FOR THE THREE MONTHS ENDED MARCH 31, 2019 COMPARED TO THE THREE MONTHS ENDED MARCH 31, 2018

Fund Share Price Performance

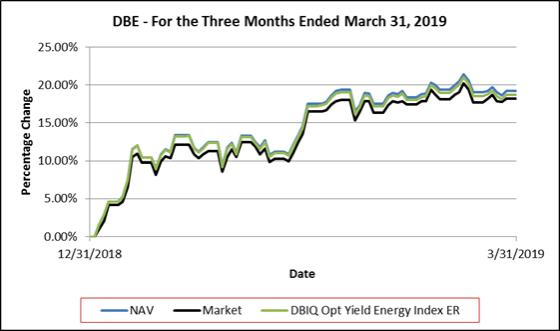

For the three months ended March 31, 2019, the NYSE Arca market value of each Share increased 18.26% from $12.43 per Share to $14.70 per Share. The Share price low and high for the three months ended March 31, 2019 and related change from the Share price on December 31, 2018 was as follows: Shares traded at a low of $12.55 per Share (+0.97 %) on January 2, 2019, and a high of $14.94 per Share (+20.19 %) on March 20, 2019.

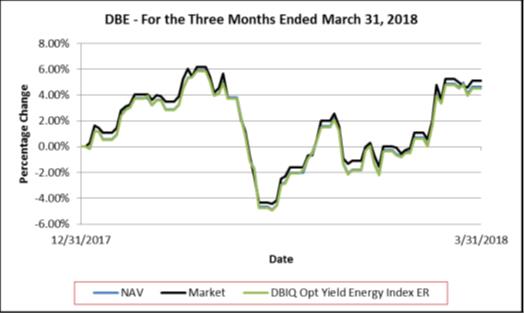

For the three months ended March 31, 2018, the NYSE Arca market value of each Share increased 5.09% from $14.54 per Share to $15.28 per Share. The Share price low and high for the three months ended March 31, 2018 and related change from the Share price on December 31, 2017 was as follows: Shares traded at a low of $13.90 per Share(-4.40%) on February 12, 2018, and a high of $15.44 per Share (+6.19%) on January 26, 2018.

Fund Share Net Asset Performance

For the three months ended March 31, 2019, the NAV of each Share increased 19.14% from $12.33 per Share to $14.69 per Share. Rising commodity futures contract prices for Light Sweet Crude Oil, Ultra Low Sulphur Diesel, Brent Crude Oil, RBOB Gasoline and Natural Gas during the three months ended March 31, 2019, contributed to an overall 18.68% increase in the level of the Index and to a 19.38% increase in the level of theDBIQ-OY Energy TR™.

Net income (loss) for the three months ended March 31, 2019 was $17.0 million, primarily resulting from $0.6 million of income, net realized gain (loss) of $(5.7) million, net change in unrealized gain (loss) of $22.3 million and operating expenses of $0.2 million.

For the three months ended March 31, 2018, the NAV of each Share increased 4.66% from $14.59 per Share to $15.27 per Share. Rising commodity futures contracts prices for Light Sweet Crude Oil, Ultra Low Sulphur Diesel, Brent Crude Oil, RBOB Gasoline and Natural Gas during the three months ended March 31, 2018, contributed to an overall 4.49% increase in the level of the Index and to a 4.90% increase in the level of theDBIQ-OY Energy TR™.

Net income (loss) for the three months ended March 31, 2018 was $8.0 million, primarily resulting from $0.6 million of income,

net realized gain (loss) of $7.8 million, net change in unrealized gain (loss) of $(0.1) million and operating expenses of $0.3 million.

Critical Accounting Policies

The financial statements and accompanying notes are prepared in accordance with U.S. GAAP. The preparation of these financial statements relies on estimates and assumptions that impact the Fund’s financial position and results of operations. These estimates and assumptions affect the Fund’s application of accounting policies. In addition, please refer to Note 2 to the financial statements of the Fund for further discussion of the Fund’s accounting policies and Item 7 – Management’s Discussions and Analysis of Financial Condition and Results of Operations – Critical Accounting Policies on Form10-K for the year ended December 31, 2018.

Off-Balance Sheet Arrangements and Contractual Obligations

In the normal course of its business, the Fund is a party to financial instruments withoff-balance sheet risk. The term“off-balance sheet risk” refers to an unrecorded potential liability that, even though it does not appear on the balance sheet, may result in a future obligation or loss. The financial instruments used by the Fund are commodity futures, the values of which are based upon an underlying asset and generally represent future commitments which have a reasonable possibility to be settled in cash or through physical delivery. The financial instruments are traded on an exchange and are standardized contracts.

The Fund has not utilized, nor does it expect to utilize in the future, special purpose entities to facilitateoff-balance sheet financing arrangements and has no loan guarantee arrangements oroff-balance sheet arrangements of any kind, other than agreements entered into in the normal course of business noted above, which may include indemnification provisions related to certain risks service providers undertake in providing services to the Fund. While the Fund’s exposure under such indemnification provisions cannot be estimated, these general business indemnifications are not expected to have a material impact on the Fund’s financial position. The Managing Owner expects the risk of loss relating to indemnification to be remote.

The Fund has financial obligations to the Managing Owner and the Commodity Broker under the Trust Agreement and its agreement with the Commodity Broker (the “Commodity Broker Agreement”), respectively. Management Fee payments made to the Managing Owner, pursuant to the Trust Agreement, are calculated as a fixed percentage of the Fund’s NAV. Commission payments to the Commodity Broker, pursuant to the Commodity Broker Agreement, are on acontract-by-contract, or round-turn, basis. As such, the Managing Owner cannot anticipate the amount of payments that will be required under these arrangements for future periods as NAVs and trading activity will not be known until a future date. The Fund’s agreement with the Commodity Broker may be terminated by either party for various reasons. All Management Fees and commission payments are paid to the Managing Owner and the Commodity Broker, respectively.

24