May 2009

Cautionary Note About Forward-Looking Statements

Except for the historical information contained in this presentation (this “Presentation”), the

matters discussed in this Presentation or otherwise incorporated by reference into this

Presentation are “forward-looking statements.” Such forward-looking statements are made

pursuant to the safe-harbor provisions of the Private Securities Litigation Reform Act of 1995.

These statements can be identified by the use of forward-looking terminology such as “believes,”

“expects,” “may,” “will,” “should” or “anticipates” or comparable terminology, or by discussions

of strategy that involve risks and uncertainties. These forward-looking statements involve risks

and uncertainties, including those identified within the Company's Current Report on Form 8-K

filed with the U.S. Securities and Exchange Commission (the "SEC") on February 11, 2008 as well

as the Company's other filings with the SEC from time to time. Although the Company believes

the expectations reflected in such forward-looking statements are based on reasonable

assumptions, the Company cannot assure shareholders or investors that these expectations will

prove correct, and the actual results that the Company achieves may differ materially from any

forward-looking statements, due to such risks and uncertainties. These forward-looking

statements are based on current expectations, and the Company assumes no obligation to

update this information, except as required by law.

Agenda

I.

Overview

II.

Industry Overview

III.

Strategy Overview

IV.

Organizational Overview

V.

Financial Overview

Agenda

I.

Overview

II.

Industry Overview

III.

Strategy Overview

IV.

Organizational Overview

V.

Financial Overview

Overview

China’s expanding economy and surging domestic consumption is driving brands to increase

and speed up expansion into China

The expansion is driving rapidly increasing advertising spend in China as existing and new

brands compete for consumer attention

The Chinese market poses significant challenges to advertisers

Large consumer base but small as a percentage of the population

Consumer base, though large, is a small percentage of the population (roughly 10%)

Traditional television, outdoor and print media has become very expensive

The effective cost of most mass media advertising price a significant number of brands out of the

market

Advertisers looking for solutions that target the affluent and mass affluent consumer base

Legend Media’s business plan is pinned to the market trends and follows a simple two rule

approach

Secure the rights to advertising media that clearly targets the trends of the emerging affluent and

mass affluent

Any rights secured have to be low cost (undervalued by the market) thus building a high margin

business

1 “China Media Forecasts”, GroupM; Internal Conversion from RMB to US$

Overview

Legend Media has entered into two distinct sectors of the advertising industry that have overlying

connection – they target the mass affluent of China

Radio Advertising: part of the foundation of the Company and is the pivotal piece of the entire growth

strategy

Radio advertising in China is highly fragmented, underutilized and undervalued

Clearly targets car owners, a leading indicator of affluence

Largest radio listening audience in the world with over 394 million radio households

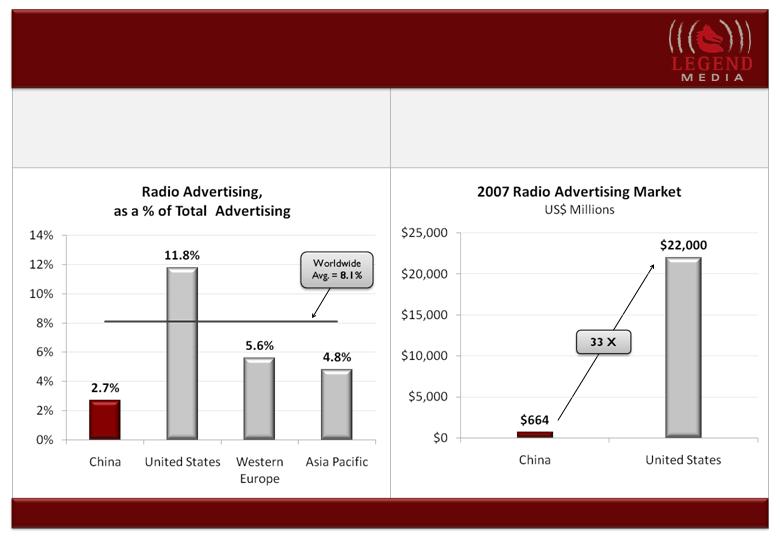

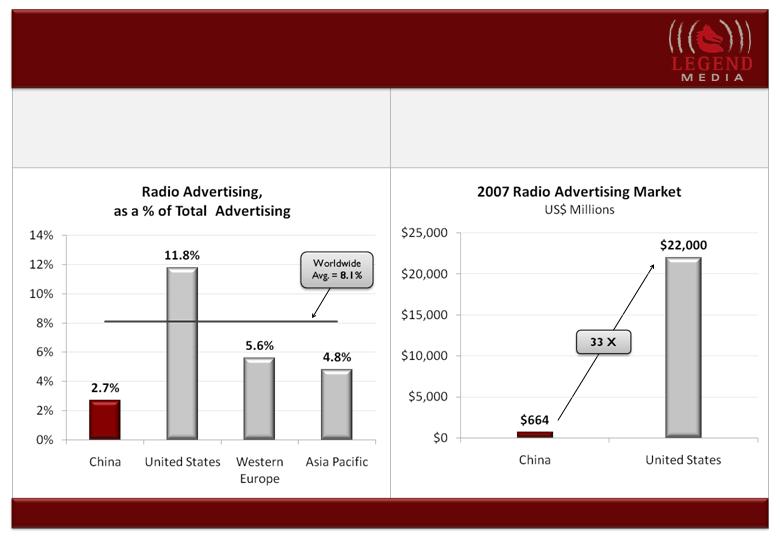

2.7% of China’s national advertising being spent on radio versus a worldwide average of 8.1% and a

US average 11.8%

China’s 2007 radio advertising spend hit US$ 646 million versus US$ 22 billion in the US

Legend Media is positioned to acquire large blocks of low cost radio advertising without the capital

typically associated with buying radio stations

Airline magazine advertising: targeted medium that fits with the Company’s strategy and compliments the

efforts made in radio

Travel is a leading predictor of affluence in China

The magazine provides an entry into to certain advertisers who are not aware of the value of radio

Limited inventory in the market has made it a far easier sale than radio

Current Radio Network

Xian

Beijing

Tianjin

Beijing FM90.5

News and entertainment; reaches

over 17 million

45,940 advertising minutes per year

Tianjin FM 92.5

Pop music; reaches over 10 million

19,710 advertising minutes per year

Xian FM 95.5

Pop Music; reaches over 8 million

19,710, advertising minutes per year.

Reaching 35 Million

and increasing

HNA Airline Group

80 pages of advertising per month

Copy at every seat of every flight

3 year exclusive agreement

Targets the affluent travelers in China

HNA Airline Group

11 airlines serving domestic and international routes

198 aircraft operating over 4,200 flights per week

15,000,000 passengers in 2006, over 17,000,000 in 2007

and over 20,000,000 in 2008

4th largest airline group in China

Airline Magazine

Plus:

International Routes to

Africa

Luanda, Angola

Asia

Astana, Kazakhstan

Osaka, Japan

Seoul, South Korea

Taipei, Taiwan

Bangkok, Thailand

Dubai, UAE

Europe

Brussels, Belgium

Berlin, Germany

Budapest, Hungary

Novosibirsk, Russia

St. Petersburg, Russia

North America

Seattle, WA, United States

Route Map

Premium Client Base

Agenda

I.

Company Overview

II.

Industry Overview

III.

Strategy Overview

IV.

Organizational Overview

V.

Financial Overview

Conducive Environment for Advertising

China’s…

Rapidly growing economy

15% CAGR from 2002 – 2007

14% CAGR from 2007 - 2012

Growing affluence and disposable income

3rd largest economy in the world; 2nd largest economy based on “purchasing power parity”

By 2015, there will be 27 million households in China earning over 100,000 RMB, growing to 41

million in 2025E

In 2006, China had 310,000 US$ millionaires, estimated to grow to 609,000 by 2011, the

world’s most

By 2011 there will be 16 million high net-worth individuals in China with $6.2 trillion in total

assets 1

Is resulting in…

Rapid increase of domestic consumption

Rapid increase in China advertising sales

1 “HSBC joins race to cash in on China's new millionaires “, Reuters March 31, 2008

Domestic Consumption Driving Advertising Boom

$ 1.5 trillion in 2008

21.6% growth in 2008

20% forecasted growth in

2009

No expectation of a

slowdown as the

government pushes for

retail sales expansion

China’s emergence as

fastest growing and

potentially largest retail

market in the world is

driving brands to shift

strategic focus towards

brand building in China

Source: National Bureau of Statistics of China, www.chinaview.cn

China’s Advertising Spend Rapidly Expanding

Expanding affluent and

middle class

2008 retail sales exceeded

$1.5 trillion

China’s economic policies

geared towards further

expansion of consumer

consumption

Brands looking to reach

largest consumer market in

the world

China has become the 2nd

largest advertising market

in the world behind the

United States and still has

not fully developed /

utilized their media assets

Source(s): Barboza, David ( July 20, 2008). “Western Olympic Ads Cheerlead for China”. NYTimes.com; GroupM (2008). “China Media Forecasts”, Internal Conversion from RMB to US$;

Radio Industry Overview

Forecasted fast growing radio advertising market `

Radio advertising is expected to grow 50.6% in 2008 and 33.4% in 2009

Underutilized Chinese radio advertising market

2.7% of China’s advertising is spent on radio vs. a worldwide average of 8.1% and a US average of 11.8%.

Low utilization rates

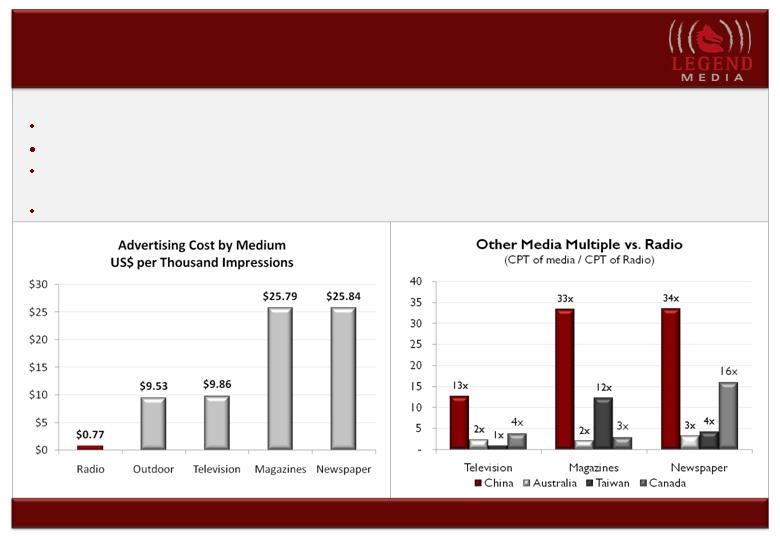

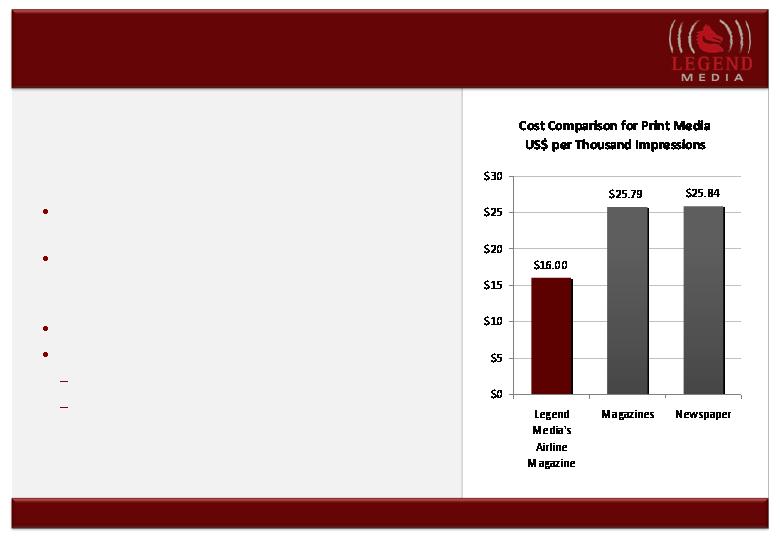

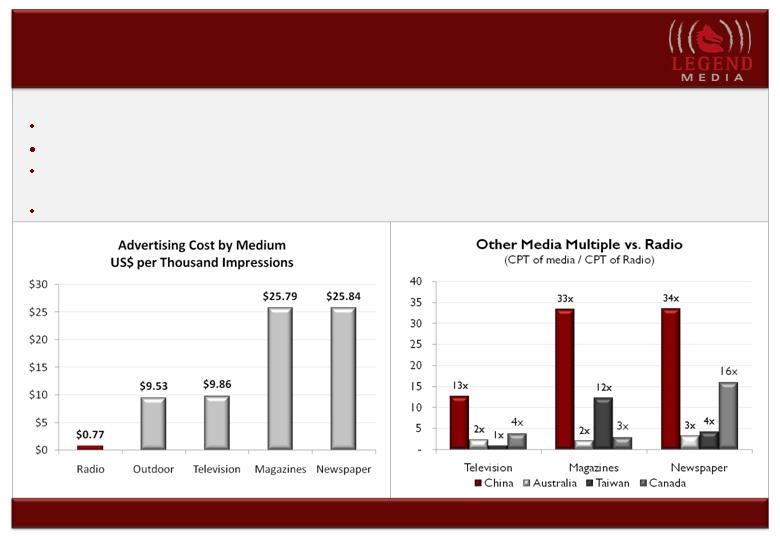

Most cost effective advertising method in China – radio advertising

China has the largest radio listening audience in the world with over 646 million radio audience.

Radio advertising is most cost effective: only $0.77 per thousand impressions in China vs. $9.53 for

outdoor, $9.86 for television, $25.79 for magazines, $25.84 for newspapers in China.

Low acquiring cost of radio advertising minutes

The forecasted average cost of acquiring radio advertising minutes is $22 per minute and the average

selling price is $193 per sold minute. Break even point is at 23.8% utilization rate.

Fragmented Chinese radio advertising market and low competition

China’s radio advertising market is undervalued and highly fragmented, yet has great growth potential

Legend Media is in the position to take an advantage of the fast growing yet fragmented radio advertising

market

Radio Advertising Still Developing

Recent and forecasted

growth rate outpacing

overall advertising growth

Expansion has come

without a market

consolidator / market

champion

Highly fragmented market

which until recently has

been overlooked as a

method to reach the

consumer base in China

Increasingly mobile

population increases value

of radio as TV hours reduce

China’s radio industry

poised for a renaissance

Source(s): GroupM (2008). “China Media Forecasts”, Internal Conversion from RMB to US$;

China’s Radio Advertising Underutilized

As a % of total advertising, China’s radio industry,

on average, trails the rest of the world

In 2007, the USA’s total advertising spend was 12

times larger than China’s while USA’s radio

advertising was 33 times larger than China’s.

Source: ZenithOptimedia. Group[M and PriceWaterhouseCoopers; Internal calculations prepared for certain figures using ZenithOptimedia, GroupM and PriceWaterhouseCoopers data

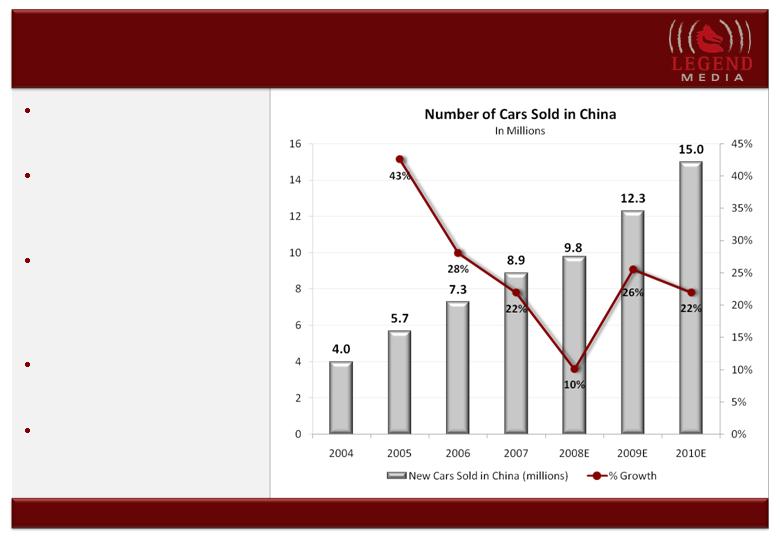

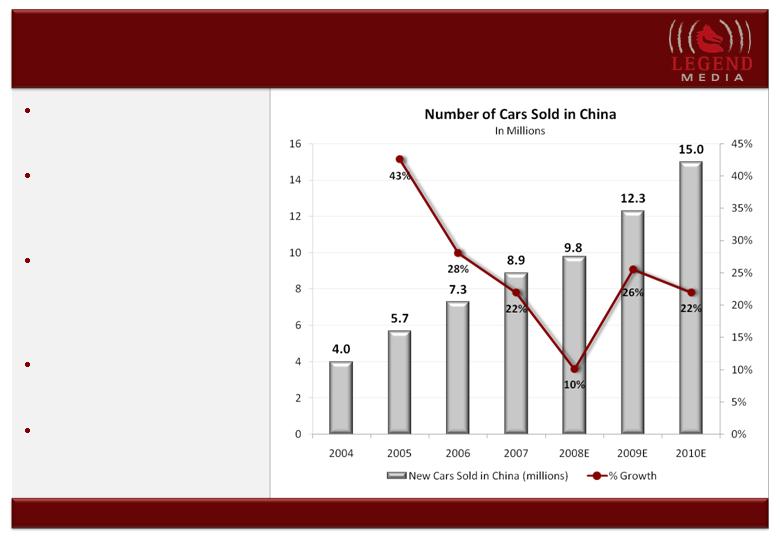

Radio Underutilized Despite Growing Car Sales

Car radio listening audience

grew 35% in 2007 alongside car

sales

95% of drivers listen to radios

and most of them spend at least

30 minutes listening to radios

every time

Nationwide increase in traffic

leads to longer commutes and

radio listening times for drivers:

90% of drivers choose to listen

to radios while waiting in traffic

60% of drivers reporting paying

attention to the radio

advertising

Radio is well positioned to target

China’s affluent as car sales

continue to grow

Source: National Bureau of Statistics of China, Xinhua Economic News, Google Finance and internal calculations

Radio Underutilized Despite Financial Value

Lower Cost per Thousand than Alternatives

In China, television and outdoor are 12 times more than radio; magazines and newspapers 33 times more

Compared to other markets the CPT value discrepancy is too large

Reaching over 93% of the population, radio satisfies large advertisers’ needs to expand nationally at a very low

cost per impression

A national radio platform will be cost attractive to advertisers and have long term price momentum

Focused on Targeting the Affluent

Owning a car and travelling by air are important for

social status in China

Both overseas and domestic travel are the top

choices for leisure activity of China’s affluent

Source: “Insights”. (Second Quarter 2007 and Third Quarter 2007”). MasterCard Worldwide and HSBC. www.masterintelligence.com;

Airline Magazine Industry Overview

Fast growing airline / airport based advertising as air travel booms

Effective way to reach affluent consumers.

76% of China’s affluent have flown in past 2 years

56.5% fly annually

Low acquiring cost of airline magazine pages

$1,500,000 per year for 80 pages of advertising per month

$1,600 per page per month for a magazine with a reach over 1,200,000 monthly

Airline magazines have not been specifically exploited as cost to acquire pages is still low

Legend Media is in a good position to take an advantage of the airline magazine niche as it can

leverage existing success with 4 th largest airline in China

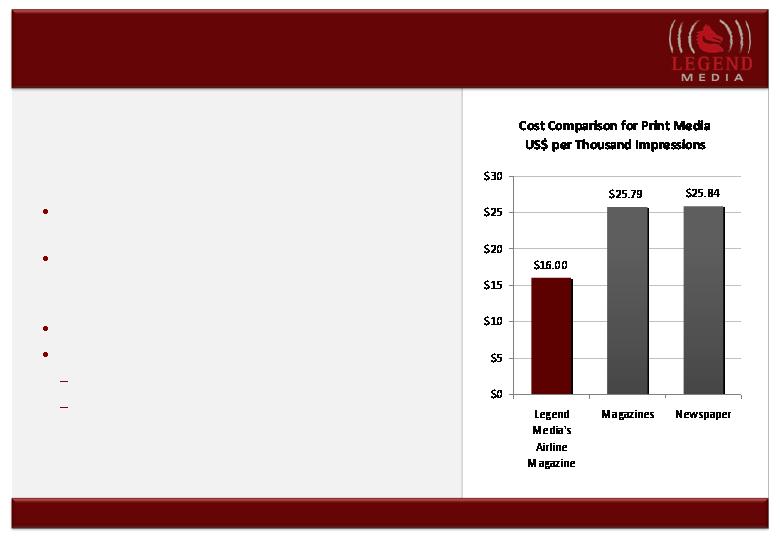

Legend’s Airline Magazine is Well Positioned

Legend’s airline magazine is positioned to satisfy

large advertisers’ needs to reach the affluent and

middle class at a cost lower than traditional print

media

Legend’s airline magazine has the potential to reach

20,000,000 people per year

Legend is partnered with the only privately held

airline group in China which has significant

expansion plans

Airline passengers are a captive audience

Excellent value proposition for advertisers

Lower cost per thousand than other print medium

Targeted to affluent

Premium Client Base

Agenda

I.

Company Overview

II.

Industry Overview

III.

Strategy Overview

IV.

Organizational Overview

V.

Financial Overview

Legend Media’s Strategy Summary

Develop Scale of Inventory

Opportunity exists for a “land grab”

Radio stations are motivated to sell

advertising minutes at low rates

Radio stations are government

owned and yet to be efficiently

commercialized

Utilization rates are low at under

20% nationally

Take advantage of undervalued

media and aggressively acquire

advertising rights

Acquire existing companies looking

for exit

508,000 minutes can be acquired

today if capital is available

Provide Content Support

Help stations develop content

Provide syndicated content

for free

Provide outside consultants

to provide strategic advice

Initial focus on morning and evening

drive times

Develop the #1 content for

these periods

Revenue / minute 2x to 3x

other times

Use content as a branding method

for advertisers

Increase interaction between

audience and station

Use acquired content talent to

provide support to all channels

Increase Listenership

Run listenership campaigns through

on and off-air contests which help

improve the content

Use special events to promote the

media in the long run, and enhance

the reputation to the clients

Promote as a way to pass the

time commuting

Target mass transit users

Create incentives for Taxi’s to tune

in

Use special events tied in with on-

air

Use barter to increase level of

sponsored events

Use outdoor media to promote trial

Legend Media’s Strategy Summary

Refine and Improve Sales Efforts

Activate 4A agencies

With scale the offering value

increases enough to get 4A

support

Use existing relationships to

create strategic alliances

Add senior radio sales talent to

existing sales teams

Recruit in talent from

developed markets

Recruit senior talent from

existing media companies

Use Andre Nair and Clear Channel

sales executives to provide

overarching strategies

Champion radio and sell on the

value of radio

Find Outlets for Unsold Inventory

Barter radio advertising for

Outdoor media to promote

the channels

Products that can be

converted to cash (even at a

discount)

JV with established shopping TV

channel to launch radio based

product sales

Launch internet sites related to the

content being played and promote

the sites with unsold inventory

Provides internet ad space

Creates database for direct

marketing applications

Web Based Industry Solution

Create web based application to

provide advertisers and agencies a

comprehensive view of all available

inventory

“Make it easy” to buy radio

advertising at the local, regional and

national level

Allow access to all radio channels

Charge access fees and high

commissions

Expands inventory without fixed

costs

Effective control of market by

controlling sales channel

Reduces competition by providing

channels an efficient distribution

model

Legend Media’s Strategy Summary

Local

Focus on city /

provincial based brands

Heavy focus on driving

new sales versus brand

building

Promote radio as a way

to drive customers in

the “door”

Focus on selling off

peak and remnant

space at very attractive

prices

Use price as a sales tool

where needed

National

Focus on large

international brands

Promote value

proposition of radio as

a national platform

with tremendous value

Sell premium time at a

premium price

Focus on helping brand

building and driving

incremental sales

Push business into

agencies while agencies

pull the business in

Direct

Agency Based

Activate relationships

with large international

and local agencies

Ensure agencies add

radio to mix of media

offered to clients

Educate media buyers

on the value

proposition of radio in

China

In near-term, offer

higher commissions

than competitive

media

Marketing

Support sales team and

agency efforts

Active B2B campaign

targeting local and

headquarters decision

makers of

multinational brands

Provide information on

the value of radio in

the Chinese market and

how it can help brands

Indirect

Agenda

I.

Company Overview

II.

Industry Overview

III.

Strategy Overview

IV.

Organizational Overview

V.

Financial Overview

Legend Media’s Foundation

Experienced,

execution oriented

management team

Clear and

executable strategy

Strong board and

outside advisors

Competitive Strength Overview

Strong management team

Diverse operating experience while having deep experience in China’s advertising market

Execution oriented, capable of converting a great strategy into action

Sino American team

Sales strategy development guided by relevant advisors

Clear understanding of market and keys to developing a successful sales model

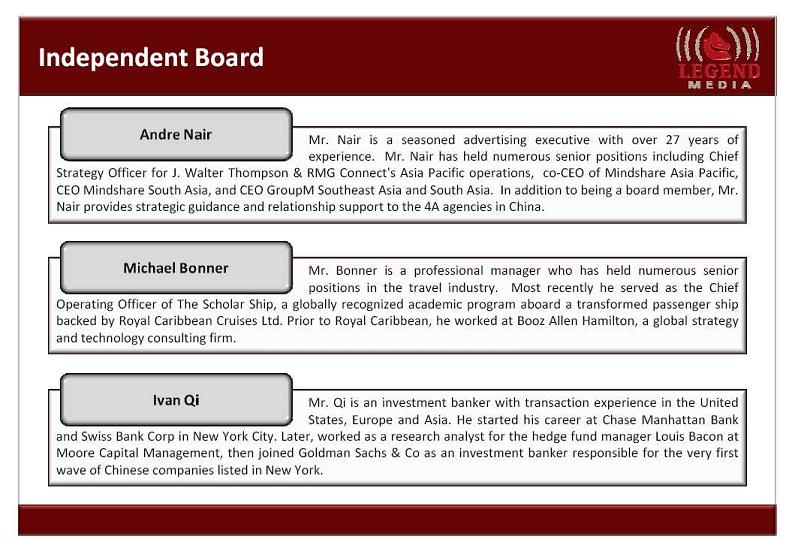

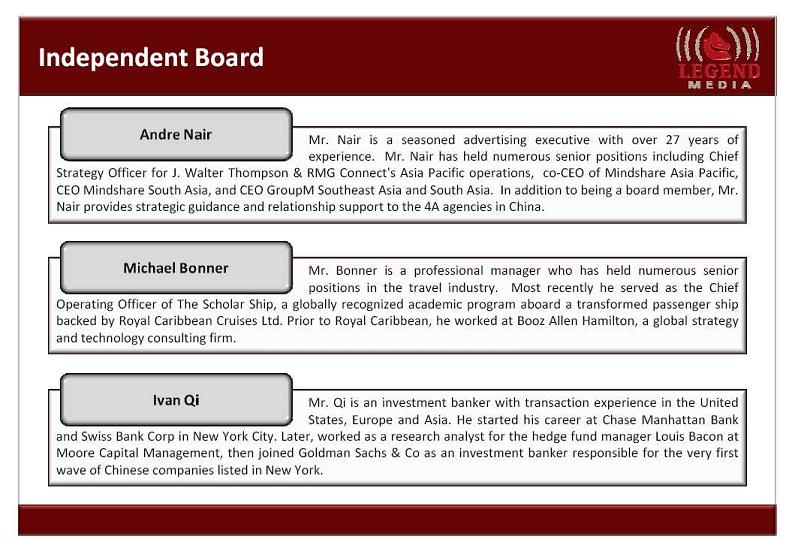

Andre Nair, with 27 years of 4A experience, provides relationship resources and sales

strategy guidance

Experienced Radio Sale Executives (from Clear Channel) from the USA have been involved

with the development of the sales strategy from the beginning

Ready to access talent

Additional sales leadership identified and ready to join as Company scales

Sales leadership talent from China, Taiwan, Singapore and the United States identified

and ready to join as Company scales

In-depth knowledge of current state of radio advertising market

Competitive Strength Overview

Strong relationship with regulatory agencies

Consistent communication between Company leadership and members of the regulatory

agencies

Deep relationships with heads of radio stations

Management has access to key decision makers at national, provincial and city level radio

stations in China by which favorable pricing and terms can be secured

Strong ties to competing radio advertising companies

Management maintains relationships with senior managers of the competing radio

advertising companies

The relationships have provided a pathway to acquiring two competing companies at

what is expected to be favorable rates and terms

Administrative, Finance and Accounting

Transparent

Automated and scalable

US GAAP reporting

Uniquely Qualified to Succeed in China’s Media Market

The right relationships

Ju BaoChun’s has deep relationships with the necessary parties

Regulatory relationships that will facilitate negotiations for CCR and other prime radio assets

Radio station relationships that will ensure internal support needed to a) gain control of the

advertising rights and b) provide needed content consulting

Competing radio advertising companies that will work to facilitate with the acquisition portion of

the strategy

Andre Nair is connected to every major media buyer and brand in Asia

27 years of ad agency experience with a focus on media buying can be fully applied

The heads of GroupM China and Universal McCann China are former employees of Mr. Nair

Competing radio advertising companies do not have the high level personal relationships with the

media buyers and brands

The right people

Ju BaoChun has spent most of his adult life selling advertising, securing media rights at a low cost and

building successful advertising sales organizations

Jin Xin has a proven history of building and managing multi location, multi channel sales organizations

Jeffrey Dash understands emerging markets and what it takes to build a solid and scalable infrastructure

Uniquely Qualified to Succeed in China’s Media Market

The right strategy

Build a media base focused on reaching China’s affluent

Focus on national radio channels to quickly build a national listenership at relative low cost

No need to do it one city at a time when national radio reaches 93 % of the population

Acquire competitors

In talks with competition about acquiring their media assets

Competitors will require some restructuring to help maximize their results;

The management of competitors come from the content / creative end of the industry; the businesses will

need to be refocused on sales, marketing and technology

Continue to develop a robust sales platform focused meeting advertisers needs to reach the

affluent of China

Company Accomplishments to Date

Beginning

February 2008 Company formed and reverse merged onto OTCBB (LEGE)

March 2008 secured first round of $5 million

May 2008 entered radio advertising business with first acquisition

Recruited world class board of directors and advisors

Added seasoned advertising and business professionals to the board

Recruited current and former Clear Channel sales executives to act as advisors

Acquisition of radio stations

Secured advertising rights for Tianjin FM 92.5

Secured advertising rights for Beijing FM 90.5

Secured advertising rights for Xian FM 95.5

Acquired airline advertising business and experienced radio advertising manager

Exclusive agent for HNA Airline Group’s airline magazine

Added established professional management with extensive radio experience

Expanded sales force and gained experience

Added experienced sales force to sales infrastructure

Company Accomplishments to Date

Establishment of sales force

Expanded sales force in Beijing, Tianjin and Xian

Added senior executive with a proven track record of building multi location and multi channel sales

organizations

Built infrastructure of internal controls and financial system

Implemented accounting module of market leading ERP system

Added standard internal controls

Operating units report to corporate where all transactions are reviewed and all account records kept

Entire finance and account structure scalable as Company expands

Positioned company for next round of acquisitions

Solid senior management that mixes deep local understanding with western best practices

An established set of relationships, advisors and prospective employees capable of executing on the

strategy

Established and scalable accounting and finance infrastructure

A clear roadmap for acquisitions and expansion that ensures a market leading position

Agenda

I.

Company Overview

II.

Industry Overview

III.

Strategy Overview

IV.

Organizational Overview

V.

Financial Overview

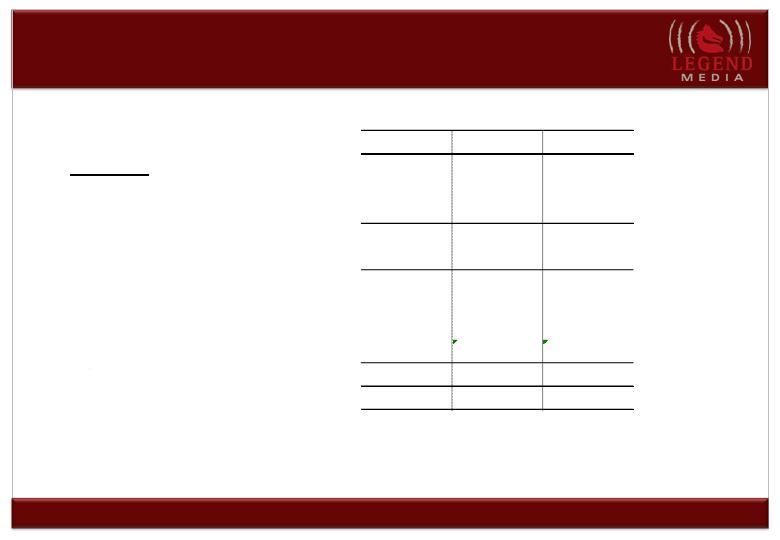

Note to financial numbers

Numbers through 2009 are based on our current plan with existing resources

2010 is based on our existing business plus the assumption we secure a

second round of financing and

We close the two targeted acquisitions; one is close to a term sheet while the

second is early stage discussions

We secure the rights to an additional x radio channels

The Company has a fiscal year ending June 30; all annual numbers are

presented on a fiscal year basis unless otherwise noted

Pro Forma Profit and Loss (fiscal year ended June 30)

FY 08

FY09 F

FY10 F

in USD 000

Revenue

4,726

$

11,005

$

40,623

$

Cost of Revenue

2,789

5,470

13,469

Gross Profit

1,937

5,535

27,154

margin %

41%

50%

67%

S, G & A

Selling Expense

871

2,762

8,960

Overhead, Operating Units

329

1,635

3,419

Overhead, Corporate

1,492

1,569

1,500

S, G & A

2,692

5,966

13,879

EBITDA

(755)

$

(431)

$

13,275

$