Exhibit 99.2 United Bank Balance Sheets (Unaudited) (Dollars in Thousands, Except Share Data) September 30, December 31, 2018 2017 ASSETS Cash and Due From Banks $ 5,303 $ 7,030 Federal Funds Sold 48,940 5,428 Interest-bearing Deposits 277 41 Cash & Cash Equivalents 54,520 12,499 Interest-Bearing Deposits 280 2,109 Securities Available for Sale - 36,633 Restricted Stock 495 499 Loans Held for Sale 117 181 Loans, Net 201,093 205,044 Premises and Equipment, Net 2,848 2,922 Other Real Estate Owned - 205 Cash Value of Life Insurance 6,014 5,903 Mortgage Servicing Assets 2,551 2,294 Other Assets 1,089 1,599 TOTAL ASSETS $ 269,007 $ 269,888 LIABILITIES: Non-Interest-Bearing Deposits $ 63,445 $ 67,611 Interest-Bearing Deposits 164,079 161,430 Total Deposits 227,524 229,041 Borrowed Funds 10,389 10,252 Other Liabilities 1,420 1,319 Total Liabilities 239,333 240,642 STOCKHOLDERS' EQUITY Common stock 510 510 Additional paid-in capital 5,100 5,100 Retained Earnings 24,064 23,798 Accumulated Other Comprehensive Income (loss) - (162) Total stockholder equity 29,674 29,246 TOTAL LIABILITIES AND STOCKHOLDERS' EQUITY $ 269,007 $ 269,888 See condensed notes to unaudited financial statements. 1

United Bank Statement of Income (Unaudited) (Dollars in Thousands, Except Share Data) Nine Months Ended September 30, 2018 2017 Interest and Dividend Income: Loans, including fees $ 7,919 $ 7,006 Securities: Taxable 171 182 Tax-Exempt 149 165 Other 235 86 Total Interest and Dividend Income 8,474 7,439 Interest Expense: Deposits 675 502 Borrowed funds 350 346 Total Interest Expense 1,025 848 Net Interest Income before Provision for Loan and Lease 7,449 6,591 Losses Provision (credit) for Loan Losses - - Net Interest Income after Provision for Loan and Lease Losses 7,449 6,591 Noninterest income: Service fees 785 749 Mortgage banking activities 1,461 1,617 Increase in cash value of life insurance 110 117 Net gain on sale of other real estate owned 98 28 Net gain (loss) on sale of securities available for sale (439) 1 Other 124 73 Total Noninterest Income 2,139 2,585 Noninterest Expense Salaries & Employee Benefits 4,718 3,629 Occupancy and Equipment 497 439 Data Processing 666 704 Professional Fees 135 194 ATM, EFT, & Debit card fees 224 232 Other 453 418 Total Noninterest Expenses 6,693 5,616 Income before provision for income taxes 2,895 3,188 Provision for income taxes 531 1,089 Net Income $ 2,364 $ 2,471 See condensed notes to unaudited financial statements. 2

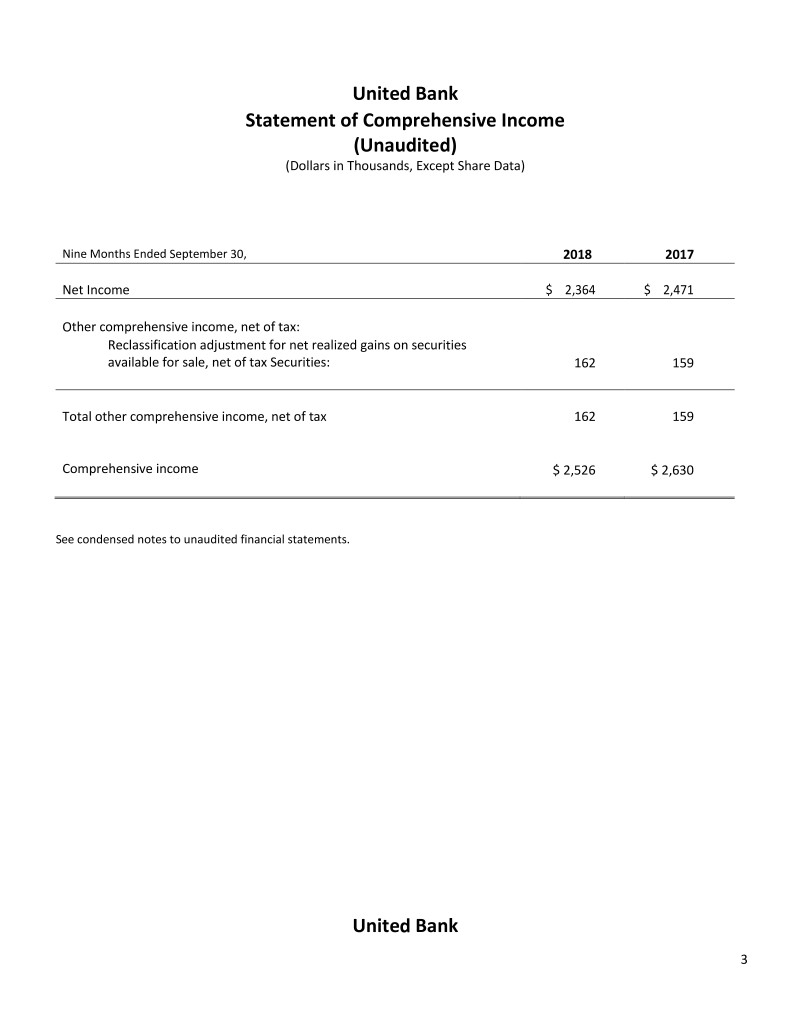

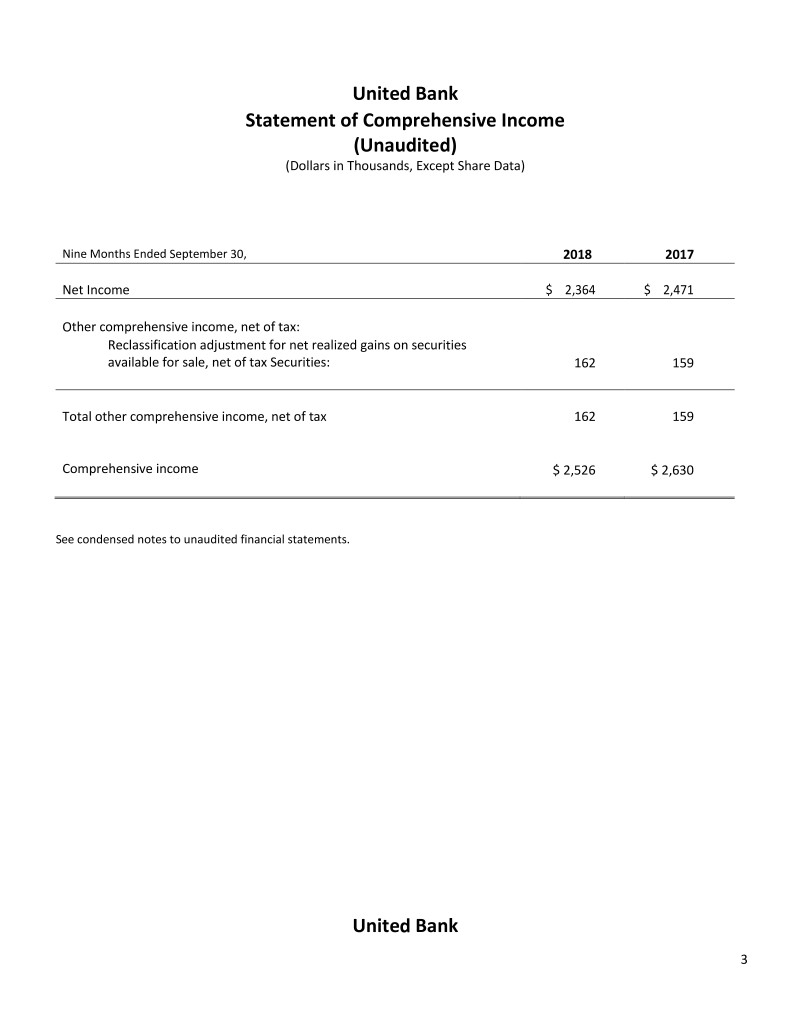

United Bank Statement of Comprehensive Income (Unaudited) (Dollars in Thousands, Except Share Data) Nine Months Ended September 30, 2018 2017 Net Income $ 2,364 $ 2,471 Other comprehensive income, net of tax: Reclassification adjustment for net realized gains on securities available for sale, net of tax Securities: 162 159 Total other comprehensive income, net of tax 162 159 Comprehensive income $ 2,526 $ 2,630 See condensed notes to unaudited financial statements. United Bank 3

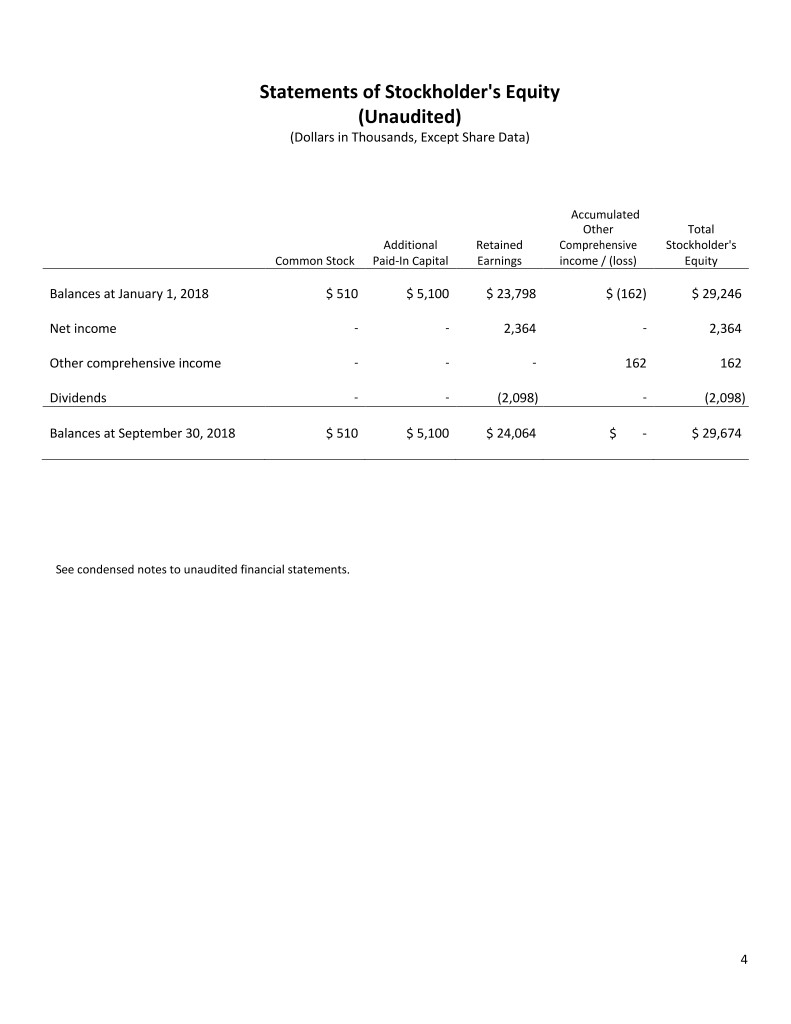

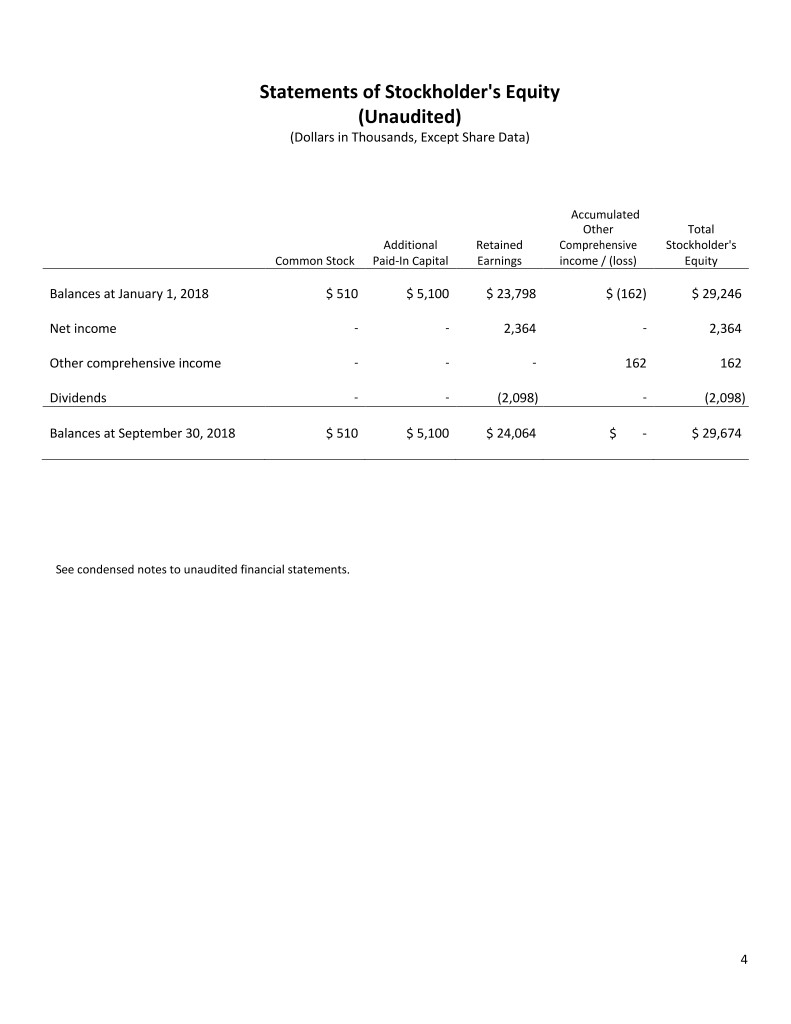

Statements of Stockholder's Equity (Unaudited) (Dollars in Thousands, Except Share Data) Accumulated Other Total Additional Retained Comprehensive Stockholder's Common Stock Paid-In Capital Earnings income / (loss) Equity Balances at January 1, 2018 $ 510 $ 5,100 $ 23,798 $ (162) $ 29,246 Net income - - 2,364 - 2,364 Other comprehensive income - - - 162 162 Dividends - - (2,098) - (2,098) Balances at September 30, 2018 $ 510 $ 5,100 $ 24,064 $ - $ 29,674 See condensed notes to unaudited financial statements. 4

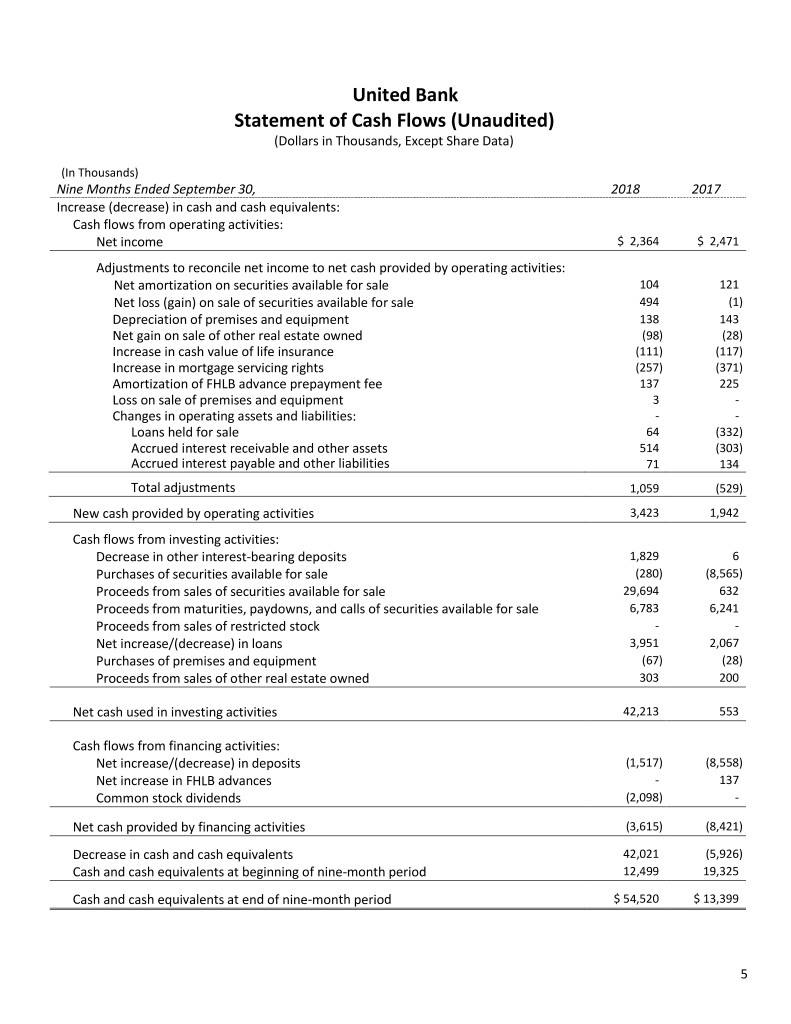

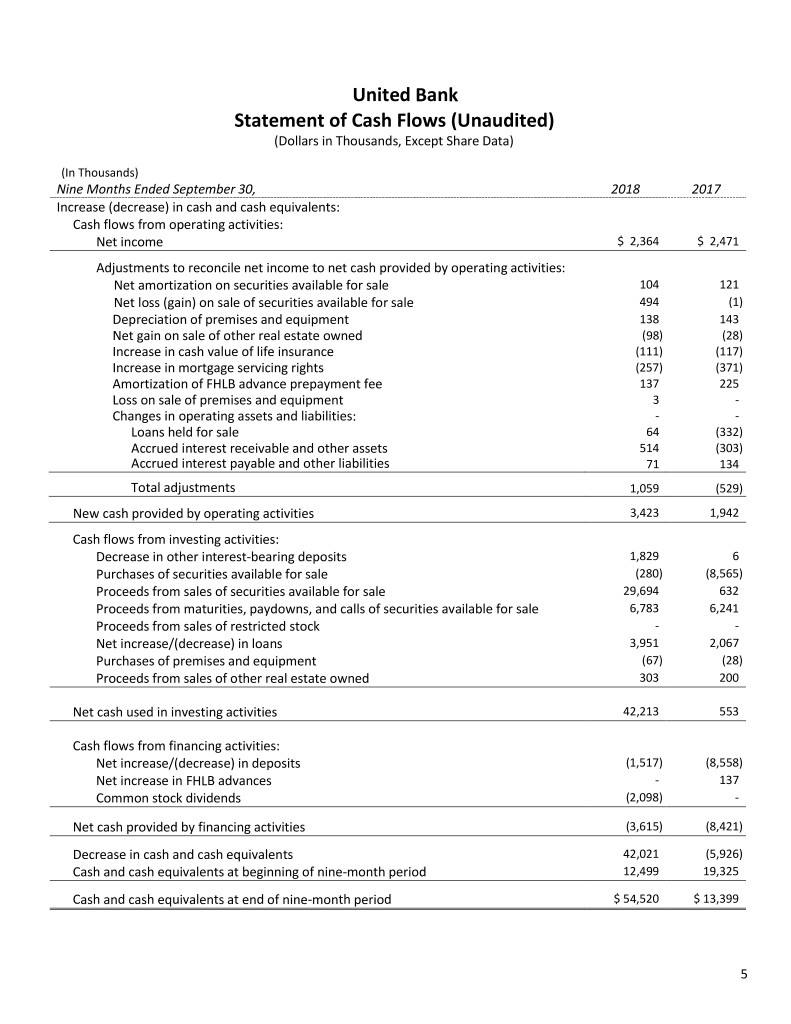

United Bank Statement of Cash Flows (Unaudited) (Dollars in Thousands, Except Share Data) (In Thousands) Nine Months Ended September 30, 2018 2017 Increase (decrease) in cash and cash equivalents: Cash flows from operating activities: Net income $ 2,364 $ 2,471 Adjustments to reconcile net income to net cash provided by operating activities: Net amortization on securities available for sale 104 121 Net loss (gain) on sale of securities available for sale 494 (1) Depreciation of premises and equipment 138 143 Net gain on sale of other real estate owned (98) (28) Increase in cash value of life insurance (111) (117) Increase in mortgage servicing rights (257) (371) Amortization of FHLB advance prepayment fee 137 225 Loss on sale of premises and equipment 3 - Changes in operating assets and liabilities: - - Loans held for sale 64 (332) Accrued interest receivable and other assets 514 (303) Accrued interest payable and other liabilities 71 134 Total adjustments 1,059 (529) New cash provided by operating activities 3,423 1,942 Cash flows from investing activities: Decrease in other interest-bearing deposits 1,829 6 Purchases of securities available for sale (280) (8,565) Proceeds from sales of securities available for sale 29,694 632 Proceeds from maturities, paydowns, and calls of securities available for sale 6,783 6,241 Proceeds from sales of restricted stock - - Net increase/(decrease) in loans 3,951 2,067 Purchases of premises and equipment (67) (28) Proceeds from sales of other real estate owned 303 200 Net cash used in investing activities 42,213 553 Cash flows from financing activities: Net increase/(decrease) in deposits (1,517) (8,558) Net increase in FHLB advances - 137 Common stock dividends (2,098) - Net cash provided by financing activities (3,615) (8,421) Decrease in cash and cash equivalents 42,021 (5,926) Cash and cash equivalents at beginning of nine-month period 12,499 19,325 Cash and cash equivalents at end of nine-month period $ 54,520 $ 13,399 5

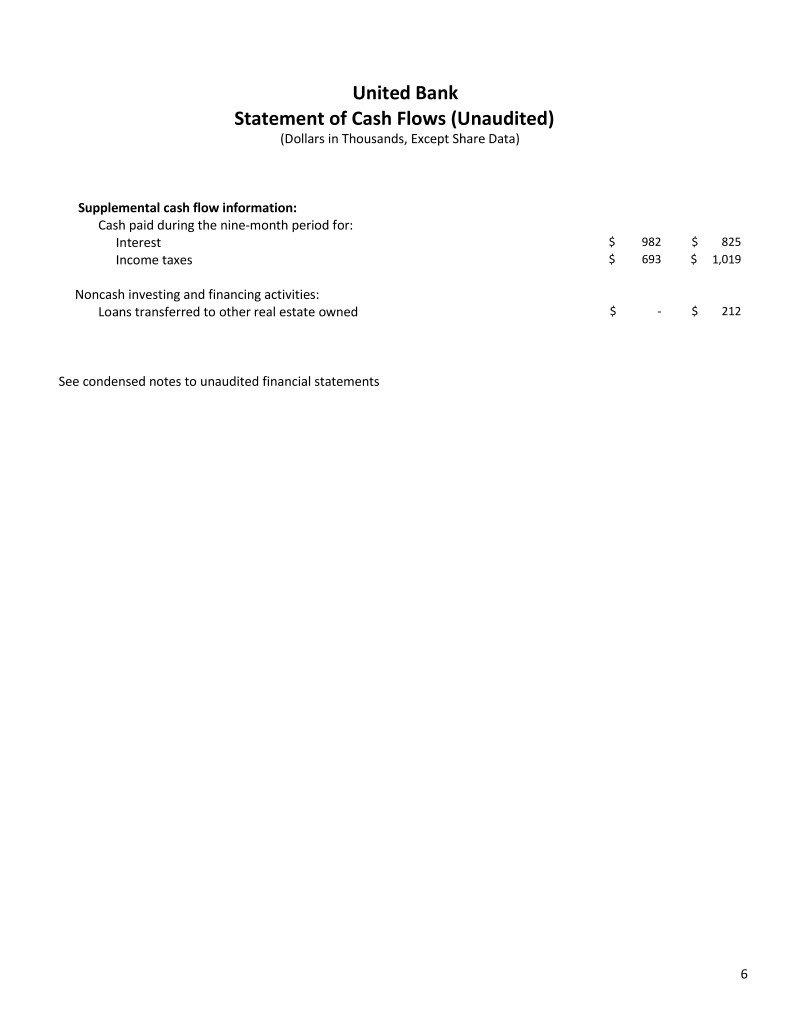

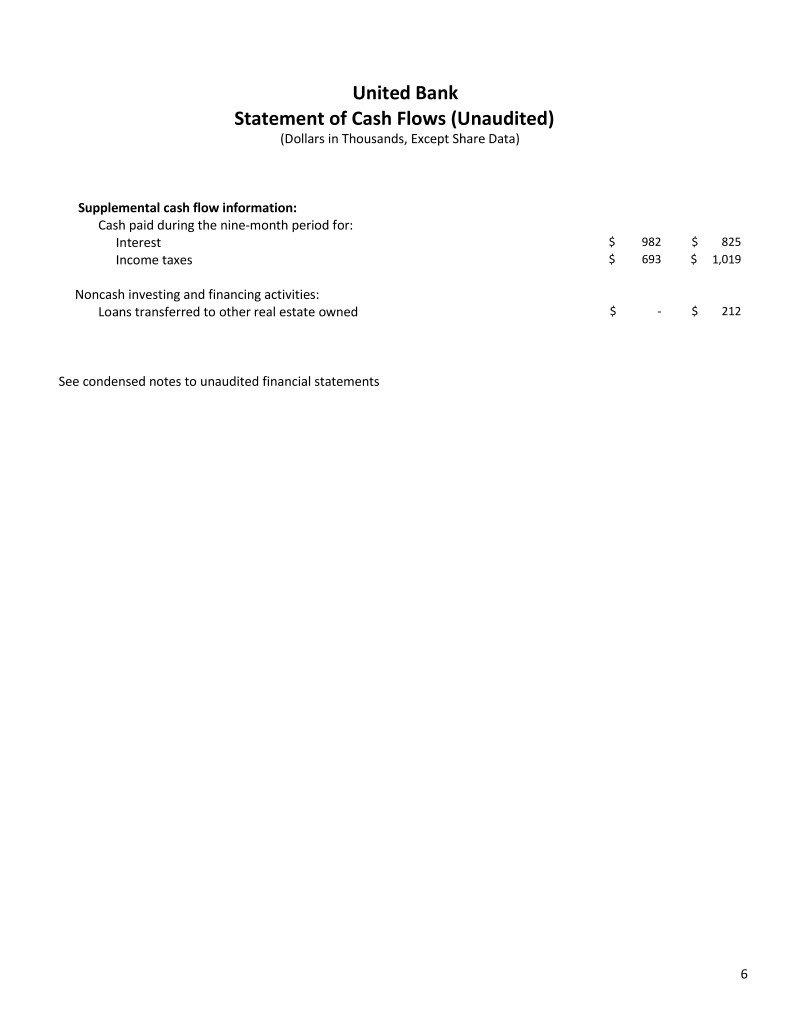

United Bank Statement of Cash Flows (Unaudited) (Dollars in Thousands, Except Share Data) Supplemental cash flow information: Cash paid during the nine-month period for: Interest $ 982 $ 825 Income taxes $ 693 $ 1,019 Noncash investing and financing activities: Loans transferred to other real estate owned $ - $ 212 See condensed notes to unaudited financial statements 6

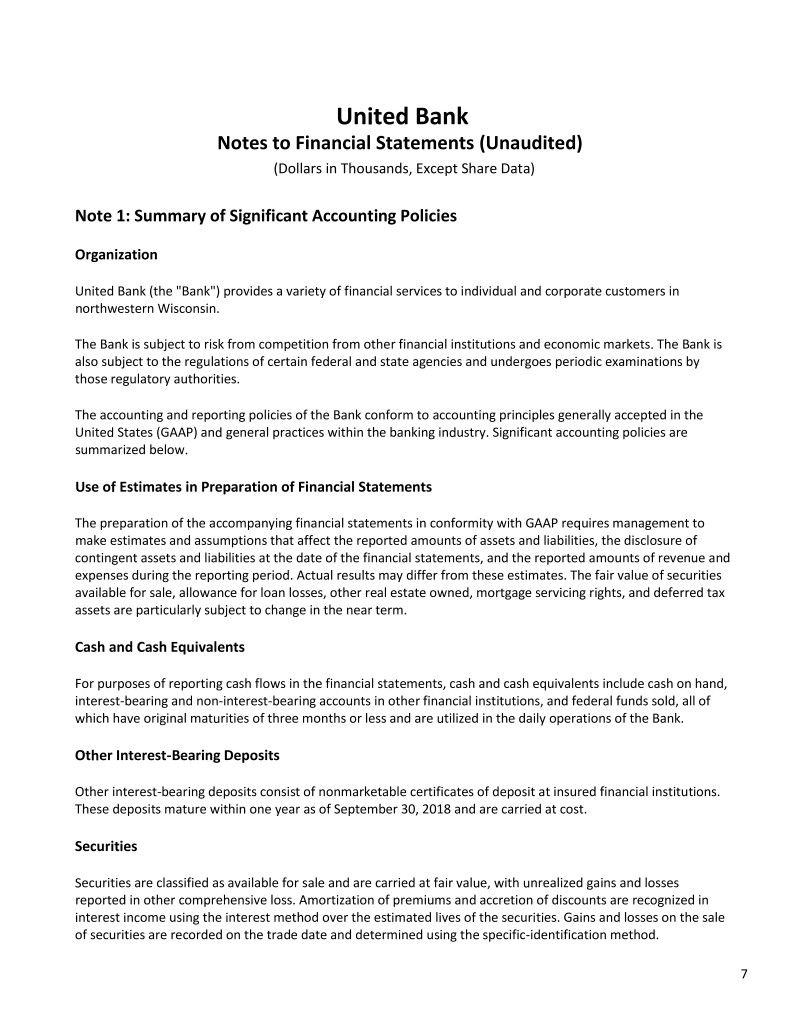

United Bank Notes to Financial Statements (Unaudited) (Dollars in Thousands, Except Share Data) Note 1: Summary of Significant Accounting Policies Organization United Bank (the "Bank") provides a variety of financial services to individual and corporate customers in northwestern Wisconsin. The Bank is subject to risk from competition from other financial institutions and economic markets. The Bank is also subject to the regulations of certain federal and state agencies and undergoes periodic examinations by those regulatory authorities. The accounting and reporting policies of the Bank conform to accounting principles generally accepted in the United States (GAAP) and general practices within the banking industry. Significant accounting policies are summarized below. Use of Estimates in Preparation of Financial Statements The preparation of the accompanying financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities, the disclosure of contingent assets and liabilities at the date of the financial statements, and the reported amounts of revenue and expenses during the reporting period. Actual results may differ from these estimates. The fair value of securities available for sale, allowance for loan losses, other real estate owned, mortgage servicing rights, and deferred tax assets are particularly subject to change in the near term. Cash and Cash Equivalents For purposes of reporting cash flows in the financial statements, cash and cash equivalents include cash on hand, interest-bearing and non-interest-bearing accounts in other financial institutions, and federal funds sold, all of which have original maturities of three months or less and are utilized in the daily operations of the Bank. Other Interest-Bearing Deposits Other interest-bearing deposits consist of nonmarketable certificates of deposit at insured financial institutions. These deposits mature within one year as of September 30, 2018 and are carried at cost. Securities Securities are classified as available for sale and are carried at fair value, with unrealized gains and losses reported in other comprehensive loss. Amortization of premiums and accretion of discounts are recognized in interest income using the interest method over the estimated lives of the securities. Gains and losses on the sale of securities are recorded on the trade date and determined using the specific-identification method. 7

United Bank Notes to Financial Statements (Unaudited) (Dollars in Thousands, Except Share Data) Note 1: Summary of Significant Accounting Policies (Continued) Securities (Continued) Declines in fair value of securities that are deemed to be other than temporary, if applicable, are reflected in earnings as realized losses. In estimating other-than-temporary impairment losses, management considers the length of time and the extent to which fair value has been less than cost, the financial condition and near-term prospects of the issuer, and the intent and ability of the Bank to retain its investment in the issuer for a period of time sufficient to allow for any anticipated recovery in fair value. Restricted Stock Restricted stock consists of Federal Home Loan Bank (FHLB) stock, Farmer Mac stock, and Bankers' Bank stock. The stock is carried at cost which approximates fair value. The Bank is required to hold the stock as a member of these institutions, and transfer of the stock is substantially restricted. The FHLB stock is pledged as collateral for outstanding FHLB advances. Restricted stock is evaluated for impairment on a periodic basis. Loans Held for Sale Loans originated and intended for sale in the secondary market are carried at the lower of cost or estimated fair value in the aggregate. Net unrealized losses, if any, are recognized through a valuation allowance by charges to income. Realized gains and losses on the sale of loans held for sale are determined using the specific- identification method. Loans Loans that management has the intent and ability to hold for the foreseeable future or until maturity or payoff generally are reported at their outstanding unpaid principal balances adjusted for charge-offs and an allowance for loan losses. Interest on loans is accrued and credited to income based on the unpaid principal balance. Loan- origination fees and direct origination costs are recognized as income or expense when received or incurred since capitalization of these fees and costs would not have a significant impact on the financial statements. The accrual of interest on a loan is discontinued when management believes the borrower will be unable to make payments as they become due. When loans are placed on nonaccrual status or charged off, all unpaid accrued interest is reversed against interest income. The interest on these loans is subsequently accounted for on the cash basis or using the cost-recovery method until qualifying for return to accrual. Loans are returned to accrual status when all the principal and interest amounts contractually due are brought current and future payments are reasonably assured. 8

United Bank Notes to Financial Statements (Unaudited) (Dollars in Thousands, Except Share Data) Note 1: Summary of Significant Accounting Policies (Continued) Allowance for Loan Losses The allowance for loan losses is a valuation allowance for probable incurred credit losses. Loan losses are charged against the allowance when management believes the uncollectability of a loan balance is confirmed. Subsequent recoveries, if any, are credited to the allowance. Management estimates the allowance balance required using past loan loss experience, the nature and volume of the portfolio, information about specific borrower situations and estimated collateral values, economic conditions, and other factors. Allocations of the allowance may be made for specific loans, but the entire allowance is available for any loan that, in management's judgment, should be charged off. The allowance consists of specific and general components. The specific component relates to loans that are individually classified as impaired. A loan is impaired when, based on current information and events, it is probable that the Bank will be unable to collect all amounts due according to the contractual terms of the loan agreement. Loans for which the terms have been modified resulting in a concession, and for which the borrower is experiencing financial difficulties, are considered troubled debt restructurings (TDRs) and classified as impaired. Factors considered by management in determining impairment include payment status, collateral value, and the probability of collecting scheduled principal and interest payments when due. Loans that experience insignificant payment delays and payment shortfalls generally are not classified as impaired. Management determines the significance of payment delays and payment shortfalls on a case-by-case basis, taking into consideration all of the circumstances surrounding the loan and the borrower, including the length of the delay, the reasons for the delay, the borrower's prior payment record, and the amount of the shortfall in relation to the principal and interest owed. If a loan is impaired, a portion of the allowance is allocated so that the loan net of the specific allocation equals the present value of estimated future cash flows using the loan’s existing rate or the fair value of underlying collateral less applicable estimated selling costs if repayment is expected solely from the collateral. TDRs are individually evaluated for impairment and included in the separately identified impairment disclosures. TDRs are measured at the present value of estimated future cash flows using the loan’s original effective rate. If a TDR is considered to be a collateral dependent loan, the loan is measured at the fair value of the collateral less applicable estimated selling costs. For TDRs that subsequently default, the Bank determines the amount of the allowance on that loan in accordance with the accounting policy for the allowance for loan losses on loans individually identified as impaired. The general component covers loans that are collectively evaluated for impairment. Large groups of smaller balance homogeneous loans, such as consumer and residential real estate loans, are collectively evaluated for impairment. The general allowance component also includes loans that are not individually identified for impairment evaluation, such as commercial loans below the individual evaluation threshold, as well as those loans that are individually evaluated but are not considered impaired. 9

United Bank Notes to Financial Statements (Unaudited) (Dollars in Thousands, Except Share Data) Note 1: Summary of Significant Accounting Policies (Continued) Allowance for Loan Losses (Continued) The general component is based on historical loss experience adjusted for current qualitative factors. The historical loss experience is determined by loan class and is based on the actual loss history experienced by the Bank. This actual loss experience is supplemented with other qualitative factors based on the risks present for loan class. These qualitative factors include: levels of and trends in delinquencies and impaired loans; levels of and trends in charge-offs and recoveries; trends in volume and terms of loans; effects of any changes in risk selection and underwriting standards; other changes in lending policies, procedures, and practices; experience, ability, and depth of lending management and other relevant staff; national and local economic trends and conditions; industry conditions; and effects of changes in credit concentrations. Management considers the following when assessing risk in the Bank's loan portfolio: Commercial and industrial and agricultural production loans are primarily for working capital, physical asset expansion, asset acquisition loans, and other. These loans are made based primarily on historical and projected cash flow of the borrower and secondarily on the underlying collateral provided by the borrower. The cash flows of borrowers, however, may not behave as forecasted and collateral securing loans may fluctuate in value due to economic or individual performance factors. Financial information is obtained from the borrowers to evaluate cash flows sufficiency to service debt and are periodically updated during the life of the loan. Commercial real estate and agricultural real estate loans are dependent on the industries tied to these loans. Commercial real estate loans are primarily secured by office and industrial buildings, warehouses, small retail shopping facilities, and various special purpose properties, including hotels and restaurants. Agricultural loans are primarily for land acquisition. Financial information is obtained from the borrowers and/or the individual project to evaluate cash flows sufficiency to service debt and is periodically updated during the life of the loan. Loan performance may be adversely affected by factors impacting the general economy or conditions specific to the real estate market such as geographic location and/or property type. Residential real estate loans are affected by the local residential real estate market, the local economy, and, for variable rate mortgages, movement in indices tied to these loans. At the time of origination, the Bank evaluates the borrower's repayment ability through a review of debt to income and credit scores. Appraisals are obtained to support the loan amount. Financial information is obtained from the borrowers to evaluate cash flows sufficiency to service debt at the time of origination. Consumer and other loans may take the form of installment loans, demand loans, or single payment loans and are extended to individuals for household, family, and other personal expenditures. At the time of origination, the Bank evaluates the borrower's repayment ability through a review of debt to income and credit scores. 10

United Bank Notes to Financial Statements (Unaudited) (Dollars in Thousands, Except Share Data) Note 1: Summary of Significant Accounting Policies (Continued) Premises and Equipment Premises and equipment are stated at cost less accumulated depreciation computed on the straight-line method over the estimated useful lives of the assets. Other Real Estate Owned Assets acquired through, or in lieu of, loan foreclosure are held for sale and are initially recorded at fair value, less costs to sell, at the date of foreclosure, establishing a new cost basis. Subsequent to foreclosure, valuations are periodically performed by management, and the assets are carried at the lower of carrying amount or fair value less cost to sell. Revenue and expenses from operations and changes in the valuation allowance are included in other noninterest expense. Cash Value of Life Insurance The Bank has purchased life insurance policies on certain key executives. Life insurance is measured at the amount that could be realized under the insurance contract as of the balance sheet date, which generally is the cash surrender value of the policy. Mortgage Servicing Rights The Bank services mortgage loans it sells to third-party institutions. Servicing loans includes collecting monthly principal and interest payments from borrowers, passing such payments through to the third-party investors, and maintaining escrow accounts for taxes and insurance. When necessary, the Bank also performs collection functions for delinquent loan payments, handles loan foreclosure proceedings, and disposes of foreclosed property. The Bank generally earns a servicing fee of 25 basis points on the outstanding loan balance for performing these services as well as fees and interest income from ancillary sources, such as late fees and float. Servicing fees, late fees, and other ancillary income earned each year are reported in the statement of income as a component of mortgage banking activities. Mortgage servicing rights are recognized as assets when mortgage loans are sold or when servicing rights are acquired. Mortgage servicing rights recognized when mortgage loans are sold are included as a component of mortgage banking activities and are measured at fair value at acquisition and at each subsequent reporting date. The fair value of mortgage servicing rights is estimated using market prices for comparable contracts, when available, or a valuation model that calculates the present value of estimated future net servicing income. The valuation model incorporates assumptions that market participants would use in estimating future net servicing income, such as costs to service, a discount rate, custodial earnings rate, ancillary income, default rates and losses, and prepayment speeds. The fair value of mortgage servicing rights may change due to changes in discount rates, prepayment expectations, default rates, and other factors. Changes in fair value are recognized each period and reported in the statement of income as a component of mortgage banking activities. 11

United Bank Notes to Financial Statements (Unaudited) (Dollars in Thousands, Except Share Data) Note 1: Summary of Significant Accounting Policies (Continued) Other Comprehensive Income (Loss) Other comprehensive income (loss) is shown on the statement of comprehensive income. The Bank's accumulated other comprehensive loss consists of unrealized gain (loss) on securities available for sale, net of tax, and is shown on the statement of stockholder's equity. Reclassification adjustments out of other comprehensive income (loss) for gains realized on sales of securities available for sale comprise the entire balance of "Net gain on sale of securities available for sale" on the statement of income. Advertising Advertising costs are expensed as incurred. Income Taxes Deferred tax assets and liabilities have been determined using the liability method. Deferred tax assets and liabilities are determined based on the difference between the financial statements and tax bases of assets and liabilities as measured by the current enacted tax rates that will be in effect when these differences are expected to reverse. Provision (credit) for deferred taxes is the result of changes in the deferred tax assets and liabilities. Deferred tax assets are reduced by a valuation allowance when, in the opinion of management, it is more likely than not that some portion or all of the deferred tax assets will not be realized in the near future. The Bank may also recognize a liability for unrecognized tax benefits from uncertain tax positions. Unrecognized tax benefits represent the differences between a tax position taken or expected to be taken in a tax return and the benefit recognized and measured in the financial statements. Interest and penalties related to unrecognized tax benefits are classified as interest expense and other expense, respectively. With few exceptions, the Bank is no longer subject to federal or state examination by tax authorities for years ended before December 31, 2014. Rate Lock Commitments The Bank enters into commitments to originate loans whereby the interest rate on the loan is determined prior to funding (rate lock commitments). Rate lock commitments on mortgage loans that are intended to be sold are considered to be derivatives. Rate lock commitments are recorded only to the extent of fees received since recording the estimated fair value of these commitments would not have a significant impact on the financial statements. Off-Balance-Sheet Instruments In the ordinary course of business, the Bank has entered into off-balance-sheet financial instruments, including commitments to extend credit, unfunded commitments under lines of credit, credit card commitments, and standby letters of credit. Such financial instruments are recorded in the financial statements when they become payable. 12

United Bank Notes to Financial Statements (Unaudited) (Dollars in Thousands, Except Share Data) Note 1: Summary of Significant Accounting Policies (Continued) Transfers of Financial Assets Transfers of financial assets are accounted for as sales when control over the assets has been relinquished. Control over transferred assets is deemed to be surrendered when the assets have been isolated from the Bank, the transferee obtains the right (free of conditions that constrain it from taking advantage of that right) to pledge or exchange the transferred assets, and the Bank does not maintain effective control over the transferred assets through an agreement to repurchase them before their maturity. Legal Contingencies Various legal claims arise from time to time in the normal course of business. In the opinion of management, any liability resulting from such proceedings would not have a material impact on the financial statements of the Bank. Concentration of Credit Risk Most of the Bank's loans and off-balance-sheet commitments have been granted to borrowers in the Bank's market area. The concentrations of credit by type and industry groups are set forth in Notes 5 and 15. The Bank's exposure to credit risk is significantly affected by economic changes in the Bank's market area. New Accounting Pronouncements The following Accounting Standards Updates (ASU) have been issued by the Financial Accounting Standards Board (FASB) and may impact the Bank's financial statements in future reporting periods. ASU No. 2014-09, Revenue from Contracts with Customers - The objective of this new standard is to provide a common revenue standard for all entities that enter into contracts with customers to transfer goods or services or contracts to transfer nonfinancial assets. This new accounting standard is effective for financial statements issued for annual reporting periods beginning after December 15, 2018. The Bank is evaluating what impact this new standard will have on its financial statements. ASU No. 2016-01, Recognition and Measurement of Financial Assets and Financial Liabilities - This standard makes a number of changes to the recognition and measurement standards of financial instruments, including the following changes: 1) equity securities with a readily determinable fair value will have to be measured at fair value with changes in fair value recognized in net income; and 2) entities that are not public business entities will no longer be required to disclose the fair value of financial instruments measured at amortized cost. This new standard is effective for financial statements issued for annual periods beginning after December 15, 2018. However, the Bank is permitted to adopt and has adopted the provision in the standard eliminating the requirement to disclose the fair value of financial instruments measured at amortized cost. As a result, the financial statements for the year ended September 30, 2018 does not disclose the fair value of financial instruments measured at amortized cost. The Bank does not believe the adoption of the remainder of the standard will have a significant impact on its financial statements. 13

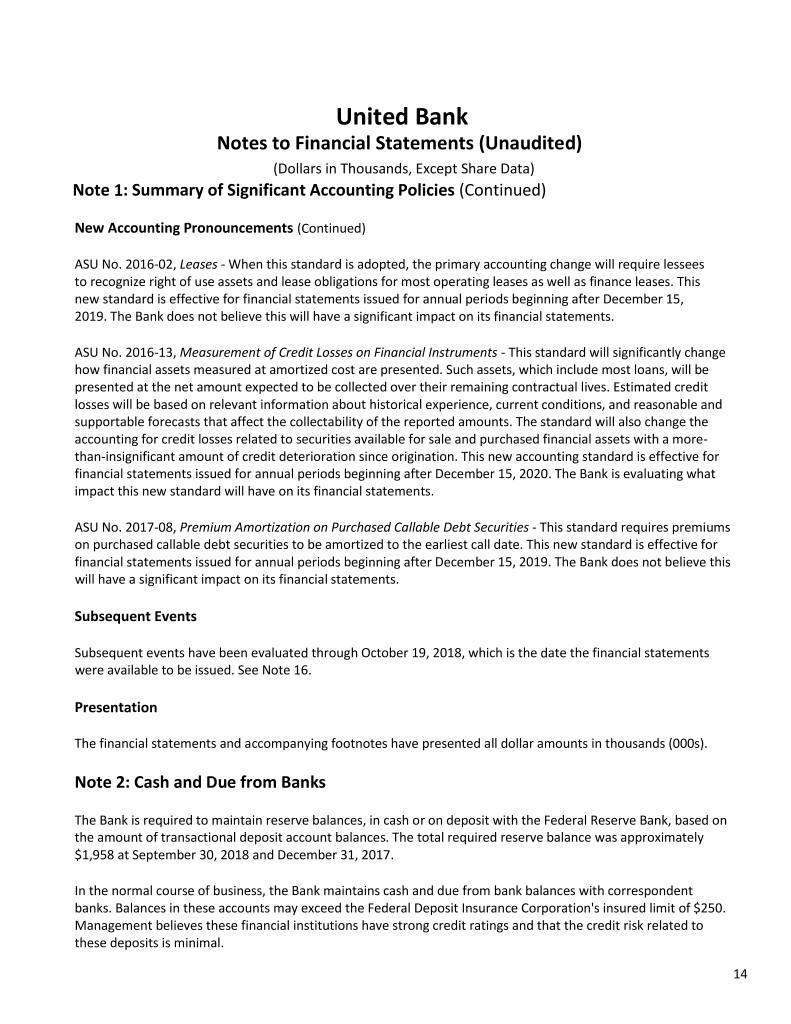

United Bank Notes to Financial Statements (Unaudited) (Dollars in Thousands, Except Share Data) Note 1: Summary of Significant Accounting Policies (Continued) New Accounting Pronouncements (Continued) ASU No. 2016-02, Leases - When this standard is adopted, the primary accounting change will require lessees to recognize right of use assets and lease obligations for most operating leases as well as finance leases. This new standard is effective for financial statements issued for annual periods beginning after December 15, 2019. The Bank does not believe this will have a significant impact on its financial statements. ASU No. 2016-13, Measurement of Credit Losses on Financial Instruments - This standard will significantly change how financial assets measured at amortized cost are presented. Such assets, which include most loans, will be presented at the net amount expected to be collected over their remaining contractual lives. Estimated credit losses will be based on relevant information about historical experience, current conditions, and reasonable and supportable forecasts that affect the collectability of the reported amounts. The standard will also change the accounting for credit losses related to securities available for sale and purchased financial assets with a more- than-insignificant amount of credit deterioration since origination. This new accounting standard is effective for financial statements issued for annual periods beginning after December 15, 2020. The Bank is evaluating what impact this new standard will have on its financial statements. ASU No. 2017-08, Premium Amortization on Purchased Callable Debt Securities - This standard requires premiums on purchased callable debt securities to be amortized to the earliest call date. This new standard is effective for financial statements issued for annual periods beginning after December 15, 2019. The Bank does not believe this will have a significant impact on its financial statements. Subsequent Events Subsequent events have been evaluated through October 19, 2018, which is the date the financial statements were available to be issued. See Note 16. Presentation The financial statements and accompanying footnotes have presented all dollar amounts in thousands (000s). Note 2: Cash and Due from Banks The Bank is required to maintain reserve balances, in cash or on deposit with the Federal Reserve Bank, based on the amount of transactional deposit account balances. The total required reserve balance was approximately $1,958 at September 30, 2018 and December 31, 2017. In the normal course of business, the Bank maintains cash and due from bank balances with correspondent banks. Balances in these accounts may exceed the Federal Deposit Insurance Corporation's insured limit of $250. Management believes these financial institutions have strong credit ratings and that the credit risk related to these deposits is minimal. 14

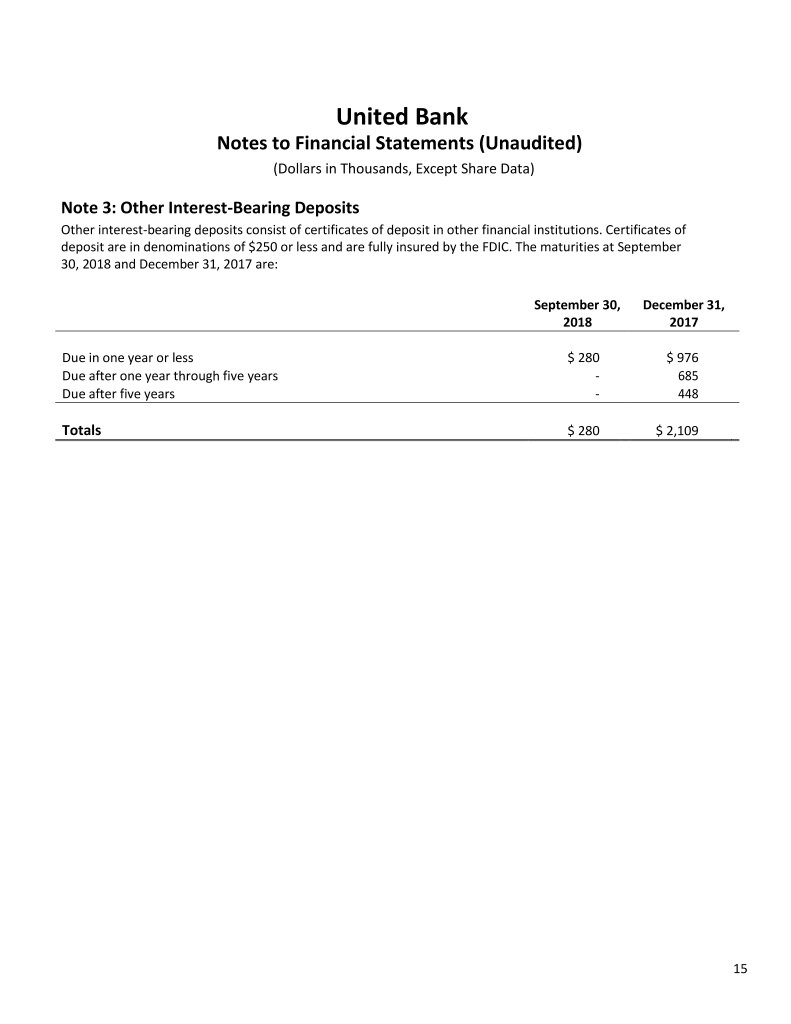

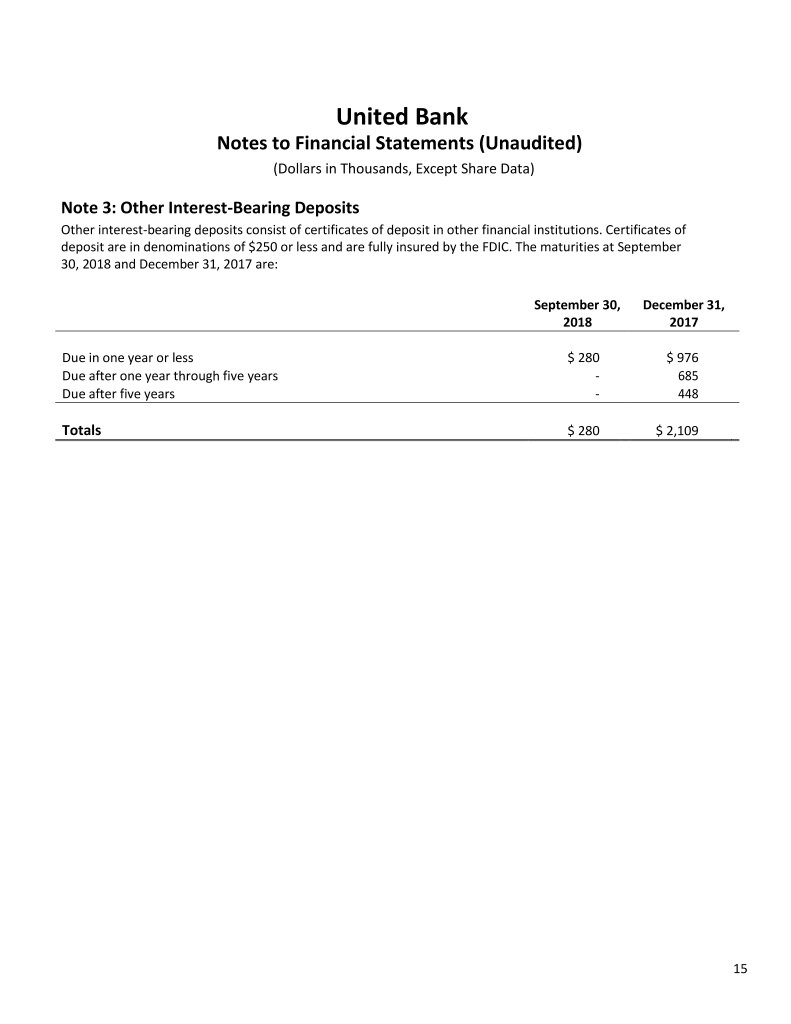

United Bank Notes to Financial Statements (Unaudited) (Dollars in Thousands, Except Share Data) Note 3: Other Interest-Bearing Deposits Other interest-bearing deposits consist of certificates of deposit in other financial institutions. Certificates of deposit are in denominations of $250 or less and are fully insured by the FDIC. The maturities at September 30, 2018 and December 31, 2017 are: September 30, December 31, 2018 2017 Due in one year or less $ 280 $ 976 Due after one year through five years - 685 Due after five years - 448 Totals $ 280 $ 2,109 15

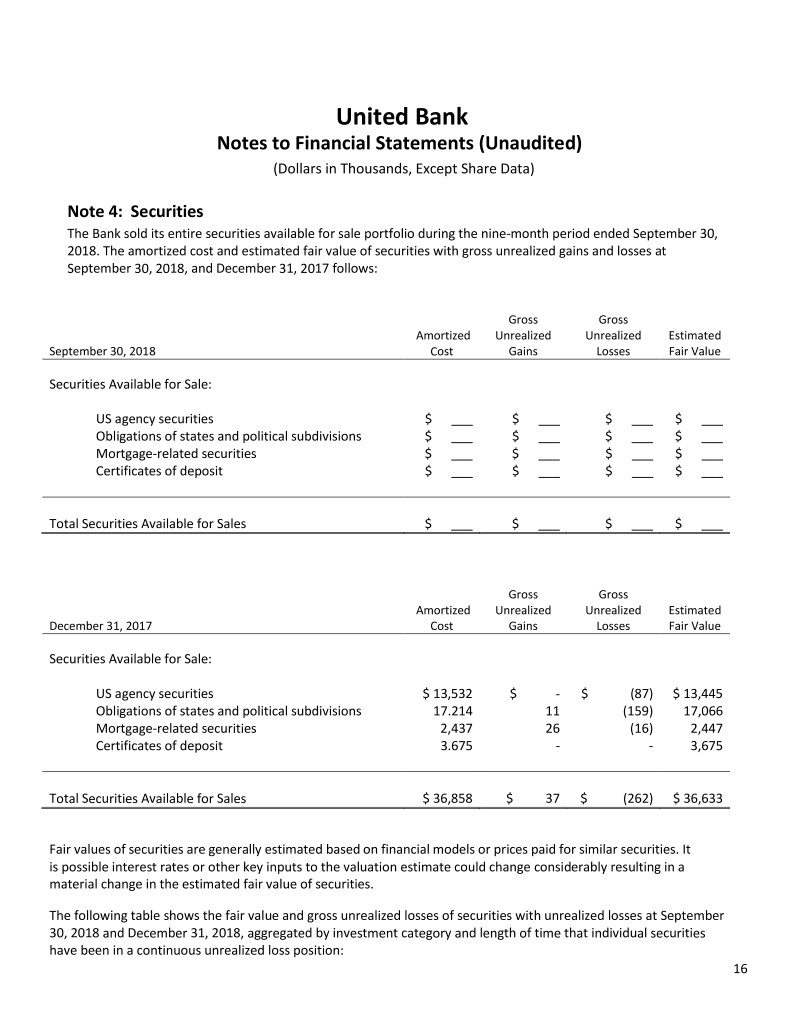

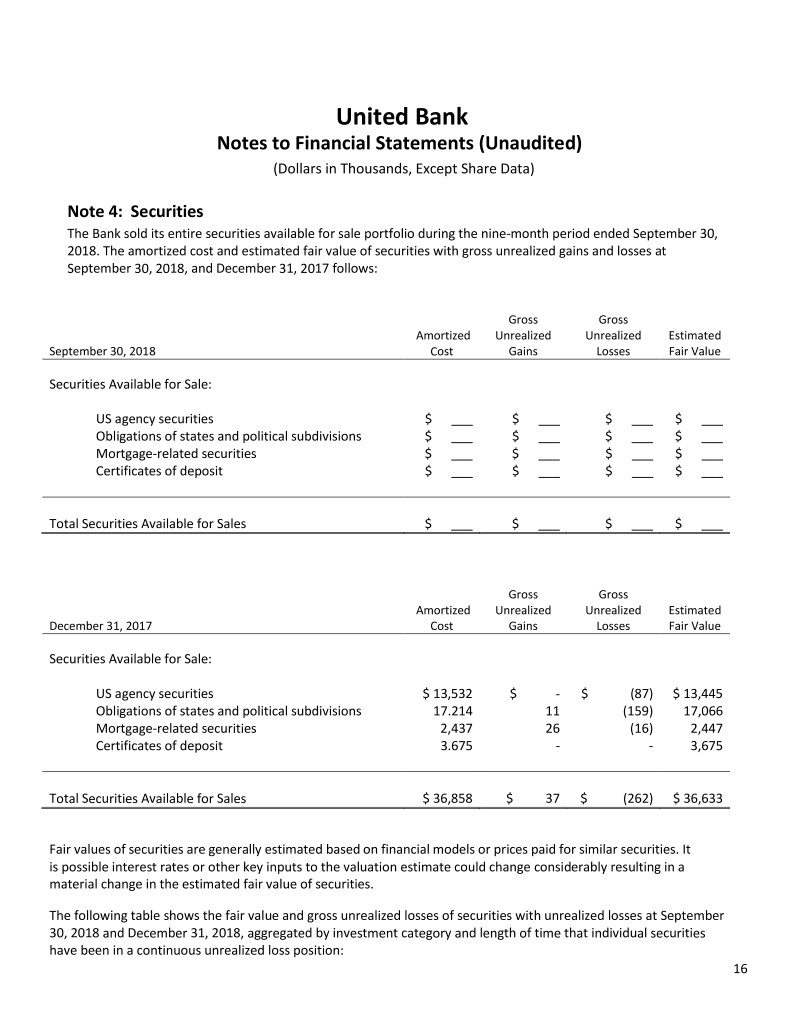

United Bank Notes to Financial Statements (Unaudited) (Dollars in Thousands, Except Share Data) Note 4: Securities The Bank sold its entire securities available for sale portfolio during the nine-month period ended September 30, 2018. The amortized cost and estimated fair value of securities with gross unrealized gains and losses at September 30, 2018, and December 31, 2017 follows: Gross Gross Amortized Unrealized Unrealized Estimated September 30, 2018 Cost Gains Losses Fair Value Securities Available for Sale: US agency securities $ ___ $ ___ $ ___ $ ___ Obligations of states and political subdivisions $ ___ $ ___ $ ___ $ ___ Mortgage-related securities $ ___ $ ___ $ ___ $ ___ Certificates of deposit $ ___ $ ___ $ ___ $ ___ Total Securities Available for Sales $ ___ $ ___ $ ___ $ ___ Gross Gross Amortized Unrealized Unrealized Estimated December 31, 2017 Cost Gains Losses Fair Value Securities Available for Sale: US agency securities $ 13,532 $ - $ (87) $ 13,445 Obligations of states and political subdivisions 17.214 11 (159) 17,066 Mortgage-related securities 2,437 26 (16) 2,447 Certificates of deposit 3.675 - - 3,675 Total Securities Available for Sales $ 36,858 $ 37 $ (262) $ 36,633 Fair values of securities are generally estimated based on financial models or prices paid for similar securities. It is possible interest rates or other key inputs to the valuation estimate could change considerably resulting in a material change in the estimated fair value of securities. The following table shows the fair value and gross unrealized losses of securities with unrealized losses at September 30, 2018 and December 31, 2018, aggregated by investment category and length of time that individual securities have been in a continuous unrealized loss position: 16

United Bank Notes to Financial Statements (Unaudited) (Dollars in Thousands, Except Share Data) Note 4: Securities (Continued) Less Than 12 Months 12 Months or More Total Fair Unrealized Fair Unrealized Unrealized September 30, 2018 Value Losses Value Losses Fair Value Losses US agency securities $ ___ $ ___ $ ___ $ ___ $ ___ $ ___ Obligations of states and political subdivisions $ ___ $ ___ $ ___ $ ___ $ ___ $ ___ Mortgage-related securities $ ___ $ ___ $ ___ $ ___ $ ___ $ ___ Totals $ ___ $ ___ $ ___ $ ___ $ ___ $ ___ Less Than 12 Months 12 Months or More Total Fair Unrealized Fair Unrealized Fair Unrealized December 31, 2017 Value Losses Value Losses Value Losses US agency securities $ 10,965 $ (65) $2,480 $ (22) $13,445 $ (87) Obligations of states and political subdivisions 12,545 (102) 2,914 (57) 15,459 (159) Mortgage-related securities 1,629 (16) - - 1,629 (16) Totals $25,139 $ (183) $ 5,394 $ (79) $30,533 $ (262) At September 30, 2017, 54 debt securities have unrealized losses. These unrealized losses relate principally to the changes in interest rates and are not due to changes in the financial condition of the issuer, the quality of any underlying assets, or applicable credit enhancements. In analyzing whether unrealized losses on debt securities are other than temporary, management considers whether the securities are issued by a government body or agency, whether a rating agency has downgraded the securities, industry analysts' reports, the financial condition and performance of the issuer, and the quality of any underlying assets or credit enhancements. Since management has the ability to hold debt securities for the foreseeable future, no declines are deemed to be other than temporary. The following is a summary of amortized cost and estimated fair value of debt securities by contractual maturity as of September 30, 2018 and December 31, 2017. Contractual maturities will differ from expected maturities for mortgage-related securities because borrowers may have the right to call or prepay obligations without penalties. 17

United Bank Notes to Financial Statements (Unaudited) (Dollars in Thousands, Except Share Data) Note 4: Securities (Continued) September 30, 2018 Available for Sale Amortized Estimated (In Thousands) Cost Fair Value Due in One Year or Less $ ___ $ ___ Due After One Year Through Five Years $ ___ $ ___ Due After Five Years Through Ten Years $ ___ $ ___ Subtotals $ ___ $ ___ Mortgage-related securities $ ___ $ ___ Totals $ ___ $ ___ December 31, 2017 Available for Sale Amortized Estimated Cost Fair Value Due in One Year or Less $ 6,658 $ 6,638 Due After One Year Through Five Years 26,138 25,934 Due After Five Years Through Ten Years 1,625 1,614 Subtotals $ 34,421 $34,186 Mortgage-related securities 2,437 2,447 Totals $ 36,858 $ 36,633 18

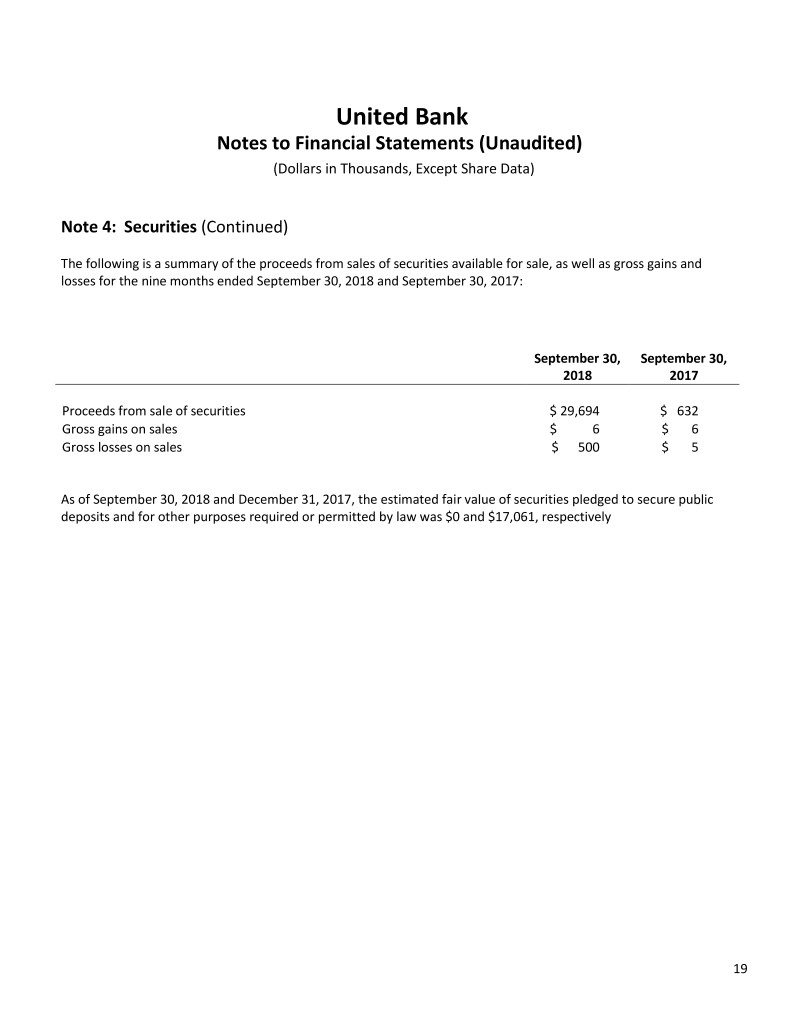

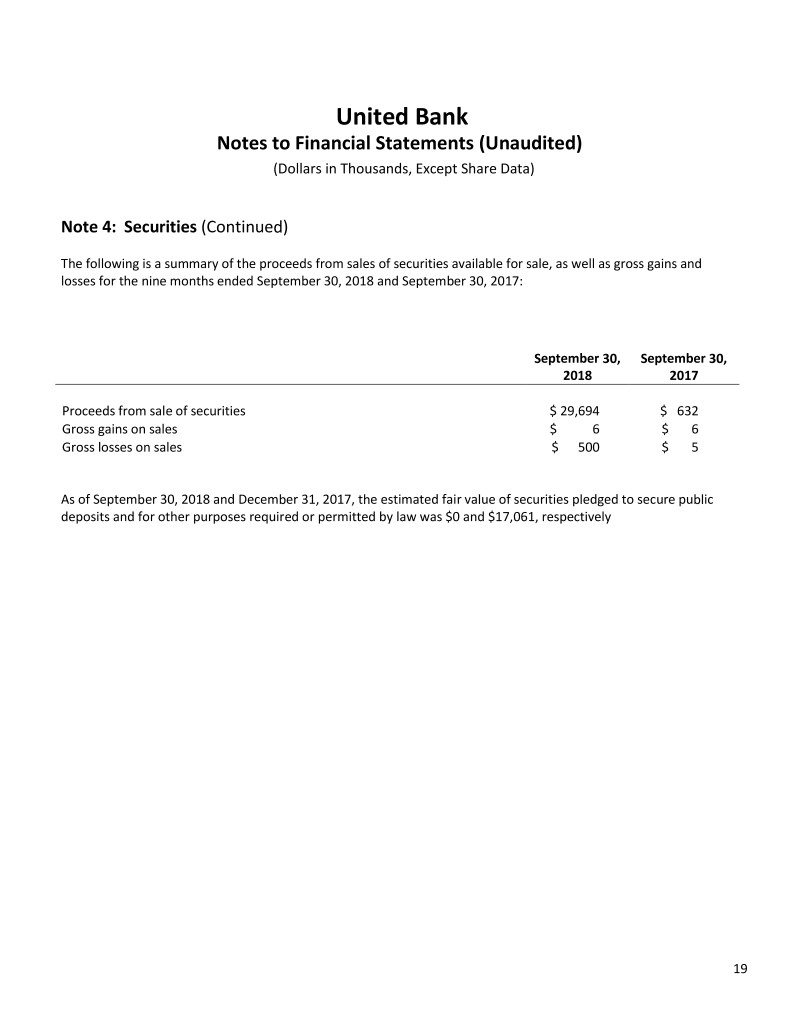

United Bank Notes to Financial Statements (Unaudited) (Dollars in Thousands, Except Share Data) Note 4: Securities (Continued) The following is a summary of the proceeds from sales of securities available for sale, as well as gross gains and losses for the nine months ended September 30, 2018 and September 30, 2017: September 30, September 30, 2018 2017 Proceeds from sale of securities $ 29,694 $ 632 Gross gains on sales $ 6 $ 6 Gross losses on sales $ 500 $ 5 As of September 30, 2018 and December 31, 2017, the estimated fair value of securities pledged to secure public deposits and for other purposes required or permitted by law was $0 and $17,061, respectively 19

United Bank Notes to Financial Statements (Unaudited) (Dollars in Thousands, Except Share Data) Note 5: Loans The following table presents total loans at September 30, 2018 and December 31, 2017, by portfolio segment and class of loan: September 30, December 31, 2018 2017 Commercial: Commercial and industrial $ 28,986 $ 22,688 Commercial real estate 103,569 116,079 Agricultural production 9,930 9,285 Agricultural real estate 15,732 9,604 Residential real estate 42,369 47,178 Consumer 2,556 2,271 Subtotal 203,142 207,105 Allowance for loan losses (2,049) (2,061) Loans, net $ 201,093 $ 205,044 Activity in the allowance for loan losses by loan class follows. 20

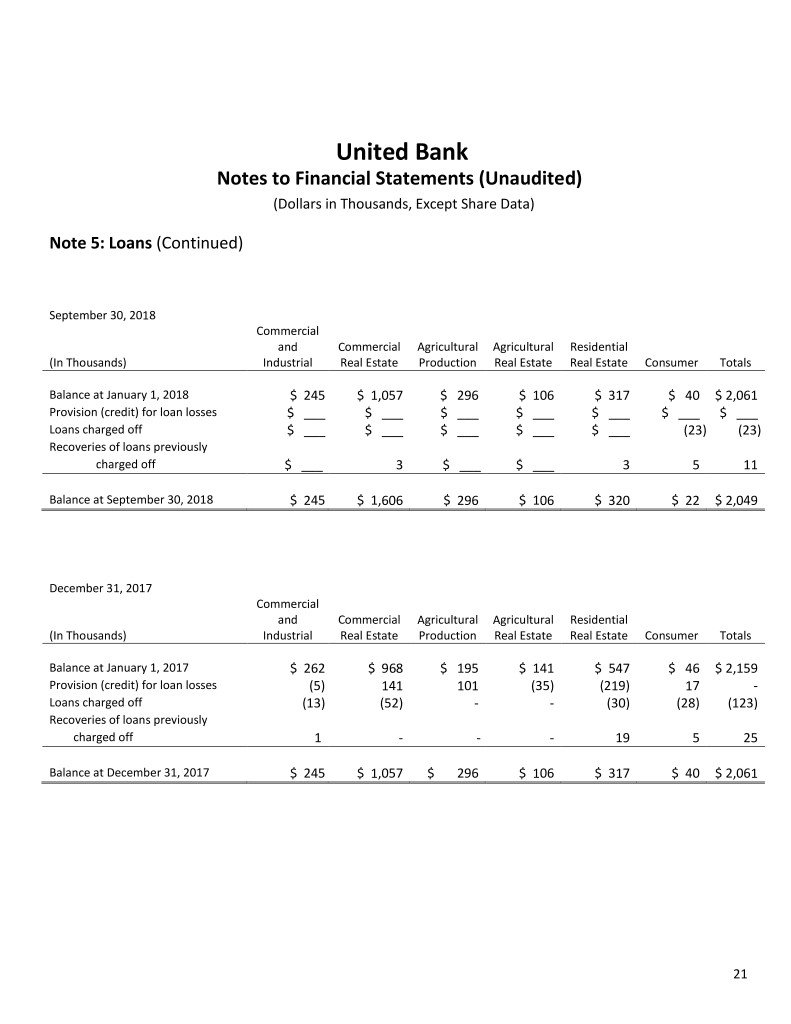

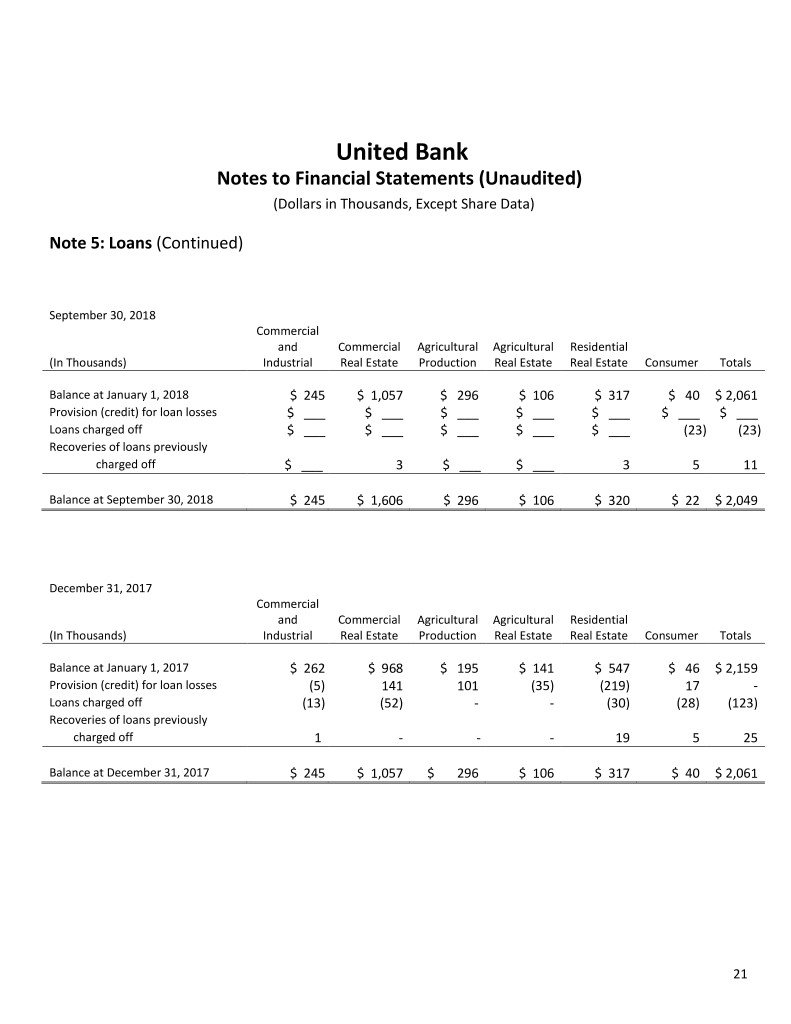

United Bank Notes to Financial Statements (Unaudited) (Dollars in Thousands, Except Share Data) Note 5: Loans (Continued) September 30, 2018 Commercial and Commercial Agricultural Agricultural Residential (In Thousands) Industrial Real Estate Production Real Estate Real Estate Consumer Totals Balance at January 1, 2018 $ 245 $ 1,057 $ 296 $ 106 $ 317 $ 40 $ 2,061 Provision (credit) for loan losses $ ___ $ ___ $ ___ $ ___ $ ___ $ ___ $ ___ Loans charged off $ ___ $ ___ $ ___ $ ___ $ ___ (23) (23) Recoveries of loans previously charged off $ ___ 3 $ ___ $ ___ 3 5 11 Balance at September 30, 2018 $ 245 $ 1,606 $ 296 $ 106 $ 320 $ 22 $ 2,049 December 31, 2017 Commercial and Commercial Agricultural Agricultural Residential (In Thousands) Industrial Real Estate Production Real Estate Real Estate Consumer Totals Balance at January 1, 2017 $ 262 $ 968 $ 195 $ 141 $ 547 $ 46 $ 2,159 Provision (credit) for loan losses (5) 141 101 (35) (219) 17 - Loans charged off (13) (52) - - (30) (28) (123) Recoveries of loans previously charged off 1 - - - 19 5 25 Balance at December 31, 2017 $ 245 $ 1,057 $ 296 $ 106 $ 317 $ 40 $ 2,061 21

United Bank Notes to Financial Statements (Unaudited) (Dollars in Thousands, Except Share Data) Note 5: Loans (Continued) Information about how loans were evaluated for impairment and the related allowance for loan losses as of September 30, 2018 and December 31, 2017. September 30, 2018 Commercial and Commercial Agricultural Agricultural Residential (In Thousands) Industrial Real Estate Production Real Estate Real Estate Consumer Totals Loans Individually evaluated for impairment $ 348 $ 4,116 $ - $ - $ 117 $ - $ 4,581 Collectively evaluated for impairment 28,638 99,453 9,930 15,732 42,252 2,556 198,561 Total Loans $28,986 $103,569 $9,930 $15,732 $42,369 $ 2,556 $203,142 Related allowance for loan losses: Individually evaluated for impairment $ 87 $ 161 $ - $ 46 $ - $ - $ 294 Collectively evaluated for impairment 292 741 4 23 650 45 1,755 Total allowance for loan losses $ 379 $ 902 $ 4 $ 69 $ 650 $ 45 $ 2,049 December 31, 2017 Commercial and Commercial Agricultural Agricultural Residential (In Thousands) Industrial Real Estate Production Real Estate Real Estate Consumer Totals Loans Individually evaluated for impairment $ 575 $ 4,824 12 $ - $ 876 $ - $ 6,287 Collectively evaluated for impairment 22,113 111,255 9,273 9,604 46,302 2,271 200,818 Total Loans $22,688 $ 116,079 $9,285 $ 9,604 $47,178 $2,271 $207,105 Related allowance for loan losses: Individually evaluated for impairment $ 88 $ 235 $ - $ - $ 91 $ - $ 414 Collectively evaluated for impairment 157 822 296 106 226 40 1,647 Total allowance for loan losses $ 245 $ 1,057 296 $ 106 $ 317 $ 40 $ 2,061 22

United Bank Notes to Financial Statements (Unaudited) (Dollars in Thousands, Except Share Data) Note 5: Loans (Continued) Information regarding impaired loans by loan class for the nine months ended September 30, 2018, follows: Recorded Principal Related Average Interest Investment Balance Allowance Investment Recognized Loans with no related allowance for loan losses Commercial and industrial $ 1,173 $ 1,231 $ - $ 809 $ 46 Commercial real estate 409 1,484 - 444 46 Residential real estate 465 549 - 478 18 Totals 2,047 3,264 - 1,731 110 Loans with an allowance for loan losses: Commercial and industrial 348 350 87 354 3 Commercial real estate 4,117 4,117 207 4,154 205 Residential real estate 117 122 - 120 7 Totals 4,582 4,589 294 4,628 215 Grand Totals $ 6,629 $ 7,853 $ 294 $ 6,359 $ 325 Information regarding impaired loans by loan class for the twelve months ended December 31, 2017, follows: Recorded Principal Related Average Interest Investment Balance Allowance Investment Recognized Loans with no related allowance for loan losses Commercial and industrial $ 172 $ 231 $ - $ 257 $ 18 Commercial real estate 193 239 - 286 16 Agricultural Production 12 12 - 14 1 Residential real estate 665 758 - 778 40 Totals 1,042 1,240 - 1,335 75 Loans with an allowance for loan losses: Commercial and industrial 403 403 88 417 14 Commercial real estate 4,631 4,631 235 4,300 247 Residential real estate 211 226 91 234 13 Totals 5,245 5,260 414 4,951 274 Grand Totals $ 6,287 $ 6,500 $ 414 $ 6,286 $ 349 No additional funds are committed to be advanced in connection with impaired loans as of September 30, 2018. 23

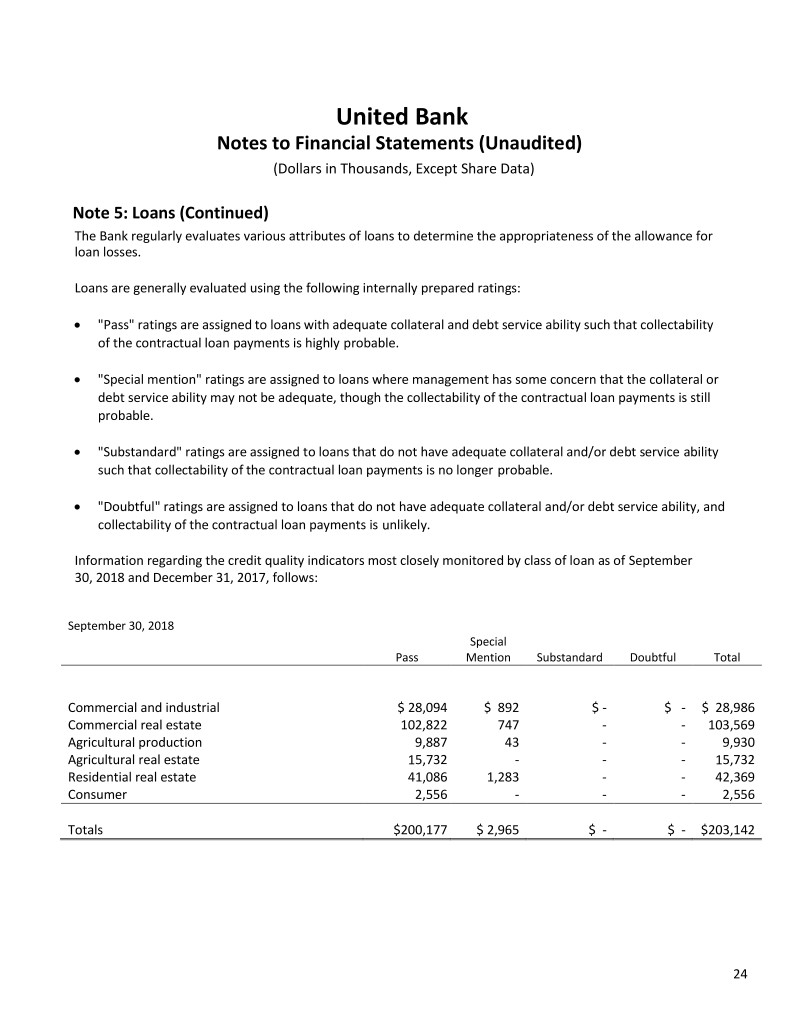

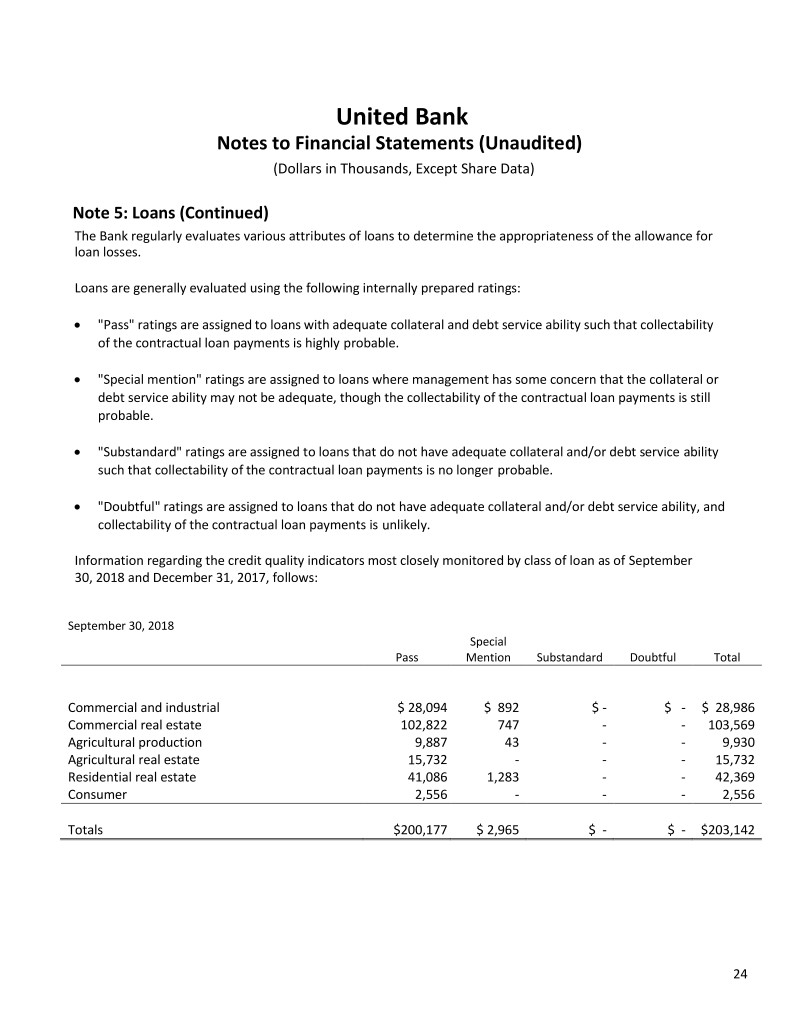

United Bank Notes to Financial Statements (Unaudited) (Dollars in Thousands, Except Share Data) Note 5: Loans (Continued) The Bank regularly evaluates various attributes of loans to determine the appropriateness of the allowance for loan losses. Loans are generally evaluated using the following internally prepared ratings: "Pass" ratings are assigned to loans with adequate collateral and debt service ability such that collectability of the contractual loan payments is highly probable. "Special mention" ratings are assigned to loans where management has some concern that the collateral or debt service ability may not be adequate, though the collectability of the contractual loan payments is still probable. "Substandard" ratings are assigned to loans that do not have adequate collateral and/or debt service ability such that collectability of the contractual loan payments is no longer probable. "Doubtful" ratings are assigned to loans that do not have adequate collateral and/or debt service ability, and collectability of the contractual loan payments is unlikely. Information regarding the credit quality indicators most closely monitored by class of loan as of September 30, 2018 and December 31, 2017, follows: September 30, 2018 Special Pass Mention Substandard Doubtful Total Commercial and industrial $ 28,094 $ 892 $ - $ - $ 28,986 Commercial real estate 102,822 747 - - 103,569 Agricultural production 9,887 43 - - 9,930 Agricultural real estate 15,732 - - - 15,732 Residential real estate 41,086 1,283 - - 42,369 Consumer 2,556 - - - 2,556 Totals $200,177 $ 2,965 $ - $ - $203,142 24

United Bank Notes to Financial Statements (Unaudited) (Dollars in Thousands, Except Share Data) December 31, 2017 Special Pass Mention Substandard Doubtful Total Commercial and industrial $ 21,432 $ 747 $ 509 $ - $ 22,688 Commercial real estate 110,999 785 4,295 - 116,079 Agricultural production 8,596 689 - - 9,285 Agricultural real estate 9,484 120 - - 9,604 Residential real estate 45,881 783 514 - 47,178 Consumer 2,271 - - - 2,271 Totals $198,663 $ 3,124 $ 5,318 $ - $207,105 25

United Bank Notes to Financial Statements (Unaudited) (Dollars in Thousands, Except Share Data) Note 5: Loans (Continued) Loan aging information as of September 30, 2018 follows: Accruing Loans Current Loans Due Past Due Nonaccrual Total Loans 30-89 Days 90+ days Loans Loans Commercial and industrial $ 28,157 $ 395 $ - $ 434 $ 28,986 Commercial real estate 102,799 674 - 96 103,569 Agricultural production 9,930 - - - 9,930 Agricultural real estate 15,361 198 - 173 15,732 Residential real estate 41,784 438 - 147 42,369 Consumer 2,541 15 - - 2,556 Totals $200,572 $ 1,720 $ - $ 850 $203,142 Loan aging information as of December 31, 2017 follows: Accruing Loans Current Loans Due Past Due Nonaccrual Total Loans 30-89 Days 90+ days Loans Loans Commercial and industrial $ 22,180 $ 44 $ - $ 464 $ 22,688 Commercial real estate 115,858 - - 221 116,079 Agricultural production 9,273 12 - - 9,285 Agricultural real estate 9,533 71 - - 9,604 Residential real estate 46,390 548 - 240 47,178 Consumer 2,258 13 - - 2,271 Totals $205,492 $ 688 $ - $ 925 $207,105 26

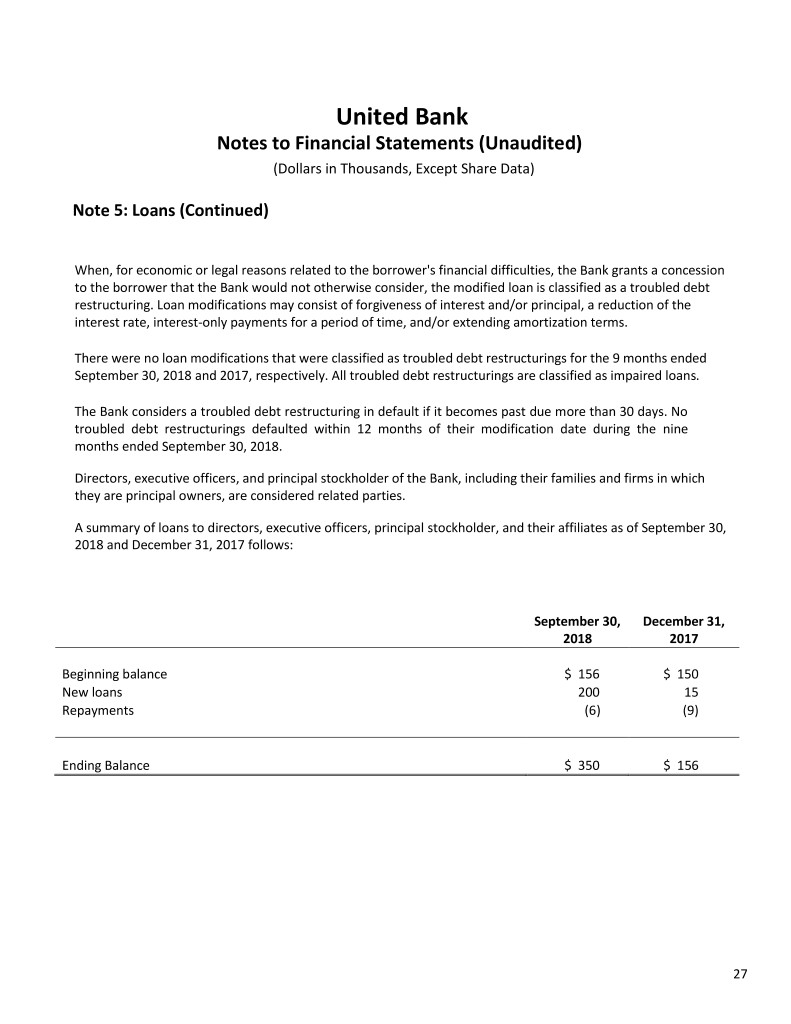

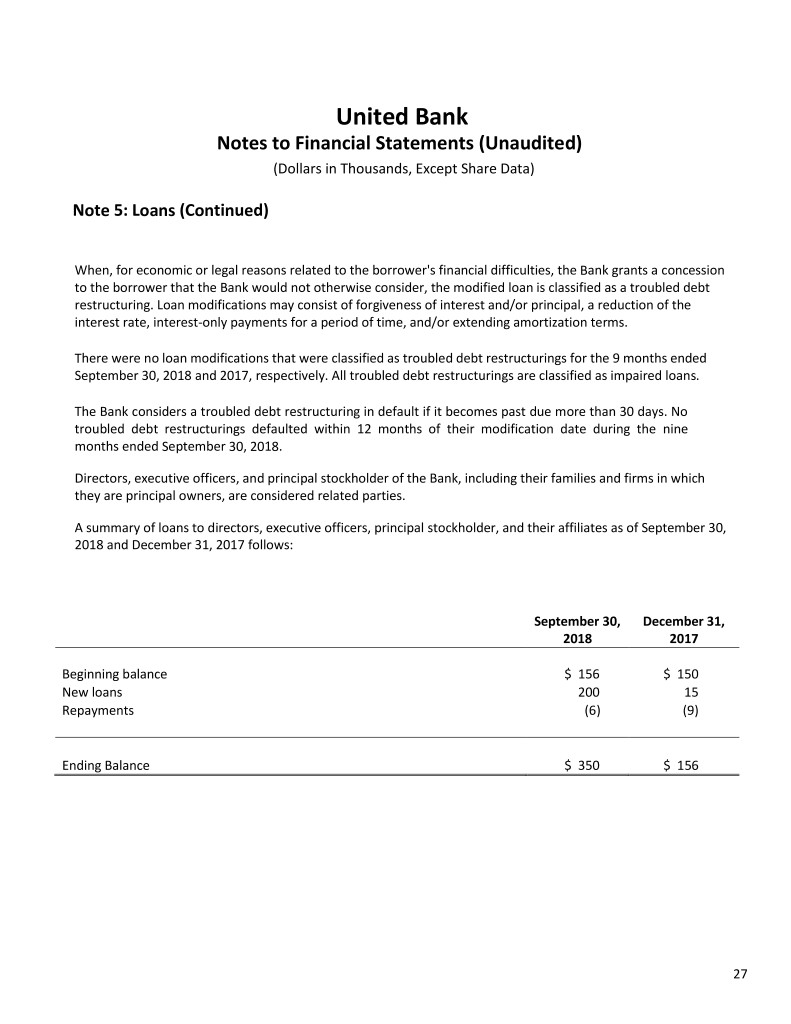

United Bank Notes to Financial Statements (Unaudited) (Dollars in Thousands, Except Share Data) Note 5: Loans (Continued) When, for economic or legal reasons related to the borrower's financial difficulties, the Bank grants a concession to the borrower that the Bank would not otherwise consider, the modified loan is classified as a troubled debt restructuring. Loan modifications may consist of forgiveness of interest and/or principal, a reduction of the interest rate, interest-only payments for a period of time, and/or extending amortization terms. There were no loan modifications that were classified as troubled debt restructurings for the 9 months ended September 30, 2018 and 2017, respectively. All troubled debt restructurings are classified as impaired loans. The Bank considers a troubled debt restructuring in default if it becomes past due more than 30 days. No troubled debt restructurings defaulted within 12 months of their modification date during the nine months ended September 30, 2018. Directors, executive officers, and principal stockholder of the Bank, including their families and firms in which they are principal owners, are considered related parties. A summary of loans to directors, executive officers, principal stockholder, and their affiliates as of September 30, 2018 and December 31, 2017 follows: September 30, December 31, 2018 2017 Beginning balance $ 156 $ 150 New loans 200 15 Repayments (6) (9) Ending Balance $ 350 $ 156 27

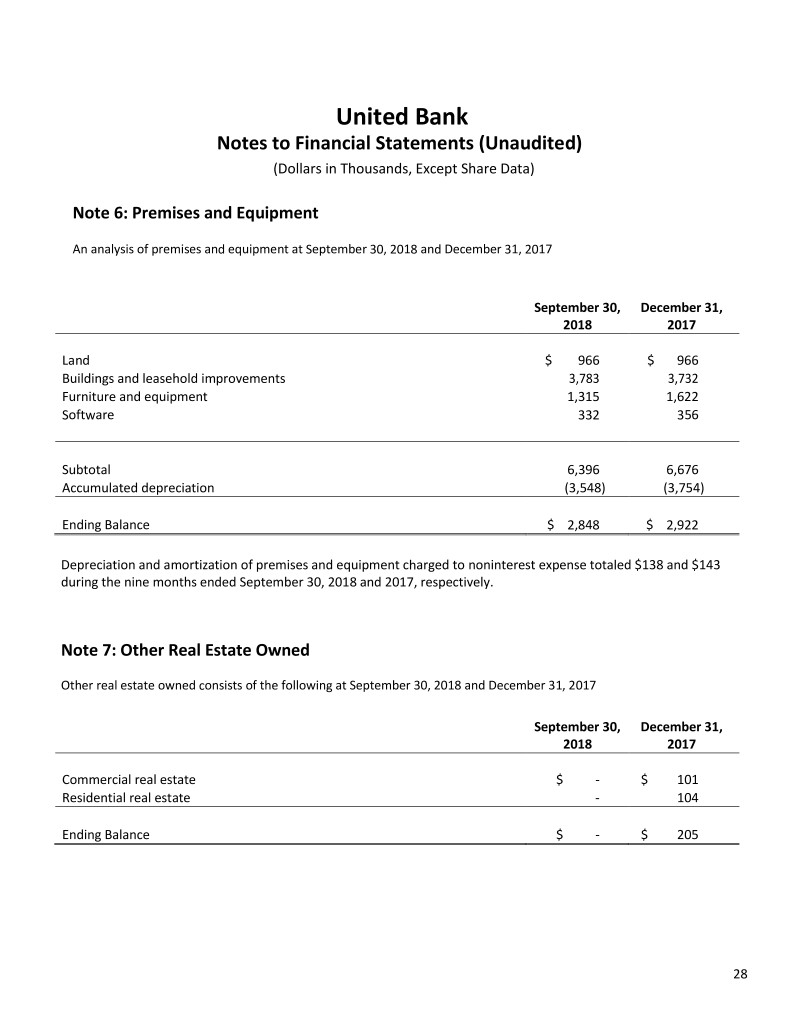

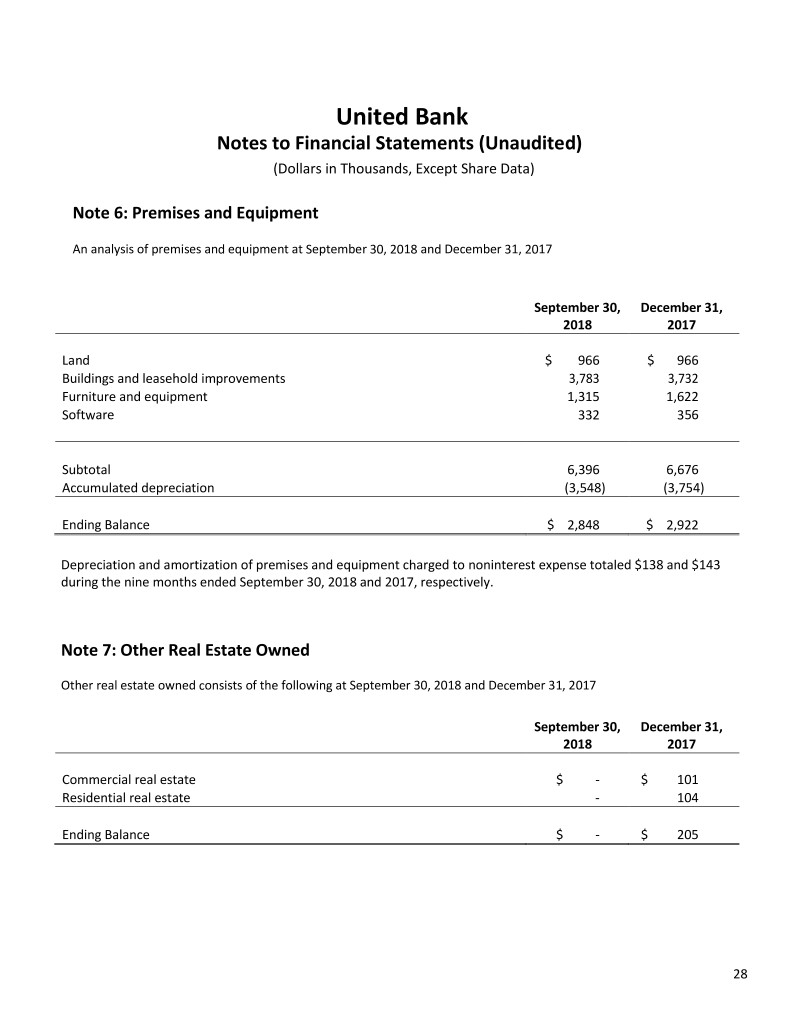

United Bank Notes to Financial Statements (Unaudited) (Dollars in Thousands, Except Share Data) Note 6: Premises and Equipment An analysis of premises and equipment at September 30, 2018 and December 31, 2017 September 30, December 31, 2018 2017 Land $ 966 $ 966 Buildings and leasehold improvements 3,783 3,732 Furniture and equipment 1,315 1,622 Software 332 356 Subtotal 6,396 6,676 Accumulated depreciation (3,548) (3,754) Ending Balance $ 2,848 $ 2,922 Depreciation and amortization of premises and equipment charged to noninterest expense totaled $138 and $143 during the nine months ended September 30, 2018 and 2017, respectively. Note 7: Other Real Estate Owned Other real estate owned consists of the following at September 30, 2018 and December 31, 2017 September 30, December 31, 2018 2017 Commercial real estate $ - $ 101 Residential real estate - 104 Ending Balance $ - $ 205 28

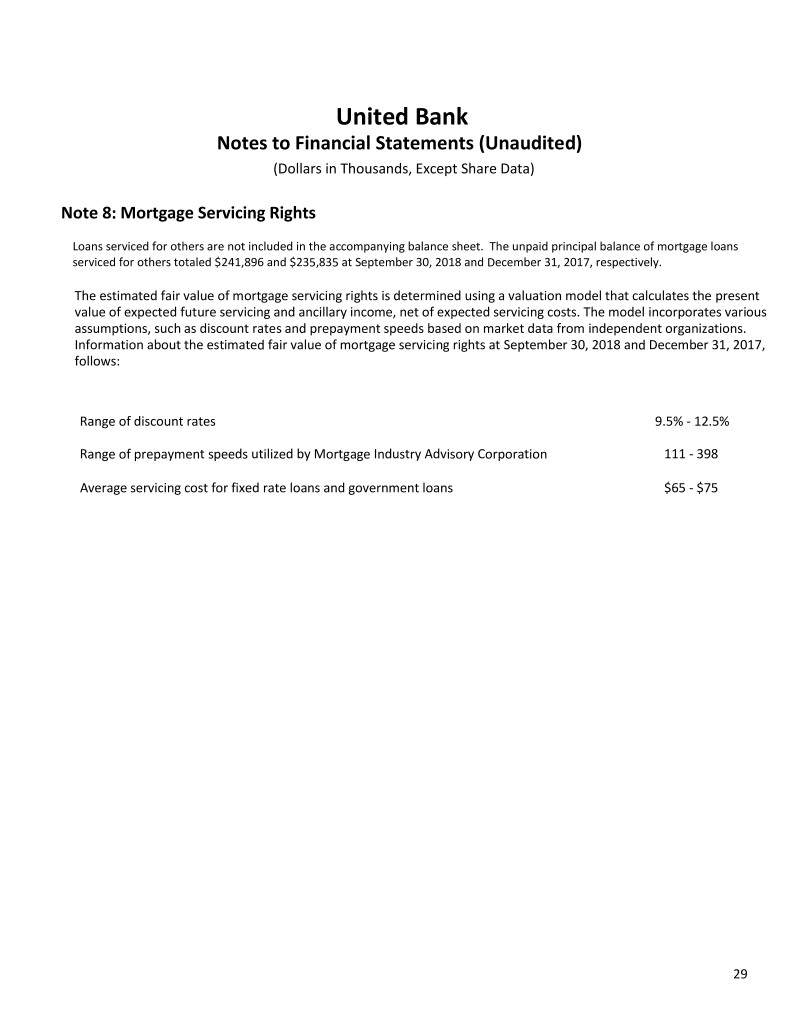

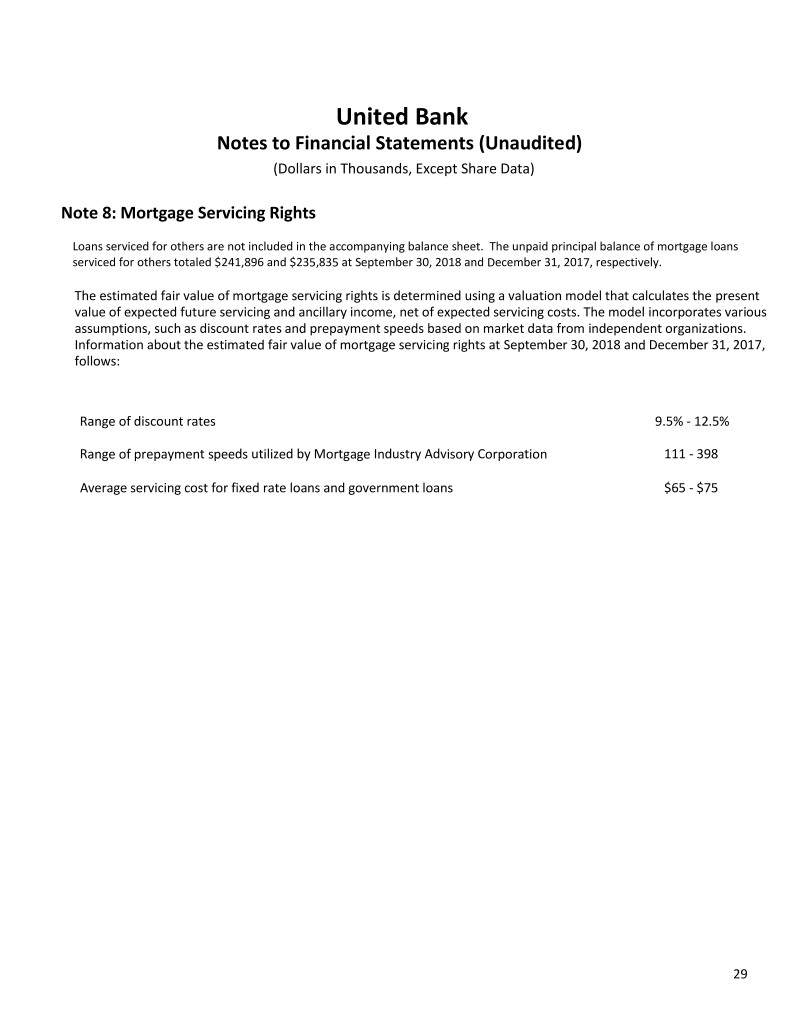

United Bank Notes to Financial Statements (Unaudited) (Dollars in Thousands, Except Share Data) Note 8: Mortgage Servicing Rights Loans serviced for others are not included in the accompanying balance sheet. The unpaid principal balance of mortgage loans serviced for others totaled $241,896 and $235,835 at September 30, 2018 and December 31, 2017, respectively. The estimated fair value of mortgage servicing rights is determined using a valuation model that calculates the present value of expected future servicing and ancillary income, net of expected servicing costs. The model incorporates various assumptions, such as discount rates and prepayment speeds based on market data from independent organizations. Information about the estimated fair value of mortgage servicing rights at September 30, 2018 and December 31, 2017, follows: Range of discount rates 9.5% - 12.5% Range of prepayment speeds utilized by Mortgage Industry Advisory Corporation 111 - 398 Average servicing cost for fixed rate loans and government loans $65 - $75 29

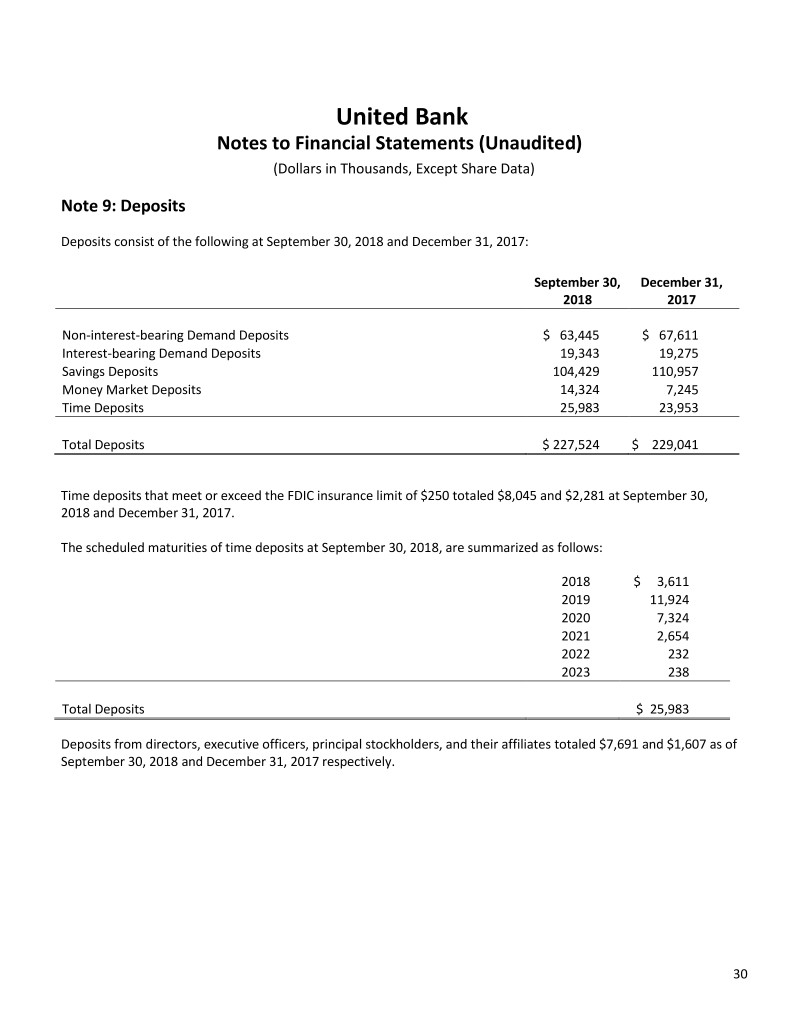

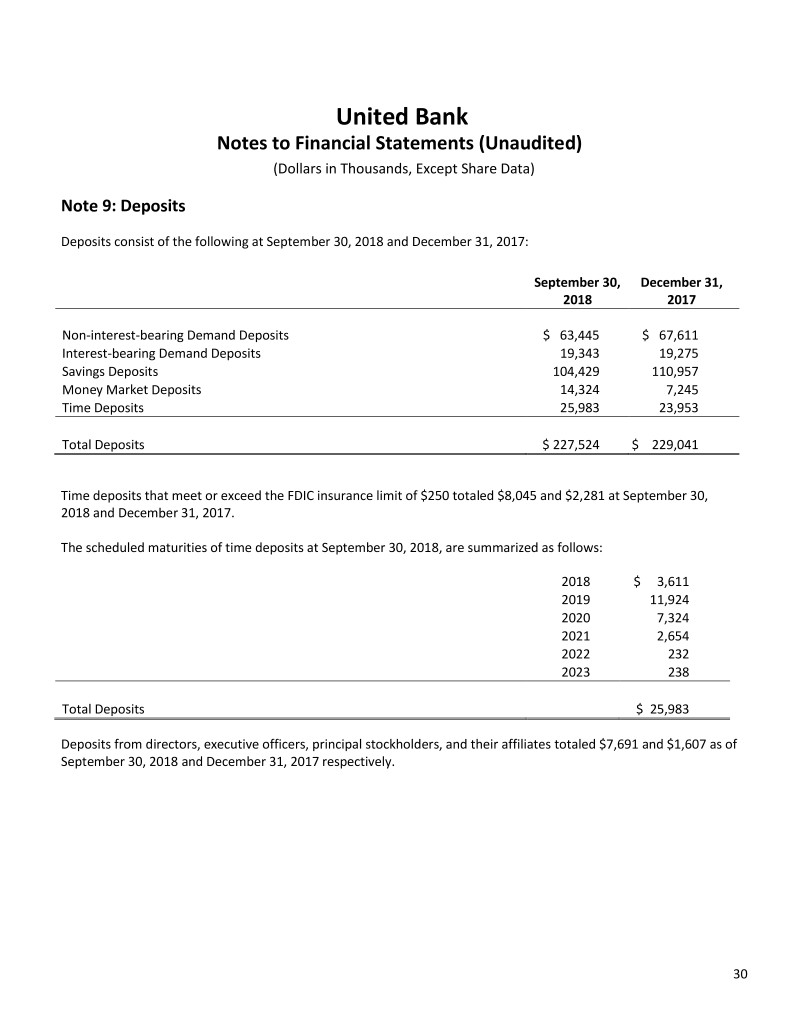

United Bank Notes to Financial Statements (Unaudited) (Dollars in Thousands, Except Share Data) Note 9: Deposits Deposits consist of the following at September 30, 2018 and December 31, 2017: September 30, December 31, 2018 2017 Non-interest-bearing Demand Deposits $ 63,445 $ 67,611 Interest-bearing Demand Deposits 19,343 19,275 Savings Deposits 104,429 110,957 Money Market Deposits 14,324 7,245 Time Deposits 25,983 23,953 Total Deposits $ 227,524 $ 229,041 Time deposits that meet or exceed the FDIC insurance limit of $250 totaled $8,045 and $2,281 at September 30, 2018 and December 31, 2017. The scheduled maturities of time deposits at September 30, 2018, are summarized as follows: 2018 $ 3,611 2019 11,924 2020 7,324 2021 2,654 2022 232 2023 238 Total Deposits $ 25,983 Deposits from directors, executive officers, principal stockholders, and their affiliates totaled $7,691 and $1,607 as of September 30, 2018 and December 31, 2017 respectively. 30

United Bank Notes to Financial Statements (Unaudited) (Dollars in Thousands, Except Share Data) Note 10: Borrowed Funds Borrowed funds at September 30, 2018 and December 31, 2017 consisted of Federal Home Loan Bank (FHLB), fixed rate, fixed term advances totaling $10,389 and $10,252, respectively. The advances have an interest rate of 2.45%, and the advances all mature during 2022. Actual maturities may differ from the scheduled principal maturities due to call options on the various advances. The Bank has a master contract agreement with the Federal Home Loan Bank that provides for borrowing. The FHLB provides both fixed and floating rate advances. Floating rates are tied to short-term market rates of interest, such as London InterBank Offered Rate (LIBOR), federal funds, or treasury bill rates. Advances with call provisions permit the FHLB to request payment beginning on the call date and quarterly thereafter. FHLB advances are subject to a prepayment penalty if they are repaid prior to maturity. At September 30, 2018, FHLB advances are secured by $495 of FHLB stock and $29,927 of residential, commercial, and agricultural loans. At September 30, 2018, the Bank's available and unused portion of this borrowing agreement totaled approximately $10,311, though in order to borrow any additional amounts, the Bank would need to purchase additional FHLB stock. Note 11: Deferred Compensation The Bank has entered into various deferred compensation agreements with some of its executive officers. The liability outstanding under the agreements was $0 and $246 at September 30, 2018 and December 31, 2017, respectively. The Bank paid $265 and $18 of deferred compensation during the nine months ended September 30, 2018 and 2017, respectively. The amounts charged to operations were $19 and $0 during the nine months ended September 30, 2018 and 2017, respectively. Note 12: Retirement Plan The Bank sponsors a defined contribution plan that covers substantially all employees. The Bank matches 100% of employee contributions up to 3% of their annual compensation. The Bank also matches 50% of an employee's contributions between 3% and 5% their annual compensation. Expense charged to operations was $121 and $96 during the nine months ended September 30, 2018 and 2017, respectively. 31

United Bank Notes to Financial Statements (Unaudited) (Dollars in Thousands, Except Share Data) Note 13: Equity and Regulatory Matters The payment of dividends by the Bank would be restricted if the Bank does not meet the minimum Capital Conservation Buffer as defined by Basel III regulatory capital guidelines and/or if, after payment of the dividend, the Bank would be unable to maintain satisfactory regulatory capital ratios. The Bank is subject to various regulatory capital requirements administered by federal and state banking agencies. Failure to meet minimum capital requirements can initiate certain mandatory, and possibly additional discretionary, actions by regulators that, if undertaken, could have a direct material effect on the Bank's financial statements. Under capital adequacy guidelines and the regulatory framework for prompt corrective action, the Bank must meet specific capital guidelines that involve quantitative measures of assets, liabilities, and certain off- balance-sheet items as calculated under regulatory accounting practices. The capital amounts and classification are also subject to qualitative judgments by the regulators about components, risk weightings, and other factors. Quantitative measures established by regulation to ensure capital adequacy require the Bank to maintain minimum amounts and ratios (set forth in the table below) of Common Equity Tier 1, Tier 1, Total capital to risk- weighted assets, and of Tier 1 capital to average assets. It is management's opinion, as of September 30, 2018 and December 31, 2017, that the Bank meets all applicable capital adequacy requirements. As of September 30, 2018 the most recent notification from the FDIC categorized the Bank as well capitalized under the regulatory framework for prompt corrective action. To be categorized as well capitalized, the Bank must maintain minimum regulatory capital ratios as set forth in the table. There are no conditions or events since that notification that management believes have changed the Bank's category. The Bank's actual capital amounts and ratios as of September 30, 2018 and December 31, 2017, are presented in the following table: As of September 30, 2018 To Be Well Capitalized Under Prompt For Capital Corrective Action Actual Adequacy Purposes Provisions (In Thousands) Amount Ratio Amount Ratio Amount Ratio Common Equity Tier 1 Capital (to risk-weighted assets) $ 29,674 14.10% $ 9,467 4.50% $13,675 6.50% Tier 1 capital (to risk-weighted assets) 29,674 14.10% 12,623 6.00% 16,831 8.00% Total capital (to risk-weighted assets) 31,723 15.08% 16,831 8.00% 21,038 10.00% Tier 1 capital (to average assets) 29,674 10.93% 10,862 4.00% 13,577 5.00% 32

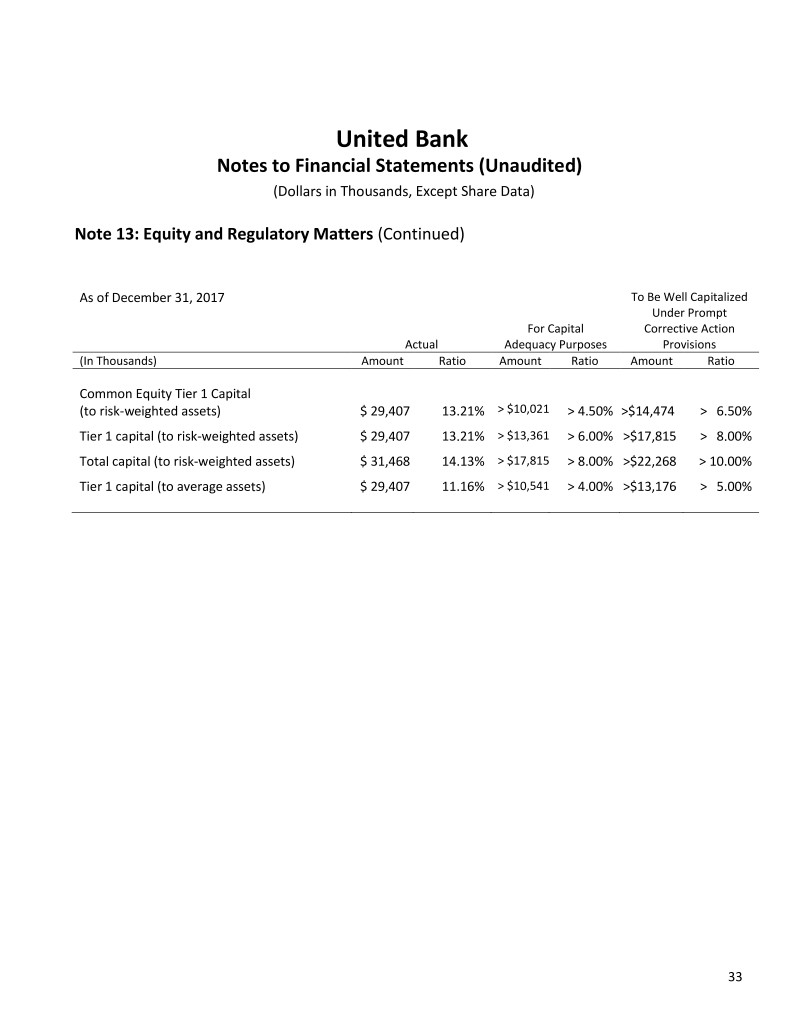

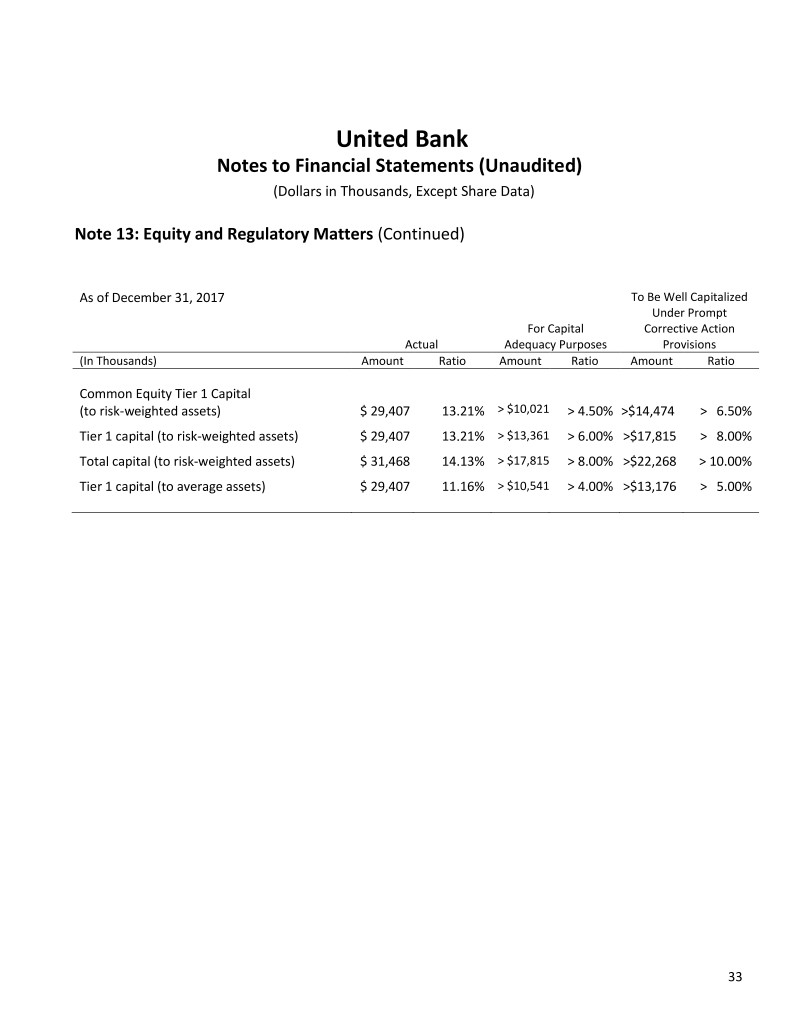

United Bank Notes to Financial Statements (Unaudited) (Dollars in Thousands, Except Share Data) Note 13: Equity and Regulatory Matters (Continued) As of December 31, 2017 To Be Well Capitalized Under Prompt For Capital Corrective Action Actual Adequacy Purposes Provisions (In Thousands) Amount Ratio Amount Ratio Amount Ratio Common Equity Tier 1 Capital (to risk-weighted assets) $ 29,407 13.21% > $10,021 > 4.50% >$14,474 > 6.50% Tier 1 capital (to risk-weighted assets) $ 29,407 13.21% > $13,361 > 6.00% >$17,815 > 8.00% Total capital (to risk-weighted assets) $ 31,468 14.13% > $17,815 > 8.00% >$22,268 > 10.00% Tier 1 capital (to average assets) $ 29,407 11.16% > $10,541 > 4.00% >$13,176 > 5.00% 33

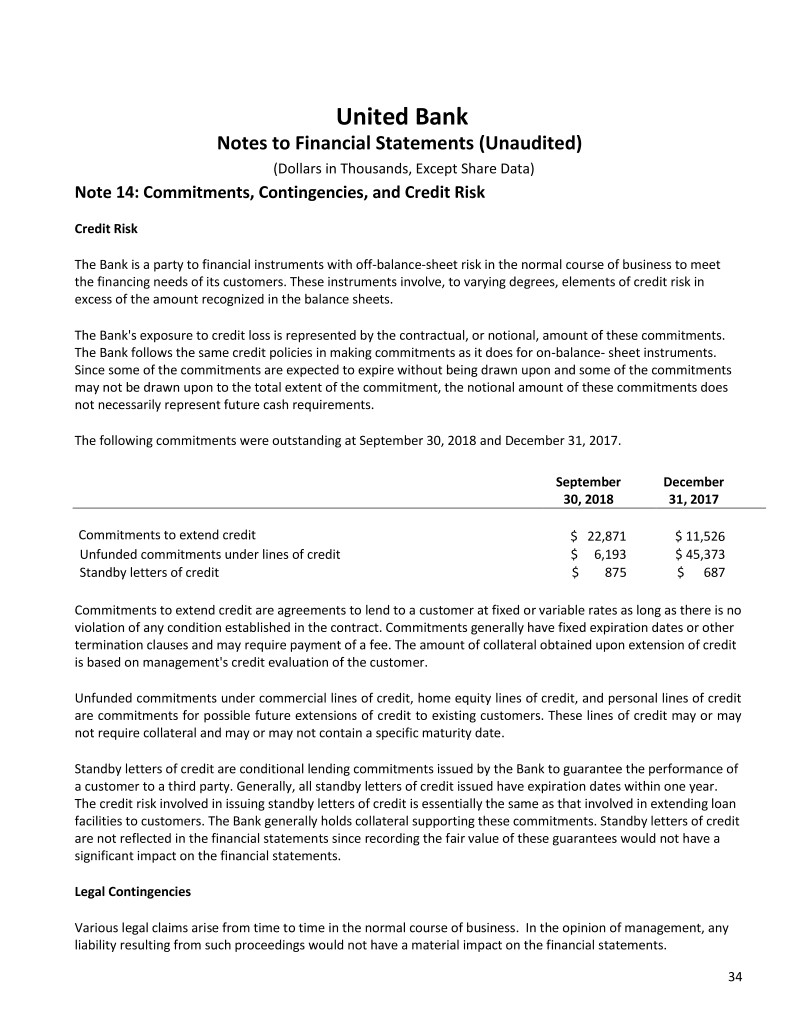

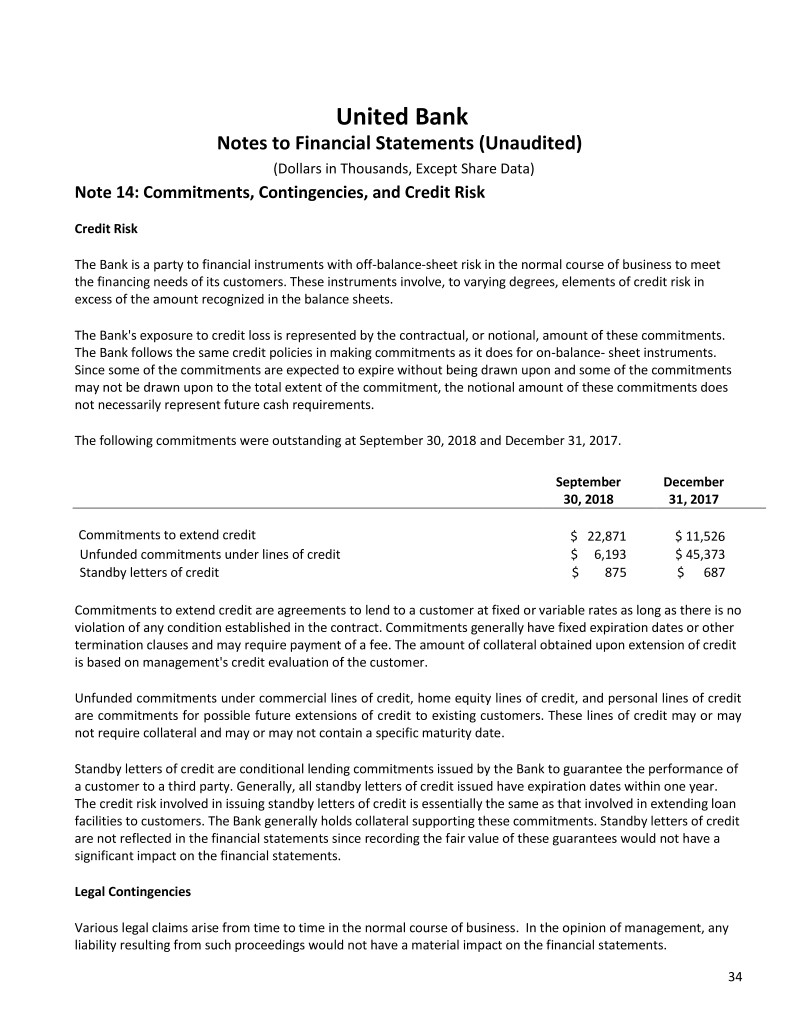

United Bank Notes to Financial Statements (Unaudited) (Dollars in Thousands, Except Share Data) Note 14: Commitments, Contingencies, and Credit Risk Credit Risk The Bank is a party to financial instruments with off-balance-sheet risk in the normal course of business to meet the financing needs of its customers. These instruments involve, to varying degrees, elements of credit risk in excess of the amount recognized in the balance sheets. The Bank's exposure to credit loss is represented by the contractual, or notional, amount of these commitments. The Bank follows the same credit policies in making commitments as it does for on-balance- sheet instruments. Since some of the commitments are expected to expire without being drawn upon and some of the commitments may not be drawn upon to the total extent of the commitment, the notional amount of these commitments does not necessarily represent future cash requirements. The following commitments were outstanding at September 30, 2018 and December 31, 2017. September December 30, 2018 31, 2017 Commitments to extend credit $ 22,871 $ 11,526 Unfunded commitments under lines of credit $ 6,193 $ 45,373 Standby letters of credit $ 875 $ 687 Commitments to extend credit are agreements to lend to a customer at fixed or variable rates as long as there is no violation of any condition established in the contract. Commitments generally have fixed expiration dates or other termination clauses and may require payment of a fee. The amount of collateral obtained upon extension of credit is based on management's credit evaluation of the customer. Unfunded commitments under commercial lines of credit, home equity lines of credit, and personal lines of credit are commitments for possible future extensions of credit to existing customers. These lines of credit may or may not require collateral and may or may not contain a specific maturity date. Standby letters of credit are conditional lending commitments issued by the Bank to guarantee the performance of a customer to a third party. Generally, all standby letters of credit issued have expiration dates within one year. The credit risk involved in issuing standby letters of credit is essentially the same as that involved in extending loan facilities to customers. The Bank generally holds collateral supporting these commitments. Standby letters of credit are not reflected in the financial statements since recording the fair value of these guarantees would not have a significant impact on the financial statements. Legal Contingencies Various legal claims arise from time to time in the normal course of business. In the opinion of management, any liability resulting from such proceedings would not have a material impact on the financial statements. 34

United Bank Notes to Financial Statements (Unaudited) (Dollars in Thousands, Except Share Data) Note 14: Commitments, Contingencies, and Credit Risk (Continued) Concentrations of Credit Risk As of September 30, 2018 and December 31, 2017, the Bank also had loans outstanding by industry group as follows: September 30, 2018 December 31, 2017 Loans Percent of Loans Percent of (In Thousands) Outstanding Tier 1 Capital Outstanding Tier 1 Capital Land development and construction $ 5,971 20% $ 10,678 36% Hotels and motels $ 13,614 46% $ 13,467 46% Non-owner occupied residential real estate $ 21,953 74% $ 23,940 81% Recreational vehicle parks and campgrounds $ 38,700 130% $ 49,238 167% Note 15: Fair Value Measurements Some assets, such as securities available for sale and mortgage servicing rights, are measured at fair value on a recurring basis under GAAP. Other assets, such as impaired loans and other real estate owned, may be measured at fair value on a nonrecurring basis. Following is a description of the valuation methodology and significant inputs used for each asset measured at fair value on a recurring or nonrecurring basis, as well as the classification of the asset within the fair value hierarchy. Securities available for sale - Securities available for sale may be classified as Level 1, Level 2, or Level 3 measurements within the fair value hierarchy. Level 1 securities include equity securities traded on a national exchange. The fair value measurement of a Level 1 security is based on the quoted price of the security. Level 2 securities include U.S. agency securities, obligations of states and political subdivisions, corporate securities, mortgage-related securities, certificates of deposit, and commercial paper. The fair value measurement of a Level 2 security is obtained from an independent pricing service and is based on recent sales of similar securities and other observable market data. Level 3 securities include securities that are not traded in a market. The fair value measurements of a Level 3 security is based on a discounted cash flow model that incorporates assumptions market participants would use to measure the fair value of the security. Loans - Loans are not measured at fair value on a recurring basis. However, loans considered to be impaired (see Note 1) may be measured at fair value on a nonrecurring basis. The fair value measurement of an impaired loan that is collateral dependent is based on the fair value of the underlying collateral. Independent appraisals are obtained that utilize one or more valuation methodologies--typically they will incorporate a comparable sales approach and an income approach. Management routinely evaluates the fair value measurements of independent appraisers and adjusts those valuations based on differences noted between actual selling prices of collateral and the most recent appraised value. Such adjustments are usually significant, which results in a Level 3 classification. All other impaired loan measurements are based on the present value of expected future cash flows discounted at the applicable effective interest rate and, thus, are not fair value measurements. Mortgage servicing rights - Mortgage servicing rights are measured at fair value on a recurring basis. Serviced loan pools are stratified by year of origination, and a fair value measurement is obtained for each stratum from an independent firm. The measurement is based on recent sales of mortgage servicing rights with similar characteristics. Since the fair value measurement is based on observable market data, it is considered a Level 2 measurement. 35

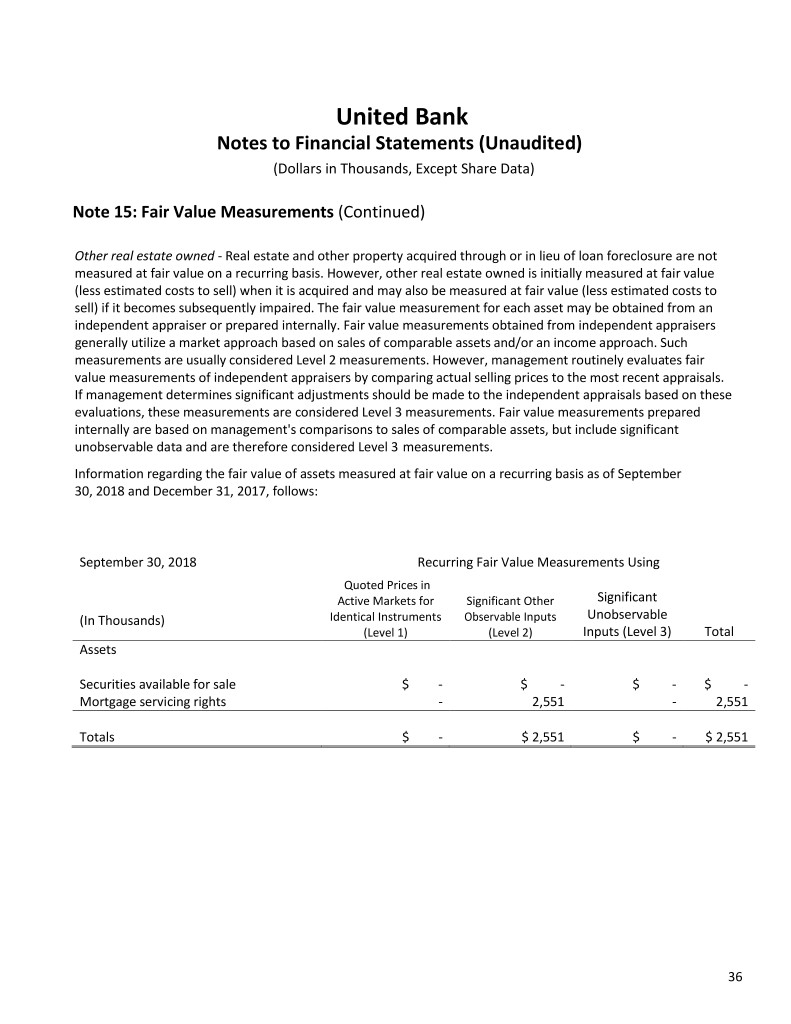

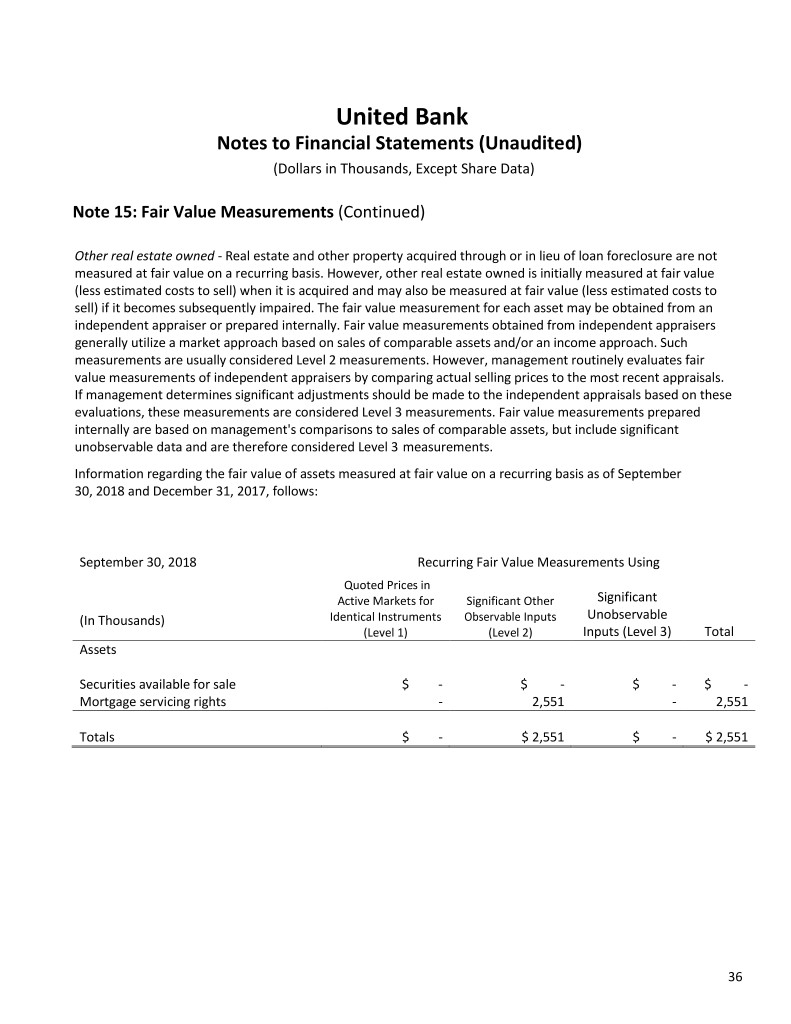

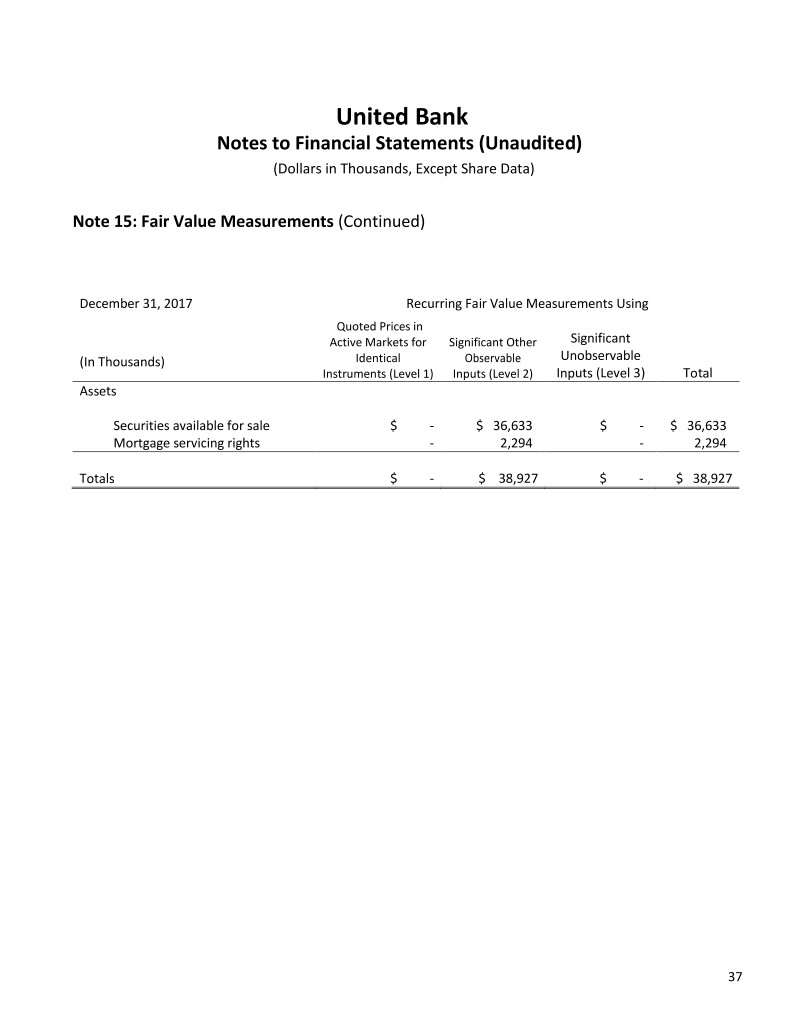

United Bank Notes to Financial Statements (Unaudited) (Dollars in Thousands, Except Share Data) Note 15: Fair Value Measurements (Continued) Other real estate owned - Real estate and other property acquired through or in lieu of loan foreclosure are not measured at fair value on a recurring basis. However, other real estate owned is initially measured at fair value (less estimated costs to sell) when it is acquired and may also be measured at fair value (less estimated costs to sell) if it becomes subsequently impaired. The fair value measurement for each asset may be obtained from an independent appraiser or prepared internally. Fair value measurements obtained from independent appraisers generally utilize a market approach based on sales of comparable assets and/or an income approach. Such measurements are usually considered Level 2 measurements. However, management routinely evaluates fair value measurements of independent appraisers by comparing actual selling prices to the most recent appraisals. If management determines significant adjustments should be made to the independent appraisals based on these evaluations, these measurements are considered Level 3 measurements. Fair value measurements prepared internally are based on management's comparisons to sales of comparable assets, but include significant unobservable data and are therefore considered Level 3 measurements. Information regarding the fair value of assets measured at fair value on a recurring basis as of September 30, 2018 and December 31, 2017, follows: September 30, 2018 Recurring Fair Value Measurements Using Quoted Prices in Active Markets for Significant Other Significant (In Thousands) Identical Instruments Observable Inputs Unobservable (Level 1) (Level 2) Inputs (Level 3) Total Assets Securities available for sale $ - $ - $ - $ - Mortgage servicing rights - 2,551 - 2,551 Totals $ - $ 2,551 $ - $ 2,551 36

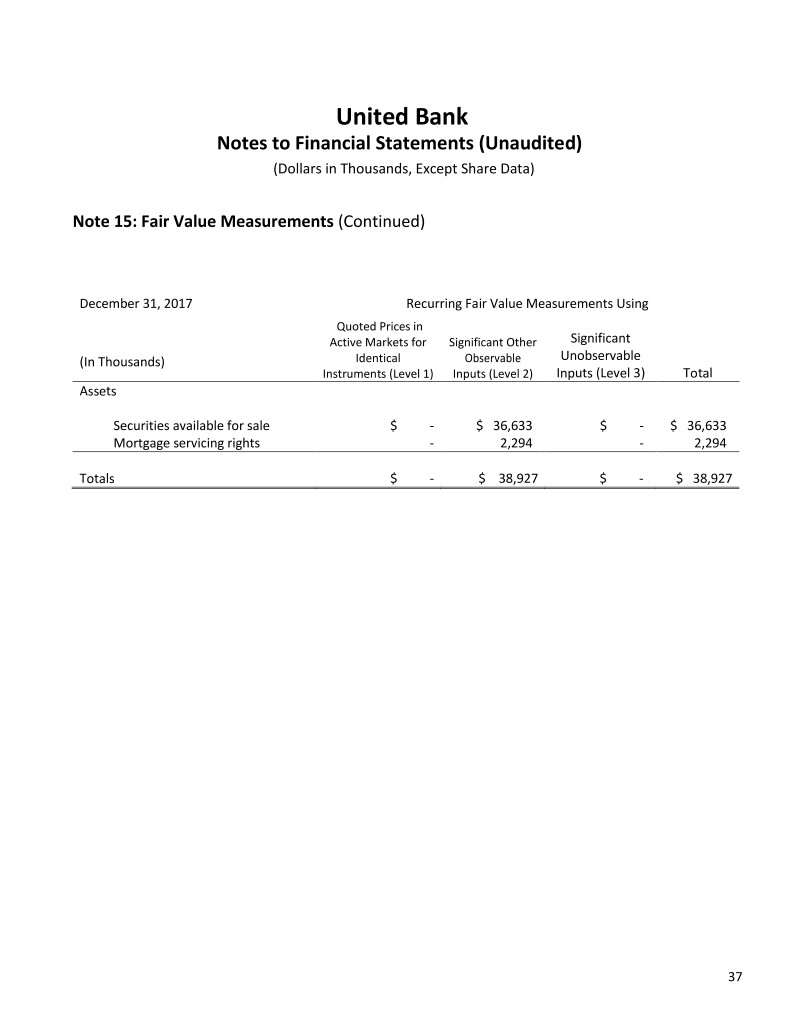

United Bank Notes to Financial Statements (Unaudited) (Dollars in Thousands, Except Share Data) Note 15: Fair Value Measurements (Continued) December 31, 2017 Recurring Fair Value Measurements Using Quoted Prices in Active Markets for Significant Other Significant (In Thousands) Identical Observable Unobservable Instruments (Level 1) Inputs (Level 2) Inputs (Level 3) Total Assets Securities available for sale $ - $ 36,633 $ - $ 36,633 Mortgage servicing rights - 2,294 - 2,294 Totals $ - $ 38,927 $ - $ 38,927 37

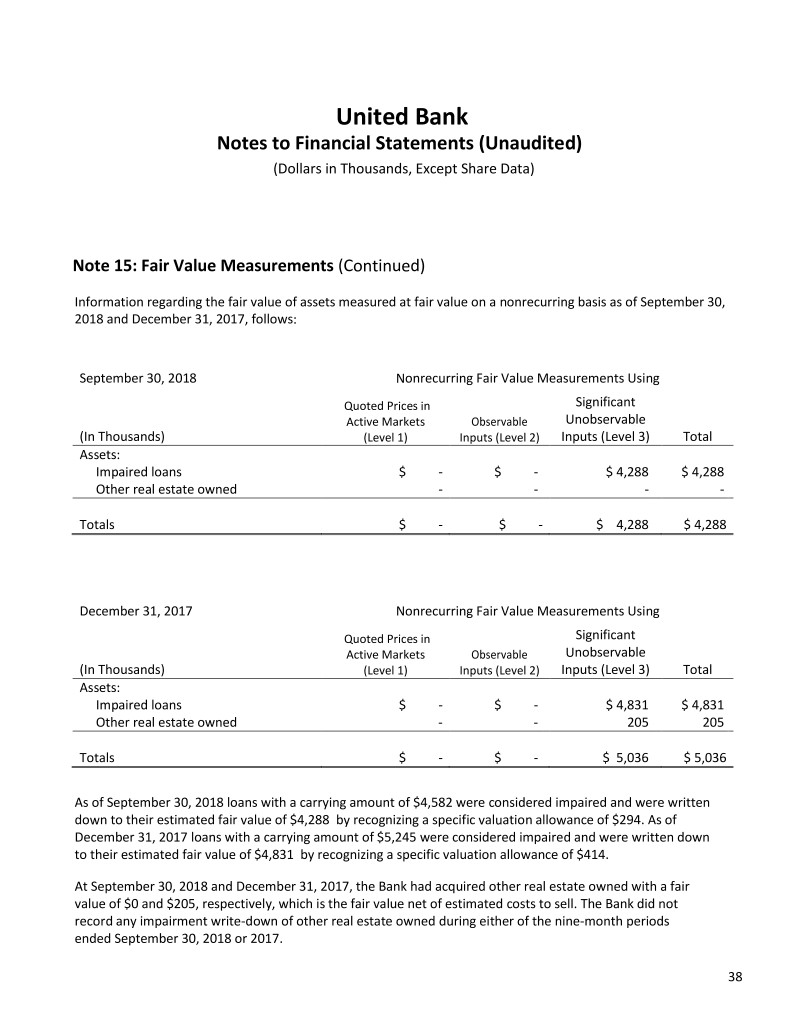

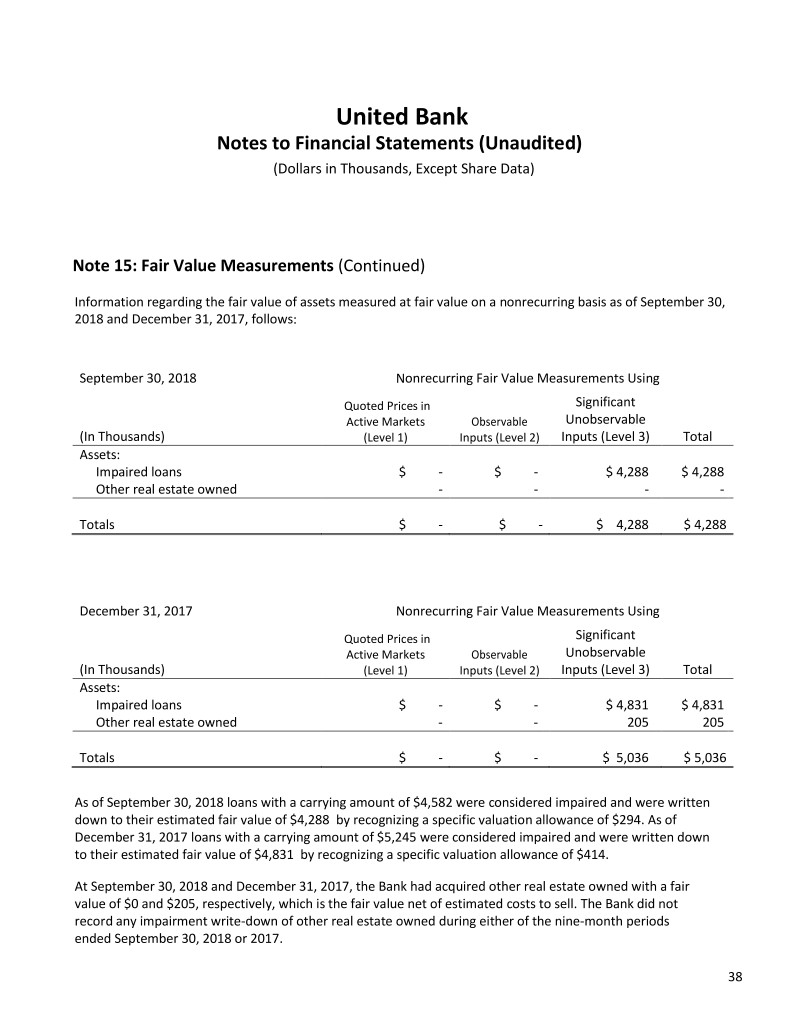

United Bank Notes to Financial Statements (Unaudited) (Dollars in Thousands, Except Share Data) Note 15: Fair Value Measurements (Continued) Information regarding the fair value of assets measured at fair value on a nonrecurring basis as of September 30, 2018 and December 31, 2017, follows: September 30, 2018 Nonrecurring Fair Value Measurements Using Quoted Prices in Significant Active Markets Observable Unobservable (In Thousands) (Level 1) Inputs (Level 2) Inputs (Level 3) Total Assets: Impaired loans $ - $ - $ 4,288 $ 4,288 Other real estate owned - - - - Totals $ - $ - $ 4,288 $ 4,288 December 31, 2017 Nonrecurring Fair Value Measurements Using Quoted Prices in Significant Active Markets Observable Unobservable (In Thousands) (Level 1) Inputs (Level 2) Inputs (Level 3) Total Assets: Impaired loans $ - $ - $ 4,831 $ 4,831 Other real estate owned - - 205 205 Totals $ - $ - $ 5,036 $ 5,036 As of September 30, 2018 loans with a carrying amount of $4,582 were considered impaired and were written down to their estimated fair value of $4,288 by recognizing a specific valuation allowance of $294. As of December 31, 2017 loans with a carrying amount of $5,245 were considered impaired and were written down to their estimated fair value of $4,831 by recognizing a specific valuation allowance of $414. At September 30, 2018 and December 31, 2017, the Bank had acquired other real estate owned with a fair value of $0 and $205, respectively, which is the fair value net of estimated costs to sell. The Bank did not record any impairment write-down of other real estate owned during either of the nine-month periods ended September 30, 2018 or 2017. 38

United Bank Notes to Financial Statements (Unaudited) (Dollars in Thousands, Except Share Data) The following presents quantitative information about nonrecurring Level 3 fair value measurements at September 30, 2018 and December 31, 2017: September 30, 2018 Range / Weighted Fair Value Valuation Technique Unobservable Input(s) Average Market and/or Income Management discount Impaired loans $ 4,288 approach on appraised values 10% - 40% Market and/or Income Management discount Other real estate owned $ - approach on appraised values 10% - 40% December 31, 2017 Range / Weighted Fair Value Valuation Technique Unobservable Input(s) Average Market and/or Income Management discount Impaired loans $ 4,831 approach on appraised values 10% - 40% Market and/or Income Management discount Other real estate owned $ 205 approach on appraised values 10% - 40% Note 16: Subsequent Event On October 19, 2018, the Bank was acquired by Citizens Community Bancorp, Inc. {“CCBI”). 100% of the Bank’s common stock was acquired by CCBI for a purchase price of approximately $50.7 million, plus approximately $0.4 million in closing date contractual purchase adjustments, for a total cash consideration of approximately $51.1 million. 39