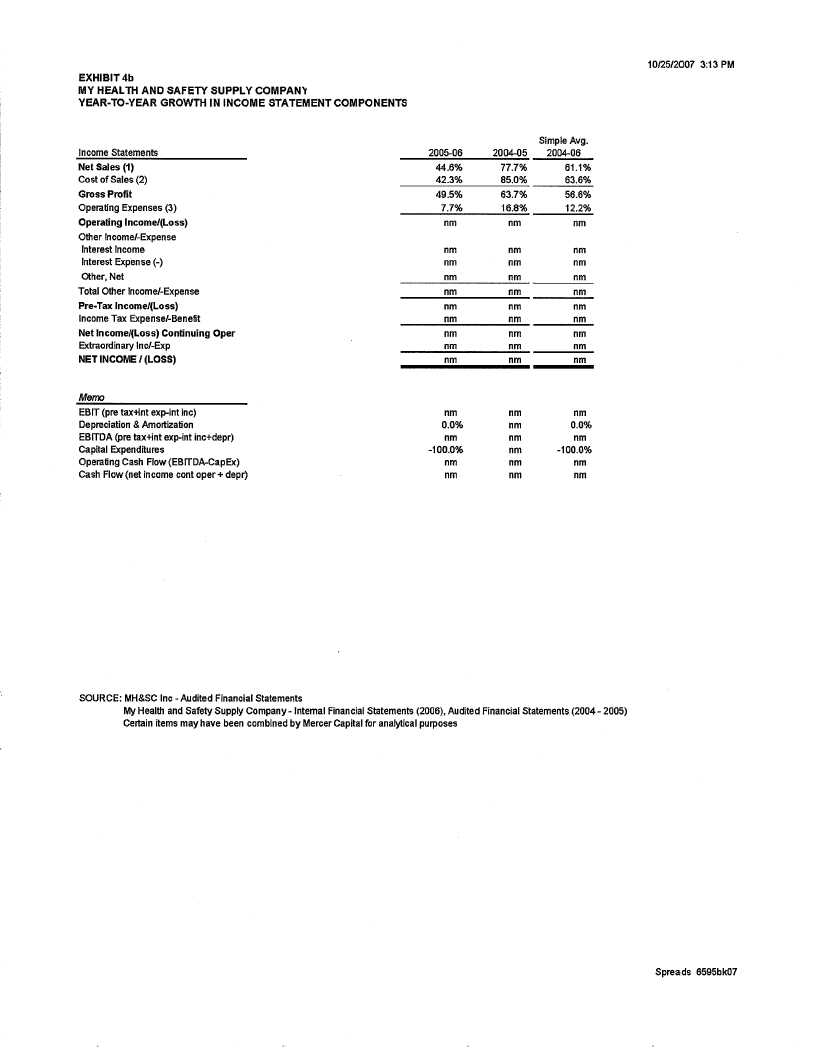

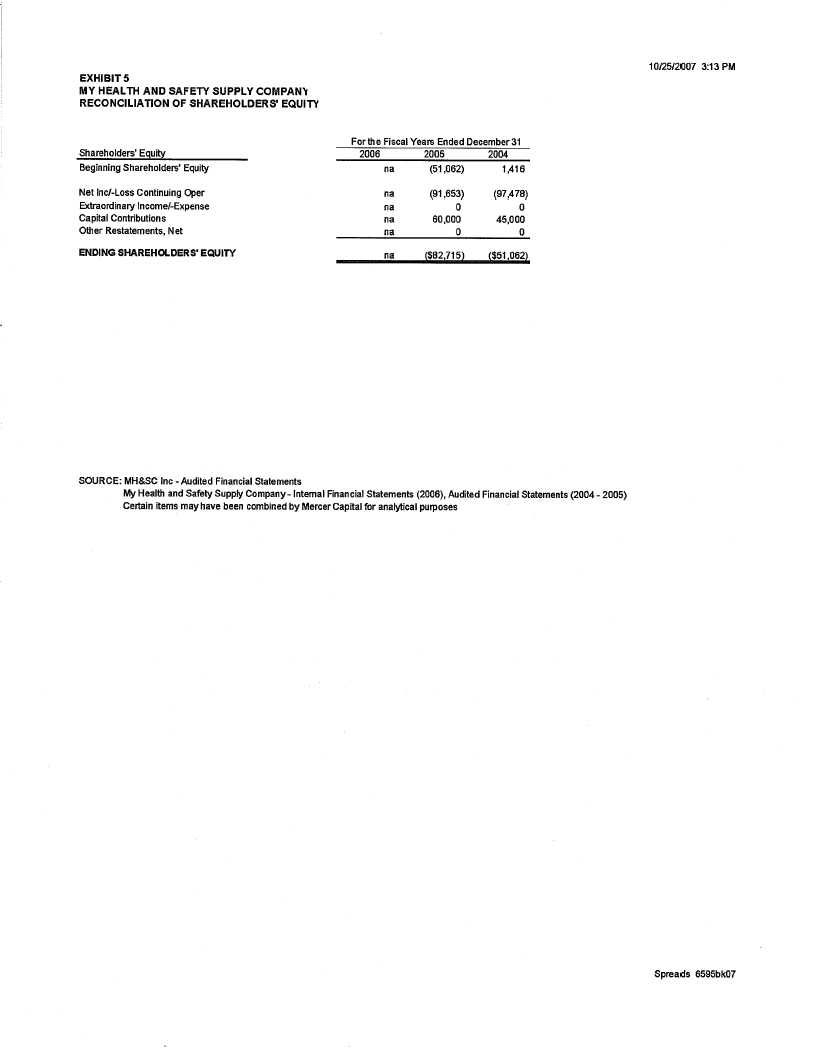

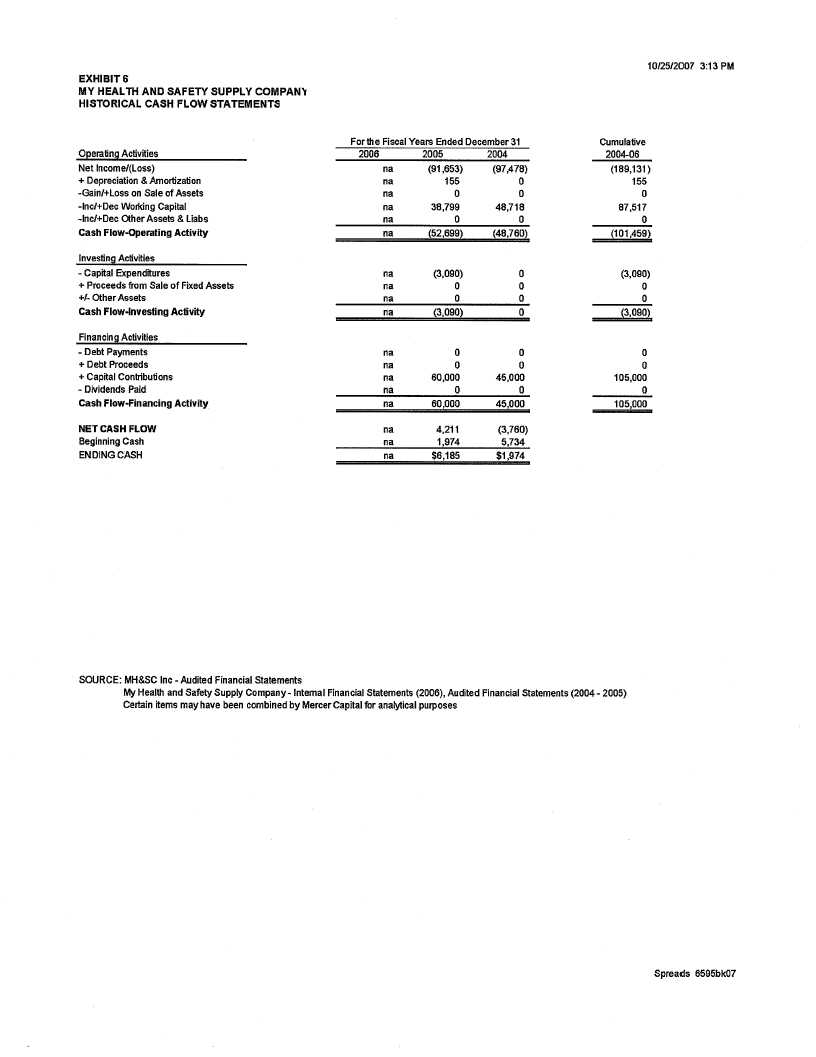

Answer: The Company retained Mercer Capital Management, Inc. (“Mercer Capital”) to measure the fair value of the Company’s goodwill. Mercer Capital determined the fair value based on definitions established in SFAS 157 and used the approach to measure the fair value of the reporting unit. As a result of the valuation performed by Mercer Capital, the Company restated its financial statements for the period ended December 31, 2006 to account for the impairment of $168,888 of goodwill associated with the acquisition of My Health & Safety Supply Company, LLC and amended Note 2 to its financial statements to this impairment.

I have enclosed a copy of Mercer Capital’s report for your review.

Amendment No. 5 to Form SB-2 includes the Company’s unaudited financial statements for the period ended September 30, 2007.

I have enclosed two black-lined copies of Amendment No. 5 to Form SB-2 and two clean copies of Amendment No. 5 to Form SB-2 to expedite your review.

If you have any questions, please feel free to contact me.

| | | |

| | | Very truly yours, |

| | /s/ Amy J. Tawney |

| |

Amy J. Tawney |

AJT/jam

Enclosures

cc: Cory Heitz