EXHIBIT 99.2 F. & M. BANCORP OF TOMAH, INC. AND SUBSIDIARY CONSOLIDATED BALANCE SHEETS Unaudited Audited June 30, December 31, 2019 2018 ASSETS Cash and Due from Financial Institutions $ 2,524,551 $ 4,721,770 Federal Funds Sold 13,233,000 12,595,000 Cash and Cash Equivalents 15,757,551 17,316,770 Interest-Bearing Deposits in Other Financial Institutions 991,932 1,487,919 Securities Available-for-Sale at Fair Value (Amortized Cost is $36,996,703 in 2019 and $41,194,744 in 2018) 37,345,837 40,860,030 Restricted Stock 2,393,315 946,999 Loans, Net of Allowance for Loan Losses ($3,047,329 in 2019 and $2,831,035 in 2018) 127,247,432 127,920,918 Premises and Equipment, Net 1,832,743 1,904,620 Accrued Interest Receivable 693,327 690,981 Cash Value of Life Insurance 4,718,582 4,664,505 Deferred Tax Asset, Net 686,322 1,004,219 Other Assets 615,395 499,465 Total Assets $ 192,282,436 $ 197,296,426 LIABILITIES AND STOCKHOLDERS' EQUITY LIABILITIES Deposits: Noninterest-Bearing $ 23,911,948 $ 26,378,313 Interest-Bearing 124,560,249 128,023,190 Total Deposits 148,472,197 154,401,503 Repurchase Agreements - 2,567 Other Borrowings 2,000,000 2,000,000 Federal Home Loan Bank Advances 18,030,000 18,500,000 Accrued Interest Payable 181,384 164,983 Other Liabilities 735,627 787,860 Total Liabilities 169,419,208 175,856,913 STOCKHOLDERS' EQUITY Common Stock, $.25 Par Value, 400,000 Shares Authorized; 380,182 Issued in 2019 and in 2018 95,046 95,046 Treasury Stock, at Cost: 163,641 Shares in 2019 and 163,636 in 2018 (7,412,321) (7,411,862) Additional Paid-In Capital 2,557,676 2,557,676 Retained Earnings 27,452,794 26,445,709 Accumulated Other Comprehensive Income (Loss) 170,033 (247,056) Total Stockholders' Equity 22,863,228 21,439,513 Total Liabilities and Stockholders' Equity $ 192,282,436 $ 197,296,426 See accompanying Notes to Consolidated Financial Statements. (1)

F. & M. BANCORP OF TOMAH, INC. AND SUBSIDIARY CONSOLIDATED STATEMENTS OF INCOME SIX MONTHS ENDED JUNE 30, 2019 AND 2018 Unaudited Unaudited Six months ended: June 30, June 30, 2019 2018 INTEREST AND DIVIDEND INCOME Loans, Including Fees $ 3,182,147 $ 3,253,030 Investment Securities 466,971 477,585 Federal Funds Sold and Other 196,840 98,785 Total Interest and Dividend Income 3,845,958 3,829,400 INTEREST EXPENSE Deposits 546,599 453,955 Federal Funds Purchased and Repurchase Agreements 6 719 Federal Home Loan Advances and Other Borrowings 249,299 243,566 Total Interest Expense 795,904 698,240 NET INTEREST INCOME 3,050,054 3,131,160 PROVISION FOR LOAN LOSSES 175,000 - NET INTEREST INCOME AFTER PROVISION FOR LOAN LOSSES 2,875,054 3,131,160 NONINTEREST INCOME Service Charges and Fees 105,195 121,885 Net Gain on Sale of Available-For-Sale Securities 15,412 69,528 Net Change in Market Value on Equity Securities 1,480,716 - Net Gain (Loss) on Sale of Foreclosed Assets 7,206 (26,943) Net Loss on Disposal of Premise and Equipment - (6,244) Other 259,049 261,865 Total Noninterest Income 1,867,578 420,091 NONINTEREST EXPENSES Compensation and Employee Benefits 1,243,980 1,473,017 Occupancy and Equipment 213,163 280,598 Printing and Office Supplies 316,440 324,165 Advertising 122,960 104,663 Other 1,418,650 615,455 Total Noninterest Expenses 3,315,193 2,797,898 INCOME BEFORE INCOME TAXES 1,427,439 753,353 INCOME TAX EXPENSE 420,354 115,809 NET INCOME $ 1,007,085 $ 637,544 See accompanying Notes to Consolidated Financial Statements. (2)

F. & M. BANCORP OF TOMAH, INC. AND SUBSIDIARY CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME SIX MONTHS ENDED JUNE 30, 2019 AND 2018 Unaudited Unaudited June 30, June 30, 2019 2018 NET INCOME $ 1,007,085 $ 637,544 Other Comprehensive Income (Loss): Unrealized Gains (Loss) on Available-for-Sale Securities 496,420 (430,739) Reclassification Adjustment for Gain Realized in Income 15,412 69,528 Change in Fair Value of Derivative Instruments Designated as Cash Flow Hedges (91,044) 91,581 Income Tax Benefit (3,699) (16,687) Total Other Comprehensive Income (Loss) 417,089 (286,317) TOTAL COMPREHENSIVE INCOME $ 1,424,174 $ 351,227 See accompanying Notes to Consolidated Financial Statements. (3)

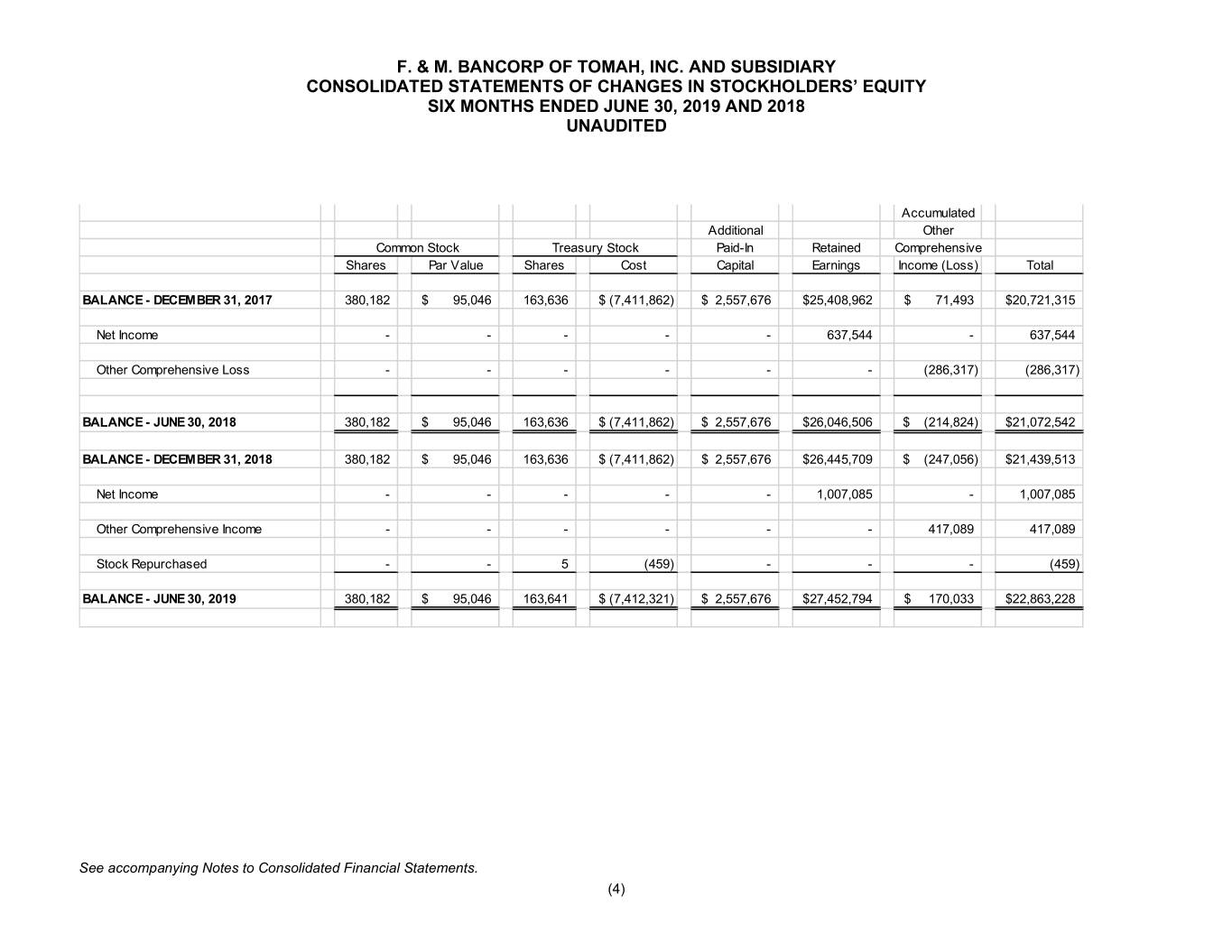

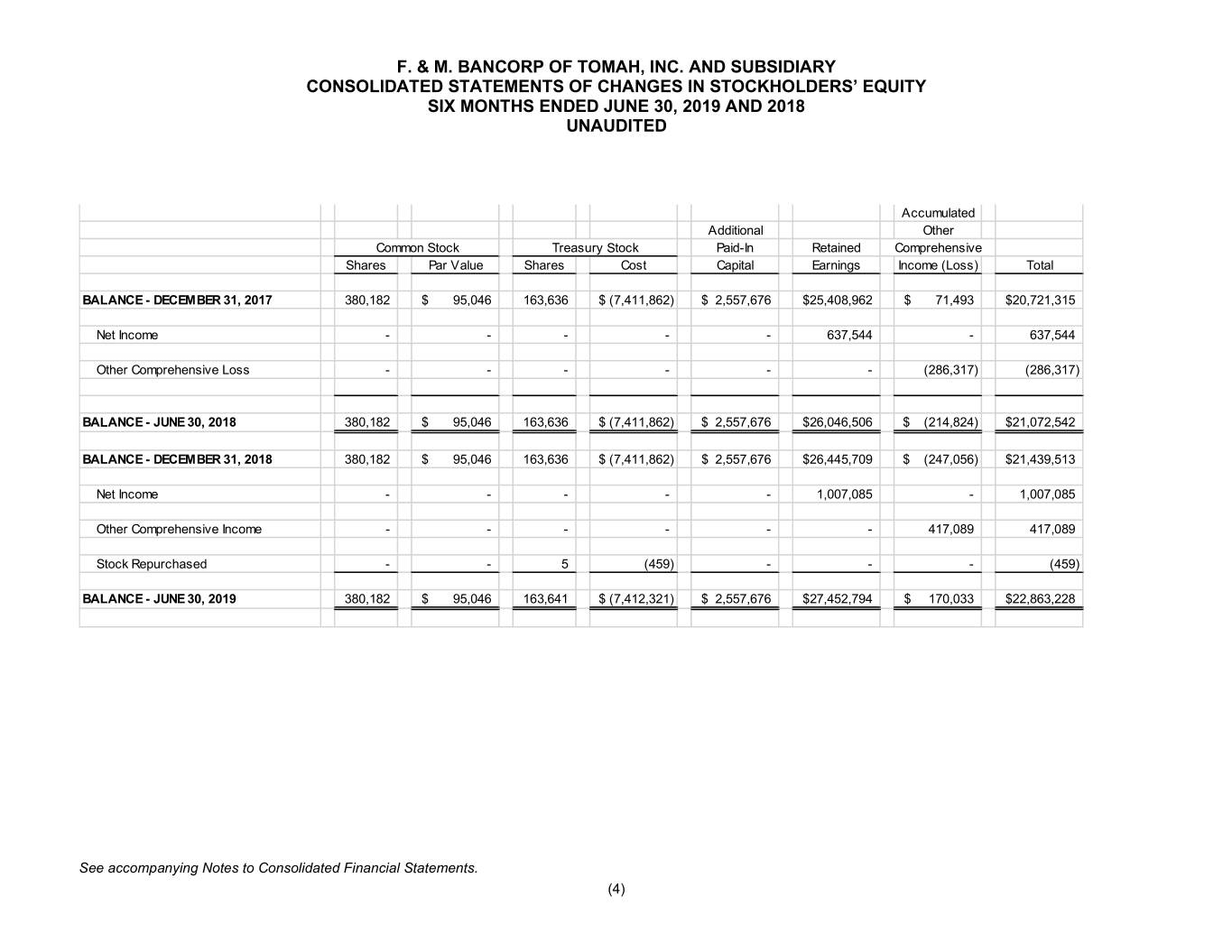

F. & M. BANCORP OF TOMAH, INC. AND SUBSIDIARY CONSOLIDATED STATEMENTS OF CHANGES IN STOCKHOLDERS’ EQUITY SIX MONTHS ENDED JUNE 30, 2019 AND 2018 UNAUDITED Accumulated Additional Other Common Stock Treasury Stock Paid-In Retained Comprehensive Shares Par Value Shares Cos t Capital Earnings Income (Loss) Total BALANCE - DECEM BER 31, 2017 380,182 $ 95,046 163,636 $ (7,411,862) $ 2,557,676 $25,408,962 $ 71,493 $20,721,315 Net Income - - - - - 637,544 - 637,544 Other Comprehensive Loss - - - - - - (286,317) (286,317) BALANCE - JUNE 30, 2018 380,182 $ 95,046 163,636 $ (7,411,862) $ 2,557,676 $26,046,506 $ (214,824) $21,072,542 BALANCE - DECEM BER 31, 2018 380,182 $ 95,046 163,636 $ (7,411,862) $ 2,557,676 $26,445,709 $ (247,056) $21,439,513 Net Income - - - - - 1,007,085 - 1,007,085 Other Comprehensive Income - - - - - - 417,089 417,089 Stock Repurchased - - 5 (459) - - - (459) BALANCE - JUNE 30, 2019 380,182 $ 95,046 163,641 $ (7,412,321) $ 2,557,676 $27,452,794 $ 170,033 $22,863,228 See accompanying Notes to Consolidated Financial Statements. (4)

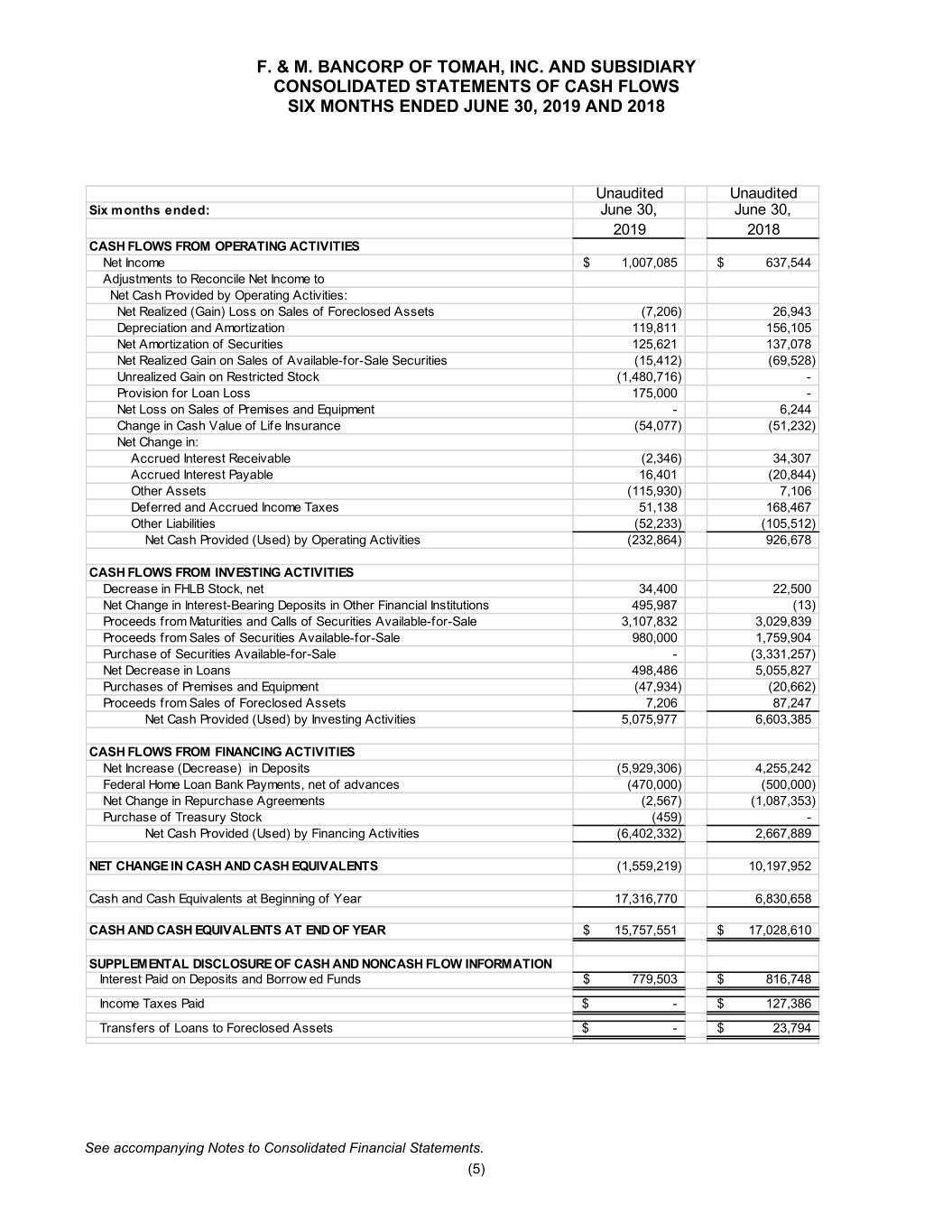

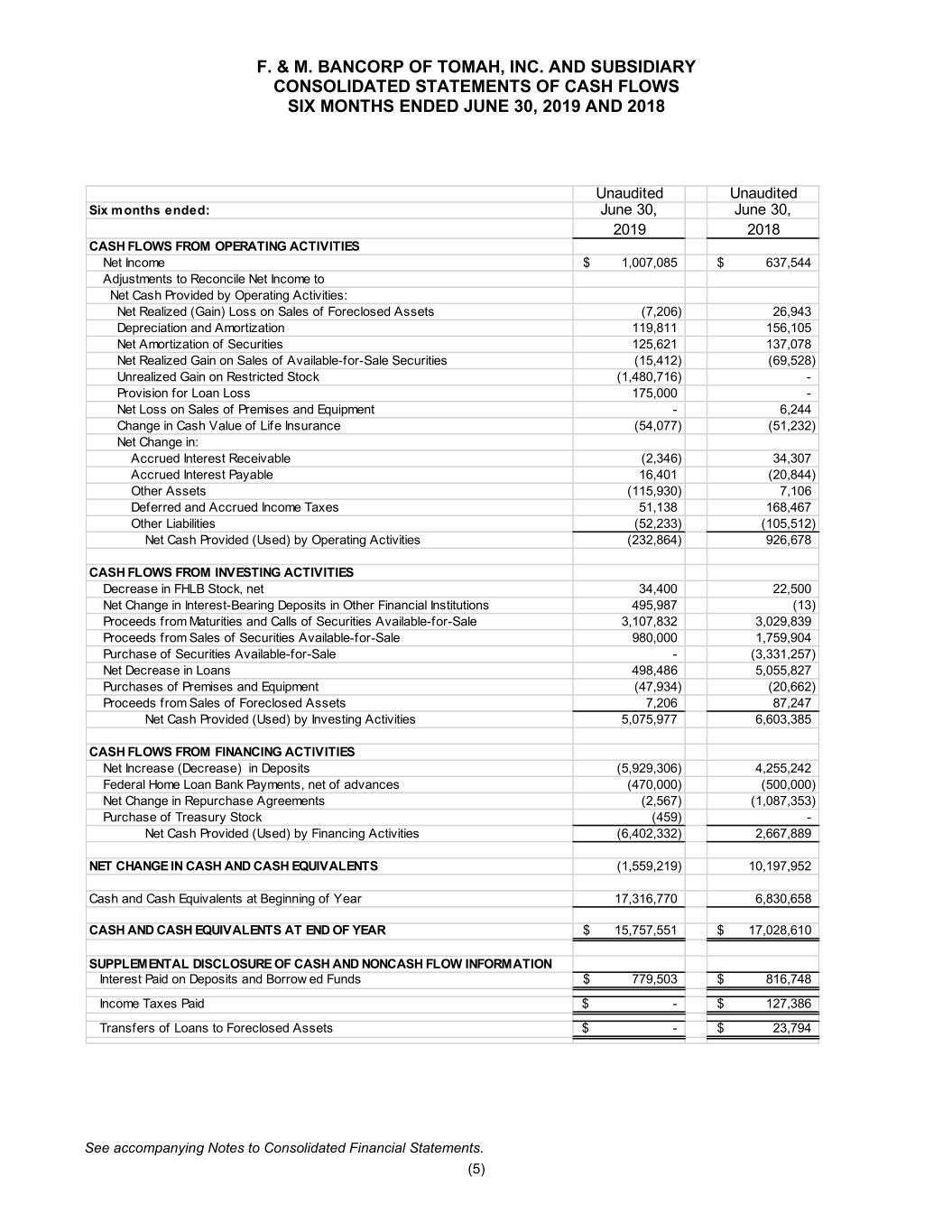

F. & M. BANCORP OF TOMAH, INC. AND SUBSIDIARY CONSOLIDATED STATEMENTS OF CASH FLOWS SIX MONTHS ENDED JUNE 30, 2019 AND 2018 Unaudited Unaudited Six months ended: June 30, June 30, 2019 2018 CASH FLOWS FROM OPERATING ACTIVITIES Net Income $ 1,007,085 $ 637,544 Adjustments to Reconcile Net Income to Net Cash Provided by Operating Activities: Net Realized (Gain) Loss on Sales of Foreclosed Assets (7,206) 26,943 Depreciation and Amortization 119,811 156,105 Net Amortization of Securities 125,621 137,078 Net Realized Gain on Sales of Available-for-Sale Securities (15,412) (69,528) Unrealized Gain on Restricted Stock (1,480,716) - Provision for Loan Loss 175,000 - Net Loss on Sales of Premises and Equipment - 6,244 Change in Cash Value of Life Insurance (54,077) (51,232) Net Change in: Accrued Interest Receivable (2,346) 34,307 Accrued Interest Payable 16,401 (20,844) Other Assets (115,930) 7,106 Deferred and Accrued Income Taxes 51,138 168,467 Other Liabilities (52,233) (105,512) Net Cash Provided (Used) by Operating Activities (232,864) 926,678 CASH FLOWS FROM INVESTING ACTIVITIES Decrease in FHLB Stock, net 34,400 22,500 Net Change in Interest-Bearing Deposits in Other Financial Institutions 495,987 (13) Proceeds from Maturities and Calls of Securities Available-for-Sale 3,107,832 3,029,839 Proceeds from Sales of Securities Available-for-Sale 980,000 1,759,904 Purchase of Securities Available-for-Sale - (3,331,257) Net Decrease in Loans 498,486 5,055,827 Purchases of Premises and Equipment (47,934) (20,662) Proceeds from Sales of Foreclosed Assets 7,206 87,247 Net Cash Provided (Used) by Investing Activities 5,075,977 6,603,385 CASH FLOWS FROM FINANCING ACTIVITIES Net Increase (Decrease) in Deposits (5,929,306) 4,255,242 Federal Home Loan Bank Payments, net of advances (470,000) (500,000) Net Change in Repurchase Agreements (2,567) (1,087,353) Purchase of Treasury Stock (459) - Net Cash Provided (Used) by Financing Activities (6,402,332) 2,667,889 NET CHANGE IN CASH AND CASH EQUIV ALENTS (1,559,219) 10,197,952 Cash and Cash Equivalents at Beginning of Year 17,316,770 6,830,658 CASH AND CASH EQUIV ALENTS AT END OF YEAR $ 15,757,551 $ 17,028,610 SUPPLEM ENTAL DISCLOSURE OF CASH AND NONCASH FLOW INFORM ATION Interest Paid on Deposits and Borrow ed Funds $ 779,503 $ 816,748 Income Taxes Paid $ - $ 127,386 Transfers of Loans to Foreclosed Assets $ - $ 23,794 See accompanying Notes to Consolidated Financial Statements. (5)

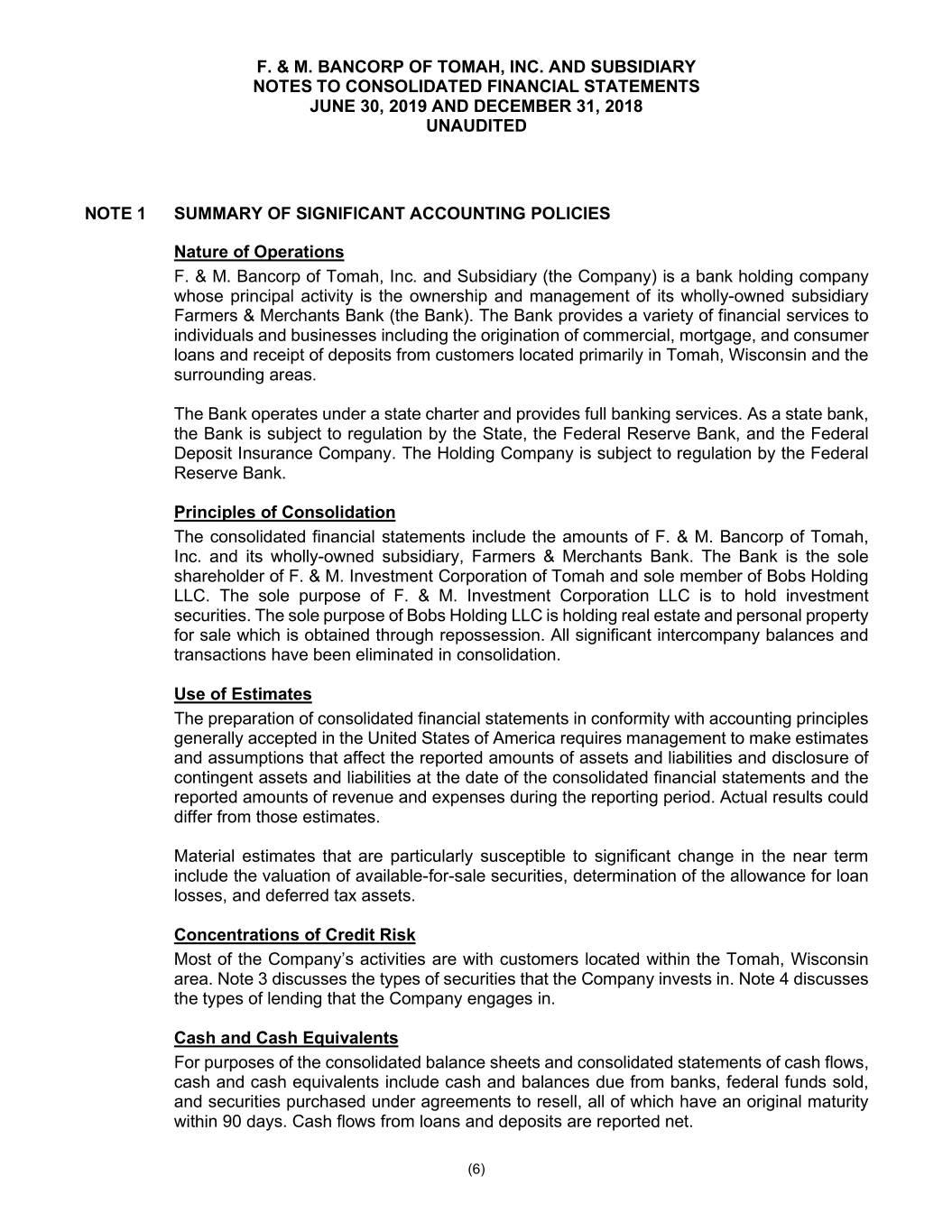

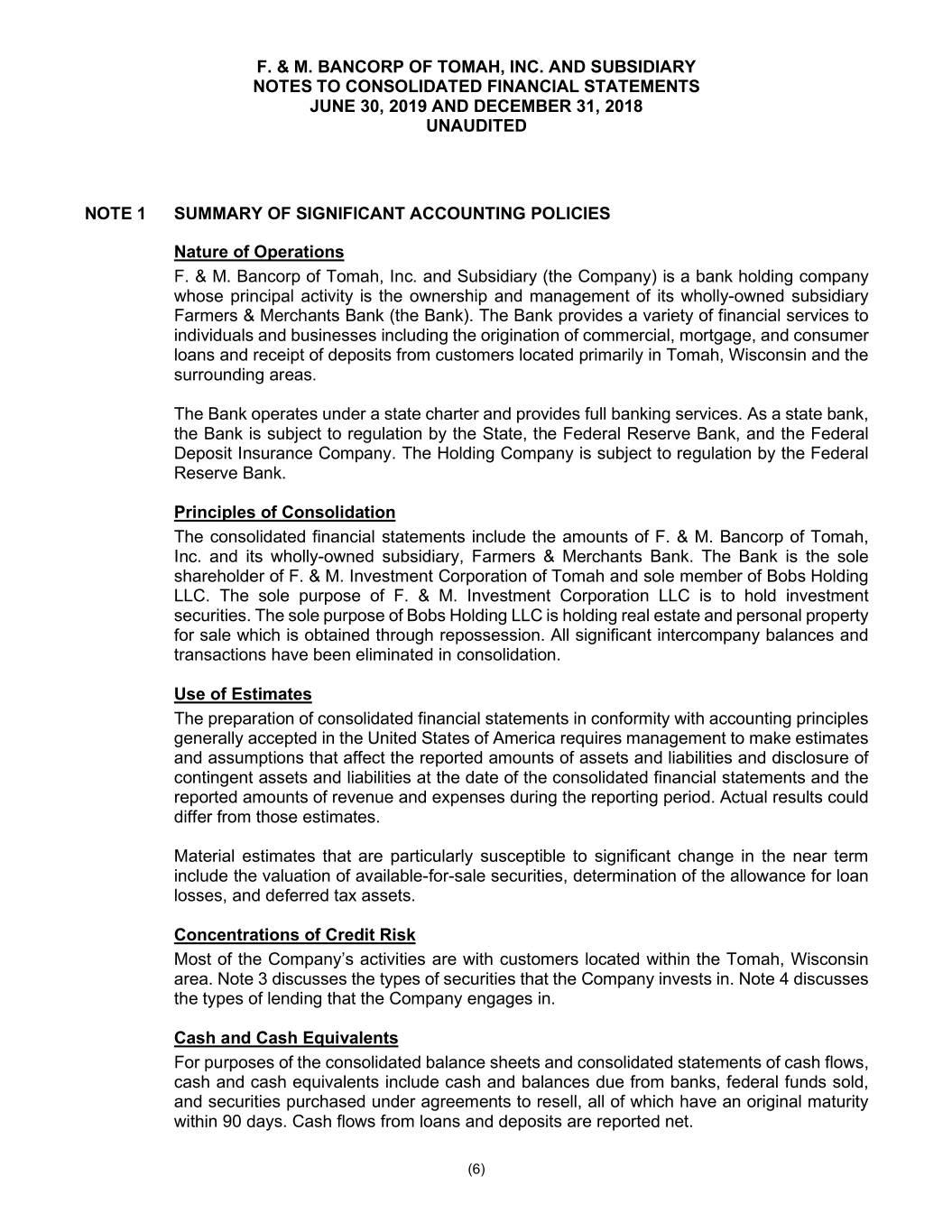

F. & M. BANCORP OF TOMAH, INC. AND SUBSIDIARY NOTES TO CONSOLIDATED FINANCIAL STATEMENTS JUNE 30, 2019 AND DECEMBER 31, 2018 UNAUDITED NOTE 1 SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES Nature of Operations F. & M. Bancorp of Tomah, Inc. and Subsidiary (the Company) is a bank holding company whose principal activity is the ownership and management of its wholly-owned subsidiary Farmers & Merchants Bank (the Bank). The Bank provides a variety of financial services to individuals and businesses including the origination of commercial, mortgage, and consumer loans and receipt of deposits from customers located primarily in Tomah, Wisconsin and the surrounding areas. The Bank operates under a state charter and provides full banking services. As a state bank, the Bank is subject to regulation by the State, the Federal Reserve Bank, and the Federal Deposit Insurance Company. The Holding Company is subject to regulation by the Federal Reserve Bank. Principles of Consolidation The consolidated financial statements include the amounts of F. & M. Bancorp of Tomah, Inc. and its wholly-owned subsidiary, Farmers & Merchants Bank. The Bank is the sole shareholder of F. & M. Investment Corporation of Tomah and sole member of Bobs Holding LLC. The sole purpose of F. & M. Investment Corporation LLC is to hold investment securities. The sole purpose of Bobs Holding LLC is holding real estate and personal property for sale which is obtained through repossession. All significant intercompany balances and transactions have been eliminated in consolidation. Use of Estimates The preparation of consolidated financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the consolidated financial statements and the reported amounts of revenue and expenses during the reporting period. Actual results could differ from those estimates. Material estimates that are particularly susceptible to significant change in the near term include the valuation of available-for-sale securities, determination of the allowance for loan losses, and deferred tax assets. Concentrations of Credit Risk Most of the Company’s activities are with customers located within the Tomah, Wisconsin area. Note 3 discusses the types of securities that the Company invests in. Note 4 discusses the types of lending that the Company engages in. Cash and Cash Equivalents For purposes of the consolidated balance sheets and consolidated statements of cash flows, cash and cash equivalents include cash and balances due from banks, federal funds sold, and securities purchased under agreements to resell, all of which have an original maturity within 90 days. Cash flows from loans and deposits are reported net. (6)

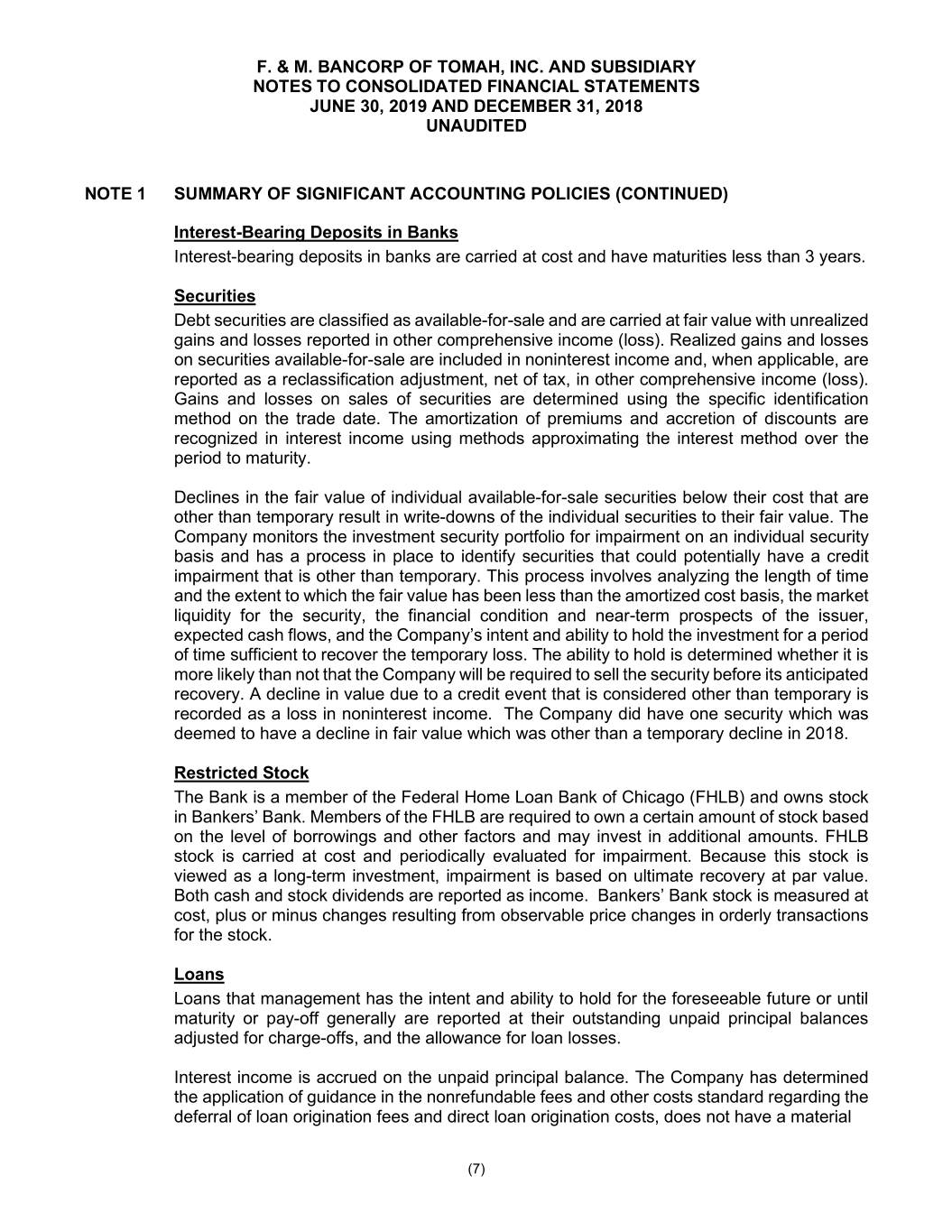

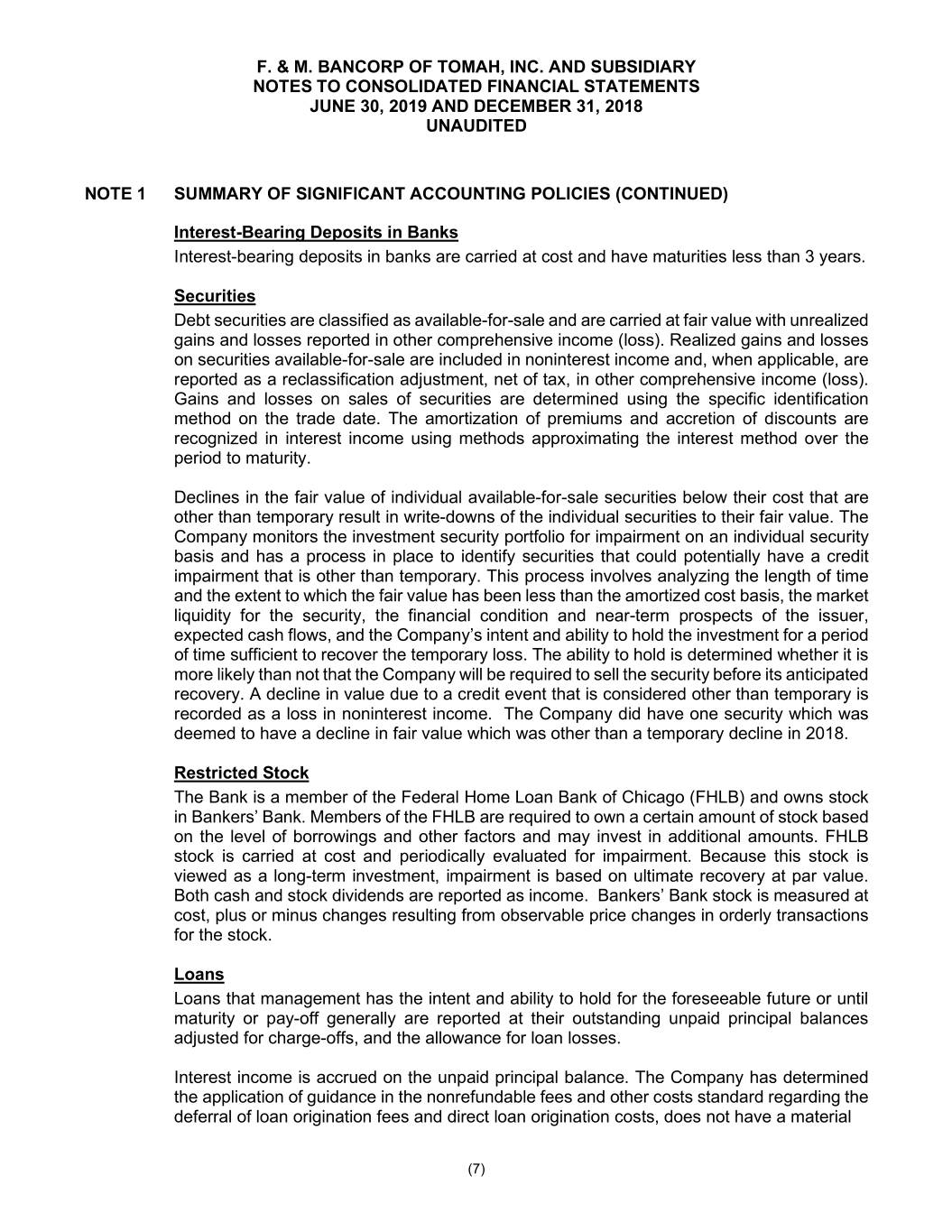

F. & M. BANCORP OF TOMAH, INC. AND SUBSIDIARY NOTES TO CONSOLIDATED FINANCIAL STATEMENTS JUNE 30, 2019 AND DECEMBER 31, 2018 UNAUDITED NOTE 1 SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (CONTINUED) Interest-Bearing Deposits in Banks Interest-bearing deposits in banks are carried at cost and have maturities less than 3 years. Securities Debt securities are classified as available-for-sale and are carried at fair value with unrealized gains and losses reported in other comprehensive income (loss). Realized gains and losses on securities available-for-sale are included in noninterest income and, when applicable, are reported as a reclassification adjustment, net of tax, in other comprehensive income (loss). Gains and losses on sales of securities are determined using the specific identification method on the trade date. The amortization of premiums and accretion of discounts are recognized in interest income using methods approximating the interest method over the period to maturity. Declines in the fair value of individual available-for-sale securities below their cost that are other than temporary result in write-downs of the individual securities to their fair value. The Company monitors the investment security portfolio for impairment on an individual security basis and has a process in place to identify securities that could potentially have a credit impairment that is other than temporary. This process involves analyzing the length of time and the extent to which the fair value has been less than the amortized cost basis, the market liquidity for the security, the financial condition and near-term prospects of the issuer, expected cash flows, and the Company’s intent and ability to hold the investment for a period of time sufficient to recover the temporary loss. The ability to hold is determined whether it is more likely than not that the Company will be required to sell the security before its anticipated recovery. A decline in value due to a credit event that is considered other than temporary is recorded as a loss in noninterest income. The Company did have one security which was deemed to have a decline in fair value which was other than a temporary decline in 2018. Restricted Stock The Bank is a member of the Federal Home Loan Bank of Chicago (FHLB) and owns stock in Bankers’ Bank. Members of the FHLB are required to own a certain amount of stock based on the level of borrowings and other factors and may invest in additional amounts. FHLB stock is carried at cost and periodically evaluated for impairment. Because this stock is viewed as a long-term investment, impairment is based on ultimate recovery at par value. Both cash and stock dividends are reported as income. Bankers’ Bank stock is measured at cost, plus or minus changes resulting from observable price changes in orderly transactions for the stock. Loans Loans that management has the intent and ability to hold for the foreseeable future or until maturity or pay-off generally are reported at their outstanding unpaid principal balances adjusted for charge-offs, and the allowance for loan losses. Interest income is accrued on the unpaid principal balance. The Company has determined the application of guidance in the nonrefundable fees and other costs standard regarding the deferral of loan origination fees and direct loan origination costs, does not have a material (7)

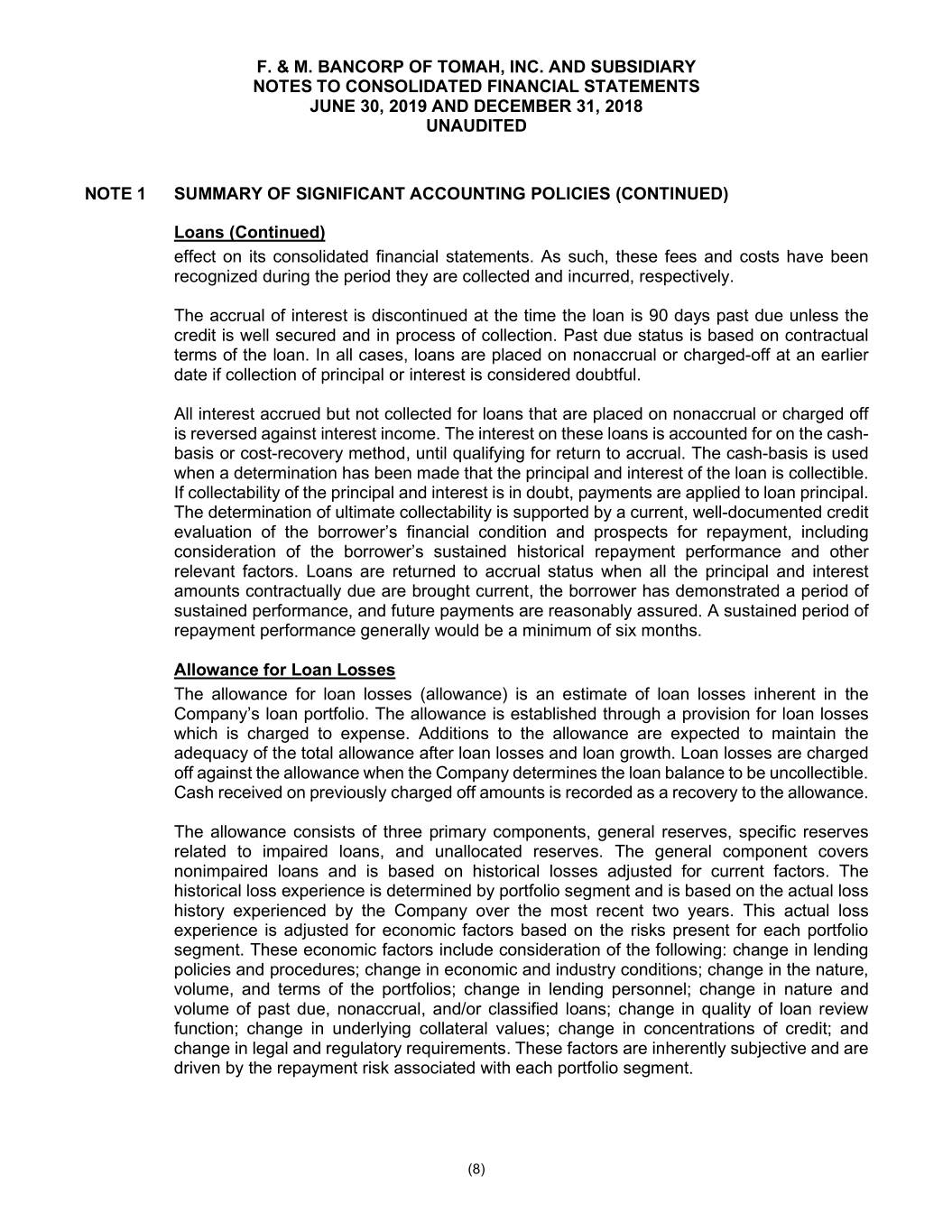

F. & M. BANCORP OF TOMAH, INC. AND SUBSIDIARY NOTES TO CONSOLIDATED FINANCIAL STATEMENTS JUNE 30, 2019 AND DECEMBER 31, 2018 UNAUDITED NOTE 1 SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (CONTINUED) Loans (Continued) effect on its consolidated financial statements. As such, these fees and costs have been recognized during the period they are collected and incurred, respectively. The accrual of interest is discontinued at the time the loan is 90 days past due unless the credit is well secured and in process of collection. Past due status is based on contractual terms of the loan. In all cases, loans are placed on nonaccrual or charged-off at an earlier date if collection of principal or interest is considered doubtful. All interest accrued but not collected for loans that are placed on nonaccrual or charged off is reversed against interest income. The interest on these loans is accounted for on the cash- basis or cost-recovery method, until qualifying for return to accrual. The cash-basis is used when a determination has been made that the principal and interest of the loan is collectible. If collectability of the principal and interest is in doubt, payments are applied to loan principal. The determination of ultimate collectability is supported by a current, well-documented credit evaluation of the borrower’s financial condition and prospects for repayment, including consideration of the borrower’s sustained historical repayment performance and other relevant factors. Loans are returned to accrual status when all the principal and interest amounts contractually due are brought current, the borrower has demonstrated a period of sustained performance, and future payments are reasonably assured. A sustained period of repayment performance generally would be a minimum of six months. Allowance for Loan Losses The allowance for loan losses (allowance) is an estimate of loan losses inherent in the Company’s loan portfolio. The allowance is established through a provision for loan losses which is charged to expense. Additions to the allowance are expected to maintain the adequacy of the total allowance after loan losses and loan growth. Loan losses are charged off against the allowance when the Company determines the loan balance to be uncollectible. Cash received on previously charged off amounts is recorded as a recovery to the allowance. The allowance consists of three primary components, general reserves, specific reserves related to impaired loans, and unallocated reserves. The general component covers nonimpaired loans and is based on historical losses adjusted for current factors. The historical loss experience is determined by portfolio segment and is based on the actual loss history experienced by the Company over the most recent two years. This actual loss experience is adjusted for economic factors based on the risks present for each portfolio segment. These economic factors include consideration of the following: change in lending policies and procedures; change in economic and industry conditions; change in the nature, volume, and terms of the portfolios; change in lending personnel; change in nature and volume of past due, nonaccrual, and/or classified loans; change in quality of loan review function; change in underlying collateral values; change in concentrations of credit; and change in legal and regulatory requirements. These factors are inherently subjective and are driven by the repayment risk associated with each portfolio segment. (8)

F. & M. BANCORP OF TOMAH, INC. AND SUBSIDIARY NOTES TO CONSOLIDATED FINANCIAL STATEMENTS JUNE 30, 2019 AND DECEMBER 31, 2018 UNAUDITED NOTE 1 SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (CONTINUED) Allowance for Loan Losses (Continued) A loan is considered impaired when, based on current information and events, it is probable that the Company will be unable to collect the scheduled payments of principal or interest when due according to the contractual terms of the loan agreement. Loans determined to be impaired are individually evaluated for impairment. When a loan is impaired, the Company measures impairment based on the present value of expected future cash flows discounted at the original contractual interest rate, except that as a practical expedient, it may measure impairment based on an observable market price, or the fair value of the collateral if collateral dependent. A loan is collateral dependent if the repayment is expected to be provided solely by the underlying collateral. Allowance allocations other than general and specific are included in the unallocated portion. While allocations are made for loans based upon historical loss analysis, the unallocated portion is designed to cover the uncertainty of how current economic conditions and other uncertainties may impact the existing loan portfolio. Factors to consider include national and state economic conditions such as increases in unemployment and the real estate lending crisis. The unallocated reserve addresses inherent probable losses not included elsewhere in the allowance for loan losses. While calculating allocated reserve, the unallocated reserve supports uncertainties within the loan portfolio. Under certain circumstances, the Company will provide borrowers relief through loan restructurings. A restructuring of debt constitutes a troubled debt restructuring (TDR) if the Company for economic or legal reasons related to the borrower’s financial difficulties grants a concession to the borrower that it would not otherwise consider. Restructured loans typically present an elevated level of credit risk as the borrowers are not able to perform according to the original contractual terms. Loans that are reported as TDRs are considered impaired and measured for impairment as described above in the calendar year of the restructuring. In subsequent years, a restructured loan may cease being classified as impaired if the loan was modified at a market rate and is performing according to the modified terms. TDR concessions can include reduction of interest rates, extension of maturity dates, forgiveness of principal or interest due, or acceptance of other assets in full or partial satisfaction of the debt. Restructured loans can involve loans remaining on nonaccrual, moving to nonaccrual, or continuing on accrual status, depending on the individual facts and circumstances of the borrower. Nonaccrual restructured loans are included and treated with other nonaccrual loans. The Company assigns a risk rating to all loans and periodically performs detailed internal reviews of all such loans over a certain threshold to identify credit risks and to assess the overall collectability of the portfolio. These risk ratings are also subject to examination by the Company’s regulators. During the internal reviews, management monitors and analyzes the financial condition of borrowers and guarantors, trends in the industries in which the borrowers operate and the fair values of collateral securing the loans. These credit quality indicators are used to assign a risk rating to each individual loan. (9)

F. & M. BANCORP OF TOMAH, INC. AND SUBSIDIARY NOTES TO CONSOLIDATED FINANCIAL STATEMENTS JUNE 30, 2019 AND DECEMBER 31, 2018 UNAUDITED NOTE 1 SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (CONTINUED) Allowance for Loan Losses (Continued) The risk ratings can be grouped into six major categories, defined as follows: Pass: A pass loan is a credit with no existing or known potential weaknesses deserving of management’s close attention. Management Attention: Borrower has potential weaknesses resulting from performance trends or management concerns. The financial condition of the borrower has taken a negative turn and may be temporarily strained. Cash flow may be weak; cash reserves remain adequate to meet near-term debt service but may not be adequate for long-term coverage. Collateral coverage may currently be adequate. Borrower’s management weakness is evident. Loans rated management attention are not considered watch listed, criticized, or classified assets. Special Mention: A Special Mention loan has potential weaknesses that deserve management’s close attention. If left uncorrected, these potential weaknesses may result in deterioration of the repayment prospects for the asset or in the Company’s credit position at some future date. Special mention assets are not adversely classified and do not expose an institution to sufficient risk to warrant adverse classification. Borrowers may be experiencing adverse operating trends or an ill-proportioned balance sheet. Adverse economic or market conditions, such as interest rate increases or the entry of a new competitor, may also support a special mention rating. Nonfinancial reasons for rating a credit exposure special mention include borrower’s management problems, pending litigation, an ineffective loan agreement or other material structural weakness, and any other significant deviation from prudent lending practices. Substandard: Loans classified as substandard are not adequately protected by the current net worth and paying capacity of the borrower or of the collateral pledged, if any. Loans classified as substandard have a well-defined weakness or weaknesses that jeopardize the repayment of the debt. Well-defined weaknesses include a borrower’s lack of marketability, inadequate cash flow, or collateral support, failure to complete construction on time, or the failure to fulfill economic expectations. These loans are characterized by the distinct possibility that the Company will sustain some loss if the deficiencies are not corrected. Doubtful: Loans classified as doubtful have all the weaknesses inherent in those classified as substandard, with the added characteristic that the weaknesses make collection or repayment in full, on the basis of currently existing facts, conditions, and values, highly questionable and improbable. Loss: Loans classified as loss are considered uncollectible and are charged off immediately. (10)

F. & M. BANCORP OF TOMAH, INC. AND SUBSIDIARY NOTES TO CONSOLIDATED FINANCIAL STATEMENTS JUNE 30, 2019 AND DECEMBER 31, 2018 UNAUDITED NOTE 1 SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (CONTINUED) Allowance for Loan Losses (Continued) The Company maintains a separate general valuation allowance for each portfolio segment. These portfolio segments include construction and land development, 1-4 family and multi- family residential real estate, nonfarm nonresidential real estate, agricultural, commercial loans, consumer and other, and SBA guaranteed purchased loans with risk characteristics described as follows: Construction and Land Development: Construction and land development loans generally possess a higher inherent risk of loss than other real estate portfolio segments. A major risk arises from the necessity to complete projects within a specified cost and time line. Trends in the construction industry significantly impact the credit quality of these loans, as demand drives construction activity. In addition, trends in real estate values significantly impact the credit quality of these loans, as property values determine the economic viability of construction projects. 1-4 Family and Multi-Family Residential Real Estate: The degree of risk in residential mortgage lending depends primarily on the loan amount in relation to collateral value, the interest rate, and the borrower’s ability to repay in an orderly fashion. These loans generally possess a lower inherent risk of loss than other real estate portfolio segments. Economic trends determined by unemployment rates and other key economic indicators are closely correlated to the credit quality of these loans. Nonfarm Nonresidential Real Estate: The nonfarm nonresidential real estate portfolio is comprised of commercial real estate loans which generally possess a higher inherent risk of loss than other real estate portfolio segments, except construction and land development loans. Adverse economic developments or an overbuilt market impact commercial real estate projects and may result in troubled loans. Trends in vacancy rates of commercial properties impact the credit quality of these loans. High vacancy rates reduce operating revenues and the ability for the properties to produce sufficient cash flow to service debt obligations. Agricultural: Loans to individuals secured by farmland or farm equipment generally possesses a higher risk compared to other portfolios as the repayment of the credit is dependent upon an existing farming operation. Trends in the agriculture industry have a significant impact on the credit quality of these loans as input and output costs factor heavily in the success of farming operations. Commercial Loans: Commercial loans generally possess a lower inherent risk of loss than real estate portfolio segments because these loans are generally underwritten to existing cash flows of operating businesses. Debt coverage is provided by business cash flows and economic trends influenced by unemployment rates and other key economic indicators are closely correlated to the credit quality of these loans. Consumer and Other: The consumer and other loan portfolios are usually comprised of a large number of small loans. Most loans are made directly for consumer purchases and student loans. Economic trends determined by unemployment rates and other key economic indicators are closely correlated to the credit quality of these loans. (11)

F. & M. BANCORP OF TOMAH, INC. AND SUBSIDIARY NOTES TO CONSOLIDATED FINANCIAL STATEMENTS JUNE 30, 2019 AND DECEMBER 31, 2018 UNAUDITED NOTE 1 SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (CONTINUED) Allowance for Loan Losses (Continued) SBA Guaranteed Purchase: Commercial SBA loans generally possess a lower inherent risk of loss than other commercial and real estate portfolio segments because these loans are generally underwritten to existing cash flows of operating businesses and are guaranteed by the Small Business Administration (SBA). The SBA guarantees that these loans will be repaid, thus eliminating some of the risk to the lending partners. Economic trends influenced by unemployment rates and other key economic indicators are closely related to the credit quality of these loans. Although management believes the allowance to be adequate, ultimate losses may vary from its estimates. At least quarterly, the board of directors reviews the adequacy of the allowance, including consideration of the relevant risks in the portfolio, current economic conditions, and other factors. If the board of directors and management determine changes are warranted based on those reviews, the allowance is adjusted. In addition, the Company’s primary regulator reviews the adequacy of the allowance. The regulatory agencies may require additions to the allowance based on their judgment about information available at the time of their examinations. Foreclosed Assets Assets acquired through, or in lieu of, loan foreclosure are held for sale and are initially recorded at fair value less estimated selling cost at the date of foreclosure, establishing a new cost basis. Any write-downs based on the asset’s fair value at the date of acquisition are charged to the allowance for loan losses. Subsequent to foreclosure, valuations are periodically performed by management and the assets held for sale are carried at the lower of the new cost basis or fair value less cost to sell. This evaluation is inherently subjective and requires estimates that are susceptible to significant revisions as more information becomes available. Impairment losses on assets to be held and used are measured at the amount by which the carrying amount of a property exceeds its fair value. Costs of significant asset improvements are capitalized, whereas costs relating to holding assets are expensed. Revenue and expenses from operations and changes in the valuation allowance are included in net expenses from foreclosed assets. Premises and Equipment Land is carried at cost. Other premises and equipment are carried at cost net of accumulated depreciation. Depreciation is computed on the straight-line method based principally on the estimated useful lives of the assets. Maintenance and repairs are expensed as incurred while major additions and improvements are capitalized. Gains and losses on dispositions are included in noninterest income. (12)

F. & M. BANCORP OF TOMAH, INC. AND SUBSIDIARY NOTES TO CONSOLIDATED FINANCIAL STATEMENTS JUNE 30, 2019 AND DECEMBER 31, 2018 UNAUDITED NOTE 1 SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (CONTINUED) Impairment of Long-Lived Assets The Company tests long-lived assets for impairment whenever events or changes in circumstances indicate the carrying amount of an asset may not be recoverable. Recoverability of assets to be held and used is measured by a comparison of the carrying amount of an asset to future undiscounted net cash flows expected to be generated by the asset. If such assets are considered to be impaired, the impairment to be recognized is measured by the amount by which the carrying amount of the assets exceeds the fair value of the assets. Assets to be disposed of are reported at the lower of carrying amount or fair value less estimated costs to sell. Transfers of Financial Assets and Participating Interests Transfers of an entire financial asset or a participating interest in an entire financial asset are accounted for as sales when control over the assets has been surrendered. Control over transferred assets is deemed to be surrendered when (1) the assets have been isolated from the Company, (2) the transferee obtains the right (free of conditions that constrain it from taking advantage of that right) to pledge or exchange the transferred assets, and (3) the Company does not maintain effective control over the transferred assets through an agreement to repurchase them before their maturity. The transfer of a participating interest in an entire financial asset must also meet the definition of a participating interest. A participating interest in a financial asset has all of the following characteristics: (1) from the date of transfer, it must represent a proportionate (pro rata) ownership interest in the financial asset, (2) from the date of transfer, all cash flows received, except any cash flows allocated as any compensation for servicing or other services performed, must be divided proportionately among participating interest holders in the amount equal to their share ownership, (3) the rights of each participating interest holder must have the same priority, (4) no party has the right to pledge or exchange the entire financial asset unless all participating interest holders agree to do so. Bank Owned Life Insurance The Company has purchased life insurance policies on certain key executives. Bank owned life insurance is recorded at its cash surrender value, or the amount that can be realized, if lower. Advertising Costs Advertising costs are expensed as incurred. Securities Sold Under Agreements to Repurchase Securities sold under agreements to repurchase generally mature within one to four days from the transaction date. Securities sold under agreements to repurchase are reflected at the amount of cash received in connection with the transaction. The Company may be required to provide additional collateral based on the fair value of the underlying securities. (13)

F. & M. BANCORP OF TOMAH, INC. AND SUBSIDIARY NOTES TO CONSOLIDATED FINANCIAL STATEMENTS JUNE 30, 2019 AND DECEMBER 31, 2018 UNAUDITED NOTE 1 SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (CONTINUED) Income Taxes Deferred tax assets and liabilities are recognized for the future tax consequences attributable to temporary differences between the consolidated financial statement carrying amounts of existing assets and liabilities and their respective tax bases. Deferred tax assets and liabilities are measured using enacted tax rates expected to apply to taxable income in the years in which those temporary differences are expected to be recovered or settled. The effect on deferred tax assets and liabilities of a change in tax rates is recognized in income in the period that includes the enactment date. These calculations are based on many complex factors including estimates of the timing of reversals of temporary differences, the interpretation of federal and state income tax laws, and a determination of the differences between the tax and the financial reporting basis of assets and liabilities. Actual results could differ significantly from the estimates and interpretations used in determining the current and deferred income tax liabilities. Under accounting principles generally accepted in the United States of America, a valuation allowance is required to be recognized if it is “more likely than not” that the deferred tax asset will not be realized. The determination of the ability to realize the deferred tax assets is highly subjective and dependent upon judgment concerning management’s evaluation of both positive and negative evidence, the forecasts of future income, applicable tax planning strategies, and assessments of the current and future economic and business conditions. The Company follows the provision of accounting for uncertainty in income taxes. The Company can recognize in the consolidated financial statements the impact of a tax position taken, or expected to be taken, if it is more likely than not that the tax position taken will be sustained on audit based on the technical merit of the position. The Company has evaluated its tax position and determined that it has no uncertain tax positions at June 30, 2019 and December 31, 2018. The Company files consolidated federal and state income tax returns and it is not subject to federal or state income tax examinations for taxable years prior to 2015. Interest Rate Swap Agreements Interest rate swap agreements are recognized as either assets or liabilities and are measured at fair value. The Company utilizes interest rate swap agreements to manage its interest rate risk on fixed rate municipal securities and variable rate debt. They are not used for speculative purposes. Terms of the instruments are structured with the intent of achieving a high degree of hedge effectiveness. The changes in fair value of the interest rate swap agreements are recognized in earnings or in other comprehensive income, depending on the use of the swap and whether it qualifies for hedge accounting. A derivative that does not qualify, or is not designated, as a hedge will be reflected at fair value, with changes in value recognized in income. (14)

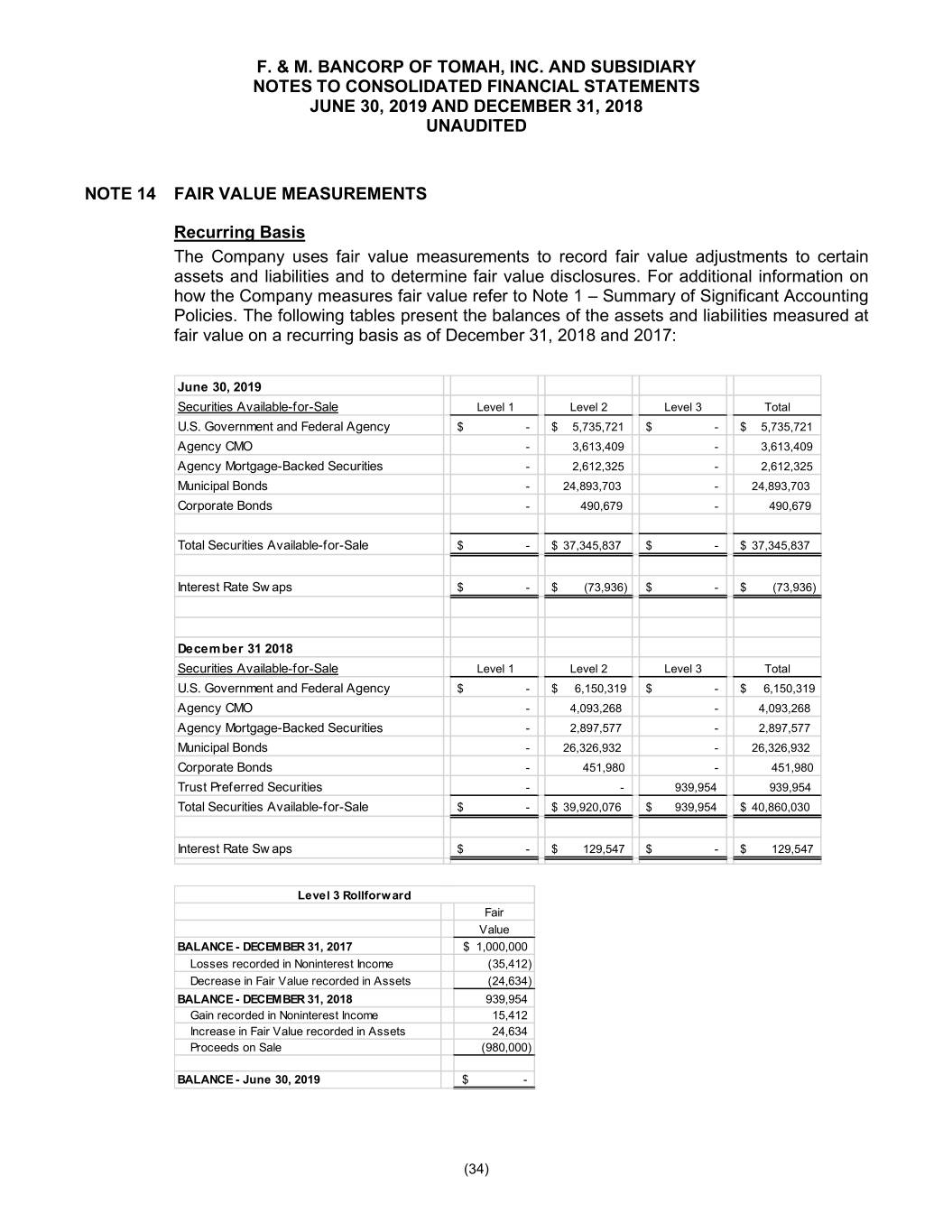

F. & M. BANCORP OF TOMAH, INC. AND SUBSIDIARY NOTES TO CONSOLIDATED FINANCIAL STATEMENTS JUNE 30, 2019 AND DECEMBER 31, 2018 UNAUDITED NOTE 1 SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (CONTINUED) Interest Rate Swap Agreements (Continued) The effective portion of the changes in fair values of derivatives that qualify as cash flow hedges are recorded in other comprehensive income. Amounts receivable or payable under the swap agreements are reclassified from other comprehensive income to net income as an adjustment to the expense of the related transaction. These amounts are included in the consolidated statements of income as interest expense. Comprehensive income (loss) and its components are required to be presented for each year a statement of income is presented. The only components included in other comprehensive income (loss) for the Company are the net unrealized gain (loss) on available-for-sale securities and its interest rate swap agreements. Comprehensive Income (Loss) Recognized revenue, expenses, gains, and losses are included in net income. Certain changes in assets and liabilities, such as unrealized gains and losses on securities available for sale, are reported as a separate component of the equity section of the consolidated balance sheet and such items, along with net income, are components of comprehensive income (loss). The pre-tax amounts of gain (loss) on sale of available-for-sale securities and other-than- temporary impairment reclassified from accumulated other comprehensive income (loss) are included in noninterest income. Unrealized Gains and Gains and Losses on Losses on Cash Flow Available-for- Hedges Sale Securities Total December 31, 2017 $ (75,706) $ 147,199 $ 71,493 Other comprehensive income 91,581 (377,898) (286,317) June 30, 2018 $ 15,875 $ (230,699) $ (214,824) December 31, 2018 $ (3,961) $ (243,095) $ (247,056) Other comprehensive income (91,044) 508,133 417,089 June 30, 2019 $ (95,005) $ 265,038 $ 170,033 Fair Value The Company categorizes its assets and liabilities measured at fair value into a three-level hierarchy based on the priority of the inputs to the valuation technique used to determine fair value. The fair value hierarchy gives the highest priority to quoted prices in active markets for identical assets or liabilities (Level 1) and the lowest priority to unobservable inputs (Level 3). If the inputs used in the determination of the fair value measurement fall within different levels (15)

F. & M. BANCORP OF TOMAH, INC. AND SUBSIDIARY NOTES TO CONSOLIDATED FINANCIAL STATEMENTS JUNE 30, 2019 AND DECEMBER 31, 2018 UNAUDITED Fair Value (Continued) of the hierarchy, the categorization is based on the lowest level input that is significant to the fair value measurement. Assets and liabilities valued at fair value are categorized based on the inputs to the valuation techniques as follows: Level 1 – Inputs that utilize quoted prices (unadjusted) in active markets for identical assets or liabilities that an entity has the ability to access. Level 2 – Inputs that include quoted prices for similar assets and liabilities in active markets and inputs that are observable for the asset or liability, either directly or indirectly, for substantially the full term of the financial instrument. Fair values for these instruments are estimated using pricing models, quoted prices of securities with similar characteristics, or discounted cash flows. Level 3 – Inputs that are unobservable inputs for the asset or liability, which are typically based on an entity’s own assumptions, as there is little, if any, related market activity. Subsequent to initial recognition, the Company may remeasure the carrying value of assets and liabilities measured on a nonrecurring basis to fair value. Adjustments to fair value usually result when certain assets are impaired. Such assets are written down from their carrying amounts to their fair value. Professional standards allow entities the irrevocable option to elect to measure certain financial instruments and other items at fair value for the initial and subsequent measurement on an instrument-by-instrument basis. The Company has not elected to measure any existing financial instruments at fair value under the fair value option; however, it may elect to measure newly acquired financial instruments at fair value in the future. New Accounting Standards In June 2016, the FASB approved ASU 2016-13, Financial Instruments – Credit Losses (Topic 326): Measurement of Credit Losses on Financial Instruments. The main objective of the ASU is to provide financial statement users with more decision-useful information about the expected credit losses on financial instruments and other commitments to extend credit held by a reporting entity at each reporting date. To achieve this objective, the amendments in the ASU replace the incurred loss impairment methodology in current GAAP with a methodology that reflects expected credit losses and requires consideration of a broader range of reasonable and supportable information to inform credit loss estimates. The ASU is effective for the Bank for the fiscal year beginning after December 15, 2021, and interim periods within that fiscal year. Early adoption is permitted for the fiscal year beginning after December 15, 2018, including interim periods within this fiscal year. The Company is currently evaluating the impact of ASU 2016-13 on the consolidated financial statements. FASB has issued a proposed change to this ASU that would delay the implementation date until January 1, 2023 for the Company. (16)

F. & M. BANCORP OF TOMAH, INC. AND SUBSIDIARY NOTES TO CONSOLIDATED FINANCIAL STATEMENTS JUNE 30, 2019 AND DECEMBER 31, 2018 UNAUDITED NOTE 1 SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (CONTINUED) In May 2014, the FASB issued ASU No. 2014-09, Revenue from Contracts with Customers (Topic 606), which does not apply to financial instruments. The core principle of the guidance is that an entity should recognize revenue to depict the transfer of promised goods or services to customers in an amount that reflects the consideration to which the entity expects to be entitled in exchange for those goods and services. The amendments can be applied retrospectively to each prior reporting period or retrospectively with the cumulative effect of initially applying this ASU recognized at the date of initial application. Early application is not permitted. The Company implemented the ASU beginning January 1, 2019 with no material impact to its statement of operations. Recognition and Measurement of Financial Assets and Financial Liabilities (“ASU 2016-01”). This guidance changes how entities account for equity investments that do not result in consolidation and are not accounted for under the equity method of accounting. Entities will be required to measure these investments at fair value at the end of each reporting period and recognize changes in fair value in net income. A practicability exception will be available for equity investments that do not have readily determinable fair values; however, the exception requires the Company to adjust the carrying amount for impairment and observable price changes in orderly transactions for the identical or a similar investment of the same issuer. This guidance also changes certain disclosure requirements and other aspects of current GAAP. The Company implemented this guidance January 1, 2019 and as result the Company recorded net change in market value on equity securities of $1,480,716 in the income statement. In February 2018, the FASB issued ASU 2018-02, Income Statement – Reporting Comprehensive Income (Topic 220): Reclassification of Certain Tax Effects from Accumulated Other Comprehensive Income, which requires companies to reclassify the stranded effects in other comprehensive income to retained earnings as a result of the change in the tax rates under the Tax Cuts and Jobs Act, Public Law 115-97 (the “2017 Tax Act”). The amendment is effective for fiscal years beginning after December 15, 2018, with early adoption permitted, including adoption in an interim period. The Company early adopted this amendment as of January 1, 2018. Subsequent Events In preparing these consolidated financial statements, the Company has evaluated events and transactions for potential recognition or disclosure through September 17, 2019, the date the consolidated financial statements were available to be issued. On January 21, 2019, F. & M. Bancorp of Tomah, Inc. entered into an Agreement and Plan of Merger with Citizens Community Bancorp, Inc., pursuant to which F. & M. Bancorp of Tomah, Inc. will merge into Citizens Community Bancorp, Inc., with Citizens Community Bancorp, Inc. as the surviving corporation. At the time of the bank merger, the Bank’s banking offices will become branches of Citizens Community Bancorp, Inc. The merger was completed as of the start of business July 1, 2019. (17)

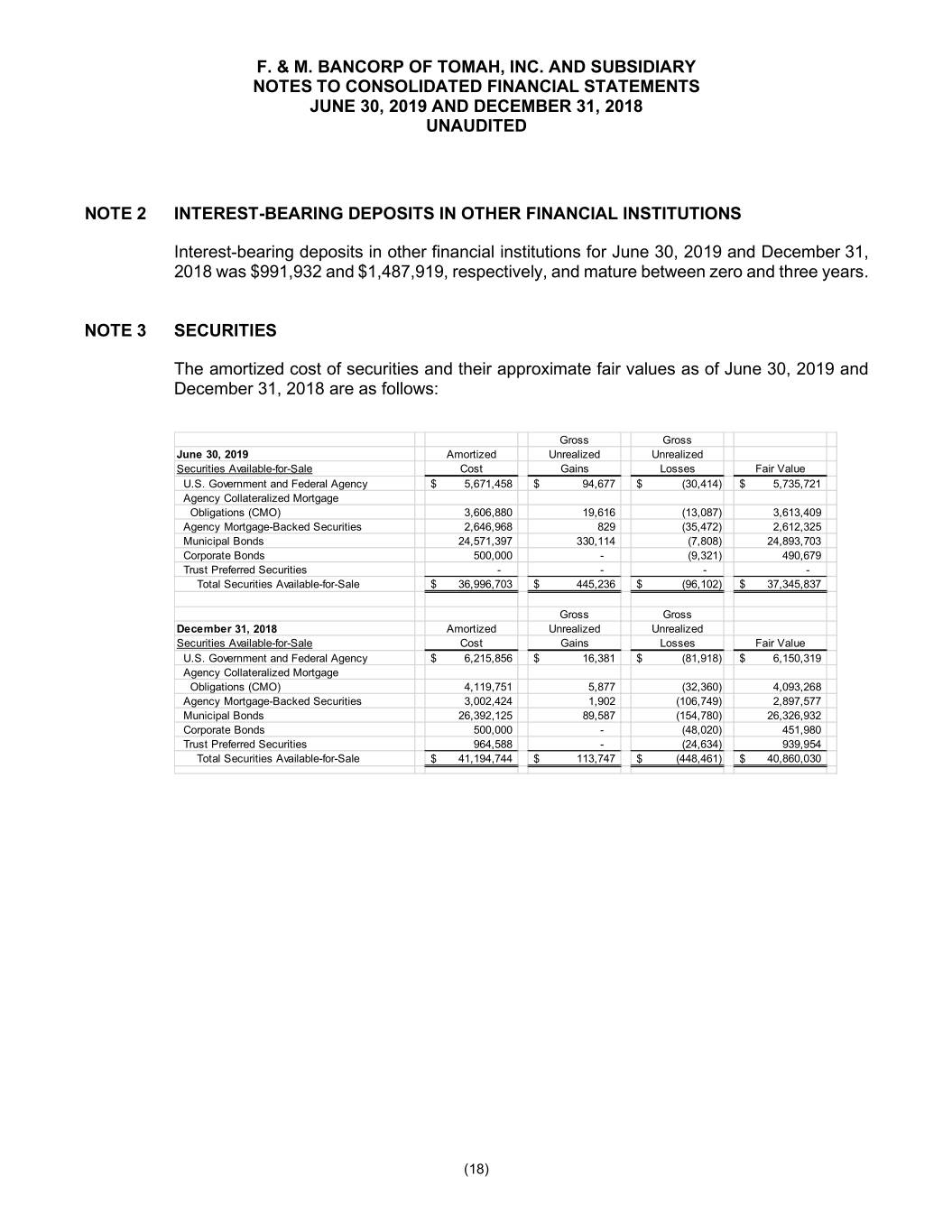

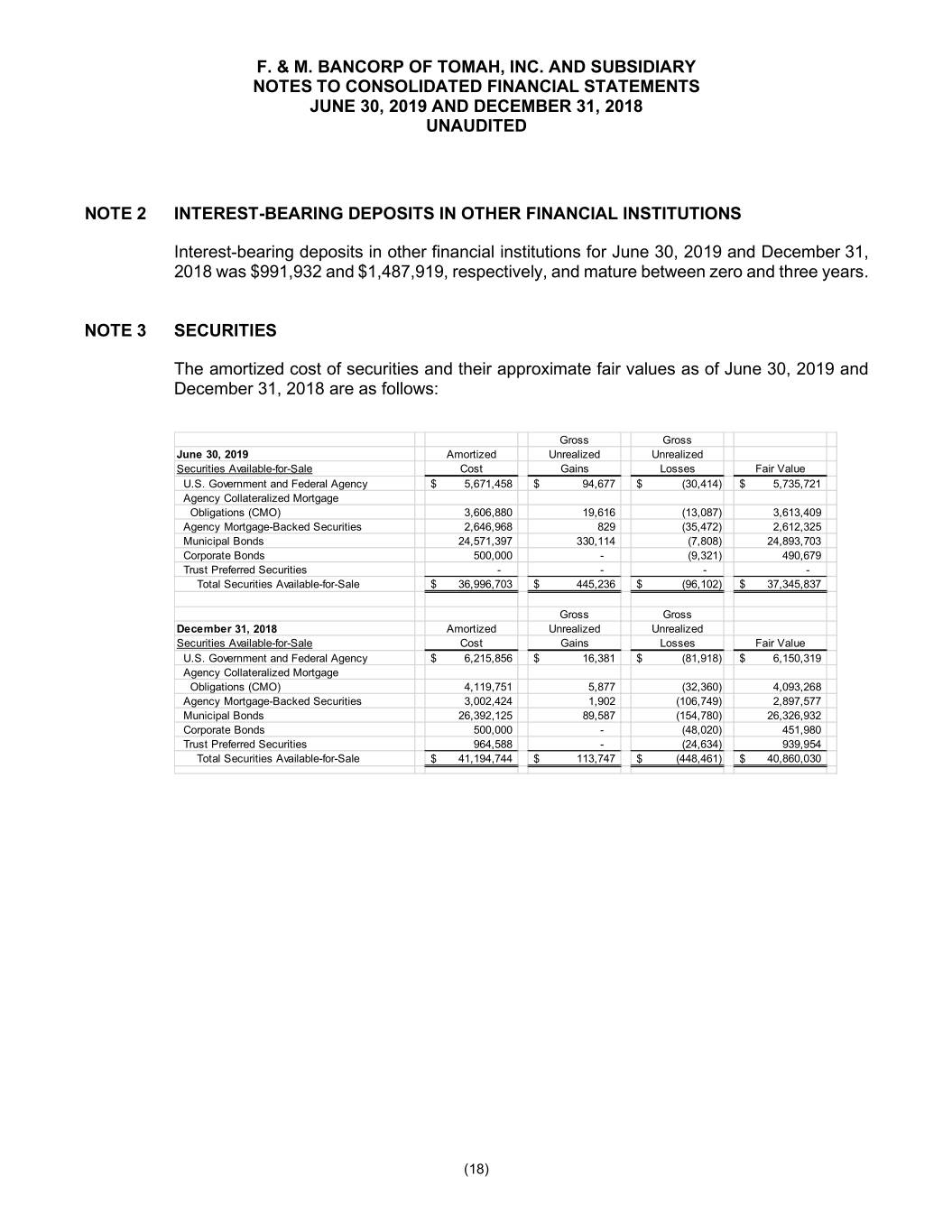

F. & M. BANCORP OF TOMAH, INC. AND SUBSIDIARY NOTES TO CONSOLIDATED FINANCIAL STATEMENTS JUNE 30, 2019 AND DECEMBER 31, 2018 UNAUDITED NOTE 2 INTEREST-BEARING DEPOSITS IN OTHER FINANCIAL INSTITUTIONS Interest-bearing deposits in other financial institutions for June 30, 2019 and December 31, 2018 was $991,932 and $1,487,919, respectively, and mature between zero and three years. NOTE 3 SECURITIES The amortized cost of securities and their approximate fair values as of June 30, 2019 and December 31, 2018 are as follows: Gross Gross June 30, 2019 Amortized Unrealized Unrealized Securities Available-for-Sale Cost Gains Losses Fair Value U.S. Government and Federal Agency $ 5,671,458 $ 94,677 $ (30,414) $ 5,735,721 Agency Collateralized Mortgage Obligations (CMO) 3,606,880 19,616 (13,087) 3,613,409 Agency Mortgage-Backed Securities 2,646,968 829 (35,472) 2,612,325 Municipal Bonds 24,571,397 330,114 (7,808) 24,893,703 Corporate Bonds 500,000 - (9,321) 490,679 Trust Preferred Securities - - - - Total Securities Available-for-Sale $ 36,996,703 $ 445,236 $ (96,102) $ 37,345,837 Gross Gross December 31, 2018 Amortized Unrealized Unrealized Securities Available-for-Sale Cost Gains Losses Fair Value U.S. Government and Federal Agency $ 6,215,856 $ 16,381 $ (81,918) $ 6,150,319 Agency Collateralized Mortgage Obligations (CMO) 4,119,751 5,877 (32,360) 4,093,268 Agency Mortgage-Backed Securities 3,002,424 1,902 (106,749) 2,897,577 Municipal Bonds 26,392,125 89,587 (154,780) 26,326,932 Corporate Bonds 500,000 - (48,020) 451,980 Trust Preferred Securities 964,588 - (24,634) 939,954 Total Securities Available-for-Sale $ 41,194,744 $ 113,747 $ (448,461) $ 40,860,030 (18)

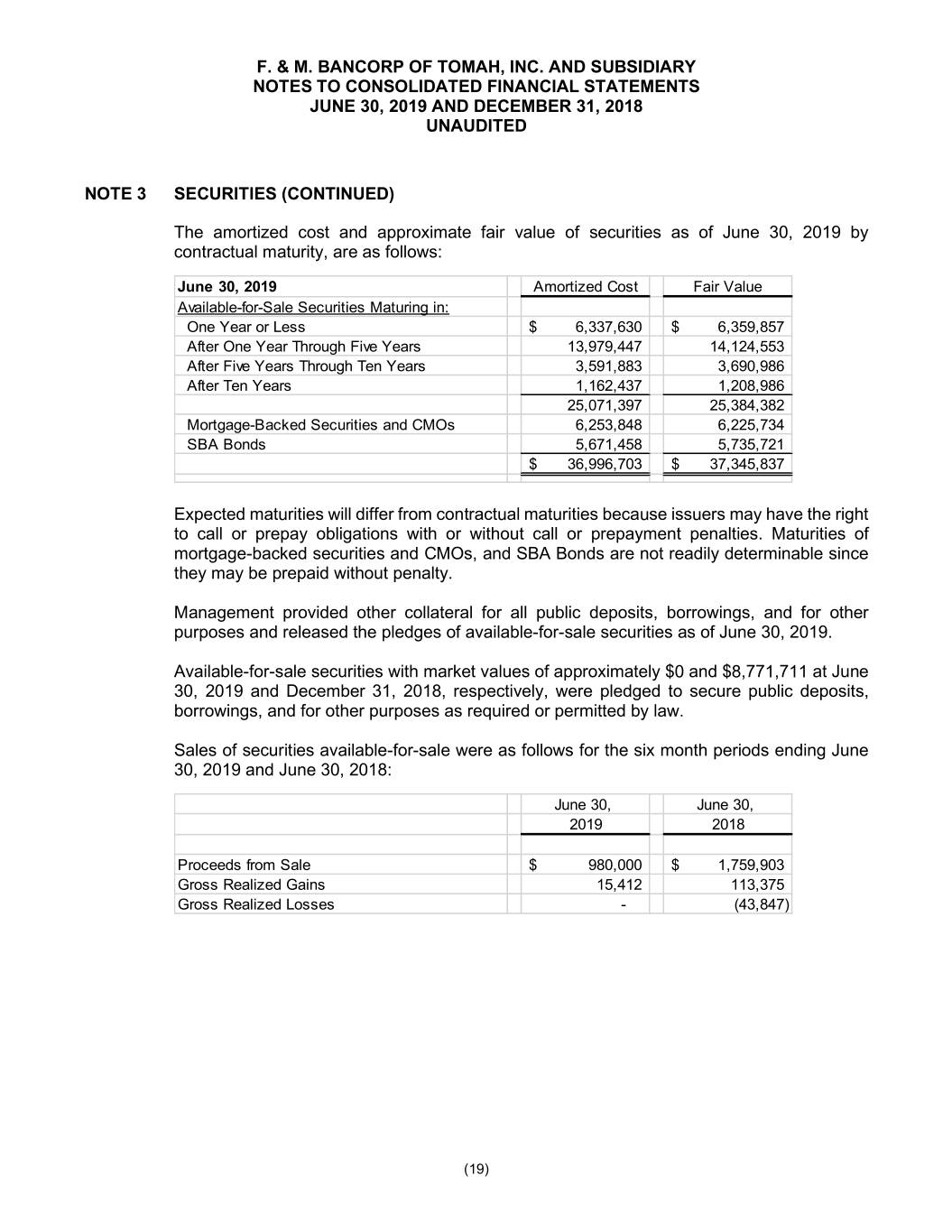

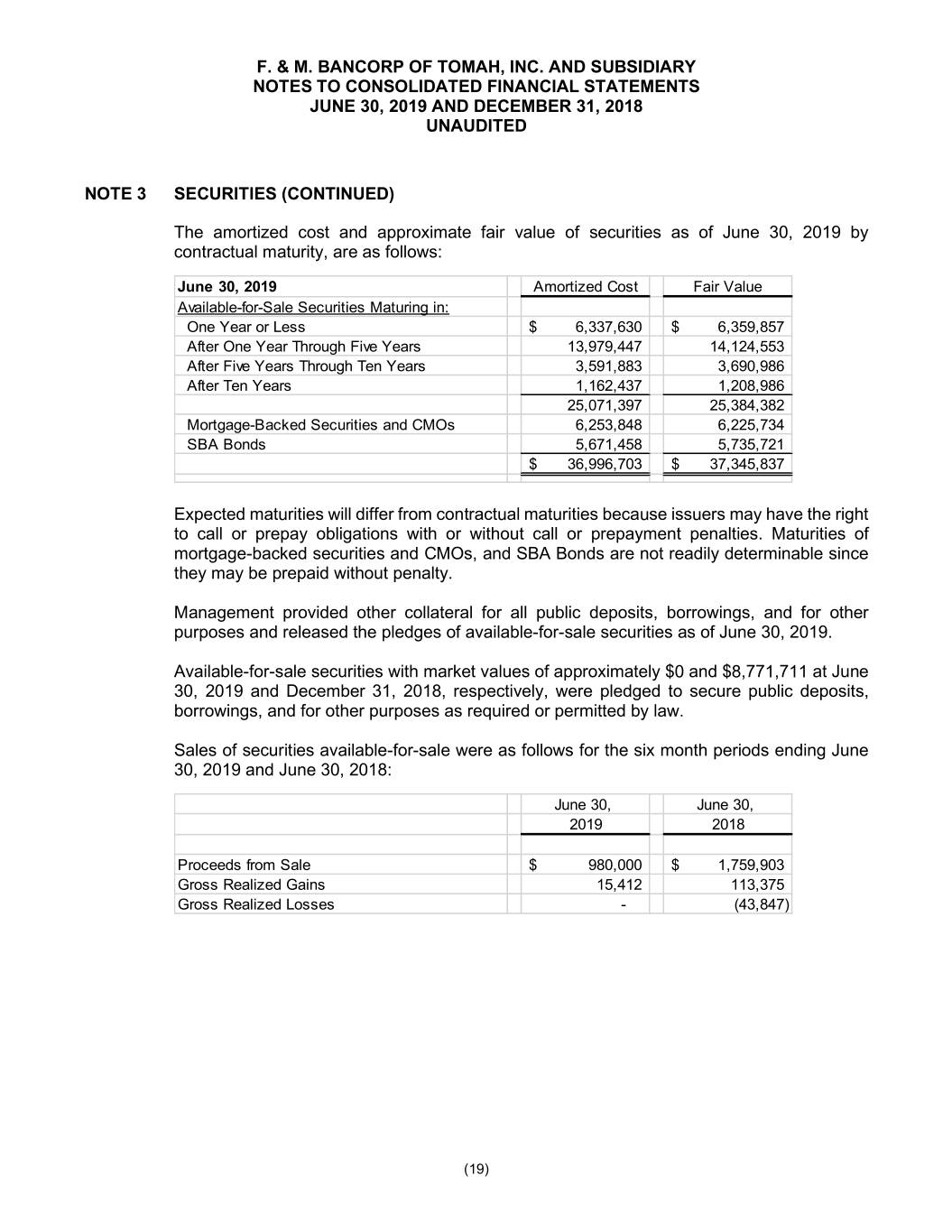

F. & M. BANCORP OF TOMAH, INC. AND SUBSIDIARY NOTES TO CONSOLIDATED FINANCIAL STATEMENTS JUNE 30, 2019 AND DECEMBER 31, 2018 UNAUDITED NOTE 3 SECURITIES (CONTINUED) The amortized cost and approximate fair value of securities as of June 30, 2019 by contractual maturity, are as follows: June 30, 2019 Amortized Cost Fair Value Available-for-Sale Securities Maturing in: One Year or Less $ 6,337,630 $ 6,359,857 After One Year Through Five Years 13,979,447 14,124,553 After Five Years Through Ten Years 3,591,883 3,690,986 After Ten Years 1,162,437 1,208,986 25,071,397 25,384,382 Mortgage-Backed Securities and CMOs 6,253,848 6,225,734 SBA Bonds 5,671,458 5,735,721 $ 36,996,703 $ 37,345,837 Expected maturities will differ from contractual maturities because issuers may have the right to call or prepay obligations with or without call or prepayment penalties. Maturities of mortgage-backed securities and CMOs, and SBA Bonds are not readily determinable since they may be prepaid without penalty. Management provided other collateral for all public deposits, borrowings, and for other purposes and released the pledges of available-for-sale securities as of June 30, 2019. Available-for-sale securities with market values of approximately $0 and $8,771,711 at June 30, 2019 and December 31, 2018, respectively, were pledged to secure public deposits, borrowings, and for other purposes as required or permitted by law. Sales of securities available-for-sale were as follows for the six month periods ending June 30, 2019 and June 30, 2018: June 30, June 30, 2019 2018 Proceeds from Sale $ 980,000 $ 1,759,903 Gross Realized Gains 15,412 113,375 Gross Realized Losses - (43,847) (19)

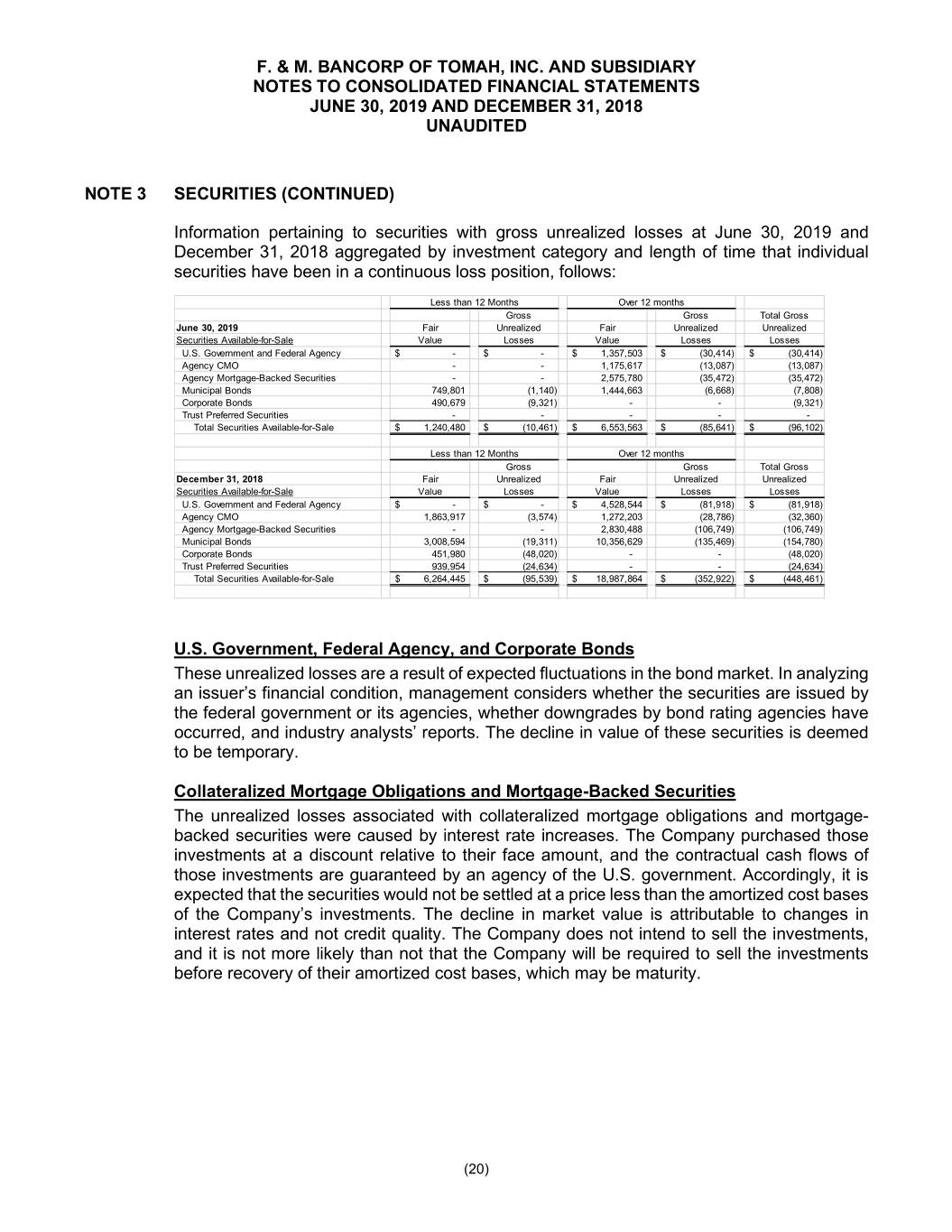

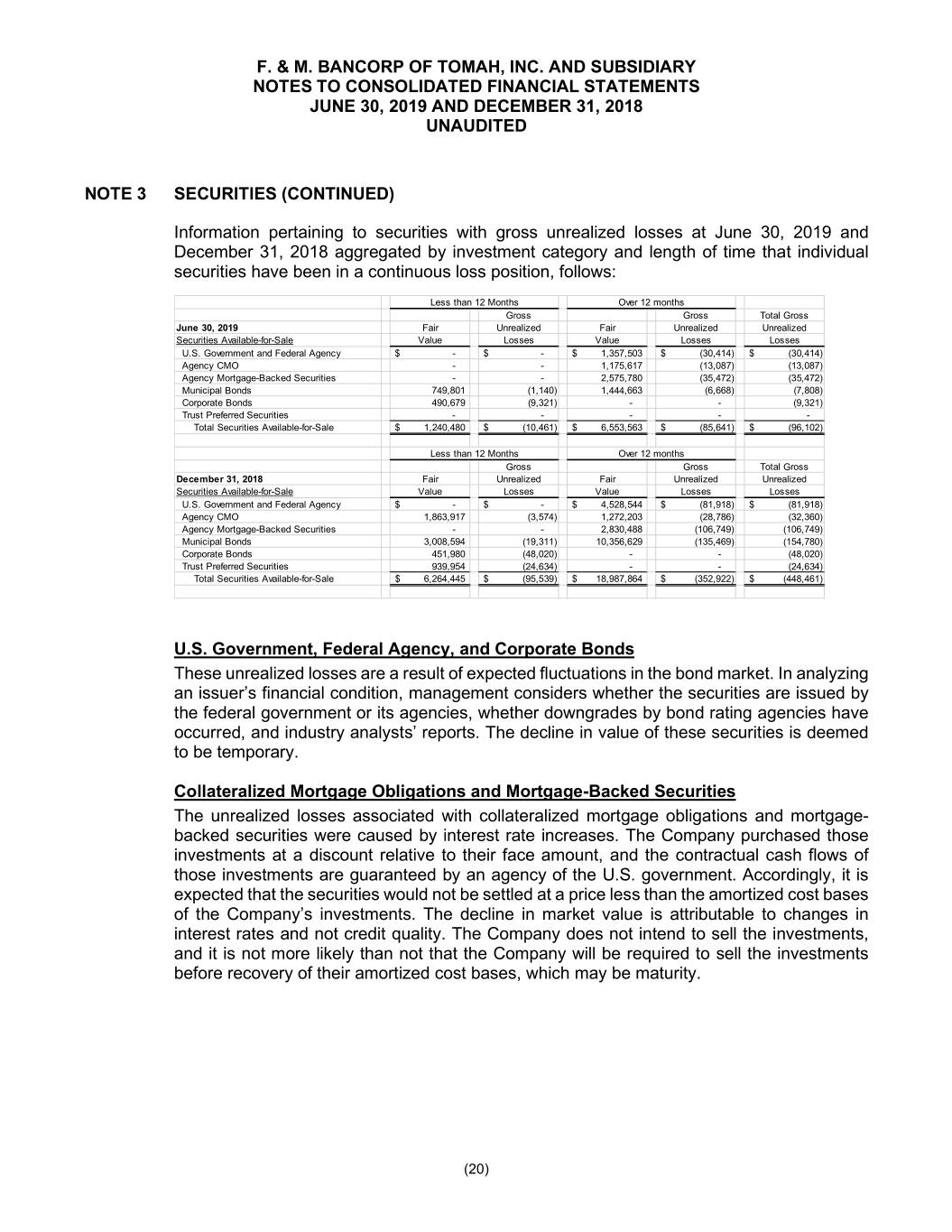

F. & M. BANCORP OF TOMAH, INC. AND SUBSIDIARY NOTES TO CONSOLIDATED FINANCIAL STATEMENTS JUNE 30, 2019 AND DECEMBER 31, 2018 UNAUDITED NOTE 3 SECURITIES (CONTINUED) Information pertaining to securities with gross unrealized losses at June 30, 2019 and December 31, 2018 aggregated by investment category and length of time that individual securities have been in a continuous loss position, follows: Less than 12 Months Over 12 months Gross Gross Total Gross June 30, 2019 Fair Unrealized Fair Unrealized Unrealized Securities Available-for-Sale Value Losses Value Losses Losses U.S. Government and Federal Agency $ - $ - $ 1,357,503 $ (30,414) $ (30,414) Agency CMO - - 1,175,617 (13,087) (13,087) Agency Mortgage-Backed Securities - - 2,575,780 (35,472) (35,472) Municipal Bonds 749,801 (1,140) 1,444,663 (6,668) (7,808) Corporate Bonds 490,679 (9,321) - - (9,321) Trust Preferred Securities - - - - - Total Securities Available-for-Sale $ 1,240,480 $ (10,461) $ 6,553,563 $ (85,641) $ (96,102) Less than 12 Months Over 12 months Gross Gross Total Gross December 31, 2018 Fair Unrealized Fair Unrealized Unrealized Securities Available-for-Sale Value Losses Value Losses Losses U.S. Government and Federal Agency $ - $ - $ 4,528,544 $ (81,918) $ (81,918) Agency CMO 1,863,917 (3,574) 1,272,203 (28,786) (32,360) Agency Mortgage-Backed Securities - - 2,830,488 (106,749) (106,749) Municipal Bonds 3,008,594 (19,311) 10,356,629 (135,469) (154,780) Corporate Bonds 451,980 (48,020) - - (48,020) Trust Preferred Securities 939,954 (24,634) - - (24,634) Total Securities Available-for-Sale $ 6,264,445 $ (95,539) $ 18,987,864 $ (352,922) $ (448,461) U.S. Government, Federal Agency, and Corporate Bonds These unrealized losses are a result of expected fluctuations in the bond market. In analyzing an issuer’s financial condition, management considers whether the securities are issued by the federal government or its agencies, whether downgrades by bond rating agencies have occurred, and industry analysts’ reports. The decline in value of these securities is deemed to be temporary. Collateralized Mortgage Obligations and Mortgage-Backed Securities The unrealized losses associated with collateralized mortgage obligations and mortgage- backed securities were caused by interest rate increases. The Company purchased those investments at a discount relative to their face amount, and the contractual cash flows of those investments are guaranteed by an agency of the U.S. government. Accordingly, it is expected that the securities would not be settled at a price less than the amortized cost bases of the Company’s investments. The decline in market value is attributable to changes in interest rates and not credit quality. The Company does not intend to sell the investments, and it is not more likely than not that the Company will be required to sell the investments before recovery of their amortized cost bases, which may be maturity. (20)

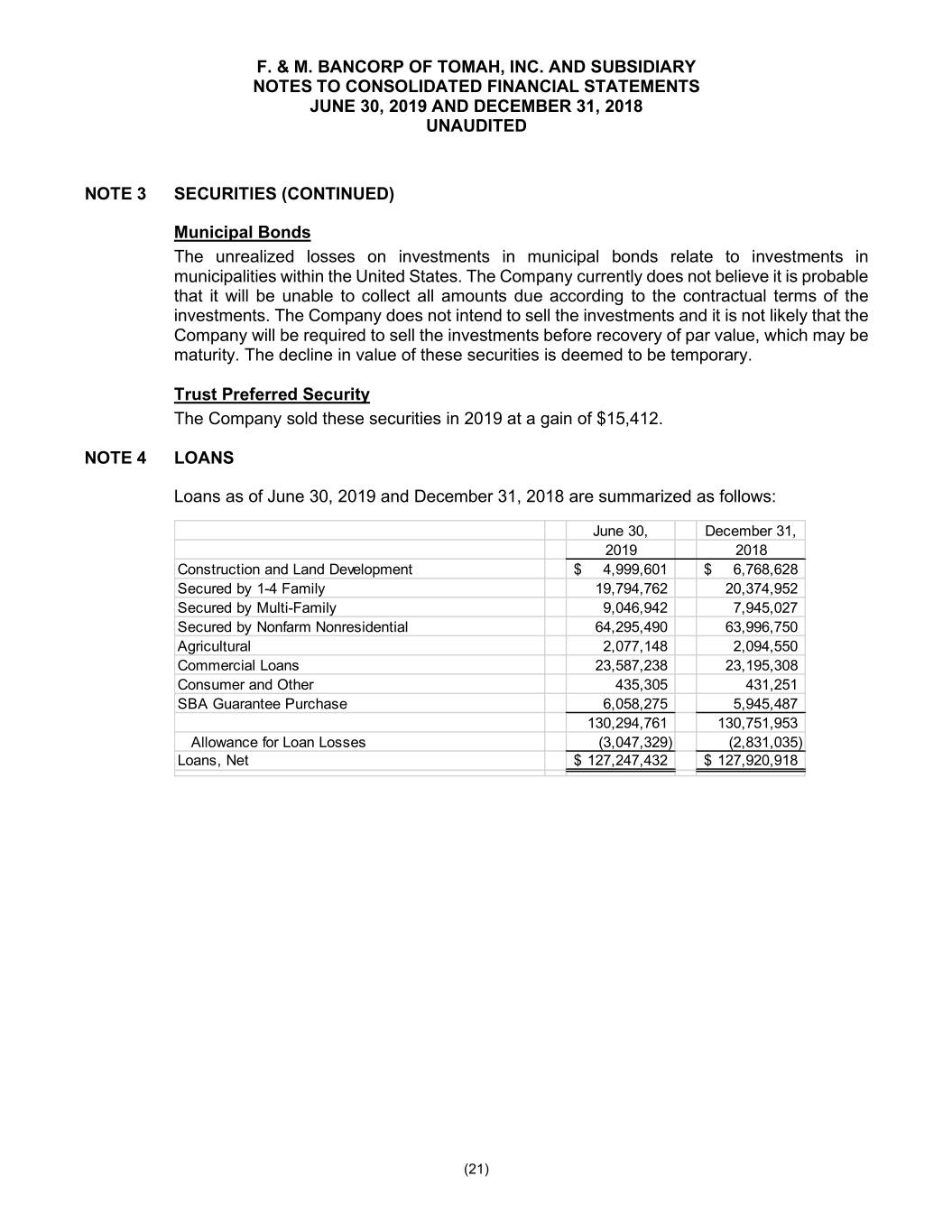

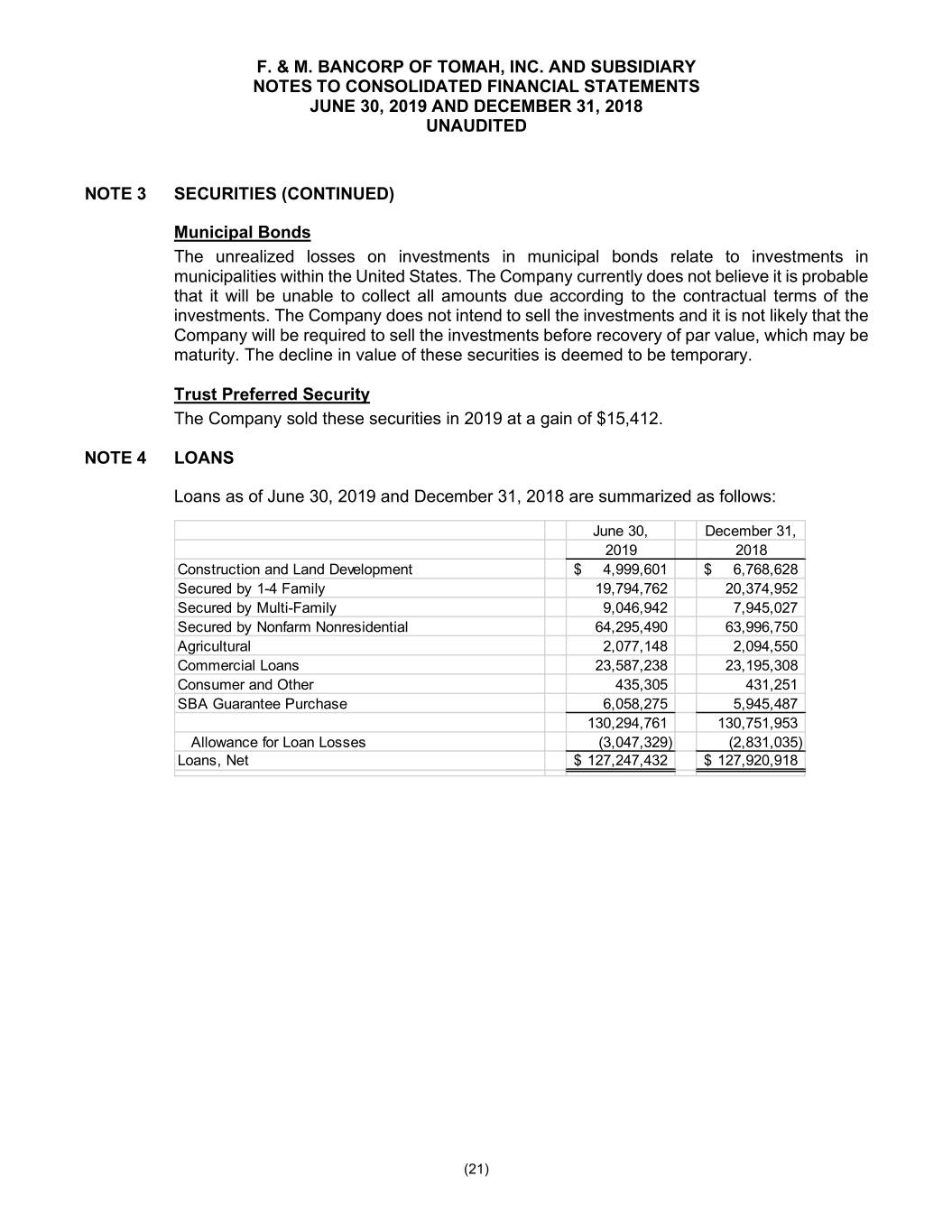

F. & M. BANCORP OF TOMAH, INC. AND SUBSIDIARY NOTES TO CONSOLIDATED FINANCIAL STATEMENTS JUNE 30, 2019 AND DECEMBER 31, 2018 UNAUDITED NOTE 3 SECURITIES (CONTINUED) Municipal Bonds The unrealized losses on investments in municipal bonds relate to investments in municipalities within the United States. The Company currently does not believe it is probable that it will be unable to collect all amounts due according to the contractual terms of the investments. The Company does not intend to sell the investments and it is not likely that the Company will be required to sell the investments before recovery of par value, which may be maturity. The decline in value of these securities is deemed to be temporary. Trust Preferred Security The Company sold these securities in 2019 at a gain of $15,412. NOTE 4 LOANS Loans as of June 30, 2019 and December 31, 2018 are summarized as follows: June 30, December 31, 2019 2018 Construction and Land Development $ 4,999,601 $ 6,768,628 Secured by 1-4 Family 19,794,762 20,374,952 Secured by Multi-Family 9,046,942 7,945,027 Secured by Nonfarm Nonresidential 64,295,490 63,996,750 Agricultural 2,077,148 2,094,550 Commercial Loans 23,587,238 23,195,308 Consumer and Other 435,305 431,251 SBA Guarantee Purchase 6,058,275 5,945,487 130,294,761 130,751,953 Allowance for Loan Losses (3,047,329) (2,831,035) Loans, Net $ 127,247,432 $ 127,920,918 (21)

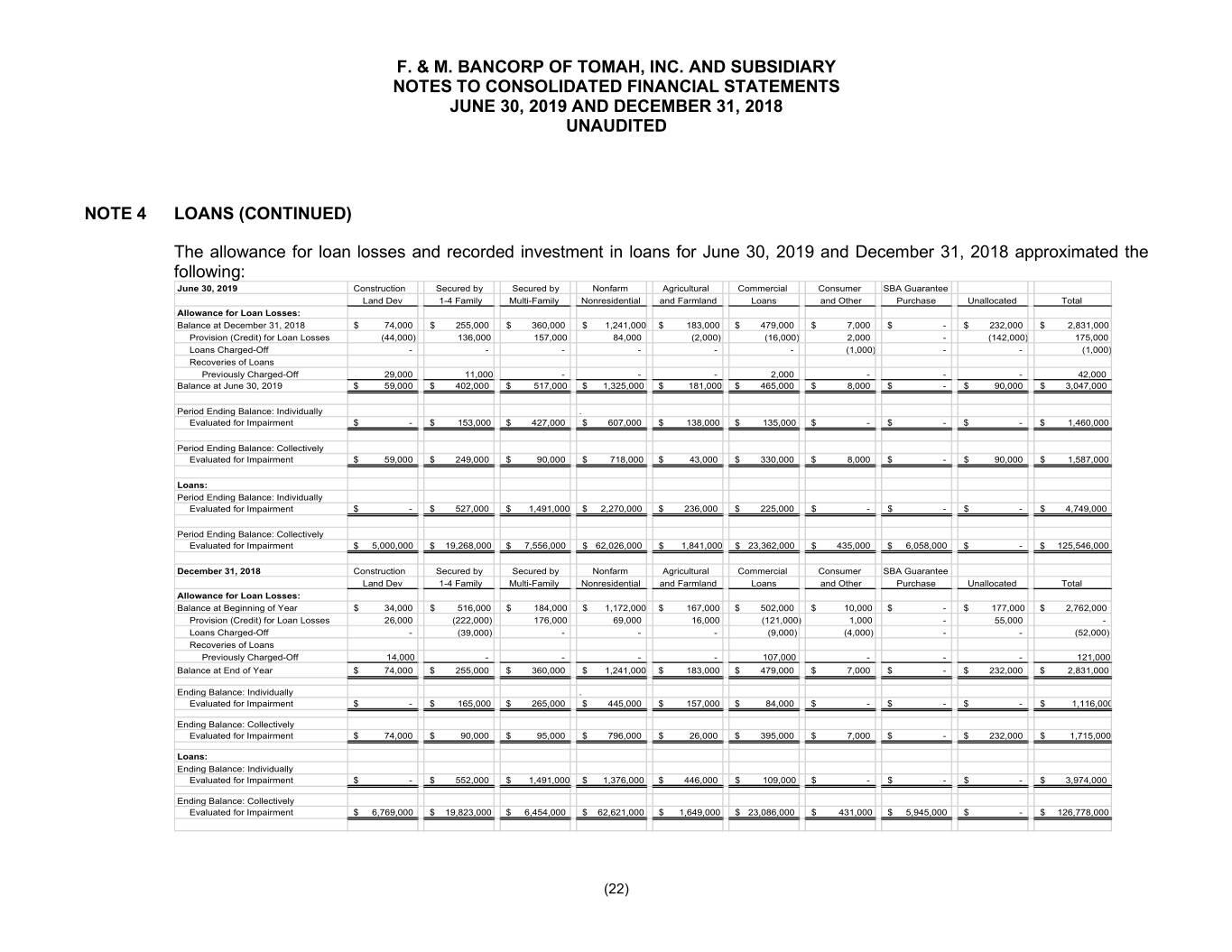

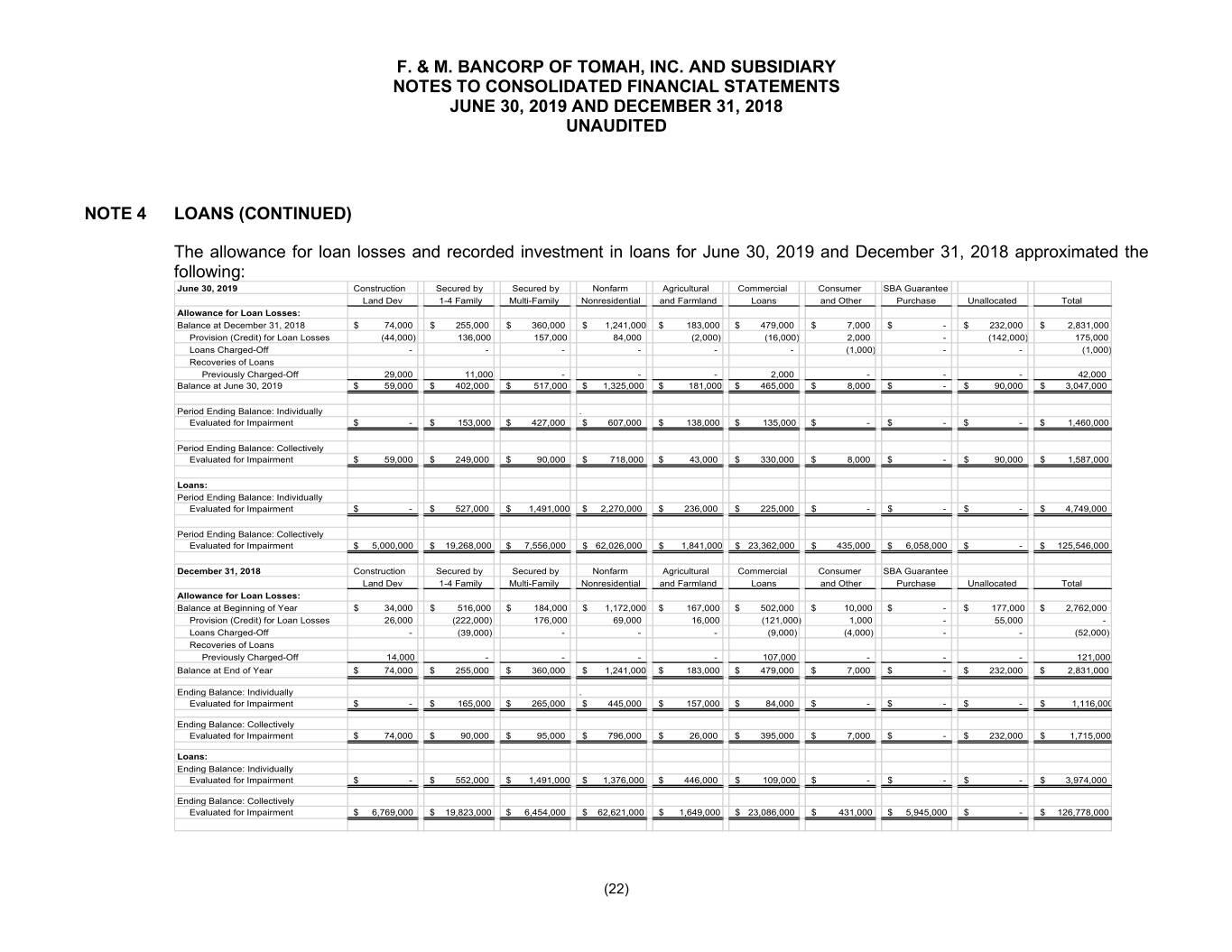

F. & M. BANCORP OF TOMAH, INC. AND SUBSIDIARY NOTES TO CONSOLIDATED FINANCIAL STATEMENTS JUNE 30, 2019 AND DECEMBER 31, 2018 UNAUDITED NOTE 4 LOANS (CONTINUED) The allowance for loan losses and recorded investment in loans for June 30, 2019 and December 31, 2018 approximated the following: June 30, 2019 Construction Secured by Secured by Nonfarm Agricultural Commercial Consumer SBA Guarantee Land Dev 1-4 Family Multi-Family Nonresidential and Farmland Loans and Other Purchase Unallocated Total Allowance for Loan Losses: Balance at December 31, 2018 $ 74,000 $ 255,000 $ 360,000 $ 1,241,000 $ 183,000 $ 479,000 $ 7,000 $ - $ 232,000 $ 2,831,000 Provision (Credit) for Loan Losses (44,000) 136,000 157,000 84,000 (2,000) (16,000) 2,000 - (142,000) 175,000 Loans Charged-Off - - - - - - (1,000) - - (1,000) Recoveries of Loans Previously Charged-Off 29,000 11,000 - - - 2,000 - - - 42,000 Balance at June 30, 2019 $ 59,000 $ 402,000 $ 517,000 $ 1,325,000 $ 181,000 $ 465,000 $ 8,000 $ - $ 90,000 $ 3,047,000 Period Ending Balance: Individually . Evaluated for Impairment $ - $ 153,000 $ 427,000 $ 607,000 $ 138,000 $ 135,000 $ - $ - $ - $ 1,460,000 Period Ending Balance: Collectively Evaluated for Impairment $ 59,000 $ 249,000 $ 90,000 $ 718,000 $ 43,000 $ 330,000 $ 8,000 $ - $ 90,000 $ 1,587,000 Loans: Period Ending Balance: Individually Evaluated for Impairment $ - $ 527,000 $ 1,491,000 $ 2,270,000 $ 236,000 $ 225,000 $ - $ - $ - $ 4,749,000 Period Ending Balance: Collectively Evaluated for Impairment $ 5,000,000 $ 19,268,000 $ 7,556,000 $ 62,026,000 $ 1,841,000 $ 23,362,000 $ 435,000 $ 6,058,000 $ - $ 125,546,000 December 31, 2018 Construction Secured by Secured by Nonfarm Agricultural Commercial Consumer SBA Guarantee Land Dev 1-4 Family Multi-Family Nonresidential and Farmland Loans and Other Purchase Unallocated Total Allowance for Loan Losses: Balance at Beginning of Year $ 34,000 $ 516,000 $ 184,000 $ 1,172,000 $ 167,000 $ 502,000 $ 10,000 $ - $ 177,000 $ 2,762,000 Provision (Credit) for Loan Losses 26,000 (222,000) 176,000 69,000 16,000 (121,000) 1,000 - 55,000 - Loans Charged-Off - (39,000) - - - (9,000) (4,000) - - (52,000) Recoveries of Loans Previously Charged-Off 14,000 - - - - 107,000 - - - 121,000 Balance at End of Year $ 74,000 $ 255,000 $ 360,000 $ 1,241,000 $ 183,000 $ 479,000 $ 7,000 $ - $ 232,000 $ 2,831,000 Ending Balance: Individually . Evaluated for Impairment $ - $ 165,000 $ 265,000 $ 445,000 $ 157,000 $ 84,000 $ - $ - $ - $ 1,116,000 Ending Balance: Collectively Evaluated for Impairment $ 74,000 $ 90,000 $ 95,000 $ 796,000 $ 26,000 $ 395,000 $ 7,000 $ - $ 232,000 $ 1,715,000 Loans: Ending Balance: Individually Evaluated for Impairment $ - $ 552,000 $ 1,491,000 $ 1,376,000 $ 446,000 $ 109,000 $ - $ - $ - $ 3,974,000 Ending Balance: Collectively Evaluated for Impairment $ 6,769,000 $ 19,823,000 $ 6,454,000 $ 62,621,000 $ 1,649,000 $ 23,086,000 $ 431,000 $ 5,945,000 $ - $ 126,778,000 (22)

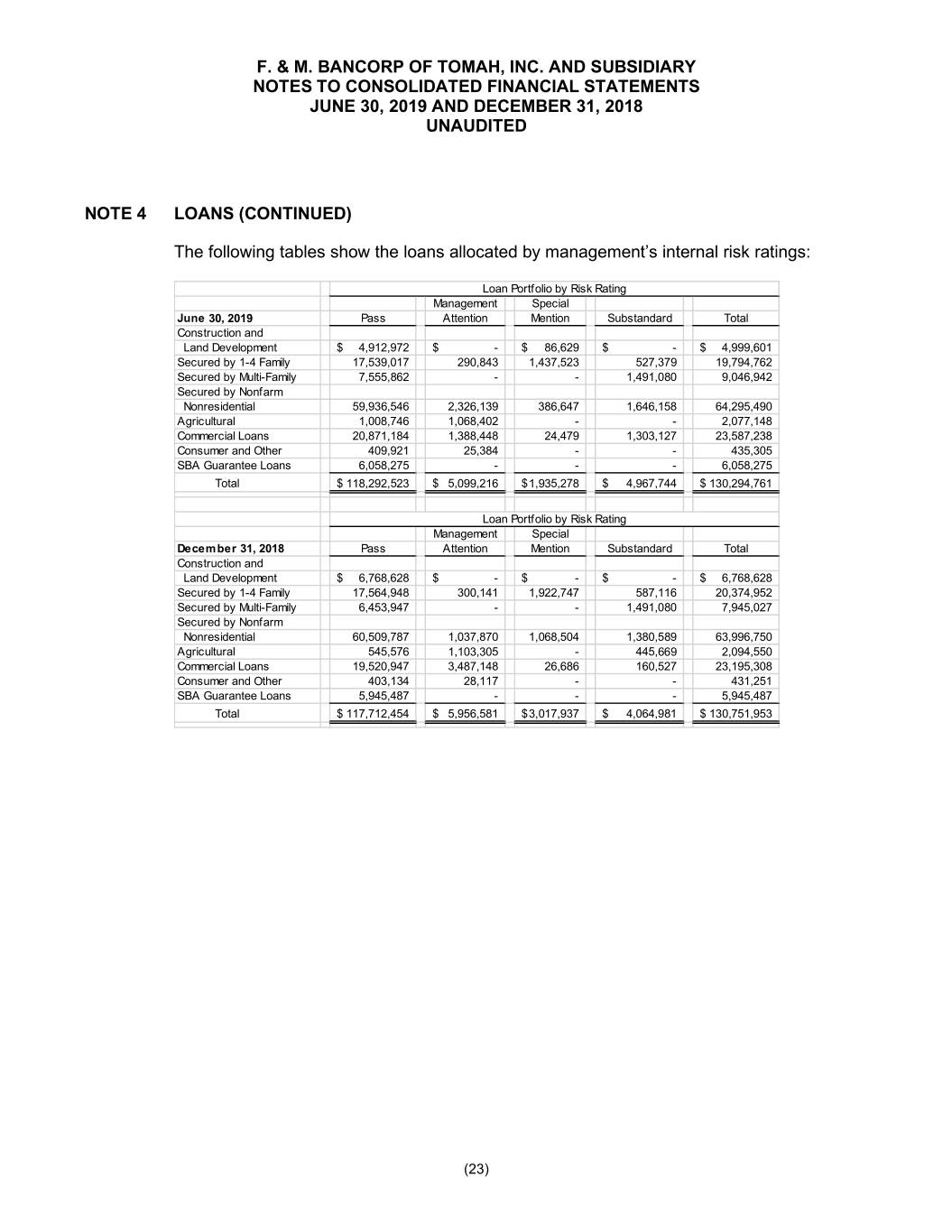

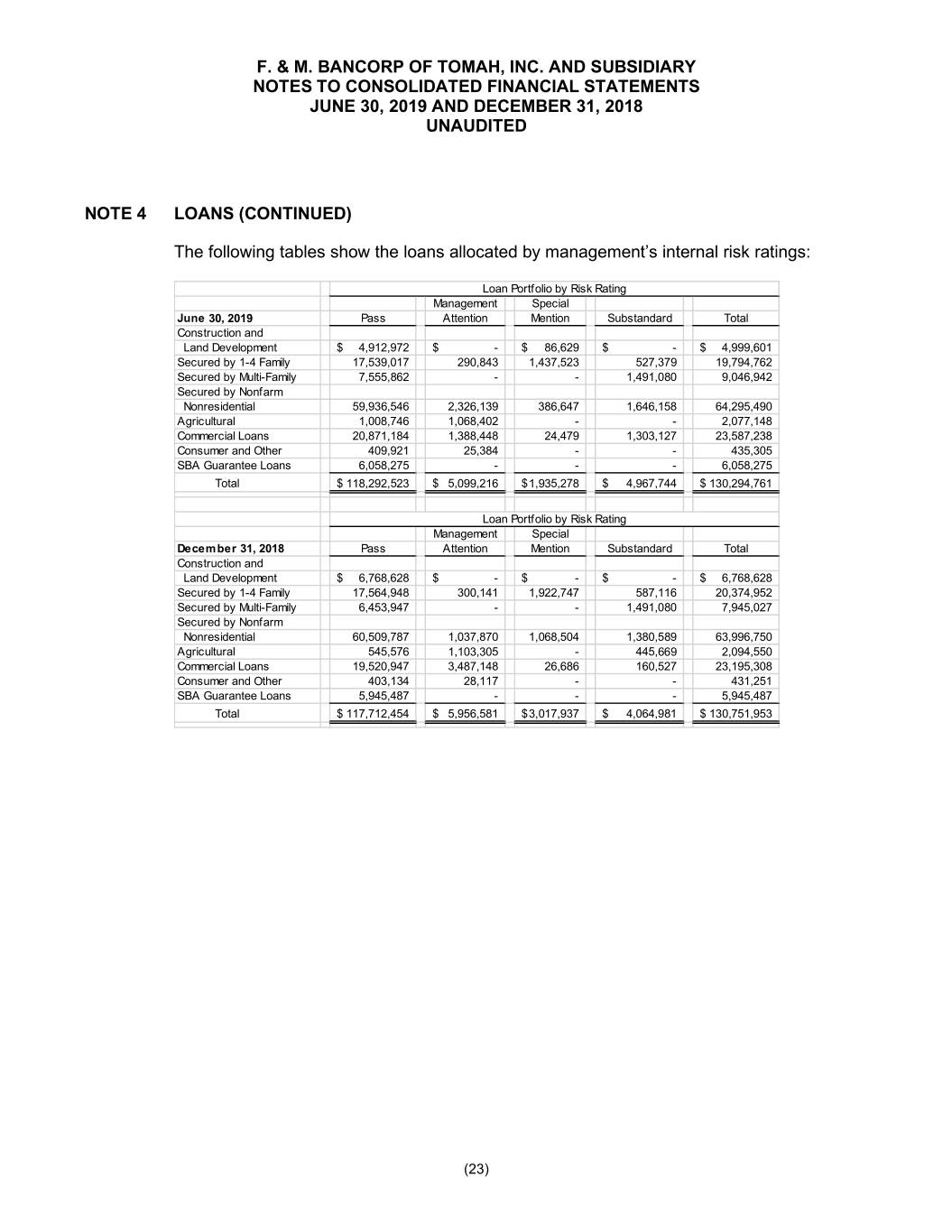

F. & M. BANCORP OF TOMAH, INC. AND SUBSIDIARY NOTES TO CONSOLIDATED FINANCIAL STATEMENTS JUNE 30, 2019 AND DECEMBER 31, 2018 UNAUDITED NOTE 4 LOANS (CONTINUED) The following tables show the loans allocated by management’s internal risk ratings: Loan Portfolio by Risk Rating Management Special June 30, 2019 Pas s Attention Mention Substandard Total Construction and Land Development $ 4,912,972 $ - $ 86,629 $ - $ 4,999,601 Secured by 1-4 Family 17,539,017 290,843 1,437,523 527,379 19,794,762 Secured by Multi-Family 7,555,862 - - 1,491,080 9,046,942 Secured by Nonfarm Nonresidential 59,936,546 2,326,139 386,647 1,646,158 64,295,490 Agricultural 1,008,746 1,068,402 - - 2,077,148 Commercial Loans 20,871,184 1,388,448 24,479 1,303,127 23,587,238 Consumer and Other 409,921 25,384 - - 435,305 SBA Guarantee Loans 6,058,275 - - - 6,058,275 Total $ 118,292,523 $ 5,099,216 $ 1,935,278 $ 4,967,744 $ 130,294,761 Loan Portfolio by Risk Rating Management Special December 31, 2018 Pas s Attention Mention Substandard Total Construction and Land Development $ 6,768,628 $ - $ - $ - $ 6,768,628 Secured by 1-4 Family 17,564,948 300,141 1,922,747 587,116 20,374,952 Secured by Multi-Family 6,453,947 - - 1,491,080 7,945,027 Secured by Nonfarm Nonresidential 60,509,787 1,037,870 1,068,504 1,380,589 63,996,750 Agricultural 545,576 1,103,305 - 445,669 2,094,550 Commercial Loans 19,520,947 3,487,148 26,686 160,527 23,195,308 Consumer and Other 403,134 28,117 - - 431,251 SBA Guarantee Loans 5,945,487 - - - 5,945,487 Total $ 117,712,454 $ 5,956,581 $ 3,017,937 $ 4,064,981 $ 130,751,953 (23)

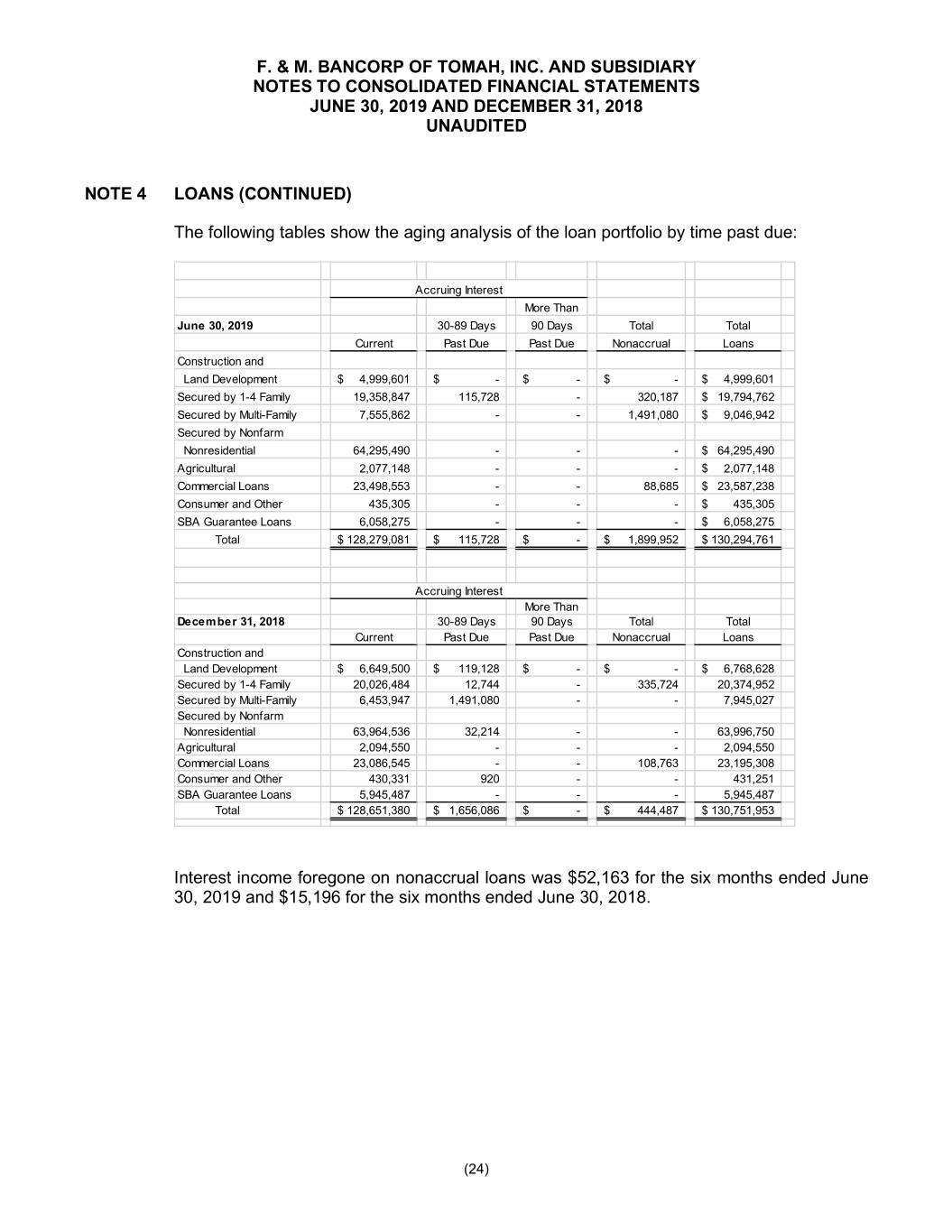

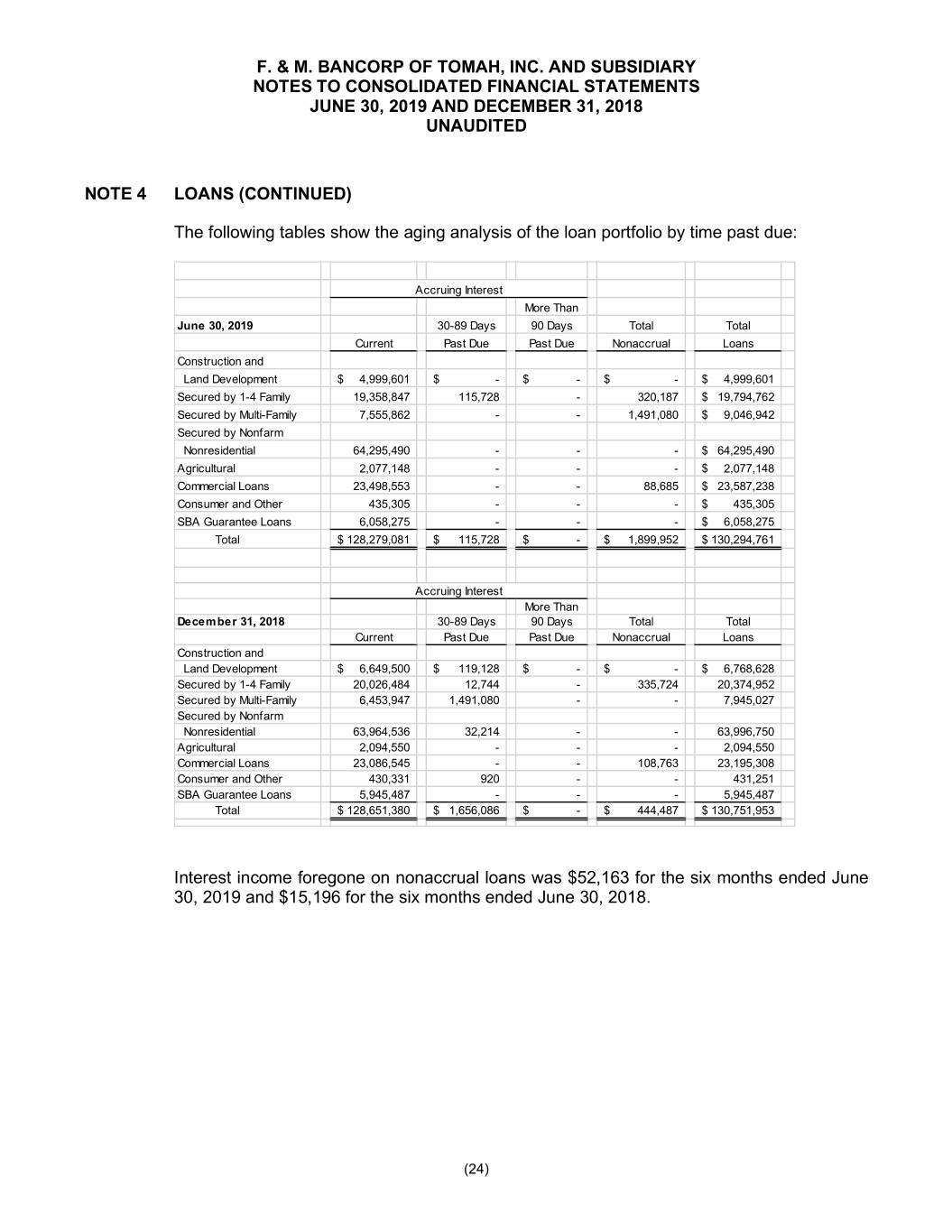

F. & M. BANCORP OF TOMAH, INC. AND SUBSIDIARY NOTES TO CONSOLIDATED FINANCIAL STATEMENTS JUNE 30, 2019 AND DECEMBER 31, 2018 UNAUDITED NOTE 4 LOANS (CONTINUED) The following tables show the aging analysis of the loan portfolio by time past due: Accruing Interest More Than June 30, 2019 30-89 Days 90 Days Total Total Current Past Due Past Due Nonaccrual Loans Construction and Land Development $ 4,999,601 $ - $ - $ - $ 4,999,601 Secured by 1-4 Family 19,358,847 115,728 - 320,187 $ 19,794,762 Secured by Multi-Family 7,555,862 - - 1,491,080 $ 9,046,942 Secured by Nonfarm Nonresidential 64,295,490 - - - $ 64,295,490 Agricultural 2,077,148 - - - $ 2,077,148 Commercial Loans 23,498,553 - - 88,685 $ 23,587,238 Consumer and Other 435,305 - - - $ 435,305 SBA Guarantee Loans 6,058,275 - - - $ 6,058,275 Total $ 128,279,081 $ 115,728 $ - $ 1,899,952 $ 130,294,761 Accruing Interest More Than December 31, 2018 30-89 Days 90 Days Total Total Current Past Due Past Due Nonaccrual Loans Construction and Land Development $ 6,649,500 $ 119,128 $ - $ - $ 6,768,628 Secured by 1-4 Family 20,026,484 12,744 - 335,724 20,374,952 Secured by Multi-Family 6,453,947 1,491,080 - - 7,945,027 Secured by Nonfarm Nonresidential 63,964,536 32,214 - - 63,996,750 Agricultural 2,094,550 - - - 2,094,550 Commercial Loans 23,086,545 - - 108,763 23,195,308 Consumer and Other 430,331 920 - - 431,251 SBA Guarantee Loans 5,945,487 - - - 5,945,487 Total $ 128,651,380 $ 1,656,086 $ - $ 444,487 $ 130,751,953 Interest income foregone on nonaccrual loans was $52,163 for the six months ended June 30, 2019 and $15,196 for the six months ended June 30, 2018. (24)

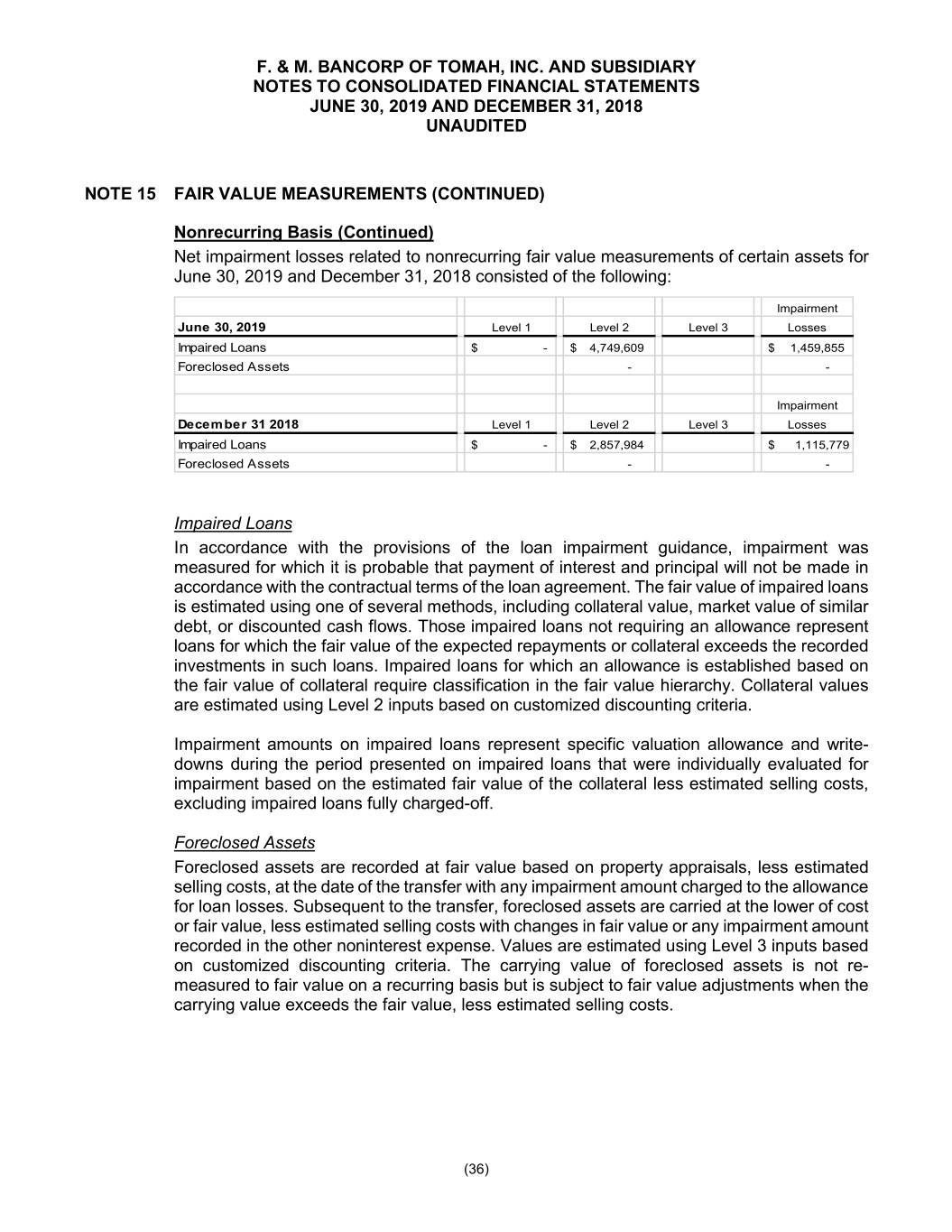

F. & M. BANCORP OF TOMAH, INC. AND SUBSIDIARY NOTES TO CONSOLIDATED FINANCIAL STATEMENTS JUNE 30, 2019 AND DECEMBER 31, 2018 UNAUDITED NOTE 4 LOANS (CONTINUED) The following tables present information related to impaired loans: June 30, 2019 Unpaid Average Interest Recorded Principal Related Recorded Income Investment Balance Allow ance Investment Recognized Loans With No Related Allow ance Recorded: - - - - Total - - - - - Loans With an Allow ance Recorded: Secured by 1-4 Family $ 528,920 $ 570,441 $ 153,292 $ 578,023 $ 14,736 Secured by Multi-Family 1,491,080 1,491,080 426,764 1,491,080 - Secured by Nonfarm Nonresidential 1,309,060 1,311,838 399,411 1,322,296 37,582 Agricultural 443,010 443,010 227,091 444,275 8,939 Commercial Loans 977,539 1,031,299 253,297 1,057,803 39,218 Total 4,749,609 4,847,668 1,459,855 4,893,477 100,475 Total Impaired Loans: Secured by 1-4 Family $ 528,920 $ 570,441 $ 153,292 $ 578,023 $ 14,736 Secured by Multi-Family 1,491,080 1,491,080 426,764 1,491,080 - Secured by Nonfarm Nonresidential 1,309,060 1,311,838 399,411 1,322,296 37,582 Agricultural 443,010 443,010 227,091 444,275 8,939 Commercial Loans 977,539 1,031,299 253,297 1,057,803 39,218 Total $ 4,749,609 $ 4,847,668 $ 1,459,855 $ 4,893,477 $ 100,475 December 31, 2018 Unpaid Average Interest Recorded Principal Related Recorded Income Investment Balance Allow ance Investment Recognized Loans With No Related Allow ance Recorded: Secured by Nonfarm Nonresidential $ 907,407 $ 907,407 $ - $ 919,202 $ 36,347 Total 907,407 907,407 - 919,202 36,347 Loans With an Allow ance Recorded: Secured by 1-4 Family $ 552,081 $ 587,116 $ 165,201 $ 604,825 $ 12,499 Secured by Nonfarm Nonresidential 468,762 473,182 445,042 485,958 29,445 Secured by Multi-Family 1,491,080 1,491,080 264,901 1,583,419 80,270 Agricultural 445,669 445,669 156,438 446,964 18,127 Commercial Loans 108,763 160,527 84,197 175,790 - Total 3,066,355 3,157,574 1,115,779 3,296,956 140,341 Total Impaired Loans: Secured by 1-4 Family $ 552,081 $ 587,116 $ 165,201 $ 604,825 $ 12,499 Secured by Nonfarm Nonresidential 1,376,169 1,380,589 445,042 1,405,160 65,792 Secured by Multi-Family 1,491,080 1,491,080 264,901 1,583,419 80,270 Agricultural 445,669 445,669 156,438 446,964 18,127 Commercial Loans 108,763 160,527 84,197 175,790 - Total $ 3,973,762 $ 4,064,981 $ 1,115,779 $ 4,216,158 $ 176,688 (25)

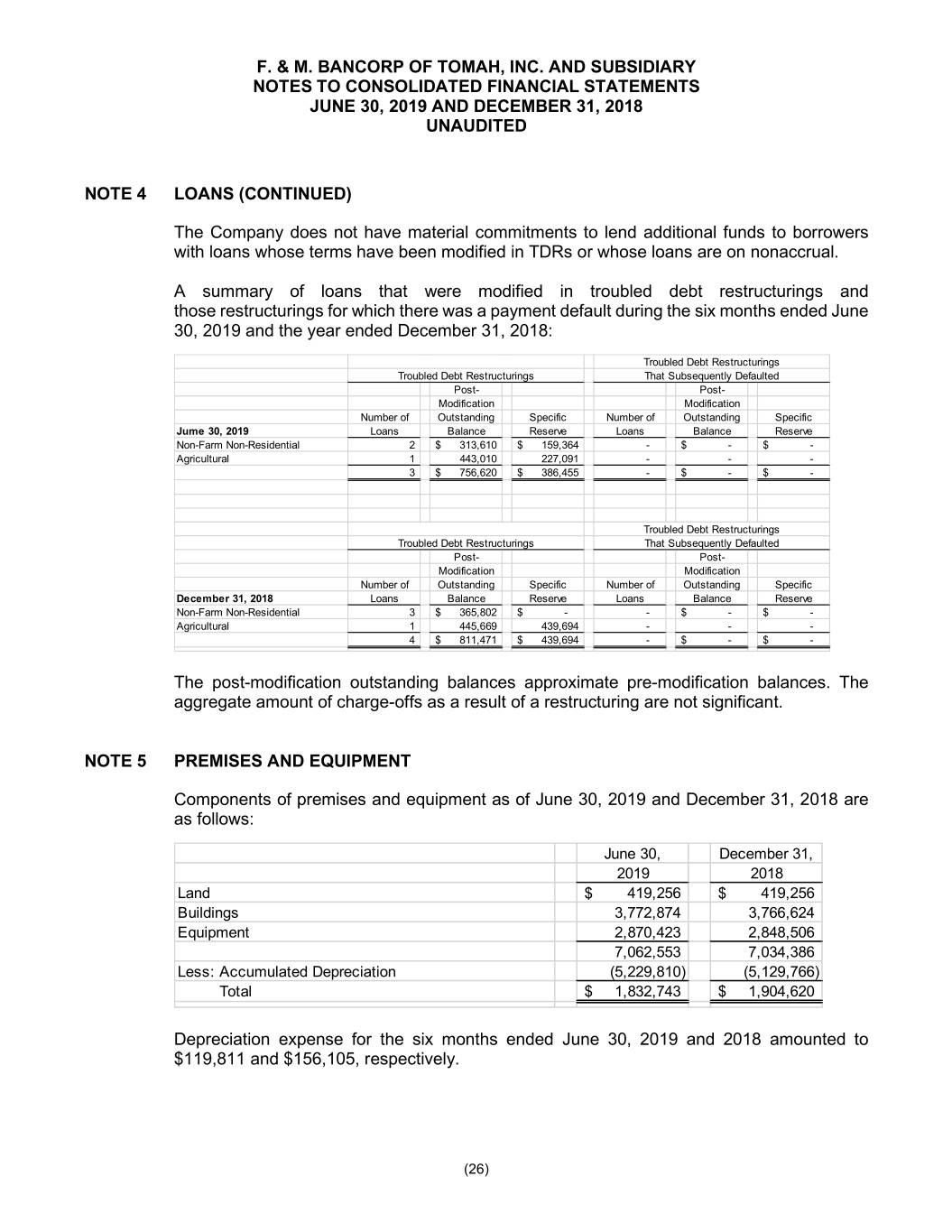

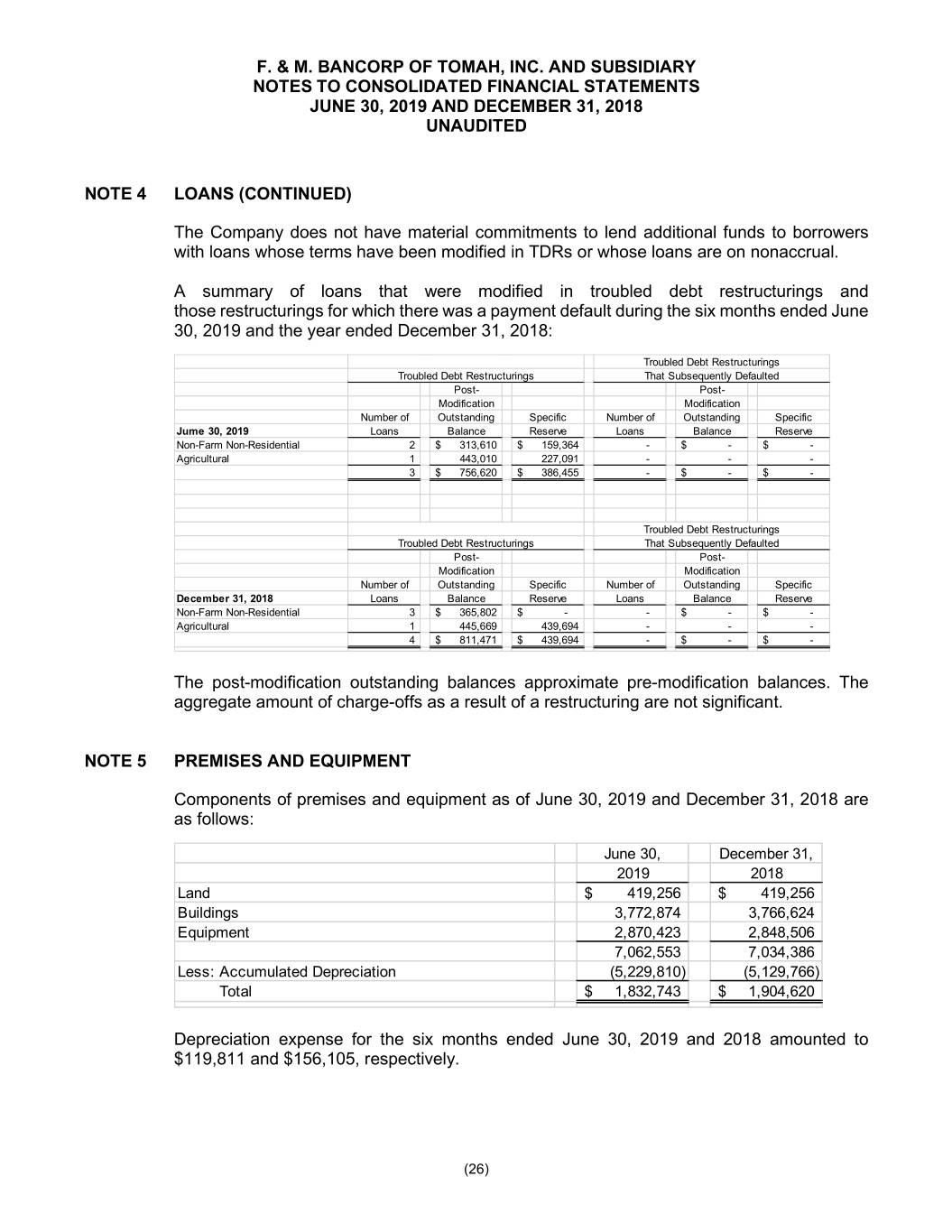

F. & M. BANCORP OF TOMAH, INC. AND SUBSIDIARY NOTES TO CONSOLIDATED FINANCIAL STATEMENTS JUNE 30, 2019 AND DECEMBER 31, 2018 UNAUDITED NOTE 4 LOANS (CONTINUED) The Company does not have material commitments to lend additional funds to borrowers with loans whose terms have been modified in TDRs or whose loans are on nonaccrual. A summary of loans that were modified in troubled debt restructurings and those restructurings for which there was a payment default during the six months ended June 30, 2019 and the year ended December 31, 2018: Troubled Debt Restructurings Troubled Debt Restructurings That Subsequently Defaulted Post- Post- Modification Modification Number of Outstanding Specific Number of Outstanding Specific Jume 30, 2019 Loans Balance Reserve Loans Balance Reserve Non-Farm Non-Residential 2 $ 313,610 $ 159,364 - $ - $ - Agricultural 1 443,010 227,091 - - - 3 $ 756,620 $ 386,455 - $ - $ - Troubled Debt Restructurings Troubled Debt Restructurings That Subsequently Defaulted Post- Post- Modification Modification Number of Outstanding Specific Number of Outstanding Specific December 31, 2018 Loans Balance Reserve Loans Balance Reserve Non-Farm Non-Residential 3 $ 365,802 $ - - $ - $ - Agricultural 1 445,669 439,694 - - - 4 $ 811,471 $ 439,694 - $ - $ - The post-modification outstanding balances approximate pre-modification balances. The aggregate amount of charge-offs as a result of a restructuring are not significant. NOTE 5 PREMISES AND EQUIPMENT Components of premises and equipment as of June 30, 2019 and December 31, 2018 are as follows: June 30, December 31, 2019 2018 Land $ 419,256 $ 419,256 Buildings 3,772,874 3,766,624 Equipment 2,870,423 2,848,506 7,062,553 7,034,386 Less: Accumulated Depreciation (5,229,810) (5,129,766) Total $ 1,832,743 $ 1,904,620 Depreciation expense for the six months ended June 30, 2019 and 2018 amounted to $119,811 and $156,105, respectively. (26)

F. & M. BANCORP OF TOMAH, INC. AND SUBSIDIARY NOTES TO CONSOLIDATED FINANCIAL STATEMENTS JUNE 30, 2019 AND DECEMBER 31, 2018 UNAUDITED NOTE 6 DEPOSITS Deposits at June 30, 2019 and December 31, 2018 are summarized as follows: June 30 December 31, 2019 2018 Noninterest Bearing Demand Deposits $ 23,911,948 $ 26,378,313 Interest Bearing Demand Deposits 74,014,906 76,353,386 Savings Deposits 16,490,592 16,025,815 Certificates of Deposit Less than or Equal to $250,000 29,826,332 17,439,087 Certificates of Deposit Greater than $250,000 4,228,419 18,204,902 $ 148,472,197 $ 154,401,503 At June 30, 2019, the scheduled maturities of certificates of deposit are as follows: Year Ending December 31, Amount 2019 $ 4,353,327 2020 20,304,643 2021 7,609,001 2022 1,736,500 2023 51,280 Total $ 34,054,751 NOTE 7 BORROWINGS The Company has an outstanding note with a third-party bank in the amount of $2,000,000. The note bears interest on the unpaid principal at a fixed rate of 3.5%. The note matures on November 8, 2019. The note has an outstanding balance of $2,000,000 at June 30, 2019 and December 31, 2018, respectively. The Bank is required to maintain certain reporting and financial covenants. As of June 30, 2019, the Bank was in compliance with all required covenants. The Company has entered into Advances, Pledge, and Security Agreements with the FHLB. Loans, with an advance equivalent of $53,438,435 and $51,821,134 as of June 30, 2019 and December 31, 2018, respectively, were pledged to the FHLB as collateral in the event the Company requests any advances on the line. The interest rate is determined by the FHLB when funds are borrowed and interest on these advances is paid monthly. (27)

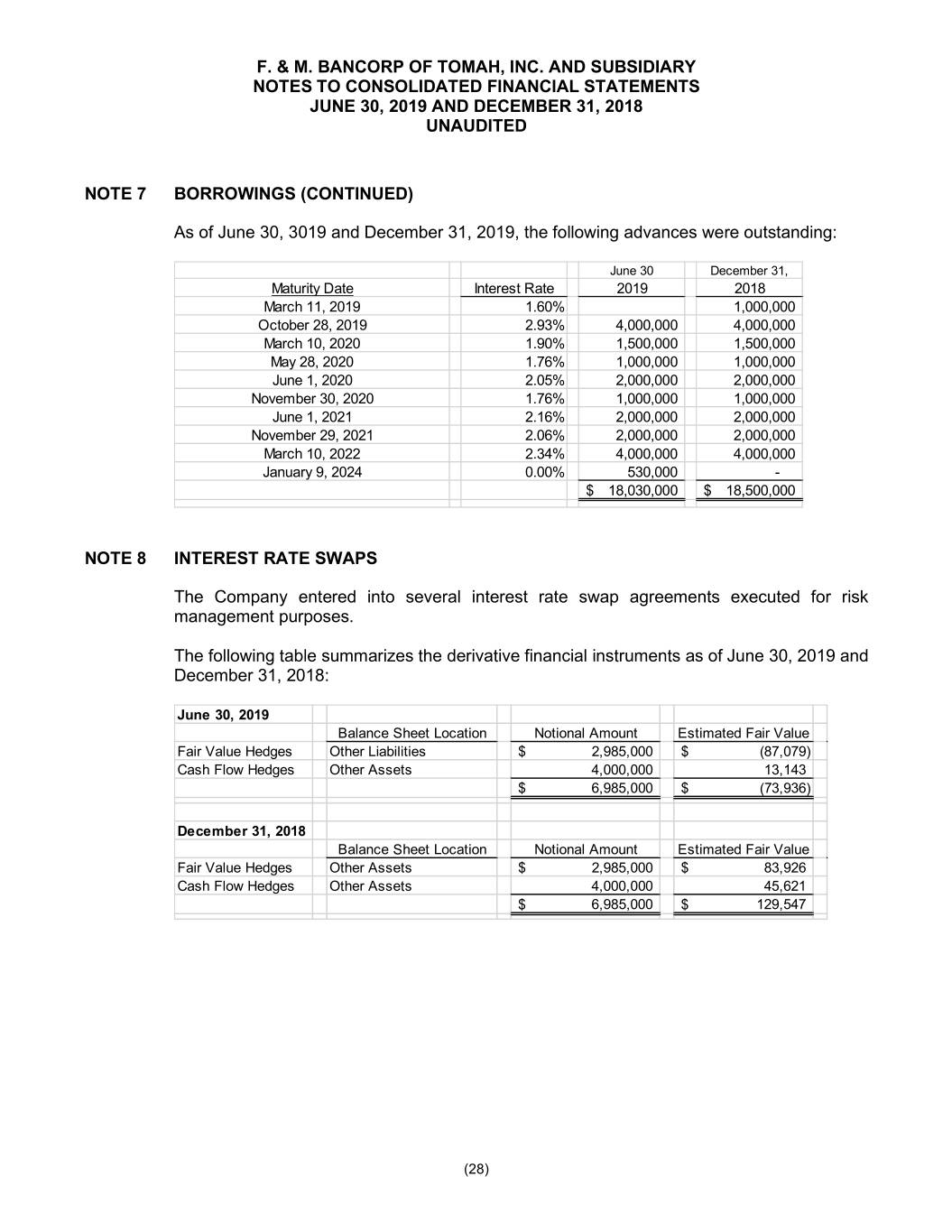

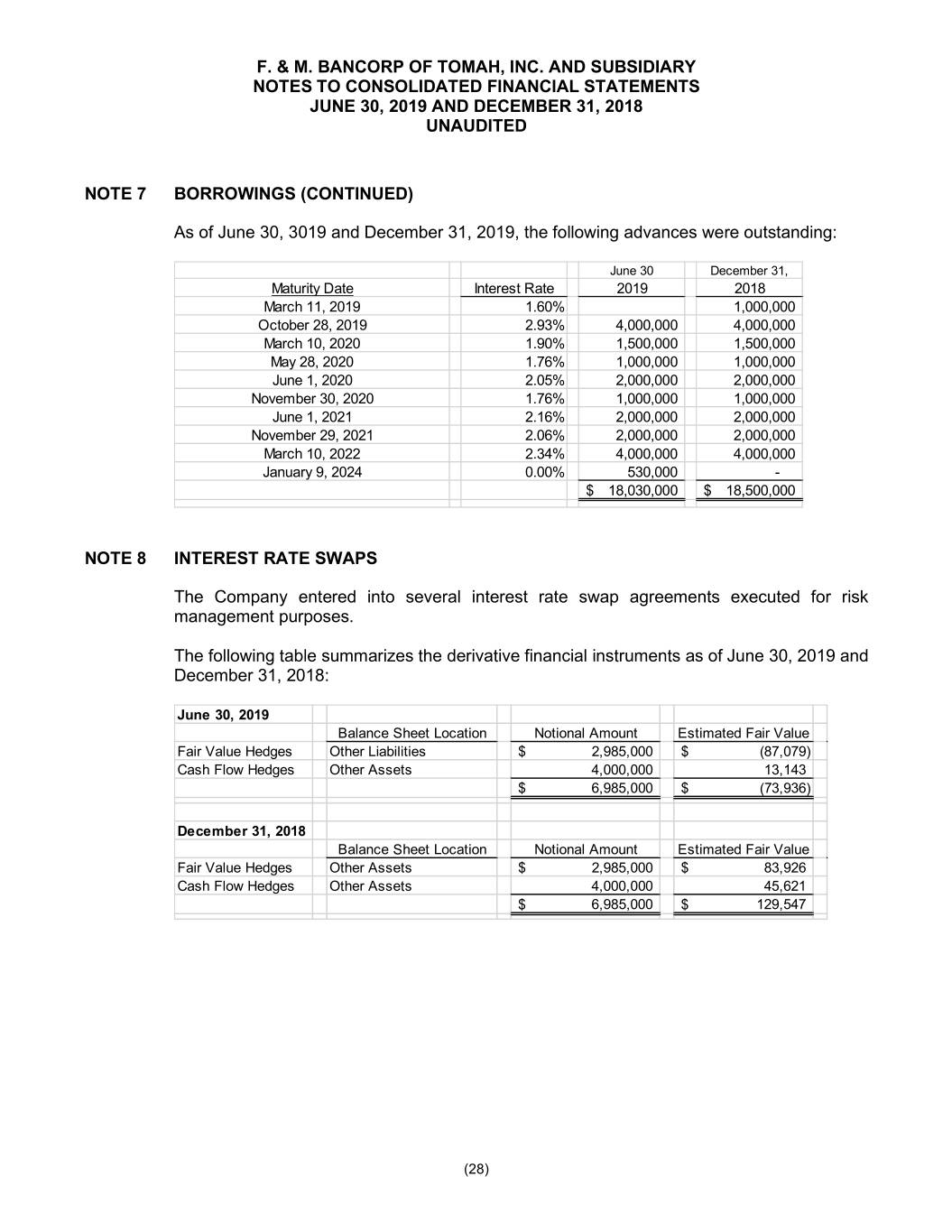

F. & M. BANCORP OF TOMAH, INC. AND SUBSIDIARY NOTES TO CONSOLIDATED FINANCIAL STATEMENTS JUNE 30, 2019 AND DECEMBER 31, 2018 UNAUDITED NOTE 7 BORROWINGS (CONTINUED) As of June 30, 3019 and December 31, 2019, the following advances were outstanding: June 30 December 31, Maturity Date Interest Rate 2019 2018 March 11, 2019 1.60% 1,000,000 October 28, 2019 2.93% 4,000,000 4,000,000 March 10, 2020 1.90% 1,500,000 1,500,000 May 28, 2020 1.76% 1,000,000 1,000,000 June 1, 2020 2.05% 2,000,000 2,000,000 November 30, 2020 1.76% 1,000,000 1,000,000 June 1, 2021 2.16% 2,000,000 2,000,000 November 29, 2021 2.06% 2,000,000 2,000,000 March 10, 2022 2.34% 4,000,000 4,000,000 January 9, 2024 0.00% 530,000 - $ 18,030,000 $ 18,500,000 NOTE 8 INTEREST RATE SWAPS The Company entered into several interest rate swap agreements executed for risk management purposes. The following table summarizes the derivative financial instruments as of June 30, 2019 and December 31, 2018: June 30, 2019 Balance Sheet Location Notional Amount Estimated Fair Value Fair Value Hedges Other Liabilities $ 2,985,000 $ (87,079) Cash Flow Hedges Other Assets 4,000,000 13,143 $ 6,985,000 $ (73,936) December 31, 2018 Balance Sheet Location Notional Amount Estimated Fair Value Fair Value Hedges Other Assets $ 2,985,000 $ 83,926 Cash Flow Hedges Other Assets 4,000,000 45,621 $ 6,985,000 $ 129,547 (28)

F. & M. BANCORP OF TOMAH, INC. AND SUBSIDIARY NOTES TO CONSOLIDATED FINANCIAL STATEMENTS JUNE 30, 2019 AND DECEMBER 31, 2018 UNAUDITED NOTE 8 INTEREST RATE SWAPS (CONTINUED) To qualify for hedge accounting, a derivative must be highly effective at reducing the risk associated with the exposure being hedged. In addition, for a derivative to be designated as a hedge, the risk management objective and strategy must be documented. Hedge documentation must identify the derivative hedging instrument, the asset or liability or forecasted transaction and type of risk to be hedged, and how the effectiveness of the derivative is assessed prospectively and retrospectively. To assess effectiveness, the Company uses statistical methods such as regression analysis, as well as nonstatistical methods including dollar-value comparisons of the change in the fair value of the derivative to the change in the fair value or cash flows of the hedged item. The extent to which a derivative has been, and is expected to continue to be, effective at offsetting changes in the fair value or cash flows of the hedged item must be assessed and documented at least quarterly. Any hedge ineffectiveness (i.e., the amount by which the gain or loss on the designated derivative instrument does not exactly offset the change in the hedged item attributable to the hedged risk) must be reported in current-period earnings. If it is determined that a derivative is not highly effective at hedging the designated exposure, hedge accounting is discontinued. Fair Value Hedges The Company uses fair value hedges to hedge fixed-rate long-term available-for-sale securities. For qualifying fair value hedges, the changes in the fair value of the derivative, and in the value of the hedged item for the risk being hedged, are recognized in other comprehensive income. If the hedge relationship is terminated, then the adjustment to the hedged item continues to be reported as part of the basis of the hedged item, and for benchmark interest rate hedges is amortized to earnings as a yield adjustment. Derivative amounts affecting earnings are recognized consistent with the classification of the hedged item – primarily net interest income and principal transactions revenue. The following table provides gains (losses) on fair value hedges for the periods ending June 30, 2019 and December 31, 2018: June 30, 2019 Location of Gain or (Loss) Amount of Gain or Amount of Gain or Fair Value Hedging Recognized in Income on (Loss) Recognized in (Loss) Recognized in Relationships Derivat ive Income on Investments Income on Derivative Interest Rate Swaps Interest Income (Expense) $ (87,079) $ 97,095 December 31, 2018 Location of Gain or (Loss) Amount of Gain or Amount of Gain or Fair Value Hedging Recognized in Income on (Loss) Recognized in (Loss) Recognized in Relationships Derivat ive Income on Investments Income on Derivative Interest Rate Swaps Interest Income (Expense) $ 83,926 $ (81,576) (29)

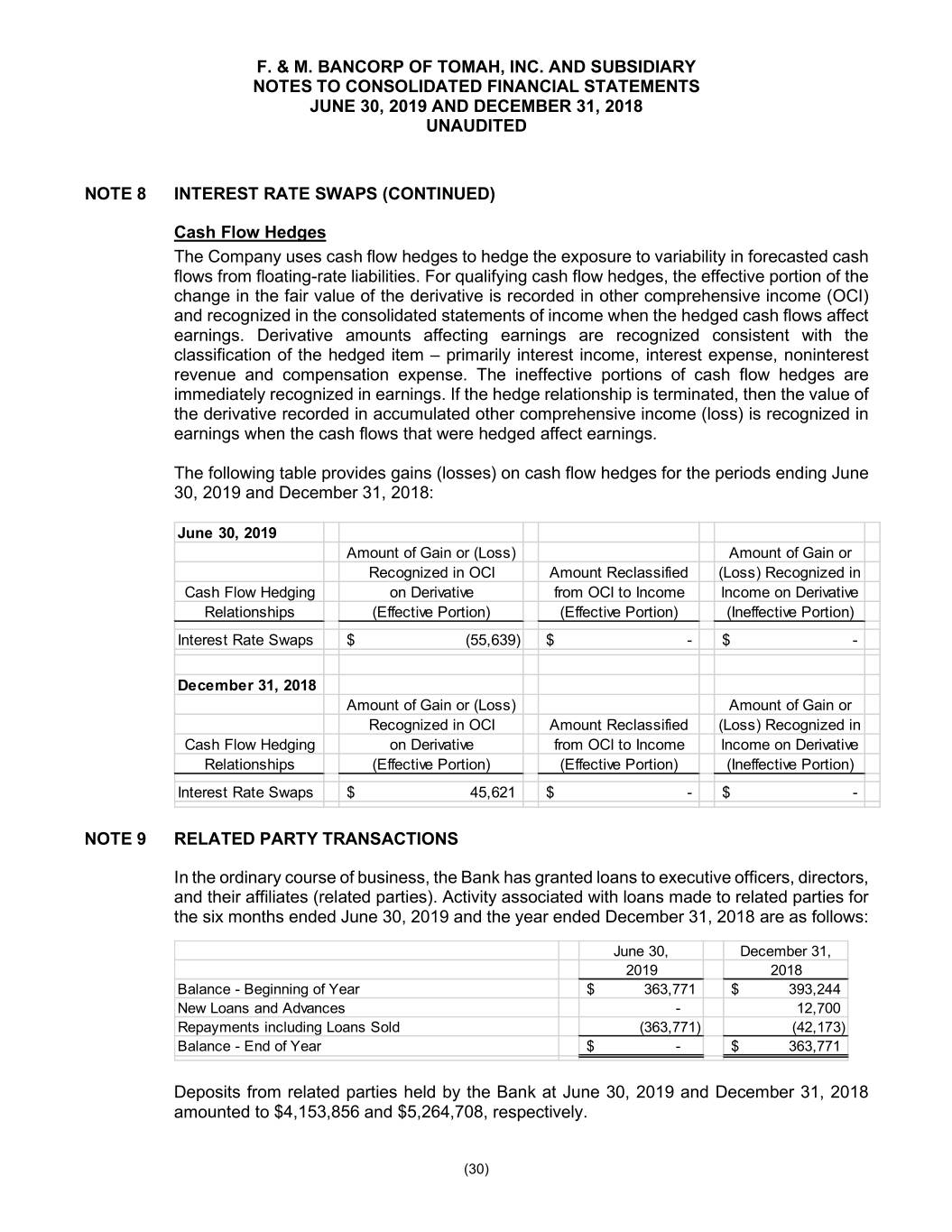

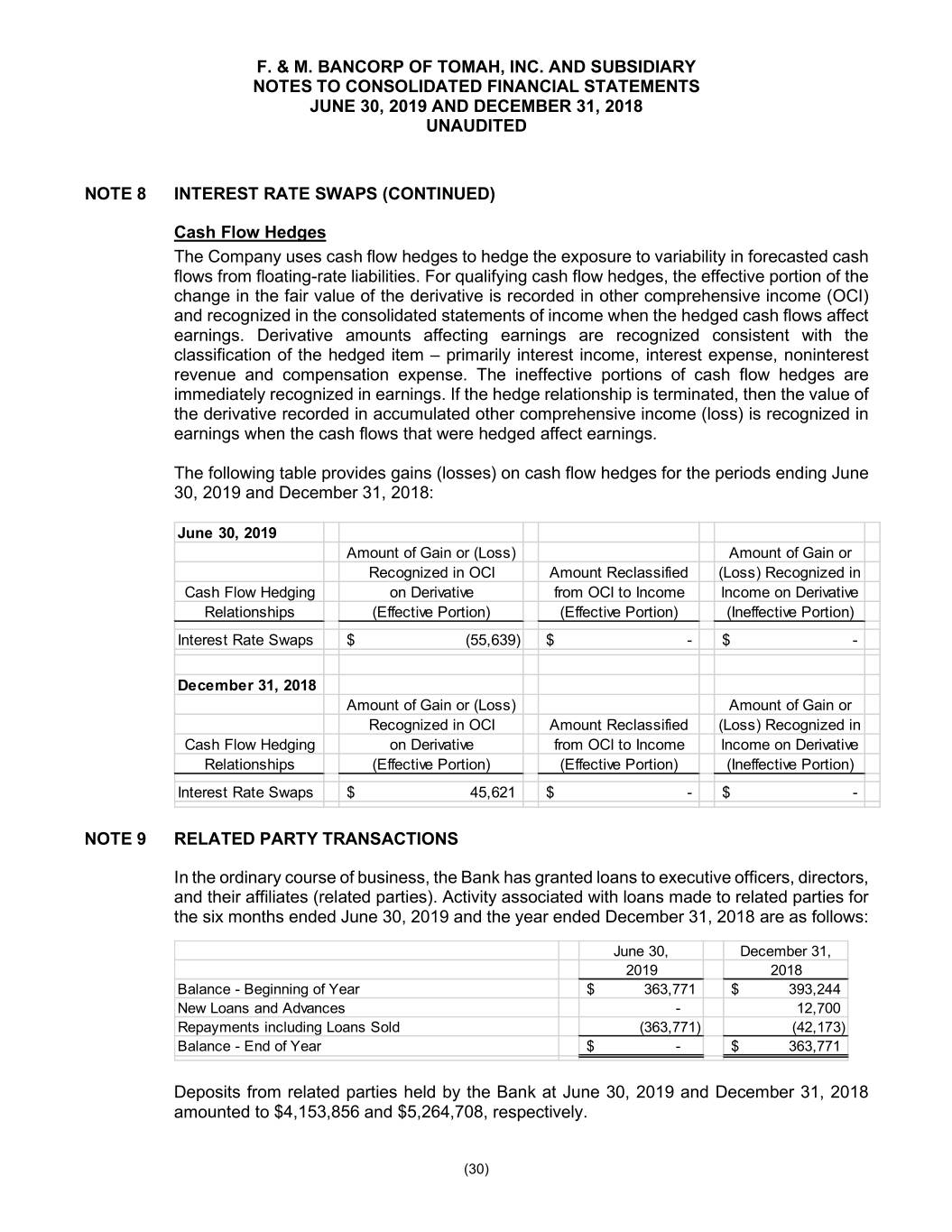

F. & M. BANCORP OF TOMAH, INC. AND SUBSIDIARY NOTES TO CONSOLIDATED FINANCIAL STATEMENTS JUNE 30, 2019 AND DECEMBER 31, 2018 UNAUDITED NOTE 8 INTEREST RATE SWAPS (CONTINUED) Cash Flow Hedges The Company uses cash flow hedges to hedge the exposure to variability in forecasted cash flows from floating-rate liabilities. For qualifying cash flow hedges, the effective portion of the change in the fair value of the derivative is recorded in other comprehensive income (OCI) and recognized in the consolidated statements of income when the hedged cash flows affect earnings. Derivative amounts affecting earnings are recognized consistent with the classification of the hedged item – primarily interest income, interest expense, noninterest revenue and compensation expense. The ineffective portions of cash flow hedges are immediately recognized in earnings. If the hedge relationship is terminated, then the value of the derivative recorded in accumulated other comprehensive income (loss) is recognized in earnings when the cash flows that were hedged affect earnings. The following table provides gains (losses) on cash flow hedges for the periods ending June 30, 2019 and December 31, 2018: June 30, 2019 Amount of Gain or (Loss) Amount of Gain or Recognized in OCI Amount Reclassified (Loss) Recognized in Cash Flow Hedging on Derivative from OCI to Income Income on Derivative Relationships (Effective Portion) (Effective Portion) (Ineffective Portion) Interest Rate Swaps $ (55,639) $ - $ - December 31, 2018 Amount of Gain or (Loss) Amount of Gain or Recognized in OCI Amount Reclassified (Loss) Recognized in Cash Flow Hedging on Derivative from OCI to Income Income on Derivative Relationships (Effective Portion) (Effective Portion) (Ineffective Portion) Interest Rate Swaps $ 45,621 $ - $ - NOTE 9 RELATED PARTY TRANSACTIONS In the ordinary course of business, the Bank has granted loans to executive officers, directors, and their affiliates (related parties). Activity associated with loans made to related parties for the six months ended June 30, 2019 and the year ended December 31, 2018 are as follows: June 30, December 31, 2019 2018 Balance - Beginning of Year $ 363,771 $ 393,244 New Loans and Advances - 12,700 Repayments including Loans Sold (363,771) (42,173) Balance - End of Year $ - $ 363,771 Deposits from related parties held by the Bank at June 30, 2019 and December 31, 2018 amounted to $4,153,856 and $5,264,708, respectively. (30)

F. & M. BANCORP OF TOMAH, INC. AND SUBSIDIARY NOTES TO CONSOLIDATED FINANCIAL STATEMENTS JUNE 30, 2019 AND DECEMBER 31, 2018 UNAUDITED NOTE 10 FINANCIAL INSTRUMENTS WITH OFF-BALANCE SHEET RISK In the normal course of business, the Bank has outstanding commitments and contingent liabilities, such as commitments to extend credit and standby letters of credit, which are not included in the accompanying consolidated financial statements. The Bank’s exposure to credit loss in the event of nonperformance by the other party to the financial instruments for commitments to extend credit and standby letters of credit is represented by the contractual or notional amount of those instruments. The Bank uses the same credit policies in making such commitments as it does for instruments that are included in the consolidated balance sheets. At June 30, 2019 and December 31, 2018, the following financial instruments whose contract amount represents credit risk were approximately as follows: June 30, December 31, 2019 2018 Unfunded Commitments Under Lines of Credit $ 23,647,614 $ 15,752,948 Standby Letters of Credit 375,000 231,283 Total $ 24,022,614 $ 15,984,231 Commitments to extend credit are agreements to lend to a customer as long as there is no violation of any condition established in the contract. Commitments generally have fixed expiration dates or other termination clauses and may require payment of a fee. Since many of the commitments are expected to expire without being drawn upon, the total commitment amounts do not necessarily represent future cash requirements. The Bank evaluates each customer’s creditworthiness on a case-by-case basis. The amount of collateral obtained, if deemed necessary by the Bank upon extension of credit, is based on management’s credit evaluation. Collateral held varies but may include accounts receivable, inventory, property and equipment, and income producing commercial properties. Standby letters of credit are conditional commitments issued by the Bank to guarantee the performance of a customer to a third party. Standby letters of credit generally have fixed expiration dates or other termination clauses and may require payment of a fee. The credit risk involved in issuing letters of credit is essentially the same as that involved in extending loan facilities to customers. The Bank’s policy for obtaining collateral, and the nature of such collateral, is essentially the same as that involved in making commitments to extend credit. The Bank was not required to perform on any financial guarantees and did not incur any losses on its commitments during the past two years. NOTE 11 LEGAL CONTINGENCIES The Company may be subject to claims and lawsuits which may arise primarily in the ordinary course of business. It is the opinion of management, if such claims are made, that the disposition or ultimate resolution of the claims and lawsuits will not have a material adverse effect on the consolidated financial position of the Company. (31)

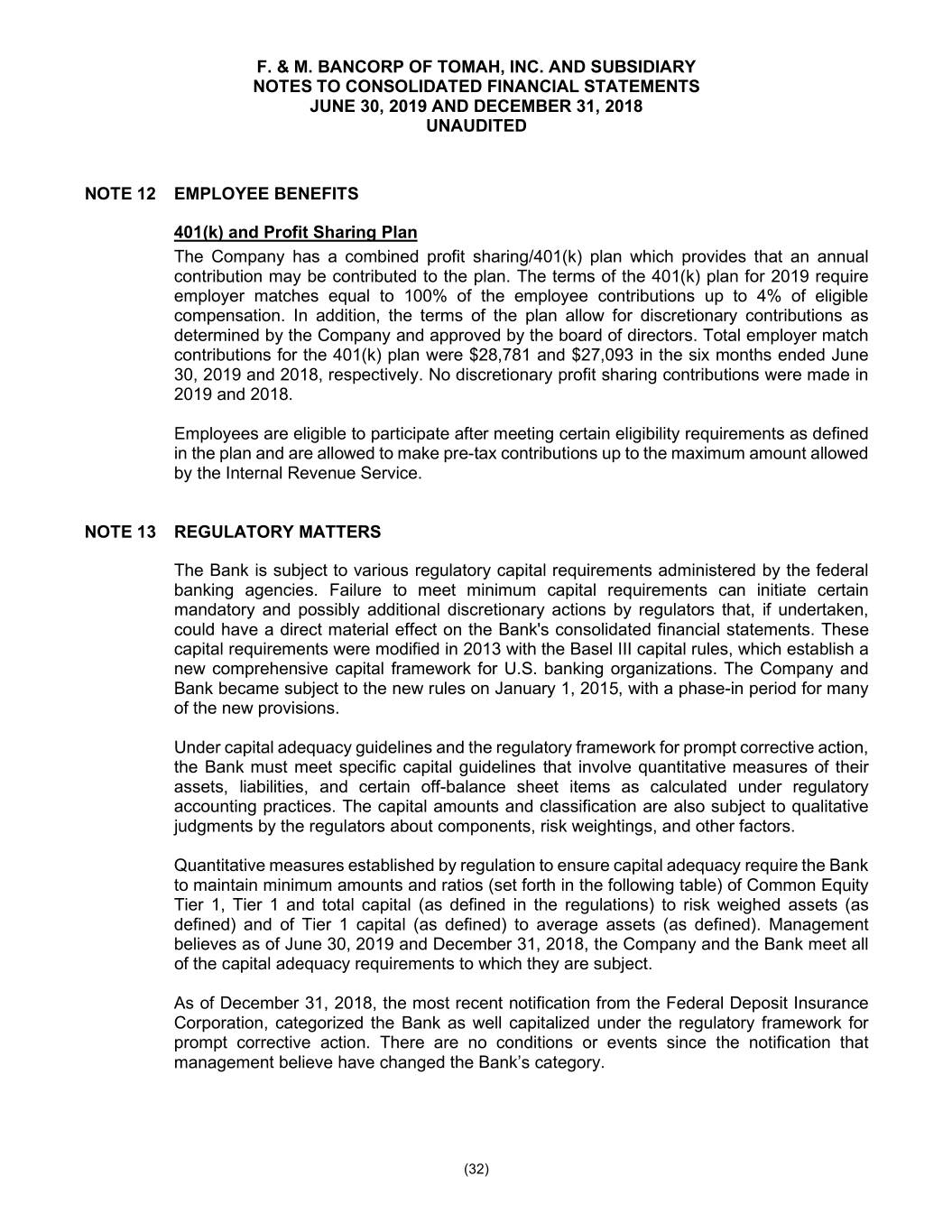

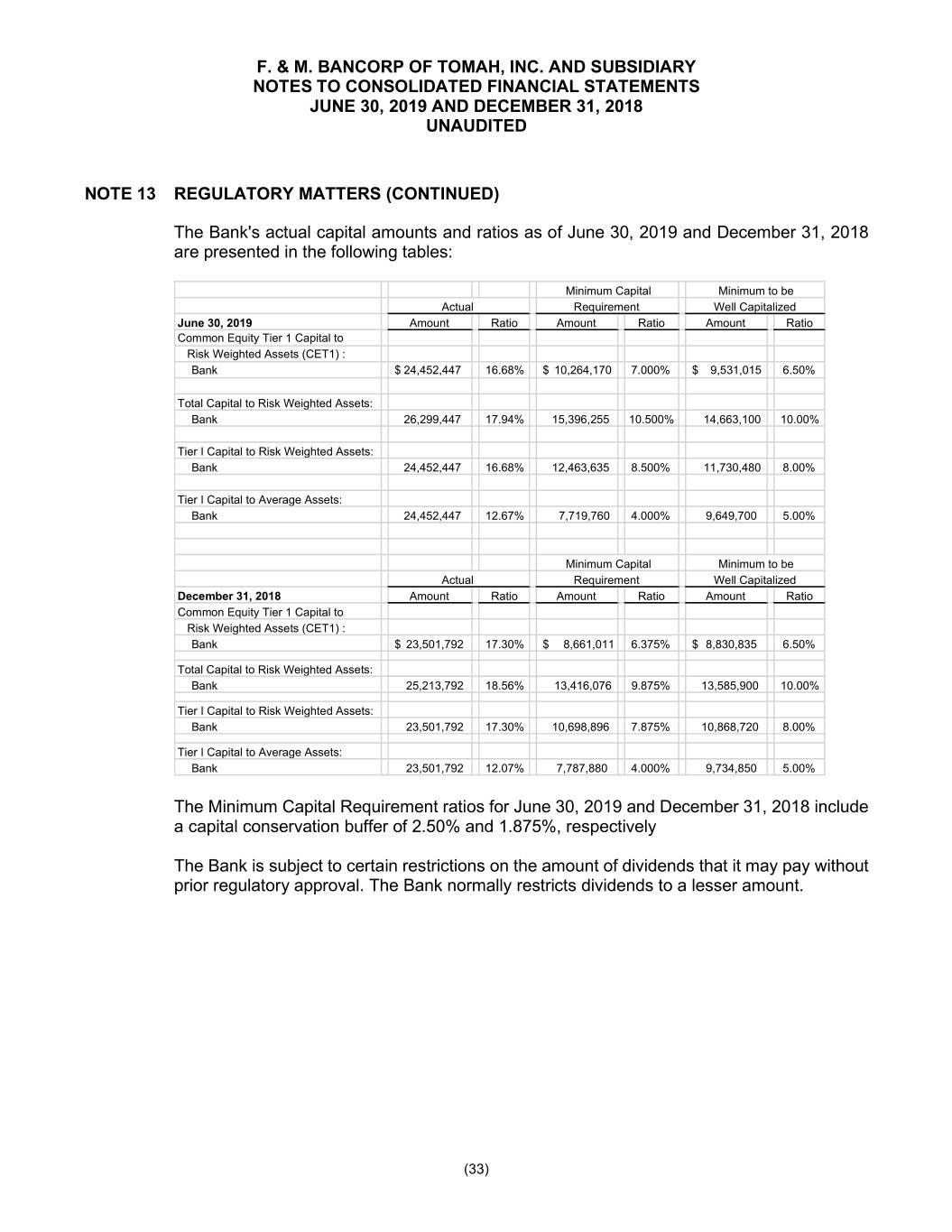

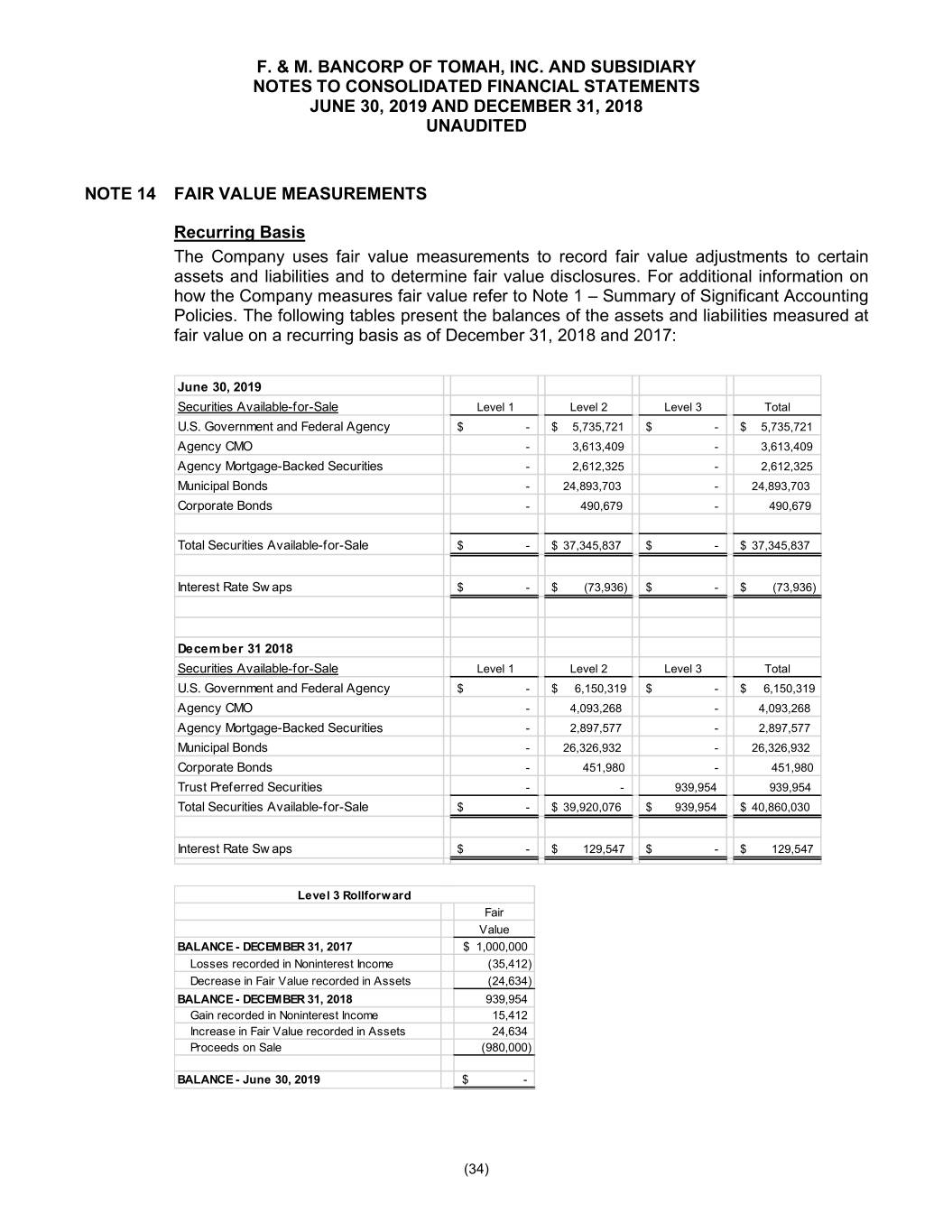

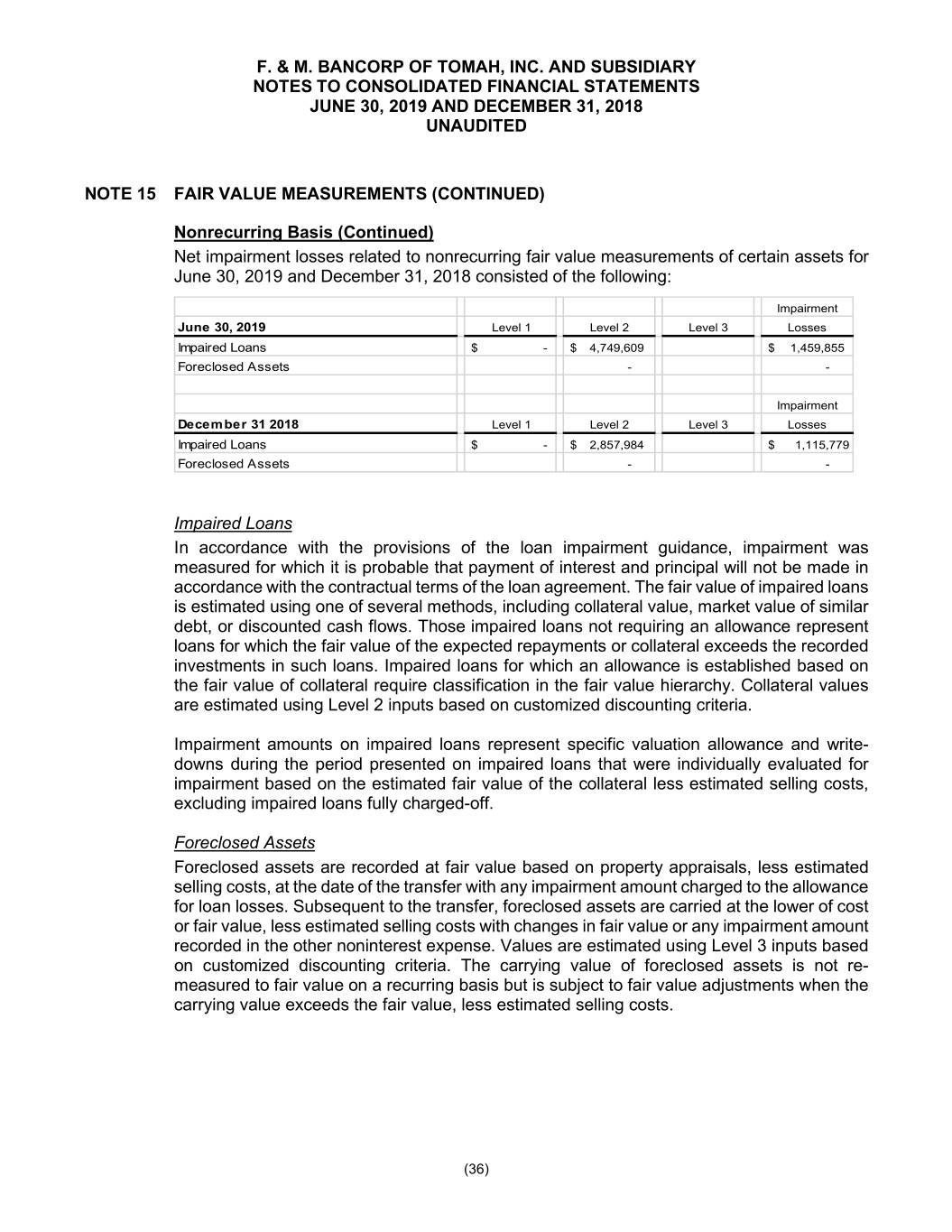

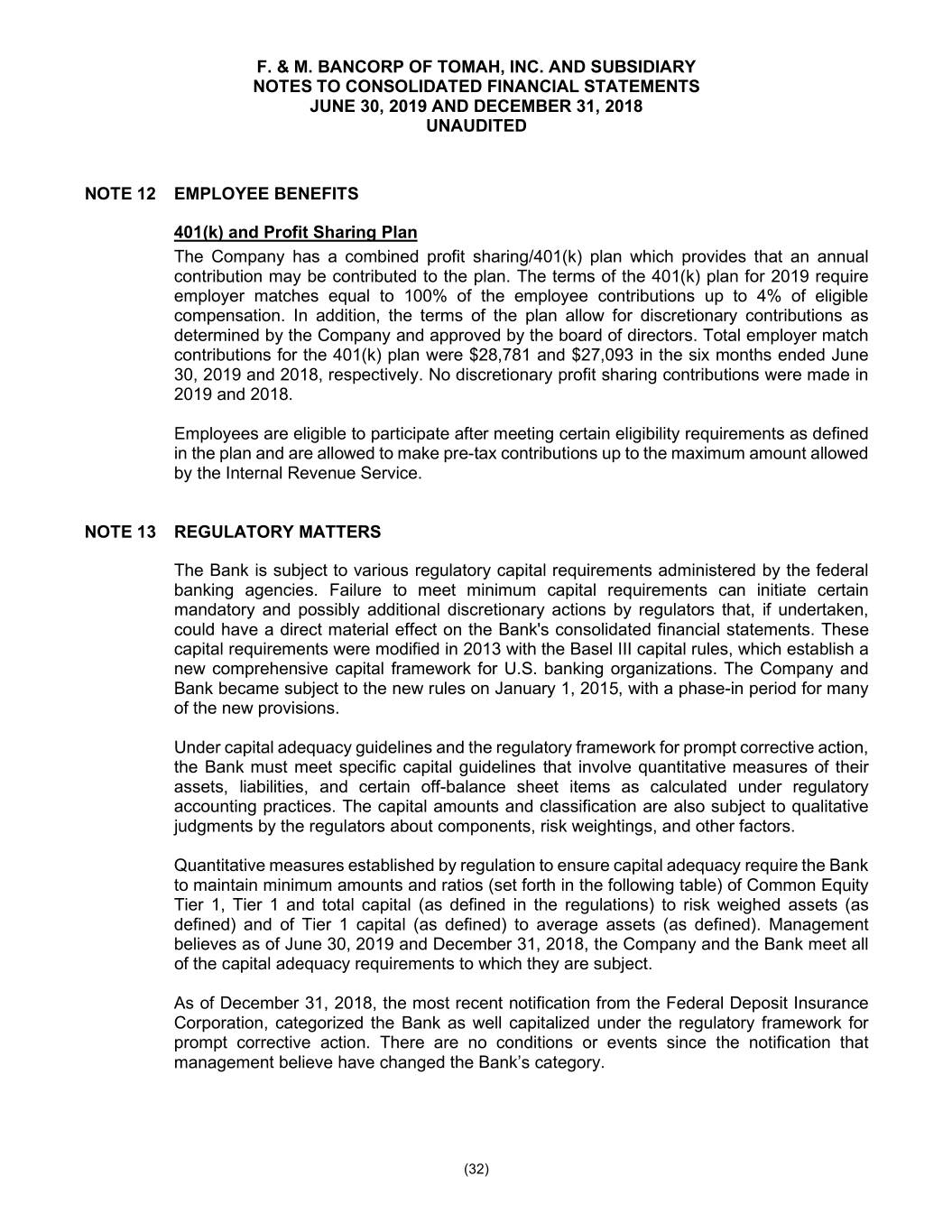

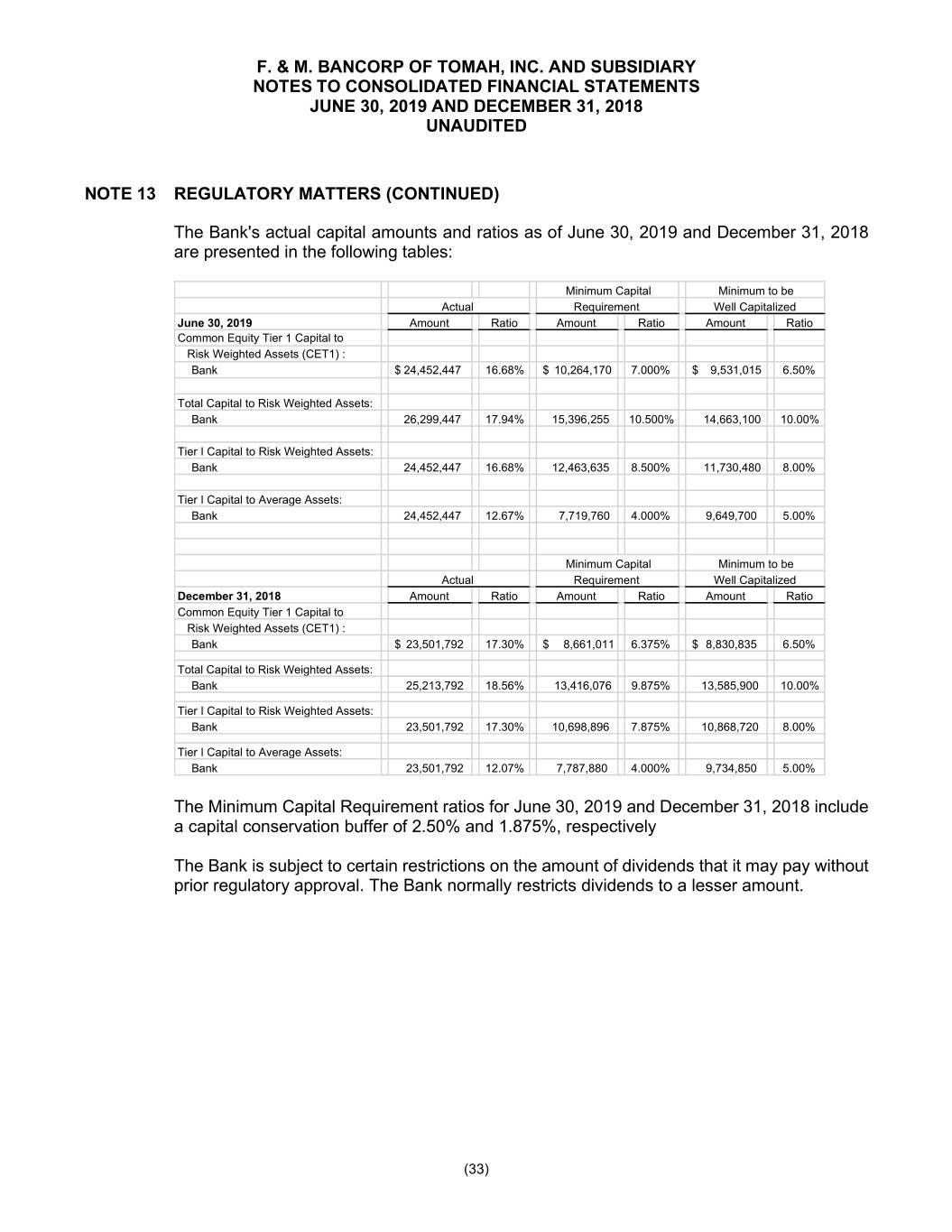

F. & M. BANCORP OF TOMAH, INC. AND SUBSIDIARY NOTES TO CONSOLIDATED FINANCIAL STATEMENTS JUNE 30, 2019 AND DECEMBER 31, 2018 UNAUDITED NOTE 12 EMPLOYEE BENEFITS 401(k) and Profit Sharing Plan The Company has a combined profit sharing/401(k) plan which provides that an annual contribution may be contributed to the plan. The terms of the 401(k) plan for 2019 require employer matches equal to 100% of the employee contributions up to 4% of eligible compensation. In addition, the terms of the plan allow for discretionary contributions as determined by the Company and approved by the board of directors. Total employer match contributions for the 401(k) plan were $28,781 and $27,093 in the six months ended June 30, 2019 and 2018, respectively. No discretionary profit sharing contributions were made in 2019 and 2018. Employees are eligible to participate after meeting certain eligibility requirements as defined in the plan and are allowed to make pre-tax contributions up to the maximum amount allowed by the Internal Revenue Service. NOTE 13 REGULATORY MATTERS The Bank is subject to various regulatory capital requirements administered by the federal banking agencies. Failure to meet minimum capital requirements can initiate certain mandatory and possibly additional discretionary actions by regulators that, if undertaken, could have a direct material effect on the Bank's consolidated financial statements. These capital requirements were modified in 2013 with the Basel III capital rules, which establish a new comprehensive capital framework for U.S. banking organizations. The Company and Bank became subject to the new rules on January 1, 2015, with a phase-in period for many of the new provisions. Under capital adequacy guidelines and the regulatory framework for prompt corrective action, the Bank must meet specific capital guidelines that involve quantitative measures of their assets, liabilities, and certain off-balance sheet items as calculated under regulatory accounting practices. The capital amounts and classification are also subject to qualitative judgments by the regulators about components, risk weightings, and other factors. Quantitative measures established by regulation to ensure capital adequacy require the Bank to maintain minimum amounts and ratios (set forth in the following table) of Common Equity Tier 1, Tier 1 and total capital (as defined in the regulations) to risk weighed assets (as defined) and of Tier 1 capital (as defined) to average assets (as defined). Management believes as of June 30, 2019 and December 31, 2018, the Company and the Bank meet all of the capital adequacy requirements to which they are subject. As of December 31, 2018, the most recent notification from the Federal Deposit Insurance Corporation, categorized the Bank as well capitalized under the regulatory framework for prompt corrective action. There are no conditions or events since the notification that management believe have changed the Bank’s category. (32)