DEFINITIVE PROXY STATEMENT

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Proxy Statement Pursuant to Section 14(a) of

The Securities Exchange Act of 1934

Filed by the Registrant [X]

Filed by a Party other than a Registrant [ ]

Check the appropriate box:

[ ] Preliminary Proxy Statement

[ ] Confidential, for Use of the Commission Only (as permitted by Rule 14(a)-6(e)(2))

[X] Definitive Proxy Statement

[ ] Definitive Additional Materials

[ ] Soliciting Material Pursuant to §240.14a-12

Juhl Energy, Inc. |

(Name of Registrant as Specified In Its Charter) |

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

|

Payment of Filing Fee (Check the appropriate box): |

[X] No fee required. |

[ ] Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11 |

1) Title of each class of securities to which transaction applies: |

|

2) Aggregate number of securities to which transaction applies: |

|

3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

|

4) Proposed maximum aggregate value of transaction: |

|

5) Total fee paid: |

|

[ ] Fee paid previously with preliminary materials. |

[ ] Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

1) Amount Previously Paid: |

|

2) Form, Schedule or Registration Statement No.: |

|

3) Filing Party: |

|

4) Date Filed: |

|

|

Juhl Energy, Inc.

Notice of Annual Meeting of Stockholders

To Be Held on Tuesday, August 13, 2013

To the Stockholders of Juhl Energy, Inc.:

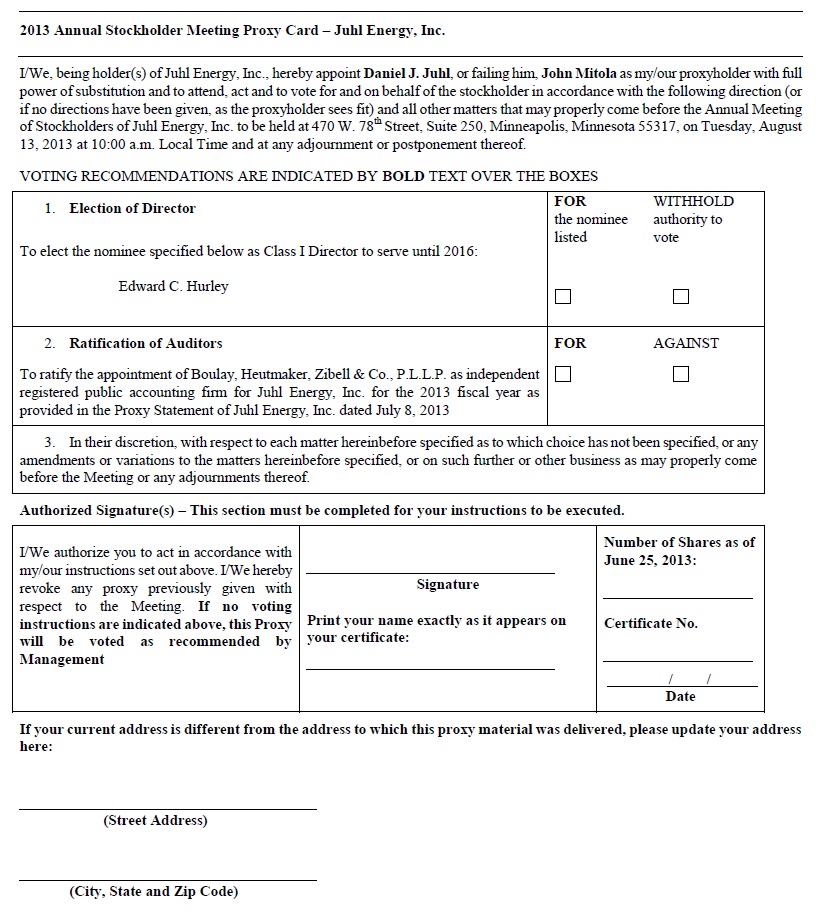

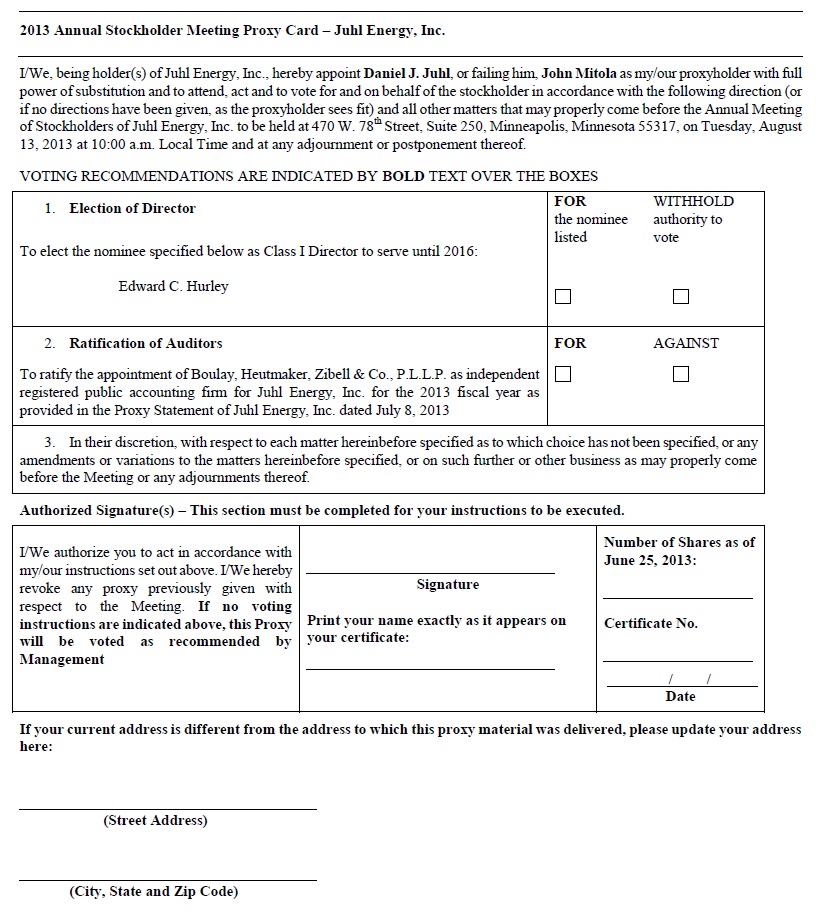

NOTICE IS HEREBY GIVEN that the Annual Meeting of Stockholders (the “Meeting”) of Juhl Energy, Inc. (the “Company”) will be held on Tuesday, August 13, 2013, at 10 a.m. Local Time, at offices of the Company at 470 W. 78th Street, Suite 250, Minneapolis, Minnesota 55317, for the purpose of considering and voting upon the following matters:

| | 1. | To elect one (1) Class I director, for a term of three (3) years to serve until the 2016 annual meeting of stockholders; |

| | 2. | To ratify the appointment of Boulay, Heutmaker, Zibell & Co., P.L.L.P. as the Company’s independent registered public accounting firm for the 2013 fiscal year; and |

| | 3. | To transact such other business as may properly come before the Meeting and any adjournments or postponements thereof. |

The Board of Directors has fixed the close of business on June 25, 2013 as the record date for determining those stockholders entitled to receive notice of and to vote at the Meeting and any adjournments or postponements thereof.

Whether or not you expect to be present, please sign, date and return the enclosed proxy card in the pre-addressed envelope provided for that purpose as promptly as possible.

By Order of the Board of Directors,

/s/ Daniel J. Juhl

Daniel J. Juhl

Chairman

Pipestone, Minnesota

July 8, 2013

ALL STOCKHOLDERS ARE INVITED TO ATTEND THE MEETING IN PERSON. THOSE STOCKHOLDERS WHO ARE UNABLE TO ATTEND ARE RESPECTFULLY URGED TO EXECUTE AND RETURN THE ENCLOSED PROXY AS PROMPTLY AS POSSIBLE. STOCKHOLDERS WHO EXECUTE A PROXY MAY NEVERTHELESS ATTEND THE MEETING, REVOIKE THEIR PROXY AND VOTE THEIR SHARES IN PERSON.

IMPORTANT

Whether or not you expect to attend the Meeting, please complete, date, and sign the accompanying proxy, and return it promptly in the enclosed return envelope. If you grant a proxy, you may revoke it at any time prior to the Meeting or nevertheless vote in person at the Meeting.

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE ANNUAL MEETING OF STOCKHOLDERS TO BE HELD ON TUESDAY, AUGUST 13, 2013: This Notice of Annual Meeting, our proxy statement, our Annual Report on Form 10-K/A for the year ended December 31, 2012 and our Quarterly Report on Form 10-Q for the quarter ended March 31, 2013, are available on our website atwww.juhlenergy.com.

Juhl Energy, Inc.

Annual Meeting of Stockholders

To Be Held on Tuesday, August 13, 2013

Proxy Statement

General

We are providing these proxy materials in connection with the solicitation by the Board of Directors (the “Board”) of Juhl Energy, Inc. of proxies to be voted at our 2013 Annual Meeting of Stockholders to be held on Tuesday, August 13, 2013, at 10 a.m. Local Time at offices of the Company, 470 W. 78th Street, Suite 250, Minneapolis, Minnesota 55317 and at any postponement or adjournment thereof. In this proxy statement, Juhl Energy, Inc. is referred to as the “Company,” “we,” “our” or “us.”

The approximate date that this proxy statement and the enclosed form of proxy are first being sent to our stockholders is July 10, 2013.

Outstanding Securities and Voting Rights

Only holders of record of our common stock at the close of business on June 25, 2013, the record date, will be entitled to notice of and to vote at the Meeting. On that date, we had 23,414,451 shares of common stock outstanding. Each share of common stock is entitled to one vote at the Meeting.

A majority of the stock issued and outstanding and entitled to vote, present in person or represented by proxy, constitutes a quorum for the transaction of business at the Meeting. Abstentions and broker “non-votes” are counted as present and entitled to vote for purposes of determining whether a quorum exists. A “broker non-vote” occurs when a nominee holding shares for a beneficial owner does not vote on a particular proposal because the nominee does not have discretionary voting power with respect to that item and has not received voting instructions from the beneficial owners.

Voting by Shareholders with Shares Held Directly in Their Names

Shareholders with shares registered directly in their names in the Company’s stock records maintained by its transfer agent, Empire Stock Transfer, Inc. may vote their shares in the following manner:

| | ● | by completing, dating, signing and mailing the accompanying form of proxy in the return envelope provided to 1859 Whitney Mesa Drive, Henderson, NV 89014 |

| | ● | by completing, dating, signing and faxing your proxy directly to Empire Stock Transfer at (702) 974-1444 or |

| | ● | by completing, dating, signing, and emailing your proxy directly to Empire Stock Transfer atrico@empirestock.com |

In addition, ballots will be passed out to any shareholder who wants to vote in person at the Meeting.

Voting by Shareholders with Shares Held Through a Bank, Brokerage Firm, or Other Nominee

Shareholders who hold shares through a bank or brokerage firm should refer to the voting instruction form forwarded by their bank or brokerage firm to see which options are available to them. In addition to voting by mail, a number of banks and brokerage firms participate in a program provided through Broadridge Financial Solutions, Inc. (“Broadridge”) that offers various voting options. Votes submitted through Broadridge’s program must be received by the deadlines specified therein.

In addition, ballots will be passed out to any shareholder who wants to vote in person at the Meeting. Should you decide to attend the Annual Meeting and vote your shares in person, you MUST obtain a proxy executed in your favor from your bank or brokerage firm for your ballot to be counted.

Voting of Proxies

The persons authorized to vote your shares will vote them as you specify. In the absence of directions, proxies will be voted “FOR” the election of the Class I nominee to the Board named herein and “FOR” the ratification of Boulay, Heutmaker, Zibell & Co., P.L.L.P. as the Company’s independent registered public accounting firm for the 2013 fiscal year. The Board knows of no other business to be brought before the Meeting. If, however, other matters are properly presented, the person named in the proxies in the accompanying proxy card will vote in accordance with their discretion with respect to such matters.

All votes will be tabulated by the Company’s transfer agent, Empire Stock Transfer, Inc., who will separately tabulate affirmative and negative votes, abstentions and broker non-votes. A list of the record stockholders entitled to vote at the Meeting will be available at the Company’s offices, 1502 17th Street SE, Pipestone, Minnesota 56164 for a period of ten (10) days prior to the Meeting for examination by any stockholder.

The Company will report the voting results on a Form 8-K shortly after the Annual Meeting.

Revocation

If you own common stock of record, you may revoke a previously granted proxy at any time before it is voted by delivering to the Company a written notice of revocation or duly executed proxy bearing a later date, or by attending the Meeting and voting in person. Any stockholder owning common stock in street name may change or revoke previously granted voting instructions by contacting the bank or brokerage firm holding the shares or by obtaining a legal proxy from such bank or brokerage firm and voting in person at the Meeting.

Costs of Mailing and Solicitation

The Company will bear the cost of preparing, assembling and mailing this Proxy Statement, the Notice of Meeting and the enclosed proxy. In addition to the use of mail, our employees may solicit proxies personally and by telephone. Our employees will receive no compensation for soliciting proxies other than their regular salaries. We may request banks, brokers and other custodians, nominees and fiduciaries to forward copies of the proxy material to their principals and to request authority for the execution of proxies. We may reimburse such persons for their expenses in so doing.

Adjournment or Postponement of the Meeting

The Meeting may be adjourned or postponed without notice other than by an announcement made at the Meeting, if approved by the holders of a majority of the shares represented and entitled to vote at the Meeting. No proxies voted against approval of any of the proposals will be voted in favor of adjournment or postponement for the purpose of soliciting additional proxies. If we postpone the Meeting, we will issue a press release to announce the new date, time and location of the Meeting.

BENEFICIAL SECURITY OWNERSHIP

The following table sets forth information regarding the number of shares of our common stock beneficially owned on June 25, 2013 by:

| • | each person who is known by us to beneficially own 5% or more of our common stock, |

| • | each of our directors and executive officers, and |

| • | all of our directors and executive officers as a group. |

Beneficial ownership is determined in accordance with the rules of the SEC and generally includes voting or investment power with respect to securities. Shares of our common stock which may be acquired upon exercise of stock options or warrants which are currently exercisable or which become exercisable within 60 days after the date indicated in the table are deemed beneficially owned by the optionees. Subject to any applicable community property laws, the persons or entities named in the table above have sole voting and investment power with respect to all shares indicated as beneficially owned by them.

Name (1) | | Number of Shares Beneficially Owned (2) | | | Percentage of Shares Beneficially Owned (3) | |

5% Stockholders: | | | | | | |

Vision Opportunity Master Fund, Ltd. | | | 12,514,003 | (4,13) | | | 37.01 | % |

Greenview Capital, LLC | | | 1,955,368 | (5,13) | | | 8.26 | % |

Daybreak Special Situations Master Fund, Ltd. | | | 1,955,368 | (6,13) | | | 8.26 | % |

Executive Officers and Directors: | | | | | | | | |

Daniel J. Juhl | | | 14,000,000 | (7) | | | 59.79 | % |

John P. Mitola | | | 1,760,000 | (8) | | | 7.35 | % |

John J. Brand | | | 250,000 | (9) | | | 1.05 | % |

Edward C. Hurley | | | 20,000 | (10) | | | * | |

General Wesley Clark | | | 525,300 | (11) | | | 2.19 | % |

James Beck | | | 20,000 | (12) | | | * | |

All executive officers and directors as a group (6 persons) | | | 16,575,300 | | | | 67.01 | % |

| | * | Represents less than 1%. |

1 Other than the 5% Stockholders listed above, the address of each person is c/o Juhl Energy, Inc., 1502 17th Street SE, Pipestone, Minnesota 56164.

2 Unless otherwise indicated, includes shares owned by a spouse, minor children and relatives sharing the same home, as well as entities owned or controlled by the named person. Also includes shares if the named person has the right to acquire those shares within 60 days after June 25, 2013, by the exercise or conversion of any warrant, stock option or convertible preferred stock. Unless otherwise noted, shares are owned of record and beneficially by the named person.

3 The calculation in this column is based upon 23,414,451 shares of common stock outstanding on June 25, 2013. The 189,729 treasury shares beneficially held by the Company are excluded from the number of shares of common stock outstanding and are not deemed outstanding for purposes of computing the percentages in this column. The shares of common stock underlying warrants, stock options and convertible preferred stock are deemed outstanding for purposes of computing the percentage of the person holding them but are not deemed outstanding for the purpose of computing the percentage of any other person.

4 Consists of (a) 2,115,253 shares of common stock currently held by Vision Opportunity Master Fund, (b) 4,560,000 shares of common stock issuable upon the conversion of Series A convertible preferred stock and (c) 5,838,750 shares of common stock issuable upon the conversion of Series B convertible preferred stock. Adam Benowitz is the Portfolio Manager of Vision Capital Advisors, LLC, the investment manager of Vision Opportunity Master Fund, Ltd., which is the registered holder of the securities. Mr. Benowitz, as the Managing Member of Vision Capital Advisors, LLC and the Director of Vision Opportunity Master Fund, has voting and dispositive power over the securities owned by Vision Opportunity Master Fund. The preferred stock is subject to the ownership limitation detailed in Note 13 below. The address for Vision Opportunity Master Fund, Ltd. is c/o Citi Hedge Fund Services (Cayman) Limited, Cayman Corporate Centre, 27 Hospital Road, 5th Floor, Grand Cayman KY1-1109, Cayman Islands.

5 Consists of (a) 1,083,846 shares of common stock owned by Greenview Capital, LLC and its individual members (John Prinz and Gene Maher), (b) 611,522 shares of common stock currently held by Daybreak Special Situations Master Fund, an affiliate of Greenview Capital, LLC and Larry Butz as Managing Partner of Daybreak Capital Management, LLC, the investment advisor to Daybreak Special Situations Master Fund, Ltd., and, and (c) 260,000 shares of common stock issuable upon the conversion of Series A convertible preferred stock held by Daybreak Special Situations Master Fund. The preferred stock is subject to the ownership limitation detailed in Note 13 below. Larry Butz as Managing Partner of Daybreak Capital Management LLC, the investment advisor to Daybreak Special Situations Master Fund, Ltd., has voting and dispositive power over the shares held by Daybreak Special Situations Master Fund, Ltd. Mr. Butz, as Managing Partner of Daybreak Capital Management LLC, may be deemed to beneficially own the shares of common stock held by Daybreak Special Situations Master Fund, Ltd. Each of Daybreak Capital Management LLC and Mr. Butz disclaim beneficial ownership of such shares. Daybreak Capital Management LLC is an affiliate of Greenview Capital LLC, and the beneficial ownership figures include shares beneficially owned by Greenview Capital. The address for Greenview Capital, LLC is 303 Broadway Street, Libertyville, Illinois 60048.

6 Consists of (a) 611,522 shares of common stock owned by Daybreak Special Situations Master Fund and Larry Butz as Managing Partner of Daybreak Capital Management, LLC, the investment advisor to Daybreak Special Siutations Master Fund, Ltd., (b) 1,083,846 shares of common stock beneficially owned by Greenview Capital, LLC, an affiliate of Daybreak Special Situations Master Fund, and its individual members (John Prinz and Gene Maher), and (c) 260,000 shares of common stock issuable upon the conversion of Series A convertible preferred stock. The preferred stock is subject to the ownership limitation detailed in Note 13 below. The address for Daybreak Special Situations Master Fund, Ltd. is 143 E. Main St Suite 150 Lake Zurich, IL 60047.

7 Includes (a) 3,500,000 shares of common stock held by Mr. Juhl (b) 3,500,000 shares of common stock held by Mary Juhl, Mr. Juhl’s spouse, and (c) 7,000,000 shares of common stock held by the Juhl Family Limited Partnership, a Delaware limited partnership in which Mr. Juhl is the general partner.

8 Includes (a) 1,125,000 shares of common stock held by Mr. Mitola, (b) 125,000 shares of common stock held by the Mitola Family Limited Partnership, a Delaware limited partnership of which Mr. Mitola is the general partner and (c) 510,000 shares of common stock issuable upon the exercise of stock options exercisable within 60 days.

9 Consists of 250,000 shares of common stock issuable upon the exercise of stock options exercisable within 60 days.

10 Consists of 20,000 shares of common stock issuable upon the exercise of stock options exercisable within 60 days.

11 Consists of (a) 5,300 shares of common stock held by General Clark and (b) 520,000 shares of common stock issuable upon the exercise of stock options exercisable within 60 days.

12 Consists of 20,000 shares of common stock issuable upon the exercise of stock options exercisable within 60 days.

13 Vision Opportunity Master Fund holds shares of Series A preferred stock and Series B preferred stock that are convertible into shares of common stock. Daybreak Special Situations Master Fund holds shares of Series A preferred stock that are convertible into shares of common stock. The agreement with respect to which these stockholders purchased the preferred stock contains a limitation of 9.9% (a so-called “blocker”) on the number of shares such stockholders may beneficially own at any time. The 9.9% ownership limitation, however, does not prevent a stockholder from selling some of its holdings and then receiving additional shares. In this way, a stockholder could sell more than the 9.9% ownership limitation while never holding more than this limit. These numbers do not reflect the 9.9% ownership limitation.

PROPOSAL 1:

ELECTION OF DIRECTORS

Pursuant to our Amended and Restated By-Laws, our Board of Directors shall consist of not less than two or more than ten members, with the exact number to be fixed from time to time in accordance with a resolution adopted by a majority of the entire Board of Directors. By resolution, our Board of Directors has fixed the number of directors at five. Our Board of Directors is divided into three classes, designated as Class I, Class II and Class III, who are elected for three-year terms. The term of the Class I director, Edward C. Hurley, expires at the Meeting.

The following table lists each of our directors, their respective ages and the class in which they serve as of the date of this Proxy Statement:

Name | Age | Class |

Edward C. Hurley | 59 | Class I (term expiring at 2013 Annual Meeting; nominated for re-election) |

| | |

John Mitola | 47 | Class II (term expiring at 2014 Annual Meeting) |

| | |

General Wesley Clark (ret.) | 68 | Class II (term expiring at 2014 Annual Meeting) |

| | |

Daniel J. Juhl | 62 | Class III (term expiring at 2015 Annual Meeting) |

| | |

James W. Beck | 69 | Class III (term expiring at 2015 Annual Meeting) |

Nominee for Re-election

The following individual has been recommended and nominated by the Nominations and Governance Committee of the Board of Directors to serve as director of Juhl Energy, Inc. as a Class I Director to serve until the annual meeting of stockholders in 2016:

Edward C. Hurley

The nominee is a current Director who was elected by a majority of our stockholders and who has been nominated for re-election by our Nominations and Governance Committee and our existing Board. The Class I Director will be elected to serve until the annual meeting of stockholders in 2016 or until such director’s successor shall have been elected and qualified or until such director’s earlier resignation, removal from office or death.

The nominee has consented to being named in the Proxy Statement and to serve if elected. If, prior to the Meeting, the nominee should become unable or unwilling to serve, the shares of common stock represented by properly executed and returned proxies will be voted for such person as shall be designated by the Board of Directors.

The following provides information regarding the nominee, including the nominee’s age, principal occupation, business experience for at least the past five (5) years and directorships in other reporting companies.

Edward C. Hurley,age59, became a director of our Company in July 2008 following our reverse public offering transaction and has been a member of our audit committee since November 2009. Mr. Hurley also serves on the nominations and governance committee and chairs our compensation committee. Mr. Hurley is a partner with Foley & Lardner LLP where he is a member of the Energy Industry Team, focusing his practice on public utility regulation, a position he has held since May 2010.

Mr. Hurley dedicated over 16 years of his career at the Illinois Commerce Commission ("ICC") where he served as the agency's chairman, as well as a commissioner and an administrative law judge. During his tenure at the ICC, Mr. Hurley was involved in resolving complex issues impacting Illinois businesses governed by the ICC, including the deregulation of the electric energy markets, the process for procurement of electricity by electric utilities, and mergers and acquisitions of telecommunications, electric, and natural gas utilities. He also served as the Special Director of the Office of Emergency Energy Assistance for the State of Illinois, being responsible for the successful implementation of the "Keep Warm Illinois" and "Keep Cool Illinois" Campaigns that were driven by anticipated increases in the costs of natural gas and electricity.

Mr. Hurley also has been involved in regulatory issues at a national level. While at the ICC, Mr. Hurley was active in the National Association of Regulatory Utility Commissioners, where he served on the board of directors as well as the Water Committee. In these roles, Mr. Hurley gained a national perspective regarding the regulatory requirements imposed upon utilities operating in newly competitive markets. He continues to be an active participant, as well as a guest speaker, at numerous conferences relating to issues impacting businesses that operate in regulated industries, including energy, telecommunications and investor-owned water systems. Mr. Hurley has been a member of the National Coal Council since 2004. Prior to joining Foley, Mr. Hurley was of counsel with Chico & Nunes, P.C. He began his career representing clients in litigation in private practice and as an Illinois Assistant Attorney General. Mr. Hurley received his J.D. from John Marshall Law School in 1980 and his B.S.B.A. from Marquette University in 1976.

The Company believes that Mr. Hurley’s significant experience in his leadership role at a large public agency in the energy arena adds valuable depth to the Company’s board of directors.

Continuing Directors

CLASS II DIRECTORS SERVING UNTIL 2014

John P. Mitola became our President and a member of our board of directors on June 24, 2008, and had served in similar positions with Juhl Energy Development since April 2008. Mr. Mitola has more than 20 years of experience in the energy and environmental industries, real estate development, venture capital, engineering and construction. He was a managing partner with Kingsdale Capital International, a private equity and capital advisory firm that specialized in merchant banking, leveraged buyouts and corporate finance, since August 2006. From 2003 to 2009 Mr. Mitola served as Chairman of the Illinois Toll Highway Authority, one of the largest agencies in Illinois and one of the largest transportation agencies in North America with a $600 million annual operating budget and a $6.3 billion capital program, operating over 274 miles of roadway serving the Chicago metro region.

Most recently, Mr. Mitola was Chief Executive Officer and a director of Electric City Corp., a publicly-held company that specialized in energy efficiency systems, where he served from January 2000 to February 2006. Prior to his role at Electric City, Mr. Mitola was vice president and general manager of Exelon Thermal Technologies, a subsidiary of Exelon Corp. that designed and built alternative energy systems, from March 1997 to December 1999. Prior to serving as its general manager, Mr. Mitola served in various leadership roles at Exelon Thermal Technologies from January 1990 until his move to Electric City Corp. in January 2000. Mr. Mitola is also a member of the board of directors of another publicly-traded company, IDO Security Inc. He is a member of the American Society of Heating, Refrigerating and Air-Conditioning Engineers, and the Association of Energy Engineers. His community affiliations include membership in the Economic Club of Chicago, City Club of Chicago, Union League Club and the governing board of the Christopher House Board of Directors. He is also a member of the board of the Illinois Council Against Handgun Violence. Mr. Mitola received his B.S. degree in engineering from the University of Illinois at Urbana-Champaign and J.D. degree from DePaul University College of Law.

Mr. Mitola’s varied experience in energy-related businesses, his public company experience and the administrative skills he has acquired over his career make him particularly capable to lead the Company’s management team and serve as one of its directors.

General Wesley Clark (ret.) became a director of our Company in January 2009, and is a member of our nominations and governance committee, of which he currently serves as chair. He is also a member of our compensation committee and our audit committee. Wesley K. Clark is a businessman, educator, writer and commentator.

General Clark serves as Chairman and CEO of Wesley K. Clark & Associates, a strategic consulting firm; Co-Chairman of Growth Energy; senior fellow at UCLA's Burkle Center for International Relations; Chairman of Clean Terra, Inc.; Director of International Crisis Group; Chairman of City Year Little Rock; as well as numerous corporate boards. In addition to serving on the board of directors of the Company, General Clark serves on the board of directors of AMG Advanced Metallurgical Group N.V, a global producer of specialty metals and metallurgical vacuum furnace systems; BNK Petroleum Inc., an energy company focused on the acquisition, exploration and production of large oil and gas reserves; Bankers Petroleum Ltd., a Canadian-based oil and gas exploration and production company; Amaya Gaming, a Canadian company in the electronic gaming industry, Torvec Inc., a U.S. automotive technology company; and is a partner in United Global Resources, LLC, a U.S. broker dealer focused on project development. General Clark has authored three books and serves as a member of the Clinton Global Initiative's Energy & Climate Change Advisory Board, and ACORE's Advisory Board.

General Clark retired a four star general after 38 years in the United States Army. He graduated first in his class at West Point and completed degrees in Philosophy, Politics and Economics at Oxford University (B.A. and M.A.) as a Rhodes Scholar. While serving in Vietnam, he commanded an infantry company in combat, where he was severely wounded and evacuated home on a stretcher. He later commanded at the battalion, brigade and division level, and served in a number of significant staff positions, including service as the Director Strategic Plans and Policy (J-5). In his last assignment as Supreme Allied Commander Europe, he led NATO forces to victory in Operation Allied Force, saving 1.5 million Albanians from ethnic cleansing.

His awards include the Presidential Medal of Freedom, Defense Distinguished Service Medal (five awards), Silver star, Bronze star, Purple Heart, honorary knighthoods from the British and Dutch governments, and numerous other awards from other governments, including award of Commander of the Legion of Honor (France).

The Company believes that the exceptional leadership skills developed by General Clark during his illustrious career and his prominence as a spokesman for energy-related issues lend perspective to the Board and provide opportunities for growth of the Company.

CLASS III DIRECTORS SERVING UNTIL 2015

Daniel J. Juhl became our Chairman of the Board and Principal Executive Officer on June 24, 2008, and had served as President of Juhl Energy Development since September 2007 and Juhl Energy Services, since January 1989. Mr. Juhl has been involved in the wind power industry for more than 30 years. He has experience in the design, manufacture, maintenance and sale of wind turbines. He also provides consulting services in the wind power industry helping farmers develop wind projects that qualify for Minnesota’s renewable energy production incentives. Mr. Juhl has been involved in the development of about 1,500 megawatts of wind generation in his 30+ years of experience in the field. He has served as the principal technology officer of Next Generation Power Systems, Inc. from October 2005 until the present. He has been the principal consultant for wind energy projects to Edison Capital, John Deere Capital, Vestas, EWT, Suzlon Turbine Manufacturing, and various public and private utilities throughout the United States and Canada. He has appeared before numerous state and federal governmental bodies advocating wind power and community-based energy development on behalf of landowners, farmers and ranchers. Mr. Juhl wrote the popular wind energy reference guidebook, “Harvesting Wind Energy as a Cash Crop.”

Mr. Juhl’s extensive experience in the wind power industry and his specific experience as founder of Juhl Energy Development and Juhl Energy Services, the related companies which are now our wholly-owned subsidiaries, provide the Company with a solid foundation of knowledge about the industry, lends stability to the Company’s position in the industry and makes Mr. Juhl uniquely qualified to serve as CEO and a director of the Company.

James W. Beck became a director of our Company in November 2009, and is a member of our audit committee as of November 2009 of which he currently serves as chair. He is also a member of our compensation committee and our nominations and corporate governance committee. Mr. Beck is a majority owner of Intepro, a company engaged in the development of software for vertical markets having to meet requirements for regulatory compliance, and is a co-owner of EMCllc, a firm engaged in the engineering, design and implementation of energy efficient lighting systems in industrial and commercial applications throughout North America for new construction and retrofit markets. Mr. Beck has previously been involved with companies engaged in the evaluation and implementation of energy usage, alternative energy sources, electrical continuation, and energy conservation. Mr. Beck earned a B.S. degree in business from the University of Minnesota. Mr. Beck serves as a member of the Board of Directors of AIA Insurance Services in Lewiston, Idaho, serves as a member of the Advisory Committee of Summit Academy in Minneapolis, Minnesota and is involved in various other community and civic activities.

The Company’s addition of Mr. Beck as a director was founded upon his expertise in the areas of energy usage and conventional and alternative energy and his practical experience in the application of that knowledge to commercial markets which the Company believes will be a valuable asset to its Board.

Independent Directors

Mr. Hurley, General Clark and Mr. Beck serve on our board of directors as “independent directors” defined under NASDAQ rules and by the regulations of the Securities Exchange Act of 1934.

Board Composition and Meetings of Board of Directors

The Board of Directors is currently composed of five members. All actions of the Board of Directors require the approval of a majority of the directors in attendance at a meeting at which a quorum is present. In 2012, our Board of Directors met in person three times and acted by written consent three times.

Board Committees

The Company has established an Audit Committee and has created a Compensation Committee and a Nominations and Governance Committee, in compliance with established corporate governance requirements.

Audit Committee. The Board of Directors of the Company established an Audit Committee on November 24, 2009. At that time, Mr. Beck was appointed Audit Committee Chairman, and Mr. Hurley and General Clark were appointed as members of the Audit Committee. As a result, the Audit Committee is comprised of our "independent" directors as defined in NASDAQ Marketplace Rule 5605(a)(2). Further, the Board of Directors of the Company adopted an Audit Committee Charter on April 8, 2010. The Audit Committee reviews the results and scope of the audit and the financial recommendations provided by our independent registered public accounting firm. Further, the Audit Committee reviews the scope, timing and fees for the annual audit and the results of audit examinations performed by the internal auditors and independent public accountants, including their recommendations to improve the system of accounting and internal controls.

The Company does not have a member of its Audit Committee who qualifies as a “financial expert” at this time. The Company believes that the relevant business experience of its current Board and Audit Committee members provides adequate oversight of accounting and financial reporting and internal controls. The Company expects, however, to consider the addition of an Audit Committee financial expert in the future as may be required by a national stock exchange.

Compensation Committee. The Board of Directors of the Company established a Compensation Committee on April 8, 2010. The Compensation Committee is comprised of our “independent” directors as defined in NASDAQ Marketplace Rule 5605(a)(2). The Compensation Committee reviews and approves our salary and benefit policies, including compensation of executive officers. Further, the Compensation Committee administers our Incentive Compensation Plan, and recommends and approves grants of stock options, restricted stock and other awards under that plan.

Nominations and Governance Committee. The Board of Directors of the Company established a Nominations and Governance Committee (“Nominations Committee”) on April 8, 2010. The Nominations Committee is comprised of our “independent” directors as defined in NASDAQ Marketplace Rule 5605(a)(2). The Nominations Committee reviews the qualifications of prospective directors for consideration by the board of directors as management’s nominees for directors. The purpose of the Nominations Committee is to select, or recommend for our entire board’s selection, the individuals to stand for election as directors at the annual meeting of stockholders and to oversee the selection and composition of committees of our Board. The Nominations Committee’s duties also include considering the adequacy of our corporate governance and overseeing and approving management continuity planning processes.

We will consider nominations for directors submitted by stockholders. Stockholder nominations for election to the Board must be made by written notification received by us not later than sixty days prior to the next annual meeting of stockholders. Such notification shall contain, at a minimum, the following information:

| 1. | The name and residential address of the proposed nominee and of each notifying stockholder; |

| 2. | The principal occupation of the proposed nominee; |

| 3. | A representation that the notifying stockholder intends to appear in person or by proxy at the meeting to nominate the person specified in the notice; |

| 4. | The total number of our shares owned by the notifying stockholder; |

| 5. | A description of all arrangements or understandings between the notifying stockholder and the proposed nominee and any other person or persons pursuant to which the nomination is to be made by the notifying stockholder; |

| 6. | Any other information regarding the nominee that would be required to be included in a proxy statement filed with the SEC; and |

| 7. | The consent of the nominee to serve as one of our directors, if elected. |

The Nominations Committee will return, without consideration, any notice of proposed nomination which does not contain the foregoing information.

The Nominations Committee has not established specific criteria or minimum qualifications that must be met by committee-nominated or shareholder-nominated nominees for director. Regardless of the source of a given nominee’s nomination, the Nominations Committee evaluates each nominee based solely upon his/her educational attainments, relevant experience and professional stature. The Nominations Committee primarily seeks nominations for director from institutional security holders, members of the investment banking community and current directors.

Indebtedness of Directors and Executive Officers

None of our directors or executive officers or their respective associates or affiliates is indebted to us.

Family Relationships

There are no family relationships among our directors and executive officers.

Section 16(a) Beneficial Ownership Reporting Compliance

We have securities registered under Section 12 of the Exchange Act and, accordingly, our directors, officers and affiliates are required to file reports under Section 16(a) of the Exchange Act.

All of our officers and directors are current in the filing of their beneficial ownership reports pursuant to Section 16(a) of the Exchange Act.

Certain Relationships and Related Transactions

Juhl Energy provides management, administrative and accounting services to four wind farm operations in each of which Dan Juhl and immediate family members hold equity interests of less than 5%. The revenues earned by those four wind farm operations in the years ended December 31, 2012 and 2011 was $15,000 and $123,000, respectively.

Our CEO, Dan Juhl, is the .1% minority interest member of the 10.2 MW Woodstock Hills wind farm, which the Company acquired a 99.9% membership interest.

Directors, Executive Officers and Corporate Governance

The following table shows the positions held by our board of directors and executive officers, and their ages as of June 25, 2013:

Name | | Age | | Position |

Daniel J. Juhl | | 62 | | Chairman of the Board of Directors and Chief Executive Officer |

John P. Mitola | | 47 | | President and Director |

John J. Brand | | 57 | | Chief Financial Officer |

Edward C. Hurley | | 59 | | Director |

General Wesley Clark (ret.) | | 68 | | Director |

James W. Beck | | 69 | | Director |

EXECUTIVE COMPENSATION

The following table sets forth, for the most recent two fiscal years, all cash compensation paid, distributed or accrued, including salary and bonus amounts, for services rendered to us by our Principal Executive Officer and four other executive officers in such year who received or are entitled to receive remuneration in excess of $100,000 during the stated period and any individuals for whom disclosure would have been made in this table but for the fact that the individual was not serving as an executive officer as at December 31, 2012:

Summary Compensation Table |

Name and Principal Position | Fiscal Year | Salary $ | Bonus $ | Stock Awards $ | Option Awards1 $ | Non-Equity Incentive Plan Compen- sation $ | Nonqualified Deferred Compensation Earnings $ | All Other Compensation $ | Totals $ |

Daniel J. Juhl Chairman and Principal Executive Officer | 2012 2011 | 236,250 214,585 | - 60,000 | - - | - - | - - | - - | 10,2962 82,2273 | 246,546 356,812 |

John P. Mitola President | 2012 2011 | 236,250 214,585 | - 50,000 | - - | - - | - - | - - | 10,2962 82,2273 | 246,546 346,812 |

John Brand Principal Financial Officer | 2012 2011 | 180,000 150,000 | - 45,000 | - - | - - | - - | - - | 10,2002 41,9454 | 190,200 236,945 |

1 The determination of value of option awards is based upon the Black-Scholes Option pricing model, details and assumptions of which are set out in our financial statements included in our annual report on Form 10-K/A filed with the U.S. Securities and Exchange Commission on April 4, 2013. The amounts represent annual amortization of fair value of stock options granted to the named executive officer.

2Represents Car Allowance and Health Savings Account contribution

3Represents Car Allowance, Health Savings Account contribution and salary catch-up

4Represents Car Allowance, Health Savings Account contribution and PTO

The aggregate amount of benefits in each of the years indicated did not exceed the lesser of $50,000 or 10% of the compensation of any named officer.

Outstanding Equity Awards at Fiscal Year-End

| | | |

Option Awards | | Stock Awards | |

Name | | Number of Securities Underlying Unexercised Options (#) Exercisable | | | Number of Securities Underlying Unexercised Options(#) Unexercisable | | | Equity Incentive Plan Awards: Number of Securities Underlying Unexercised Unearned Options (#) | | | Option Exercise Price ($) | | Option Expiration Date | | Number of Shares orUnits of Stock That Have Not Vested (#) | | | Market Value of Shares or Units of Stock That Have Not Vested ($) | | | Equity Incentive Plan Awards: Number of Unearned Shares, Units or Other Rights That Have Not Vested (#) | | | Equity IncentivePlan Awards: Market or PayoutValue of Unearned Shares, Units or Other Rights ThatHave Not Vested ($) | |

John P. Mitola | | | 510,000 | | | | - | | | | - | | | $ | 1.00 | | 06/24/2018 | | | - | | | | - | | | | - | | | | - | |

John J. Brand | | | 100,000 | | | | - | | | | - | | | $ | 1.95 | | 01/26/2019 | | | - | | | | - | | | | - | | | | - | |

John J. Brand | | | 150,000 | | | | - | | | | - | | | $ | 2.11 | | 08/13/2019 | | | - | | | | - | | | | - | | | | - | |

Compensation of Directors

Directors are expected to timely and fully participate in all regular and special board meetings, and all meetings of committees on which they serve. We compensate directors through stock options granted under our 2008 Incentive Compensation Plan and an annual cash stipend.

In July of 2008, Edward C. Hurley was appointed as a director of the Company. In connection with his appointment, we granted Mr. Hurley stock options to purchase 10,000 shares of Company common stock at $1.00 per share over a two-year vesting period. Mr. Hurley also receives cash compensation of $4,000 per quarter, $700 per quarter as Chair of the Compensation Committee and $500 for attendance at any Board committee meeting. On June 1, 2011 we granted Mr. Hurley stock options to purchase 10,000 shares of common stock at $1.15 per share which vested on December 31, 2011.

On January 14, 2009, General Wesley K. Clark was appointed as a director of the Company to serve under the terms of a letter agreement between the Company and General Clark dated January 13, 2009. In January 2009, we granted General Clark stock options to purchase 10,000 shares of common stock at $2.11 per share. In addition, on June 29, 2009, we granted General Clark stock options to purchase 500,000 shares of our common stock outside of our 2008 Incentive Compensation Plan at $2.00 per share, with 166,666 shares immediately exercisable, 166,667 options which vested on June 29, 2010 and 166,667 options which vested on June 29, 2011. General Clark also receives cash compensation of $4,000 per quarter, $700 per quarter as Chair of the Nominations and Governance Committee and $500 for attendance at any Board committee meeting. On June 1, 2011 we granted General Clark stock options to purchase 10,000 shares of common stock at $1.15 per share which vested on December 31, 2011.

On November 24, 2009, James W. Beck was appointed as a director of the Company. In connection with his election, we granted Mr. Beck stock options to purchase 10,000 shares of Company common stock at $1.89 per share over a two-year vesting period. Mr. Beck also receives cash compensation of $4,000 per quarter, $1,000 per quarter as Chair of the Audit Committee and $500 for attendance at any Board committee meeting. On June 1, 2011 we granted Mr. Beck stock options to purchase 10,000 shares of common stock at $1.15 per share which vested on December 31, 2011.

The table below summarizes the compensation that we paid to non-management directors for the fiscal year ended December 31, 2012.

Director Compensation

Name | Fees Earned or Paid in Cash ($) | Stock Awards ($) | Option Awards ($) | Non-Equity Incentive Plan Compensation ($) | Nonqualified Deferred Compensation Earnings ($) | All Other Compensation ($) | Total ($) |

Edward C. Hurley | 20,300 | - | - | - | - | - | 20,300 |

General Wesley Clark | 19,800 | - | - | - | - | - | 19,800 |

James Beck | 26,500 | - | - | - | - | - | 26,500 |

Employment Agreements

Effective January 1, 2012 we entered into an Executive Employment Agreement with Mr. Juhl under which we will employ Mr. Juhl as Chief Executive Officer for a five-year term ending on December 31, 2016. During the first year of the term, Mr. Juhl’s monthly salary will be $19,687.50, and Mr. Juhl’s monthly salary will be increased by five percent (5%) during each remaining year of the term. We are obligated to pay Mr. Juhl an annual performance bonus of a maximum of his annual salary upon reaching certain goals established by the board of directors. The performance bonus is conditioned upon (a) profitable operations of our company for the full year for which the bonus is to be paid and (b) minimum revenue growth during the year for which the bonus is to be paid as established by the board of directors. Mr. Juhl is entitled to be granted options to purchase 1,000,000 shares of common stock of the Company, subject to approval by the board of directors and any additional required approvals. Mr. Juhl receives an automobile allowance of $750 per month, 20 days of paid annual vacation and other employee benefits provided to similarly-situated employees. Mr. Juhl is entitled to severance compensation in an amount equal to 90 days’ pay in the event he terminates his employment for good reason.

Effective January 1, 2012 we entered into an Executive Employment Agreement with Mr. Mitola under which we will employ Mr. Mitola as President for a five-year term ending on December 31, 2016. During the first year of the term, Mr. Mitola’s monthly salary will be $19,687.50, and Mr. Mitola’s monthly salary will be increased by five percent (5%) during each remaining year of the term. We are obligated to pay Mr. Mitola an annual performance bonus of a maximum of his annual salary upon reaching certain goals established by the board of directors. The performance bonus is conditioned upon (a) profitable operations of our company for the full year for which the bonus is to be paid and (b) minimum revenue growth during the year for which the bonus is to be paid as established by the board of directors. Mr. Mitola is entitled to be granted options to purchase 1,000,000 shares of common stock of the Company, subject to approval by the board of directors and any additional required approvals. Mr. Mitola receives an automobile allowance of $750 per month, 20 days of paid annual vacation and other employee benefits provided to similarly-situated employees. Mr. Mitola is entitled to severance compensation in an amount equal to 90 days’ pay in the event he terminates his employment for good reason.

Effective January 1, 2012 we entered into an Executive Employment Agreement with Mr. Brand under which we will employ Mr. Brand as Chief Financial Officer for a five-year term ending on December 31, 2016. During the first year of the term, Mr. Brand’s monthly salary will be $15,000, and Mr. Brand’s monthly salary will be increased in the range of three percent (3%) to five percent (5%) annually based on the judgment of the board of directors as recommended by the Compensation Committee based on the balance sheet health of the Company and other relevant factors. We are obligated to pay Mr. Brand an annual performance bonus of a maximum of his annual salary upon reaching certain goals established by the board of directors. Mr. Brand is entitled to be granted options to purchase 750,000 shares of common stock of the Company, subject to approval by the board of directors and any additional required approvals. Mr. Brand receives an automobile allowance of $750 per month, 20 days of paid annual vacation and other employee benefits provided to similarly-situated employees. Mr. Brand is entitled to severance compensation in an amount equal to 90 days’ pay in the event he terminates his employment for good reason.

Equity Compensation Plan Information

There are 2,897,111 shares of common stock reserved for issuance under our Amended and Restated 2008 Incentive Compensation Plan. We adopted our Incentive Compensation Plan on June 16, 2008, and the Amended and Restated 2008 Incentive Compensation Plan was approved on October 1, 2012.

The following table provides information as of December 31, 2012, with respect to the shares of common stock that may be issued under our existing equity compensation plan.

Equity Compensation Plan Information

Plan Category | Number of shares of common stock to be issued upon exercise of outstanding options, warrants and rights (a) | Weighted-average exercise price of outstanding options, warrants and rights (b) | Number of securities remaining available for future issuance under equity compensation plans (excluding securities reflected in column (a)) (c) |

Equity compensation plans approved by security holders | 1,510,000 | $1.43 | 1,387,111 |

| | | |

Equity compensation plans not approved by security holders | 700,000 | $2.25 | - |

| | | |

Total | 2,210,000 | $1.69 | 1,387,111 |

The 700,000 options and warrants granted under equity compensation plans not approved by security holders include the following:

| ● | Options granted June 29, 2009 as compensation to our director, General Wesley Clark, to purchase 500,000 shares of common stock at $2.00 per share, with 166,666 shares immediately exercisable, 166,667 options vesting on June 29, 2010 and 166,667 options vesting on June 29, 2011. The options expire June 29, 2019. |

| ● | Warrants granted December 19, 2008 as compensation to a consultant to purchase 25,000 shares of common stock at $7.00 per share, which warrants expire June 19, 2013. |

| ● | Warrants granted December 19, 2008 as compensation to a consultant to purchase 25,000 shares of common stock at $10.00 per share, which warrants expire June 19, 2013. |

| ● | Warrants granted December 31, 2009 as compensation to two consultants each to purchase 50,000 shares of common stock at $1.25 per share, which warrants expire December 31, 2014. |

| ● | Warrants granted September 12, 2012 as compensation to a consultant to purchase 50,000 shares of common stock at $0.50 per share, which warrants expire September 12, 2015. |

Vote Required and Recommendation

The Class I Director will be elected by a plurality of votes cast at the Meeting. Plurality voting means that the nominee in Class I who receives the highest number of votes cast in person or by proxy at the Meeting by holders of shares of the Company’s common stock entitled to vote thereon shall be elected as a Class I Director, irrespective of the number of votes received and even if the votes are less than a majority of the votes cast. The Board recommends that its stockholders vote “FOR” the nominee for Class I Director set forth above.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” THE NOMINEE FOR CLASS I DIRECTOR SET FORTH ABOVE.

PROPOSAL 2:

RATIFICATION OF APPOINTMENT OF INDEPENDENT

REGISTERED PUBLIC ACCOUNTING FIRM

The Audit Committee of the Board assists the Board in its oversight of the quality and integrity of the financial reporting practices of the Company. The Audit Committee is responsible for the appointment, compensation, retention and oversight of the work of the Company’s independent auditor. It is the responsibility of the Audit Committee to annually select and appoint the independent auditor, consider the independence and effectiveness of the independent auditor and approve the fees and other compensation to be paid to the independent auditor.

The Audit Committee has selected Boulay, Heutmaker, Zibell & Co., P.L.L.P. (“Boulay”) to perform the audit of the Company’s consolidated financial statements for the 2013 fiscal year. We are asking the stockholders to ratify this selection. Representatives of Boulay will be present at the Meeting, will have the opportunity to make a statement if they so desire, and will be available to answer appropriate questions.

Boulay has served as the Company’s independent auditors since June 24, 2008. Boulay has advised the Company that neither it, nor any of its members, has any direct financial interest in the Company as a promoter, underwriters, voting trustee, director, officer, employee or stockholder. All professional services rendered by Boulay during the fiscal year ended December 31, 2012 were furnished at customary rates.

For the year ended December 31, 2012, the total fees charged to the Company for audit services were approximately $205,000. These audit fees were incurred for the audit of the Company’s annual financial statements included within Form 10-K, review of the consolidated financial statements included in the Company’s quarterly reports on Form 10-Q, and the review of the various required periodic reporting filings. The Company incurred approximately $23,000 for tax or other various financial statement consulting services for the year ended December 31, 2012.

For the year ended December 31, 2011, the total fees charged to the Company for audit services were approximately $225,000. These audit fees were incurred for the audit of the Company’s annual financial statements included within Form 10-K, review of the consolidated financial statements included in the Company’s quarterly reports on Form 10-Q, and the review of the various required periodic reporting filings. The Company incurred approximately $43,000 for tax or other various financial statement consulting services for the year ended December 31, 2011.

The current policy of the board of directors is to approve the appointment of the principal auditing firm and any permissible audit-related services. The audit and audit-related fees have been approved by specific board action in 2012.

Vote Required and Recommendation

The ratification of the selection of Boulay, Heutmaker, Zibell & Co., P.L.L.P. as our independent certified public accountants for the 2013 fiscal year requires the affirmative vote of the holders of a majority of the shares of the Company’s common stock present in person or by proxy at the Meeting and entitled to vote on the proposal. Abstentions will be counted as present at the Meeting for purposes of this matter and will have the effect of a vote against the ratification of the appointment of Boulay, Heutmaker, Zibell & Co., P.L.L.P. as independent auditors.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” RATIFICATION OF THE APPOINTMENT OF BOULAY, HEUTMAKER, ZIBELL & CO., P.L.L.P. AS THE COMPANY’S INDEPENDENT AUDITORS FOR THE 2013 FISCAL YEAR.

STOCKHOLDER MATTERS

Stockholder Proposals for Inclusion in Next Year’s Proxy Statement

The Charter of the Company’s Nominations Committee of the Board of Directors provides that stockholder nominations for election to the Board must be made by written notification received by the Nominations Committee not later than sixty days prior to the next annual meeting of stockholders. Such notification shall contain, at a minimum, the following information:

| | 1. | The name and residential address of the proposed nominee and of each notifying stockholder; |

| | |

| | 2. | The principal occupation of the proposed nominee; |

| | |

| | 3. | A representation that the notifying stockholder intends to appear in person or by proxy at the meeting to nominate the person specified in the notice; |

| | |

| | 4. | The total number of our shares owned by the notifying stockholder; |

| | |

| | 5. | A description of all arrangements or understandings between the notifying stockholder and the proposed nominee and any other person or persons pursuant to which the nomination is to be made by the notifying stockholder; |

| | |

| | 6. | Any other information regarding the nominee that would be required to be included in a proxy statement filed with the SEC; and |

| | |

| | 7. | The consent of the nominee to serve as a director of the Company, if elected. |

The Committee will return, without consideration, any notice of proposed nomination which does not contain the foregoing information. Please provide notice via registered, certified, or express mail to Juhl Energy, Inc., 1502 17th Street SE, Pipestone, Minnesota 56164, ATTN: Corporate Secretary.

OTHER BUSINESS

The Board knows of no other business to be brought before the Meeting. If, however, any other business should properly come before the Meeting, the persons named in the accompanying proxy will vote proxies in their discretion as they may deem appropriate, unless they are directed by a proxy to do otherwise.

OTHER INFORMATION

The Company’s 2012 annual report on Form 10-K/A, excluding exhibits, will be mailed without charge to any stockholder entitled to vote at the Meeting, upon written request to John Brand, Chief Financial Officer, Juhl Energy, Inc., 1502 17th Street SE, Pipestone, Minnesota 56164.

Important Notice Regarding Availability of Proxy Materials

The Company’s proxy statement and the Company’s 2012 annual report on Form 10-K/A and the Company’s quarterly report on Form 10-Q for the quarter ended March 31, 2013, are also available for review at the Company’s websitewww.juhlenergy.com and atwww.sec.gov. If want to receive a paper or e-mail copy of these documents, you must request one. There is NO charge for requesting a copy.

Please choose one of the following methods to make your request:

By Email:jb@juhlwind.com

By Telephone: 507-777-4310

By Letter: to Mr. John Brand, Chief Financial Officer, as noted above

HOUSEHOLDING OF PROXY DOCUMENTS

Only one copy of this Proxy Statement is being delivered to stockholders residing at the same address, unless those stockholders have notified us of their desire to receive multiple copies of the Proxy Statement.

Stockholders residing at the same address who currently receive only one copy of the Proxy Statement and who would like to receive an additional copy of the Proxy Statement for this Meeting or in the future may contact our Chief Financial Officer by phone at 507-777-4310 or by mail to the Chief Financial Officer, 1502 17th Street SE, Pipestone, Minnesota 56164.

| By Order of the Board of Directors | |

| | |

| /s/ Daniel J. Juhl | |

| | |

| DANIEL J. JUHL,Chairman | |

Pipestone, Minnesota

July 8, 2013