Filed Pursuant to Rule 433 ExRegistration Statement No. __________ Issuer Free Writing Prospectus Dated October __, 2015 Relating to Preliminary Prospectus SupplemeEXHIBITnt Dated Oc99.2tober __, 2015 $65,000,000 Private Placement June 2018 Strictly Confidential 1

Caution Regarding Forward Looking Statements This presentation contains certain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, and Section 21E of the Securities Exchange Act of 1934. These statements include, but are not limited to, descriptions of the financial condition, results of operations, asset and credit quality trends, profitability, projected earnings, future plans, strategies and expectations of Citizens Community Bancorp, Inc. (“CZWI” or the “Company”). The Company intends such forward-looking statements to be covered by the safe harbor provisions for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995 and is including this statement for purposes of complying with those safe harbor provisions. Forward-looking statements, which are based on certain assumptions of the Company, are generally identifiable by use of the words “believe,” “expect,” “intend,” “anticipate,” “estimate,” “project,” “seek,” “target,” “potential,” “focus,” “may,” “could,” “should” or similar expressions. These forward-looking statements express management’s current expectations or forecasts of future events, and by their nature, are subject to risks and uncertainties. Therefore, there are a number of factors that might cause actual results to differ materially from those in such statements. These uncertainties include conditions in the financial markets and economic conditions generally; the possibility of a deterioration in the residential real estate markets; interest rate risk; lending risk; the sufficiency of loan allowances; changes in the fair value or ratings downgrades of our securities; competitive pressures among depository and other financial institutions; our ability to realize the benefits of net deferred tax assets; our ability to maintain or increase our market share; acts of terrorism and political or military actions by the United States or other governments; legislative or regulatory changes or actions, or significant litigation, adversely affecting the CCFBank; increases in FDIC insurance premiums or special assessments by the FDIC; disintermediation risk; our inability to obtain needed liquidity; our ability to raise capital needed to fund growth or meet regulatory requirements; the possibility that our internal controls and procedures could fail or be circumvented; our ability to attract and retain key personnel; our ability to keep pace with technological change; cybersecurity risks; risks posed by acquisitions and other expansion opportunities; changes in accounting principles, policies or guidelines and their impact on financial performance; restrictions on our ability to pay dividends; the potential volatility of our stock price; and such other matters as discussed in this presentation or identified in the Company’s periodic filings with the Securities and Exchange Commission, particularly those matters described under the heading “Risk Factors” in its Annual Report on Form 10-K for the year ended September 30, 2017 and Quarterly Report on Form 10-Q for the quarter ended March 31, 2018. Additional information concerning specific risk factors pertaining to this capital raise and the proposed acquisition of United Bank will be contained in an appendix to the Securities Purchase Agreement to be used in the private placement. You are cautioned not to place undue reliance on forward-looking statements, which reflect the Company’s outlook only and speak only as of the date of this presentation or the dates indicated in the statements. The Company assumes no obligation to update or supplement forward-looking statements. For further information on these and other factors that could impact the Company and the statements contained herein, reference should be made to the Company’s filings with the Securities and Exchange Commission. This presentation is a summary only. The Company is not making any implied or express representation or warranty as to the accuracy or completeness of the information contained herein. This presentation is neither an offer to sell nor a solicitation of an offer to purchase any securities of the Company. 2

Unaudited Pro Forma Financial Information This presentation contains certain unaudited pro forma information regarding the financial condition and results of operations of the company after giving effect to the private placement, acquisition and other pro forma adjustments. The unaudited pro forma information assumes that the acquisition is accounted for under the acquisition method of accounting, and that the assets and liabilities of United Bank will be recorded by CZWI at their respective fair values as of the date the acquisition is completed. The unaudited pro forma balance sheet gives effect to the transaction as if the acquisition had occurred on March 31, 2018. The unaudited pro forma information has been derived from and should be read in conjunction with the consolidated financial statements and related notes of CZWI, which are included in its Annual Report on Form 10-K for the year ended September 30, 2017 and subsequent Quarterly Reports on Form 10-Q. The unaudited pro forma information is presented for illustrative purposes only and does not indicate the financial results of the combined company had the private placement occurred and the companies actually been combined at the beginning of each period presented, nor the impact of possible business model changes. This unaudited pro forma information reflects adjustments to illustrate the effect of the private placement and acquisition had they been completed on the date(s) indicated, which are based upon preliminary estimates, to record United Bank’s identifiable assets acquired and liabilities assumed at fair value and the resulting goodwill recognized. The unaudited pro forma information also does not consider any potential effects of changes in market conditions on revenues, potential revenue enhancements, or asset dispositions, among other factors. The purchase price allocation reflected in this information is preliminary, and the final allocation of the purchase price will be based upon the actual purchase price and the fair value of United Bank’s assets and liabilities as of the date of the completion of the acquisition. In addition, following the completion of the acquisition, there may be further refinements of the purchase price allocation as additional information becomes available. Accordingly, the final purchase accounting adjustments may differ materially from the pro forma adjustments reflected in this presentation. 3

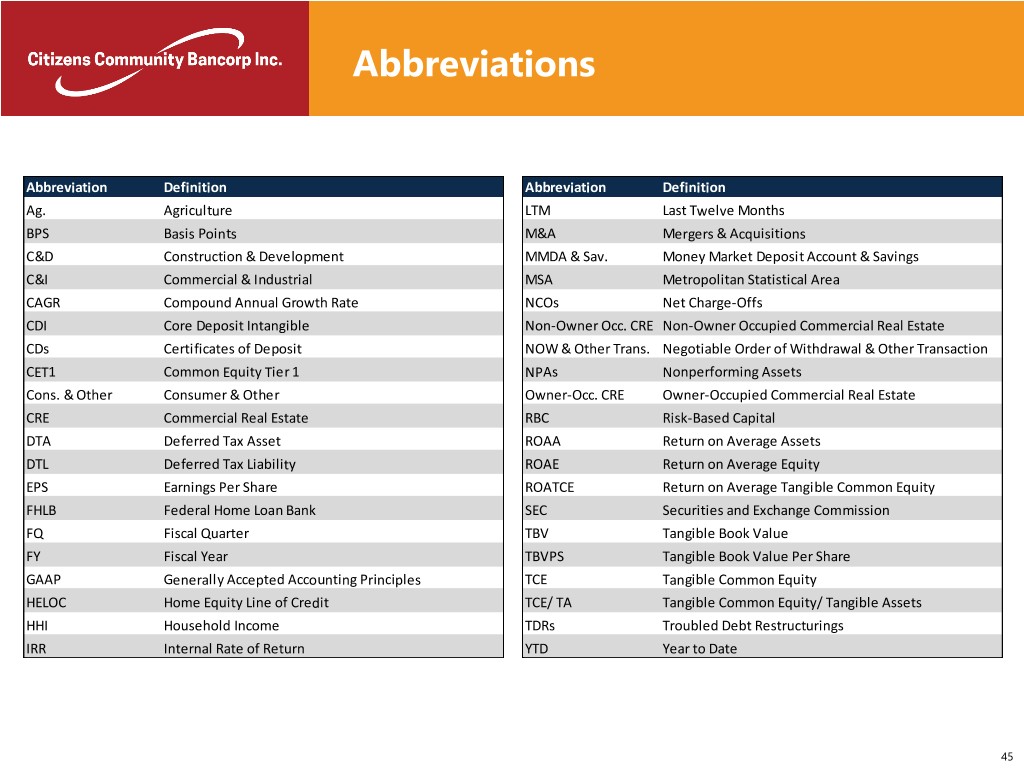

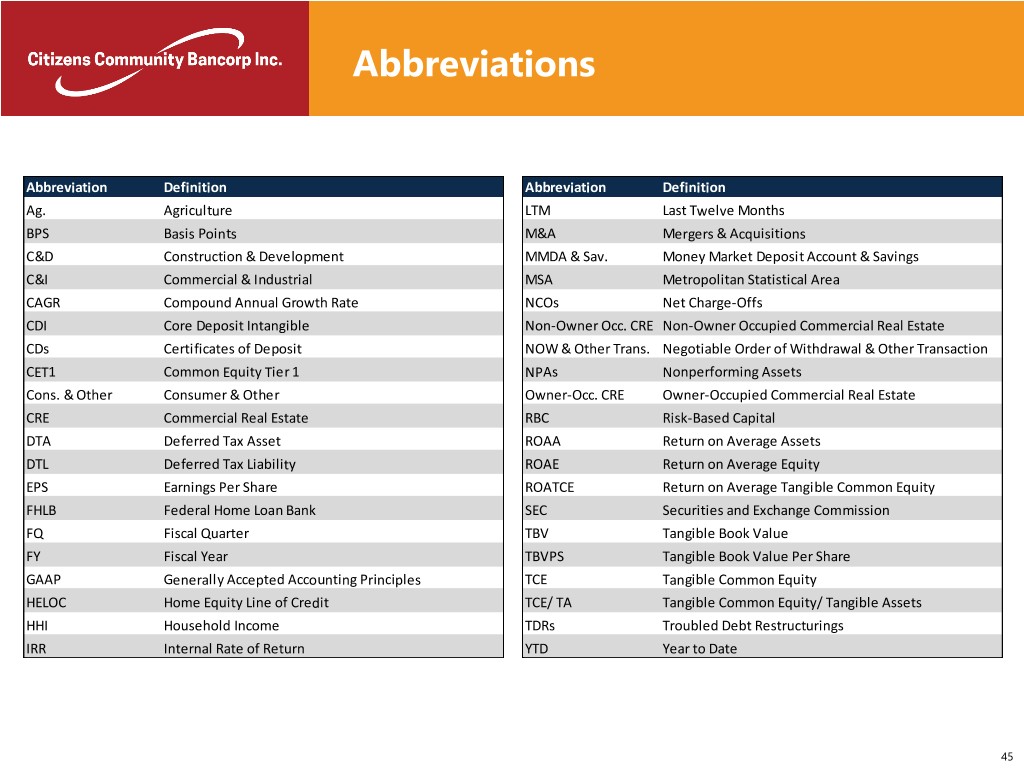

Additional Disclosures & Abbreviations DOCUMENTS INCORPORATED BY REFERENCE This presentation should be read in conjunction with any documents that are filed by the Company with the Securities and Exchange Commission (SEC), including, without limitation, its Annual Report on Form 10-K for the year ended September 30, 2017, its subsequent Quarterly Reports on Form 10-Q for the fiscal quarters ended December 31, 2017 and March 31, 2018; its Current Reports on Form 8-K, and other documents that have been filed with the SEC. The filings listed above and any additional documents that the Company may file with the SEC pursuant to Section 13(a), 13(c), 14 or 15(d) of the Exchange Act on or after the date hereof are incorporated by reference herein. PRIVATE PLACEMENT SUBJECT TO DEFINITIVE SECURITIES PURCHASE AGREEMENT The private placement will be subject to the terms and conditions of a definitive securities purchase agreement and related documents, which will describe certain risks and uncertainties with respect to the private placement and other transactions described herein. This presentation (the “Transaction Documents”) should be read in conjunction with those risk factors, the risk factors described under “Risk Factors” to the Company’s Annual Report on Form 10-K for the year ended September 30, 2017, and any updates to those risk factors or new risk factors contained in the Company’s subsequent Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q and Current Reports on Form 8-K filed with the SEC, all of which are incorporated by reference herein. This communication shall not constitute an offer to sell or the solicitation of an offer to sell or the solicitation of an offer to buy any securities, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful under the securities laws of any such jurisdiction. The offer and sale will be made only pursuant to the Transaction Documents. NON-GAAP FINANCIAL MEASURES These slides may contain non-GAAP financial measures. For purposes of Regulation G, a non-GAAP financial measure is a numerical measure of the registrant’s historical or future financial performance, financial position or cash flows that excludes amounts, or is subject to adjustments that have the effect of excluding amounts, that are included in the most directly comparable measure calculated and presented in accordance with GAAP in the statement of income, balance sheet or statement of cash flows (or equivalent statements) of the issuer; or includes amounts, or is subject to adjustments that have the effect of including amounts, that are excluded from the most directly comparable measure so calculated and presented. In this regard, GAAP refers to generally accepted accounting principles in the United States. Non-GAAP financial measures referred to herein include core earnings, core EPS, tangible common equity and tangible book value per share. Reconciliations of all non-GAAP financial measures used herein to the comparable GAAP financial measures in the appendix at the end of this presentation. ABBREVIATIONS Abbreviations used throughout this investor presentation are defined in the appendix at the end of the presentation. 4

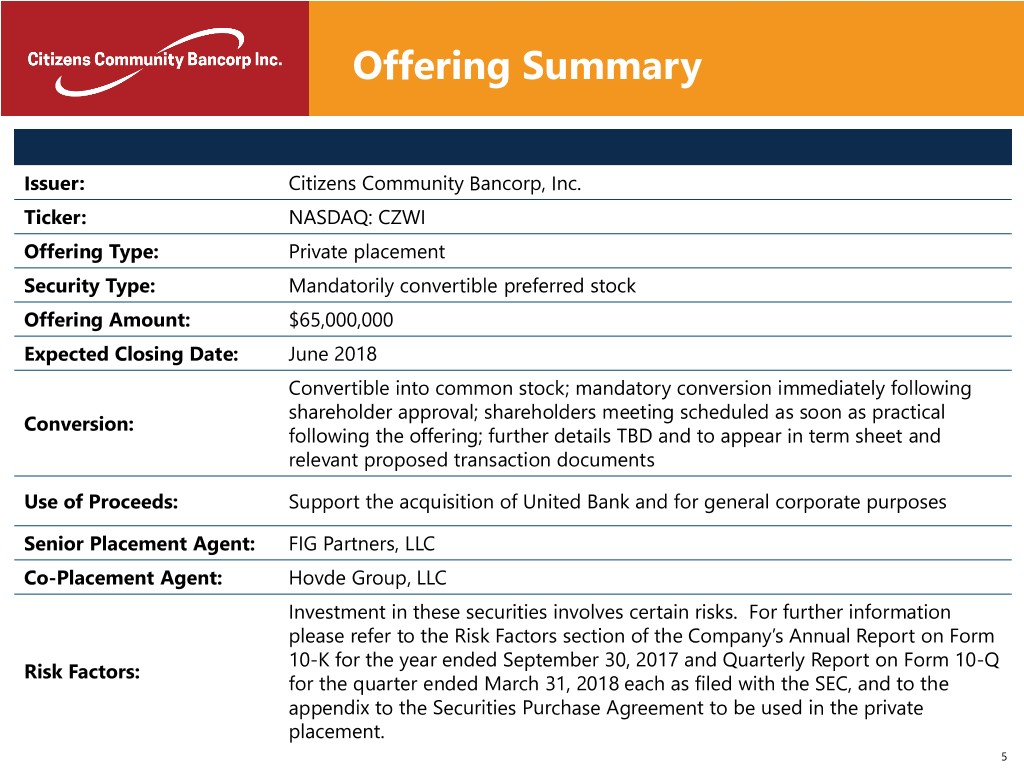

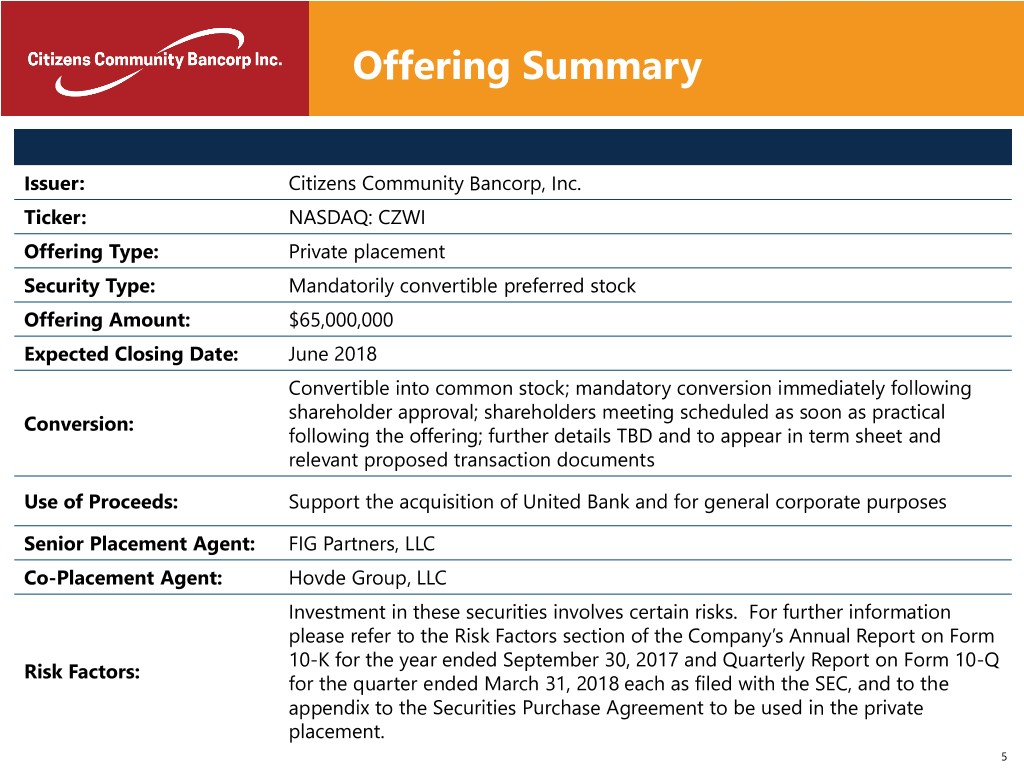

Offering Summary Issuer: Citizens Community Bancorp, Inc. Ticker: NASDAQ: CZWI Offering Type: Private placement Security Type: Mandatorily convertible preferred stock Offering Amount: $65,000,000 Expected Closing Date: June 2018 Convertible into common stock; mandatory conversion immediately following shareholder approval; shareholders meeting scheduled as soon as practical Conversion: following the offering; further details TBD and to appear in term sheet and relevant proposed transaction documents Use of Proceeds: Support the acquisition of United Bank and for general corporate purposes Senior Placement Agent: FIG Partners, LLC Co-Placement Agent: Hovde Group, LLC Investment in these securities involves certain risks. For further information please refer to the Risk Factors section of the Company’s Annual Report on Form 10-K for the year ended September 30, 2017 and Quarterly Report on Form 10-Q Risk Factors: for the quarter ended March 31, 2018 each as filed with the SEC, and to the appendix to the Securities Purchase Agreement to be used in the private placement. 5

Offering Rationale ❑ Offering an attractive valuation and entry point for a pro forma $1.2 billion asset institution ❑ Proposed acquisition of United Bank is consistent with CZWI’s turnaround and expansion strategy and is expected to substantially increase the Company’s presence in it’s primary market of Eau Claire, WI ❑ Post transaction, CZWI would rank as the largest community bank by total assets headquartered in the Chippewa Valley Region / Greater Eau Claire market ❑ Management has a proven track record and history of successful acquisitions ❑ Strengthens capital ratios ❑ Offering is an opportunity to broaden the Company’s investor base and sponsorship, and combined with CZWI passing the $1.0 billion total assets threshold at the close of the proposed acquisition, expectation is for both a greater market capitalization and potential for improved trading liquidity post-offering ❑ Allows CZWI to build capital on a pro forma basis going forward, positioning the Company to take advantage of future potential M&A opportunities, a key part of CZWI’s strategy 6

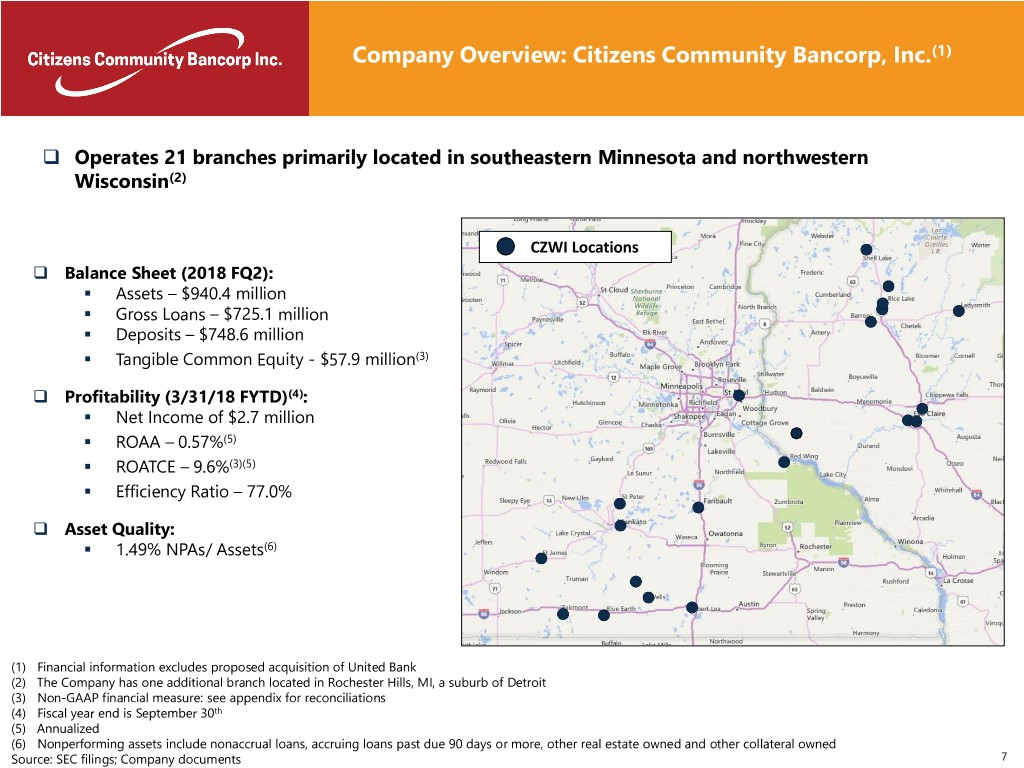

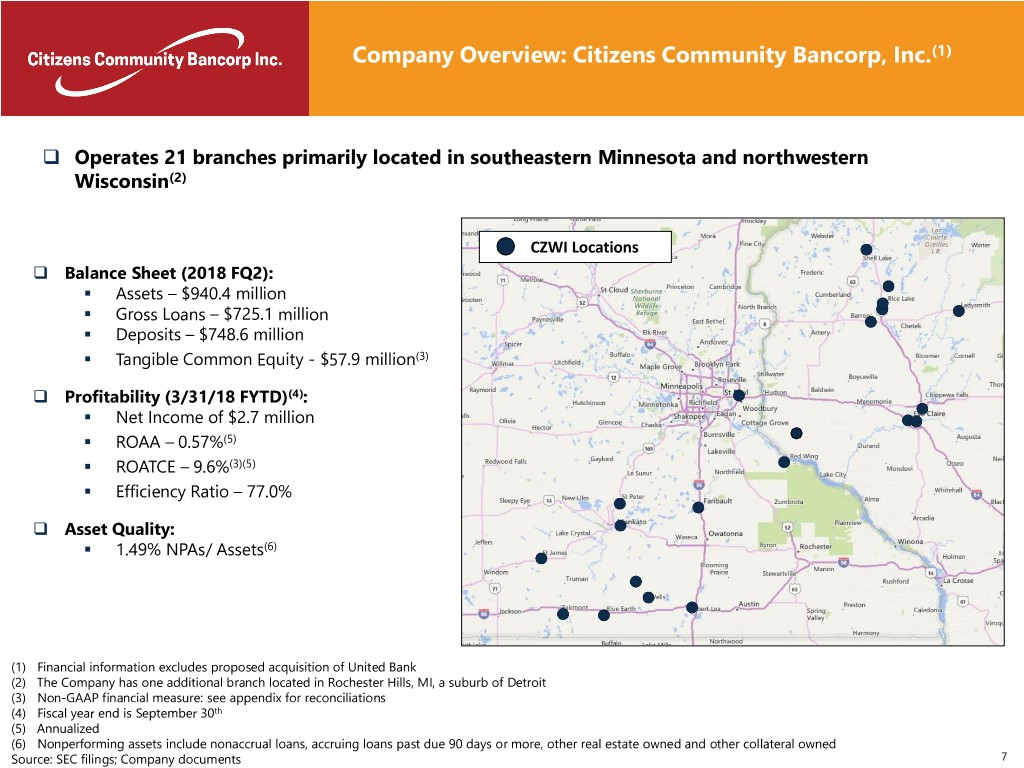

Company Overview: Citizens Community Bancorp, Inc.(1) ❑ Operates 21 branches primarily located in southeastern Minnesota and northwestern Wisconsin(2) CZWI Locations ❑ Balance Sheet (2018 FQ2): ▪ Assets – $940.4 million ▪ Gross Loans – $725.1 million ▪ Deposits – $748.6 million ▪ Tangible Common Equity - $57.9 million(3) ❑ Profitability (3/31/18 FYTD)(4): ▪ Net Income of $2.7 million ▪ ROAA – 0.57%(5) ▪ ROATCE – 9.6%(3)(5) ▪ Efficiency Ratio – 77.0% ❑ Asset Quality: ▪ 1.49% NPAs/ Assets(6) (1) Financial information excludes proposed acquisition of United Bank (2) The Company has one additional branch located in Rochester Hills, MI, a suburb of Detroit (3) Non-GAAP financial measure: see appendix for reconciliations (4) Fiscal year end is September 30th (5) Annualized (6) Nonperforming assets include nonaccrual loans, accruing loans past due 90 days or more, other real estate owned and other collateral owned Source: SEC filings; Company documents 7

Experienced Leadership Team Stephen M. “Steve” Bianchi – President & Chief Executive Officer Board of Directors Mr. Bianchi has served as President and Chief Executive Officer of Name Bio the Company and President and a director of Citizens Community Federal N.A., the Company's wholly owned subsidiary (the "Bank"), since June 2016. Mr. Bianchi has also served as a member of the Richard W. McHugh President & Majority Owner of Choice Products USA, CZWI Board since May 2017. Mr. Bianchi served as President and Chairman LLC Chief Executive Officer of HF Financial Corp. and Home Federal Bank, both based in Sioux Falls, South Dakota from October 2011 through Stephen M. "Steve" May 2016. Mr. Bianchi was a member of the board of directors of Bianchi President & CEO of Citizens Community Bancorp, Inc. Home Federal Bank. Mr. Bianchi also served in several senior Director and Citizens Community Federal management positions at Wells Fargo Bank and Associated Bank prior to his employment with HF Financial Corp. and Home Federal Bank. Mr. Bianchi holds an MBA from Providence College and a B.S. Kristina M. Bourget Vice President and General Counsel at Wisconsin in Finance from Providence College and has over 30 years of Director Independent Network banking experience. Francis E. Felber Director Founder of Ag Risk Managers Insurance Agency LLC James S. Broucek – Executive Vice President, Chief Financial Officer, Principal Accounting Officer & Treasurer, and Secretary Mr. Broucek served as a Senior Manager of Wipfli LLP from James R. Lang December 2013 through October 2017. Before joining Wipfli, Mr. Director President & Owner of Advantech Manufacturing, Inc. Broucek held several positions with TCF Financial Corporation and its subsidiaries from 1995 to 2013, with his last position being Treasurer of TCF Financial. Prior to joining TCF Financial, Mr. Broucek served as James D. "Jim" Moll Former President & CEO of Wells Financial Corp., Director Licensed CPA the Controller of Great Lakes Bancorp. He currently serves as a member of the Strategic Issues Council of the Financial Manager Society, Inc. and as a member of the Finance Committee of Timothy L. Olson Vice President of Project Development for Royal Youthprise. Director Construction, Licensed CPA Michael L. "Mike" Swenson Former President and CEO of Northern States Power Director Company Wisconsin Source: Company documents and S&P Global Market Intelligence 8

Recent Franchise Expansion ❑ CZWI has been focused on transforming the Company away from a consumer based bank into a commercial focused operation, creating a strengthened franchise value through this process ❑ The proposed acquisition of United Bank is consistent with this strategy, particularly given United’s commercial driven business and close proximity to CZWI’s corporate headquarters 2016 Acquisition of 2 Central Bank branches in northwestern WI: $27.1 million deposits 2016 Acquisition of Community Bank of Northern Wisconsin (Rice Lake, WI): $167 million in assets 2017 Acquisition of Wells Financial Corp. (Wells, MN): $256 million in assets 2018 Proposed acquisition of United Bank (Osseo, WI): $281 million in assets Source: SEC filings; Company documents 9

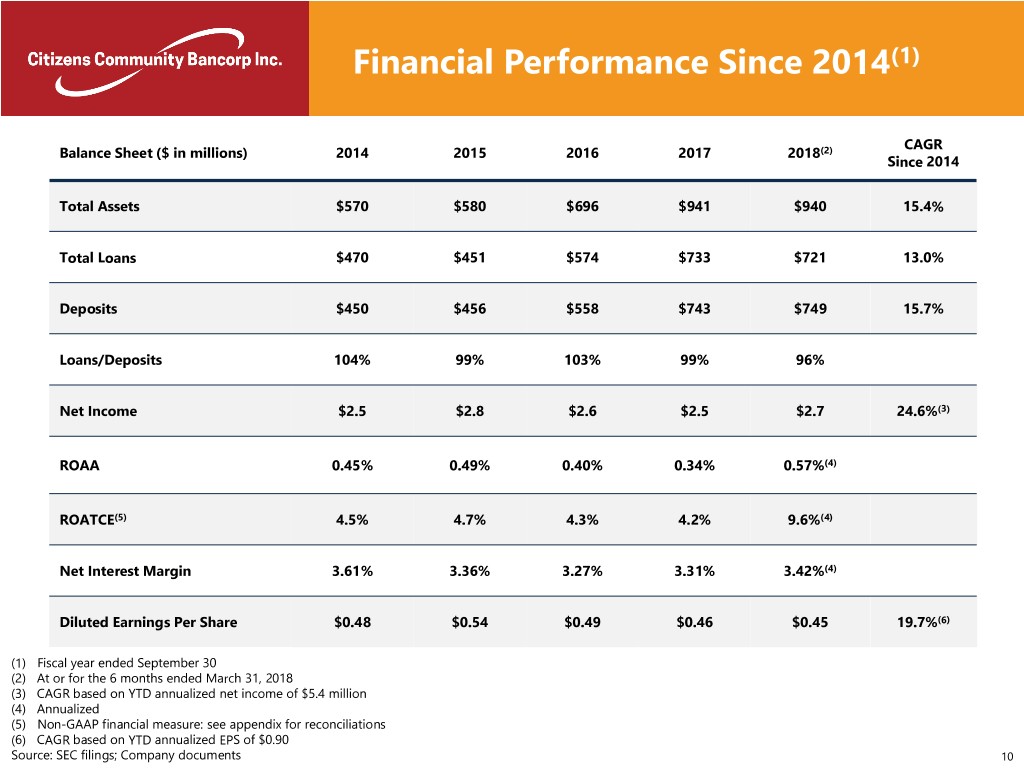

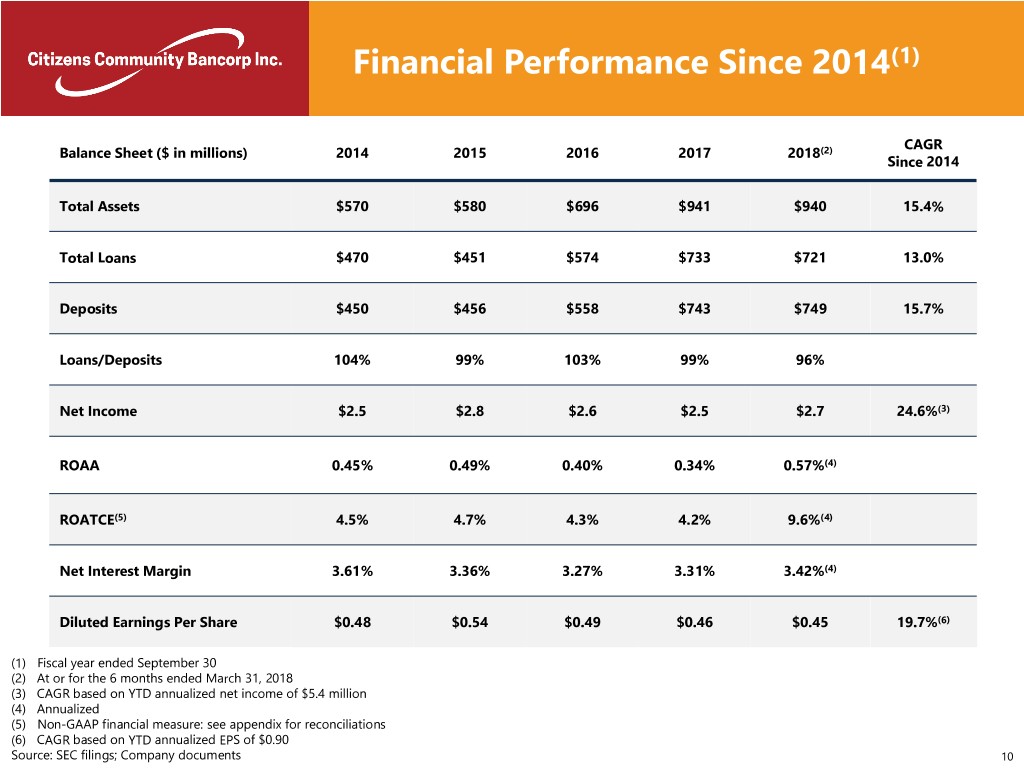

Financial Performance Since 2014(1) CAGR Balance Sheet ($ in millions) 2014 2015 2016 2017 2018(2) Since 2014 Total Assets $570 $580 $696 $941 $940 15.4% Total Loans $470 $451 $574 $733 $721 13.0% Deposits $450 $456 $558 $743 $749 15.7% Loans/Deposits 104% 99% 103% 99% 96% Net Income $2.5 $2.8 $2.6 $2.5 $2.7 24.6%(3) ROAA 0.45% 0.49% 0.40% 0.34% 0.57%(4) ROATCE(5) 4.5% 4.7% 4.3% 4.2% 9.6%(4) Net Interest Margin 3.61% 3.36% 3.27% 3.31% 3.42%(4) Diluted Earnings Per Share $0.48 $0.54 $0.49 $0.46 $0.45 19.7%(6) (1) Fiscal year ended September 30 (2) At or for the 6 months ended March 31, 2018 (3) CAGR based on YTD annualized net income of $5.4 million (4) Annualized (5) Non-GAAP financial measure: see appendix for reconciliations (6) CAGR based on YTD annualized EPS of $0.90 Source: SEC filings; Company documents 10

CZWI Focus Items ENHANCING THE QUANTITY AND QUALITY OF EARNINGS We are enhancing shareholder value by improving the loan and deposit mix, deepening customer relationships and strengthening other sources of revenue. EXPERTISE IN COMMERCIAL & AG BANKING We take pride in serving small and mid-sized business and Ag operators in our communities with the best professionals, products and process. EXPERIENCED & PROVEN STRATEGIC LEADERSHIP TEAM Our team has over 174 years of banking experience to draw upon with national, regional and community banks. ENTERPRISE PRODUCTIVITY & RISK MANAGEMENT We are leveraging technology to improve productivity and support future growth, while proactively managing operating and credit risk. Source: Company documents 11

Key Market Differentiators • Serving small to mid-sized • Experienced, energetic entrepreneurs leadership team • Responsive professionals • Accountability for doing the • Products to compete vs. big right thing and getting banks, superior to smaller results community banks • Entrepreneurial spirit, winning attitude BUSINESS CULTURE MODEL STRATEGIC GROWTH CREDIT • Loan and deposit growth • Prudent risk taking through prudent M&A • Process driven, transparent • Robust commercial loan • Nimble, centralized approval and deposit growth process • Quality and quantity of • Proactive risk management earnings improving Source: Company documents 12

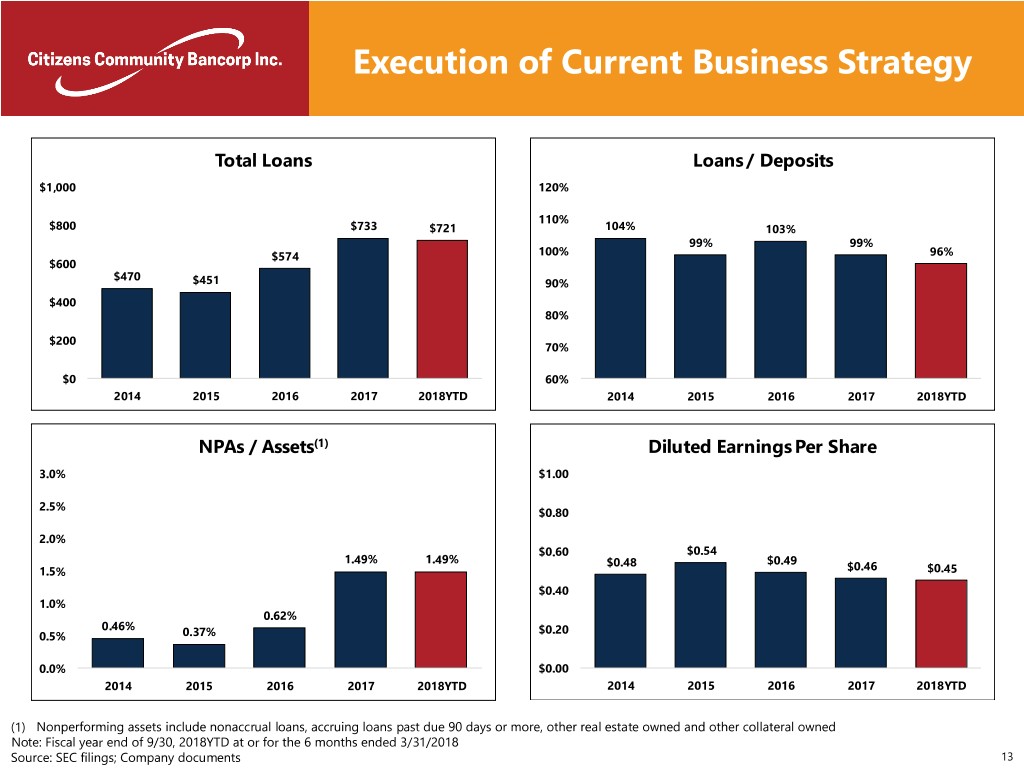

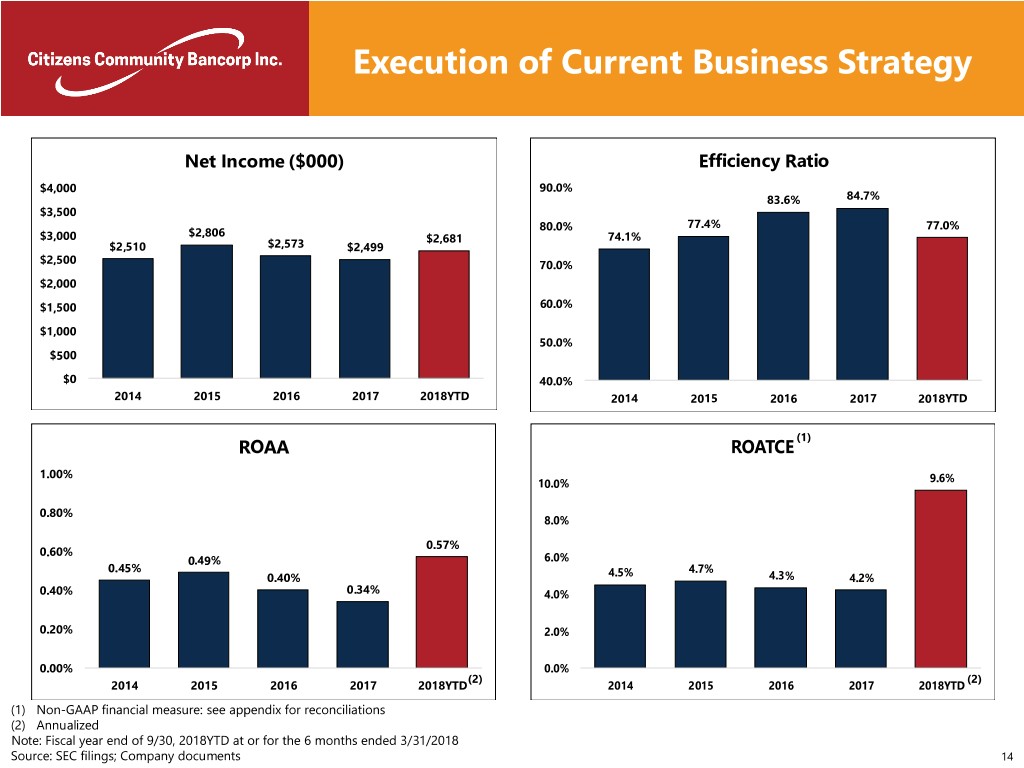

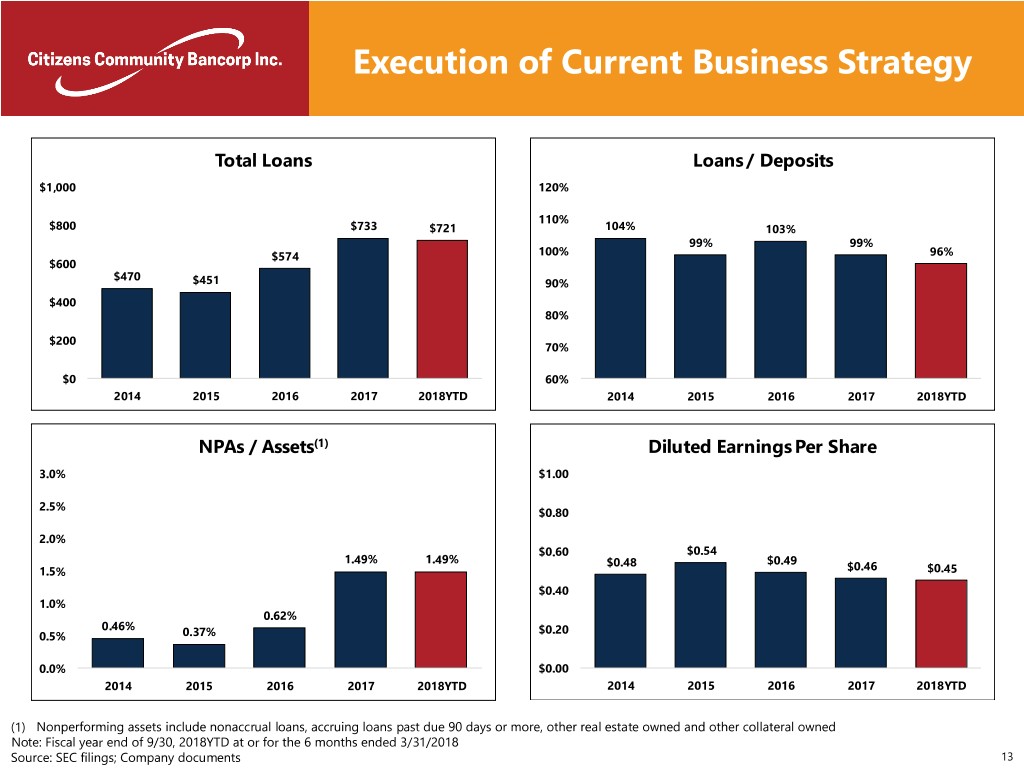

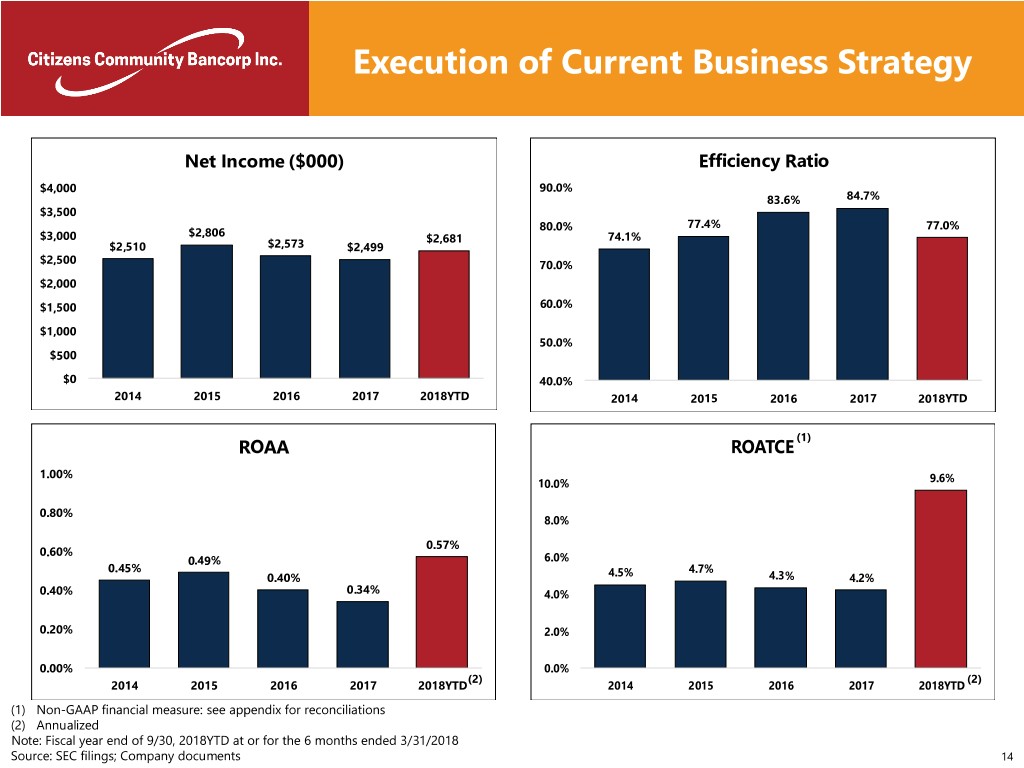

Execution of Current Business Strategy Total Loans Loans / Deposits $1,000 120% 110% $800 $733 $721 104% 103% 99% 99% $574 100% 96% $600 $470 $451 90% $400 80% $200 70% $0 60% 2014 2015 2016 2017 2018YTD 2014 2015 2016 2017 2018YTD NPAs / Assets(1) Diluted Earnings Per Share 3.0% $1.00 2.5% $0.80 2.0% $0.60 $0.54 1.49% 1.49% $0.48 $0.49 1.5% $0.46 $0.45 $0.40 1.0% 0.62% 0.46% $0.20 0.5% 0.37% 0.0% $0.00 2014 2015 2016 2017 2018YTD 2014 2015 2016 2017 2018YTD (1) Nonperforming assets include nonaccrual loans, accruing loans past due 90 days or more, other real estate owned and other collateral owned Note: Fiscal year end of 9/30, 2018YTD at or for the 6 months ended 3/31/2018 Source: SEC filings; Company documents 13

Execution of Current Business Strategy Net Income ($000) Efficiency Ratio $4,000 90.0% 83.6% 84.7% $3,500 80.0% 77.4% 77.0% $2,806 $3,000 $2,681 74.1% $2,510 $2,573 $2,499 $2,500 70.0% $2,000 $1,500 60.0% $1,000 50.0% $500 $0 40.0% 2014 2015 2016 2017 2018YTD 2014 2015 2016 2017 2018YTD (1) ROAA ROATCE 1.00% 10.0% 9.6% 0.80% 8.0% 0.57% 0.60% 0.49% 6.0% 0.45% 4.7% 0.40% 4.5% 4.3% 4.2% 0.40% 0.34% 4.0% 0.20% 2.0% 0.00% 0.0% (2) (2) 2014 2015 2016 2017 2018YTD 2014 2015 2016 2017 2018YTD (1) Non-GAAP financial measure: see appendix for reconciliations (2) Annualized Note: Fiscal year end of 9/30, 2018YTD at or for the 6 months ended 3/31/2018 Source: SEC filings; Company documents 14

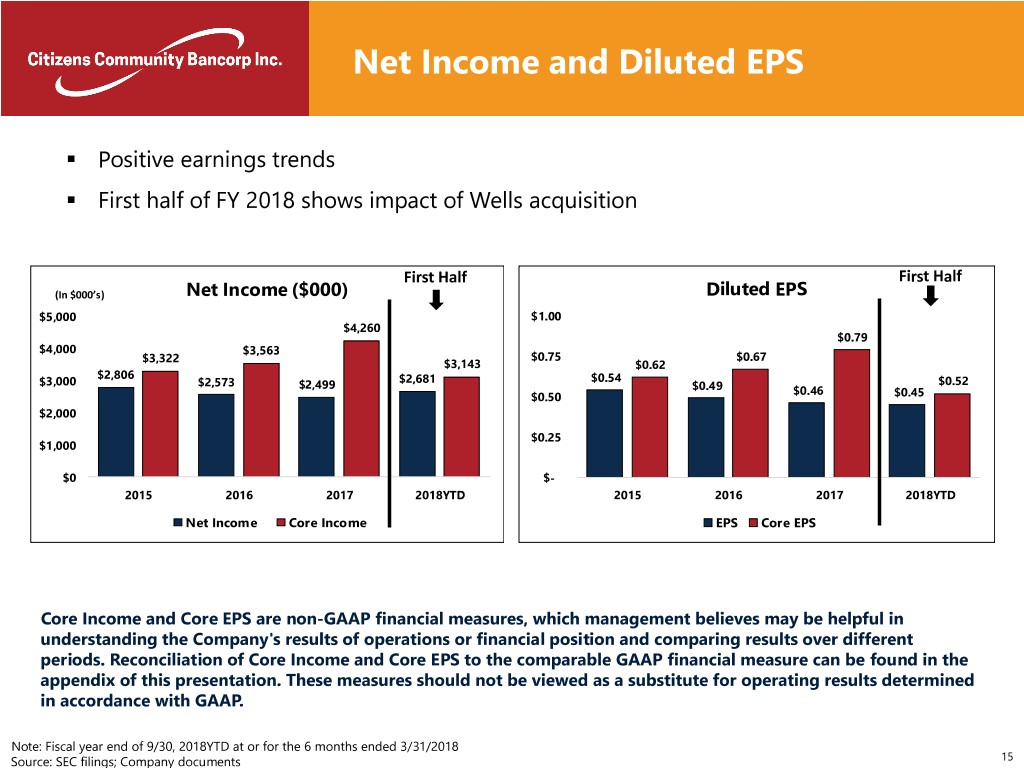

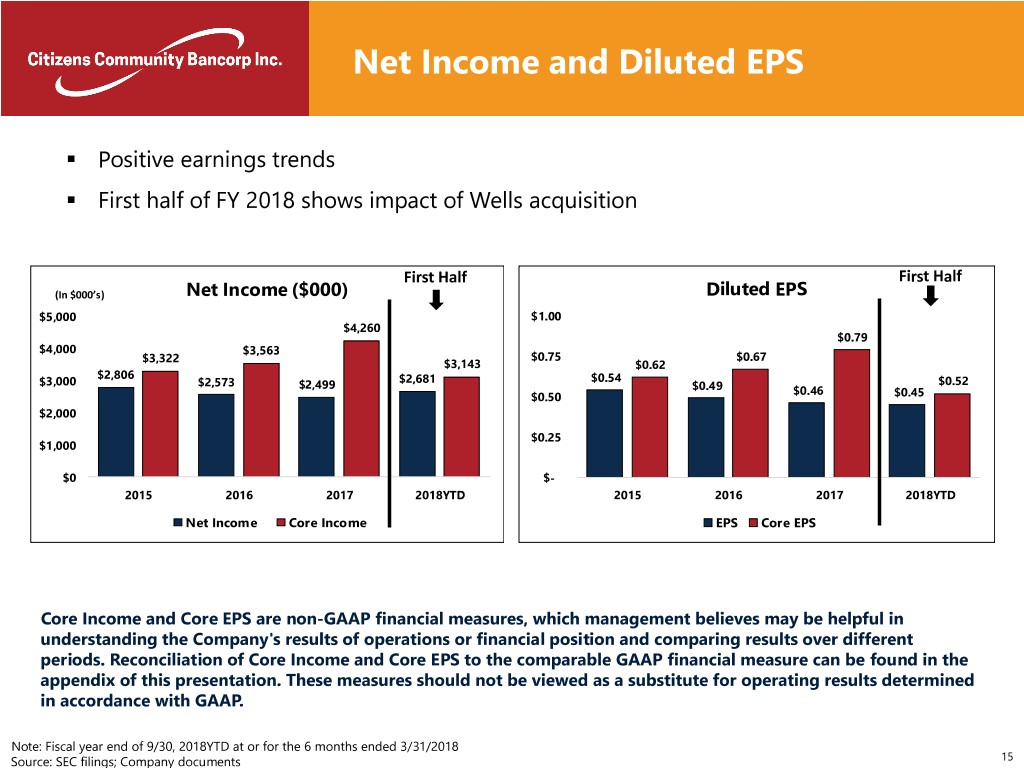

Net Income and Diluted EPS ▪ Positive earnings trends ▪ First half of FY 2018 shows impact of Wells acquisition First Half First Half (In $000’s) Net Income ($000) Diluted EPS $5,000 $1.00 $4,260 $0.79 $4,000 $3,563 $3,322 $0.75 $0.67 $3,143 $0.62 $2,806 $0.54 $3,000 $2,573 $2,499 $2,681 $0.52 $0.49 $0.46 $0.50 $0.45 $2,000 $0.25 $1,000 $0 $- 2015 2016 2017 2018YTD 2015 2016 2017 2018YTD Net Income Core Income EPS Core EPS Core Income and Core EPS are non-GAAP financial measures, which management believes may be helpful in understanding the Company's results of operations or financial position and comparing results over different periods. Reconciliation of Core Income and Core EPS to the comparable GAAP financial measure can be found in the appendix of this presentation. These measures should not be viewed as a substitute for operating results determined in accordance with GAAP. Note: Fiscal year end of 9/30, 2018YTD at or for the 6 months ended 3/31/2018 Source: SEC filings; Company documents 15

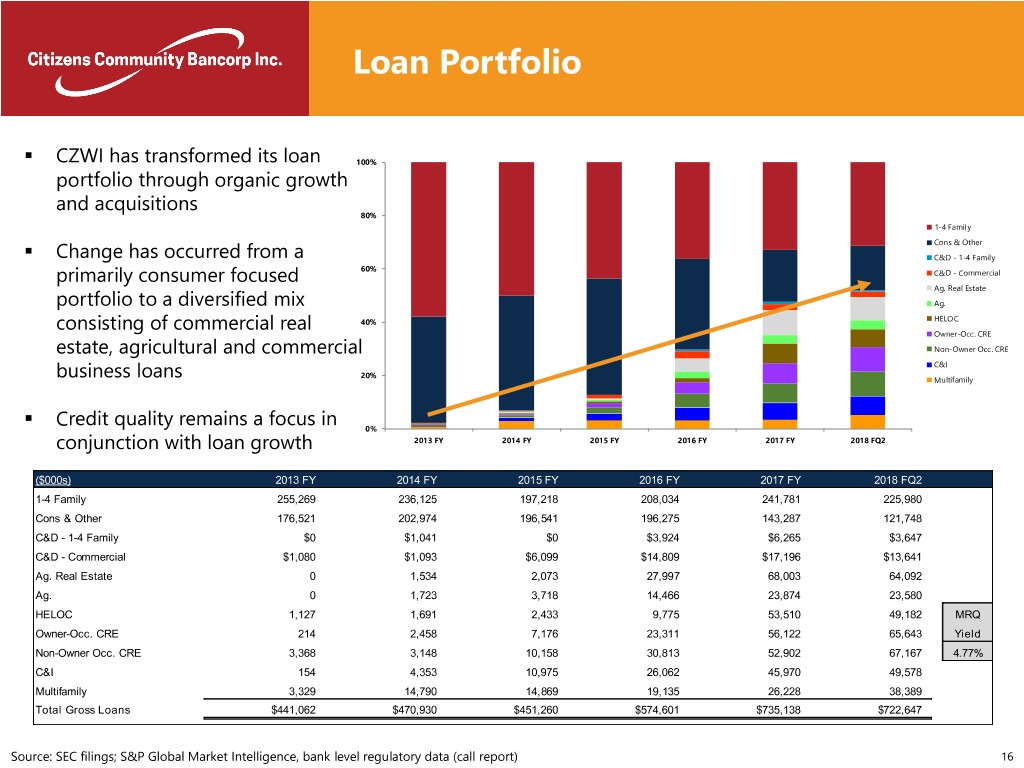

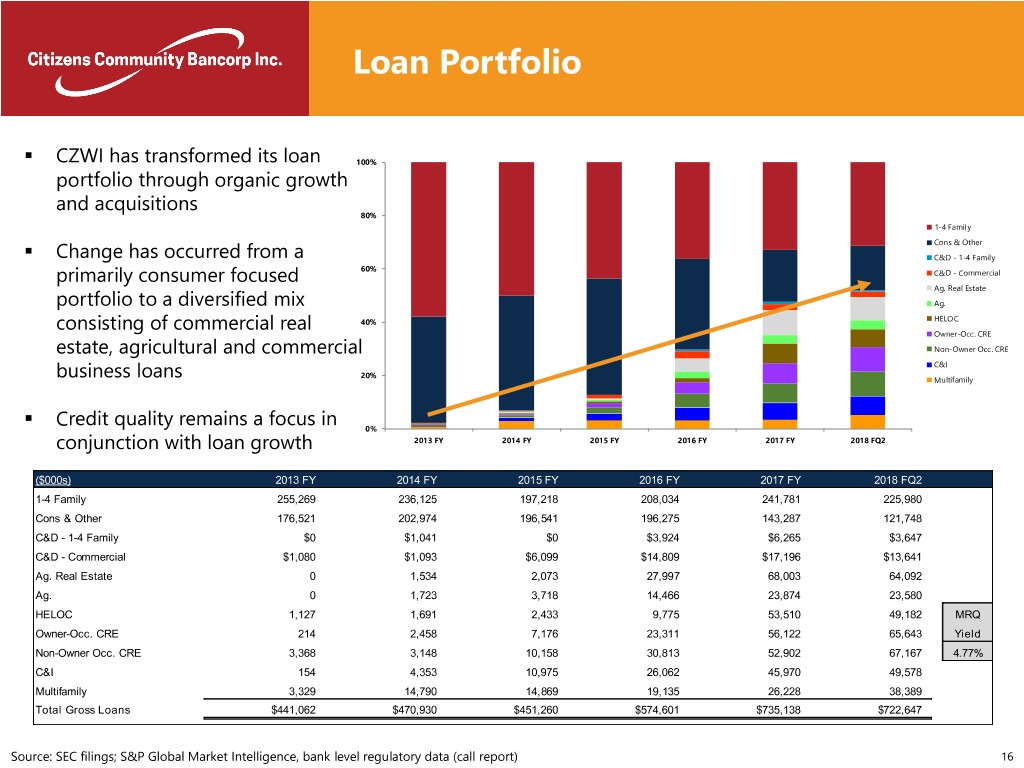

Loan Portfolio ▪ CZWI has transformed its loan 100% portfolio through organic growth and acquisitions 80% 1-4 Family ▪ Cons & Other Change has occurred from a C&D - 1-4 Family 60% primarily consumer focused C&D - Commercial Ag. Real Estate portfolio to a diversified mix Ag. consisting of commercial real 40% HELOC Owner-Occ. CRE estate, agricultural and commercial Non-Owner Occ. CRE C&I 20% business loans Multifamily ▪ Credit quality remains a focus in 0% conjunction with loan growth 2013 FY 2014 FY 2015 FY 2016 FY 2017 FY 2018 FQ2 ($000s) 2013 FY 2014 FY 2015 FY 2016 FY 2017 FY 2018 FQ2 1-4 Family 255,269 236,125 197,218 208,034 241,781 225,980 Cons & Other 176,521 202,974 196,541 196,275 143,287 121,748 C&D - 1-4 Family $0 $1,041 $0 $3,924 $6,265 $3,647 C&D - Commercial $1,080 $1,093 $6,099 $14,809 $17,196 $13,641 Ag. Real Estate 0 1,534 2,073 27,997 68,003 64,092 Ag. 0 1,723 3,718 14,466 23,874 23,580 HELOC 1,127 1,691 2,433 9,775 53,510 49,182 MRQ Owner-Occ. CRE 214 2,458 7,176 23,311 56,122 65,643 Yield Non-Owner Occ. CRE 3,368 3,148 10,158 30,813 52,902 67,167 4.77% C&I 154 4,353 10,975 26,062 45,970 49,578 Multifamily 3,329 14,790 14,869 19,135 26,228 38,389 Total Gross Loans $441,062 $470,930 $451,260 $574,601 $735,138 $722,647 Source: SEC filings; S&P Global Market Intelligence, bank level regulatory data (call report) 16

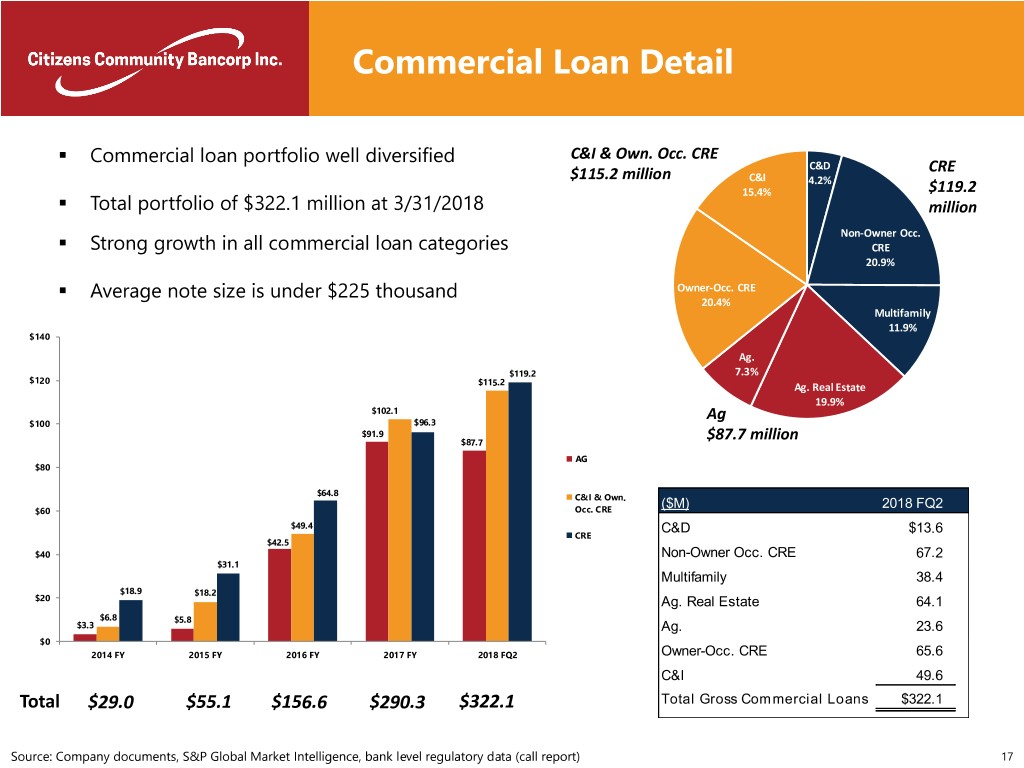

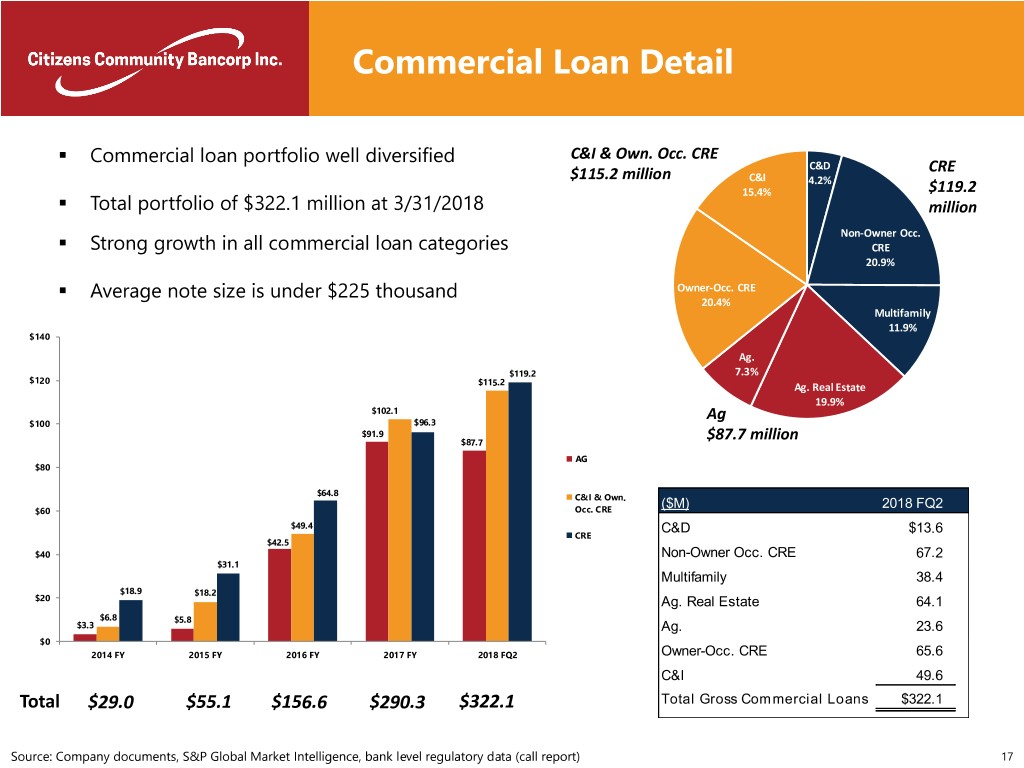

Commercial Loan Detail ▪ Commercial loan portfolio well diversified C&I & Own. Occ. CRE C&D CRE $115.2 million C&I 4.2% ▪ 15.4% $119.2 Total portfolio of $322.1 million at 3/31/2018 million ▪ Non-Owner Occ. Strong growth in all commercial loan categories CRE 20.9% ▪ Average note size is under $225 thousand Owner-Occ. CRE 20.4% Multifamily 11.9% $140 Ag. $119.2 7.3% $120 $115.2 Ag. Real Estate 19.9% $102.1 Ag $100 $96.3 $91.9 $87.7 $87.7 million AG $80 $64.8 C&I & Own. ($M) 2018 FQ2 $60 Occ. CRE $49.4 C&D $13.6 CRE $42.5 $40 Non-Owner Occ. CRE 67.2 $31.1 Multifamily 38.4 $18.9 $18.2 $20 Ag. Real Estate 64.1 $6.8 $5.8 $3.3 Ag. 23.6 $0 2014 FY 2015 FY 2016 FY 2017 FY 2018 FQ2 Owner-Occ. CRE 65.6 C&I 49.6 Total $29.0 $55.1 $156.6 $290.3 $322.1 Total Gross Commercial Loans $322.1 Source: Company documents, S&P Global Market Intelligence, bank level regulatory data (call report) 17

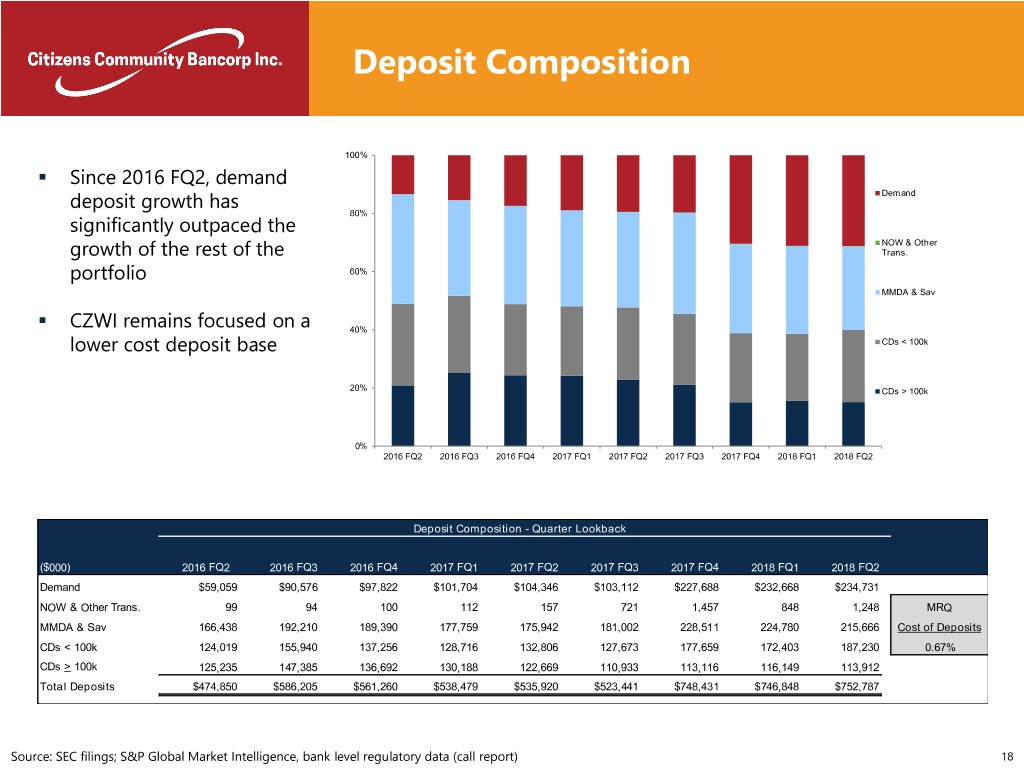

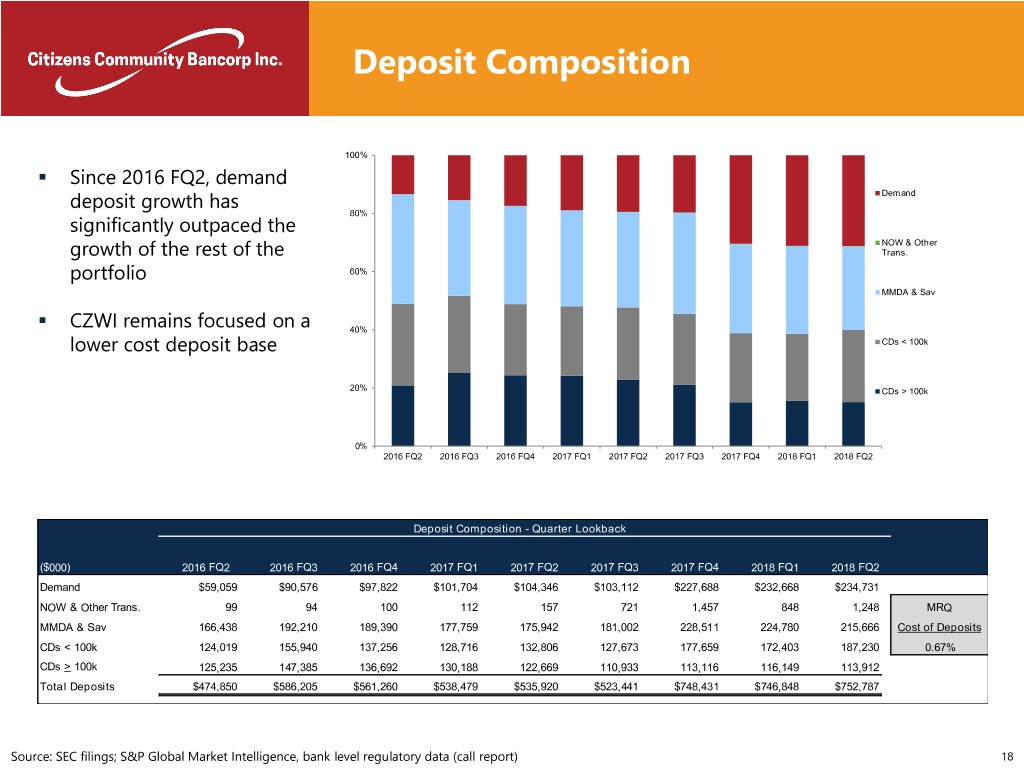

Deposit Composition 100% ▪ Since 2016 FQ2, demand deposit growth has Demand 80% significantly outpaced the NOW & Other growth of the rest of the Trans. portfolio 60% MMDA & Sav ▪ CZWI remains focused on a 40% lower cost deposit base CDs < 100k 20% CDs > 100k 0% 2016 FQ2 2016 FQ3 2016 FQ4 2017 FQ1 2017 FQ2 2017 FQ3 2017 FQ4 2018 FQ1 2018 FQ2 Deposit Composition - Quarter Lookback ($000) 2016 FQ2 2016 FQ3 2016 FQ4 2017 FQ1 2017 FQ2 2017 FQ3 2017 FQ4 2018 FQ1 2018 FQ2 Demand $59,059 $90,576 $97,822 $101,704 $104,346 $103,112 $227,688 $232,668 $234,731 NOW & Other Trans. 99 94 100 112 157 721 1,457 848 1,248 MRQ MMDA & Sav 166,438 192,210 189,390 177,759 175,942 181,002 228,511 224,780 215,666 Cost of Deposits CDs < 100k 124,019 155,940 137,256 128,716 132,806 127,673 177,659 172,403 187,230 0.67% CDs > 100k 125,235 147,385 136,692 130,188 122,669 110,933 113,116 116,149 113,912 Total Deposits $474,850 $586,205 $561,260 $538,479 $535,920 $523,441 $748,431 $746,848 $752,787 Source: SEC filings; S&P Global Market Intelligence, bank level regulatory data (call report) 18

Market Demographics ❑ CZWI operates in diverse markets within the northwestern region of Wisconsin, metro Twin Cities and the Mankato, Minnesota MSA Eau Claire: ▪ Features a broad-based, diverse economy, which is driven by commercial, retail and medical industries Mankato: ▪ The Mankato market also possesses a broad-based, diverse economy Eau Claire Area Employers Mankato Area Employers Source: S&P Global Market Intelligence, eauclairedevelopment.com, greatermankato.com, Google Images 19

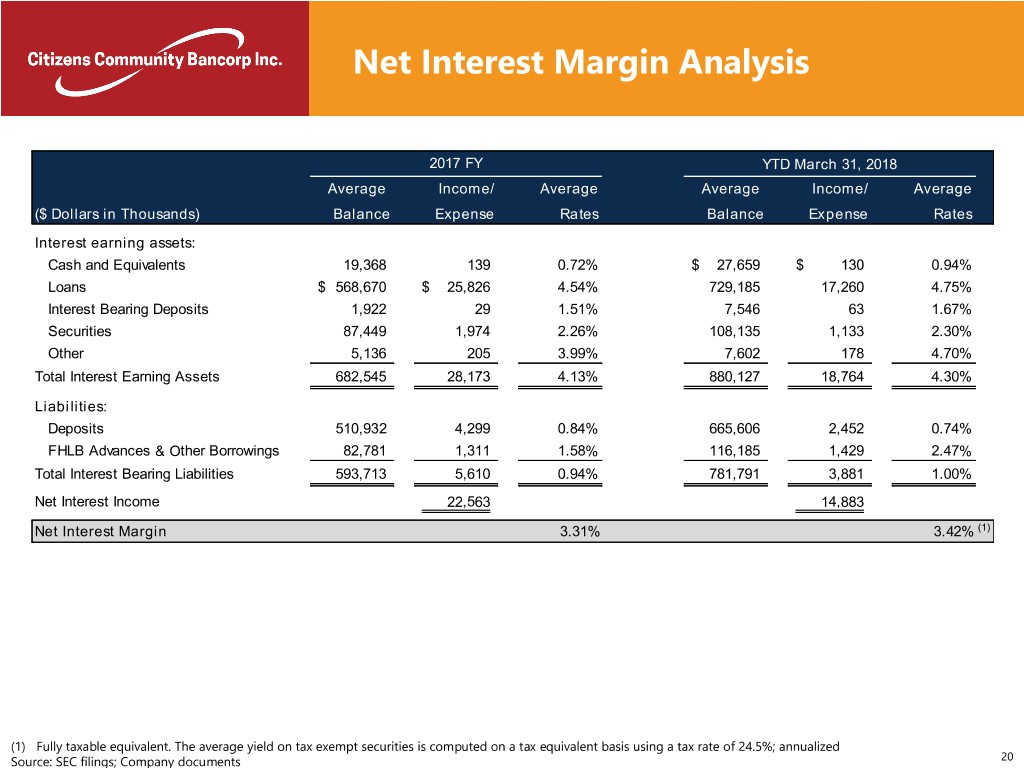

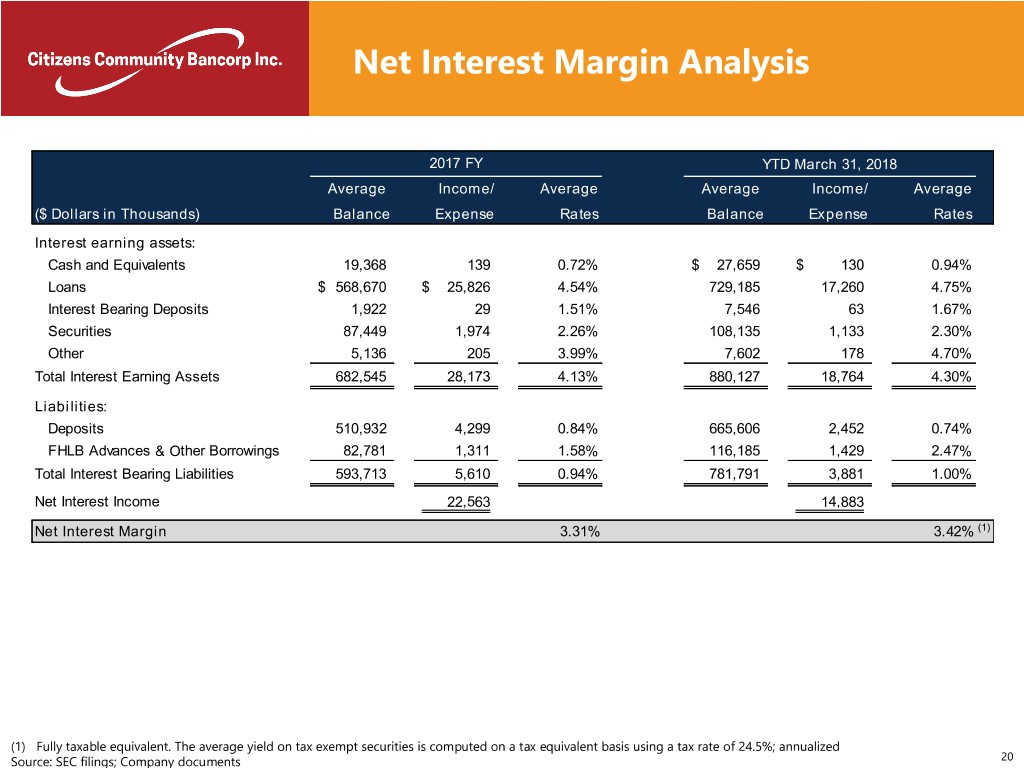

Net Interest Margin Analysis 2017 FY YTD March 31, 2018 Average Income/ Average Average Income/ Average ($ Dollars in Thousands) Balance Expense Rates Balance Expense Rates Interest earning assets: Cash and Equivalents 19,368 139 0.72% $ 27,659 $ 130 0.94% Loans $ 568,670 $ 25,826 4.54% 729,185 17,260 4.75% Interest Bearing Deposits 1,922 29 1.51% 7,546 63 1.67% Securities 87,449 1,974 2.26% 108,135 1,133 2.30% Other 5,136 205 3.99% 7,602 178 4.70% Total Interest Earning Assets 682,545 28,173 4.13% 880,127 18,764 4.30% Liabilities: Deposits 510,932 4,299 0.84% 665,606 2,452 0.74% FHLB Advances & Other Borrowings 82,781 1,311 1.58% 116,185 1,429 2.47% Total Interest Bearing Liabilities 593,713 5,610 0.94% 781,791 3,881 1.00% Net Interest Income 22,563 14,883 Net Interest Margin 3.31% 3.42% (1) (1) Fully taxable equivalent. The average yield on tax exempt securities is computed on a tax equivalent basis using a tax rate of 24.5%; annualized Source: SEC filings; Company documents 20

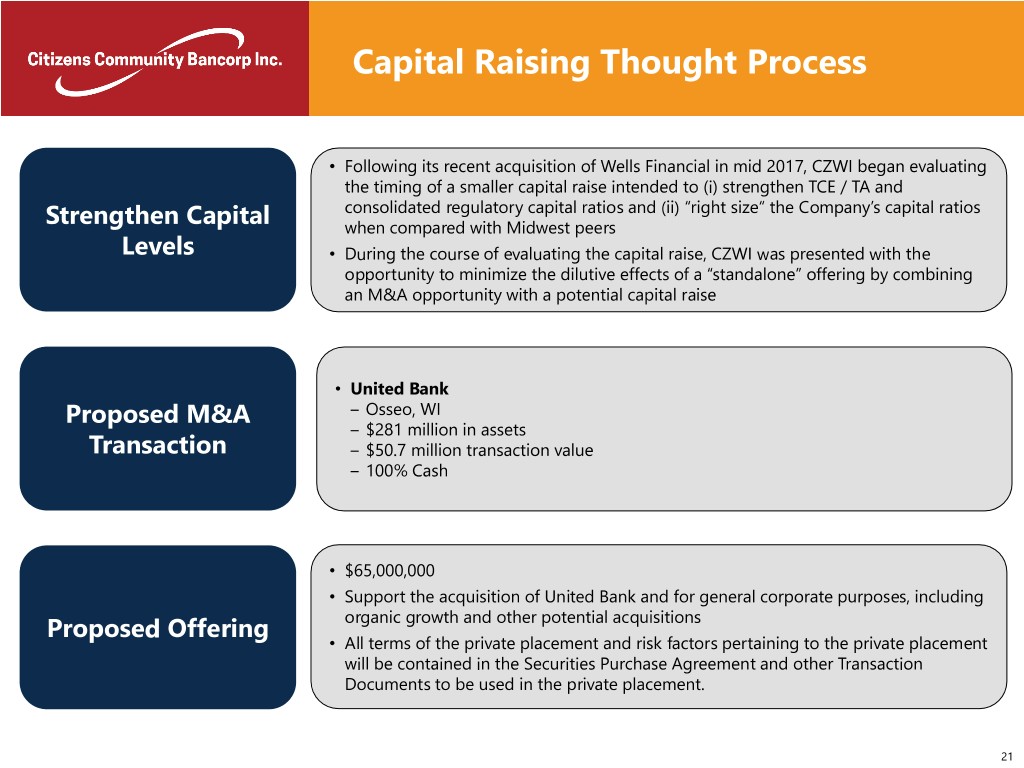

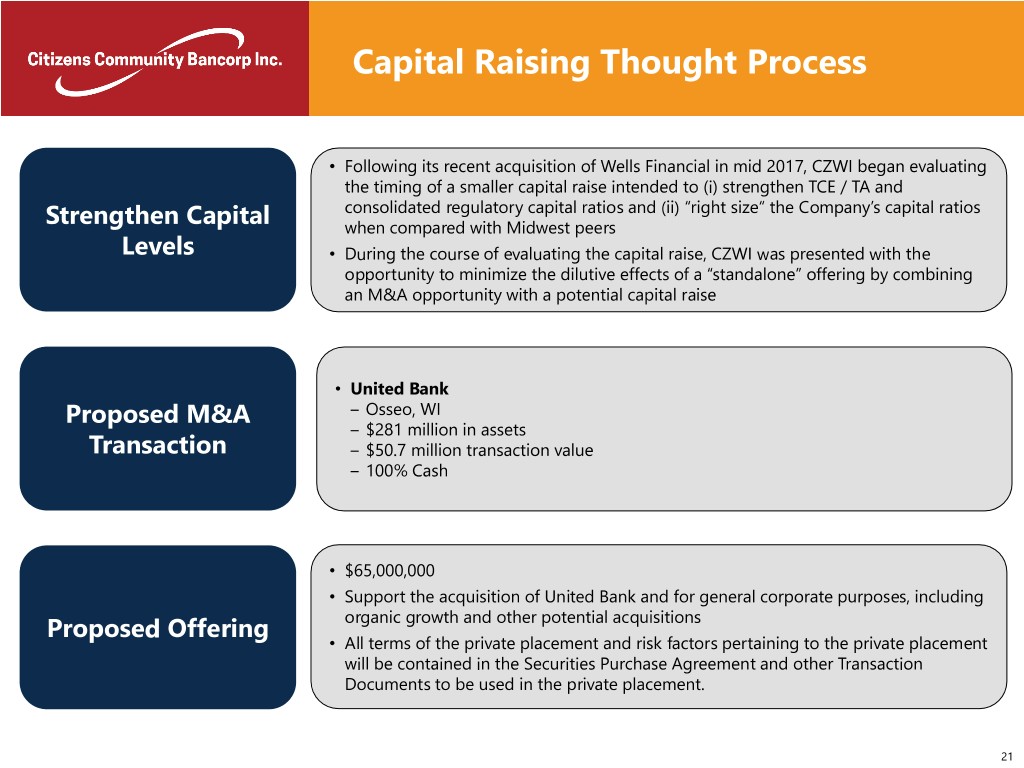

Capital Raising Thought Process • Following its recent acquisition of Wells Financial in mid 2017, CZWI began evaluating the timing of a smaller capital raise intended to (i) strengthen TCE / TA and consolidated regulatory capital ratios and (ii) “right size“ the Company’s capital ratios Strengthen Capital when compared with Midwest peers Levels • During the course of evaluating the capital raise, CZWI was presented with the opportunity to minimize the dilutive effects of a “standalone” offering by combining an M&A opportunity with a potential capital raise • United Bank Proposed M&A ‒ Osseo, WI ‒ $281 million in assets Transaction ‒ $50.7 million transaction value ‒ 100% Cash • $65,000,000 • Support the acquisition of United Bank and for general corporate purposes, including Proposed Offering organic growth and other potential acquisitions • All terms of the private placement and risk factors pertaining to the private placement will be contained in the Securities Purchase Agreement and other Transaction Documents to be used in the private placement. 21

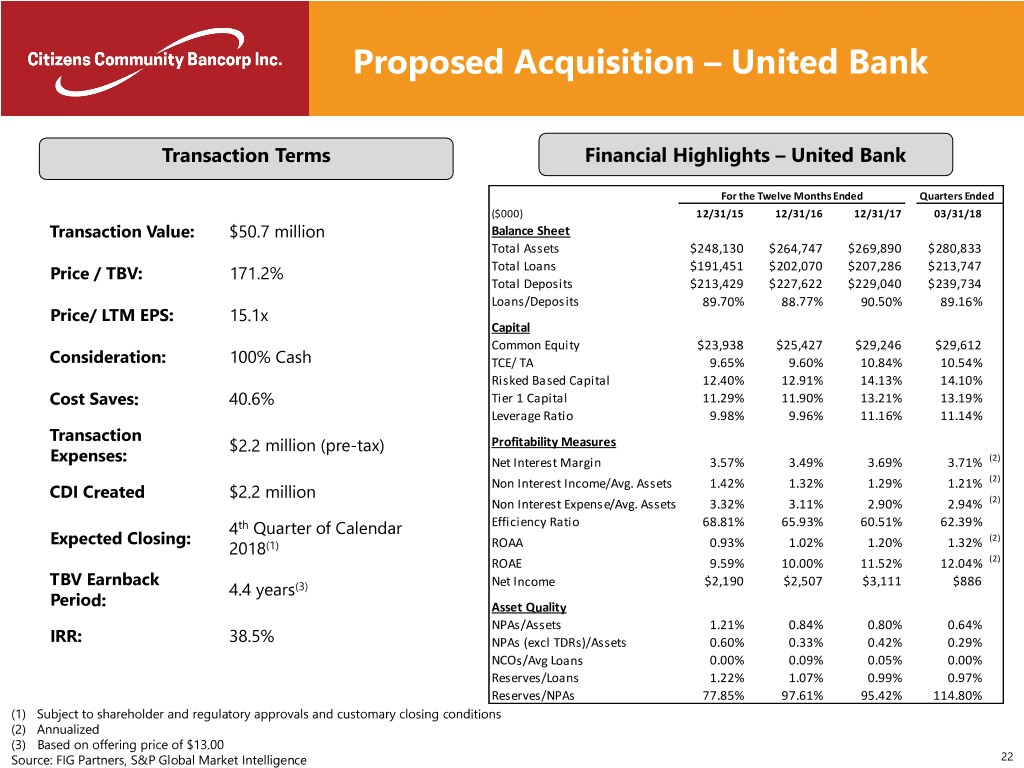

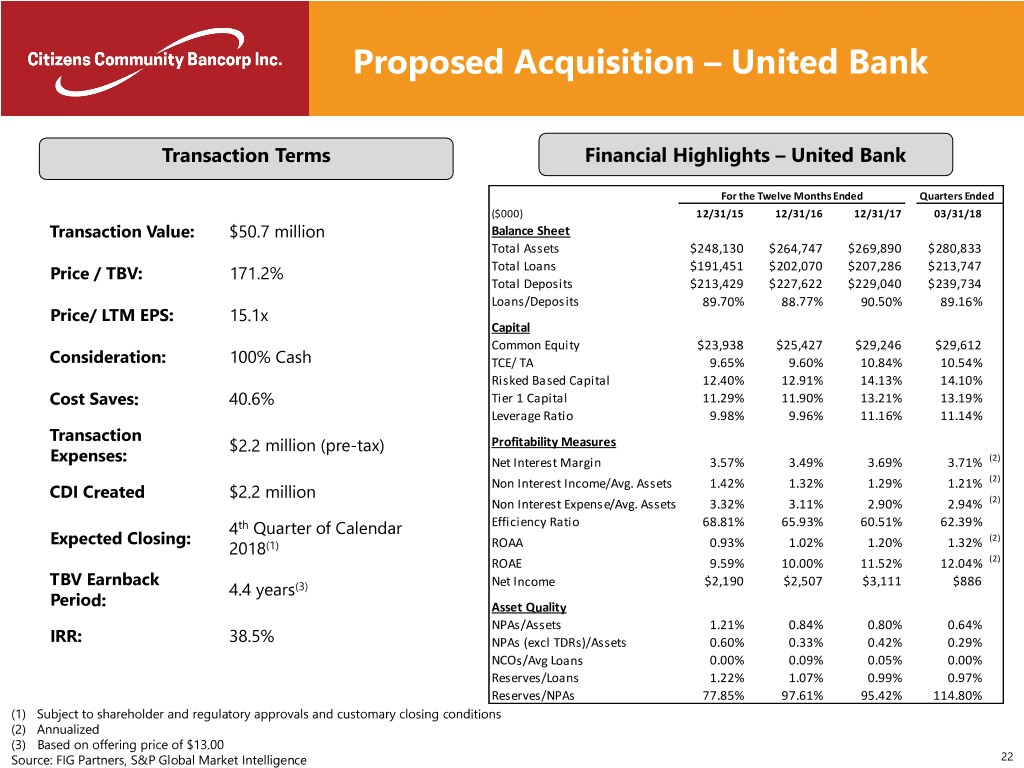

Proposed Acquisition – United Bank Transaction Terms Financial Highlights – United Bank For the Twelve Months Ended Quarters Ended ($000) 12/31/15 12/31/16 12/31/17 03/31/18 Transaction Value: $50.7 million Balance Sheet Total Assets $248,130 $264,747 $269,890 $280,833 Price / TBV: 171.2% Total Loans $191,451 $202,070 $207,286 $213,747 Total Deposits $213,429 $227,622 $229,040 $239,734 Loans/Deposits 89.70% 88.77% 90.50% 89.16% Price/ LTM EPS: 15.1x Capital Common Equity $23,938 $25,427 $29,246 $29,612 Consideration: 100% Cash TCE/ TA 9.65% 9.60% 10.84% 10.54% Risked Based Capital 12.40% 12.91% 14.13% 14.10% Cost Saves: 40.6% Tier 1 Capital 11.29% 11.90% 13.21% 13.19% Leverage Ratio 9.98% 9.96% 11.16% 11.14% Transaction $2.2 million (pre-tax) Profitability Measures Expenses: Net Interest Margin 3.57% 3.49% 3.69% 3.71% (2) (2) CDI Created $2.2 million Non Interest Income/Avg. Assets 1.42% 1.32% 1.29% 1.21% Non Interest Expense/Avg. Assets 3.32% 3.11% 2.90% 2.94% (2) 4th Quarter of Calendar Efficiency Ratio 68.81% 65.93% 60.51% 62.39% Expected Closing: (2) 2018(1) ROAA 0.93% 1.02% 1.20% 1.32% ROAE 9.59% 10.00% 11.52% 12.04% (2) TBV Earnback 4.4 years(3) Net Income $2,190 $2,507 $3,111 $886 Period: Asset Quality NPAs/Assets 1.21% 0.84% 0.80% 0.64% IRR: 38.5% NPAs (excl TDRs)/Assets 0.60% 0.33% 0.42% 0.29% NCOs/Avg Loans 0.00% 0.09% 0.05% 0.00% Reserves/Loans 1.22% 1.07% 0.99% 0.97% Reserves/NPAs 77.85% 97.61% 95.42% 114.80% (1) Subject to shareholder and regulatory approvals and customary closing conditions (2) Annualized (3) Based on offering price of $13.00 Source: FIG Partners, S&P Global Market Intelligence 22

Transaction Rationale ▪ Attractive in-market/contiguous market transaction, as United Bank has one Eau Claire branch plus five other “close proximity” locations ▪ Assuming consummation of the proposed acquisition, Company would rank Strategic #2 in deposit market share in Eau Claire County(1) Rationale ▪ Combination consistent with CZWI’s “community banking” growth strategy ▪ Leverages existing local infrastructure for maximum efficiencies ▪ Excellent credit quality due to strong underwriting standards ▪ Low cost deposit base ▪ Comprehensive due diligence process completed ▪ Reviewed specific loans that would be risk rated higher under CZWI criteria Risk ▪ Loan review by CCF credit diligence team Mitigation ▪ Gross estimated credit mark to loans of $2.3 million (1.1%) ▪ Third party review on interest rate mark on loans and deposits (1) Deposit information as of June 30, 2017 23

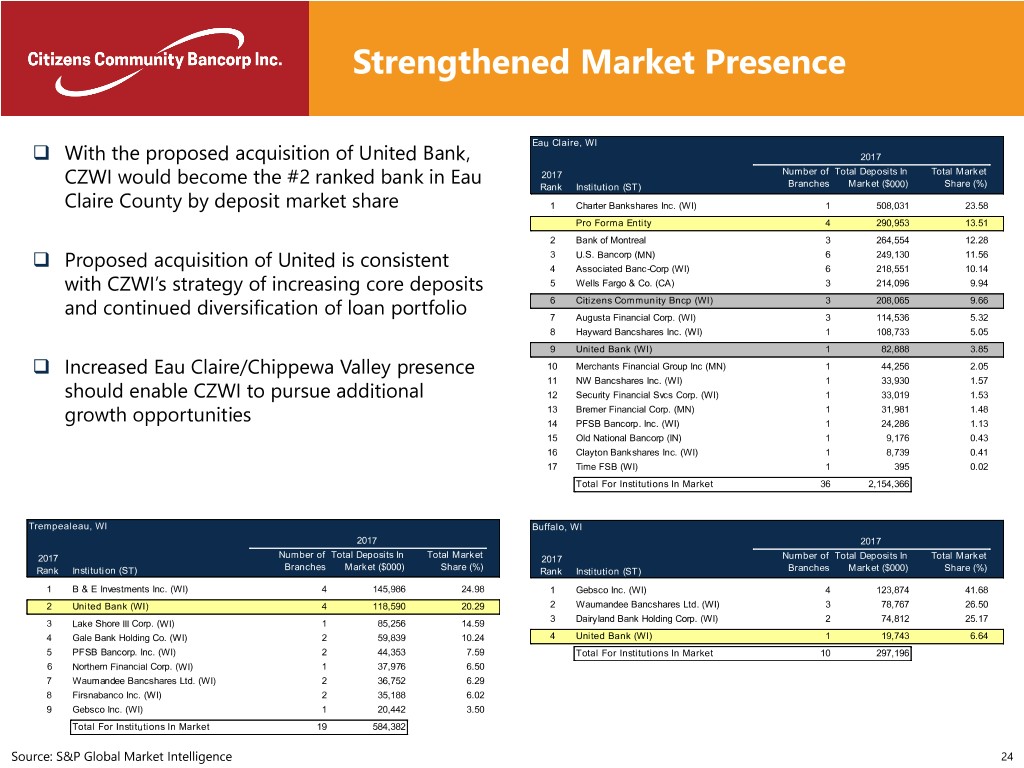

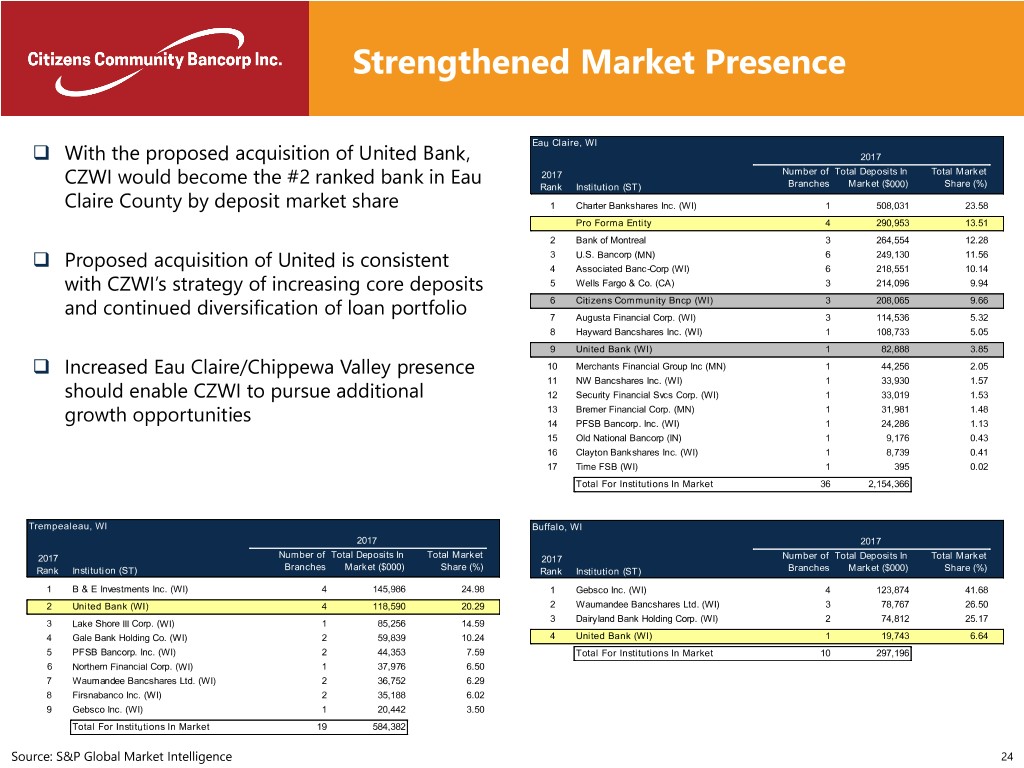

Strengthened Market Presence ❑ Eau Claire, WI With the proposed acquisition of United Bank, 2017 2017 Number of Total Deposits In Total Market CZWI would become the #2 ranked bank in Eau Rank Institution (ST) Branches Market ($000) Share (%) Claire County by deposit market share 1 Charter Bankshares Inc. (WI) 1 508,031 23.58 Pro Forma Entity 4 290,953 13.51 2 Bank of Montreal 3 264,554 12.28 ❑ 3 U.S. Bancorp (MN) 6 249,130 11.56 Proposed acquisition of United is consistent 4 Associated Banc-Corp (WI) 6 218,551 10.14 with CZWI’s strategy of increasing core deposits 5 Wells Fargo & Co. (CA) 3 214,096 9.94 6 Citizens Community Bncp (WI) 3 208,065 9.66 and continued diversification of loan portfolio 7 Augusta Financial Corp. (WI) 3 114,536 5.32 8 Hayward Bancshares Inc. (WI) 1 108,733 5.05 9 United Bank (WI) 1 82,888 3.85 ❑ Increased Eau Claire/Chippewa Valley presence 10 Merchants Financial Group Inc (MN) 1 44,256 2.05 11 NW Bancshares Inc. (WI) 1 33,930 1.57 should enable CZWI to pursue additional 12 Security Financial Svcs Corp. (WI) 1 33,019 1.53 13 Bremer Financial Corp. (MN) 1 31,981 1.48 growth opportunities 14 PFSB Bancorp. Inc. (WI) 1 24,286 1.13 15 Old National Bancorp (IN) 1 9,176 0.43 16 Clayton Bankshares Inc. (WI) 1 8,739 0.41 17 Time FSB (WI) 1 395 0.02 Total For Institutions In Market 36 2,154,366 Trempealeau, WI Buffalo, WI 2017 2017 2017 Number of Total Deposits In Total Market 2017 Number of Total Deposits In Total Market Rank Institution (ST) Branches Market ($000) Share (%) Rank Institution (ST) Branches Market ($000) Share (%) 1 B & E Investments Inc. (WI) 4 145,986 24.98 1 Gebsco Inc. (WI) 4 123,874 41.68 2 United Bank (WI) 4 118,590 20.29 2 Waumandee Bancshares Ltd. (WI) 3 78,767 26.50 3 Dairyland Bank Holding Corp. (WI) 2 74,812 25.17 3 Lake Shore III Corp. (WI) 1 85,256 14.59 4 Gale Bank Holding Co. (WI) 2 59,839 10.24 4 United Bank (WI) 1 19,743 6.64 5 PFSB Bancorp. Inc. (WI) 2 44,353 7.59 Total For Institutions In Market 10 297,196 6 Northern Financial Corp. (WI) 1 37,976 6.50 7 Waumandee Bancshares Ltd. (WI) 2 36,752 6.29 8 Firsnabanco Inc. (WI) 2 35,188 6.02 9 Gebsco Inc. (WI) 1 20,442 3.50 Total For Institutions In Market 19 584,382 Source: S&P Global Market Intelligence 24

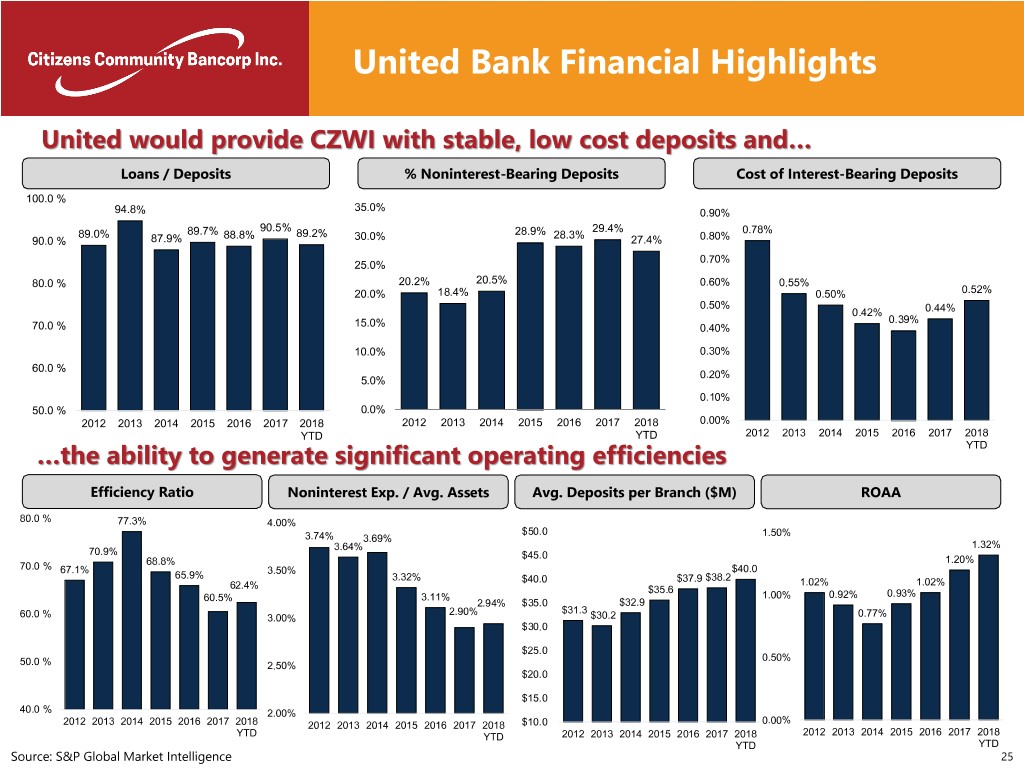

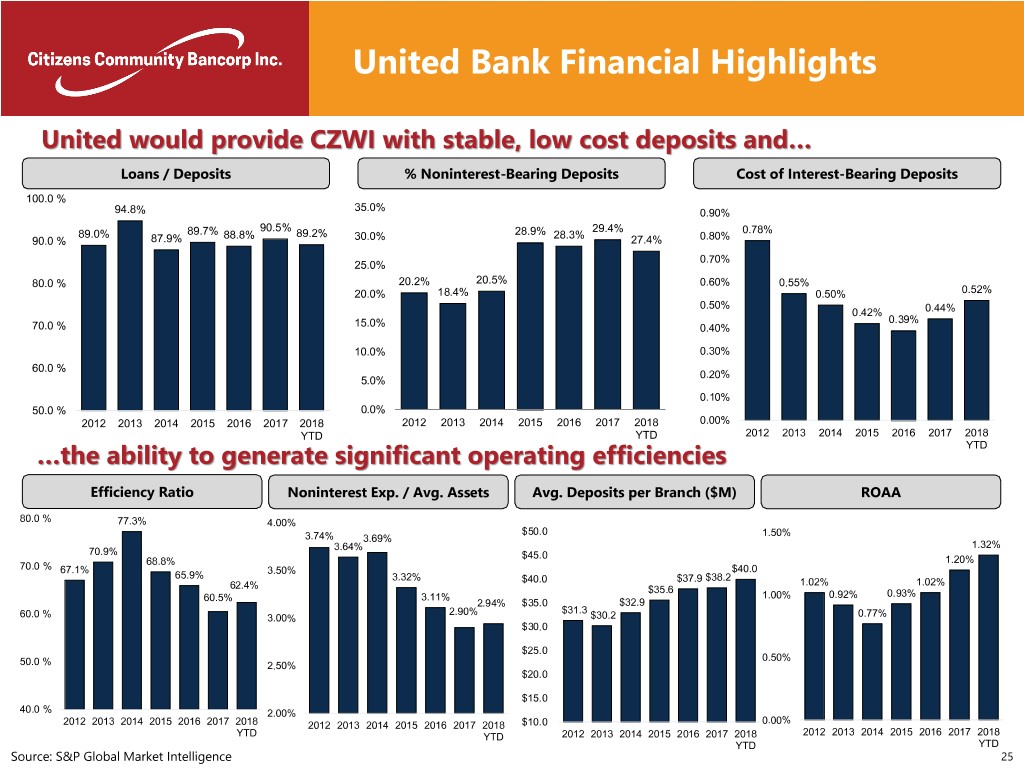

United Bank Financial Highlights United would provide CZWI with stable, low cost deposits and… Loans / Deposits % Noninterest-Bearing Deposits Cost of Interest-Bearing Deposits 100.0 % 35.0% 94.8% 0.90% 90.5% 29.4% 89.0% 89.7% 88.8% 89.2% 28.9% 28.3% 0.78% 90.0 % 87.9% 30.0% 27.4% 0.80% 0.70% 25.0% 80.0 % 20.2% 20.5% 0.60% 0.55% 20.0% 18.4% 0.50% 0.52% 0.50% 0.42% 0.44% 0.39% 70.0 % 15.0% 0.40% 10.0% 0.30% 60.0 % 0.20% 5.0% 0.10% 50.0 % 0.0% 2012 2013 2014 2015 2016 2017 2018 2012 2013 2014 2015 2016 2017 2018 0.00% YTD YTD 2012 2013 2014 2015 2016 2017 2018 …the ability to generate significant operating efficiencies YTD Efficiency Ratio Noninterest Exp. / Avg. Assets Avg. Deposits per Branch ($M) ROAA 80.0 % 77.3% 4.00% $50.0 1.50% 3.74% 3.69% 3.64% 1.32% 70.9% $45.0 68.8% 1.20% 70.0 % 67.1% $40.0 65.9% 3.50% 3.32% $40.0 $37.9 $38.2 1.02% 1.02% 62.4% $35.6 60.5% 3.11% 1.00% 0.92% 0.93% 2.94% $35.0 $32.9 2.90% $31.3 60.0 % 3.00% $30.2 0.77% $30.0 $25.0 0.50% 50.0 % 2.50% $20.0 $15.0 40.0 % 2.00% 0.00% 2012 2013 2014 2015 2016 2017 2018 2012 2013 2014 2015 2016 2017 2018 $10.0 YTD YTD 2012 2013 2014 2015 2016 2017 2018 2012 2013 2014 2015 2016 2017 2018 YTD YTD Source: S&P Global Market Intelligence 25

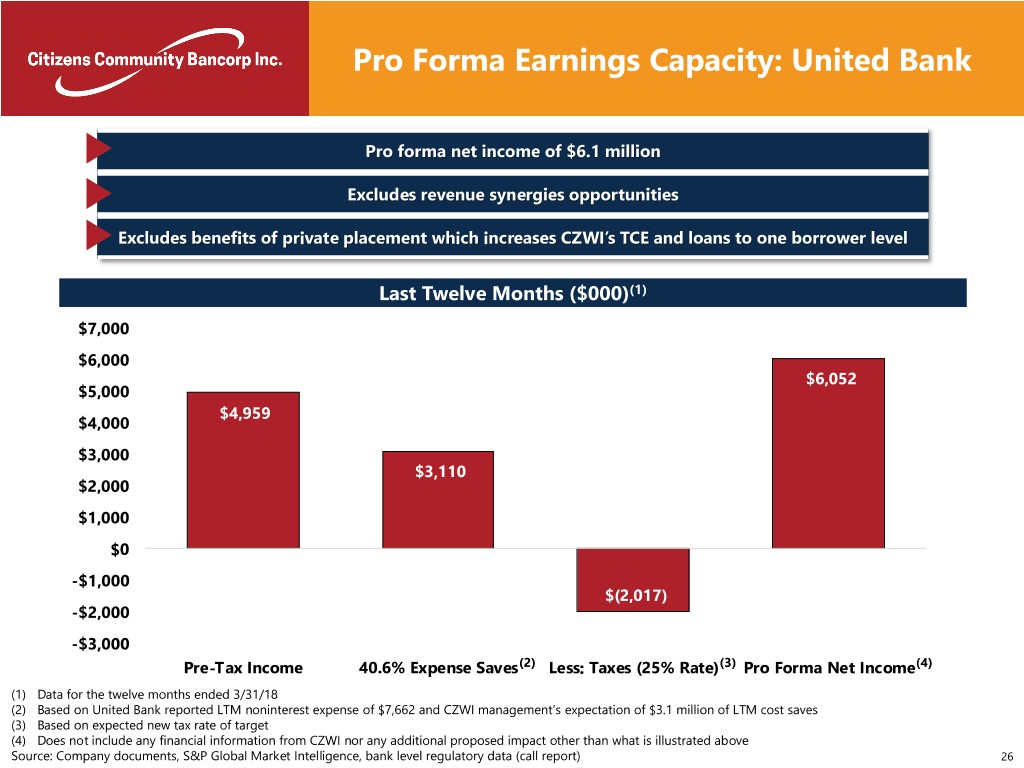

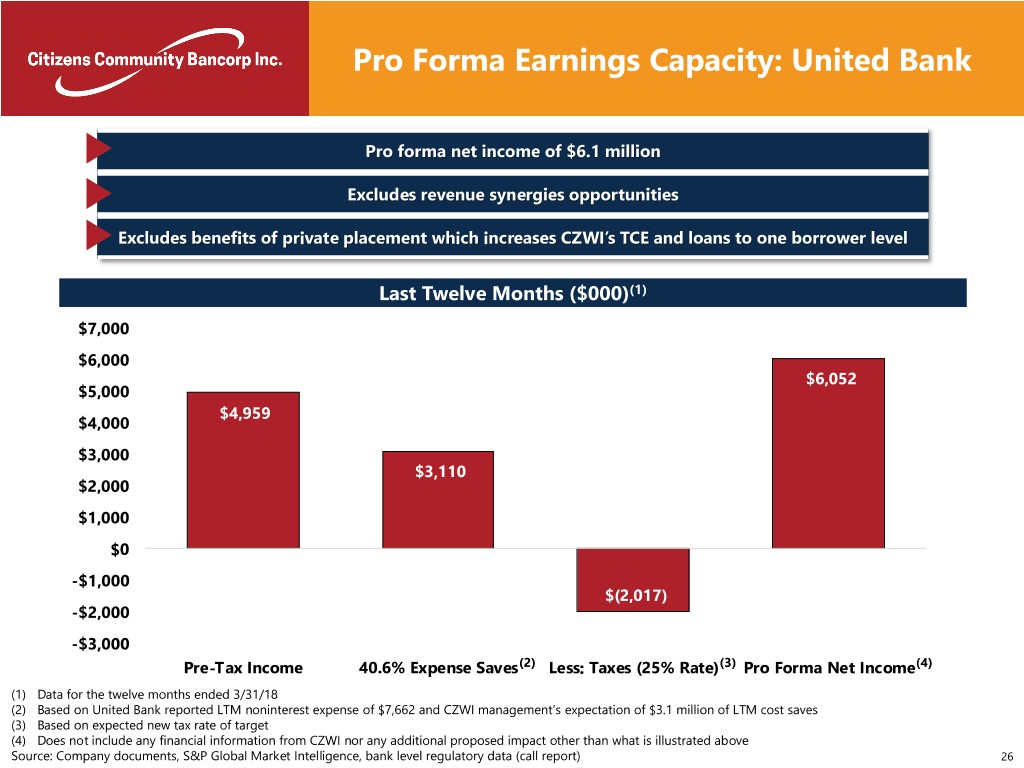

Pro Forma Earnings Capacity: United Bank Pro forma net income of $6.1 million Excludes revenue synergies opportunities Excludes benefits of private placement which increases CZWI’s TCE and loans to one borrower level Last Twelve Months ($000)(1) $7,000 $6,000 $6,052 $5,000 $4,959 $4,000 $3,000 $3,110 $2,000 $1,000 $0 -$1,000 $(2,017) -$2,000 -$3,000 Pre-Tax Income 40.6% Expense Saves(2) Less: Taxes (25% Rate)(3) Pro Forma Net Income(4) (1) Data for the twelve months ended 3/31/18 (2) Based on United Bank reported LTM noninterest expense of $7,662 and CZWI management’s expectation of $3.1 million of LTM cost saves (3) Based on expected new tax rate of target (4) Does not include any financial information from CZWI nor any additional proposed impact other than what is illustrated above Source: Company documents, S&P Global Market Intelligence, bank level regulatory data (call report) 26

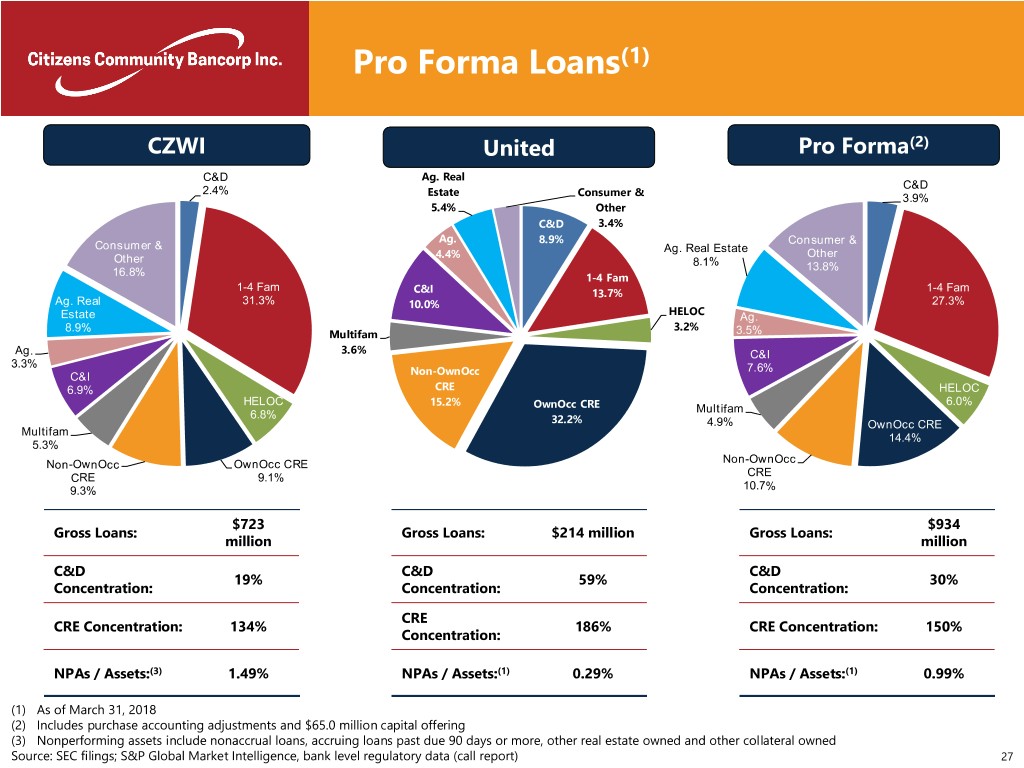

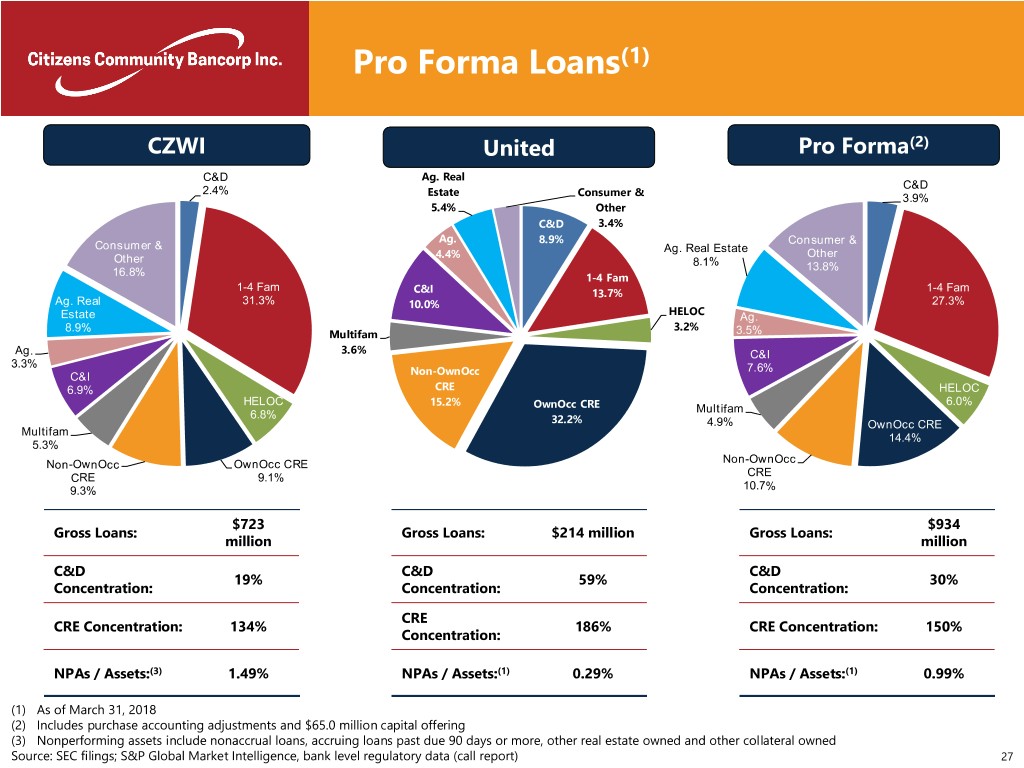

Pro Forma Loans(1) CZWI United Pro Forma(2) C&D Ag. Real C&D 2.4% Estate Consumer & 3.9% 5.4% Other C&D 3.4% Ag. 8.9% Consumer & Consumer & Ag. Real Estate Other 4.4% Other 8.1% 13.8% 16.8% 1-4 Fam 1-4 Fam C&I 13.7% 1-4 Fam Ag. Real 31.3% 10.0% 27.3% Estate HELOC Ag. 8.9% 3.2% Multifam 3.5% Ag. 3.6% C&I 3.3% 7.6% C&I Non-OwnOcc 6.9% CRE HELOC HELOC 15.2% 6.0% OwnOcc CRE Multifam 6.8% 32.2% 4.9% OwnOcc CRE Multifam 14.4% 5.3% Non-OwnOcc OwnOcc CRE Non-OwnOcc CRE 9.1% CRE 9.3% 10.7% $723 $934 Gross Loans: Gross Loans: $214 million Gross Loans: million million C&D C&D C&D 19% 59% 30% Concentration: Concentration: Concentration: CRE CRE Concentration: 134% 186% CRE Concentration: 150% Concentration: NPAs / Assets:(3) 1.49% NPAs / Assets:(1) 0.29% NPAs / Assets:(1) 0.99% (1) As of March 31, 2018 (2) Includes purchase accounting adjustments and $65.0 million capital offering (3) Nonperforming assets include nonaccrual loans, accruing loans past due 90 days or more, other real estate owned and other collateral owned Source: SEC filings; S&P Global Market Intelligence, bank level regulatory data (call report) 27

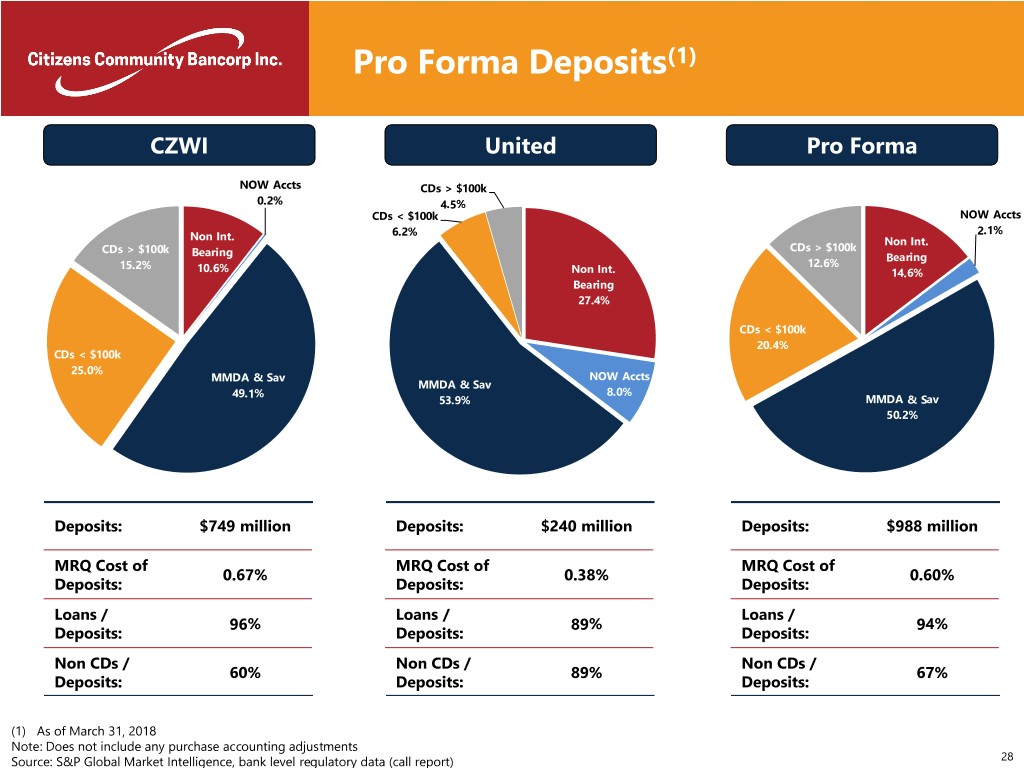

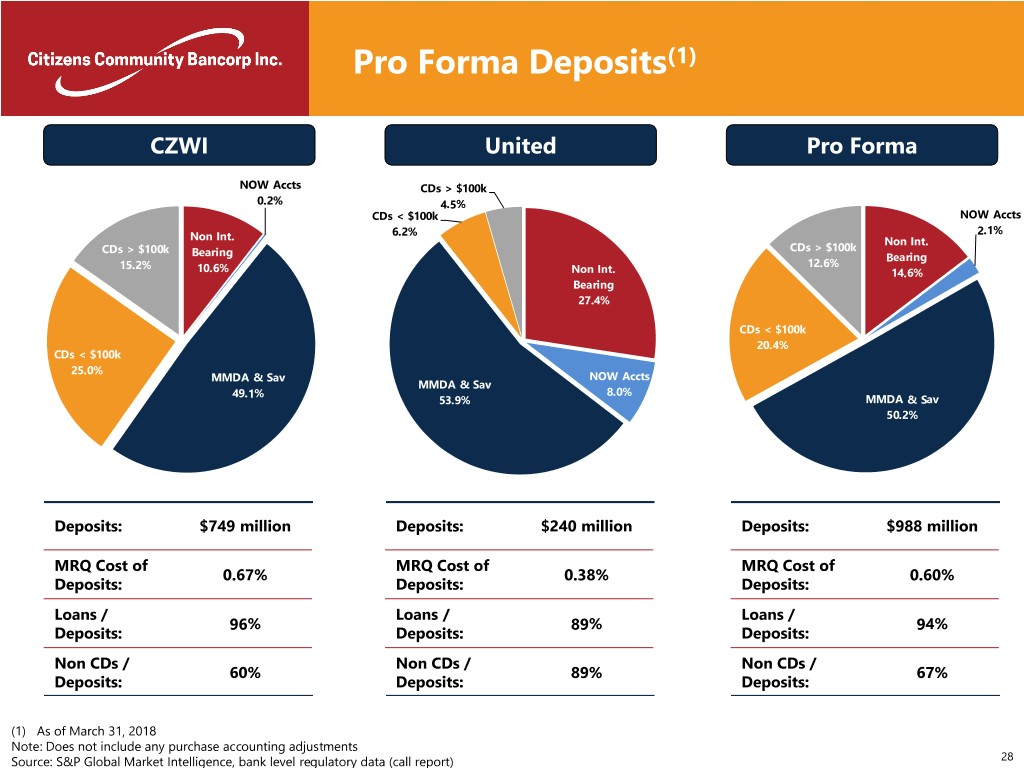

Pro Forma Deposits(1) CZWI United Pro Forma NOW Accts CDs > $100k 0.2% 4.5% CDs < $100k NOW Accts 6.2% 2.1% Non Int. Non Int. CDs > $100k CDs > $100k Bearing Bearing 15.2% 12.6% 10.6% Non Int. 14.6% Bearing 27.4% CDs < $100k 20.4% CDs < $100k 25.0% MMDA & Sav NOW Accts MMDA & Sav 49.1% 8.0% 53.9% MMDA & Sav 50.2% Deposits: $749 million Deposits: $240 million Deposits: $988 million MRQ Cost of MRQ Cost of MRQ Cost of 0.67% 0.38% 0.60% Deposits: Deposits: Deposits: Loans / Loans / Loans / 96% 89% 94% Deposits: Deposits: Deposits: Non CDs / Non CDs / Non CDs / 60% 89% 67% Deposits: Deposits: Deposits: (1) As of March 31, 2018 Note: Does not include any purchase accounting adjustments Source: S&P Global Market Intelligence, bank level regulatory data (call report) 28

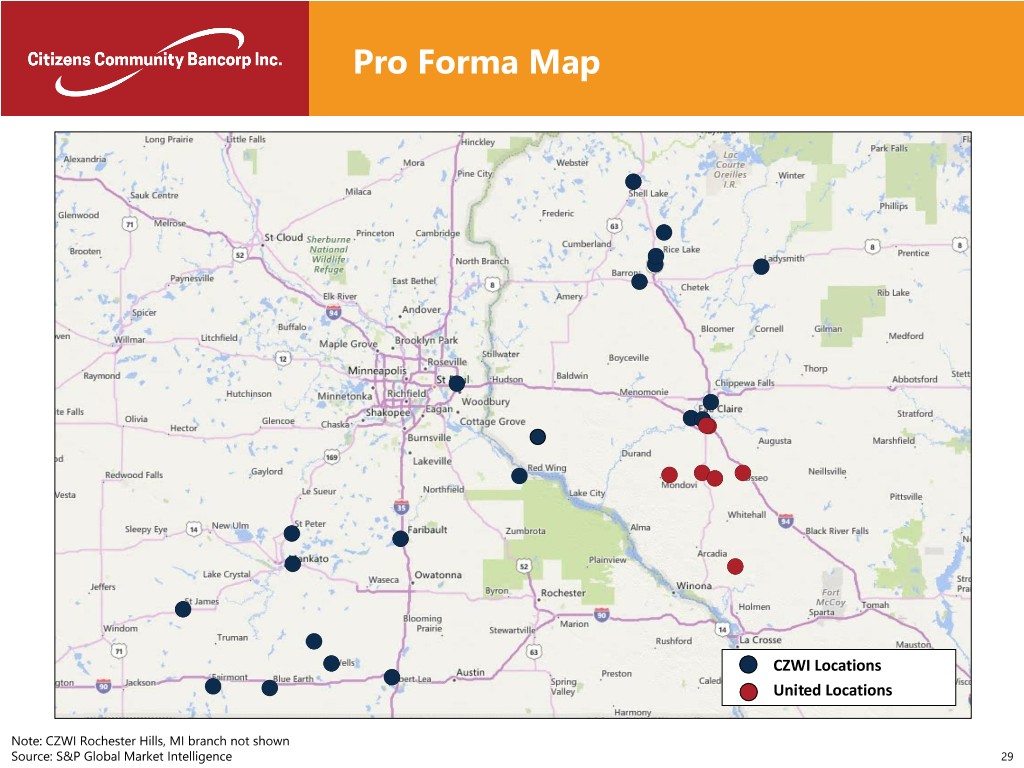

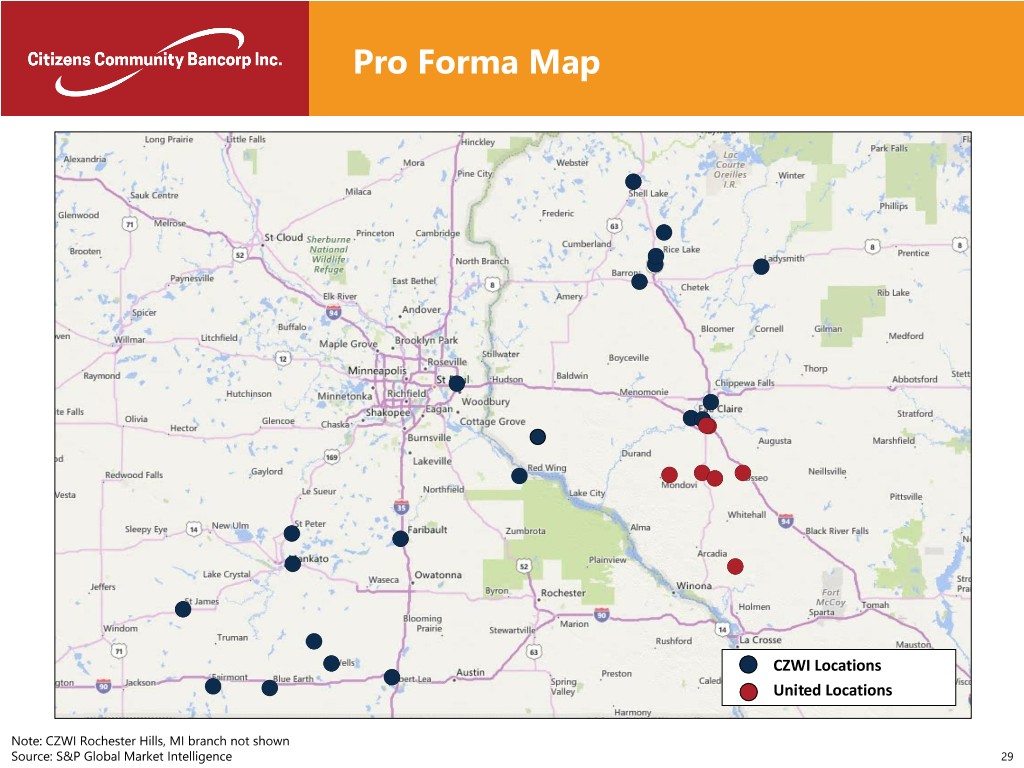

Pro Forma Map CZWI Locations United Locations Note: CZWI Rochester Hills, MI branch not shown Source: S&P Global Market Intelligence 29

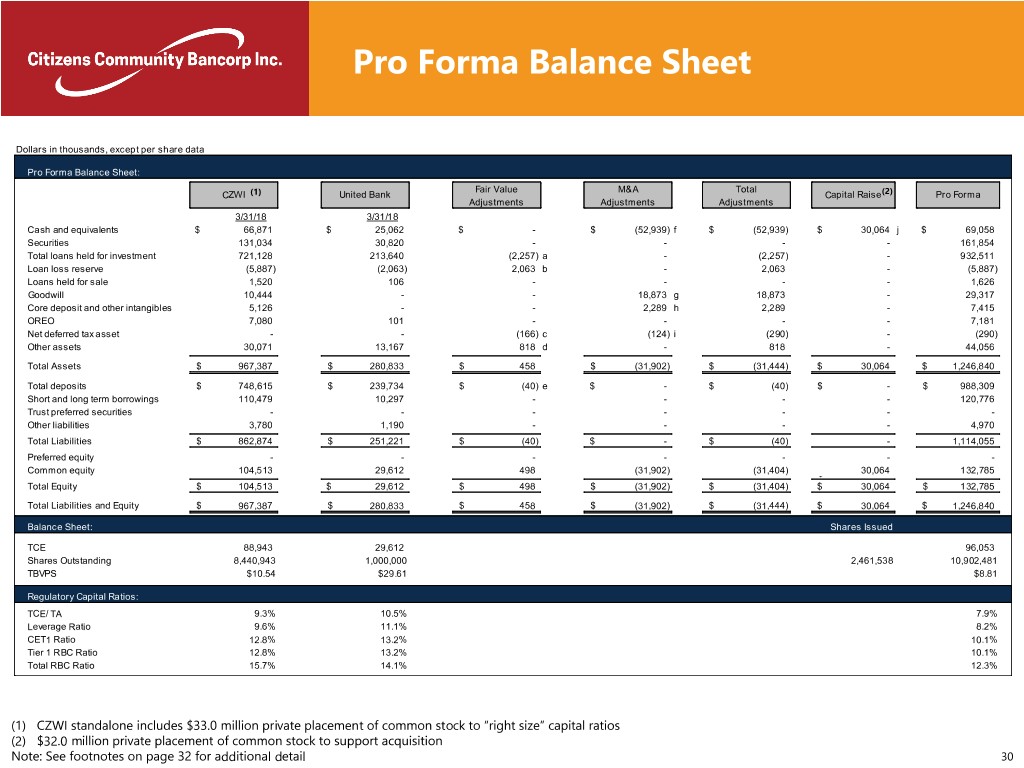

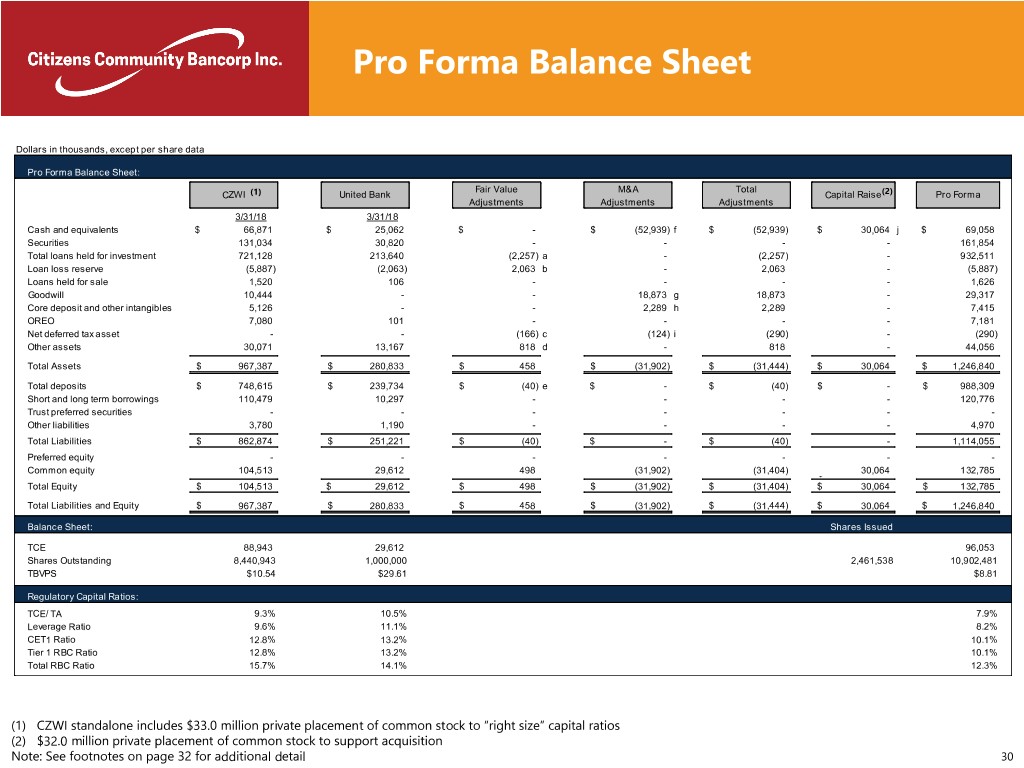

Pro Forma Balance Sheet Dollars in thousands, except per share data Pro Forma Balance Sheet: Fair Value M&A Total CZWI (1) United Bank Capital Raise(2) Pro Forma Adjustments Adjustments Adjustments 3/31/18 3/31/18 Cash and equivalents $ 66,871 $ 25,062 $ - $ (52,939) f $ (52,939) $ 30,064 j $ 69,058 Securities 131,034 30,820 - - - - 161,854 Total loans held for investment 721,128 213,640 (2,257) a - (2,257) - 932,511 Loan loss reserve (5,887) (2,063) 2,063 b - 2,063 - (5,887) Loans held for sale 1,520 106 - - - - 1,626 Goodwill 10,444 - - 18,873 g 18,873 - 29,317 Core deposit and other intangibles 5,126 - - 2,289 h 2,289 - 7,415 OREO 7,080 101 - - - - 7,181 Net deferred tax asset - - (166) c (124) i (290) - (290) Other assets 30,071 13,167 818 d - 818 - 44,056 Total Assets $ 967,387 $ 280,833 $ 458 $ (31,902) $ (31,444) $ 30,064 $ 1,246,840 Total deposits $ 748,615 $ 239,734 $ (40) e $ - $ (40) $ - $ 988,309 Short and long term borrowings 110,479 10,297 - - - - 120,776 Trust preferred securities - - - - - - - Other liabilities 3,780 1,190 - - - - 4,970 Total Liabilities $ 862,874 $ 251,221 $ (40) $ - $ (40) - 1,114,055 Preferred equity - - - - - - - Common equity 104,513 29,612 498 (31,902) (31,404) $ 30,064 - 132,785 Total Equity $ 104,513 $ 29,612 $ 498 $ (31,902) $ (31,404) $ 30,064 $ 132,785 Total Liabilities and Equity $ 967,387 $ 280,833 $ 458 $ (31,902) $ (31,444) $ 30,064 $ 1,246,840 Balance Sheet: Shares Issued TCE 88,943 29,612 96,053 Shares Outstanding 8,440,943 1,000,000 2,461,538 10,902,481 TBVPS $10.54 $29.61 $8.81 Regulatory Capital Ratios: TCE/ TA 9.3% 10.5% 7.9% Leverage Ratio 9.6% 11.1% 8.2% CET1 Ratio 12.8% 13.2% 10.1% Tier 1 RBC Ratio 12.8% 13.2% 10.1% Total RBC Ratio 15.7% 14.1% 12.3% (1) CZWI standalone includes $33.0 million private placement of common stock to “right size” capital ratios (2) $32.0 million private placement of common stock to support acquisition Note: See footnotes on page 32 for additional detail 30

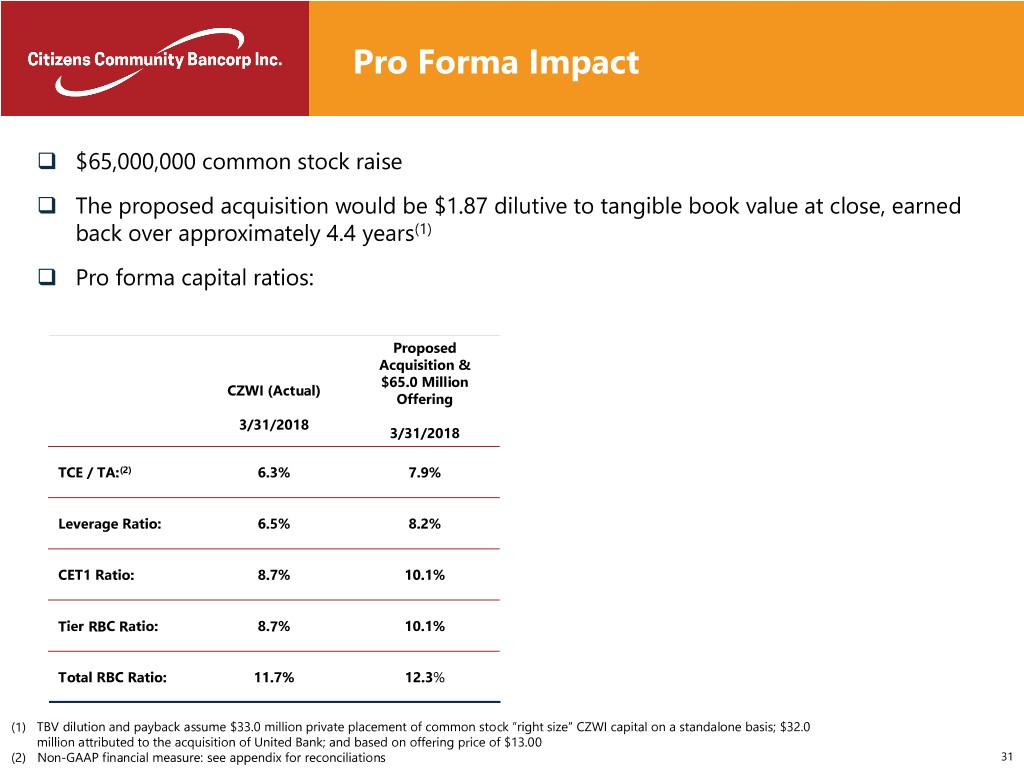

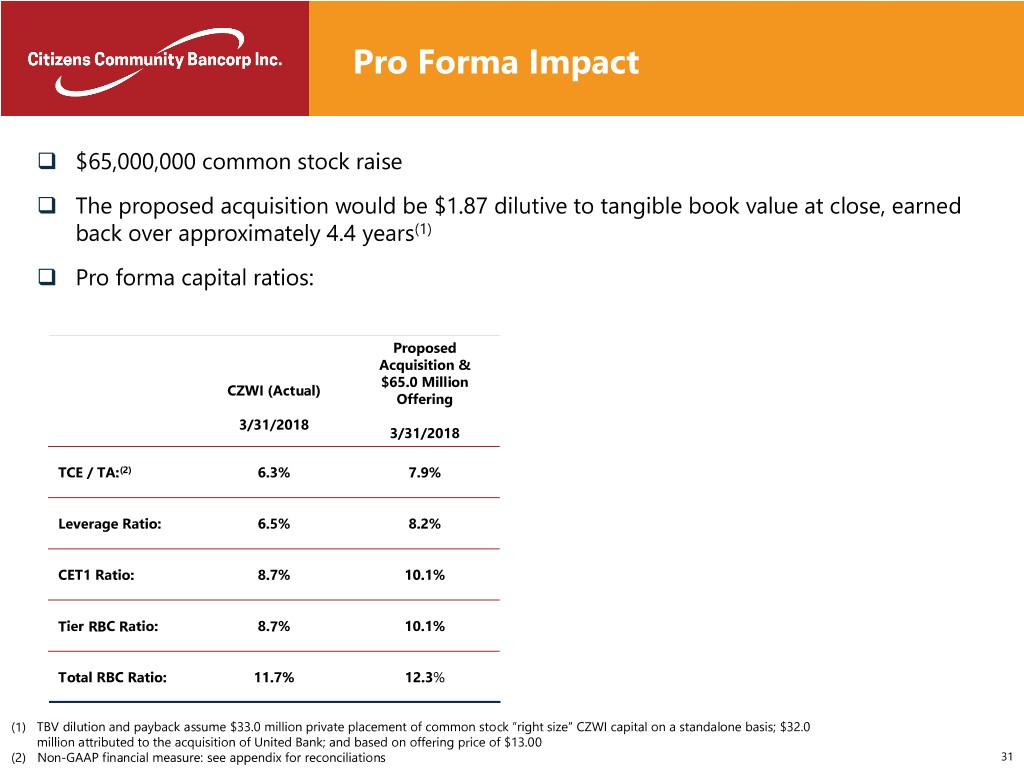

Pro Forma Impact ❑ $65,000,000 common stock raise ❑ The proposed acquisition would be $1.87 dilutive to tangible book value at close, earned back over approximately 4.4 years(1) ❑ Pro forma capital ratios: Proposed Acquisition & $65.0 Million CZWI (Actual) Offering 3/31/2018 3/31/2018 TCE / TA:(2) 6.3% 7.9% Leverage Ratio: 6.5% 8.2% CET1 Ratio: 8.7% 10.1% Tier RBC Ratio: 8.7% 10.1% Total RBC Ratio: 11.7% 12.3% (1) TBV dilution and payback assume $33.0 million private placement of common stock “right size” CZWI capital on a standalone basis; $32.0 million attributed to the acquisition of United Bank; and based on offering price of $13.00 (2) Non-GAAP financial measure: see appendix for reconciliations 31

Pro Forma Balance Sheet Footnotes Footnotes a. Loan fair value adjustment b. Elimination of loan loss reserve c. Net DTL related to fair value purchase marks d. Fixed asset fair value adjustment e. Deposit fair value adjustment f. $50.7 million cash consideration plus $2.2 million of transaction related expenses g. Goodwill created h. Core deposit intangible created i. Net DTL created from $448 thousand DTA from transaction expenses plus $572 thousand DTL from CDI created j. Net proceeds from $32.0 million private placement of common stock (1) CZWI standalone includes $33.0 million private placement of common stock to “right size” capital ratios 32

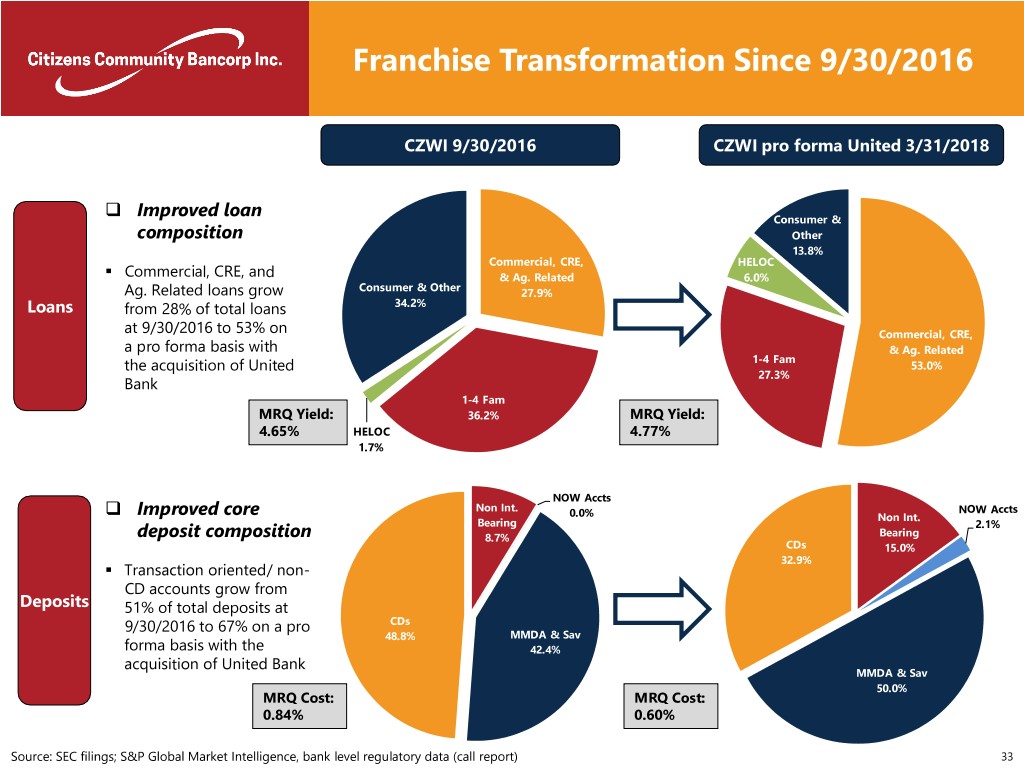

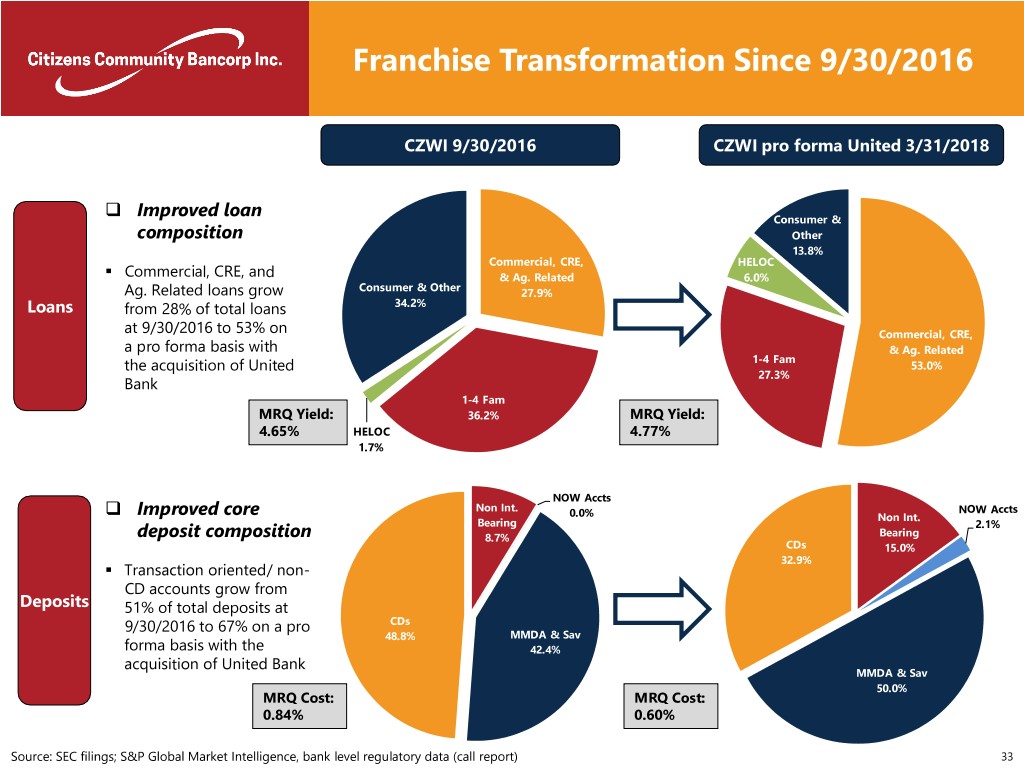

Franchise Transformation Since 9/30/2016 CZWI 9/30/2016 CZWI pro forma United 3/31/2018 ❑ Improved loan Consumer & composition Other 13.8% ▪ Commercial, CRE, HELOC Commercial, CRE, and & Ag. Related 6.0% Consumer & Other Ag. Related loans grow 27.9% Loans from 28% of total loans 34.2% at 9/30/2016 to 53% on Commercial, CRE, a pro forma basis with & Ag. Related 1-4 Fam the acquisition of United 53.0% 27.3% Bank 1-4 Fam MRQ Yield: 36.2% MRQ Yield: 4.65% HELOC 4.77% 1.7% NOW Accts ❑ Non Int. NOW Accts Improved core 0.0% Non Int. Bearing 2.1% deposit composition 8.7% Bearing CDs 15.0% 32.9% ▪ Transaction oriented/ non- CD accounts grow from Deposits 51% of total deposits at z 9/30/2016 to 67% on a pro CDs 48.8% MMDA & Sav forma basis with the 42.4% acquisition of United Bank MMDA & Sav 50.0% MRQ Cost: MRQ Cost: 0.84% 0.60% Source: SEC filings; S&P Global Market Intelligence, bank level regulatory data (call report) 33

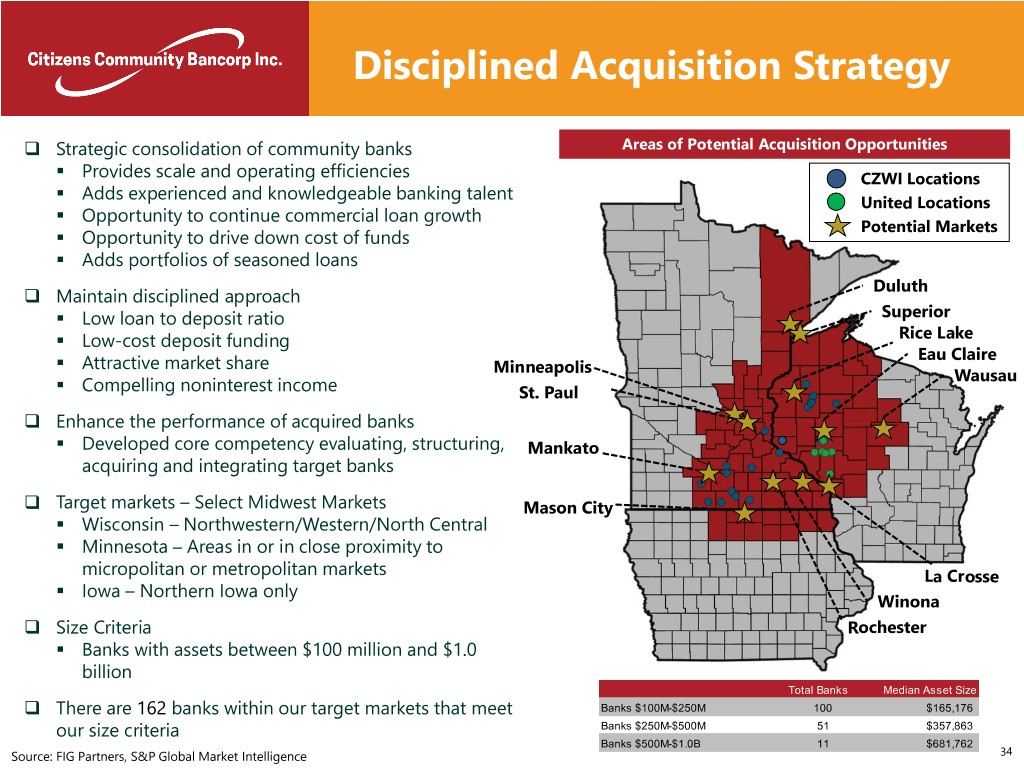

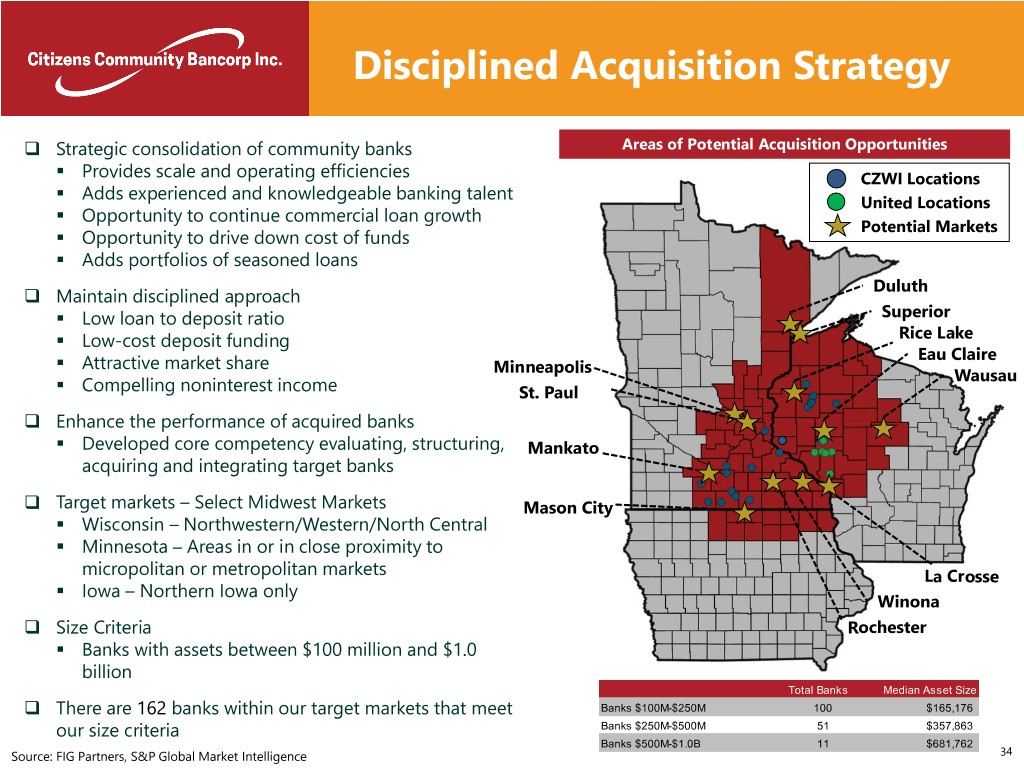

Disciplined Acquisition Strategy ❑ Strategic consolidation of community banks Areas of Potential Acquisition Opportunities ▪ Provides scale and operating efficiencies CZWI Locations ▪ Adds experienced and knowledgeable banking talent United Locations ▪ Opportunity to continue commercial loan growth Potential Markets ▪ Opportunity to drive down cost of funds ▪ Adds portfolios of seasoned loans Duluth ❑ Maintain disciplined approach ▪ Low loan to deposit ratio Superior ▪ Low-cost deposit funding Rice Lake ▪ Eau Claire Attractive market share Minneapolis ▪ Wausau Compelling noninterest income St. Paul ❑ Enhance the performance of acquired banks ▪ Developed core competency evaluating, structuring, Mankato acquiring and integrating target banks ❑ Target markets – Select Midwest Markets Mason City ▪ Wisconsin – Northwestern/Western/North Central ▪ Minnesota – Areas in or in close proximity to micropolitan or metropolitan markets La Crosse ▪ Iowa – Northern Iowa only Winona ❑ Size Criteria Rochester ▪ Banks with assets between $100 million and $1.0 billion Total Banks Median Asset Size ❑ There are 162 banks within our target markets that meet Banks $100M-$250M 100 $165,176 our size criteria Banks $250M-$500M 51 $357,863 Banks $500M-$1.0B 11 $681,762 Source: FIG Partners, S&P Global Market Intelligence 34

Investment Highlights ❑ Offering an attractive valuation and entry point for a pro forma $1.2 billion asset institution ❑ CZWI’s proposed acquisition of United would be transformative for the Company and would establish CZWI as #2 in deposit market share in Eau Claire County ❑ CZWI is expected to cross the $1.0 Billion in assets threshold which should lead to greater market capitalization and potential for improved trading liquidity post offering ❑ Post acquisition, CZWI would have approximately $1.2 billion in assets and rank as the largest community bank headquartered in the Chippewa Valley Region / Greater Eau Claire market ❑ CZWI has positioned itself to effectively compete and profitably offer community banking products and services in the Micropolitan, Metropolitan and Rural Demographic markets in which the Bank operates ❑ Proposed acquisition would provide CZWI with a stable low cost deposit base for organic growth opportunities in the Bank’s key markets ❑ Experienced and successful leadership team ❑ Offering is an opportunity to broaden the Company’s investor base and sponsorship ❑ Significant number of potential future M&A opportunities ❑ Continued pursuit of low cost deposits through organic growth and M&A activity ❑ Strong credit quality ❑ Proactive risk management 35

Asset Liability Management Appendix 36

Experienced Leadership Team 174 Years of Banking Experience… President / CEO EVP / CFO SVP Chief Credit Officer SVP Corporate Development 31 / 2 32 / < 1 year 23 / 23 24 / 3 SVP Chief Technology Officer SVP West Region President SVP East Region President VP Human Resources Community Banking Community Banking 35 / 9 13 / < 1 year 15 / 8 1 / 1 ...46 Years at CZWI 37

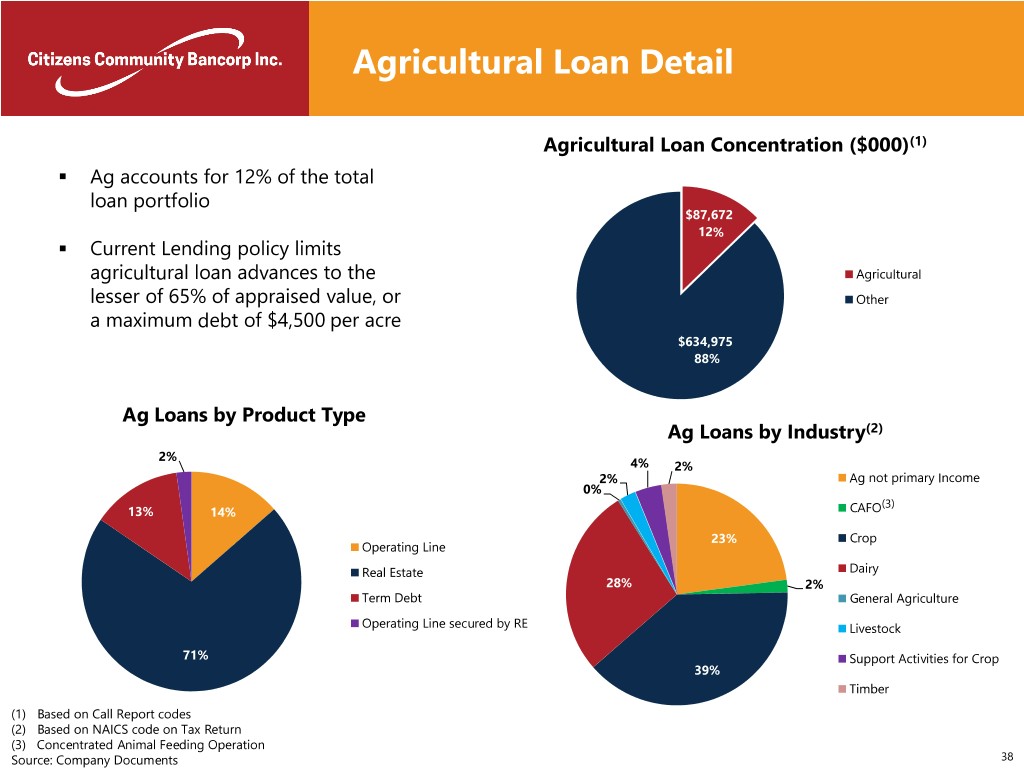

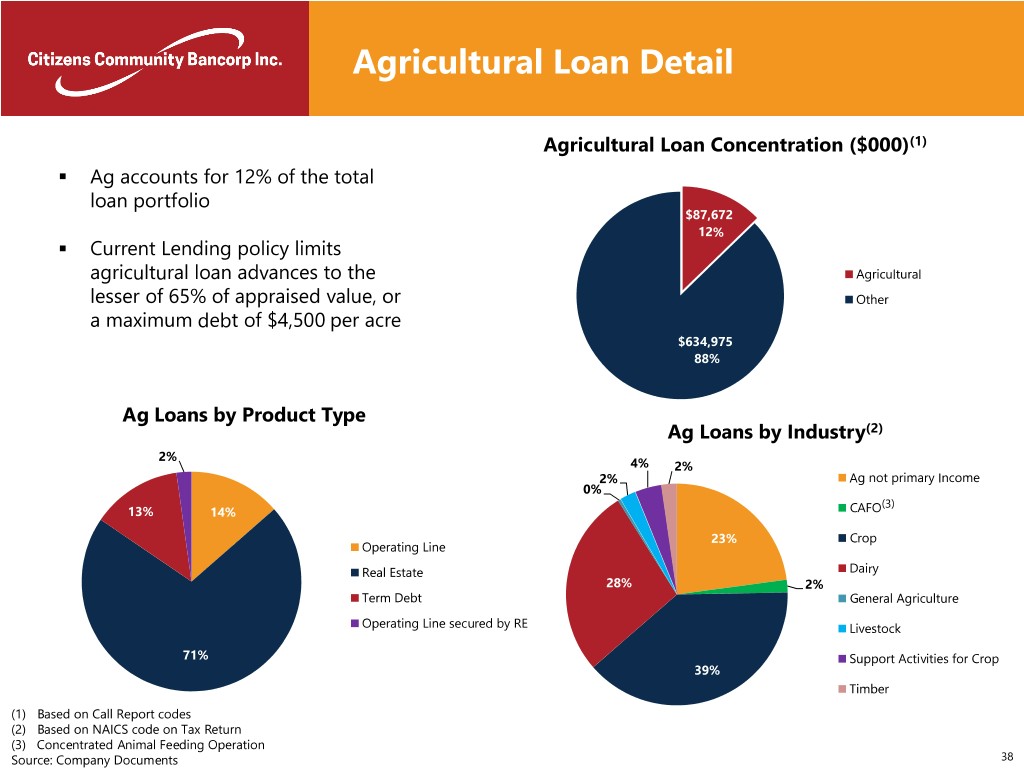

Agricultural Loan Detail Agricultural Loan Concentration ($000)(1) ▪ Ag accounts for 12% of the total loan portfolio $87,672 12% ▪ Current Lending policy limits agricultural loan advances to the Agricultural lesser of 65% of appraised value, or Other a maximum debt of $4,500 per acre $634,975 88% Ag Loans by Product Type Ag Loans by Industry(2) 2% 4% 2% 2% Ag not primary Income 0% (3) 13% 14% CAFO 23% Crop Operating Line Real Estate Dairy 28% 2% Term Debt General Agriculture Operating Line secured by RE Livestock 71% Support Activities for Crop 39% Timber (1) Based on Call Report codes (2) Based on NAICS code on Tax Return (3) Concentrated Animal Feeding Operation Source: Company Documents 38

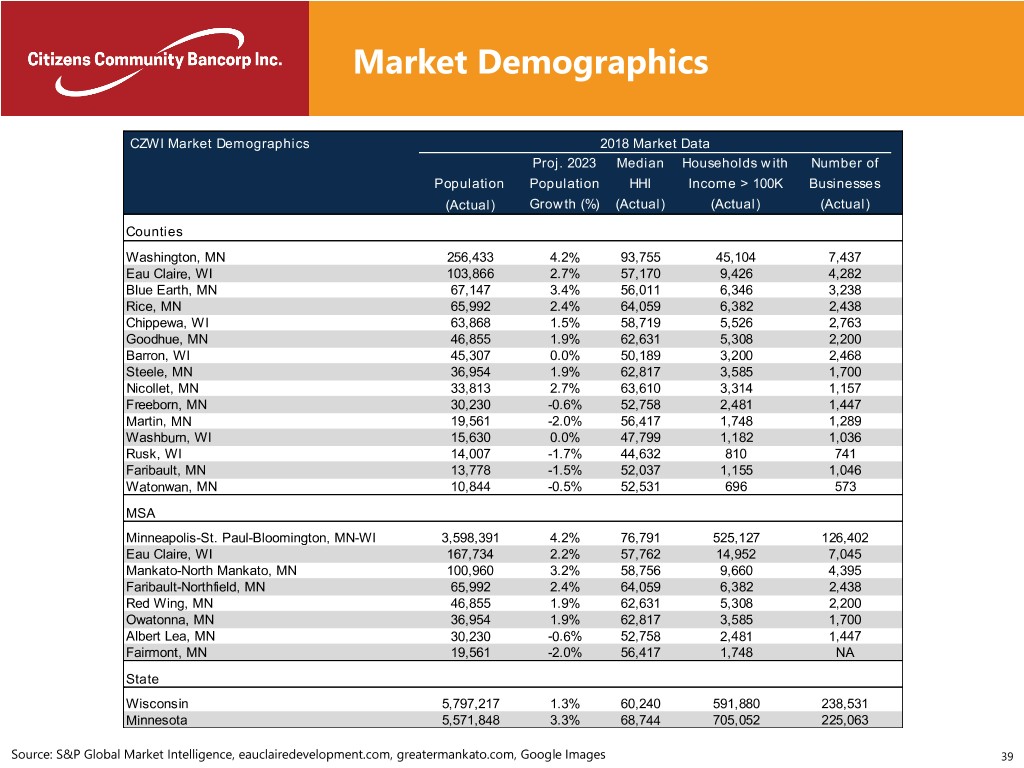

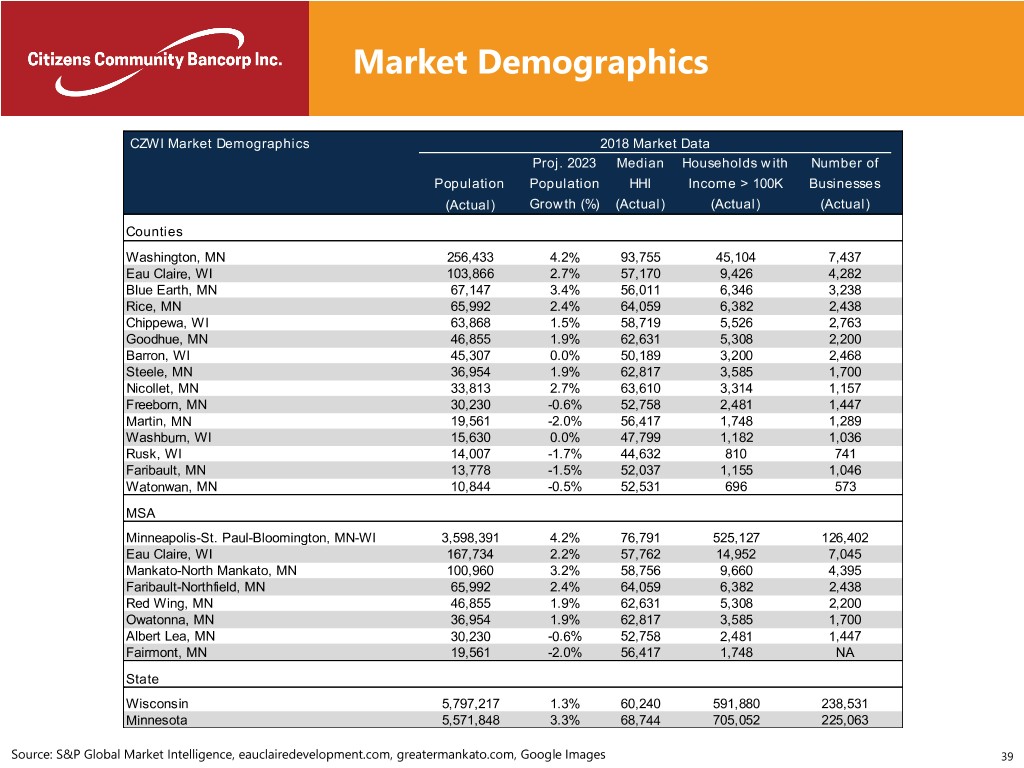

Market Demographics CZWI Market Demographics 2018 Market Data Proj. 2023 Median Households with Number of Population Population HHI Income > 100K Businesses (Actual) Growth (%) (Actual) (Actual) (Actual) Counties Washington, MN 256,433 4.2% 93,755 45,104 7,437 Eau Claire, WI 103,866 2.7% 57,170 9,426 4,282 Blue Earth, MN 67,147 3.4% 56,011 6,346 3,238 Rice, MN 65,992 2.4% 64,059 6,382 2,438 Chippewa, WI 63,868 1.5% 58,719 5,526 2,763 Goodhue, MN 46,855 1.9% 62,631 5,308 2,200 Barron, WI 45,307 0.0% 50,189 3,200 2,468 Steele, MN 36,954 1.9% 62,817 3,585 1,700 Nicollet, MN 33,813 2.7% 63,610 3,314 1,157 Freeborn, MN 30,230 -0.6% 52,758 2,481 1,447 Martin, MN 19,561 -2.0% 56,417 1,748 1,289 Washburn, WI 15,630 0.0% 47,799 1,182 1,036 Rusk, WI 14,007 -1.7% 44,632 810 741 Faribault, MN 13,778 -1.5% 52,037 1,155 1,046 Watonwan, MN 10,844 -0.5% 52,531 696 573 MSA Minneapolis-St. Paul-Bloomington, MN-WI 3,598,391 4.2% 76,791 525,127 126,402 Eau Claire, WI 167,734 2.2% 57,762 14,952 7,045 Mankato-North Mankato, MN 100,960 3.2% 58,756 9,660 4,395 Faribault-Northfield, MN 65,992 2.4% 64,059 6,382 2,438 Red Wing, MN 46,855 1.9% 62,631 5,308 2,200 Owatonna, MN 36,954 1.9% 62,817 3,585 1,700 Albert Lea, MN 30,230 -0.6% 52,758 2,481 1,447 Fairmont, MN 19,561 -2.0% 56,417 1,748 NA State Wisconsin 5,797,217 1.3% 60,240 591,880 238,531 Minnesota 5,571,848 3.3% 68,744 705,052 225,063 Source: S&P Global Market Intelligence, eauclairedevelopment.com, greatermankato.com, Google Images 39

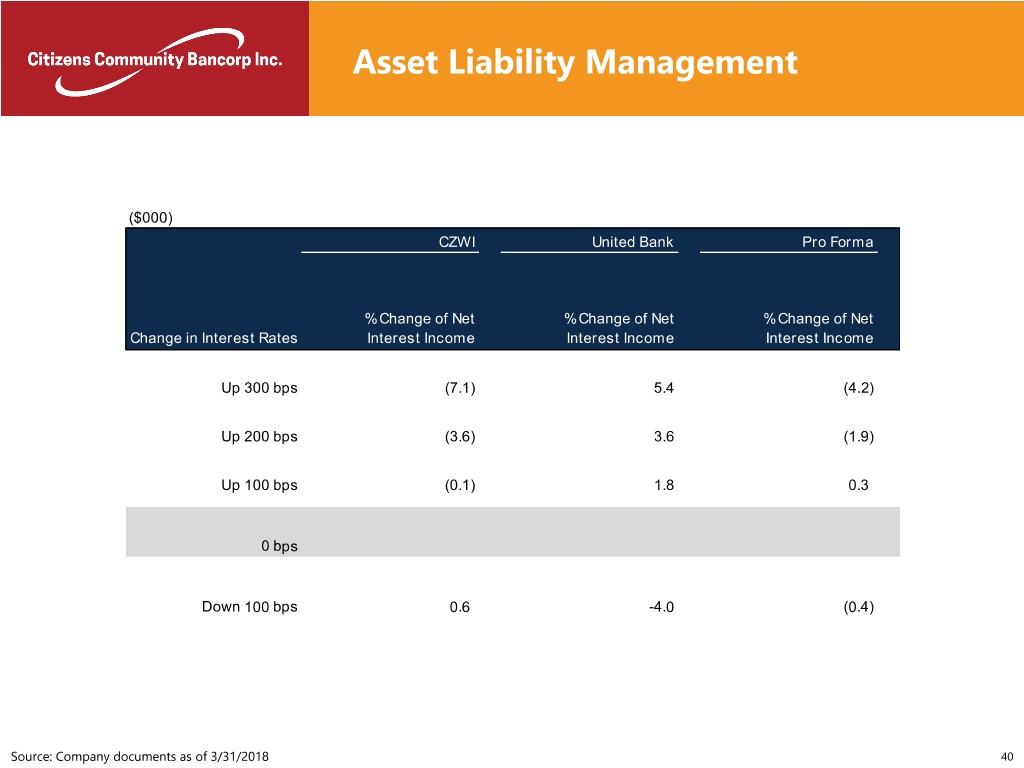

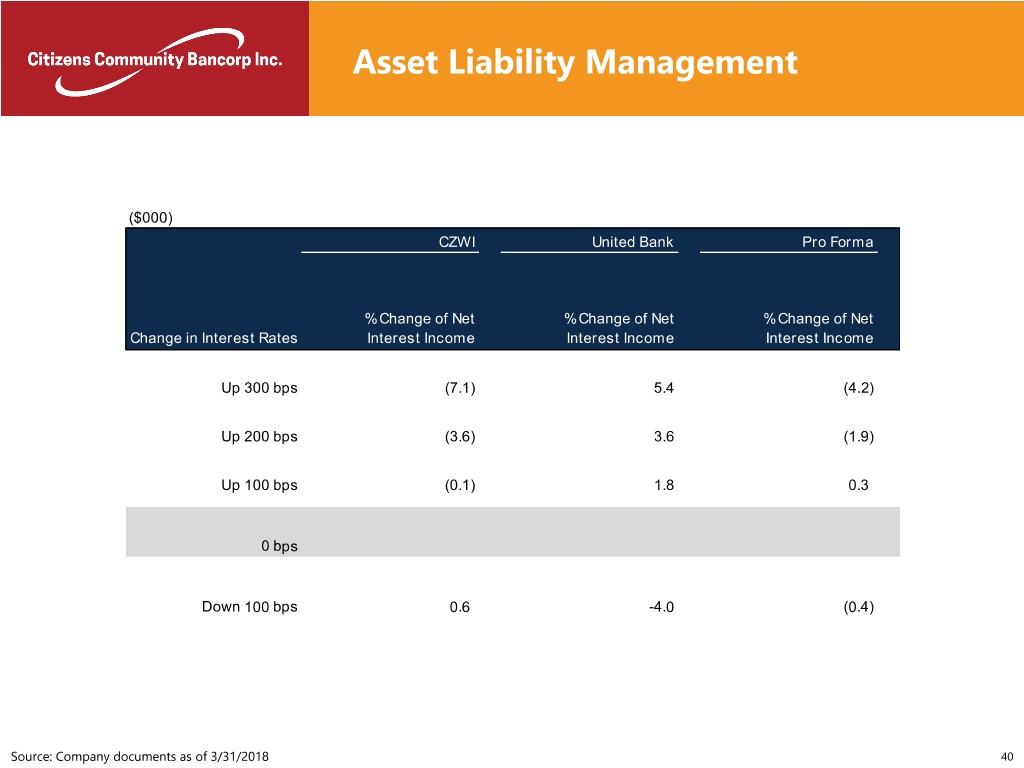

Asset Liability Management ($000) CZWI United Bank Pro Forma % Change of Net % Change of Net % Change of Net Change in Interest Rates Interest Income Interest Income Interest Income Up 300 bps (7.1) 5.4 (4.2) Up 200 bps (3.6) 3.6 (1.9) Up 100 bps (0.1) 1.8 0.3 0 bps Down 100 bps 0.6 -4.0 (0.4) Source: Company documents as of 3/31/2018 40

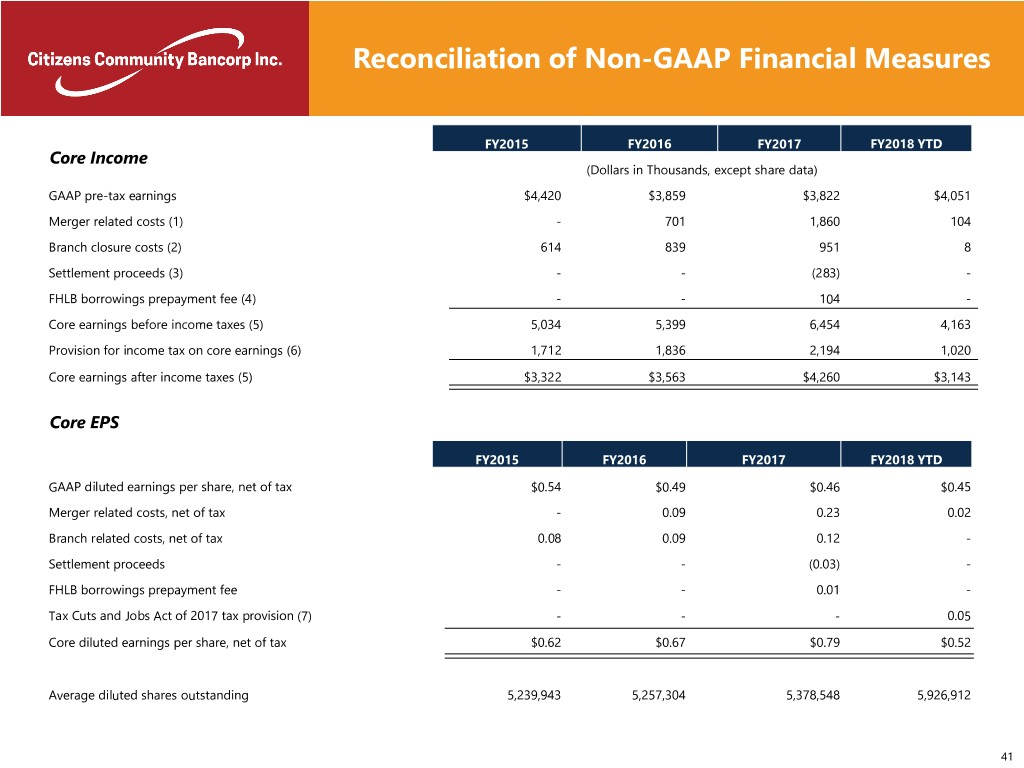

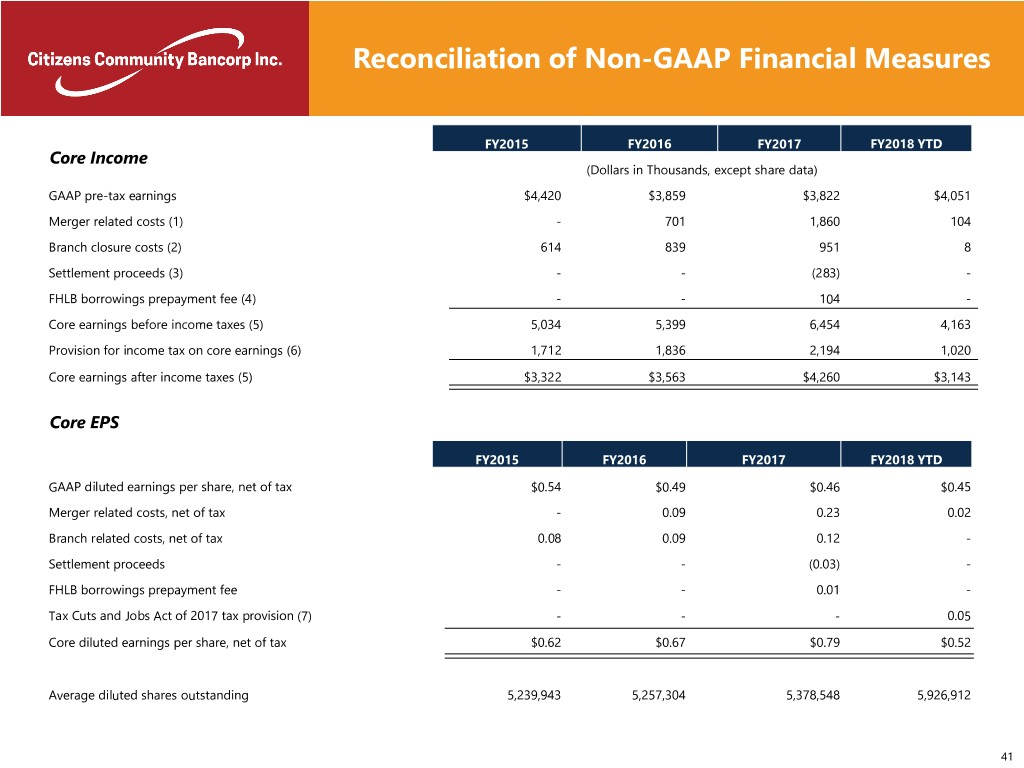

Reconciliation of Non-GAAP Financial Measures FY2015 FY2016 FY2017 FY2018 YTD Core Income (Dollars in Thousands, except share data) GAAP pre-tax earnings $4,420 $3,859 $3,822 $4,051 Merger related costs (1) - 701 1,860 104 Branch closure costs (2) 614 839 951 8 Settlement proceeds (3) - - (283) - FHLB borrowings prepayment fee (4) - - 104 - Core earnings before income taxes (5) 5,034 5,399 6,454 4,163 Provision for income tax on core earnings (6) 1,712 1,836 2,194 1,020 Core earnings after income taxes (5) $3,322 $3,563 $4,260 $3,143 Core EPS FY2015 FY2016 FY2017 FY2018 YTD GAAP diluted earnings per share, net of tax $0.54 $0.49 $0.46 $0.45 Merger related costs, net of tax - 0.09 0.23 0.02 Branch related costs, net of tax 0.08 0.09 0.12 - Settlement proceeds - - (0.03) - FHLB borrowings prepayment fee - - 0.01 - Tax Cuts and Jobs Act of 2017 tax provision (7) - - - 0.05 Core diluted earnings per share, net of tax $0.62 $0.67 $0.79 $0.52 Average diluted shares outstanding 5,239,943 5,257,304 5,378,548 5,926,912 41

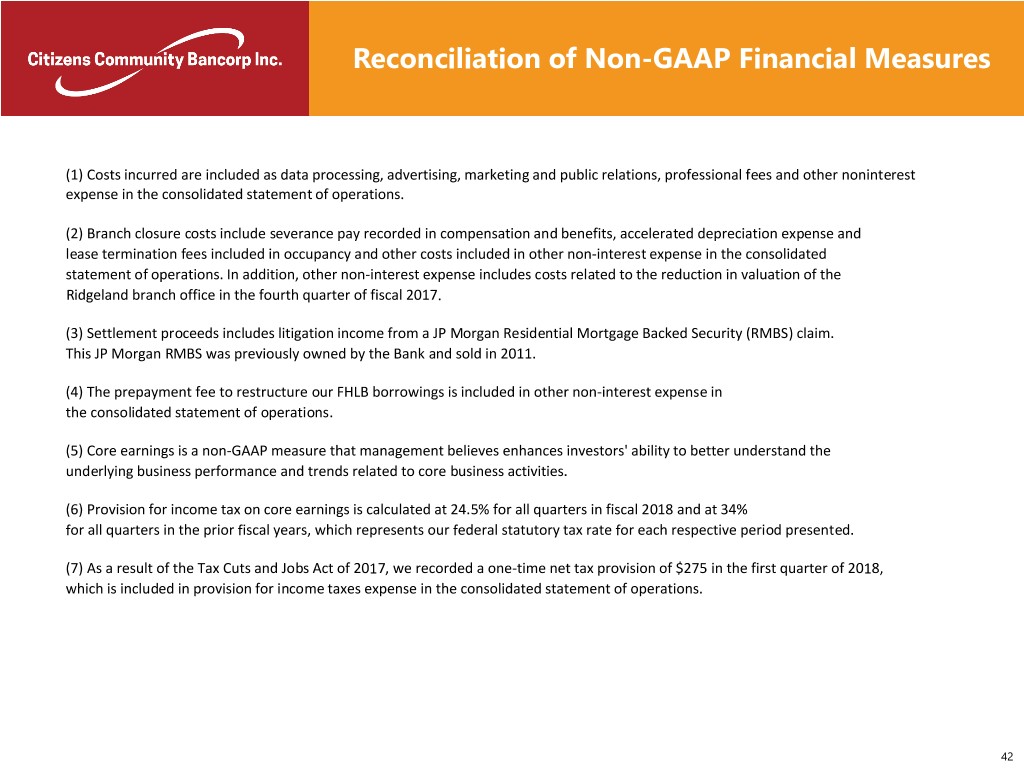

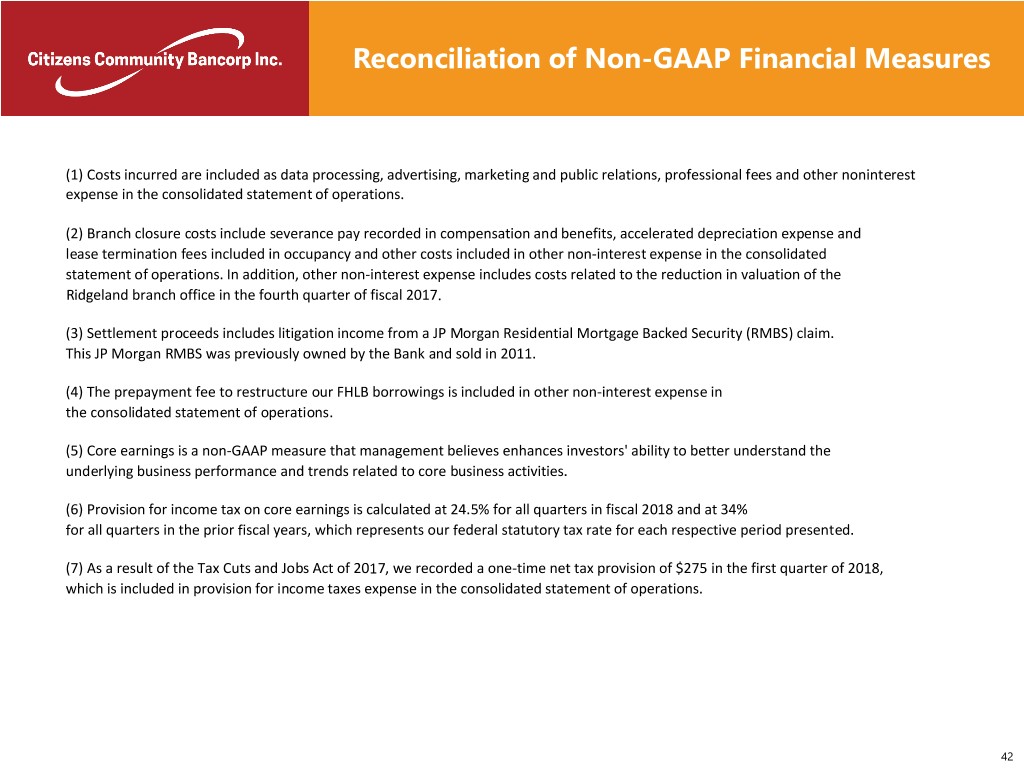

Reconciliation of Non-GAAP Financial Measures (1) Costs incurred are included as data processing, advertising, marketing and public relations, professional fees and other noninterest expense in the consolidated statement of operations. (2) Branch closure costs include severance pay recorded in compensation and benefits, accelerated depreciation expense and lease termination fees included in occupancy and other costs included in other non-interest expense in the consolidated statement of operations. In addition, other non-interest expense includes costs related to the reduction in valuation of the Ridgeland branch office in the fourth quarter of fiscal 2017. (3) Settlement proceeds includes litigation income from a JP Morgan Residential Mortgage Backed Security (RMBS) claim. This JP Morgan RMBS was previously owned by the Bank and sold in 2011. (4) The prepayment fee to restructure our FHLB borrowings is included in other non-interest expense in the consolidated statement of operations. (5) Core earnings is a non-GAAP measure that management believes enhances investors' ability to better understand the underlying business performance and trends related to core business activities. (6) Provision for income tax on core earnings is calculated at 24.5% for all quarters in fiscal 2018 and at 34% for all quarters in the prior fiscal years, which represents our federal statutory tax rate for each respective period presented. (7) As a result of the Tax Cuts and Jobs Act of 2017, we recorded a one-time net tax provision of $275 in the first quarter of 2018, which is included in provision for income taxes expense in the consolidated statement of operations. 42

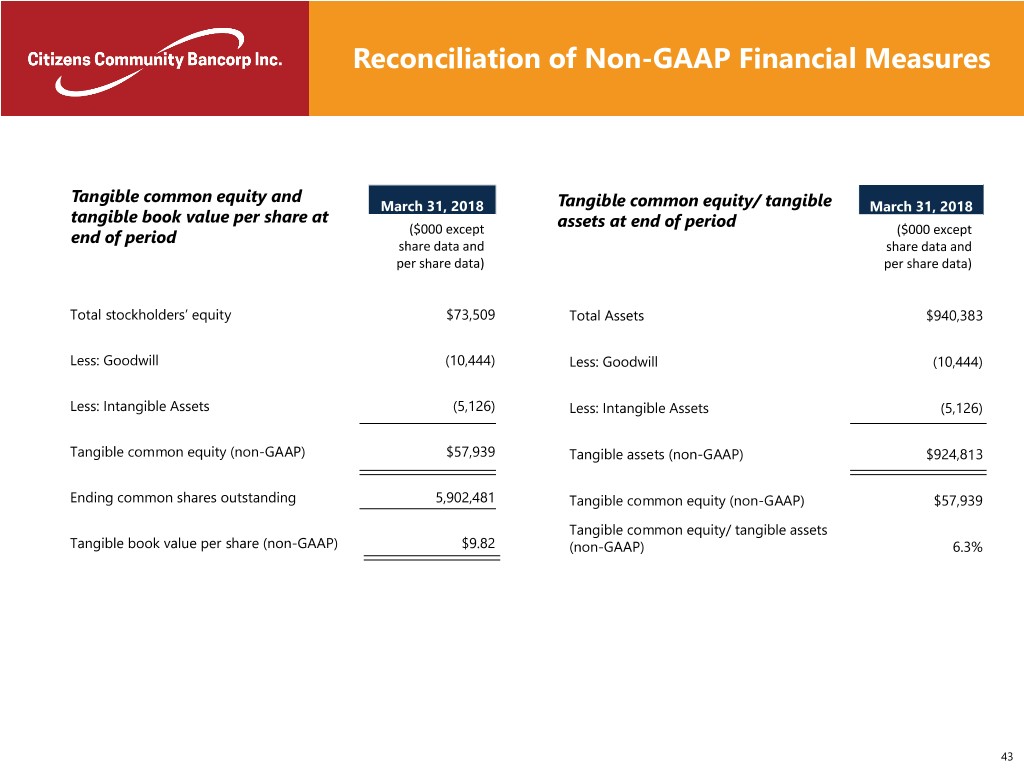

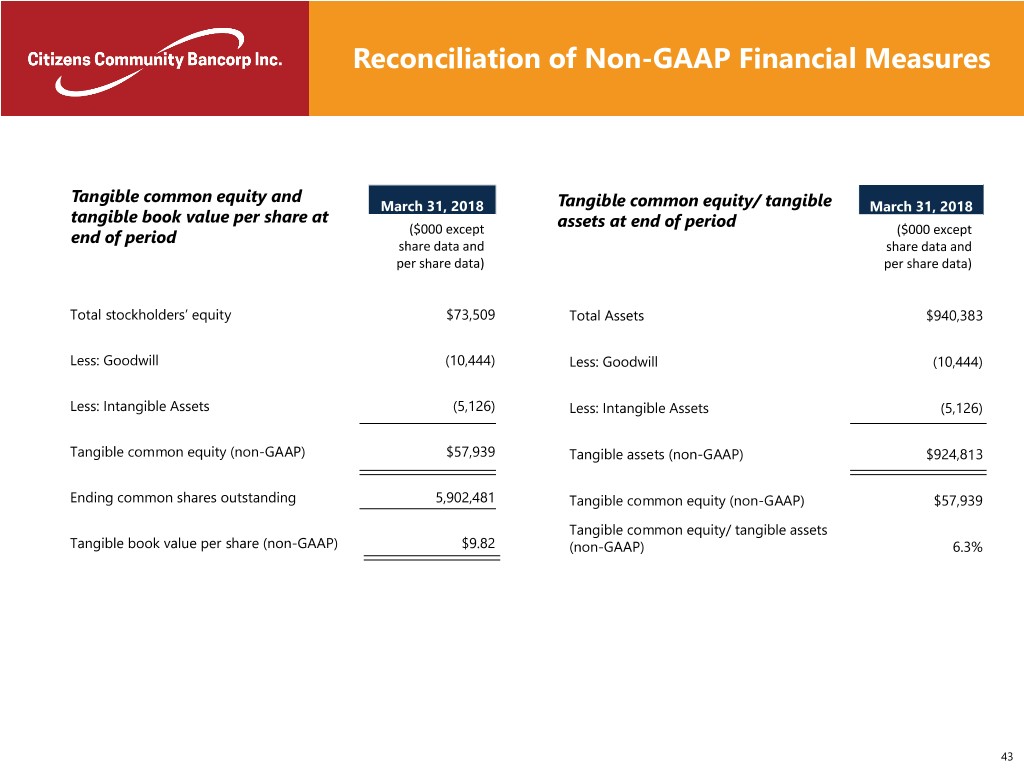

Reconciliation of Non-GAAP Financial Measures Tangible common equity and March 31, 2018 Tangible common equity/ tangible March 31, 2018 tangible book value per share at assets at end of period end of period ($000 except ($000 except share data and share data and per share data) per share data) Total stockholders’ equity $73,509 Total Assets $940,383 Less: Goodwill (10,444) Less: Goodwill (10,444) Less: Intangible Assets (5,126) Less: Intangible Assets (5,126) Tangible common equity (non-GAAP) $57,939 Tangible assets (non-GAAP) $924,813 Ending common shares outstanding 5,902,481 Tangible common equity (non-GAAP) $57,939 Tangible common equity/ tangible assets Tangible book value per share (non-GAAP) $9.82 (non-GAAP) 6.3% 43

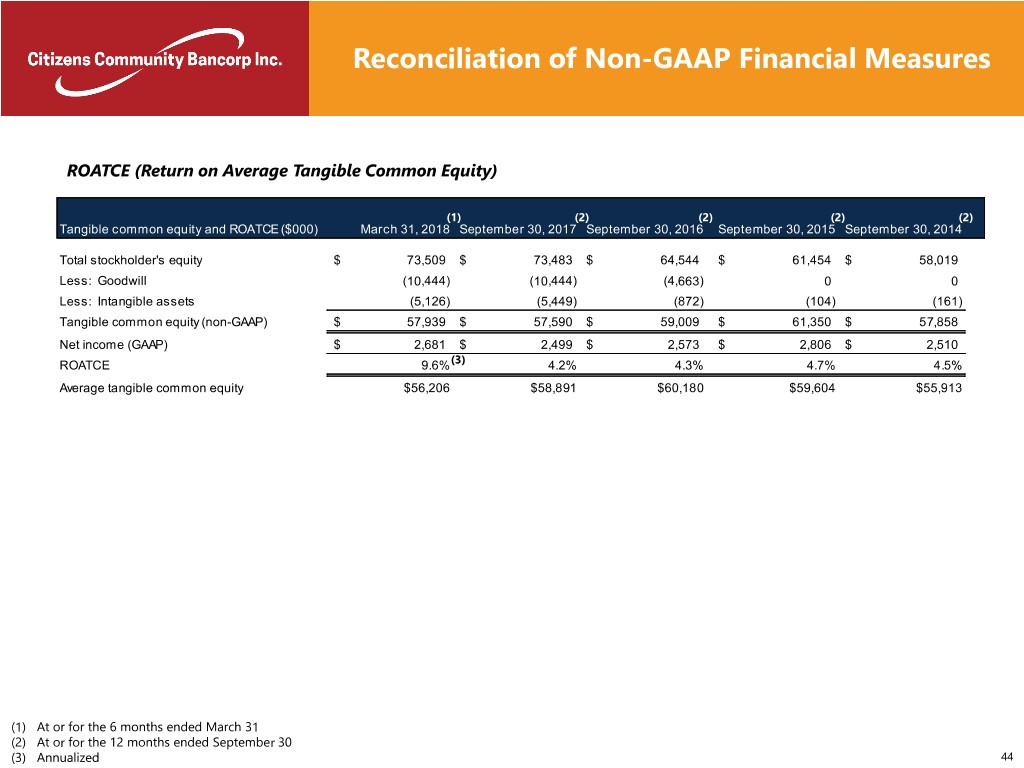

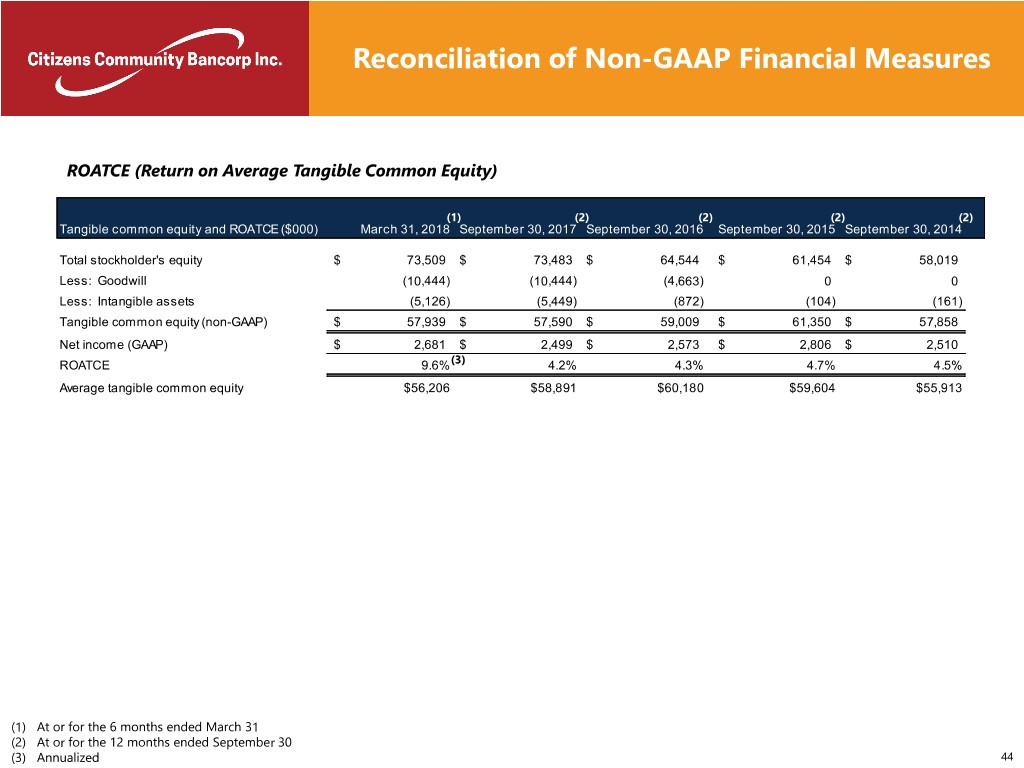

Reconciliation of Non-GAAP Financial Measures ROATCE (Return on Average Tangible Common Equity) (1) (2) (2) (2) (2) Tangible common equity and ROATCE ($000) March 31, 2018 September 30, 2017 September 30, 2016 September 30, 2015 September 30, 2014 Total stockholder's equity $ 73,509 $ 73,483 $ 64,544 $ 61,454 $ 58,019 Less: Goodwill (10,444) (10,444) (4,663) 0 0 Less: Intangible assets (5,126) (5,449) (872) (104) (161) Tangible common equity (non-GAAP) $ 57,939 $ 57,590 $ 59,009 $ 61,350 $ 57,858 Net income (GAAP) $ 2,681 $ 2,499 $ 2,573 $ 2,806 $ 2,510 ROATCE 9.6%(3) 4.2% 4.3% 4.7% 4.5% Average tangible common equity $56,206 $58,891 $60,180 $59,604 $55,913 (1) At or for the 6 months ended March 31 (2) At or for the 12 months ended September 30 (3) Annualized 44

Abbreviations Abbreviation Definition Abbreviation Definition Ag. Agriculture (1) LTM (2) Last Twelve(2) Months (2) (2) BPS Basis Points M&A Mergers & Acquisitions C&D Construction & Development MMDA & Sav. Money Market Deposit Account & Savings C&I Commercial & Industrial MSA Metropolitan Statistical Area CAGR Compound Annual Growth Rate NCOs Net Charge-Offs CDI Core Deposit Intangible Non-Owner Occ. CRE Non-Owner Occupied Commercial Real Estate CDs Certificates of Deposit NOW & Other Trans. Negotiable Order of Withdrawal & Other Transaction CET1 Common Equity Tier 1 NPAs Nonperforming Assets Cons. & Other Consumer & Other Owner-Occ. CRE Owner-Occupied Commercial Real Estate CRE Commercial Real Estate RBC Risk-Based Capital DTA Deferred Tax Asset ROAA Return on Average Assets DTL Deferred Tax Liability ROAE Return on Average Equity EPS Earnings Per Share ROATCE Return on Average Tangible Common Equity FHLB Federal Home Loan Bank SEC Securities and Exchange Commission FQ Fiscal Quarter TBV Tangible Book Value FY Fiscal Year TBVPS Tangible Book Value Per Share GAAP Generally Accepted Accounting Principles TCE Tangible Common Equity HELOC Home Equity Line of Credit TCE/ TA Tangible Common Equity/ Tangible Assets HHI Household Income TDRs Troubled Debt Restructurings IRR Internal Rate of Return YTD Year to Date 45