| | | UNITED STATES | | |

| | | SECURITIES AND EXCHANGE COMMISSION |

| | | Washington, D.C. 20549 | | |

| |

| | | FORM 10-KSB | | |

| | | (Mark One) | | |

| |

| [ X ] | | ANNUAL REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE |

| | | ACT OF 1934 FOR THE FISCAL YEARS ENDEDDECEMBER 31, 2006ANDDECEMBER |

| | | 31, 2007OR | | |

| |

| [ ] | | TRANSITION REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE |

| | | ACT OF 1934 FOR THE TRANSITION PERIOD FROM | | TO |

| Commission file number: 333-135759 |

HARRISON MINING INC.

______________________________________________________________________________

(Exact name of small business issuer in its charter)

| Nevada | | 20-5086912 |

| |

|

| (State or other jurisdiction of incorporation | | (I.R.S. Employer Identification No.) |

| or organization) | | |

| |

| 502 East John Street | | |

| Carson City, Nevada | | 89706 |

| |

|

| (Address of principal executive offices) | | (Zip Code) |

Issuer's telephone number: (XXX) XXX-XXXX

Securities Registered Under Section 12(b) of the Exchange Act:None

Securities Registered Under Section 12(g) of the Exchange Act:Common Stock, $0.001 par value(Title of class)

Check whether the issuer (1) filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act during the past 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Check if there is no disclosure of delinquent filers in response to Item 405 of Regulation S-B is not contained in this form, and no disclosure will be contained, to the best of the Registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-KSB or any amendment to this Form 10-KSB. [ ]

State issuer's revenues for fiscal years 2006 and 2007: $Nil

State the number of shares outstanding of each of the issuer's classes of common equity, as of the latest practicable date: 3,750,000 issued and outstanding as at April 30, 2008 (the issuer had 3,750,000 issued and outstanding as at December 31, 2006).

Documents Incorporated by Reference: None.

Transitional Small Business Format. Yes [ ] No [X]

2

PART I

ITEM 1. DESCRIPTION OF BUSINESS

Harrison Mining Inc. (“we”, “us”, “our” or similar terms) was organized under the laws of the State of Nevada on March 10, 2006 to explore mining claims in the Province of British Columbia, Canada. Our principal executive offices are located at 502 East John Street, Carson City, Nevada, 89706. Our telephone number is (xxx) xxx-xxxx. We are qualified to do business in the Province of British Columbia, Canada pursuant to being extra-provincially registered.

On November 30, 2006 our Registration Statement on Form SB-1 was declared effective enabling us to offer up to a maximum offering of 2,500,000 common shares at a price of $0.01 per share.

We currently have no revenue from operations. We are in a start-up phase with our existing assets and we have no significant assets, tangible or intangible. There can be no assurance that we will generate revenues in the future, or that we will be able to operate profitably in the future, if at all. We have incurred net losses since inception of our operations in March 2006. We have never declared bankruptcy, have never been in receivership, and never been involved in any legal action or proceedings. Since becoming incorporated, we have not made any significant purchase or sale of assets, nor have we been involved in any mergers, acquisitions or consolidations.

Certain Definitions

Andesitic. Describing a type of volcanic rock. This gray to black rock is composed of about 54 to 62 percent silica (SiO2), plus some iron and magnesium.

Argillaceous. Describing rocks or sediments containing particles that are silt- or clay-sized, less than 0.625 mm in size. Most have a high clay-mineral content, and many contain a sufficient percentage of organic material to be considered a source rock for hydrocarbon.

Archean.Of or belonging to the earlier of the two divisions of Precambrian time, from approximately 3.8 to 2.5 billion years ago, marked by an atmosphere with little free oxygen, the formation of the first rocks and oceans, and the development of unicellular life. Of or relating to the oldest known rocks, those of the Precambrian Eon, that are predominantly igneous in composition.

Assaying.Laboratory examination that determines the content or proportion of a specific metal (ie: gold) contained within a sample. Technique usually involves firing/smelting.

Breccia.Rock composed of sharp-angled fragments embedded in a fine-grained matrix.

Conglomerate.A coarse-grained clastic sedimentary rock, composed of rounded to subangular fragments larger than 2 mm in diameter (granules, pebbles, cobbles, boulders) set in a fine-grained matrix of sand or silt, and commonly cemented by calcium carbonate, iron oxide, silica, or hardened clay; the consolidated equivalent of gravel. The rock or mineral fragments may be of varied composition and range widely in size, and are usually rounded and smoothed from transportation by water or from wave action.

Cratons.Parts of the Earth's crust that have attained stability, and have been little deformed for a prolonged period.

3

Dacite.Dacite is a type of volcanic rock that is light-colored and rich in silica (63 to 68 percent).

Development Stage.A “development stage” project is one which is undergoing preparation of an established commercially mineable deposit for its extraction but which is not yet in production. This stage occurs after completion of a feasibility study.

Dolomite Beds.Dolomite beds are associated and interbedded with limestone, commonly representing postdepositional replacement of limestone.

Dore.Unrefined gold bullion bars containing various impurities such as silver, copper and mercury, which will be further refined to near pure gold.

Dyke or Dike. A tabular igneous intrusion that cuts across the bedding or foliation of the country rock.

Exploration Stage.An “exploration stage” prospect is one which is not in either the development or production stage.

Fault.A break in the continuity of a body of rock. It is accompanied by a movement on one side of the break or the other so that what were once parts of one continuous rock stratum or vein are now separated. The amount of displacement of the parts may range from a few inches to thousands of feet.

Fold.A curve or bend of a planar structure such as rock strata, bedding planes, foliation, or cleavage.

Foliation.A general term for a planar arrangement of textural or structural features in any type of rock; esp., the planar structure that results from flattening of the constituent grains of a metamorphic rock.

Formation.A distinct layer of sedimentary rock of similar composition.

Gabbro.A group of dark-colored, basic intrusive igneous rocks composed principally of basic plagioclase (commonly labradorite or bytownite) and clinopyroxene (augite), with or without olivine and orthopyroxene; also, any member of that group. It is the approximate intrusive equivalent of basalt. Apatite and magnetite or ilmenite are common accessory minerals.

Geochemistry.The study of the distribution and amounts of the chemical elements in minerals, ores, rocks, solids, water, and the atmosphere.

Geophysicist.One who studies the earth; in particular the physics of the solid earth, the atmosphere and the earth’s magnetosphere.

Geotechnical.The study of ground stability.

Galena.A gray mineral, essentially PbS, the principal ore of lead.

Gneiss.A foliated rock formed by regional metamorphism, in which bands or lens-shaped strata or bodies of rock of granular minerals alternate with bands or lens-shaped strata or bodies or rock in which minerals having flaky or elongate prismatic habits predominate.

Granitic.Pertaining to or composed of granite.

4

Heap Leach.a mineral processing method involving the crushing and stacking of an ore on an impermeable liner upon which solutions are sprayed that dissolve metals such as gold and copper; the solutions containing the metals are then collected and treated to recover the metals.

Intrusions.Masses of igneous rock that, while molten, were forced into or between other rocks.

Kimberlite.A blue/gray igneous rock that contains olivine, serpentine, calcite and silica and is the principal original environment of diamonds.

Lamproite.Dark-colored igneous rocks rich in potassium and magnesium.

Lithospere.The solid outer portion of the Earth.

Mantle.The zone of the Earth below the crust and above the core.

Mapped or Geological.The recording of geologic information such as the distribution and nature of rock

Mapping.Units and the occurrence of structural features, mineral deposits, and fossil localities.

Migmatite.A composite rock composed of igneous or igneous-appearing and/or metamorphic materials that are generally distinguishable megascopically.

Mineral.A naturally formed chemical element or compound having a definite chemical composition and, usually, a characteristics crystal form.

Mineralization.The term “mineralized material” refers to material that is not included in the reserve as it does not meet all of the criteria for adequate demonstration for economic or legal extraction.

Mining.Mining is the process of extraction and benefication of mineral reserves to produce a marketable metal or mineral product. Exploration continues during the mining process and, in many cases, mineral reserves are expanded during the life of the mine operations as the exploration potential of the deposit is realized.

Outcrop.That part of a geologic formation or structure that appears at the surface of the earth.

Pipes.Vertical conduits.

Plagioclase.Any of a group of feldspars containing a mixture of sodium and calcium feldspars, distinguished by their extinction angles.

Probable Reserve.The term “probable reserve” refers to reserves for which quantity and grade and/or quality are computed from information similar to that used for proven (measured) reserves, but the sites for inspection, sampling, and measurement are farther apart or are otherwise less adequately spaced. The degree of assurance, although lower than that for proven reserves, is high enough to assume continuity between points of observation.

Production Stage.A “production stage” project is actively engaged in the process of extraction and beneficiation of mineral reserves to produce a marketable metal or mineral product.

5

Proterozoic.Of or relating to the later of the two divisions of Precambrian time, from approximately 2.5 billion to 570 million years ago, marked by the buildup of oxygen and the appearance of the first multicellular eukaryotic life forms.

Pyrite.the most common of the sulfide minerals. It is usually found associated with other sulfides or oxides in quartz veins, sedimentary rock and metamorphic rock, as well as in coal beds. Pyrite is used for the production of sulfur dioxide, e.g. for the paper industry, and in the manufacture of sulfuric acid, though such applications are declining in importance.

Rhyolitic.Describing a type of volcanic lava or rock that is usually light in color; it contains 69 percent silica and is high in potassium and sodium.

Reserve.The term “reserve” refers to that part of a mineral deposit which could be economically and legally extracted or produced at the time of the reserve determination. Reserves must be supported by a feasibility study done to bankable standards that demonstrates the economic extraction. (“Bankable standards” implies that the confidence attached to the costs and achievements developed in the study is sufficient for the project to be eligible for external debt financing.) A reserve includes adjustments to the in-situ tonnes and grade to include diluting materials and allowances for losses that might occur when the material is mined.

Sedimentary.Formed by the deposition of sediment.

Shear.A form of strain resulting from stresses that cause or tend to cause contiguous parts of a body of rock to slide relatively to each other in a direction parallel to their plane of contact.

Sill.A concordant sheet of igneous rock lying nearly horizontal. A sill may become a dike or vice versa.

Stockwork.A complex system of structurally controlled or randomly oriented veins. Stockworks are common in many ore deposit types and especially notable in greisens. They are also referred to as stringer zones.

Strike.The direction or trend that a structural surface, e.g. a bedding or fault plane, takes as it intersects the horizontal.

Strip.To remove overburden in order to expose ore.

Till.Generally unconsolidated matter, deposited directly by and underneath a glacier without subsequent reworking by meltwater, and consisting of a mixture of clay, silt, sand, gravel, and boulders ranging widely in size and shape.

Tuffaceous.Describing a type of pyroclastic rock (meaning "fire fragmented") refers to broken-up rocks, pumice, ash, and other bits of material that are formed in a volcanic eruption.

Unconformably.Not succeeding the underlying rocks in immediate order of age or not fitting together with them as parts of a continuous whole.

Vein.A thin, sheet like crosscutting body of hydrothermal mineralization, principally quartz.

Wall Rock.The rock adjacent to a vein.

6

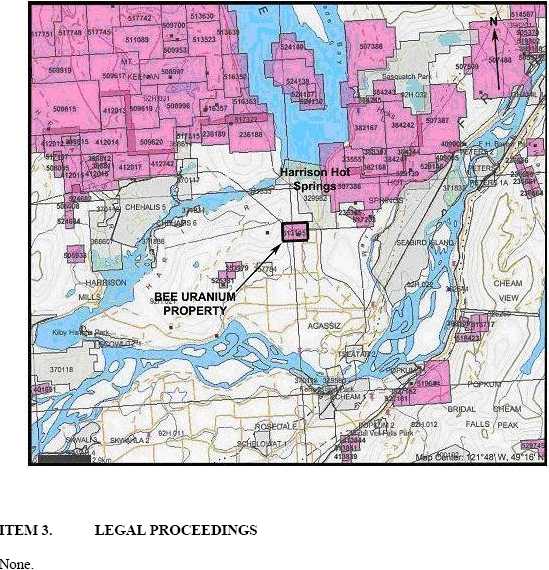

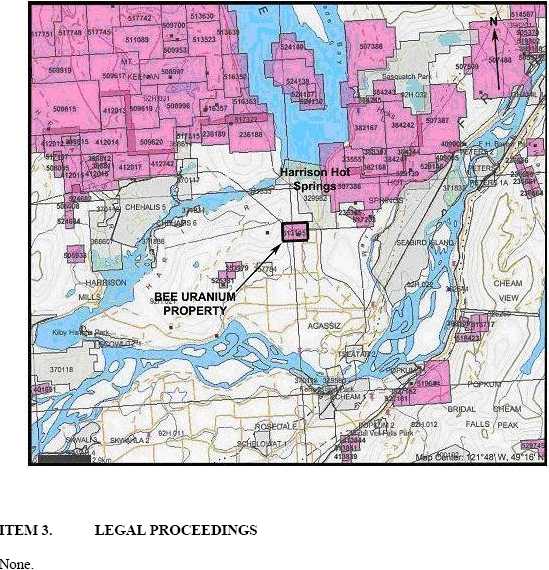

| ITEM 2. DESCRIPTION OF PROPERTY |

We currently maintain an office in Nevada at 502 East John Street, Carson City, Nevada, 89706. We currently use our President’s home as our headquarters at no charge.

We are in the process of establishing ourselves as a company to engage in the exploration of mineral properties for uranium in the Province of British Columbia, Canada. We have staked one (1) mineral claim that contains six cell claim units that total 126.45 hectares. We refer to this mining claim as the Bee Uranium Property (“ Bee Uranium ” or “Bee Uranium Property”). On April 20, 2006 we purchased the Bee Uranium Property for USD $7,500.

Our report on the Bee Uranium Property was prepared by Gregory R. Thomson of P. Geo and James W. Laird of Laird Exploration Ltd., professional geoscientists registered in the Province of British Columbia. Gregory R. Thomson is a graduate Geologist from the University of British Columbia (1970) and has over twenty-five (25) years of mineral exploration experience in the Province of British Columbia.

Jim Laird is a prospector and mining exploration contractor and has been acting in such capacity for more than twenty-five (25) years. Mr. Laird has completed the BC EMPR course “Advanced Mineral Exploration for Prospectors, 1980”. Mr. Laird is familiar with the geology of the Bee Uranium Property project area.

The Bee Uranium Property is located on the lower, east slope of Mount Agassiz, to the west of Miami Creek. Access to the property is by road from the nearby town of Harrison Hot Springs. The Bee Uranium Property is found near the southern tip of the Pacific Ranges, which is a physiographic subdivision of the Coast Mountains. The slopes of Mount Agassiz are steep and rugged, with numerous rock bluffs.

Access is gained by traveling approximately three kilometers south from Harrison Hot Springs along Highway No. 9. At this point, a powerline road is traveled for approximately 800 meters west from Highway 9 to Miami Creek. The Bee Mine showing area is easily accessed from this point, lying at an elevation of 150 meters, immediately west of Miami Creek.

The Bee Uranium Property mineral claim lies within the New Westminster Mining Division at 49º 16.5’ north latitude and 121º 48’ west longitude.

The current mineral property occupies the steep easterly slopes of Mt. Agassiz, ranging from about 600 meters elevation on Mt. Agassiz to about 50 meters along Miami Creek. The Bee Uranium Property mineral showing is at 150 meters elevation, near the base of Mt. Agassiz.

The mineral property is covered by coniferous forest that consists of fir, cedar and hemlock. Swampy brush is found along the sides of Miami Creek. The climate is moderate with warm summers and cool rainy winters.

7

BEE URANIUM PROPERTY BC LOCATION MAP

The Bee Uranium Property comprises one (1) mineral claim containing 6 cell claim units totaling 126.45 hectares:

| | | Work Due | | | | |

| BC Tenure # | | | | | | | | Total Area (Hectares) |

| | | Date | | Cells | | | | |

| 513195 | | May 23, 2006 6 | | | | 126.45 |

Geology of the Mineral Claims

The Bee Uranium Property contains mineralization that is classified as a Rare Element Pegmatite*. Deposits of this type are not recognized in British Columbia; however, they can be considered important sources of the rare elements niobium** and yttrium***. It is yet uncertain what potential exists for locating a commercially exploitable mineral deposit on the Bee Uranium Property.

[*Pegmatite is a very coarse-grained igneous rock that has a grain size of 20 mm or more; such rocks are referred to as pegmatitic.]

[**Niobium (or columbium) is a chemical element in the periodic table that has the symbol Nb and atomic number 41. A rare, soft, gray, ductile transition metal, niobium is found in niobite and used in alloys. The most notable alloys are used to make special steels and strong welded

8

joints. Niobium was discovered in a variety of columbite (now called niobite) and was at first named after this mineral.]

[***yttrium is a chemical element in the periodic table that has the symbol Y and atomic number 39. A silvery metallic transition metal, yttrium is common in rare-earth minerals and two of its compounds are used to make the red color phosphors in cathode ray tube displays, such as those used for televisions.]

Mineralization is predominantly within the pegmatite or coarse-grained granitic extrusion. An unidentified uranium mineral, possibly uraninite or uraniferous magnetite occurs as sporadic fine disseminated black crystals in association with clusters of fine-grained pyrite. A greenish yellow secondary mineral, possibly phosphuranylite is also evident through the rock matrix.

Occasional patches of chalcopyrite with splashes of malachite and erythrite (cobalt bloom) occur sporadically within the zone. Pale purplish fluorite is present in association with the quartz.

There is potential in this geological environment to form a sandstone-hosted uranium deposit in sediments of the Kent Formation similar to the large deposits in the Athabaska Basin, Saskatchewan. The mineral associations are also similar to Olympic-Dam style mineralization. Neither model type has been explored for in this area, an exploration program should test the potential of these geological models.

Exploration History and Previous Operations

In 1978, an exploration program that consisted of geologic mapping, radiometric surveys and soil sampling was carried out to locate potential areas of uranium mineralization, in proximity to the mineral showing area of the Bee Uranium Property. This exploration work was carried out on behalf of Jet-Star Resources Ltd. of Vancouver, British Columbia.

The results of the radiometric and soil sampling surveys were inconclusive. The radiometric survey indicated that the mineral showing on the Bee Uranium Property is quite localized. However, a 145-sample geochemical soil survey showed an anomaly of higher than average uranium values extending along an east-west trend for a minimum length of 50 meters to a maximum of 150 meters.

9

ITEM 4. SUBMISSION OF MATTERS TO A VOTE OF SECURITY HOLDERS

There were no matters submitted to a shareholder vote during the fiscal year ended December 31, 2006 or the fiscal year ended December 31, 2007.

| | | PART II |

| |

| |

| ITEM 5. | | MARKET FOR COMMON EQUITY AND RELATED STOCKHOLDER |

| | | MATTERS |

Our common stock is not currently traded or quoted in any market place, nor are we aware of any established public trading market for our common stock.

10

| ITEM 6. | | MANAGEMENT'S DISCUSSION AND ANALYSIS OR PLAN OF |

| | | OPERATION |

Plan of Operation

At present, based on current operations, we do not have sufficient cash and liquid assets to satisfy our cash requirements over the next twelve (12) months. We have not generated any revenues from operations, and thus, do not have proceeds sufficient to meet our current monthly overhead, which includes our on-going business. We anticipate that we will not earn revenues until such time as we have entered into commercial production, if any, of our mineral properties. We are presently in the exploration stage of our business and we can provide no assurance that we will discover commercially exploitable levels of mineral resources on our properties, or if such resources are discovered, that we will enter into commercial production of our mineral properties.

Our business plan is to proceed with the exploration of the Bee Uranium Property to determine whether there is a potential for uranium or other metals located on the properties that comprise the mineral claims. We have decided to proceed with the exploration program recommended by the geological report referenced above. We anticipate that the three (3) phases of the recommended geological exploration program will cost approximately US$25,000.00, US$100,000.00 and US$175,000.00, respectively.

We had $NIL in cash as of December 31, 2006 and December 31, 2007. The lack of cash has kept us from conducting any exploration work on the property. We do not have sufficient capital to meet our projected costs over the next 12 months.

We anticipate that we will incur the following expenses over the twelve (12) month period following commencement of exploration of the Bee Uranium Property:

- $875 to be paid to the Provincial government to keep the Bee Uranium Property claimsvalid;

- US$25,000.00 in connection with the completion of Phase 1 of our recommendedgeological work program;

- US$100,000.00 in connection with the completion of Phase 2 of our recommendedgeological work program;

- US$175,000.00 in connection with the completion of Phase 3 of our recommendedgeological work program; and

- $10,000.00 for operating expenses, including professional legal and accounting expensesassociated with compliance with the periodic reporting requirements after we become areporting issuer under the Securities Exchange Act of 1934.

If we determine not to proceed with further exploration of our mineral claims due to a determination that the results of our initial geological program do not warrant further exploration or due to an inability to finance further exploration, we plan to pursue the acquisition of an interest in other mineral claims. We anticipate that any future acquisition would involve the acquisition of an option to earn an interest in a mineral claim, as we anticipate that we would not have sufficient cash to purchase a mineral claim of sufficient merit to warrant exploration. This means that we might offer shares of our stock to obtain an option on a property. Once we obtain an option, we would then pursue finding the funds necessary to explore the mineral claim by one or more of the following means: engaging in an offering of our stock; engaging in borrowing; or locating a joint venture partner or partners.

11

Should it be required, and if we are able to negotiate favorable terms, we may look to raise funds in excess of the current cash requirement by way of debt or equity financing in order to accelerate our growth. We are currently assessing strategic mergers and/or joint ventures with complementary businesses in order to enhance and support our current operational objectives.

We do not currently have any employees, have not had any employees since our inception and do not anticipate hiring any employees during the upcoming twelve (12) months. Our sole officer and director, Jim Laird, currently performs all tasks necessary to run our operations, including our corporate development and financial operations.

Off-Balance Sheet Arrangements

We presently do not have any off-balance sheet arrangements and have not had any off-balance sheet arrangements since our inception.

| ITEM 7.FINANCIAL STATEMENTS |

Our Annual Financial Statements for the years ended December 31, 2006 and December 31, 2007 will follow the text of this Form 10-KSB.

ITEM 8. | CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE |

None. ITEM 8A. | CONTROLS AND PROCEDURES |

As of the end of each of the periods covered by this report, we evaluated the effectiveness of the design and operation of our disclosure controls and procedures and our internal controls and procedures over financial reporting. This evaluation was done under the supervision and with the participation of management, including our President and Chief Financial Officer (“CFO”). In accordance with Securities and Exchange Commission (“SEC”) requirements, our President and CFO note that, since the date of the evaluation to the date of this consolidated Annual Report, there have been no significant changes in internal controls or in other factors that could significantly affect internal controls, including any corrective actions with regard to significant deficiencies and material weaknesses. Based upon our evaluation, our President and CFO have concluded that our disclosure controls are effective to ensure that mat erial information relating to us is made known to management, including our President and CFO, particularly during the period when our periodic reports are being prepared, and that our internal controls are effective to provide reasonable assurance that our financial statements are fairly presented in conformity with generally accepted accounting principles (“GAAP”).

| ITEM 8.B. OTHER INFORMATION |

12

| ITEM 9. | | DIRECTORS, EXECUTIVE OFFICERS, PROMOTORS AND CONTROL |

| | | PERSONS; COMPLIANCE WITH SECTION 16(a) OF THE EXCHANGE |

| | | ACT |

Identification of Directors and Executive Officers

At present, we have only one executive officer and director. Mr. Jim Laird has served as our President, Secretary, Treasurer and Director since our inception on March 10, 2006. Our Bylaws provide for a Board of Directors (“Board”) ranging from one (1) to nine (9) members, with the exact number to be specified by the Board. All directors will hold office until the next annual meeting of the stockholders following their election and until their successors have been elected and qualified. The Board appoints executive officers. Executive officers will hold office until the next annual meeting of our Board following their appointment and until their successors have been appointed and qualified. The list presented below sets forth the name and age of our sole director and executive officer, indicating all positions and offices with us held by such person and his term of office as director and executive officer and the period during which he has served as such:

| Name | | Age | | Positions | | Director Since |

| |

| |

| |

|

| Jim Laird | | 50 | | President, Secretary, Treasurer and | | March 2006 |

| | | | | Director | | |

| |

| |

| |

|

| Business Experience | | | | | | |

Jim Laird has been a prospector and mining exploration contractor for more than twenty-five (25) years. Mr. Laird completed the BC EMPR course “Advanced Mineral Exploration for Prospectors, 1980”. Mr. Laird is familiar with the geology of the project area and has more than twenty (20) years experience consulting in the Harrison Lake - Fraser Valley area.

Involvement in Certain Legal Proceedings

None.

Promoters and Control Persons

Not applicable.

Section 16(a) Beneficial Ownership Reporting Compliance

Not applicable.

| ITEM 10. | | EXECUTIVE COMPENSATION |

| (a) | | General |

13

There has been no compensation, including, but not limited to, salary, stock or options, awarded to, earned by, or paid to any of our named executive officers or directors during the last two (2) fiscal years covered by this report.

(b)Summary Compensation Table

Not applicable.

(c)Narrative Disclosure to Summary Compensation Table

Not applicable.

(d)Outstanding Equity Awards at Fiscal Year-End Table

None.

(e)Additional Narrative Disclosure

Not applicable.

(f)Compensation of Directors

We do not pay compensation to directors for attendance at meetings. We do reimburse directors for reasonable expenses incurred during the course of their performance. There has been no compensation awarded to, earned by, or paid to any of our named directors during the last two (2) fiscal years covered by this report.

| ITEM 11. | | SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND |

| | | | | MANAGEMENT |

| |

| (a) | | Security Ownership of Certain Beneficial Owners |

The table below sets forth all persons (including any group) who are known to us to be the beneficial owner of more than five percent (5%) of any class of our voting securities. We have no other class of voting securities other than common stock.

| Title of | | Name and address of | | Amount and nature of beneficial | | Percent of |

| class | | beneficial owner | | owner | | class |

| (1) | | (2) | | (3) | | (4)* |

| |

| |

| |

|

| |

| Common | | Jim Laird | | 1,250,000 common shares; owned 33% |

| | | PO Box 672 | | directly | | |

| | | Lions Bay, BC, V0N 2E0 | | | | |

* Based on 3,750,000 shares of common stock outstanding as of December 31, 2006 and 3,750,000 shares of common stock outstanding as of December 31, 2007.

14

(b)Security Ownership of Management

The following sets forth each class of our equity securities, including directors' qualifying shares, beneficially owned by all our directors and nominees, and our directors and executive officers as a group.

| Title of | | Name of | | Amount and nature of | | Percent of |

| Class | | beneficial owner | | beneficial ownership | | Class* |

| (1) | | (2) | | (3) | | (4) |

| |

| |

| |

|

| |

| Common | | Jim Laird | | 1,250,000 common shares; | | 33% |

| | | President, Secretary, | | owned directly | | |

| | | Treasurer and Director | | | | |

| |

| |

| |

|

| |

| All Directors and | | - | | 1,250,000 common shares | | 33% |

| Officers | | | | | | |

| as a Group | | | | | | |

| |

| |

| |

|

* Based on 3,750,000 shares of common stock outstanding as of December 31, 2006 and 3,750,000 shares of common stock outstanding as of December 31, 2007.

(c)Changes in Control

None.

| ITEM 12. | | CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS |

| (a) | | Transactions With Related Persons |

As of the date of this report, there are no, and have not been since inception, any material agreements or proposed transactions, whether direct or indirect, with any director, executive officer, nominee for election as a director, principal security holder or any relative or spouse of such persons.

(b)Parents

None.

(c)Promoters and Control Persons

Not applicable.

(d)Director Independence |

We currently have only one (1) director, Jim Laird. Mr. Laird is not considered independent as he is our currently acting President, Secretary and Treasurer.

15

| 31 | Certifications by our Chief Executive Officer and Chief Financial Officer pursuant to Rule 13a-14(a) of the Exchange Act, as adopted pursuant to Section 302 of the Sarbanes- Oxley Act of 2002. |

| |

| 32 | Certifications by our Chief Executive Officer and Chief Financial Officer Pursuant to 18 U.S.C. Section 1350, as Adopted Pursuant to Section 906 of the Sarbanes-Oxley Act of 2002. |

| |

| ITEM 14. | | PRINCIPAL ACCOUNTANT FEES AND SERVICES |

| (a) | | Audit Fees |

For the fiscal year ended December 31, 2006 we paid Moore and Associates $3,000 in audit fees. For the fiscal year ended December 31, 2007, we paid Moore and Associates $3,000 in audit fees. We had no audit fees for fiscal year 2005 as we were not formed until March 10, 2006.

(b)Audit-Related Fees

None.

(c)Tax Fees

None.

(d)All Other Fees

None.

(e)Policies and Procedures for Approval of Audit and Non-Audit Services:

We do not currently have an audit committee and have not had an audit committee since our date of inception. Our Board approves all audit and non-audit services.

Pursuant to the requirements of Section 13 or 15(d) of the Securities and Exchange Act of 1934, we have duly caused this report to be signed on our behalf by the undersigned, thereunto duly authorized.

| | By: /s/ Jim Laird

Jim Laird, President, Secretary and

Treasurer (principal executive officer,

principal financial officer and principal

accounting officer) |

16

MOORE & ASSOCIATES, CHARTERED

ACCOUNTANTS AND ADVISORSPCAOB REGISTERED

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Board of Directors

Harrison Mining, Inc.

(An Exploration Stage Company) |

We have audited the accompanying balance sheets of Harrison Mining, Inc. (An Exploration Stage Company) as of December 31, 2007 and 2006 (Restated), and the related statements of operations, stockholders’ equity and cash flows for the year ended December 31, 2007, for the period from inception on March 10, 2006 to December 31, 2006 (Restated), and cumulative amounts from inception on March 10, 2006 to December 31, 2007. These financial statements are the responsibility of the Company’s management. Our responsibility is to express an opinion on these financial statements based on our audits.

We conducted our audit in accordance with standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audits to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements referred to above present fairly, in all material respects, the financial position of Harrison Mining, Inc. (An Exploration Stage Company) as of December 31, 2007 and 2006 (Restated), and the related statements of operations, stockholders’ equity and cash flows for the year ended December 31, 2007, for the period from inception on March 10, 2006 to December 31, 2006 (Restated), and cumulative amounts from inception on March 10, 2006 to December 31, 2007, in conformity with accounting principles generally accepted in the United States of America.

The accompanying financial statements have been prepared assuming that the Company will continue as a going concern. As discussed in Note 3 to the financial statements, the Company has incurred a net loss of $14,225 for the period from inception on March 10, 2006 to December 31, 2007 and has not generated any revenues. These factors raise substantial doubt about its ability to continue as a going concern. Management’s plans concerning these matters are also described in Note 3. The financial statements do not include any adjustments that might result from the outcome of this uncertainty.

/s/ Moore & Associates, Chartered

Moore & Associates Chartered Las Vegas, Nevada January 5, 2009

6490 West Desert Inn Rd, Las Vegas, NV 89146 (702) 253-7499 Fax (702) 253-7501

HARRISON MINING INC.

(An Exploration Stage Company)

Financial Statements |

From Inception (March 10, 2006) to December 31, 2007

Harrison Mining Inc.

(An Exploration Stage Company)

Financial Statements

(Stated in US Dollars) |

| From Inception (March 10, 2006) to December 31, 2007 | | Page |

| |

|

| Report of Independent Registered Public Accounting Firm | | 3 |

| Balance Sheets | | 4 |

| Statements of Operations | | 5 |

| Statements of Cash Flows | | 6 |

| Statements of Stockholder’s Equity (Deficit) | | 7 |

| Notes to the Financial Statements | | 8-12 |

F-1

HARRISON MINING INC.

BALANCE SHEETS

(An Exploration Stage Company)

(Stated in US Dollars) |

| |

| | | December 31, | | December 31, |

| | | 2007 | | 2006 |

| | | | | (Restated) |

| ASSETS | |

| |

|

| CURRENT ASSETS |

| Cash and Equivalents | | | | |

| Total Current Assets | | $- | | $- |

| |

| |

|

| TOTAL ASSETS | | $- | | $- |

| | |

| |

|

| |

| CURRENT LIABILITIES | | | | |

| Accounts Payables | | $725 | | $475 |

| Total Current Liabilities | |

725 | |

475 |

| | | | | |

| | | | | |

| TOTAL LIABILITIES | | 725 | | 475 |

| |

| STOCKHOLDERS' EQUITY (Deficit) | | | | |

| 100,000,000 Common Shares Authorized, | | | | |

| $0.001 par value | | | | |

| 3,750,000 Shares Issued and outstanding at | | | | |

| December 31, 2007 and 2006 respectively. | | 3,750 | | 3,750 |

| Paid in Capital | | 9,750 | | 6,750 |

| Accumulated Deficit During Exploration Stage | | | | |

| Retained Earnings (Loss) | | (14,225) | | (10,975) |

| TOTAL STOCKHOLDERS EQUITY (Deficit) | |

(725) | |

(475) |

| |

| TOTAL LIABILITIES & | | | | |

| STOCKHOLDER'S EQUITY | | $ - | | $ - |

| | |

| |

|

The accompanying notes are an integral part of these financial statements

F-2

HARRISON MINING INC. STATEMENTS OF OPERATIONS

From Inception (March 10, 2006) to December 31, 2007

| (An Exploration Stage Company) |

| (Stated in US Dollars) |

| |

| |

| | | | | Period from March | | Cumulative amounts |

| | | Year ended | | 10, 2006 (Date of | | from March 10, 2006 |

| | | December 31, | | Inception) to | | (Date of Inception) to |

| | | 2007 | | December 31, 2006 | | December 31, 2007 |

| | | | | (Restated) | | |

| | |

| |

| |

|

| |

| Revenue | | $- | | $- | | $- |

| | |

| |

| |

|

| |

| Expenses | | | | | | |

| Incorporation | | 250 | | 475 | | 725 |

| General & | | 3,000 | | 3,000 | | 6,000 |

| Administrative | | | | | | |

| Expenses | | | | | | |

| | |

| |

| |

|

| |

| Total Expenses | | 3,250 | | 3,475 | | 6,725 |

| | |

| |

| |

|

| |

| Other Income and | | | | | | |

| Expenses | | | | | | |

| Impairment (loss) of | | $ 0 | | $ (7,500) | | $ (7,500) |

| Mineral Rights | | | | | | |

| | |

| |

| |

|

| |

| Provision for Income | | $ 0 | | $ 0 | | $ 0 |

| Taxes | | | | | | |

| | |

| |

| |

|

| |

| Net (Loss) | | $ (3,250) | | $ (10,975) | | $ (14,225) |

| | |

| |

| |

|

| |

| Basic And Diluted (Loss) | | | | | | |

| Per Share | | $ (0.00) | | $ (0.00) | | |

| | |

| |

| | |

| |

| Weighted Average | | | | | | |

| Number Of Shares | | 3,750,000 | | 3,750,000 | | |

| Outstanding | | | | | | |

The accompanying notes are an integral

part of these financial statements. F-3 |

HARRISON MINING INC.

STATEMENTS OF CASH FLOWS |

From Inception (March 10, 2006) to December 31, 2007

(An Exploration Stage Company)

(Stated in US Dollars) |

| | | | | Period from March 10, | | Cumulative amounts |

| | | Year ended | | 2006 (Date of | | from March 10, 2006 |

| | | December 31, | | Inception) to | | (Date of Inception) |

| | | 2007 | | December 31, 2006 | | to December 31, 2007 |

| | | | | (Restated) | | |

| |

| |

| |

|

| |

| Operating Activities | | | | | | |

| Net loss for the period | | $ (3,235) | | $(10,975) | | $(14,225) |

| | |

| |

| |

|

| |

| Adjustments to | | | | | | |

| Reconcile Net Loss to | | | | | | |

| Net Cash Used by | | | | | | |

| Operating Activities | | | | | | |

| Accounts payable and | | | | | | |

| accrued liabilities | | $ 250 | | $475 | | $725 |

| | |

| |

| |

|

| Net Cash Flows | | | | | | |

| used in Operating | | $ (3,000) | | $(10,500) | | $ (13,500) |

| Activities | | | | | | |

| | |

| |

| |

|

| |

| Investing Activities | | | | | | |

| | |

| |

| |

|

| Net Cash Flows | | | | | | |

| Used In Investing | | | | | | |

| Activities | | $ - | | $- | | $- |

| | |

| |

| |

|

| |

| |

| Financing Activities | | | | | | |

| Issuance of common | | $ 0 | | $3,750 | | $3,750 |

| shares | | | | | | |

| | |

| |

| |

|

| Additional Paid-in | | $ 3,000 | | $6,750 | | $9,750 |

| Capital | | | | | | |

| | |

| |

| |

|

| Net Cash Flows | | | | | | |

| provided by | | $ 3,000 | | $10,500 | | $13,500 |

| Financing | | | | | | |

| Activities | | | | | | |

| | |

| |

| |

|

| Net increase (decrease) in | | $ 0 | | $0 | | $0 |

| cash | | | | | | |

| | |

| |

| |

|

| |

| |

| Cash/Cash Equivalents, | | $ - | | $- | | $- |

| Beginning Of Period | | | | | | |

| | |

| |

| |

|

| |

| Cash/Cash Equivalents, | | $ - | | $- | | $- |

| End Of Period | | | | | | |

| | |

| |

| |

|

| The accompanying notes are an integral |

| part of these financial statements. |

F- 4

| HARRISON MINING INC. |

| STATEMENTS OF STOCKHOLDER’S EQUITY (DEFICIT) |

| From Inception (March 10, 2006) to December 31, 2007 |

| (An Exploration Stage Company) |

| (Stated in US Dollars) |

| |

| | | Common Stock | | Additional | | Accumulated | | Total |

| | | Shares | | Amount | | Paid in | | Deficit | | Equity |

| | | | | | | Capital | | | | Deficit |

| | |

| |

| |

| |

| |

|

| |

| Common Stock Issued to | | | | | | | | | | |

| Founders | | | | | | | | | | |

| for Cash ($0.002 per | | 3,750,000 | | $ 3,750 $ | | 3,750 | | - | | $ 7,500 |

| share) on March 10, 2006 | | | | | | | | | | |

| |

| Contributed Capital | | - | | - $ | | 3,000 | | - | | $ 3,000 |

| on June 20, 2006 | | | | | | | | | | |

| |

| Net (Loss) for Period | | | | | | | | | | |

| Ended December 31, 2006 | | - | | - | | - $ | | (10,975) | | $ (7,975) |

| | |

| |

| |

| |

| |

|

| |

| Balance, December 31, | | | | | | | | | | |

| 2006 (Restated) | | 3,750,000 | | $ 3,750 $ | | 6,750 $ | | (10,975) | | $ (475) |

| |

| Contributed Capital | | - | | - $ | | 3,000 | | - | | $ 3,000 |

| on October 3, 2007 | | | | | | | | | | |

| |

| Net (Loss) for Period | | | | | | | | | | |

| Ended December 31, 2007 | | - | | - | | - $ | | (3,250) | | $ (3,250) |

| | |

| |

| |

| |

| |

|

| |

| Balance, December 31, | | | | | | | | | | |

| 2007 | | 3,750,000 | | $ 3,750 $ | | 9,750 $ | | (14,225) | | $ (725) |

| | |

| |

| |

| |

| |

|

| |

| |

| The accompanying notes are an integral |

| part of these financial statements. |

F- 5

HARRISON MINING INC.

(An Exploration Stage Company)

Footnotes to the Financial Statements. |

From Inception (March 10, 2006) to December 31, 2007 (Stated in U.S. Dollars)

| NOTE 1 - | | ORGANIZATION AND DESCRIPTION OF BUSINESS |

| |

| | | The company was incorporated in the State of Nevada on March 10, 2006 as |

| | | Harrison Mining Inc. (the “Company”). The Company is engaged in the exploration, |

| | | development and production of uranium, precious and other metals. |

| |

| NOTE 2 - | | SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES |

| |

| | | a. Accounting Method |

| |

| | | The Company’s financial statements are prepared using the accrual method of |

| | | accounting. The Company has elected a December 31 year-end. |

| |

| | | b. Revenue Recognition |

| |

| | | The Company recognizes revenue when persuasive evidence of an arrangement |

| | | exists, goods delivered, the contract price is fixed or determinable and collectability |

| | | is reasonably assured. |

| |

| | | c. Income Taxes |

| |

| | | The provision for income taxes is the total of the current taxes payable and the net of |

| | | the change in the deferred income taxes. Provision is made for the deferred income |

| | | taxes where differences exist between the period in which transactions affect current |

| | | taxable income and the period in which they enter into the determination of net |

| | | income in the financial statements. |

| |

| | | The Company provides for income taxes under Statement of Financial Accounting |

| | | Standards (“SFAS”) No. 109, Accounting for Income Taxes. SFAS No. 109 requires |

| | | the use of an asset and liability approach in accounting for income taxes. Deferred |

| | | tax assets and liabilities are recorded based on the differences between the financial |

| | | statement and tax bases of assets and liabilities and the tax rates in effect when these |

| | | differences are expected to reverse. |

| |

| | | SFAS No. 109 requires the reduction of deferred tax assets by a valuation allowance |

| | | if, based on the weight of available evidence, it is more likely than not that some or |

| | | all of the deferred tax assets will not be realized. In the Company’s opinion, it is |

| | | uncertain whether they will generate sufficient taxable income in the future to fully |

| | | utilize the net deferred tax asset. |

| |

| | | The provision for income taxes is comprised of the net changes in deferred taxes less |

| | | the valuation account plus the current taxes payable. The Company has not yet filed |

| | | its federal income tax return for fiscal years 2006 or 2007. It expects to file such |

| | | returns by the end of the current fiscal year. |

F-6

HARRISON MINING INC.

(An Exploration Stage Company)

Footnotes to the Financial Statements. |

From Inception (March 10, 2006) to December 31, 2007 (Stated in U.S. Dollars)

| NOTE 2 - | | SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (continued) | | |

| |

| | | d. Foreign currency translation | | | | | | |

| |

| | | Foreign currency transactions are recorded at the rate of exchange on the date of the |

| | | transaction. At the balance sheet date, monetary assets and liabilities denominated in |

| | | foreign currencies are reported using the closing exchange rate. | | Exchange |

| | | differences arising on the settlement of transactions at rates different from those at |

| | | the date of the transaction, as well as unrealized foreign exchange differences on |

| | | unsettled foreign currency monetary assets and liabilities, are recognized in the |

| | | income statement. | | | | | | | | |

| |

| | | Unrealized exchange differences on non-monetary financial assets (investments in |

| | | equity instruments) are a component of the change in their entire fair value. For a |

| | | non-monetary financial asset unrealized exchange differences are recognized in the |

| | | income statement. | | For non-monetary financial investments, unrealized exchange |

| | | differences are recorded directly in Equity until the asset is sold or becomes |

| | | impaired. | | | | | | | | |

| |

| | | e. Use of Estimates | | | | | | | | |

| |

| | | The preparation of the financial statements in conformity with generally accepted |

| | | accounting principles (“GAAP”) requires management to make estimates and |

| | | assumptions that affect the reported amounts of assets and liabilities and disclosure of |

| | | contingent assets and liabilities at the date of the financial statements and the reported |

| | | amounts of revenues and expenses during the reporting period. Actual results could |

| | | differ from those estimates. | | | | | | |

| |

| | | f. Assets | | | | | | | | |

| | | The Company held no assets as of December 31, 2007 or December 31, 2006. |

| |

| | | | | December 31, | | | | December 31, |

| | | | | 2007 | | | | | | 2006 |

| | | ASSETS | | | | | | | | |

| |

| | | CURRENT ASSETS | | | | | | | | |

| | |

| |

| |

| |

| |

|

| | | Cash and Equivalents | | $ - | | $ - |

| | | | |

| |

|

| | | Total Current Assets | | | | | | | | |

| | |

| |

| |

| |

| |

|

| |

| | | FIXED ASSETS | | | | | | | | |

| | |

| |

| |

| |

| |

|

| | | Total Fixed Assets | | | | - | | | | - |

| | |

| |

| |

| |

| |

|

| |

| | | TOTAL ASSETS | | $ - | | $ - |

| | | | |

| |

|

F-7

HARRISON MINING INC.

(An Exploration Stage Company)

Footnotes to the Financial Statements. |

From Inception (March 10, 2006) to December 31, 2007 (Stated in U.S. Dollars)

NOTE 2 - SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (continued)

Mineral Property.

The Bee Uranium Property contains mineralization that is classified as a Rare Element Pegmatite. Economic deposits of this type are not recognized in British Columbia; however, they can be considered important sources of the rare elements niobium and yttrium. It is yet uncertain what potential exists for locating economic levels of uranium on the Bee property.

The following budget provided by an initial geological field assessment of the Bee Uranium Property is as follows:

Phase 1

Reconnaissance geological mapping, prospecting and rock sampling.

Estimated cost: $25,000.00 CDN ($21,451.75 US utilizing the prevailing exchange rate on December 31, 2006 of one Canadian dollar to 0.85807 US dollars and $25,484.00 US utilizing the prevailing exchange rate on December 31, 2007 of one Canadian dollar to 1.01936 US dollars).

Phase 2

Phase 2 involves a detailed geological mapping and rock sampling, grid construction, soil and silt geochemical survey, IP survey, establishing drill and trenching targets.

Estimated cost: $100,000.00 CDN ($85,807.00 US utilizing the prevailing exchange rate on December 31, 2006 of one Canadian dollar to 0.85807 US dollars and $101,936.00 US utilizing the prevailing exchange rate on December 31, 2007 of one Canadian dollar to 1.01936 US dollars).

F-8

HARRISON MINING INC.

(An Exploration Stage Company)

Footnotes to the Financial Statements. |

From Inception (March 10, 2006) to December 31, 2007 (Stated in U.S. Dollars)

NOTE 2 - SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (continued)

Phase 3

Phase 3 involves 1000 metres of diamond drilling including geological supervision, assays, report and other ancillary costs.

Estimated cost: $175,000.00 CDN ($150,162.25 US utilizing the prevailing exchange rate on December 31, 2006 of one Canadian dollar to 0.85807 US dollars and $178,388.00 US utilizing the prevailing exchange rate on December 31, 2007 of one Canadian dollar to 1.01936 US dollars.)

Total Phase 1 through Phase 3 Estimated Costs: $300,000.00 CDN ($257,421.00 US utilizing the prevailing exchange rate on December 31, 2006 of one Canadian dollar to 0.85807 US dollars and $305,808.00 US utilizing the prevailing exchange rate on December 31, 2007 of one Canadian dollar to 1.01936 US dollars.)

g. Income (Loss)

Income represents all of the Company’s revenue less all its expenses in the period incurred. The Company had no revenues as of December 31, 2006 or December 31, 2007. During the year ended December 31, 2007, the Company incurred $3,250 in expenses representing incurred corporate filing fees. During the year ended December 31, 2006, the Company incurred $10,975 in expenses of which $7,500 represented recognition of an impairment loss for the mineral claims and $3,475 for incorporation costs.

In accordance with FASB/FAS 142 option 12, paragraph 11 “Intangible Assets Subject to Amortization”, a recognized intangible asset shall be amortized over its useful life to the reporting entity unless that life is determined to be indefinite. If an intangible asset has been has a finite useful life, but the precise length of that life is not known, that intangible asset shall be amortized over the best estimate of its useful life. The method of amortization shall reflect the pattern in which the economic benefits of the intangible asset are consumed or otherwise used up. If that pattern cannot be reliable determined, a straight-line amortization method shall be used. An intangible asset shall not be written down or off in the period of acquisition unless it becomes impaired during that period.

F-9

| | | HARRISON MINING INC. |

| | | (An Exploration Stage Company) |

| | | Footnotes to the Financial Statements. |

| | | From Inception (March 10, 2006) to December 31, 2007 |

| | | (Stated in U.S. Dollars) |

| |

| NOTE 2 - | | SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (continued) |

| | | | | Period from March | | Cumulative amounts |

| | | Year ended | | 10, 2006 (Date of | | from March 10, 2006 |

| | | December 31, 2007 | | Inception) to | | (Date of Inception) to |

| | | | | December 31, 2006 | | December 31, 2007 |

| | |

| |

| |

|

| |

| Revenue | | $ - | | $ - | | $ - |

| | |

| |

| |

|

| |

| Expenses | | | | | | |

| Incorporation | | 250 | | 475 | | 725 |

| General & | | 3,000 | | 3,000 | | 6,000 |

| Administrative | | | | | | |

| Expenses | | | | | | |

| | |

| |

| |

|

| |

| Total Expenses | | 3,250 | | 3,475 | | 6,725 |

| | |

| |

| |

|

| |

| Other Income and | | | | | | |

| Expenses | | | | | | |

| Impairment (loss) | | $ 0 | | $ (7,500) | | $ (7,500) |

| of Mineral Rights | | | | | | |

| | |

| |

| |

|

| |

| Net (Loss) | | $ (3,250) | | $ (10,975) | | $ (14,225) |

| | |

| |

| |

|

h. Basic Earnings (Loss) Per Share

In accordance with SFAS No. 128-“Earnings Per Share”, the basic loss per common share is computed by dividing net loss available to common stockholders by the weighted average number of common shares outstanding. Diluted loss per common share is computed similar to basic loss per common share except that the denominator is increased to include the number of additional common shares that would have been outstanding if the potential common shares had been issued and if the additional common shares were dilutive. At December 31, 2006 and December 31, 2007, the Company has no stock equivalents that were anti-dilutive and excluded in the earnings per share computation.

| | | Year ended December | | Period from March 10, |

| | | 31, 2007 | | 2006 (Date of Inception) |

| | | | | to December 31, 2006 |

| |

| |

|

| |

| Net (Loss) | | $ (3,250) | | $ (10,975) |

| | |

| |

|

| |

| Basic And Diluted | | | | |

| (Loss) Per Share | | $ (0.00) | | $ (0.00) |

| | |

| |

|

| |

| Weighted Average | | | | |

| Number Of Shares | | 3,750,000 | | 3,750,000 |

| Outstanding | | | | |

F-10

HARRISON MINING INC.

(An Exploration Stage Company)

Footnotes to the Financial Statements. |

From Inception (March 10, 2006) to December 31, 2007 (Stated in U.S. Dollars)

| NOTE 2 - | | SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (continued) |

| | | i. Cash and Cash Equivalents | | | | |

| | | For purposes of the statement of cash flows, the Company considers all highly liquid |

| | | investments purchased with maturity of three months or less to be cash equivalents. |

| | | | | | | December 31, | | December 31, |

| | | | | | | 2007 | | 2006 |

| | | | |

| |

| |

|

| |

| | | ASSETS | | | | | | |

| | | CURRENT ASSETS | | | | | | |

| | |

| |

| |

| |

|

| | | Cash and Equivalents | | $ - | | $ - |

| | | | |

| |

|

| | | Total Current Assets | | | | | | |

| j. | Liabilities |

| |

| | Liabilities are made up of current liabilities. |

| |

| | Current liabilities include accounts payable of $725 on aggregate. |

| |

| | | December 31, | | December 31, |

| | | 2007 | | 2006 |

| | |

| |

|

| |

| CURRENT LIABILITIES | | | | |

| |

| |

|

| Accounts Payable | | $ 725 | | $ 475 |

| | |

| |

|

| Total Current Liabilities | | $ 725 | | $ 475 |

| |

| |

|

| |

| LONG-TERM LIABILITIES | | | | |

| |

| |

|

| Total Long-Term Liabilities | | $ - | | $ - |

| |

| |

|

| |

| TOTAL LIABILITIES | | $ 725 | | $ 475 |

| |

| Share Capital | | | | |

| a) | Authorized: 100,000,000 common shares with a par value of $0.001. |

| |

| b) | Issued: As of December 31, 2006 and December 31, 2007, there were three millionseven hundred fifty thousand(3,750,000) shares issued and outstanding at a value of $0.002 per share for a total of $7,500. |

| |

F-11

HARRISON MINING INC.

(An Exploration Stage Company)

Footnotes to the Financial Statements. |

From Inception (March 10, 2006) to December 31, 2007 (Stated in U.S. Dollars)

NOTE 2 - SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (continued)

The Company has no stock option plan, warrants or other dilutive securities.

The accompanying financial statements have been prepared assuming that the Company will continue as a going concern, which contemplates the realization of assets and the liquidation of liabilities in the normal course of business. However, the Company has accumulated a loss and is new. This raises substantial doubt about the Company’s ability to continue as a going concern. The financial statements do not include any adjustments that might result from this uncertainty.

As shown in the accompanying financial statements, the Company has incurred a net (loss) of ($14,225) for the period from March 10, 2006 (inception) to December 31, 2007 and has not generated any revenues. The future of the Company is dependent upon its ability to obtain financing and upon future profitable operations from the development of acquisitions. Management has plans to seek additional capital through a private placement and public offering of its common stock. The financial statements do not include any adjustments relating to the recoverability and classification of recorded assets, or the amounts of and classification of liabilities that might be necessary in the event the Company cannot continue in existence.

NOTE 4 - RESTATEMENT OF 2006 FINANCIAL STATEMENTS

The Company restated its balance sheet dated December 31, 2006 and statement of operations for the year ended December 31, 2006 to reflect certain expenses that were not previously recorded. The Company incurred $3,475 of total expenses in 2006 as opposed to $725 as previously reported. A comparison of the original to the restated numbers is as follows:

| Restated | Original |

| December 31, 2006 | | |

| Total Current Liabilities | 475 | 725 |

Total Long-Term Liabilities Total Liabilities | -

475 | -

725 |

Common Stock |

3,750 |

3,750 |

| Additional Paid-in-Capital | 6,750 | 3,750 |

| Accumulated Deficit | (10,975) | (8,225) |

Total Stockholders' Equity |

(475) |

(725) |

Incorporation Expense |

475 |

725 |

| General & Administrative Expenses |

(3,000) |

- - |

| Net Income (Loss) |

(10,975) |

(8,225) |

|

|

|

F-12