2022 First Quarter Results Piper Sandler Upper Midwest Bank Tour

Cautionary Notes and Additional Disclosures 2 DATES AND PERIODS PRESENTED Unless otherwise noted, “20YY” refers to either the corresponding fiscal year-end date or the corresponding 12-months (i.e. fiscal year) then ended. “MMM-YY” refers to either the corresponding quarter-end date, or the corresponding three-month period then ended. CAUTIONARY NOTE REGARDING FORWARD LOOKING STATEMENTS This presentation may contain certain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, and Section 21E of the Securities Exchange Act of 1934. These statements include, but are not limited to, descriptions of the financial condition, results of operations, asset and credit quality trends, profitability, projected earnings, future plans, strategies and expectations of Citizens Community Bancorp, Inc. (“CZWI” or the “Company”) and its subsidiary, Citizens Community Federal, National Association (“CCFBank”) . The Company intends such forward-looking statements to be covered by the safe harbor provisions for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995 and is including this statement for purposes of complying with those safe harbor provisions. Forward-looking statements, which are based on certain assumptions of the Company, are generally identifiable by use of the words “believe,” “expect,” “estimates,” “intend,” “anticipate,” “estimate,” “project,” “on pace,” “seek,” “target,” “potential,” “focus,” “may,” “preliminary,” “could,” “should” or similar expressions. These forward-looking statements express management’s current expectations or forecasts of future events, and by their nature, are subject to risks and uncertainties. Therefore, there are a number of factors that might cause actual results to differ materially from those in such statements. These uncertainties include conditions in the financial markets and economic conditions generally; adverse impacts to the Company or CCFBank arising from the COVID-19 pandemic; acts of terrorism and political or military actions by the United States or other governments; the possibility of a deterioration in the residential real estate markets; interest rate risk; lending risk; higher lending risks associated with our commercial and agricultural banking activities; the sufficiency of loan allowances; changes in the fair value or ratings downgrades of our securities; competitive pressures among depository and other financial institutions; disintermediation risk; our ability to maintain our reputation; our ability to maintain or increase our market share; our ability to realize the benefits of net deferred tax assets; our inability to obtain needed liquidity; our ability to raise capital needed to fund growth or meet regulatory requirements; our ability to attract and retain key personnel; our ability to keep pace with technological change; prevalence of fraud and other financial crimes; cybersecurity risks; the possibility that our internal controls and procedures could fail or be circumvented; our ability to successfully execute our acquisition growth strategy; risks posed by acquisitions and other expansion opportunities, including difficulties and delays in integrating the acquired business operations or fully realizing the cost savings and other benefits; restrictions on our ability to pay dividends; the potential volatility of our stock price; accounting standards for loan losses; legislative or regulatory changes or actions, or significant litigation, adversely affecting the Company or CCFBank; public company reporting obligations; changes in federal or state tax laws; and changes in accounting principles, policies or guidelines and their impact on financial performance. Stockholders, potential investors and other readers are urged to consider these factors carefully in evaluating the forward-looking statements and are cautioned not to place undue reliance on such forward- looking statements. Such uncertainties and other risks that may affect the Company's performance are discussed further in Part I, Item 1A, "Risk Factors," in the Company's Form 10-K, for the year ended December 31, 2021, filed with the Securities and Exchange Commission ("SEC") on March 2, 2022, the Company’s Form 10-Q for the quarter ended March 31, 2022, filed with the SEC on May 4, 2022, and the Company's subsequent filings with the SEC. The Company undertakes no obligation to make any revisions to the forward-looking statements contained herein or to update them to reflect events or circumstances occurring after the date hereof. NON-GAAP FINANCIAL MEASURES These slides contain non-GAAP financial measures. For purposes of Regulation G, a non-GAAP financial measure is a numerical measure of the registrant's historical or future financial performance, financial position or cash flows that excludes amounts, or is subject to adjustments that have the effect of excluding amounts, that are included in the most directly comparable measure calculated and presented in accordance with GAAP in the statement of income, balance sheet or statement of cash flows (or equivalent statements) of the issuer; or includes amounts, or is subject to adjustments that have the effect of including amounts, that are excluded from the most directly comparable measure so calculated and presented. In this regard, GAAP refers to generally accepted accounting principles in the United States. Non·GAAP financial measures referred to herein include net income as adjusted, EPS as adjusted, ROAA as adjusted, return on average tangible common equity (ROATCE), ROATCE as adjusted, tangible book value, tangible book value per share, efficiency ratio as adjusted and tangible common equity / tangible assets. Reconciliations of all Non·GAAP financial measures used herein to the comparable GAAP financial measures in the appendix at the end of this presentation. SOURCE Unless otherwise noted, internal Company documents

Investment Summary Stable Markets Strong earnings and ROATCE profile with capacity and infrastructure to grow organically 3 Returns Asset Quality Diverse stable geographies and industries mitigate risk and enhance steady growth prospects Sound underwriting practices and portfolio administration have produced strong credit performance Capital Ratios Strong bank capital ratios and improving holding company ratios Shareholder Friendly Board and Executive Management commitment to the company’s stock evidenced by approved share repurchase authorizations in November 2020 and July 2021 and open market purchases

89.2% 82.3% 76.1% 87.1% 73.7% 86.5% 87.1% 84.0% 80.8% 89.6% 74.1% 87.4% 0.0% 25.0% 50.0% 75.0% 100.0% Overall Role Team Supervisor Compensation Organization Colleague Engagement 2021 Favorable 2022 Favorable Excellent Target Favorable Target 75% 50% Values Our six main values are: integrity, commitment, innovation, collaboration, focus, and sustainability. Vision Make more possible for our customers, colleagues, communities, and shareholders! Mission Provide the best products, service, and ideas to our customers every interaction every day. Culture & Engagement 4 Participation Rates 2021: 71.8% 2022: 91.4%

Performance Objectives Increase Tangible Book and Shareholder Value Maintain Strong Asset Quality Metrics Increase Operating Leverage Sustainable Business Practices Targeted growth in TBV of 8-10% and achieve ROA and ROE in the upper half of its peer group Maintain NPAs, classifieds and NCOs at or below peer group Maintain efficiency ratio in the 60% range by growing revenue and controlling expenses Execute sustainable business practices that strengthen our culture and communities, foster equity, diversity and inclusion and ensure sound corporate and board governance 5

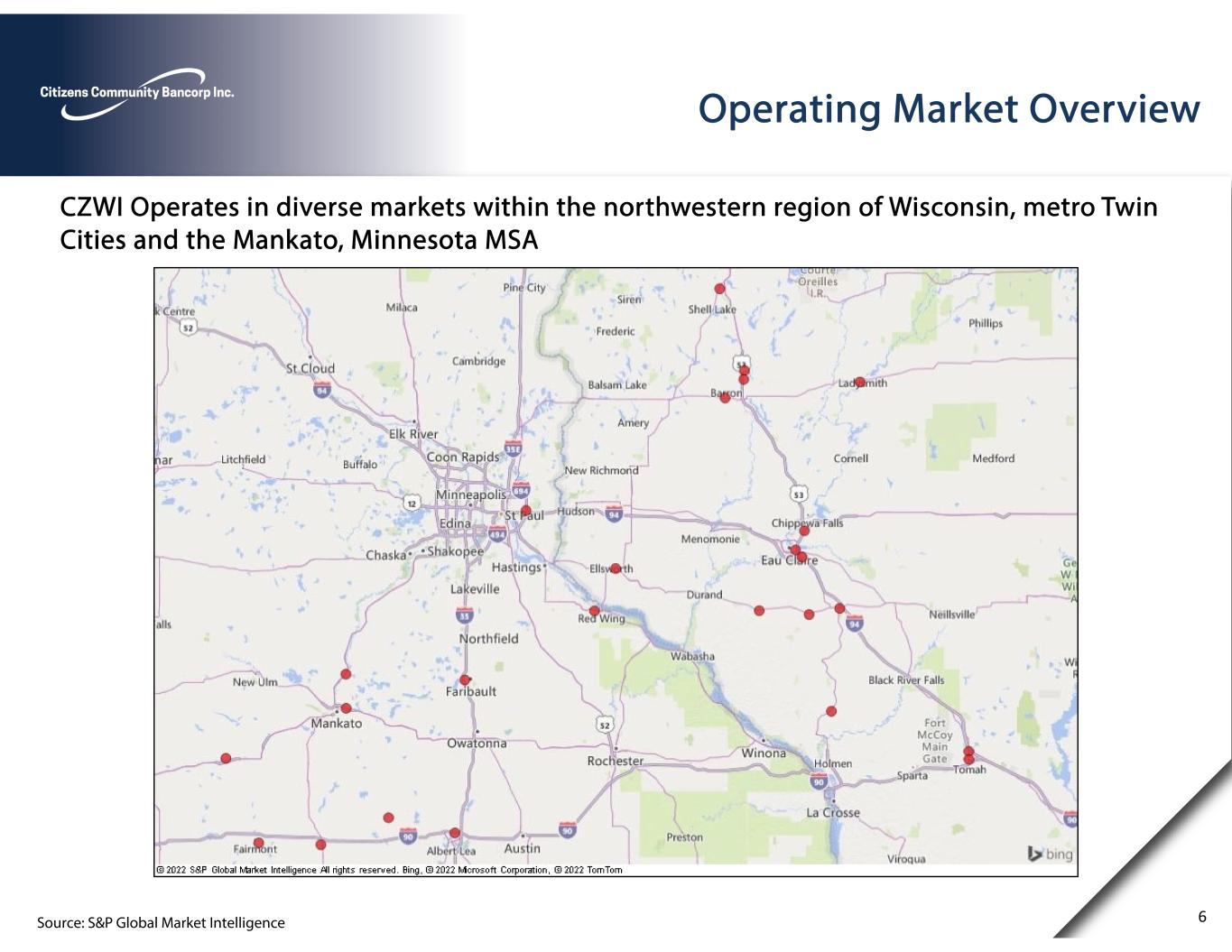

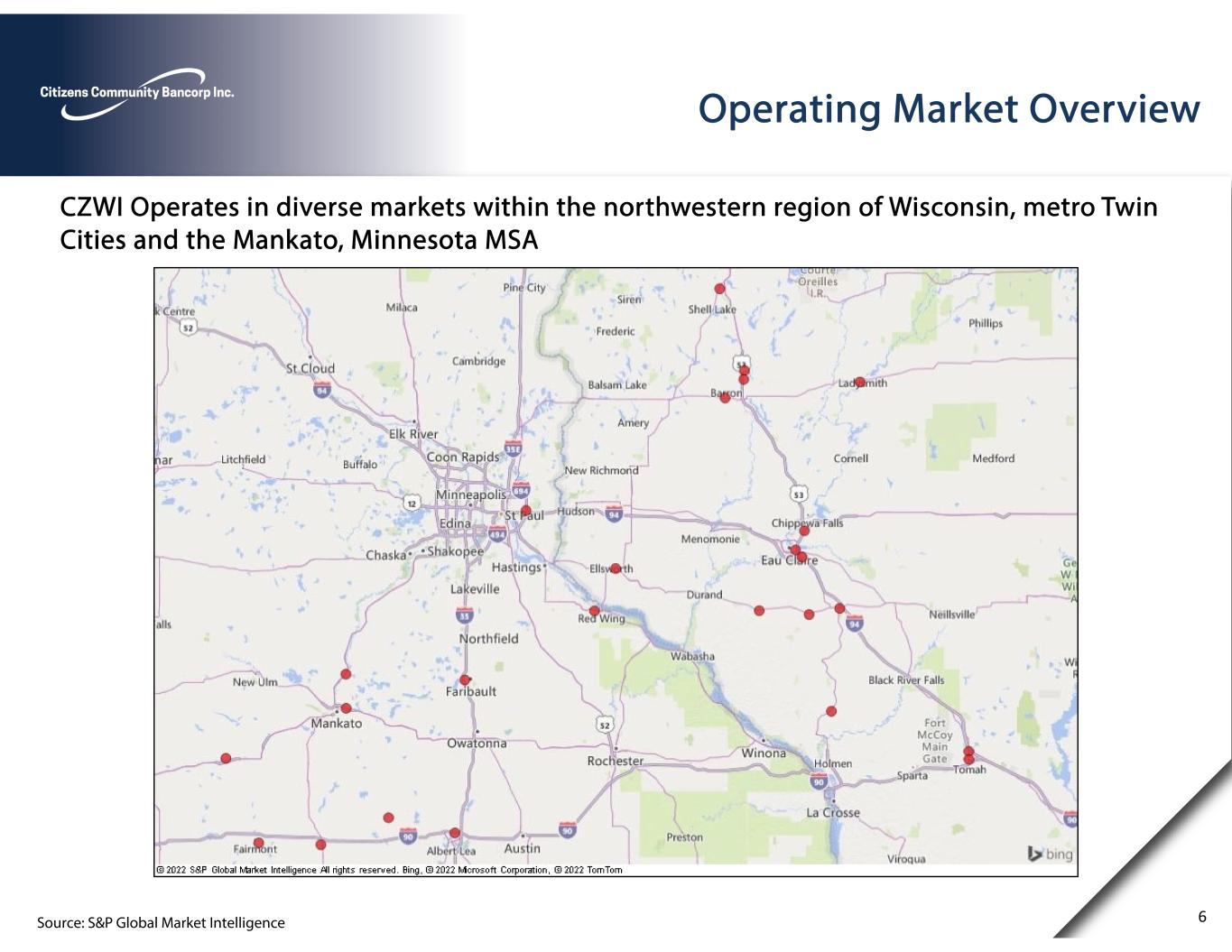

Operating Market Overview CZWI Operates in diverse markets within the northwestern region of Wisconsin, metro Twin Cities and the Mankato, Minnesota MSA Source: S&P Global Market Intelligence 0 0 0 0 0 6

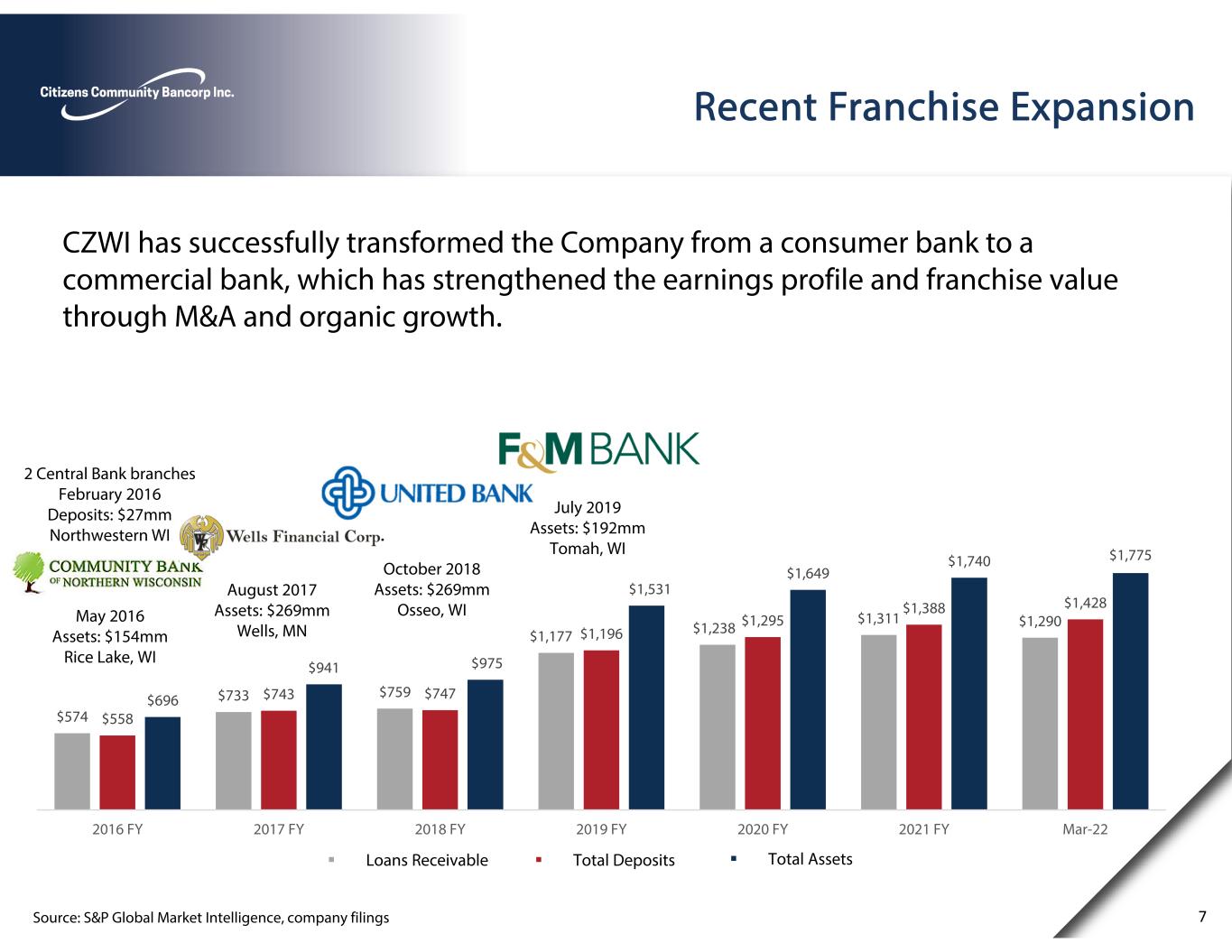

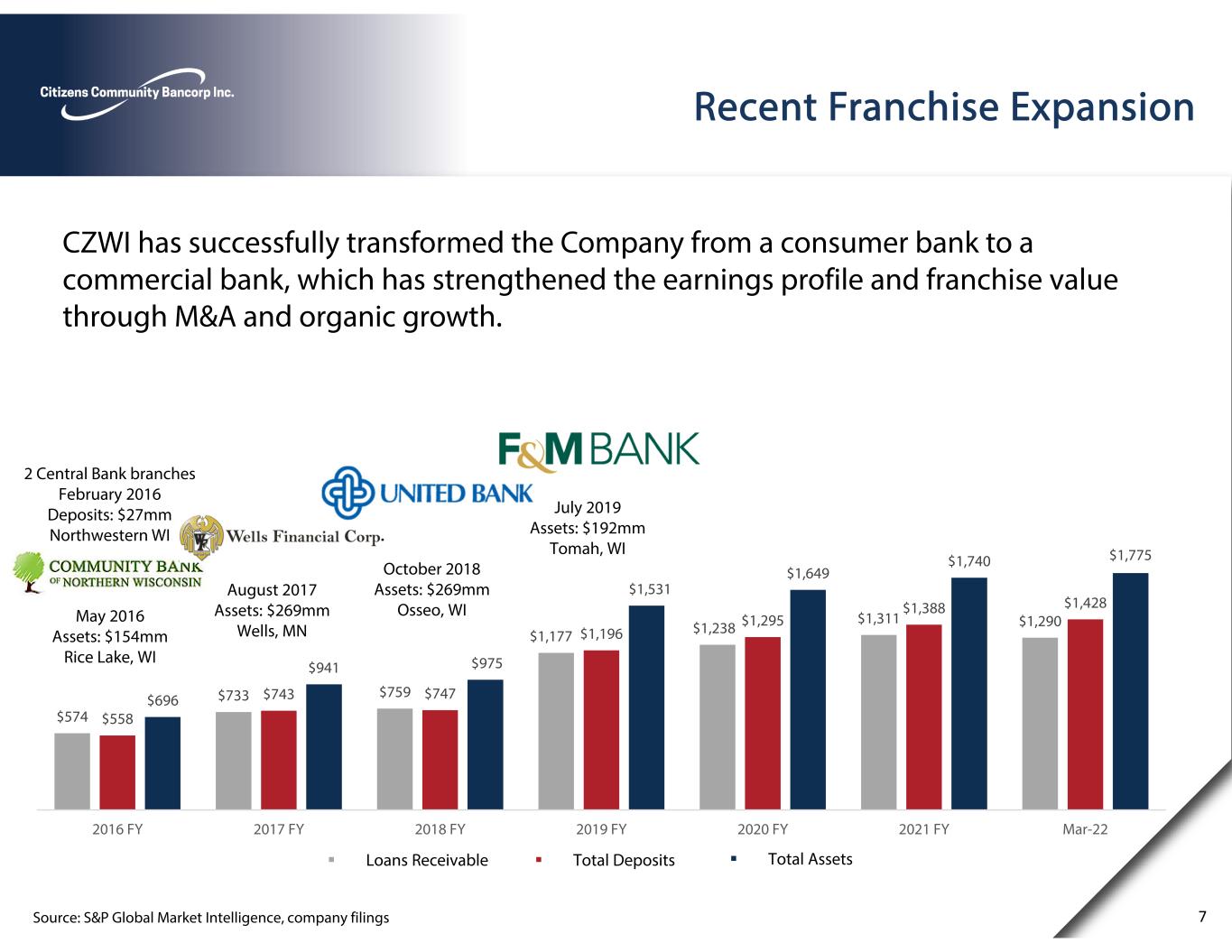

Recent Franchise Expansion CZWI has successfully transformed the Company from a consumer bank to a commercial bank, which has strengthened the earnings profile and franchise value through M&A and organic growth. Total Assets Loans Receivable Total Deposits Source: S&P Global Market Intelligence, company filings 7 $574 $733 $759 $1,177 $1,238 $1,311 $1,290 $558 $743 $747 $1,196 $1,295 $1,388 $1,428 $696 $941 $975 $1,531 $1,649 $1,740 $1,775 2016 FY 2017 FY 2018 FY 2019 FY 2020 FY 2021 FY Mar-22 July 2019 Assets: $192mm Tomah, WI May 2016 Assets: $154mm Rice Lake, WI 2 Central Bank branches February 2016 Deposits: $27mm Northwestern WI August 2017 Assets: $269mm Wells, MN October 2018 Assets: $269mm Osseo, WI

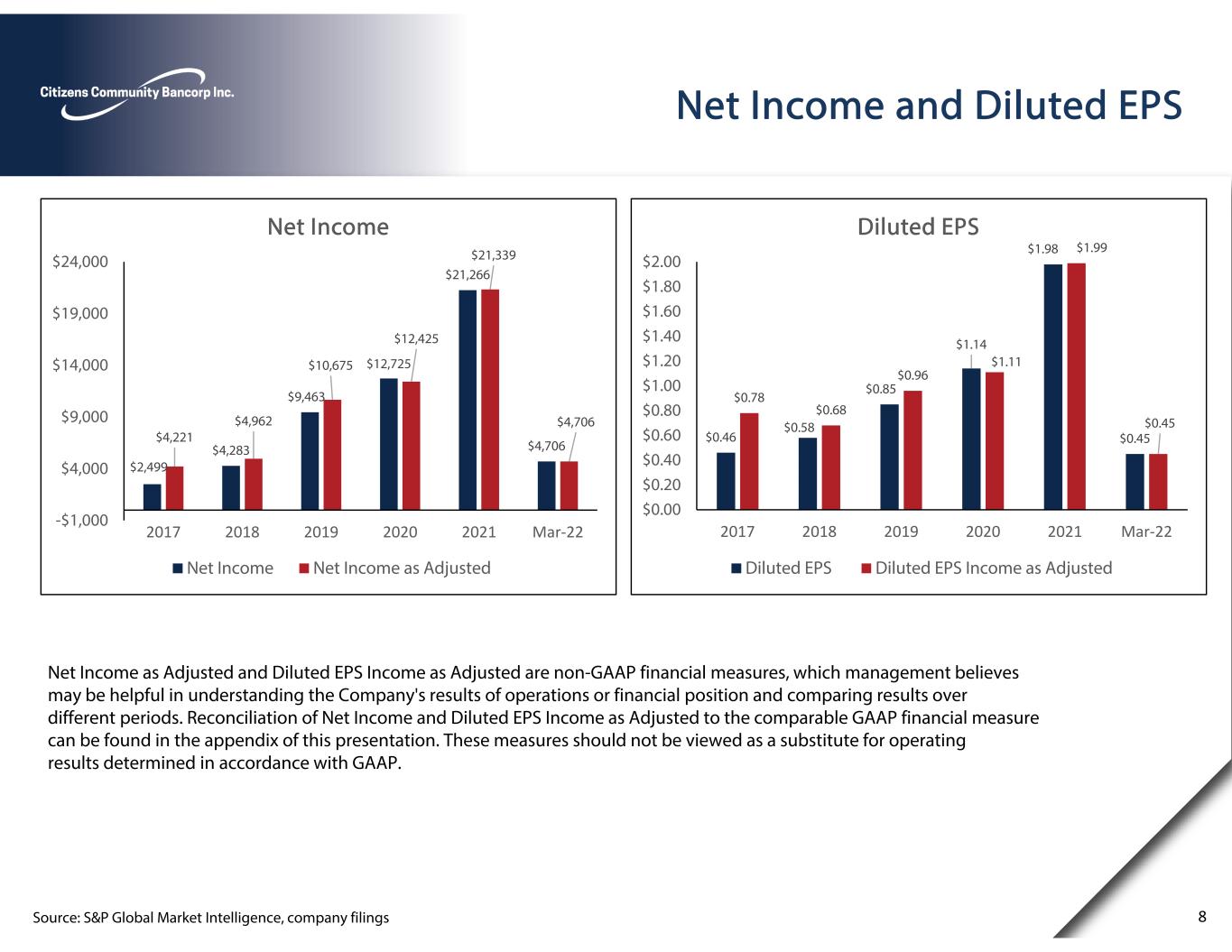

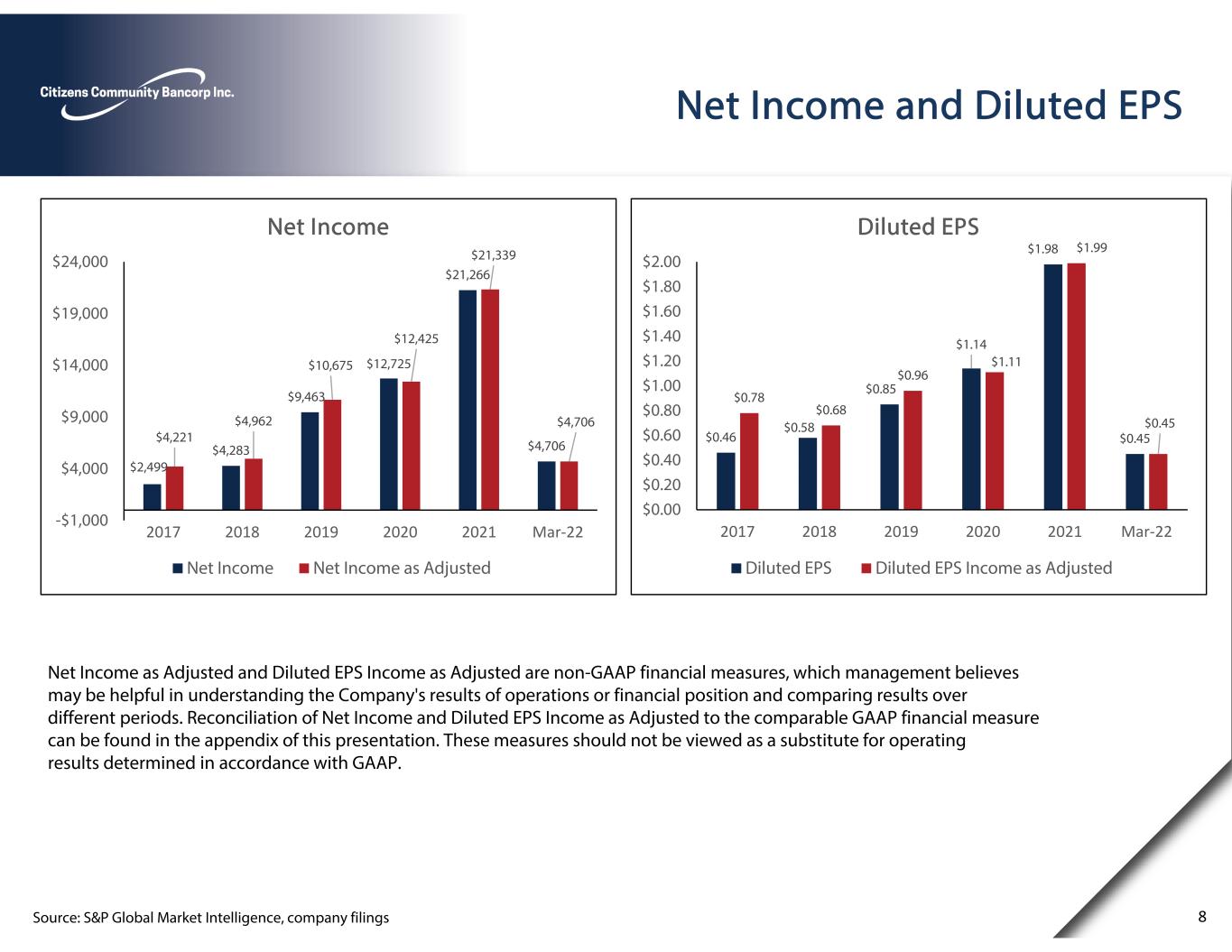

Net Income and Diluted EPS Source: S&P Global Market Intelligence, company filings Net Income as Adjusted and Diluted EPS Income as Adjusted are non-GAAP financial measures, which management believes may be helpful in understanding the Company's results of operations or financial position and comparing results over different periods. Reconciliation of Net Income and Diluted EPS Income as Adjusted to the comparable GAAP financial measure can be found in the appendix of this presentation. These measures should not be viewed as a substitute for operating results determined in accordance with GAAP. 8 $2,499 $4,283 $9,463 $12,725 $21,266 $4,706 $4,221 $4,962 $10,675 $12,425 $21,339 $4,706 -$1,000 $4,000 $9,000 $14,000 $19,000 $24,000 2017 2018 2019 2020 2021 Mar‐22 Net Income Net Income Net Income as Adjusted $0.46 $0.58 $0.85 $1.14 $1.98 $0.45 $0.78 $0.68 $0.96 $1.11 $1.99 $0.45 $0.00 $0.20 $0.40 $0.60 $0.80 $1.00 $1.20 $1.40 $1.60 $1.80 $2.00 2017 2018 2019 2020 2021 Mar‐22 Diluted EPS Diluted EPS Diluted EPS Income as Adjusted

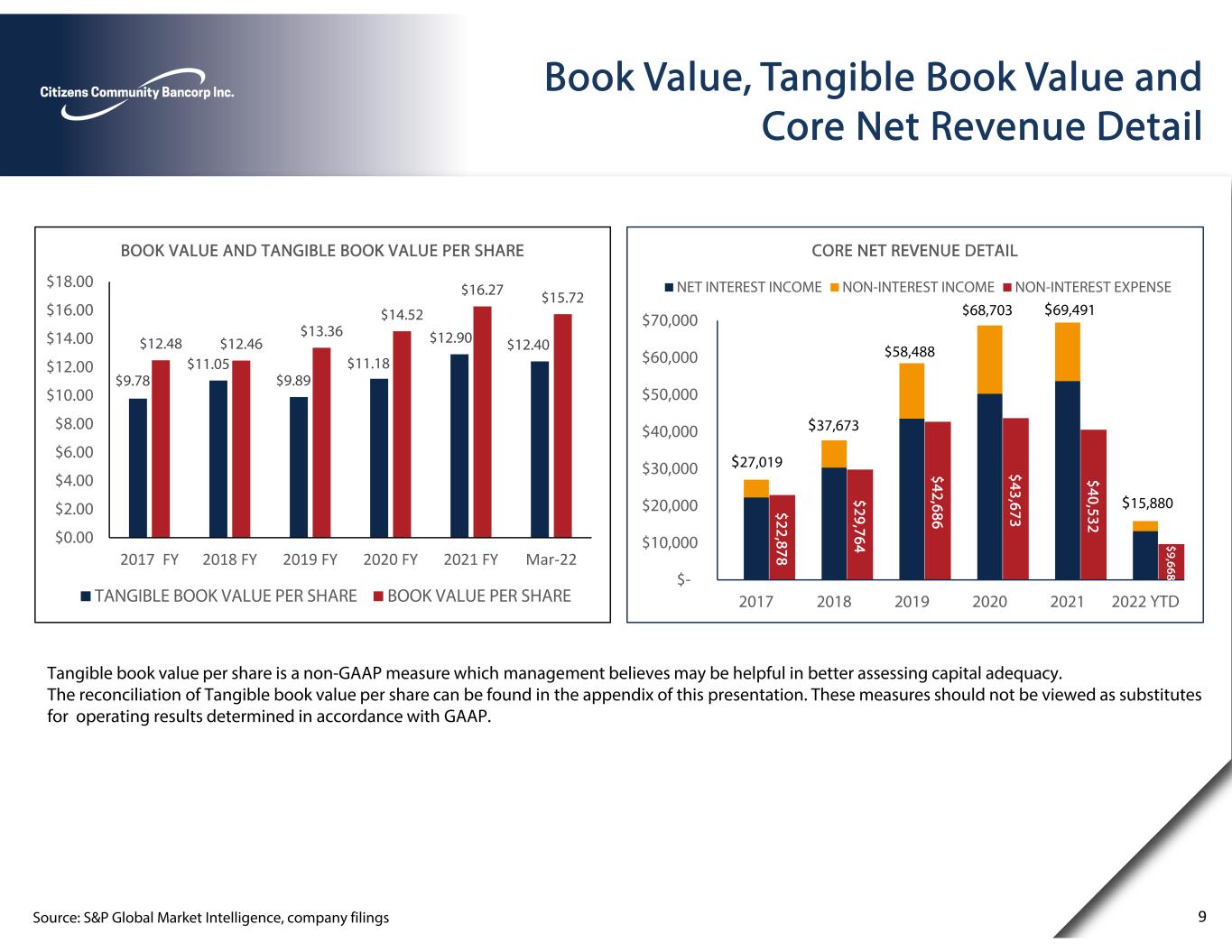

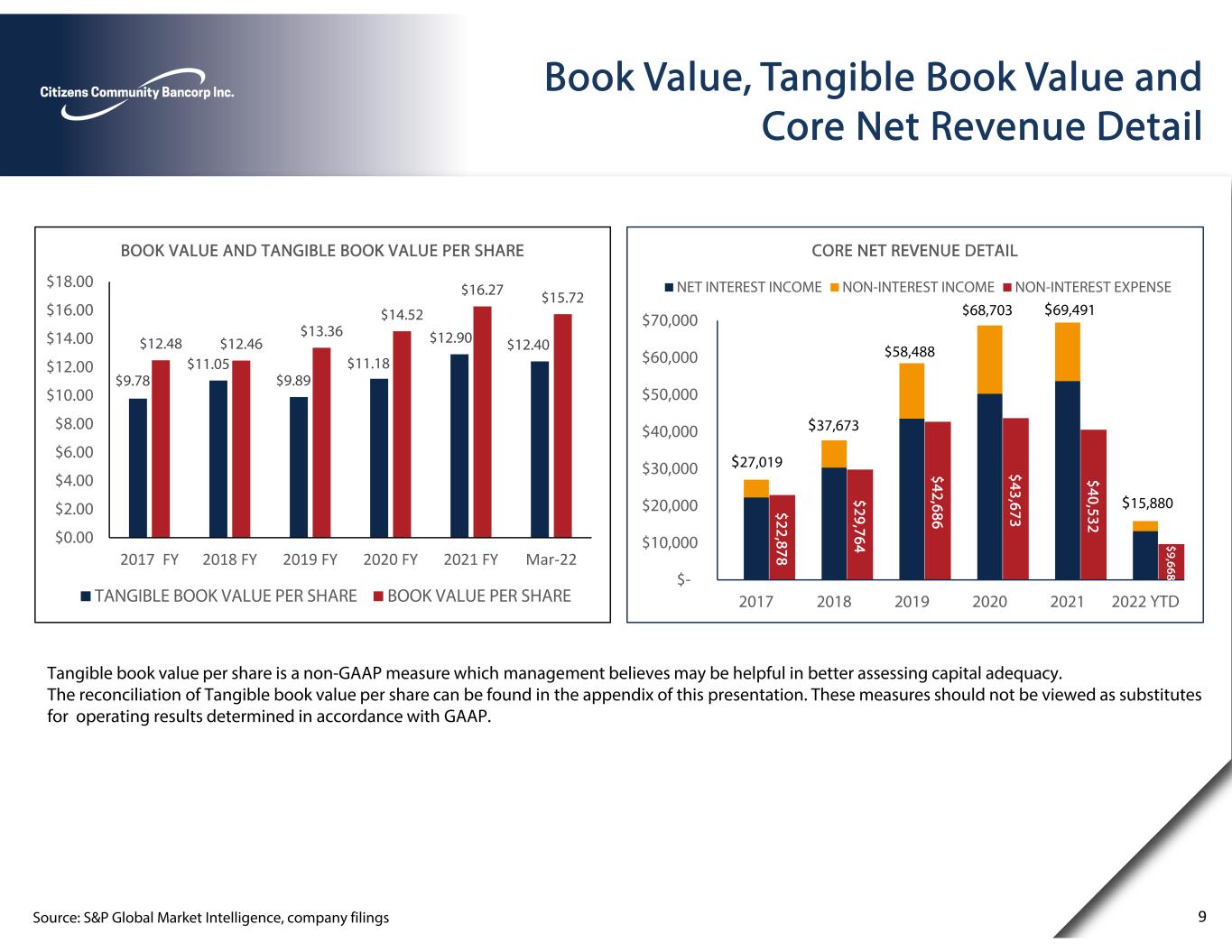

Book Value, Tangible Book Value and Core Net Revenue Detail Source: S&P Global Market Intelligence, company filings Tangible book value per share is a non-GAAP measure which management believes may be helpful in better assessing capital adequacy. The reconciliation of Tangible book value per share can be found in the appendix of this presentation. These measures should not be viewed as substitutes for operating results determined in accordance with GAAP. 9 $9.78 $11.05 $9.89 $11.18 $12.90 $12.40$12.48 $12.46 $13.36 $14.52 $16.27 $15.72 $0.00 $2.00 $4.00 $6.00 $8.00 $10.00 $12.00 $14.00 $16.00 $18.00 2017 FY 2018 FY 2019 FY 2020 FY 2021 FY Mar‐22 BOOK VALUE AND TANGIBLE BOOK VALUE PER SHARE TANGIBLE BOOK VALUE PER SHARE BOOK VALUE PER SHARE $22,878 $29,764 $42,686 $43,673 $40,532 $9,668 $- $10,000 $20,000 $30,000 $40,000 $50,000 $60,000 $70,000 2017 2018 2019 2020 2021 2022 YTD CORE NET REVENUE DETAIL NET INTEREST INCOME NON-INTEREST INCOME NON-INTEREST EXPENSE $58,488 $68,703 $69,491 $27,019 $37,673 $15,880

Return on average assets as adjusted, return on average tangible common equity (ROATCE) and ROATCE as adjusted are non-GAAP measures, which management believes may be helpful in better understanding the underlying business performance trends related to average assets and average tangible equity. Reconciliations of ROAA as adjusted, ROTCE, and ROTCE as adjusted can be found in the appendix of this presentation. These measures should not be viewed as substitutes for operating results determined in accordance with GAAP. Return on Average Assets and Return on Average Tangible Common Equity Source: SEC filings and Company documents 10 0.34% 0.45% 0.68% 0.80% 1.23% 1.09% 0.58% 0.52% 0.76% 0.78% 1.24% 1.09% 0.00% 0.20% 0.40% 0.60% 0.80% 1.00% 1.20% 1.40% 2017 2018 2019 2020 2021 Mar-22 ROAA ROAA ROAA INCOME AS ADJUSTED 4.5% 5.3% 10.1% 12.1% 17.6% 15.3% 7.5% 6.0% 11.2% 11.8% 17.6% 15.3% 0.0% 5.0% 10.0% 15.0% 20.0% 2017 2018 2019 2020 2021 Mar-22 ROATCE ROATCE ROATCE INCOME AS ADJUSTED

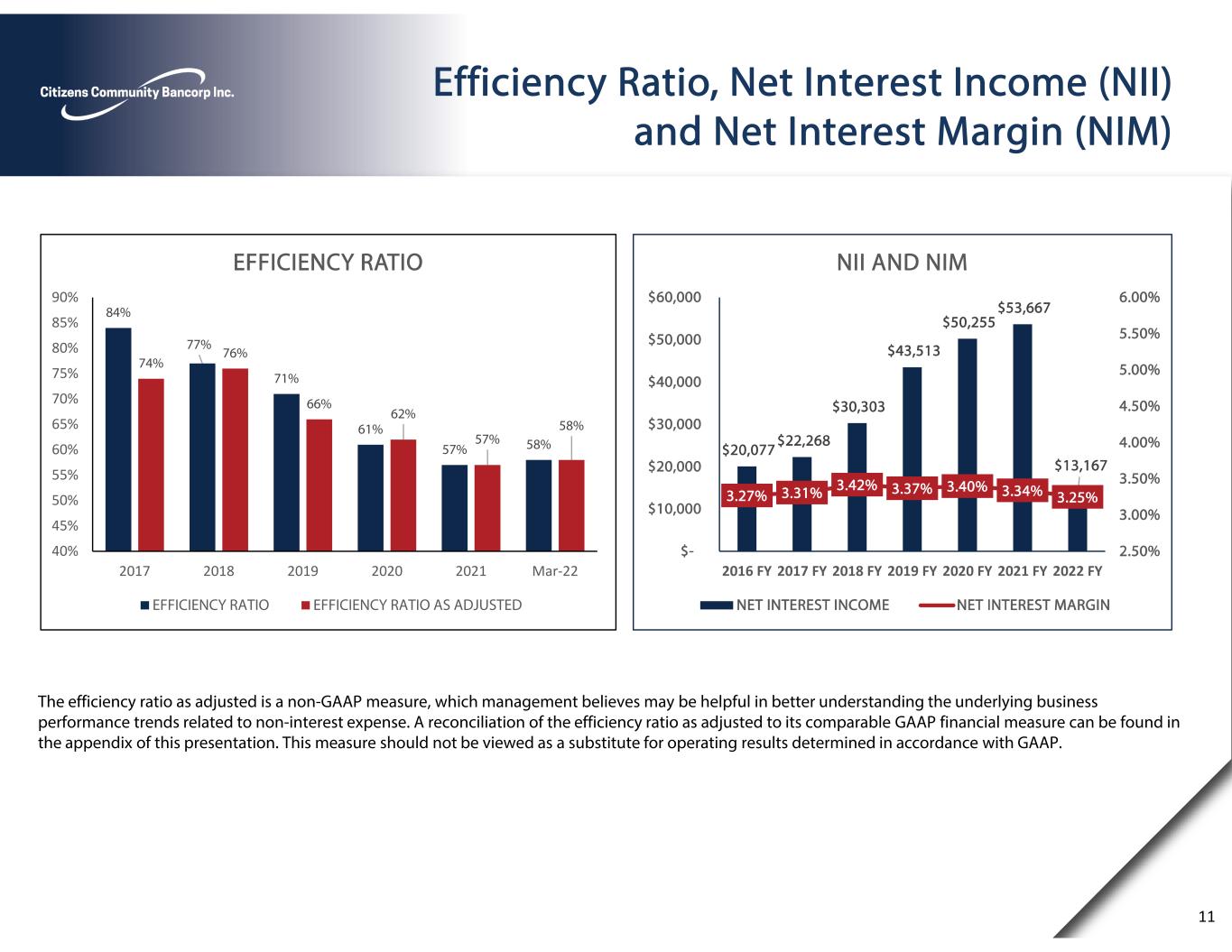

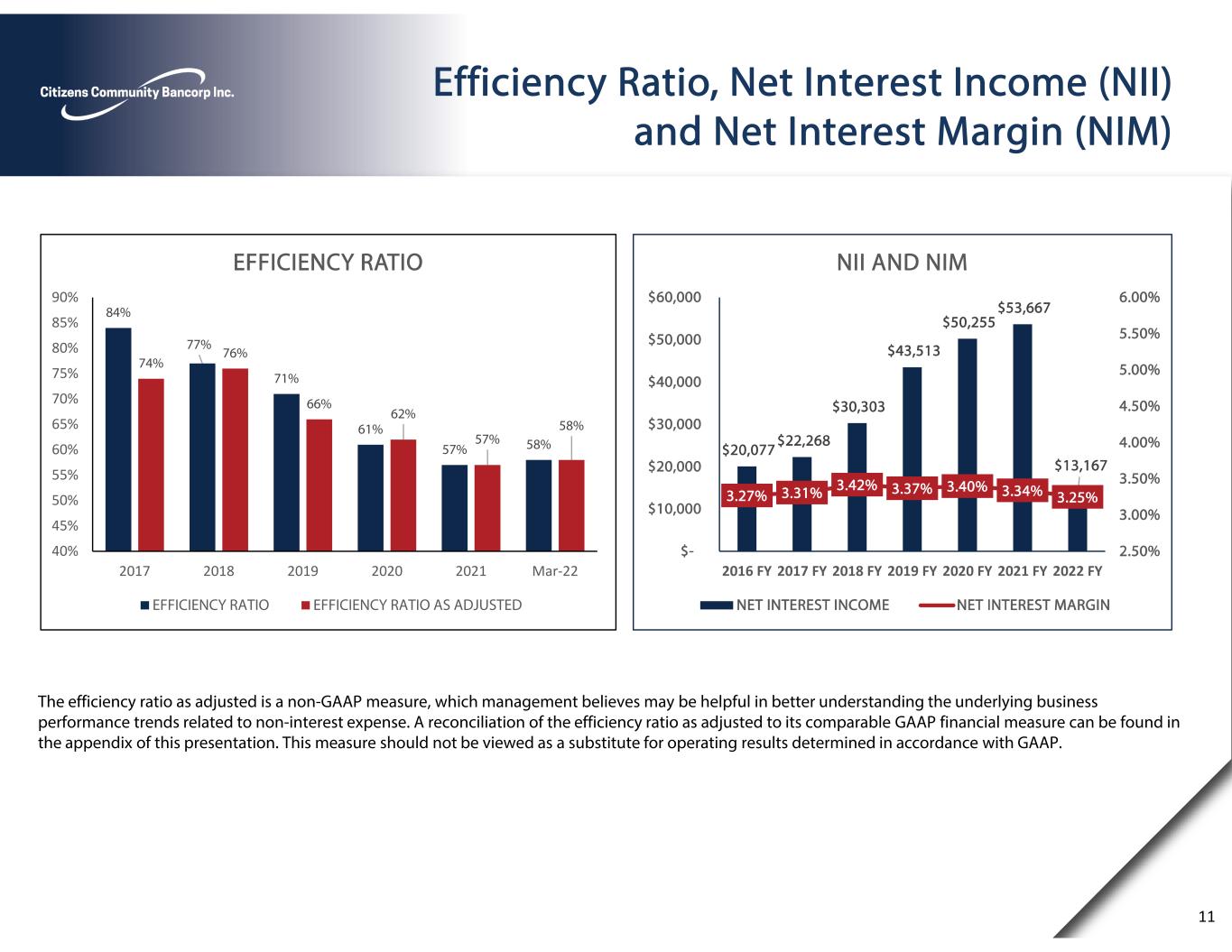

Efficiency Ratio, Net Interest Income (NII) and Net Interest Margin (NIM) The efficiency ratio as adjusted is a non-GAAP measure, which management believes may be helpful in better understanding the underlying business performance trends related to non-interest expense. A reconciliation of the efficiency ratio as adjusted to its comparable GAAP financial measure can be found in the appendix of this presentation. This measure should not be viewed as a substitute for operating results determined in accordance with GAAP. 11 84% 77% 71% 61% 57% 58% 74% 76% 66% 62% 57% 58% 40% 45% 50% 55% 60% 65% 70% 75% 80% 85% 90% 2017 2018 2019 2020 2021 Mar‐22 EFFICIENCY RATIO EFFICIENCY RATIO EFFICIENCY RATIO AS ADJUSTED $20,077 $22,268 $30,303 $43,513 $50,255 $53,667 $13,167 3.27% 3.31% 3.42% 3.37% 3.40% 3.34% 3.25% 2.50% 3.00% 3.50% 4.00% 4.50% 5.00% 5.50% 6.00% $- $10,000 $20,000 $30,000 $40,000 $50,000 $60,000 2016 FY 2017 FY 2018 FY 2019 FY 2020 FY 2021 FY 2022 FY NII AND NIM NET INTEREST INCOME NET INTEREST MARGIN

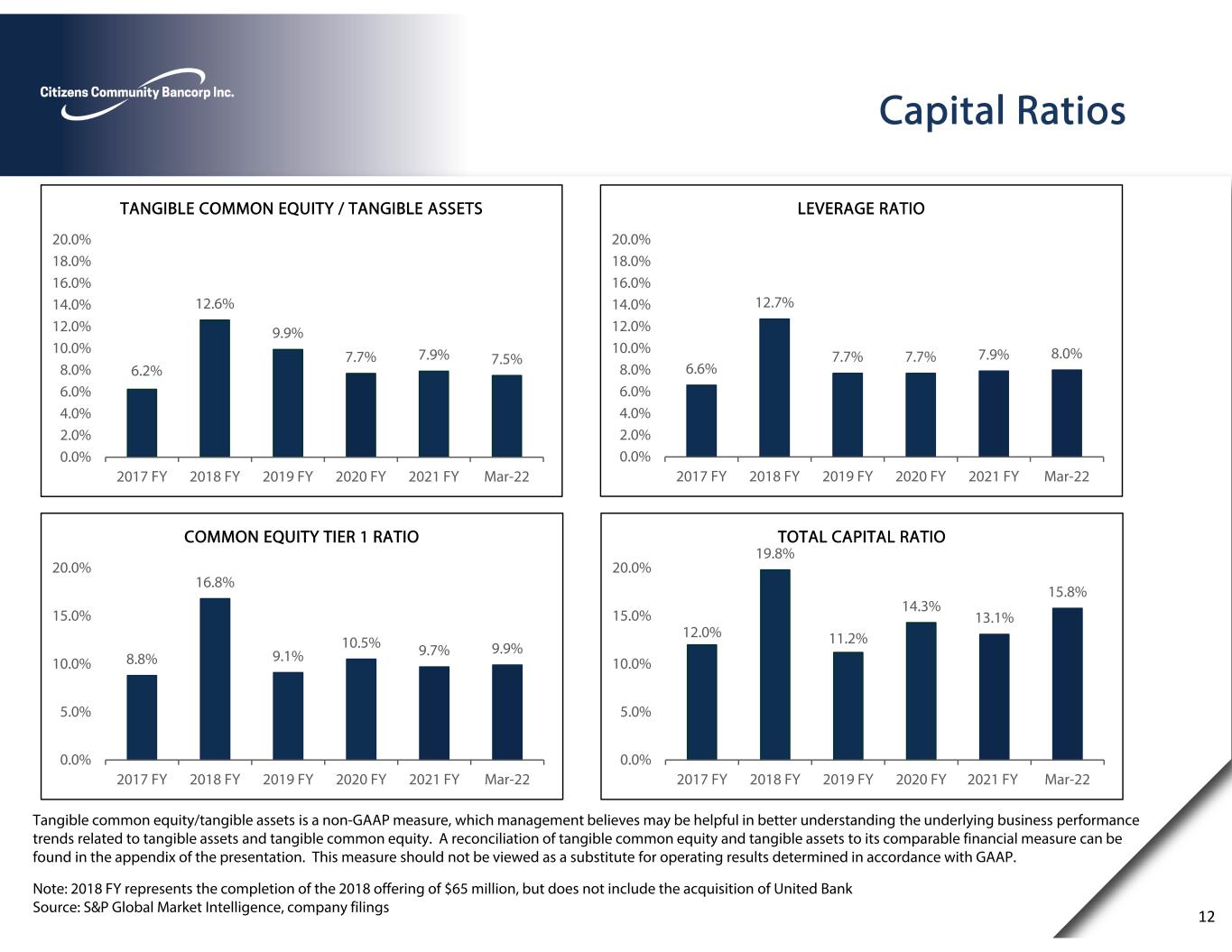

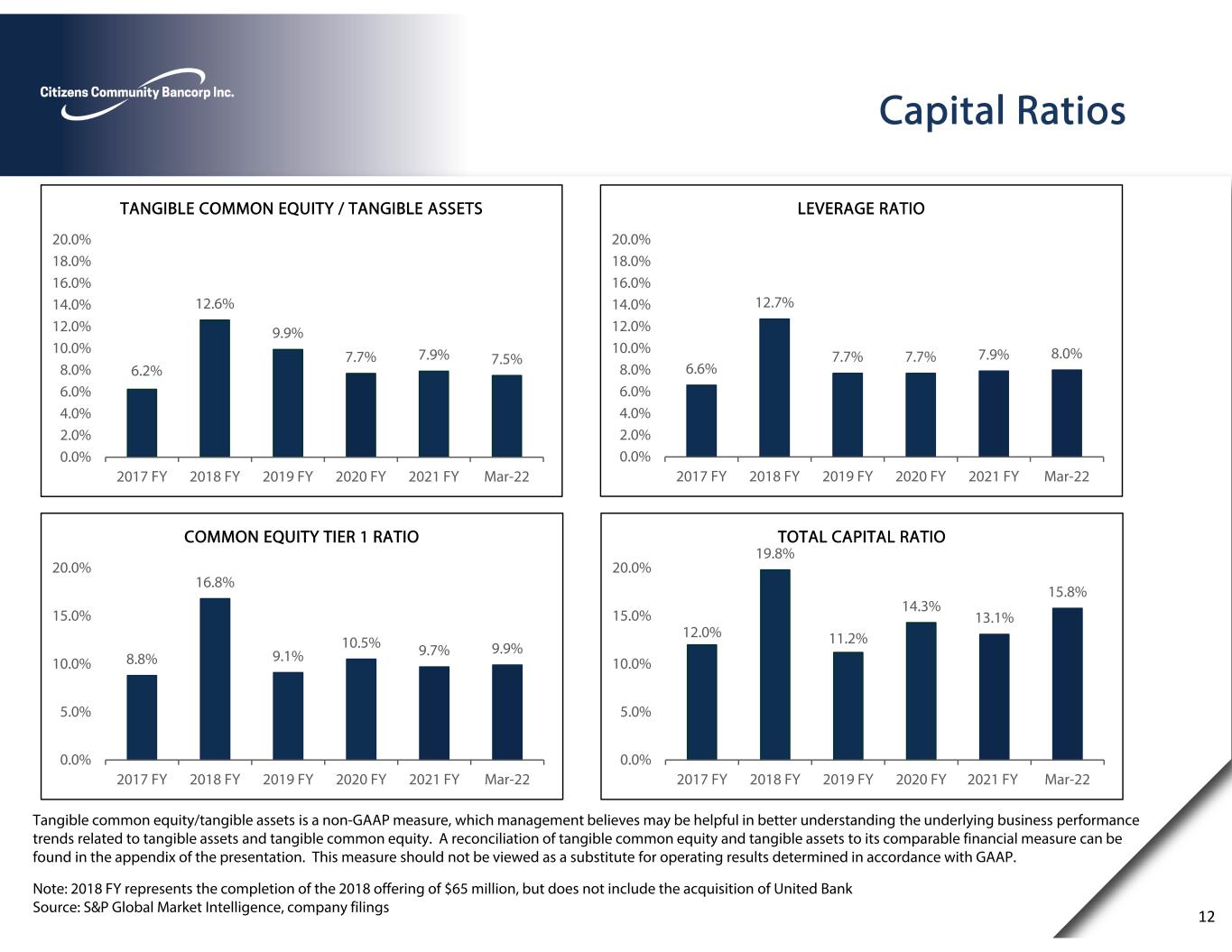

Capital Ratios Note: 2018 FY represents the completion of the 2018 offering of $65 million, but does not include the acquisition of United Bank Source: S&P Global Market Intelligence, company filings 12 6.6% 12.7% 7.7% 7.7% 7.9% 8.0% 0.0% 2.0% 4.0% 6.0% 8.0% 10.0% 12.0% 14.0% 16.0% 18.0% 20.0% 2017 FY 2018 FY 2019 FY 2020 FY 2021 FY Mar-22 LEVERAGE RATIO 8.8% 16.8% 9.1% 10.5% 9.7% 9.9% 0.0% 5.0% 10.0% 15.0% 20.0% 2017 FY 2018 FY 2019 FY 2020 FY 2021 FY Mar-22 COMMON EQUITY TIER 1 RATIO 12.0% 19.8% 11.2% 14.3% 13.1% 15.8% 0.0% 5.0% 10.0% 15.0% 20.0% 2017 FY 2018 FY 2019 FY 2020 FY 2021 FY Mar-22 TOTAL CAPITAL RATIO Tangible common equity/tangible assets is a non-GAAP measure, which management believes may be helpful in better understanding the underlying business performance trends related to tangible assets and tangible common equity. A reconciliation of tangible common equity and tangible assets to its comparable financial measure can be found in the appendix of the presentation. This measure should not be viewed as a substitute for operating results determined in accordance with GAAP. 6.2% 12.6% 9.9% 7.7% 7.9% 7.5% 0.0% 2.0% 4.0% 6.0% 8.0% 10.0% 12.0% 14.0% 16.0% 18.0% 20.0% 2017 FY 2018 FY 2019 FY 2020 FY 2021 FY Mar-22 TANGIBLE COMMON EQUITY / TANGIBLE ASSETS

Asset Quality 0.82% 0.89% 0.88% 1.38% 1.29% 1.30%1.25% 1.11% 1.25% 1.55% 1.40% 1.44% 1.77% 1.43% 1.45% 0.00% 0.30% 0.60% 0.90% 1.20% 1.50% 1.80% 2.10% 2017 FY 2018 FY 2019 FY 2020 FY 2021 FY Mar‐22 ALLOWANCE FOR LOAN LOSSES (ALLL) ALL AS A % OF TOTAL LOANS ALL ALLOCATED TO ORIGINATED LOANS AS A % OF ORIGINATED LOANS ALL ALLOCATED TO ORIGINATED LOANS AS A % OF ORIGINATED LOANS, NET OF SBA PPP LOANS 1.49% 1.14% 1.41% 0.70% 0.76% 0.77% 0.00% 0.30% 0.60% 0.90% 1.20% 1.50% 1.80% 2.10% 2017 FY 2018 FY 2019 FY 2020 FY 2021 FY Mar-22 NON-PERFORMING ASSETS (NPA) / ASSETS CCF ORIGINATED NPA/ASSETS CCF ACQUIRED NPA/ASSETS 13 73.90% 81.04% 51.19% 150.38% 143.03% 137.22% 0.00% 20.00% 40.00% 60.00% 80.00% 100.00% 120.00% 140.00% 160.00% 2017 FY 2018 FY 2019 FY 2020 FY 2021 FY Mar-22 ALLL / NON-PERFORMING LOANS (NPL) ALLL/NPL 0.07% 0.07% 0.08% 0.08% 0.01% 0.03% 0.00% 0.20% 0.40% 0.60% 0.80% 1.00% 2017 FY 2018 FY 2019 FY 2020 FY 2021 FY Mar-22 NET CHARGE OFFS (NCOS)/ AVERAGE LOANS NCOS / AVERAGE LOANS

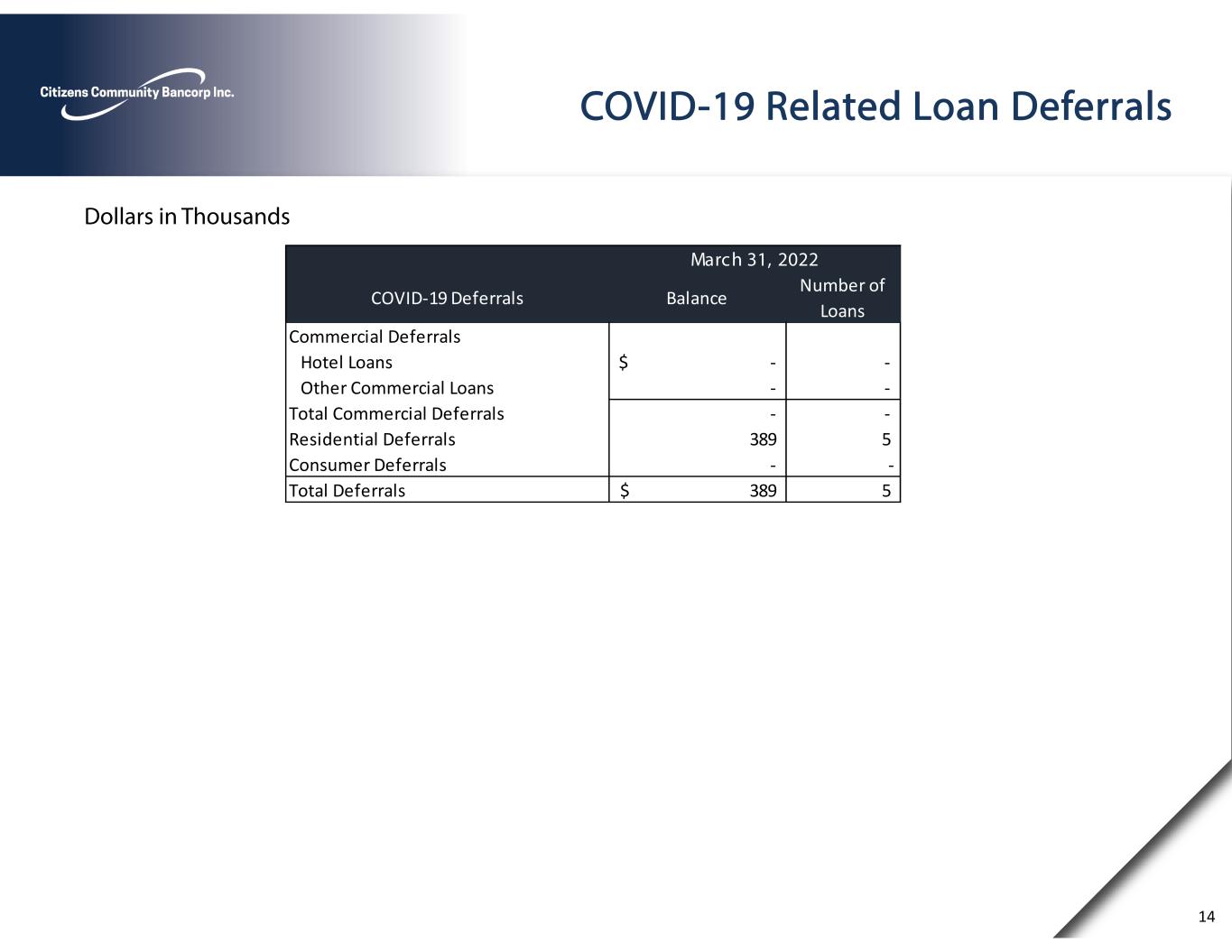

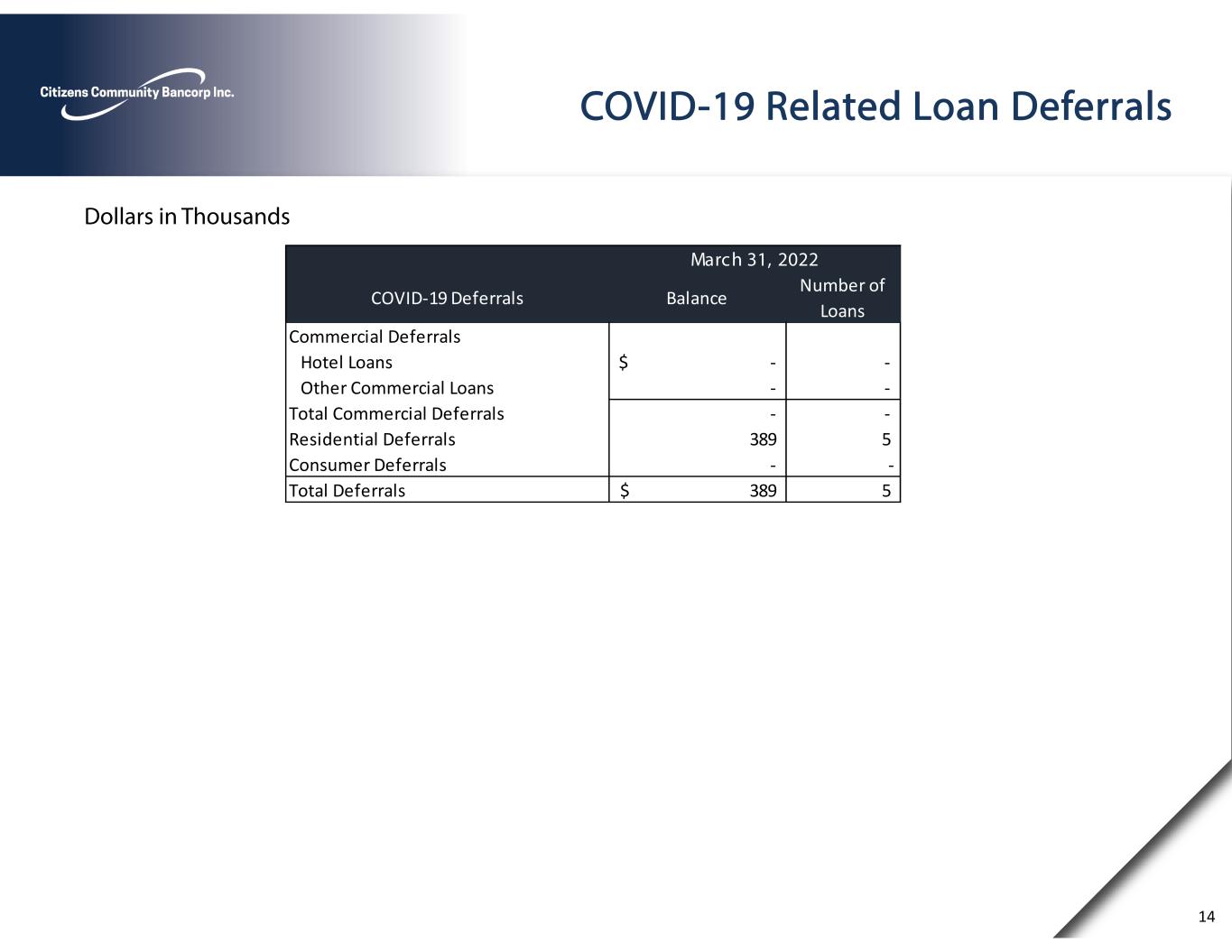

COVID-19 Related Loan Deferrals Dollars in Thousands 14 COVID‐19 Deferrals Balance Number of Loans Commercial Deferrals Hotel Loans ‐$ ‐ Other Commercial Loans ‐ ‐ Total Commercial Deferrals ‐ ‐ Residential Deferrals 389 5 Consumer Deferrals ‐ ‐ Total Deferrals 389$ 5 March 31, 2022

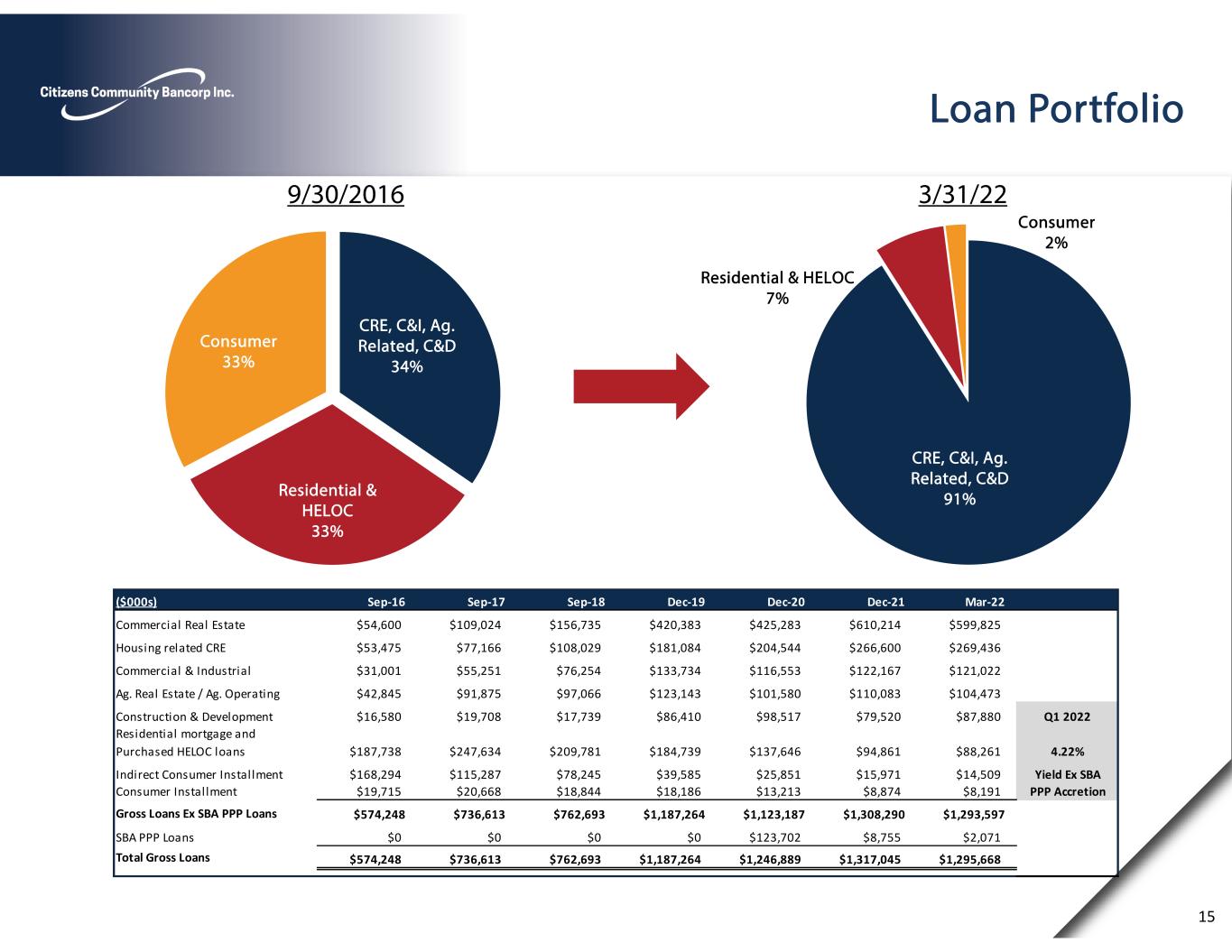

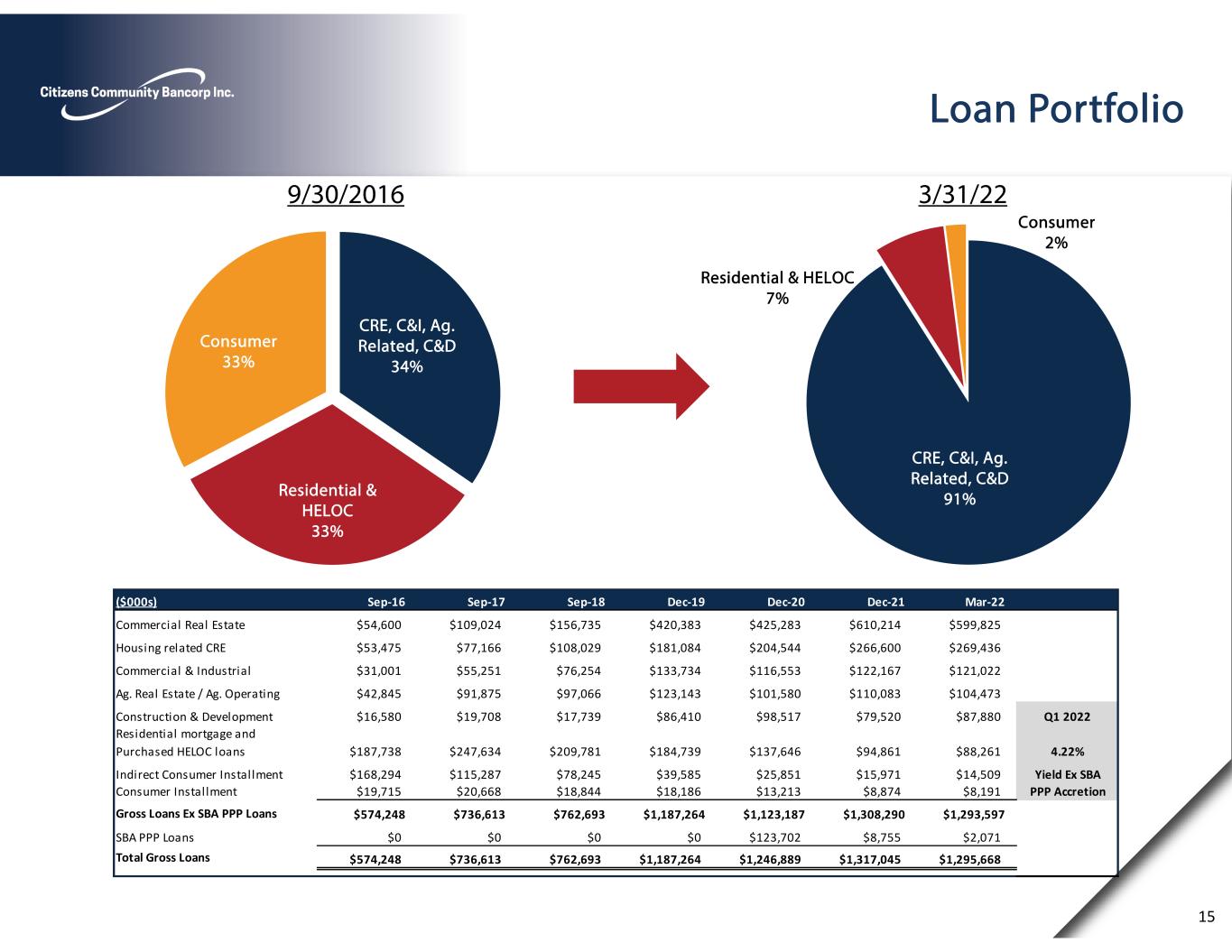

CRE, C&I, Ag. Related, C&D 91% Residential & HELOC 7% Consumer 2% Loan Portfolio 9/30/2016 3/31/22 CRE, C&I, Ag. Related, C&D 34% Residential & HELOC 33% Consumer 33% ($000s) Sep‐16 Sep‐17 Sep‐18 Dec‐19 Dec‐20 Dec‐21 Mar‐22 Commercial Real Estate $54,600 $109,024 $156,735 $420,383 $425,283 $610,214 $599,825 Housing related CRE $53,475 $77,166 $108,029 $181,084 $204,544 $266,600 $269,436 Commercial & Industrial $31,001 $55,251 $76,254 $133,734 $116,553 $122,167 $121,022 Ag. Real Estate / Ag. Operating $42,845 $91,875 $97,066 $123,143 $101,580 $110,083 $104,473 Construction & Development $16,580 $19,708 $17,739 $86,410 $98,517 $79,520 $87,880 Q1 2022 Residential mortgage and Purchased HELOC loans $187,738 $247,634 $209,781 $184,739 $137,646 $94,861 $88,261 4.22% Indirect Consumer Installment $168,294 $115,287 $78,245 $39,585 $25,851 $15,971 $14,509 Yield Ex SBA Consumer Installment $19,715 $20,668 $18,844 $18,186 $13,213 $8,874 $8,191 PPP Accretion Gross Loans Ex SBA PPP Loans $574,248 $736,613 $762,693 $1,187,264 $1,123,187 $1,308,290 $1,293,597 SBA PPP Loans $0 $0 $0 $0 $123,702 $8,755 $2,071 Total Gross Loans $574,248 $736,613 $762,693 $1,187,264 $1,246,889 $1,317,045 $1,295,668 15

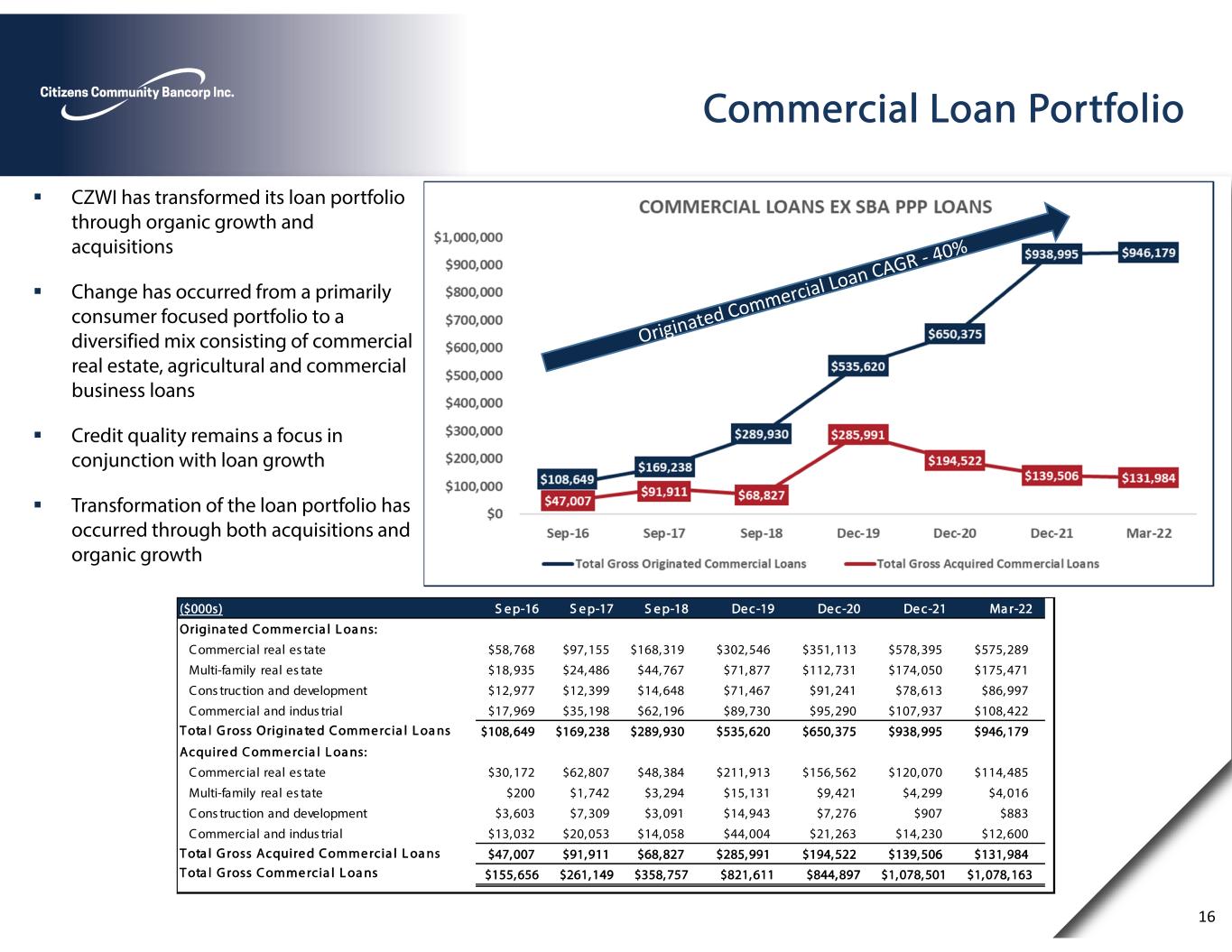

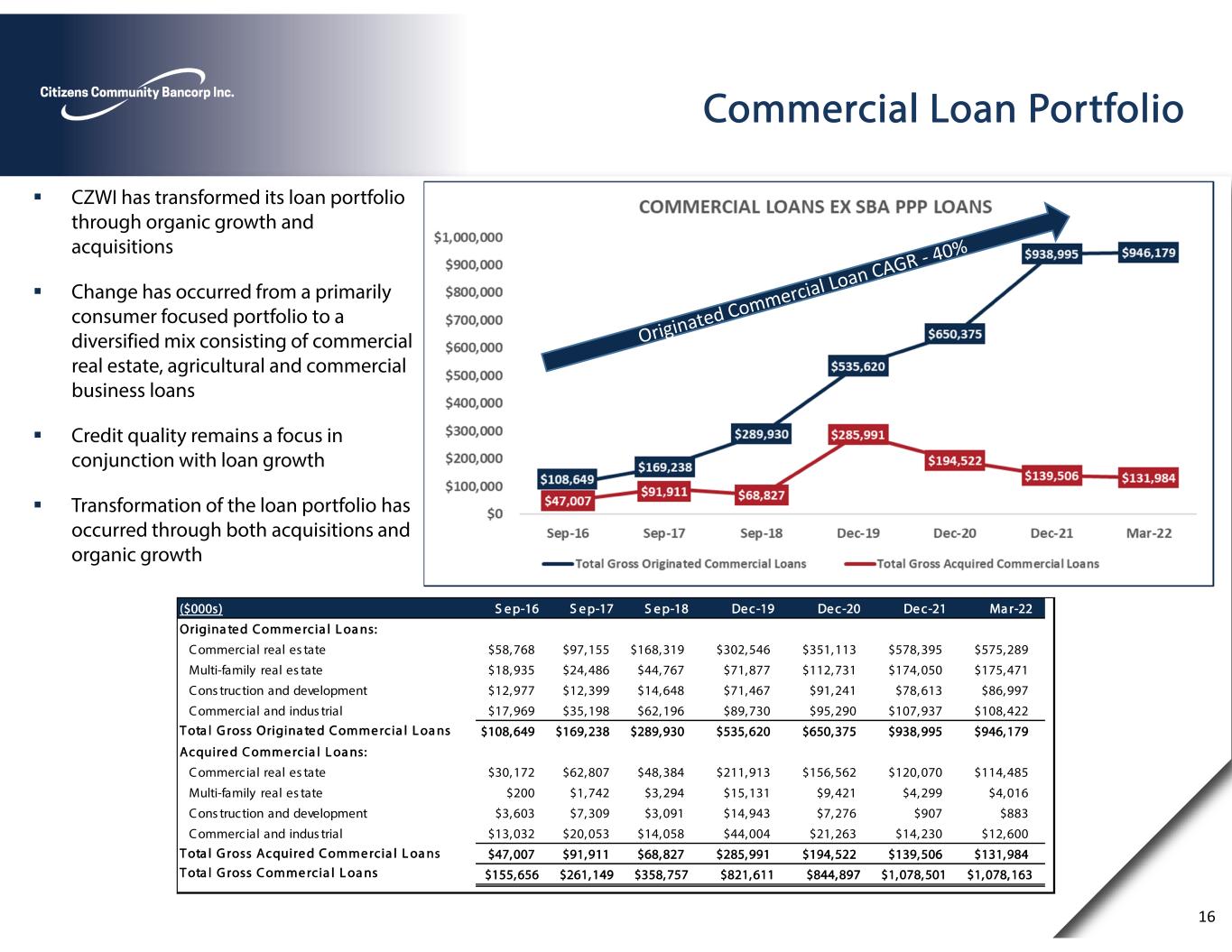

Commercial Loan Portfolio CZWI has transformed its loan portfolio through organic growth and acquisitions Change has occurred from a primarily consumer focused portfolio to a diversified mix consisting of commercial real estate, agricultural and commercial business loans Credit quality remains a focus in conjunction with loan growth Transformation of the loan portfolio has occurred through both acquisitions and organic growth 16 ($000s) S e p-16 S e p-17 S e p-18 De c-19 De c-20 De c-21 Ma r-22 Origina te d C omme rcia l L oa ns: C ommercial real es tate $58,768 $97,155 $168,319 $302,546 $351,113 $578,395 $575,289 Multi-family real es tate $18,935 $24,486 $44,767 $71,877 $112,731 $174,050 $175,471 C ons truction and development $12,977 $12,399 $14,648 $71,467 $91,241 $78,613 $86,997 C ommercial and indus trial $17,969 $35,198 $62,196 $89,730 $95,290 $107,937 $108,422 T ota l G ross Origina te d C omme rcia l L oa ns $108,649 $169,238 $289,930 $535,620 $650,375 $938,995 $946,179 Acquire d C omme rcia l L oa ns: C ommercial real es tate $30,172 $62,807 $48,384 $211,913 $156,562 $120,070 $114,485 Multi-family real es tate $200 $1,742 $3,294 $15,131 $9,421 $4,299 $4,016 C ons truction and development $3,603 $7,309 $3,091 $14,943 $7,276 $907 $883 C ommercial and indus trial $13,032 $20,053 $14,058 $44,004 $21,263 $14,230 $12,600 T ota l G ross Acquire d C omme rcia l L oa ns $47,007 $91,911 $68,827 $285,991 $194,522 $139,506 $131,984 T ota l G ross C omme rcia l L oa ns $155,656 $261,149 $358,757 $821,611 $844,897 $1,078,501 $1,078,163

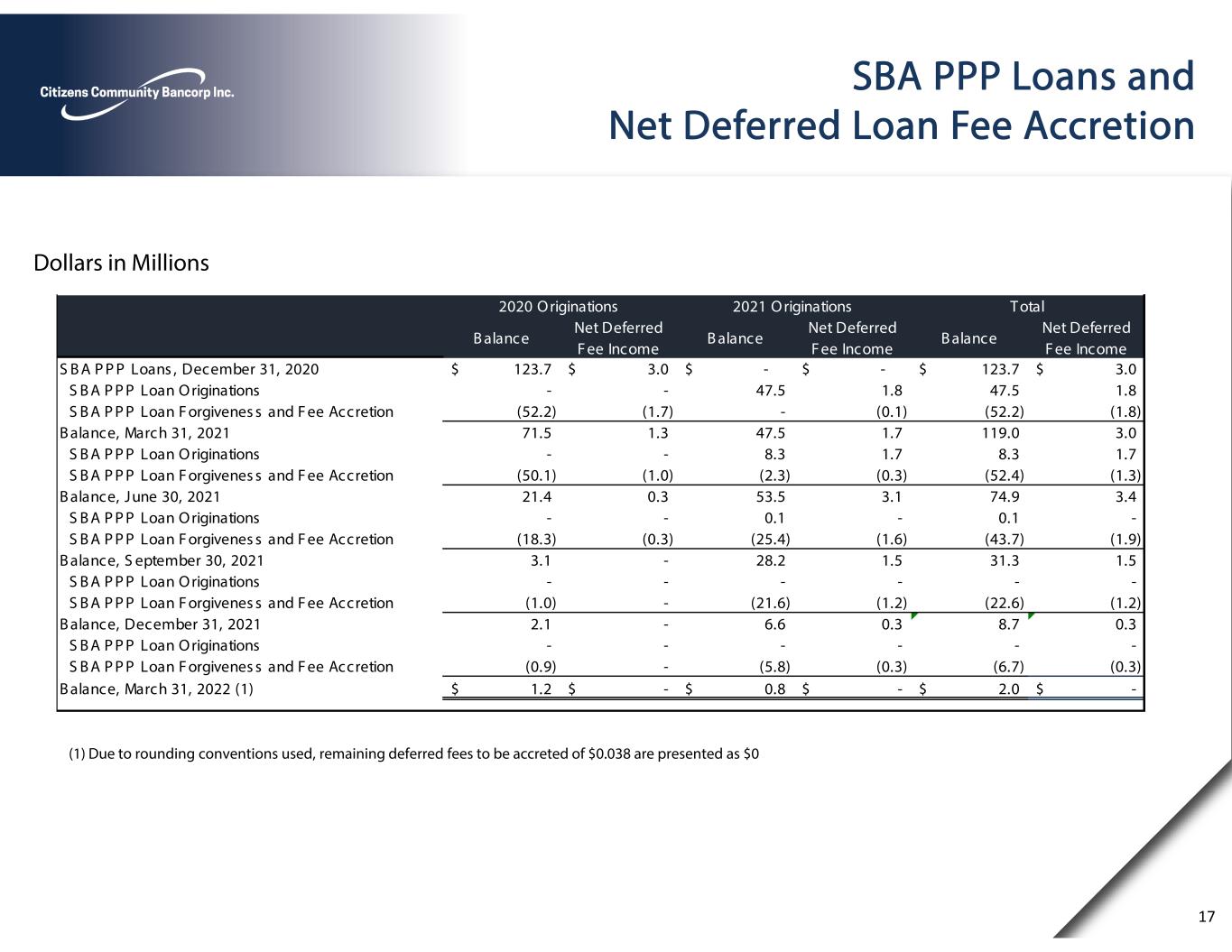

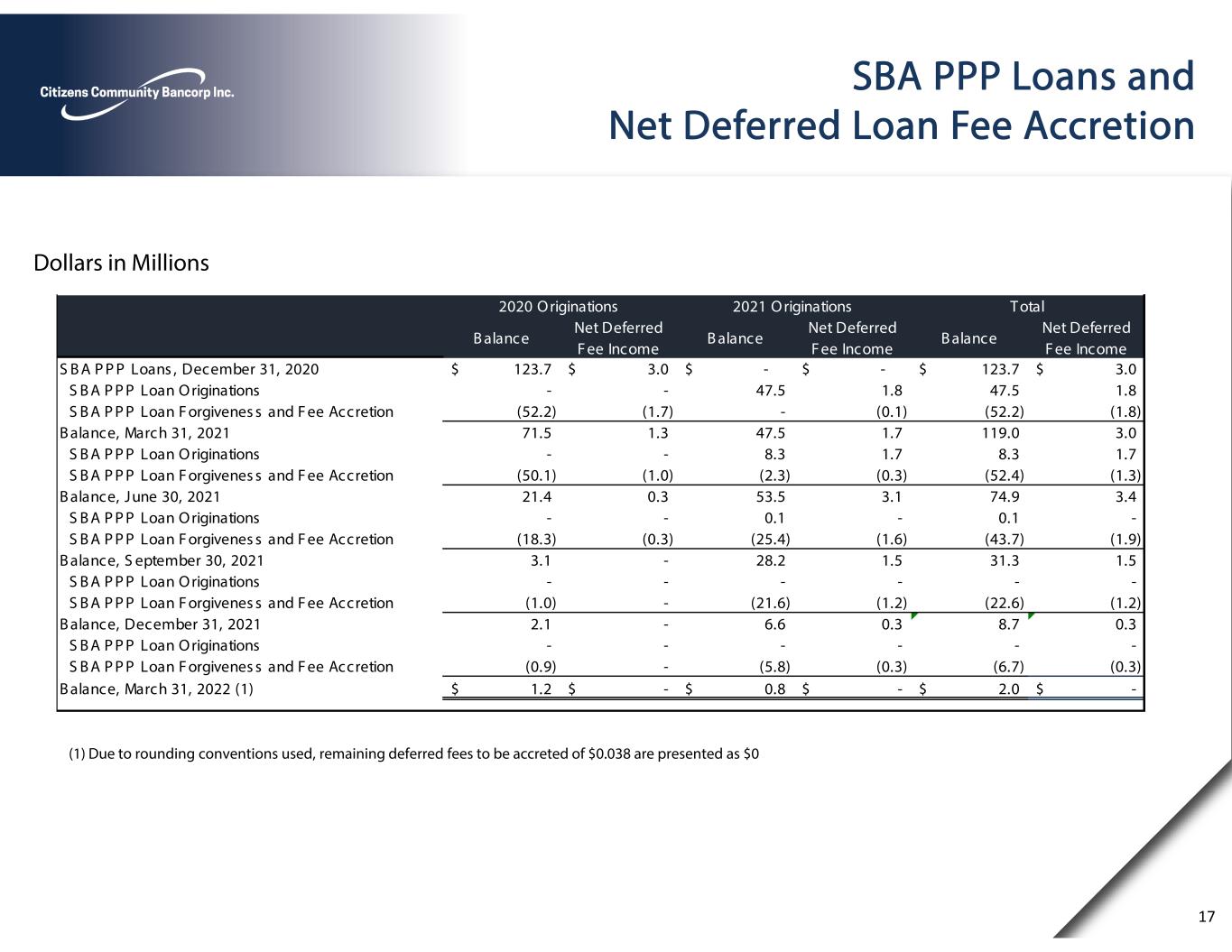

SBA PPP Loans and Net Deferred Loan Fee Accretion 17 Dollars in Millions B alance Net Deferred F ee Income B alance Net Deferred F ee Income B alance Net Deferred F ee Income S B A P P P Loans , December 31, 2020 123.7$ 3.0$ -$ -$ 123.7$ 3.0$ S B A P P P Loan O riginations - - 47.5 1.8 47.5 1.8 S B A P P P Loan F orgivenes s and F ee Accretion (52.2) (1.7) - (0.1) (52.2) (1.8) B alance, March 31, 2021 71.5 1.3 47.5 1.7 119.0 3.0 S B A P P P Loan O riginations - - 8.3 1.7 8.3 1.7 S B A P P P Loan F orgivenes s and F ee Accretion (50.1) (1.0) (2.3) (0.3) (52.4) (1.3) B alance, June 30, 2021 21.4 0.3 53.5 3.1 74.9 3.4 S B A P P P Loan O riginations - - 0.1 - 0.1 - S B A P P P Loan F orgivenes s and F ee Accretion (18.3) (0.3) (25.4) (1.6) (43.7) (1.9) B alance, S eptember 30, 2021 3.1 - 28.2 1.5 31.3 1.5 S B A P P P Loan O riginations - - - - - - S B A P P P Loan F orgivenes s and F ee Accretion (1.0) - (21.6) (1.2) (22.6) (1.2) B alance, December 31, 2021 2.1 - 6.6 0.3 8.7 0.3 S B A P P P Loan O riginations - - - - - - S B A P P P Loan F orgivenes s and F ee Accretion (0.9) - (5.8) (0.3) (6.7) (0.3) B alance, March 31, 2022 (1) 1.2$ -$ 0.8$ -$ 2.0$ -$ 2020 O riginations 2021 O riginations Total (1) Due to rounding conventions used, remaining deferred fees to be accreted of $0.038 are presented as $0

Deposit Composition Focus has been on transforming the deposit composition to core deposits Deposit transformation and growth has been achieved through both acquisitions and organic initiatives 9/30/2016 3/31/2022 Source: S&P Global Market Intelligence, company filings Non Interest Bearing Demand 8% Interest Bearing Demand 9% MMDA & Savings 34% CDs 49% 18 Non Interest Bearing Demand 19% Interest Bearing Demand 30% MMDA & Savings 39% CDs 12% ($000) S e p-16 S e p-17 S e p-18 De c-19 De c-20 De c-21 Ma r-22 Non-interes t-bearing demand depos its $45,408 $75,318 $87,495 $168,157 $238,348 $276,631 $269,481 Interes t bearing demand depos its $48,934 $147,912 $139,276 $223,102 $301,764 $396,231 $423,251 Q1 2022 S avings accounts $52,153 $102,756 $97,329 $156,599 $196,348 $222,674 $241,072 C ost of De posits Money market accounts $137,234 $125,749 $109,314 $246,430 $245,549 $288,985 $321,409 0.31% C ertificate accounts $273,948 $290,769 $313,115 $401,414 $313,247 $203,014 $173,010 T ota l De posits $557,677 $742,504 $746,529 $1,195,702 $1,295,256 $1,387,535 $1,428,223 Depos it C ompos ition - Q uarter L ookback

Appendix 19

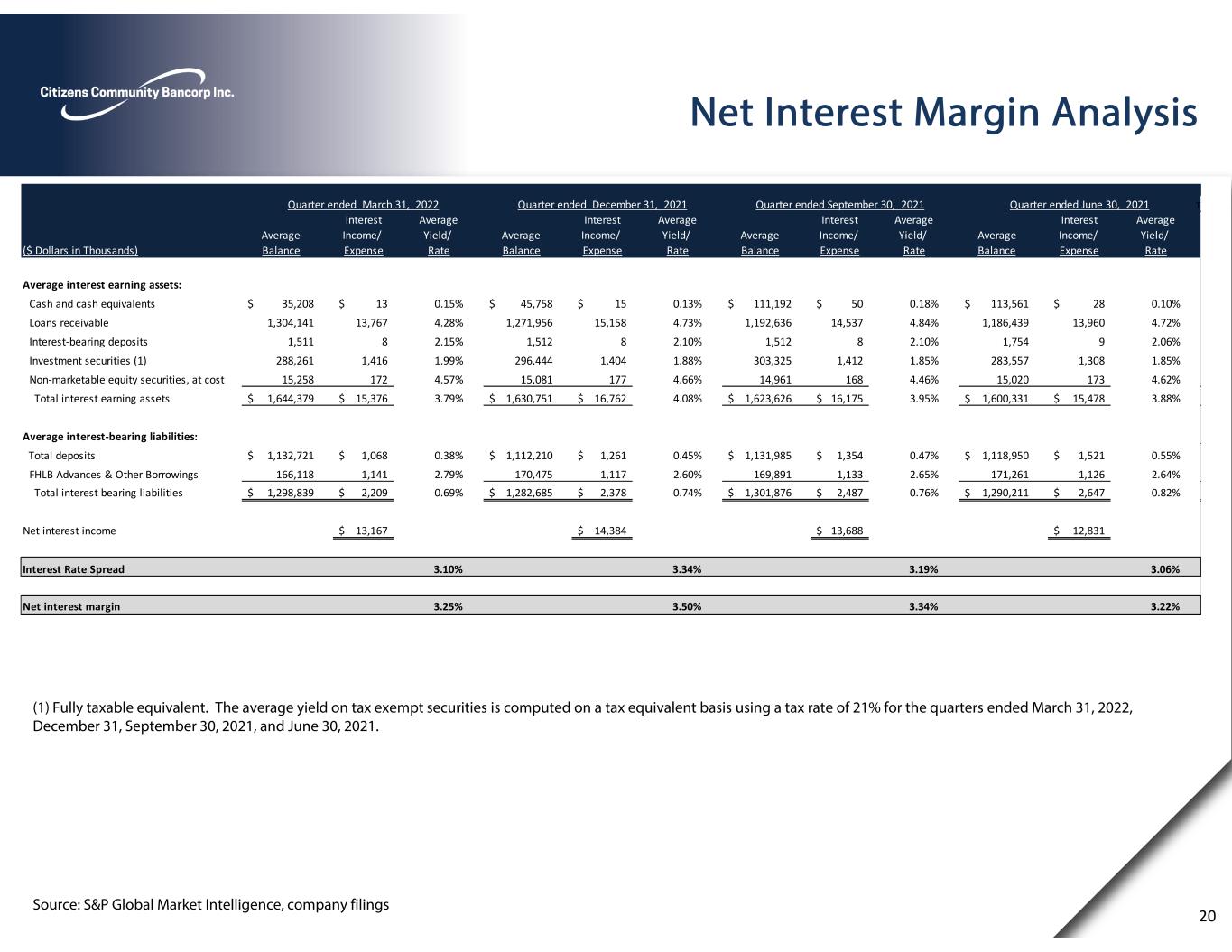

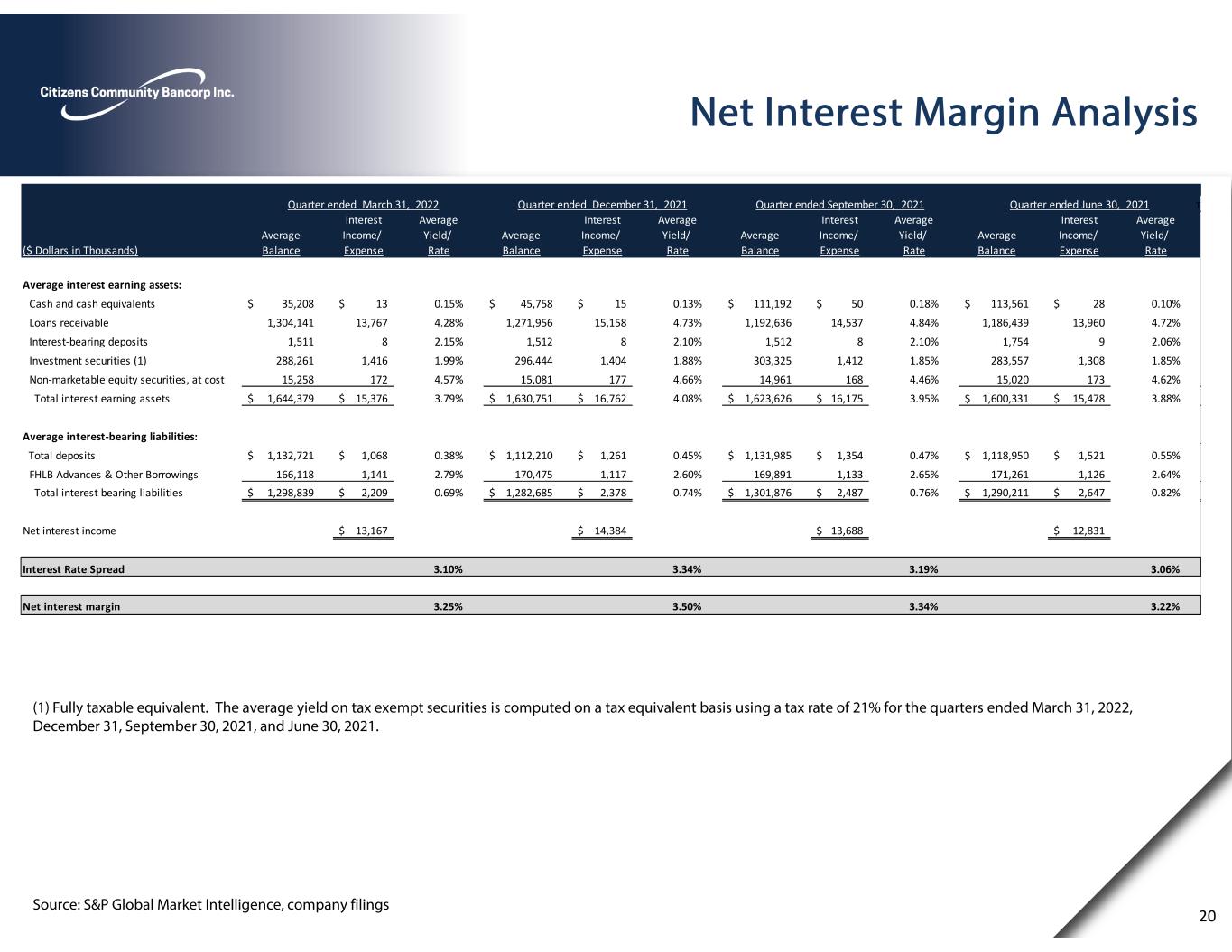

Net Interest Margin Analysis Source: S&P Global Market Intelligence, company filings 20 (1) Fully taxable equivalent. The average yield on tax exempt securities is computed on a tax equivalent basis using a tax rate of 21% for the quarters ended March 31, 2022, December 31, September 30, 2021, and June 30, 2021. Quarter ended March 31, 2022 Quarter ended December 31, 2021 Quarter ended September 30, 2021 Quarter ended June 30, 2021 Th Interest Average Interest Average Interest Average Interest Average Average Income/ Yield/ Average Income/ Yield/ Average Income/ Yield/ Average Income/ Yield/ ($ Dollars in Thousands) Balance Expense Rate Balance Expense Rate Balance Expense Rate Balance Expense Rate Average interest earning assets: Cash and cash equivalents 35,208$ 13$ 0.15% 45,758$ 15$ 0.13% 111,192$ 50$ 0.18% 113,561$ 28$ 0.10% Loans receivable 1,304,141 13,767 4.28% 1,271,956 15,158 4.73% 1,192,636 14,537 4.84% 1,186,439 13,960 4.72% Interest‐bearing deposits 1,511 8 2.15% 1,512 8 2.10% 1,512 8 2.10% 1,754 9 2.06% Investment securities (1) 288,261 1,416 1.99% 296,444 1,404 1.88% 303,325 1,412 1.85% 283,557 1,308 1.85% Non‐marketable equity securities, at cost 15,258 172 4.57% 15,081 177 4.66% 14,961 168 4.46% 15,020 173 4.62% Total interest earning assets 1,644,379$ 15,376$ 3.79% 1,630,751$ 16,762$ 4.08% 1,623,626$ 16,175$ 3.95% 1,600,331$ 15,478$ 3.88% Average interest‐bearing liabilities: Total deposits 1,132,721$ 1,068$ 0.38% 1,112,210$ 1,261$ 0.45% 1,131,985$ 1,354$ 0.47% 1,118,950$ 1,521$ 0.55% FHLB Advances & Other Borrowings 166,118 1,141 2.79% 170,475 1,117 2.60% 169,891 1,133 2.65% 171,261 1,126 2.64% Total interest bearing liabilities 1,298,839$ 2,209$ 0.69% 1,282,685$ 2,378$ 0.74% 1,301,876$ 2,487$ 0.76% 1,290,211$ 2,647$ 0.82% Net interest income 13,167$ 14,384$ 13,688$ 12,831$ Interest Rate Spread 3.10% 3.34% 3.19% 3.06% Net interest margin 3.25% 3.50% 3.34% 3.22%

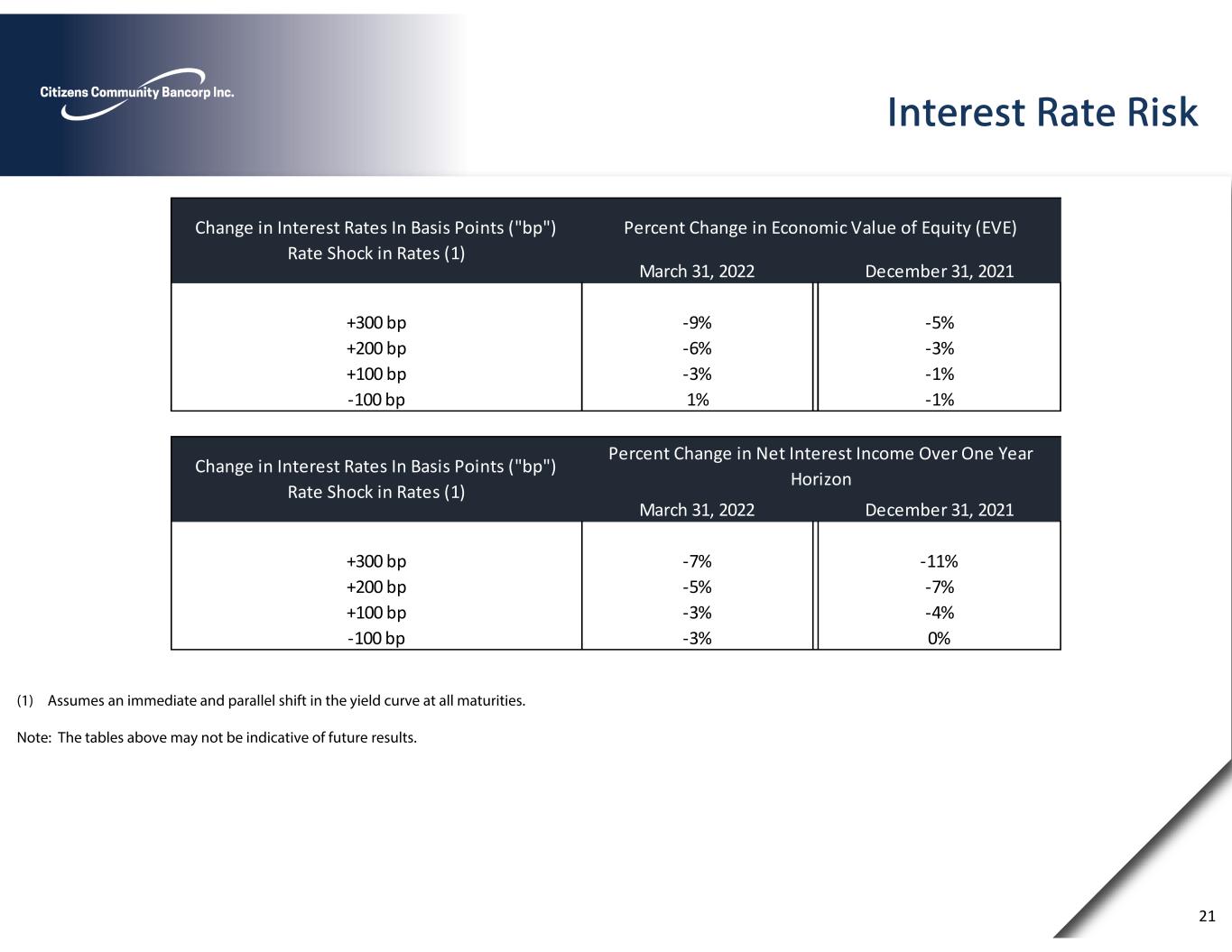

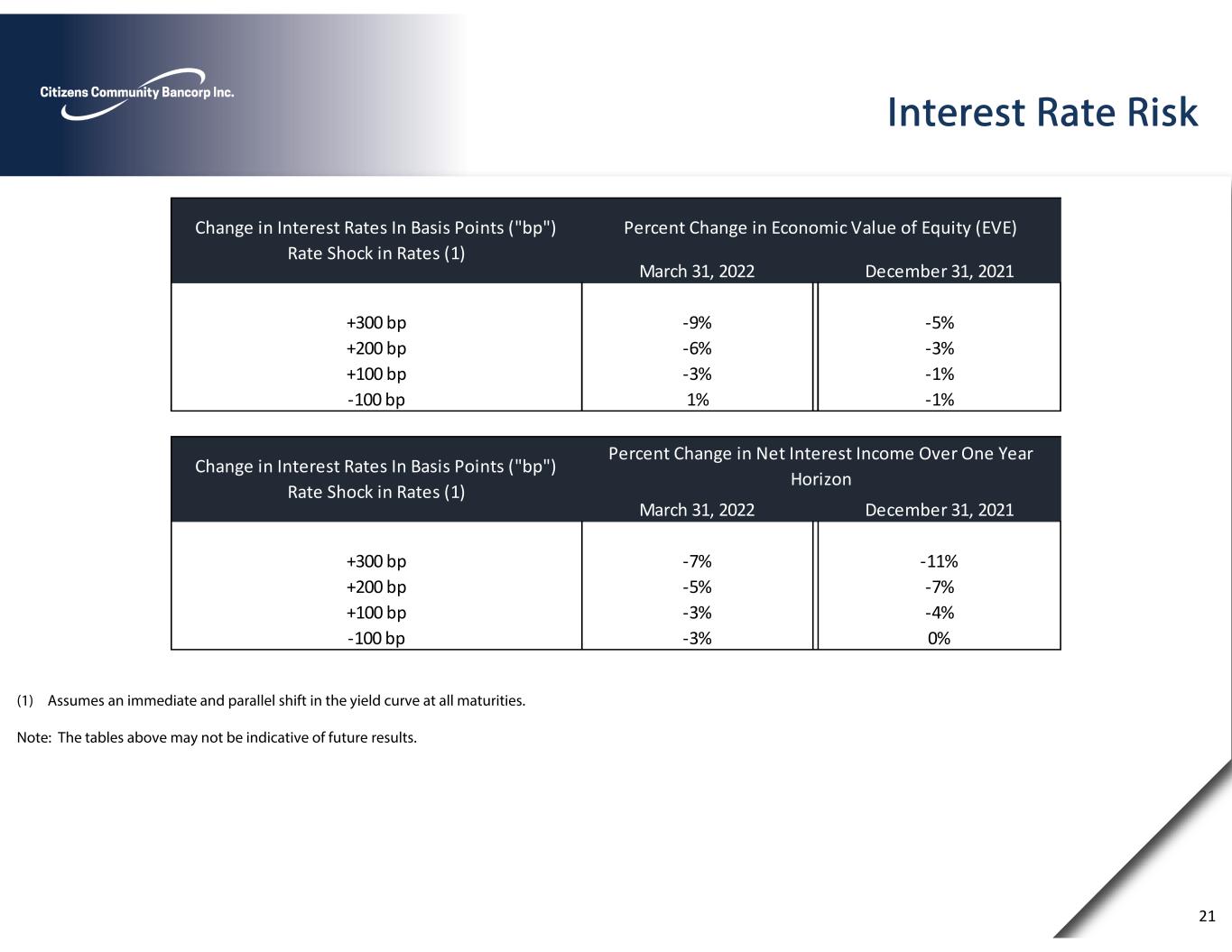

Interest Rate Risk 21 (1) Assumes an immediate and parallel shift in the yield curve at all maturities. Note: The tables above may not be indicative of future results. March 31, 2022 December 31, 2021 +300 bp ‐9% ‐5% +200 bp ‐6% ‐3% +100 bp ‐3% ‐1% ‐100 bp 1% ‐1% March 31, 2022 December 31, 2021 +300 bp ‐7% ‐11% +200 bp ‐5% ‐7% +100 bp ‐3% ‐4% ‐100 bp ‐3% 0% Percent Change in Economic Value of Equity (EVE)Change in Interest Rates In Basis Points ("bp") Rate Shock in Rates (1) Change in Interest Rates In Basis Points ("bp") Rate Shock in Rates (1) Percent Change in Net Interest Income Over One Year Horizon

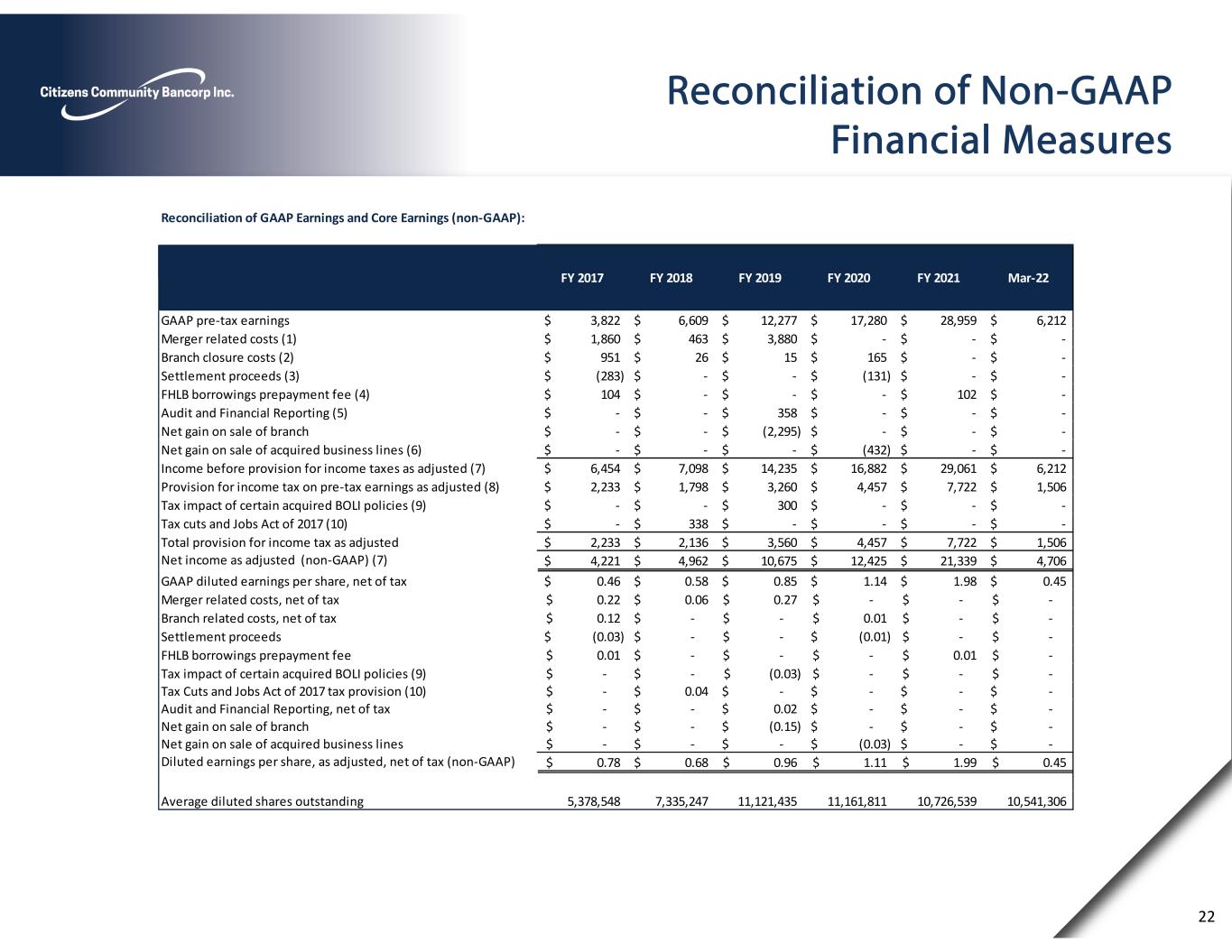

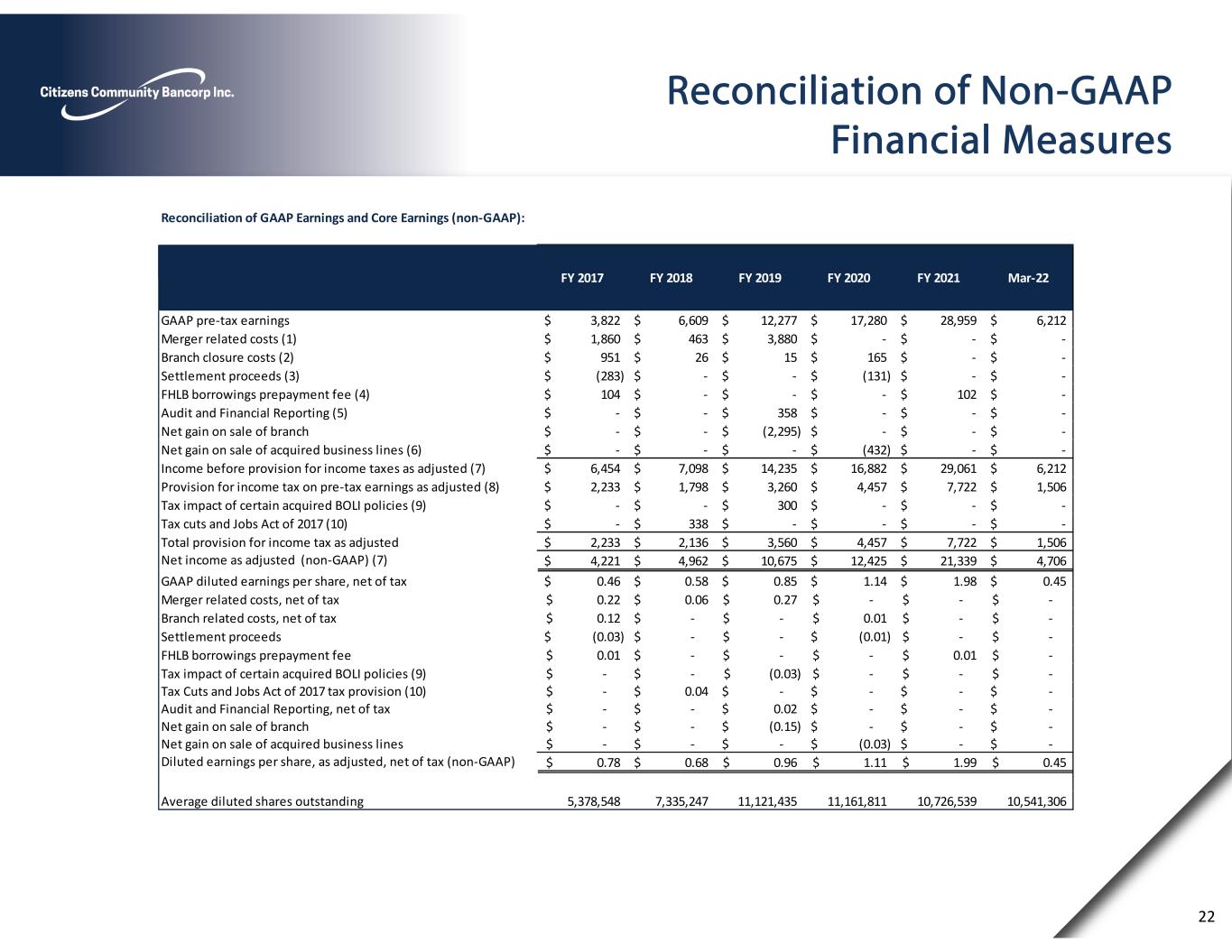

22 Reconciliation of Non-GAAP Financial Measures Reconciliation of GAAP Earnings and Core Earnings (non‐GAAP): GAAP pre‐tax earnings 3,822$ 6,609$ 12,277$ 17,280$ 28,959$ 6,212$ Merger related costs (1) 1,860$ 463$ 3,880$ ‐$ ‐$ ‐$ Branch closure costs (2) 951$ 26$ 15$ 165$ ‐$ ‐$ Settlement proceeds (3) (283)$ ‐$ ‐$ (131)$ ‐$ ‐$ FHLB borrowings prepayment fee (4) 104$ ‐$ ‐$ ‐$ 102$ ‐$ Audit and Financial Reporting (5) ‐$ ‐$ 358$ ‐$ ‐$ ‐$ Net gain on sale of branch ‐$ ‐$ (2,295)$ ‐$ ‐$ ‐$ Net gain on sale of acquired business lines (6) ‐$ ‐$ ‐$ (432)$ ‐$ ‐$ Income before provision for income taxes as adjusted (7) 6,454$ 7,098$ 14,235$ 16,882$ 29,061$ 6,212$ Provision for income tax on pre‐tax earnings as adjusted (8) 2,233$ 1,798$ 3,260$ 4,457$ 7,722$ 1,506$ Tax impact of certain acquired BOLI policies (9) ‐$ ‐$ 300$ ‐$ ‐$ ‐$ Tax cuts and Jobs Act of 2017 (10) ‐$ 338$ ‐$ ‐$ ‐$ ‐$ Total provision for income tax as adjusted 2,233$ 2,136$ 3,560$ 4,457$ 7,722$ 1,506$ Net income as adjusted (non‐GAAP) (7) 4,221$ 4,962$ 10,675$ 12,425$ 21,339$ 4,706$ GAAP diluted earnings per share, net of tax 0.46$ 0.58$ 0.85$ 1.14$ 1.98$ 0.45$ Merger related costs, net of tax 0.22$ 0.06$ 0.27$ ‐$ ‐$ ‐$ Branch related costs, net of tax 0.12$ ‐$ ‐$ 0.01$ ‐$ ‐$ Settlement proceeds (0.03)$ ‐$ ‐$ (0.01)$ ‐$ ‐$ FHLB borrowings prepayment fee 0.01$ ‐$ ‐$ ‐$ 0.01$ ‐$ Tax impact of certain acquired BOLI policies (9) ‐$ ‐$ (0.03)$ ‐$ ‐$ ‐$ Tax Cuts and Jobs Act of 2017 tax provision (10) ‐$ 0.04$ ‐$ ‐$ ‐$ ‐$ Audit and Financial Reporting, net of tax ‐$ ‐$ 0.02$ ‐$ ‐$ ‐$ Net gain on sale of branch ‐$ ‐$ (0.15)$ ‐$ ‐$ ‐$ Net gain on sale of acquired business lines ‐$ ‐$ ‐$ (0.03)$ ‐$ ‐$ Diluted earnings per share, as adjusted, net of tax (non‐GAAP) 0.78$ 0.68$ 0.96$ 1.11$ 1.99$ 0.45$ Average diluted shares outstanding 5,378,548 7,335,247 11,121,435 11,161,811 10,726,539 10,541,306 Mar‐22FY 2017 FY 2018 FY 2019 FY 2020 FY 2021

(1) All costs incurred are presented as professional fees and other non-interest expense in the consolidated statement of operations and include costs $0 $0, $0, $341,000, $350,000, and $565,000 for the three months ended March 31, 2022 and years ended December 31, 2021, December 31, 2020, December 31, 2019, September 30, 2018, and September 30, 2017, respectively, which are nondeductible expenses for federal income tax purposes. (2) Branch closure costs include severance pay recorded in compensation and benefits, accelerated depreciation expense and lease termination fees included in occupancy and other costs included in other non-interest expense in the consolidated statement of operations. In addition, other non- interest expense includes costs related to the reduction in valuation of a closed branch office in the fourth quarter of fiscal 2017 and costs associated with three branch closures during the quarter ended December 31, 2020. Professional services includes legal costs related to the sale of the Michigan branch included in these Branch closure costs during the quarter ended March 31, 2019. (3) Settlement proceeds includes litigation income from a JP Morgan Residential Mortgage-Backed Security (RMBS) claim. This JP Morgan RMBS was previously owned by the Bank and sold in 2011. (4) The prepayment fee to restructure our FHLB borrowings is included in other non-interest expense in the consolidated statement of operations. (5) Audit and financial reporting costs include additional audit and professional fees related to the change in our year end from September 30 to December 31, effective December 31, 2018. (6) Net gain on sale of acquired business lines resulted from (1) the sale of Wells Insurance Agency and (2) the termination and sale of the wealth management business line sales contract acquired in a former acquisition. (7) Income before provision for income tax as adjusted and net income as adjusted are non-GAAP measures that management believes enhances the markets ability to assess the underlying business performance and trends related to core business activities. (8) Provision for income tax on pre-tax income as adjusted is calculated at our effective tax rate for each respective period presented. (9) Tax impact of certain acquired BOLI policies from United Bank. (10) As a result of the Tax Cuts and Jobs Act of 2017, we recorded a one-time net tax provision of $338,000 in 2018, which is included in provision for income taxes expense in the consolidated statement of operations. 23 Reconciliation of Non-GAAP Financial Measures

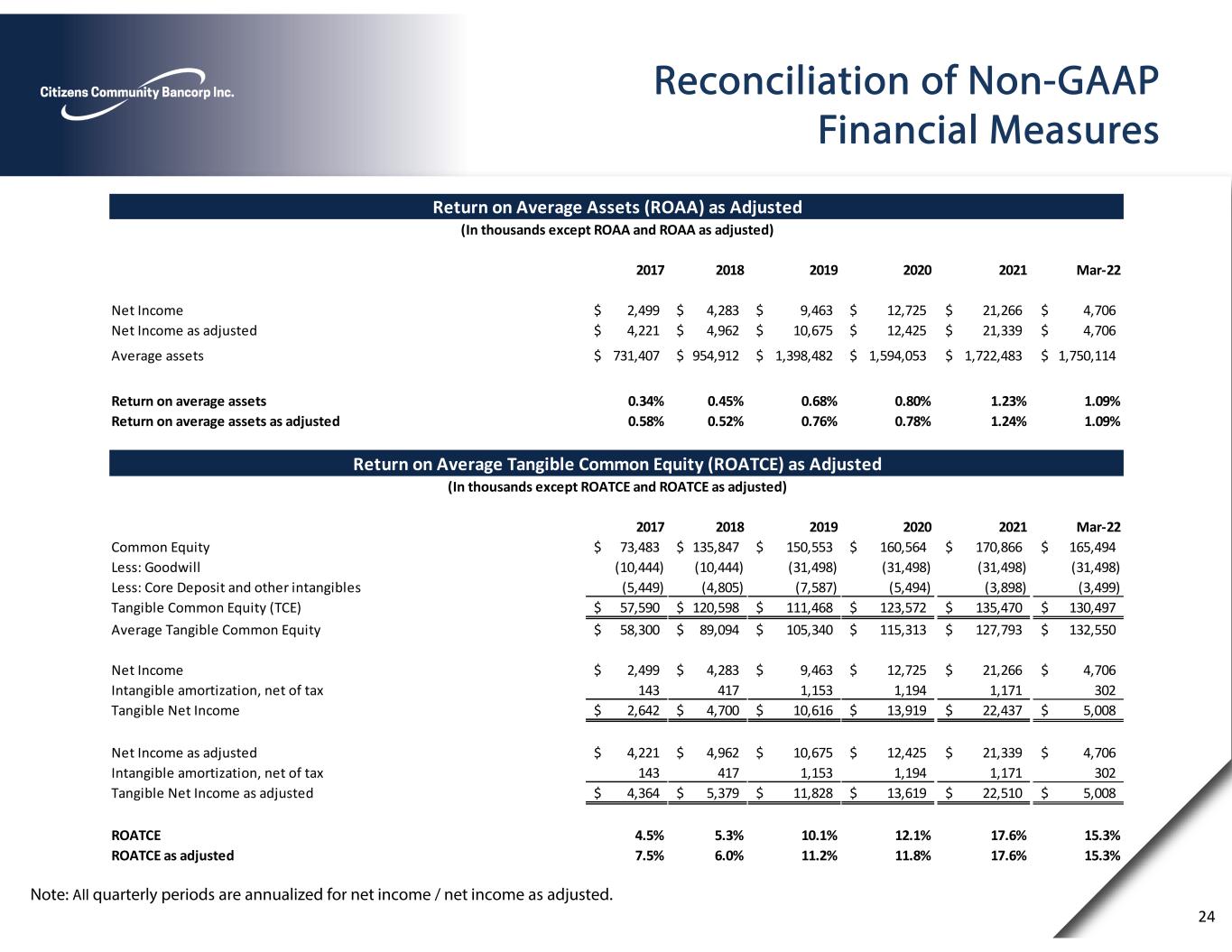

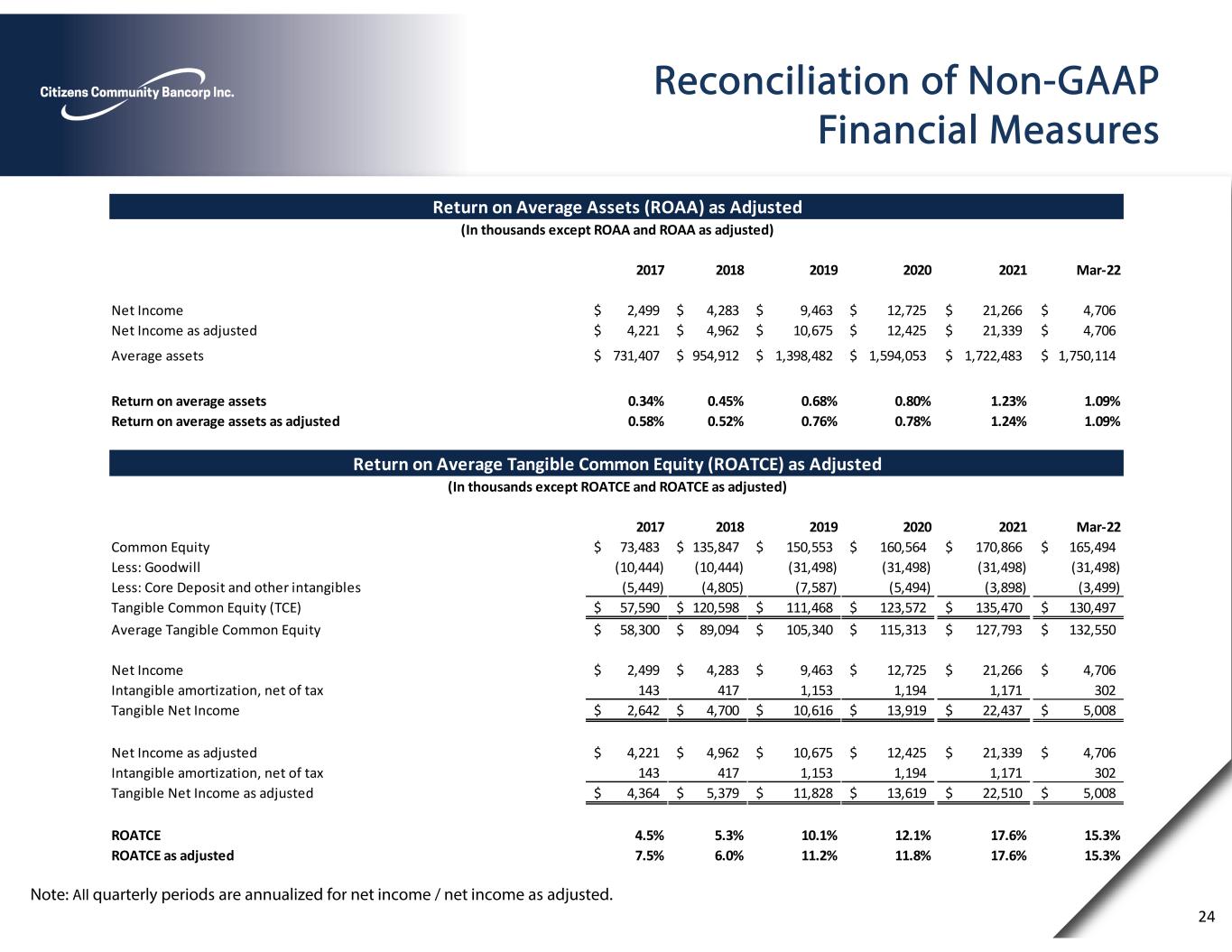

Note: All quarterly periods are annualized for net income / net income as adjusted. 24 Reconciliation of Non-GAAP Financial Measures 2017 2018 2019 2020 2021 Mar‐22 Net Income 2,499$ 4,283$ 9,463$ 12,725$ 21,266$ 4,706$ Net Income as adjusted 4,221$ 4,962$ 10,675$ 12,425$ 21,339$ 4,706$ Average assets 731,407$ 954,912$ 1,398,482$ 1,594,053$ 1,722,483$ 1,750,114$ Return on average assets 0.34% 0.45% 0.68% 0.80% 1.23% 1.09% Return on average assets as adjusted 0.58% 0.52% 0.76% 0.78% 1.24% 1.09% 2017 2018 2019 2020 2021 Mar‐22 Common Equity 73,483$ 135,847$ 150,553$ 160,564$ 170,866$ 165,494$ Less: Goodwill (10,444) (10,444) (31,498) (31,498) (31,498) (31,498) Less: Core Deposit and other intangibles (5,449) (4,805) (7,587) (5,494) (3,898) (3,499) Tangible Common Equity (TCE) 57,590$ 120,598$ 111,468$ 123,572$ 135,470$ 130,497$ Average Tangible Common Equity 58,300$ 89,094$ 105,340$ 115,313$ 127,793$ 132,550$ Net Income 2,499$ 4,283$ 9,463$ 12,725$ 21,266$ 4,706$ Intangible amortization, net of tax 143 417 1,153 1,194 1,171 302 Tangible Net Income 2,642$ 4,700$ 10,616$ 13,919$ 22,437$ 5,008$ Net Income as adjusted 4,221$ 4,962$ 10,675$ 12,425$ 21,339$ 4,706$ Intangible amortization, net of tax 143 417 1,153 1,194 1,171 302 Tangible Net Income as adjusted 4,364$ 5,379$ 11,828$ 13,619$ 22,510$ 5,008$ ROATCE 4.5% 5.3% 10.1% 12.1% 17.6% 15.3% ROATCE as adjusted 7.5% 6.0% 11.2% 11.8% 17.6% 15.3% Return on Average Assets (ROAA) as Adjusted Return on Average Tangible Common Equity (ROATCE) as Adjusted (In thousands except ROATCE and ROATCE as adjusted) (In thousands except ROAA and ROAA as adjusted)

Reconciliation of Non-GAAP Financial Measures Note: All quarterly periods are annualized for net income / net income as adjusted 25 2017 2018 2019 2020 2021 Mar‐22 Non‐interest Expense (GAAP) 22,878$ 29,764$ 42,686$ 43,673$ 40,532$ 9,668$ Less amortization of intangibles (219) (644) (1,496) (1,622) (1,596) (399) Efficiency ratio numerator 22,659 29,120 41,190 42,051 38,936 9,269 Merger related costs (1,860) (463) (3,880) ‐ ‐ ‐ Branch Closure costs (951) (26) (15) (165) ‐ ‐ Audit and financial reporting ‐ ‐ (358) ‐ ‐ ‐ Prepayment fee (104) ‐ ‐ ‐ (102) ‐ Efficiency ratio numerator as adjusted 19,744$ 28,631$ 36,937$ 41,886$ 38,834$ 9,269$ Non‐interest income 4,751$ 7,370$ 14,975$ 18,448$ 15,824$ 2,713$ Net interest margin 22,268 30,303 43,513 50,255 53,667 13,167 Loss (Gain) on investment securities (111) 17 (271) (110) (1,224) 37 Efficiency ratio denominator (GAAP) 26,908 37,690 58,217 68,593 68,267 15,917 Net gain on sale of branch ‐ ‐ (2,295) ‐ ‐ ‐ Net gain on sale of acquired business l ines ‐ ‐ ‐ (432) ‐ ‐ Settlement proceeds (283) ‐ ‐ (131) ‐ ‐ �� Efficiency ratio denominator as adjusted 26,625$ 37,690$ 55,922$ 68,030$ 68,267$ 15,917$ Efficiency ratio 84% 77% 71% 61% 57% 58% Efficiency ratio as adjusted 74% 76% 66% 62% 57% 58% 2017 2018 2019 2020 2021 Mar‐22 Total Stockholders' equity 73,483$ 135,847$ 150,553$ 160,564$ 170,866$ 165,494$ Less: Goodwill (10,444) (10,444) (31,498) (31,498) (31,498) (31,498) Less: Core deposit and intangibles (5,449) (4,805) (7,587) (5,494) (3,898) (3,499) Tangible book value (non‐GAAP) 57,590$ 120,598$ 111,468$ 123,572$ 135,470$ 130,497$ Shares outstanding 5,888,816 10,913,853 11,266,954 11,056,349 10,502,442 10,526,781 Book Value 12.48$ 12.45$ 13.36$ 14.52$ 16.27$ 15.72$ TBVPS 9.78$ 11.05$ 9.89$ 11.18$ 12.90$ 12.40$ 2017 2018 2019 2020 2021 Mar‐22 Total Assets 940,664$ 975,409$ 1,167,060$ 1,649,095$ 1,739,628$ 1,775,469$ Less: Goodwill (10,444) (10,444) (31,498) (31,498) (31,498) (31,498) Less: Core deposit and intangibles (5,449) (4,805) (7,587) (5,494) (3,898) (3,499) Tangible Assets (non‐GAAP) 924,771$ 960,160$ 1,127,975$ 1,612,103$ 1,704,232$ 1,740,472$ Tangible Common Equity / Tangible Assets 6.2% 12.6% 9.9% 7.7% 7.9% 7.5% Efficiency Ratio as Adjusted Tangible Book Value Per Share (TBVPS) as Adjusted Tangible Common Equity / Tangible Assets (In thousands except Tangible Common Equity / Tangible Asets) (In thousands except Shares Outstanding, Book Value and TBVPS) (In thousands except Efficiency Ratio and Efficiency Ratio as adjusted)

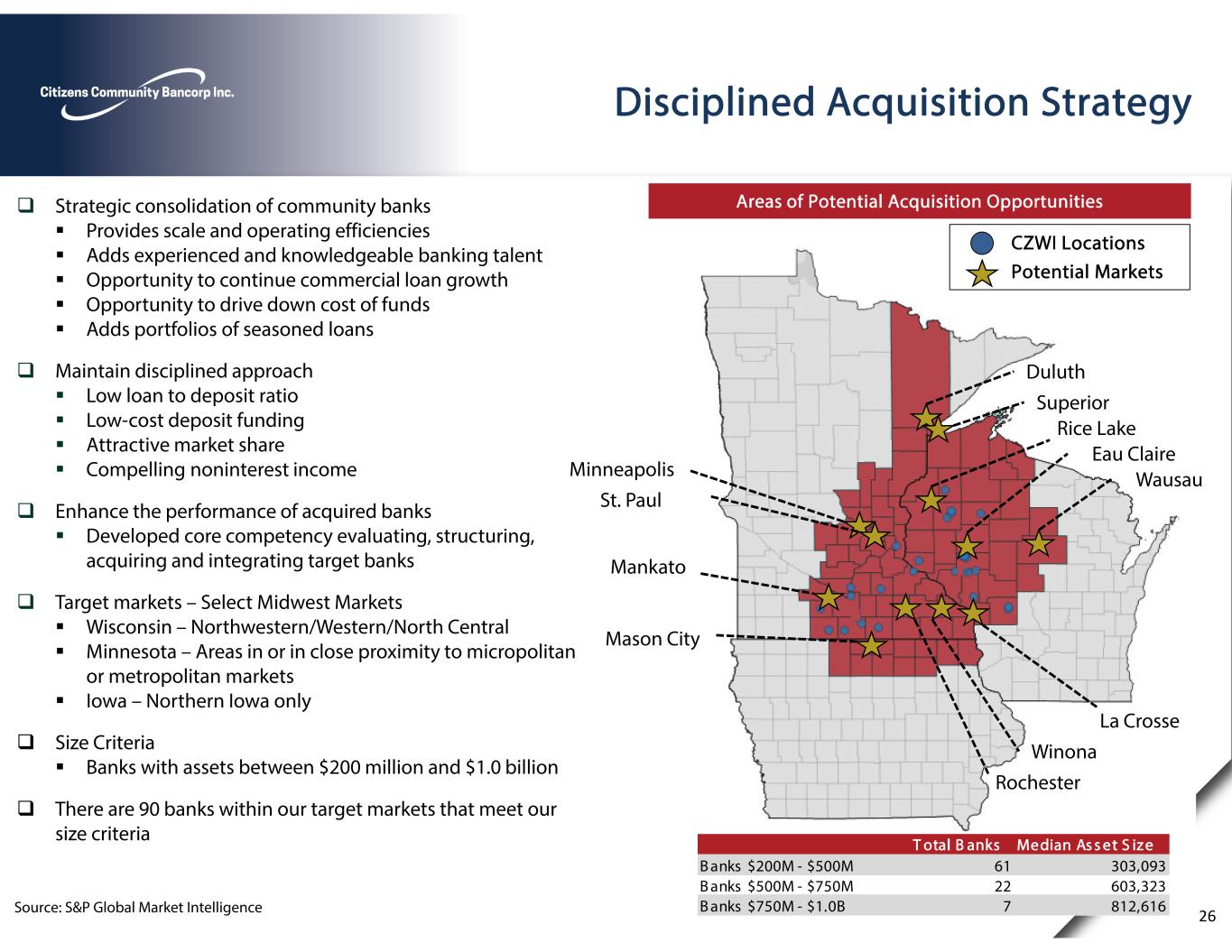

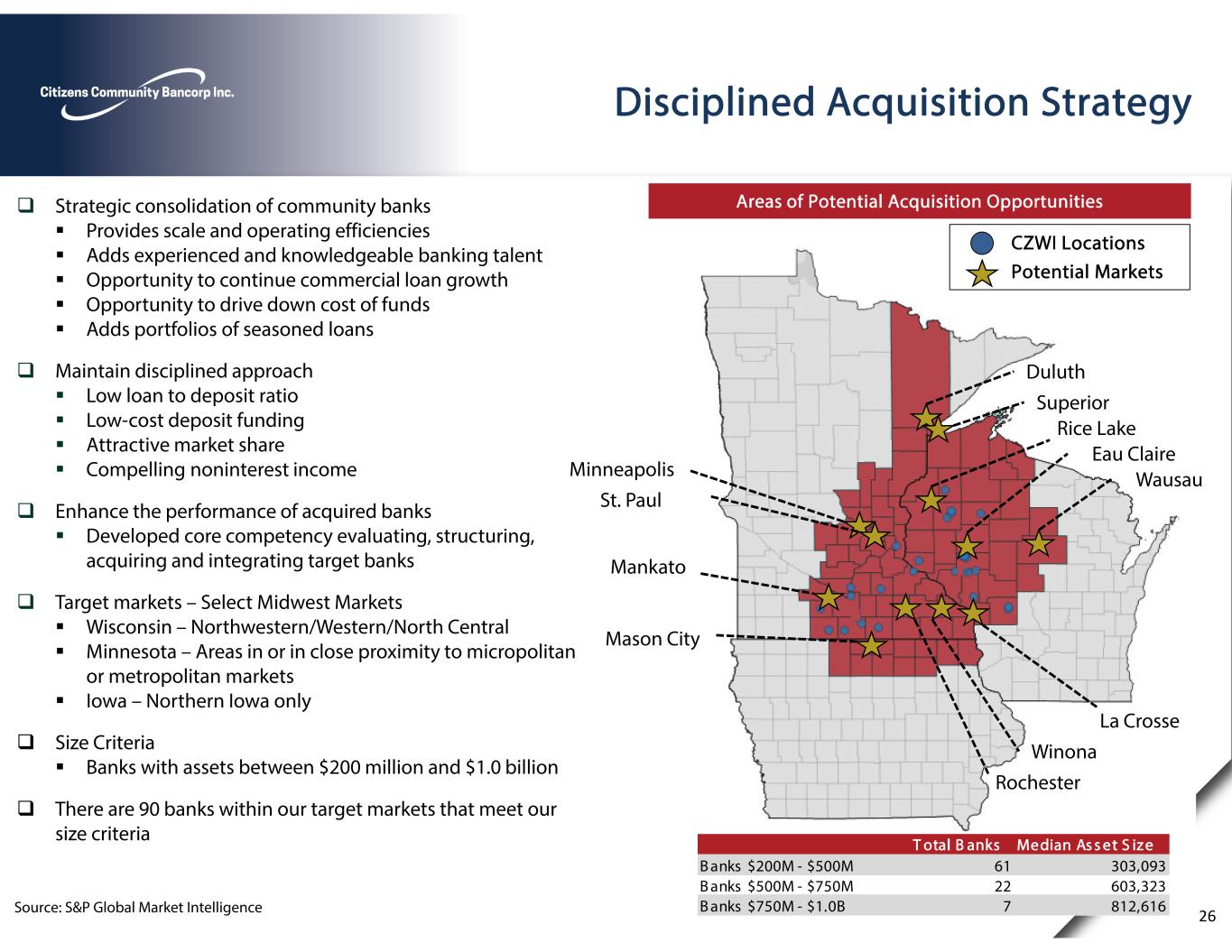

26 Disciplined Acquisition Strategy Strategic consolidation of community banks Provides scale and operating efficiencies Adds experienced and knowledgeable banking talent Opportunity to continue commercial loan growth Opportunity to drive down cost of funds Adds portfolios of seasoned loans Maintain disciplined approach Low loan to deposit ratio Low-cost deposit funding Attractive market share Compelling noninterest income Enhance the performance of acquired banks Developed core competency evaluating, structuring, acquiring and integrating target banks Target markets – Select Midwest Markets Wisconsin – Northwestern/Western/North Central Minnesota – Areas in or in close proximity to micropolitan or metropolitan markets Iowa – Northern Iowa only Size Criteria Banks with assets between $200 million and $1.0 billion There are 90 banks within our target markets that meet our size criteria Areas of Potential Acquisition Opportunities CZWI Locations Potential Markets Eau Claire Superior Rice Lake La Crosse Mankato Winona Mason City Rochester St. Paul Minneapolis Duluth Wausau Source: S&P Global Market Intelligence T otal B anks Median As s et S ize B anks $200M - $500M 61 303,093 B anks $500M - $750M 22 603,323 B anks $750M - $1.0B 7 812,616

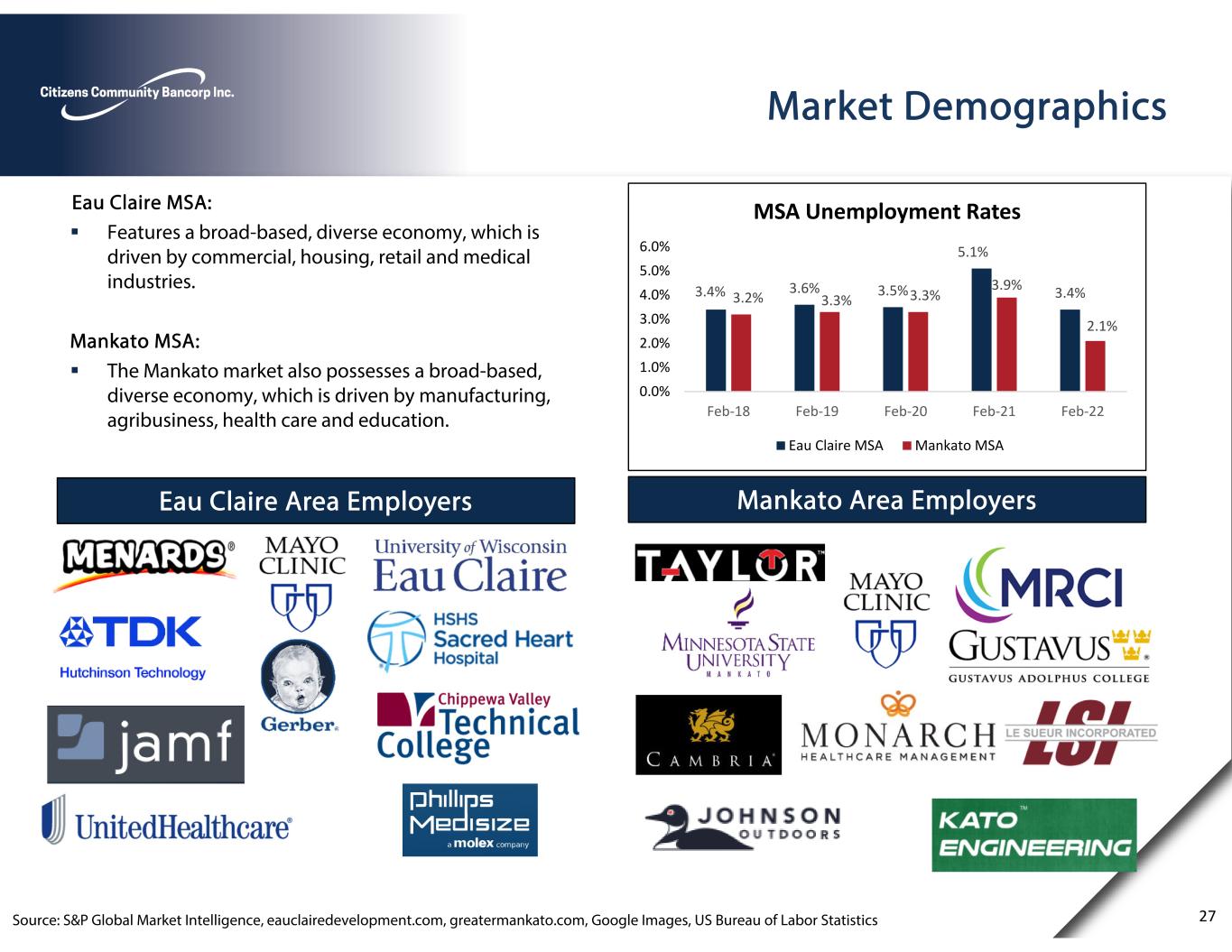

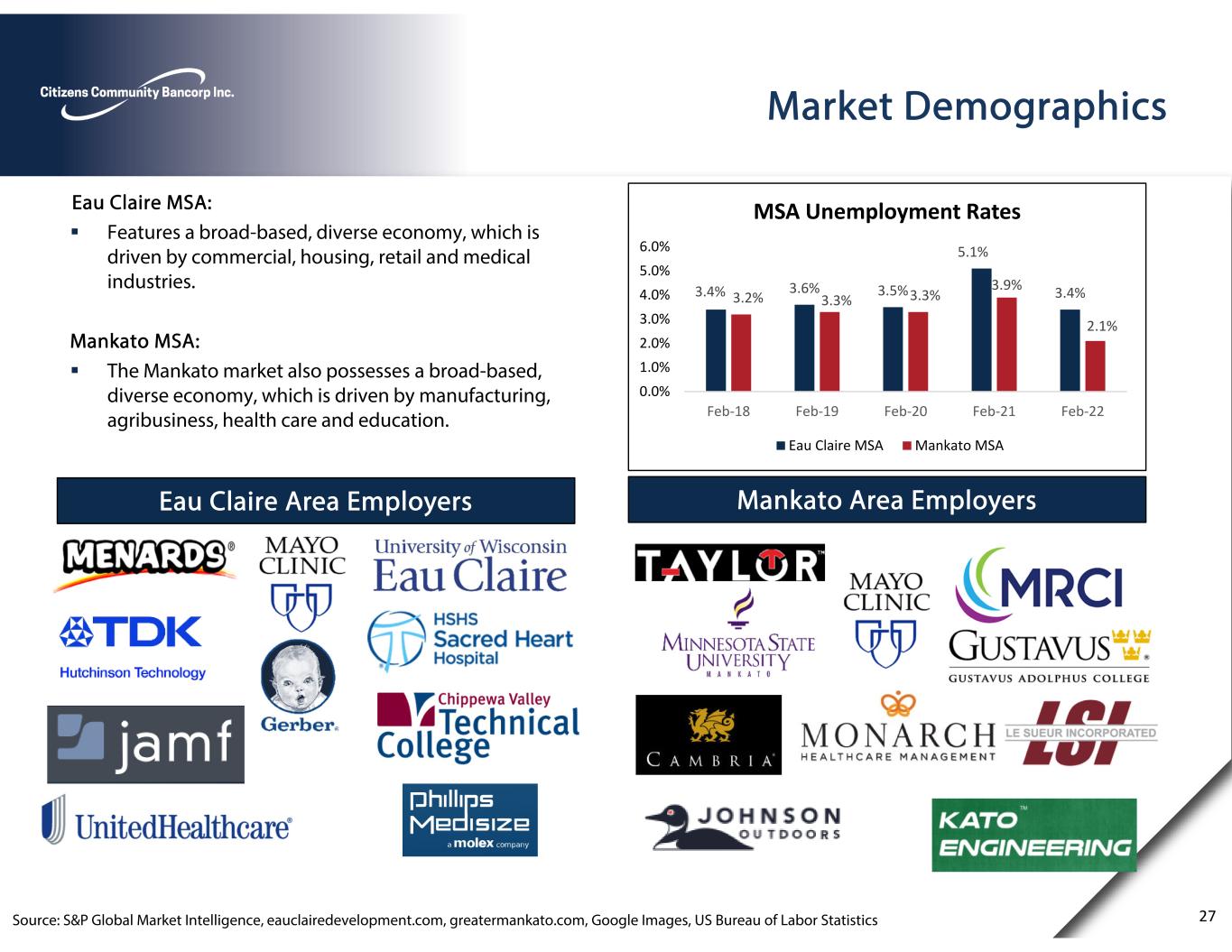

Source: S&P Global Market Intelligence, eauclairedevelopment.com, greatermankato.com, Google Images, US Bureau of Labor Statistics Eau Claire MSA: Features a broad-based, diverse economy, which is driven by commercial, housing, retail and medical industries. Mankato MSA: The Mankato market also possesses a broad-based, diverse economy, which is driven by manufacturing, agribusiness, health care and education. Mankato Area EmployersEau Claire Area Employers Market Demographics 27 3.4% 3.6% 3.5% 5.1% 3.4%3.2% 3.3% 3.3% 3.9% 2.1% 0.0% 1.0% 2.0% 3.0% 4.0% 5.0% 6.0% Feb‐18 Feb‐19 Feb‐20 Feb‐21 Feb‐22 MSA Unemployment Rates Eau Claire MSA Mankato MSA

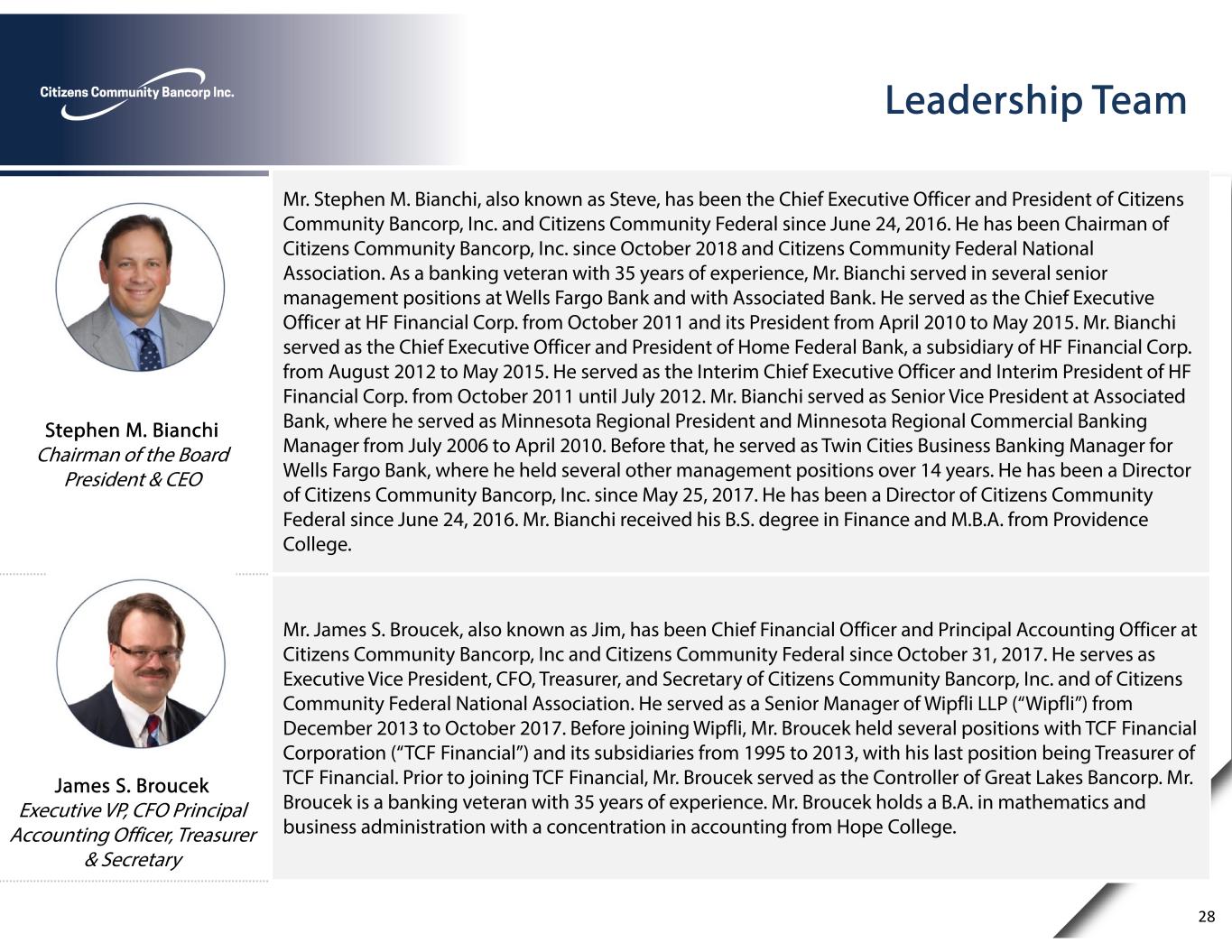

Leadership Team Stephen M. Bianchi Chairman of the Board President & CEO Mr. Stephen M. Bianchi, also known as Steve, has been the Chief Executive Officer and President of Citizens Community Bancorp, Inc. and Citizens Community Federal since June 24, 2016. He has been Chairman of Citizens Community Bancorp, Inc. since October 2018 and Citizens Community Federal National Association. As a banking veteran with 35 years of experience, Mr. Bianchi served in several senior management positions at Wells Fargo Bank and with Associated Bank. He served as the Chief Executive Officer at HF Financial Corp. from October 2011 and its President from April 2010 to May 2015. Mr. Bianchi served as the Chief Executive Officer and President of Home Federal Bank, a subsidiary of HF Financial Corp. from August 2012 to May 2015. He served as the Interim Chief Executive Officer and Interim President of HF Financial Corp. from October 2011 until July 2012. Mr. Bianchi served as Senior Vice President at Associated Bank, where he served as Minnesota Regional President and Minnesota Regional Commercial Banking Manager from July 2006 to April 2010. Before that, he served as Twin Cities Business Banking Manager for Wells Fargo Bank, where he held several other management positions over 14 years. He has been a Director of Citizens Community Bancorp, Inc. since May 25, 2017. He has been a Director of Citizens Community Federal since June 24, 2016. Mr. Bianchi received his B.S. degree in Finance and M.B.A. from Providence College. James S. Broucek Executive VP, CFO Principal Accounting Officer, Treasurer & Secretary Mr. James S. Broucek, also known as Jim, has been Chief Financial Officer and Principal Accounting Officer at Citizens Community Bancorp, Inc and Citizens Community Federal since October 31, 2017. He serves as Executive Vice President, CFO, Treasurer, and Secretary of Citizens Community Bancorp, Inc. and of Citizens Community Federal National Association. He served as a Senior Manager of Wipfli LLP (“Wipfli”) from December 2013 to October 2017. Before joining Wipfli, Mr. Broucek held several positions with TCF Financial Corporation (“TCF Financial”) and its subsidiaries from 1995 to 2013, with his last position being Treasurer of TCF Financial. Prior to joining TCF Financial, Mr. Broucek served as the Controller of Great Lakes Bancorp. Mr. Broucek is a banking veteran with 35 years of experience. Mr. Broucek holds a B.A. in mathematics and business administration with a concentration in accounting from Hope College. 28