Each of the four indices included in the Global Index Basket will initially be weighted as set forth below based on the value of each index on the Pricing Date, as determined by the calculation agent, to achieve a Starting Value of 100 for the Global Index Basket on that date:

The value of the Global Index Basket on any index business day, including the Valuation Date, will equal the sum of the products of each index’s closing level and that index’s basket composition ratio.

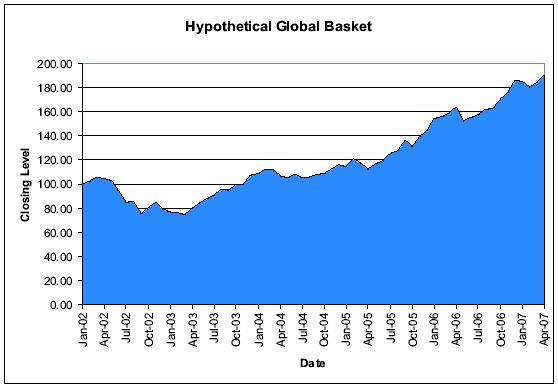

The following graph sets forth the hypothetical historical closing values of the Global Index Basket on each index business day, commencing on January 31, 2002 and ending on April 30, 2007. Each value was calculated as if the Global Index Basket had been created on January 31, 2002 with an initial value of 100. The Global Index Basket will actually be established on the Pricing Date with an initial value of 100. The hypothetical historical closing values set forth below in the graph have not been reviewed or verified by Dow Jones & Company, Inc. (“Dow Jones”), STOXX Limited (“STOXX”), Nihon Keizai Shimbun, Inc. (“NKS”), Standard & Poor’s (“S&P”) or any other independent third party.

Actual historical closing values of each component index were used to calculate the hypothetical historical closing values of the Global Index Basket. However, these hypothetical historical closing values should not be taken as an indication of the actual composition of the Global Index Basket on the Pricing Date or the future performance of the Global Index Basket. Any hypothetical historical upward or downward trend in the value of the Global Index Basket during any period set forth below is not an indication that the Global Index Basket is more or less likely to increase or decrease at any time during the term of the Certificates.

10 | | Safety FirstsmInvestments |

The source of the data on each component index used to compute the hypothetical historical closing values of the Global Index Basket is Bloomberg.

You should refer to the preliminary prospectus and pricing supplement related to this offering for additional information on the Global Index Basket and each component index, including its respective makeup, method of calculation and changes in its components. All such disclosures in the preliminary prospectus and pricing supplement are derived from publicly available information. None of the Trust, Citigroup Funding, Citigroup Inc., Citigroup Global Markets or any of the trustees assumes any responsibility for the accuracy or completeness of such information. You should also be aware that an investment in the Certificates does not entitle you to any dividends, voting rights or any other ownership or other interest in respect of the stocks of the companies included in the indices comprising the Global Index Basket.

License Agreements.Citigroup Funding or its affiliates have entered into a non-exclusive license agreement with the publisher of each index comprising the Global Index Basket, providing for the license to Citigroup Funding and its affiliates, in exchange for a fee, of the right to use each index in connection with certain securities, including the Certificates, the Securities and the Warrants. Each license agreement provides that the following language, as applicable must be stated in this offering summary.

STOXX and Dow Jones have no relationship to Citigroup Funding, other than the licensing of the use of the “Dow Jones EURO STOXX 50 Index,” “Dow Jones,” “Dow Jones Industrial Average,” and “DJIA,” and the related trademarks, as the case may be, for use in connection with the calculation of the Certificates, the Securities and the Warrants.

STOXX and Dow Jones do not sponsor, endorse, sell or promote the Certificates, the Securities or the Warrants; make investment recommendations that any person invest in the Certificates, the Securities or the Warrants or any other securities; have any responsibility or liability for or make any decisions about the timing, amount or pricing of the Certificates, the Securities or the Warrants; have any responsibility or liability for the administration, management or marketing of

Safety FirstsmInvestments | | 11 |

the Certificates, the Securities or the Warrants; or consider the Certificates, the Securities or the Warrants or the owners thereof in determining, composing or calculating the Dow Jones EURO STOXX 50 Index or the Dow Jones Industrial Average or have any obligation to do so.

NEITHER STOXX NOR DOW JONES GUARANTEES THE ACCURACY AND/OR THE COMPLETENESS OF THE DOW JONES EURO STOXX 50 INDEX OR THE DOW JONES INDUSTRIAL AVERAGE OR ANY DATA INCLUDED THEREIN AND NEITHER STOXX NOR DOW JONES SHALL HAVE ANY LIABILITY FOR ANY ERRORS, OMISSIONS OR INTERRUPTIONS THEREIN. NEITHER STOXX NOR DOW JONES MAKES ANY WARRANTY, EXPRESS OR IMPLIED, AS TO RESULTS TO BE OBTAINED BY CITIGROUP FUNDING, OWNERS OF THE CERTIFICATES, THE SECURITIES OR THE WARRANTS, OR ANY OTHER PERSON OR ENTITY FROM THE USE OF THE INDEX OR DJIA OR ANY DATA INCLUDED THEREIN. NEITHER DOW JONES NOR STOXX MAKES ANY EXPRESS OR IMPLIED WARRANTIES, AND BOTH DOW JONES AND STOXX EXPRESSLY DISCLAIM ALL WARRANTIES OF MERCHANTABILITY OR FITNESS FOR A PARTICULAR PURPOSE OR USE WITH RESPECT TO THE INDEX OR DJIA OR ANY DATA INCLUDED THEREIN. WITHOUT LIMITING ANY OF THE FOREGOING, IN NO EVENT SHALL DOW JONES OR STOXX HAVE ANY LIABILITY FOR ANY LOST PROFITS OR INDIRECT, PUNITIVE, SPECIAL OR CONSEQUENTIAL DAMAGES (INCLUDING LOST PROFITS), EVEN IF NOTIFIED OF THE POSSIBILITY OF SUCH DAMAGES.

The license agreement with STOXX and Dow Jones is solely for the benefit of Citigroup Funding and its affiliates, and not for the benefit of the owners of the Certificates, the Securities or the Warrants or any other third parties.

The Nikkei 225 Stock Average is the intellectual property of NKS. “Nikkei,” “Nikkei Stock Average,” “Nikkei Average” and “Nikkei 225” are the service marks of NKS. NKS reserves all the rights, including copyright, to the Nikkei 225 Stock Average. The use of and reference to the Nikkei 225 Stock Average in connection with the Certificates, the Securities or the Warrants have been consented to by NKS, the publisher of the Nikkei 225 Stock Average.

NKS gives no assurance regarding any modification or change in any methodology used in calculating the Nikkei 225 Stock Average and is under no obligation to continue the calculation and dissemination of the Nikkei 225 Stock Average. Neither the Certificates, the Securities nor the Warrants are sponsored, endorsed, sold or promoted by NKS. No inference should be drawn from the information contained in this offering summary that NKS makes any representation or warranty, implied or express, to Citigroup Funding, the holders of the Certificates, the Securities or the Warrants or any member of the public regarding the advisability of investing in securities generally or in the Certificates, the Securities or the Warrants in particular or the ability of the Nikkei 225 Stock Average to track general stock market performance. NKS has no obligation to take the needs of Citigroup Funding or the holders of the Certificates, the Securities or the Warrants into consideration in determining, composing or calculating the Nikkei 225 Stock Average. NKS is not responsible for, and has not participated in the determination of, the timing of, prices for, or quantities of, the Certificates, the Securities or the Warrants to be issued or any other amount payable with respect to the Certificates, the Securities or the Warrants. NKS has no obligation or liability in connection with the administration, marketing or trading of the Certificates, the Securities or the Warrants.

NKS disclaims all responsibility for any errors or omissions in the calculation and dissemination of the Nikkei 225 Stock Average or the manner in which such index is applied in determining the Supplemental Distribution Amount or any other amount payable in respect of the Certificates, the Securities or the Warrants.

Neither the Certificates, the Securities or the Warrants are sponsored, endorsed, sold or promoted by S&P. S&P makes no representation or warranty, express or implied, to the holders of the Certificates, the Securities or the Warrants or any member of the public regarding the advisability of investing in securities generally or in the Certificates, the Securities or the Warrants particularly or the ability of the S&P BRIC 40 Index to track general stock market performance. S&P’s only relationship to Citigroup Funding (other than transactions entered into in the ordinary

12 | | Safety FirstsmInvestments |

course of business) is the licensing of certain servicemarks and trade names of S&P and of the S&P BRIC 40 Index which is determined, composed and calculated by S&P without regard to Citigroup Funding or the Certificates, the Securities or the Warrants. S&P has no obligation to take the needs of Citigroup Funding or the holders of the Certificates, the Securities or the Warrants into consideration in determining, composing or calculating the S&P BRIC 40 Index. S&P is not responsible for and has not participated in the determination of the timing of the sale of the Certificates, prices at which the Certificates are initially to be sold, or quantities of the Certificates, the Securities or the Warrants to be issued or in the determination or calculation of the equation by which the Certificates, the Securities or the Warrants are to be converted into cash. S&P has no obligation or liability in connection with the administration, marketing or trading of the Certificates, the Securities or the Warrants.

Safety FirstsmInvestments | | 13 |

Hypothetical Maturity Payment Examples

The examples of hypothetical maturity payments set forth below are intended to illustrate the effect of different Ending Values on the amount payable on the Certificates at maturity. All of the hypothetical examples are based on the following assumptions:

• Issue Price:$10.00 | • Term of the Certificates:5.08 years |

• Starting Value:100 | |

• The Certificates are held to maturity and are not exchanged for the Securities and the Warrants. |

As shown by the examples below, if the Basket Return is 0% or less, you will receive an amount at maturity equal to $10.00 per certificate, the amount of your initial investment in the Certificates. If the Basket Return is greater than 0%, you will receive an amount at maturity that is greater than your initial investment in the Certificates.

Ending Value | Basket Return | Supplemental

Distribution

Amount(1) | Maturity

Payment(2) | Total

Return on the

Certificates | Annualized

Return on the

Certificates(3) |

| | | | | | | |

30.0 | | -70.00% | | $0.00 | $10.00 | 0.00% | 0.00% |

40.0 | | -60.00% | | $0.00 | $10.00 | 0.00% | 0.00% |

50.0 | | -50.00% | | $0.00 | $10.00 | 0.00% | 0.00% |

60.0 | | -40.00% | | $0.00 | $10.00 | 0.00% | 0.00% |

70.0 | | -30.00% | | $0.00 | $10.00 | 0.00% | 0.00% |

75.0 | | -25.00% | | $0.00 | $10.00 | 0.00% | 0.00% |

80.0 | | -20.00% | | $0.00 | $10.00 | 0.00% | 0.00% |

85.0 | | -15.00% | | $0.00 | $10.00 | 0.00% | 0.00% |

90.0 | | -10.00% | | $0.00 | $10.00 | 0.00% | 0.00% |

95.0 | | -5.00% | | $0.00 | $10.00 | 0.00% | 0.00% |

97.5 | | -2.50% | | $0.00 | $10.00 | 0.00% | 0.00% |

100.0 | | 0.00% | | $0.00 | $10.00 | 0.00% | 0.00% |

102.5 | | 2.50% | | $0.25 | $10.25 | 2.50% | 0.49% |

105.0 | | 5.00% | | $0.50 | $10.50 | 5.00% | 0.97% |

107.5 | | 7.50% | | $0.75 | $10.75 | 7.50% | 1.43% |

110.0 | | 10.00% | | $1.00 | $11.00 | 10.00% | 1.89% |

115.0 | | 15.00% | | $1.50 | $11.50 | 15.00% | 2.79% |

120.0 | | 20.00% | | $2.00 | $12.00 | 20.00% | 3.65% |

125.0 | | 25.00% | | $2.50 | $12.50 | 25.00% | 4.49% |

130.0 | | 30.00% | | $3.00 | $13.00 | 30.00% | 5.30% |

140.0 | | 40.00% | | $4.00 | $14.00 | 40.00% | 6.85% |

150.0 | | 50.00% | | $5.00 | $15.00 | 50.00% | 8.31% |

160.0 | | 60.00% | | $6.00 | $16.00 | 60.00% | 9.69% |

(1) | Supplemental Distribution Amount = $10.00 × Basket Return, provided that the Supplemental Distribution Amount will not be less than zero |

(2) | Maturity Payment = $10.00 + Supplemental Distribution Amount |

The examples above are for purposes of illustration only. The actual maturity payment will depend on the actual Supplemental Distribution Amount which, in turn, will depend on the actual Ending Value.

14 | | Safety FirstsmInvestments |

Hypothetical Historical Index Return Examples

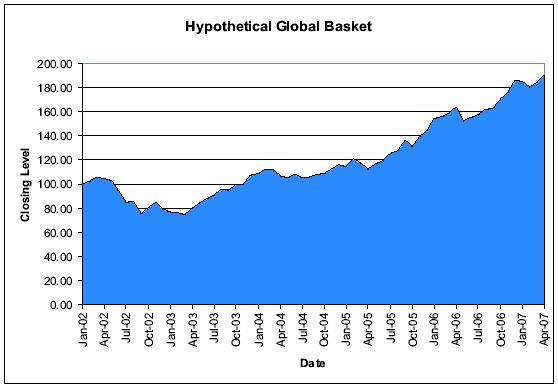

The following graph sets forth the hypothetical return of the Global Index Basket on each Index Business Day for the 5.08-year period from March 6, 2006 through May 10, 2007, created using actual historical date on the components of the Global Index Basket from February 2, 2001 through May 10, 2007, with the value of the Global Index Basket set to 100 at the start of each 5.08-year period. No hypothetical historical index returns can be presented for any 5.08-year period before March 6, 2006 because there is no data available on the S&P BRIC 40 Index prior to February 2, 2001 available. Although we have used actual historical data on each of the four indices comprising the Global Index Basket, the hypothetical returns were generated by the retroactive application of the computation of the Global Index Basket described in “The Global Index Basket” above and do not represent actual returns on the Global Index Basket since it has not yet been established. Additionally, the hypothetical returns were generated without regard to any dividends payable on the stocks underlying the indices comprising the Global Index Basket and,with respect to the value of the Dow Jones EURO STOXX 50 Index and the Nikkei 225 Stock Average, without regard to changes in the value of the Euro and the Japanese yen, respectively, relative to the U.S. dollar.

This graph is for purposes of illustration only and is not intended to be indicative of future levels of the Global Index Basket, the potential return of the Global Index Basket, any of its underlying indices or what the value of the Certificates, Securities or Warrants may be. Any upward or downward trend in the hypothetical returns in any period set forth below is not an indication that the return on the Global Index Basket or the Supplemental Distribution Amount on the Certificates is more or less likely to increase or decrease at any time during the term of the Certificates. The actual Supplemental Distribution Amount, if any, will depend on the actual Basket Return which, in turn, will depend on the actual Starting Value and Ending Value of the Global Index Basket. These hypothetical returns, as well as the historical data used by the calculation agent to determine the returns, have not been reviewed or verified by Dow Jones, STOXX, NKS, S&P or any other independent third party.

The source of the data on each component index used to compute the hypothetical historical index return examples of the Global Index Basket is Bloomberg.

Safety FirstsmInvestments | | 15 |

ERISA and IRA Purchase Considerations

Employee benefit plans subject to ERISA, entities the assets of which are deemed to constitute the assets of such plans, governmental or other plans subject to laws substantially similar to ERISA and retirement accounts (including Keogh, SEP and SIMPLE plans, individual retirement accounts and individual retirement annuities) are permitted to purchase the Certificates, the Securities and the Warrants as long as either (A) (1) no Citigroup Global Market affiliate or employee is a fiduciary to such plan or retirement account that has or exercises any discretionary authority or control with respect to the assets of such plan or retirement account used to purchase the Certificates, the Securities or the Warrants or renders investment advice with respect to those assets, and (2) such plan or retirement account is paying no more than adequate consideration for the Certificates, the Securities or the Warrants or (B) its acquisition and holding of the Certificates, the Securities or the Warrants is not prohibited by any such provisions or laws or is exempt from any such prohibition.

However, individual retirement accounts, individual retirement annuities and Keogh plans, as well as employee benefit plans that permit participants to direct the investment of their accounts, will NOT be permitted to purchase or hold the Certificates, the Securities or the Warrants if the account, plan or annuity is for the benefit of an employee of Citigroup Global Markets or a family member and the employee receives any compensation (such as, for example, an addition to bonus) based on the purchase of the Certificates, the Securities or the Warrants by the account, plan or annuity.

You should refer to the section “ERISA Matters” in the preliminary prospectus and pricing supplement related to this offering for more information.

Additional Considerations

If the closing value of any of the indices comprising the Global Index Basket is not available on the Valuation Date, the Calculation Agent may determine the Ending Value in accordance with the procedures set forth in the preliminary prospectus and pricing supplement related to this offering. In addition, if any of the indices comprising the Global Index Basket is discontinued, the Calculation Agent may determine the Ending Value by reference to a successor index or, if no successor index is available, in accordance with the procedures last used to calculate the relevant index prior to any such discontinuance. You should refer to the sections “Description of the Certificates – Supplemental Distribution Amount” and “– Discontinuance of an Index Comprising the Global Index Basket” in the preliminary prospectus and pricing supplement for more information.

Citigroup Global Markets is an affiliate of the Trust and Citigroup Funding. Accordingly, the offering will conform to the requirements set forth in Rule 2810 of the Conduct Rules of the National Association of Securities Dealers regarding direct participation programs.

Client accounts over which Citigroup or its affiliates have investment discretion are NOT permitted to purchase the Certificates, either directly or indirectly.

“Standard and Poor’s®,” “S&P 500®,” and “S&P®” are trademarks of The McGraw-Hill Companies, Inc. and have been licensed for use by Citigroup Funding Inc. “Nikkei,” “Nikkei Stock Average,” “Nikkei Average,” and “Nikkei 225” are the service marks of Nihon Keizai Shimbun, Inc. The Nikkei 225 Stock Average is the intellectual property of Nihon Keizai Shimbun, Inc. and Nihon Keizai Shimbun, Inc. reserves all the rights, including copyright, to the Nikkei 225 Stock Average. “Dow Jones” and “Dow Jones Industrial Average” are service marks of Dow Jones & Company. “STOXX,” “EURO STOXX,” and “EURO STOXX 50” are service marks of STOXX Limited (“STOXX”). These service marks have been licensed for use for certain purposes by Citigroup Funding Inc. Neither the Certificates, Securities or Warrants have been passed on by Standard & Poor’s, the McGraw-Hill Companies, Nihon Keizai Shimbun, Inc., Dow Jones or STOXX. Neither the Certificates, Securities nor the Warrants are sponsored, endorsed, sold or promoted by Standard & Poor’s, the McGraw-Hill Companies, Nihon Keizai Shimbun, Inc., Dow Jones or STOXX and none of the above makes any warranties or bears any liability with respect thereto.

©2007 Citigroup Global Markets Inc. All rights reserved. Citi and Citi and Arc Design are trademarks and service marks of Citigroup Inc. or its affiliates and are used and registered throughout the world.