Exhibit 99.1

Expecting Excellence,

Delivering Results

Annual Shareholder's Meeting

March 27, 2014, at 4:00pm

Eau Claire Golf and Country Club

Welcome and Introduction

* Edward H. Schaefer

President and CEO

* Mark Oldenberg

Chief Financial Officer

Forward Looking Statements

Cautionary Note Regarding Forward Looking Statements

This presentation includes forward-looking statements about the financial condition, results of operations and business of Citizens Community Bancorp, Inc. Forward-looking statements can be identified by the fact that they do not relate strictly to historical or current facts. These statements may be identified by the use of forward-looking words or phrases such as “anticipate,” “believe,” “could,” “expect,” “intend,” “may,” “planned,” “potential,” “should,” “will,” “would” or the negative of those terms or other words of similar meaning. These forward-looking statements are intended to be covered by the safe-harbor provisions of the Private Securities Litigation Reform Act of 1995.

Such forward-looking statements in this presentation are inherently subject to many uncertainties in our operations and business environment. These uncertainties include general economic conditions, in particular, relating to consumer demand for our products and services; our ability to maintain current deposit and loan levels at current interest rates; deteriorating credit quality, including changes in the interest-rate environment reducing interest margins; prepayment speeds, loan origination and sale volumes, charge-offs and loan loss provisions; and other matters described in the Company's SEC filings, including under the section "Risk Factors" in Item 1A of the Company's Form 10-K Report for the fiscal year ending September 30, 2013. Shareholders, potential investors and other readers are urged to consider these factors carefully in evaluating the forward-looking statements and are cautioned not to place undue reliance on such forward-looking statements. The forward-looking statements made herein are only made as of the date of this presentation and we undertake no obligation to publicly update such forward-looking statements to reflect subsequent events or circumstances occurring after the date of this release.

Expecting Excellence,

Delivering Results

* Accomplishments, Highlights

* Financial Performance

* Asset Quality

* Creating Shareholder Value

* Questions

Overview

|

| |

| * | Based in Eau Claire, WI, Citizens Community Federal serves more than 50,000 customers in Wisconsin, Minnesota and Michigan. |

|

| |

| * | 23 branch locations, including 15 in-store locations. |

|

| |

| * | Full service retail banking, expanded services and electronic banking, commercial banking platform established in 2013. |

Fiscal 2013 Accomplishments

|

| | |

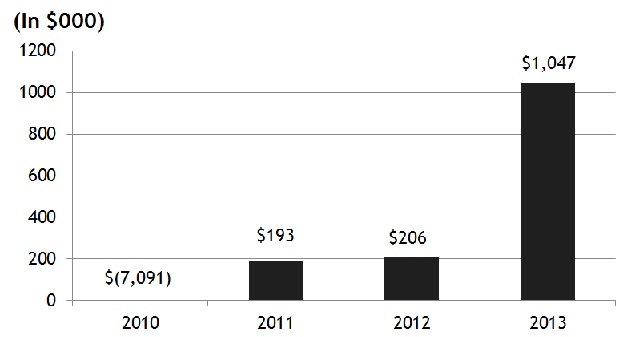

* | | Earnings increased fourfold from fiscal 2012. |

| | | |

* | | Nonperforming loan balances declined 42% year-over-year. |

| | | |

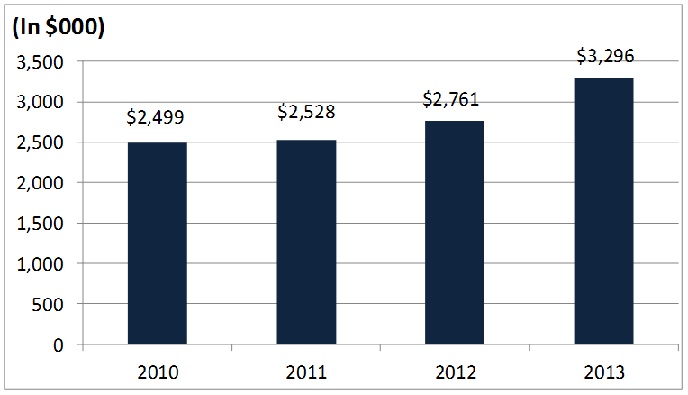

* | | Non-interest income up 82%, reflecting additional fees from new products and services. |

| | | |

* | | Established and staffed commercial banking group. |

| | | |

* | | $11.9 million in new commercial loans in 2013 over 2012. |

| | | |

* | | Deposit growth reflected relationship banking initiatives. |

| | | |

* | | Branch network rationalization to improve efficiency, productivity: two branch closings, third announced in 2014. |

| | | |

* | | Resumed paying dividends. An annual dividend was paid in fiscal 2013. |

Delivering Results: Fiscal 1Q 2014

|

| | |

| * | | Continuing credit quality improvement: net charge-offs at 0.45% of average loans, nonperforming loans at 0.52% of total assets. |

| | | |

* | | Credit, underwriting, risk management practices supporting ongoing asset quality. |

| | | |

* | | Opened new Rice Lake, WI facility. |

| | | |

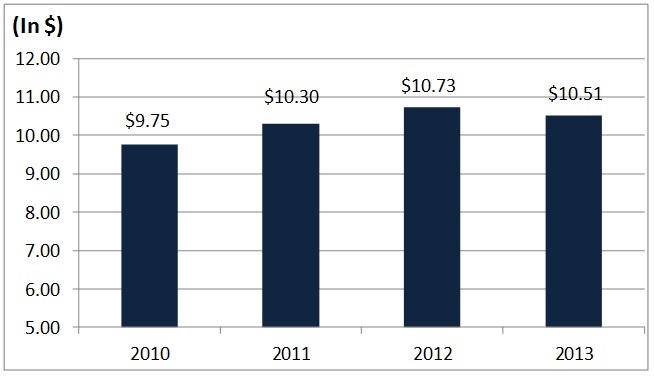

* | | Book value per share reflected value enhancement, rising to $10.71 at December 31, 2013 versus $10.36 the year before. |

| | | |

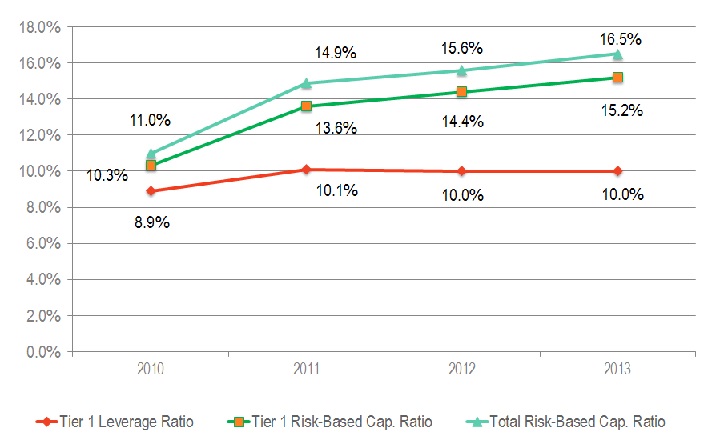

* | | Well capitalized by accepted regulatory standards. |

PERFORMANCE HIGHLIGHTS

Net Income

(Fiscal Year End)

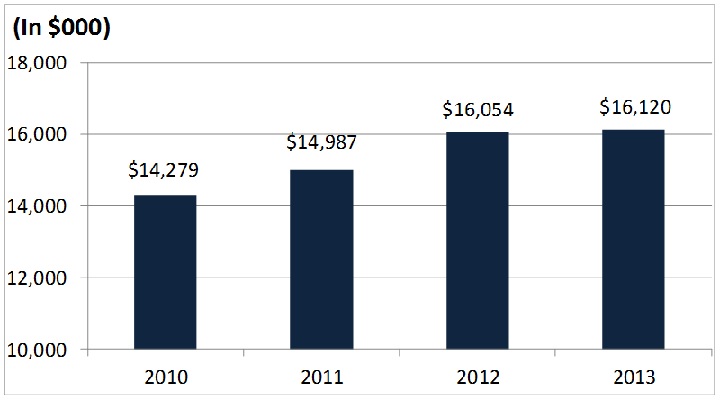

Net Interest Income After Provision

(Fiscal Year Ended)

Loan & Deposit Fee Income

(Fiscal Year Ended)

Interest and Non-Interest

Income Drivers

|

| | |

| * | | Expanded Secondary Market Lending Operation. |

| | | |

* | | Expanded Purchase Mortgage Originations. |

| | | |

* | | Commercial Banking Generated Interest Income on Loans, Non-Interest Fee Income. |

| | | |

* | | Enhanced Depository Services. |

| | | |

* | | Leveraged Indirect Lending Relationships. |

ASSET QUALITY

CREDIT QUALITY

COMPLIANCE

CAPITAL STRENGTH

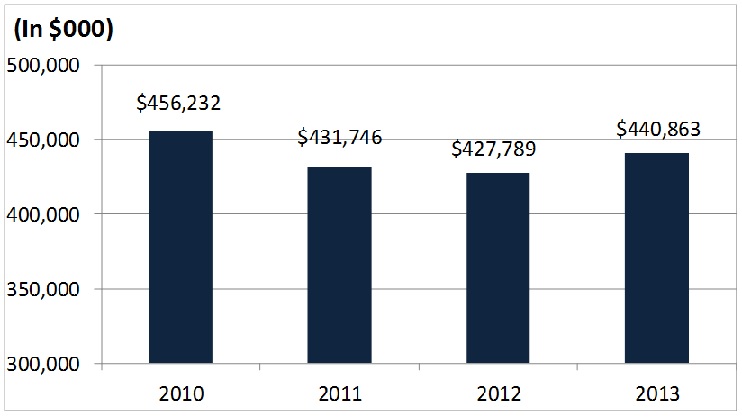

Balance Sheet Four Year Trends

* Removed Non-Performing Loans

* New Loans To Replace Pay-Downs

* Commercial Loan Growth

* Accelerating Core Deposit Activity

*Utilize Wholesale Borrowings, When Appropriate, to

Supplement Core Deposits

* Focus on Most Productive Assets, Markets

Loan Trends: Focus on Quality Growth

(Total Loans - Fiscal Year Ended)

Classified Assets/Total Assets Ratio

(Fiscal Year Ended)

Delinquency

|

| | | | | | | | |

| | | December 2010 | | December 2011 | | December 2012 | | December 2013 |

91 Plus (without OREO and OCO) | | $7,219,179 | | $4,242,084 | | $3,246,358 | | $1,698,770 |

| 1.60% | | 0.98% | | 0.77% | | 0.38% |

| OREO | | $240,300 | | $723,666 | | $837,043 | | $1,382,033 |

| OCO | | $278,977 | | $307,813 | | $195,068 | | $118,347 |

91 Plus (including OREO and OCO) | | $7,738,456 | | $5,273,563 | | $4,278,469 | | $3,199,150 |

| 1.59% | | 1.22% | | 1.02% | | 0.72% |

| 30-89 Days | | $10,326,456 | | $8,570,869 | | $5,978,640 | | $3,690,127 |

| 2.29% | | 1.99% | | 1.42% | | 0.84% |

All percentages shown are as a percent of total loans.

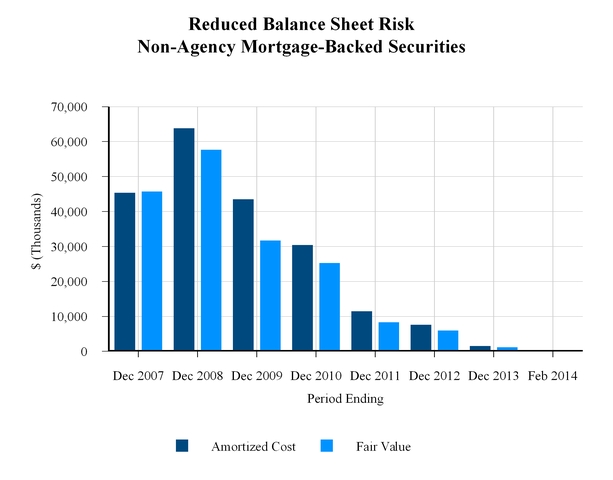

|

| | | | | | | | | |

| | | Dec. 2007 | Dec. 2008 | Dec. 2009 | Dec. 2010 | Dec. 2011 | Dec. 2012 | Dec. 2013 | Feb. 2014 |

| Amortized Cost | | 45,357 | 63,805 | 43,482 | 30,417 | 11,467 | 7,579 | 1,547 | 0 |

| Fair Value | | 45,756 | 57,678 | 31,705 | 25,276 | 8,298 | 5,928 | 1,136 | 0 |

Compliance and Audit

|

| | |

| * | | Removal of MOU in March 2013. |

| | | |

* | | Board Audit Committee Supporting The Compliance and Audit Initiatives, as Well as Providing Program Oversight. |

| | | |

* | | Continuing to Develop Organization Wide Enterprise Risk Management Processes and Reporting. |

Strengthened Capital

Creating

Shareholder

Value

Expecting Excellence,

Delivering Results

Book Value Per Share

(Fiscal Year Ended)

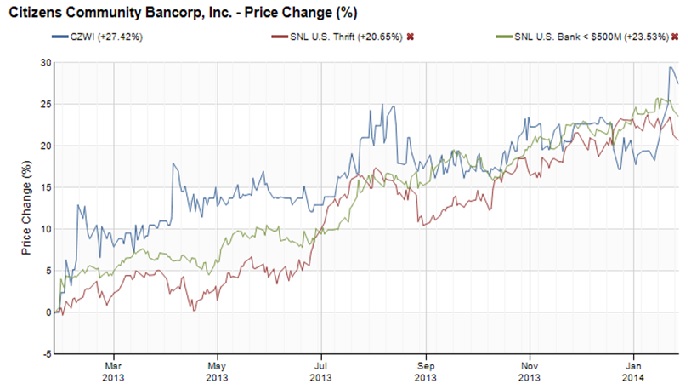

One Year Stock Performance

Delivering Results - Fiscal 2014

|

| | | |

* | | Focus on Efficiency, Productivity of Branches |

| | | |

| * | | Commercial Lending, Products, Service |

| | | |

| * | | Profitable Balance Sheet Growth |

| | | |

| | | * | Commercial |

| | | |

| | | * | Residential Purchase Mortgages |

| | | |

| | | * | Consumer and Indirect Lending |

| | | |

* | | Build Core Deposits Through Relationship Banking |

| | | |

| * | | Disciplined Interest, Non-Interest Expense Management |

| | | |

| * | | Continuing Asset Quality Improvement |

| | | |

| * | | Opportunities to Further Rationalize Branch Network |

| | | |

| * | | Annual Dividend doubled in Q2 Fiscal 2014 - $0.04 per share |

Questions?