Exhibit 99.1

WWW . DAKOTAPLAINS . COM NYSE MKT: DAKP CORPORATE PRESENTATION J UNE 24, 2014

F ORWARD L OOKING S TATEMENTS Statements made by representatives of Dakota Plains Holdings, Inc . (“Dakota Plains” or the “Company”) during the course of this presentation that are not historical facts, are forward - looking statements . These statements are based on certain assumptions and expectations made by the Company which reflect management’s experience, estimates and perception of historical trends, current conditions, anticipated future developments and other factors believed to be appropriate . Such statements are subject to a number of assumptions, risks and uncertainties, many of which are beyond the control of the Company, which may cause actual results to differ materially from those implied or anticipated in the forward - looking statements . These include risks relating to global economics or politics, our ability to obtain additional capital needed to implement our business plan, minimal operating history, loss of key personnel, lack of business diversification, reliance on strategic, third - party relationships, financial performance and results, prices and demand for oil, our ability to make acquisitions on economically acceptable terms, and other factors described from time to time in the Company’s periodic reports filed with the SEC that could cause actual results to differ materially from those anticipated or implied in the forward - looking statements . Dakota Plains undertakes no obligation to publicly update any forward - looking statements, whether as a result of new information or future events . 2

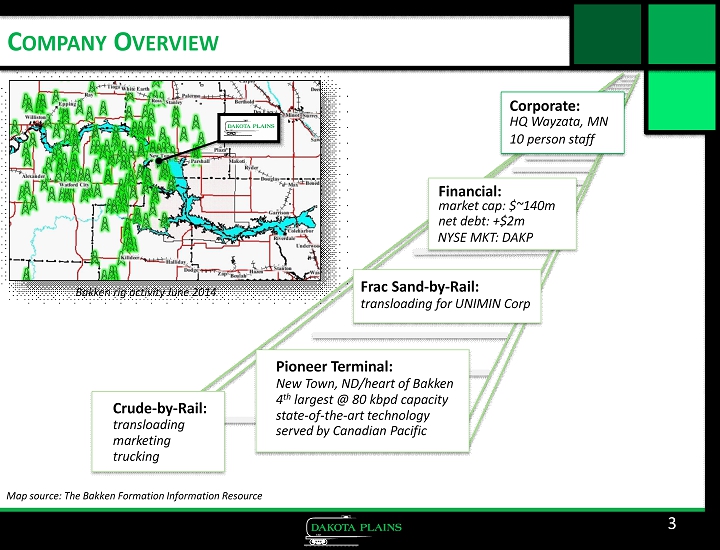

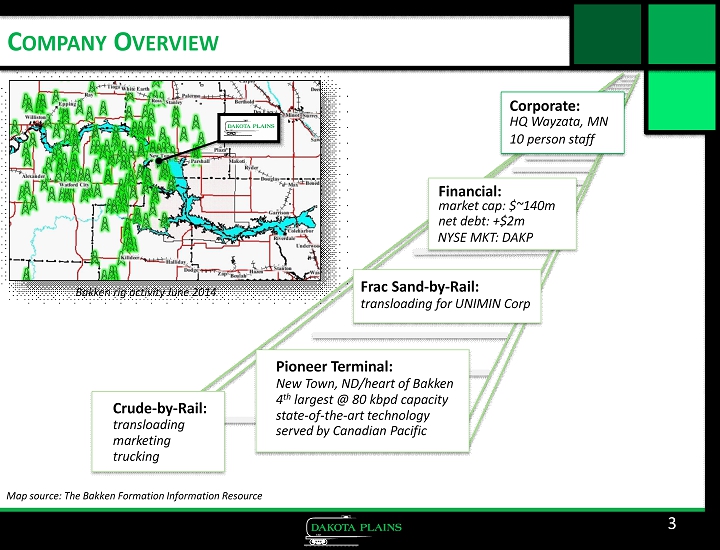

C OMPANY O VERVIEW 3 Bakken rig activity June 2014 Map source: The Bakken Formation Information Resource Crude - by - Rail: trucking transloading marketing Pioneer Terminal: state - of - the - art technology New Town, ND/heart of Bakken 4 th largest @ 80 kbpd capacity served by Canadian Pacific Frac Sand - by - Rail: transloading for UNIMIN Corp Financial: market cap: $~140m net debt: +$2m NYSE MKT: DAKP Corporate: HQ Wayzata, MN 10 person staff

R ECENT H EADLINES » UNIMIN frac sand operations commenced on June 12, 2014 » Listed on NYSE MKT exchange; trading commenced on June 17, 2014 » On June 19, 2014, Canadian class action related to Lac Megantic train incident dismissed Dakota Plains Holdings and its wholly owned subsidiaries 4

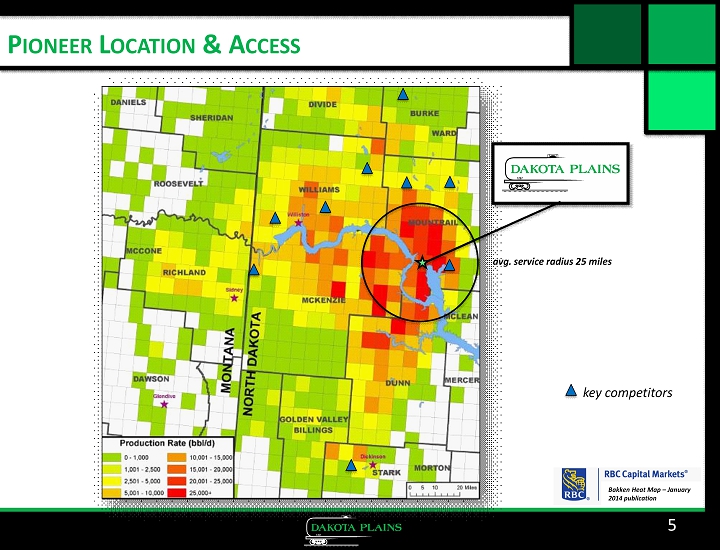

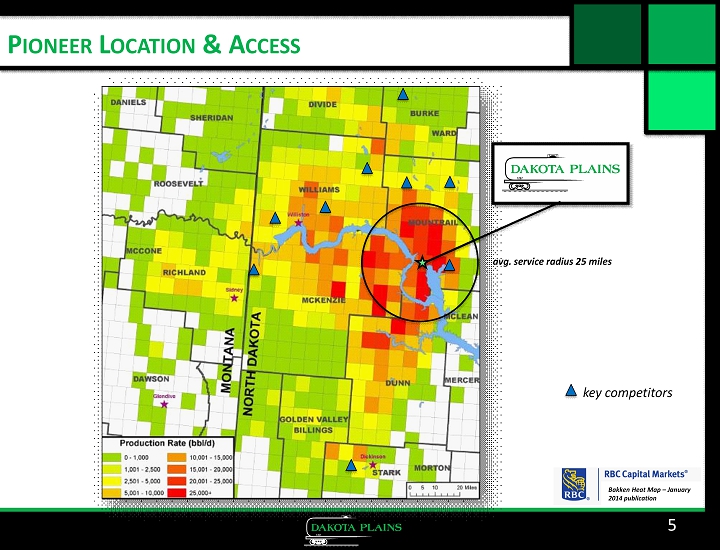

P IONEER L OCATION & A CCESS 5 Bakken Heat Map – January 2014 publication avg. service radius 25 miles key competitors

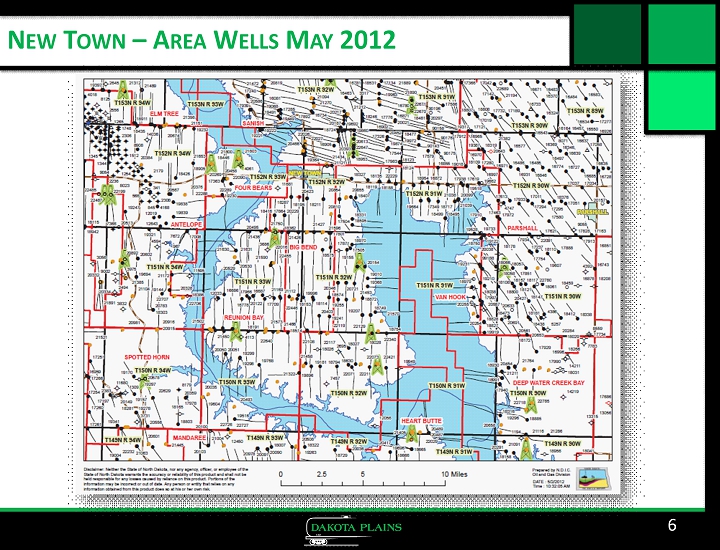

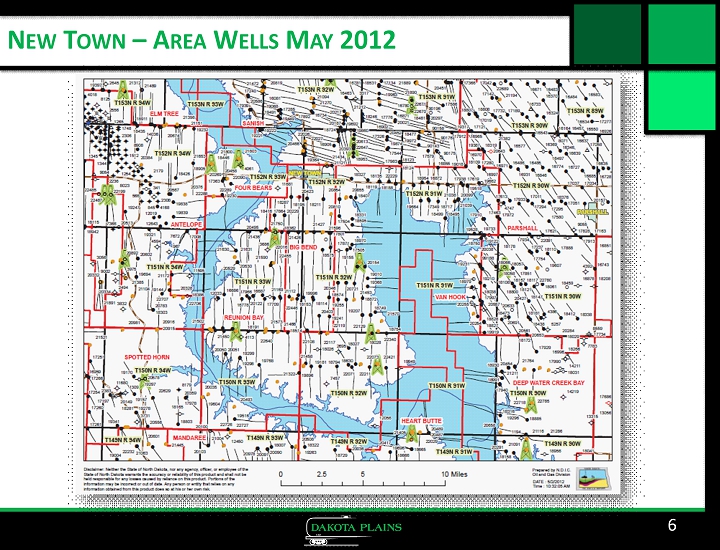

N EW T OWN – A REA W ELLS M AY 2012 6

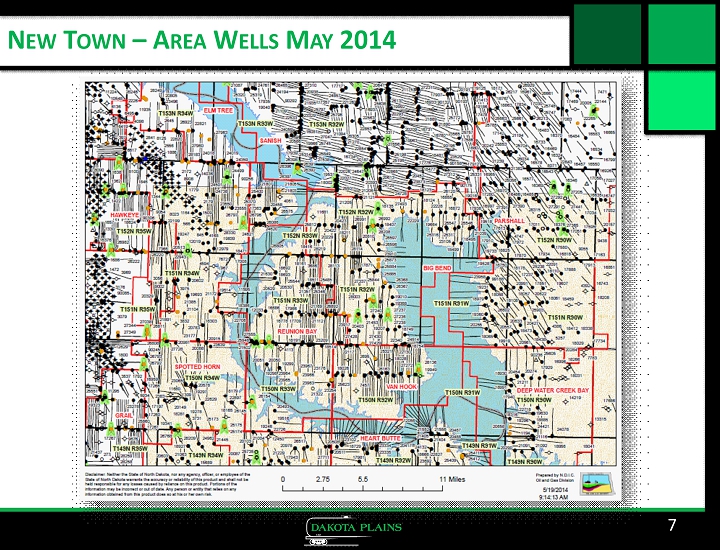

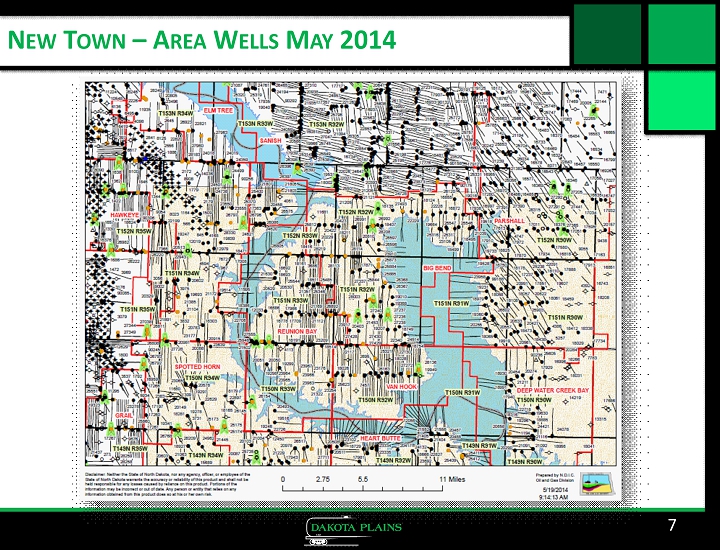

N EW T OWN – A REA W ELLS M AY 2014 7

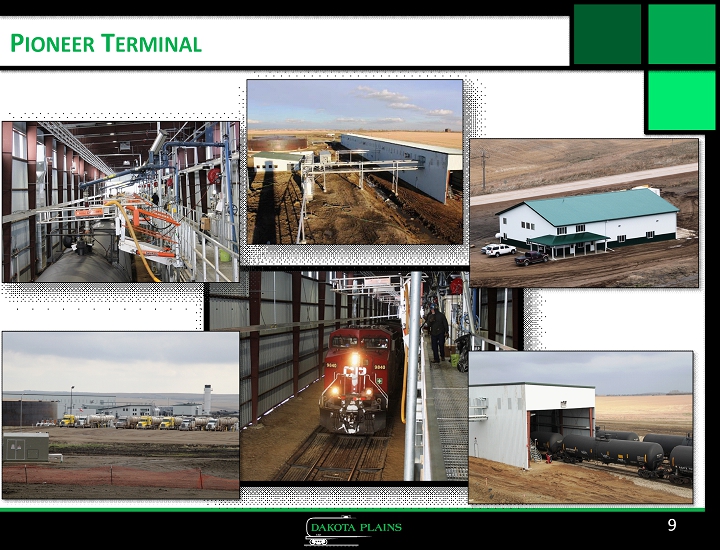

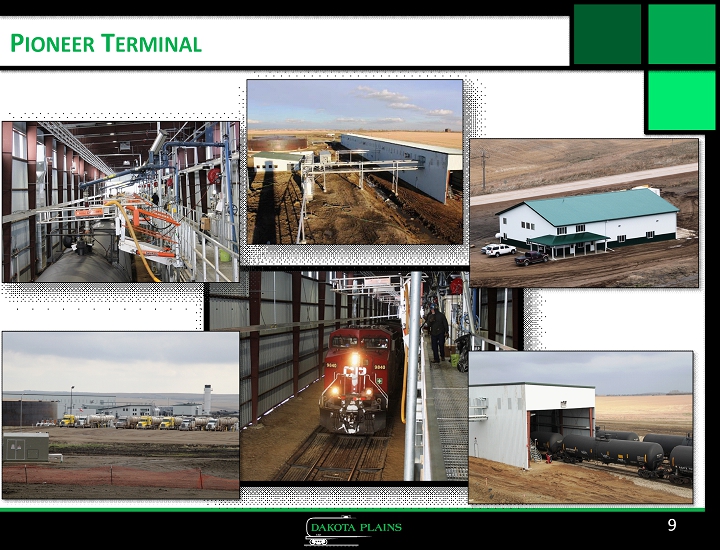

8 P IONEER T ERMINAL IN N EW T OWN , ND 10 STATION RAIL LOADING 70 ACRE INDUSTRIAL YARD SPACE D OUBLE LOOP TRACK FOR TWO 120 - UNIT TRAINS F OUR LADDER TRACKS FOR FUTURE INBOUND UNIMIN FRAC SAND T ERMINAL I NBOUND PIPELINES 10 TRUCK OFFLOAD STATIONS 180 K BBLS STORAGE , 270 K PERMITTED

9 P IONEER T ERMINAL

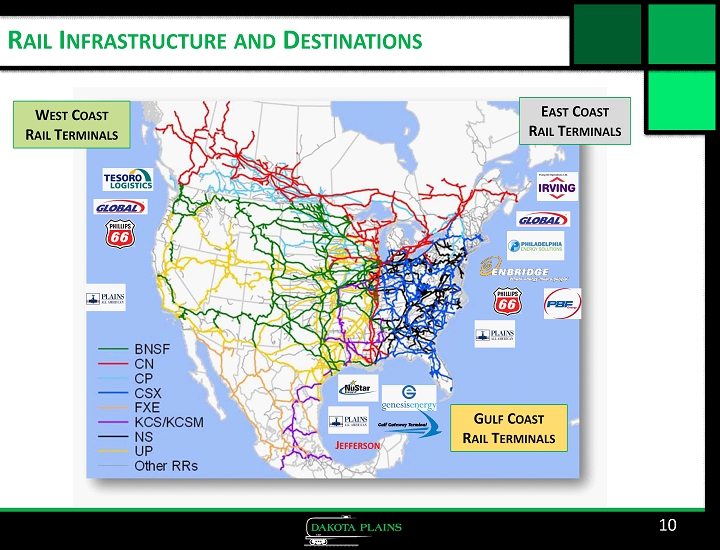

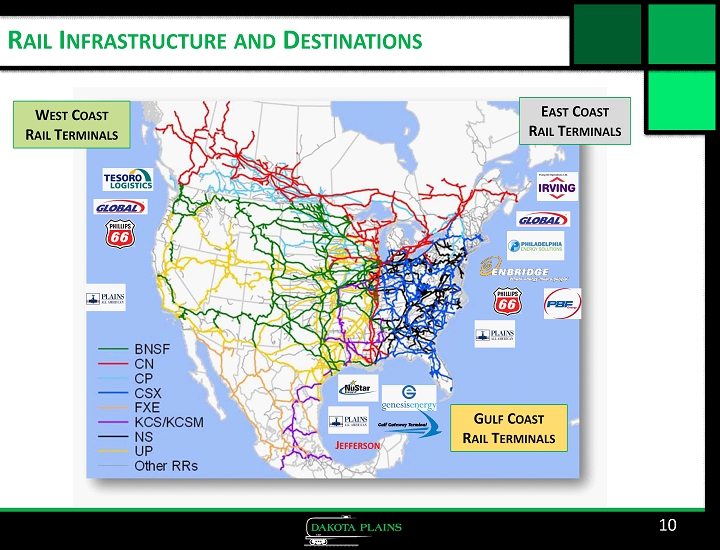

R AIL I NFRASTRUCTURE AND D ESTINATIONS 10 J EFFERSON W EST C OAST R AIL T ERMINALS E AST C OAST R AIL T ERMINALS G ULF C OAST R AIL T ERMINALS

UNIMIN F RAC S AND T RANSLOADING 11 □ Land is owned by Dakota Plains Holdings, Inc. □ All CAPEX provided, and assets are owned, by Unimin □ Operations for Dakota Plains’ sand joint venture commenced June 12, 2014 □ JV generates revenue through a monthly lease and a fixed fee/ton paid by Unimin □ Rail Link, Inc. ( G enesee & Wyoming subsidiary) contracted to operate and maintain the sand terminal □ Transloading sand capacity is 750,000 tons per year □ 8,000 tons of fixed storage, quad high - speed truck load outs, and new track capacity for 70 loaded railcars F OUR U NIMIN LADDER TRACKS F OUR E XISTING LADDER TRACKS L OOP TRACKS S TORAGE S ILOS & L OADOUT

W HERE A RE W E ? 12 2011 2012 2013 2014 3 passive interest JVs to capitalize on niche rail play Rail industry becomes sustainable solution; need scale to compete Approve $50m Pioneer expansion Transition from passive to operating company Manage cash amidst poor marketing margins Manage response to Lac Megantic incident Execute Pioneer successfully Renegotiate JV contracts Restructure balance sheet Marketing margins remain low Repositioning DAKP Focused growth strategy Lac Megantic legal recourse Events Today

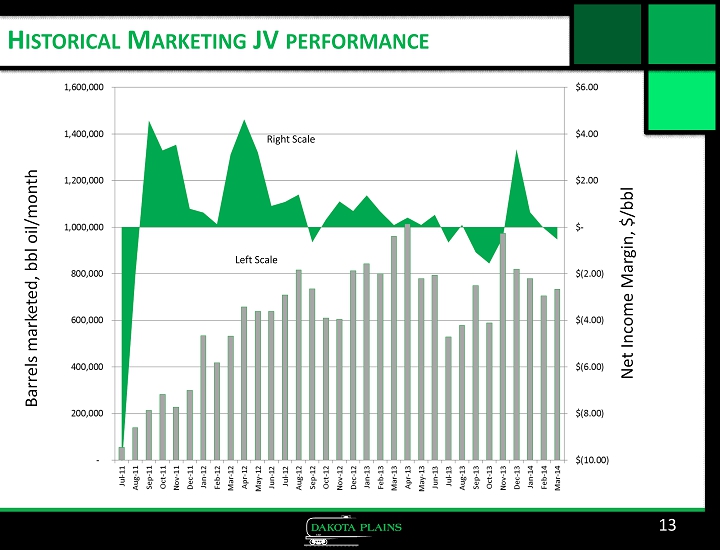

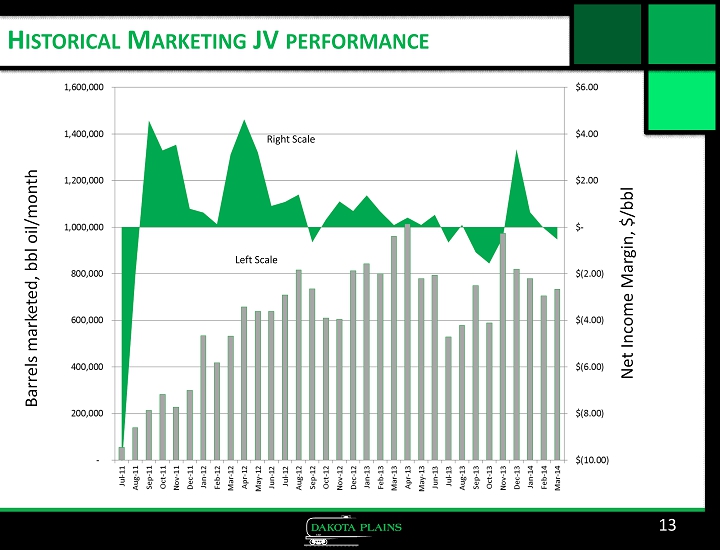

13 H ISTORICAL M ARKETING JV PERFORMANCE Barrels marketed, bbl oil/month Net Income Margin, $/bbl Right Scale Left Scale

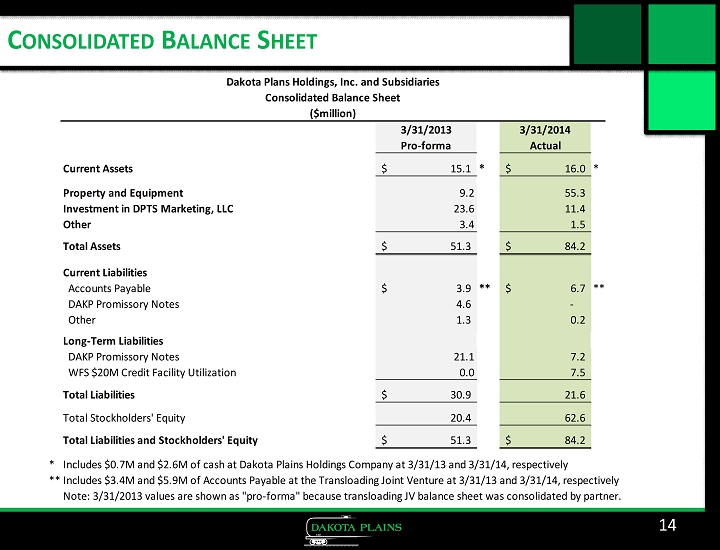

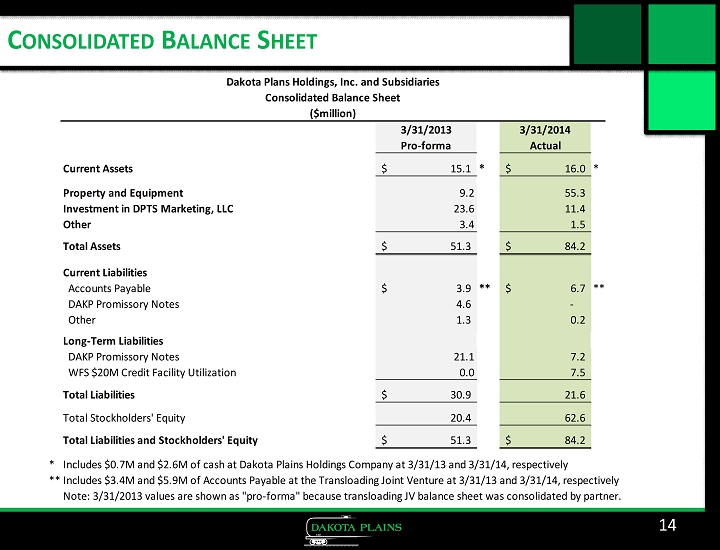

C ONSOLIDATED B ALANCE S HEET 14 3/31/2013 3/31/2014 Pro-forma Actual Current Assets 15.1$ * 16.0$ * Property and Equipment 9.2 55.3 Investment in DPTS Marketing, LLC 23.6 11.4 Other 3.4 1.5 Total Assets 51.3$ 84.2$ Current Liabilities Accounts Payable 3.9$ ** 6.7$ ** DAKP Promissory Notes 4.6 - Other 1.3 0.2 Long-Term Liabilities DAKP Promissory Notes 21.1 7.2 WFS $20M Credit Facility Utilization 0.0 7.5 Total Liabilities 30.9$ 21.6 Total Stockholders' Equity 20.4 62.6 Total Liabilities and Stockholders' Equity 51.3$ 84.2$ * Includes $0.7M and $2.6M of cash at Dakota Plains Holdings Company at 3/31/13 and 3/31/14, respectively **Includes $3.4M and $5.9M of Accounts Payable at the Transloading Joint Venture at 3/31/13 and 3/31/14, respectively Note: 3/31/2013 values are shown as "pro-forma" because transloading JV balance sheet was consolidated by partner. Dakota Plans Holdings, Inc. and Subsidiaries Consolidated Balance Sheet ($million)

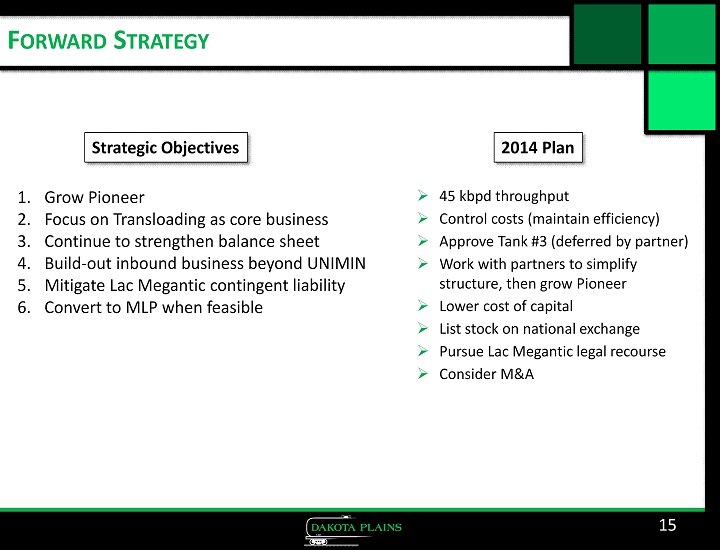

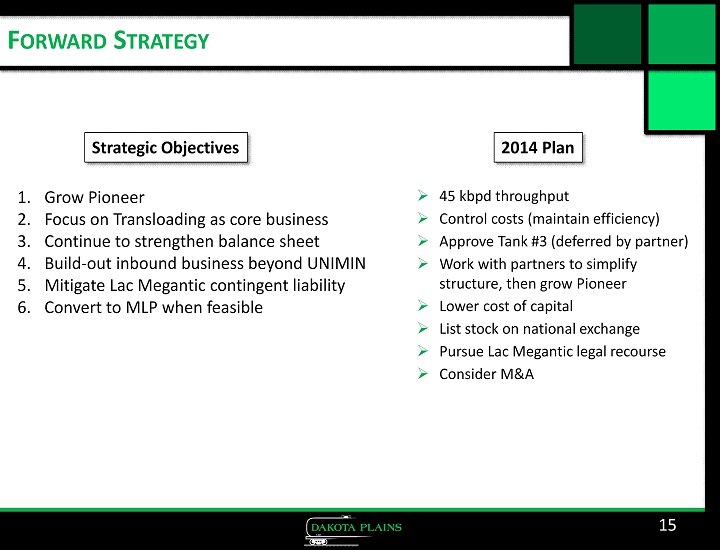

F ORWARD S TRATEGY 15 » 45 kbpd throughput » Control costs (maintain efficiency) » Approve Tank #3 (deferred by partner) » Work with partners to simplify structure, then grow Pioneer » Lower cost of capital » List stock on national exchange » Pursue Lac Megantic legal recourse » Consider M&A 1. Grow Pioneer 2. Focus on Transloading as core business 3. Continue to strengthen balance sheet 4. Build - out inbound business beyond UNIMIN 5. Mitigate Lac Megantic contingent liability 6. Convert to MLP when feasible Strategic Objectives 2014 Plan

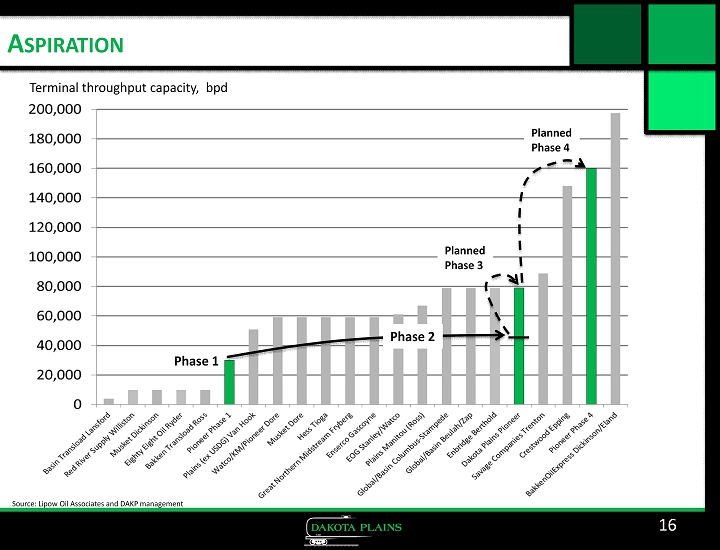

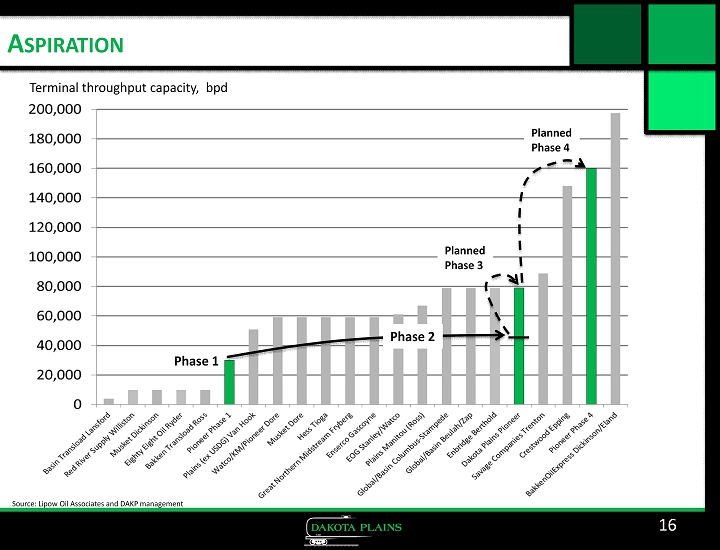

A SPIRATION 16 Source: Lipow Oil Associates and DAKP management Terminal throughput capacity, bpd Planned Phase 3 Planned Phase 4 Phase 1 Phase 2

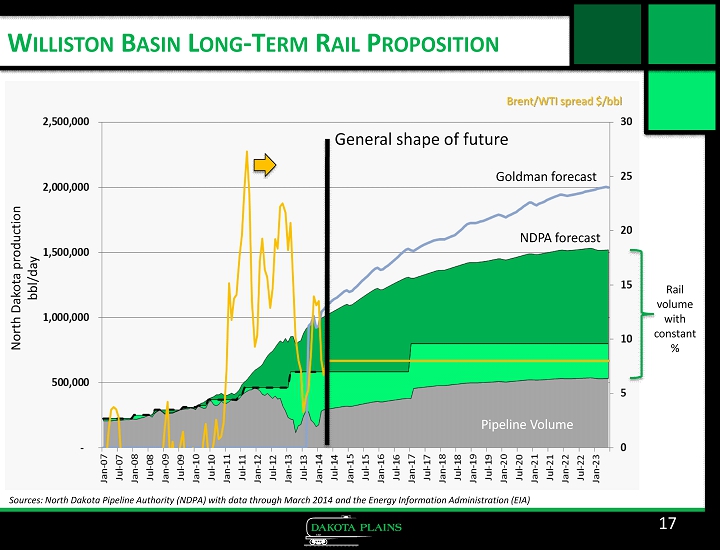

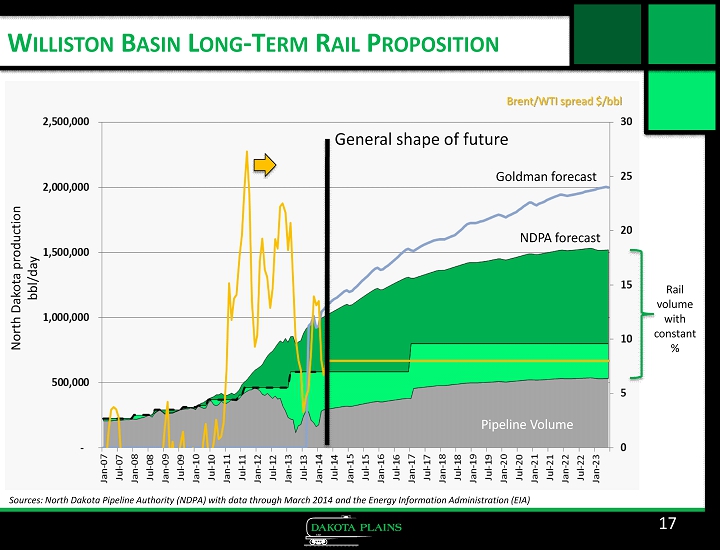

W ILLISTON B ASIN L ONG - T ERM R AIL P ROPOSITION 17 Sources: North Dakota Pipeline Authority (NDPA) with data through March 2014 and the Energy Information Administration (EIA) Brent/WTI spread $/ bbl North Dakota production bbl/day General shape of future NDPA forecast Goldman forecast Rail volume with constant % Pipeline Volume

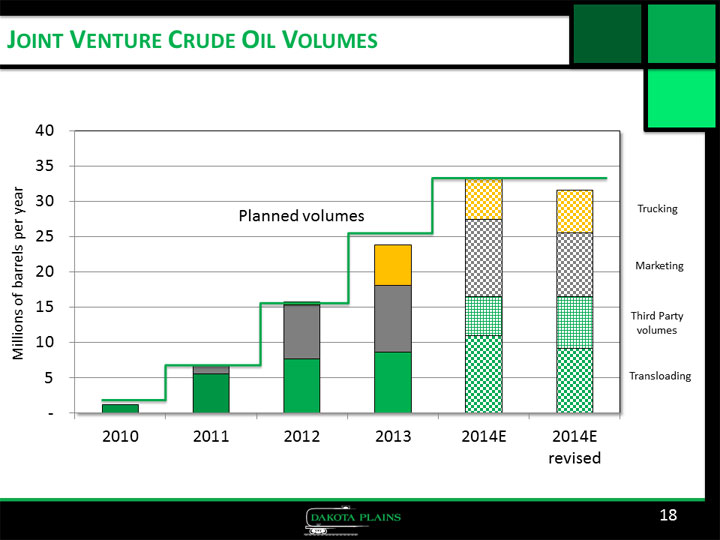

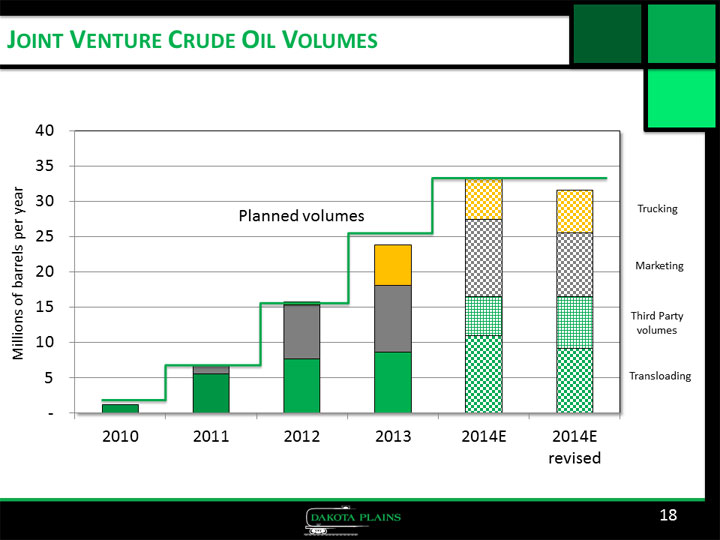

J OINT V ENTURE C RUDE O IL V OLUMES - 5 10 15 20 25 30 35 40 2010 2011 2012 2013 2014E 2014E revised 18 Millions of barrels per year Planned volumes Third Party volumes Transloading Marketing Trucking

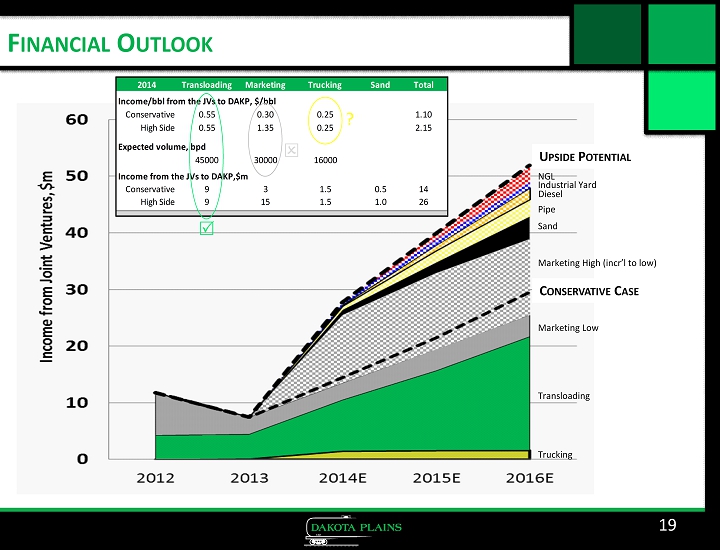

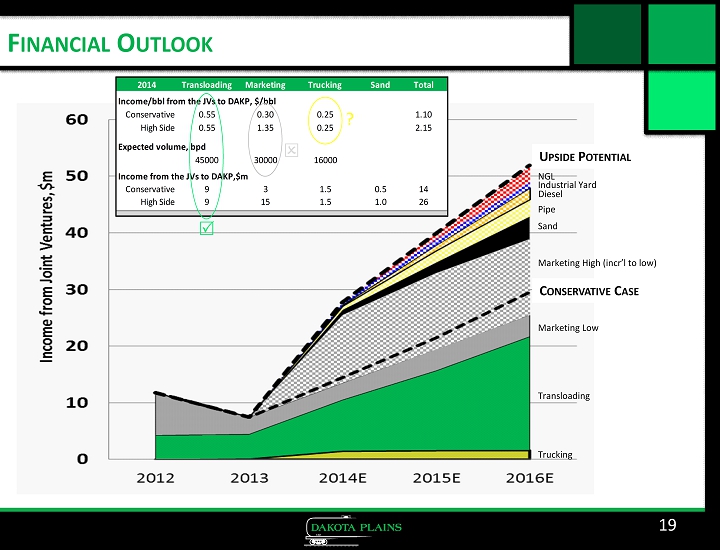

F INANCIAL O UTLOOK 19 C ONSERVATIVE C ASE U PSIDE P OTENTIAL 2014 Transloading Marketing Trucking Sand Total Income/bbl from the JVs to DAKP, $/bbl Conservative 0.55 0.30 0.25 1.10 High Side 0.55 1.35 0.25 2.15 Expected volume, bpd 45000 30000 16000 Income from the JVs to DAKP,$m Conservative 9 3 1.5 0.5 14 High Side 9 15 1.5 1.0 26 Trucking Transloading Marketing Low Marketing High ( incr’l to low) Sand Pipe Diesel Industrial Yard NGL ?

C ONCLUSIONS □ Pioneer Oil & Sand Terminal: state - of - the - art, heart of the Bakken/Three Forks □ Transloading is core business □ Short - term: increase Pioneer throughput and maintain safety & efficiency □ Long - term: grow Pioneer & beyond; convert to MLP when feasible □ Key components of growth strategy: risk mitigation, balance sheet strength, control, predictability, simplicity □ Crude by rail a long - term proposition for transporting Bakken oil to market 20

A PPENDIX

2013 R EPOSITIONING OF DAKP 22 □ Inability to audit poor marketing results □ Room to improve transloading operations □ No tangible assets; P&L lacks transparency □ Falling behind on rail terminal scale □ No funding available for Pioneer expansion □ Ladder tracks unused after Pioneer transition □ Gathering pipelines are displacing trucking for oil transportation from wellhead □ Debt service obligations of $800k each quarter; no funds for April 2014 debt repayment of $4.6m; no funds for 2014 overhead □ Incident response to Lac Megantic □ Lac Megantic contingent liability Challenge Accomplishment □ Renegotiated JV terms to allow DAKP audit rights □ Renegotiated JV terms to transition oversight to DAKP □ Renegotiated transloading accounting consolidation □ Approved & executed construction $50m project flawlessly □ Negotiated dividend & credit facility to fund Pioneer □ Secured UNIMIN frac sand business □ Negotiated Slawson subsidiary pipeline and new Continental and Bridger volumes to ramp up to 45 kbpd for 2014 □ Restructured debt, debt - to - equity conversion, reduced debt by $19m, made $7.5m debt repayment & prepaid April 2014 note, secured 2014 working capital □ Managed media, partners, service providers, & protected company interests □ Prepared legal response and took steps to contain within insurance limits any settlement obligation Notwithstanding missed performance targets of volumes and EBITDA, due primarily to poor marketing margins, management has overcome challenges to reposition the company.

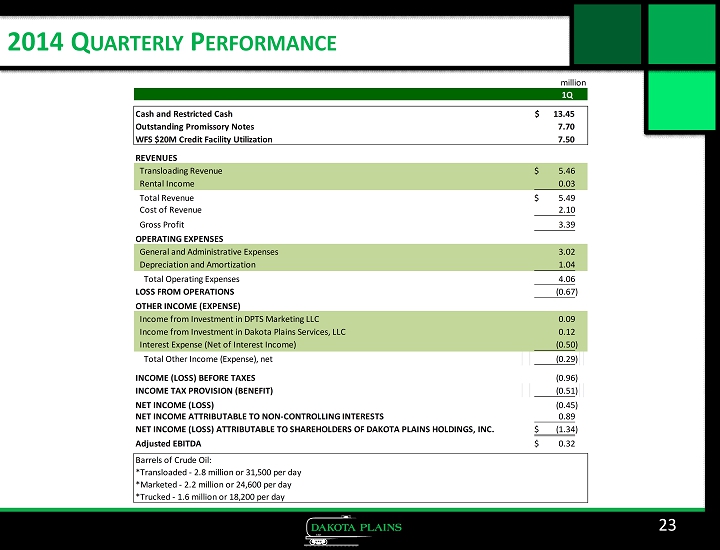

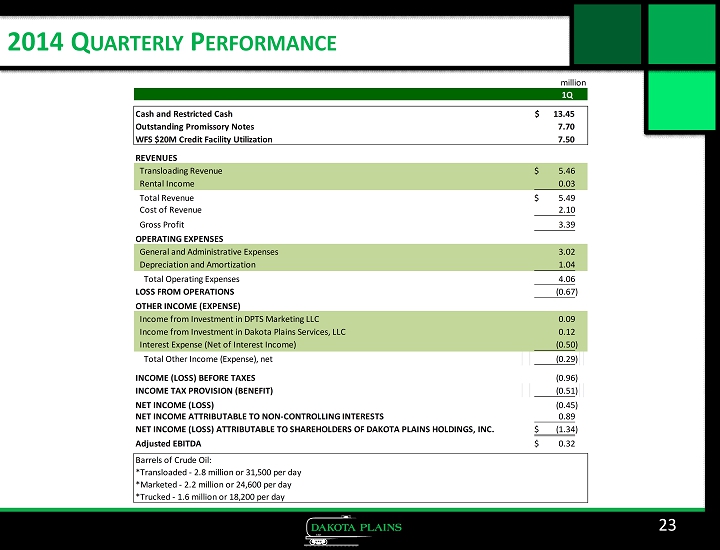

23 2014 Q UARTERLY P ERFORMANCE 1Q Cash and Restricted Cash 13.45$ Outstanding Promissory Notes 7.70 WFS $20M Credit Facility Utilization 7.50 REVENUES Transloading Revenue 5.46$ Rental Income 0.03 Total Revenue 5.49$ Cost of Revenue 2.10 Gross Profit 3.39 OPERATING EXPENSES General and Administrative Expenses 3.02 Depreciation and Amortization 1.04 Total Operating Expenses 4.06 LOSS FROM OPERATIONS (0.67) OTHER INCOME (EXPENSE) Income from Investment in DPTS Marketing LLC 0.09 Income from Investment in Dakota Plains Services, LLC 0.12 Interest Expense (Net of Interest Income) (0.50) Total Other Income (Expense), net (0.29) INCOME (LOSS) BEFORE TAXES (0.96) INCOME TAX PROVISION (BENEFIT) (0.51) NET INCOME (LOSS) (0.45) NET INCOME ATTRIBUTABLE TO NON-CONTROLLING INTERESTS 0.89 NET INCOME (LOSS) ATTRIBUTABLE TO SHAREHOLDERS OF DAKOTA PLAINS HOLDINGS, INC. (1.34)$ Adjusted EBITDA 0.32$ Barrels of Crude Oil: *Transloaded - 2.8 million or 31,500 per day *Marketed - 2.2 million or 24,600 per day *Trucked - 1.6 million or 18,200 per day million

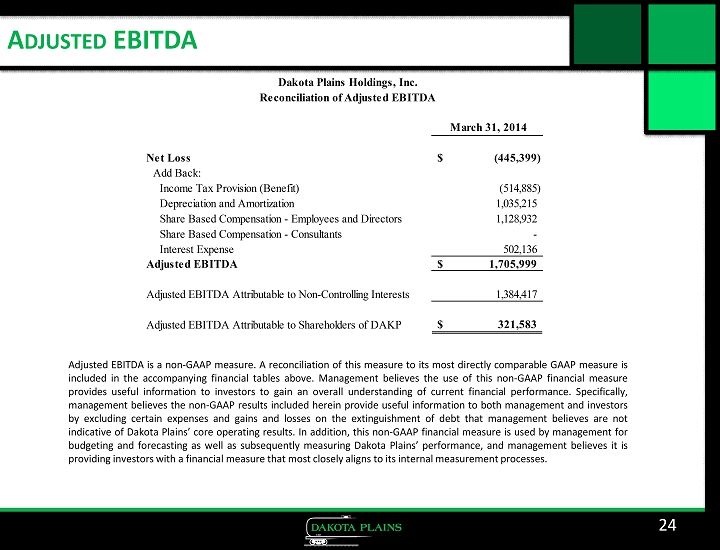

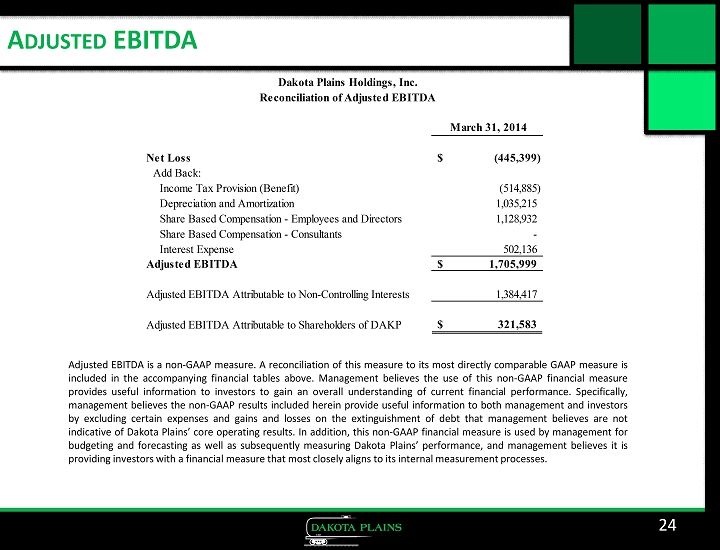

A DJUSTED EBITDA 24 Adjusted EBITDA is a non - GAAP measure . A reconciliation of this measure to its most directly comparable GAAP measure is included in the accompanying financial tables above . Management believes the use of this non - GAAP financial measure provides useful information to investors to gain an overall understanding of current financial performance . Specifically, management believes the non - GAAP results included herein provide useful information to both management and investors by excluding certain expenses and gains and losses on the extinguishment of debt that management believes are not indicative of Dakota Plains’ core operating results . In addition, this non - GAAP financial measure is used by management for budgeting and forecasting as well as subsequently measuring Dakota Plains’ performance, and management believes it is providing investors with a financial measure that most closely aligns to its internal measurement processes . March 31, 2014 Net Loss (445,399)$ Add Back: Income Tax Provision (Benefit) (514,885) Depreciation and Amortization 1,035,215 Share Based Compensation - Employees and Directors 1,128,932 Share Based Compensation - Consultants - Interest Expense 502,136 Adjusted EBITDA 1,705,999$ Adjusted EBITDA Attributable to Non-Controlling Interests 1,384,417 Adjusted EBITDA Attributable to Shareholders of DAKP 321,583$ Dakota Plains Holdings, Inc. Reconciliation of Adjusted EBITDA

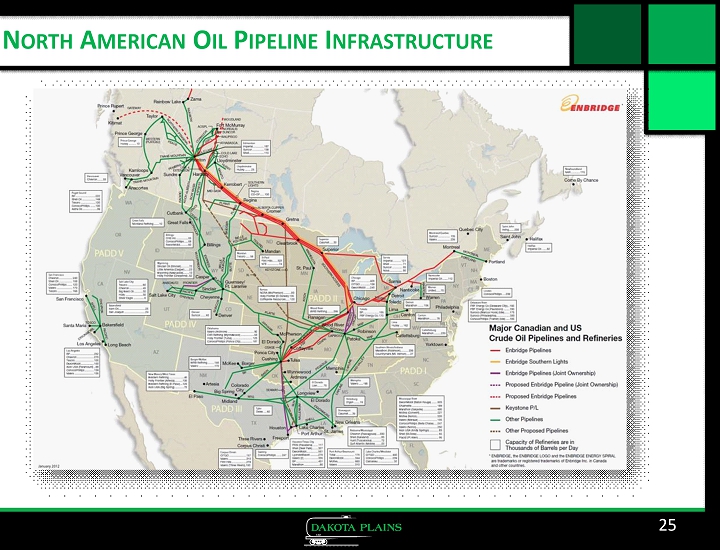

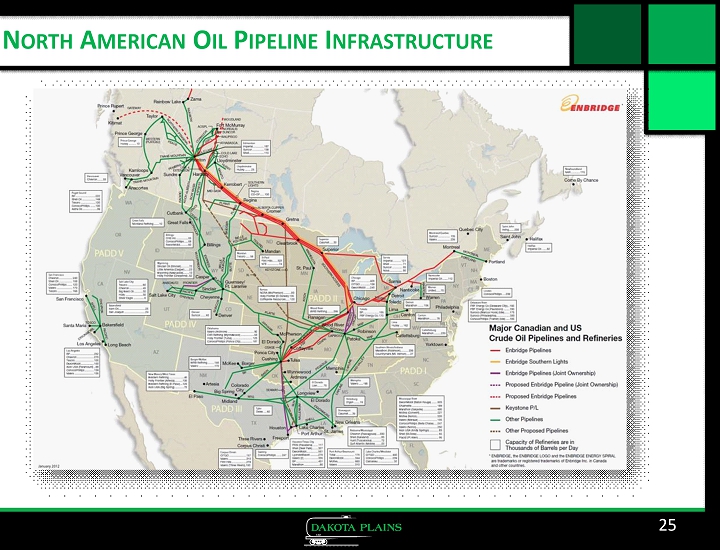

N ORTH A MERICAN O IL P IPELINE I NFRASTRUCTURE 25

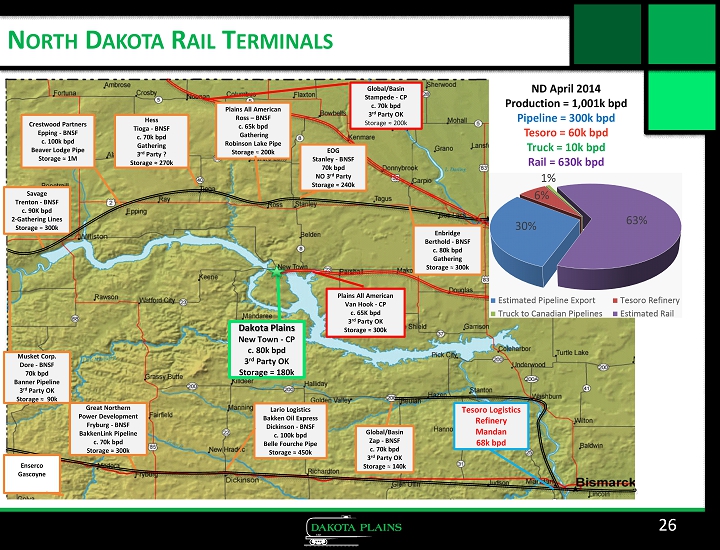

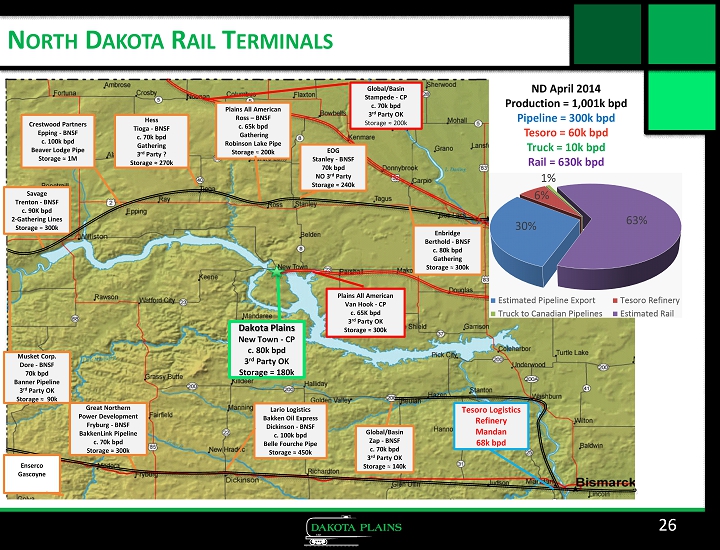

26 N ORTH D AKOTA R AIL T ERMINALS Dakota Plains New Town - CP c. 80k bpd 3 rd Party OK Storage = 180k Lario Logistics Bakken Oil Express Dickinson - BNSF c. 100k bpd Belle Fourche Pipe Storage ≈ 450k Global/Basin Zap - BNSF c. 70k bpd 3 rd Party OK Storage ≈ 140k Savage Trenton - BNSF c. 9 0K bpd 2 - Gathering Lines Storage ≈ 300k Crestwood Partners Epping - BNSF c. 100k bpd Beaver Lodge Pipe Storage ≈ 1M Hess Tioga - BNSF c. 70k bpd Gathering 3 rd Party ? Storage ≈ 270k Global/Basin Stampede - CP c. 70k bpd 3 rd Party OK Storage ≈ 200k Musket Corp. Dore - BNSF 7 0k bpd Banner Pipeline 3 rd Party OK Storage ≈ 90k Great Northern Power Development Fryburg - BNSF BakkenLink Pipeline c. 70k bpd Storage ≈ 300k Plains All American Van Hook - CP c. 65K bpd 3 rd Party OK Storage ≈ 300k Plains All American Ross – BNSF c. 65k bpd Gathering Robinson Lake Pipe Storage ≈ 200k EOG Stanley - BNSF 70k bpd NO 3 rd Party Storage ≈ 240k Enbridge Berthold - BNSF c. 80k bpd Gathering Storage ≈ 300k Tesoro Logistics Refinery Mandan 68k bpd Enserco Gascoyne ND April 2014 Production = 1,001k bpd Pipeline = 300k bpd Tesoro = 60k bpd Truck = 10k bpd Rail = 630k bpd