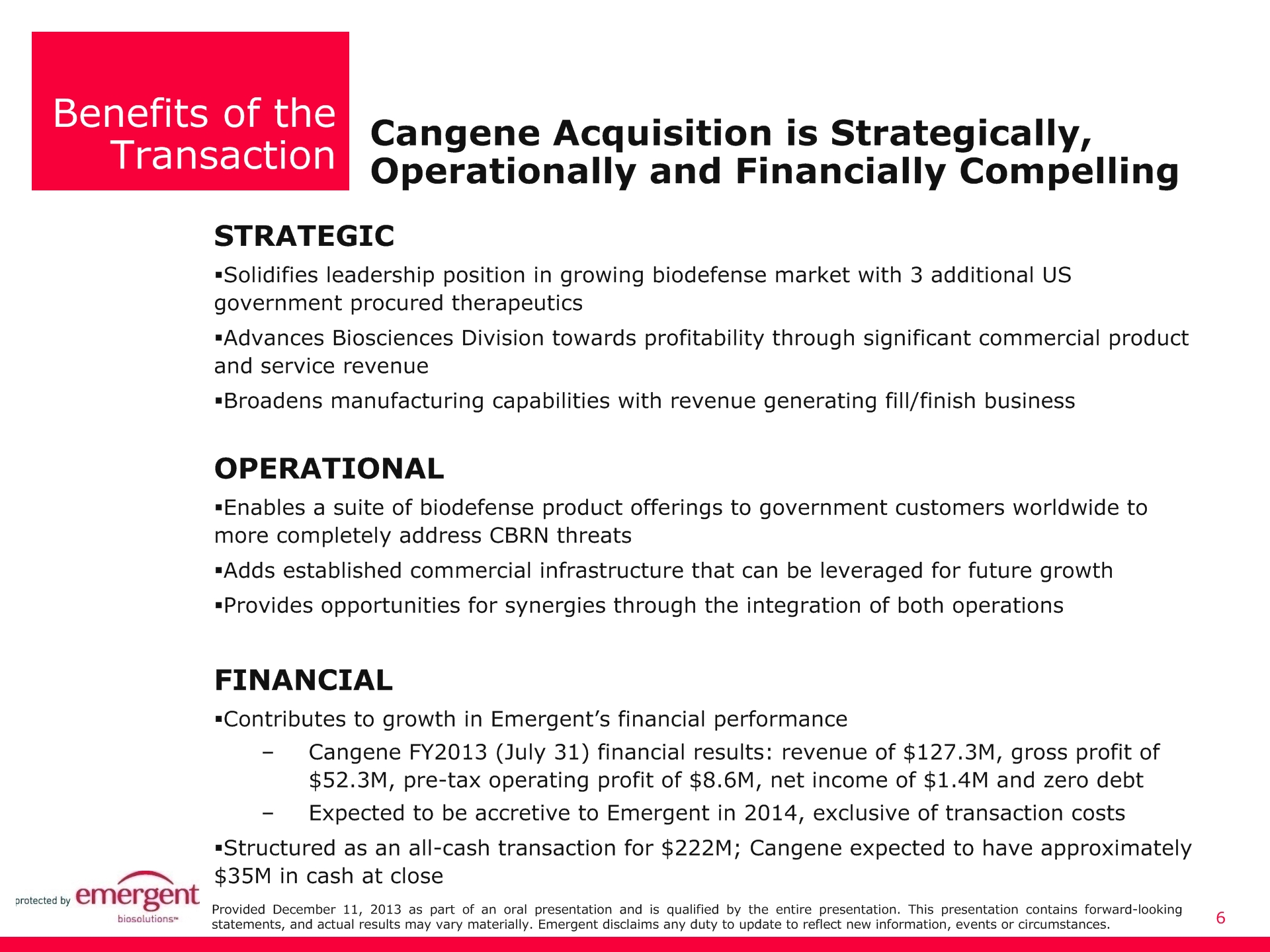

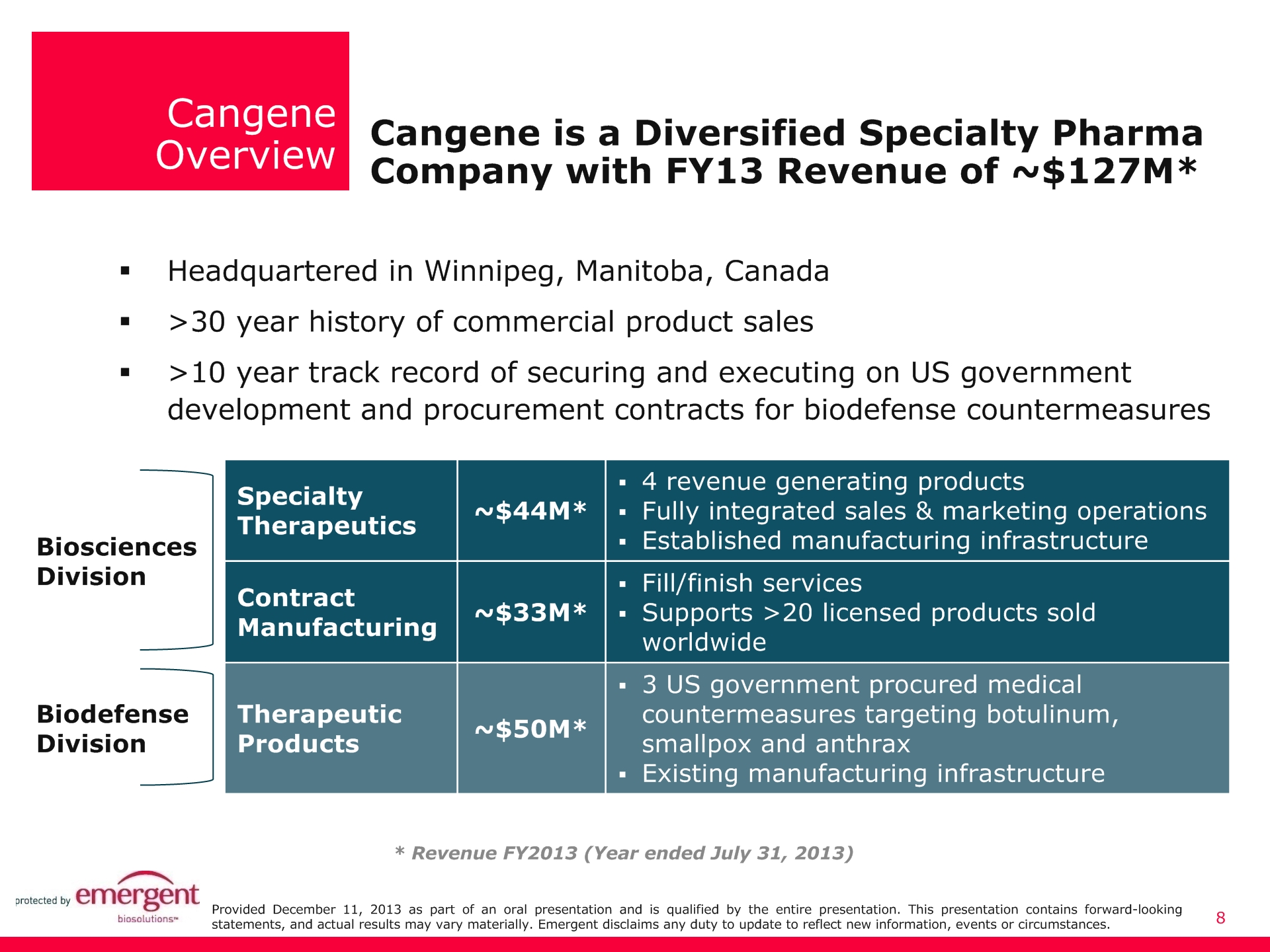

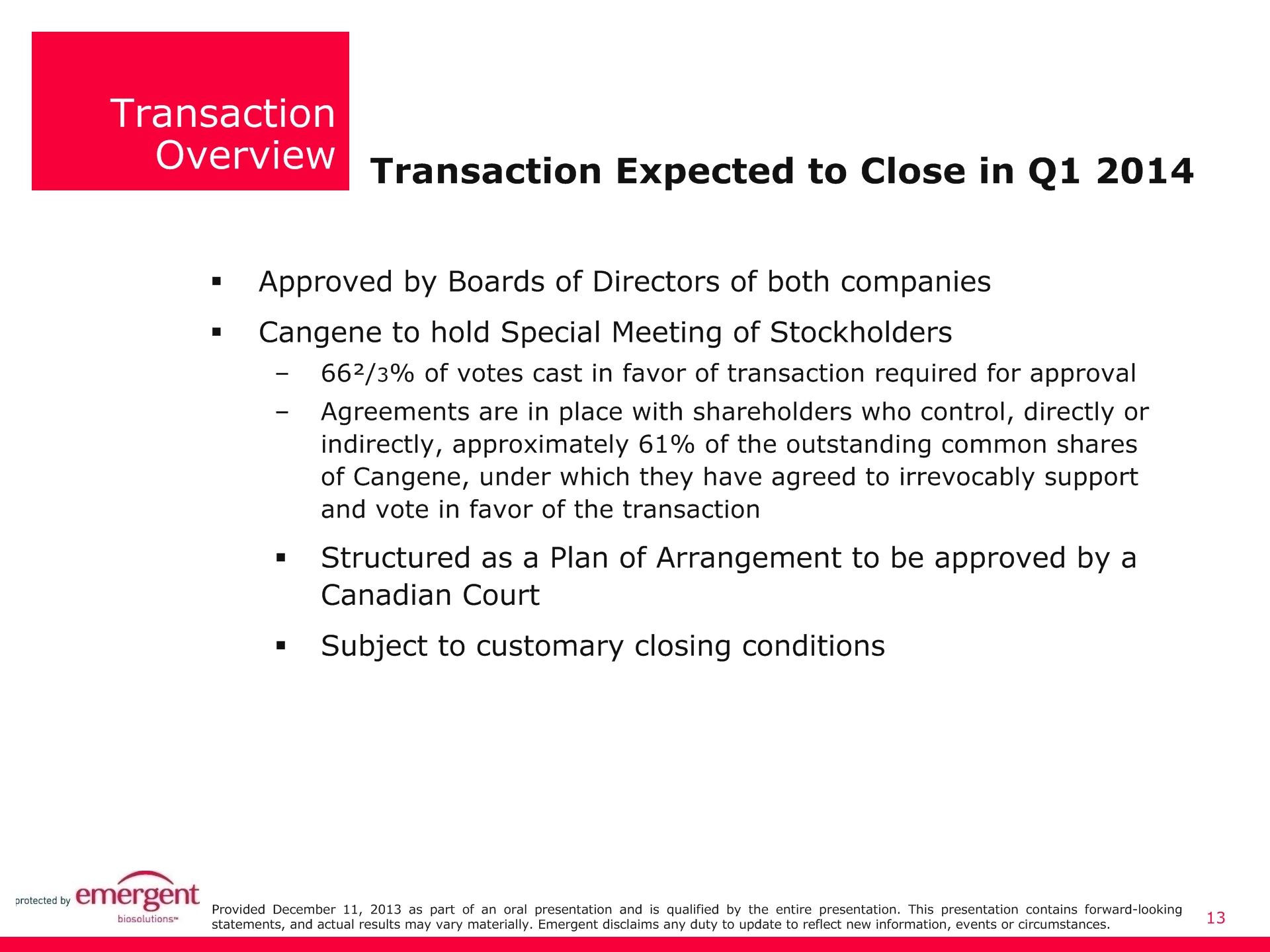

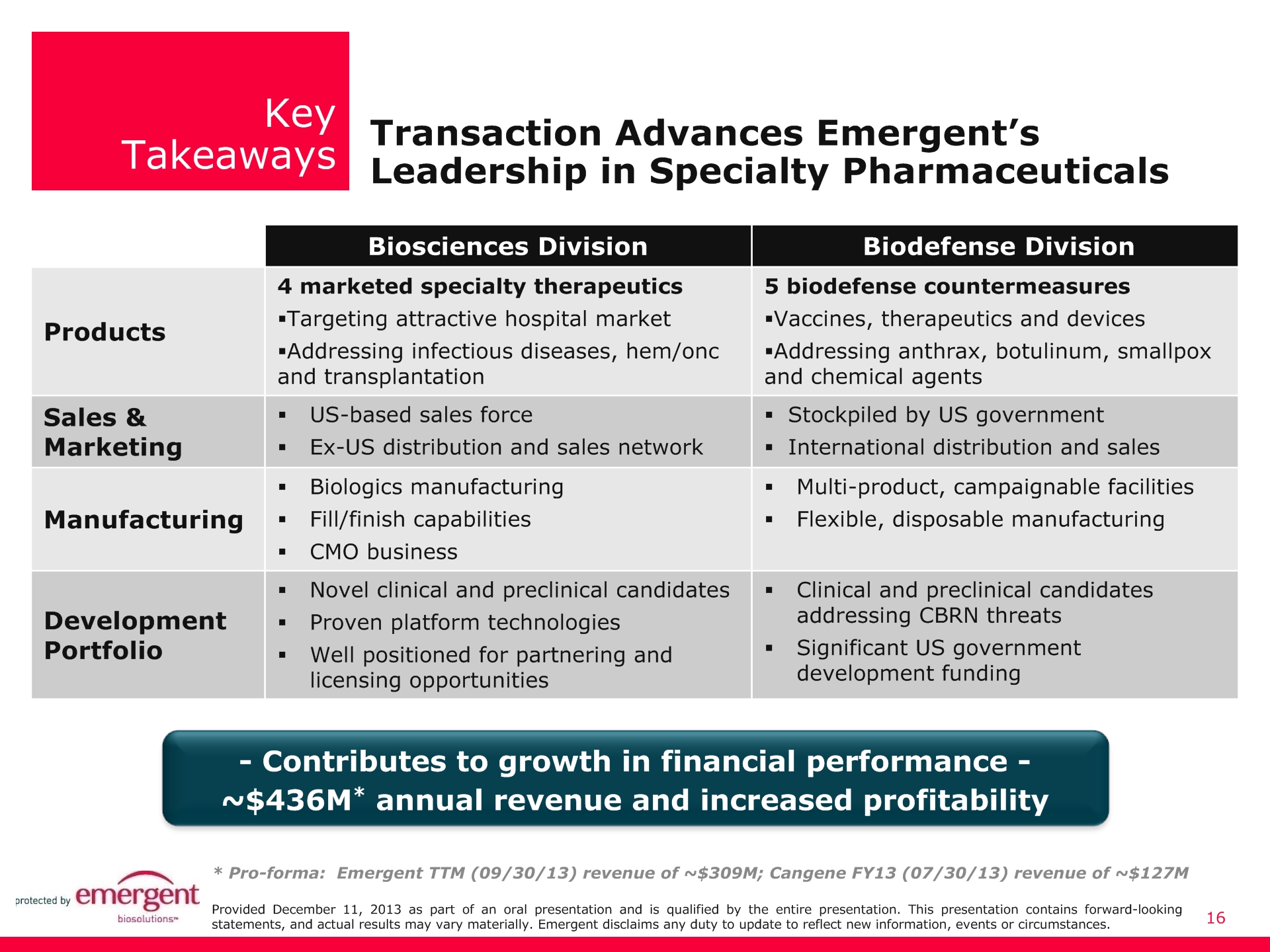

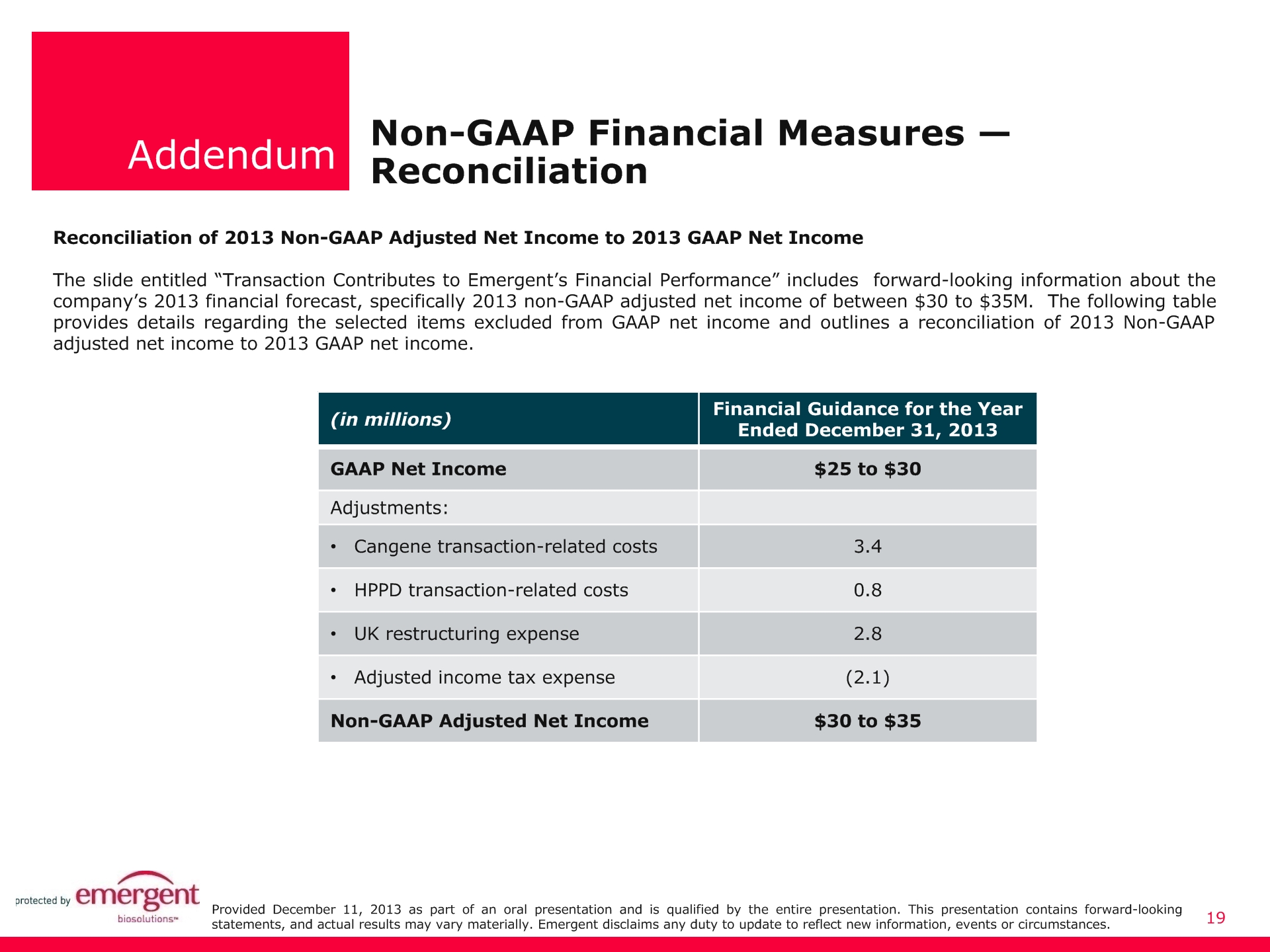

PROPRIETARY AND CONFIDENTIAL This presentation includes forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Any statements, other than statements of historical fact, including statements regarding the expected closing of the transaction, the potential opportunities and financial impact of the transaction, our financial guidance, and any other statements containing the words "believes", "expects", "anticipates", "intends", "plans", "forecasts", "estimates" and similar expressions, are forward-looking statements. These forward-looking statements are based on our current intentions, beliefs and expectations regarding future events. We cannot guarantee that any forward-looking statement will be accurate. Investors should realize that if underlying assumptions prove inaccurate or unknown risks or uncertainties materialize, actual results could differ materially from our expectations. Investors are, therefore, cautioned not to place undue reliance on any forward-looking statement. Any forward-looking statement speaks only as of the date of this press release, and, except as required by law, we do not undertake to update any forward-looking statement to reflect new information, events or circumstances.There are a number of important factors that could cause the company's actual results to differ materially from those indicated by such forward-looking statements, including uncertainties as to the satisfaction of closing conditions with respect to the transaction, including the timing and receipt of Cangene shareholder, Canadian court and regulatory approvals; our ability to successfully integrate the business and realize the potential benefits of the transaction; appropriations for BioThrax® procurement; our ability to successfully integrate the recent acquisition of the HPPD business and realize the benefits of the HPPD transaction; our ability to obtain new BioThrax sales contracts or modifications to existing contracts; our plans to pursue label expansions and improvements for BioThrax; availability of funding for our U.S. government grants and contracts; our ability to identify and acquire or in-license products or late-stage product candidates that satisfy our selection criteria; whether anticipated synergies and benefits from an acquisition or in-license are realized within expected time periods or at all; our ability to enter into selective collaboration arrangements; our ability to expand our manufacturing facilities and capabilities; the rate and degree of market acceptance and clinical utility of our products; the success of our ongoing and planned development programs; the timing of and our ability to obtain and maintain regulatory approvals for our product candidates; and our commercialization, marketing and manufacturing capabilities and strategy. The foregoing sets forth many, but not all, of the factors that could cause actual results to differ from our expectations in any forward-looking statement. Investors should consider this cautionary statement, as well as the risk factors identified in our periodic reports filed with the SEC, when evaluating our forward-looking statements.The guidance in this presentation was only effective as of the date originally given and this presentation does not constitute an update or affirmation of such guidance. * Emergent Acquisition of Cangene Forward Looking Statements Provided December 11, 2013 as part of an oral presentation and is qualified by the entire presentation. This presentation contains forward-looking statements, and actual results may vary materially. Emergent disclaims any duty to update to reflect new information, events or circumstances.