Excerpts from the Information Statement of Aptevo Therapeutics Inc., dated July 22, 2016

CERTAIN RELATIONSHIPS AND RELATED PARTY TRANSACTIONS

Agreements with Emergent

Following the separation and distribution, Aptevo and Emergent will operate separately, each as an independent public company. Aptevo will enter into a separation and distribution agreement with Emergent, which is referred to in this information statement as the "separation agreement," to effect the separation. In connection with the separation, Aptevo will also enter into various other agreements to provide a framework for its relationship with Emergent after the separation, including a transition services agreement, a tax matters agreement, an employee matters agreement, a manufacturing services agreement, a Canadian distributor agreement, a trademark license agreement and a product license agreement. These agreements will provide for the allocation between Aptevo and Emergent of Emergent's assets, liabilities and obligations (including investments, property and employee benefits, and tax-related assets and liabilities) attributable to periods prior to, at and after Aptevo's separation from Emergent and will govern certain relationships between Aptevo and Emergent after the separation.

The material agreements described below will be filed as exhibits to the registration statement on Form 10 of which this information statement is a part. The summaries of each of these agreements set forth the terms of the agreements that we believe are material. These summaries are qualified in their entireties by reference to the full text of the applicable agreements, which are incorporated by reference into this information statement. When used in this section, "distribution date" refers to the date on which Emergent distributes Aptevo common stock to the holders of Emergent common stock.

Separation Agreement

Transfer of Assets and Assumption of Liabilities

The separation agreement will identify the assets to be transferred, the liabilities to be assumed and the contracts to be assigned to each of Aptevo and Emergent as part of the separation of Emergent into two companies, and will provide for when and how these transfers, assumptions and assignments will occur. Certain of the necessary transfers, assumptions and assignments will be accomplished through the internal reorganization. In particular, the separation agreement will provide that, among other things, subject to the terms and conditions contained therein:

| • | certain assets related to Emergent's biosciences business (and certain legacy businesses and operations of Aptevo), which we refer to as the "Aptevo Assets," will be transferred to Aptevo or one of its subsidiaries; |

| • | certain liabilities related to Aptevo's business or the Aptevo Assets, which we refer to as the "Aptevo Liabilities," will be retained by or transferred to Aptevo, including certain liabilities associated with previously consummated divestitures of assets primarily related to the biosciences business; and |

| • | all of the assets and liabilities (including whether accrued, contingent or otherwise) other than the Aptevo Assets and Aptevo Liabilities (such assets and liabilities, other than the Aptevo Assets and the Aptevo Liabilities, we refer to as the "Excluded Assets" and "Excluded Liabilities," respectively) will be retained by or transferred to Emergent. |

Except as expressly set forth in the separation agreement or any ancillary agreement, neither Aptevo nor Emergent will make any representation or warranty as to the assets, business or liabilities transferred or assumed as part of the separation, as to any approvals or notifications required in connection with the transfers, as to the value of or the freedom from any security interests of any of the assets transferred, as to the absence or presence of any defenses or right of setoff or freedom from counterclaim with respect to any claim or other asset of either Aptevo or Emergent, or as to the legal sufficiency of any assignment, document or instrument delivered to convey title to any asset or thing of value to be transferred in connection with the separation. All assets will be transferred on an "as is," "where is" basis, and the respective transferees will bear the economic and legal risks that any conveyance will prove to be insufficient to vest in the transferee good and marketable title, free and clear of all security interests, that any necessary consents or governmental approvals are not obtained, or that any requirements of law, agreements, security interests, or judgments are not complied with.

Information in this information statement with respect to the assets and liabilities of the parties following the distribution is presented based on the allocation of such assets and liabilities pursuant to the separation agreement, unless the context otherwise requires. The separation agreement will provide that, in the event that the transfer or assignment of certain assets and liabilities to Aptevo or Emergent, as applicable, does not occur prior to the separation, then until such assets or liabilities are able to be transferred or assigned, Aptevo or Emergent, as applicable, will hold such assets in trust for the other party.

The Distribution

The separation agreement will also govern the rights and obligations of the parties regarding the distribution following the completion of the separation. On the distribution date, Emergent will distribute to its stockholders that hold Emergent common stock as of the record date for the distribution all of the issued and outstanding shares of Aptevo common stock on a pro rata basis. Stockholders will receive cash in lieu of any fractional shares, if applicable.

Conditions to the Distribution

The separation agreement will provide that the distribution is subject to satisfaction (or waiver by Emergent) of certain conditions. These conditions are described under "The Separation and Distribution—Conditions to the Distribution." Emergent will have the sole and absolute discretion to determine (and change) the terms of, and to determine whether to proceed with, the distribution and, to the extent that it determines to so proceed, to determine the record date for the distribution and the distribution date.

Claims

In general, each party to the separation agreement will assume liability for all pending, threatened and unasserted legal matters related to its own business or its assumed or retained liabilities and will indemnify the other party for any liability to the extent arising out of or resulting from such assumed or retained legal matters.

Releases

The separation agreement will provide that Aptevo and its affiliates will release and discharge Emergent and its affiliates from all liabilities assumed by Aptevo as part of the separation, from all acts and events occurring or failing to occur, and all conditions existing, on or before the distribution date relating to Aptevo's business, and from all liabilities existing or arising in connection with the implementation of the separation, except as expressly set forth in the separation agreement. Emergent and its affiliates will release and discharge Aptevo and its affiliates from all liabilities retained by Emergent and its affiliates as part of the separation and from all liabilities existing or arising in connection with the implementation of the separation, except as expressly set forth in the separation agreement.

These releases will not extend to obligations or liabilities under any agreements between the parties that remain in effect following the separation, which agreements include, but are not limited to, a transition services agreement, a tax matters agreement, an employee matters agreement, a manufacturing services agreement, a Canadian distributor agreement, a trademark license agreement and a product license agreement.

Indemnification

In the separation agreement, Aptevo will agree to indemnify, defend and hold harmless Emergent, each of Emergent's affiliates and each of Emergent and its affiliates' respective directors, officers and employees, from and against all liabilities relating to, arising out of or resulting from:

| • | the failure of Aptevo, any subsidiary of Aptevo, or any person controlled by Aptevo, which we refer to as the "Aptevo Group" or any other person to pay, perform or otherwise promptly discharge any Aptevo Liabilities or Aptevo Contract in accordance with its respective terms, whether prior to, on or after the distribution date; |

| • | the business and operations of the biosciences business and related businesses and operations (except to the extent it constitutes an Excluded Liability), any Aptevo Liability or any Aptevo Contract; |

| • | any breach by Aptevo or any other member of the Aptevo Group of the separation agreement or any of the ancillary agreements; |

| • | except to the extent it constitutes an Excluded Liability, any guarantee, indemnification obligation, letter of credit reimbursement obligation, surety, bond or other credit support agreement, arrangement, commitment or understanding for the benefit of any member of the Aptevo Group by Emergent, any subsidiary of Emergent, any person controlled by Emergent, which we refer to as the "Emergent Group," that survives following the distribution; and |

| • | any untrue statement or alleged untrue statement in the registration statement on Form 10, including within this information statement, of a material fact, except to the extent related exclusively to Emergent Group, Emergent Business, Emergent's intentions with respect to the distribution or terms of the distribution. |

Emergent will agree to indemnify, defend and hold harmless Aptevo, each of Aptevo's affiliates and each of Aptevo's and Aptevo's affiliates' respective directors, officers and employees from and against all liabilities relating to, arising out of or resulting from:

| • | the failure of Emergent or any other member of the Emergent Group or any other person to pay, perform or otherwise promptly discharge any Excluded Liabilities in accordance with their terms, whether prior to, on or after the distribution date; |

| • | the Excluded Liabilities; |

| • | the businesses and operations of the Emergent Group other than the biosciences business (except to the extent it constitutes an Aptevo Liability and other than the conduct of business, operations or activities for the benefit of the Aptevo Group pursuant to any ancillary agreement); |

| • | any breach by Emergent or any other member of the Emergent Group of the separation agreement or any of the ancillary agreements; and |

| • | any untrue statement or alleged untrue statement in the registration statement on Form 10, including within this information statement, of a material fact, solely to the extent such statement or omission is related exclusively to Emergent Group, Emergent Business, Emergent's intentions with respect to the distribution or terms of the distribution. |

The separation agreement will also establish procedures with respect to claims subject to indemnification and related matters.

Insurance

The separation agreement provides for the allocation between the parties of rights and obligations under existing insurance policies with respect to occurrences prior to the distribution and sets forth procedures for the administration of insured claims.

Non-competition and Non-solicitation Provisions

The separation agreement prohibits Emergent from making, manufacturing, using, selling, offering for sale, importing or otherwise exploiting protein therapeutics intended to treat oncolytic diseases during the period commencing upon completion of the distribution and ending on the earlier of the third anniversary of the completion of the distribution or a change of control of Emergent, subject to certain exceptions.

The separation agreement also prohibits, for a period of 12 months following the completion of the distribution, each of Emergent and Aptevo from soliciting the employees of the other party to leave his or her employment with the other party, or to hire such party, subject to certain exceptions.

Further Assurances

In addition to the actions specifically provided for in the separation agreement, except as otherwise set forth therein or in any ancillary agreement, both Aptevo and Emergent agree in the separation agreement to use reasonable best efforts, prior to, on and after the distribution date, to take, or cause to be taken, all actions, and to do, or cause to be done, all things necessary, proper or advisable under applicable laws, regulations and agreements to consummate and make effective the transactions contemplated by the separation agreement and the ancillary agreements.

Dispute Resolution

The separation agreement will contain provisions that govern, except as otherwise provided in any ancillary agreement, the resolution of disputes, controversies or claims that may arise between Aptevo and Emergent related to the separation or distribution. These provisions will contemplate that efforts will be made to resolve disputes, controversies and claims by negotiation by applicable local or functional representatives of Aptevo and Emergent and, if necessary, escalation of the matter to a transition committee composed of representatives of Aptevo and Emergent. If such efforts are not successful, either Aptevo or Emergent may submit the dispute, controversy or claim to binding arbitration, subject to the provisions of the separation agreement.

Expenses

Except as expressly set forth in the separation agreement or in any ancillary agreement, Emergent will be responsible for all costs and expenses incurred in connection with the separation prior to the distribution date, including costs and expenses relating to legal and tax counsel, financial advisors and accounting advisory work related to the separation. Except as expressly set forth in the separation agreement or in any ancillary agreement, or as otherwise agreed in writing by Emergent and Aptevo, all costs and expenses incurred in connection with the separation after the distribution will be paid by the party incurring such cost and expense.

Other Matters

Other matters governed by the separation agreement will include access to financial and other information, confidentiality, access to and provision of records and treatment of outstanding guarantees and similar credit support.

Termination

The separation agreement will provide that it may be terminated, and the separation and distribution may be modified or abandoned, at any time prior to the distribution date in the sole discretion of Emergent without the approval of any person, including Aptevo or Emergent stockholders. In the event of a termination of the separation agreement, no party, nor any of its directors, officers or employees, will have any liability of any kind to the other party or any other person. After the distribution date, the separation agreement may not be terminated except by an agreement in writing signed by both Emergent and Aptevo.

Transition Services Agreement

Aptevo and Emergent will enter into a transition services agreement in connection with the separation pursuant to which Emergent and its affiliates will provide to Aptevo and its affiliates, on an interim, transitional basis, various services, including, but not limited to, accounts payable administration, information technology services, regulatory and clinical support, general administrative services and other support services. The agreed-upon charges for such services are generally intended to allow Emergent to recover all direct and indirect costs. Aptevo will be provided with reasonable information that supports the charges for such transition service by Emergent.

The services will commence on the distribution date and terminate up to two years following the distribution date. Aptevo may terminate certain specified services by giving prior written notice to Emergent and paying any applicable wind-down charges.

Subject to certain exceptions, the liabilities of Emergent under the transition services agreement will generally be limited to the aggregate charges (excluding any third-party costs and expenses included in such charges) actually paid to Emergent by Aptevo pursuant to the transition services agreement. The transition services agreement also will provide that Emergent will not be liable to Aptevo for any special, indirect, incidental, punitive or consequential damages.

Tax Matters Agreement

In connection with the separation, Aptevo and Emergent will enter into a tax matters agreement that will govern the parties' respective rights, responsibilities and obligations with respect to taxes (including taxes arising in the ordinary course of business and taxes, if any, incurred as a result of any failure of the distribution and certain related transactions to qualify as tax-free for U.S. federal income tax purposes), tax attributes, the preparation and filing of tax returns, the control of audits and other tax proceedings, and assistance and cooperation in respect of tax matters.

With respect to taxes arising in the ordinary course of business, Aptevo will generally be liable for all taxes relating to the biosciences business that are attributable to the period after the distribution, and Emergent will indemnify Aptevo for all taxes relating to the biosciences business that are attributable to the period prior to the distribution.

In addition, to preserve the tax-free treatment to Emergent and its stockholders of the distribution, under the tax matters agreement, Emergent and Aptevo will be restricted from taking, or failing to take, any action that could reasonably be expected to prevent the distribution, together with certain related transactions, from qualifying as a transaction described in Sections 355 and 368(a)(1)(D) of the Code. In particular, for a period of two years following the separation, Aptevo will be restricted from taking certain actions (including restrictions on share issuances, business combinations, sales of assets, amendments to organizational documents and similar transactions) that could cause the distribution, together with certain related transactions, to fail to so qualify. Aptevo may take such a restricted action if (i) it provides Emergent with an opinion from a U.S. tax counsel or accountant of recognized national standing, reasonably acceptable to Emergent, in form and substance satisfactory to Emergent, that the transaction will not affect the tax-free status of the distribution and certain related transactions, (ii) Emergent obtains, at Aptevo's request, a supplemental ruling from the IRS, in form and substance reasonably satisfactory to Emergent, that the action will not affect the tax-free status of the distribution and certain related transactions, or (iii) Emergent waives in writing the requirement to obtain such opinion or ruling.

The tax matters agreement will provide special rules that allocate tax liabilities and related expenses (including damages related to claims of Emergent stockholders) resulting from the failure of the distribution, together with certain related transactions, to qualify as a tax-free transaction under Sections 355 and 368(a)(1)(D) of the Code. In general, under the tax matters agreement, each party is expected to be responsible for any taxes imposed on Aptevo or Emergent that arise from the failure of the distribution, together with certain related transactions, to qualify as a transaction described under Sections 355 and 368(a)(1)(D), to the extent that the failure to so qualify is attributable to actions, events or transactions relating to such party's respective stock, assets or business, or a breach of the relevant representations or covenants made by that party in the tax matters agreement or the IRS private letter ruling or in the representation letters provided to WilmerHale LLP in connection with its providing an opinion regarding the tax consequences of the distribution and certain related transactions. This indemnification will apply with respect to an acquisition of a party's stock even if such party has not facilitated such acquisition. This indemnification will also apply even if Emergent has permitted Aptevo to take an action that would otherwise have been prohibited under the tax-related covenants described above.

Employee Matters Agreement

Aptevo and Emergent will enter into an employee matters agreement prior to the distribution to allocate liabilities and responsibilities relating to employment matters, employee compensation and benefit plans and programs and other related matters.

Generally, the employee matters agreement will provide for the transfer or assignment of employees from Emergent to Aptevo, provide for the establishment of Aptevo compensation and benefit plans and programs, which are expected to be generally comparable to those currently in place at Emergent, and allocate liabilities and responsibilities relating to their respective employees' and former employees' compensation and benefit plans and programs between Emergent and Aptevo. Among other things, the employee matters agreement will provide that, following the distribution, Aptevo's active employees generally will no longer participate in benefit plans sponsored or maintained by Emergent and will commence participation in Aptevo's benefit plans. The employee matters agreement will also provide for the treatment of outstanding Emergent equity awards (as described in the section entitled "The Separation and Distribution—Treatment of Equity Based Compensation") and certain other outstanding incentive awards. In addition, the employee matters agreement will set forth the general principles relating to employee matters, including the assumption and/or retention of liabilities and related benefit plan assets, the treatment of expense reimbursements, workers' compensation, employee leaves of absence, the provision of employee service credit, the sharing of employee information and the non-duplication or acceleration of benefits.

Intellectual Property Agreements

Product License Agreement. Aptevo will enter into a product license agreement with Emergent pursuant to which Emergent will grant to Aptevo a perpetual, exclusive royalty-free, nontransferable worldwide license, under certain licensed intellectual property rights, to research, develop, make, have made, use, sell, offer to sell and import WinRho SDF, HepaGam B and VARIZIG in their respective indications. Aptevo will only be permitted to exercise rights under the license with respect to Emergent's human hyperimmune platform manufacturing know-how through a third-party contract manufacturer, and then only if the manufacturer is bound to maintain the confidentiality of the manufacturing know-how and is either approved by Emergent, in its sole discretion, or there has been a manufacturing failure under the manufacturing services agreement. In addition, Aptevo will grant Emergent a non-exclusive, royalty-free, worldwide, perpetual, irrevocable, fully paid-up, fully sublicensable, fully transferable license to reproduce, copy, make derivative works of, use and otherwise exploit the clinical and pre-clinical data, including the related safety data, that exists on the distribution date and is related to WinRho SDF, HepaGam B and VARIZIG.

Aptevo may terminate its rights under the agreement at any time by providing written notice to Emergent. Emergent may terminate the agreement if Aptevo breaches the agreement and the breach is not cured within a specified period of time or is uncurable. Each party may terminate the agreement if the other party experiences certain bankruptcy events.

Trademark License Agreement. Aptevo will enter into a license agreement with Emergent pursuant to which Emergent will grant Aptevo a non-exclusive, royalty-free, worldwide, non-sublicenseable license under certain trademarks of Emergent to distribute the physical inventory of packaging and marketing materials assigned to Aptevo as part of the distribution, solely to sell, offer to sell and otherwise commercialize the commercial products until such inventory of packaging and marketing materials is depleted but in no event after the third anniversary of the distribution. The license will also permit Aptevo to include Emergent's trademarks on additional packaging and marketing materials created after the distribution date for WinRho SDF, HepaGam B, and VARIZIG intended for sale outside the United States, to the extent necessary to comply with regulatory requirements for so long as Emergent is providing distribution services for those products or manufacturing services for such products, or both. In addition, Emergent will covenant not to sue Aptevo for trade dress infringement pertaining to applicable packaging materials while Emergent is performing services for Aptevo under the manufacturing services agreement and for a specified period of time thereafter. Aptevo will grant Emergent a non-exclusive, worldwide, irrevocable, royalty-free license to use, have used, display and have displayed trademarks of Aptevo in furtherance of Emergent's performance under the agreements between Emergent and Aptevo and for incidental uses (the latter limited to two years from the distribution date).

Aptevo may terminate its rights under the agreement at any time by providing written notice to Emergent. Emergent may terminate the agreement if Aptevo breaches the agreement and the breach is not cured within a specified period of time or is uncurable.

Commercial Agreements

The terms of these agreements are still being finalized and the descriptions included herein will be updated in a subsequent amendment.

Manufacturing Services Agreement. Aptevo will enter a manufacturing services agreement with Emergent prior to the distribution pursuant. The expiration date of the manufacturing services agreement is ten years following the date of its execution, which is expected to occur on the separation date.

Under the manufacturing services agreement, Emergent will manufacture, fill and finish, label, package and ship the hyperimmune products for Aptevo and will provide these services, other than manufacturing, fill and finish and certain other services, for the IXINITY product as well. Management believes these payments approximate those that would be made in an arm's length transaction.

Canadian Distributor Agreement. Aptevo will enter into a Canadian distributor agreement with Emergent pursuant to which Emergent will make product intended for sale in Canada available to Aptevo's Canadian customers.

Funding Arrangement

At or prior to the separation, Emergent will issue a non-negotiable promissory note in the amount of $20 million to Aptevo. This note will be unsecured, will bear no interest, will be non-transferrable and will be payable by Emergent six to 12 months after the distribution date on demand by Aptevo. For additional information, see the section entitled "Risk Factors—Risks Related to Aptevo's Business."

THE SEPARATION AND DISTRIBUTION

Overview

On August 6, 2015, Emergent announced its intention to separate its biosciences business. The separation will occur by means of a pro rata distribution to Emergent stockholders of 100% of the shares of common stock of Aptevo, which was formed to hold certain assets of Emergent's biosciences business. In connection with this distribution, we expect that Emergent will complete an internal reorganization, which we refer to as the "internal reorganization," as a result of which Aptevo will become the parent company of those Emergent operations comprising, and the entities that will conduct, the biosciences business.

On July 10, 2016, the Emergent board of directors approved the distribution of all of Aptevo's issued and outstanding shares of common stock on the basis of one share of Aptevo common stock for every two shares of Emergent common stock held as of the close of business on July 22, 2016, the record date for the distribution.

On August 1, 2016, the distribution date, each Emergent stockholder will receive one share of Aptevo common stock for every two shares of Emergent common stock held at the close of business on the record date for the distribution, as described below. Emergent stockholders will receive cash in lieu of any fractional shares of Aptevo common stock that they would have received after application of this ratio. You will not be required to make any payment, surrender or exchange your Emergent common stock or take any other action to receive your shares of Aptevo common stock in the distribution. The distribution of Aptevo common stock as described in this information statement is subject to the satisfaction or waiver of certain conditions. For a more detailed description of these conditions, see "—Conditions to the Distribution."

Reasons for the Separation

The Emergent board of directors believes that separating the biosciences business from the biodefense business of Emergent is in the best interests of Emergent and its stockholders for a number of reasons, including the following:

| • | Allocation of Capital. The Emergent board believes that the separation will permit each company to allocate its financial resources in a manner more tailored to its own commercial and strategic priorities and eliminate the competition for capital that has arisen between the two businesses. |

| • | Targeted Investment Opportunities. The Emergent board believes that the separation will (1) allow each company to target investors attracted to its business profile, (2) allow investors to separately value each company based on its unique investment identity and (3) attract investors to each company that are not willing to invest in a combined entity but are willing to invest in a distinct "pure play" company. |

| • | Access to Capital and Acquisition Currency. The Emergent board believes that the separation will create an independent equity currency for each of Emergent and Aptevo that will afford each company (1) direct, standalone access to the capital markets, (2) the opportunity to capitalize on its unique growth opportunities and (3) facilitate an ability to finance future acquisitions using its capital stock. |

| • | Management Focus and Operational Efficiency. The Emergent board believes that the separation will permit the management of each company to tailor business strategies to best pursue targeted opportunities for long-term growth and profitability and enhance the business focus of each company and better align resources to achieve strategic priorities. |

| • | Competitive Equity Compensation. The Emergent board believes that the separation will permit Aptevo to use equity compensation to attract and retain top talent in a manner and degree consistent with its operational priorities and growth prospects and more competitive with its industry peers, and that the separation will better align the value of equity compensation with the performance of the business for which the individual is employed, which is expected to make equity compensation more attractive to potential and existing employees. |

The Emergent board of directors also considered a number of potentially negative factors in evaluating the separation, including the following:

| • | Increased Administrative Costs. As a current part of Emergent, Aptevo takes advantage of certain functions performed by Emergent, such as accounting, tax, legal, human resources and other general and administrative functions. After the separation, Emergent will not perform certain of these functions for Aptevo, and, because of Aptevo's smaller scale as a standalone company, Aptevo's cost of performing such functions may be higher than the amounts reflected in Aptevo's historical financial statements, which may adversely affect Aptevo's results of operations. |

| • | Disruption Related to the Separation. The actions required to separate Emergent's and Aptevo's respective businesses could disrupt Aptevo's operations. |

| • | Increased Impact of Certain Costs. Certain costs and liabilities that were otherwise less significant to Emergent as a whole will be more significant for Aptevo as a standalone company due to Aptevo being smaller than Emergent. |

| • | Significant Separation Costs. Emergent and Aptevo will incur costs in connection with the transition to being standalone public companies that may include accounting, tax, legal, and other professional services costs, recruiting and relocation costs associated with hiring key senior management personnel who are new to Aptevo, costs related to establishing a new brand identity in the marketplace, tax costs and costs to separate information systems. |

| • | Risk of Failure to Achieve Anticipated Benefits of the Separation. Aptevo may not achieve the anticipated benefits of the separation for a variety of reasons, including, among others: (1) the separation will require significant amounts of management's time and effort, which may divert management's attention from operating and growing its business; and (2) following the separation, Aptevo may be more susceptible to market fluctuations and other adverse events than if Aptevo were still a part of Emergent because its business will be less diversified than Emergent's business prior to the completion of the separation. |

| • | Limitations on Strategic Transactions. Under the terms of the tax matters agreement that Aptevo will enter into with Emergent, for a period of two years following the separation, Aptevo will be restricted from taking certain actions that could cause the distribution, together with certain related transactions, to fail to qualify as a tax-free transaction for U.S. federal income tax purposes. During this period, these restrictions may limit Aptevo's ability to pursue certain strategic transactions and equity issuances or engage in other transactions that might increase the value of its business. |

| • | Loss of Scale. As a current part of Emergent, Aptevo takes advantage of Emergent's size and purchasing power in procuring certain goods and services. After the separation, as a standalone company, Aptevo may be unable to obtain these goods, services, and technologies at prices or on terms as favorable as those Emergent obtained prior to completion of the separation. |

| • | Loss of Joint Arrangements. As a current part of Emergent, Aptevo takes advantage of Emergent's overall presence to procure more advantageous distribution arrangements. After the separation, as a standalone company, Aptevo may be unable to obtain similar arrangements to the same extent as Emergent did, or on terms as favorable as those Emergent obtained, prior to completion of the separation. |

| • | Uncertainty Regarding Stock Prices. We cannot predict the effect of the separation on the trading prices of Aptevo or Emergent common stock or whether the combined market value of 0.5 shares of Aptevo common stock and one share of Emergent common stock will be less than, equal to, or greater than the market value of one share of Emergent common stock prior to the distribution. |

In determining to pursue the separation, the Emergent board of directors concluded that the potential benefits of the separation outweighed the potential negative factors.

Formation of Aptevo

Aptevo was formed in Delaware in February 2016 for the purpose of holding certain assets and liabilities of Emergent's biosciences business. As part of the plan to separate the biosciences business from the remainder of its businesses, in connection with the internal reorganization, Emergent plans to transfer the equity interests of certain entities that are expected to operate the biosciences business and the assets and liabilities of the biosciences business to Aptevo prior to the distribution.

When and How You Will Receive the Distribution

With the assistance of Broadridge Financial Solutions, Inc., the distribution agent for the distribution, which we refer to as the "distribution agent," Emergent expects to distribute Aptevo common stock on August 1, 2016, the distribution date, to all holders of outstanding Emergent common stock as of the close of business on July 22, 2016, the record date for the distribution. The distribution agent will serve as the settlement and distribution agent in connection with the distribution and the transfer agent and registrar for Aptevo common stock.

If you own Emergent common stock as of the close of business on the record date for the distribution, Aptevo common stock that you are entitled to receive in the distribution will be issued as of the distribution date, to you in direct registration form or in certificated form or to your bank or brokerage firm on your behalf. If you are a registered holder, the distribution agent will then mail you a direct registration account statement that reflects your shares of Aptevo common stock. If you hold your Emergent shares through a bank or brokerage firm, your bank or brokerage firm will credit your account for the Aptevo shares. Direct registration form refers to a method of recording share ownership when no physical share certificates are issued to stockholders. If you sell Emergent common stock in the "regular-way" market up to and including the distribution date, you will be selling your right to receive shares of Aptevo common stock in the distribution.

Commencing on or shortly after the distribution date, if you hold physical share certificates that represent your Emergent common stock and you are the registered holder of the shares represented by those certificates, the distribution agent will mail to you an account statement that indicates the number of shares of Aptevo common stock that have been registered in your name.

Most Emergent stockholders hold their common stock through a bank or brokerage firm. In such cases, the bank or brokerage firm is said to hold the shares in "street name" and ownership would be recorded on the bank or brokerage firm's books. If you hold your Emergent common stock through a bank or brokerage firm, your bank or brokerage firm will credit your account for the Aptevo common stock that you are entitled to receive in the distribution. If you have any questions concerning the mechanics of having shares held in "street name," please contact your bank or brokerage firm.

Transferability of Shares You Receive

Shares of Aptevo common stock distributed to holders in connection with the distribution will be transferable without registration under the Securities Act of 1933, as amended, or the Securities Act, except for shares received by persons who may be deemed to be our affiliates. Persons who may be deemed to be our affiliates after the distribution generally include individuals or entities that control, are controlled by or are under common control with us, which may include certain of our executive officers, directors or principal stockholders. Securities held by our affiliates will be subject to resale restrictions under the Securities Act. Our affiliates will be permitted to sell shares of our common stock only pursuant to an effective registration statement or an exemption from the registration requirements of the Securities Act, such as the exemption afforded by Rule 144 under the Securities Act.

Number of Shares of Aptevo Common Stock You Will Receive

For every two shares of Emergent common stock that you own at the close of business on July 22, 2016, the record date for the distribution, you will receive one share of Aptevo common stock on the distribution date. Emergent will not distribute any fractional shares of Aptevo common stock to its stockholders. Instead, if you are a registered holder, the distribution agent will aggregate fractional shares into whole shares, sell the whole shares in the open market at prevailing market prices and distribute the aggregate cash proceeds (net of discounts and commissions) of the sales pro rata (based on the fractional share such holder would otherwise be entitled to receive) to each holder who otherwise would have been entitled to receive a fractional share in the distribution. The distribution agent, in its sole discretion, without any influence by Emergent or Aptevo, will determine when, how, and through which broker-dealer and at what price to sell the whole shares. Any broker-dealer used by the distribution agent will not be an affiliate of either Emergent or Aptevo and the distribution agent is not an affiliate of either Emergent or Aptevo. Neither Aptevo nor Emergent will be able to guarantee any minimum sale price in connection with the sale of these shares. Recipients of cash in lieu of fractional shares will not be entitled to any interest on the amounts of payment made in lieu of fractional shares.

The receipt by a holder of a pro rata share of the aggregate net cash proceeds of these sales of fractional shares will be taxable to such holder for U.S. federal income tax purposes. See "Material U.S. Federal Income Tax Consequences" for additional information regarding the material U.S. federal income tax consequences of the distribution, including the receipt of cash in lieu of fractional shares. If you hold physical certificates for shares of Emergent common stock and are the registered holder, you will receive a check from the distribution agent in an amount equal to your pro rata share of the aggregate net cash proceeds of the sales. We estimate that it will take approximately two weeks from the distribution date for the distribution agent to complete the distributions of the aggregate net cash proceeds. If you hold your shares of Emergent common stock through a bank or brokerage firm, your bank or brokerage firm will receive, on your behalf, your pro rata share of the aggregate net cash proceeds of the sales and will electronically credit your account for your share of such proceeds.

Treatment of Equity Based Compensation

Generally, pursuant to the employee matters agreement, each award of Emergent restricted stock units that is held by an Emergent employee or service provider (an "Emergent Holder") as of the effective time of the distribution will be adjusted (the "Adjusted Emergent RSUs"), and each award of Emergent restricted stock units held by an Aptevo employee or service provider (an "Aptevo Holder") as of the effective time of the distribution will be converted to a restricted stock unit award entitling the Aptevo Holder to Aptevo common stock (the "Aptevo RSUs"). The adjustment and conversion, respectively, will be structured to reflect the effect of the distribution. The Adjusted Emergent RSUs and the Aptevo RSUs will otherwise be subject to the same terms and conditions that applied to the original Emergent restricted stock units immediately before the distribution.

Similarly, the employee matters agreement generally provides that each Emergent stock option that is held by an Emergent Holder will remain an option to purchase Emergent common stock but will be adjusted (an "Adjusted Emergent Option"), and each Emergent stock option that is held by an Aptevo Holder will be converted into an option to purchase Aptevo common stock (an "Aptevo Option"). The exercise price and the number of shares covered by each Adjusted Emergent Option and Aptevo Option will reflect the effect of the distribution. Each Adjusted Emergent Option and Aptevo Option will otherwise be subject to the same terms and conditions that applied to the original Emergent stock options immediately before the distribution.

For purposes of the equity awards, the distribution will not result in a termination of employment or service for any holder of equity awards. Rather, the date of termination of employment or service with the applicable plan sponsor following the distribution shall be the holder's termination date for purposes of outstanding equity awards. Following the distribution each Aptevo Holder will be considered to have been employed by or have provided services to, as the case may be, Aptevo before and after the distribution for purposes of vesting of such holder's Aptevo RSUs and/or Aptevo Options.

Notwithstanding the foregoing and his anticipated election to the Aptevo board of directors, the employee matters agreement provides that any outstanding Emergent equity awards held by Dr. Niederhuber at the effective time of the distribution, including those recently awarded under the section entitled "Certain Relationships and Related Party Transactions—Consulting Arrangements Entered into in Connection with the Separation," will not be converted into awards to acquire shares of Aptevo common stock. Rather, he will be treated as an Emergent Holder and receive Adjusted Emergent RSUs and Adjusted Emergent Options. The employee matters agreement further provides that his Adjusted Emergent RSUs and Adjusted Emergent Options will continue to vest in accordance with their terms while he provides consulting services to Emergent.

No award shall be adjusted or converted as described above unless such adjustment or conversion is consistent with all applicable laws, including U.S. securities laws. The adjustment or conversion of Emergent stock options and Emergent restricted stock units will be effectuated in a manner that is intended to avoid the imposition of any penalty or other taxes on the holders of such awards pursuant to Section 409A of the Code. Following the distribution, Emergent will be responsible for all liabilities associated with the Adjusted Emergent RSUs and Adjusted Emergent Options, and Aptevo will be responsible for all liabilities associated with Aptevo RSUs and Aptevo Options.

For a further discussion of the employee matters agreement, see the section entitled "Certain Relationships and Related Party Transactions—Employee Matters Agreement."

Internal Reorganization

As part of the separation, and prior to the distribution, Emergent and its subsidiaries expect to complete an internal reorganization in order to transfer to Aptevo the biosciences business that Aptevo will hold following the separation. Among other things and subject to limited exceptions, the internal reorganization is expected to result in Aptevo owning, directly or indirectly, the operations comprising and the entities that conduct the biosciences business.

The internal reorganization is expected to include various restructuring transactions pursuant to which (1) the operations, assets and liabilities of Emergent and its subsidiaries used to conduct the biosciences business will be separated from the operations, assets and liabilities of Emergent and its subsidiaries used to conduct the biodefense business and (2) such biosciences operations, assets and liabilities will be contributed, transferred or otherwise allocated to Aptevo or one of its direct or indirect subsidiaries. Such restructuring transactions may take the form of asset transfers, mergers, demergers, dividends, contributions and similar transactions, and may involve the formation of new subsidiaries in U.S. and non-U.S. jurisdictions to own and operate the biosciences business or the biodefense business in such jurisdictions.

In the final step of the internal reorganization, Emergent will contribute to Aptevo certain assets, including all of the equity interests in the entities that are expected to conduct the biosciences business.

Following the completion of the internal reorganization and immediately prior to the distribution, Aptevo will be the parent company of the entities that are expected to conduct the biosciences business and Emergent (through subsidiaries other than Aptevo and its subsidiaries) will remain the parent company of the entities that are expected to conduct the biodefense business.

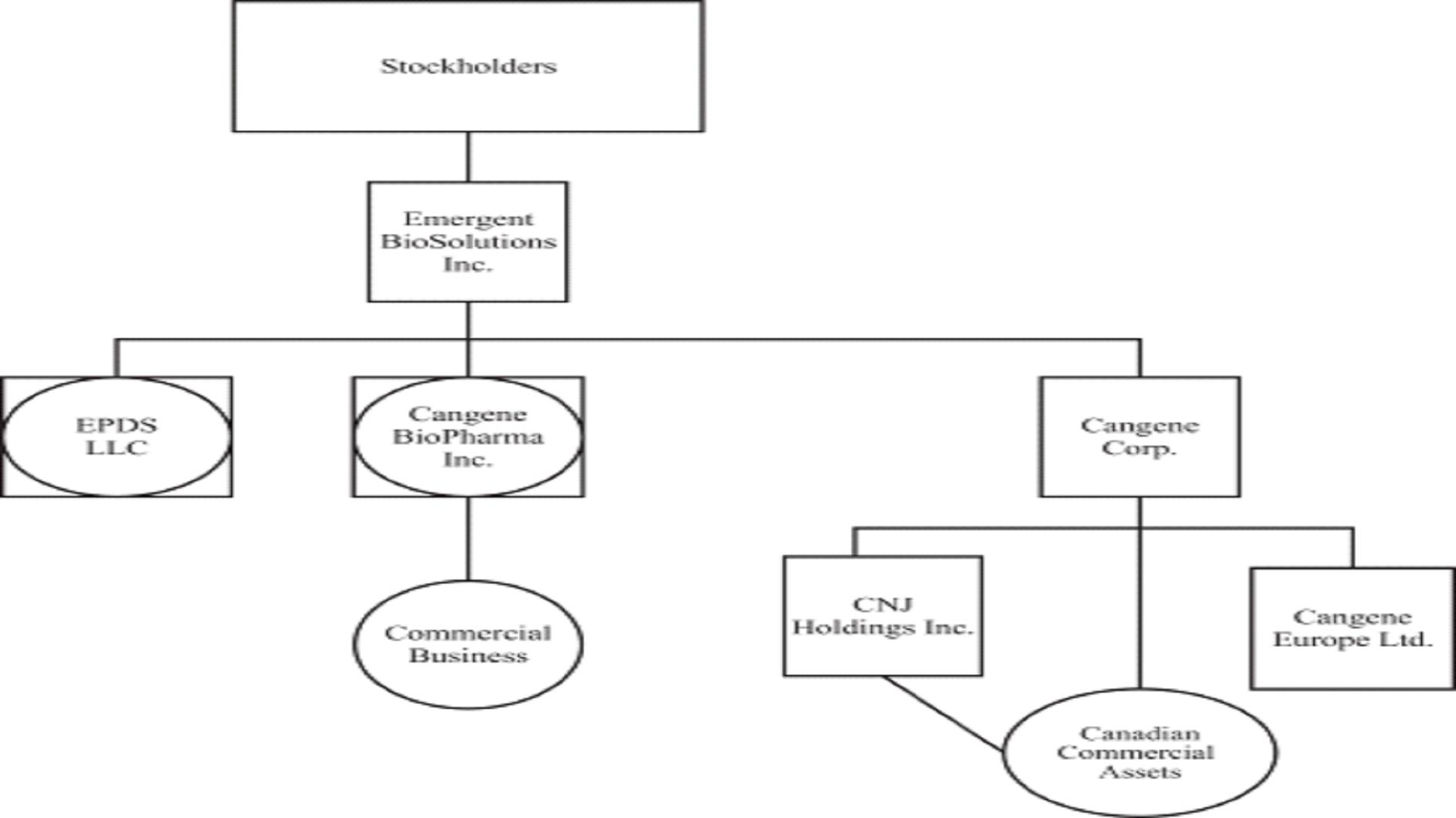

As more fully explained below, the diagram immediately below shows the simplified structure of the pre-internal reorganization businesses and entities of Emergent that are being contributed to Aptevo Therapeutics, Inc.:

The Biosciences Business of Emergent BioSolutions Inc., as defined in Note 1 to the Audited Combined Financial Statements contained in this information statement, include the certain businesses and entities that will be contributed to Aptevo Therapeutics Inc. in the internal reorganization in anticipation of the separation, which are owned through multiple different entities. The diagram above has been simplified for illustrative purposes and does not set forth all affiliated entities, including intermediate subsidiaries. The material businesses and primary entities that will be contributed directly to Aptevo Therapeutics Inc. by Emergent, which are included in the chart above, are discussed below.

Emergent will directly contribute to Aptevo Therapeutics Inc. the Emergent Product Development Seattle LLC, or EPDS LLC, entity, which is primarily a research and development company focused on the generation and clinical testing of recombinant protein therapeutics, based on the ADAPTIR platform, for the treatment of cancer and autoimmune disease. The other primary entity being directly contributed by Emergent is Cangene Europe Limited, which focuses on hematology (blood disease) therapeutics.

The businesses being contributed in the internal reorganization come from multiple Emergent entities. Such entities include Cangene BioPharma Inc. (its hyperimmune commercial business assets are being contributed, but not its contract manufacturing business) and Canadian entities Cangene Corporation and CNJ Holdings Inc. (each of which will have their hyperimmune commercial business assets contributed to Aptevo Therapeutics Inc., but not their biodefense hyperimmune businesses).

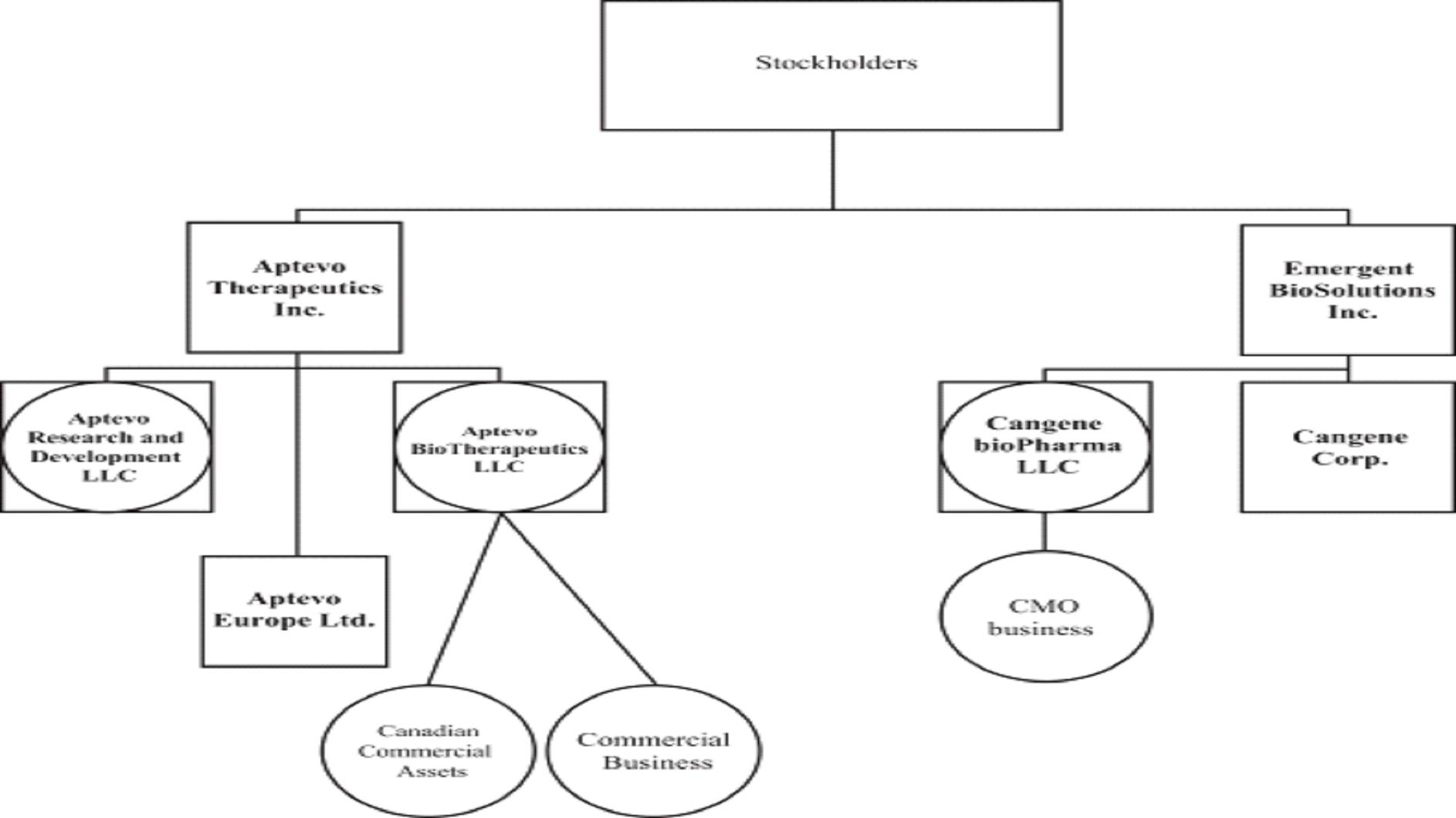

The diagram below shows what we expect will be the simplified structure of each of Aptevo and Emergent after completion of the internal reorganization, the separation and the distribution:

This diagram has been simplified for illustrative purposes and does not set forth all affiliated entities, including intermediate subsidiaries.

Results of the Distribution

After the distribution, Aptevo will be an independent, publicly-traded company. The actual number of shares to be distributed will be determined at the close of business on July 22, 2016, the record date for the distribution, and will reflect any exercise of Emergent options between the date the Emergent board of directors declares the distribution and the record date for the distribution. The distribution will not affect the number of outstanding shares of Emergent common stock or any rights of Emergent stockholders. Emergent will not distribute any fractional shares of Aptevo common stock.

We will enter into a separation agreement and other related agreements with Emergent before the distribution to effect the separation and provide a framework for our relationship with Emergent after the separation. These agreements will provide for the allocation between Emergent and Aptevo of Emergent's assets, liabilities and obligations (including employee benefits, intellectual property, and tax-related assets and liabilities) attributable to periods prior to Aptevo's separation from Emergent and will govern the relationship between Emergent and Aptevo after the separation. For a more detailed description of these agreements, see "Certain Relationships and Related Party Transactions."

Market for Aptevo Common Stock

There is currently no public trading market for Aptevo common stock. Aptevo has received approval to have its shares of common stock listed on The NASDAQ Global Select Market under the symbol "APVO," subject to official notice of distribution. Aptevo has not and will not set the initial price of its common stock. The initial price will be established by the public markets.

We cannot predict the price at which Aptevo common stock will trade after the distribution. In fact, the combined trading prices, after the distribution, of the shares of Aptevo common stock that each Emergent stockholder will receive in the distribution and the Emergent common stock held at the record date for the distribution may not equal the "regular-way" trading price of the Emergent common stock immediately prior to the distribution. The price at which Aptevo common stock trades may fluctuate significantly, particularly until an orderly public market develops. Trading prices for Aptevo common stock will be determined in the public markets and may be influenced by many factors. See "Risk Factors—Risks Related to Aptevo's Common Stock."

Trading Between the Record Date and Distribution Date

Beginning on or shortly before the record date for the distribution and continuing up to and including through the distribution date, Emergent expects that there will be two markets in Emergent common stock: a "regular-way" market and an "ex-distribution" market. Emergent common stock that trades on the "regular-way" market will trade with an entitlement to Aptevo common stock distributed in the distribution. Emergent common stock that trades on the "ex-distribution" market will trade without an entitlement to Aptevo common stock distributed in the distribution. Therefore, if you sell shares of Emergent common stock in the "regular-way" market up to and including through the distribution date, you will be selling your right to receive shares of Aptevo common stock in the distribution. If you own Emergent common stock at the close of business on the record date and sell those shares on the "ex-distribution" market up to and including through the distribution date, you will receive the shares of Aptevo common stock that you are entitled to receive pursuant to your ownership of shares of Emergent common stock as of the record date.

Furthermore, beginning on or shortly before the record date for the distribution and continuing up to and including the distribution date, Aptevo expects that there will be a "when-issued" market in its common stock. "When-issued" trading refers to a sale or purchase made conditionally because the security has been authorized but not yet issued. The "when-issued" trading market will be a market for Aptevo common stock that will be distributed to holders of Emergent common stock on the distribution date. If you owned Emergent common stock at the close of business on the record date for the distribution, you would be entitled to Aptevo common stock distributed pursuant to the distribution. You may trade this entitlement to shares of Aptevo common stock, without trading the Emergent common stock you own, on the "when-issued" market. On the first trading day following the distribution date, "when-issued" trading with respect to Aptevo common stock will end, and "regular-way" trading will begin.

Conditions to the Distribution

The distribution will be effective on August 1, 2016, which is the distribution date, provided that the conditions set forth in the separation agreement have been satisfied (or waived by Emergent in its sole and absolute discretion), including, among others

| • | the continued validity of a private letter ruling received by Emergent from the IRS regarding certain U.S. federal income tax matters relating to the distribution and certain related transactions; |

| • | the receipt of a tax opinion from counsel to Emergent substantially to the effect that, for U.S. federal income tax purposes, the distribution and certain related transactions, taken together, will qualify as a transaction described under Sections 355(a) and 368(a)(1)(D) of the Code; |

| • | the internal reorganization having been completed and the transfer of certain assets and liabilities of the biosciences business from Emergent to Aptevo having been completed in accordance with the separation agreement; |

| • | no order, injunction, or decree issued by any government authority of competent jurisdiction or other legal restraint or prohibition preventing the consummation of the separation, distribution or any of the related transactions being in effect; |

| • | the actions and filings necessary or appropriate under applicable U.S. federal, U.S. state or other securities laws or blue sky laws and the rules and regulations thereunder having been taken or made, and, where applicable, having become effective or been accepted; |

| • | all governmental approvals necessary to consummate the separation, the distribution and the transactions related thereto and to permit the operation of Aptevo's business after the distribution date having been obtained and being in full force and effect; |

| • | the separation and the distribution not violating or resulting in a breach of applicable law or any material contract of Emergent or Aptevo or any of their respective subsidiaries; |

| • | the approval for listing on NASDAQ for the shares of Aptevo common stock to be delivered to the record holders in the distribution having been obtained, subject to official notice of issuance; |

| • | the SEC declaring effective the Form 10, with no order suspending the effectiveness of the Form 10 in effect and no proceedings for such purposes pending before or threatened by the SEC; |

| • | this information statement and such other information concerning Aptevo, its business, operations and management, the distribution and such other matters as Emergent shall determine in its sole and absolute discretion and as may otherwise be required by law having been mailed to the holders of record of Emergent common stock on the record date; |

| • | Emergent's board of directors authorizing and approving the distribution and not having withdrawn such authorization and approval; |

| • | Emergent's board of directors approving the assets and liabilities included in the Aptevo balance sheet; and |

| • | no other events or developments existing or having occurred that, in the judgment of Emergent's board of directors, in its sole and absolute discretion, makes it inadvisable to effect the separation, the distribution or the transactions related thereto. |

Emergent will have the sole and absolute discretion to determine (and change) the terms of, and whether to proceed with, the distribution and, to the extent it determines to so proceed, to determine the record date for the distribution and the distribution date, and the distribution ratio. Emergent will also have sole and absolute discretion to waive any of the conditions to the distribution. Emergent does not intend to notify its stockholders of any modifications to the terms of the separation or distribution that, in the judgment of its board of directors, are not material. For example, the Emergent board of directors might consider material such matters as significant changes to the distribution ratio and the assets to be contributed or the liabilities to be assumed in the separation. To the extent that the Emergent board of directors determines that any modifications by Emergent materially change the material terms of the distribution, Emergent will notify Emergent stockholders in a manner reasonably calculated to inform them about the modification as may be required by law, by, for example, publishing a press release, filing a current report on Form 8-K, or circulating a supplement to this information statement.