UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): June 24, 2008

JUHL WIND, INC.

(Exact Name of Registrant as Specified in Charter)

| Delaware | | 333-141010 | | 20-4947667 |

| (State or other jurisdiction | | (Commission File Number) | | (IRS Employer |

| of incorporation) | | Identification No.) | | |

996 190th Avenue Woodstock, Minnesota | | 56186 |

| (Address of principal executive offices) | | (Zip Code) |

Registrant’s telephone number, including area code: (507) 777-4310

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 DFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement communications pursuant to Rule 13e-4 (c) under the Exchange Act (17 CFR 240.13e-4(c))

CURRENT REPORT ON FORM 8-K

JUHL WIND, INC.

June __, 2008

TABLE OF CONTENTS

| | | Page |

| | | |

| Items 1.01, 5.01, 5.02 and 5.03 | |

| | |

| �� | Entry into a Material Definitive Agreement / Changes in Control of Registrant / Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers / Amendments to Articles of Incorporation or By-Laws; Change In Fiscal Year | 1 |

| | | |

| Item 2.01. | Completion of Acquisition or Disposition of Assets | 4 |

| | | |

| Item 3.02. | Unregistered Sales of Equity Securities | 59 |

| | | |

| Changes in Registrant’s Certifying Accountant | 59 |

| | | |

| Item 9.01. | Financial Statements and Exhibits | 60 |

Items 1.01, 5.01, 5.02 and 5.03 . Entry into a Material Definitive Agreement / Changes in Control of Registrant / Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers / Amendments to Articles of Incorporation or By-Laws; Change In Fiscal Year.

Summary

On June 24, 2008, we acquired all of the outstanding shares of common stock of two related companies, Juhl Energy Development, Inc., a Minnesota corporation (“Juhl Energy”), and DanMar and Associates, Inc., a Minnesota corporation (“DanMar”), in exchange for 15,250,000 shares of our common stock, par value $.0001 per share. As a result, Juhl Energy and DanMar are now our wholly-owned subsidiaries. The transaction is referred to in this current report as the exchange transaction.

As a result of the exchange transaction, we are now engaged in the development of community wind power in various small communities in the Midwestern United States and Canada, with the ultimate goal of building medium scale wind farms jointly owned with local communities and farm owners. The wind farms are connected to the general utility electric grid to produce clean, environmentally-sound wind power for use by the electric power industry. Since 2003, Juhl Energy and DanMar have developed 11 wind farms, accounting for more than 117 megawatts of wind power, that currently operate in the midwest region of the United States. At the time of the exchange transaction, Juhl Energy and DanMar were engaged in various aspects of the development of 16 wind farms totaling an additional 400 megawatts of community wind power systems.

Before the exchange transaction, our corporate name was MH & SC, Incorporated and our trading symbol was MHSC.OB. Concurrently with the exchange transaction, we changed our corporate name to Juhl Wind, Inc. and have requested a change of our trading symbol. As a result of the exchange transaction, Juhl Energy and DanMar became our wholly-owned subsidiaries, with the former stockholders of Juhl Energy and DanMar acquiring 15,250,000 shares of our common stock. Both Juhl Energy and DanMar were controlled by Daniel J. Juhl, their founder and our new Chairman and Chief Executive Officer. The exchange transaction was consummated pursuant to a Securities Exchange Agreement, dated June 24, 2008, between us, and Juhl Energy and DanMar and, for certain limited purposes, the former stockholders of Juhl Energy and DanMar.

Concurrently with the closing of the exchange transaction, we completed a private placement to two institutional investors and two other accredited investors of units consisting of shares of our newly-created series A convertible preferred stock, par value $.0001 per share, and detachable five-year class A, class B and class C warrants to purchase shares of our common stock at an exercise price of $1.25 (class A), $1.50 (class B) and $1.75 (class C) per share. In total, we sold 5,160,000 shares of our series A convertible preferred stock (convertible at any time into a like number of shares of common stock) and class A, class B and class C warrants to each purchase 2,580,000 shares of common stock, or an aggregate of 7,740,000 shares of common stock. We received gross proceeds of $5,160,000 in consideration for the sale of the units, $4,560,000 from Vision Opportunity Master Fund, Ltd., $500,000 from Daybreak Special Situation Fund, L.P. and $100,000 from Bruce Myers and Imtiaz Khan.

Concurrently with the closing of the exchange transaction and the private placement, we cancelled 3,765,000 shares of our common stock held by Vision Opportunity Master Fund. Following the closing of the exchange transaction, pursuant to a purchase and sale agreement, we sold all of the outstanding membership interests of our wholly-owned subsidiary, My Health & Safety Supply Company, LLC, an Indiana limited liability company, to Mr. Heitz in full satisfaction of related party advances made by him to us in the principal amount of $121,000, plus accrued but unpaid interest. We determined that this business was incidental to our new wind energy business.

The Exchange Transaction

General

At the closing of the exchange transaction, the two former beneficial stockholders of Juhl Energy and DanMar received shares of our common stock for all of the outstanding shares of common stock of Juhl Energy and Danmar held by them. As a result, at the closing of the exchange transaction, we issued an aggregate of 15,250,000 shares of our common stock to the former stockholders of Juhl Energy and DanMar, representing approximately 60.6% of our outstanding shares of common stock, inclusive of 5,160,000 shares of common stock issuable upon the conversion of our series A convertible preferred stock sold in our concurrent private placement. The consideration issued in the exchange transaction was determined as a result of arm’s-length negotiations between us and Juhl Energy and DanMar and their respective stockholders.

We also issued 2,250,000 shares of our common stock to Greenview Capital, LLC and unrelated designees at the closing of the exchange transaction in consideration for merger advisory services in connection with the transaction.

The disclosure set forth under Item 2.01 of this current report is incorporated herein in its entirety by reference.

Changes Resulting from the Exchange Transaction

We intend to carry on Juhl Energy’s and DanMar’s wind energy business as our sole line of business. We have relocated our executive offices to those of Juhl Energy at 996 190th Avenue, Woodstock, Minnesota 56186. Our new telephone number is (507) 777-4310, fax number is (507) 562-8091, and corporate website is www.juhlwind.com. The contents of our website are not part of this current report.

Our pre-exchange transaction stockholders will not be required to exchange their existing MH&SC stock certificates for new certificates of Juhl Wind, since the OTC Bulletin Board will consider our existing stock certificates as constituting “good delivery” in securities transactions subsequent to the exchange transaction. The American Stock Exchange and Nasdaq Capital Market, where we intend to apply to list our common stock for trading, will also consider the submission of existing stock certificates as “good delivery.” We cannot be certain that we will receive approval to list our common stock on the American Stock Exchange or Nasdaq Capital Market.

Change of Board Composition and Executive Officers

Prior to the closing of the exchange transaction and private placement, our board of directors was composed only of Cory Heitz. On June 24, 2008, immediately following such transactions, Mr. Heitz resigned as our director, and Daniel J. Juhl and John P. Mitola became directors of our company. We expect Edward C. Hurley to become our third director shortly following the exchange transaction. All directors hold office until the next annual meeting of stockholders and the election and qualification of their successors.

Prior to the closing of the exchange transaction and private placement, Cory Heitz was our Chief Executive Officer, Principal Financial Officer and Principal Accounting Officer. Mr. Heitz resigned from all of the offices that he held effective on June 24, 2008.

On June 24, 2008, our board of directors named the following persons as our new executive officers: Daniel J. Juhl - Chairman of the Board and Chief Executive Officer, John P. Mitola - President, and Jeffrey C. Paulson - General Counsel, Vice President and Secretary. Officers are elected annually by our board of directors and serve at the discretion of our board. We are currently in the process of identifying a new Chief Financial Officer. Mr. Mitola will serve in that capacity until a new Chief Financial Officer is hired.

The disclosure set forth under “Directors and Executive Officers” in Item 2.01 of this current report is incorporated herein in its entirety by reference.

Change of Stockholder Control

Except as described above under “Change of Board Composition and Executive Officers,” no arrangements or understandings exist among our present or former controlling stockholders with respect to the election of persons to our board of directors and, to our knowledge, no other arrangements exist that might result in a change of control of our company. Further, as a result of our issuance of 15,250,000 shares of common stock to the former stockholders of Juhl Energy and DanMar, a change of stockholder control has occurred. Prior to the closing of the exchange transaction, Vision Opportunity Master Fund owned 79.8% of our outstanding shares of common stock. After these transactions, the two former beneficial stockholders of Juhl Energy and DanMar own approximately 60.6% of our outstanding shares of common stock, inclusive of shares of common stock issuable upon conversion of our series A convertible preferred stock. We are continuing as a “smaller reporting company,” as defined under the Securities Exchange Act of 1934, following the exchange transaction.

The disclosure set forth under “Security Ownership of Certain Beneficial Owners and Management” in Item 2.01 of this current report is incorporated herein in its entirety by reference.

Accounting Treatment

In accordance with Statement of Financial Accounting Standards No. 141, “Business Combinations,” and the assumptions and adjustments described in the accompanying notes to the unaudited pro forma combined condensed financial statements, Juhl Energy and DanMar are considered the accounting acquiror in the exchange transaction. Because Juhl Energy’s and DanMar’s owners as a group retained or received the larger portion of the voting rights in the combined entity and Juhl Energy’s and DanMar’s senior management represents a majority of the senior management of the combined entity, Juhl Energy and DanMar were considered the acquiror for accounting purposes and will account for the exchange transaction as a reverse acquisition. The acquisition will be accounted for as the recapitalization of Juhl Energy and DanMar since, at the time of the acquisition, we were a company with minimal assets and liabilities. Consequently, the assets and liabilities and the historical operations that will be reflected in the consolidated financial statements will be those of Juhl Energy and DanMar and will be recorded at the historical cost basis of Juhl Energy and DanMar.

Amendments to Certificate of Incorporation

In connection with the exchange transaction, our board of directors and stockholders approved and filed a certificate of amendment to our certificate of incorporation with the Delaware Secretary of State on June 20, 2008, thereby changing our corporate name to Juhl Wind, Inc. The certificate of amendment additionally (a) amended our capital stock provisions to provide for the authority to issue 100,000,000 shares of common stock, par value $.0001 per share, and 20,000,000 shares of preferred stock, par value $.0001 per share, and (b) added an indemnification provision for the benefit of our directors, in compliance with Section 174 of the General Corporation Law of the State of Delaware. On June 24, 2008, we also filed a Certificate of Designation of Rights, Preferences and Limitations to establish a class of 6,000,000 shares of series A 8% convertible preferred stock. See “Description of Securities - Series A Convertible Preferred Stock” in Item 2.01 below.

Item 2.01. Completion of Acquisition or Disposition of Assets.

Information concerning the principal terms of the exchange transaction and our business is set forth below.

The Exchange Transaction

On June 24, 2008, we entered into a Securities Exchange Agreement with Juhl Energy and DanMar and, for certain limited purposes, their respective stockholders. On June 24, 2008, the exchange transaction provided for in the Securities Exchange Agreement was completed and Juhl Energy and DanMar became our wholly-owned subsidiaries.

Pursuant to the Securities Exchange Agreement, at closing, the two former beneficial stockholders of Juhl Energy and DanMar received an aggregate of 15,250,000 shares of our common stock, representing approximately 60.6% of our outstanding shares of common stock, inclusive of shares of common stock issuable upon the conversion of our series A convertible preferred stock sold in our concurrent private placement. In exchange for the shares we issued to the former Juhl Energy and DanMar stockholders, we acquired 100% of the outstanding common stock of Juhl Energy and DanMar. The consideration issued in the exchange transaction was determined as a result of arm’s-length negotiations between the parties.

Following the exchange transaction, we succeeded to the wind energy business of Juhl Energy and DanMar as our sole line of business. See “Description of Business” below. Prior to the exchange transaction, there were no material relationships between us and Juhl Energy or DanMar, between Juhl Energy or DanMar and our affiliates, directors or officers, or between any associates of Juhl Energy or DanMar and our officers or directors. All of our pre-exchange transaction liabilities were settled on or immediately following the closing.

Description of Our Company and Predecessor

We were formed as a Delaware corporation in January 2006 as Help-U-Drive Incorporated for the purpose of developing a business to assist impaired drivers. Upon further investigation, we decided that this was not a business opportunity we wanted to pursue due to potential liability and other reasons. In October 2006, we acquired My Health and Safety Supply Company, LLC, an Indiana limited liability company, pursuant to a plan of exchange with the holders of 100% of the outstanding membership interests of My Health & Safety Supply Company. We changed our name MH & SC, Incorporated in September 2006. My Health & Safety Supply Company, LLC became our wholly-owned subsidiary and began developing its business to market a variety of health and safety products on the Internet. This business was sold following the exchange transaction as being incidental to our new wind energy business. In March 2007, we filed a registration statement with the U.S. Securities and Exchange Commission (SEC), which became effective in December 2007, and we became a publicly-reporting and trading company.

Following the closing of the share exchange transaction with Juhl Energy and DanMar, we determined to succeed to the wind energy business of Juhl Energy and DanMar as our sole line of business. Accordingly, we believe the past trading history of our common stock should not be viewed as relevant due to the change in our business. Pursuant to the exchange transaction, effective June 24, 2008, we changed our corporate name to Juhl Wind, Inc.

Description of Business

Unless the context otherwise requires, “we,” “our,” “us” and similar expressions refer to Juhl Energy and DanMar together prior to the closing of the exchange transaction on June 24, 2008, and Juhl Wind, Inc., as successor to the business of Juhl Energy and DanMar, following the closing of the share exchange transaction.

Overview of Our Business

We are engaged in the development of a type of wind power in various small communities in the midwestern United States and Canada that has been labeled “community wind power.” Our ultimate goal is to build medium to large-scale wind farms jointly owned by local communities, farm owners and our company. The wind farms are connected to the general utility electric grid to produce clean, environmentally-sound wind power for use by the electric power industry.

Since 2003, we have developed 11 wind farms, accounting for more than 117 megawatts of wind power, that currently operate in the midwest region of the United States. We are presently engaged in various aspects of the development of 16 wind farms totaling an additional 400 megawatts of community wind power systems.

Our projects are based on the formation of partnerships with the farmers upon whose land the wind turbines are installed. Over the years, this type of wind power has been labeled “community wind power” because the systems are actually owned by the farmers themselves and the local communities they serve. The concept of “community wind” was created by Daniel J. Juhl, our Chairman and Chief Executive Officer. Community wind is a specialized sector in the wind energy industry that differs from the large, utility-owned wind power systems that are also being built in the United States. Our goal, and Mr. Juhl’s focus over the past years, is to share ownership with farmers and to build a network of farmer-owned community wind power systems.

Mr. Juhl is an acknowledged expert in the wind power field and is considered a pioneer in the wind industry having been active in the field since the mid-1980s. He was a leader in the passage of specific legislation supporting wind power development in the states of Minnesota and Nebraska. John P. Mitola, our President, has significant experience in the energy industry and electric industry regulation, oversight and governmental policy. Previously, he served as chief executive officer and a director of Electric City Corp., a publicly-held company that specializes in energy efficiency systems, and as the general manager of Exelon Thermal Technologies, a subsidiary of Exelon Corp. that designs and builds alternative energy systems.

Our management has been involved in the wind power industry for more than 25 years. We have experience in the design, manufacture, maintenance and sale of wind turbines, as well as the full-scale development of wind farms. We hold contract rights, are involved with projects in development and under negotiation, and provide development activities in the wind power industry. Our contract rights relate to administrative services agreements which call for management and administrative services to be provided for several existing Minnesota wind farms. Our assets include four wind power development agreements, nine projects in development and under negotiation, agreements to conduct wind power feasibility studies and various development activities in the wind power industry.

Industry and Market Overview

Demand for electricity has dramatically increased as our society has become more technologically driven, and this trend is expected to continue. Significant new capacity for the generation of electricity will be required to meet anticipated demand. According to widely published industry data, nearly half of all electricity produced in the United States is generated by coal, which is the largest source of carbon dioxide in the atmosphere. Other major sources of electricity are nuclear (19%), natural gas (20%), hydropower (7%) and oil (2%) (statistics may be found at Energy Information Administration, U. S. Department of Energy, http://www.eia.doe.gov/kids/energyfacts/sources/electricity.html#Generation). Wind power accounts for nearly 1% of electricity production in the United States, according to the American Wind Energy Association. The amount of electricity generated from coal in the United States increased 63% between 1980 and 2001 (see web page located at eia.doe.gov/emeu/aer/pdf/pages/sec8 17.pdf), and is currently projected to be 51% higher in 2025 than in 2002, (see web page located at eia.doe.gov/oiaf/archive/aeo04/coal.html#ctc).

Most of the world’s main energy sources are still based on the consumption of non-renewable resources such as petroleum, coal, natural gas and uranium. However, while still a small segment of the energy supply, renewable sources such as wind power are growing rapidly in market share. Wind power delivers multiple environmental benefits. Wind power operates without emitting any greenhouse gases and has one of the lowest greenhouse gas lifecycle emissions of any power technology. Wind power results in no harmful emissions, no extraction of fuel, no radioactive or hazardous wastes and no use of water to steam or cooling. Wind projects are developed over large areas, but their carbon footprint is light. Farmers, ranchers and most other land owners can continue their usual activities after wind turbines are installed on their property.

Wind power generation increased seven fold between 1990 and 2010, a rate of 10.4% per year (see web page located at eia.doe.gov/cneaf/electricity/pub_summaries/renew_es.html). Net growth in the wind power industry is expected to exceed 21% per year. Although wind power produces under 1% of electricity worldwide, it accounts for approximately 6% of the renewable energy production worldwide, and 19% of electricity production in Denmark (information at web page eia.doe.gov/kids/energyfacts/sources/renewable/wind.html), 10% in Spain and 7% in Germany. Statistics may be found at Global Wind Energy Council(see web page located gwec.net/index.php?id=11).

Wind power has become a mainstream option for electricity generation, and we believe that it is a critical element to solving climate change and delivering cost-effective domestic power in the United States. The U.S. wind power industry exceeded all previous records in 2007, with 45% growth and over 5,200 megawatts installed (see information at web page gwec.net/index.php?id=24). That new capacity will generate 16 billion kilowatt hours of clean, cost-effective electricity in 2008 (which is equal to powering 1.5 million homes in the United States). Wind power is now one of the largest sources of new electricity generation of any kind. According to a report of the American Wind Energy Association, the national trade association for the wind energy industry, wind projects accounted for about 30% of all new power generating capacity added in the United States in 2007 (see web page located at gwec.net/index.php?id=24).

In 2007, the United States led the world in wind power installations for the third year in a row. The American Wind Energy Association reported that global wind capacity increased by more than 20,000 megawatts with 5,244 megawatts installed in the United States. Spain and China were the second and third largest markets last year with 3,515 megawatts and 3,449 megawatts of wind power capacity added, respectively (see web page located at gwec.net/index.php?id=11).

Wind power can deliver zero-emissions electricity in large amounts. According to the American Solar Energy Society, energy efficiency and renewable energies can provide most, if not all, of the U.S. carbon emission reductions needed to keep atmospheric carbon dioxide levels at no more than 450 to 500 parts per million, the level targeted in the more protective climate change bills before the U.S. Congress. According to the American Wind Energy Association, wind power would offer a large reduction “wedge” by providing about 20% of the U.S. electricity supply.

Furthermore, wind power delivers zero-emissions electricity at an affordable cost. No other power plants being built in the United States today generate zero-emissions electricity at a cost per kilowatt-hour nearly as affordable as wind power. Consequently, using wind power lowers the cost of complying with emissions reduction goals. The affordable cost of wind power is stable over time. Wind projects do not use any fuel for their operations, so the price of wind power does not vary when fuel prices increase. When utilities acquire wind power, they lock in electricity at a stable price for 20 years or more.

Wind, however, is intermittent and electricity generated from wind power can be highly variable. Good site selection and advantageous positioning of turbines on a selected site are critical to the economic production of electricity by wind energy. The primary cost of producing wind-powered electricity is the construction cost. Wind energy has no fuel costs and relative low maintenance costs (see web page located at awea.org/utility/pdf/Wind_and_Reliability_Factsheet.pdf).

We intend to continue to identify sites to produce wind energy in the upper Midwestern United States and Canada.

Growth in Demand for Wind Power and Our Position and Service Offerings

Demand for wind power in the United States is growing rapidly and we believe the call for growth in community wind power is increasing as well. We are one of the few companies that has actually completed and put into operation a portfolio of community wind projects, and we are experiencing strong growth in demand to provide turnkey development of community wind systems across the Midwestern United States. Our strategy is to leverage our portfolio of existing projects and to take on new developments located in the Midwestern United States and Canada, where proper conditions exist for successful developments: acceptable wind resources, suitable transmission access and an appropriate regulatory framework providing acceptable power purchase agreements and long-term utility agreements.

The U.S. Department of Energy recently issued a report entitled “20 Percent Wind Energy by 2030” (available at web page 1.eere.energy.gov/windandhydro/pdfs/41869.pdf), establishing the viability of the potential for wind energy in the United States to grow to approximately 304 gigawatts from today’s level of 16 gigawatts. This projected level of growth is estimated to cost $15 billion per year for the next 22 years of growth. Community wind systems will make up a segment of this growth, leading to what we estimate will be significant growth in community wind systems.

Growth in wind power is being driven by several environmental, socio-economic and energy policy factors that include:

| | · | ongoing increases in electricity demand due to population growth and growth in energy consuming devices such as computers, televisions and air conditioning systems, |

| | · | the increasing cost of the predominant fuels required to drive the existing fleet of conventional electric generation such as coal, natural gas, nuclear and oil, |

| | · | the increasing cost and difficulty faced in the construction of conventional electric generation plants, |

| | · | existing and growing legislative and regulatory mandates for “cleaner” forms of electric generation, including state renewable portfolio standards and the U.S. federal tax incentives for wind and solar generation, |

| | · | ongoing improvements to wind power systems making them more cost effective and improving availability to meet demand and |

| | · | worldwide concern over greenhouse gas emissions and calls to reduce global warming due to the carbon dioxide produced by conventional electric generation. |

In light of these factors and the resulting increase in demand for wind power, we believe that we are uniquely positioned to experience significant year-over-year growth and development of specific community wind farms throughout the United States. We can provide full-scale development of wind farms across the range of required steps including:

| | · | initial feasibility studies and project design, |

| | · | formation of required land right’s agreements to accommodate turbine placement on each project’s specific farm land, |

| | · | transmission interconnection studies, design and agreements with independent system operators (ISOs) and utilities, |

| | · | negotiation and execution of power purchase agreements, |

| | · | arrangement of equity and debt project financing, |

| | · | construction oversight and services, |

| | · | project commissioning and |

| | · | wind farm operations and maintenance. |

In addition, we can provide general consulting services to help farmers and communities evaluate possible community wind farm projects and initiate their development. Often, we will take on the entire development process including all of the services outlined above. As project developer, we arrange every aspect of the development process and would receive payment for the services as each step or a combination of steps is accomplished. After establishing that a project has appropriate wind resource and transmission interconnection, we would move on to complete land right’s agreements, community limited liability company structures and the power purchase agreement with the local utility.

Through the community wind approach, we involve land owners and the local community by establishing a limited liability company that extends ownership to the participants along with the initial equity investor. Land owners are critical to any wind farm because wind turbines must be placed in open areas requiring a large amount of land necessary to “harvest the wind.” Turbines are typically placed on a small plot of land, less than one acre is removed from normal use (such as farming or grazing), for each 50 acres of wind resource captured. Turbines must be spaced a certain minimum distance apart to avoid “shadowing” each other and reducing power output. By integrating the land owners into the land rights and ownership structures, we can allow a wind-enabled farm to more than double the annual net income from cultivation or grazing. We also find financing, secure a contract with a utility to buy the electricity produced, purchase the equipment and contract for the construction of the system, and arrange for operation of the wind farm.

Company Structure

As a result of the exchange transaction, Juhl Energy and DanMar are our wholly-owned subsidiaries. Juhl Energy and DanMar have primarily been involved in providing development, management and consulting services to various wind farm projects throughout the midwest. DanMar was incorporated in January 2003 and is located in Woodstock, Minnesota. In September 2007, DanMar assigned certain development and management business to a newly-formed corporation, Juhl Energy.

Juhl Energy also has a subsidiary, Community Wind Development Group LLC, which was a predecessor to Juhl Energy in the nature of the work provided, but which had more than one owner. Upon formation of Juhl Energy, it was determined to be in the best interests of Juhl Energy to consolidate ownership in Community Wind Development, so the other owners’ equity interests were acquired by Juhl Energy on January 1, 2008. The operations of Community Wind Development have been consolidated with Juhl Energy since the acquisition date.

Historically, DanMar and Juhl Energy have both engaged in similar development, management and consulting projects. It is our intention that prospectively, the companies will perform separate functions. DanMar will engage in purely consultative projects, offering solely advice on projects being developed by the owners of the projects or other third parties. Juhl Energy will engage in development and construction projects where Juhl Energy will, in many cases, oversee the entire development of wind farms.

Our Community Wind Farm Portfolio

We believe that we have completed and placed into service more community wind power systems than any other U.S. enterprise. To date, we have developed 11 community wind farms located primarily in the “Buffalo Ridge” area of southwestern Minnesota. These systems have been developed since the mid-1980s and total more than 117 megawatts. They are fully operational today. In addition, we provide operating and maintenance services to five of the 11 existing wind farms.

In addition to the first 11 wind farms developed by us, we have another 16 community wind projects in various phases of development totaling more than 400 megawatts. These projects are primarily located in the states of Minnesota, Nebraska and South Dakota. A sampling of the projects, which are in the phase of development referenced below, include the following:

Project Name | | Megawatts | | Phase |

| Existing Wind Farms | | 84 | | Operational |

| Grant County, MN | | 20 | | Construction |

| Valley View, MN | | 10 | | Construction |

| Traverse County, MN | | 20 | | Construction 2009 |

| Crofton Hills, NE | | 42 | | Construction 2009 |

| Brownsdale (2 projects), MN | | 50 | | Financing and PPA |

| Kittson/Marshall, MN | | 80 | | Interconnection Study |

| Kennedy/Kittson, MN | | 20 | | Interconnection Study |

| Meeker, MN | | 20 | | Interconnection Study |

| Thief River Falls, MN | | 20 | | Feasibility |

7 Additional Midwest Projects (Projects not yet announced) | | 118 | | Initial Study/Feasibility |

Based on our pipeline of projects, we believe that we will experience consistent growth in the number of projects completed and the number of projects for which we are providing operational oversight. We expect that the continued growth in our project pipeline will act as a key competitive advantage as the community wind power industry grows throughout the United States and Canada.

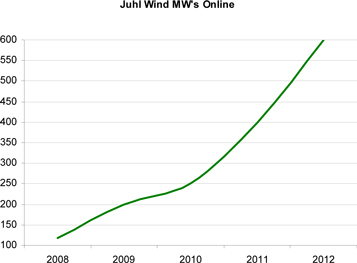

Estimated Wind Farm Growth

The chart below reflects our management’s estimates only and may vary due to project timing, turbine availability and ability to obtain financing and other factors. See “Risk Factors” below.

Growth Strategy

We specialize in the development of community wind power systems, and we believe that we are among the leaders in the field. Our growth strategy is anchored by the competitive advantage of our portfolio of completed projects coupled with the projects we currently have under development. Our plan is to continue to provide the full range of development services across each phase of development, which we expect will grow our revenue and profitability from each project under development.

In addition to growing our revenue per project, we will continue to grow our projects under development by utilizing competitive strengths and taking advantage of market conditions to build long-term growth, as follows:

| | · | We expect to increase our capacity by entering regional markets through organic development. Upon entering a market we work to become a leading wind energy operator and an influential voice within the region. We strive to develop projects in-house from the initial site selection through construction and operation. |

| | · | We may acquire developers of community wind systems that currently have developments underway. However, at the present time, we have not entered into any agreements or understandings with respect to any potential acquisitions. |

| | · | We expect to create relationships as a community stakeholder. We prioritize the creation of strong community relationships that we believe are essential to generating support and securing land and permits necessary for our wind farms. Our team works closely with the landowners who will host the wind farms to ensure that they fully understand the impact of having turbines on their property. Throughout the development process, we assess and monitor the landowners’ and broader community’s receptiveness and willingness to host a wind farm in their area. This proactive involvement in the community also enables us to submit permit applications that comply with local regulations while addressing local concerns. |

| | · | We expect to work with governmental agencies to help us incent the creation of community wind farms and offer favorable tax breaks. Further, we intend to use tax equity financing arrangements in order to monetize the value generated by production tax credits and accelerated tax depreciation that are available to us as a wind energy generator. |

| | · | We will continue to strive to attract, train and retain the most talented people in the industry. As we continue to grow our business, we will need to attract, train and retain additional employees. We believe that our management team will be instrumental in attracting new and experienced talent, such as engineers, developers and meteorology experts. We plan to provide extensive training and we believe that we offer an attractive employment opportunity in the markets in which we operate. |

Sales and Marketing

We derived approximately 50% and 42% of our revenue from sales to five wind farm customers under management agreements in 2007 and 2006, respectively.

Historically, DanMar and Juhl Energy have not relied on any direct sales or marketing efforts, but have gained exposure through trade publications, word of mouth and industry conferences. We currently have a pipeline of projects we believe will last at least two years and it is being supplemented on an on-going basis without direct selling efforts. We anticipate being able to add a significant number of projects to this pipeline driven primarily by Daniel J. Juhl and John P. Mitola, trade publications, industry events and word of mouth. Our web site, www.juhlwind.com, will also serve as a marketing tool. If, at some point, management determines the pipeline of potential customers is less than anticipated or desired, or if we are unable to sustain our desired rate of growth and expansion with these sales and marketing methods, we will reevaluate the sales and marketing efforts and address the issue at that time.

Wind Energy Technology, Resources and Suppliers

Wind power is a form of renewable energy; that is, energy that is replenished daily by the sun. As portions of the earth are heated by the sun, air rushes to fill the low pressure areas, creating wind power. The wind is slowed dramatically by friction as it brushes the ground and vegetation. It may not feel very windy at ground level, yet the power in the wind may be five times greater at the height of a 40 story building (the height of the blade tip on a large, modern wind turbine) than the breeze an individual encounters at ground level.

Wind power is converted to electricity by a wind turbine. In a typical, modern large-scale wind turbine, the kinetic energy in the wind (the energy of moving air molecules) is converted to rotational motion by the rotor (a three-bladed assembly at the front of the wind turbine). The rotor turns a shaft which transfers the motion into the nacelle (the large housing at the top of a wind turbine tower). Inside the nacelle, the slowly rotating shaft enters a gearbox that greatly increases the rotational shaft speed. The output (high-speed) shaft is connected to a generator that converts the rotational movement into electricity at medium voltage (a few hundred volts). The electricity flows down heavy electric cables inside the tower to a transformer, which increases the voltage of the electric power to the distribution voltage (a few thousand volts). Higher voltage electricity flows more easily through electric lines, generating less heat and fewer point losses. The distribution-voltage power flows through the underground lines to a collection point where the power may be combined with other turbines. In many cases, the electricity is sent to nearby farms, residences and towns where it is used. Otherwise, the distribution-voltage power is sent to a substation where the voltage is increased dramatically to transmission-voltage power (a few hundred thousand volts) and sent through very tall transmission lines many miles to distant cities and factories.

Wind turbines come in a variety of sizes, depending upon the use of the electricity. A large, utility-scale turbine described above may have blades over 40 meters long, meaning the diameter of the rotor is over 80 meters (nearly the length of a football field). The turbines might be mounted on towers 80 meters tall (one blade would extend half way down the tower), produce 1.8 megawatts of power (1800 kilowatts), supply enough electricity for 600 homes and cost over $1.5 million. Wind turbines designed to supply part of the electricity used by a home or business are much smaller and less costly. A residential - or farm-sized turbine - may have a rotor up to 15 meters (50 feet) in diameter mounted on a metal lattice tower up to 35 meters (120 feet) tall. These turbines may cost from as little as a few thousand dollars for very small units up to approximately $40,000 to $80,000.

Wind industry manufacturing facilities surged from a very small base in the United States in 2005 to over 100 in 2007, and many existing facilities are expanding. In 2007, new tower, blade, turbine and assembly plants opened in the states of Illinois, Iowa, South Dakota, Texas and Wisconsin. Also in 2007, seven other facilities were announced in the states of Arkansas, Colorado, Iowa, North Carolina, New York and Oklahoma.

Competition

In the United States, large utility companies dominate the energy production industry and coal continues to dominate as the primary resource for electricity production. Electricity generated from wind energy faces competition from other traditional resources such as nuclear, oil and natural gas. The advantages of conventional production of electricity are that:

| | · | the technology and infrastructure already exist for the use of fossil fuels such as coal, oil and natural gas, |

| | · | commonly-used fossil fuels in liquid form such as light crude oil, gasoline and liquefied petroleum gas are easy to distribute and |

| | · | petroleum energy density (an important element in land and air transportation fuel tanks) in terms of volume (cubic space) and mass (weight) is superior to some alternative energy sources. |

However, energy produced by conventional resources also faces a number of challenges including:

| | · | the inefficient atmospheric combustion (burning) of fossil fuels leads to the release of pollution into the atmosphere including carbon dioxide which is largely considered the primary cause of global warming, |

| | · | dependence on fossil fuels from volatile regions or countries of the world creates energy security risks for dependent countries, |

| | · | fossil fuels are non-renewable unsustainable resources which will eventually decline in production and become exhausted with potentially dire consequences to societies that remain highly dependent on them and |

| | · | extraction of fossil fuels is becoming more expensive and more dangerous as readily-available resources are exhausted and mines get deeper and oil rigs must drill deeper and further out in oceans. |

In contrast, electricity generated from wind energy:

| | · | produces no water or air pollution that can contaminate the environment because there are no chemical processes involved in wind power generation; therefore, there are no waste by-products such as carbon dioxide, |

| | · | does not contribute to global warming because it does not generate greenhouse gases, |

| | · | is a renewable source of energy and |

| | · | in the case of community wind power, farming and grazing can still take place on land occupied by wind turbines. |

However, wind energy producers also face certain obstacles including:

| | · | the reality that wind is unpredictable and, therefore, wind power is not predictably available, and when the wind speed decreases, less electricity is generated, |

| | · | residents in communities where wind farms exist may consider them an “eyesore” and |

| | · | wind farms, depending on the location and type of turbine, may negatively affect bird migration patterns and may pose a danger to the birds themselves; however, newer, larger wind turbines have slower moving blades which seem to be visible to most birds. |

We expect that primary competition for the wind power industry will continue to come from utility company producers of electricity generated from coal and other non-renewable energy sources.

Within the U.S. wind power market itself, there is also a high degree of competition, with growth opportunities in all sectors of the industry regularly attracting new entrants. For example, in 2007, over 15 utility-scale wind turbine manufacturers are selling turbines in the United States market, up from only six in 2005.

New entrants in the wind power development market, however, face certain barriers to entry. The capital costs of buying and maintaining turbines are high. Other significant factors include the cost of land acquisition, the availability of transmission lines, land use considerations and the environmental impact of construction and operations. Finally, another critical barrier to entry into the wind power development business is the necessary experience required to bring project to the point where they are able to secure interconnection agreements, power purchase agreements and project financing for construction.

We are aware of two companies that are working in the community wind power area and which management views as being competitive with certain aspects of our company. They are:

Nacel Energy - A community wind development company founded in 2006 and focused on developing community wind projects in Texas and Kansas. To our knowledge, Nacel Energy has yet to fully complete the development of a project.

Wind Energy America - This company is located in and focused on community wind power in Minnesota and is currently employing a strategy where it purchases rights to current or developing wind projects.

Our Competitive Advantages

We believe that we have a number of competitive advantages in the community wind energy production sector; one of our key advantages being that we have completed 11 community wind farm projects to date totaling more than 117 megawatts. We expect that when new projects are considering retaining a development enterprise, the ability to point to actual projects completed, along with the extensive knowledge base developed and relationships necessary to get the job done, will provide us an edge in winning projects in the future. These relationships include those with utility power purchasers, equity and debt project finance sources, turbine suppliers and constructors.

We believe that our experience in developing wind farms in new market areas and in operating energy companies will enable us to continue to successfully expand our development portfolio. Further, we believe our management’s understanding of deregulated energy markets enables us to maximize the value of our development portfolio. Our team has experience in site selection, market analysis, land acquisition, community relations, permitting, financing, regulation and construction.

For community wind projects to be completed successfully, projects must be constructed in a cost-effective manner. In the course of completing 11 projects to date, we have been able to demonstrate to project owners, equity investors and lenders, that we can build wind farms on a cost-effective basis.

In the midwestern U.S. markets where we are active, our management team maintains local presence and promotes community stakeholder involvement. By maintaining offices in Woodstock, Minnesota and Chicago, Illinois, and becoming involved in local community affairs, we develop a meaningful local presence, which we believe provides us with a significant advantage when working through the local permitting processes and helps to enlist the support of our local communities for wind farms. We believe that our local approach has enabled us to secure approvals and support for our projects in regions that have historically voiced meaningful opposition and has given us a significant advantage over competitors, who are not as active in the local communities in which we are developing wind farms. Our management’s active participation in the state and local regulatory and legislative processes has led to the growth of community wind across the Midwest.

As a result of our project portfolio and industry-respected management team, we enjoy strong relationships with key trading partners that are required for successful wind farm development. These relationships include regulators, turbine suppliers, electric component suppliers, equity investors, project lenders, engineering firms, constructors, electric transmission operators and electric utilities.

Intellectual Property

We depend on our ability to develop and maintain the proprietary aspects of our technology to distinguish our products from our competitors’ products. To protect our proprietary technology, we rely primarily on a combination of confidentiality procedures. It is our policy to require employees and consultants to execute confidentiality agreements and invention assignment agreements upon the commencement of their relationship with us. These agreements provide that confidential information developed or made known during the course of a relationship with us must be kept confidential and not disclosed to third parties except in specific circumstances and for the assignment to us of intellectual property rights developed within the scope of the employment relationship.

Government Regulation

Traditionally, utility markets in the United States have been highly regulated. The U.S. power industry is currently in transition as it moves toward a more competitive environment in wholesale and retail markets. The commercial viability of wind power will increasingly depend upon pricing as the trend toward deregulation continues.

Management anticipates that additional favorable government legislation will have a positive impact on our business.

The growing concern over global warming caused by greenhouse gas emissions has also contributed to the growth in the wind energy industry. According to the Intergovernmental Panel on Climate Change Fourth Assessment Report, experts have noted that 11 of the last 12 years (1995-2006) rank among the warmest years since 1850. Additionally, the global average sea level has risen at an average rate of 1.8 millimeters per year since 1961 and at 3.1 millimeters per year since 1993, due to the melting of glaciers, ice caps and polar ice sheets, coupled with thermal expansion of the oceans. The importance of reducing greenhouse gases has been recognized by the international community, as demonstrated by the signing and ratification of the Kyoto Protocol, which requires reductions in greenhouse gases by the 177 (as of March 2008) signatory nations. While the United States did not ratify the Kyoto Protocol, state-level initiatives have been undertaken to reduce greenhouse gas emissions. California was the first state to pass global warming legislation, and ten states on the east coast have signed the Regional Greenhouse Gas Initiative, which proposes to require a 10% reduction in power plant carbon dioxide emissions by 2019.

Various state and federal governments have placed restrictions on fossil fuel emissions and it is anticipated that additional requirements for limitation of such emissions will continue. Substituting wind energy for traditional fossil fuel-fired generation would help reduce carbon dioxide emissions due to the environmentally-friendly attributes of wind energy. According to the Energy Information Administration, the United States had the highest carbon dioxide emissions of all countries in the world in 2005, contributing approximately 20% of the world's carbon dioxide emissions. Since 1990, carbon dioxide emissions from the United States' electric power industry have increased by a cumulative amount of 27%, from 1.9 billion metric tons to 2.5 billion metric tons.

Environmental legislation and regulations provide additional incentives for the development of wind energy by increasing the marginal cost of energy generated through fossil-fuel technologies. For example, regulations such as the Clean Air Interstate Rule and the Regional Haze Rule have been designed to reduce ozone concentrations, particulate emissions and haze and other requirements to control mercury emissions can require conventional energy generators to make significant expenditures, implement pollution control measures or purchase emissions credits to meet compliance requirements. These measures have increased fossil fuel-fired generators' capital and operating costs and put upward pressure on the market price of energy. Because wind energy producers are price takers in energy markets, these legislative measures effectively serve to make the return on wind energy more attractive relative to other sources of generation.

We believe there is significant support in the U.S. to enact legislation that will attempt to reduce the amount of carbon dioxide produced by electrical generators. Although the ultimate form of legislation is still being debated, the two most likely alternatives are (i) a direct emissions tax or (ii) a cap-and-trade regime. We believe either of these alternatives would likely result in higher overall power prices, as the marginal cost of electricity in the U.S. is generally set by carbon intensive generation assets which burn fossil fuels such as oil, natural gas and coal. As a non-carbon emitter and a market price taker, we are positioned to benefit from these higher power prices.

Growth in the United States' wind energy market has also been driven by state and federal legislation designed to encourage the development and deployment of renewable energy technologies. This support includes:

Renewable Portfolio Standards (RPS)

In response to the push for cleaner power generation and more secure energy supplies, many states have enacted RPS programs. These programs either require electric utilities and other retail energy suppliers to produce or acquire a certain percentage of their annual electricity consumption from renewable power generation resources or, as in the case of New York, designate an entity to administer the central procurement of RECs for the state. Wind energy producers generate renewable energy certificates due to the environmentally beneficial attributes associated with their production of electricity.

According to the United States Department of Energy-Energy Efficiency and Renewable Energy (April 2008), the number of states with RPS programs has doubled in the last six years and, as of April 2008, 31 states and the District of Columbia had adopted some form of RPS program. The report also indicates the District of Columbia and 25 of the 31 states have mandatory RPS requirements and combined, these 25 states represent over 50% of total U.S. electrical load. A number of states including Arizona, California, Colorado, Minnesota, Nevada, New Jersey, New Mexico, Pennsylvania and Texas, have been so successful in meeting their original RPS targets that they have revised their programs to include higher targets. The report adds that other states such as Missouri, North Dakota, South Dakota, Utah, Vermont and Virginia have adopted state goals, which set targets, not requirements, for certain percentages of total energy to be generated from renewable resources. .

Almost every state that has implemented an RPS program will need considerable additional renewable energy capacity to meet its RPS requirements. Much of the forecasted 50,000 megawatt installed wind capacity by 2015 (forecast by Emerging Energy Research) will be driven by current and proposed RPS targets, along with additional demand from states without renewable standards.

Renewable Energy Certificates (REC)

A REC is a stand-alone tradable instrument representing the attributes associated with one megawatt hour of energy produced from a renewable energy source. These attributes typically include reduced air and water pollution, reduced greenhouse gas emissions and increased use of domestic energy sources. Many states use RECs to track and verify compliance with their RPS programs. Retail energy suppliers can meet the requirements by purchasing RECs from renewable energy generators, in addition to producing or acquiring the electricity from renewable sources. Under many RPS programs, energy providers that fail to meet RPS requirements are assessed a penalty for the shortfall, usually known as an alternative compliance payment. Because RECs can be purchased to satisfy the RPS requirements and avoid an alternative compliance payment, the amount of the alternative compliance payment effectively sets a cap on REC prices. In situations where REC supply is short, REC prices approach the alternative compliance payment, which in several states is approximately $50 to $59 per megawatt hour. As a result, REC prices can rival the price of energy and RECs can represent a significant additional revenue stream for wind energy generators.

Production Tax Credits (PTC)

The PTC provides wind energy generators with a credit against federal income taxes, annually adjusted for inflation, for a duration of ten years from the date that the wind turbine is placed into service. In 2007, the PTC was $20 per megawatt hour. Wind energy generators with insufficient taxable income to benefit from the PTC may take advantage of a variety of investment structures to monetize the tax benefits.

The PTC was originally enacted in 1992 for windparks placed into service after December 31, 1993 and before July 1, 1999. The PTC subsequently has been extended five times, but has been allowed to lapse three times (for periods of three, six and nine months) prior to retroactive extension. Currently, the PTC is scheduled to expire on December 31, 2008, unless an extension or renewal is enacted into law.

Accelerated Tax Depreciation

Tax depreciation is a non-cash expense meant to approximate the loss of an asset's value over time and is generally the portion of an investment in an asset that can be deducted from taxable income in any given tax period. Current federal income tax law requires taxpayers to depreciate most tangible personal property placed in service after 1986 using the modified accelerated cost recovery system, or MACRS, under which taxpayers are entitled to use the 200% or 150% declining balance method depending on the class of property, rather than the straight line method. In addition, under MACRS, a significant portion of windpark assets is deemed to have depreciable life of five years which is substantially shorter than the 15 to 25 year depreciable lives of many non-renewable power supply assets. This shorter depreciable life and the accelerated depreciation method results in a significantly accelerated realization of tax depreciation for windparks compared to other types of power projects. Wind energy generators with insufficient taxable income to benefit from this accelerated depreciation often monetize the accelerated depreciation, along with the PTCs, through forming a limited liability company with third parties.

Facilities

Our corporate office is located at 996 190th Avenue, Woodstock, Minnesota 56186. We occupy approximately 2,000 square feet of office and storage space under a ground lease with Kas Brothers, relatives of an employee of our company. DanMar subsequently erected a barn-type structure with functional office space on the leased property and owns the building located on the property. In consideration of the ground lease, we pay the real property taxes for the land leased to us, which was $2,100 in 2007. We also utilize approximately 200 square feet of office space in Chicago, Illinois without charge, and we will likely need to acquire leasehold space in Chicago in the near future.

Employees

As of June 24, 2008, we employed seven full-time employees, excluding employees and consultants of any affiliated companies that are not at least 50%-owned subsidiaries of ours. None of our employees is subject to a collective bargaining agreement and we believe that relations with our employees are very good. We also frequently use third party consultants to assist in the completion of various projects. Third parties are instrumental to keep the construction and development of projects on time and on budget.

Legal Proceedings

We are not currently involved in any pending or threatened litigation or other legal proceedings.

Risk Factors

Our business involves significant risks and uncertainties, many of which are beyond our control, and any investment in our common stock involves a high degree of risk. Discussed below are many of the material risk factors faced by us that may have an impact on our future results.

Risks Related to Our Business and Our Industry

We are still in an early stage of development and have earned limited revenues to date.

We have earned limited revenue to date and have supported our operations primarily through cash flow from consulting services and wind farm management, and debt and private equity investment. Our operations are subject to all of the risks inherent in the establishment of a new business enterprise. Our likelihood of success must be considered in light of the problems, expenses, difficulties, complications and delays frequently encountered in connection with a new business and the development of an alternative energy generation platform. For the year ended December 31, 2007, we had total revenue of $707,161 and net income of $296,767. At December 31, 2007, we had total stockholder’s equity of $677,935, a decline of $80,970 from December 31, 2006. Total stockholder’s equity increased $59,444 to $737,379 as of March 31, 2008. On a pro forma basis on March 31, 2008, after giving effect to the completion of the exchange transaction and private placement, our stockholders’ equity increased $421,222 to $1,158,601. See “Description of Business” and Financial Statements. For the three-month period ended March 31, 2008, we had unaudited total revenue of $164,690, compared to total revenue of $146,035 for the comparable period in 2007. We had net income of $54,563 for the three months ended March 31, 2008, compared to net income of $70,478 for the comparable 2007 period. We cannot assure you that we will continue to have net income in the future.

We are dependent on Daniel J. Juhl’s leadership of our company.

Our business depends on the availability to us of Daniel J. Juhl, our Chairman of the Board and Chief Executive Officer. Mr. Juhl founded Juhl Energy and DanMar, and has been a pioneer in the community wind power industry. The business contacts and relationships that we maintain are predominantly those of Mr. Juhl. Our business would be materially and adversely affected if his services would become unavailable to us. We cannot assure you that Mr. Juhl will continue to be available to us, although we have entered into a three-year employment agreement with Mr. Juhl expiring in December 2011 and maintain key-man life insurance for our benefit on Mr. Juhl’s life in the amount of $3.0 million.

We have a limited operating history and we have not demonstrated that we can manage electricity generating stations on a large scale.

We have a limited history of managing electricity generating stations and limited data upon which you can evaluate our business. Our prospects for success must be considered in the context of a new company in a developing industry. The risks we face include developing and acquiring wind farms, compliance with significant regulation, reliance on third parties, operating in a competitive environment in which electricity rates will be set by the operation of market forces and regulatory constraints, uncertain performance of electricity generating stations, financing our business and meeting the challenges of the other risk factors described below. If we are unable to address all of these risks, our business, results of operations and financial condition may suffer.

Revenues from wind farms are subject to fluctuating market prices for energy and capacity.

The revenues generated by wind farms depend on market prices of energy in competitive wholesale energy markets. Market prices for both energy and capacity are volatile and depend on numerous factors outside our control including economic conditions, population growth, electrical load growth, government and regulatory policy, weather, the availability of alternate generation and transmission facilities, balance of supply and demand, seasonality, transmission and transportation constraints and the price of natural gas and alternative fuels or energy sources. The wholesale power markets are also subject to market regulation by the Federal Energy Regulatory Commission, independent system operators, and regional transmission operators which can impact market prices for energy and capacity sold in such markets, including by imposing price caps, mechanisms to address price volatility or illiquidity in the markets or system instability and market power mitigation measures. We cannot assure you that market prices will be at levels that enable us to operate profitably or as anticipated. A decline in electricity or capacity market prices below anticipated levels could have a material adverse impact on our revenues or results of operations. In markets where wind farms qualify to receive capacity payments, it is typical that only a portion of the wind farm’s capacity is eligible to receive capacity payments. This portion is typically based on the previous year’s average net capacity factor during peak periods. In addition, changes to regulatory policy or market rules regarding the qualification of wind generation as a capacity resource could limit or eliminate a wind farm’s ability to receive payments for its generating capacity.

There are a small number of wind turbine manufacturers, and increased demand may lead to difficulty in obtaining wind turbines and related components at affordable prices or in a timely manner.

There are only a small number of companies that have the expertise and access to the necessary components to build multi-megawatt class wind turbines. The rapid growth in the aggregate worldwide wind energy industry has created significantly increased demand for wind turbines and their related components that is currently not being adequately satisfied by suppliers. Wind turbine suppliers have significant supply backlogs, which tend to drive up prices and delay the delivery of ordered wind turbines and components. Any delays in the delivery to us of ordered wind turbines and components may delay the successful completion of our wind farms under development. Additionally, price increases may make it more costly for us to acquire wind turbines.

We cannot assure you that our wind farms will be able to purchase a sufficient quantity of turbines and other technical equipment to satisfy demand or that wind turbine and other component manufacturers will not give priority to other market participants, including competitors of ours. To the extent that wind turbine manufacturers become unable or unwilling to supply wind turbines, our wind farms may be unable to find suitable replacements. Such inability to acquire turbines would have a material adverse effect on our business prospects, results of operations and financial condition.

The federal government may not extend or may decrease tax incentives for renewable energy, including wind energy, which would have an adverse impact on our development strategy.

Federal tax incentives applicable to the wind energy industry currently in effect include the production tax credit (“PTC”) and accelerated tax depreciation for certain assets of wind farms. The current version of the PTC provides the owner of a wind turbine placed in operation before the end of 2008 with a ten-year credit against its federal income tax obligations based on the amount of electricity generated by the wind turbine. The accelerated depreciation for certain assets of wind farms provides for a five-year depreciable life for these assets, rather than the 15 to 25 year depreciable lives of many non-renewable energy assets.

The PTC is scheduled to expire on December 31, 2008, and, unless extended or renewed by the U.S. Congress, will not be available for energy generated from wind turbines placed in service after that date. To date, legislative efforts to extend the PTC have failed, and we cannot assure you that current or any subsequent efforts to extend or renew this tax incentive will be successful or that any subsequent extension or renewal will be on terms that are as favorable as those that currently exist. In addition, there can be no assurance that any subsequent extension or renewal of the PTC would be enacted prior to its expiration or, if allowed to expire, that any extension or renewal enacted thereafter would be enacted with retroactive effect. We also cannot assure you that the tax laws providing for accelerated depreciation of wind farm assets will not be modified, amended or repealed in the future. If the federal PTC is not extended or renewed, or is extended or renewed at a lower rate, financing options for wind farms will be reduced and development plans for additional wind farms will be adversely affected.

Tax equity investors have limited funds, and wind energy producers compete with other renewable energy producers for tax equity financing. In the current rapidly expanding market, the cost of tax equity financing may increase and there may not be sufficient tax equity financing available to meet the total demand in any year. In addition, one or more current tax equity investors may decide to withdraw from this market thereby depleting the pool of funds available for tax equity financing. Alternative financing will be more expensive and there may not be sufficient liquidity in alternate financial markets. As a result, development of additional wind farms by us would be adversely affected.

Industry sales cycles can be lengthy and unpredictable.

Sales cycles with companies that purchase electricity from generators to supply electricity to consumers are generally long and unpredictable due to budgeting, purchasing and regulatory processes which can take longer than expected to complete. Our customers will typically issue requests for quotes and proposals, establish evaluation committees, review different technical options with vendors, analyze performance and cost/benefit justifications and perform a regulatory review, in addition to applying the normal budget approval process within an organization. Delays in completing these processes can cause delays in purchasing and variability to our financial projections and could adversely affect results of operations.

The performance of wind farms is dependent upon meteorological and atmospheric conditions that fluctuate over time.

The production of electricity generated by wind farms will be the source of substantially all of our revenues. As a result, our results of operations will be highly dependent on meteorological and atmospheric conditions.

Site selection requires the evaluation of the quality of the wind resources based upon a variety of factors. The wind data gathered on site and data collected through other sources form the basis of wind resource projections for a wind farm's performance, revenue generation, operating profit, project debt capacity, project tax equity capacity and return on investment, which are fundamental elements of our business planning. Wind resource projections at the time of commercial operations can have a significant impact on the level of capital that we can raise. Wind resource projections do not predict the wind at any specific period of time in the future. Therefore, even in the event where prediction of a wind farm's wind resources becomes validated over time, the wind farm will experience hours, days, months and even years that are below wind resource predictions. Wind resource projections may not predict the actual wind resources observed by the wind farm over a long period of time. Assumptions included in wind resource projections, such as the interference between turbines, effects of vegetation and land use, and terrain effects may not be accurate. Wind resources average monthly and average time of day long-term predictions may not be accurate and, therefore, the energy wind farms produce over time may have a different value than forecast. If as a result of inaccurate wind resource projections, the performance of one or more of our wind farms falls below projected levels, our business, results of operations and financial condition could be materially adversely affected.

Operational factors may reduce energy production below projections, causing a reduction in revenue.

The amount of electricity generated by a wind farm depends upon many factors in addition to the quality of the wind resources, including but not limited to turbine performance, aerodynamic losses resulting from wear on the wind turbine, degradation of other components, icing or soiling of the blades and the number of times an individual turbine or an entire wind farm may need to be shut down for maintenance or to avoid damage due to extreme weather conditions. In addition, conditions on the electrical transmission network can impact the amount of energy a wind farm can deliver to the network. We cannot assure you that any of our wind farms will meet energy production expectations in any given time period.

If wind farm energy projections are not realized, we could face a number of material consequences, including the following:

| · | our sales of energy may be significantly lower than forecast, |

| · | the amount of capacity permitted to be sold from our wind farms may be lower than forecast and |

| · | our wind farms may be unable to meet the obligations of agreements based on projected production and as a result revenue would be lower than forecasted. |

Operation of our wind power stations is subject to disruption.

As with all power generation facilities, operation of our electricity generating stations will involve operating risks, including:

| | · | our possible inability to achieve the output and efficiency levels for our electricity generating stations that we have projected, |

| | · | facility shutdown due to a breakdown or failure of equipment or processes, violation of permit requirements (whether through operations or change in law), operator error or catastrophic events such as fires, explosions, floods or other similar occurrences affecting us, our electricity generating stations or third parties upon which our business may depend and |

| | · | disputes with labor unions in which certain personnel involved in the operation of our electricity generating stations are members and disputes under various collective bargaining agreements applicable to our electricity generating stations. |

The wind farms which we currently manage are located in the state of Minnesota. If changes occur in the Minnesota market or its regulatory environment in a manner that negatively affects our business, it could have a negative effect on our results of operations and financial condition.

The occurrence of one or more of these events could significantly reduce revenues expected to be produced by our electricity generating stations or significantly increase the expenses of our electricity generating stations, thereby adversely affecting our business, results of operations and financial condition.

Our financial projections assume that we will be able to operate our electricity generating stations nearly continually and we may have trouble meeting our obligations if we are not successful.

We will need to achieve high levels of availability and dispatch for our electricity generating stations to operate profitably. We operate under the assumption that we will achieve high levels of availability and dispatch in developing the revenue figures included in our financial projections. However, developments could affect the dispatch rate of our electricity generating stations, including the following:

| | · | equipment problems or other problems which affect the ability of our electricity generating stations to operate, |

| | · | non-utility generators being placed before our electricity generating stations in the dispatch sequence of generating plants, |

| | · | extended operation of nuclear generating plants beyond their presently expected dates of decommissioning or resumption of generation by nuclear facilities that are currently out of service, |

| | · | implementation of additional or more stringent environmental compliance measures or |

| | · | the construction of new generating plants which may be more efficient and cost effective than our electricity generating stations. |

The wind energy industry is extensively regulated and changes in or new regulations or delays in regulatory approval could hurt our business development.