Exhibit 99.1

OTCQB: DAKP C ORPORATE P RESENTATION N OVEMBER 2013 WWW . DAKOTAPLAINS . COM

Forward Looking Statements Statements made by representatives of Dakota Plains Holdings, Inc . (“Dakota Plains” or the “Company”) during the course of this presentation that are not historical facts, are forward - looking statements . These statements are based on certain assumptions and expectations made by the Company which reflect management’s experience, estimates and perception of historical trends, current conditions, anticipated future developments and other factors believed to be appropriate . Such statements are subject to a number of assumptions, risks and uncertainties, many of which are beyond the control of the Company, which may cause actual results to differ materially from those implied or anticipated in the forward - looking statements . These include risks relating to global economics or politics, our ability to obtain additional capital needed to implement our business plan, minimal operating history, loss of key personnel, lack of business diversification, reliance on strategic, third - party relationships, financial performance and results, prices and demand for oil, our ability to make acquisitions on economically acceptable terms, and other factors described from time to time in the Company’s periodic reports filed with the SEC that could cause actual results to differ materially from those anticipated or implied in the forward - looking statements . Dakota Plains undertakes no obligation to publicly update any forward - looking statements, whether as a result of new information or future events . 2

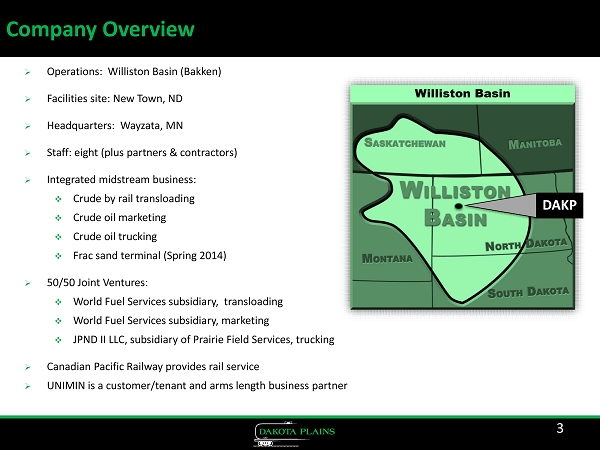

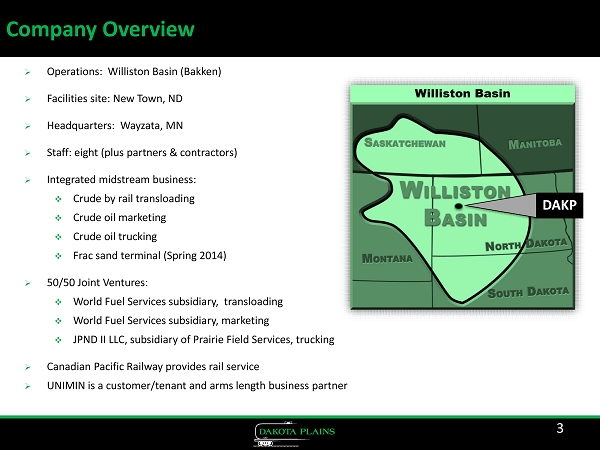

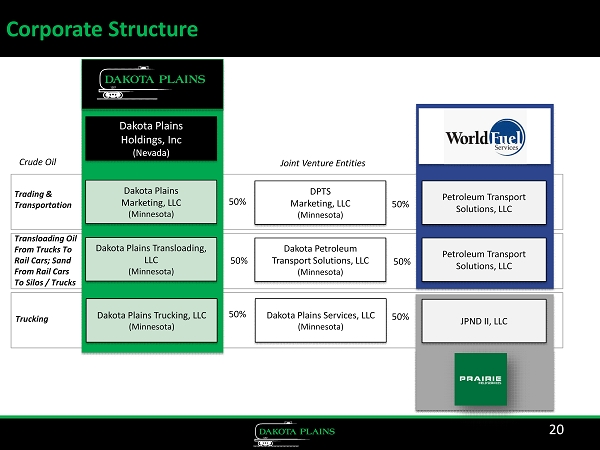

Company Overview » Operations: Williston Basin (Bakken) » Facilities site: New Town, ND » Headquarters: Wayzata, MN » Staff: eight (plus partners & contractors) » Integrated midstream business: □ Crude by rail transloading □ Crude oil marketing □ Crude oil trucking □ Frac sand terminal (Spring 2014) » 50/50 Joint Ventures: □ World Fuel Services subsidiary, transloading □ World Fuel Services subsidiary, marketing □ JPND II LLC, subsidiary of Prairie Field Services, trucking » Canadian Pacific Railway provides rail service » UNIMIN is a customer/tenant and arms length business partner DAKP 3

Company Highlights 11/26/2013 4 Strategic Location □ Serves top producing counties in North Dakota - Mountrail and McKenzie counties □ At terminus of Canadian Pacific line, which offers enhanced rail access and reduced congestion □ Unique road access to highway infrastructure, providing the only Missouri River bridge crossing for approximately 70 miles Unique Infrastructure Capabilities □ Pioneer Terminal double loop tracks capable of transloading a 120 car unit train per day □ 180,000 bbls of existing onsite storage, with expansion to 270,000 bbls permitted & designed □ Capacity for five gathering pipelines (one online and one has been announced) □ Four ladder tracks expanding to eight for inbound commodity products □ 70 acre industrial yard site secured inside loop track World Class Joint Ventures □ Transloading joint venture oversight transitioning to DAKP (DAKP will consolidate the transloading JV financials from Q4 2013) □ Strobel Starotska Transfer provides terminal logistics service □ Crude oil marketing joint venture; joint venture has 1,000+ leased rail cars □ Trucking joint venture provides vertical integration and greater control of crude delivery to Pioneer Experienced Management & Board □ Management has extensive expertise in the midstream and upstream segments, project construction, finance, legal, and entrepreneurial growth □ Board expertise in the fields of rail, logistics, finance, and the Williston Basin Experienced and High - Performing Team □ Pioneer expansion built on time and under budget for $50 million to increase throughput capacity from 30,000 bpd to 80,000 bpd; Pioneer enables further growth in 2014 and 2015 □ Frac sand terminal project underway with UNIMIN (largest supplier to Bakken); other expected projects include diesel inbound, NGL outbound, drill pipe yard, and industrial yard Growth Inventory

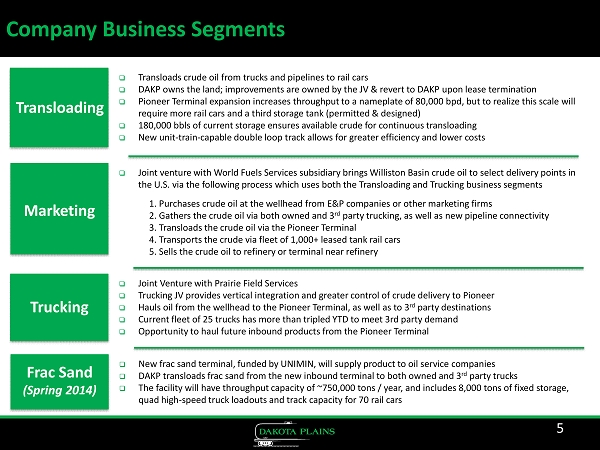

Company Business Segments 5 Transloading □ Transloads crude oil from trucks and pipelines to rail cars □ DAKP owns the land; improvements are owned by the JV & revert to DAKP upon lease termination □ Pioneer Terminal expansion increases throughput to a nameplate of 80,000 bpd, but to realize this scale will require more rail cars and a third storage tank (permitted & designed) □ 180,000 bbls of current storage ensures available crude for continuous transloading □ New unit - train - capable double loop track allows for greater efficiency and lower costs Marketing □ Joint venture with World Fuels Services subsidiary brings Williston Basin crude oil to select delivery points in the U.S. via the following process which uses both the Transloading and Trucking business segments 1. Purchases crude oil at the wellhead from E&P companies or other marketing firms 2. Gathers the crude oil via both owned and 3 rd party trucking, as well as new pipeline connectivity 3. Transloads the crude oil via the Pioneer Terminal 4. Transports the crude via fleet of 1,000+ leased tank rail cars 5. Sells the crude oil to refinery or terminal near refinery Trucking □ Joint Venture with Prairie Field Services □ Trucking JV provides vertical integration and greater control of crude delivery to Pioneer □ Hauls oil from the wellhead to the Pioneer Terminal, as well as to 3 rd party destinations □ Current fleet of 25 trucks has more than tripled YTD to meet 3rd party demand □ Opportunity to haul future inbound products from the Pioneer Terminal Frac Sand (Spring 2014) □ New frac sand terminal, funded by UNIMIN, will supply product to oil service companies □ DAKP transloads frac sand from the new inbound terminal to both owned and 3 rd party trucks □ The facility will have throughput capacity of ~750,000 tons / year, and includes 8,000 tons of fixed storage, quad high - speed truck loadouts and track capacity for 70 rail cars

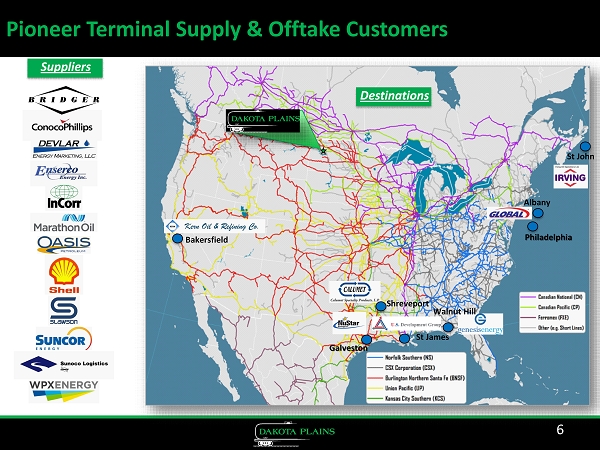

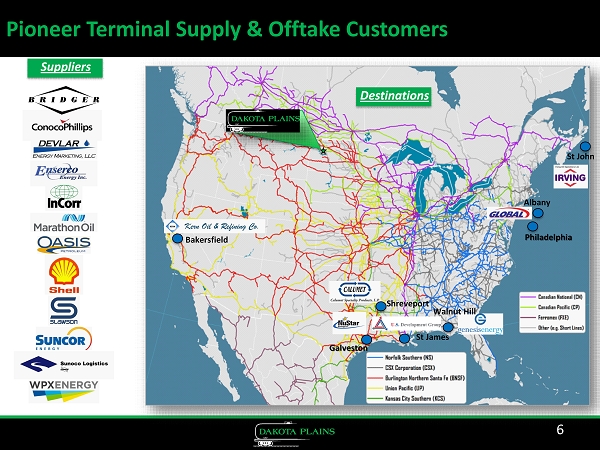

Pioneer Terminal Supply & Offtake Customers 6 Suppliers Bakersfield St James Walnut Hill Shreveport Albany St John Philadelphia Galveston Destinations

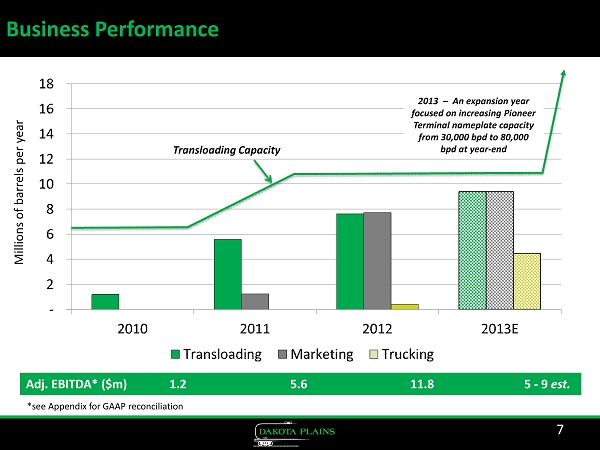

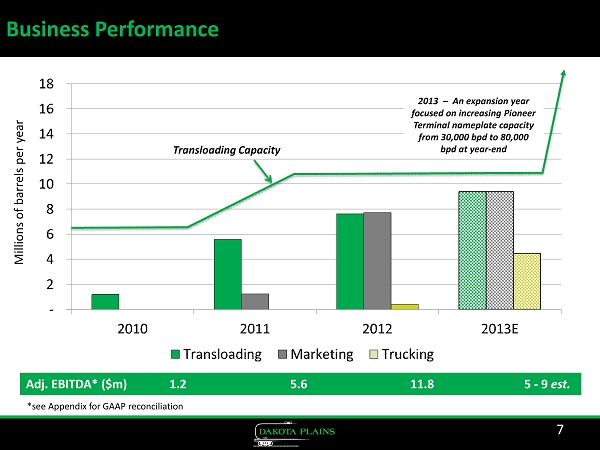

Business Performance 7 Millions of barrels per year Transloading Capacity 2013 – An expansion year focused on increasing Pioneer Terminal nameplate capacity from 30,000 bpd to 80,000 bpd at year - end Adj. EBITDA* ($m) 1.2 5.6 11.8 5 - 9 est. *see Appendix for GAAP reconciliation

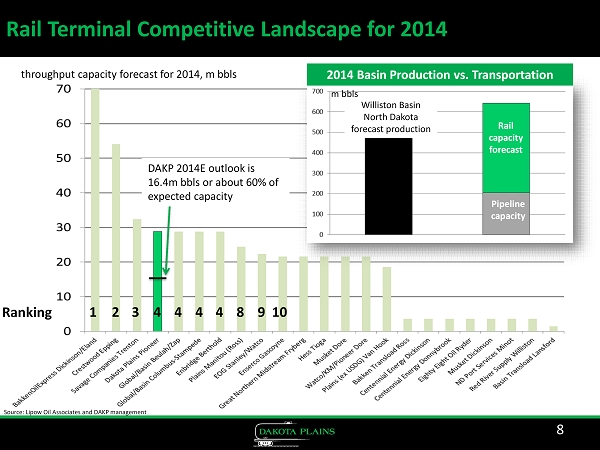

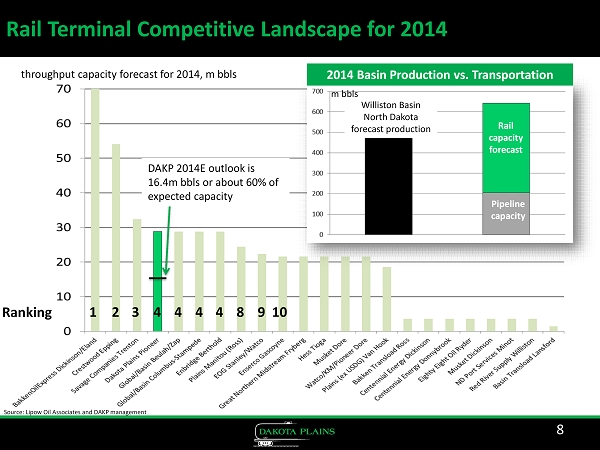

Rail Terminal Competitive Landscape for 2014 8 Source: Lipow Oil Associates and DAKP management throughput capacity forecast for 2014, m bbls DAKP 2014E outlook is 16.4m bbls or about 60% of expected capacity Williston Basin North Dakota forecast production Rail capacity forecast Pipeline capacity m bbls 1 2 3 4 Ranking 4 4 4 8 9 10 2014 Basin Production vs. Transportation

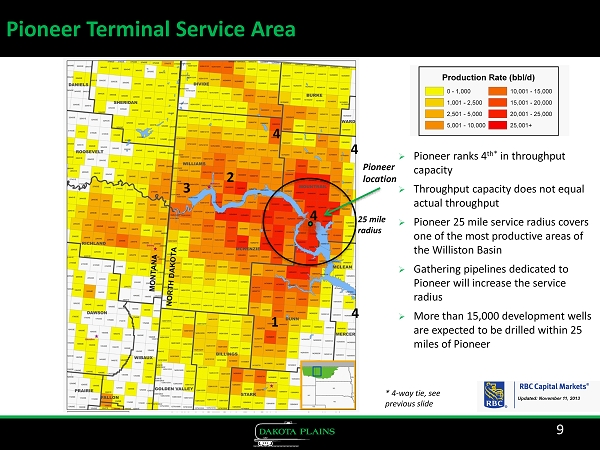

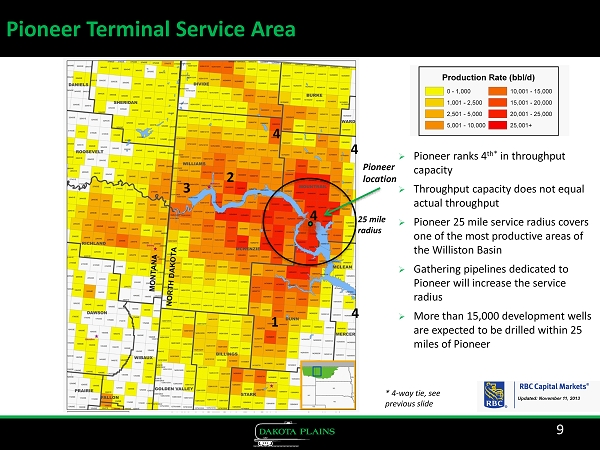

Pioneer Terminal Service Area 9 1 2 3 4 » Pioneer ranks 4 th* in throughput capacity » Throughput capacity does not equal actual throughput » Pioneer 25 mile service radius covers one of the most productive areas of the Williston Basin » Gathering pipelines dedicated to Pioneer will increase the service radius » More than 15,000 development wells are expected to be drilled within 25 miles of Pioneer Pioneer location * 4 - way tie, see previous slide 4 4 4 25 mile radius

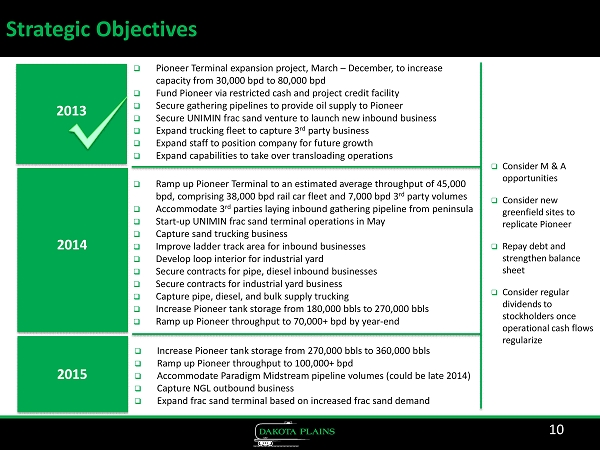

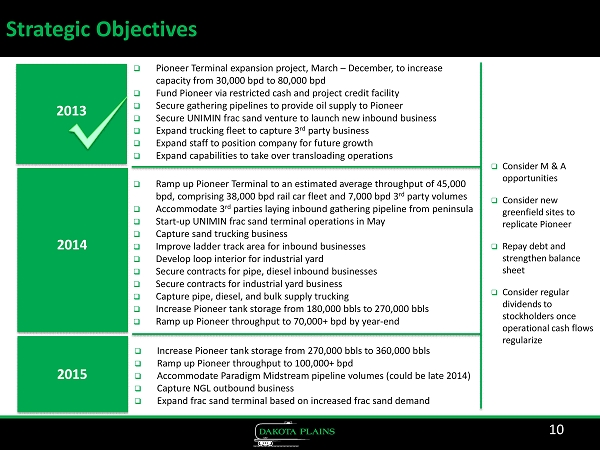

Strategic Objectives 11/26/2013 10 2013 □ Pioneer Terminal expansion project, March – December, to increase capacity from 30,000 bpd to 80,000 bpd □ Fund Pioneer via restricted cash and project credit facility □ Secure gathering pipelines to provide oil supply to Pioneer □ Secure UNIMIN frac sand venture to launch new inbound business □ Expand trucking fleet to capture 3 rd party business □ Expand staff to position company for future growth □ Expand capabilities to take over transloading operations 2014 □ Ramp up Pioneer Terminal to an estimated average throughput of 45,000 bpd, comprising 38,000 bpd rail car fleet and 7,000 bpd 3 rd party volumes □ Accommodate 3 rd parties laying inbound gathering pipeline from peninsula □ Start - up UNIMIN frac sand terminal operations in May □ Capture sand trucking business □ Improve ladder track area for inbound businesses □ Develop loop interior for industrial yard □ Secure contracts for pipe, diesel inbound businesses □ Secure contracts for industrial yard business □ Capture pipe, diesel, and bulk supply trucking □ Increase Pioneer tank storage from 180,000 bbls to 270,000 bbls □ Ramp up Pioneer throughput to 70,000+ bpd by year - end 2015 □ Increase Pioneer tank storage from 270,000 bbls to 360,000 bbls □ Ramp up Pioneer throughput to 100,000+ bpd □ Accommodate Paradigm Midstream pipeline volumes (could be late 2014) □ Capture NGL outbound business □ Expand frac sand terminal based on increased frac sand demand □ Consider M & A opportunities □ Consider new greenfield sites to replicate Pioneer □ Repay debt and strengthen balance sheet □ Consider regular dividends to stockholders once operational cash flows regularize

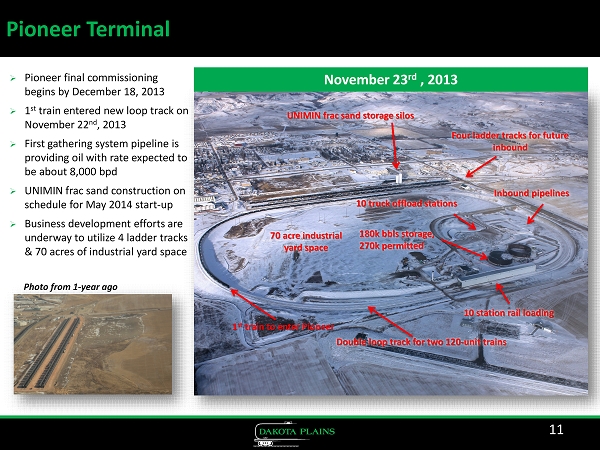

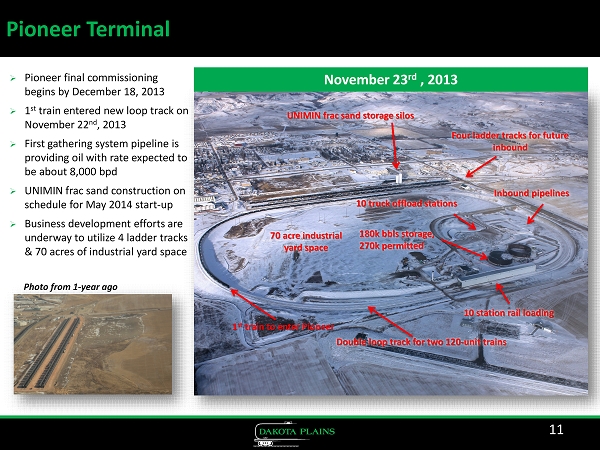

11 Pioneer Terminal November 23 rd , 2013 10 station rail loading 70 acre industrial yard space Double loop track for two 120 - unit trains Four ladder tracks for future inbound » Pioneer final commissioning begins by December 18, 2013 » 1 st train entered new loop track on November 22 nd , 2013 » First gathering system pipeline is providing oil with rate expected to be about 8,000 bpd » UNIMIN frac sand construction on schedule for May 2014 start - up » Business development efforts are underway to utilize 4 ladder tracks & 70 acres of industrial yard space UNIMIN frac sand storage silos Inbound pipelines 10 truck offload stations 180k bbls storage, 270k permitted 1 st train to enter Pioneer Photo from 1 - year ago

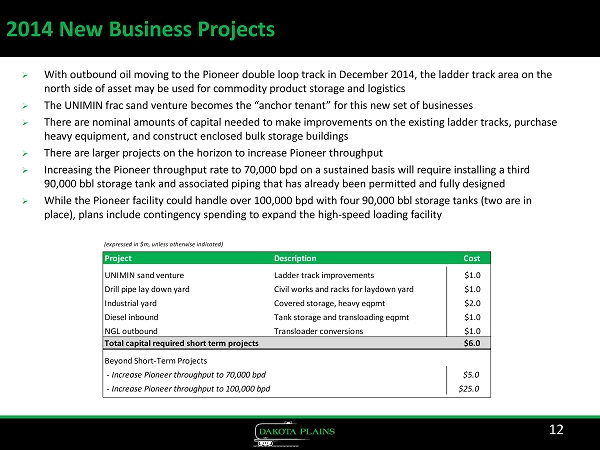

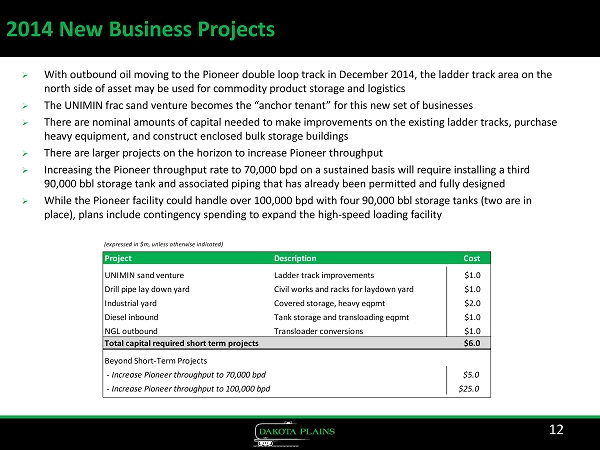

2014 New Business Projects 12 » With outbound oil moving to the Pioneer double loop track in December 2014, the ladder track area on the north side of asset may be used for commodity product storage and logistics » The UNIMIN frac sand venture becomes the “anchor tenant” for this new set of businesses » There are nominal amounts of capital needed to make improvements on the existing ladder tracks, purchase heavy equipment, and construct enclosed bulk storage buildings » There are larger projects on the horizon to increase Pioneer throughput » Increasing the Pioneer throughput rate to 70,000 bpd on a sustained basis will require installing a third 90,000 bbl storage tank and associated piping that has already been permitted and fully designed » While the Pioneer facility could handle over 100,000 bpd with four 90,000 bbl storage tanks (two are in place), plans include contingency spending to expand the high - speed loading facility (expressed in $m, unless otherwise indicated) Project Description Cost UNIMIN sand venture Ladder track improvements $1.0 Drill pipe lay down yard Civil works and racks for laydown yard $1.0 Industrial yard Covered storage, heavy eqpmt $2.0 Diesel inbound Tank storage and transloading eqpmt $1.0 NGL outbound Transloader conversions $1.0 Total capital required short term projects $6.0 Beyond Short-Term Projects - Increase Pioneer throughput to 70,000 bpd $5.0 - Increase Pioneer throughput to 100,000 bpd $25.0

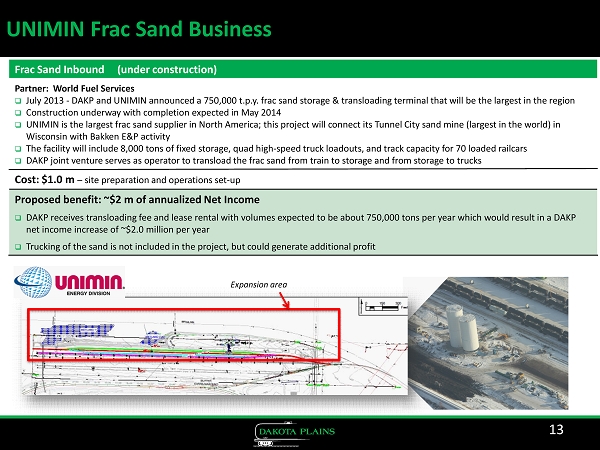

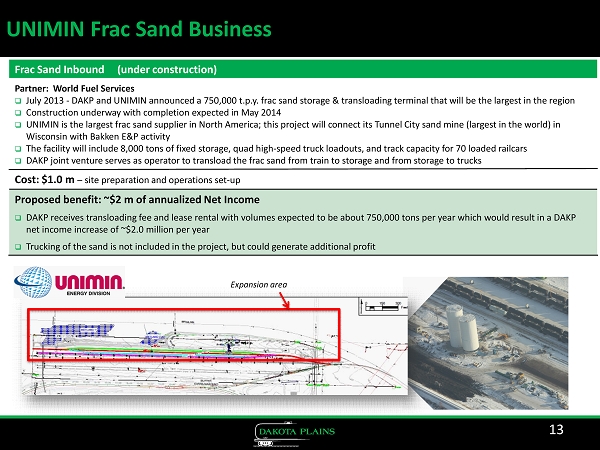

UNIMIN Frac Sand Business 13 Frac Sand Inbound (under construction) Partner: World Fuel Services □ July 2013 - DAKP and UNIMIN announced a 750,000 t.p.y . frac sand storage & transloading terminal that will be the largest in the region □ Construction underway with completion expected in May 2014 □ UNIMIN is the largest frac sand supplier in North America; this project will connect its Tunnel City sand mine (largest in th e w orld) in Wisconsin with Bakken E&P activity □ The facility will include 8,000 tons of fixed storage, quad high - speed truck loadouts , and track capacity for 70 loaded railcars □ DAKP joint venture serves as operator to transload the frac sand from train to storage and from storage to trucks Cost: $1.0 m – site preparation and operations set - up Proposed b enefit: ~$2 m of annualized Net Income □ DAKP receives transloading fee and lease rental with volumes expected to be about 750,000 tons per year which would result in a DAKP net income increase of ~$2.0 million per year □ Trucking of the sand is not included in the project, but could generate additional profit Expansion area

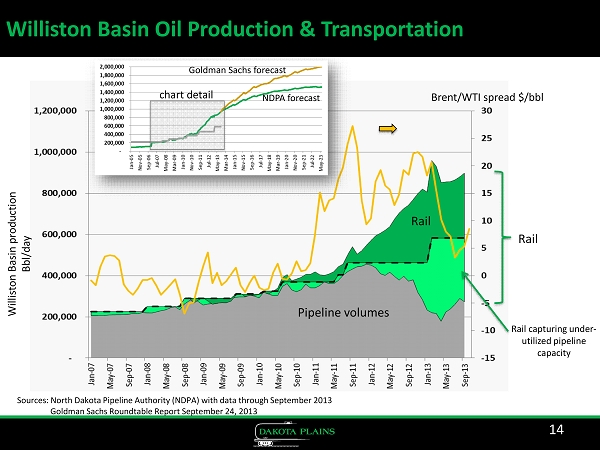

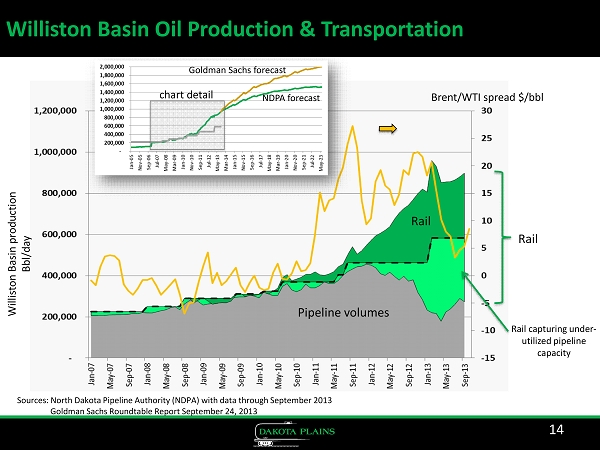

Williston Basin Oil Production & Transportation 14 Brent/WTI spread $/bbl Pipeline volumes Rail capturing under - utilized pipeline capacity Williston Basin production Bbl/day Sources: North Dakota Pipeline Authority (NDPA) with data through September 2013 Goldman Sachs Roundtable Report September 24, 2013 Rail Rail chart detail Goldman Sachs forecast NDPA forecast

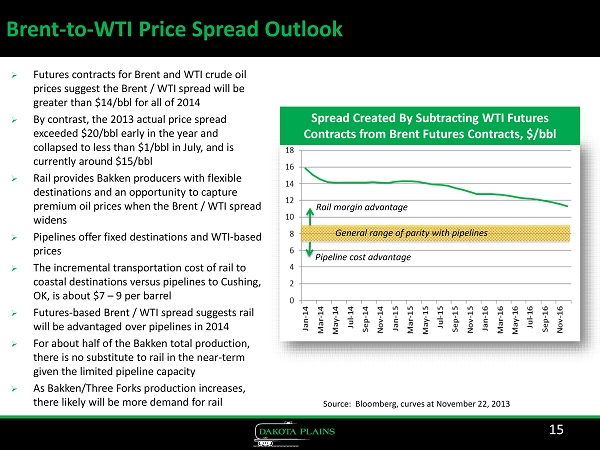

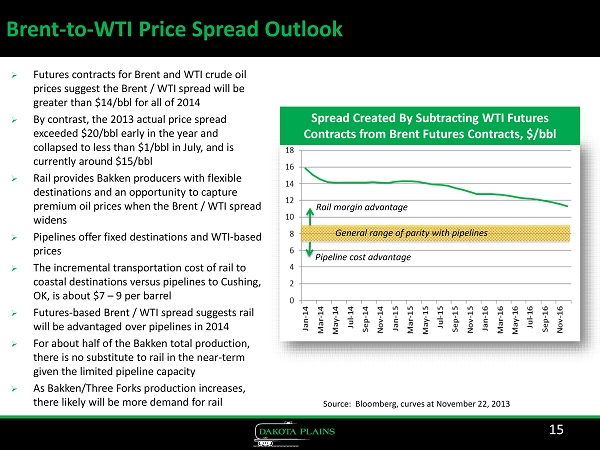

Brent - to - WTI Price Spread Outlook 15 Spread Created By Subtracting WTI Futures Contracts from Brent Futures Contracts, $/bbl General range of parity with pipelines Pipeline cost advantage Rail margin advantage » Futures contracts for Brent and WTI crude oil prices suggest the Brent / WTI spread will be greater than $14/bbl for all of 2014 » By contrast, the 2013 actual price spread exceeded $20/bbl early in the year and collapsed to less than $1/bbl in July, and is currently around $15/bbl » Rail provides Bakken producers with flexible destinations and an opportunity to capture premium oil prices when the Brent / WTI spread widens » Pipelines offer fixed destinations and WTI - based prices » The incremental transportation cost of rail to coastal destinations versus pipelines to Cushing, OK, is about $7 – 9 per barrel » Futures - based Brent / WTI spread suggests rail will be advantaged over pipelines in 2014 » For about half of the Bakken total production, there is no substitute to rail in the near - term given the limited pipeline capacity » As Bakken/Three Forks production increases, there likely will be more demand for rail Source: Bloomberg, curves at November 22, 2013

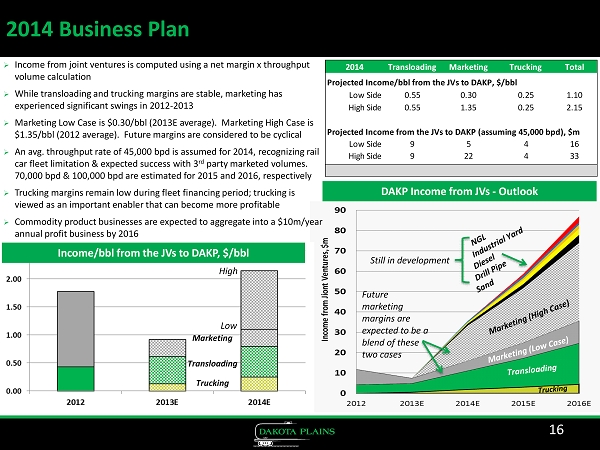

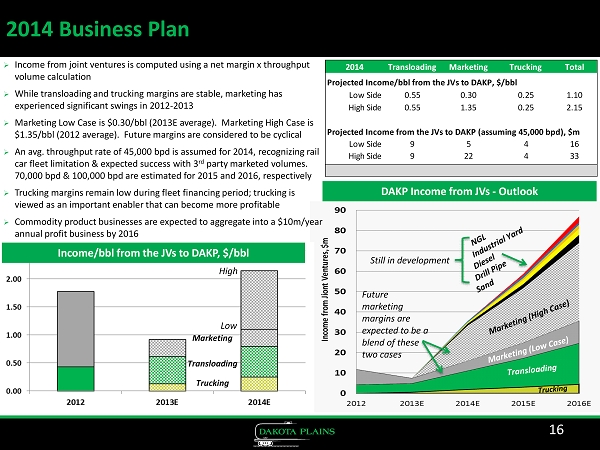

16 2014 Business Plan » Income from joint ventures is computed using a net margin x throughput volume calculation » While transloading and trucking margins are stable, marketing has experienced significant swings in 2012 - 2013 » Marketing Low Case is $0.30/bbl (2013E average). Marketing High Case is $1.35/bbl (2012 average). Future margins are considered to be cyclical » An avg. throughput rate of 45,000 bpd is assumed for 2014, recognizing rail car fleet limitation & expected success with 3 rd party marketed volumes. 70,000 bpd & 100,000 bpd are estimated for 2015 and 2016, respectively » Trucking margins remain low during fleet financing period; trucking is viewed as an important enabler that can become more profitable » Commodity product businesses are expected to aggregate into a $10m/year annual profit business by 2016 Income/bbl from the JVs to DAKP, $/bbl Transloading Trucking Marketing Low High DAKP Income from JVs - Outlook Still in development Future marketing margins are expected to be a blend of these two cases 2014 Transloading Marketing Trucking Total Projected Income/bbl from the JVs to DAKP, $/bbl Low Side 0.55 0.30 0.25 1.10 High Side 0.55 1.35 0.25 2.15 Projected Income from the JVs to DAKP (assuming 45,000 bpd), $m Low Side 9 5 4 16 High Side 9 22 4 33

Conclusions » Dakota Plains and its partners have created an efficient, state - of - the - art rail terminal and integrated midstream operation in New Town, ND, in the heart of the Bakken/Williston Basin » Through the strength of its joint ventures and service agreements, Dakota Plains is poised to grow dramatically in the coming years » Pioneer Terminal in 2014 is expected to become tied as the fourth largest throughput in the basin » Business segments that include trucking, transloading, marketing, and frac sand today are expected to expand in 2014 to include other commodity - related storage and logistics services to local producers » Business and competitive dynamics underpin a view that crude - by - rail is a long - term proposition 17 1 st train on newly built Pioneer double loop track

Appendix

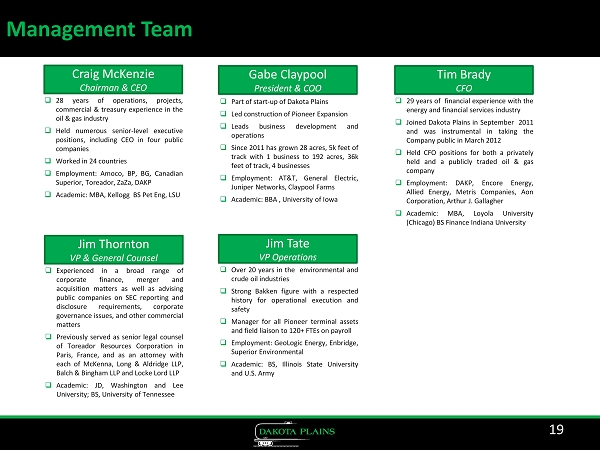

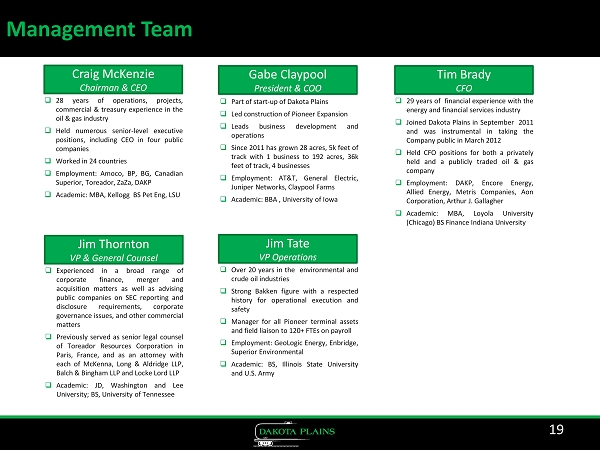

Management Team 19 Craig McKenzie Chairman & CEO □ 28 years of operations, projects, commercial & treasury experience in the oil & gas industry □ Held numerous senior - level executive positions, including CEO in four public companies □ Worked in 24 countries □ Employment : Amoco, BP, BG, Canadian Superior, Toreador, ZaZa, DAKP □ Academic : MBA, Kellogg BS Pet Eng, LSU Gabe Claypool President & COO Tim Brady CFO Jim Thornton VP & General Counsel □ Experienced in a broad range of corporate finance, merger and acquisition matters as well as advising public companies on SEC reporting and disclosure requirements, corporate governance issues, and other commercial matters □ Previously served as senior legal counsel of Toreador Resources Corporation in Paris, France, and as an attorney with each of McKenna, Long & Aldridge LLP, Balch & Bingham LLP and Locke Lord LLP □ Academic : JD, Washington and Lee University ; BS, University of Tennessee Jim Tate VP Operations □ Over 20 years in the environmental and crude oil industries □ Strong Bakken figure with a respected history for operational execution and safety □ Manager for all Pioneer terminal assets and field liaison to 120 + FTEs on payroll □ Employment : GeoLogic Energy, Enbridge, Superior Environmental □ Academic : BS, Illinois State University and U . S . Army □ 29 years of financial experience with the energy and financial services industry □ Joined Dakota Plains in September 2011 and was instrumental in taking the Company public in March 2012 □ Held CFO positions for both a privately held and a publicly traded oil & gas company □ Employment : DAKP, Encore Energy, Allied Energy, Metris Companies, Aon Corporation, Arthur J . Gallagher □ Academic : MBA, Loyola University (Chicago) BS Finance Indiana University □ Part of start - up of Dakota Plains □ Led construction of Pioneer Expansion □ Leads business development and operations □ Since 2011 has grown 28 acres, 5 k feet of track with 1 business to 192 acres, 36 k feet of track, 4 businesses □ Employment : AT&T, General Electric, Juniper Networks, Claypool Farms □ Academic : BBA , University of Iowa

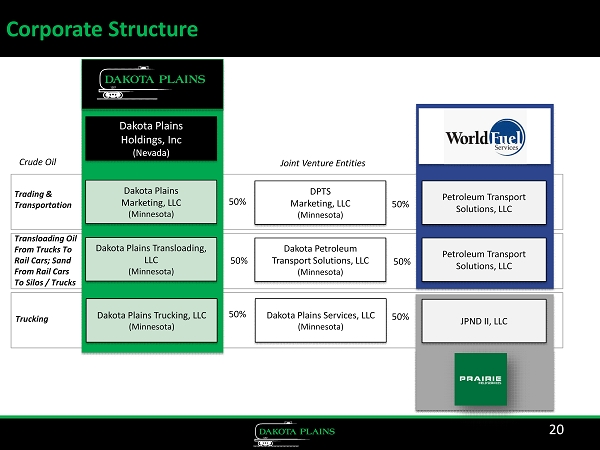

20 50% Petroleum Transport Solutions, LLC 50% Petroleum Transport Solutions, LLC JPND II, LLC 50% Dakota Plains Marketing, LLC (Minnesota) DPTS Marketing, LLC (Minnesota) Dakota Petroleum Transport Solutions, LLC (Minnesota) Dakota Plains Transloading, LLC (Minnesota) Dakota Plains Services, LLC (Minnesota) Dakota Plains Trucking, LLC (Minnesota) Dakota Plains Holdings, Inc (Nevada) Trading & Transportation Transloading Oil From Trucks To Rail Cars; Sand From Rail Cars To Silos / Trucks Trucking 50% 50% 50% Joint Venture Entities Crude Oil Corporate Structure

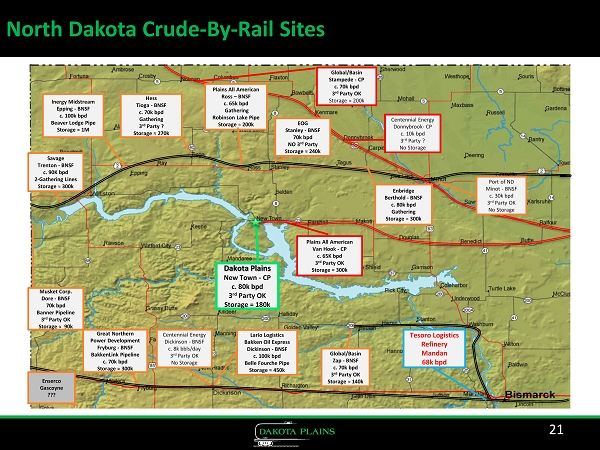

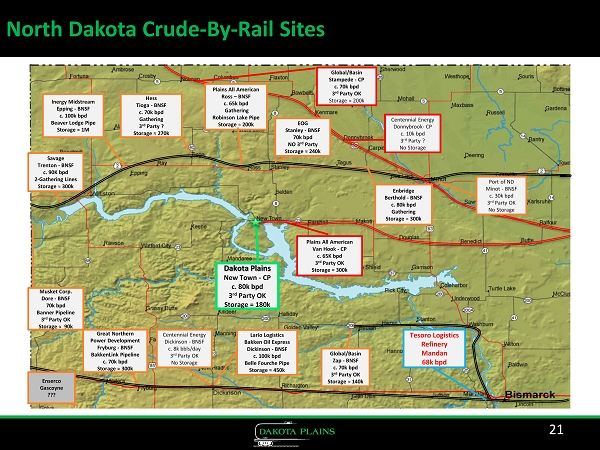

21 North Dakota Crude - By - Rail Sites Dakota Plains New Town - CP c. 80k bpd 3 rd Party OK Storage = 180k Lario Logistics Bakken Oil Express Dickinson - BNSF c. 100k bpd Belle Fourche Pipe Storage ≈ 450k Global/Basin Zap - BNSF c. 70k bpd 3 rd Party OK Storage ≈ 140k Savage Trenton - BNSF c. 90K bpd 2 - Gathering Lines Storage ≈ 300k Inergy Midstream Epping - BNSF c. 100k bpd Beaver Lodge Pipe Storage ≈ 1M Hess Tioga - BNSF c. 70k bpd Gathering 3 rd Party ? Storage ≈ 270k Global/Basin Stampede - CP c. 70k bpd 3 rd Party OK Storage ≈ 200k Centennial Energy Donnybrook - CP c. 10k bpd 3 rd Party ? No Storage Musket Corp. Dore - BNSF 70k bpd Banner Pipeline 3 rd Party OK Storage ≈ 90k Centennial Energy Dickinson - BNSF c. 8k bbls/day 3 rd Party OK No Storage Great Northern Power Development Fryburg - BNSF BakkenLink Pipeline c. 70k bpd Storage ≈ 300k Plains All American Van Hook - CP c. 65K bpd 3 rd Party OK Storage ≈ 300k Plains All American Ross – BNSF c. 65k bpd Gathering Robinson Lake Pipe Storage ≈ 200k EOG Stanley - BNSF 70k bpd NO 3 rd Party Storage ≈ 240k Enbridge Berthold - BNSF c. 80k bpd Gathering Storage ≈ 300k Port of ND Minot - BNSF c. 30k bpd 3 rd Party OK No Storage Tesoro Logistics Refinery Mandan 68k bpd Enserco Gascoyne ???

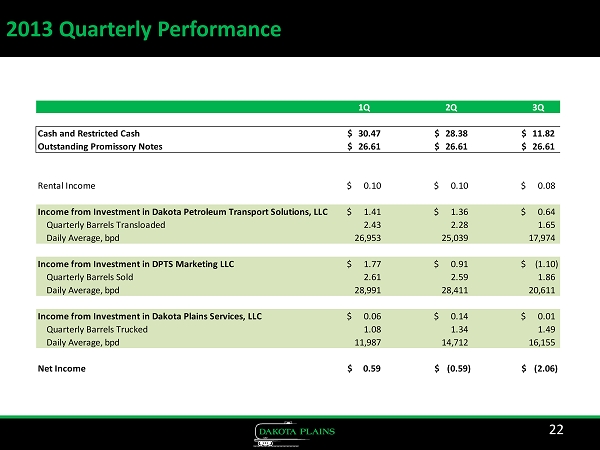

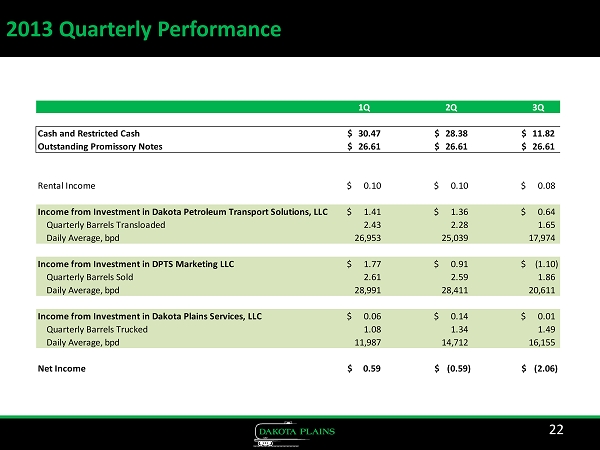

22 2013 Quarterly Performance 1Q 2Q 3Q Cash and Restricted Cash 30.47$ 28.38$ 11.82$ Outstanding Promissory Notes 26.61$ 26.61$ 26.61$ Rental Income 0.10$ 0.10$ 0.08$ Income from Investment in Dakota Petroleum Transport Solutions, LLC 1.41$ 1.36$ 0.64$ Quarterly Barrels Transloaded 2.43 2.28 1.65 Daily Average, bpd 26,953 25,039 17,974 Income from Investment in DPTS Marketing LLC 1.77$ 0.91$ (1.10)$ Quarterly Barrels Sold 2.61 2.59 1.86 Daily Average, bpd 28,991 28,411 20,611 Income from Investment in Dakota Plains Services, LLC 0.06$ 0.14$ 0.01$ Quarterly Barrels Trucked 1.08 1.34 1.49 Daily Average, bpd 11,987 14,712 16,155 Net Income 0.59$ (0.59)$ (2.06)$

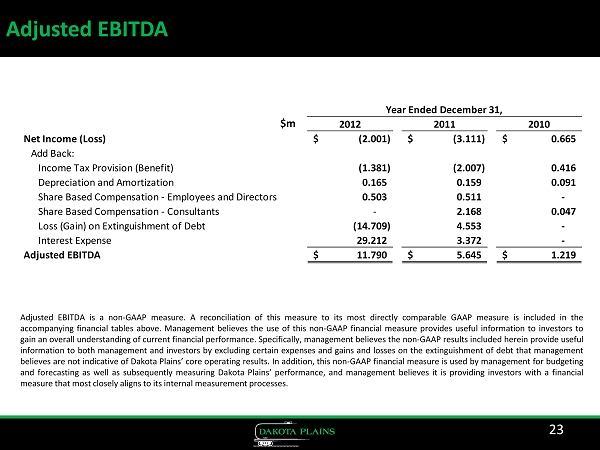

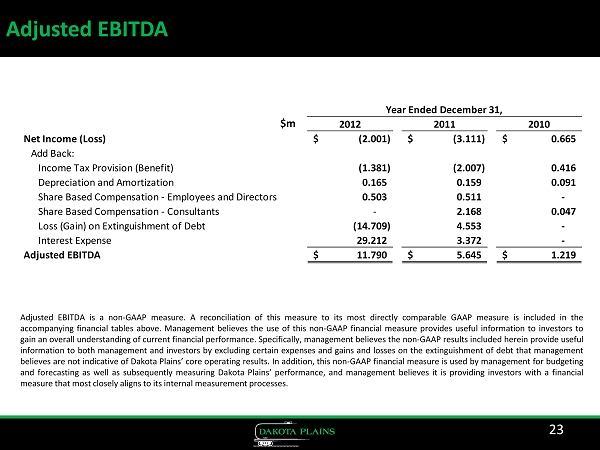

23 Adjusted EBITDA 2012 2011 2010 Net Income (Loss) (2.001)$ (3.111)$ 0.665$ Add Back: Income Tax Provision (Benefit) (1.381) (2.007) 0.416 Depreciation and Amortization 0.165 0.159 0.091 Share Based Compensation - Employees and Directors 0.503 0.511 - Share Based Compensation - Consultants - 2.168 0.047 Loss (Gain) on Extinguishment of Debt (14.709) 4.553 - Interest Expense 29.212 3.372 - Adjusted EBITDA 11.790$ 5.645$ 1.219$ Year Ended December 31, $m Adjusted EBITDA is a non - GAAP measure . A reconciliation of this measure to its most directly comparable GAAP measure is included in the accompanying financial tables above . Management believes the use of this non - GAAP financial measure provides useful information to investors to gain an overall understanding of current financial performance . Specifically, management believes the non - GAAP results included herein provide useful information to both management and investors by excluding certain expenses and gains and losses on the extinguishment of debt that management believes are not indicative of Dakota Plains’ core operating results . In addition, this non - GAAP financial measure is used by management for budgeting and forecasting as well as subsequently measuring Dakota Plains’ performance, and management believes it is providing investors with a financial measure that most closely aligns to its internal measurement processes .