Q2 2024 Financial Results Update August 6, 2024

PROPRIETARY AND CONFIDENTIAL Q2 2024 Update Introduction

This presentation includes forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. All statements, other than statements of historical fact, including statements regarding the future performance of the Company or any of our businesses, our business strategy, future operations, future financial position, future revenues and earnings, our ability to achieve the objectives of our restructuring initiatives and divestitures, including our future results, projected costs, prospects, plans and objectives of management, are forward-looking statements. We generally identify forward-looking statements by using words like “anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,” “forecast,” “future,” “goal,” “intend,” “may,” “plan,” “position,” “possible,” “potential,” “predict,” “project,” “should,” “target,” “will,” “would,” and similar expressions or variations thereof, or the negative thereof, but these terms are not the exclusive means of identifying such statements. Forward-looking statements are based on our current intentions, beliefs, assumptions and expectations regarding future events based on information that is currently available. Readers should realize that if underlying assumptions prove inaccurate or if known or unknown risks or uncertainties materialize, actual results could differ materially from our expectations. Readers are, therefore, cautioned not to place undue reliance on any forward-looking statement contained herein. Any such forward- looking statement speaks only as of the date of this presentation, and, except as required by law, we do not undertake any obligation to update any forward-looking statement to reflect new information, events or circumstances. There are a number of important factors that could cause our actual results to differ materially from those indicated by such forward-looking statements, including, among others, the availability of USG funding for contracts related to procurement of our medical countermeasure ("MCM") products, including CYFENDUS® (Anthrax Vaccine Adsorbed (AVA), Adjuvanted), previously known as AV7909, BioThrax® (Anthrax Vaccine Adsorbed) and ACAM2000® (Smallpox (Vaccinia) Vaccine, Live), among others, as well as contracts related to development of medical countermeasures; the availability of government funding for our other commercialized products, including EbangaTM (ansuvimab-zykl) and BAT® (Botulism Antitoxin Heptavalent (A,B,C,D,E,F,G)-(Equine)); our ability to meet our commitments to quality and compliance in all of our manufacturing operations; our ability to negotiate additional USG procurement or follow-on contracts for our MCM products that have expired or will be expiring; the commercial availability and acceptance of over-the-counter NARCAN® (naloxone HCl) Nasal Spray; the impact of a generic and competitive marketplace on NARCAN® Nasal Spray and future NARCAN® Nasal Spray sales; our ability to perform under our contracts with the USG, including the timing of and specifications relating to deliveries; our ability to provide Bioservices (as defined below) for the development and/or manufacture of product and/or product candidates of our customers at required levels and on required timelines; the ability of our contractors and suppliers to maintain compliance with current good manufacturing practices and other regulatory obligations; our ability to negotiate further commitments related to the collaboration and deployment of capacity toward future commercial manufacturing under our existing Bioservices contracts; our ability to collect reimbursement for raw materials and payment of services fees from our Bioservices customers; the results of pending stockholder litigation and government investigations and their potential impact on our business; our ability to comply with the operating and financial covenants and the capital raise requirements by the stated deadline required by our revolving credit facility and our term loan facility under a senior secured credit agreement, dated October 15, 2018, between the Company and multiple lending institutions, as amended from time to time, as well as our 3.875% Senior Unsecured Notes due 2028; our ability to maintain adequate internal control over financial reporting and to prepare accurate financial statements in a timely manner; our ability to resolve the going concern qualification in our consolidated financial statements and otherwise successfully manage our liquidity in order to continue as a going concern; the procurement of our product candidates by USG entities under regulatory authorities that permit government procurement of certain medical products prior to FDA marketing authorization, and corresponding procurement by government entities outside of the United States; our ability to realize the expected benefits of the sale of our travel health business to Bavarian Nordic, the sale of RSDL® to SERB Pharmaceuticals and the pending sale of our Drug Product facility in Baltimore-Camden to Bora Pharmaceuticals Injectables Inc.; the impact of the organizational changes we announced in January 2023, August 2023 and May 2024; our ability to identify and acquire companies, businesses, products or product candidates that satisfy our selection criteria; the impact of cyber security incidents, including the risks from the unauthorized access, interruption, failure or compromise of our information systems or those of our business partners, collaborators or other third parties; the success of our commercialization, marketing and manufacturing capabilities and strategy; and the accuracy of our estimates regarding future revenues, expenses, capital requirements and needs for additional financing. The foregoing sets forth many, but not all, of the factors that could cause actual results to differ from our expectations in any forward-looking statement. Readers should consider this cautionary statement, as well as the risks identified in our periodic reports filed with the Securities and Exchange Commission, when evaluating our forward-looking statements. Trademarks Emergent®, BioThrax®, BAT®, Anthrasil®, CNJ-016®, ACAM2000®, NARCAN®, CYFENDUS®, TEMBEXA® and any and all Emergent BioSolutions Inc. brands, products, services and feature names, logos and slogans are trademarks or registered trademarks of Emergent BioSolutions Inc. or its subsidiaries in the United States or other countries. All other brands, products, services and feature names or trademarks are the property of their respective owners, including RSDL® (Reactive Skin Decontamination Lotion), which was acquired by SERB on July 31, 2024. 3 Safe Harbor Statement/Trademarks INTRODUCTION

Agenda 4Q2 2024 Update INTRODUCTION Presenter Topic(s) Joseph C. Papa President and CEO • Multi-Year Plan Update • Key Product Highlights & Future Catalysts Rich Lindahl EVP, CFO and Treasurer • Q2 2024 Financial Review • FY 2024 and Q3 2024 Guidance Joseph C. Papa President and CEO • Driving Profitable, Sustainable Long-Term Growth • Closing Remarks Q&A

PROPRIETARY AND CONFIDENTIAL Q2 2024 Update Multi-Year Plan Update Joseph C. Papa President and Chief Executive Officer 55

Great Progress Against Our Multi-Year Plan 6 Multi-Year Plan Update • Our multi-year plan to stabilize, turnaround and transform will create a solid platform to build and grow – so that Emergent continues in service of its mission to protect, enhance, and save lives worldwide for many years to come. Raising the midpoint of 2024 Revenue and Adjusted EBITDA Guidance

PROPRIETARY AND CONFIDENTIAL Critical Strategic Actions Progress Our Stabilization Efforts 7 Amended Credit Agreement, April 2024 Resolved Janssen contract dispute, July 2024 Completed FDA Inspection at the Baltimore-Camden facility, July 2024 Reduced headcount by ~50% and will save ~$110 million in operating expenses Continuously improving our overall quality and compliance outcomes Resolving Bioservices balance sheet Our commitment to quality and compliance is foundational to our company mission to protect, enhance and help save lives. Multi-Year Plan Update

On track toward significant debt reduction; operating performance and working capital improvements 8 Multi-Year Plan Update $85M Junior Capital Raise requirement is expected to be satisfied by the asset sale proceeds Deadline for this requirement was extended from July 31, 2024 to September 29, 2024 Streamlining our business by divesting certain products and assets • $75 million for the sale of RSDL® to SERB • $30 million for the sale of Baltimore-Camden facility to Bora, plus significant headcount reduction • $7 million for the sale of an underutilized warehouse in Canton, MA $50 million received from Janssen settlement $30 million in milestone payments from Bavarian Nordic, inclusive of anticipated receipt of $10 million in Q3 and expected $20 million by year end Operational cash flow from business performance improvements Working capital improvements

Product Portfolio/Core Business Driver | NARCAN Nasal Spray 9 Multi-Year Plan Update NARCAN® Nasal Spray continues to impact communities in the U.S. and Canada to help reduce opioid overdose deaths • Shelf-life extension (36 months to 48 months) in Canada Public interest channel remains strong with best-in-class NARCANDirect distribution network • Several key states reporting reduction in deaths • Delivering to 18,000 entities • New West Coast distribution center One year since OTC launch; expanding access points across retailers, public places, businesses and workplaces • Distributed across 32,000 retailers • 5+ business agreements executed • Key partners (Nat'l Safety Council) are engaged • Launched NARCAN.com/Workplace Key Insights: • Demand for naloxone is expected to increase in the U.S. and Canada as the epidemic continues • Federal/state programs continue to combat the crisis • Opioid settlement $54+B into states over next 10-15 years • The Lancet reported fatal opioid overdoses lower American life expectancy by nearly a year1 • New survey found broader awareness on fentanyl poisonings and continued education is needed to increase public understanding of naloxone’s role in preventing fentanyl-related deaths2 • American Medical Association strongly supports putting naloxone next to defibrillators in public places3 Pursuing new and unexpected stakeholders and channels to expand access Line extensions and kitting Key Highlights Future Catalysts & Opportunities to Expand Reach 1 Hebert, A. H., & Hill, A. L. (2024). Impact of opioid overdoses on US life expectancy and years of life lost, by demographic group and stimulant co-involvement: A mortality data analysis from 2019 to 2022. The Lancet. https:// doi.org/10.1016/j.lana.2024.100813 2 Bryter Inc. interviewed 2,010 American adults online between May 10 and May 12, 2024. The survey was designed representative of the American adult (18+) population by age, gender, region and household income. Data on file. 3 American Medical Association, Put naloxone next to defibrillators in public places, July 2024; accessed August 5, 2024

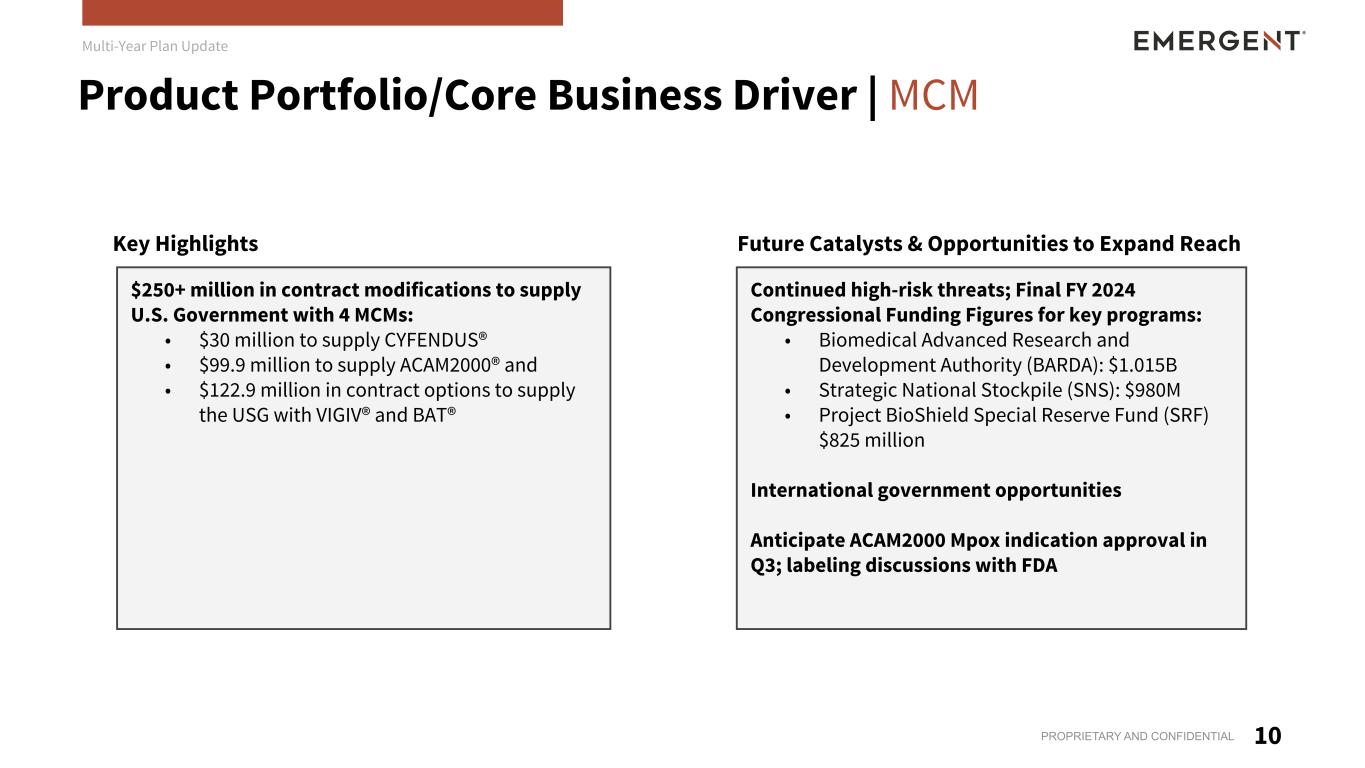

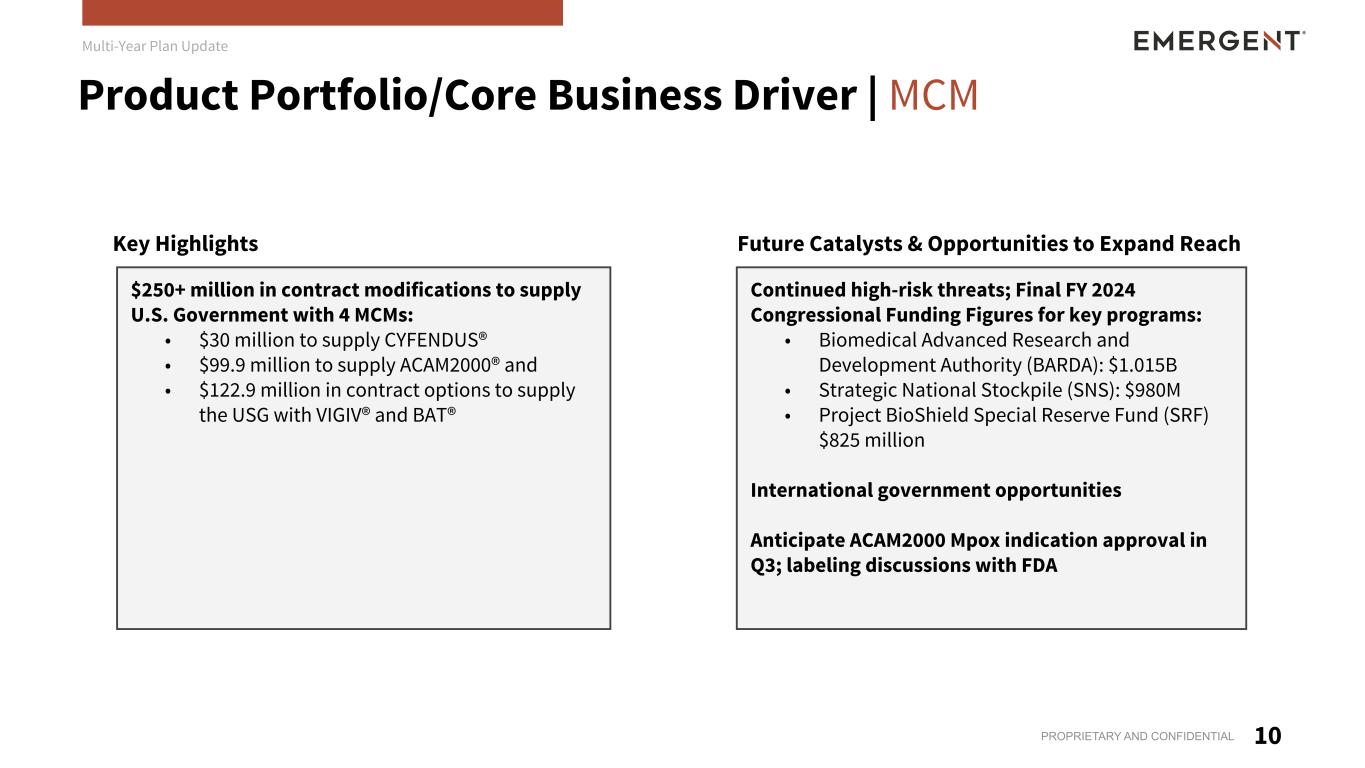

PROPRIETARY AND CONFIDENTIAL Product Portfolio/Core Business Driver | MCM Key Highlights Future Catalysts & Opportunities to Expand Reach $250+ million in contract modifications to supply U.S. Government with 4 MCMs: • $30 million to supply CYFENDUS® • $99.9 million to supply ACAM2000® and • $122.9 million in contract options to supply the USG with VIGIV® and BAT® Continued high-risk threats; Final FY 2024 Congressional Funding Figures for key programs: • Biomedical Advanced Research and Development Authority (BARDA): $1.015B • Strategic National Stockpile (SNS): $980M • Project BioShield Special Reserve Fund (SRF) $825 million International government opportunities Anticipate ACAM2000 Mpox indication approval in Q3; labeling discussions with FDA 10 Multi-Year Plan Update

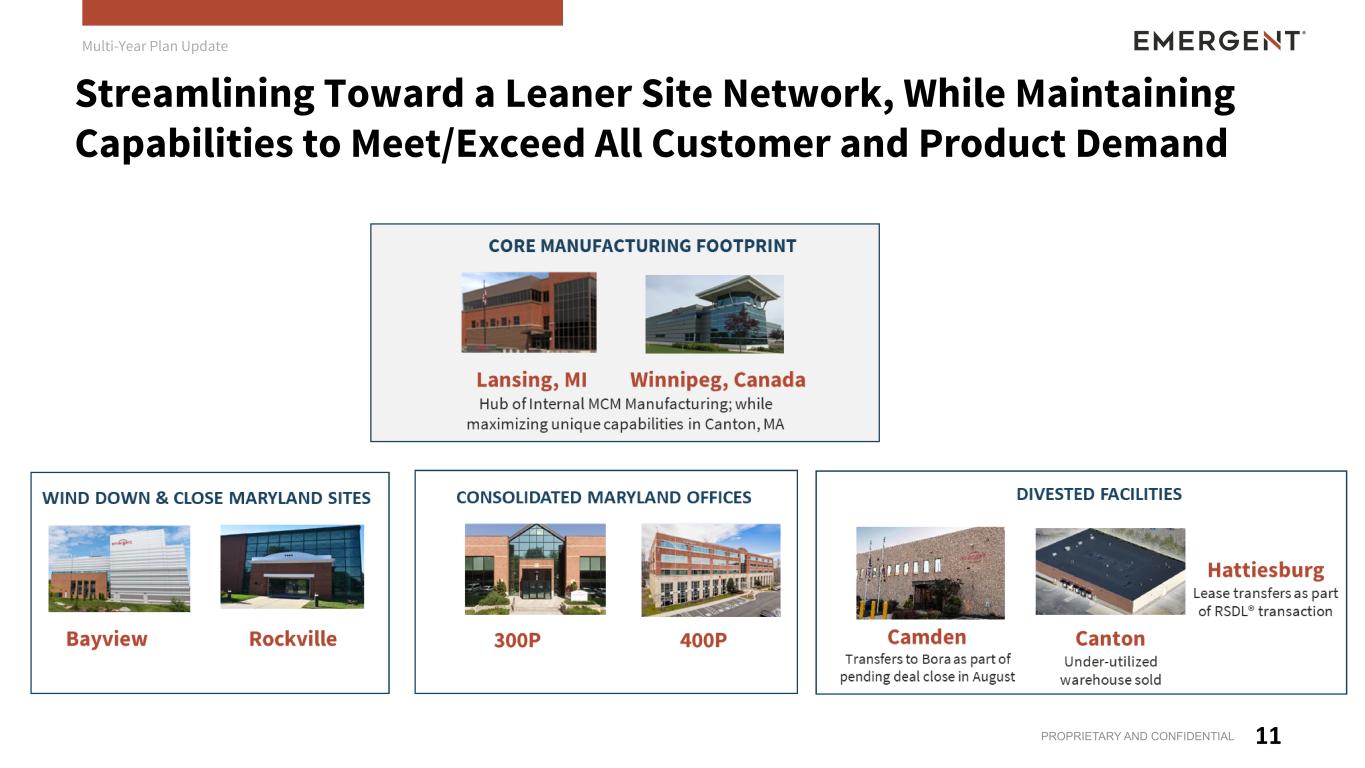

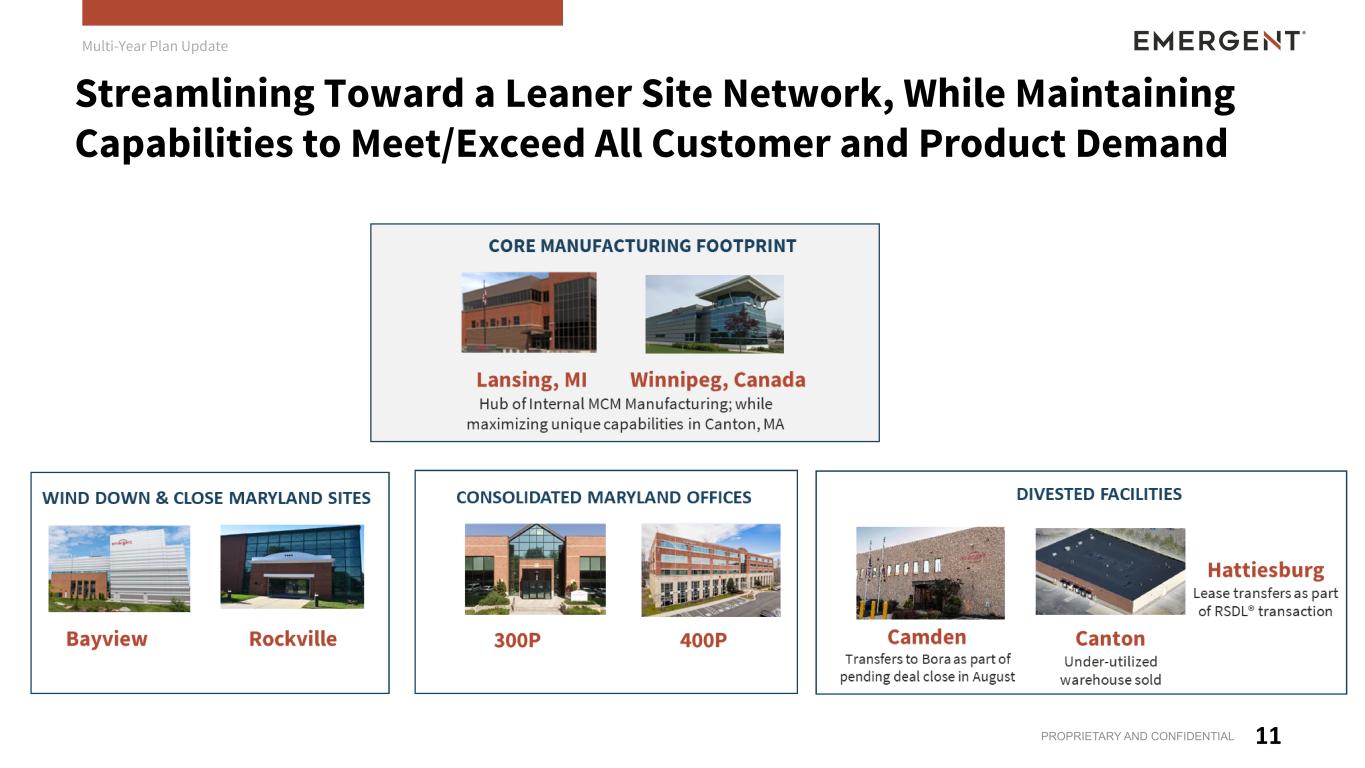

PROPRIETARY AND CONFIDENTIAL Streamlining Toward a Leaner Site Network, While Maintaining Capabilities to Meet/Exceed All Customer and Product Demand 11 Multi-Year Plan Update

Product Portfolio | Key Product Details 12* Subject to exercise of procurement options Multi-Year Plan Update

Rich Lindahl Executive Vice President and Chief Financial Officer Q2 2024 Update Financials 13

Key Financial Performance Metrics Q2 2024 vs. Q2 20231 14 Total Revenues Adjusted EBITDA2 FINANCIALS ($ in millions) Q2 2023 Q2 2024 1. All financial information incorporated within this presentation is unaudited. 2. See "End Notes: Non-GAAP Financial Measures" and "Appendix" for the definitions of non-GAAP terms and reconciliations to the most directly comparable GAAP financial measures. $254.7 $337.9 Q2 2023 Q2 2024 Q2 2023 Q2 2024 Q2 2023 Q2 2024 $(10.1) $55.9 $65.4 $143.0 43% 26% Total Segment Adjusted Gross Margin2 --- Total Segment Adjusted Gross Margin %2

Significant Non-Recurring Items: Q2 20241,2 15 FINANCIALS 1. All financial information incorporated within this presentation is unaudited. 2. See "End Notes: Non-GAAP Financial Measures" and "Appendix" for the definitions of non-GAAP terms and reconciliations to the most directly comparable GAAP financial measures.

Notable Revenue Elements Q2 2024 vs. Q2 20231 16 FINANCIALS 1. All financial information incorporated within this presentation is unaudited. 2. Product sales, net are reported net of variable consideration including returns, rebates, wholesaler fees and prompt pay discounts in accordance with U.S. generally accepted accounting principles. ($ in millions) Q2 2024 Q2 2023 % Change Product sales, net (2): NARCAN® $ 120.0 $ 133.9 (10) % Other Commercial Products — 4.0 NM Anthrax MCM 38.7 21.1 83 % Smallpox MCM 17.9 123.8 (86) % Other Products 6.8 19.4 (65) % Total Product sales, net $ 183.4 $ 302.2 (39) % Bioservices: Services $ 64.5 $ 26.4 144 % Leases 0.2 2.7 (93) % Total Bioservices revenues $ 64.7 $ 29.1 122 % Contracts and grants $ 6.6 $ 6.6 — % Total revenues $ 254.7 $ 337.9 (25) % NM - Not Meaningful

Key Financial Performance Metrics Q2 2024 vs. Q2 2023 1 17 SG&A $ --- SG&A Margin %2 FINANCIALS ($ in millions) 1.All financial information incorporated within this presentation is unaudited. 2. SG&A Margin is calculated as SG&A Expense divided by total revenues. Q2 2023 Q2 2023 Q2 2023 Q2 2023 Q2 2023 Q2 2024 Q2 2024 Q2 2024 Q2 2024 Q2 2024 $32.7 $26.0 $85.9 $91.4 27%34% Cost of Commercial Product Sales Cost of MCM Product Sales Cost of Bioservices R&D $ Q2 2024 Q2 2023 $53.4 $54.4 $31.1 $80.5 $211.6 $55.7

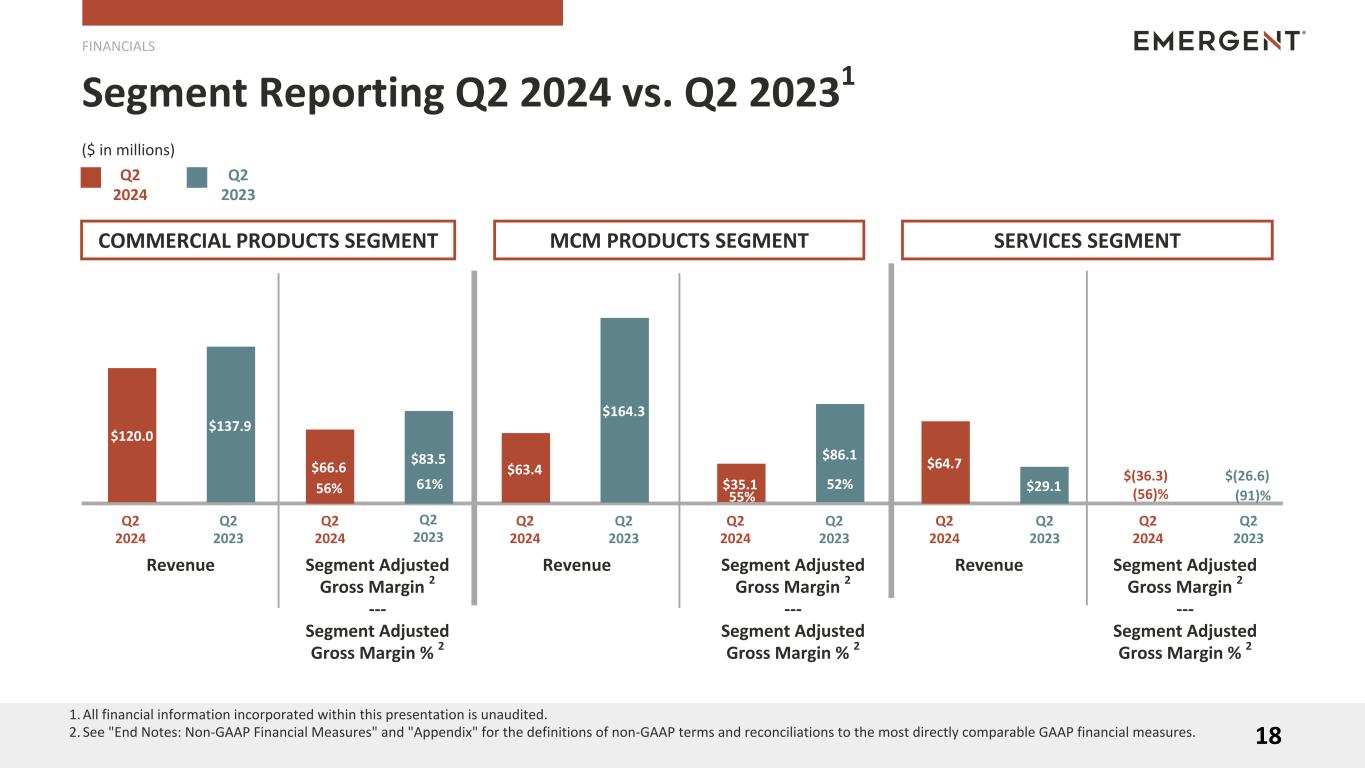

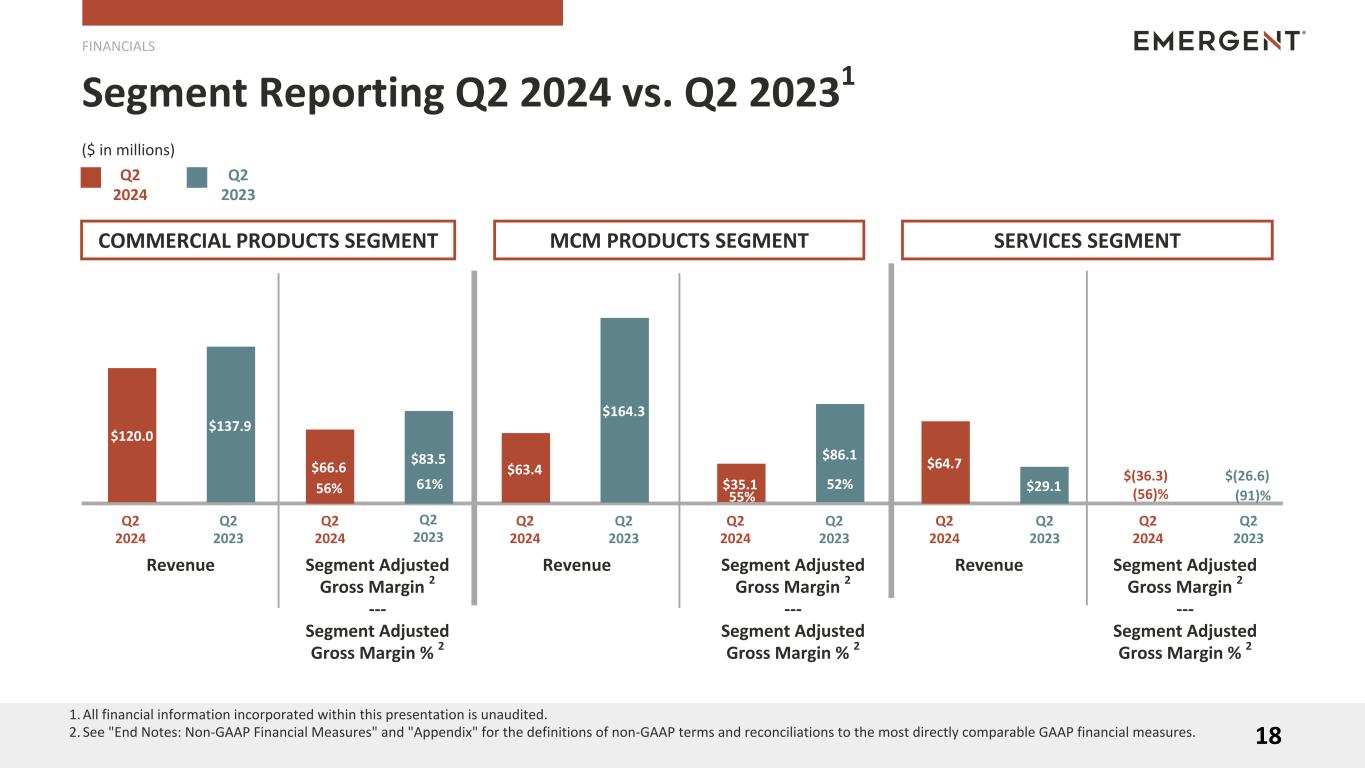

Segment Reporting Q2 2024 vs. Q2 20231 18 Revenue Segment Adjusted Gross Margin 2 --- Segment Adjusted Gross Margin % 2 Segment Adjusted Gross Margin 2 --- Segment Adjusted Gross Margin % 2 Revenue FINANCIALS ($ in millions) COMMERCIAL PRODUCTS SEGMENT MCM PRODUCTS SEGMENT 1.All financial information incorporated within this presentation is unaudited. 2. See "End Notes: Non-GAAP Financial Measures" and "Appendix" for the definitions of non-GAAP terms and reconciliations to the most directly comparable GAAP financial measures. Q2 2023 Q2 2024 $120.0 $137.9 Q2 2023 $66.6 $83.5 Q2 2023 Q2 2023 Q2 2023 Q2 2024 Q2 2024 Q2 2024 $63.4 $164.3 Q2 2024 61%56% 52% Segment Adjusted Gross Margin 2 --- Segment Adjusted Gross Margin % 2 Revenue SERVICES SEGMENT $64.7 $29.1 Q2 2023 Q2 2023 Q2 2024 Q2 2024 $(26.6)$(36.3) (91)%(56)% $35.1 $86.1 52% 55%

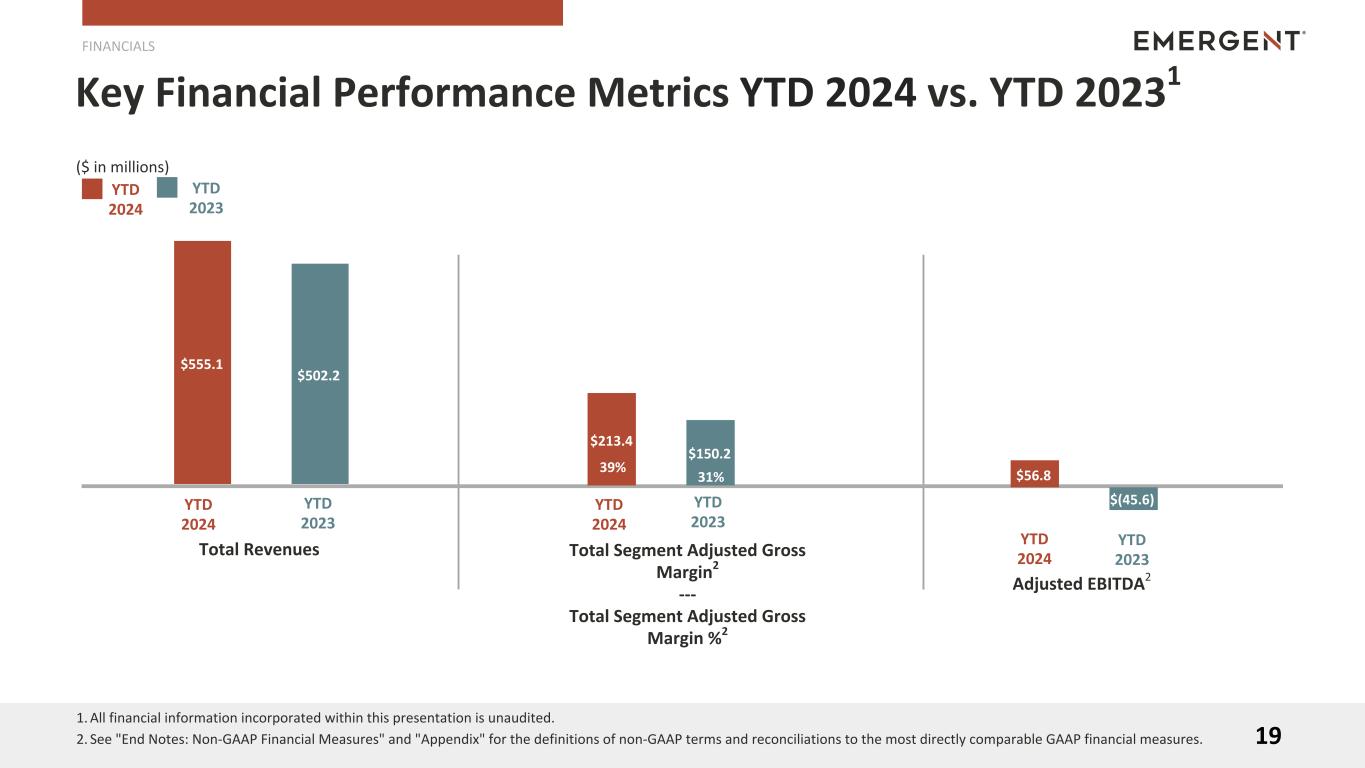

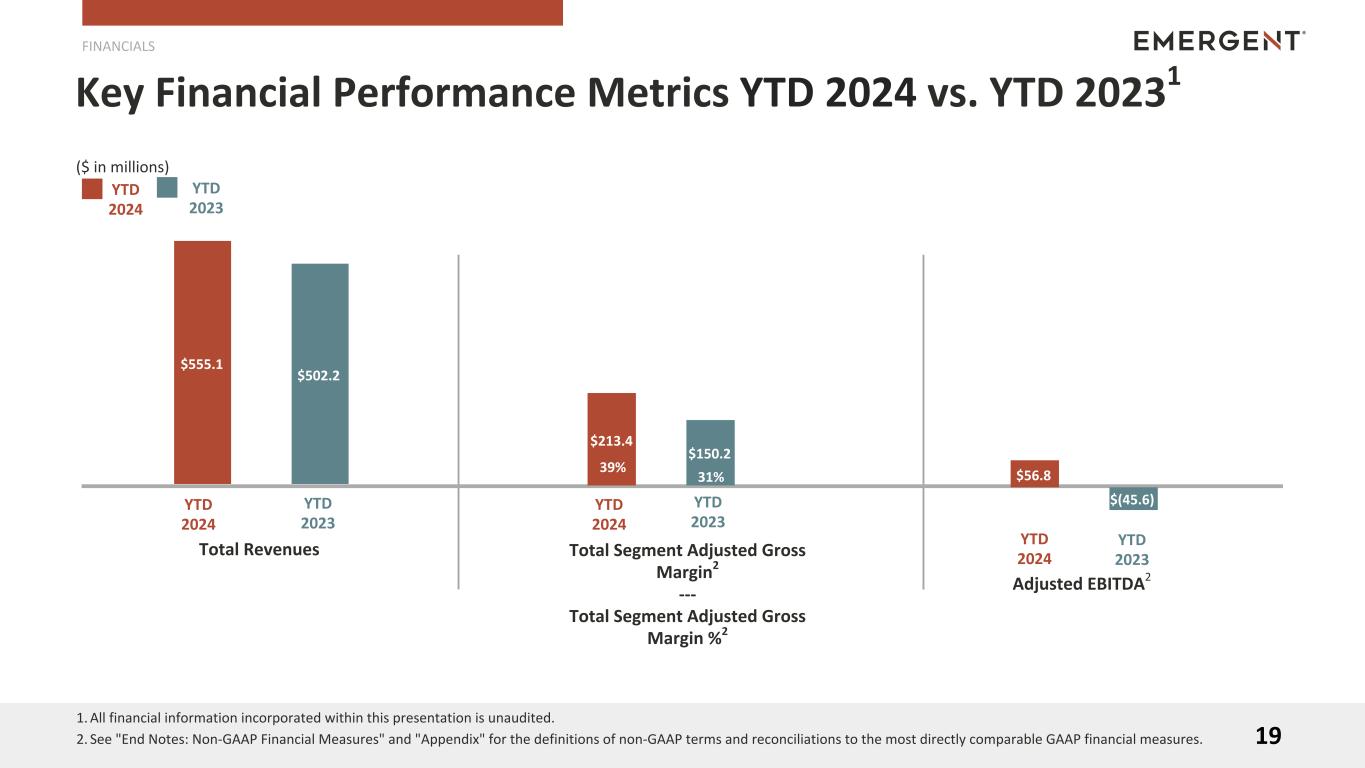

Key Financial Performance Metrics YTD 2024 vs. YTD 20231 19 Total Revenues Adjusted EBITDA2 FINANCIALS ($ in millions) 1.All financial information incorporated within this presentation is unaudited. 2. See "End Notes: Non-GAAP Financial Measures" and "Appendix" for the definitions of non-GAAP terms and reconciliations to the most directly comparable GAAP financial measures. $555.1 $502.2 YTD 2023 YTD 2024 $56.8 $(45.6)YTD 2023 YTD 2024 YTD 2023 YTD 2024 YTD 2023 YTD 2024Total Segment Adjusted Gross Margin2 --- Total Segment Adjusted Gross Margin %2 $213.4 $150.2 31% 39%

Balance Sheet & Cash Flow Metrics 20 FINANCIALS As of June 30, 2024 For the Six Months Ended June 30, 2024 CASH $69.7 ACCOUNTS RECEIVABLE, NET $196.3 TOTAL DEBT $863.8 NET DEBT1,2, 5 $794.1 NET WORKING CAPITAL1,2,3,5 $380.3 OPERATING CASH FLOW $(15.1) CAPITAL EXPENDITURES $15.4 (unaudited, $ in millions) 1. Debt amount indicated on the Company’s balance sheet is net of unamortized debt issuance costs of $1.6M. 2. Net Debt is calculated as Total Debt minus Cash and cash equivalents ($863.8M - $69.7M = $794.1). 3. Net Working capital is calculated as the difference between our current assets, excluding cash and cash equivalents and our current liabilities, excluding debt, current portion (($654.5M - $69.7M) - ($619.7M - $415.2M) = $380.3M) 4. Liquidity is calculated as Cash and cash equivalents, Restricted cash and available borrowing capacity under our Revolving Credit Facility ($69.7M + $1.3M + $11.8M = $82.8M) 5. See "End Notes: Non-GAAP Financial Measures" and "Appendix" for the definitions of non-GAAP terms and reconciliations to the most directly comparable GAAP financial measures. • Q2 2024 Liquidity: $83 million4 • Q2 2024 Operating Cash Flow: $48 million • Net Debt improved $37 million vs Prior Quarter1,2,5 • Net Working Capital improved $53 million vs Prior Quarter3,5

FINANCIALS 1.All financial information incorporated within this presentation is unaudited. 2. See "End Notes: Non-GAAP Financial Measures" and "Appendix" for the definitions of non-GAAP terms and reconciliations to the most directly comparable GAAP financial measures. 2024 Full Year Revenue & Adjusted EBITDA Guidance1,2 Continuing to increase the midpoint of 2024 Revenue and Adjusted EBITDA2 Guidance Range 21

Driving Profitable, Sustainable Long- Term Growth 22

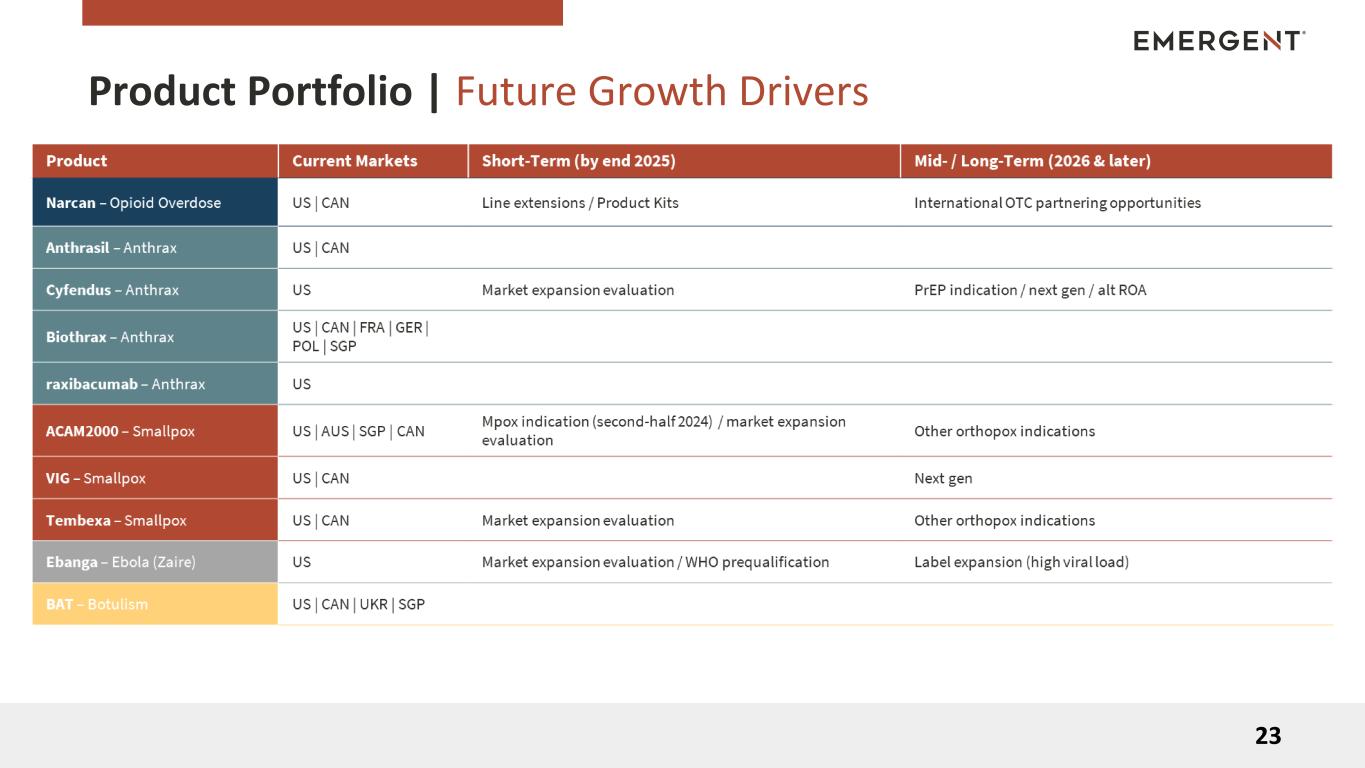

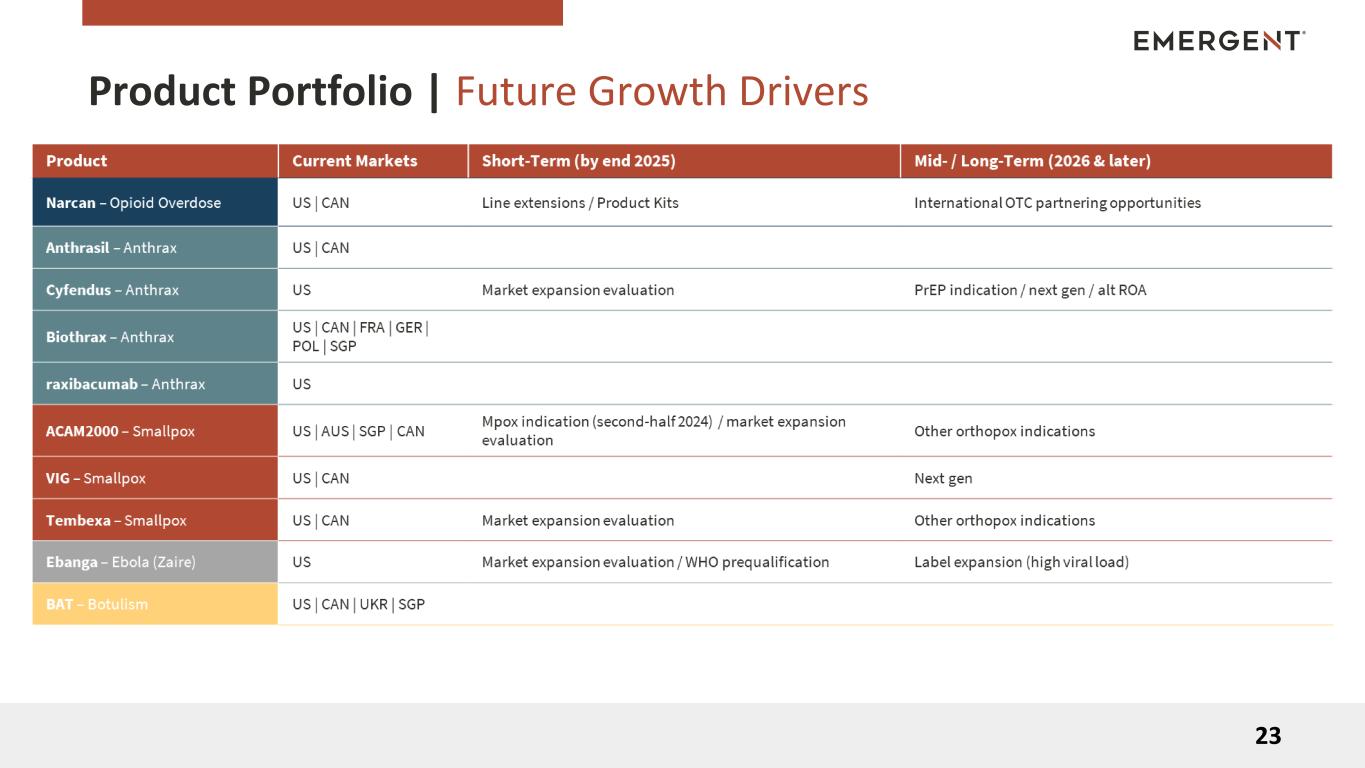

Product Portfolio | Future Growth Drivers 23

Summary 24 FINANCIALS • Continued stabilization helps position EBS for the future • Great progress toward debt reduction • Strong YTD results are helping to build a solid foundation for the company to embark on its turnaround phase • NARCAN® Nasal Spray continuing solid performance • New MCM contract awards and orders from the U.S. Government • Well positioned for success, driven by our unique focus on protecting communities and addressing global health threats

PROPRIETARY AND CONFIDENTIAL 25 Q&A

In this presentation, we sometimes use information derived from consolidated and segment financial information that may not be presented in our financial statements or prepared in accordance with generally accepted accounting principles in the United States (“GAAP”). Certain of these financial measures are considered not in conformity with GAAP (“non-GAAP financial measures”) under the United States Securities and Exchange Commission (“SEC”) rules. Specifically, we have referred to the following non-GAAP financial measures: • Adjusted Net Loss • Adjusted EBITDA • Total Segment Revenues • Total Segment Gross Margin • Total Segment Gross Margin % • Total Segment Adjusted Gross Margin • Total Segment Adjusted Gross Margin % • Segment Adjusted Gross Margin • Segment Adjusted Gross Margin % • Net Debt • Net Working Capital We define Adjusted Net Loss which is a non-GAAP financial measure, as net loss excluding the impact of changes in fair value of contingent consideration, acquisition and divestiture-related costs, severance and restructuring costs, other income (expense) items, settlement charge, net, exit and disposal costs, impairment charges, gain (loss) on sale of business and assets held for sale and non-cash amortization charges. We believe that these non-GAAP financial measures, when considered together with our GAAP financial results and GAAP financial measures, provide management and investors with an additional understanding of our business operating results, including underlying trends. We define Adjusted EBITDA, which is a non-GAAP financial measure, as consolidated net loss before income tax provision (benefit), interest expense, net, depreciation, amortization of intangible assets, changes in fair value of contingent consideration, severance and restructuring costs, other income (expense) items, settlement charge, net, impairments, gain (loss) on sale of business and assets held for sale and acquisition and divestiture-related costs. We believe that this non-GAAP financial measure, when considered together with our GAAP financial results and GAAP financial measures, provides management and investors with a more complete understanding of our operating results, including underlying trends. In addition, EBITDA is a common alternative measure of operating performance used by many of our competitors. It is used by investors, financial analysts, rating agencies and others to value and compare the financial performance of companies in our industry, although it may be defined differently by different companies. Therefore, we also believe that this non-GAAP financial measure, considered along with corresponding GAAP financial measures, provides management and investors with additional information for comparison of our operating results with the operating results of other companies. We have included the definitions of Segment Gross Margin and Segment Gross Margin %, which are GAAP financial measures, below in order to more fully define the components of certain non-GAAP financial measures presented in this presentation. We define Segment Gross Margin, as a segment's revenues, less a segment's cost of sales or services. We define Segment Gross Margin %, as Segment Gross Margin as a percentage of a segments revenues. We define Segment Adjusted Gross Margin, which is a non-GAAP financial measure as Segment Gross Margin excluding the impact of restructuring costs and non-cash items related to changes in the fair value of contingent consideration, settlement charge, net and inventory step-up provision.We define Segment Adjusted Gross Margin %, which is a non-GAAP financial measure, as Segment Adjusted Gross Margin as a percentage of a segment's revenues. 26 End Notes: Non-GAAP Financial Measures

We define Total Segment Revenues, which is a non-GAAP financial measure, as our total revenues, less contracts and grants revenue, which is also equal to the sum of the revenues of our reportable operating segments. We define Total Segment Gross Margin, which is a non-GAAP financial measure, as Total Segment Revenues less our aggregate cost of sales or services. We define Total Segment Gross Margin %, which is a non-GAAP financial measure, as Total Segment Gross Margin as a percentage of Total Segment Revenues. We define Total Segment Adjusted Gross Margin, which is a non-GAAP financial measure, as Total Segment Gross Margin, excluding the impact of restructuring costs and changes in the fair value of contingent consideration. We define Total Segment Adjusted Gross Margin %, which is a non-GAAP financial measure, as Total Segment Adjusted Gross Margin as a percentage of Total Segment Revenues. We define Net Debt, which is a non-GAAP financial measure, as our total debt less our cash and cash equivalents. We believe this non-GAAP financial measure, when considered together with our GAAP financial results, provides management and investors with an additional understanding of the Company's ability to pay its debts. We define Net Working Capital, which is a non-GAAP financial measure, as the difference between our current assets, excluding cash and cash equivalents and our current liabilities, excluding debt, current portion. We believe this non-GAAP financial measure, when considered together with our GAAP financial results, provides management and investors with an additional understanding of the Company's ability to pay it's current obligations. Non-GAAP financial measures are not defined in the same manner by all companies and may not be comparable with other similarly titled measures of other companies. The determination of the amounts that are excluded from these non-GAAP financial measures are a matter of management judgment and depend upon, among other factors, the nature of the underlying expense or income amounts. Because non-GAAP financial measures exclude the effect of items that will increase or decrease the Company’s reported results of operations, management strongly encourages investors to review the Company’s consolidated financial statements and publicly filed reports in their entirety. For additional information on the non-GAAP financial measures noted here, please refer to the reconciliation tables provide in the Appendix to this presentation as well as the associated press release which can be found on the Company’s website at www.emergentbiosolutions.com. 27 End Notes: Non-GAAP Financial Measures (Continued)

28 Appendix 28

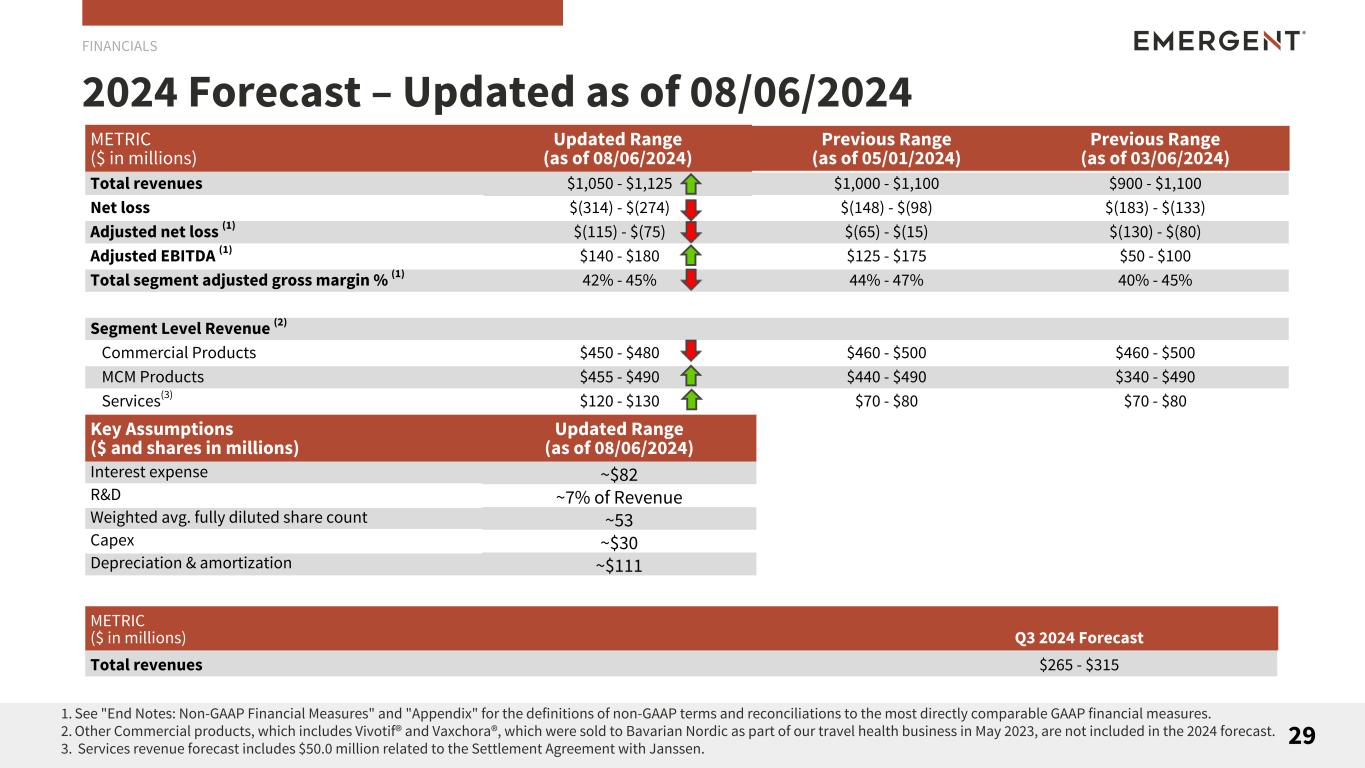

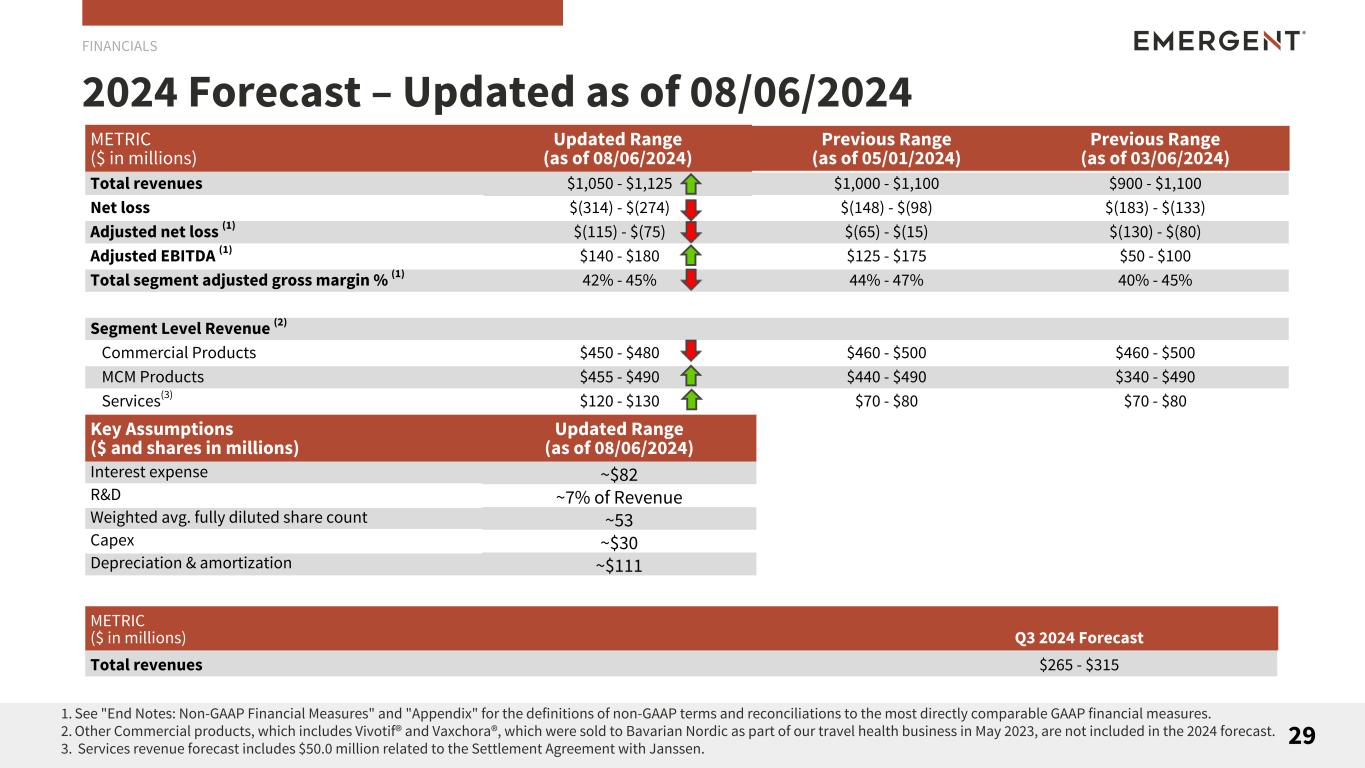

2024 Forecast – Updated as of 08/06/2024 29 FINANCIALS 1. See "End Notes: Non-GAAP Financial Measures" and "Appendix" for the definitions of non-GAAP terms and reconciliations to the most directly comparable GAAP financial measures. 2. Other Commercial products, which includes Vivotif® and Vaxchora®, which were sold to Bavarian Nordic as part of our travel health business in May 2023, are not included in the 2024 forecast. 3. Services revenue forecast includes $50.0 million related to the Settlement Agreement with Janssen. METRIC ($ in millions) Updated Range (as of 08/06/2024) Previous Range (as of 05/01/2024) Previous Range (as of 03/06/2024) Total revenues $1,050 - $1,125 $1,000 - $1,100 $900 - $1,100 Net loss $(314) - $(274) $(148) - $(98) $(183) - $(133) Adjusted net loss (1) $(115) - $(75) $(65) - $(15) $(130) - $(80) Adjusted EBITDA (1) $140 - $180 $125 - $175 $50 - $100 Total segment adjusted gross margin % (1) 42% - 45% 44% - 47% 40% - 45% Segment Level Revenue (2) Commercial Products $450 - $480 $460 - $500 $460 - $500 MCM Products $455 - $490 $440 - $490 $340 - $490 Services(3) $120 - $130 $70 - $80 $70 - $80 METRIC ($ in millions) Q3 2024 Forecast Total revenues $265 - $315 Key Assumptions ($ and shares in millions) Updated Range (as of 08/06/2024) Interest expense ~$82 R&D ~7% of Revenue Weighted avg. fully diluted share count ~53 Capex ~$30 Depreciation & amortization ~$111

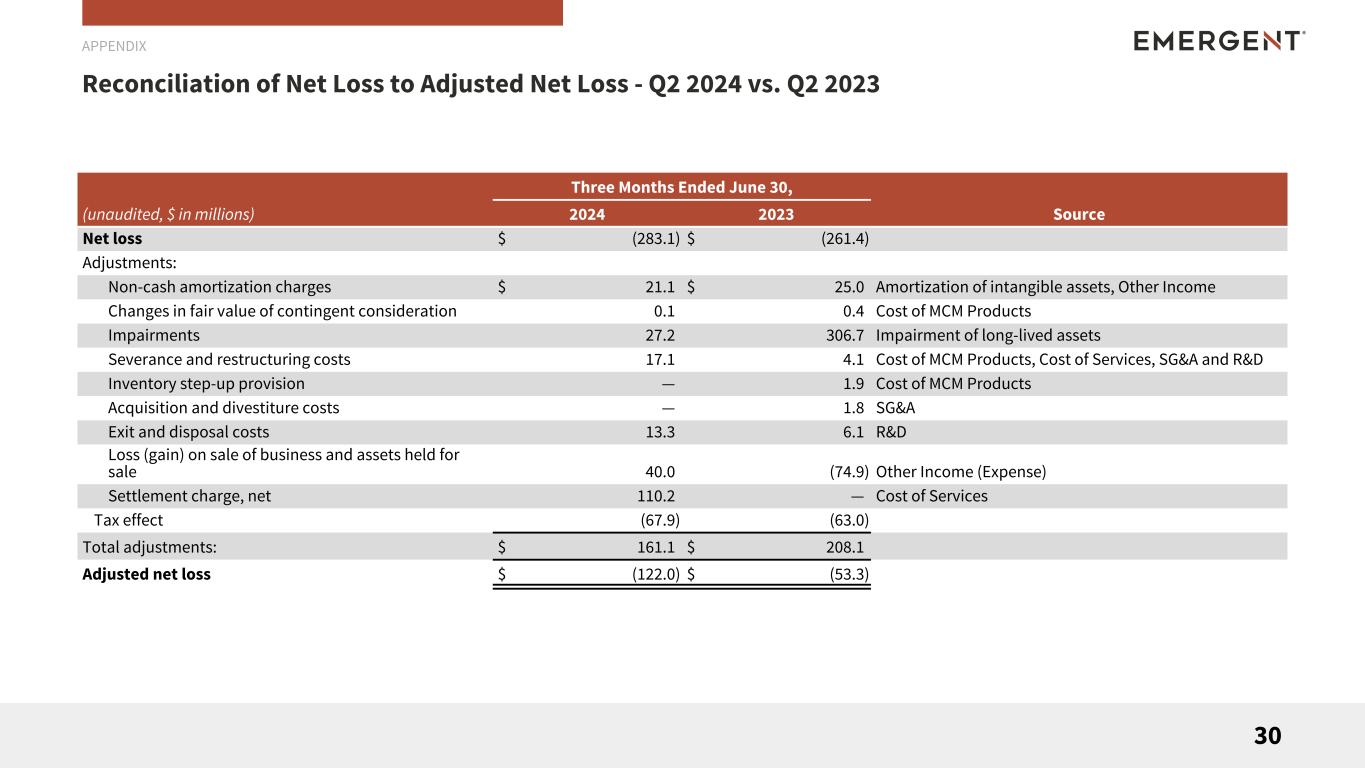

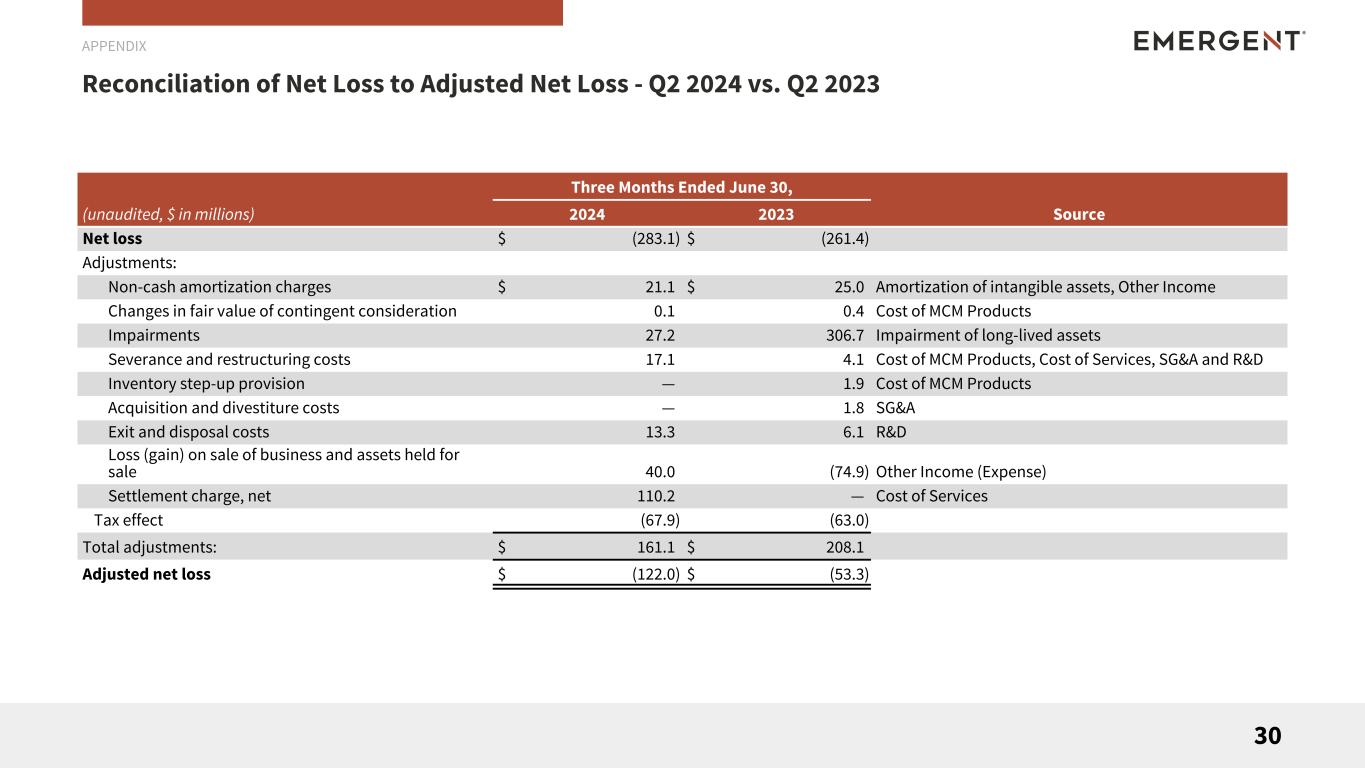

Reconciliation of Net Loss to Adjusted Net Loss - Q2 2024 vs. Q2 2023 30 APPENDIX (unaudited, $ in millions) Three Months Ended June 30, 2024 2023 Source Net loss $ (283.1) $ (261.4) Adjustments: Non-cash amortization charges $ 21.1 $ 25.0 Amortization of intangible assets, Other Income Changes in fair value of contingent consideration 0.1 0.4 Cost of MCM Products Impairments 27.2 306.7 Impairment of long-lived assets Severance and restructuring costs 17.1 4.1 Cost of MCM Products, Cost of Services, SG&A and R&D Inventory step-up provision — 1.9 Cost of MCM Products Acquisition and divestiture costs — 1.8 SG&A Exit and disposal costs 13.3 6.1 R&D Loss (gain) on sale of business and assets held for sale 40.0 (74.9) Other Income (Expense) Settlement charge, net 110.2 — Cost of Services Tax effect (67.9) (63.0) Total adjustments: $ 161.1 $ 208.1 Adjusted net loss $ (122.0) $ (53.3)

Reconciliation of Net Loss to Adjusted Net Loss – YTD 2024 vs. YTD 2023 APPENDIX (unaudited, $ in millions) Six Months Ended June 30, 2024 2023 Source Net loss $ (274.1) $ (447.6) Adjustments: Non-cash amortization charges $ 44.3 $ 43.0 Amortization of intangible assets, Other Income Changes in fair value of contingent consideration 0.6 0.7 Cost of MCM Products Impairments 27.2 306.7 Impairment of long-lived assets Severance and restructuring costs 16.6 13.8 Cost of MCM Products, Cost of Services, SG&A and R&D Inventory step-up provision — 1.9 Cost of MCM Products Acquisition and divestiture costs — 2.9 SG&A Exit and disposal costs 13.3 6.1 R&D Loss (gain) on sale of business and assets held for sale 40.0 (74.9) Other Income (Expense) Settlement charge, net 110.2 — Cost of Services Other income (expense), net item 3.1 — Other Income (Expense) Tax effect (72.1) (69.4) Total adjustments: $ 183.2 $ 230.8 Adjusted net loss $ (90.9) $ (216.8) 31

Reconciliation of Net Loss to Adjusted EBITDA - Q2 2024 vs. Q2 2023 32 APPENDIX (unaudited, $ in millions) Three Months Ended June 30, 2024 2023 Net loss $ (283.1) $ (261.4) Adjustments: Depreciation & amortization $ 28.5 $ 32.9 Income taxes 13.3 11.2 Total interest expense, net 23.3 27.1 Impairments 27.2 306.7 Inventory step-up provision — 1.9 Changes in fair value of contingent consideration 0.1 0.4 Severance and restructuring costs 17.1 4.1 Exit and disposal costs 13.3 6.1 Acquisition and divestiture costs — 1.8 Loss (gain) on sale of business and assets held for sale 40.0 (74.9) Settlement charge, net 110.2 — Total adjustments $ 273.0 $ 317.3 Adjusted EBITDA $ (10.1) $ 55.9

Reconciliation of Net Loss to Adjusted EBITDA – YTD 2024 vs. YTD 2023 Q2 2024 Update APPENDIX (unaudited, $ in millions) Six Months Ended June 30, 2024 2023 Net loss $ (274.1) $ (447.6) Adjustments: Depreciation & amortization $ 56.4 $ 67.5 Income taxes 16.4 36.8 Total interest expense, net 47.1 40.5 Impairments 27.2 306.7 Inventory step-up provision — 1.9 Changes in fair value of contingent consideration 0.6 0.7 Severance and restructuring costs 16.6 13.8 Exit and disposal costs 13.3 6.1 Acquisition and divestiture costs — 2.9 Loss (gain) on sale of business and assets held for sale 40.0 (74.9) Settlement charge, net 110.2 — Other income (expense), net item 3.1 — Total adjustments $ 330.9 $ 402.0 Adjusted EBITDA $ 56.8 $ (45.6) 33

Reconciliations of Total Revenues to Total Segment Revenues and of Segment and Total Segment Gross Margin and Gross Margin % to Segment and Total Segment Adjusted Gross Margin and Adjusted Gross Margin % - Q2 2024 vs. Q2 2023 34 APPENDIX Three Months Ended June 30, 2024 (unaudited, in millions) Commercial Products MCM Products Services Total Segment Contracts & Grants Total Revenues Revenues $ 120.0 $ 63.4 $ 64.7 $ 248.1 $ 6.6 $ 254.7 Cost of sales or services 53.4 31.1 211.6 296.1 Gross margin $ 66.6 $ 32.3 $ (146.9) $ (48.0) Gross margin % 56 % 51 % (227) % (19) % Add back: Changes in fair value of contingent consideration $ — $ 0.1 $ — $ 0.1 Settlement charge, net — — 110.2 110.2 Restructuring costs — 2.7 0.4 3.1 Adjusted gross margin $ 66.6 $ 35.1 $ (36.3) $ 65.4 Adjusted gross margin % (1) 56 % 55 % (56) % 26 % (1) Total Segment results for the three months ended June 30, 2024 includes $50.0 million attributable to the Settlement Agreement with Janssen. The revenue and cost of services is related to raw materials purchased for the Janssen Agreement which Janssen had not reimbursed. Excluding the revenue and cost of services impacts of the Settlement Agreement, Total Segment Adjusted Gross Margin % would have been 7% higher for the three months ended June 30, 2024. Three Months Ended June 30, 2023 (unaudited, in millions) Commercial Products MCM Products Services Total Segment Contracts & Grants Total Revenues Revenues $ 137.9 $ 164.3 $ 29.1 $ 331.3 $ 6.6 $ 337.9 Cost of sales or services 54.4 80.5 55.7 190.6 Gross margin $ 83.5 $ 83.8 $ (26.6) $ 140.7 Gross margin % 61 % 51 % (91) % 42 % Add back: Changes in fair value of contingent consideration $ — $ 0.4 $ — $ 0.4 Inventory step-up provision — 1.9 — 1.9 Adjusted gross margin $ 83.5 $ 86.1 $ (26.6) $ 143.0 Adjusted gross margin % 61 % 52 % (91) % 43 %

Reconciliations of Total Revenues to Total Segment Revenues and of Segment and Total Segment Gross Margin and Gross Margin % to Segment and Total Segment Adjusted Gross Margin and Adjusted Gross Margin % – YTD 2024 vs. YTD 2023 35 APPENDIX Six Months Ended June 30, 2024 (unaudited, in millions) Commercial Products MCM Products Services Total Segment Contracts & Grants Total Revenues Revenues $ 238.5 $ 218.8 $ 83.2 $ 540.5 $ 14.6 $ 555.1 Cost of sales or services 105.5 93.3 241.9 440.7 Gross margin $ 133.0 $ 125.5 $ (158.7) $ 99.8 Gross margin % 56 % 57 % (191) % 18 % Add back: Changes in fair value of contingent consideration $ — $ 0.6 $ — $ 0.6 Settlement charge, net — — 110.2 110.2 Restructuring costs — 2.6 0.2 2.8 Adjusted gross margin $ 133.0 $ 128.7 $ (48.3) $ 213.4 Adjusted gross margin %(1) 56 % 59 % (58) % 39 % (1) Total Segment results for the six months ended June 30, 2024 includes $50.0 million attributable to the Settlement Agreement with Janssen. The revenue and cost of services is related to raw materials purchased for the Janssen Agreement which Janssen had not reimbursed. Excluding the impacts of the Settlement Agreement, Total Segment Adjusted Gross Margin % would have been 4% higher for the six months ended June 30, 2024. Six Months Ended June 30, 2023 (unaudited, in millions) Commercial Products MCM Products Services Total Segment Contracts & Grants Total Revenues Revenues $ 244.1 $ 201.5 $ 43.5 $ 489.1 $ 13.1 $ 502.2 Cost of sales or services 100.2 135.9 107.4 343.5 Gross margin $ 143.9 $ 65.6 $ (63.9) $ 145.6 Gross margin % 59 % 33 % (147) % 30 % Add back: Changes in fair value of contingent consideration $ — $ 0.7 $ — $ 0.7 Inventory step-up provision — 1.9 — 1.9 Restructuring costs — 2.0 — 2.0 Adjusted gross margin $ 143.9 $ 70.2 $ (63.9) $ 150.2 Adjusted gross margin % 59 % 35 % (147) % 31 %

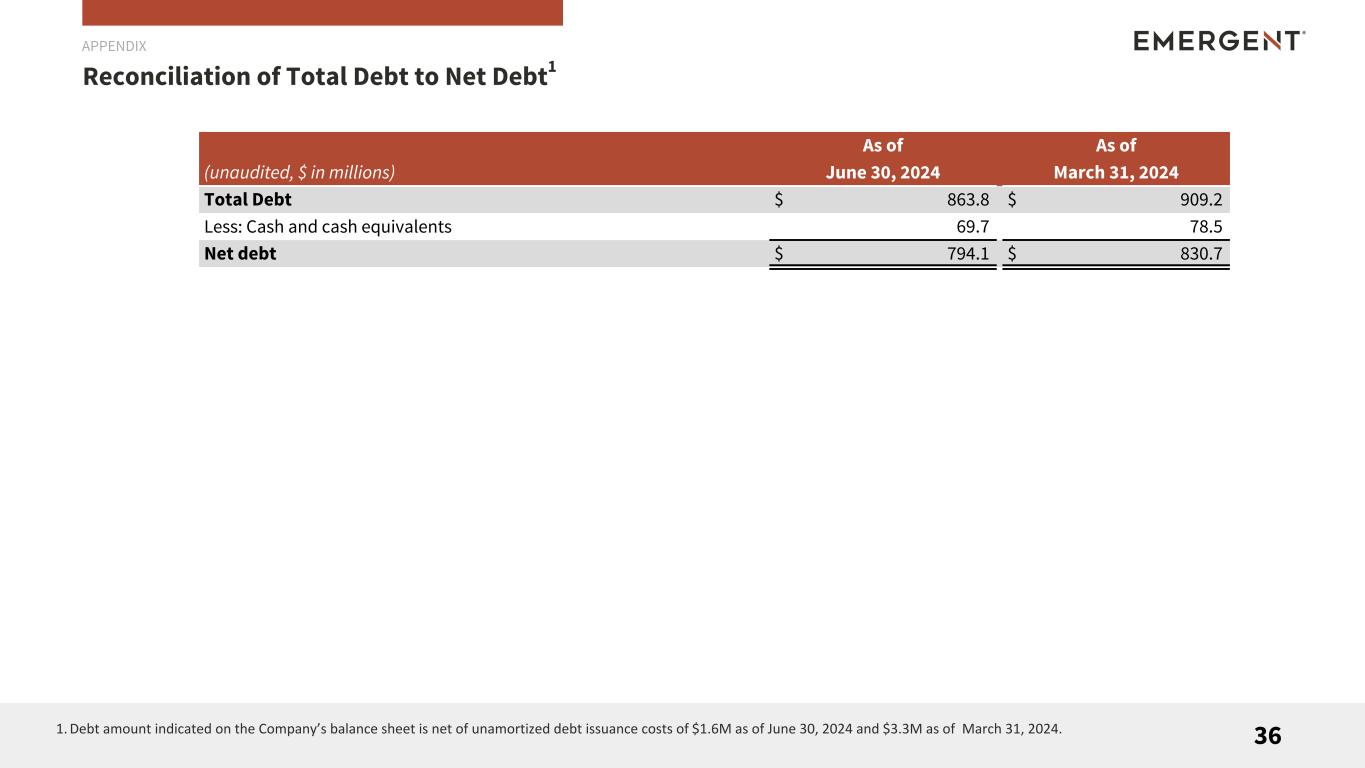

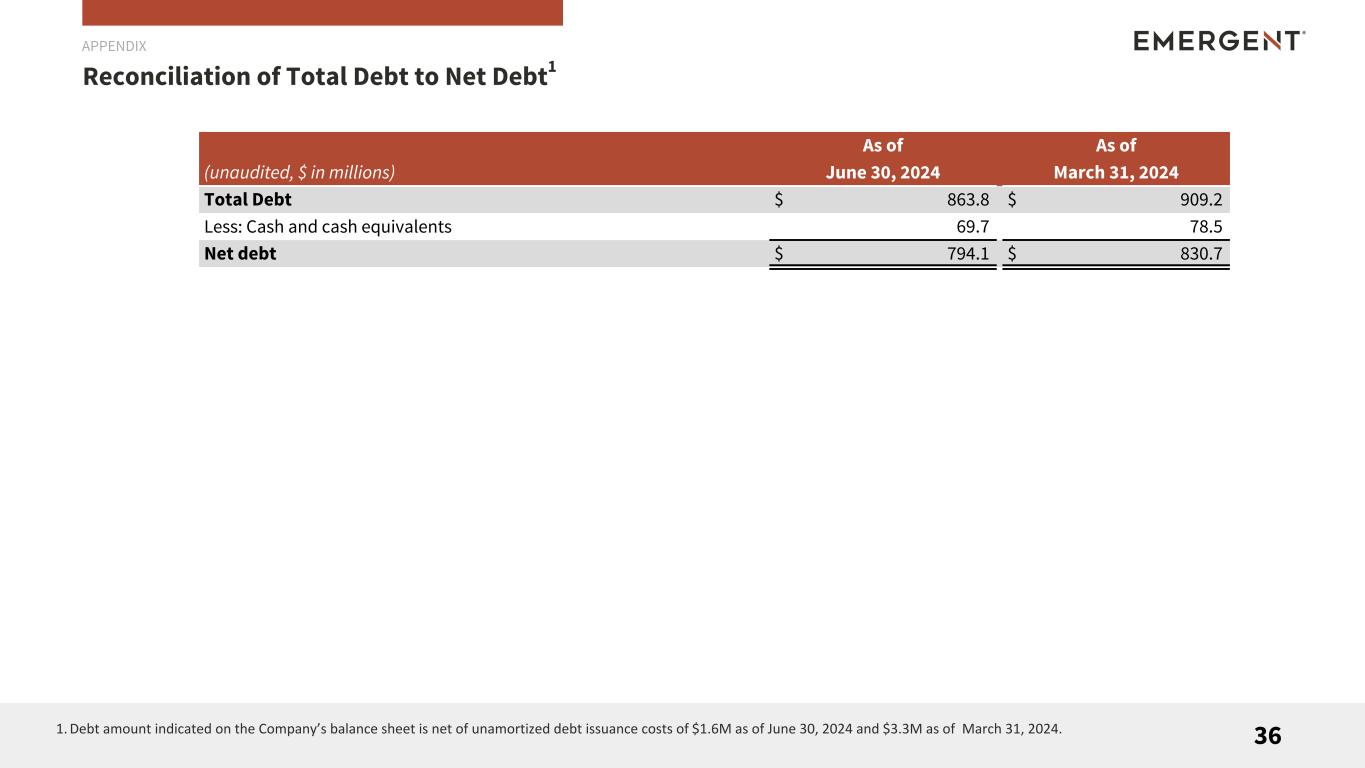

Reconciliation of Total Debt to Net Debt1 36 APPENDIX (unaudited, $ in millions) As of As of June 30, 2024 March 31, 2024 Total Debt $ 863.8 $ 909.2 Less: Cash and cash equivalents 69.7 78.5 Net debt $ 794.1 $ 830.7 1.Debt amount indicated on the Company’s balance sheet is net of unamortized debt issuance costs of $1.6M as of June 30, 2024 and $3.3M as of March 31, 2024.

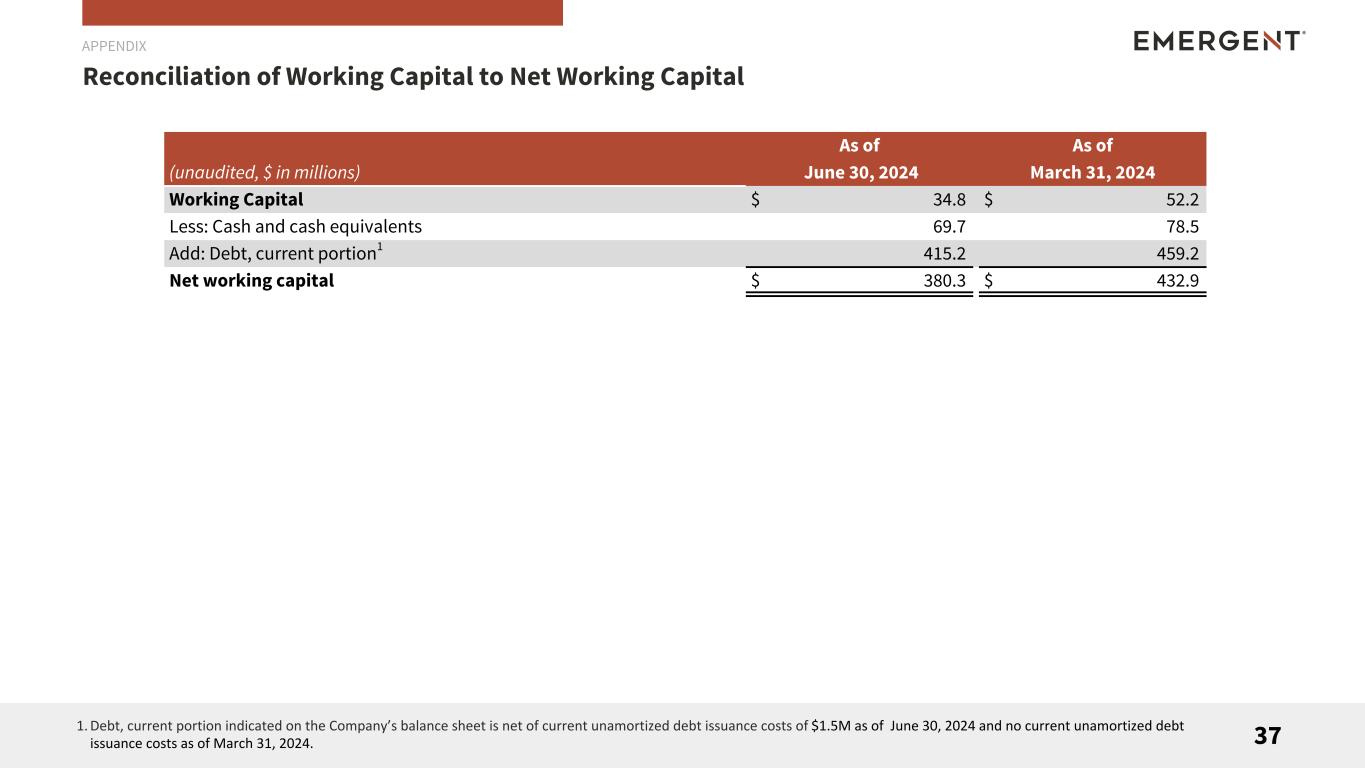

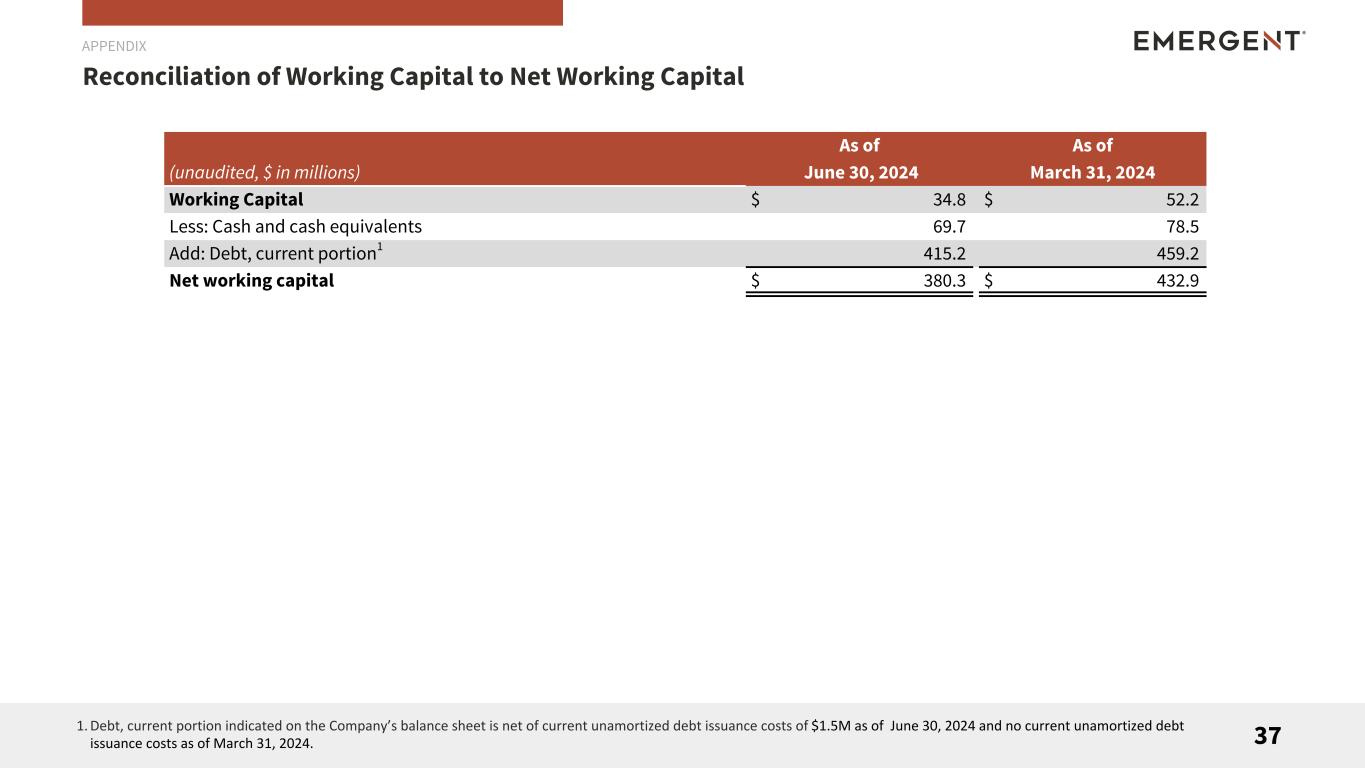

Reconciliation of Working Capital to Net Working Capital 37 APPENDIX (unaudited, $ in millions) As of As of June 30, 2024 March 31, 2024 Working Capital $ 34.8 $ 52.2 Less: Cash and cash equivalents 69.7 78.5 Add: Debt, current portion1 415.2 459.2 Net working capital $ 380.3 $ 432.9 1.Debt, current portion indicated on the Company’s balance sheet is net of current unamortized debt issuance costs of $1.5M as of June 30, 2024 and no current unamortized debt issuance costs as of March 31, 2024.

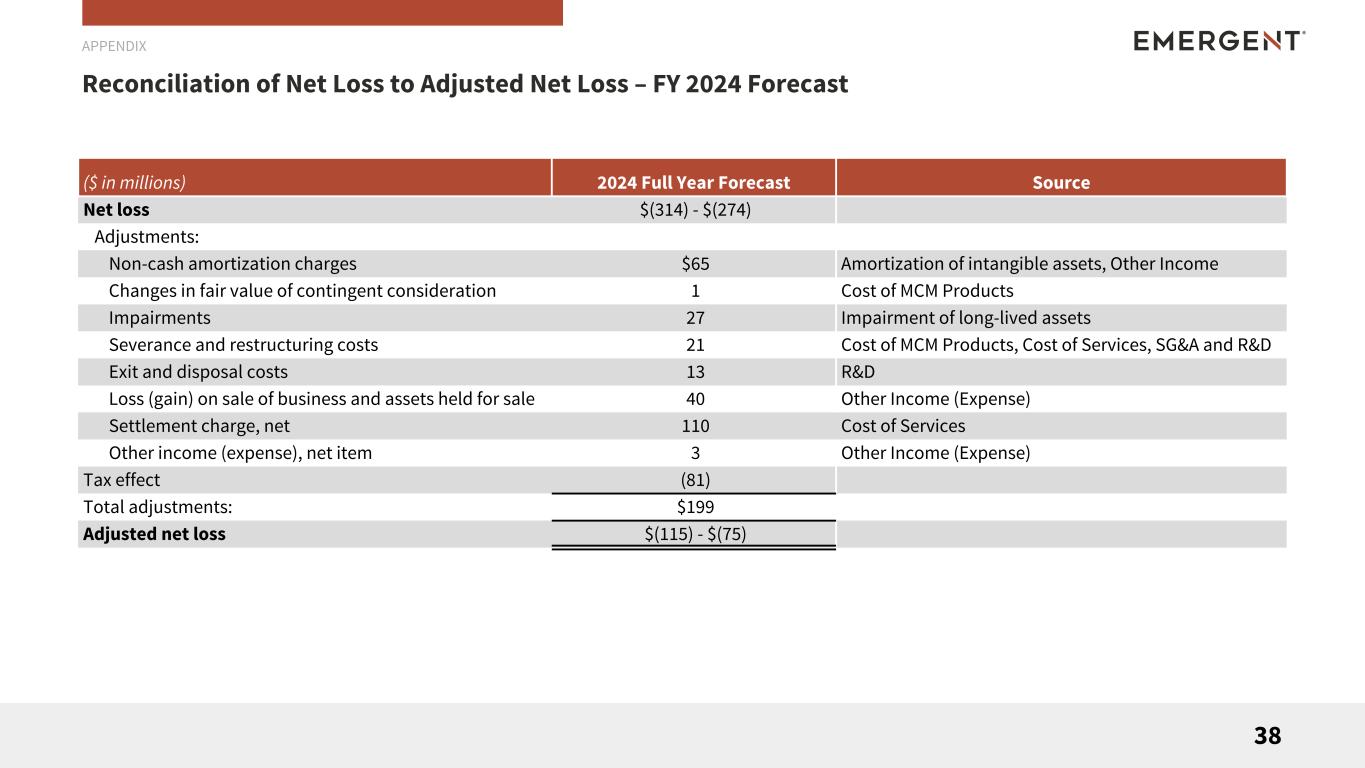

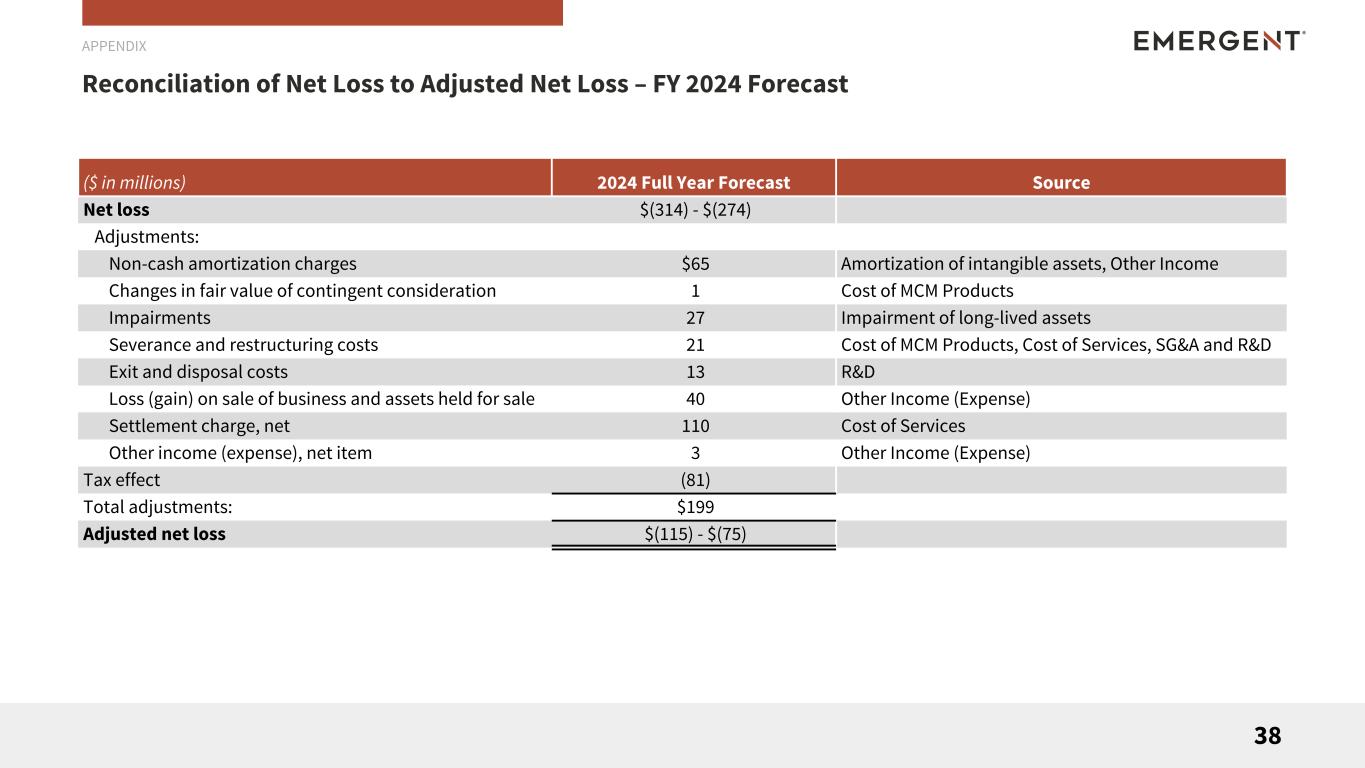

Reconciliation of Net Loss to Adjusted Net Loss – FY 2024 Forecast 38 APPENDIX ($ in millions) 2024 Full Year Forecast Source Net loss $(314) - $(274) Adjustments: Non-cash amortization charges $65 Amortization of intangible assets, Other Income Changes in fair value of contingent consideration 1 Cost of MCM Products Impairments 27 Impairment of long-lived assets Severance and restructuring costs 21 Cost of MCM Products, Cost of Services, SG&A and R&D Exit and disposal costs 13 R&D Loss (gain) on sale of business and assets held for sale 40 Other Income (Expense) Settlement charge, net 110 Cost of Services Other income (expense), net item 3 Other Income (Expense) Tax effect (81) Total adjustments: $199 Adjusted net loss $(115) - $(75)

Reconciliation of Net Loss to Adjusted EBITDA – FY 2024 Forecast 39 APPENDIX ($ in millions) 2024 Full Year Forecast Net loss $(314) - $(274) Adjustments: Depreciation & amortization $111 Income taxes 46 Total interest expense, net 82 Impairments 27 Changes in fair value of contingent consideration 1 Severance and restructuring costs 21 Exit and disposal costs 13 Loss (gain) on sale of business and assets held for sale 40 Settlement charge, net 110 Other income (expense), net item 3 Total adjustments $454 Adjusted EBITDA $140 - $180

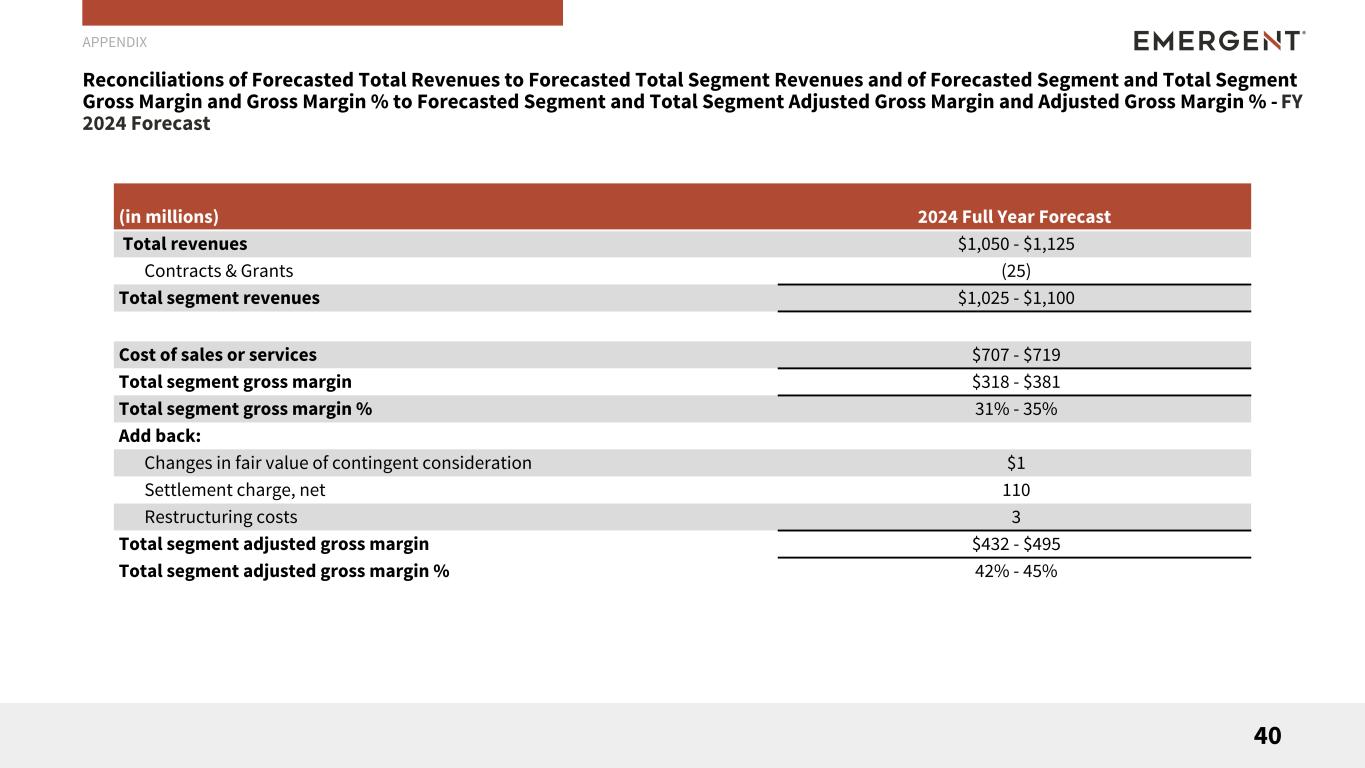

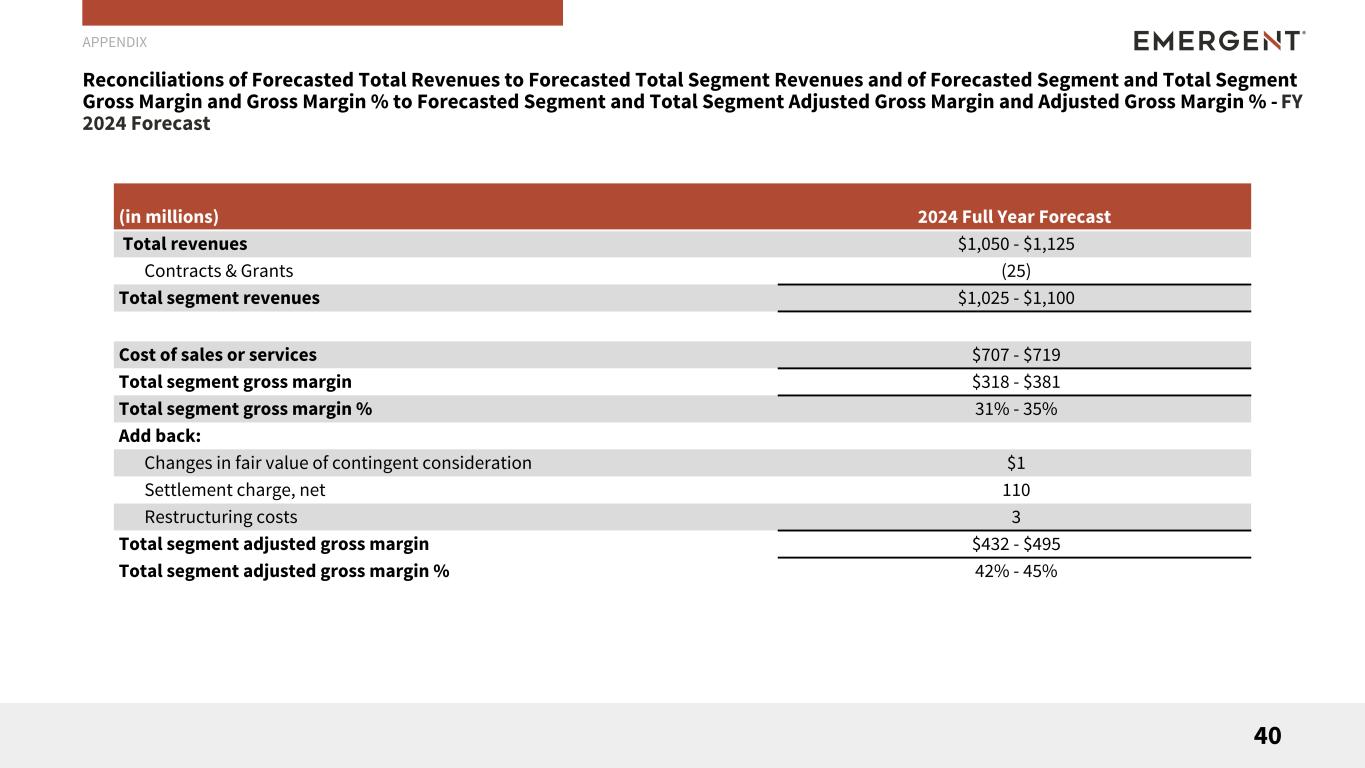

Reconciliations of Forecasted Total Revenues to Forecasted Total Segment Revenues and of Forecasted Segment and Total Segment Gross Margin and Gross Margin % to Forecasted Segment and Total Segment Adjusted Gross Margin and Adjusted Gross Margin % - FY 2024 Forecast 40 APPENDIX (in millions) 2024 Full Year Forecast Total revenues $1,050 - $1,125 Contracts & Grants (25) Total segment revenues $1,025 - $1,100 Cost of sales or services $707 - $719 Total segment gross margin $318 - $381 Total segment gross margin % 31% - 35% Add back: Changes in fair value of contingent consideration $1 Settlement charge, net 110 Restructuring costs 3 Total segment adjusted gross margin $432 - $495 Total segment adjusted gross margin % 42% - 45%

www.emergentbiosolutions.com 41