Exhibit 99.1

NYSE MKT: DAKP CORPORATE PRESENTATION FEBRUARY 10, 2015 WWW.DAKOTAPLAINS.COM

FORWARD LOOKING STATEMENTSStatements made by representatives of Dakota Plains Holdings, Inc. (“Dakota Plains” or the “Company”) during the course of this presentation that are not historical facts, are forward-looking statements. These statements are based on certain assumptions and expectations made by the Company which reflect management’s experience, estimates and perception of historical trends, current conditions,anticipated future developments and other factors believed to be appropriate. Such statements are subject to a number of assumptions, risks and uncertainties, many of which are beyond the control of the Company, which may cause actual results to differ materially from those implied or anticipated in the forward-looking statements. These include risks relating to global economics or politics, our ability to obtain additional capital needed to implement our business plan, minimal operating history, loss of key personnel, lack of business diversification, reliance on strategic, third-party relationships, financial performance and results, prices and demand for oil, our ability to make acquisitions on economically acceptable terms, and other factors described from time to time in the Company’s periodic reports filed with the SEC that could cause actual results to differ materially from those anticipated or implied in the forward-looking statements. Dakota Plains undertakes no obligation to publicly update any forward-looking statements, whether as a result of new information or future events. 2

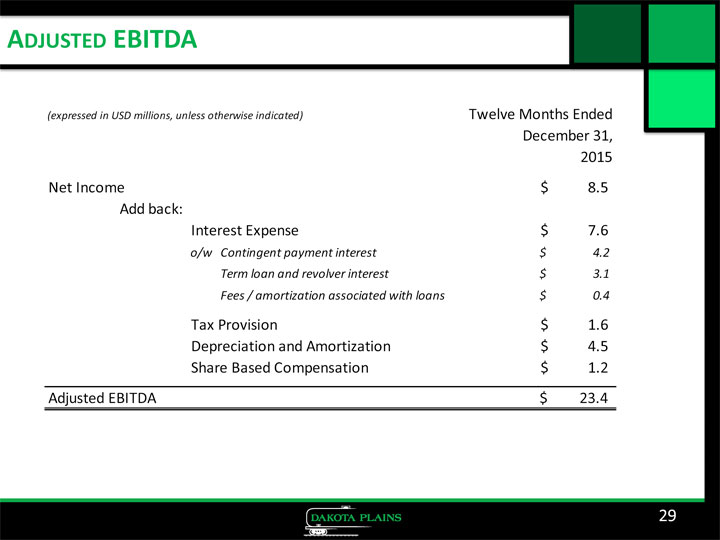

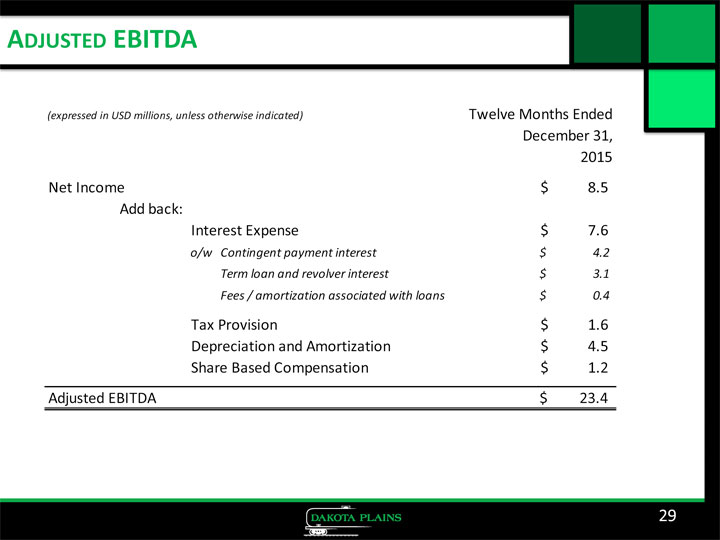

SUMMARY Corporate Overview: Corporate information Pioneer Terminal in New Town, ND With increased Canadian Pacific service, secured 55k bopd for January 2015 and were over-subscribed Have line of sight on 80k bopd by summer 2015; guidance assumes only 60k bopd in 2h15 Sand operation volumes are steady at an average of 25k tons per month Current Environment Value Chain Pipeline vs. Rail December 2014 Buyout of JV Partner: Creates value in earnings per share, EBITDA and operating cash flow per share Fully financed with low cost debt and cash on hand Simplified capital structure and financial reporting Expedites potential value-adding expansions underpinned by the strong level of interest in shippers to move oil through the Pioneer Terminal Mitigates exposure to the Lac Megantic legal claims Future Growth: Developing phased expansions toward goal of 160k bopd Tank #3 expansion is fully funded and on schedule for summer 2015 Considering a third loop track, an integral step toward 160k bopd FY 2015 adjusted EBITDA guidance of $23.4M 3

CORPORATE INFORMATION Dakota Plains Holdings, Inc. is an integrated midstream energy company operating the Pioneer Terminal with services that include outbound crude oil storage, logistics, and rail transportation and inbound frac sand logistics. The Pioneer Terminal is located in Mountrail County, North Dakota, where it is uniquely positioned to exploit opportunities in the heart of the Bakken and Three Forks plays of the Williston Basin. NYSE-MKT: DAKP; Recent closing price: $1.80 on February 6, 2015 Headquarters: Wayzata, MN FD Shares Outstanding: 57.8mm as of 12/5/2014 Long Term Debt: $48.5mm; $9mm of available credit as of 12/5/2014 Auditor: BDO USA, LLP Transfer Agent: Interwest Transfer Co, Inc. Investor Inquiries: Dan Gagnier, Sard Verbinnen & Co, (212) 687-8080 4

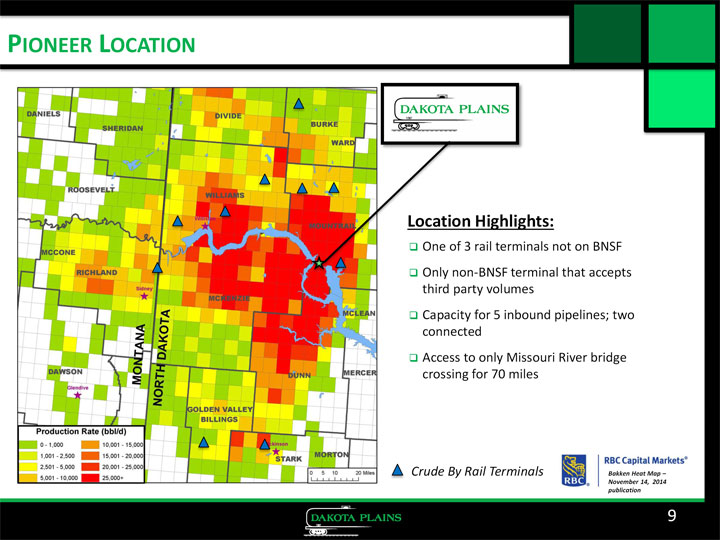

COMPANY HIGHLIGHTS Pioneer Terminal serves top producing counties in North Dakota Mountrail, McKenzie, Williams and Dunn counties At terminus of Canadian Pacific line, which offers enhanced rail access and reduced Strategic congestion One of only 3 rail terminals not on BNSF; Only non-BNSF terminal to accept third party Location volumes Unique road access to highway infrastructure, providing the only Missouri River bridge crossing for approximately 70 miles 200 acre facility; land owned by DAKP Unique Pioneer Terminal double loop tracks capable of transloading a 120 car unit train per day 180,000 bbls of existing onsite storage, with expansion to 270,000 bbls under construction Infrastructure Capacity for five gathering pipelines- two currently online Capabilities Eight ladder tracks for inbound commodity products Frac sand terminal with UNIMIN (largest supplier to Bakken) Contracted transloading fee per barrel Predictable Sand transloading fee per ton Revenue Model No direct commodity risk Opportunity to provide point-to-point logistics services on per barrel basis Experienced Management has extensive expertise in the midstream and upstream segments, project Management & construction, finance, legal, and entrepreneurial growth Board expertise in the fields of rail, logistics, finance, and the Williston Basin Board 2/9/2015 5

PIONEER TERMINAL HILAND, PELICAN & TARGA PIPELINE CDPS 180K BBLS STORAGE, 270K SUMMER 2015 TWO INBOUND UNIMIN FRAC SAND PIPELINES TERMINAL 10 STATION RAIL LOADING 10 TRUCK OFFLOAD STATIONS FOUR LADDER TRACKS = 10,000 FEET 6

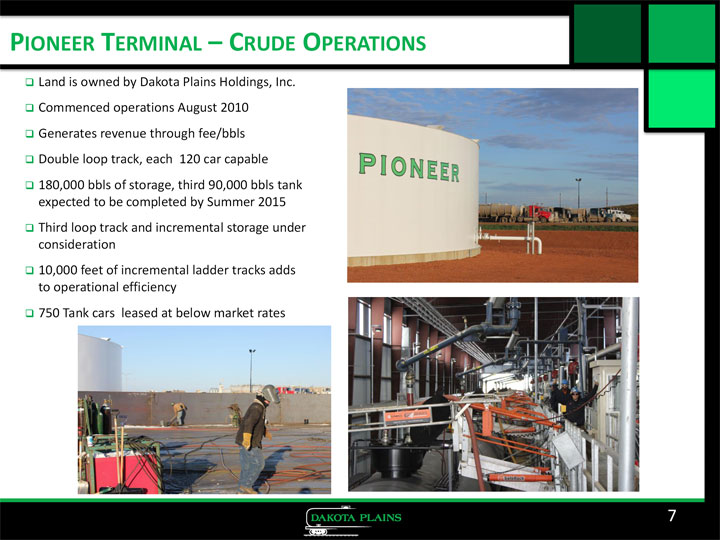

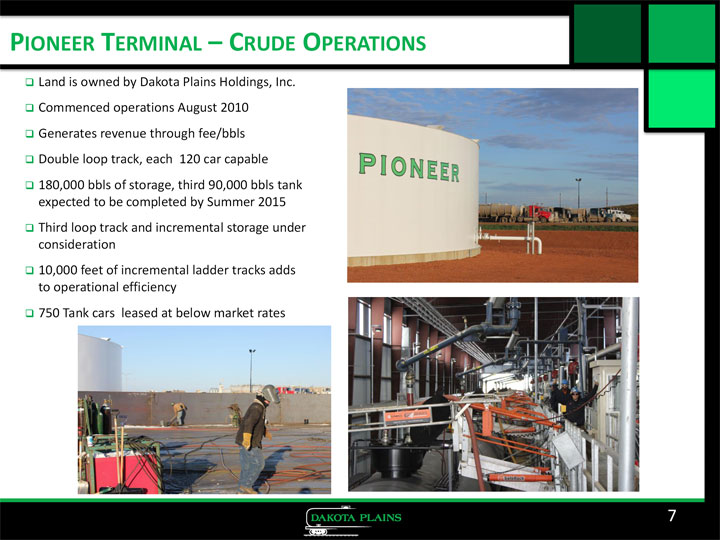

PIONEER TERMINAL CRUDE OPERATIONS Land is owned by Dakota Plains Holdings, Inc. Commenced operations August 2010 Generates revenue through fee/bbls Double loop track, each 120 car capable 180,000 bbls of storage, third 90,000 bbls tank expected to be completed by Summer 2015 Third loop track and incremental storage under consideration 10,000 feet of incremental ladder tracks adds to operational efficiency 750 Tank cars leased at below market rates 7

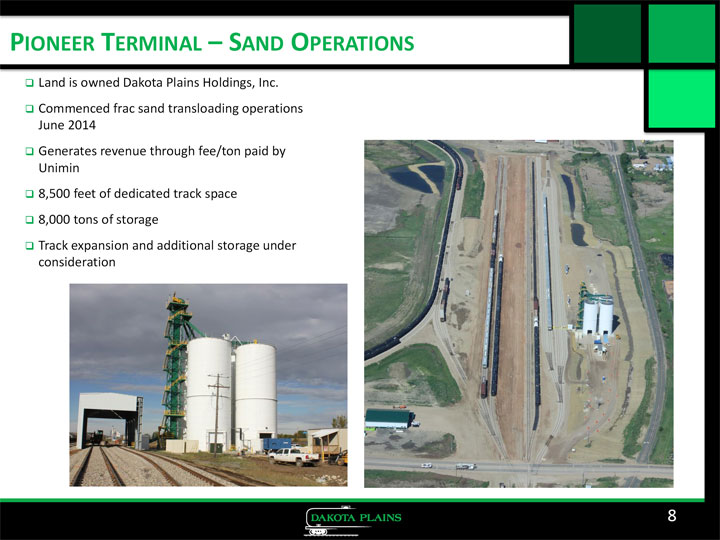

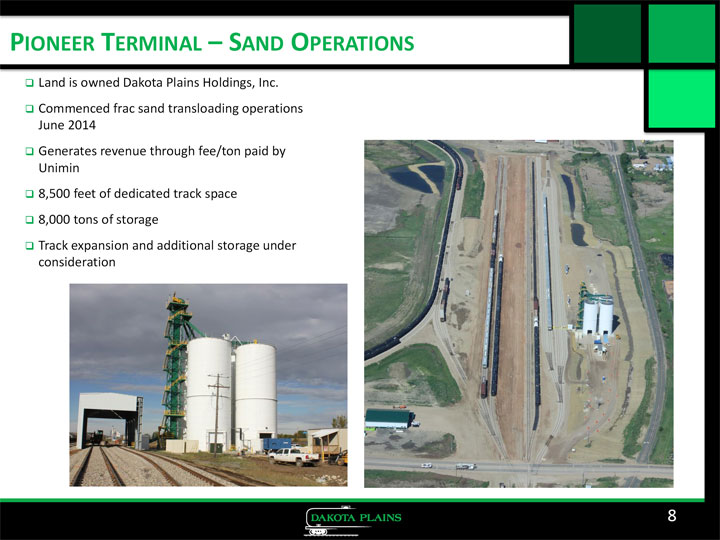

PIONEER TERMINAL SAND OPERATIONS Land is owned Dakota Plains Holdings, Inc. Commenced frac sand transloading operations June 2014 Generates revenue through fee/ton paid by Unimin 8,500 feet of dedicated track space 8,000 tons of storage Track expansion and additional storage under consideration 8

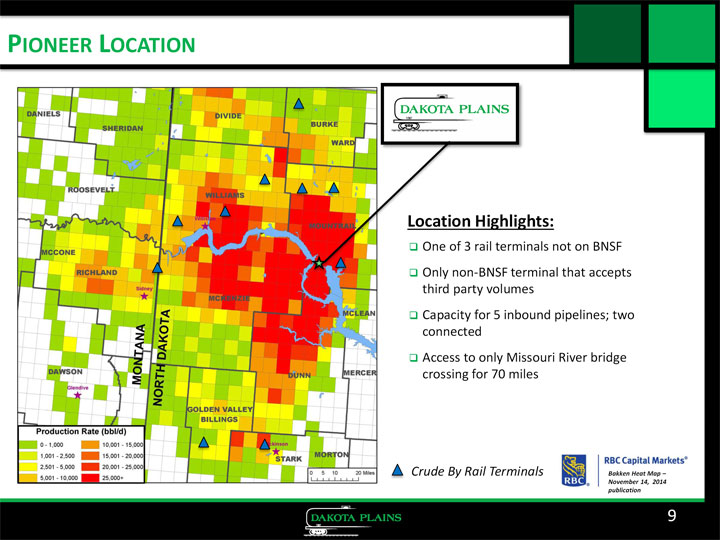

PIONEER LOCATION Location Highlights: One of 3 rail terminals not on BNSF Only non-BNSF terminal that accepts third party volumes Capacity for 5 inbound pipelines; two connected Access to only Missouri River bridge crossing for 70 miles Crude By Rail Terminals Bakken Heat Map November 14, 2014 publication 9

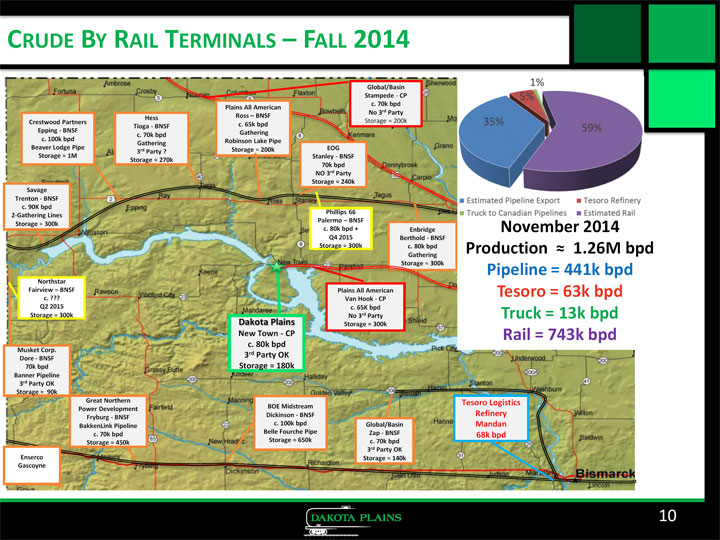

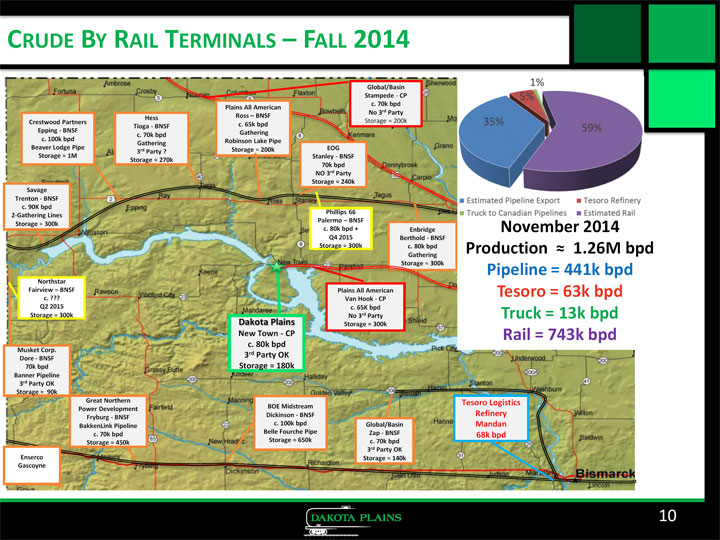

CRUDE BY RAIL TERMINALS FALL 2014 Plains All American Hess Ross BNSF Crestwood Partners c. 65k bpd Tioga - Epping - BNSF Gathering c. 70k bpd c. 100k bpd Robinson Lake Pipe Gathering Beaver Lodge Pipe Storage 200k EOG 3rd Party Storage 1M Stanley - BNSF Storage 70k bpd NO 3rd Party Storage 240k Phillips 66 Palermo BNSF c. 80k bpd + Enbridge November 2014 Q4 2015 Berthold - BNSF Storage = 300k c. 80k bpd Production 1.26M bpd Gathering Pipeline = 441k bpd Northstar Fairview BNSF Tesoro = 63k bpd c. ??? Q2 2015 c. 65K bpd Storage = 300k No 3rd Party Truck = 13k bpd Dakota Plains Storage 300k New Town - CP Rail = 743k bpd c. 80k bpd Musket Corp. 3rd Party OK Dore - BNSF 70k bpd Storage = 180k Banner Pipeline 3rd Party OK Storage 90k Great Northern Tesoro Logistics Power Development BOE Midstream Dickinson - BNSF Refinery Fryburg - BNSF BakkenLink Pipeline c. 100k bpd Global/Basin Mandan c. 70k bpd Belle Fourche Pipe Zap - 68k bpd Enserco Gascoyne 10

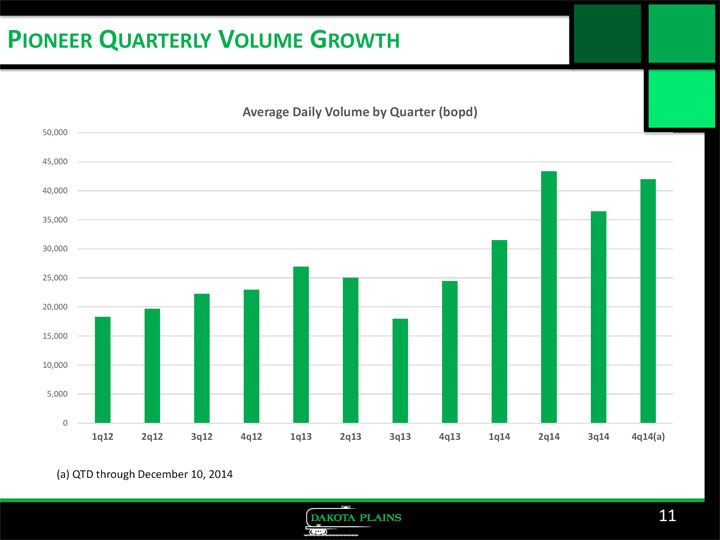

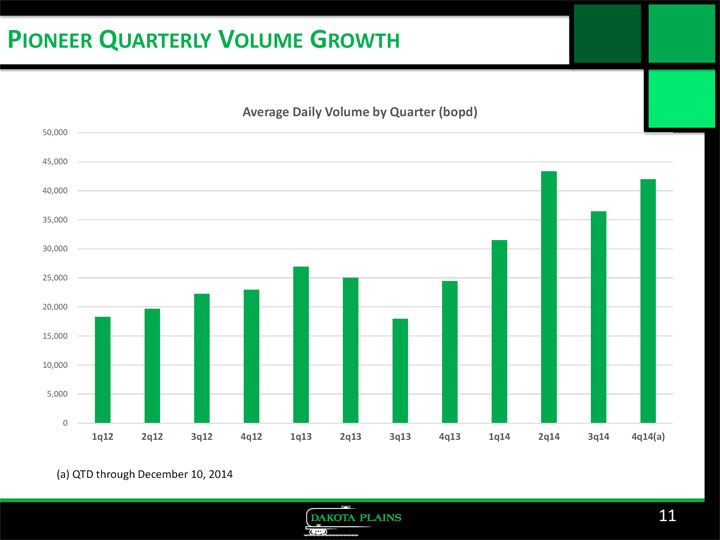

PIONEER QUARTERLY VOLUME GROWTH Average Daily Volume by Quarter (bopd) 50,000 45,000 40,000 35,000 30,000 25,000 20,000 15,000 10,000 5,000 0 1q12 2q12 3q12 4q12 1q13 2q13 3q13 4q13 1q14 2q14 3q14 4q14(a)(a) QTD through December 10, 2014 11

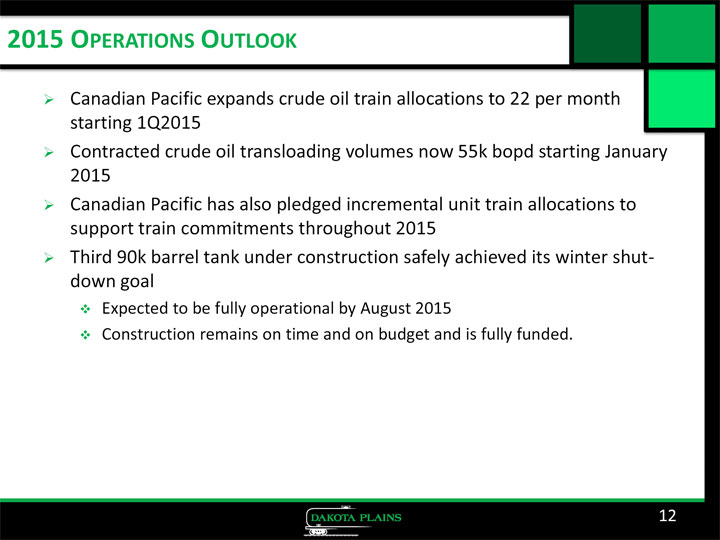

2015 OPERATIONS OUTLOOK Canadian Pacific expands crude oil train allocations to 22 per month starting 1Q2015 Contracted crude oil transloading volumes now 55k bopd starting January 2015 Canadian Pacific has also pledged incremental unit train allocations to support train commitments throughout 2015 Third 90k barrel tank under construction safely achieved its winter shutdown goal Expected to be fully operational by August 2015 Construction remains on time and on budget and is fully funded. 12

Current Environment

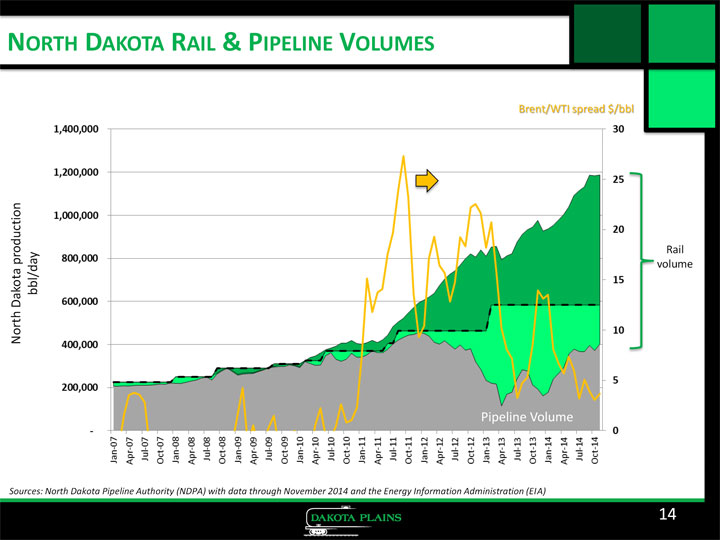

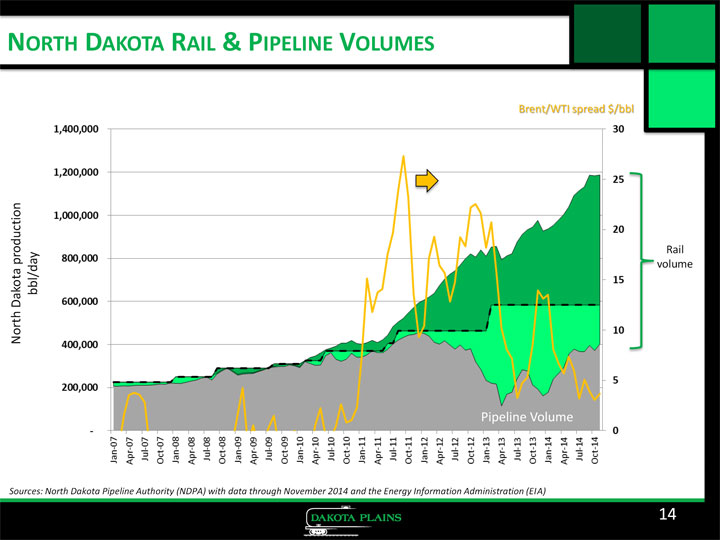

NORTH DAKOTA RAIL & PIPELINE VOLUMES Brent/WTI spread $/bbl Rail North Dakota production bbl/day volume Pipeline Volume Sources: North Dakota Pipeline Authority (NDPA) with data through November 2014 and the Energy Information Administration (EIA) 14

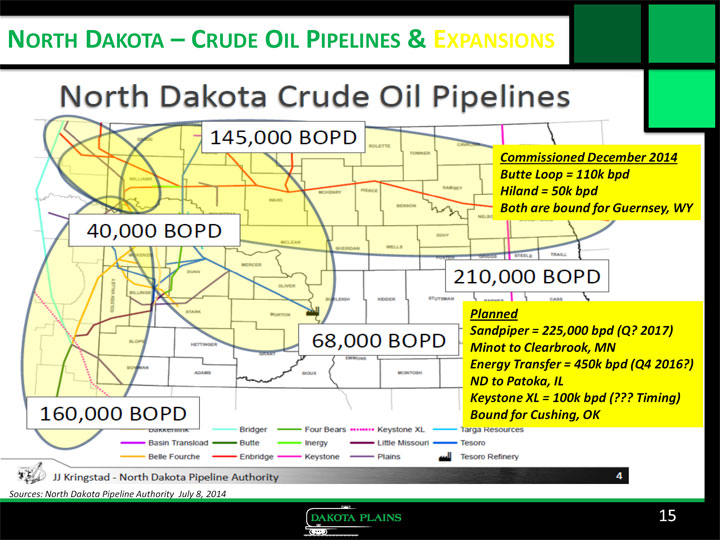

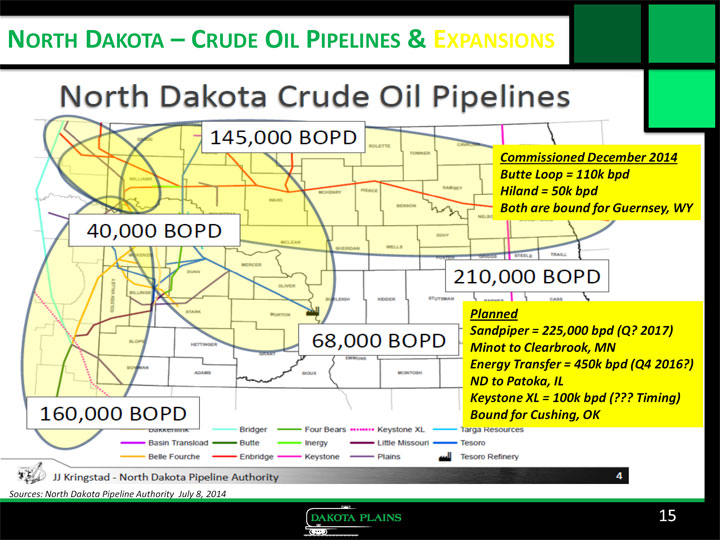

NORTH DAKOTA CRUDE OIL PIPELINES & EXPANSIONS Commissioned December 2014 Butte Loop = 110k bpd Hiland = 50k bpd Both are bound for Guernsey, WY Planned Sandpiper = 225,000 bpd (Q? 2017) Minot to Clearbrook, MN Energy Transfer = 450k bpd (Q4 2016?) ND to Patoka, IL Keystone XL = 100k bpd (??? Timing) Bound for Cushing, OK Sources: North Dakota Pipeline Authority July 8, 2014 15

REVIEW OF BUYOUT OF JV PARTNER

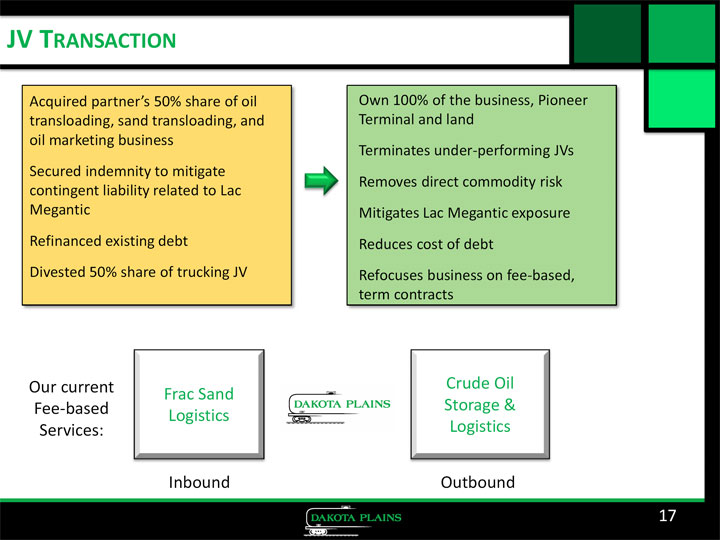

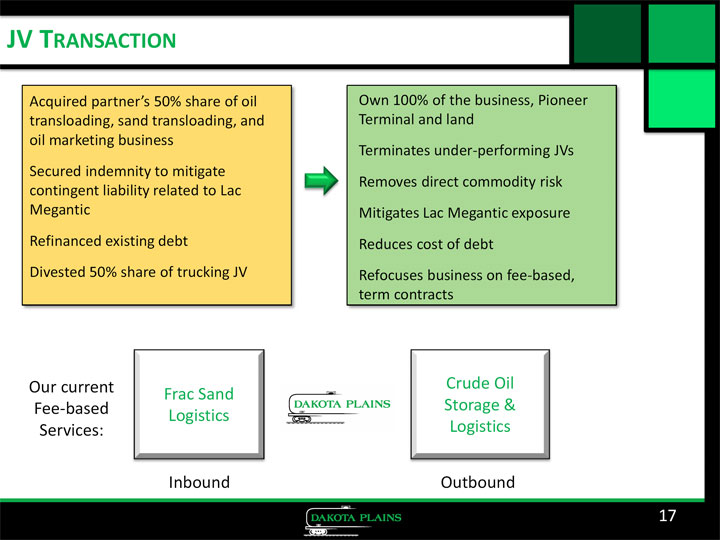

JV TRANSACTION Acquired partner’s 50% share of oil Own 100% of the business, Pioneer transloading, sand transloading, and Terminal and land oil marketing business Terminates under-performing JVs Secured indemnity to mitigate Removes direct commodity risk contingent liability related to Lac Megantic Mitigates Lac Megantic exposure Refinanced existing debt Reduces cost of debt Divested 50% share of trucking JV Refocuses business on fee-based, term contracts Our current Crude Oil Frac Sand Fee-based Storage & Logistics Services: Logistics Inbound Outbound 17

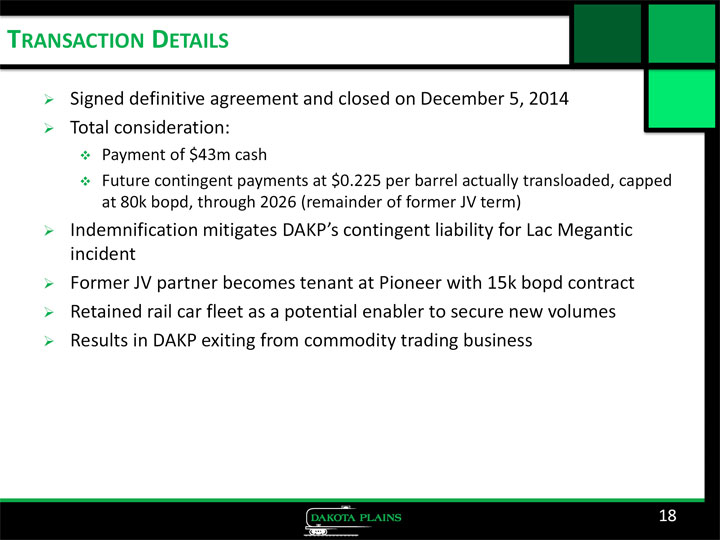

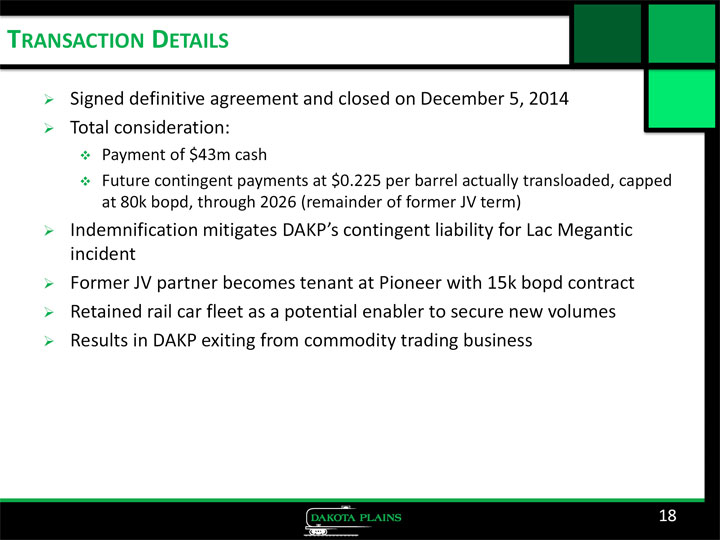

TRANSACTION DETAILS Signed definitive agreement and closed on December 5, 2014 Total consideration: Payment of $43m cash Future contingent payments at $0.225 per barrel actually transloaded, capped at 80k bopd, through 2026 (remainder of former JV term) Indemnification mitigates DAKP’s contingent liability for Lac Megantic incident Former JV partner becomes tenant at Pioneer with 15k bopd contract Retained rail car fleet as a potential enabler to secure new volumes Results in DAKP exiting from commodity trading business 18

FINANCING THE TRANSACTION The new $57.5M credit facility provided by SunTrust Bank consists of Two fully drawn tranches of term loan for a total of $37.5M One revolver of $20.0M which is $11.0M drawn The former terminal note and the former promissory notes have been refinanced in the transaction Sources Uses ($M) Cash $2.0 Cash consideration paid to WFS $43.0 New $20.0 Million DAKP Revolving Credit Facility 11.0 Refinance Terminal Note 6.4 New $15.0 Million Term Loan A 15.0 Refinance Promissory Note 7.7 New $22.5 Million Term Loan B 22.5 Fees & Other 2.3 Net Proceeds From JV Dissolution 8.9 Total Sources $59.4 Total Uses $59.4 19

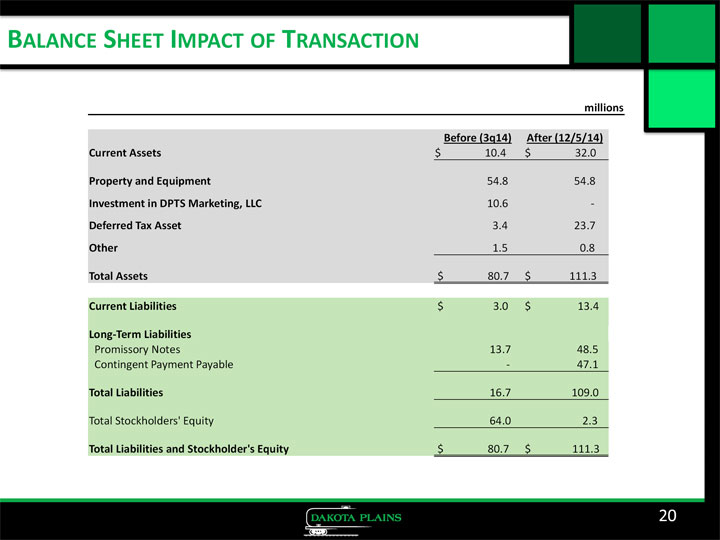

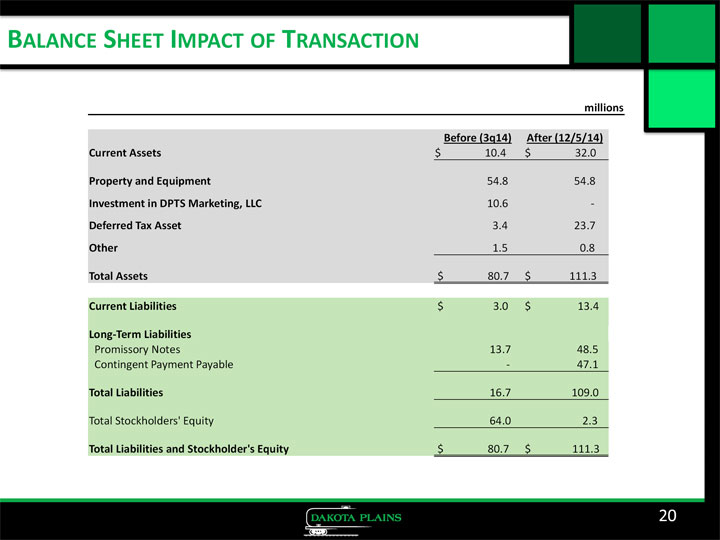

BALANCE SHEET IMPACT OF TRANSACTION millions Before (3q14) After (12/5/14) Current Assets $ 10.4 $ 32.0 Property and Equipment 54.8 54.8 Investment in DPTS Marketing, LLC 10.6 - Deferred Tax Asset 3.4 23.7 Other 1.5 0.8 Total Assets $ 80.7 $ 111.3 Current Liabilities $ 3.0 $ 13.4 Long-Term Liabilities Promissory Notes 13.7 48.5 Contingent Payment Payable - 47.1 Total Liabilities 16.7 109.0 Total Stockholders’ Equity 64.0 2.3 Total Liabilities and Stockholder’s Equity $ 80.7 $ 111.3 20

Guidance & Growth Opportunities

2015 GUIDANCE Crude oil throughput volumes: 55k bopd effective Jan 2015 Increasing to 60k bopd effective 2H2015 2015 expected average throughput volumes 57.5k bopd, opportunity to further increase volumes 2H2015 Sand throughput volumes at 97.5k tons per quarter on average 2015 expected EBITDA of $23.4M 22

2015E PRODUCT THROUGHPUT Crude (bopd) Sand (tons pcm) 70 35 65 30 Thousands Thousands 25 60 20 55 15 50 10 45 5 40 0 23

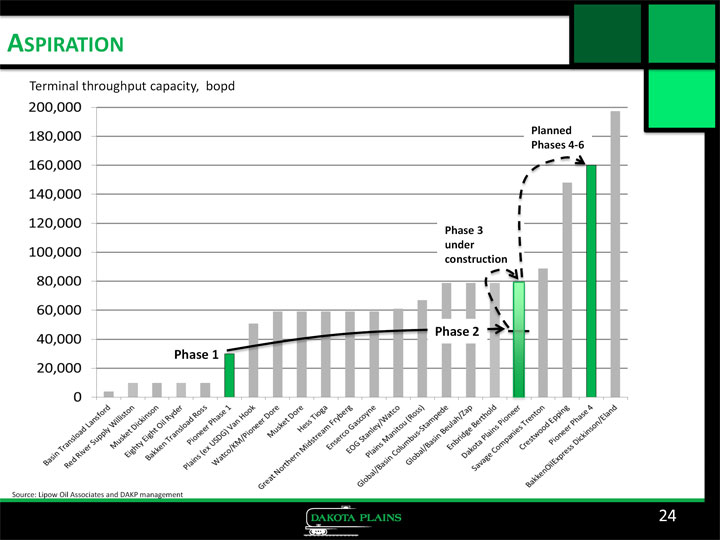

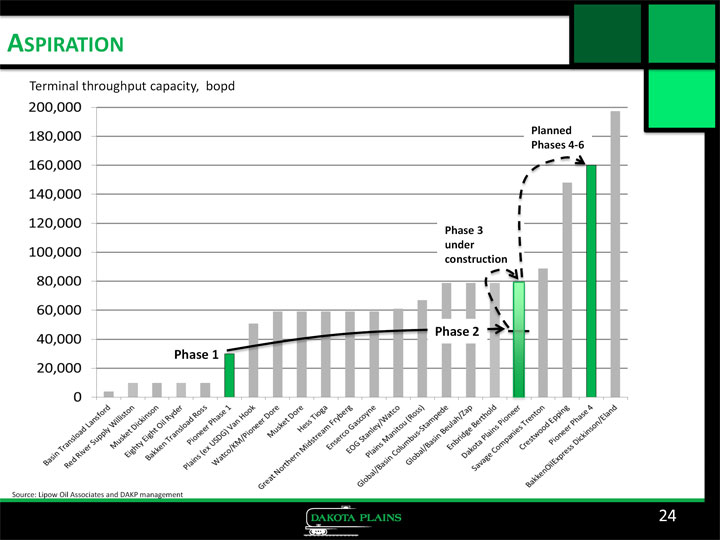

ASPIRATION Terminal throughput capacity, bopd Planned Phases 4-6 Phase 3 under construction Phase 2 Phase 1 Source: Lipow Oil Associates and DAKP management 24

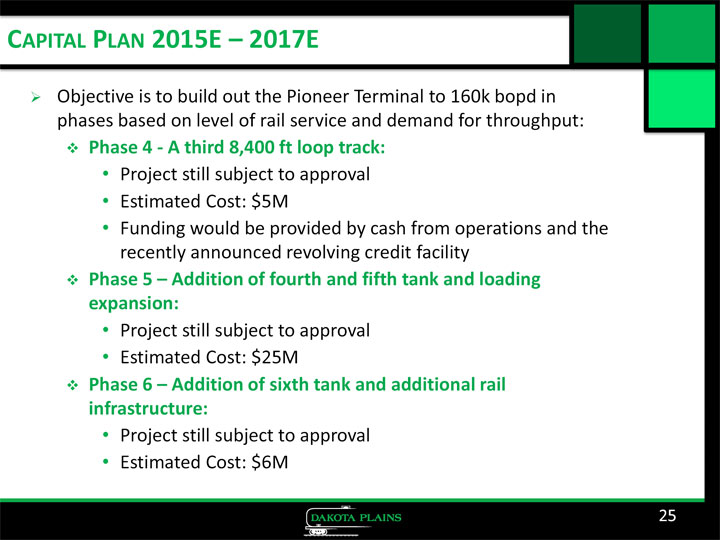

CAPITAL PLAN 2015E 2017E Objective is to build out the Pioneer Terminal to 160k bopd in phases based on level of rail service and demand for throughput: Phase 4 - A third 8,400 ft loop track: Project still subject to approval Estimated Cost: $5M Funding would be provided by cash from operations and the recently announced revolving credit facility Phase 5 Addition of fourth and fifth tank and loading expansion: Project still subject to approval Estimated Cost: $25M Phase 6 Addition of sixth tank and additional rail infrastructure: Project still subject to approval Estimated Cost: $6M 25

APPENDIX

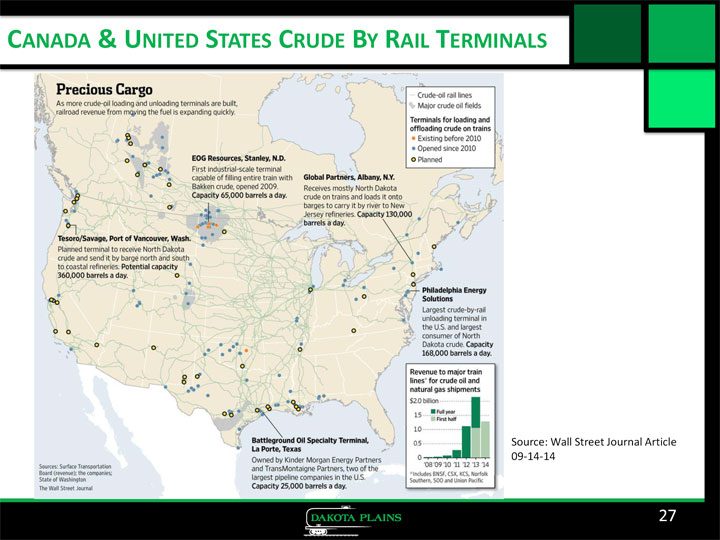

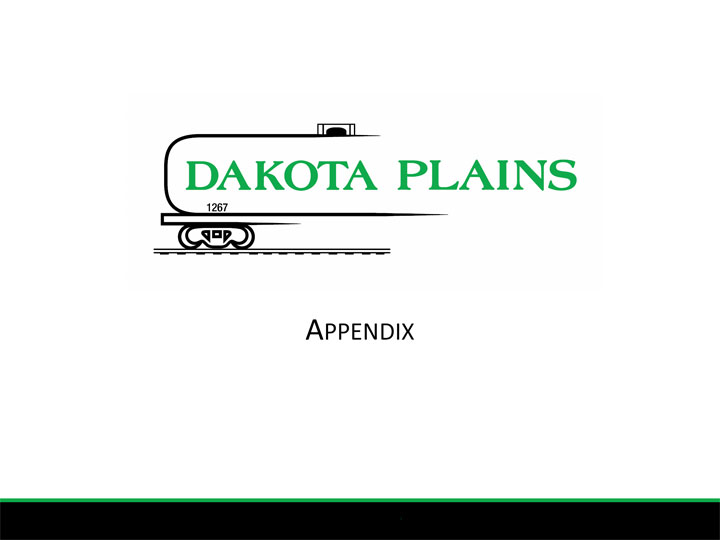

CANADA & UNITED STATES CRUDE BY RAIL TERMINALS Source: Wall Street Journal Article 09-14-14 27

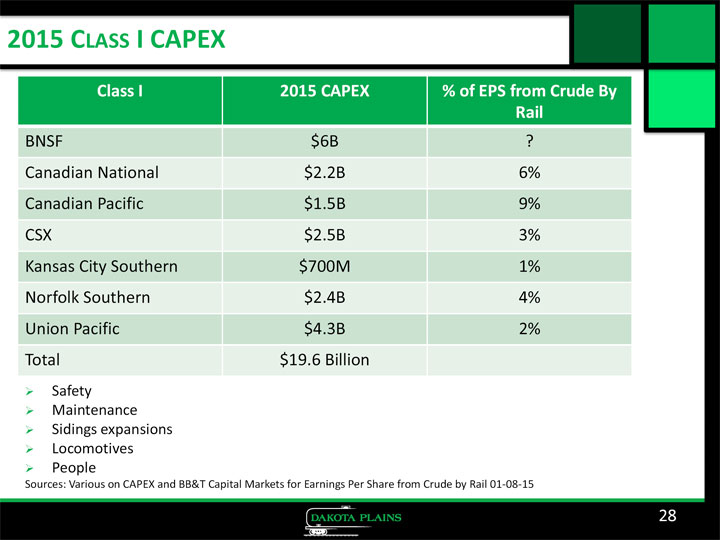

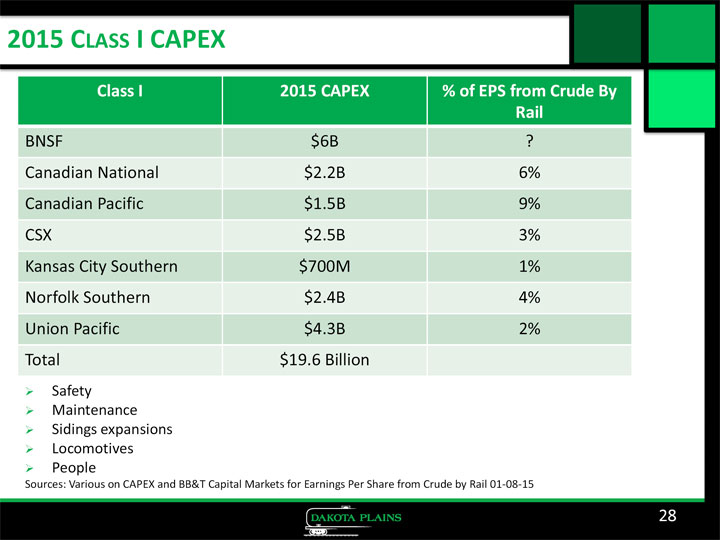

2015 CLASS I CAPEX Class I 2015 CAPEX % of EPS from Crude By Rail BNSF $6B ? Canadian National $2.2B 6% Canadian Pacific $1.5B 9% CSX $2.5B 3% Kansas City Southern $700M 1% Norfolk Southern $2.4B 4% Union Pacific $4.3B 2% Total $19.6 Billion Safety Maintenance Sidings expansions Locomotives People Sources: Various on CAPEX and BB&T Capital Markets for Earnings Per Share from Crude by Rail 01-08-15 28

ADJUSTED EBITDA (expressed in USD millions, unless otherwise indicated) Twelve Months Ended December 31, 2015 Net Income $ 8.5 Add back: Interest Expense $ 7.6 o/w Contingent payment interest $ 4.2 Term loan and revolver interest $ 3.1 Fees / amortization associated with loans $ 0.4 Tax Provision $ 1.6 Depreciation and Amortization $ 4.5 Share Based Compensation $ 1.2 Adjusted EBITDA $ 23.4 29