NAUTILUS MINERALS INC.

Suite 1400, 400 Burrard Street

Vancouver, British Columbia V6C 3A6

INFORMATION CIRCULAR

(As at May 7, 2015 except as indicated)

Nautilus Minerals Inc. (the "Company" or "Nautilus") is providing this Information Circular and a form of proxy in connection with management's solicitation of proxies for use at the annual general meeting (the "Meeting") of the Company to be held on Tuesday, June 16, 2015 and at any adjournments. Unless the context otherwise requires, when we refer in this Information Circular to the Company, its subsidiaries are also included. The Company will conduct its solicitation by mail and officers and employees of the Company may, without receiving special compensation, also telephone or make other personal contact with shareholders. The Company will pay the cost of solicitation.

This Information Circular contains references to United States dollars, Australian dollars and Canadian dollars. All dollar amounts referenced, unless otherwise indicated, are expressed in United States dollars, Australian dollars are referred to as "A$", and Canadian dollars are referred to as "C$".

APPOINTMENT OF PROXYHOLDER

The purpose of a proxy is to designate persons who will vote the proxy on a shareholder's behalf in accordance with the instructions given by the shareholder in the proxy. The persons whose names are printed in the enclosed form of proxy are officers or Directors of the Company (the "Management Proxyholders").

A shareholder has the right to appoint a person other than a Management Proxyholder, to represent the shareholder at the Meeting by striking out the names of the Management Proxyholders and by inserting the desired person's name in the blank space provided or by executing a proxy in a form similar to the enclosed form. A proxyholder need not be a shareholder.

VOTING BY PROXY

Only registered shareholders or duly appointed proxyholders are permitted to vote at the Meeting.Shares represented by a properly executed proxy will be voted or be withheld from voting on each matter referred to in the Notice of Meeting in accordance with the instructions of the shareholder on any ballot that may be called for and if the shareholder specifies a choice with respect to any matter to be acted upon, the shares will be voted accordingly.

If a shareholder does not specify a choice and the shareholder has appointed one of the Management Proxyholders as proxyholder, the Management Proxyholder will vote in favour of the matters specified in the Notice of Meeting and in favour of all other matters proposed by management at the Meeting.

The enclosed form of proxy also gives discretionary authority to the person named therein as proxyholder with respect to amendments or variations to matters identified in the Notice of the Meeting and with respect to other matters which may properly come before the Meeting.At the date of this Information Circular, management of the Company knows of no such amendments, variations or other matters to come before the Meeting.

2

COMPLETION AND RETURN OF PROXY

Completed forms of proxy must be deposited at the office of the Company’s registrar and transfer agent, Computershare Investor Services Inc., Proxy Department, 100 University Avenue, P.O. Box 4572, Toronto, Ontario, M5J 2Y1 not later than forty-eight (48) hours, excluding Saturdays, Sundays and holidays, prior to the time of the Meeting, unless the chairman of the Meeting elects to exercise his discretion to accept proxies received subsequently.

NON-REGISTERED HOLDERS

Only shareholders whose names appear on the records of the Company as the registered holders of shares or duly appointed proxyholders are permitted to vote at the Meeting.Most shareholders of the Company are "non-registered" shareholders because the shares they own are not registered in their names but instead registered in the name of a nominee such as a brokerage firm through which they purchased the shares; bank, trust company, trustee or administrator of self-administered RRSP's, RRIF's, RESP's and similar plans; or clearing agency such as The Canadian Depository for Securities Limited (a "Nominee"). If you purchased your shares through a broker, you are likely a non-registered holder.

If you, as a non-registered holder, wish to vote at the Meeting in person, you should appoint yourself as proxyholder by writing your name in the space provided on the request for voting instructions or proxy provided by the Nominee and return the form to the Nominee in the envelope provided. Do not complete the voting section of the form as your vote will be taken at the Meeting.

The Company is forwarding meeting materials directly to "non-objecting beneficial owners" (or "NOBOs"). If you are a NOBO and the Company or its agent has sent these materials directly to you (instead of through a Nominee), your name and address and information about your holdings of securities have been obtained in accordance with applicable securities regulatory requirements from the Nominee holding on your behalf. By choosing to send these materials to you directly, the Company (and not the Nominee holding on your behalf) has assumed responsibility for (i) delivering these materials to you and (ii) executing your proper voting instructions. Please return your voting instructions as specified in the request for voting instructions.

The Company is not using the "notice-and-access" delivery procedures established under Canadian securities legislation. The Company does not intend to pay for an intermediary to deliver to "objecting beneficial owners" (or "OBOs") the proxy-related materials and Form 54-101F7 Request for Voting Instructions Made by Intermediary. An OBO will not receive the materials unless the OBO's Nominee assumes the cost of delivery.

REVOCABILITY OF PROXY

In addition to revocation in any other manner permitted by law, a registered shareholder, his attorney authorized in writing or, if the shareholder is a corporation, a corporation under its corporate seal or by an officer or attorney thereof duly authorized, may revoke a proxy by instrument in writing, including a proxy bearing a later date. The instrument revoking the proxy must be deposited at the registered office of the Company, at any time up to and including the last business day preceding the date of the Meeting, or any adjournment thereof, or with the chairman of the Meeting on the day of the Meeting.

A non-registered shareholder who wishes to revoke a proxy or voting instructions should contact their Nominee well in advance of the Meeting. A non-registered shareholder who wishes to change voting instructions given by telephone or internet may be able to revoke such voting instructions by voting a second time via the same method.

3

VOTING SHARES AND PRINCIPAL HOLDERS THEREOF

The Company is authorized to issue an unlimited number of common shares without par value ("shares"), of which 445,302,865 shares are issued and outstanding as of May 7, 2015 (including 11,325,000 shares held by the Agent under the Share Loan Plan).Persons who are registered shareholders at the close of business on May 7, 2015 will be entitled to receive notice of and vote at the Meeting and will be entitled to one vote for each share held, subject to the provisions of the Share Loan Plan in respect of loan shares. For information on the Share Loan Plan, see below under the heading "Securities Authorized for Issuance Under Equity Compensation Plans – Information Concerning the Company's Share Loan Plan." The Company has only one class of shares.

To the knowledge of the Directors and executive officers of the Company, no person beneficially owns, directly or indirectly, or controls or directs shares carrying 10% or more of the voting rights attached to all shares of the Company except as listed below:

| | No. of Shares Beneficially Owned, Controlled | Percentage of Outstanding |

| Name | or Directed, Directly or Indirectly | Shares(1) |

| | | |

| Mohammed Al Barwani(2) | 122,120,852 | 27.42% |

| | | |

| Metalloinvest Holding (Cyprus) | 90,668,516 | 20.36% |

| Limited | | |

| (1) | On a diluted basis, including 11,325,000 shares held by the Agent under the Share Loan Plan. On a non-diluted basis, the applicable percentages are 28.14% (in respect of Dr. Al Barwani) and 20.89% (in respect of Metalloinvest Holding (Cyprus) Limited). |

| | |

| (2) | Shares are held via MB Holding Co. LLC and Mawarid Offshore Mining Ltd, companies indirectly controlled by Dr. Al Barwani. |

In this Information Circular, references to the number of outstanding shares on a "diluted" basis mean the number of outstanding shares including shares held by the Agent under the Share Loan Plan, and references to the number of outstanding shares on a "non-diluted" basis mean the number of outstanding shares excluding shares held by the Agent under the Share Loan Plan. See "Securities Authorized for Issuance under Equity Compensation Plans – Information Concerning the Company's Share Loan Plan" for details of the Share Loan Plan.

ELECTION OF DIRECTORS

The Directors of the Company are elected at each annual general meeting and hold office until the next annual general meeting or until their successors are appointed. The Company’s board of directors has two committees, the Audit Committee and the Governance, Nomination and Remuneration Committee (the "GN&R Committee"). Membership of each committee is as set out in the table below.

In accordance with the Company’s Articles, the directors have fixed the number of directors of the Company at six (6). Management of the Company proposes to nominate each of the following persons for election as a Director. In the absence of instructions to the contrary, the enclosed proxy will be voted for the nominees herein listed. Information concerning such persons, as furnished by the individual nominees, is as follows:

4

| | | | Number of Common |

| | Principal Occupation or | Previous Service | Shares Beneficially |

| | employment and, if not a previously | as a Director | Owned, |

Name, Jurisdiction of | elected Director, occupation during | (Date first elected | Controlled or Directed, |

Residence and Position | the past 5 years | or appointed) | Directly or Indirectly(3) |

| | | | |

| A. Geoffrey Loudon(1)(2) | Executive Chairman of the private | May 4, 2006 | 3,108,029 |

| New Zealand | New Zealand based L&M Group of | | |

| Chairman and Director | minerals and energy companies. | | |

| | | | |

| Russell Debney(1)(2) | Lawyer. Chief Executive Officer of | May 4, 2006 | 515,300 |

| New South Wales, | Direct Nickel Limited, an ASX | | |

| Australia | listed company developing process | | |

| Director | technology for the nickel laterite | | |

| | industry. | | |

| | | | |

| Cynthia Thomas(1)(2) | Principal of Conseil Advisory | June 23, 2010 | 80,000 |

| Reno, Nevada | Services Inc., a financial advisory | | |

| Director | firm specializing in the natural | | |

| | resource sector, since 2000. | | |

| | | | |

| Dr. Mohammed Al | Chairman of MB Holding Co. LLC, | September 11, 2012 | 122,120,852(4) |

| Barwani | a company with interests in oilfield | | |

| Muscat, Oman | services, exploration and production | | |

| Director | of hydrocarbon, mining & minerals, | | |

| | engineering & manufacturing and | | |

| | investments since 1982. | | |

| | | | |

| Mark Horn | Chief Executive of M. Horn & Co., | September 20, 2013 | Nil |

| Lincolnshire, U.K. | an advisory group specializing in | | |

| Director | corporate finance and research. | | |

| | | | |

| Tariq Al Barwani | Chief Executive Officer of Mawarid | April 28, 2015 | Nil |

| Muscat, Oman | Mining LLC, a wholly-owned | | |

| Director | subsidiary of MB Holding Co. LLC, | | |

| | established to explore and develop | | |

| | mining opportunities in Oman and | | |

| | internationally. | | |

| (1) | Current member of the Audit Committee. |

| (2) | Current member of the GN&R Committee. |

| (3) | Shares beneficially owned, directly or indirectly, or over which control or direction is exercised (which, for clarity, does not include shares held by the Agent pursuant to the Company's Share Loan Plan) as at May 7, 2015, based upon information furnished to the Company by individual Directors. Unless otherwise indicated, such shares are held directly. |

| (4) | Shares are held by MB Holding Co. LLC and Mawarid Offshore Mining Ltd, companies indirectly controlled by Dr. Al Barwani. |

Dr. Al Barwani and Mr. Al Barwani were nominated by MB Holding Co. LLC, which, through its subsidiary Mawarid Offshore Mining Ltd., holds 27.42% of the Company's outstanding common shares, and of which Dr. Al Barwani is the Chairman and Mr. Al Barwani is the Chief Executive Officer of Mawarid Mining LLC. Mr. Horn was nominated by Metalloinvest Holdings (Cyprus) Limited, which holds 20.36% of the Company's outstanding common shares.

Other than Dr. Al Barwani, Mr. Al Barwani and Mr. Horn, no proposed director is to be elected under any arrangement or understanding between the proposed director and any other person or company, except the directors and executive officers of the company acting solely in such capacity.

5

Majority Voting Policy

As required by the policies of the Toronto Stock Exchange (the "TSX"), the Board of Directors of the Company adopted a majority voting policy effective from March 30, 2015 (the "Majority Voting Policy"). In accordance with the requirements of the TSX, the Majority Voting Policy provides as follows:

| • | In an election of directors, other than at a Contested Meeting, any director who receives a greater number of shares withheld, than shares voted in favour of his or her election, must immediately tender his or her resignation ("Resignation") to the Board of Directors. |

| | | |

| • | The Board shall determine whether or not to accept the Resignation within 90 days after the date of the relevant meeting. |

| | | |

| | • | The Board shall accept the Resignation absent exceptional circumstances. |

| | | |

| | • | The Resignation will be effective when accepted by the Board. |

| | | |

| • | The director tendering the Resignation will not participate in any Board or committee meeting at which the Resignation is considered. |

| | | |

| • | The Company shall promptly issue a news release with the Board's decision and send a copy to TSX. |

| | | |

| | • | If the Resignation is not accepted, the news release shall fully state the reasons for that decision. |

| | | |

| • | A "Contested Meeting" is a meeting at which the number of directors nominated for election is greater than the number of seats available on the Board. |

Regulatory Orders, Bankruptcies and Directorships in Other Reporting Issuers

To the knowledge of the Company, none of the management nominees for election as a Director:

| (a) | is, as at the date of this Information Circular, or has been, within 10 years before the date of this Information Circular, a director, chief executive officer ("CEO") or chief financial officer ("CFO") of any company (including the Company) that: |

| | (i) | was the subject, while the proposed director was acting in the capacity as director, CEO or CFO of such company, of a cease trade or similar order or an order that denied the relevant company access to any exemption under securities legislation, that was in effect for a period of more than 30 consecutive days; or |

| | | |

| | (ii) | was subject to a cease trade or similar order or an order that denied the relevant company access to any exemption under securities legislation, that was in effect for a period of more than 30 consecutive days, that was issued after the proposed director ceased to be a director, CEO or CFO but which resulted from an event that occurred while the proposed director was acting in the capacity as director, CEO or CFO of such company; or |

| (b) | is, as at the date of this Information Circular, or has been within 10 years before the date of this Information Circular, a director or executive officer of any company (including the Company) that, while that person was acting in that capacity, or within a year of that person ceasing to act in that capacity, became bankrupt, made a proposal under any legislation relating to bankruptcy or insolvency or was subject to or instituted any proceedings, arrangement or compromise with creditors or had a receiver, receiver manager or trustee appointed to hold its assets; or |

6

| (c) | has, within the 10 years before the date of this Information Circular, become bankrupt, made a proposal under any legislation relating to bankruptcy or insolvency, or become subject to or instituted any proceedings, arrangement or compromise with creditors, or had a receiver, receiver manager or trustee appointed to hold the assets of the proposed director; or |

| | |

| (d) | has been subject to any penalties or sanctions imposed by a court relating to securities legislation or by a securities regulatory authority or has entered into a settlement agreement with a securities regulatory authority; or |

| | |

| (e) | has been subject to any penalties or sanctions imposed by a court or regulatory body that would likely be considered important to a reasonable security holder in deciding whether to vote for a proposed director. |

The Directors hold directorships in other reporting issuers as set out below:

Name of Director | Name of Other Reporting Issuer |

| Russell Debney | Direct Nickel Limited |

| Cynthia Thomas | Victory Nickel Inc

KWG Resources Inc |

| Mohammed Al Barwani | Al Madina Financial Services

Al Madina Insurance

Oman Air

Abu Dhabi National Takaful Insurance Company |

EXECUTIVE COMPENSATION

Compensation Discussion and Analysis

Composition of the Governance, Nomination & Remuneration Committee

The Company's GN&R Committee, on behalf of the Board of Directors, monitors compensation of executive officers of the Company. Independent Directors Messrs. Loudon and Debney and Ms. Thomas were members of the GN&R Committee during the most recently completed financial year. Mr. Loudon also serves as the Company’s Chairman.

The GN&R Committee possesses the following skills and experience that enable it to make decisions on the suitability of the Company’s compensation policies and practices: experience in the management of companies, human resources management including hiring, dismissals, as well as establishing, communicating and evaluating overall corporate objectives and personal performance objectives.

Nautilus’ Chairman, Geoff Loudon, is a geologist with international experience covering resource exploration, development and production as well as investment banking. He was founder and Chairman of Niugini Mining Limited, an international gold and copper producer. He was a founding director of Lihir Gold Limited, an international gold producer. He is Executive Chairman of New Zealand based L & M Group, which produces gold, oil and gas.

Russell Debney is a commercial and corporate lawyer as well as a Director of a number of companies in the mining and resources industry. He has significant experience in the management, financing and structuring of resource projects, particularly in the offshore environment, and is Chief Executive Officer of Direct Nickel Limited, a developer of process technology for nickel laterite deposits.

7

Cynthia Thomas is the Principal of Conseil Advisory Services Inc., an independent financial advisory firm specialising in the natural resource industry which she founded in 2000. Prior to founding Conseil, Ms. Thomas worked with Bank of Montreal, Scotiabank and ScotiaMcLeod in the corporate and investment banking divisions.

None of the members of the GN&R Committee have any indebtedness to the Company or any of its subsidiaries (other than indebtedness of Mr. Debney under the Share Loan Plan, as described below under the heading "Indebtedness of Directors and Executive Officers") nor have they any material interest, or have any associates or affiliates which have any material interest, direct or indirect, in any actual or proposed transaction in the last financial year which has materially affected or would materially affect the Company or any of its subsidiaries.

Additional information regarding the GN&R Committee is provided below under the heading "Corporate Governance Disclosure – Compensation of Directors and the CEO".

Risk Considerations

The Board considers the implications of the risks associated with the Company’s compensation policies and practices when determining rewards for its officers and Directors. The Board has undertaken a review of the risks, if any, associated with the Company’s compensation policies and practices and intends to do so at least once annually.

Executive compensation is comprised of both short-term compensation in the form of a base salary/fee and an incentive plan through the grant of stock options and loan shares as described in detail below. This structure ensures that a significant portion of executive compensation (stock options/loan shares) is both long-term and "at risk" and, accordingly, is directly linked to the achievement of business results and the creation of long term shareholder value.

The Board also has the ability to set out vesting periods in each stock option agreement and share loan plan offer. As the benefits of such compensation, if any, are not realized by officers and Directors until a significant period of time has passed, the ability of officers to take inappropriate or excessive risks that are beneficial to their compensation at the expense of the Company and the shareholders is extremely limited. Furthermore, all elements of executive compensation are discretionary. As a result, it is unlikely an officer would take inappropriate or excessive risks at the expense of the Company or the shareholders that would be beneficial to their short-term compensation when their long-term compensation might be put at risk from their actions.

Due to the relatively small size of the Company and its current management group, the Board is able to closely monitor and consider any risks which may be associated with the Company’s compensation policies and practices. Risks, if any, may be identified and mitigated through regular Board meetings during which financial and other information of the Company is reviewed.

No risks have been identified arising from the Company’s compensation policies and practices that are reasonably likely to have a material adverse effect on the Company.

Hedging of Economic Risks in the Company’s Securities

Directors and officers may not take any derivative or speculative positions in the Company’s securities. This is to prevent the purchase of financial instruments that are designed to hedge or offset any decrease in the market value of the Company’s securities.

8

Report on Executive Compensation

The Board of Directors collectively has the responsibility to administer the compensation policies related to the executive management of the Company, including those named in the Summary Compensation Table below. The Company's Goverance, Nomination & Remuneration Committee, on behalf of the Board of Directors, monitors compensation of executive officers of the Company. Additional information regarding the GN&R Committee and its role and responsibilities is provided below under the heading "Corporate Governance Disclosure – Compensation of Directors and the CEO".

Executive compensation is based upon the need to provide a compensation package that will allow the Company to attract and retain qualified and experienced executives, balanced with a pay-for-performance philosophy. Compensation for the current and prior fiscal years has historically been based upon negotiated contracts, with stock options and, since the initial approval of the Share Loan Plan at the Annual General Meeting held July 26, 2011 (the "2011 AGM"), loan shares, being issued as a long term incentive for performance. A compensation consultant was not engaged by the Company to determine executive compensation at any time since the Company's most recently completed financial year; however, an annual review of executive compensation was completed using AON Hewitt’s report entitled, “The McDonald Gold and General Mining Industry Remuneration Report No. 52” and dated October 2013 ("Remuneration Report"). The Remuneration Report is an external salary survey based on approximately 126 resource companies in respect of 173 operations, and is used by the Company to ensure it remains competitive and is able to retain its executives. The survey group is broad, representing gold and other metalliferous / non-metalliferous mining companies, mining contractors and exploration companies. Of the organisations that contribute data to the Remuneration Report, 68% are operated by mining companies and 32% are operated by mining contractors. The mining companies are benchmarked based on gross revenue, operating budget and employee numbers.

The Company has a performance based remuneration process established across the Company including the Company's executives. At the end of each year key performance indicators ("KPIs"), which have been recommended by the GN&R Committee and approved by the Board based on the Company’s goals, are assessed by the CEO. Where possible, the KPIs are specific and measurable.A short term cash incentive may be awarded to the Company's executives on attaining the annual KPIs. A short term cash incentive was awarded to the NEOs (as defined under "Summary Compensation Table" below) for the 2014 financial year and paid in January 2015.

As the Company’s 2013 KPIs were not achieved, none of the NEOs received any cash incentive payment for the 2013 financial year.

In December 2012, following approximately 60 positions being made redundant by the Company, the Board approved the implementation of a short term employee retention plan (“Retention Plan”) to ensure that the Company’s corporate memory was retained. Under the Retention Plan, which is unrelated to the achievement of the KPIs, the NEOs were entitled to a cash bonus, equal to their maximum annual cash bonus as a percentage of base salary outlined in the table below, provided that the NEO was still employed by the Company as at December 31, 2013. The cash bonus payable to NEOs under the Retention Plan was paid in January 2014.

The Company relies on the exemption in Subsection 2.1(4) of Form 51-102F6 to disclosure of performance goals or similar conditions in respect of specific quantitative or qualitative performance-related factors on the basis that such disclosure would seriously prejudice the interests of the Company. The Company is a seafloor resource exploration company and the first publically listed company to commercially explore the ocean floor for copper, gold, silver and zinc seafloor massive sulphide deposits. The Company holds tenement licences and exploration applications in various locations in the western and central Pacific Ocean and is establishing a pipeline of prospects for development. The Company’s main focus is on developing a seafloor production system that can be used to extract resources from its seafloor prospects. The system is intended to be applied to its initial development project, the Solwara 1 Project, located in the Bismarck Sea in the territorial waters of PNG. Nautilus' seafloor production system has the potential to open a new frontier of resource development as land-based mineral deposits continue to be depleted. With the Solwara 1 Project, Nautilus plans to become the world's first seafloor producer of copper and gold. If the Company were to disclose its specific performance goals it could provide the Company’s potential competitors in this newly developed market with insight into its confidential business plans and strategies and identify the factors and underlying assumptions that are reflected in the Company’s confidential business plans. Given the pioneering nature of the Company's business, the Company cannot state with accuracy how difficult it could be for the NEOs, or how likely it will be for the Company, to achieve the undisclosed performance goals.

9

The maximum annual cash bonus as a percentage of base salary for which each Named Executive Officer was eligible in 2014 is set forth in the following table:

| Position | 2014 Maximum Annual Cash |

| | Bonus (% of 2014 Base Salary(1)) |

| Michael Johnston | 30 |

| President and Chief Executive Officer | |

| Shontel Norgate | 30 |

| Chief Financial Officer | |

| Kevin Cain | 30 |

| VP – Projects | |

| Jonathan Lowe | 30 |

| VP – Strategic Development & Exploration | |

| Karen Hauff | 30 |

| General Counsel and Company Secretary | |

| (1) | Details of 2014 base salaries and actual bonuses paid to the Named Executive Officers are listed in the “Summary Compensation Table” below. |

The Company's stock option and share loan plans are used to provide the equivalent of share purchase options which are granted in consideration of the level of responsibility of the executive as well as his or her impact or contribution to the longer-term operating performance of the Company. In determining the number of options or loan shares to be granted to the executive officers, the Board of Directors takes into account the number of options or loan shares, if any, previously granted to each executive officer, and the exercise price of any outstanding options or loan shares to ensure that such grants are in accordance with the policies of the TSX, and closely align the interests of the executive officers with the interests of shareholders.

See "Securities Authorized for Issuance Under Equity Compensation Plans – Information Concerning the Company’s Stock Option Plan and Information Concerning the Company's Share Loan Plan".

Base Salary and Bonus

The Chairman of the GN&R Committee, currently Mr. Loudon, prepares recommendations for the GN&R Committee with respect to the base salary and, if appropriate, bonuses to be paid to the Chief Executive Officer and to other executive officers. The GN&R Committee approves the base salaries and bonuses for the executive officers including the Chief Executive Officer. The GN&R's recommendation for the Chief Executive Officer and the executive officers is then submitted for approval by the Board of Directors of the Company. The compensation recommended is determined based on an assessment by the GN&R Committee of the executive's performance, a consideration of compensation levels in companies similar to the Company and a review of the performance of the Company as a whole.

10

Chief Executive Officer Compensation

The compensation of the Chief Executive Officer consists of an annual base salary, and, if warranted, bonus and stock options/loan shares determined in the manner described in the above discussion of compensation for all executive officers.

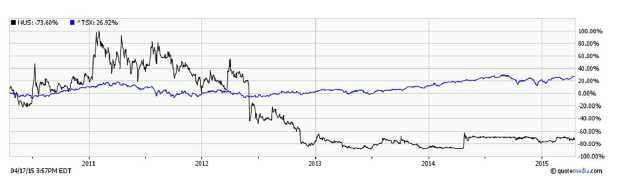

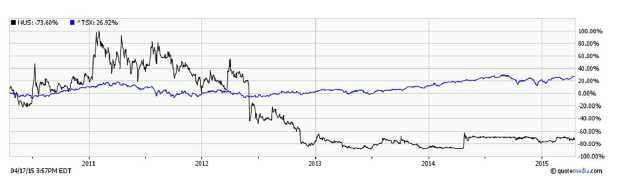

Performance Graph

The following graph compares the yearly percentage change in the cumulative total shareholder return on the common shares of the Company for the past five years, with the cumulative total return of the S&P TSX Composite Index, assuming reinvestment of dividends. The common share trading data is as reported by the TSX.

As discussed above, executive compensation is based upon the need to provide a compensation package that will allow the Company to attract and retain qualified and experienced executives, balanced with a pay-for-performance philosophy. However, there is no direct correlation between the performance graph and executive compensation.

Option/Loan Share-based awards

The Company's stock option and share loan plans are used to provide the equivalent of share purchase options which are granted in consideration of the level of responsibility of the executive as well as his or her impact or contribution to the longer-term operating performance of the Company. In determining the number of options or loan shares to be granted to the executive officers, the Board of Directors takes into account the number of options or loan shares, if any, previously granted to each executive officer, and the exercise price of any outstanding options or loan shares to ensure that such grants are in accordance with the policies of the TSX, and closely align the interests of the executive officers with the interests of shareholders.

The GN&R Committee has the responsibility to administer the compensation policies related to the executive management of the Company, including option/loan share-based awards.

Summary Compensation Table

The following table (presented in accordance with Form 51-102F6 of National Instrument 51-102Continuous Disclosure Obligations) sets forth all annual and long term compensation for services in all capacities to the Company for the three most recently completed financial years in respect of each of the individuals comprised of the Chief Executive Officer and the Chief Financial Officer as at December 31, 2014, and the other three most highly compensated executive officers of the Company as at December 31, 2014 whose individual total compensation for the most recently completed financial year exceeded $150,000 and any individual who would have satisfied these criteria but for the fact that suchindividual was not serving as such an officer at the end of the most recently completed financial year (collectively the "Named Executive Officers" or "NEOs").

11

| | | | | | Non-Equity | | | |

| | | | | | Incentive Plan | | | |

| | | | | | Compensation | | | |

| | | | | Option- | ($) | | | |

| | | | Share- | Based | | Long- | | All Other | |

| NEO Name and | | | Based | Awards | Annual | term | Pension | Compensation | Total |

| Principal | | Salary | Awards | (2) | Incentive | Incentive | Value | (5) | Compensation |

| Position(1) | Year | ($) | ($) | ($) | Plans(4) | Plans | ($) | ($) | ($) |

| Michael | 2014 | 518,948 | N/A | 271,479 | 153,427 | N/A | N/A | 62,070 | 1,005,924 |

| Johnston(3) | 2013 | 575,011 | N/A | 82,415 | Nil | N/A | N/A | 235,065 | 892,491 |

| President & | 2012 | 480,208 | N/A | 124,723 | Nil | N/A | N/A | 41,057 | 645,988 |

| Chief Executive | | | | | | | | | |

| Officer | | | | | | | | | |

| | | | | | | | | | |

| Shontel Norgate | 2014 | 314,636 | N/A | 190,036 | 84,952 | N/A | N/A | 37,567 | 627,191 |

| Chief Financial | 2013 | 337,402 | N/A | 54,943 | Nil | N/A | N/A | 141,566 | 533,911 |

| Officer | 2012 | 361,730 | N/A | 124,723 | Nil | N/A | N/A | 32,556 | 519,009 |

| | | | | | | | | | |

| Kevin Cain | 2014 | 489,482 | N/A | 190,036 | 132,160 | N/A | N/A | 58,444 | 870,122 |

| VP – Projects | 2013 | 524,898 | N/A | 54,943 | Nil | N/A | N/A | 220,198 | 800,039 |

| | 2012 | 562,746 | N/A | 124,723 | Nil | N/A | N/A | 50,647 | 738,116 |

| | | | | | | | | | |

| Jonathan Lowe | 2014 | 291,561 | N/A | 135,740 | 78,721 | N/A | N/A | 34,812 | 540,834 |

| VP – Strategic | 2013 | 312,337 | N/A | 54,943 | Nil | N/A | N/A | 130,975 | 498,255 |

| Development & | 2012 | 301,982 | N/A | 62,362 | Nil | N/A | N/A | 35,299 | 399,643 |

| Exploration | | | | | | | | | |

| Karen Hauff | 2014 | 220,303 | N/A | 135,740 | 66,761 | N/A | N/A | 28,834 | 451,638 |

| General Counsel | 2013 | 207,336 | N/A | 21,977 | Nil | N/A | N/A | 86,874 | 316,187 |

| and Company | 2012 | 222,289 | N/A | 41,574 | Nil | N/A | N/A | 22,665 | 286,528 |

| Secretary | | | | | | | | | |

| | (1) | The compensation awarded to, earned by, paid to, or payable to each of the NEOs was in Australian dollars and for the most recently completed financial year has been translated herein at the rate of A$1.00 for every US$0.9025. The rate at which compensation for the 2013 financial year has been translated is A$1.00 for every US$0.9678. The rate at which compensation for the 2012 financial year has been translated is A$1.00 for every US$1.0376. The Company uses the average annual rate to translate the compensation into the reporting currency. |

| | (2) | The numbers in this column reflect the issuance of loan shares under the Company's Share Loan Plan, which are more akin to option-based awards than share-based awards. See the discussion of the Share Loan Plan and the Option Plan below under the heading "Securities Authorized for Issuance Under Equity Compensation Plans". The Company used the Black-Scholes-Merton model as the methodology to calculate the issue date fair value, and relied on the assumptions and estimates set forth in the Company's audited financial statements for the 2014 financial year. The Company chose this methodology because it is expected to be the most accurate measure of the fair value of the Company’s options and loan shares and is consistent with the methodology used for accounting purposes. |

| | (3) | Mr. Johnston was appointed President and CEO in October 2012. He had formerly acted as VP Strategic Development and Exploration. |

| | (4) | The payment of Annual Incentives for the NEOs relevant to the 2014 financial year were paid in 2015, with no Annual Incentive paid for 2012 or 2013, however a retention bonus was paid in January 2014, as described above under the heading "Compensation Discussion and Analysis – Report on Executive Compensation". |

| | (5) | Other compensation relates to superannuation contributions made – refer to "Pension Plan Benefits" below, and includes the retention bonus paid in January 2014, as described above under the heading "Compensation Discussion and Analysis – Report on Executive Compensation". |

12

Incentive Plan Awards

Outstanding Share-Based Awards and Option-Based Awards

The following table sets forth information concerning all awards outstanding under incentive plans of the Company at the end of the most recently completed financial year, including awards granted before the most recently completed financial year, to each of the NEOs.

| | Option-Based Awards | Share-Based Awards |

| | | | | | | Market or | |

| | | | | | | Payout | Market or |

| | | | | | Number of | Value Of | Payout Value |

| | Number of | | | Value of | Shares Or | Share- | Of vested |

| | Securities | | | Unexercised | Units Of | Based | share based |

| | Underlying | Option | | In-The- | Shares | Awards | awards not |

| | Unexercised | Exercise | Option | Money | That Have | That Have | paid out or |

| | Options | Price | Expiration Date | Options(1) | Not Vested | Not Vested | distributed |

Name | (a) | (b) | (c) | (d) | (e) | (f) | (g) |

| Michael | 300,000(2) | C$1.01(2) | 09 April 2016(2) | Nil | N/A | N/A | N/A |

| Johnston | 750,000(2) | C$0.24(2) | 01 July 2016(2) | C$105,000 | N/A | N/A | N/A |

| | 1,000,000(2) | C$0.57(2) | 01 July 2017(2) | Nil | N/A | N/A | N/A |

| Shontel | 300,000(2) | C$1.01(2) | 09 April 2016(2) | Nil | N/A | N/A | N/A |

| Norgate | 500,000(2) | C$0.24(2) | 01 July 2016(2) | C$70,000 | N/A | N/A | N/A |

| | 700,000(2) | C$0.57(2) | 01 July 2017(2) | Nil | N/A | N/A | N/A |

| Kevin Cain | 300,000(2) | C$1.01(2) | 09 April 2016(2) | Nil | N/A | N/A | N/A |

| | 500,000(2) | C$0.24(2) | 01 July 2016(2) | C$70,000 | N/A | N/A | N/A |

| | 700,000(2) | C$0.57(2) | 01 July 2017(2) | Nil | N/A | N/A | N/A |

| Jonathan | 150,000(2) | C$1.01(2) | 09 April 2016(2) | Nil | N/A | N/A | N/A |

| Lowe | 500,000(2) | C$0.24(2) | 01 July 2016(2) | C$70,000 | N/A | N/A | N/A |

| | 500,000(2) | C$0.57(2) | 01 July 2017(2) | Nil | N/A | N/A | N/A |

| Karen | 100,000(2) | C$1.01(2) | 09 April 2016(2) | Nil | N/A | N/A | N/A |

| Hauff | 200,000(2) | C$0.24(2) | 01 July 2016(2) | C$28,000 | N/A | N/A | N/A |

| | 500,000(2) | C$0.57(2) | 01 July 2017(2) | Nil | N/A | N/A | N/A |

| | (1) | This amount is calculated based on the positive difference between the market value of the shares underlying the options at December 31, 2014, which was C$0.38, and the exercise or base price of the option. |

| | (2) | Reflects the issuance of loan shares under the Company's Share Loan Plan. See the discussion of the Share Loan Plan and the Option Plan below under the heading "Securities Authorized for Issuance Under Equity Compensation Plans". Column (a) reflects the number of loan shares issued; column (b) reflects the issue price of the loan shares; column (c) reflects the loan expiration date; column (d) reflects the positive difference between the market value of the shares on December 31, 2014, which was C$0.38, and the issue price reflected in column (b). |

13

Incentive Plan Awards – Value Vested Or Earned During The Year

The following table sets out the value of all non-equity incentive plan compensation earned and stock options that vested during the financial year ended December 31, 2014 for each of the Named Executive Officers:

| NEO Name | Option-Based Awards -

Value Vested

During The Year(1)

($) | Share-Based Awards -

Value Vested

During The Year

($) | Non-Equity Incentive Plan

Compensation -

Value Earned

During The Year

($) |

| Michael Johnston | $Nil | N/A | $Nil |

| Shontel Norgate | $Nil | N/A | $Nil |

| Kevin Cain | $Nil | N/A | $Nil |

| Jonathan Lowe | $Nil | N/A | $Nil |

| Karen Hauff | $Nil | N/A | $Nil |

| | (1) | This amount is the dollar value that would have been realized by obtaining the difference between the market price of the shares underlying options and the exercise price of the options under the option-based award on the vesting date. No loan shares issued to NEOs vested in 2014. |

Narrative Discussion

No short term incentives or KPIs were paid to the NEOs for either the 2012 or the 2013 financial year. A short term cash incentive for achievement of KPIs was paid to NEOs for the 2014 financial year in January 2015. Any amounts paid upon attaining annual KPIs would be considered "Non-Equity Incentive Plan Compensation" for the purposes of this Executive Compensation disclosure.

The short term incentive payment due to NEOs under the Retention Plan was paid in January 2014, as described above under the heading "Compensation Discussion and Analysis – Report on Executive Compensation".

The issue of stock options or loan shares to Named Executive Officers is approved by the Board in accordance with the Company’s stock option and share loan plans, taking into consideration their position within the Company and the number of stock options and loan shares available for issue.

No loan shares issued to NEOs vested in 2014. With respect to any options or loan shares that vested during the year:

| NEOName | Aggregate number of

options vested | Date vested | Exercise price per

share | Expiry Date |

| Michael Johnston | N/A | N/A | N/A | N/A |

| Shontel Norgate | N/A | N/A | N/A | N/A |

| Kevin Cain | N/A | N/A | N/A | N/A |

| Jonathan Lowe | N/A | N/A | N/A | N/A |

| Karen Hauff | N/A | N/A | N/A | N/A |

14

Pension Plan Benefits

The Company does not have any form of pension plan that provides for payments or benefits to the Named Executive Officers at, following, or in connection with retirement. The Company does not have any form of deferred compensation plan. The Company contributes the equivalent of 9.25% of the base salary of each Named Executive Officer into the Named Executive Officer’s preferred superannuation fund.

Termination and Change of Control Benefits

The terms of the employment contracts between the Company or its subsidiaries and the Named Executive Officers that were in existence at the end of the most recently completed financial year are as follows.

As used below, a "change of control" shall be deemed to have occurred if the Company is the subject of a takeover bid at a time when the market capitalization of the Company exceeds US$150 million, pursuant to which any person (or group of persons acting jointly or in concert) acquires more than 50.1% of the then issued and outstanding common shares of the Company. As noted below under the heading "Information Concerning the Company's Stock Option Plan" and "Information Concerning the Company's Share Loan Plan", all unvested stock options and loan shares shall vest upon a change of control. If an NEO terminates his or her service agreement within 90 days of the date of a change of control, s/he shall be entitled to a severance payment equal to his or her annual base salary. If any NEO's employment is terminated within 9 months of a change of control, such NEO shall be entitled to a severance payment equal to three times his or her annual salary.

| 1. | The Company entered into an employment agreement dated January 1, 2014 with Michael Johnston (the "Johnston Agreement") pursuant to which it engaged Mr. Johnston as its President & CEO. The Johnston Agreement provides for a base salary of $518,948 per annum. In the event of termination without cause other than following a change of control, Mr. Johnston would be entitled to six months notice. If Mr. Johnston had been terminated without cause as at December 31, 2014, he would have been entitled to a payment of $553,732. If a change of control had occurred on December 31, 2014, he would have been entitled to receive a payment of $568,248 and other benefits having a value of $138,473 if he terminated the Johnston Agreement within 90 days from the date of the change of control or a payment of $1,704,745 and other benefits having a value of $138,473 if terminated by the Company within 9 months of the change of control, and option-based awards of C$105,000.(1)(2) |

| | |

| 2. | The Company entered into an employment agreement dated August 29, 2014 with Shontel Norgate (the "Norgate Agreement") pursuant to which it has engaged Ms. Norgate as its Chief Financial Officer. The Norgate Agreement provides for a base salary of $314,636 per annum. In the event of termination without cause other than following a change of control, Ms. Norgate would be entitled to twelve weeks notice. If Ms. Norgate had been terminated without cause as at December 31, 2014, she would have been entitled to a payment of $352,588. If a change of control had occurred on December 31, 2014, she would have been entitled to receive a payment of $344,527 and other benefits having a value of $193,575 if she terminated the Norgate Agreement within 90 days from the date of the change of control or a payment of $1,033,581 and other benefits having a value of $193,575 if terminated by the Company within 9 months of the change of control, and option-based awards of C$70,000.(1)(2) |

| | |

| 3. | The Company entered into an employment agreement dated August 29, 2014 with Kevin Cain (the "Cain Agreement") pursuant to which it has engaged Mr. Cain as its VP – Projects. The Cain Agreement provides for a base salary of $489,482 per annum. In the event of termination without cause other than following a change of control, Mr. Cain would be entitled to twelve weeks notice. If Mr. Cain had been terminated without cause as at December 31, 2014, he would have been entitled to a payment of $246,025. If a change of control had occurred on December 31, 2014, he would have been entitled to receive a payment of $535,983 and other benefits having a value of $39,877 if he terminated the Cain Agreement within 90 days from the date of the change of control or a payment of $1,607,948 and other benefits having a value of $39,877 if terminated by the Company within 9 months of the change of control, and option-based awards of C$70,000.(1)(2) |

15

| 4. | The Company entered into an employment agreement dated September 18, 2014 with Jonathan Lowe (the "Lowe Agreement") pursuant to which it has engaged Mr. Lowe as its VP – Strategic Development and Exploration. The Lowe Agreement provides for a base salary of $291,561 per annum. In the event of termination without cause other than following a change of control, Mr. Lowe would be entitled to twelve weeks notice. If Mr. Lowe had been terminated without cause as at December 31, 2014, he would have been entitled to a payment of $292,850. If a change of control had occurred on December 31, 2014, he would have been entitled to receive a payment of $319,260 and other benefits having a value of $145,500 if he terminated the Lowe Agreement within 90 days from the date of the change of control or a payment of $957,779 and other benefits having a value of $145,500 if terminated by the Company within 9 months of the change of control, and option-based awards of C$70,000.(1)(2) |

| | |

| 5. | The Company entered into an employment agreement dated August 29, 2014 with Karen Hauff (the "Hauff Agreement") pursuant to which it has engaged Ms. Hauff as its General Counsel and Company Secretary. The Hauff Agreement provides for a base salary of $247,260 per annum. In the event of termination without cause other than following a change of control, Ms. Hauff would be entitled to twelve weeks notice. If Ms. Hauff had been terminated without cause as at December 31, 2014, she would have been entitled to a payment of $114,251. If a change of control had occurred on December 31, 2014, she would have been entitled to receive a payment of $270,750 and other benefits having a value of $10,116 if she terminated the Hauff Agreement within 90 days from the date of the change of control or a payment of $812,250 and other benefits having a value of $10,116 if terminated by the Company within 9 months of the change of control, and option-based awards of C$28,000.(1)(2) |

| (1) | Calculated by multiplying the difference between the market price of the shares on such date and the exercise price of the option (or issue price of the loan share) by the number of option (or loan shares) subject to early vesting. |

| (2) | The compensation awarded to, earned by, paid to, or payable to each of the NEOs was in Australian dollars and for the most recently completed financial year has been translated herein at the rate of A$1.00 for every US$0.9025. |

Director Compensation

Director Compensation Table

The following table sets forth all amounts of compensation provided to the directors who are not Named Executive Officers, for the Company’s most recently completed financial year:

| | | | | Non-Equity | | | |

| | | | | Incentive | | | |

| | | Share- | Option- | Plan | | All Other | |

| | Fees | Based | Based | Compensa- | Pension | Compensa- | |

| Director | Earned | Awards | Awards | tion | Value | tion | Total |

| Name | ($) | ($) | ($)(1) | ($) | ($) | ($) | ($) |

| A. Geoffrey Loudon | Nil | Nil | 166,979 | Nil | Nil | Nil | 166,979 |

| Russell Debney | 76,500 | Nil | 111,319(2) | Nil | Nil | Nil | 187,819 |

| Cynthia Thomas | 56,500 | Nil | 111,319 | Nil | Nil | Nil | 167,819 |

16

| | | | | Non-Equity | | | |

| | | | | Incentive | | | |

| | | Share- | Option- | Plan | | All Other | |

| | Fees | Based | Based | Compensa- | Pension | Compensa- | |

| Director | Earned | Awards | Awards | tion | Value | tion | Total |

| Name | ($) | ($) | ($)(1) | ($) | ($) | ($) | ($) |

| Mohammed Al | 47,500 | Nil | 111,319 | Nil | Nil | Nil | 158,819 |

| Barwani | | | | | | | |

| Usama Al Barwani | 41,288 | Nil | 111,319 | Nil | Nil | Nil | 152,607 |

| Mark Horn | 42,788 | Nil | 111,319 | Nil | Nil | Nil | 154,107 |

| | (1) | The Company used the Black-Scholes-Merton model as the methodology to calculate the grant date fair value, and relied on the assumptions and estimates set forth in the Company's audited financial statements for the 2014 financial year. The Company chose this methodology because it is expected to be the most accurate measure of the fair value of the Company’s options and is consistent with the methodology used for accounting purposes. |

| | (2) | Mr. Debney was issued 400,000 loan shares pursuant to the Share Loan Plan described below. The value ascribed to such loan shares has been determined using the Black-Scholes-Merton model as the methodology to calculate the grant date fair value, and relied on the assumptions and estimates set forth in the Company's audited financial statements for the 2014 financial year. The Company chose this methodology because it is expected to be the most accurate measure of the fair value of the Company’s loan shares and is consistent with the methodology used for accounting purposes. |

Historically, the Company has had no arrangements, standard or otherwise, pursuant to which Directors are compensated by the Company or its subsidiaries for their services in their capacity as Directors, or for committee participation or involvement in special assignments.

On June 26, 2013, the Board approved the following fee structure for the performance of non-executive directors of the Company.

| Annual Base Fee | Additional Annual

Chairman Fee | Additional Annual Audit

Committee Chairman Fee | Fee per Board Meeting and/or

Committee Meeting attendance |

| US$20,000 | US$20,000 | US$10,000 | US$1,500 |

The first payment pursuant to the above fee structure commenced in 2014.

The Company has a formalized stock option plan and a share loan plan for the granting of incentive stock options and loan shares to the officers, employees and Directors. The purpose of granting such options and loan shares is to assist the Company in compensating, attracting, retaining and motivating the Directors of the Company and to closely align the interests of such persons to that of the shareholders.

Incentive Plan Awards - Outstanding Share-Based Awards and Option-Based Awards

The following table sets forth information concerning all awards outstanding under incentive plans of the Company at the end of the most recently completed financial year, including awards granted before the most recently completed financial year, to each of the Directors who are not Named Executive Officers:

17

| | Option-Based Awards | Share-Based Awards |

| | | | | | | | Market or |

| | | | | | Number of | Market or | Payout Value |

| | Number of | | | Value of | Shares Or | Payout Value | of vested |

| | Securities | | | Unexercised | Units Of | Of Share- | share-based |

| | Underlying | Option | Option | In-The- | Shares That | Based Awards | awards not |

| | Unexercised | Exercise | Expiration | Money | Have Not | That Have | paid out or |

| Director | Options | Price | Date | Options(1) | Vested | Not Vested | distributed |

| Name | (a) | (b) | (c) | (d) | (e) | (f) | (g) |

| A. Geoffrey | 600,000 | C$0.52 | Jul 01 2017 | Nil | N/A | N/A | N/A |

| Loudon | 600,000 | C$0.22 | Jul 01 2016 | C$96,000 | | | |

| | 300,000 | C$0.91 | Oct 02 2015 | Nil | | | |

| Russell | 400,000(2) | C$0.52(2) | Jul 01 2017(2) | Nil(2) | N/A | N/A | N/A |

| Debney | 400,000(2) | C$0.22(2) | Jul 01 2016(2) | C$64,000(2) | | | |

| | 200,000(2) | C$0.91(2) | Oct 02 2015(2) | Nil(2) | | | |

| Cynthia | 400,000 | C$0.52 | Jul 01 2017 | Nil | N/A | N/A | N/A |

| Thomas | 320,000 | C$0.22 | Jul 01 2016 | C$51,200 | | | |

| | 200,000 | C$0.91 | Oct 02 2015 | Nil | | | |

| Mohammed | 400,000 | C$0.52 | Jul 01 2017 | Nil | N/A | N/A | N/A |

| Al Barwani | 400,000 | C$0.22 | Jul 01 2016 | C$64,000 | | | |

| | 200,000 | C$0.91 | Oct 02 2015 | Nil | | | |

| Usama Al | 400,000 | C$0.52 | Jul 01 2017 | Nil | N/A | N/A | N/A |

| Barwani | | | | | | | |

| Mark Horn | 400,000 | C$0.52 | Jul 01 2017 | Nil | N/A | N/A | N/A |

| | (1) | This amount is calculated based on the positive difference between the market value of the shares underlying the options at December 31, 2014, which was C$0.38, and the exercise price of the option. |

| | (2) | Reflects the issuance of loan shares under the Company's Share Loan Plan. See the discussion of the Share Loan Plan and the Option Plan below under the heading "Securities Authorized for Issuance Under Equity Compensation Plans". Column (a) reflects the number of loan shares issued; column (b) reflects the issue price of the loan shares; column (c) reflects the loan expiration date; column (d) reflects the positive difference between the market value of the shares on December 31, 2014, which was C$0.38, and the issue price reflected in column (b). |

Incentive Plan Awards – Value Vested Or Earned During The Year

The following table sets out the value of all stock options and loan shares that vested during the financial year ended December 31, 2014 for each of the Directors:

| | | | Non-Equity Incentive |

| | Option-Based Awards - | Share-Based Awards - | Plan Compensation - |

| | Value Vested | Value Vested | Value Earned |

| | During The Year(1) | During The Year | During The Year |

| Director Name | ($) | ($) | ($) |

| A. Geoffrey Loudon | C$40,200 | N/A | N/A |

| Russell Debney | C$26,800 | N/A | N/A |

| Cynthia Thomas | C$26,800 | N/A | N/A |

| Mohammed Al Barwani | C$26,800 | N/A | N/A |

| Usama Al Barwani | N/A | N/A | N/A |

| Mark Horn | N/A | N/A | N/A |

| | (1) | This amount is the dollar value that would have been realized by obtaining the difference between the market price of the shares underlying options and the exercise price of the options on the vesting date. |

18

The issue of stock options and loan shares to Directors is recommended by the GN&R Committee and approved by the Board in accordance with the Company’s stock option and share loan plans, taking into consideration their position within the Company and the number of stock options and loan shares available for issue.

With respect to options or loan shares that vested during the year:

| | Aggregate number of | | Exercise price | |

Director Name | common shares vested(1) | Date vested | per share | Expiry Date |

| A. Geoffrey Loudon | 120,000 | Jan 01 2014 | C$0.22 | Jul 01 2016 |

| | 120,000 | Jul 01 2014 | C$0.22 | Jul 01 2016 |

| | 60,000 | Apr 02 2014 | C$0.91 | Oct 02 2015 |

| | 60,000 | Oct 02 2014 | C$0.91 | Oct 02 2015 |

| Russell Debney | 80,000 | Jan 01 2014 | C$0.22 | Jul 01 2016 |

| | 80,000 | Jul 01 2014 | C$0.22 | Jul 01 2016 |

| | 40,000 | Apr 02 2014 | C$0.91 | Oct 02 2015 |

| | 40,000 | Oct 02 2014 | C$0.91 | Oct 02 2015 |

| Cynthia Thomas | 80,000 | Jan 01 2014 | C$0.22 | Jul 01 2016 |

| | 80,000 | Jul 01 2014 | C$0.22 | Jul 01 2016 |

| | 40,000 | Apr 02 2014 | C$0.91 | Oct 02 2015 |

| | 40,000 | Oct 02 2014 | C$0.91 | Oct 02 2015 |

| Mohammed Al Barwani | 80,000 | Jan 01 2014 | C$0.22 | Jul 01 2016 |

| | 80,000 | Jul 01 2014 | C$0.22 | Jul 01 2016 |

| | 40,000 | Apr 02 2014 | C$0.91 | Oct 02 2015 |

| | 40,000 | Oct 02 2014 | C$0.91 | Oct 02 2015 |

| Usama Al Barwani | N/A | N/A | N/A | N/A |

| Mark Horn | N/A | N/A | N/A | N/A |

| | (1) | Options and loan shares vest at 20% every six months commencing six months after the date of issue of the options or loan shares. |

SECURITIES AUTHORIZED FOR ISSUANCE UNDER EQUITY COMPENSATION PLANS

The following table sets forth the Company's compensation plans under which equity securities are authorized for issuance as at the end of the most recently completed financial year.

| | | | Number of common shares |

| | Number of common | | remaining available for |

| | shares to be issued upon | Weighted-average | future issuance under equity |

| | exercise of outstanding | exercise price of | compensation plans |

| | options, warrants and | outstanding options, | (excluding common shares |

| | rights | warrants and rights | reflected in column (a)) |

| Plan Category | (a) | (b) | (c) |

| Equity compensation plans | 16,270,000 | C$0.51 | 27,127,786(1) |

| approved by securityholders | | | |

| Equity compensation plans not | N/A | N/A | N/A |

| approved by securityholders | | | |

| Total | 16,270,000 | C$0.51 | 27,127,786 |

19

| | (1) | As described below, the Company’s stock option plan is a "rolling" stock option plan. The number of shares available for future issuance takes into account the 11,325,000 shares held by the Agent as at December 31, 2014 under the Company's Share Loan Plan, as described below. The weighted average issue price of such loan shares outstanding as at December 31, 2014 was C$0.52. |

Information Concerning the Company’s Stock Option Plan

At the Company’s Annual General Meeting held June 25, 2014 (the "2014 AGM"), the shareholders re-approved the Company’s current form of stock option plan (the "Option Plan"). The Option Plan was first approved by shareholders at the 2011 AGM and replaced the Company’s previous stock option plan which had been in place since June 4, 2008.

Information relating to the Option Plan is as follows:

| • | The Option Plan is administered by the Board of Directors or, if the Directors so determine, by a committee of the Directors authorized to administer the Option Plan (the "Committee"). |

| | | |

| • | Options may be granted to directors, officers and employees of the Company as well as persons or corporations engaged to provide services to the Company (or any entity controlled by the Company) and any individuals employed by such persons or corporations. |

| | | |

| • | The number of shares issuable to insiders of the Company at any time, under all security based compensation arrangements of the Company, cannot exceed 10% of the Company’s issued and outstanding shares. |

| | | |

| • | The number of shares issued to insiders of the Company as a group, within any one year period, under all security based compensation arrangements of the Company, cannot exceed 10% of the Company’s issued and outstanding shares as at the end of such one year period. |

| | | |

| • | The number of shares issuable upon exercise of outstanding options at any time will, when combined with the number of shares held by the Agent under the Share Loan Plan (as described below), be limited to 10% of the Company's issued and outstanding shares, on a non-diluted basis. As at May 7, 2015, an aggregate maximum of 43,397,786 shares are issuable under the Option Plan and the Share Loan Plan. |

| | | |

| • | As at May 7, 2015, an aggregate of 16,270,000 options and loan shares were issued and outstanding, representing 3.65% of the Company’s issued and outstanding common shares as at such date (or 3.75% on a non-diluted basis). Of these, 4,945,000 are outstanding options, representing 1.11% of the issued and outstanding shares (1.14% on a non-diluted basis). |

| | | |

| • | Subject to the limitation applicable to insiders of the Company and the limit on the maximum number of options available for issuance under the Option Plan, there is no restriction on the number of options that can be granted to any one person. |

| | | |

| • | The Board or, if applicable, the Committee has the authority to determine the exercise price of the options granted under the Option Plan provided that the exercise price must be not less than the closing price on the TSX on the last trading day immediately preceding the date of grant of the options. |

| | | |

| • | The Option Plan does not contain provisions allowing for the transformation of a stock option into a stock appreciation right. |

20

| • | Vesting of options will be at the discretion of the Board or, if applicable, the Committee, other than in the event of a change of control of the Company, upon which all previously unvested options shall vest immediately and shall be exercisable in whole or in part. |

| | | |

| • | The maximum term of options granted under the Option Plan is 10 years from the date of grant. The Option Plan provides that the expiry date of options shall be the later of the date set by the Board or the Committee as the last date on which an option may be exercised and, if such date falls during or within five (5) trading days after the end of a "Black-Out Period" (as defined below), the date that is ten (10) trading days following the date on which such Black-Out Period ends (the "Extension Period"); provided that if an additional Black-Out Period is subsequently imposed during the Extension Period, then such Extension Period shall be deemed to commence following the end of such additional Black-Out Period to enable the exercise of such Option within ten (10) trading days following the end of the last imposed Black-Out Period. For these purposes, a "Black-Out Period" means a period of time during which, pursuant to the policies of the Company trading in common shares or options of the Company is prohibited or restricted. |

| | | |

| • | If an optionee ceases to be eligible to receive options under the Option Plan as a result of termination for cause, any outstanding options held by such optionee on the date of such |

| | | termination shall be cancelled as of that date. |

| | | |

| • | If an optionee ceases to be eligible to receive options under the Option Plan as a result of his or her death, any outstanding options held by such optionee on such date shall be exercisable by his or her estate until the earlier of the expiry time of such options or 12 months after the date of death. |

| | | |

| • | If an optionee ceases to be eligible to receive options under the Option Plan for reasons other than termination for cause or death, any outstanding options held by such optionee at such time shall remain exercisable for a period ending on the earlier of the expiry time of such option or six months after the optionee ceases to be eligible to receive options. Notwithstanding the foregoing, the Board of Directors may, on a case by case basis, allow such options to remain in full force and effect until any time up to the original expiry time of such options, irrespective of whether such expiry time is more than six months after the optionee ceases to be eligible to receive options. |

| | | |

| • | Options granted under the Option Plan are not assignable or transferable other than pursuant to a will or by the laws of descent and distribution. |

| | | |

| • | The Board of Directors may from time to time, without shareholder approval and subject to applicable law and to the prior approval, if required, of TSX or any other regulatory body having authority over the Company or the Option Plan, suspend, terminate or discontinue the Option Plan at any time, or amend or revise the terms of the Option Plan or of any option granted under, or otherwise governed by, the Option Plan to: |

| | (a) | make amendments of a clerical or typographical nature and to include clarifying provisions in the Option Plan; |

| | | |

| | (b) | implement features or requirements that are necessary or desirable under applicable tax and securities laws; |

| | | |

| | (c) | change vesting provisions; |

| | | |

| | (d) | change termination provisions for an insider provided that the expiry time does not extend beyond the original expiry time under the Option Plan; |

21

| (e) | change termination provisions for an optionee who is not an insider beyond the original expiry time; |

| | | |

| | (f) | reduce the exercise price of an option for an optionee who is not an insider; and |

| | | |

| | (g) | implement a cashless exercise feature, payable in cash or securities; |

| | | |

| provided that no such amendment, revision, suspension, termination or discontinuance shall in any manner adversely affect any option previously granted to an optionee under the Option Plan without the consent of that optionee. Any other amendments to the Option Plan or options granted thereunder (or options otherwise governed thereby) will be subject to the approval of the shareholders. |

| | • | The Option Plan does not contain any provisions relating to the provision of financial assistance by the Company to optionees to facilitate the purchase of common shares upon the exercise of options. |

Information Concerning the Companys Share Loan Plan

The Company's share loan plan (referred to in this Information Circular as the "Share Loan Plan" or the "Loan Plan") was re-approved by the shareholders at the 2014 AGM. The Loan Plan provides for security-based compensation in a manner similar to a stock option plan by enabling participants to acquire an equity interest in the Company using a limited recourse loan provided by a subsidiary of the Company. The Loan Plan provides for loans to be made to eligible participants ("SLP Participants") who apply the proceeds toward a subscription for shares. The loans are made by a subsidiary of the Company (the "Lender") and the shares issued by Nautilus are registered in the name of Computershare Trust Company of Canada as administrative agent (the "Agent") for the benefit of the applicable SLP Participant.

The loan does not bear interest, and the Lender's recourse is limited to the value of the shares. If the SLP Participant elects to sell the shares (which will be effected by the Agent), the proceeds will be used to repay the loan and any brokerage and other fees, and the SLP Participant will be entitled to any remaining balance.

SLP Participants can only elect to sell the shares if the then-current market price is greater than the subscription price paid for those shares, such that the net proceeds of the sale will equal or exceed the outstanding loan balance in respect of the shares being sold. An SLP Participant may, during the term of the loan, elect to repay the loan and become the registered holder of the shares. If an SLP Participant ceases to be eligible to participate in the Loan Plan or if the term of the loan expires before the loan is repaid, the Agent will return the shares to the Company, and both the loan and the shares will be cancelled.

Shares issued pursuant to the Loan Plan are referred to as "Restricted Shares" as long as they are outstanding and registered in the name of the Agent (i.e. before the date that the shares are sold in the market to pay the loan or the SLP Participant otherwise repays the loan).

The purpose of the Loan Plan is to provide a tax-efficient security-based compensation program for the Company's Australian employees and directors.

The following describes certain terms of the Loan Plan, which are analogous to the terms of the Option Plan, to the extent applicable:

| | • | The SLP Participants will be full-time or part-time employees and directors of Nautilus or any subsidiary, provided any such SLP Participant has their primary residence in Australia. |

22

| • | The number of Restricted Shares outstanding at any time will, when combined with the number of shares issuable upon exercise of outstanding options under the Option Plan, be limited to 10% of the Company's issued and outstanding shares, on a non-diluted basis (but excluding outstanding Restricted Shares in the calculation of issued and outstanding shares), at that time. In the same manner as the Option Plan is "reloaded" when options are exercised, when Restricted Shares cease to be restricted on the repayment of the loan, the number of shares issuable under the Loan Plan will be increased. Any Restricted Shares that are cancelled will be eligible to be reissued, subject always to the 10% limit. The corresponding 10% limitation in the Option Plan will be applied in a manner consistent with the above 10% limitation in the Loan Plan, in that the calculation will exclude outstanding Restricted Shares in the denominator. In addition, as required by applicable Australian securities laws, the number of shares offered to Australian residents under the Loan Plan, when aggregated with the number of shares that would be issued, and the number of shares that have been issued over the previous 5 years, to Australian residents under any security based compensation arrangements, must not exceed 5% of the total number of issued shares at the time each offer is made under the Loan Plan. |

| | | |

| • | The number of shares issued to insiders of the Company as a group within a one year period under all security based compensation arrangements will not exceed 10% of the total number of issued and outstanding shares, on a non-diluted basis (but excluding outstanding Restricted Shares in the calculation of issued and outstanding shares), as at the end of such one year period. Subject to the limitations on the number of shares issuable under the Loan Plan and the Option Plan as noted above, there is no maximum number of shares that any one person is entitled to receive pursuant to the Loan Plan. |

| | | |

| • | The price at which shares will be issued under the Loan Plan will be determined by the Board of Directors or, if applicable, any committee of the Board of Directors to which administration of the Loan Plan is delegated (the "SLP Committee"), and will be not less than the closing price of the shares on the TSX on the last trading day prior to the date of issuance. |

| | | |

| • | The maximum term of loans made under the Loan Plan is 10 years. The Loan Plan contains provisions for the extension of a loan that would otherwise terminate during or within five trading days after the end of a Black-Out Period until the date that is 10 trading days after the end of an SLP Black-Out Period. A "SLP Black-Out Period" means a period of time during which, pursuant to the policies of the Company trading in shares is prohibited or restricted. |

| | | |

| • | Vesting of Restricted Shares will be at the discretion of the Board of Directors or the SLP Committee. At the time of vesting, an SLP Participant will be entitled to deal with Restricted Shares by directing that they be sold into the market or by repaying the applicable loan. In the event of a change of control of the Company, all previously unvested Restricted Shares will vest immediately. SLP Participants will agree to vote Restricted Shares beneficially owned by them in accordance with the recommendations of management. |

| | | |

| • | If an SLP Participant ceases to be eligible to receive a loan under the Loan Plan for reasons other than termination for cause (or death or legal incapacity), any existing loan made to such person (and the corresponding vested Restricted Shares) will remain outstanding for a period ending on the earlier of the expiry date of the loan or six months after the SLP Participant ceases to be eligible to receive a loan under the Loan Plan. Notwithstanding the foregoing, the Board of Directors may, on a case by case basis, allow such Restricted Shares to remain outstanding until any time up to the original expiry date of the applicable loan, irrespective of whether such expiry date is more than six months after the SLP Participant ceases to be eligible to receive a loan under the Loan Plan. If an SLP Participant ceases to be eligible to receive a loan under the Loan Plan as a result of termination for cause, any existing loan made to such person (and the corresponding Restricted Shares) will be cancelled as of that date. |

23

| • | If an SLP Participant ceases to be eligible to receive a loan under the Loan Plan as a result of death or legal incapacity, any existing loan made to such person (and the corresponding vested Restricted Shares) will remain outstanding for a period ending on the earlier of the expiry date of the loan or one year after the death or incapacity of the SLP Participant. |

| | | |

| • | Loans made under the Loan Plan and corresponding Restricted Shares are not assignable or transferable other than pursuant to a will or by the laws of descent and distribution. |

| | | |

| • | Holders of Restricted Shares will waive their rights to receive: (i) any cash dividends declared and (ii) any assets of the Company on dissolution, and shall direct that such cash or other assets be paid or directed to the Company. |

| | | |

| • | The Board of Directors may from time to time, without shareholder approval and subject to applicable law and to the prior approval, if required, of TSX or any other regulatory body having authority over the Company or the Loan Plan, suspend, terminate or discontinue the Loan Plan at any time, or amend or revise the terms of the Loan Plan or of any loan made pursuant to the Loan Plan to: |

| | (a) | make amendments of a clerical or typographical nature and to include clarifying provisions in the Loan Plan; |

| | | |

| | (b) | implement features or requirements that are necessary or desirable under applicable tax and securities laws; |

| | | |

| | (c) | change vesting provisions; |

| | | |

| | (d) | change termination provisions for an insider provided that the expiry date does not extend beyond the original expiry date under the Loan Plan; and |

| | | |

| | (e) | change termination provisions for an SLP Participant who is not an insider beyond the original expiry date; |

provided that no such amendment, revision, suspension, termination or discontinuance will in any manner adversely affect any loan previously granted to an SLP Participant under the Loan Plan without the consent of that SLP Participant. Any other amendments to the Loan Plan or loans granted thereunder will be subject to the approval of the shareholders.

As at May 7, 2015, an aggregate of 11,325,000 loan shares were issued and outstanding under the Loan Plan, representing 2.54% of the Company’s issued and outstanding common shares as at such date (2.61% on a non-diluted basis).

INDEBTEDNESS OF DIRECTORS AND EXECUTIVE OFFICERS