EXHIBIT 99.2 Earnings Release Supplement Second Quarter 2023

Citizens Community Bancorp, Inc. Table of Contents Cautionary Notes and Additional Disclosures Deposit Composition Commercial Deposit Concentrations Top 100 Depositors Liquidity Non‐Owner Occupied CRE Owner Occupied CRE Multi‐family Commercial & Industrial Loans Construction & Development Loans Agricultural Real Estate & Operating Loans Hotel Loans Restaurant Loans Campground Loans Office Loans Credit Quality/Risk Rating Descriptions Loans by Risk Rating as of June 30, 2023 Loans by Risk Rating as of March 31, 2023 Loans by Risk Rating as of December 31, 2022 Loans by Risk Rating as of March 31, 2022 Allowance for Credit Losses – Loans Allowance for Credit Losses – Unfunded Commitments Delinquency as of June 30, 2023, and March, 31 2023 Delinquency as of December 31, 2022 and June 30, 2022 Nonaccrual Loans Roll forward Other Real Estate Owned Roll forward Page(s) 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 18 19 19 20 20 21 22 23 23 Investments – Amortized Cost and Fair Value Investments – Credit Ratings Earnings Per Share Economic Value of Equity Net Interest Income Over One Year Horizon Selected Capital Composition Highlights – Bank and Company Page(s) 23 24 25 26 26 27 1

Cautionary Notes and Additional Disclosures DATES AND PERIODS PRESENTED In this earnings release financial supplement, unless otherwise noted, “20YY” refers to either the corresponding fiscal year-end date or the corresponding 12-months (i.e. fiscal year) then ended. “MMM-YY” refers to either the corresponding quarter-end date, or the corresponding three-month period then ended. CAUTIONARY NOTE REGARDING FORWARD LOOKING STATEMENTS This earnings release financial supplement may contain certain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, and Section 21E of the Securities Exchange Act of 1934. These statements include, but are not limited to, descriptions of the financial condition, results of operations, asset and credit quality trends, profitability, projected earnings, future plans, strategies and expectations of Citizens Community Bancorp, Inc. (“CZWI” or the “Company”) and its subsidiary, Citizens Community Federal, National Association (“CCFBank”). The Company intends such forward-looking statements to be covered by the safe harbor provisions for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995 and is including this statement for purposes of complying with those safe harbor provisions. Forward-looking statements, which are based on certain assumptions of the Company, are generally identifiable by use of the words “believe,” “expect,” “estimates,” “intend,” “anticipate,” “estimate,” “project,” “on pace,” “seek,” “target,” “potential,” “focus,” “may,” “preliminary,” “could,” “should” or similar expressions. These forward-looking statements express management’s current expectations or forecasts of future events, and by their nature, are subject to risks and uncertainties. Therefore, there are a number of factors that might cause actual results to differ materially from those in such statements. These uncertainties include conditions in the financial markets and economic conditions generally; adverse impacts to the Company or CCFBank arising from the COVID-19 pandemic; acts of terrorism and political or military actions by the United States or other governments; the possibility of a deterioration in the residential real estate markets; interest rate risk; lending risk; higher lending risks associated with our commercial and agricultural banking activities; the sufficiency of credit allowances; changes in the fair value or ratings downgrades of our securities; competitive pressures among depository and other financial institutions; disintermediation risk; our ability to maintain our reputation; our ability to maintain or increase our market share; our ability to realize the benefits of net deferred tax assets; our inability to obtain needed liquidity; our ability to raise capital needed to fund growth or meet regulatory requirements; our ability to attract and retain key personnel; our ability to keep pace with technological change; prevalence of fraud and other financial crimes; cybersecurity risks; the possibility that our internal controls and procedures could fail or be circumvented; our ability to successfully execute our acquisition growth strategy; risks posed by acquisitions and other expansion opportunities, including difficulties and delays in integrating the acquired business operations or fully realizing the cost savings and other benefits; restrictions on our ability to pay dividends; the potential volatility of our stock price; accounting standards for credit losses; legislative or regulatory changes or actions, or significant litigation, adversely affecting the Company or CCFBank; public company reporting obligations; changes in federal or state tax laws; and changes in accounting principles, policies or guidelines and their impact on financial performance. Stockholders, potential investors and other readers are urged to consider these factors carefully in evaluating the forward-looking statements and are cautioned not to place undue reliance on such forward-looking statements. Such uncertainties and other risks that may affect the Company's performance are discussed further in Part I, Item 1A, “Risk Factors,” in the Company’s Form 10-K, for the year ended December 31, 2022, filed with the Securities and Exchange Commission (“SEC”) on March 7, 2023, in the Company’s Form 10-Q, for the quarter ended March 31, 2023, filed with the Securities and Exchange Commission (“SEC”) on May 4, 2023, and the Company's subsequent filings with the SEC. The Company undertakes no obligation to make any revisions to the forward- looking statements contained herein or to update them to reflect events or circumstances occurring after the date hereof. NON-GAAP FINANCIAL MEASURES This earnings release financial supplement contains non-GAAP financial measures. For purposes of Regulation G, a non-GAAP financial measure is a numerical measure of the registrant's historical or future financial performance, financial position or cash flows that excludes amounts, or is subject to adjustments that have the effect of excluding amounts, that are included in the most directly comparable measure calculated and presented in accordance with GAAP in the statement of income, balance sheet or statement of cash flows (or equivalent statements) of the issuer; or includes amounts, or is subject to adjustments that have the effect of including amounts, that are excluded from the most directly comparable measure so calculated and presented. In this regard, GAAP refers to generally accepted accounting principles in the United States. Non-GAAP financial measures referred to herein include net income as adjusted, return on average equity as adjusted, and return on average assets as adjusted. Reconciliations of all non-GAAP financial measures used herein to the comparable GAAP financial measures in the appendix at the end of this presentation. 2

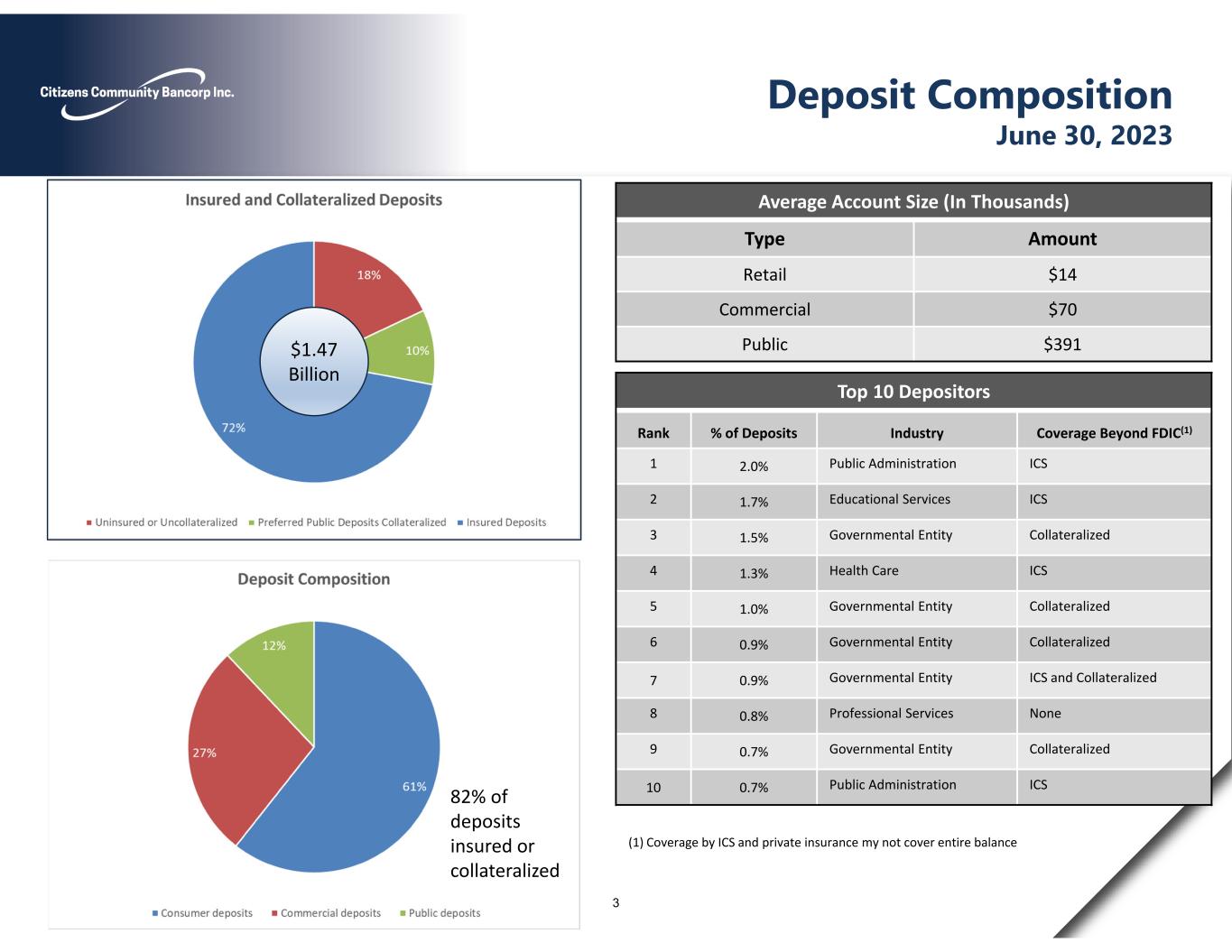

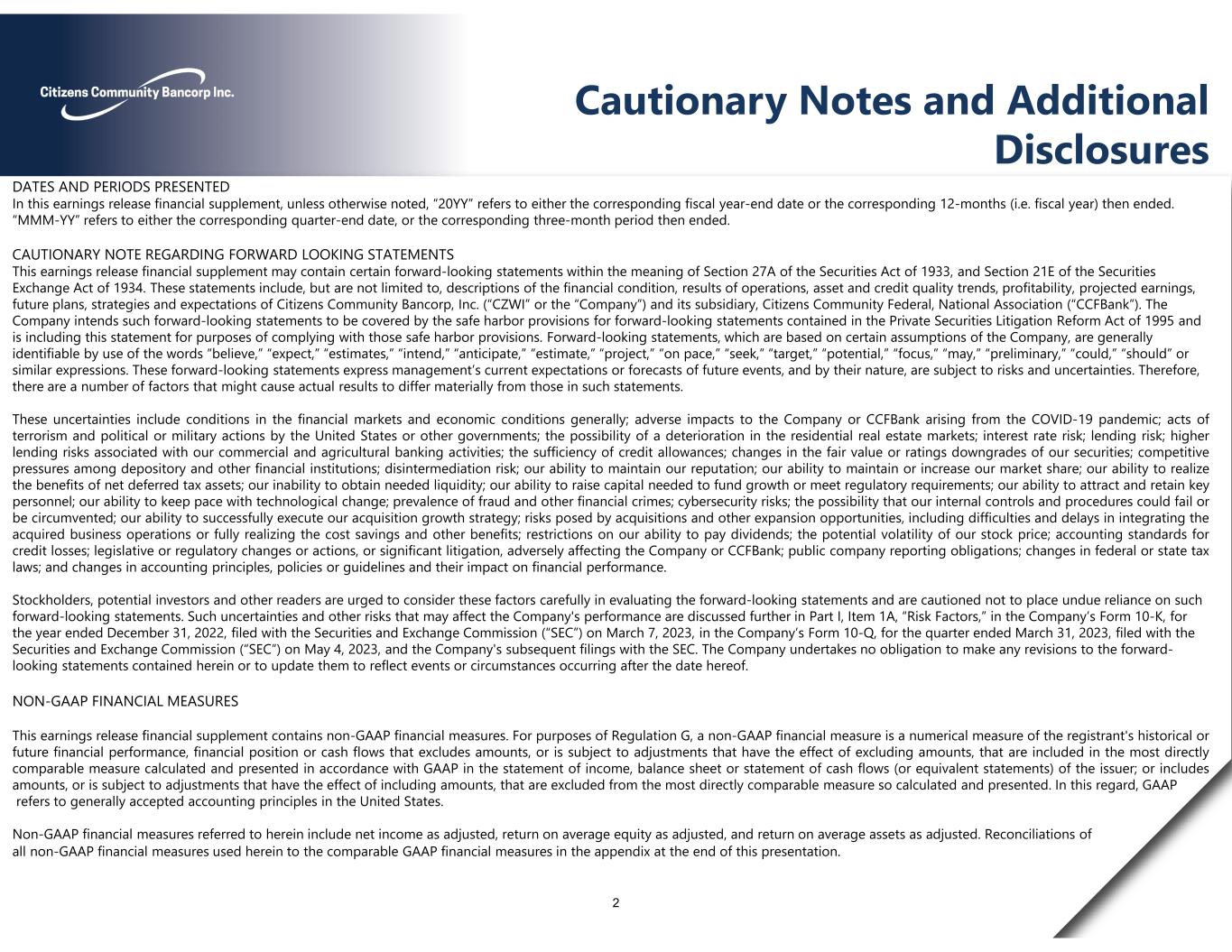

Deposit Composition June 30, 2023 Average Account Size (In Thousands) AmountType $14Retail $70Commercial $391Public$1.47 Billion 82% of deposits insured or collateralized Top 10 Depositors Coverage Beyond FDIC(1)Industry% of DepositsRank ICSPublic Administration2.0%1 ICSEducational Services1.7%2 CollateralizedGovernmental Entity1.5%3 ICSHealth Care1.3%4 CollateralizedGovernmental Entity1.0%5 CollateralizedGovernmental Entity0.9%6 ICS and CollateralizedGovernmental Entity0.9%7 NoneProfessional Services0.8%8 CollateralizedGovernmental Entity0.7%9 ICSPublic Administration0.7%10 (1) Coverage by ICS and private insurance my not cover entire balance 3

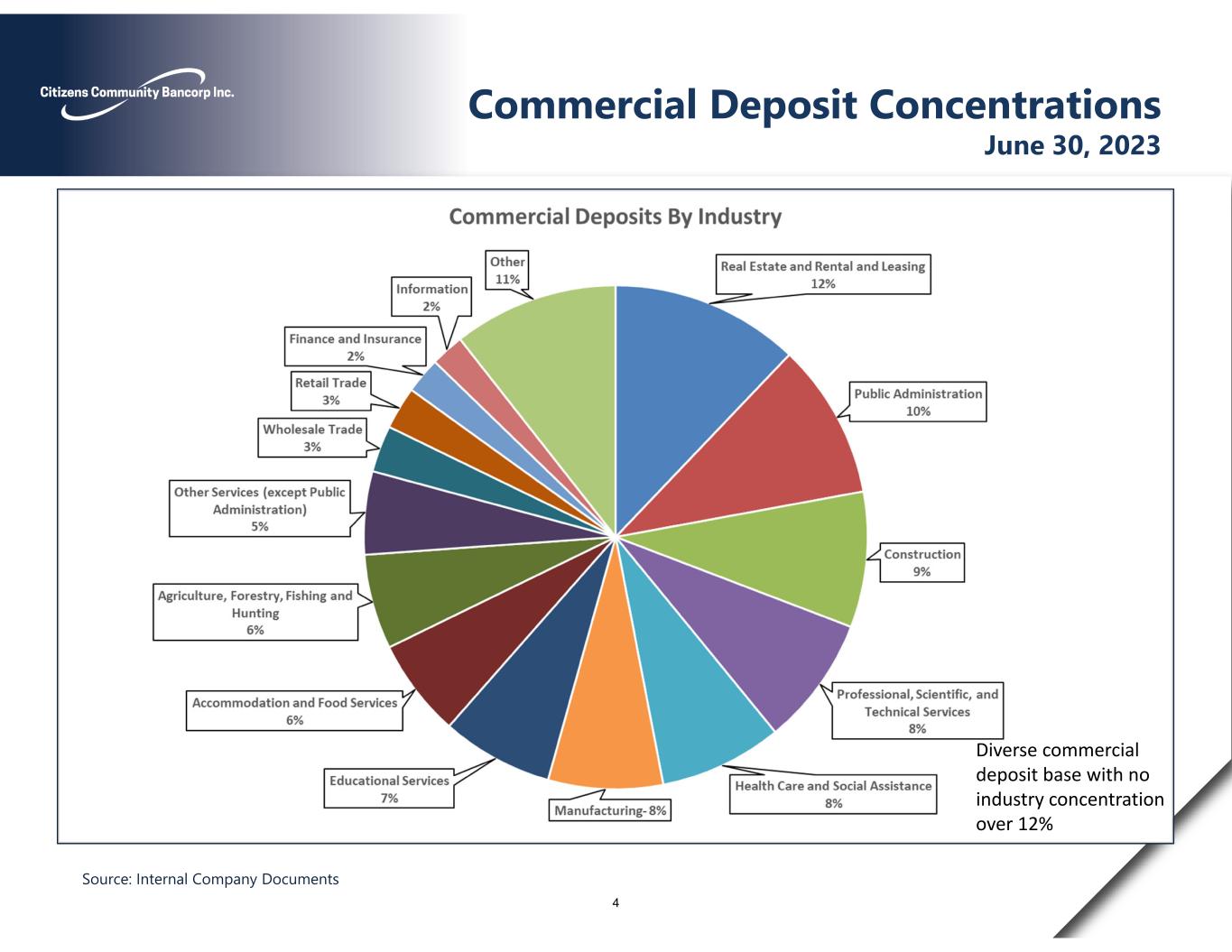

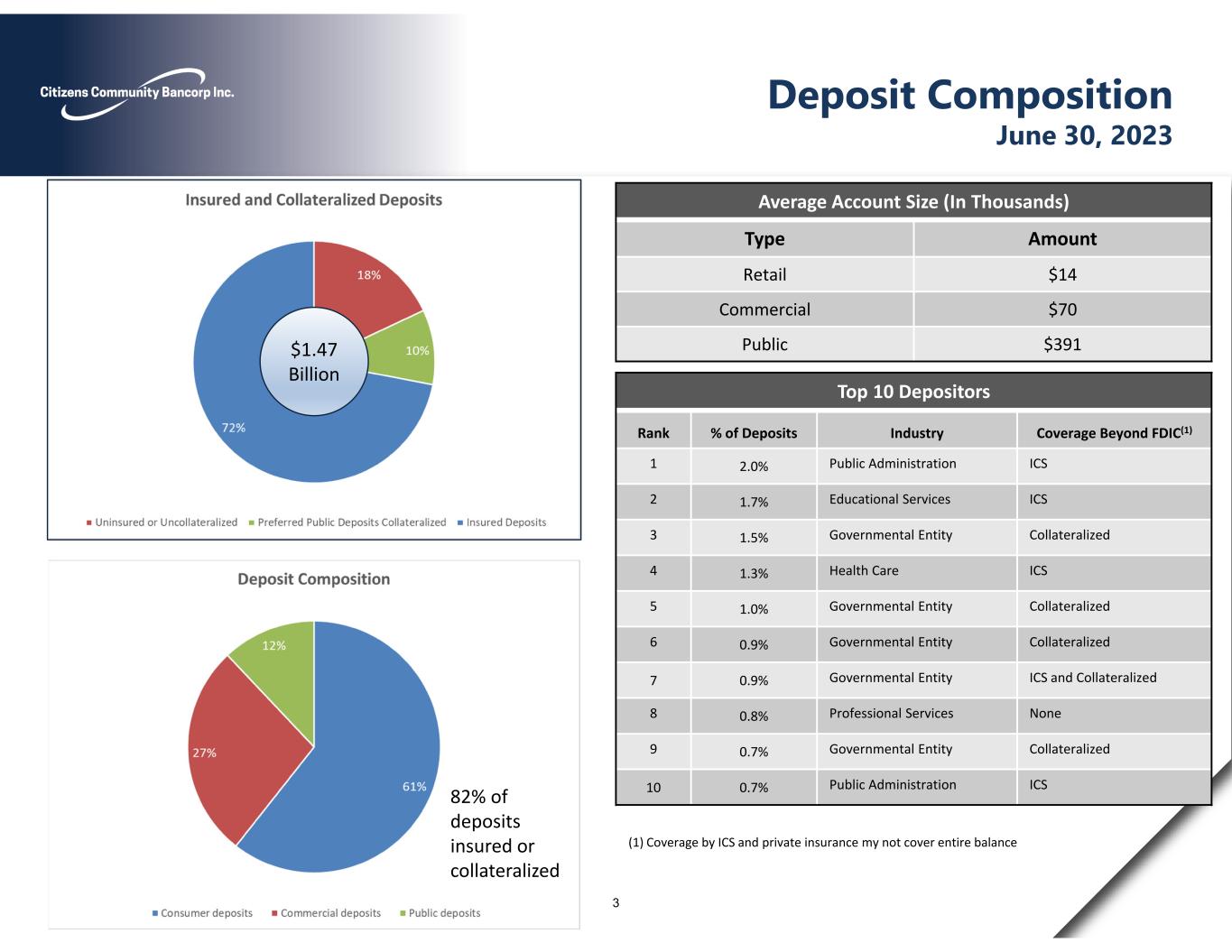

Commercial Deposit Concentrations June 30, 2023 Source: Internal Company Documents Diverse commercial deposit base with no industry concentration over 12% 4

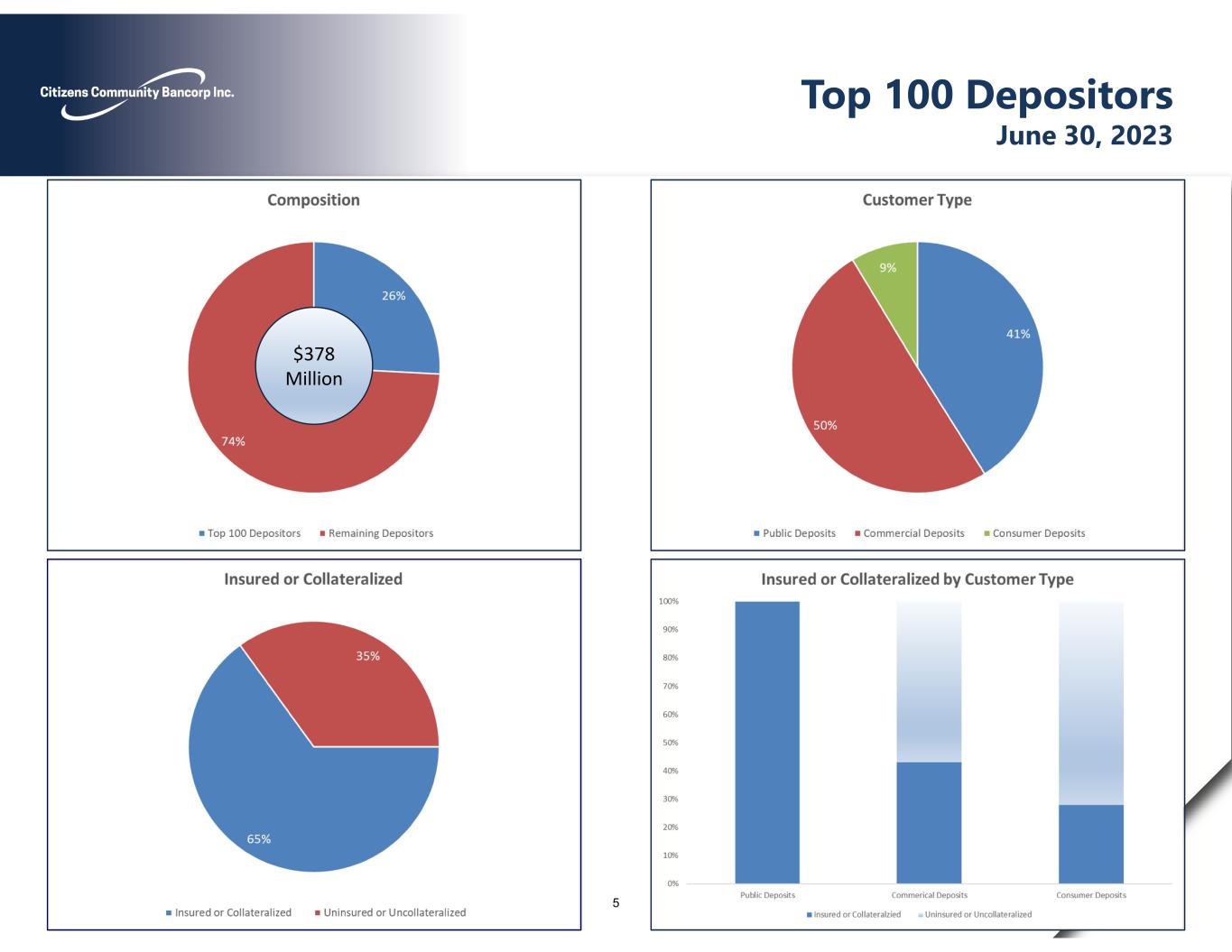

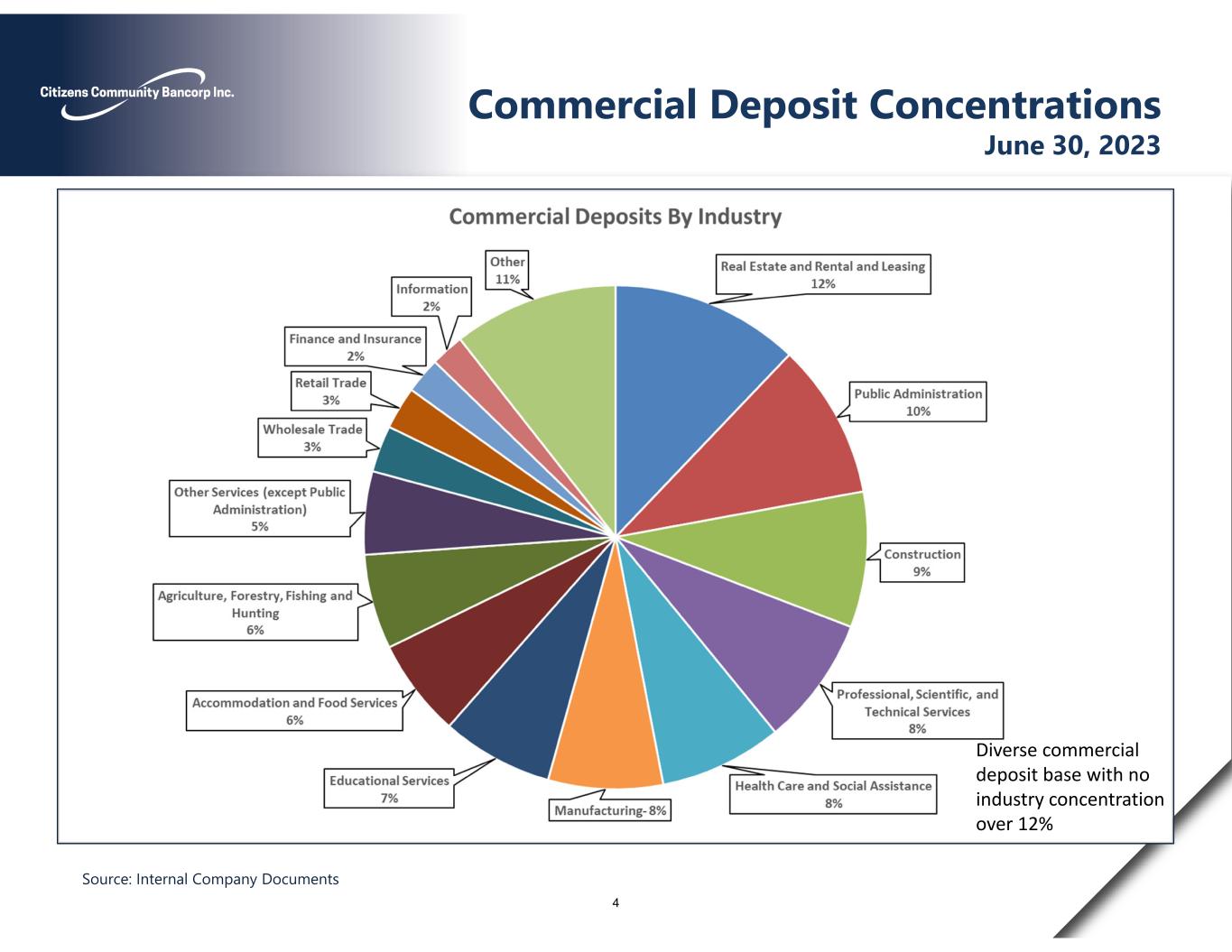

Top 100 Depositors June 30, 2023 $378 Million 5

Liquidity June 30, 2023 $611.1 Million 6

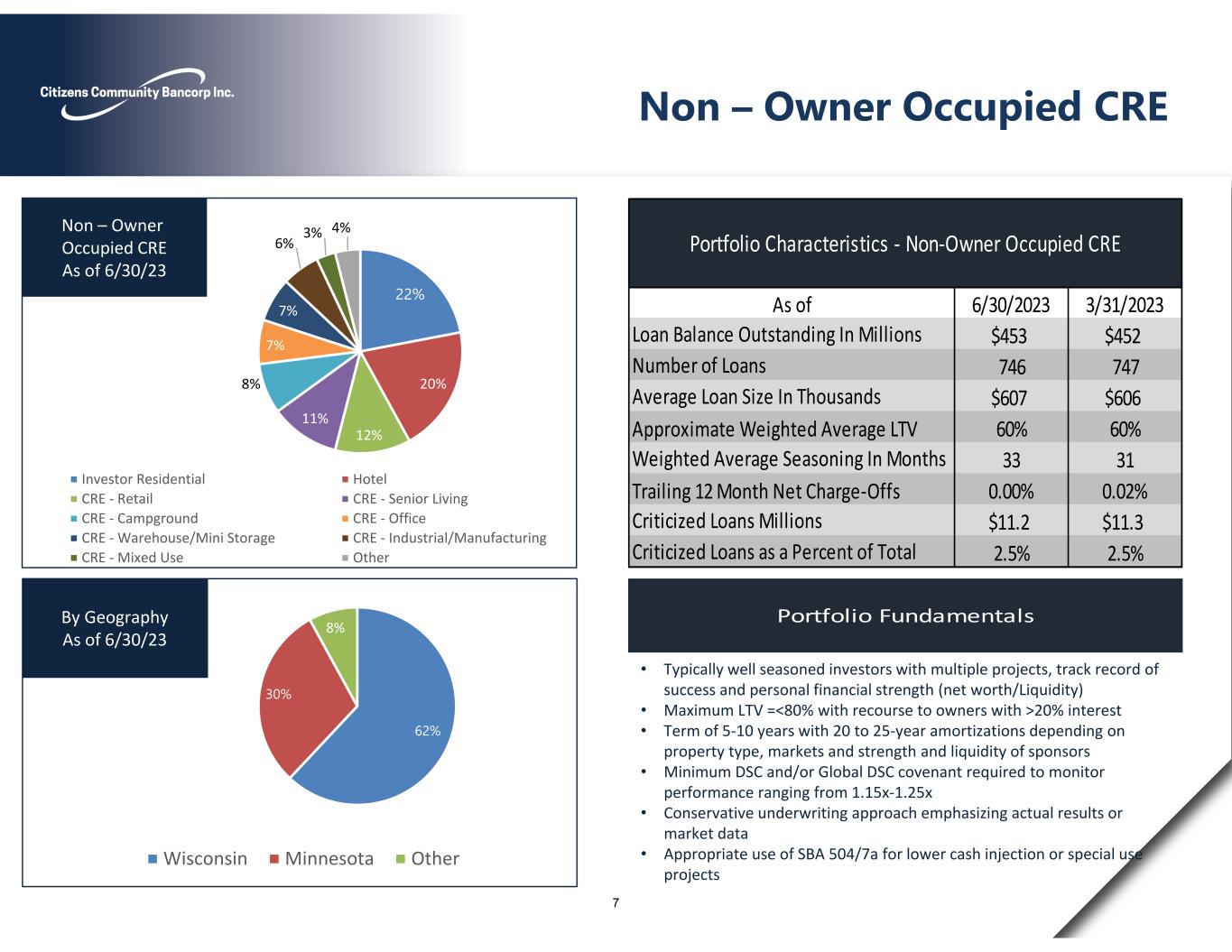

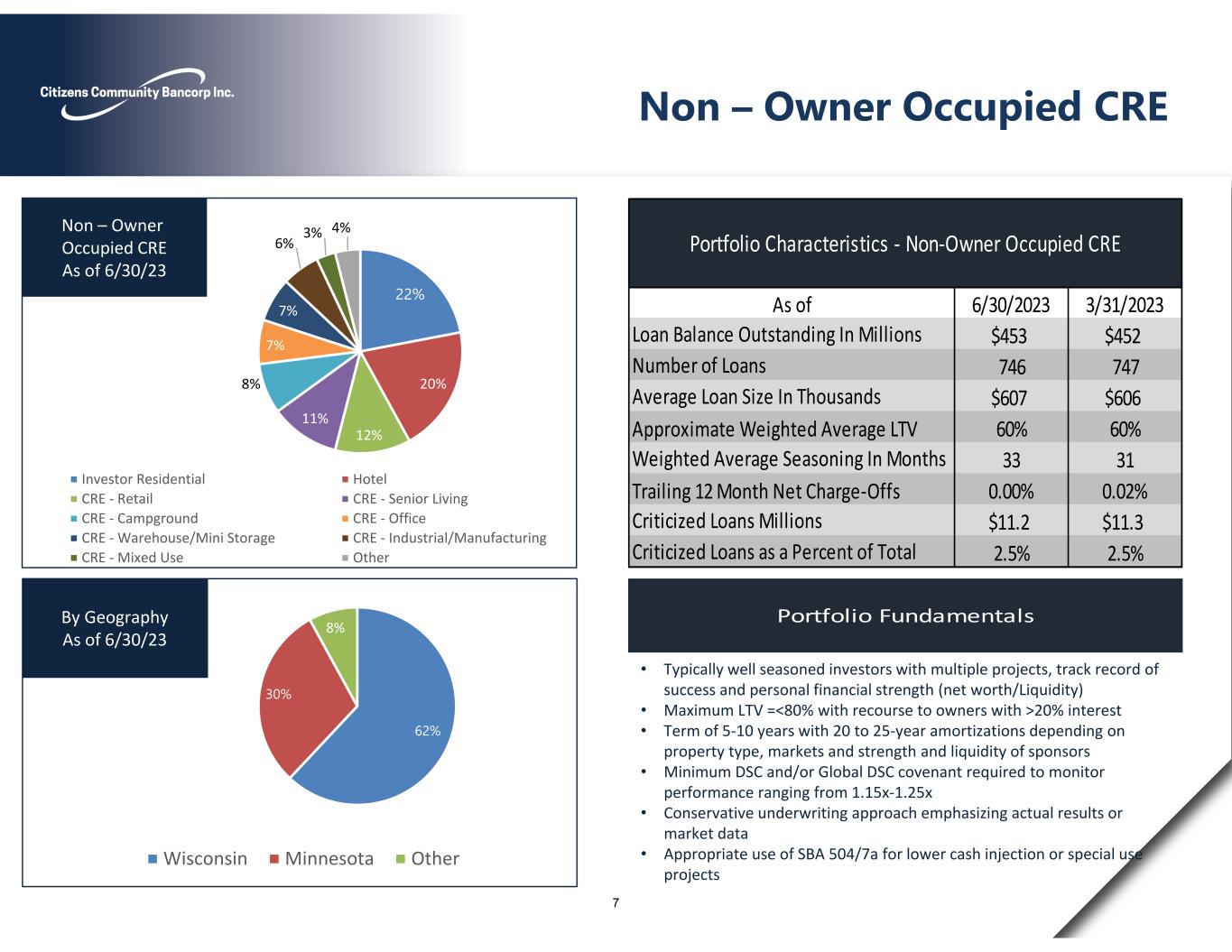

Portfolio Fundamentals 62% 30% 8% Wisconsin Minnesota Other By Geography As of 6/30/23 • Typically well seasoned investors with multiple projects, track record of success and personal financial strength (net worth/Liquidity) • Maximum LTV =<80% with recourse to owners with >20% interest • Term of 5‐10 years with 20 to 25‐year amortizations depending on property type, markets and strength and liquidity of sponsors • Minimum DSC and/or Global DSC covenant required to monitor performance ranging from 1.15x‐1.25x • Conservative underwriting approach emphasizing actual results or market data • Appropriate use of SBA 504/7a for lower cash injection or special use projects Non – Owner Occupied CRE 6/30/2023 3/31/2023 $453 $452 746 747 $607 $606 Approximate Weighted Average LTV 60% 60% 33 31 Trailing 12 Month Net Charge‐Offs 0.00% 0.02% $11.2 $11.3 2.5% 2.5% Weighted Average Seasoning In Months Loan Balance Outstanding In Millions Number of Loans Average Loan Size In Thousands Portfolio Characteristics ‐ Non‐Owner Occupied CRE As of Criticized Loans Millions Criticized Loans as a Percent of Total 22% 20% 12% 11% 8% 7% 7% 6% 3% 4% Investor Residential Hotel CRE ‐ Retail CRE ‐ Senior Living CRE ‐ Campground CRE ‐ Office CRE ‐ Warehouse/Mini Storage CRE ‐ Industrial/Manufacturing CRE ‐ Mixed Use Other Non – Owner Occupied CRE As of 6/30/23 7

16% 16% 14% 11% 10% 9% 8% 4% 12% CRE Campground CRE Restaurant CRE Industrial/Manufacturing CRE Warehouse/Mini Storage CRE Senior Living CRE Retail CRE Mixed Use CRE Office Other Owner Occupied CRE As of 6/30/23 Portfolio Fundamentals 74% 10% 16% Wisconsin Minnesota Other By Geography As of 6/30/23 • Underwritten to <80% LTV based on appraised value (<75% for Restaurant) • Term of 5‐10 years with 20‐year amortization • Recourse to owners with greater than 20% interest • DSC covenant of 1.25x on project and/or Global DSC of 1.15x • Appropriate use of SBA 504/7a for lower cash injection or special use projects • By Geography “Other” segment includes borrowers with warm climates, no income tax states Owner Occupied CRE 6/30/2023 3/31/2023 $279 $274 422 422 $661 $650 Approximate Weighted Average LTV 50% 51% 33 31 Trailing 12 Month Net Charge‐Offs 0.00% 0.00% $1.1 $1.7 0.4% 0.6%Criticized Loans as a Precent of Total Weighted Average Seasoning In Months Criticized Loans In Millions Portfolio Characteristics ‐ Owner Occupied CRE Loan Balance Outstanding In Millions Number of Loans Average Loan Size In Thousands As of 8

Portfolio Fundamentals 64% 35% 1% Wisconsin Minnesota Other By Geography As of 6/30/23 1% 20% 43% 23% 4% 7% 2% 2023 2022 2021 2020 2019 2018 Prior By Vintage As of 6/30/23 • Robust housing markets in Eau Claire and Mankato markets supported by student populations at state universities, technical colleges, and growing population and job markets • Multi‐family sponsors experienced owners with multi‐project portfolios • Typically underwritten to 75% LTV based on appraised value with recourse; metro markets and/or strong sponsors may warrant up to 80% LTV • Generally, term of 5‐10 years with 20 to 25‐year amortization (varies by new versus existing, size of market and sponsor strength) • Covenant for minimum DSC/Global DSC Multi-family 6/30/2023 3/31/2023 $208 $208 123 119 $1.69 $1.75 62% 62% Weighted Average Seasoning In Months 27 25 0% 0% $0.0 $0.0 0.0% 0.0%Criticized Loans as a Percent of Total Approximate Weighted Average LTV Trailing 12 Month Net Charge‐Offs Criticized Loans in Millions Portfolio Characteristics ‐ Multi‐family Loan Balance Outstanding In Millions Number of Loans Average Loan Size In Millions As of 9

91% 8% 1% Wisconsin Minnesota Other By Geography As of 6/30/23 19% 13% 11% 10%9% 7% 5% 5% 4% 4% 3% 10% Finance and Insurance Manufacturing Transportation and Warehousing Wholesale Trade Construction Agriculture Public Admin Administrative Support Real Estate, Rental and Leasing Retail Trade Education Services Other Commercial & Industrial As of 6/30/23 • Highly diversified, secured loan portfolio underwritten with recourse • Lines of credit reviewed annually and may have borrowing base certificates governing line usage • Fixed asset LTV’s based on age and type of equipment; <5‐year amortization • Use of SBA Guaranty Program (Preferred Lender or General Processing) as appropriate • “Retail Trade” segment consists of Farm Supply, Franchised Hardware, Franchised Auto Parts, Franchised and Non‐franchised Auto Dealers and Repair Shops, Convenience Stores/Gas Stations Commercial & Industrial Loans 6/30/2023 3/31/2023 $134 $131 662 663 $202 $198 27 26 0.02% 0.02% $60 $61 $2.9 $0.5 Criticized Loans as a Precent of Total 2.2% 0.4% Criticized Loans In Millions Weighted Average Seasoning In Months Trailing 12 Month Net Charge‐Offs Committed Line, if collateral In Millions Portfolio Characteristics ‐ Commercial & Industrial Loan Balance In Millions Number of Loans Average Loan Size In Thousands As of Portfolio Fundamentals 10

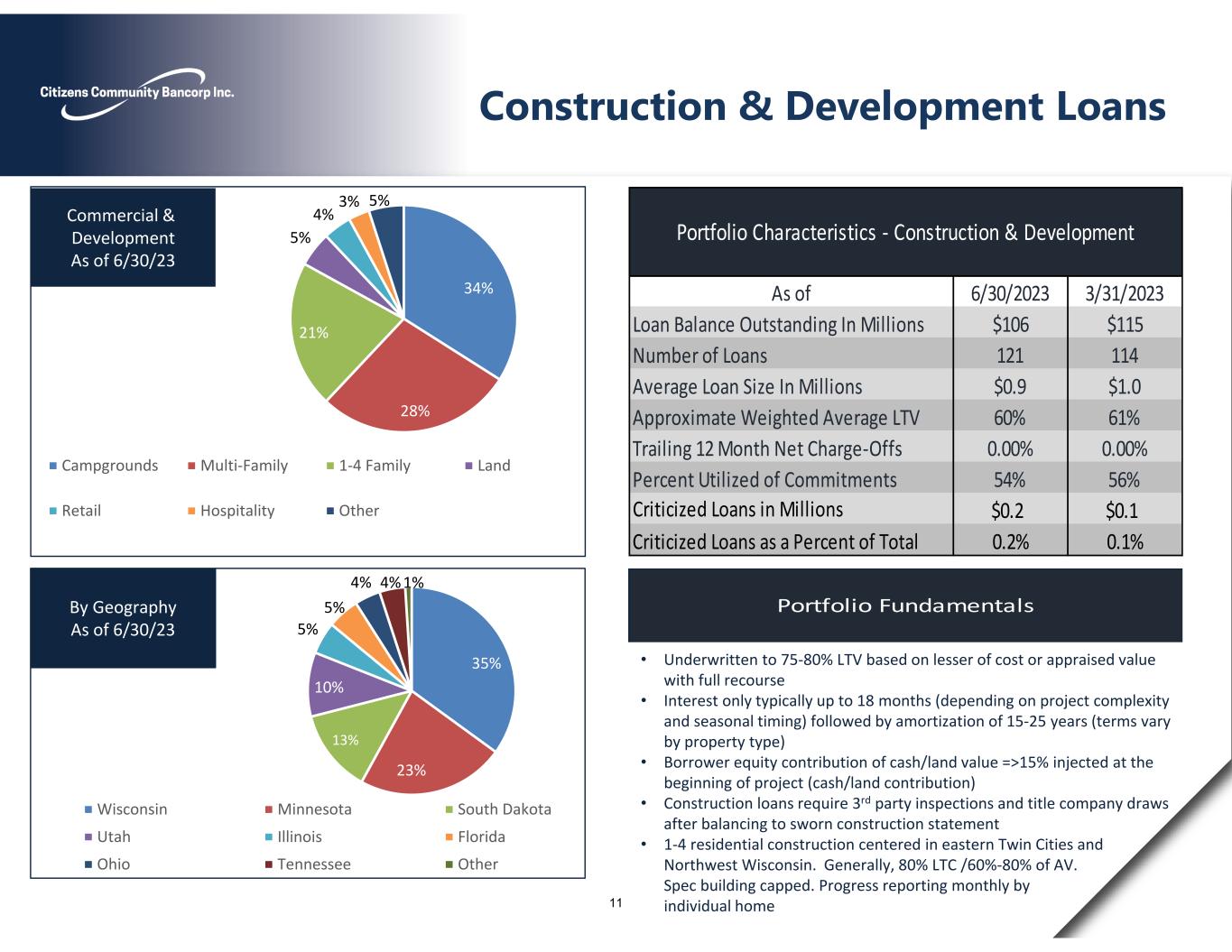

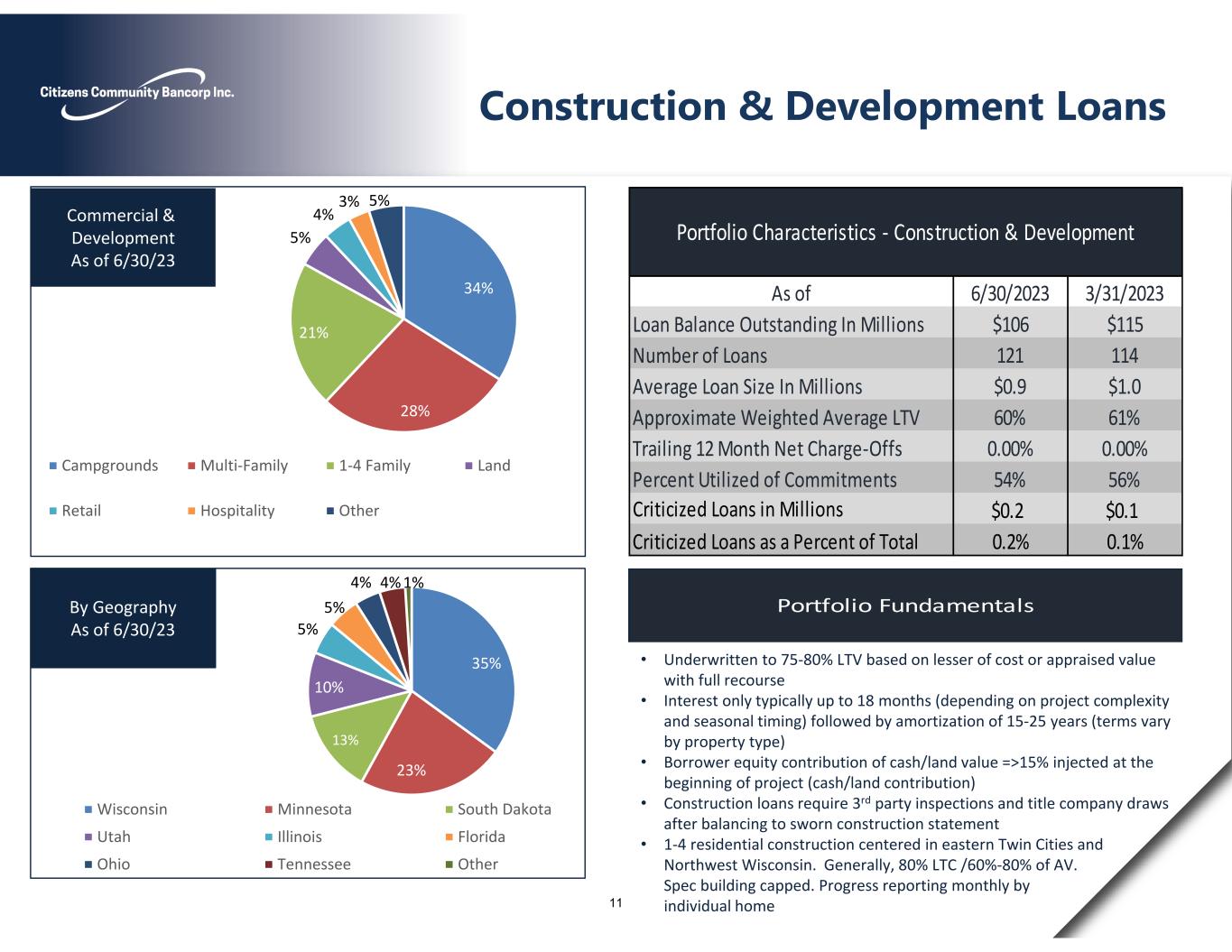

Portfolio Fundamentals 34% 28% 21% 5% 4% 3% 5% Campgrounds Multi‐Family 1‐4 Family Land Retail Hospitality Other Commercial & Development As of 6/30/23 35% 23% 13% 10% 5% 5% 4% 4%1% Wisconsin Minnesota South Dakota Utah Illinois Florida Ohio Tennessee Other By Geography As of 6/30/23 • Underwritten to 75‐80% LTV based on lesser of cost or appraised value with full recourse • Interest only typically up to 18 months (depending on project complexity and seasonal timing) followed by amortization of 15‐25 years (terms vary by property type) • Borrower equity contribution of cash/land value =>15% injected at the beginning of project (cash/land contribution) • Construction loans require 3rd party inspections and title company draws after balancing to sworn construction statement • 1‐4 residential construction centered in eastern Twin Cities and Northwest Wisconsin. Generally, 80% LTC /60%‐80% of AV. Spec building capped. Progress reporting monthly by individual home Construction & Development Loans 6/30/2023 3/31/2023 Loan Balance Outstanding In Millions $106 $115 Number of Loans 121 114 Average Loan Size In Millions $0.9 $1.0 Approximate Weighted Average LTV 60% 61% Trailing 12 Month Net Charge‐Offs 0.00% 0.00% Percent Utilized of Commitments 54% 56% $0.2 $0.1 Criticized Loans as a Percent of Total 0.2% 0.1% Portfolio Characteristics ‐ Construction & Development As of Criticized Loans in Millions 11

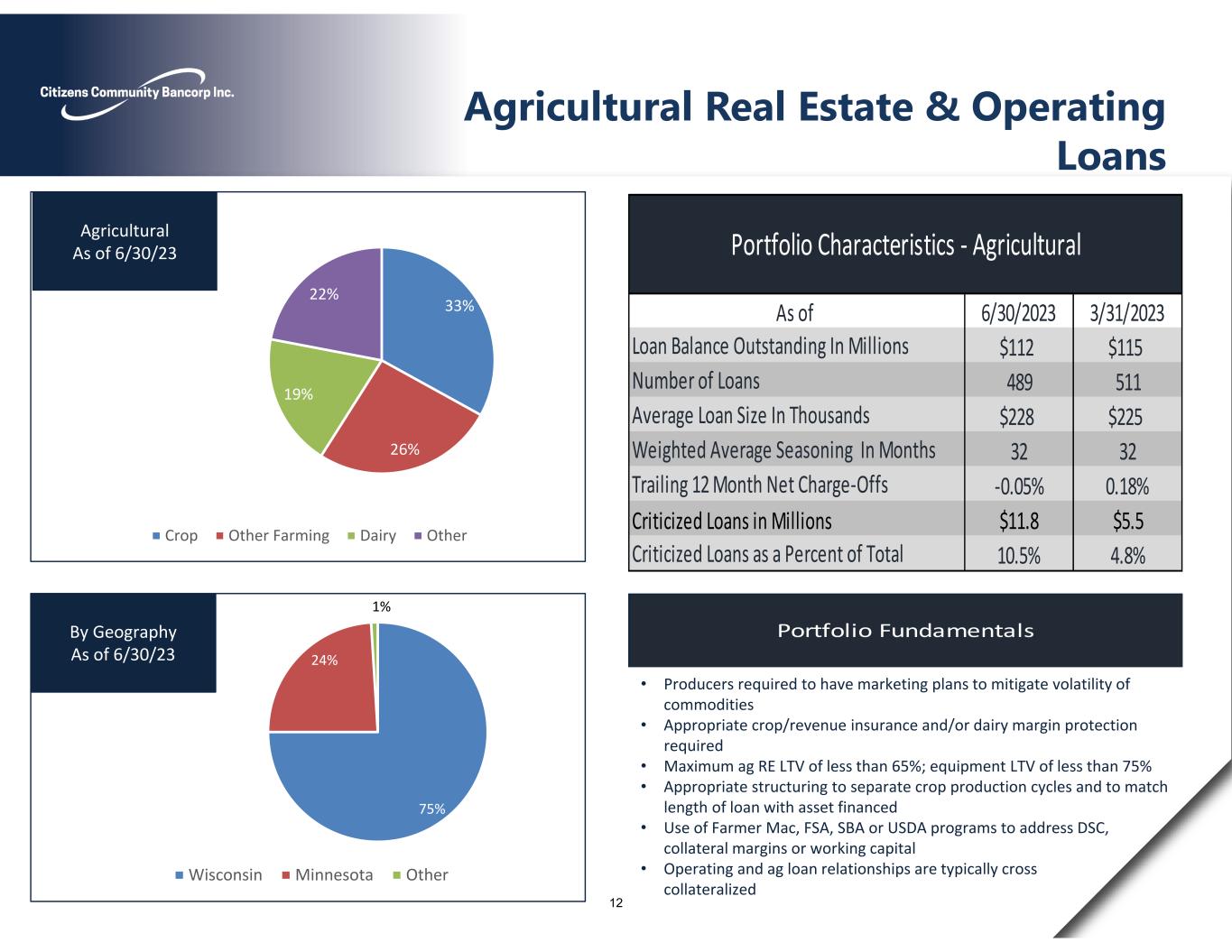

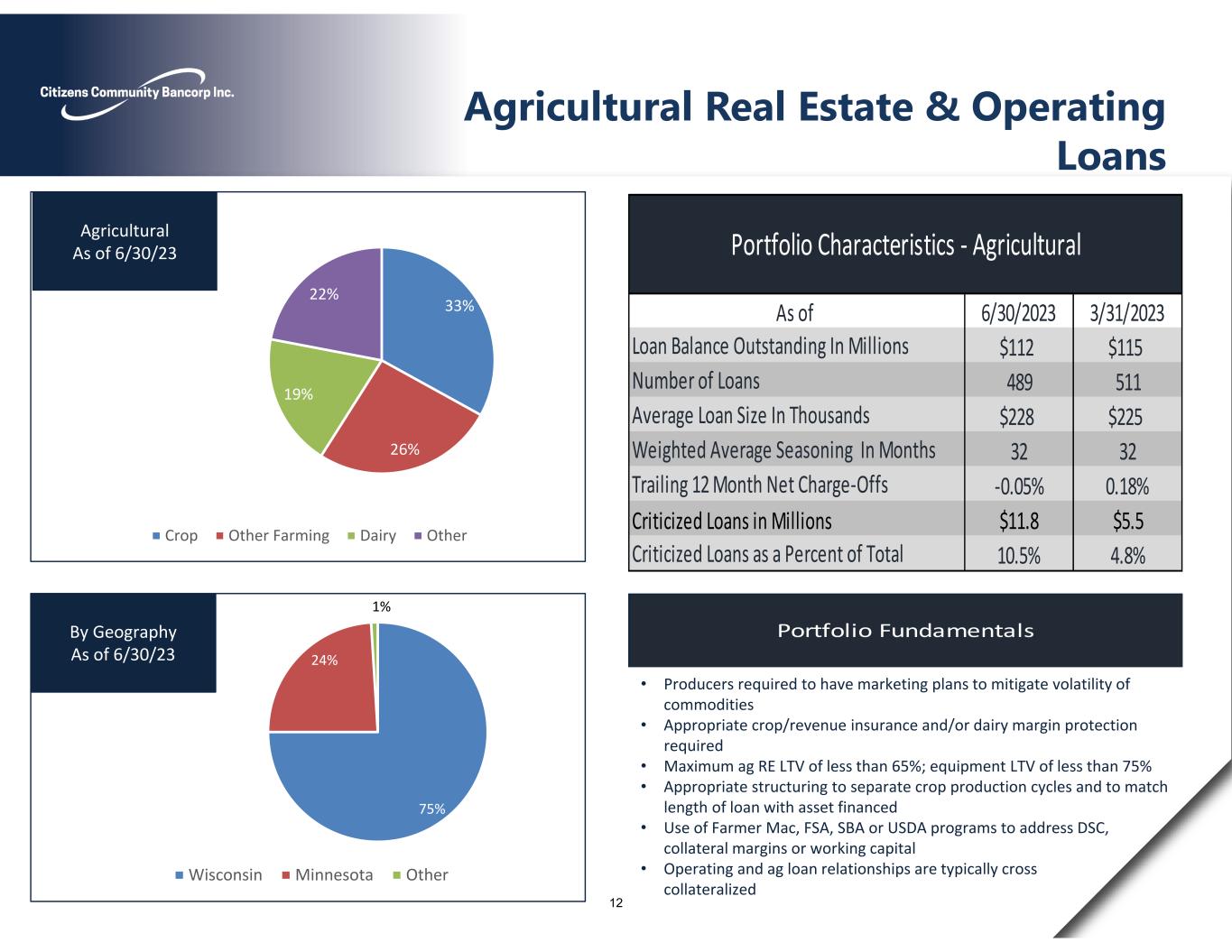

33% 26% 19% 22% Crop Other Farming Dairy Other Agricultural As of 6/30/23 Portfolio Fundamentals 75% 24% 1% Wisconsin Minnesota Other By Geography As of 6/30/23 • Producers required to have marketing plans to mitigate volatility of commodities • Appropriate crop/revenue insurance and/or dairy margin protection required • Maximum ag RE LTV of less than 65%; equipment LTV of less than 75% • Appropriate structuring to separate crop production cycles and to match length of loan with asset financed • Use of Farmer Mac, FSA, SBA or USDA programs to address DSC, collateral margins or working capital • Operating and ag loan relationships are typically cross collateralized Agricultural Real Estate & Operating Loans 6/30/2023 3/31/2023 $112 $115 489 511 $228 $225 32 32 ‐0.05% 0.18% Criticized Loans in Millions $11.8 $5.5 10.5% 4.8%Criticized Loans as a Percent of Total Weighted Average Seasoning In Months Trailing 12 Month Net Charge‐Offs Portfolio Characteristics ‐ Agricultural Loan Balance Outstanding In Millions Number of Loans Average Loan Size In Thousands As of 12

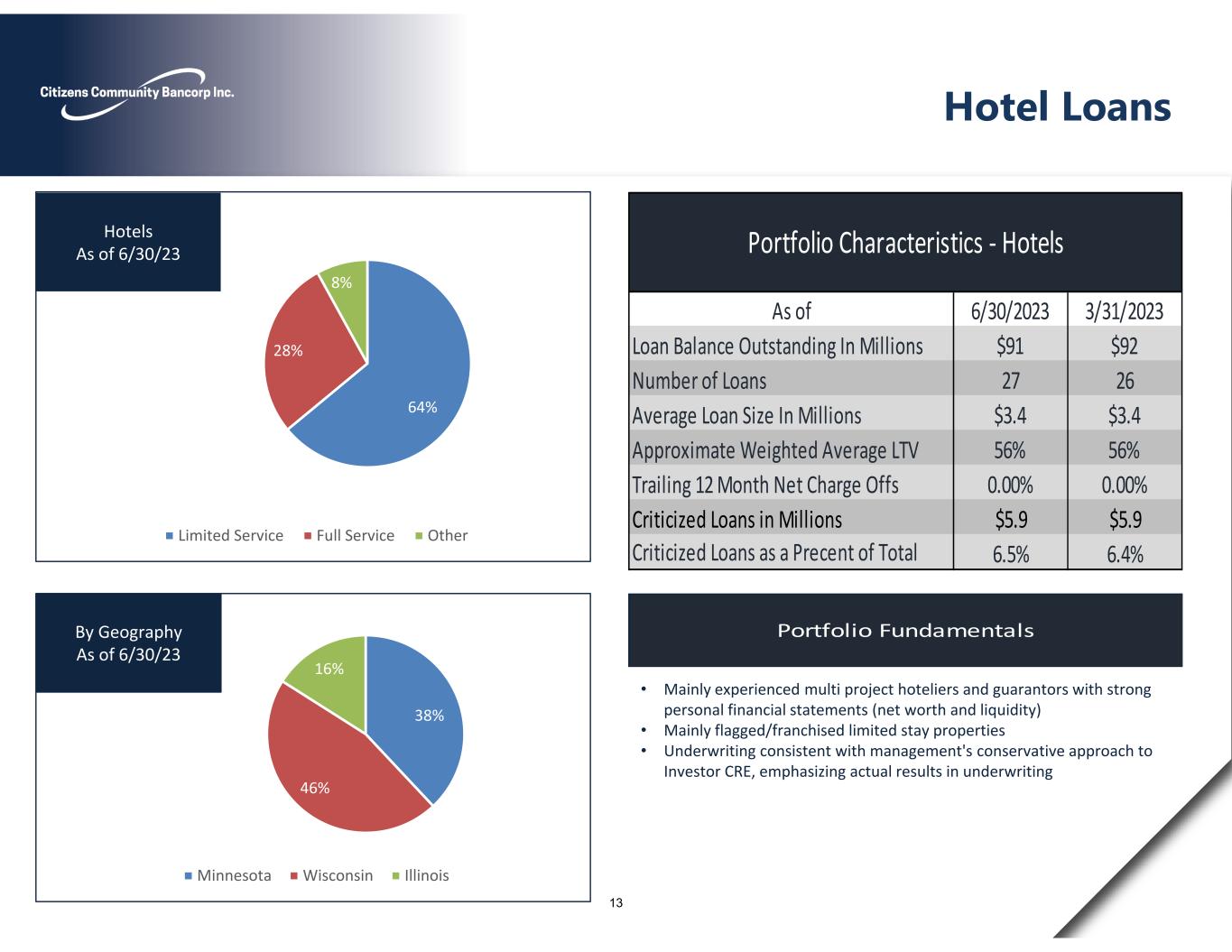

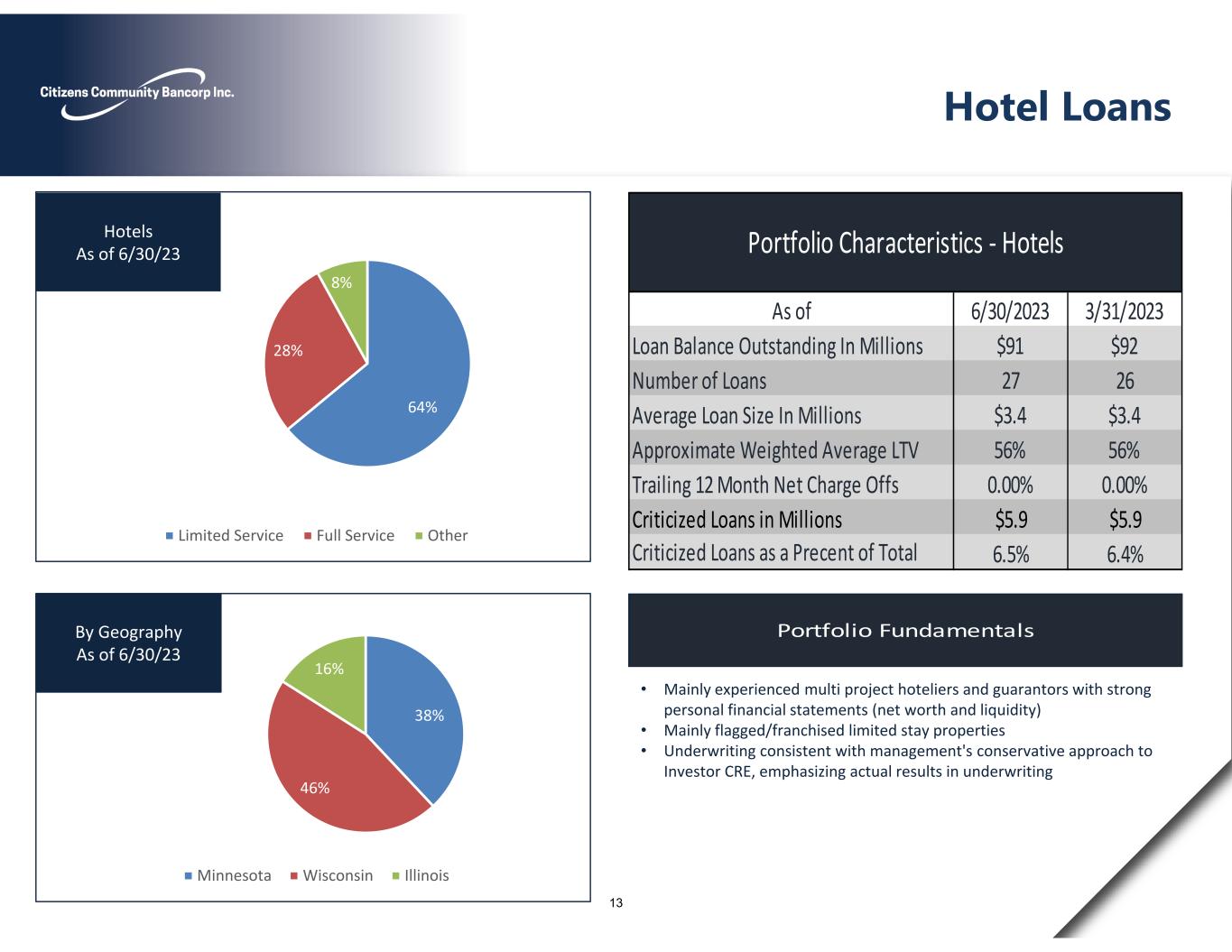

64% 28% 8% Limited Service Full Service Other Hotels As of 6/30/23 Portfolio Fundamentals 38% 46% 16% Minnesota Wisconsin Illinois By Geography As of 6/30/23 • Mainly experienced multi project hoteliers and guarantors with strong personal financial statements (net worth and liquidity) • Mainly flagged/franchised limited stay properties • Underwriting consistent with management's conservative approach to Investor CRE, emphasizing actual results in underwriting Hotel Loans 6/30/2023 3/31/2023 $91 $92 27 26 $3.4 $3.4 56% 56% 0.00% 0.00% Criticized Loans in Millions $5.9 $5.9 6.5% 6.4%Criticized Loans as a Precent of Total As of Number of Loans Trailing 12 Month Net Charge Offs Portfolio Characteristics ‐ Hotels Loan Balance Outstanding In Millions Average Loan Size In Millions Approximate Weighted Average LTV 13

68% 15% 6% 4% 3% 4% Culver's ‐ Limited Service Restaurants Other National Limited Services Drinking Establishments Bowling Centers Other Restaurants As of 6/30/23 Portfolio Fundamentals 56% 27% 17% Wisconsin Minnesota Other By Geography As of 6/30/23 • Experienced developers/operators of national Limited /Quick Service brands (Culver’s, Subway, Dairy Queen, McDonalds, Jimmy John’s, A&W) • Underwritten to =<80% LTV with full recourse (depending on sponsor history); 20‐year amortization with 5 to 10‐year terms • Use of SBA Guaranty Program (Preferred Lender or General Processing) as appropriate • Drinking establishments may have other collateral pledged and tend to be in smaller communities in our footprint • Lessors of RE include investor and owner‐occupied structure Restaurant Loans 6/30/2023 3/31/2023 $51 $48 72 69 $702 $689 51% 54% 0.00% 0.00% Criticized Loans In Millions $0.8 $0.8 1.6% 1.7%Criticized Loans as a Percent of Total Portfolio Characteristics ‐ Restaurants As of Trailing 12 Month Net Charge‐Offs Loan Balance Outstanding In Millions Number of Loans Average Loan Size In Thousands Approximate Weighted Average LTV 14

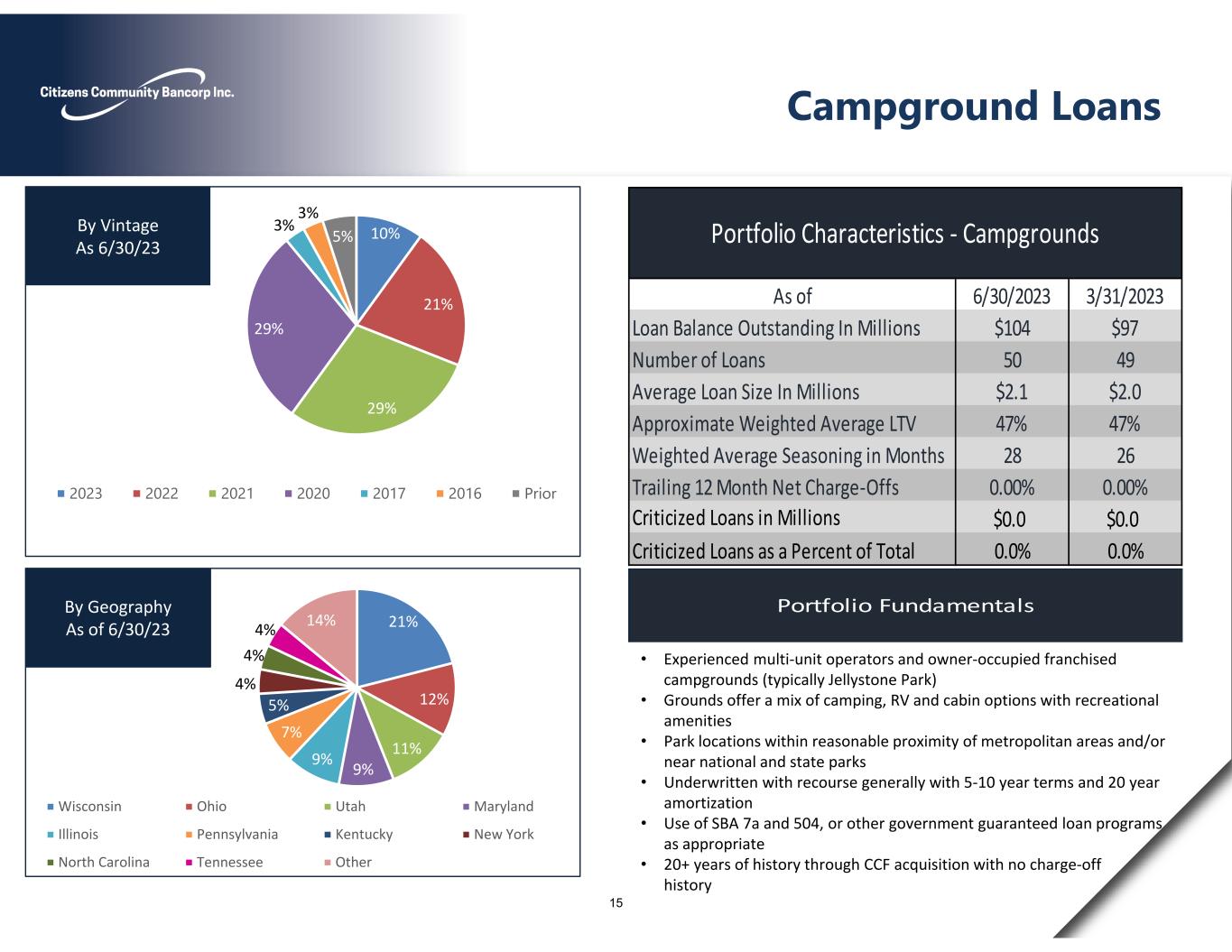

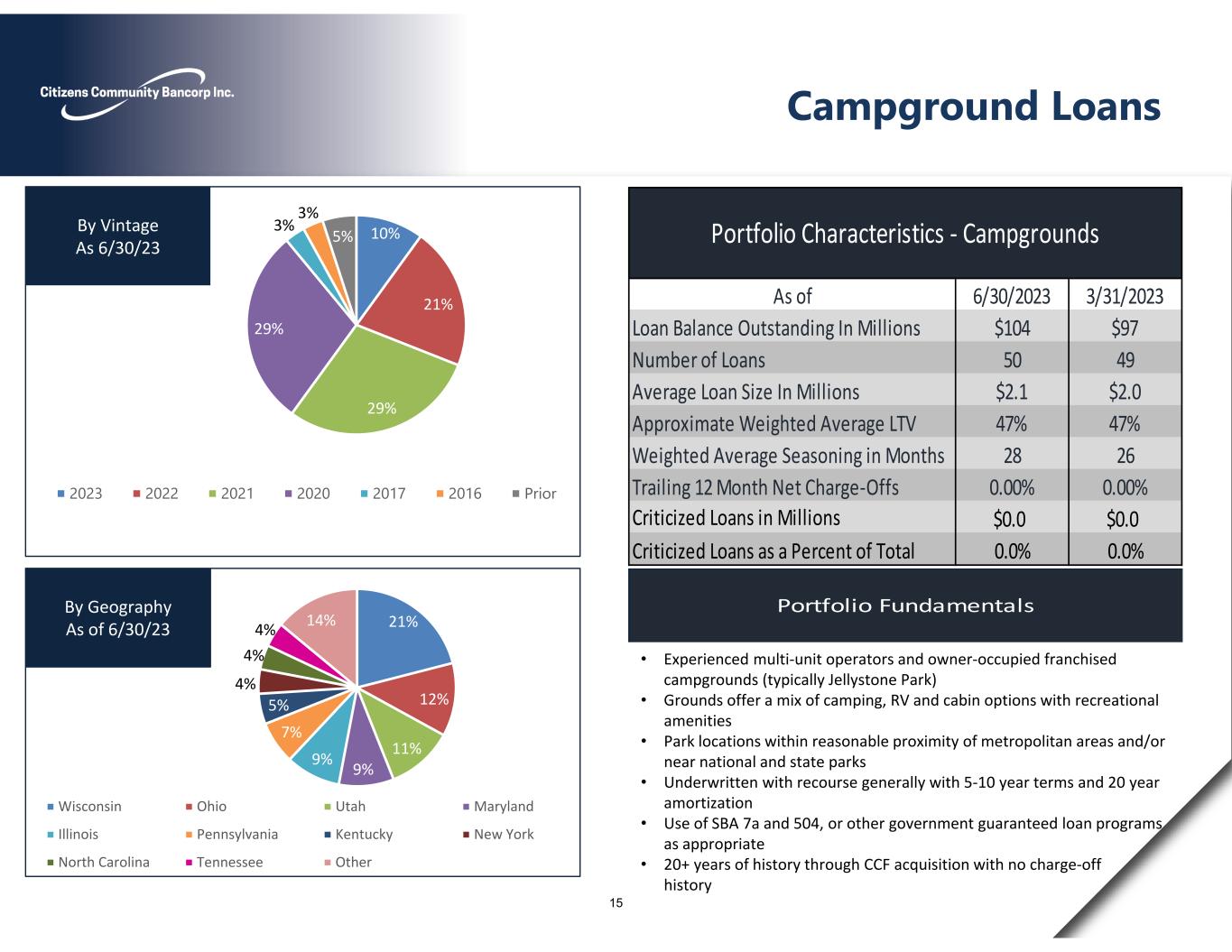

10% 21% 29% 29% 3% 3% 5% 2023 2022 2021 2020 2017 2016 Prior By Vintage As 6/30/23 Portfolio Fundamentals 21% 12% 11% 9%9% 7% 5% 4% 4% 4% 14% Wisconsin Ohio Utah Maryland Illinois Pennsylvania Kentucky New York North Carolina Tennessee Other By Geography As of 6/30/23 • Experienced multi‐unit operators and owner‐occupied franchised campgrounds (typically Jellystone Park) • Grounds offer a mix of camping, RV and cabin options with recreational amenities • Park locations within reasonable proximity of metropolitan areas and/or near national and state parks • Underwritten with recourse generally with 5‐10 year terms and 20 year amortization • Use of SBA 7a and 504, or other government guaranteed loan programs as appropriate • 20+ years of history through CCF acquisition with no charge‐off history Campground Loans 6/30/2023 3/31/2023 $104 $97 50 49 $2.1 $2.0 47% 47% 28 26 0.00% 0.00% $0.0 $0.0 Criticized Loans as a Percent of Total 0.0% 0.0% Portfolio Characteristics ‐ Campgrounds As of Weighted Average Seasoning in Months Criticized Loans in Millions Loan Balance Outstanding In Millions Number of Loans Average Loan Size In Millions Approximate Weighted Average LTV Trailing 12 Month Net Charge‐Offs 15

3% 28% 4% 40% 25% 2023 2024 2025 2026 2027 & Beyond Maturity or Next Repricing Date As of 6/30/23 Portfolio Fundamentals 63% 32% 5% Wisconsin Minnesota Other By Geography As of 6/30/23 Properties financed are generally in Wisconsin and Minnesota and 98% of properties are located outside of large cities Projects underwritten with 5‐10 year term, up to 20 year amortization, and less than 80% LTV Loans are with recourse to the sponsor/owner(s) Buildings are mostly single level buildings and no more than three floors high Tenants centered in medical, insurance, professional services and government Office Loans 6/30/2023 3/31/2023 $45 $45 72 72 $618 $626 66% 65% 34 31 0.00% 0.00% $0.0 $0.0 0.0% 0.0%Criticized Loans as a Percent of Total Portfolio Characteristics ‐ Office As of Weighted Average Seasoning in Months Criticized Loans in Millions Loan Balance Outstanding In Millions Number of Loans Average Loan Size In Thousands Approximate Weighted Average LTV Trailing 12 Month Net Charge‐Offs 16

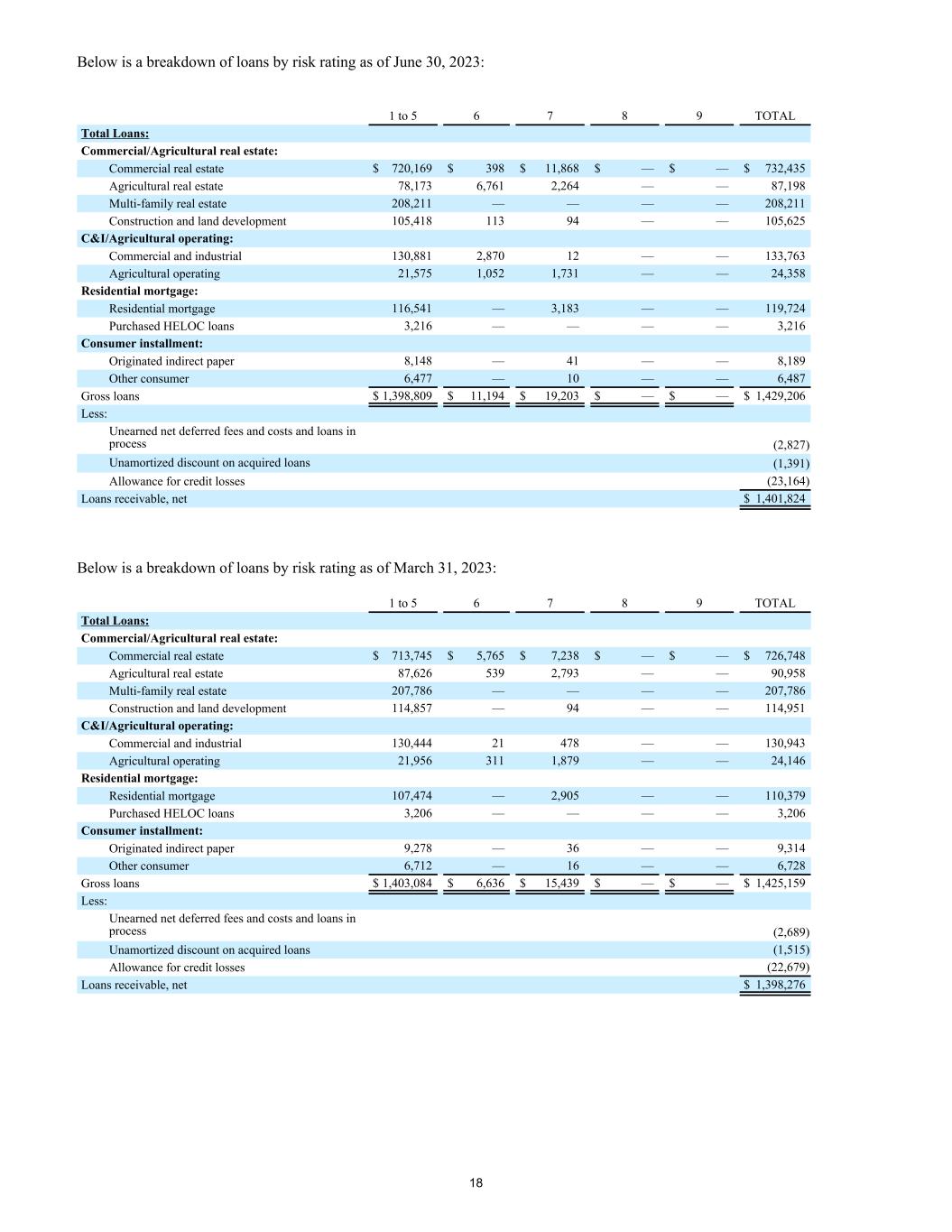

Credit Quality/Risk Ratings: Management utilizes a numeric risk rating system to identify and quantify the Bank’s risk of loss within its loan portfolio. Ratings are initially assigned prior to funding the loan, and may be changed at any time as circumstances warrant. Ratings range from the highest to lowest quality based on factors that include measurements of ability to pay, collateral type and value, borrower stability and management experience. The Bank’s loan portfolio is presented below in accordance with the risk rating framework that has been commonly adopted by the federal banking agencies. The definitions of the various risk rating categories are as follows: 1 through 4 - Pass. A “Pass” loan means that the condition of the borrower and the performance of the loan is satisfactory or better. 5 - Watch. A “Watch” loan has clearly identifiable developing weaknesses that deserve additional attention from management. Weaknesses that are not corrected or mitigated, may jeopardize the ability of the borrower to repay the loan in the future. 6 - Special Mention. A “Special Mention” loan has one or more potential weakness that deserve management’s close attention. If left uncorrected, these potential weaknesses may result in deterioration of the repayment prospects for the loan or in the institution’s credit position in the future. 7 - Substandard. A “Substandard” loan is inadequately protected by the current net worth and paying capacity of the obligor or the collateral pledged, if any. Assets classified as substandard must have a well-defined weakness, or weaknesses, that jeopardize the liquidation of the debt. They are characterized by the distinct possibility that the Bank will sustain some loss if the deficiencies are not corrected. 8 - Doubtful. A “Doubtful” loan has all the weaknesses inherent in a Substandard loan with the added characteristic that the weaknesses make collection or liquidation in full, on the basis of currently existing facts, conditions and values, highly questionable and improbable. 9 - Loss. Loans classified as “Loss” are considered uncollectible, and their continuance as bankable assets is not warranted. This classification does not mean that the loan has absolutely no recovery or salvage value, and a partial recovery may occur in the future. 17

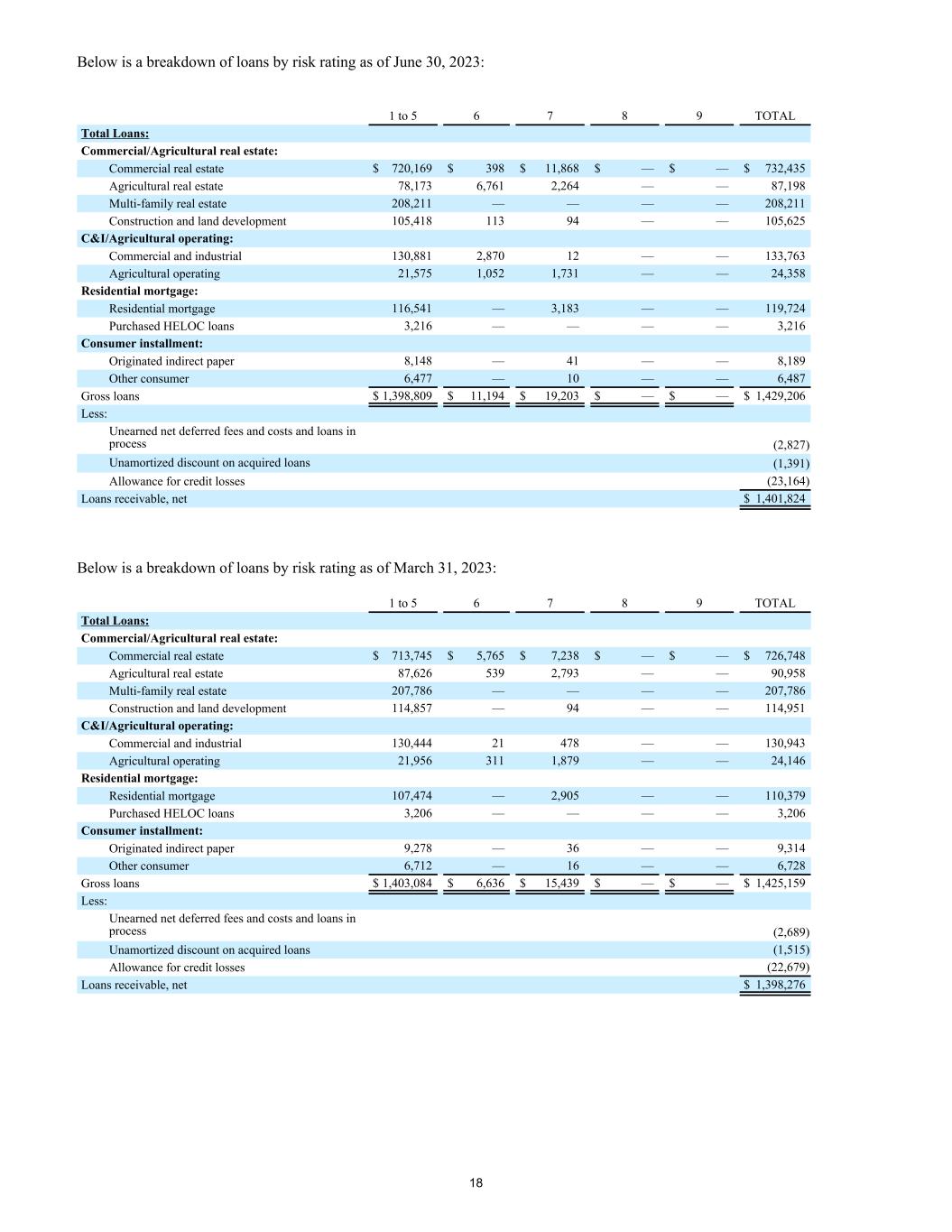

Below is a breakdown of loans by risk rating as of June 30, 2023: 1 to 5 6 7 8 9 TOTAL Total Loans: Commercial/Agricultural real estate: Commercial real estate $ 720,169 $ 398 $ 11,868 $ — $ — $ 732,435 Agricultural real estate 78,173 6,761 2,264 — — 87,198 Multi-family real estate 208,211 — — — — 208,211 Construction and land development 105,418 113 94 — — 105,625 C&I/Agricultural operating: Commercial and industrial 130,881 2,870 12 — — 133,763 Agricultural operating 21,575 1,052 1,731 — — 24,358 Residential mortgage: Residential mortgage 116,541 — 3,183 — — 119,724 Purchased HELOC loans 3,216 — — — — 3,216 Consumer installment: Originated indirect paper 8,148 — 41 — — 8,189 Other consumer 6,477 — 10 — — 6,487 Gross loans $ 1,398,809 $ 11,194 $ 19,203 $ — $ — $ 1,429,206 Less: Unearned net deferred fees and costs and loans in process (2,827) Unamortized discount on acquired loans (1,391) Allowance for credit losses (23,164) Loans receivable, net $ 1,401,824 Below is a breakdown of loans by risk rating as of March 31, 2023: 1 to 5 6 7 8 9 TOTAL Total Loans: Commercial/Agricultural real estate: Commercial real estate $ 713,745 $ 5,765 $ 7,238 $ — $ — $ 726,748 Agricultural real estate 87,626 539 2,793 — — 90,958 Multi-family real estate 207,786 — — — — 207,786 Construction and land development 114,857 — 94 — — 114,951 C&I/Agricultural operating: Commercial and industrial 130,444 21 478 — — 130,943 Agricultural operating 21,956 311 1,879 — — 24,146 Residential mortgage: Residential mortgage 107,474 — 2,905 — — 110,379 Purchased HELOC loans 3,206 — — — — 3,206 Consumer installment: Originated indirect paper 9,278 — 36 — — 9,314 Other consumer 6,712 — 16 — — 6,728 Gross loans $ 1,403,084 $ 6,636 $ 15,439 $ — $ — $ 1,425,159 Less: Unearned net deferred fees and costs and loans in process (2,689) Unamortized discount on acquired loans (1,515) Allowance for credit losses (22,679) Loans receivable, net $ 1,398,276 18

Below is a breakdown of loans by risk rating as of December 31, 2022: 1 to 5 6 7 8 9 TOTAL Total Loans: Commercial/Agricultural real estate: Commercial real estate $ 712,658 $ 5,771 $ 7,542 $ — $ — $ 725,971 Agricultural real estate 84,215 549 3,144 — — 87,908 Multi-family real estate 208,908 — — — — 208,908 Construction and land development 102,385 — 107 — — 102,492 C&I/Agricultural operating: Commercial and industrial 129,748 5,526 739 — — 136,013 Agricultural operating 26,418 324 2,064 — — 28,806 Residential mortgage: Residential mortgage 101,730 — 3,659 — — 105,389 Purchased HELOC loans 3,262 — — — — 3,262 Consumer installment: Originated indirect paper 10,190 — 46 — — 10,236 Other consumer 7,132 — 18 — — 7,150 Gross loans $ 1,386,646 $ 12,170 $ 17,319 $ — $ — $ 1,416,135 Less: Unearned net deferred fees and costs and loans in process (2,585) Unamortized discount on acquired loans (1,766) Allowance for loan losses (17,939) Loans receivable, net $ 1,393,845 Below is a breakdown of loans by risk rating as of June 30, 2022: 1 to 5 6 7 8 9 TOTAL Total Loans: Commercial/Agricultural real estate: Commercial real estate $ 688,219 $ 6,084 $ 8,614 $ — $ — $ 702,917 Agricultural real estate 72,963 406 4,438 — — 77,807 Multi-family real estate 179,649 280 — — — 179,929 Construction and land development 115,009 — 179 — — 115,188 C&I/Agricultural operating: Commercial and industrial 126,818 10,452 1,732 — — 139,002 Agricultural operating 22,355 52 2,062 — — 24,469 Residential mortgage: Residential mortgage 85,064 — 3,511 — — 88,575 Purchased HELOC loans 3,419 — — — — 3,419 Consumer installment: Originated indirect paper 12,651 — 85 — — 12,736 Other consumer 7,726 — 59 — — 7,785 Gross loans $ 1,313,873 $ 17,274 $ 20,680 $ — $ — $ 1,351,827 Less: Unearned net deferred fees and costs and loans in process (2,338) Unamortized discount on acquired loans (2,634) Allowance for loan losses (16,825) Loans receivable, net $ 1,330,030 19

Allowance for Credit Losses - Loans (in thousand, except ratios) June 30, 2023 and Three Months Ended March 31, 2023 and Three Months Ended December 31, 2022 and Three Months Ended June 30, 2022 and Three Months Ended Allowance for Credit Losses (“ACL”) ACL - Loans, at beginning of period $ 22,679 $ 17,939 $ 17,217 $ 16,818 Cumulative effect of ASU 2016-13 adoption — 4,706 — Loans charged off: Commercial/Agricultural real estate (14) (32) — (122) C&I/Agricultural operating — — (36) (247) Residential mortgage (10) (14) — (56) Consumer installment (16) (11) (14) (16) Total loans charged off (40) (57) (50) (441) Recoveries of loans previously charged off: Commercial/Agricultural real estate 27 3 62 3 C&I/Agricultural operating 16 15 8 9 Residential mortgage 36 4 — 25 Consumer installment 10 12 2 11 Total recoveries of loans previously charged off: 89 34 72 48 Net loan recoveries/(charge-offs) (“NCOs”) 49 (23) 22 (393) Additions to ACL - Loans via provision for credit losses charged to operations 436 57 700 400 ACL - Loans, at end of period $ 23,164 $ 22,679 $ 17,939 $ 16,825 Average outstanding loan balance $ 1,414,925 $ 1,421,096 $ 1,399,244 $ 1,328,661 Ratios: NCOs (annualized) to average loans (0.01) % 0.01 % (0.01) % 0.12 % Allowance for Credit Losses - Unfunded Commitments: (in thousands) In addition to the ACL - Loans, the Company has established an ACL - Unfunded Commitments of $1,544 at June 30, 2023 and $0 at December 31, 2022, classified in other liabilities on the consolidated balance sheets. June 30, 2023 and Three Months Ended March 31, 2023 and Three Months Ended December 31, 2022 and Three Months Ended June 30, 2022 and Three Months Ended ACL - Unfunded commitments - beginning of period $ 1,530 $ — $ — $ — Cumulative effect of ASU 2016-13 adoption — 1,537 — — Additions (reductions) to ACL - Unfunded commitments via provision for credit losses charged to operations 14 (7) — — ACL - Unfunded commitments - End of period $ 1,544 $ 1,530 $ — $ — 20

Delinquency Detail (in thousands) 30-59 Days Past Due and Accruing 60-89 Days Past Due and Accruing Greater Than 89 Days Past Due and Accruing Total Past Due and Accruing Nonaccrual Loans Total Past Due Accruing and Nonaccrual Loans Current Total Loans June 30, 2023 (1) Commercial/Agricultural real estate: Commercial real estate $ 127 $ — $ — $ 127 $ 11,359 $ 11,486 $ 718,905 $ 730,391 Agricultural real estate — — — — 1,712 1,712 85,247 86,959 Multi-family real estate — — — — — — 208,109 208,109 Construction and land development — — — — 94 94 104,797 104,891 C&I/Agricultural operating: Commercial and industrial — — — — 4 4 133,244 133,248 Agricultural operating 15 — — 15 1,436 1,451 22,930 24,381 Residential mortgage: Residential mortgage 973 757 492 2,222 1,029 3,251 115,867 119,118 Purchased HELOC loans 456 — — 456 — 456 2,760 3,216 Consumer installment: Originated indirect paper 17 — — 17 27 44 8,145 8,189 Other consumer 20 6 — 26 2 28 6,458 6,486 Total $ 1,608 $ 763 $ 492 $ 2,863 $ 15,663 $ 18,526 $ 1,406,462 $ 1,424,988 March 31, 2023 (1) Commercial/Agricultural real estate: Commercial real estate $ 684 $ — $ — $ 684 $ 5,514 $ 6,198 $ 718,487 $ 724,685 Agricultural real estate — — — — 2,496 2,496 88,210 90,706 Multi-family real estate — — — — — — 207,686 207,686 Construction and land development 94 — — 94 — 94 114,194 114,288 C&I/Agricultural operating: Commercial and industrial — — — — 452 452 129,965 130,417 Agricultural operating 15 — — 15 794 809 23,359 24,168 Residential mortgage: Residential mortgage 1,313 160 221 1,694 1,131 2,825 106,934 109,759 Purchased HELOC loans — — — — — — 3,206 3,206 Consumer installment: Originated indirect paper 24 — — 24 21 45 9,268 9,313 Other consumer 24 2 3 29 2 31 6,696 6,727 Total $ 2,154 $ 162 $ 224 $ 2,540 $ 10,410 $ 12,950 $ 1,408,005 $ 1,420,955 (1) Current year balances are at amortized cost. 21

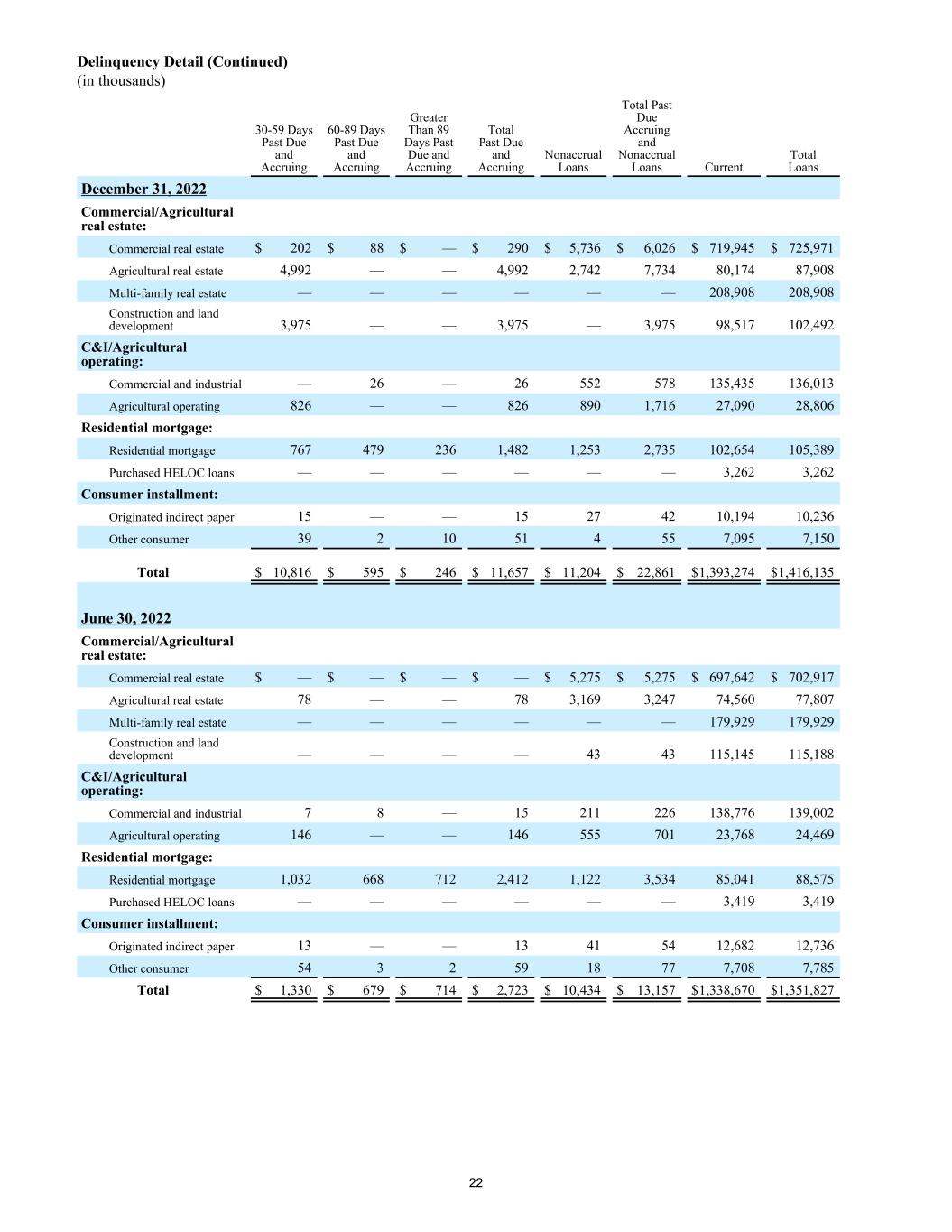

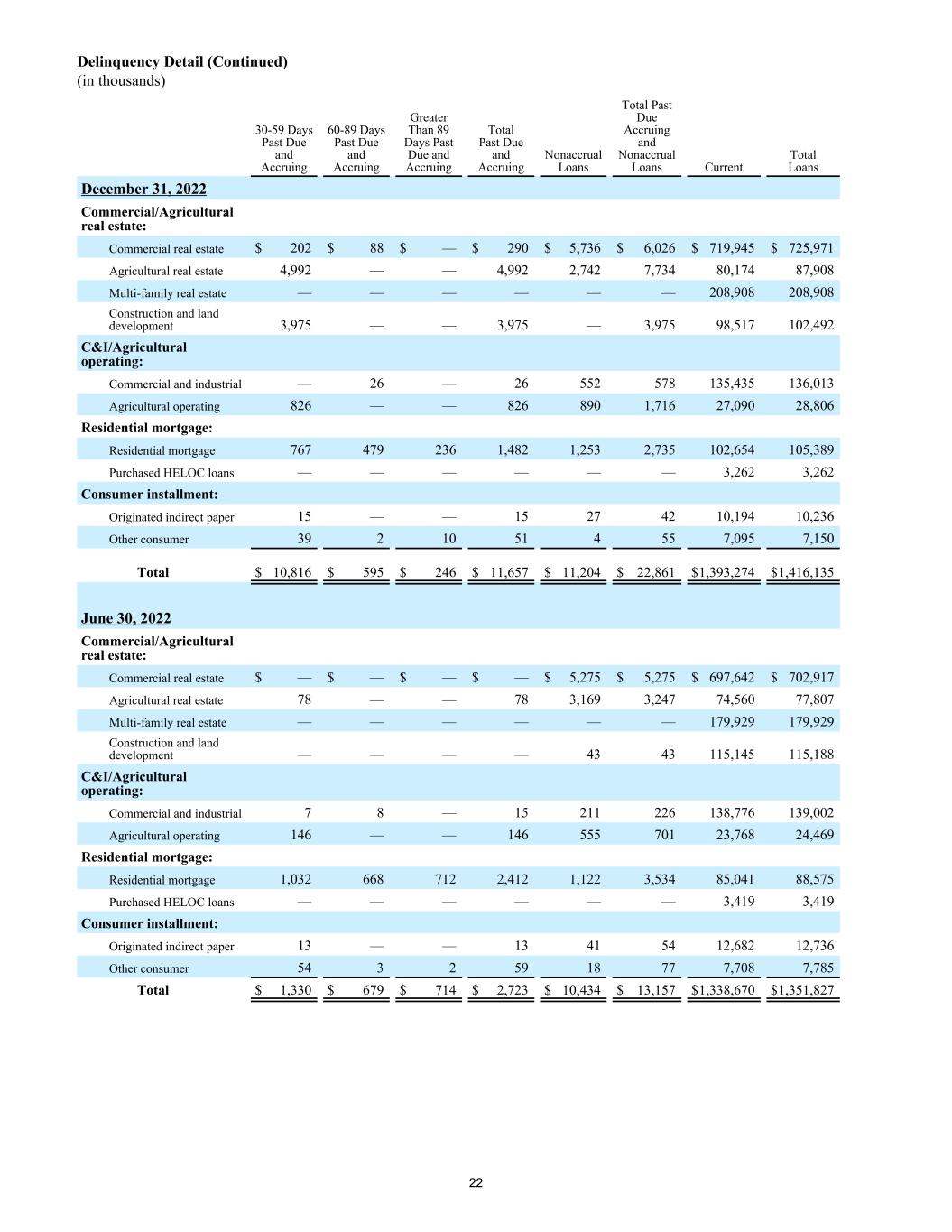

Delinquency Detail (Continued) (in thousands) 30-59 Days Past Due and Accruing 60-89 Days Past Due and Accruing Greater Than 89 Days Past Due and Accruing Total Past Due and Accruing Nonaccrual Loans Total Past Due Accruing and Nonaccrual Loans Current Total Loans December 31, 2022 Commercial/Agricultural real estate: Commercial real estate $ 202 $ 88 $ — $ 290 $ 5,736 $ 6,026 $ 719,945 $ 725,971 Agricultural real estate 4,992 — — 4,992 2,742 7,734 80,174 87,908 Multi-family real estate — — — — — — 208,908 208,908 Construction and land development 3,975 — — 3,975 — 3,975 98,517 102,492 C&I/Agricultural operating: Commercial and industrial — 26 — 26 552 578 135,435 136,013 Agricultural operating 826 — — 826 890 1,716 27,090 28,806 Residential mortgage: Residential mortgage 767 479 236 1,482 1,253 2,735 102,654 105,389 Purchased HELOC loans — — — — — — 3,262 3,262 Consumer installment: Originated indirect paper 15 — — 15 27 42 10,194 10,236 Other consumer 39 2 10 51 4 55 7,095 7,150 Total $ 10,816 $ 595 $ 246 $ 11,657 $ 11,204 $ 22,861 $ 1,393,274 $ 1,416,135 June 30, 2022 Commercial/Agricultural real estate: Commercial real estate $ — $ — $ — $ — $ 5,275 $ 5,275 $ 697,642 $ 702,917 Agricultural real estate 78 — — 78 3,169 3,247 74,560 77,807 Multi-family real estate — — — — — — 179,929 179,929 Construction and land development — — — — 43 43 115,145 115,188 C&I/Agricultural operating: Commercial and industrial 7 8 — 15 211 226 138,776 139,002 Agricultural operating 146 — — 146 555 701 23,768 24,469 Residential mortgage: Residential mortgage 1,032 668 712 2,412 1,122 3,534 85,041 88,575 Purchased HELOC loans — — — — — — 3,419 3,419 Consumer installment: Originated indirect paper 13 — — 13 41 54 12,682 12,736 Other consumer 54 3 2 59 18 77 7,708 7,785 Total $ 1,330 $ 679 $ 714 $ 2,723 $ 10,434 $ 13,157 $ 1,338,670 $ 1,351,827 22

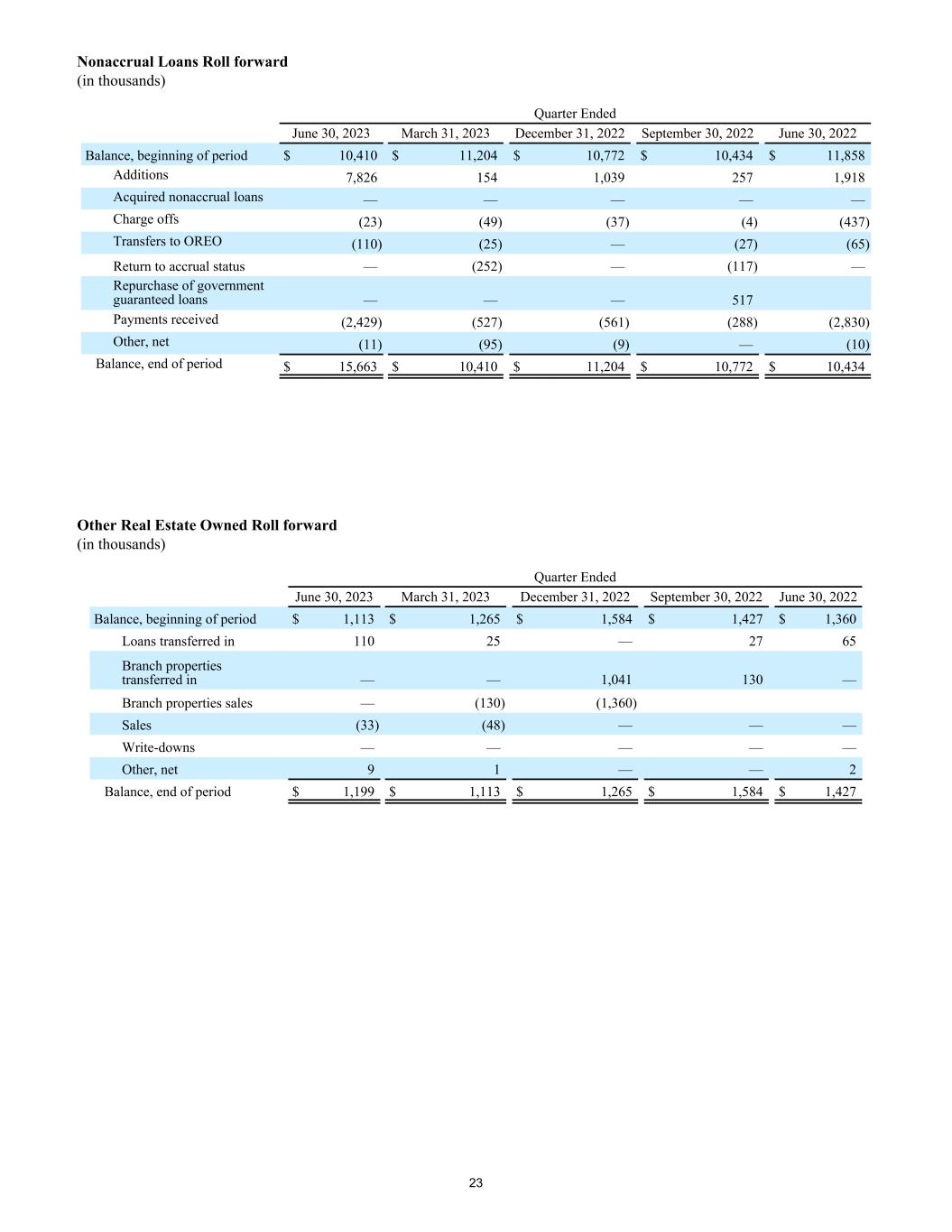

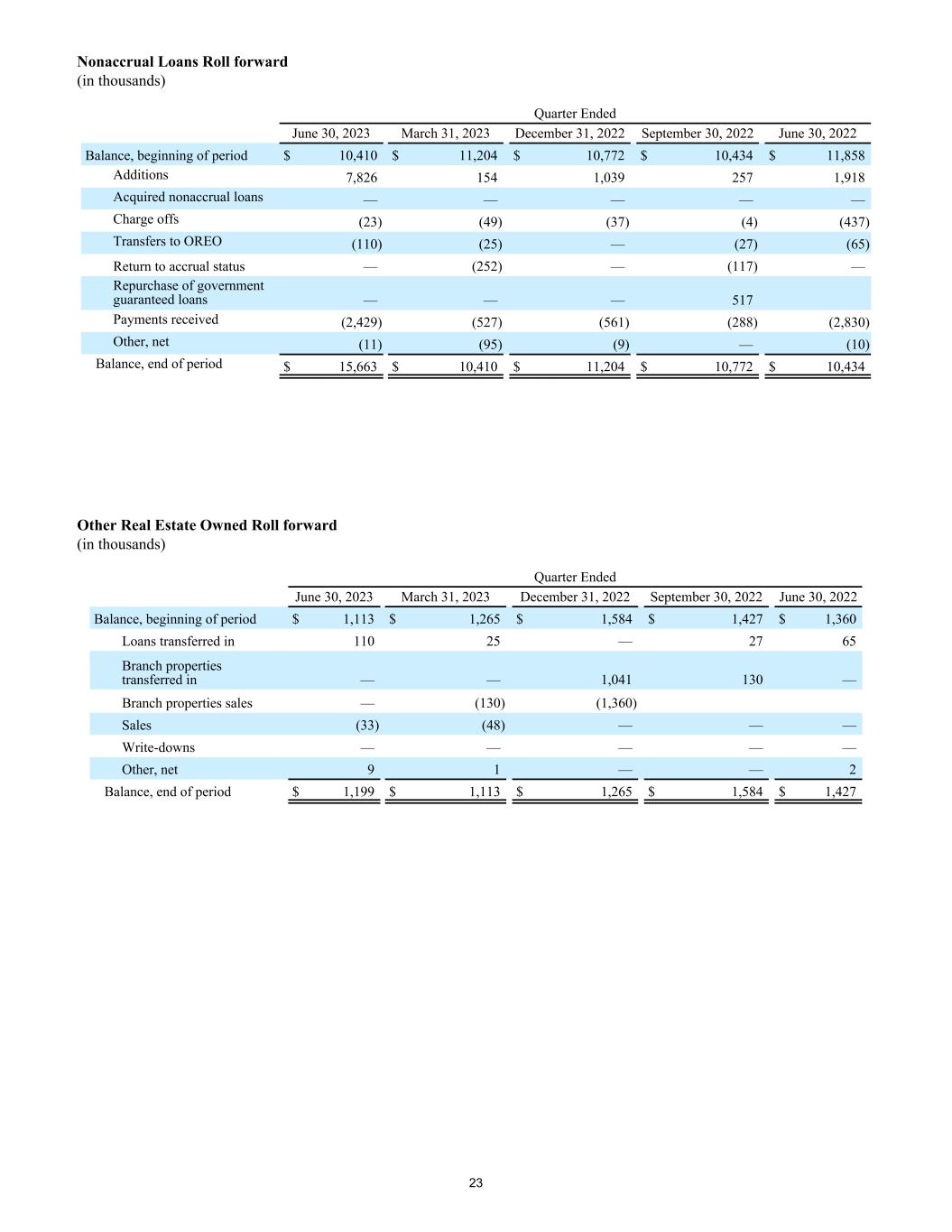

Nonaccrual Loans Roll forward (in thousands) Quarter Ended June 30, 2023 March 31, 2023 December 31, 2022 September 30, 2022 June 30, 2022 Balance, beginning of period $ 10,410 $ 11,204 $ 10,772 $ 10,434 $ 11,858 Additions 7,826 154 1,039 257 1,918 Acquired nonaccrual loans — — — — — Charge offs (23) (49) (37) (4) (437) Transfers to OREO (110) (25) — (27) (65) Return to accrual status — (252) — (117) — Repurchase of government guaranteed loans — — — 517 Payments received (2,429) (527) (561) (288) (2,830) Other, net (11) (95) (9) — (10) Balance, end of period $ 15,663 $ 10,410 $ 11,204 $ 10,772 $ 10,434 Other Real Estate Owned Roll forward (in thousands) Quarter Ended June 30, 2023 March 31, 2023 December 31, 2022 September 30, 2022 June 30, 2022 Balance, beginning of period $ 1,113 $ 1,265 $ 1,584 $ 1,427 $ 1,360 Loans transferred in 110 25 — 27 65 Branch properties transferred in — — 1,041 130 — Branch properties sales — (130) (1,360) Sales (33) (48) — — — Write-downs — — — — — Other, net 9 1 — — 2 Balance, end of period $ 1,199 $ 1,113 $ 1,265 $ 1,584 $ 1,427 23

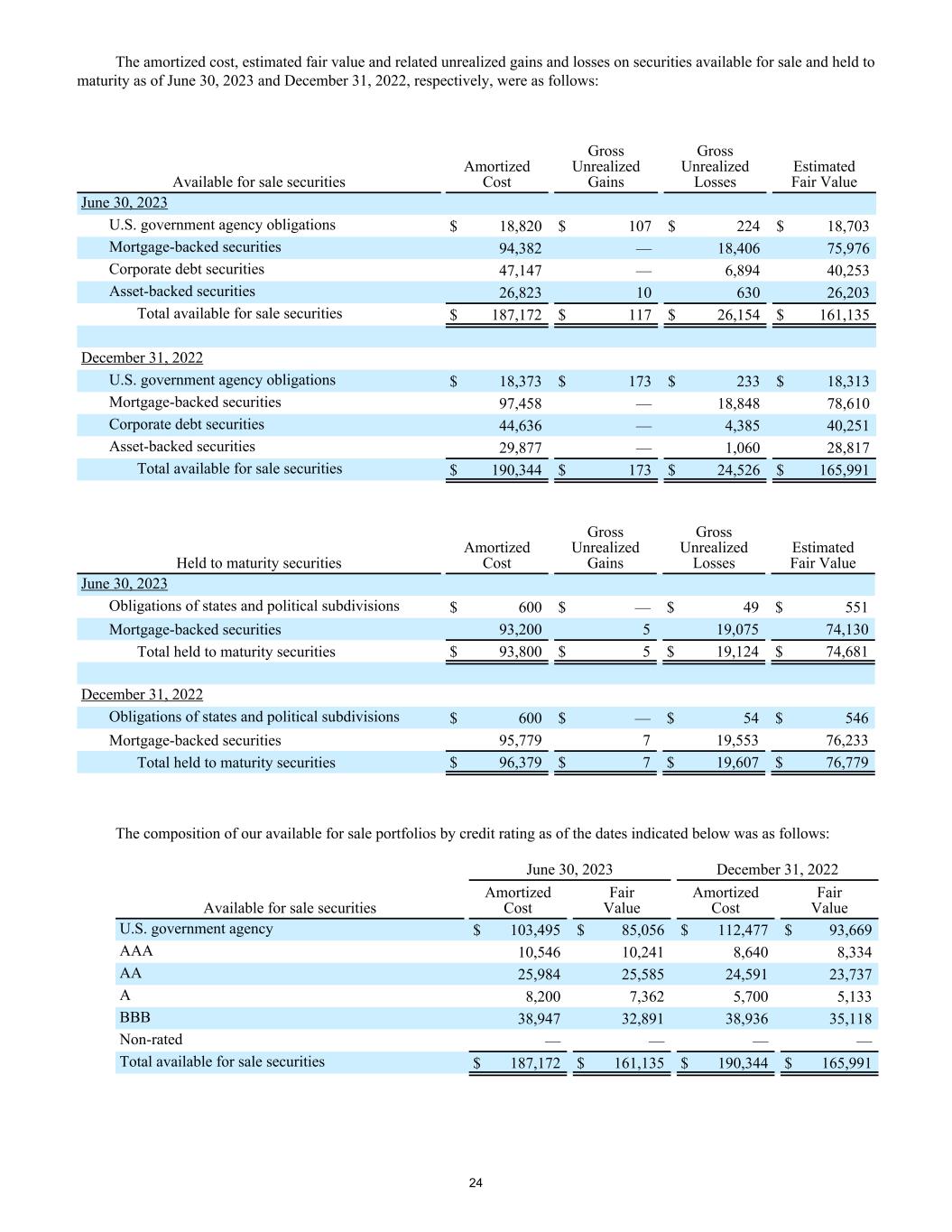

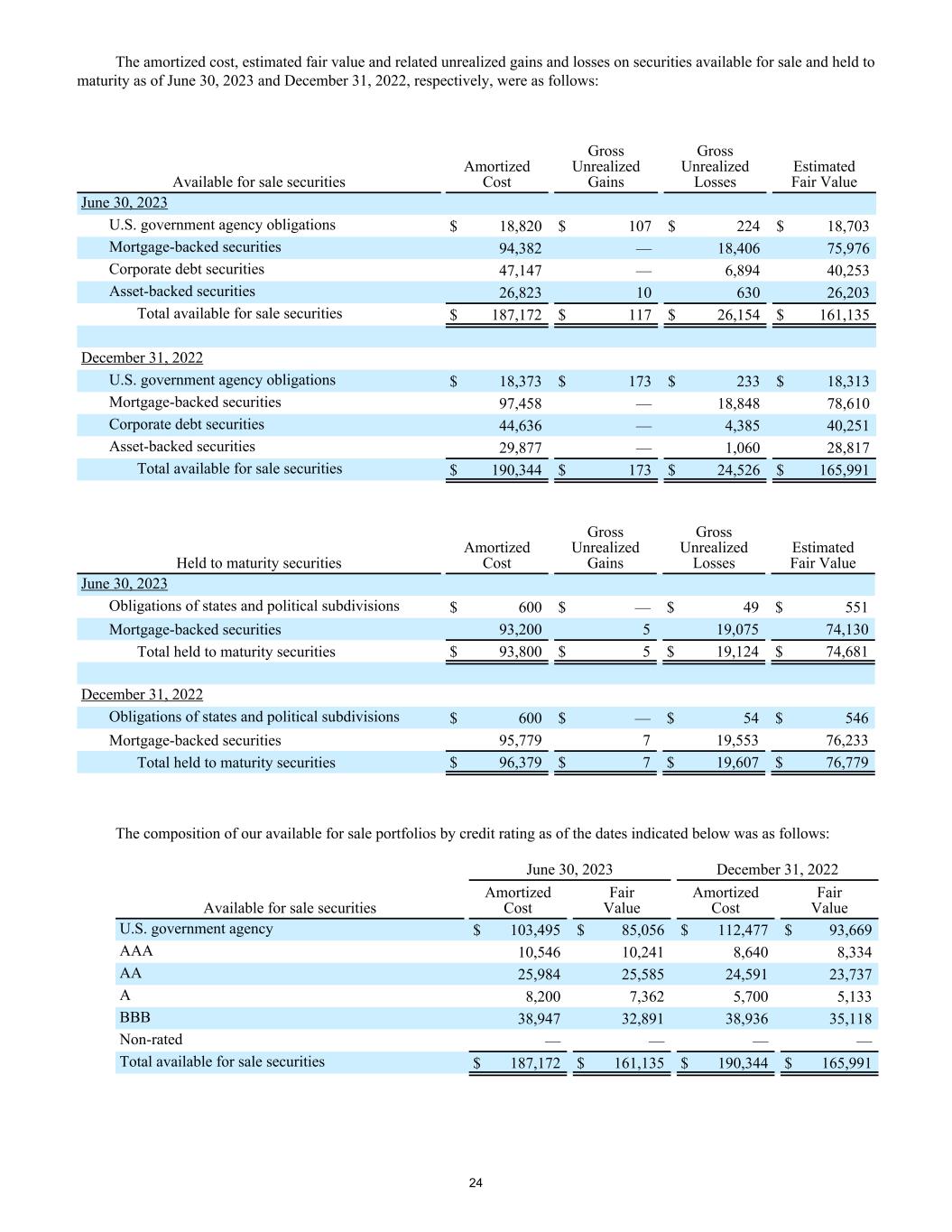

The amortized cost, estimated fair value and related unrealized gains and losses on securities available for sale and held to maturity as of June 30, 2023 and December 31, 2022, respectively, were as follows: Available for sale securities Amortized Cost Gross Unrealized Gains Gross Unrealized Losses Estimated Fair Value June 30, 2023 U.S. government agency obligations $ 18,820 $ 107 $ 224 $ 18,703 Mortgage-backed securities 94,382 — 18,406 75,976 Corporate debt securities 47,147 — 6,894 40,253 Asset-backed securities 26,823 10 630 26,203 Total available for sale securities $ 187,172 $ 117 $ 26,154 $ 161,135 December 31, 2022 U.S. government agency obligations $ 18,373 $ 173 $ 233 $ 18,313 Mortgage-backed securities 97,458 — 18,848 78,610 Corporate debt securities 44,636 — 4,385 40,251 Asset-backed securities 29,877 — 1,060 28,817 Total available for sale securities $ 190,344 $ 173 $ 24,526 $ 165,991 Held to maturity securities Amortized Cost Gross Unrealized Gains Gross Unrealized Losses Estimated Fair Value June 30, 2023 Obligations of states and political subdivisions $ 600 $ — $ 49 $ 551 Mortgage-backed securities 93,200 5 19,075 74,130 Total held to maturity securities $ 93,800 $ 5 $ 19,124 $ 74,681 December 31, 2022 Obligations of states and political subdivisions $ 600 $ — $ 54 $ 546 Mortgage-backed securities 95,779 7 19,553 76,233 Total held to maturity securities $ 96,379 $ 7 $ 19,607 $ 76,779 The composition of our available for sale portfolios by credit rating as of the dates indicated below was as follows: June 30, 2023 December 31, 2022 Available for sale securities Amortized Cost Fair Value Amortized Cost Fair Value U.S. government agency $ 103,495 $ 85,056 $ 112,477 $ 93,669 AAA 10,546 10,241 8,640 8,334 AA 25,984 25,585 24,591 23,737 A 8,200 7,362 5,700 5,133 BBB 38,947 32,891 38,936 35,118 Non-rated — — — — Total available for sale securities $ 187,172 $ 161,135 $ 190,344 $ 165,991 24

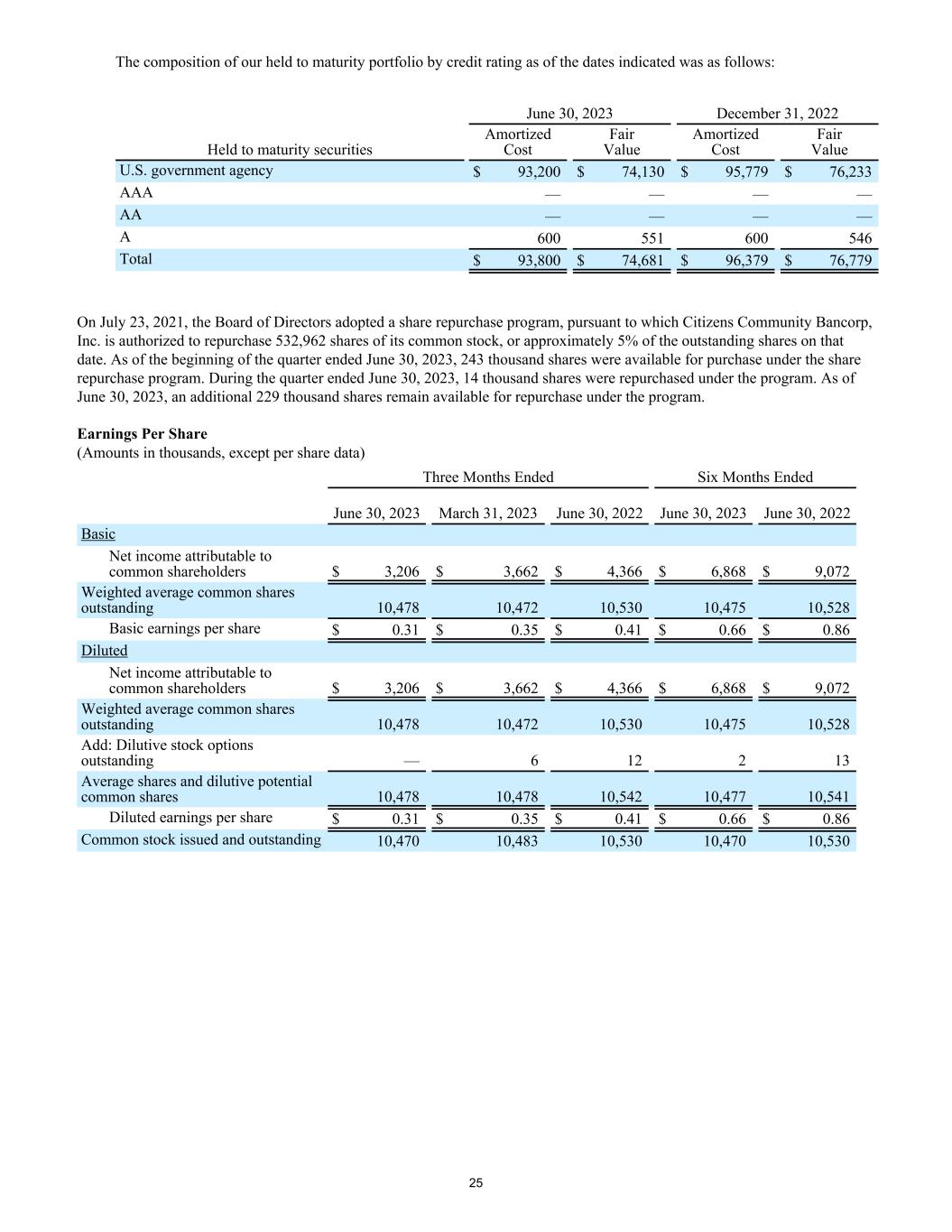

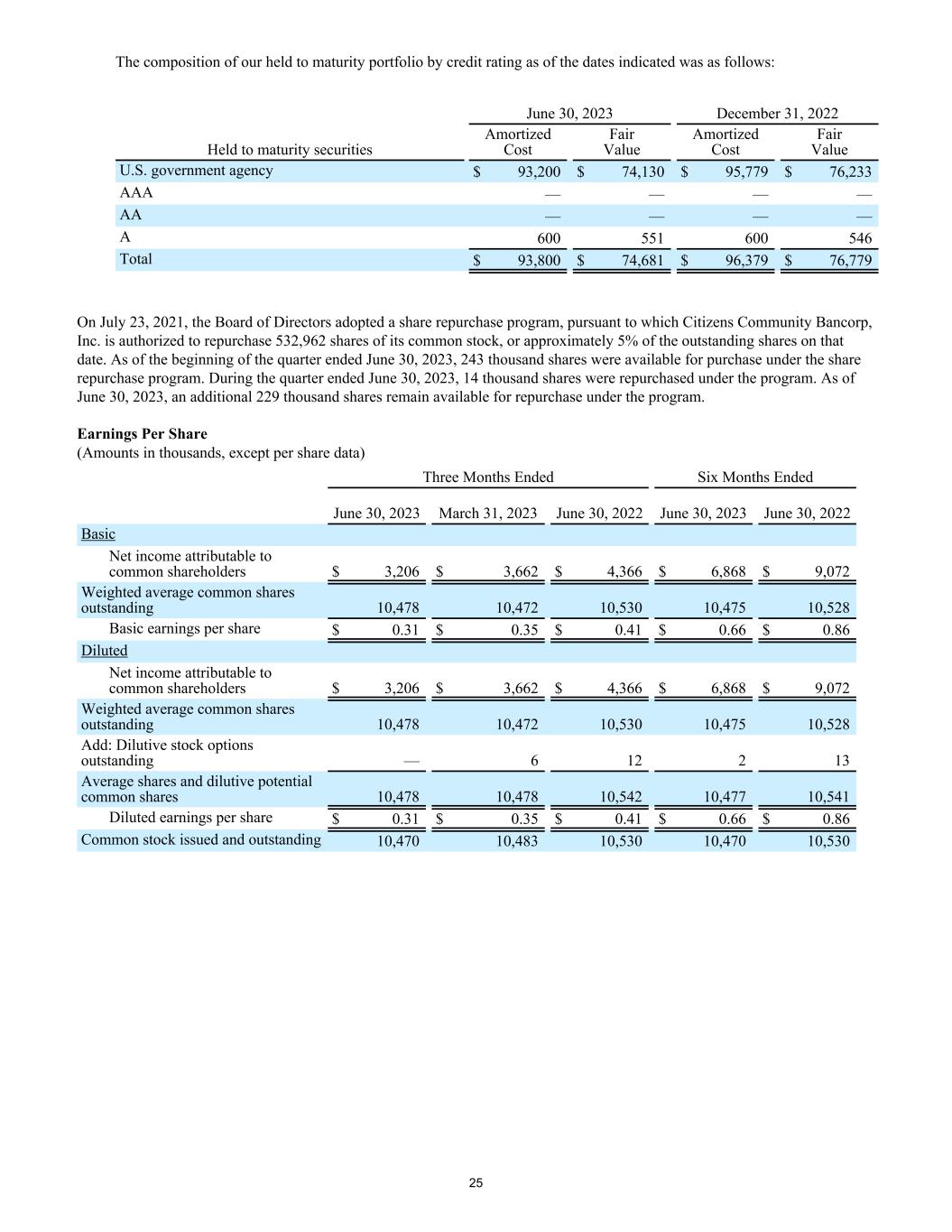

The composition of our held to maturity portfolio by credit rating as of the dates indicated was as follows: June 30, 2023 December 31, 2022 Held to maturity securities Amortized Cost Fair Value Amortized Cost Fair Value U.S. government agency $ 93,200 $ 74,130 $ 95,779 $ 76,233 AAA — — — — AA — — — — A 600 551 600 546 Total $ 93,800 $ 74,681 $ 96,379 $ 76,779 On July 23, 2021, the Board of Directors adopted a share repurchase program, pursuant to which Citizens Community Bancorp, Inc. is authorized to repurchase 532,962 shares of its common stock, or approximately 5% of the outstanding shares on that date. As of the beginning of the quarter ended June 30, 2023, 243 thousand shares were available for purchase under the share repurchase program. During the quarter ended June 30, 2023, 14 thousand shares were repurchased under the program. As of June 30, 2023, an additional 229 thousand shares remain available for repurchase under the program. Earnings Per Share (Amounts in thousands, except per share data) Three Months Ended Six Months Ended June 30, 2023 March 31, 2023 June 30, 2022 June 30, 2023 June 30, 2022 Basic Net income attributable to common shareholders $ 3,206 $ 3,662 $ 4,366 $ 6,868 $ 9,072 Weighted average common shares outstanding 10,478 10,472 10,530 10,475 10,528 Basic earnings per share $ 0.31 $ 0.35 $ 0.41 $ 0.66 $ 0.86 Diluted Net income attributable to common shareholders $ 3,206 $ 3,662 $ 4,366 $ 6,868 $ 9,072 Weighted average common shares outstanding 10,478 10,472 10,530 10,475 10,528 Add: Dilutive stock options outstanding — 6 12 2 13 Average shares and dilutive potential common shares 10,478 10,478 10,542 10,477 10,541 Diluted earnings per share $ 0.31 $ 0.35 $ 0.41 $ 0.66 $ 0.86 Common stock issued and outstanding 10,470 10,483 10,530 10,470 10,530 25

Economic Value of Equity Percent Change in Economic Value of Equity (EVE) Change in Interest Rates in Basis Points (“bp”) Rate Shock in Rates (1) At June 30, 2023 At December 31, 2022 +300 bp (3) % 0 % +200 bp (2) % 0 % +100 bp (1) % 0 % -100 bp 1 % (1) % -200 bp 1 % (4) % Net Interest Income Over One Year Horizon Percent Change in Net Interest Income Over One Year Horizon Change in Interest Rates in Basis Points (“bp”) Rate Shock in Rates (1) At June 30, 2023 At December 31, 2022 +300 bp (7) % (3) % +200 bp (4) % (2) % +100 bp (2) % (1) % -100 bp 2 % 1 % -200 bp 3 % 2 % 26

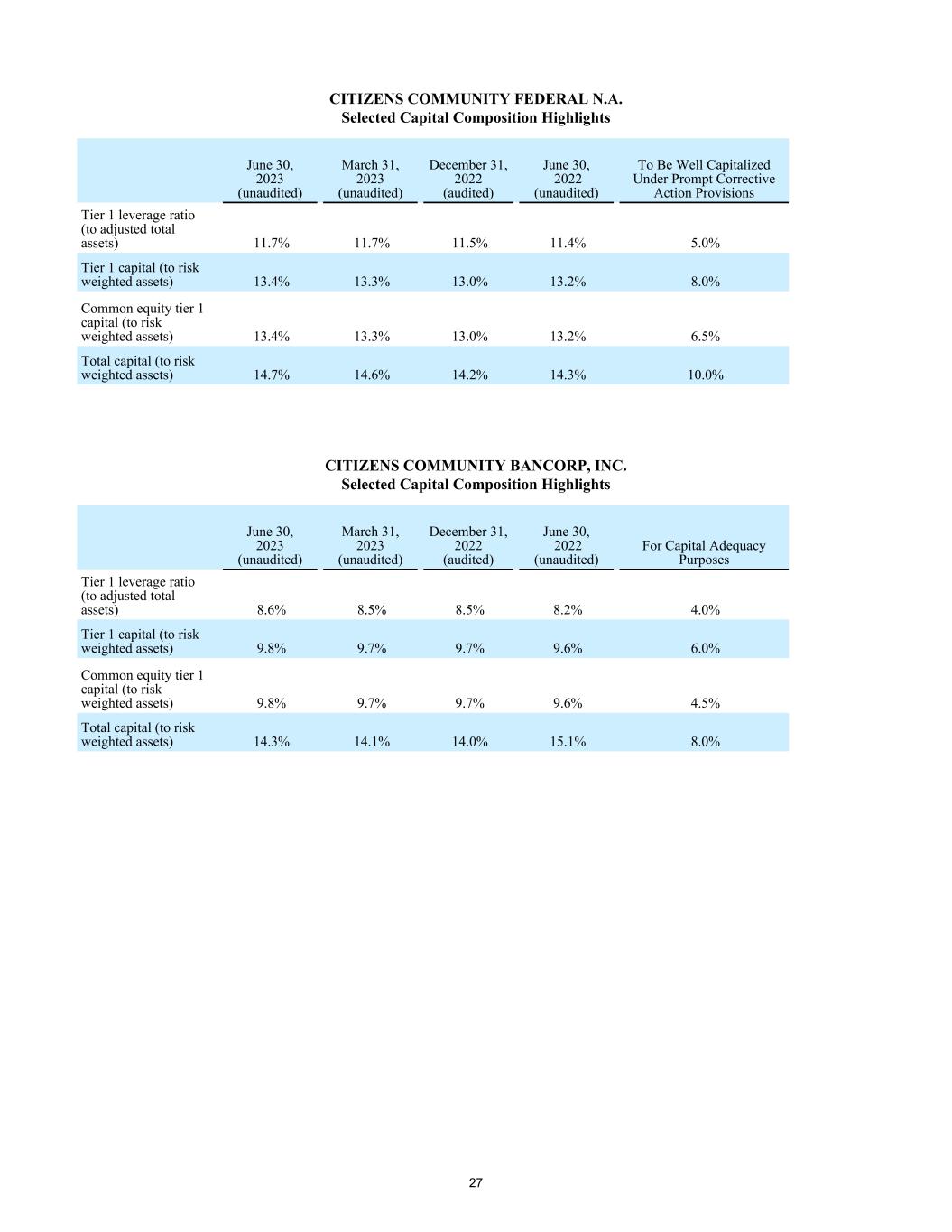

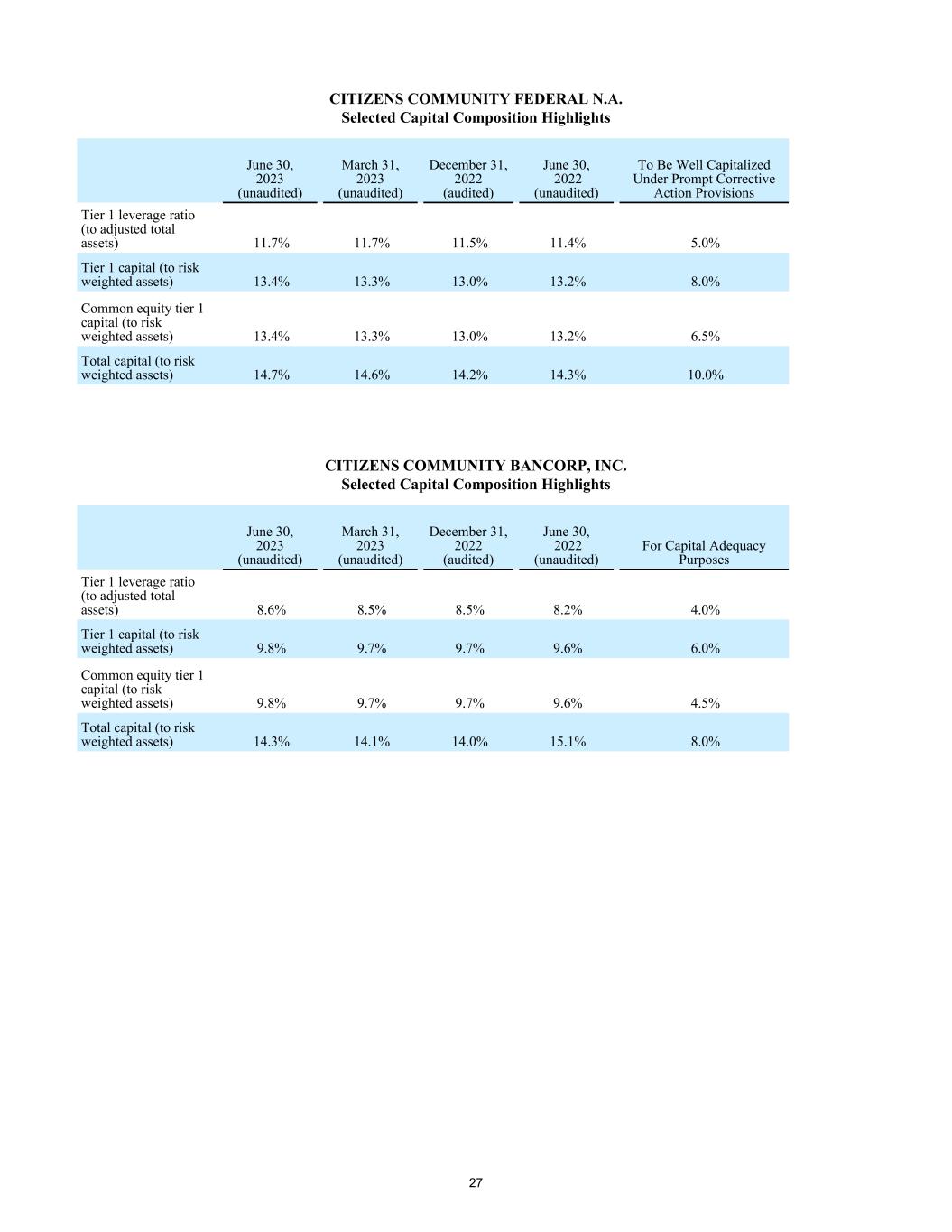

CITIZENS COMMUNITY FEDERAL N.A. Selected Capital Composition Highlights June 30, 2023 (unaudited) March 31, 2023 (unaudited) December 31, 2022 (audited) June 30, 2022 (unaudited) To Be Well Capitalized Under Prompt Corrective Action Provisions Tier 1 leverage ratio (to adjusted total assets) 11.7% 11.7% 11.5% 11.4% 5.0% Tier 1 capital (to risk weighted assets) 13.4% 13.3% 13.0% 13.2% 8.0% Common equity tier 1 capital (to risk weighted assets) 13.4% 13.3% 13.0% 13.2% 6.5% Total capital (to risk weighted assets) 14.7% 14.6% 14.2% 14.3% 10.0% CITIZENS COMMUNITY BANCORP, INC. Selected Capital Composition Highlights June 30, 2023 (unaudited) March 31, 2023 (unaudited) December 31, 2022 (audited) June 30, 2022 (unaudited) For Capital Adequacy Purposes Tier 1 leverage ratio (to adjusted total assets) 8.6% 8.5% 8.5% 8.2% 4.0% Tier 1 capital (to risk weighted assets) 9.8% 9.7% 9.7% 9.6% 6.0% Common equity tier 1 capital (to risk weighted assets) 9.8% 9.7% 9.7% 9.6% 4.5% Total capital (to risk weighted assets) 14.3% 14.1% 14.0% 15.1% 8.0% 27