Emergent BioSolutions Corporate Update 39th Annual J.P. Morgan Healthcare Conference Robert G. Kramer President and Chief Executive Officer January 11, 2021

2 2021 JP MORGAN HEALTHCARE CONFERENCE SAFE HARBOR STATEMENT / TRADEMARKS This presentation includes forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Any statements, other than statements of historical fact, including, without limitation, our financial guidance and related projections and statements regarding our ability to meet such projections in the anticipated timeframe, if at all; statements regarding our ability to develop safe and effective treatments against the novel strain of coronavirus (SARS-CoV-2) causing COVID-19 disease; the timing of and results of clinical trials; the timing of the submission of our biologics licensing application (BLA) related to AV7909; our confident outlook; being poised for next year; market opportunities; the potential size and growth of our contract development and manufacturing (CDMO) portfolio, including the value of our CDMO opportunity funnel; being positioned to achieve longer-term revenue and sustained profitability; the durability of our core business; sustaining strong operating and financial momentum and our growth profile; expansion of our sales and business development teams; enhancement of our molecule-to-market offering; driving global awareness, investing to meet market needs; cross-selling to existing clients; increasing manufacturing capacity; partnership opportunities; growth through mergers & acquisitions; total contract and related option value; and any other statements containing the words “will,” “believes,” “expects,” “anticipates,” “intends,” “plans,” “targets,” “forecasts,” “estimates” and similar expressions in conjunction with, among other things, discussions of the Company’s outlook, financial performance or financial condition, financial and operation goals, strategic goals, growth strategy, product sales, government development or procurement contracts or awards, government appropriations, manufacturing capabilities, and the timing of certain regulatory approvals or expenditures are forward-looking statements. These forward-looking statements are based on our current intentions, beliefs and expectations regarding future events. We cannot guarantee that any forward-looking statement will be accurate. Investors should realize that if underlying assumptions prove inaccurate or unknown risks or uncertainties materialize, actual results could differ materially from our expectations. Investors are, therefore, cautioned not to place undue reliance on any forward-looking statement. Any forward-looking statements speak only as of the date of this presentation, and, except as required by law, we do not undertake to update any forward-looking statement to reflect new information, events or circumstances. There are a number of important factors that could cause our actual results to differ materially from those indicated by such forward-looking statements, including the impact of global economic conditions and public health crises and epidemics, such as the impact from the global pandemic that arose from COVID-19 disease, on the markets, our operations, and employees as well as those of our customers and suppliers; our ability to obtain or maintain FDA approval or authorization for emergency or broader patient use of our COVID-19 treatments and their actual safety and effectiveness; availability of U.S. government funding for procurement for our products and certain product candidates and the future exercise of options under contracts related to such procurement; the negotiation of further commitments or contracts related to the collaboration and deployment of capacity toward future commercial manufacturing under our CDMO contracts; our ability to perform under our contracts with the U.S. government and our CDMO clients, including the timing of and specifications relating to deliveries; the continued exercise of discretion by BARDA to procure additional doses of AV7909 (Anthrax Vaccine Adsorbed, Adjuvanted) prior to approval by the FDA; our ability to secure licensure of AV7909 from the FDA within the anticipated timeframe, if at all; our ability to secure follow-on procurement contracts for our solutions to public health threats that are under procurement contracts that have expired or will be expiring; our ability to successfully appeal the patent litigation decision related to NARCAN® (naloxone hydrochloride) Nasal Spray 4mg/spray; our ability and the ability of our collaborators to enforce patents related to NARCAN® Nasal Spray against potential generic entrants; our ability to identify and acquire companies, businesses, products or product candidates that satisfy our selection criteria; our ability and the ability of our contractors and suppliers to maintain compliance with Current Good Manufacturing Practices and other regulatory obligations; our ability to comply with the operating and financial covenants required by our senior secured credit facilities and the indenture governing our senior unsecured notes due 2028; our ability to obtain and maintain regulatory approvals for our other product candidates and the timing of any such approvals; the procurement by government entities outside of the United States under regulatory exemptions prior to approval by the corresponding regulatory authorities in the applicable country; the success of our commercialization, marketing and manufacturing capabilities and strategy; and the accuracy of our estimates regarding future revenues, expenses, and capital requirements and needs for additional financing. The foregoing sets forth many, but not all, of the factors that could cause actual results to differ from our expectations in any forward-looking statement. Investors should consider this cautionary statement as well as the risk factors identified in periodic reports filed with the Securities and Exchange Commission when evaluating our forward-looking statements. Trademarks BioThrax® (Anthrax Vaccine Adsorbed), RSDL® (Reactive Skin Decontamination Lotion Kit), BAT® (Botulism Antitoxin Heptavalent (A,B,C,D,E,F and G)-(Equine)), Anthrasil® (Anthrax Immune Globulin Intravenous (Human)), VIGIV (Vaccinia Immune Globulin Intravenous (Human)), Trobigard® (atropine sulfate, obidoxime chloride), ACAM2000® (Smallpox (Vaccinia) Vaccine, Live), Vivotif® (Typhoid Vaccine Live Oral Ty21a), Vaxchora® (Cholera Vaccine, Live, Oral), NARCAN® (naloxone HCI) Nasal Spray and any and all Emergent BioSolutions Inc. brands, products, services and feature names, logos and slogans are trademarks or registered trademarks of Emergent BioSolutions Inc. or its subsidiaries in the United States or other countries. All other brands, products, services and feature names or trademarks are the property of their respective owners.

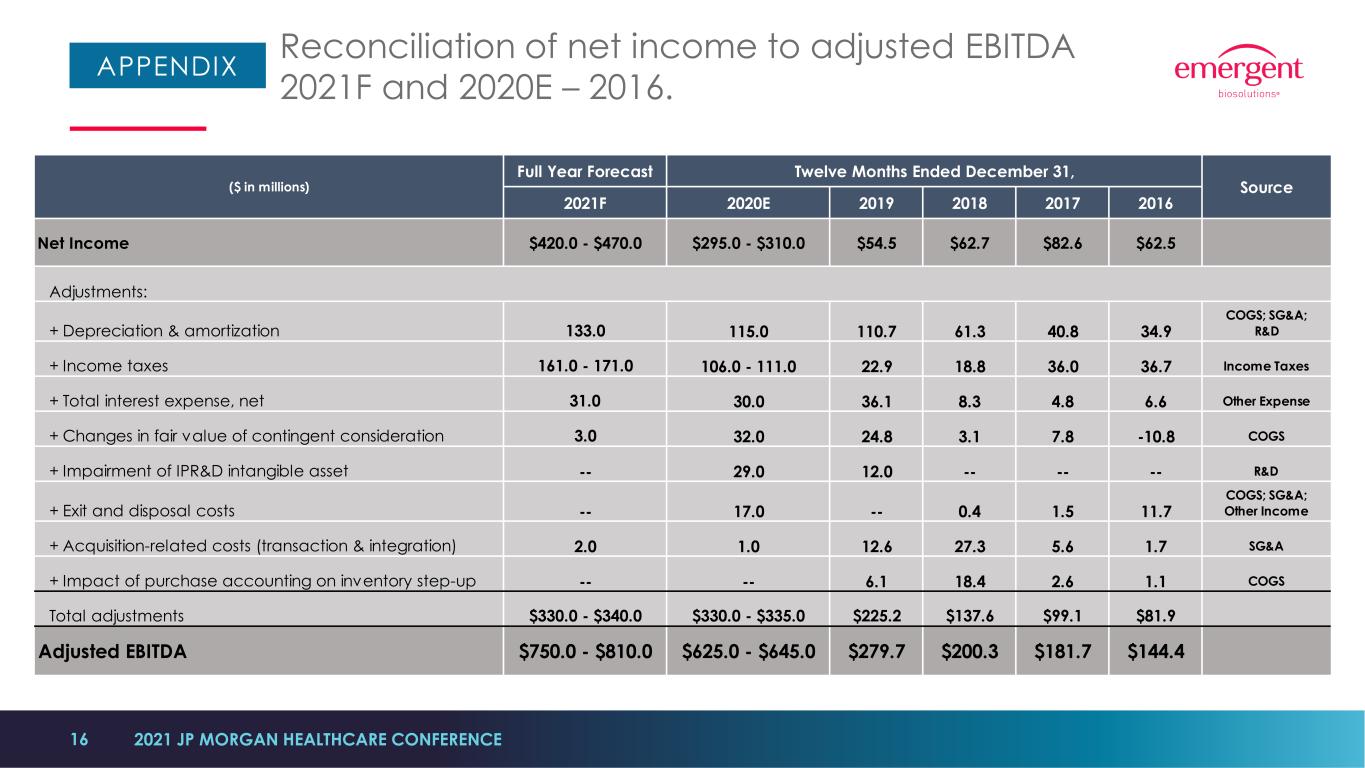

3 NON-GAAP FINANCIAL MEASURES This presentation contains two financial measures (Adjusted EBITDA (Earnings Before Depreciation and Amortization, Interest and Taxes) and Adjusted EBITDA Margin) that are considered “non-GAAP” financial measures under applicable Securities and Exchange Commission rules and regulations. These non-GAAP financial measures should be considered supplemental to and not a substitute for financial information prepared in accordance with generally accepted accounting principles. The Company’s definition of these non-GAAP measures may differ from similarly titled measures used by others. Adjusted EBITDA reflects net income excluding the impact of depreciation, amortization, interest expense and income tax provision (benefit), excluding specified items that can be highly variable and the non-cash impact of certain accounting adjustments. Adjusted EBITDA margin is defined as Adjusted EBITDA divided by total revenues. The Company views these non-GAAP financial measures as a means to facilitate management’s financial and operational decision-making, including evaluation of the Company’s historical operating results and comparison to competitors’ operating results. These non-GAAP financial measures reflect an additional way of viewing aspects of the Company’s operations that, when viewed with GAAP results and the reconciliations to the corresponding GAAP financial measure may provide a more complete understanding of factors and trends affecting the Company’s business. The determination of the amounts that are excluded from these non-GAAP financial measures are a matter of management judgment and depend upon, among other factors, the nature of the underlying expense or income amounts. Because non-GAAP financial measures exclude the effect of items that will increase or decrease the Company’s reported results of operations, management strongly encourages investors to review the Company’s consolidated financial statements and publicly filed reports in their entirety. 2021 JP MORGAN HEALTHCARE CONFERENCE

4 A life sciences company with a diversified portfolio of products + pipeline plus CDMO services focused on addressing public health threats. WHO WE ARE • Proven 22-year track record in preparedness and response • Leadership positions in key public health threat markets • Trusted partner to governments, NGOs and pharma/biotech innovators • Organized as four distinct business units with shared services • Scalable and sustainable business model 2021 JP MORGAN HEALTHCARE CONFERENCE

5 WHO WE ARE VACCINES THERAPEUTICS DEVICES • Multiple products against significant public health threats • Robust pipeline using multiple proprietary technology modalities • Excellence in manufacturing of complex biologics • Trusted partner in rapid and on-going response to public health emergencies and crises • Development Services • Drug Substance • Drug Product/Packaging CONTRACT DEVELOPMENT AND MANUFACTURING Our four business units 2021 JP MORGAN HEALTHCARE CONFERENCE PRODUCTS + PIPELINE SERVICES

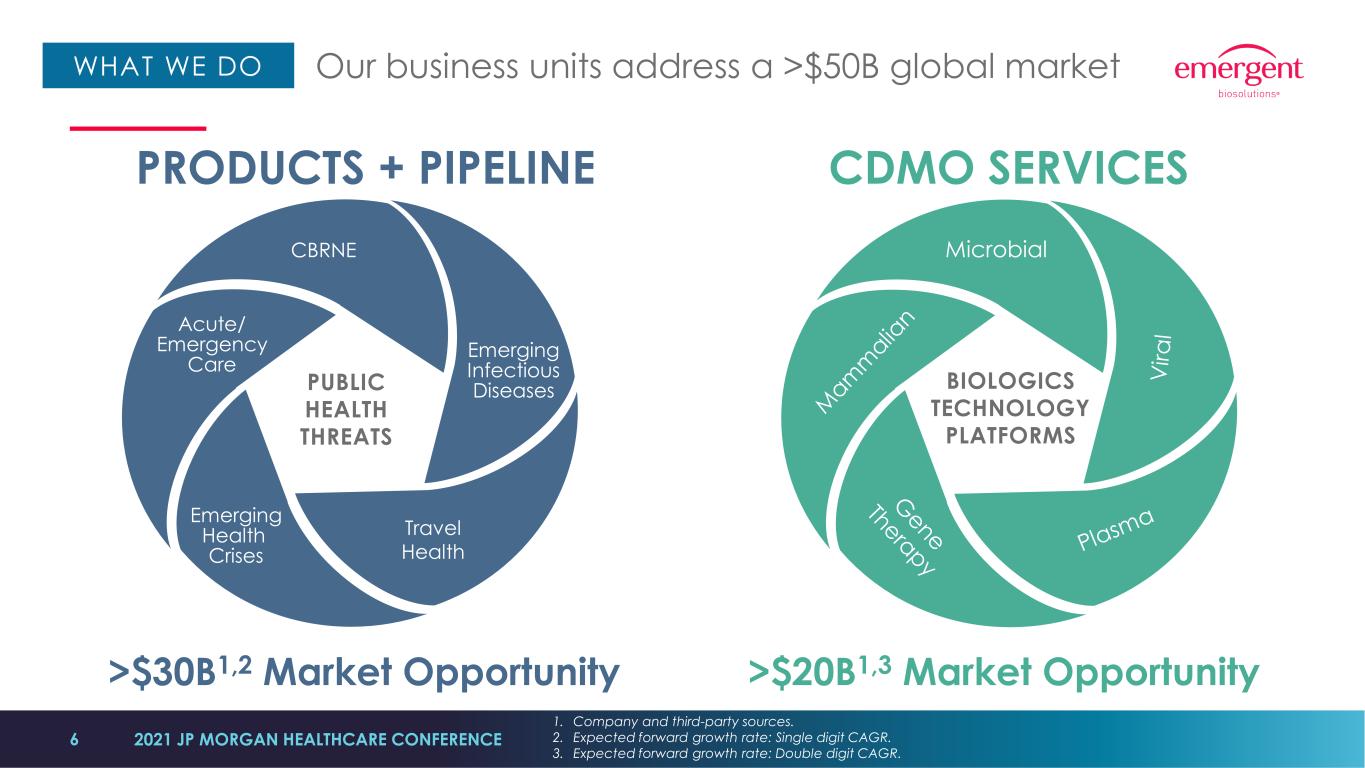

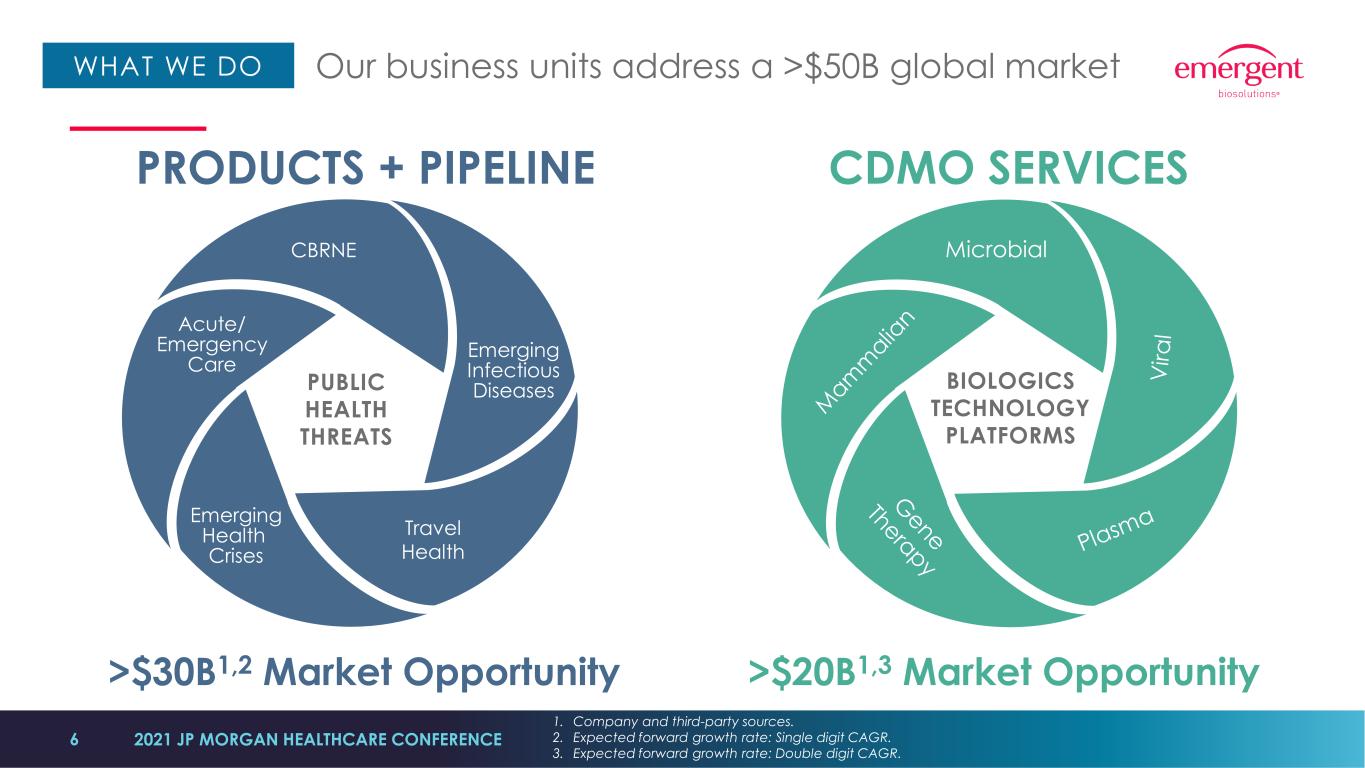

6 WHAT WE DO Microbial BIOLOGICS TECHNOLOGY PLATFORMS PRODUCTS + PIPELINE CDMO SERVICES Our business units address a >$50B global market CBRNE Emerging Infectious Diseases Travel Health Emerging Health Crises Acute/ Emergency Care PUBLIC HEALTH THREATS 2021 JP MORGAN HEALTHCARE CONFERENCE 1. Company and third-party sources. 2. Expected forward growth rate: Single digit CAGR. 3. Expected forward growth rate: Double digit CAGR. >$30B1,2 Market Opportunity >$20B1,3 Market Opportunity

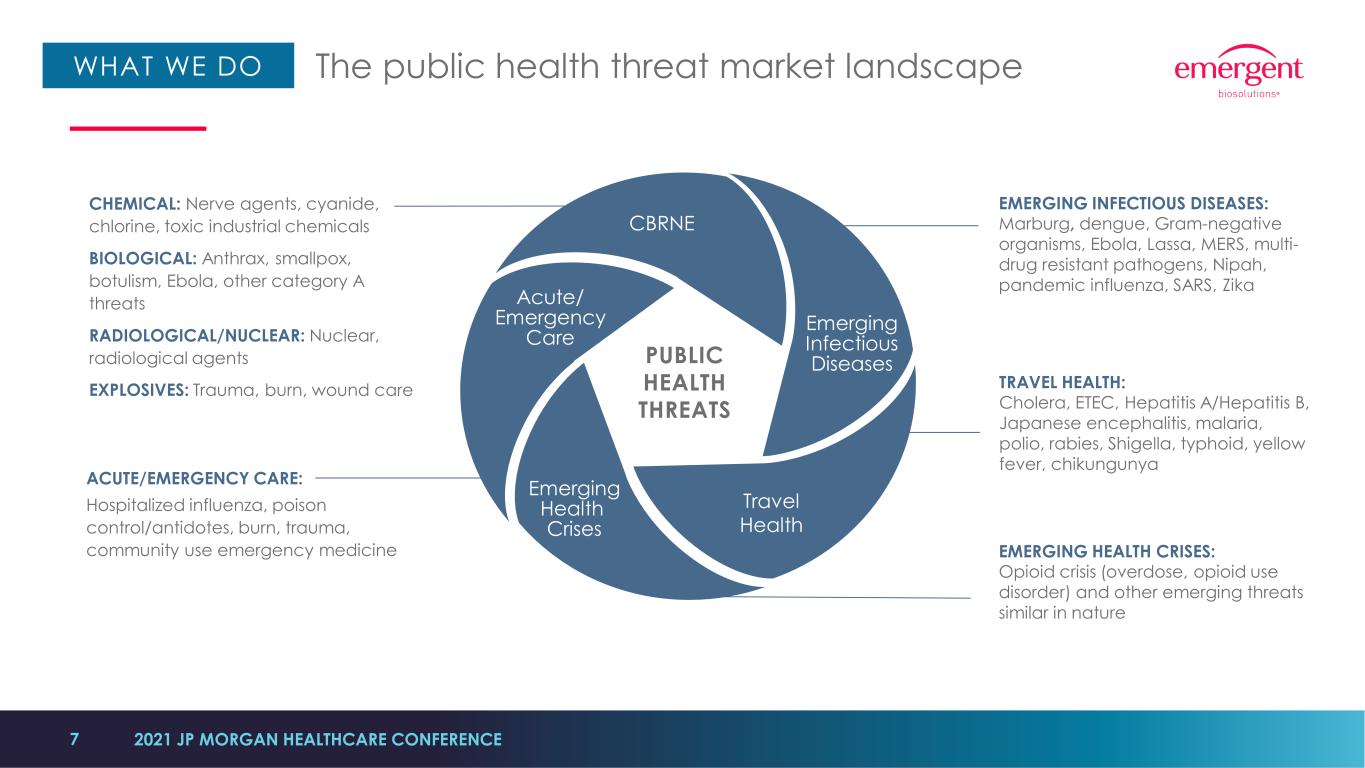

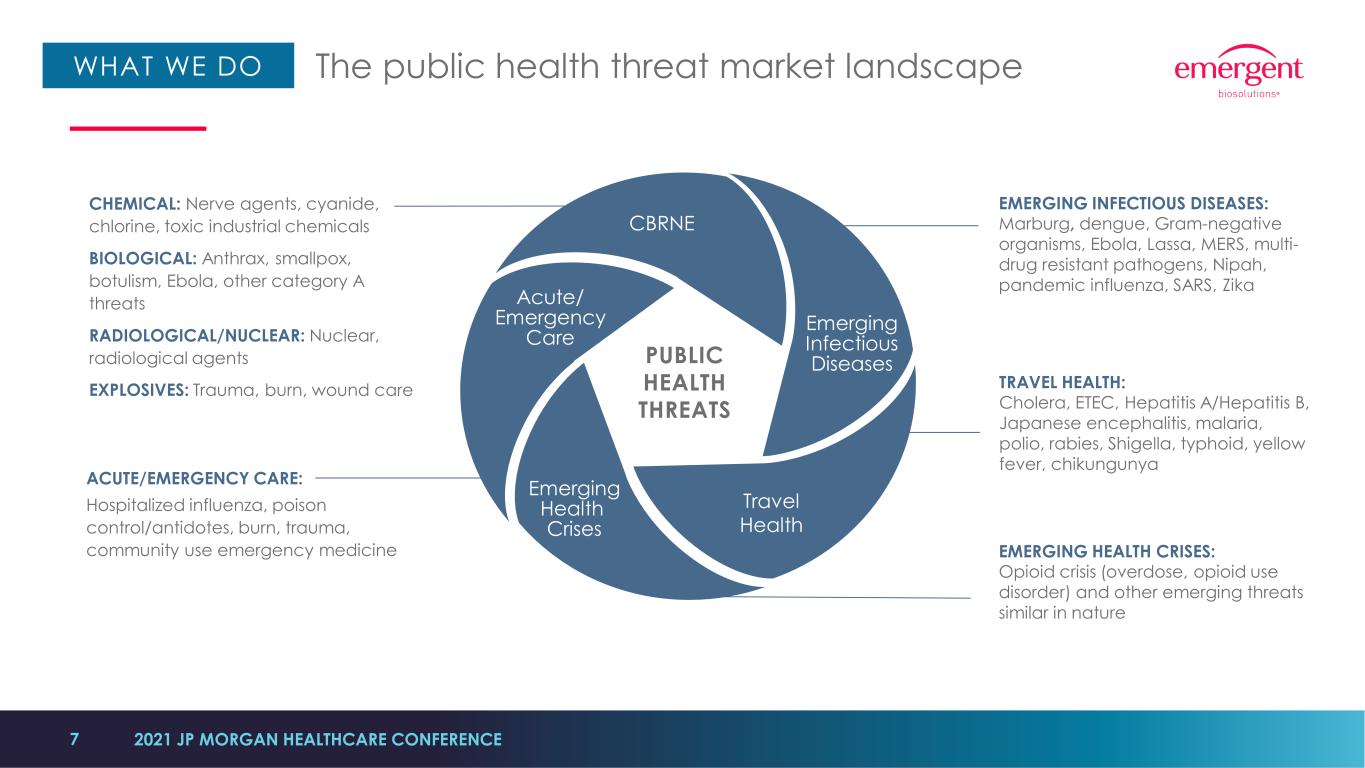

7 WHAT WE DO The public health threat market landscape CBRNE Emerging Infectious Diseases Travel Health Emerging Health Crises Acute/ Emergency Care PUBLIC HEALTH THREATS CHEMICAL: Nerve agents, cyanide, chlorine, toxic industrial chemicals BIOLOGICAL: Anthrax, smallpox, botulism, Ebola, other category A threats RADIOLOGICAL/NUCLEAR: Nuclear, radiological agents EXPLOSIVES: Trauma, burn, wound care ACUTE/EMERGENCY CARE: Hospitalized influenza, poison control/antidotes, burn, trauma, community use emergency medicine EMERGING INFECTIOUS DISEASES: Marburg, dengue, Gram-negative organisms, Ebola, Lassa, MERS, multi- drug resistant pathogens, Nipah, pandemic influenza, SARS, Zika TRAVEL HEALTH: Cholera, ETEC, Hepatitis A/Hepatitis B, Japanese encephalitis, malaria, polio, rabies, Shigella, typhoid, yellow fever, chikungunya EMERGING HEALTH CRISES: Opioid crisis (overdose, opioid use disorder) and other emerging threats similar in nature 2021 JP MORGAN HEALTHCARE CONFERENCE

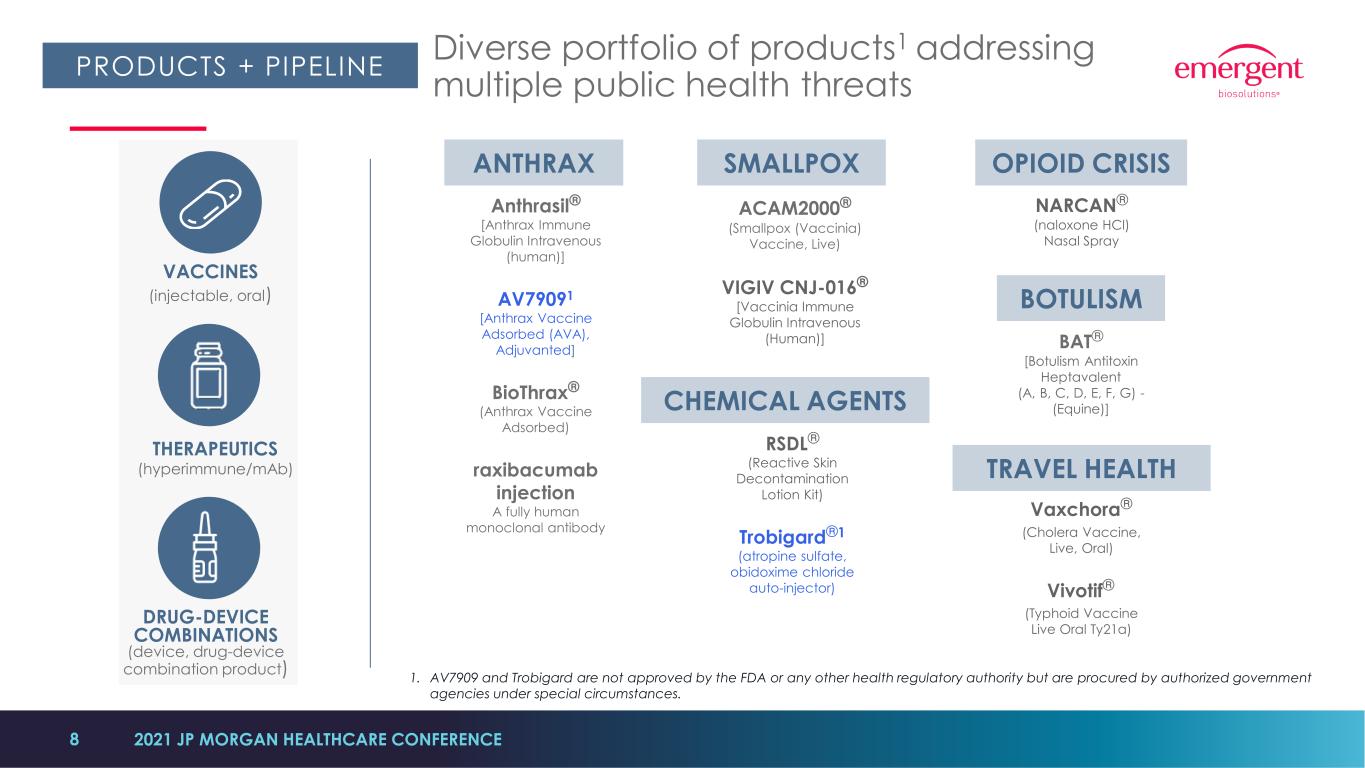

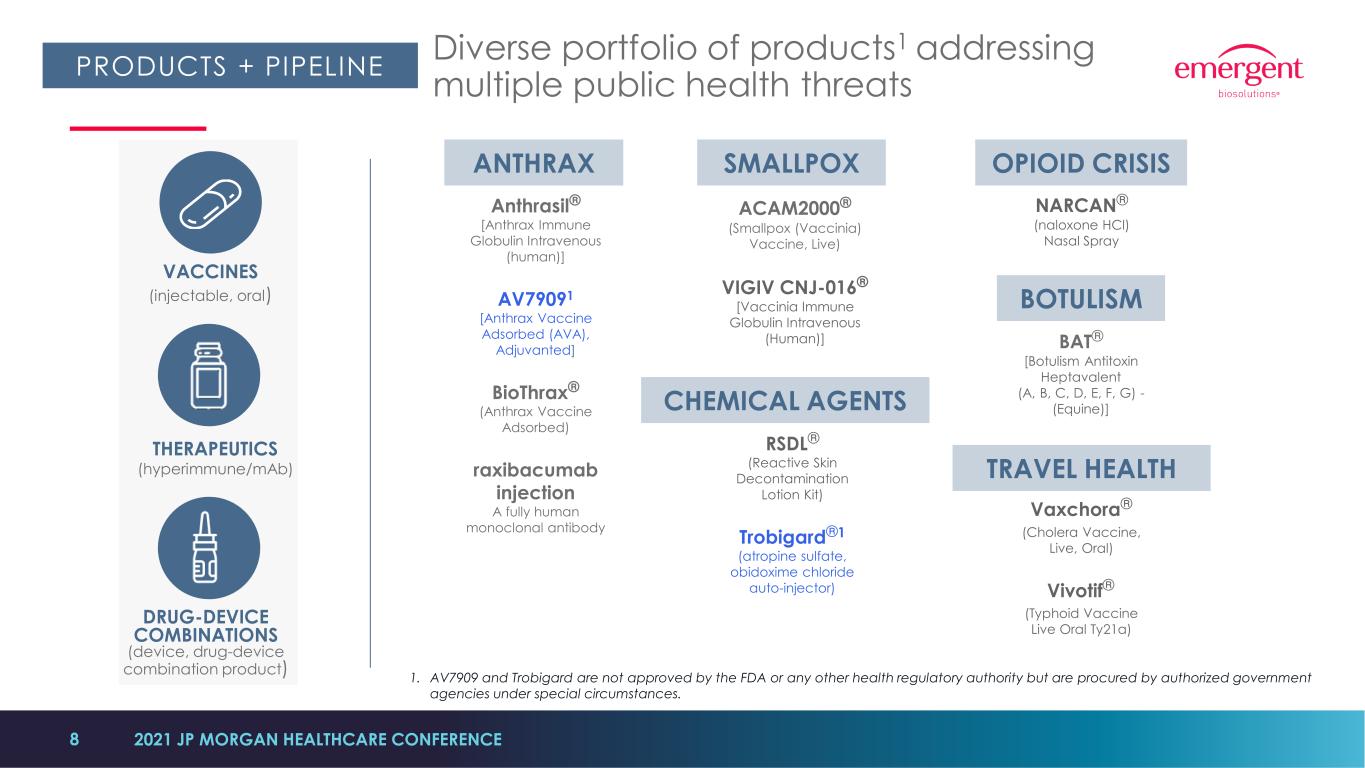

8 Diverse portfolio of products1 addressing multiple public health threats PRODUCTS + PIPELINE VACCINES (injectable, oral) THERAPEUTICS (hyperimmune/mAb) DRUG-DEVICE COMBINATIONS (device, drug-device combination product) TRAVEL HEALTH Vaxchora® (Cholera Vaccine, Live, Oral) Vivotif® (Typhoid Vaccine Live Oral Ty21a) SMALLPOX ACAM2000® (Smallpox (Vaccinia) Vaccine, Live) VIGIV CNJ-016® [Vaccinia Immune Globulin Intravenous (Human)] OPIOID CRISIS NARCAN® (naloxone HCl) Nasal Spray RSDL® (Reactive Skin Decontamination Lotion Kit) Trobigard®1 (atropine sulfate, obidoxime chloride auto-injector) Anthrasil® [Anthrax Immune Globulin Intravenous (human)] AV79091 [Anthrax Vaccine Adsorbed (AVA), Adjuvanted] BioThrax® (Anthrax Vaccine Adsorbed) raxibacumab injection A fully human monoclonal antibody ANTHRAX CHEMICAL AGENTS BOTULISM BAT® [Botulism Antitoxin Heptavalent (A, B, C, D, E, F, G) - (Equine)] 2021 JP MORGAN HEALTHCARE CONFERENCE 1. AV7909 and Trobigard are not approved by the FDA or any other health regulatory authority but are procured by authorized government agencies under special circumstances.

9 Select R&D pipeline programs – sources of potential future growth PRODUCTS + PIPELINE BUSINESS UNIT CANDIDATE THREAT CURRENT PHASE VACCINES AV79091 [Anthrax Vaccine Adsorbed (AVA), adjuvanted] CBRNE • Phase III; BLA filing anticipated 2021 CHIKV VLP (Chikungunya virus VLP vaccine) Travel Health/EID • Phase II; Phase III initiation 2021 WEVEE VLP (Western, Eastern and Venezuelan equine encephalitic VLP) CBRNE/EID • Phase I THERAPEUTICS COVID-HIG (Treatment) (Human polyclonal hyperimmune with antibodies to SARS-CoV-2) EID • Phase III; EUA potential 2021 COVID-HIG (Post-Exposure Prophylaxis (PEP)) (Human polyclonal hyperimmune with antibodies to SARS-CoV-2) EID • Phase I FLU-IGIV (Seasonal influenza A therapeutic) Acute Care • Phase II; Phase III initiation 20213 DEVICES Trobigard Auto-Injector1,2 (Atropine sulfate, obidoxime chloride auto-injector) CBRNE • Late Stage1 D4 (2PAM/atropine) CBRNE • Development Stage AP007 (Sustained-release nalmefene Injectable) Opioids/Opioid Use Disorder • Early Stage/Feasibility Phase 2021 JP MORGAN HEALTHCARE CONFERENCE 1. AV7909 and Trobigard Auto-Injector are not approved by the FDA or any other health regulatory authority but are procured by authorized government agencies under special circumstances. 2. Application submitted to a regulatory health authority in the European Union. 3. Contingent on completion of stage gate assessment and timing of seasonal influenza.

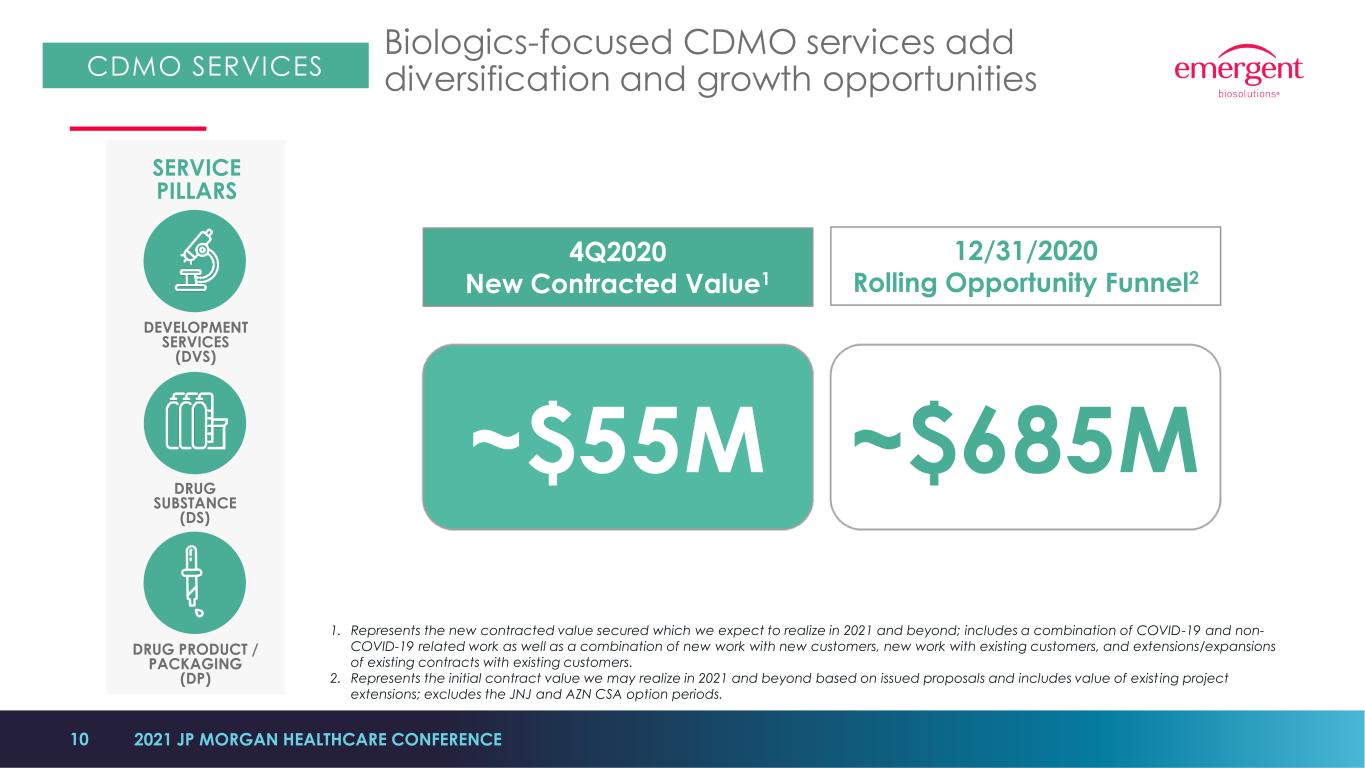

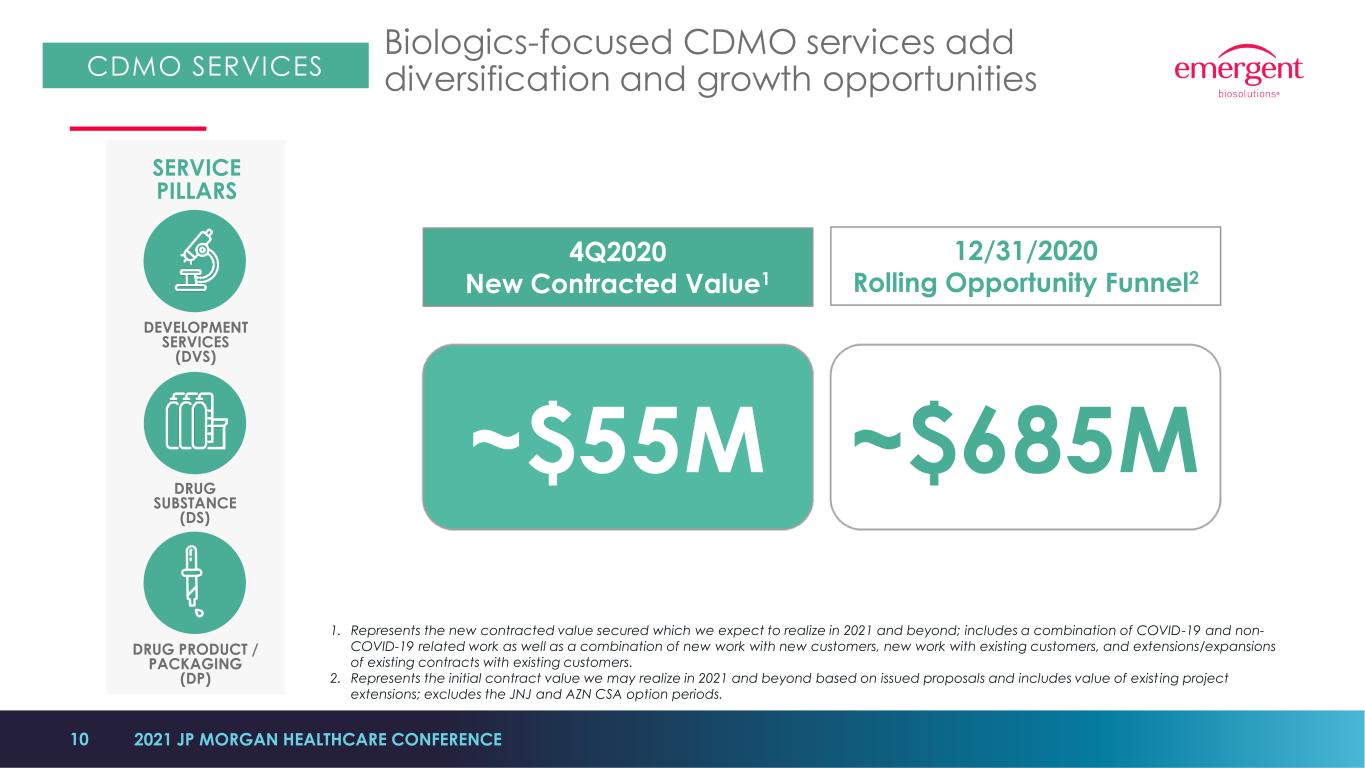

10 CDMO SERVICES Biologics-focused CDMO services add diversification and growth opportunities DEVELOPMENT SERVICES (DVS) DRUG SUBSTANCE (DS) DRUG PRODUCT / PACKAGING (DP) SERVICE PILLARS 4Q2020 New Contracted Value1 ~$685M~$55M 1. Represents the new contracted value secured which we expect to realize in 2021 and beyond; includes a combination of COVID-19 and non- COVID-19 related work as well as a combination of new work with new customers, new work with existing customers, and extensions/expansions of existing contracts with existing customers. 2. Represents the initial contract value we may realize in 2021 and beyond based on issued proposals and includes value of exist ing project extensions; excludes the JNJ and AZN CSA option periods. 2021 JP MORGAN HEALTHCARE CONFERENCE 12/31/2020 Rolling Opportunity Funnel2

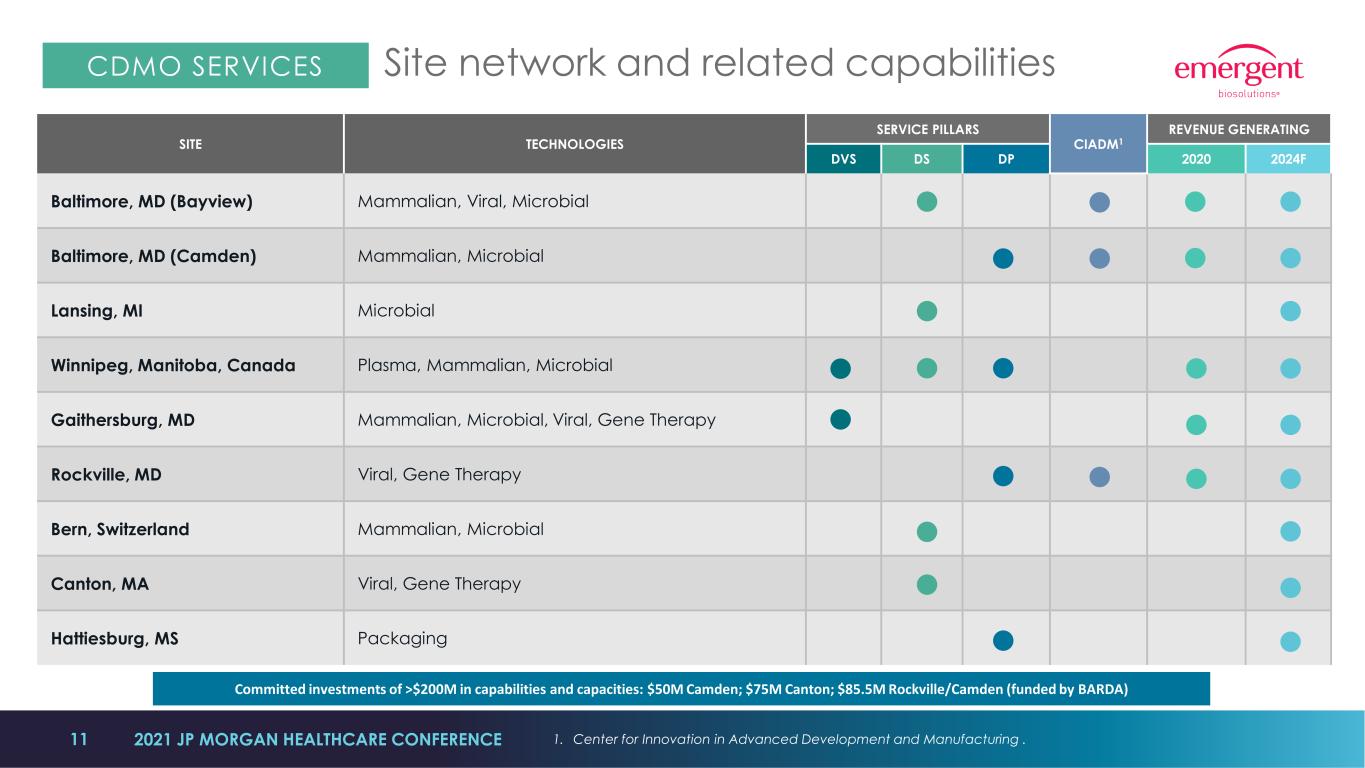

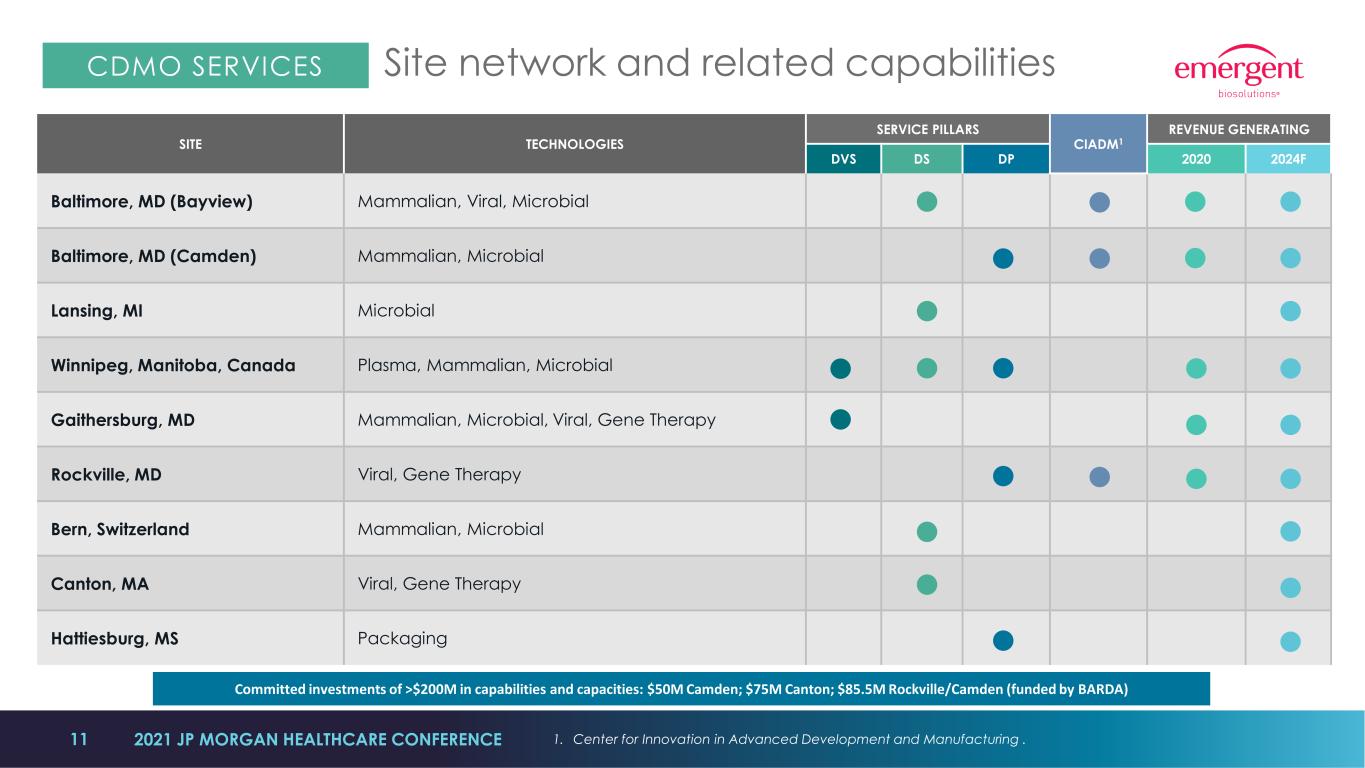

11 CDMO SERVICES Site network and related capabilities SITE TECHNOLOGIES SERVICE PILLARS CIADM1 REVENUE GENERATING DVS DS DP 2020 2024F Baltimore, MD (Bayview) Mammalian, Viral, Microbial Baltimore, MD (Camden) Mammalian, Microbial Lansing, MI Microbial Winnipeg, Manitoba, Canada Plasma, Mammalian, Microbial Gaithersburg, MD Mammalian, Microbial, Viral, Gene Therapy Rockville, MD Viral, Gene Therapy Bern, Switzerland Mammalian, Microbial Canton, MA Viral, Gene Therapy Hattiesburg, MS Packaging 2021 JP MORGAN HEALTHCARE CONFERENCE Committed investments of >$200M in capabilities and capacities: $50M Camden; $75M Canton; $85.5M Rockville/Camden (funded by BARDA) 1. Center for Innovation in Advanced Development and Manufacturing .

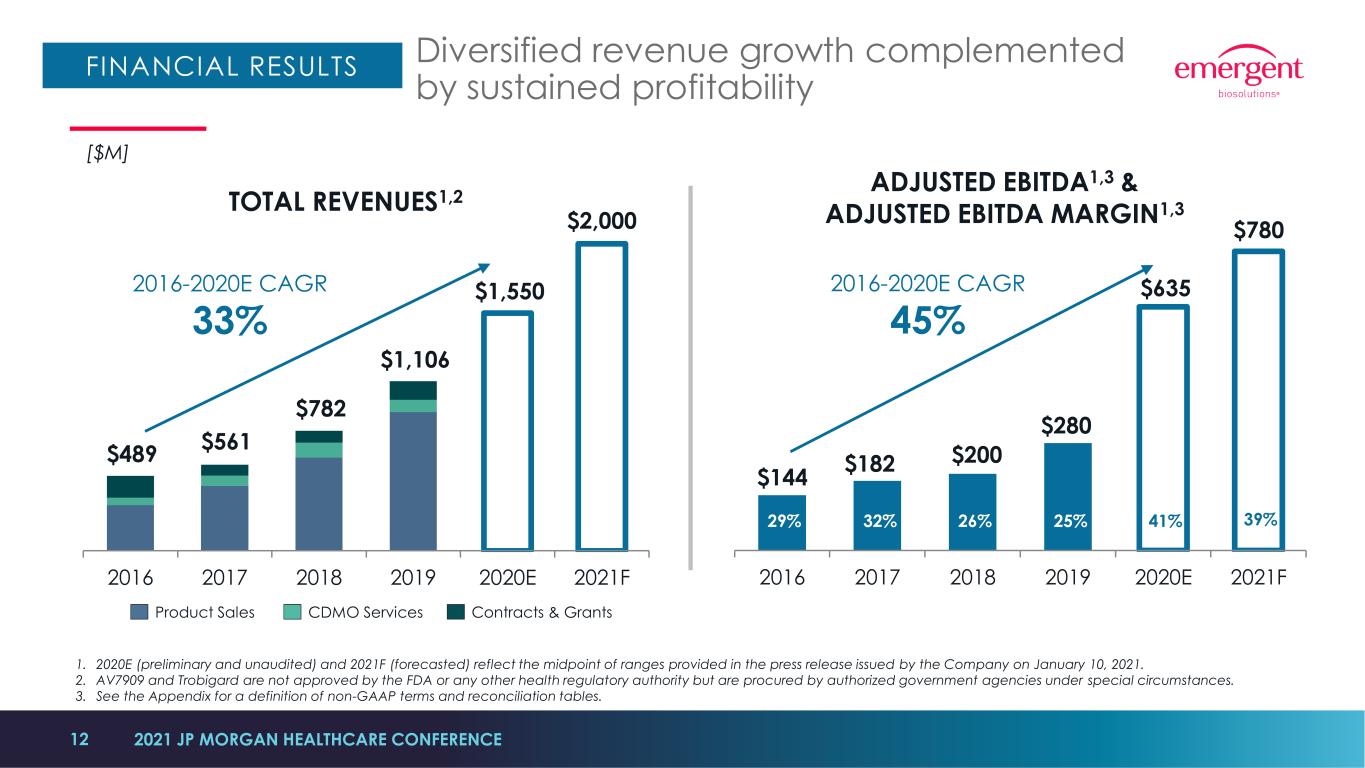

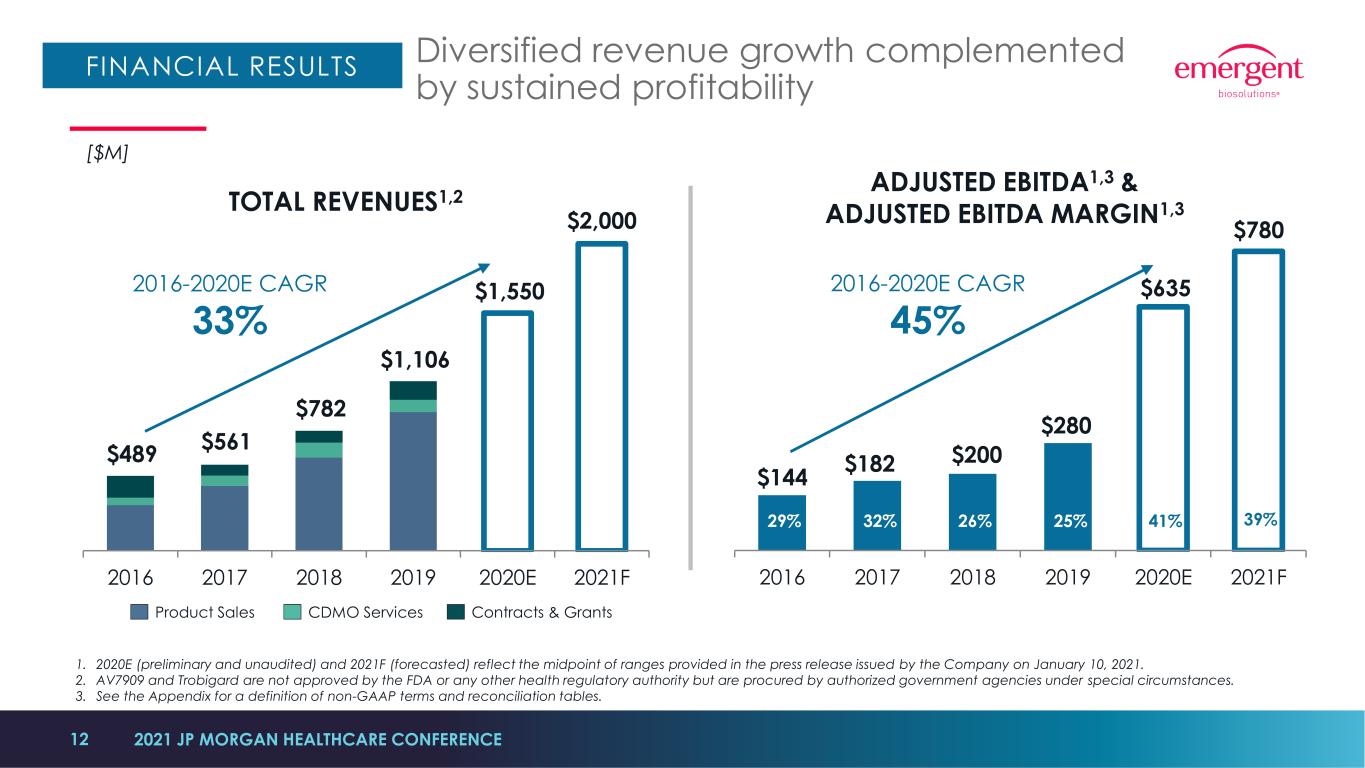

FINANCIAL RESULTS Diversified revenue growth complemented by sustained profitability 2016 2017 2018 2019 2020E 2021F TOTAL REVENUES1,2 [$M] $144 $182 $200 $280 $635 $780 2016 2017 2018 2019 2020E 2021F ADJUSTED EBITDA1,3 & ADJUSTED EBITDA MARGIN1,3 29% 32% 26% 25% 41% 39% 12 2016-2020E CAGR 45% 2016-2020E CAGR 33% $2,000 $1,550 $1,106 $782 $561 $489 Product Sales CDMO Services Contracts & Grants 1. 2020E (preliminary and unaudited) and 2021F (forecasted) reflect the midpoint of ranges provided in the press release issued by the Company on January 10, 2021. 2. AV7909 and Trobigard are not approved by the FDA or any other health regulatory authority but are procured by authorized government agencies under special circumstances. 3. See the Appendix for a definition of non-GAAP terms and reconciliation tables. 2021 JP MORGAN HEALTHCARE CONFERENCE

13 GROW THROUGH M&A STRENGTHEN R&D PORTFOLIO BUILD SCALABLE CAPABILITIES EVOLVE CULTURE EXECUTE CORE BUSINESS GROWTH STRATEGY Key pillars of our Growth Strategy 2021 JP MORGAN HEALTHCARE CONFERENCE

14 KEY TAKEAWAYS 1B lives protected or enhanced by 2030 2021 JP MORGAN HEALTHCARE CONFERENCE 1. Proven partner and established leader 2. Diversified product + pipeline and services mix 3. Scalable and sustainable business model 4. Strong financial foundation 5. POISED FOR CONTINUED GROWTH AND EXPANSION

Appendix

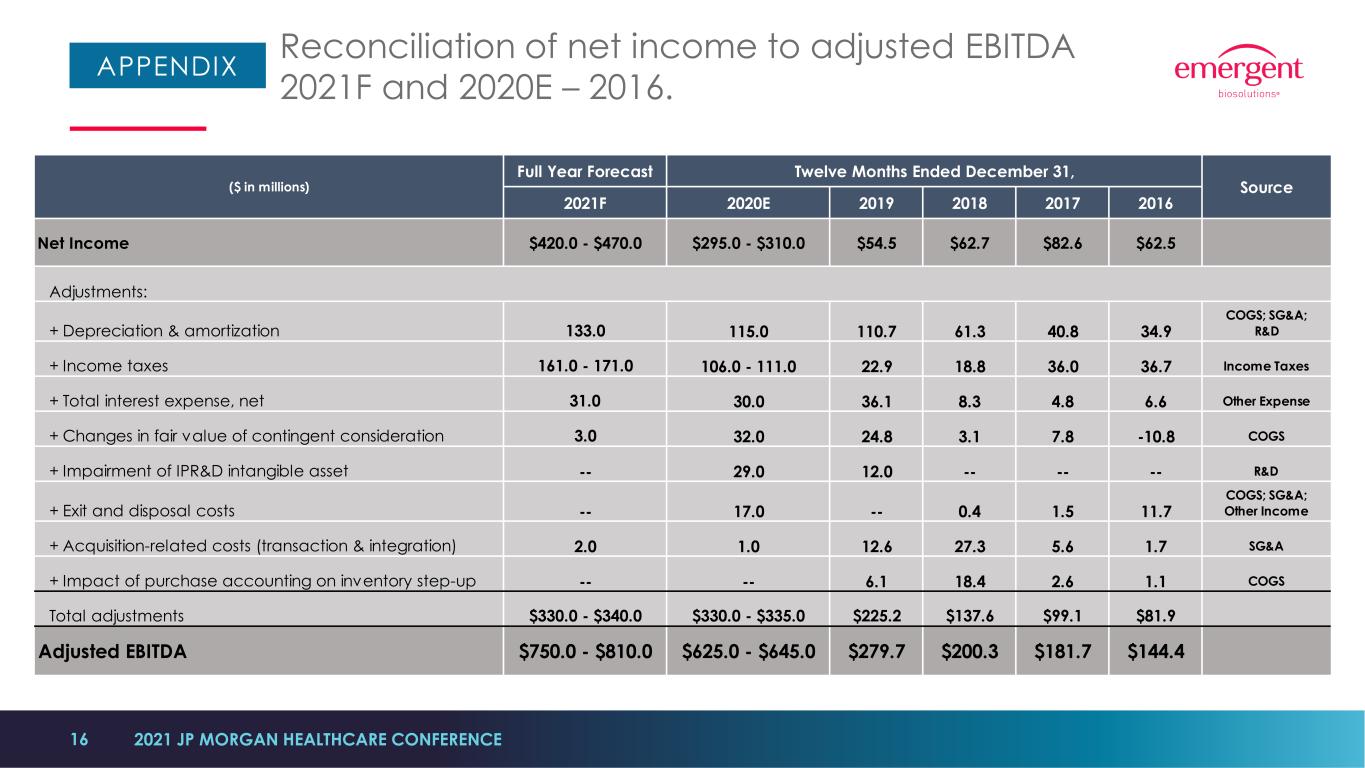

16 APPENDIX Reconciliation of net income to adjusted EBITDA 2021F and 2020E – 2016. 2021 JP MORGAN HEALTHCARE CONFERENCE Full Year Forecast 2021F 2020E 2019 2018 2017 2016 Net Income $420.0 - $470.0 $295.0 - $310.0 $54.5 $62.7 $82.6 $62.5 Adjustments: + Depreciation & amortization 133.0 115.0 110.7 61.3 40.8 34.9 COGS; SG&A; R&D + Income taxes 161.0 - 171.0 106.0 - 111.0 22.9 18.8 36.0 36.7 Income Taxes + Total interest expense, net 31.0 30.0 36.1 8.3 4.8 6.6 Other Expense + Changes in fair value of contingent consideration 3.0 32.0 24.8 3.1 7.8 -10.8 COGS + Impairment of IPR&D intangible asset -- 29.0 12.0 -- -- -- R&D + Exit and disposal costs -- 17.0 -- 0.4 1.5 11.7 COGS; SG&A; Other Income + Acquisition-related costs (transaction & integration) 2.0 1.0 12.6 27.3 5.6 1.7 SG&A + Impact of purchase accounting on inventory step-up -- -- 6.1 18.4 2.6 1.1 COGS Total adjustments $330.0 - $340.0 $330.0 - $335.0 $225.2 $137.6 $99.1 $81.9 Adjusted EBITDA $750.0 - $810.0 $625.0 - $645.0 $279.7 $200.3 $181.7 $144.4 ($ in millions) Twelve Months Ended December 31, Source

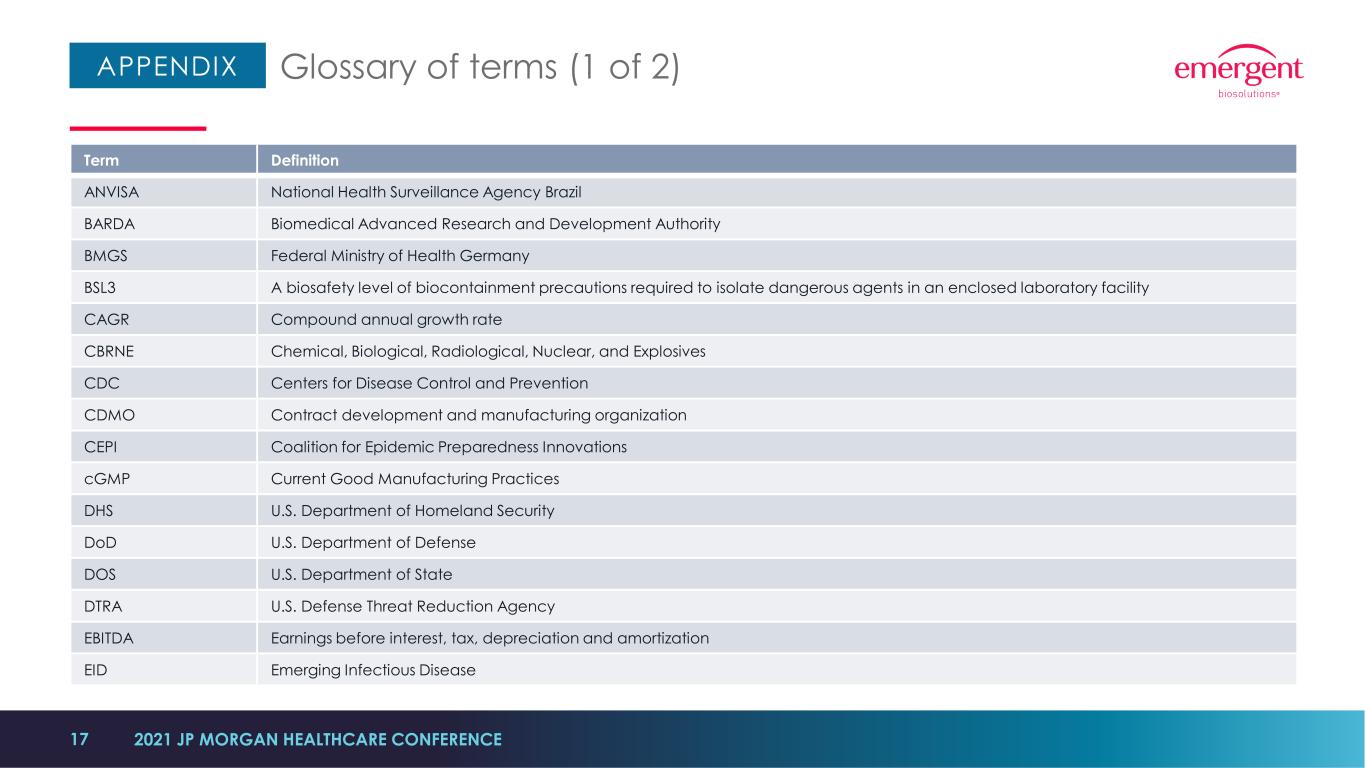

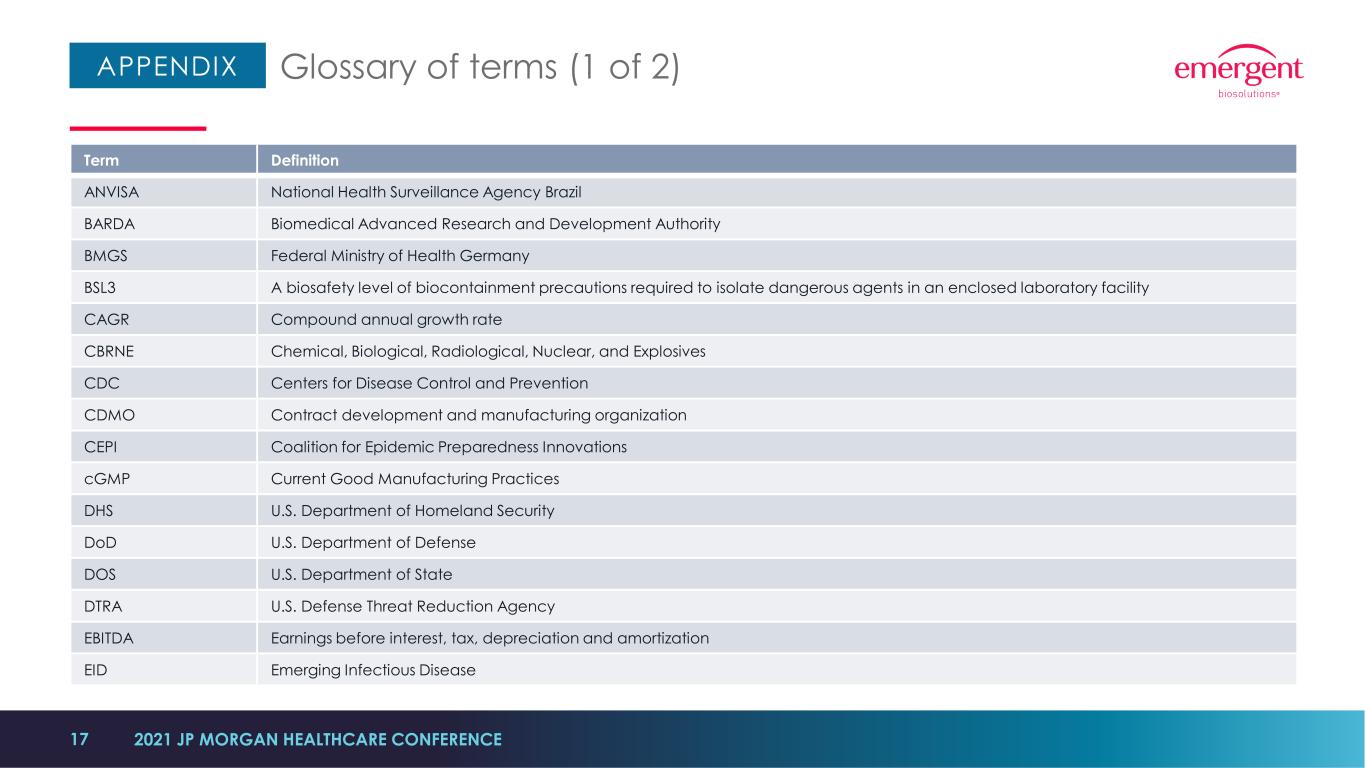

17 APPENDIX Glossary of terms (1 of 2) 2021 JP MORGAN HEALTHCARE CONFERENCE Term Definition ANVISA National Health Surveillance Agency Brazil BARDA Biomedical Advanced Research and Development Authority BMGS Federal Ministry of Health Germany BSL3 A biosafety level of biocontainment precautions required to isolate dangerous agents in an enclosed laboratory facility CAGR Compound annual growth rate CBRNE Chemical, Biological, Radiological, Nuclear, and Explosives CDC Centers for Disease Control and Prevention CDMO Contract development and manufacturing organization CEPI Coalition for Epidemic Preparedness Innovations cGMP Current Good Manufacturing Practices DHS U.S. Department of Homeland Security DoD U.S. Department of Defense DOS U.S. Department of State DTRA U.S. Defense Threat Reduction Agency EBITDA Earnings before interest, tax, depreciation and amortization EID Emerging Infectious Disease

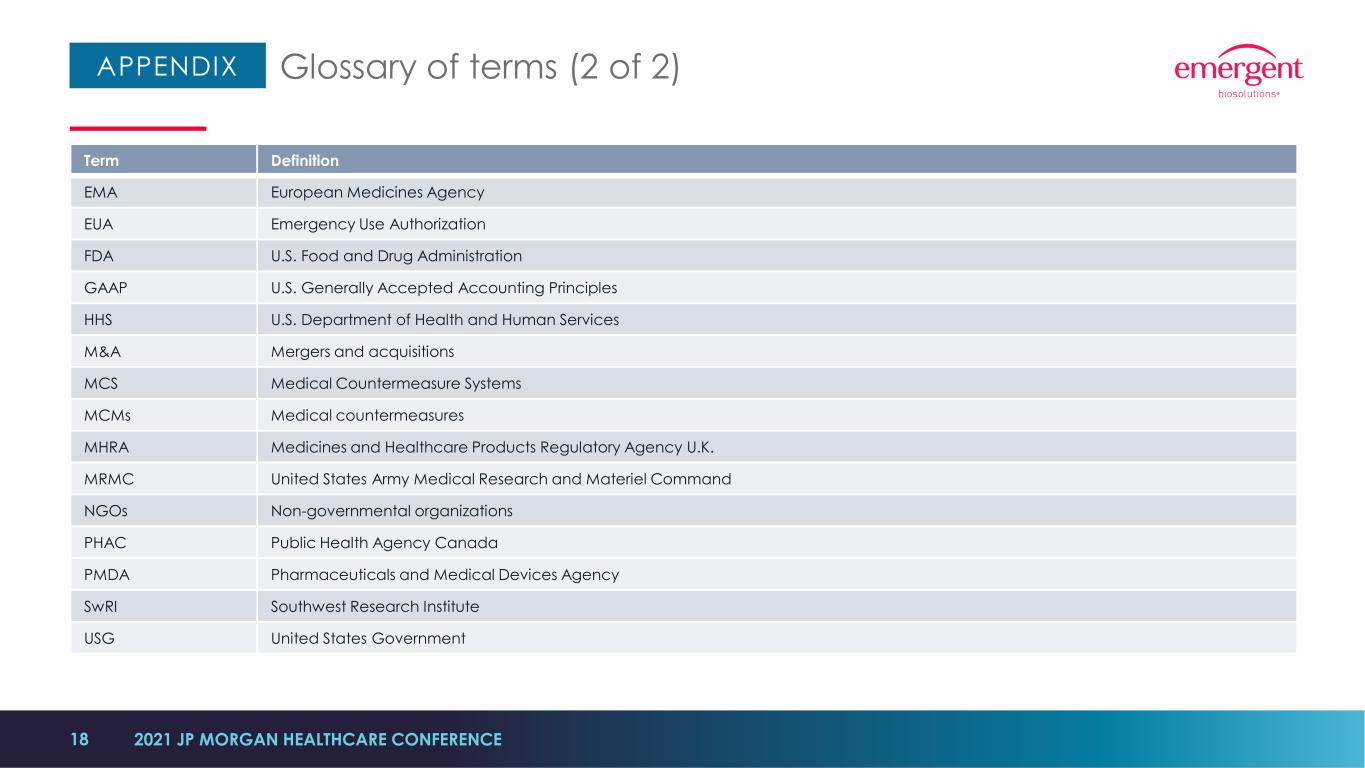

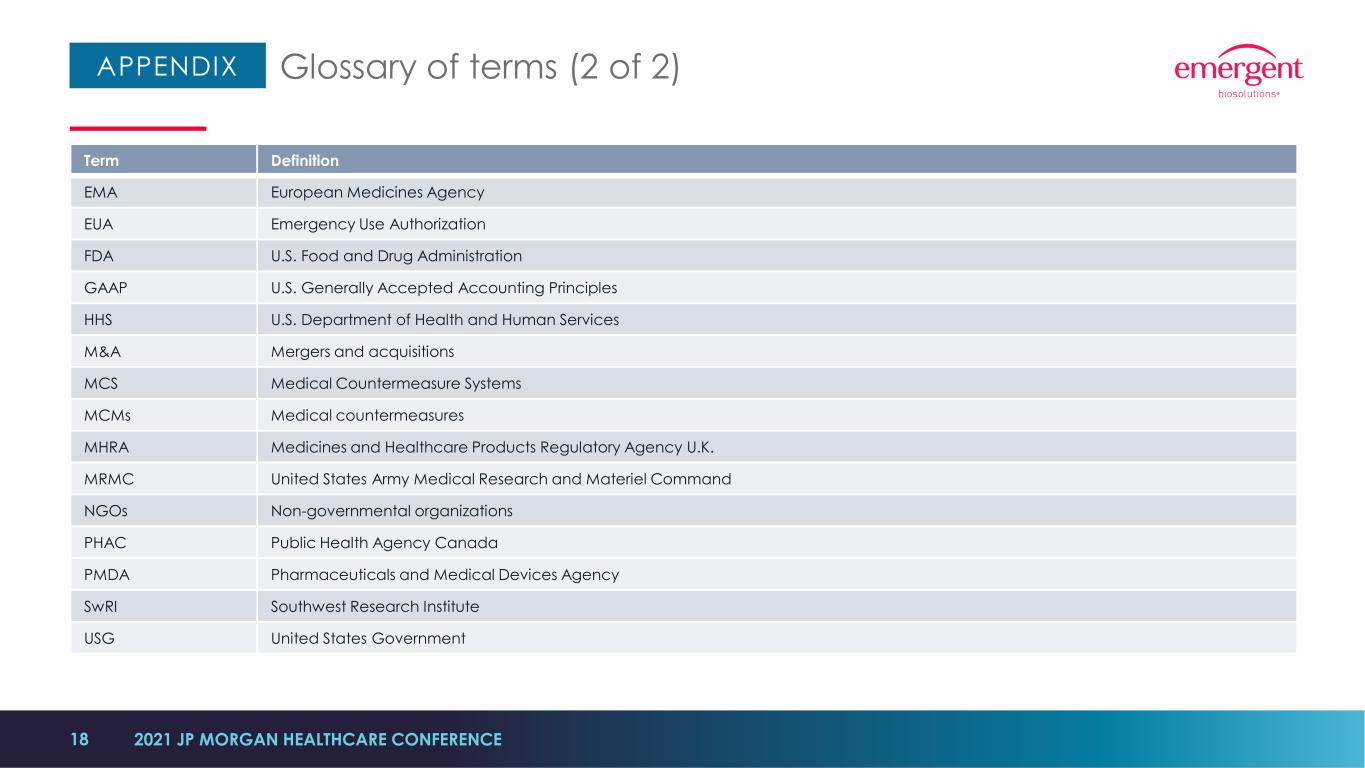

18 APPENDIX Glossary of terms (2 of 2) 2021 JP MORGAN HEALTHCARE CONFERENCE Term Definition EMA European Medicines Agency EUA Emergency Use Authorization FDA U.S. Food and Drug Administration GAAP U.S. Generally Accepted Accounting Principles HHS U.S. Department of Health and Human Services M&A Mergers and acquisitions MCS Medical Countermeasure Systems MCMs Medical countermeasures MHRA Medicines and Healthcare Products Regulatory Agency U.K. MRMC United States Army Medical Research and Materiel Command NGOs Non-governmental organizations PHAC Public Health Agency Canada PMDA Pharmaceuticals and Medical Devices Agency SwRI Southwest Research Institute USG United States Government

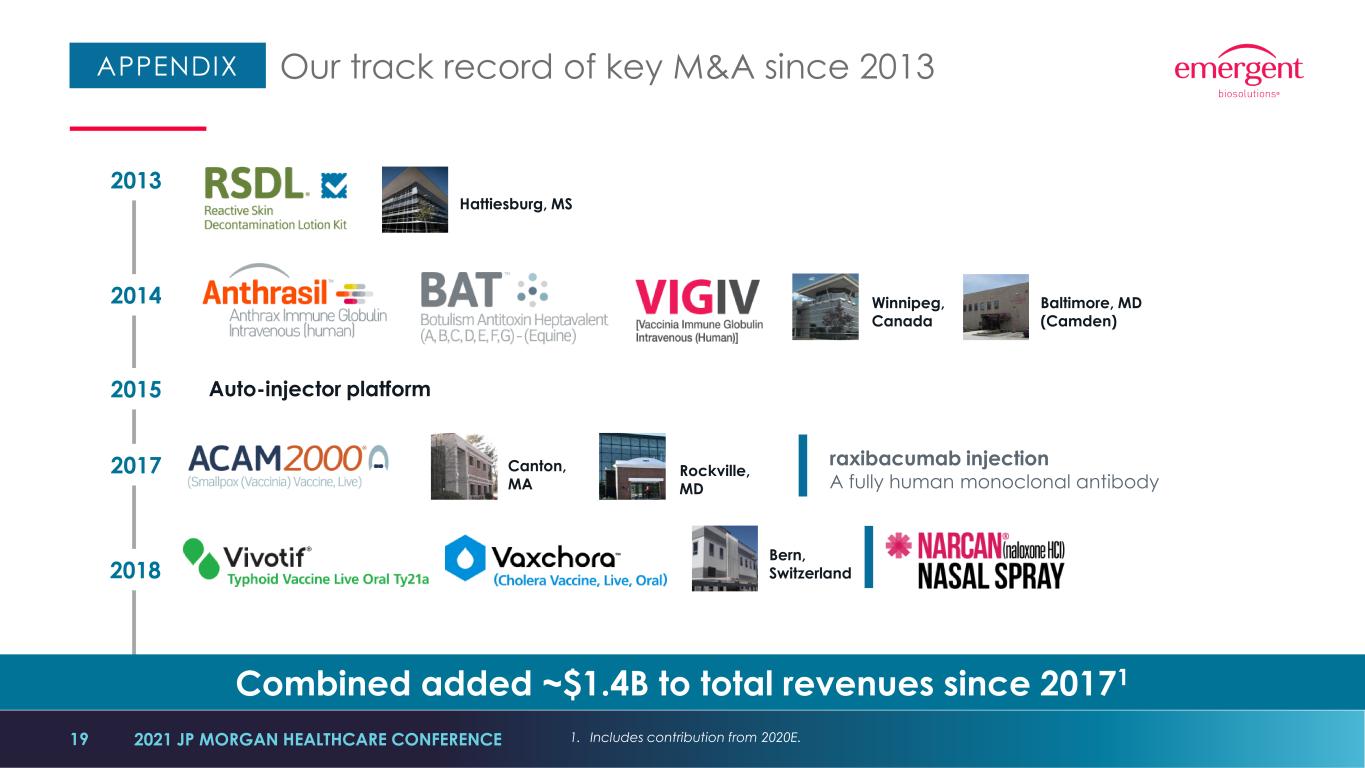

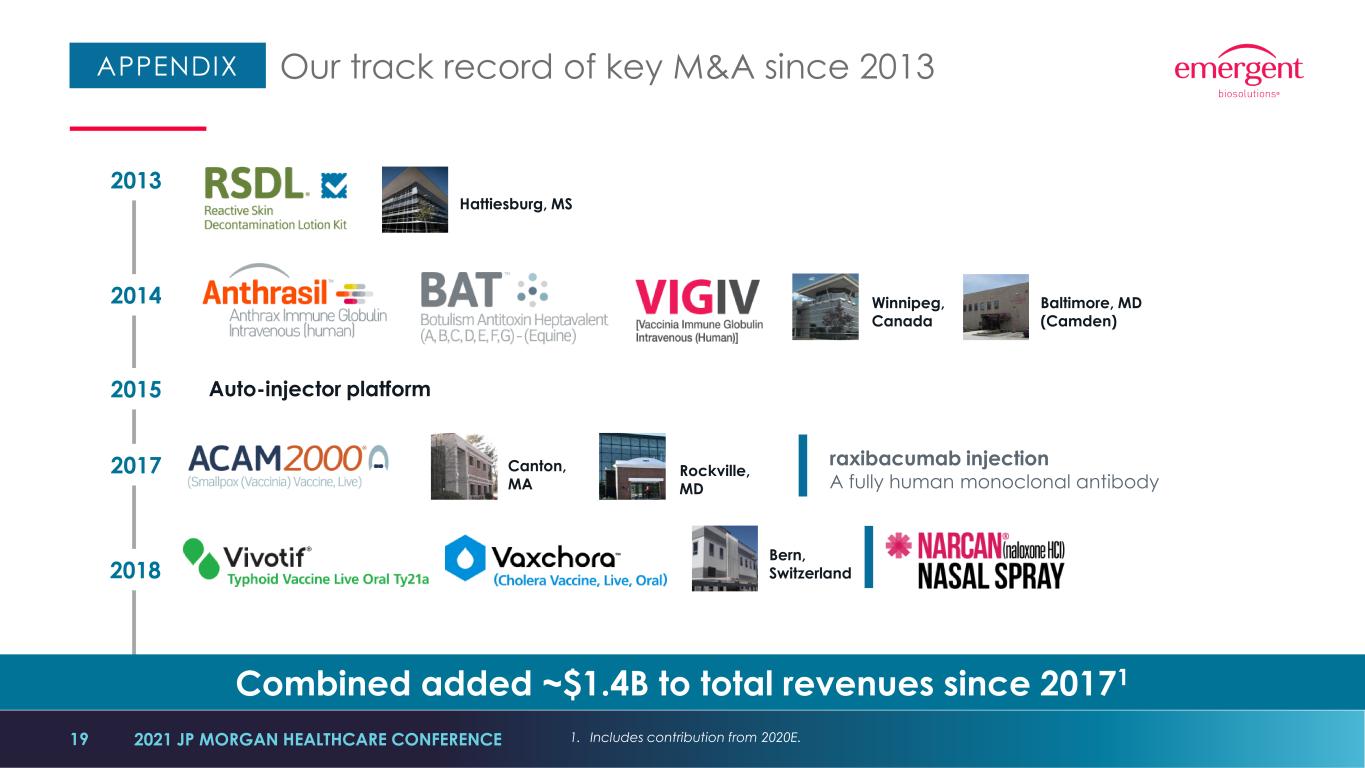

19 APPENDIX Our track record of key M&A since 2013 2021 JP MORGAN HEALTHCARE CONFERENCE 2013 Hattiesburg, MS Baltimore, MD (Camden) Winnipeg, Canada 2014 2015 Auto-injector platform 2018 Bern, Switzerland 2017 Rockville, MD Canton, MA raxibacumab injection A fully human monoclonal antibody Combined added ~$1.4B to total revenues since 20171 1. Includes contribution from 2020E.

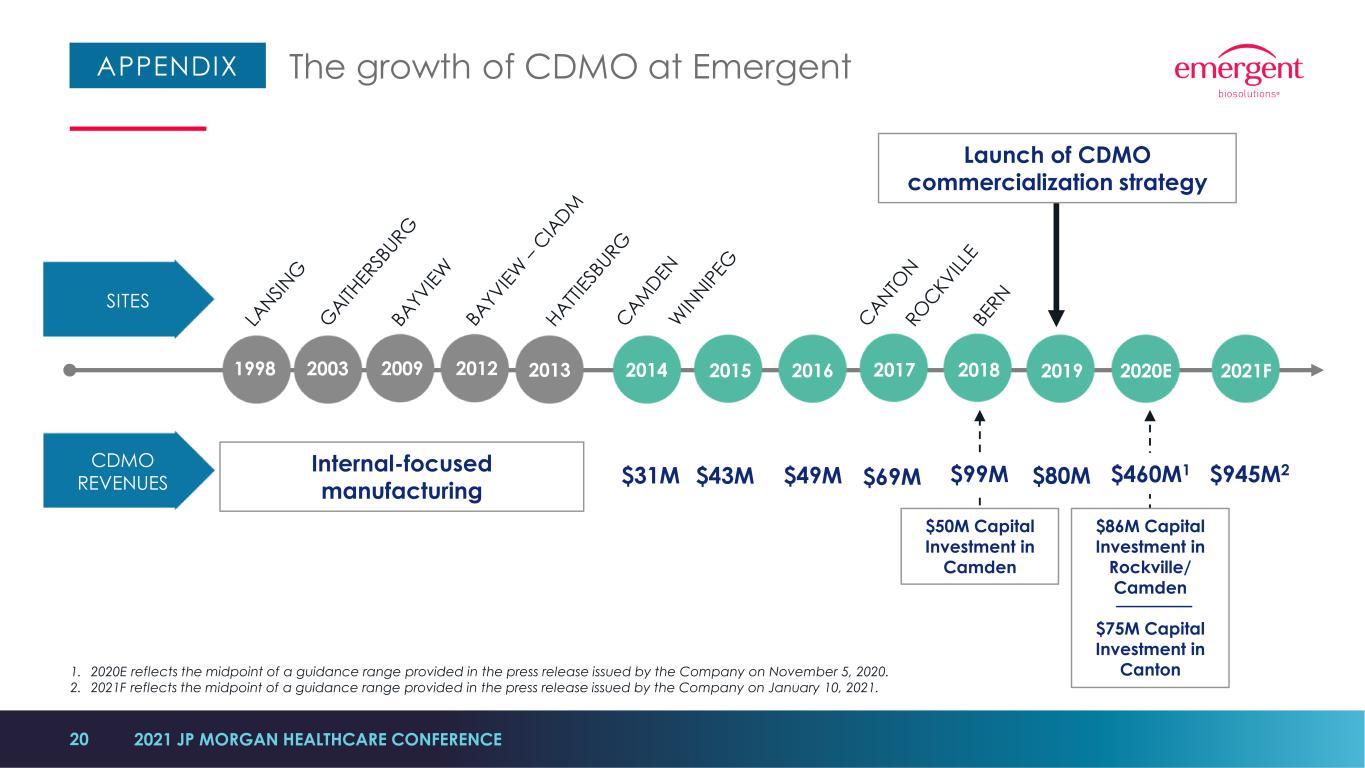

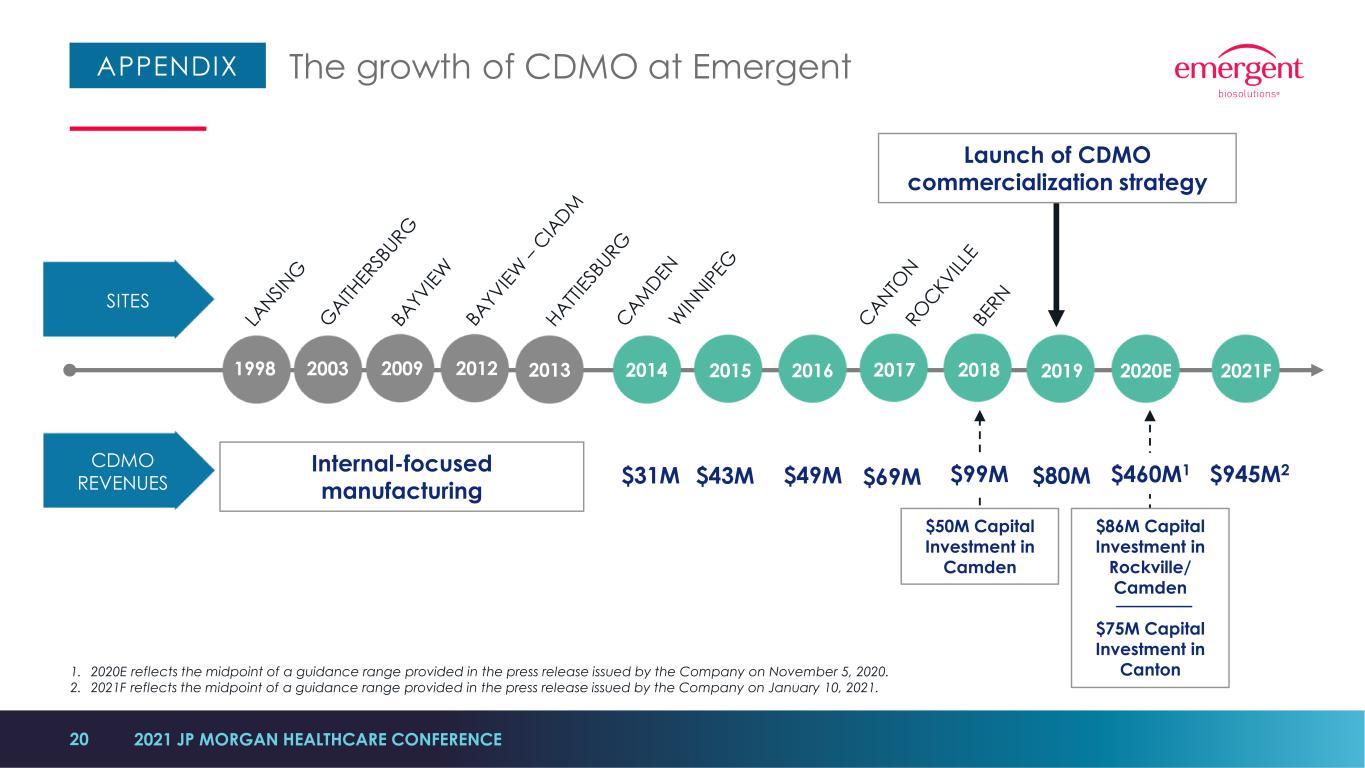

20 APPENDIX The growth of CDMO at Emergent 2021 JP MORGAN HEALTHCARE CONFERENCE 2020E20192018201720162015201420131998 2003 SITES CDMO REVENUES $43M $49M $69M $99M $80M $460M 1$31M Internal-focused manufacturing Launch of CDMO commercialization strategy 2009 2012 1. 2020E reflects the midpoint of a guidance range provided in the press release issued by the Company on November 5, 2020. 2. 2021F reflects the midpoint of a guidance range provided in the press release issued by the Company on January 10, 2021. 2021F $945M2 $50M Capital Investment in Camden $86M Capital Investment in Rockville/ Camden $75M Capital Investment in Canton

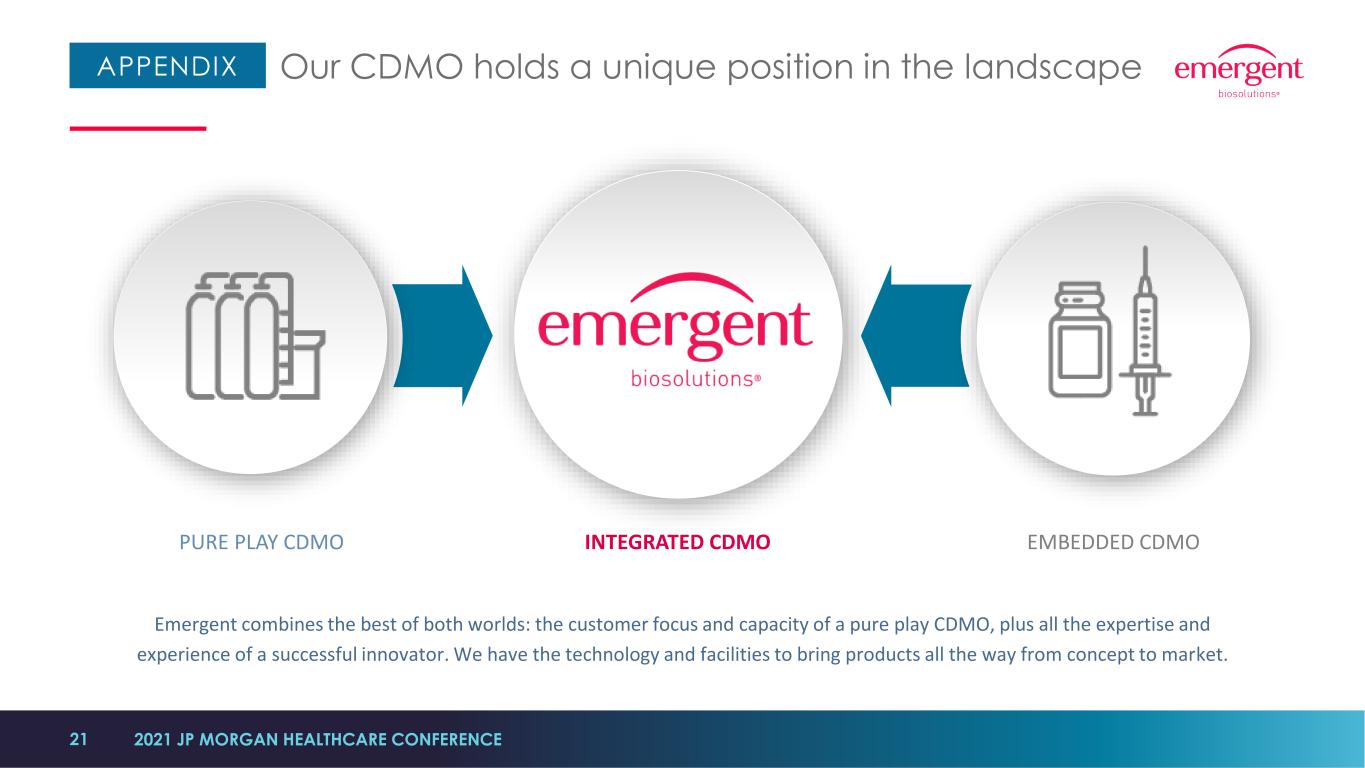

21 APPENDIX Our CDMO holds a unique position in the landscape Emergent combines the best of both worlds: the customer focus and capacity of a pure play CDMO, plus all the expertise and experience of a successful innovator. We have the technology and facilities to bring products all the way from concept to market. PURE PLAY CDMO INTEGRATED CDMO EMBEDDED CDMO 2021 JP MORGAN HEALTHCARE CONFERENCE

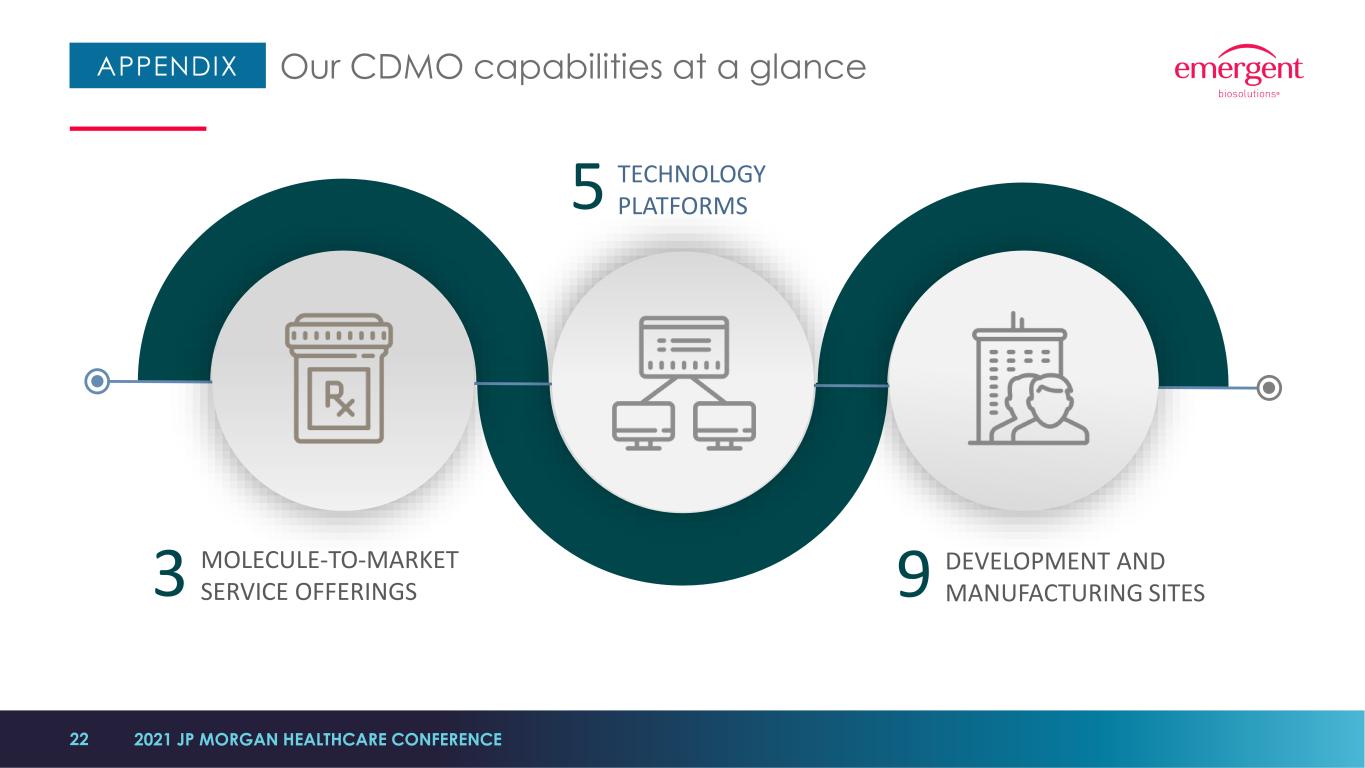

22 APPENDIX Our CDMO capabilities at a glance MOLECULE-TO-MARKET SERVICE OFFERINGS TECHNOLOGY PLATFORMS DEVELOPMENT AND MANUFACTURING SITES3 5 9 2021 JP MORGAN HEALTHCARE CONFERENCE

23 APPENDIX Our CDMO offers end-to-end integrated services DEVELOPMENT SERVICES (DVS) DRUG SUBSTANCE MANUFACTURING (DS) DRUG PRODUCT MANUFACTURING AND PACKAGING (DP) 2021 JP MORGAN HEALTHCARE CONFERENCE

24 APPENDIX Our CDMO business utilizes multiple platform technologies addressing compelling market opportunities ▪ Molecule-to-market development and manufacturing services with successful track record of innovation. ▪ Enterprise team of more than 1400 technical and quality compliance professionals. ▪ Facilities and capabilities located in proximity to pharma and biotech hubs. ▪ Unique platform of customizable offerings across entire drug development lifecycle. $15B $2B $1.5B $1B $0.5B MAMMALIAN VIRAL MICROBIAL PLASMA GENE THERAPY EMERGENT CDMO FORMULA FOR GROWTH: 2021 JP MORGAN HEALTHCARE CONFERENCE

25 APPENDIX CDMO key growth initiatives 2021 JP MORGAN HEALTHCARE CONFERENCE INVEST TO MEET MARKET NEEDS DRIVE GLOBAL BRAND AWARENESS EXPAND SALES AND BUSINESS DEVELOPMENT TEAMS ENHANCE MOLECULE- TO-MARKET OFFERING EXPLORE PARTNERSHIP OPPORTUNITIES BALANCE CLINICAL WITH COMMERCIAL CROSS-SELL TO EXISTING CLIENTS INCREASE MANUFAC- TURING CAPACITY

www.emergentbiosolutions.com