May 7, 2012

U.S. Securities and Exchange Commission

Division of Corporation Finance

100 F. Street, N.E.

Washington, D.C. 20549

| By EDGAR |

| Attn: | H. Roger Schwall | |

| | Assistant Director | |

| | | |

| Re: | Dakota Plains Holdings, Inc., formerly MCT Holding Corporation

Current Report on Form 8-K

Filed March 23, 2012

File No. 0-53390 | |

Dear Mr. Schwall:

On behalf of Dakota Plains Holdings, Inc., formerly MCT Holding Corporation (the “Company”), I am pleased to submit this response to the comments of the Staff on the above-referenced filing (the “Current Report”), as set forth in your letter dated April 24, 2012. The supplemental information set forth herein has been supplied by the Company for use in connection with the Staff’s review of the responses described below, and all such responses have been reviewed and approved by the Company. For convenience, each of the Staff’s consecutively numbered comments is set forth herein, followed by the Company’s response in bold.

Current Report on Form 8-K, filed March 23, 2012

General

| 1. | Please update your filing, such as your new quotation symbol and statuses on the OTC Markets QB and OTC Bulletin Board. |

Response:We intend to report in an Amendment No. 1 to our Current Report on Form 8-K/A (the “Amended Report”) that, since March 25, 2012, our common stock has been listed on the OTC Bulletin Board and the OTC Markets QB under the symbol “DAKP”.

Business, page 2

Gathering System Opportunity, page 6

| 2. | You indicate that you have been approached to several third parties regarding construction of a feeder pipeline. Clarify that status of your plans in these areas. To the extent known, address any anticipated capital expenditures and sources of financing under “Liquidity and Capital Resources.” |

Response:We continue to explore opportunities to work with third parties to construct a feeder pipeline that would connect directly through our New Town transloading facility but have not established definitive plans to pursue such an opportunity. Accordingly, we are not currently able to reasonably estimate the capital expenditures or sources of financing for any future feeder pipeline project.

Securities and Exchange Commission

May 7, 2012

Page 2

Storage Business Opportunity, page 6

| 3. | You indicate that you “expect to construct a permanent storage facility.” To the extent known, address any anticipated capital expenditures and sources of financing under “Liquidity and Capital Resources.” |

Response:As ofthe date of the Current Report were unable to reasonably estimate the capital expenditures or sources of financing for the construction of a permanent storage facility. Subsequent to the filing of the Current Report, our indirectly owned subsidiary, Dakota Petroleum Transport Solutions, LLC, agreed to proceed with the previously engaged engineering firm’s storage facility design and executed a letter of intent pursuant to which a storage tank manufacturer has begun construction of a storage tank. We anticipate that the construction of a permanent storage facility will result in aggregate capital expenditures of approximately $7.0 million, which we expect will be funded exclusively through cash generated by the operations of Dakota Petroleum Transport Solutions, LLC.

Even though the developments described above occurred after the original filing date of the Current Report, we intend to include them in revised disclosure in the Amended Report.

Our Customers, page 7

| 4. | We note your disclosure at page 7 that a significant portion of revenue originated from an unidentified customer and your contract expired on January 31, 2012. Where appropriate, please revise your filing to discuss how this impacts your business and expectations for your future operations. Address your ability to replace this customer. |

Response:We have had minimum disruption in our business with the loss of our only customer. As previously noted in this document, our DPTS Marketing LLC joint venture began marketing and transloading oil through our facility in July 2011, concurrent with our single customer. DPTS Marketing LLC has been able to secure the volume of oil to offset the loss of volume from that former customer.

Risk Factors, page 9

| 5. | Please revise your risk factor disclosures to be more concise and tailor each risk factor to your specific facts and circumstances. |

Response: We intend to restate the disclosure under the heading “RISK FACTORS” in Item 2.01 of the Amended Report substantially as follows:

Investing in our common stock involves risks. You should carefully consider the risks described below, in addition to the other information contained in this report, before investing in our common stock. Realization of any of the following risks, or adverse results from any matter listed under “Information Regarding Forward-Looking Statements,” could have a material adverse effect on our business, financial condition, cash flows and results of operations and could result in a decline in the trading price of our common stock. You might lose all or part of your investment. This report also contains forward-looking statements, estimates and projections that involve risks and uncertainties. Our actual results could differ materially from those anticipated in the forward-looking statements, estimates and projections as a result of specific factors, including the risks described below.

Securities and Exchange Commission

May 7, 2012

Page 3

Risks Related to Our Business

We are a company with limited operating history for you to evaluate our business.

Dakota Plains’ successor was incorporated under the laws of Nevada on November 13, 2008, and has engaged in limited business operations. We are engaged in the business of developing a transloading facility and other means to support the loading, marketing and transporting of crude oil and related products from and into the North Dakota Williston Basin oil fields. We have limited operating history for you to consider in evaluating our business and prospects. As such, it is difficult for potential investors to evaluate our business.

Dakota Plains experienced negative cash flows for its operating and investing activities during 2011, primarily due to the infrastructure investment required to purchase additional land near New Town, North Dakota and the expenses related to the expansion of the transloading facility. In addition, our Company funded the initial member preferred contribution of $10,000,000 required by each member of the DPTS marketing joint venture, to support the trading activities. Dakota Plains’ financing cash flows were positive due to the proceeds from the equity and promissory notes issuances. Dakota Plains’ net cash flow for 2011 was $1,178,375. In 2010, Dakota Plains’ operating and financing cash flows were positive, while investing cash flows were negative, resulting in a net negative cash flow of $85,299.

Our operations are subject to all of the risks, difficulties, complications and delays frequently encountered in connection with the formation of any new business, as well as those risks that are specific to the transportation and oil industries. Investors should evaluate us in light of the delays, expenses, problems and uncertainties frequently encountered by companies developing markets for new products, services and technologies. We may never overcome these obstacles.

Our business is speculative and dependent upon the implementation of our business plan and our ability to enter into agreements with third parties for transloading, marketing and the leasing of our facility on terms that will be commercially viable for us. Our dependence on third-parties will also create significant risks that such third-parties may not fulfill their obligations under appropriate contracts and arrangements or may not be sufficiently staffed or funded to properly fulfill such obligations consistent with our needs and expectations.

Our lack of diversification increases the risk of an investment in our Company, and our financial condition and results of operations may deteriorate if we fail to diversify.

Our business has initially focused on a single rail car transloading facility in New Town, North Dakota. Since its inception, Dakota Plains had focused solely on generating income through transloading at the facility. We are now generating income from our marketing joint venture. We intend to continue to pursue additional business lines, including the transporting of crude oil and related products from and into the Williston Basin oil fields. Our ability to diversify our investments will depend on our access to additional capital and financing sources and the availability of real property and other assets required to allow us to load, market and transport crude oil and related products.

Larger companies have the ability to manage their risk by diversification. However, we will lack diversification, in terms of both the nature and geographic scope of our business. As a result, we will likely be impacted more acutely by factors affecting the transportation and crude oil industries or the regions in which we operate than we would if our business were more diversified, enhancing our risk profile. If we cannot diversify our operations, our financial condition and results of operations could deteriorate.

Securities and Exchange Commission

May 7, 2012

Page 4

Strategic relationships upon which we may rely are subject to change, which may diminish our ability to conduct our operations.

Our ability to successfully operate our transloading facility depends on developing and maintaining close working relationships with industry participants and on our ability to select and evaluate suitable business arrangements and to consummate transactions in a highly competitive environment. These realities are subject to change and may impair our ability to grow.

We are dependent on independent third parties to provide truck, rail and transloading services and to report certain events to us including delivery information. We may not own or control the transportation assets that deliver our customer’s products and we do not expect to employ the people directly involved in transloading products.

Dakota Plains entered into the transloading joint venture with PTS, a subsidiary of Western Petroleum of Eden Prairie, Minnesota, in November 2009. Western Petroleum was subsequently purchased by WFS in October 2010. Under the terms of the transloading joint venture, PTS is responsible for managing the day-to-day transloading operations of our New Town facility. PTS also maintain the books and records associated with the facility. Because the transloading and marketing joint ventures are our primary means for generating income, we are highly dependent on the personnel and resources of PTS to successfully execute our business plan. Our ability to successfully maintain our relationship with PTS depends on a variety of factors, many of which will be entirely outside our control. We may not be able to establish this and other strategic relationships, or if established, we may not be able to maintain them. In addition, the dynamics of our relationships with strategic partners may require us to incur expenses or undertake activities we would not otherwise be inclined to in order to fulfill our obligations to these partners or maintain our relationships. If our strategic relationships are not established or maintained, our business prospects may be limited, which could diminish our ability to conduct our operations.

Our reliance on PTS and other third parties could cause delays in reporting certain events, including recognizing revenue and claims. If we are unable to secure sufficient equipment or other transportation services to meet our commitments to our customers, our operating results could be materially and adversely affected, and our customers could switch to our competitors temporarily or permanently. Many of these risks include:

| • | equipment shortages in the transportation industry, particularly among rail carriers and parties that lease rail cars transporting crude oil products; |

| • | potential accounting disagreements with PTS; |

| • | potential substantial additional capital improvements required to maintain facility; |

| • | interruptions in service or stoppages in transportation as a result of labor or other issues; |

| • | Canadian Pacific’s capacity constraints; |

| • | competing facilities being constructed in close proximity; |

Securities and Exchange Commission

May 7, 2012

Page 5

| • | impact of weather at origin (e.g. snow, flooding, cold temperatures) on all operations; |

| • | impact of weather at destinations (e.g. hurricanes, tornadoes, flooding); |

| • | congestion at offloading sites; |

| • | inadequate storage facilities; |

| • | changes in regulations impacting transportation; and |

| • | unanticipated changes in transportation rates. |

Competition for the loading, marketing and transporting of crude oil and related products may impair our business.

The transportation industry is highly competitive. Other companies have recently acquired and constructed transloading facilities to compete with our Company. This competition is expected to become increasingly intense as the demand to transport crude oil in North Dakota has risen in recent years. We intend initially to focus on transporting crude oil through the Canadian Pacific system. We will also compete directly with other parties transporting crude oil using Canadian Pacific, the Burlington Northern Railway, various trucking and similar concerns, the Enbridge pipeline and any other pipelines that are constructed and operated in North Dakota. Any material increase in the capacity and quality of these alternative methods or the passage of legislation granting greater latitude to them could have an adverse effect on our results of operations, financial condition or liquidity. In addition, a failure to provide the level of service required by our customers could result in loss of business to competitors. Our ability to defend, maintain or increase prices for our products and services is in part dependent on the industry’s capacity relative to customer demand, and on our ability to differentiate the value delivered by our products and services from our competitors’ products and services.

Additionally, other transportation companies may compete with us from time to time in obtaining capital from investors or in funding joint ventures with our prospective partners. Competitors include a variety of potential investors and larger companies, which, in particular, may have access to greater resources, may be more successful in the recruitment and retention of qualified employees and may conduct their own refining and petroleum marketing operations, which may give them a competitive advantage. In addition, actual or potential competitors may be strengthened through the acquisition of additional assets and interests. If we are unable to compete effectively or adequately respond to competitive pressures, this inability may materially adversely affect our results of operation and financial condition.

We may be unable to obtain additional capital that we will require to implement our business plan, which could restrict our ability to grow.

We expect that our current capital and our other existing resources will be sufficient only to provide a limited amount of working capital, and the income generated from our initial operations alone may not be sufficient to fund our expected continuing opportunities. We likely will require additional capital to continue to operate our business beyond our current opportunities.

Future facility expansions, acquisitions and capital expenditures, as well as our administrative requirements (such as salaries, insurance expenses and general overhead expenses, as well as legal compliance costs and accounting expenses) will require a substantial amount of additional capital and cash flow. There is no guarantee that we will be able to raise any required additional capital or generate sufficient cash flow from our current and proposed operations to fund our ongoing business.

We may pursue sources of additional capital through various financing transactions or arrangements, including joint venturing of projects, debt financing, equity financing or other means. We may not be successful in locating suitable financing transactions in the time period required or at all, and we may not obtain the capital we require by other means. If we do not succeed in raising additional capital, our resources may not be sufficient to fund our operations going forward.

Securities and Exchange Commission

May 7, 2012

Page 6

Future arrangements with other crude marketing firms and operators will require us to expand our facility to meet the logistical and storage needs that accompany larger throughput commitments. Any additional capital raised through the sale of equity may dilute the ownership percentage of our shareholders. This could also result in a decrease in the fair market value of our equity securities because our assets would be owned by a larger pool of outstanding equity. Given the attractive return profiles of our potential customer arrangements, we expect that any additional capital required to fulfill our transloading commitments would be funded through one or more debt instruments to minimize dilution to existing shareholders. The terms of securities we issue in future capital transactions may be more favorable to our new investors, and may include preferences, superior voting rights and the issuance of warrants or other derivative securities, and issuances of incentive awards under equity employee incentive plans, which may have a further dilutive effect.

Our ability to obtain needed financing may be impaired by such factors as the capital markets (both generally and in the oil industry in particular), our status as a new enterprise without a significant demonstrated operating history, the single location near New Town, North Dakota that we are initially operating (which limits our ability to diversify our activities) and/or the loss of key management. Further, if oil and/or natural gas prices or the commodities markets experience significant volatility or stagnation, such market conditions will likely adversely impact our income by decreasing demand for our services and simultaneously increasing our requirements for capital. If the amount of capital we are able to raise from financing activities, together with our income from operations, is not sufficient to satisfy our capital needs (even to the extent that we reduce our operations), we may be required to cease our operations.

We may incur substantial costs in pursuing future capital financing, including investment banking fees, legal fees, accounting fees, securities law compliance fees, printing and distribution expenses and other costs. We may also be required to recognize non-cash expenses in connection with certain securities we may issue, such as convertible notes and warrants, which may adversely impact our financial condition.

We may not be able to effectively manage our growth, which may harm our profitability.

Our strategy envisions expanding our business. If we fail to effectively manage our growth, our financial results could be adversely affected. Growth may place a strain on our management systems and resources. We must continue to refine and expand our business development capabilities, our systems and processes and our access to financing sources. As we grow, we must continue to hire, train, supervise and manage new employees. We cannot assure you that we will be able to:

| • | expand our systems effectively or efficiently or in a timely manner; |

Securities and Exchange Commission

May 7, 2012

Page 7

| • | allocate our human resources optimally; |

| • | identify and hire qualified employees or retain valued employees; or |

| • | incorporate effectively the components of any business that we may acquire in our effort to achieve growth. |

If we are unable to manage our growth, our operations and our financial results could be adversely affected by inefficiency, which could diminish our profitability.

Our business may suffer if we do not attract and retain talented personnel.

Our success will depend in large measure on the abilities, expertise, judgment, discretion, integrity and good faith of our management and other personnel in conducting our business. We have a small management team, and the loss of a key individual or inability to attract suitably qualified staff could materially adversely impact our business.

Our success depends on the ability of our management, employees and joint venture partner to interpret market data correctly and to interpret and respond to economic market and other conditions in order to locate and adopt appropriate investment opportunities, monitor such investments, and ultimately, if required, to successfully divest such investments. Further, no assurance can be given that our key personnel will continue their association or employment with us or that replacement personnel with comparable skills can be found. We will seek to ensure that management and any key employees are appropriately compensated; however, their services cannot be guaranteed. If we are unable to attract and retain key personnel, our business may be adversely affected.

Risks Related to Our Industry

Building and operating a transloading facility is risky and may not be commercially successful, and the advanced technologies we use cannot eliminate competition and environmental risk, which could impair our ability to generate income from our operations.

Our future success will depend initially on our success in expanding and operating our New Town, North Dakota transloading facility. We will be almost entirely dependent on the demand to transport crude oil from wells in relatively close proximity to New Town.

Our ability to generate a return on our investments, income and our resulting financial performance are significantly affected by the prices oil exploration and production companies receive for crude oil produced from their wells.

Especially in recent years, the prices at which crude oil trade in the open market have experienced significant volatility, including the recent expansion of the West Texas Intermediate and Brent spread, and will likely continue to fluctuate in the foreseeable future due to a variety of influences including, but not limited to, the following:

| • | domestic and foreign demand for crude oil by both refineries and end users; |

| • | the introduction of alternative forms of fuel to replace or compete with crude oil; |

Securities and Exchange Commission

May 7, 2012

Page 8

| • | domestic and foreign reserves and supply of crude oil; |

| • | competitive measures implemented by our competitors and domestic and foreign governmental bodies; |

| • | political climates in nations that traditionally produce and export significant quantities of crude oil (including military and other conflicts in the Middle East and surrounding geographic region) and regulations and tariffs imposed by exporting and importing nations; |

| • | domestic and foreign economic volatility and stability. |

Demand for oil is subject to factors beyond our control, which may adversely affect our operating results. Changes in the global economy, changes in the ability of our customers to access equity or credit markets and volatility in oil prices could impact our customers’ spending levels and our revenues and operating results.

The past slowdown in global economic growth and recession in the developed economies resulted in reduced demand for oil, increased spare productive capacity and lower energy prices. Weakness or deterioration of the global economy or credit market could reduce our customers’ spending levels and reduce our revenues and operating results. Incremental weakness in global economic activity will reduce demand for oil and result in lower oil prices. Incremental strength in global economic activity will create more demand for oil and support higher oil prices. In addition, demand for oil could be impacted by environmental regulation, including “cap and trade” legislation, carbon taxes and the cost for carbon capture and sequestration related regulations.

Volatility in oil prices can also impact our customers’ activity levels and spending for our products and services. Current energy prices are important contributors to cash flow for our customers and their ability to fund exploration and development activities. Expectations about future prices and price volatility are important for determining future spending levels.

Lower oil prices generally lead to decreased spending by our joint venture customers. While higher oil prices generally lead to increased spending by our joint venture customers, sustained high energy prices can be an impediment to economic growth, and can therefore negatively impact spending by our customers. Any of these factors could affect the demand for oil and could have a material adverse effect on our results of operations. Prolonged periods of low crude oil prices could cause oil exploration and production to become economically unfeasible. Decreased drilling and/or production activities by oil exploration and production companies could reduce demand for transportation of crude oil and adversely impact our business. A decrease in crude oil prices could also adversely impact our ability to raise additional capital to pursue future diversification and expansion activities.

Our inability to obtain necessary facilities could hamper our operations.

Transporting crude oil and related products is dependent on the availability of real estate adjacent to railway and roadways, construction materials and contractors, transloading equipment, transportation methods, power and technical support in the particular areas where these activities will be conducted, and our access to these facilities may be limited. Demand for such limited real estate, equipment, construction materials and contractors or access restrictions may affect the availability of such real estate and equipment to us and may delay our business activities. The pricing and grading of appropriate real estate may also be unpredictable and we may be required to make efforts to upgrade and standardize our facilities, which may entail unanticipated costs and delays. Shortages and/or the unavailability of necessary construction materials, contractors and equipment will impair our activities, either by delaying our activities, increasing our costs or otherwise.

Securities and Exchange Commission

May 7, 2012

Page 9

We may have difficulty obtaining crude oil to transport, which could harm our financial condition.

In order to transport crude oil, we depend on our ability and the ability of marketing partners to purchase production from well operators. We also rely on local infrastructure and the availability of transportation for storage and shipment of oil to our facility, but infrastructure development and storage and transportation facilities may be insufficient for our needs at commercially acceptable terms in the localities in which we operate. Well operators may also determine to utilize one or more of our competitors for any of a variety of reasons, and any lack of demand for us of our transloading facility and related services would be particularly problematic.

Furthermore, weather conditions or natural disasters, actions by companies doing business in one or more of the areas in which we operate, or labor disputes may impair the distribution of oil and in turn diminish our financial condition or ability to maintain our operations.

Supplies of crude oil are subject to factors beyond our control, which may adversely affect our operating results.

Productive capacity for oil is dependent on our customers’ decisions to develop and produce oil reserves. The ability to produce oil can be affected by the number and productivity of new wells drilled and completed, as well as the rate of production and resulting depletion of existing wells. Advanced technologies, such as horizontal drilling and hydraulic fracturing, improve total recovery but also result in a more rapid production decline.

Increases in our operating expenses will impact our operating results and financial condition.

Real estate acquisition, construction and regulatory compliance costs (including taxes) will substantially impact the net income we derive from the crude oil that we transport. These costs are subject to fluctuations and variation in different locales in which we will operate, and we may not be able to predict or control these costs. If these costs exceed our expectations, this may adversely affect our results of operations. In addition, we may not be able to earn net income at our predicted levels, which may impact our ability to satisfy our obligations.

A downturn in the economy or change in government policy could negatively impact demand for our services.

Significant, extended negative changes in economic conditions that impact the producers and consumers of the commodities transported by our Company may have an adverse effect on our operating results, financial condition or liquidity. In addition, changes in United States and foreign government policies could change the economic environment and affect demand for our services. For example, changes in clean air laws or regulation promoting alternative fuels could reduce the demand for petroleum. Also, United States and foreign government agriculture tariffs or subsidies could affect the demand for petroleum.

Penalties we may incur could impair our business.

Failure to comply with government regulations could subject us to administrative, civil or criminal penalties, could require us to forfeit property rights, and may affect the value of our assets. We may also be required to take corrective actions, such as installing additional equipment or taking other actions, each of which could require us to make substantial capital expenditures. We could also be required to indemnify our third-party contractors, joint venture partners and employees in connection with any expenses or liabilities that they may incur individually in connection with regulatory action against them. As a result, our future business prospects could deteriorate due to regulatory constraints, and our profitability could be impaired by our obligation to provide such indemnification to our employees.

Securities and Exchange Commission

May 7, 2012

Page 10

Our Company and the industry in which it operates are subject to stringent environmental laws and regulations, which may impose significant costs on its business operations.

Our Company’s operations are subject to extensive federal, state and local environmental laws and regulations concerning, among other things, emissions to the air; discharges to waters; the generation, handling, storage, transportation and disposal of waste and hazardous materials; and the cleanup of hazardous material or petroleum releases. Changes to or limits on carbon dioxide emissions could result in significant capital expenditures to comply with these regulations with respect to our equipment, vehicles and machinery. Emission regulations could also adversely affect fuel efficiency and increase operating costs. Further, permit requirements or concerns regarding emissions and other forms of pollution could inhibit our ability to build or operate our facilities in strategic locations to facilitate growth and efficient operations. Environmental liability can extend to previously owned or operated properties, leased properties and properties owned by third parties, as well as to properties currently owned and used by our subsidiaries. Environmental liabilities may arise from claims asserted by adjacent landowners or other third parties in toxic tort litigation. An accidental release of hazardous materials could result in a significant loss of life and extensive property damage. In addition, insurance premiums charged for some or all of the coverage currently maintained by our Company could increase dramatically or certain coverage may not be available to us in the future if there is a catastrophic event related to transportation of hazardous materials. Our Company could incur significant expenses to investigate and remediate environmental contamination and maintain compliance with licensing or permitting requirements related to the foregoing, any of which could adversely affect our operating results, financial condition or liquidity.

Our insurance may be inadequate to cover liabilities we may incur.

Our involvement in the transportation of oil and related products may result in us becoming subject to liability for pollution, property damage, personal injury, death or other hazards. Although we expect to obtain insurance in accordance with industry standards to address such risks and will attempt to require third-parties operating our facilities to indemnify us for such risks, such insurance and indemnification has limitations on liability that may not be sufficient to cover the full extent of such liabilities. In addition, such risks may not, in all circumstances, be insurable or, in certain circumstances, we may choose not to obtain insurance to protect against specific risks due to the high premiums associated with such insurance or for other reasons. The payment of such uninsured liabilities would reduce the funds available to us. If we suffer a significant event or occurrence that is not fully insured, or if the insurer of such event is not solvent, we could be required to divert funds from capital investment or other uses towards covering our liability for such events, and we may not be able to continue to obtain insurance on commercially reasonable terms.

Our business will suffer if we cannot obtain or maintain necessary licenses.

Our operations will require licenses, permits and in some cases renewals of licenses and permits from various governmental authorities. Our ability to obtain, sustain or renew such licenses and permits on acceptable terms is subject to change in regulations and policies and to the discretion of the applicable governments, among other factors. Our inability to obtain, or our loss of or denial of extension, to any of these licenses or permits could hamper our ability to produce income from our operations.

Securities and Exchange Commission

May 7, 2012

Page 11

Challenges to our properties may impact our financial condition.

Parties from whom we purchase real estate for our facilities, such as railways, may not provide warranty deeds ensuring we receive proper title to our properties. While we intend to make appropriate inquiries into the title of properties and other development rights we acquire, title defects may exist. In addition, we may be unable to obtain adequate insurance for title defects, on a commercially reasonable basis or at all. If title defects do exist, it is possible that we may lose all or a portion of our right, title and interests in and to the properties to which the title defects relate. If our property rights are reduced, our ability to conduct our business activities may be impaired.

We will rely on technology to conduct our business and our technology could become ineffective, obsolete or temporarily unavailable.

We rely on technology, including transloading techniques and economic models, to operate our facilities and to guide our business activities. We will be required to continually enhance and update our technology to maintain its effectiveness and to avoid disuse. The costs of doing so may be substantial, and may be higher than the costs that we anticipate for technology maintenance and development. If we are unable to maintain the effectiveness of our technology, our ability to manage our business and to compete may be impaired. Further, even if we are able to maintain technical effectiveness, our technology may not be the most efficient means of reaching our objectives, in which case we may incur higher operating costs than we would were our technology more efficient.

Future acts of terrorism or war, as well as the threat of war, may cause significant disruptions in our business operations.

Terrorist attacks, such as those that occurred on September 11, 2001, as well as the more recent attacks on the transportation systems in Madrid, London and in India, and any government response to those types of attacks and war or risk of war may adversely affect our results of operations, financial condition or liquidity. Rail lines and facilities we utilize could be direct targets or indirect casualties of an act or acts of terror, which could cause significant business interruption and result in increased costs and liabilities and decreased revenues, which could have an adverse effect on its operating results and financial condition. Such effects could be magnified if releases of hazardous materials are involved. Any act of terror, retaliatory strike, sustained military campaign or war or risk of war may have an adverse impact on our operating results and financial condition by causing or resulting in unpredictable operating or financial conditions, including disruptions of rail lines, volatility or sustained increase of fuel prices, fuel shortages, general economic decline and instability or weakness of financial markets. In addition, insurance premiums charged for some or all of the coverage currently maintained by our Company could increase dramatically or certain coverage may not be available to us in the future.

Securities and Exchange Commission

May 7, 2012

Page 12

Management’s Discussion and Analysis of Financial Condition and Results of Operations, page 17

Results of Operations, page 19

| 6. | Expand your disclosure to: |

| · | Identify, quantify and explain the loss on the extinguishment of debt; and |

| · | Identify, quantify and explain the change in the fair value of the “embedded derivative.” |

Response:

We intend to restate the disclosure under the heading “Results of Operations” in Item 2.01 of the Amended Report substantially as follows:

Fiscal Year Ended December 31, 2011 vs. Fiscal Year Ended December 31, 2010

Our Company experienced a Net Loss of $3.1 million for the fiscal year ended December 31, 2011 compared to a Net Income of $665 thousand for the fiscal year ended December 31, 2010. The Net Loss was mainly driven by the expenses related to the loss on the extinguishment of debt and the period change in fair value of the embedded derivative, reflected in interest expense. In addition, there was also an increase in G&A expense related share based compensation to employees, directors and consultants. The higher expenses were partially offset by increases in Income from Investment in Dakota Petroleum Transport Solutions, LLC and DPTS Marketing LLC equaling $4.2 million and $2.3 million respectively. The Dakota Petroleum Transport Solutions, LLC joint venture commenced operations in November 2009, the fiscal year ending December 31, 2010 was the first full year of operations. The DPTS Marketing, LLC joint venture was formed in April 2011 and began operating in July 2011. We also recognized rental income of $315 thousand in the fiscal year ended December 31, 2011 compared to $163 thousand in the fiscal year ended December 31, 2010.

Loss on extinguishment of debt for the year ended December 31, 2011 was $4,552,500. The loss on the extinguishment of debt related to the exchange of the senior and junior notes for our currently outstanding promissory notes. The loss on extinguishment of debt is comprised of the $180,000 exchange fee paid to the holders of the junior and senior notes and the $4,372,500 fair value of the embedded derivative included in our outstanding promissory notes.

The fair value of the embedded derivative included in our outstanding promissory notes increased by $1,167,500 during the year ended December 31, 2011. The increase in the fair value of the embedded derivative was due to the increased probability that the triggering event related to the embedded derivative would occur as compared to when the promissory notes were issued.

Depreciation and amortization increased due to additions relating to the build out and development of the crude oil transloading site in New Town, North Dakota.

Certain Relationships and Related Transactions, and Director Independence, page 26

| 7. | We note your reference to “any of the transactions described in this ‘Certain Relationships and Related Party Transactions’ section.” Please describe such transactions pursuant to Item 404 of Regulation S-K. |

Response:The last sentence of the second paragraph under the heading “Certain Relationship and Related Transactions” in Item 2.01 of the Current Report was inadvertently included and will be omitted from the Amended Report.

Securities and Exchange Commission

May 7, 2012

Page 13

Recent Sales of Unregistered Securities, page 27

| 8. | For each transaction, please state briefly the facts relied upon to make the exemption available. Refer to Item 701 of Regulation S-K. |

Response:As disclosed under the heading “Recent Sales of Unregistered Securities” in Item 2.01 of the Amended Report, in the case of each identified transaction, we issued the securities only to persons who were “accredited investors” or “sophisticate investors” as those terms are defined in Rule 501 of Regulation D and each recipient of securities had prior access to all material information about Dakota Plains, Inc.

We intend to further report in the Amended Report that in determining that the issuances of common stock, warrants and promissory notes qualified for an exemption under Section 4(2) and Rule 506 of Regulation D, we have relied on the following additional facts: the securities were offered only to a limited number of accredited or sophisticated investors without the use of general solicitation or advertising to market or otherwise offer the securities for sale; each investor represented to Dakota Plains, Inc. in writing that it was an accredited investor or sophisticated investor investing with the assistance of a purchaser representative and that such investor was acquiring the common stock, warrants or promissory notes, each as applicable, for its own account and not with a view to distribute them; and each investor acknowledged in writing that the common stock, warrants or promissory notes acquired were restricted securities. Furthermore, Dakota Plains, Inc. (or its successor) caused the filing of a Notice on Form D with the Commission with respect to each transaction for which such filing is required under Regulation D.

Directors and Executive Officers, page 34

| 9. | Revise Mr. Claypool’s biography to specify his position with Juniper Networks. |

Response:We intend to indicate in the Amended Report that Mr. Claypool acted as Regional Manager during his employment at Juniper Networks.

| 10. | Please revise Mr. Brady’s biography to identify his former employers by name. |

Response:We intend to indicate in the Amended Report that, from May 2011 to September 2011, Mr. Brady founded and served as chief financial officer at Encore Energy, a privately held independent operator of oil and natural gas properties and, from 2010 to 2011, he served as chief financial officer at Allied Energy a publicly traded oil and natural gas company.

Securities and Exchange Commission

May 7, 2012

Page 14

Exhibit 99.1 – Dakota Plains, Inc. Consolidated Financial Statements

Note 2 – Summary of Significant Accounting Policies, page 7

Property and Equipment, page 8

| 11. | Please expand your disclosure to describe the nature of site development assets included in your property, plant, and equipment and the status and estimated completion of any such assets that are not in use. Please also modify your disclosure to clarify the extent to which all of the trans-loading assets utilized by the joint venture are reported on your balance sheet and to replace labels with more descriptive line captions. We expect that details regarding the nature of these assets, and the costs reported as site development, would reconcile with the disclosures about your joint venture operations in Note 3, including those mentioned in relation to the Supplemental Agreement on page 11. |

Response:We intend to restate the disclosure under the heading “Property and Equipment” in Item 2.01 of the Amended Report substantially as follows:

Property and equipment are recorded at cost and depreciated using the straight-line method over their estimated useful lives. All amounts capitalized in property and equipment are in service and are being depreciated as of December 31, 2011.

| Estimated useful lives are as follows: | | | | |

| Site development | | | 15 years | |

| Other Property and Equipment | | | 3 - 5 years | |

| Land | | | — | |

Expenditures for replacements, renewals, and betterments are capitalized. Maintenance and repairs are charged to operations as incurred. Depreciation expense was $159,275 and $90,929 for the years ended December 31, 2011 and 2010, respectively.

Site Development

The Site development costs capitalized into property and equipment relate to the Company’s investment in the transloading facility operated in the joint venture with Dakota Petroleum Transport Solutions, LLC (See Note 3). The breakdown of these costs are as follows:

| Site Improvements – Phase I | | Amount | |

| Track Construction | | $ | 861,456 | |

| Private Siding Construction | | $ | 142,101 | |

| Fees & Permits | | $ | 5,356 | |

| Total | | $ | 1,008,913 | |

| | | | | |

| | | | | |

| Site Improvements – Phase II | | Amount | |

| Track Construction | | $ | 267,187 | |

| Dirt Work | | $ | 627,687 | |

| Electrical | | $ | 425,872 | |

| Total | | $ | 1,320,747 | |

| Site Development Costs – Original Lease with Joint Venture (Note 4) | $1,008,913 |

| Site Development Costs – Supplemental Agreement with Joint Venture (Note 3) | 1,320,747 |

Securities and Exchange Commission

May 7, 2012

Page 15

Note 3 – Joint Ventures, page 10

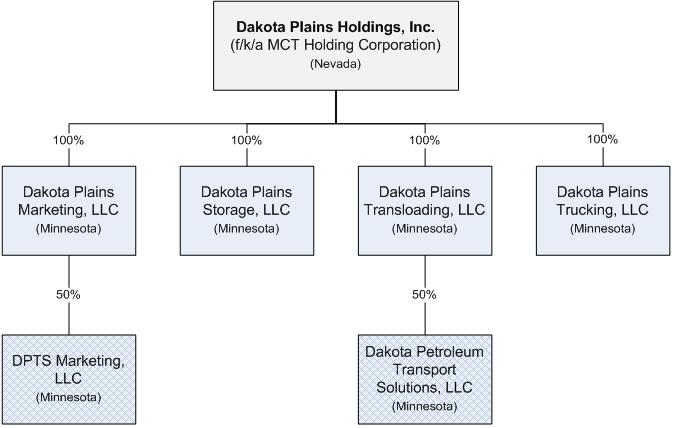

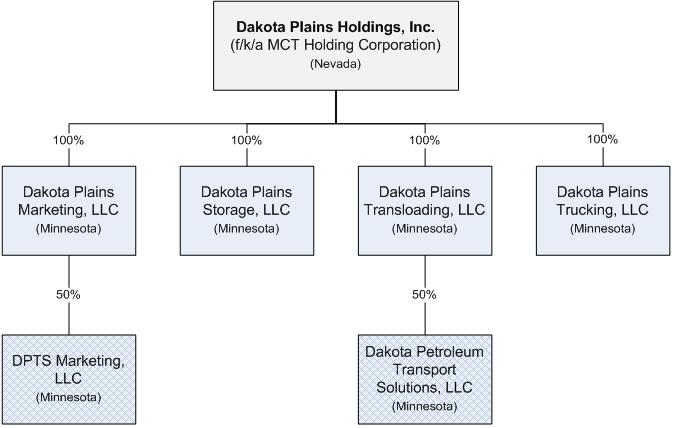

| 12. | Please modify your disclosure to clarify the various responsibilities of you and your joint venture partner over the daily operations of the joint venture activities, also to describe the extent of any direct and indirect common ownership, control or influence of, between or involving you and this partner. Please submit an organizational chart to illustrate any such relationships for the company under both present and former structures and names, including all subsidiaries. |

Response:We intend to restate the disclosure in Item 2.01 of the Amended Report to reflect that, pursuant to a Member Control Agreement, as amended and supplemented from time to time, our joint venture Petroleum Transport Solutions (“PTS”) has primary responsibility for operating, coordinating, and managing our New Town transloading facility on a day to day basis, while utilizing the expertise of our wholly-owned subsidiary, Dakota Plains Transloading, LLC, and its affiliates in providing rail-based solutions. This will occur either directly or through services contracted by Dakota Petroleum Transport Solutions, LLC with third parties, the operation of the transloading facility, including contracting for truck transport of hydrocarbons from the producers’ locations to the transloading facility and managing all accounting and bookkeeping functions in connection with the operation of the transloading facility. PTS has further agreed to assist both of the joint ventures in which our wholly owned subsidiaries participate through PTS’s contacts with marketers, transporters, refiners and other end users.

Under the Member Control Agreement with PTS has agreed to perform and be solely responsible for the purchasing, selling, storing, transporting, marketing and transacting trades in North Dakota crude oil, and entering into related agreements and conducting related activities, on behalf of DPTS Marketing LLC. All trading activities in North Dakota crude oil involving transportation by rail and requiring transloading will be transloaded at our New Town transloading facility.

Securities and Exchange Commission

May 7, 2012

Page 16

An organizational chart summarizing our wholly-owned subsidiaries and their ownership of the joint ventures in which we participate is supplementally provided for the Commission staff’s reference as follows.

Securities and Exchange Commission

May 7, 2012

Page 16

As specifically requested by the Commission, we acknowledge that:

| · | the company is responsible for the adequacy and accuracy of the disclosure in the filing; |

| · | staff comments or changes to disclosure in response to staff comments do not foreclose the Commission from taking any action with respect to the filing; and |

| · | the company may not assert staff comments as a defense in any proceeding initiated by the Commission or any person under the federal securities laws of the United States. |

Please contact us if we can further assist your review of the filing.

| | Very truly yours, | |

| | | | |

| | DAKOTA PLAINS HOLDINGS, INC. | |

| | | | |

| | By: | /s/ Timothy R. Brady | |

| | | Timothy R. Brady | |

| | | Chief Financial Officer | |

| cc: | Gabriel G. Claypool, Chief Executive Officer |

| | Tracie Towner, Staff Accountant |

| | Karl Hiller, Branch Chief |

| | Caroline Kim, Staff Attorney |

| | Joshua L. Colburn |