Welcome to the VMware Strategy and Product-oriented Bus Tour-style Q&A session at VMworld Exhibit 99.2

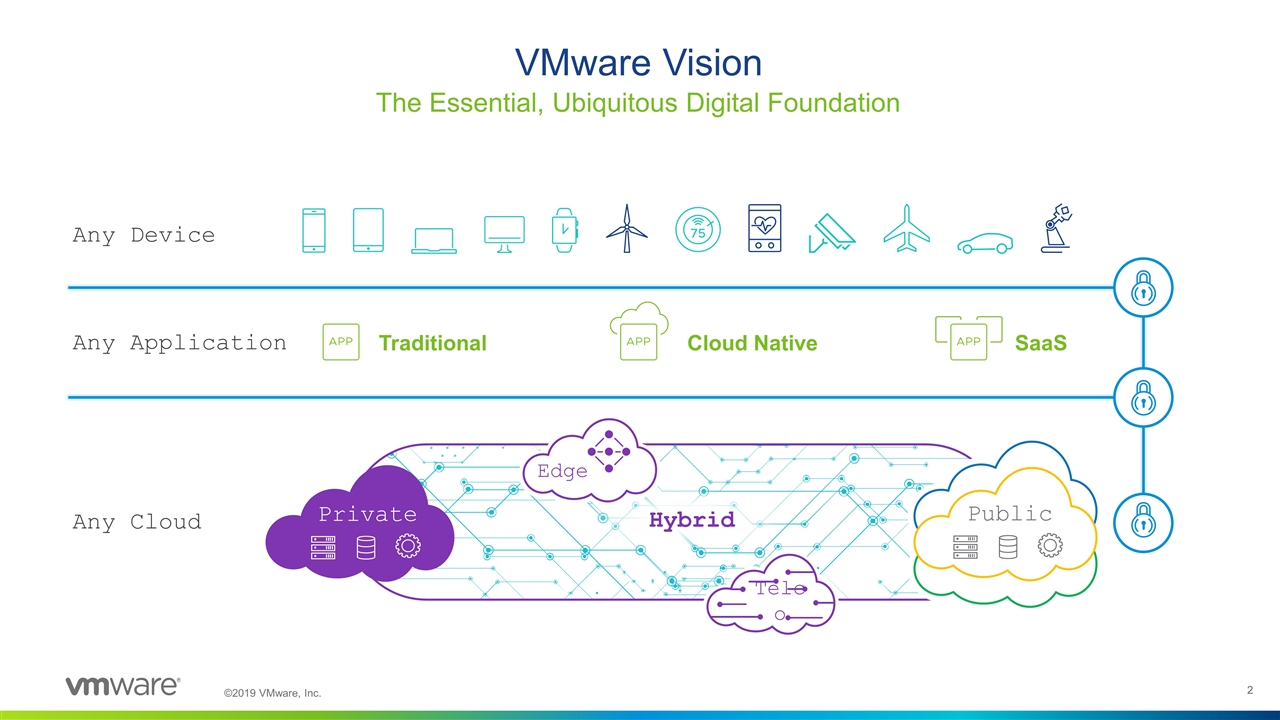

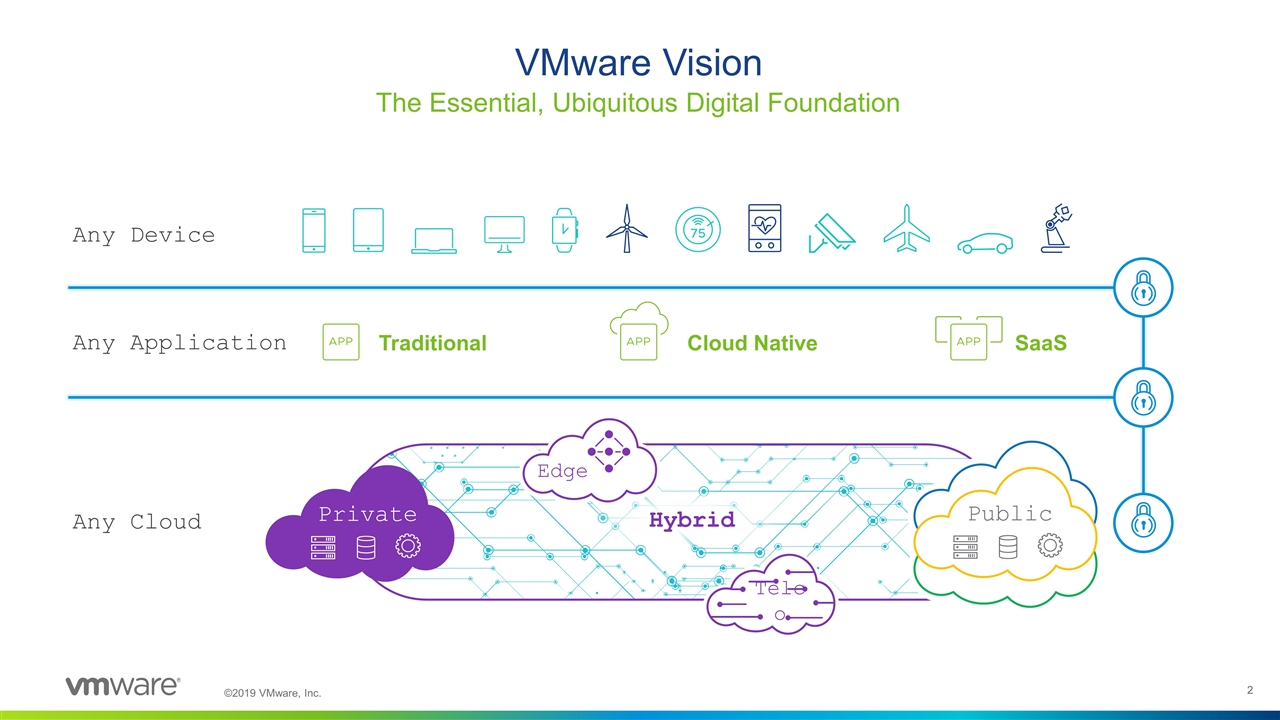

Any Device Any Application Traditional Cloud Native SaaS Any Cloud Hybrid Private Telco Edge Public Hybrid The Essential, Ubiquitous Digital Foundation VMware Vision

accelerate our strategy We are expanding our portfolio to Heptio PKS Bitnami Pivotal vSphere vSAN VMware Cloud VMware Cloud Foundation VCPP vRealize WorkspaceONE CloudHealth NSX VeloCloud Avi Networks AppDefense SecureState Carbon Black Any Cloud | Any App | Any Device Build Run Manage Connect Protect

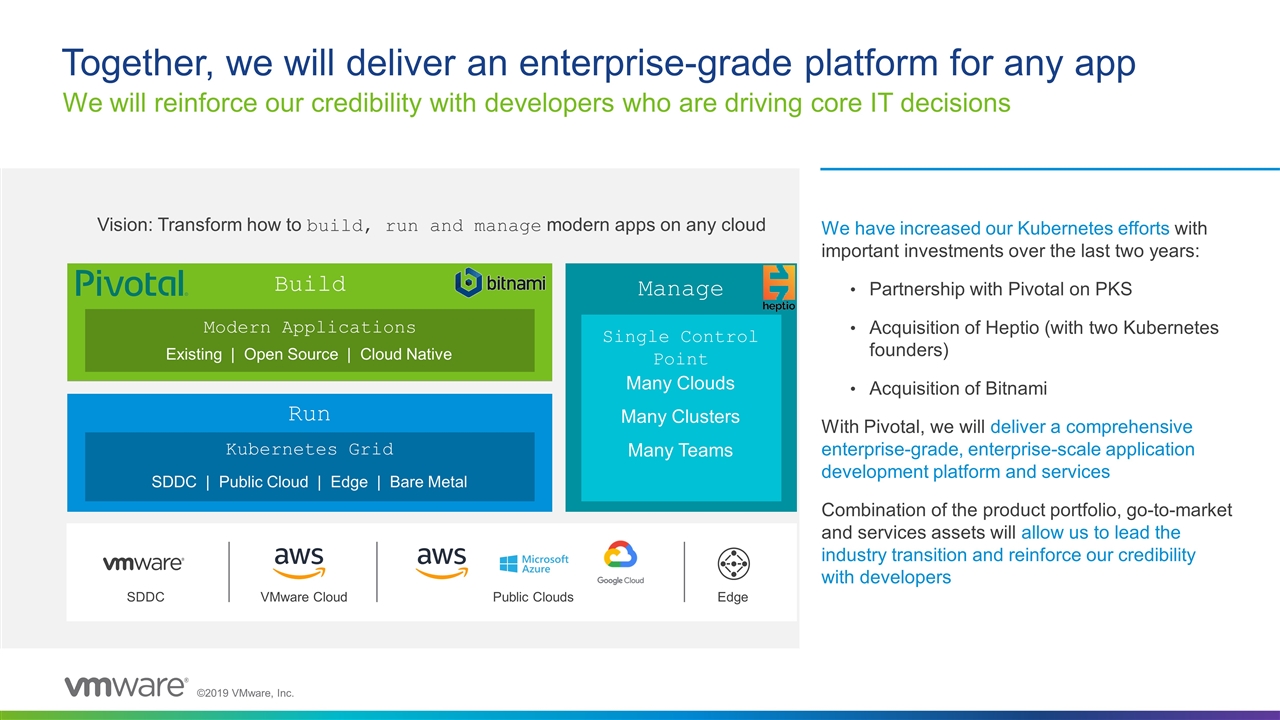

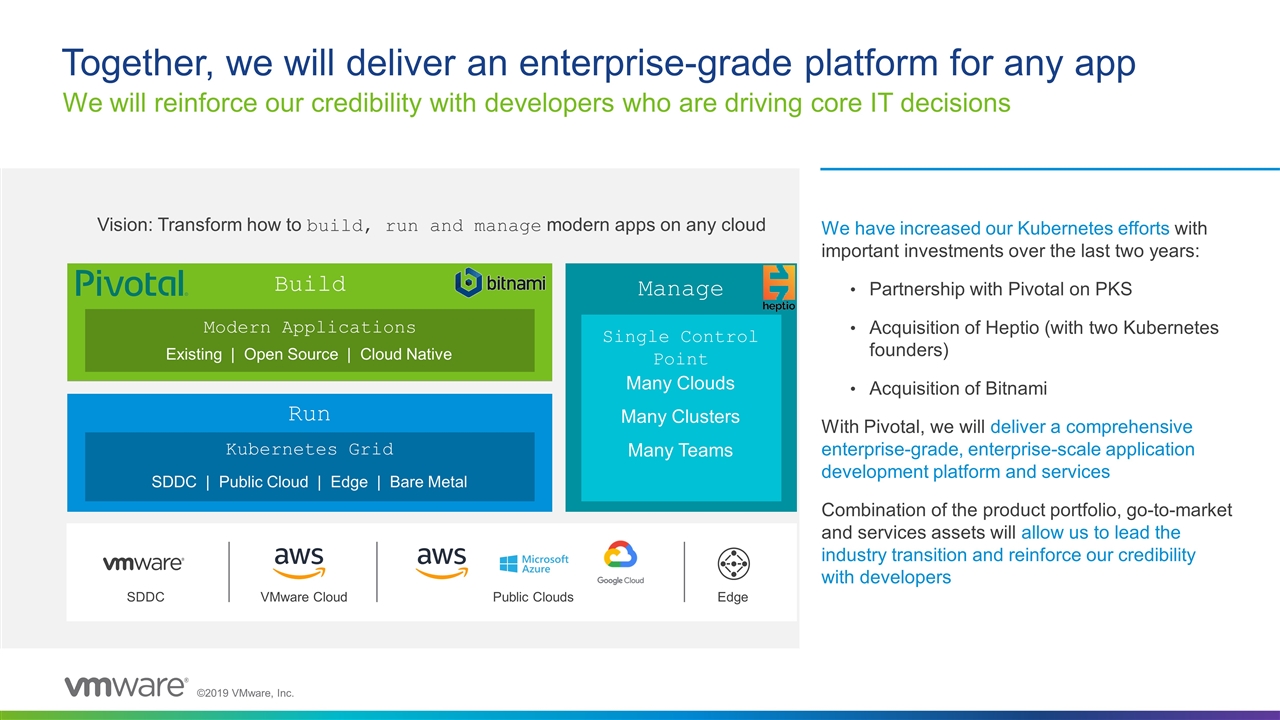

Together, we will deliver an enterprise-grade platform for any app We have increased our Kubernetes efforts with important investments over the last two years: Partnership with Pivotal on PKS Acquisition of Heptio (with two Kubernetes founders) Acquisition of Bitnami With Pivotal, we will deliver a comprehensive enterprise-grade, enterprise-scale application development platform and services Combination of the product portfolio, go-to-market and services assets will allow us to lead the industry transition and reinforce our credibility with developers We will reinforce our credibility with developers who are driving core IT decisions Run Build Manage Single Control Point Many Clouds Many Clusters Many Teams Kubernetes Grid SDDC | Public Cloud | Edge | Bare Metal Existing | Open Source | Cloud Native Modern Applications Vision: Transform how to build, run and manage modern apps on any cloud SDDC VMware Cloud Public Clouds Edge

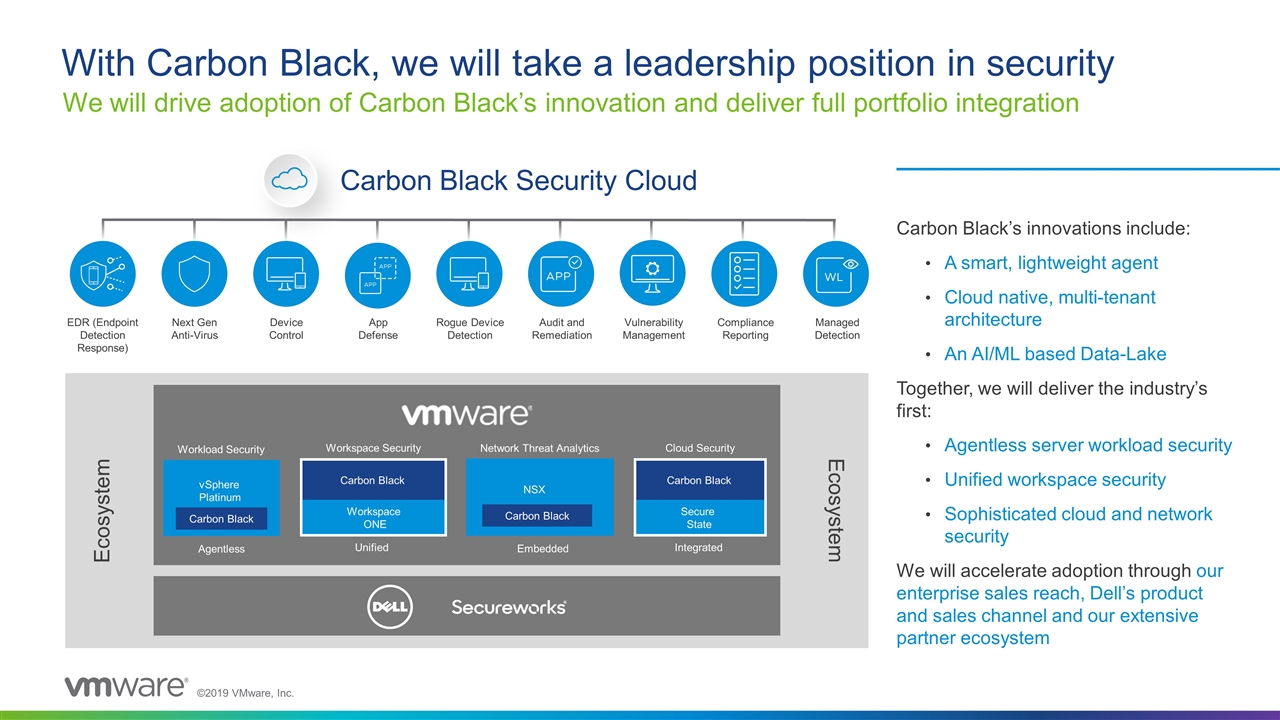

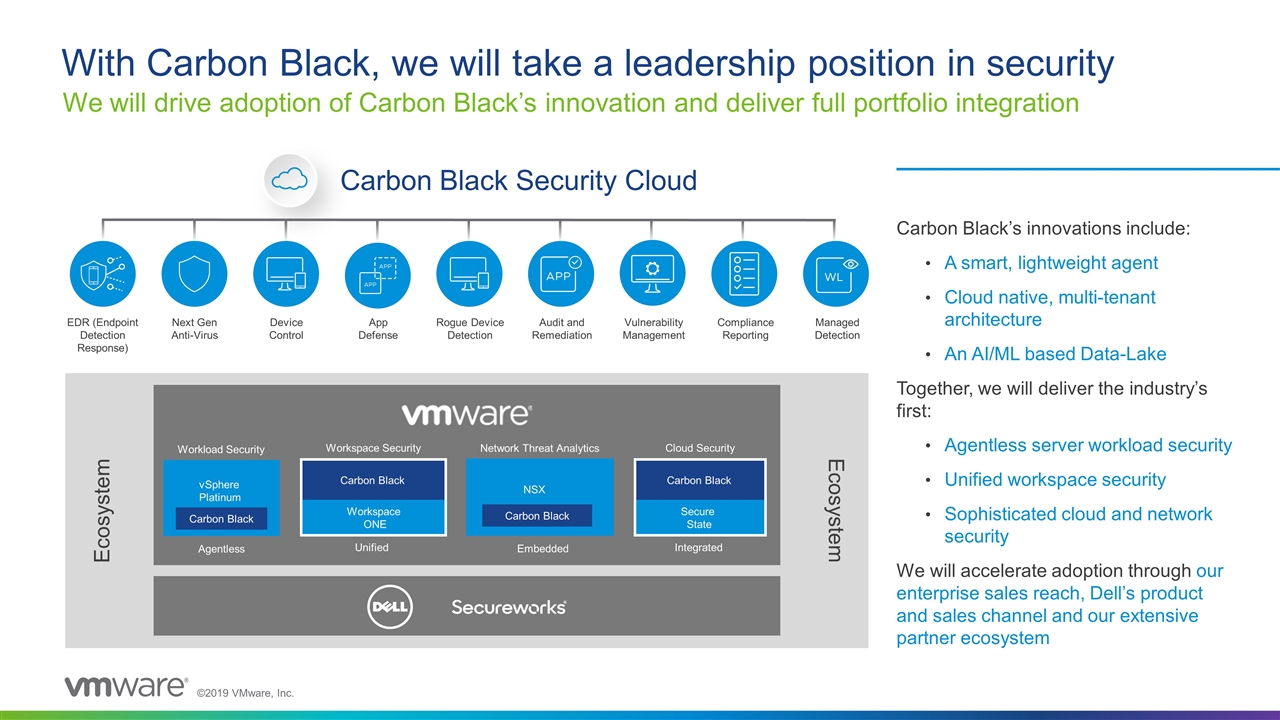

Carbon Black Security Cloud With Carbon Black, we will take a leadership position in security Carbon Black’s innovations include: A smart, lightweight agent Cloud native, multi-tenant architecture An AI/ML based Data-Lake Together, we will deliver the industry’s first: Agentless server workload security Unified workspace security Sophisticated cloud and network security We will accelerate adoption through our enterprise sales reach, Dell’s product and sales channel and our extensive partner ecosystem We will drive adoption of Carbon Black’s innovation and deliver full portfolio integration Next Gen Anti-Virus EDR (Endpoint Detection Response) Vulnerability Management Compliance Reporting Managed Detection Audit and Remediation App Defense Device Control Rogue Device Detection Carbon Black Workspace ONE Workspace Security Unified Ecosystem Ecosystem Carbon Black Secure State Cloud Security Integrated Carbon Black Workload Security Agentless vSphere Platinum Carbon Black Network Threat Analytics Embedded NSX

This presentation contains forward-looking statements including, among other things, statements regarding the proposed acquisitions of Carbon Black and Pivotal Software by VMware such as: the amount and type of consideration expected to be paid for each acquisition; the net cash and equity payouts and dilutive impact on VMware; the sources of funding for the acquisitions, including VMware’s ability to access short-term borrowing; the expected timing for the acquisitions; the growth opportunities, acceleration and expansion of VMware’s offerings associated with each acquisition and potential benefits to VMware and its customers; the expected impact on VMware’s future financial performance and results of operations including revenue growth, subscription and SaaS revenues and operating margin. These forward-looking statements are subject to applicable safe harbor provisions under federal securities laws, such as the Private Securities Litigation Reform Act of 1995. Actual results could differ materially from those projected in the forward-looking statements as a result of certain risk factors, including but not limited to: (1) the satisfaction or waiver of the conditions to closing the proposed acquisitions (including the failure to obtain necessary regulatory approvals) in the anticipated timeframe or at all; (2) uncertainties as to how many of Carbon Black’s stockholders will tender their shares in the tender offer and the outcome of the vote by Pivotal stockholders to approve the Pivotal acquisition; (3) the possibility that either or both acquisitions do not close; (4) the possibility that competing offers may be made; (5) risks related to obtaining the requisite consents to each acquisition, including, without limitation, the timing (including possible delays) and receipt of regulatory approvals from various governmental entities (including any conditions, limitations or restrictions placed on these approvals and the risk that one or more governmental entities may deny approval); (6) risks related to the ability to realize the anticipated benefits of the proposed acquisitions, including the possibility that the expected benefits from the proposed acquisitions will not be realized or will not be realized within the expected time period; (7) the risk that the businesses will not be integrated successfully; (8) disruption from the transactions making it more difficult to maintain business and operational relationships; (9) negative effects of this announcement or the consummation of the proposed acquisitions on the market price of VMware’s common stock, credit ratings and operating results; (10) the risk of litigation and regulatory actions related to the proposed acquisitions; (11) other business effects, including the effects of industry, market, economic, political or regulatory conditions; (12) other unexpected costs or delays in connection with the acquisitions; (13) adverse changes in general economic or market conditions; (14) delays or reductions in consumer, government and information technology spending; (15) competitive factors, including but not limited to pricing pressures, industry consolidation, entry of new competitors into the virtualization software and cloud, workspace and mobile computing industries, and new product and marketing initiatives by VMware’s competitors; (16) changes to product and service development timelines; (17) VMware’s relationship with Dell Technologies and Dell’s ability to control matters requiring stockholder approval, including the election of VMware’s board members and matters relating to Dell’s investment in VMware; and (18) geopolitical changes such as Brexit and increased tariffs and trade barriers that could adversely impact our non-U.S. sales. These forward-looking statements are made as of the date of this press release, are based on current expectations and are subject to uncertainties and changes in condition, significance, value and effect as well as other risks detailed in documents filed with the Securities and Exchange Commission, including VMware’s most recent reports on Form 10-K and Form 10-Q and current reports on Form 8-K that we may file from time to time, which could cause actual results to vary from expectations. VMware assumes no obligation to, and does not currently intend to, update any such forward-looking statements after the date of this release. Forward-looking statements

This communication may be deemed to be solicitation material in respect of the proposed merger with Pivotal Software (the “Pivotal Merger”). This communication does not constitute an offer to sell or the solicitation of an offer to buy VMware securities or the solicitation of any vote or approval. The proposed Pivotal Merger will be submitted to Pivotal’s stockholders for their consideration. In connection with the proposed transaction, Pivotal intends to file a proxy statement and other relevant materials with the Securities and Exchange Commission (the “SEC”) in connection with the solicitation of proxies by Pivotal, the Company and Dell Technologies in connection with the proposed transaction. The definitive proxy statement will be mailed to Pivotal’s stockholders. BEFORE MAKING ANY VOTING OR INVESTMENT DECISION WITH RESPECT TO THE PROPOSED TRANSACTION, INVESTORS AND STOCKHOLDERS OF PIVOTAL ARE URGED TO READ THE DEFINITIVE PROXY STATEMENT REGARDING THE PROPOSED TRANSACTION (INCLUDING ANY AMENDMENTS OR SUPPLEMENTS THERETO) AND OTHER RELEVANT MATERIALS CAREFULLY AND IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION. The proxy statement, any amendments or supplements thereto and other relevant materials, and any other documents filed by Pivotal with the SEC, may be obtained once such documents are filed with the SEC free of charge at the SEC’s website at www.sec.gov. In addition, Pivotal’s stockholders may obtain free copies of the documents filed with the SEC through the Investors portion of Pivotal’s website at investors.pivotal.io or by contacting Pivotal’s Investor Relations Department via e-mail at ir@pivotal.io. Pivotal, VMware, Dell Technologies Inc. and certain of their respective executive officers, directors, other members of management and employees, may under the rules of the SEC, be deemed to be “participants” in the solicitation of proxies from Pivotal’s stockholders in connection with the proposed transaction. Information regarding the persons who may be considered “participants” in the solicitation of proxies will be set forth in Pivotal’s preliminary and definitive proxy statements when filed with the SEC and other relevant documents to be filed with the SEC in connection with the proposed transaction, each of which can be obtained free of charge from the sources indicated above when they become available. Information regarding certain of these persons and their beneficial ownership of Pivotal’s common stock is also set forth in Pivotal’s proxy statement for its 2019 annual meeting of stockholders filed on May 3, 2019 with the SEC, which may be obtained free of charge from the sources indicated above. Additional information about the Pivotal acquisition and where to find it

Additional information about the Carbon Black tender offer and where to find it The tender offer referenced in this communication has not yet commenced. This communication is for informational purposes only and is neither an offer to purchase nor a solicitation of an offer to sell Carbon Black securities, nor is it a substitute for the tender offer materials that VMware and its acquisition subsidiary will file with the SEC. The solicitation and offer to buy Carbon Black stock will only be made pursuant to an Offer to Purchase and related tender offer materials. At the time the tender offer is commenced, VMware and its acquisition subsidiary will file a tender offer statement on Schedule TO and thereafter Carbon Black will file a Solicitation/Recommendation Statement on Schedule 14D-9 with the SEC with respect to the tender offer. THE TENDER OFFER MATERIALS (INCLUDING AN OFFER TO PURCHASE, A RELATED LETTER OF TRANSMITTAL AND CERTAIN OTHER TENDER OFFER DOCUMENTS) AND THE SOLICITATION/RECOMMENDATION STATEMENT ON SCHEDULE 14D-9 WILL CONTAIN IMPORTANT INFORMATION. CARBON BLACK STOCKHOLDERS ARE URGED TO READ THESE DOCUMENTS CAREFULLY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION THAT HOLDERS OF CARBON BLACK SECURITIES SHOULD CONSIDER BEFORE MAKING ANY DECISION REGARDING TENDERING THEIR SECURITIES. The Offer to Purchase, the related Letter of Transmittal and certain other tender offer documents, as well as the Solicitation/Recommendation Statement, will be made available to all holders of Carbon Black stock at no expense to them. The tender offer materials and the Solicitation/Recommendation Statement will be made available for free at the SEC’s website at www.sec.gov. Additional copies may be obtained for free by contacting VMware or Carbon Black. Copies of the documents filed with the SEC by Carbon Black will be available free of charge on Carbon Black internet website at investors.carbonblack.com/financial-information/sec-filings or by contacting Carbon Black’s Investor Relations Department at (617) 393-4700. Copies of the documents filed with the SEC by VMware will be available free of charge on VMware’s internet website at ir.vmware.com contacting VMware’s Investor Relations Department via email at IR@vmware.com. In addition to the Offer to Purchase, the related Letter of Transmittal and certain other tender offer documents, as well as the Solicitation/Recommendation Statement, VMware and Carbon Black each file annual, quarterly and current reports and other information with the SEC. VMware’s and Carbon Black’s filings with the SEC are available to the public on the SEC’s website at www.sec.gov.