UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant x Filed by a Party other than the Registrant ☐

Check the appropriate box:

| x | Preliminary Proxy Statement | |||||||

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |||||||

| ☐ | Definitive Proxy Statement | |||||||

| ☐ | Definitive Additional Materials | |||||||

| ☐ | Soliciting Material Pursuant to Section 240.14a-12. | |||||||

Athersys, Inc.

(Name of Registrant as Specified in its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

| x | No fee required. | |||||||||||||

| ☐ | Fee paid previously with preliminary materials. | |||||||||||||

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||||||||||||

| A MESSAGE FROM THE CHIEF EXECUTIVE OFFICER OF ATHERSYS | ||||||||

| Dear Fellow Stockholders: | ||||||||

| The Athersys 2023 Annual Meeting of Stockholders will take place on September 27, 2023 at 8:30 a.m. Eastern time and you are cordially invited to join us virtually. We are asking stockholders to elect five Director nominees including Daniel Camardo, Neema Mayhugh, Joseph Nolan, Jane Wasman and Jack L. Wyszomierski. The Board also recommends you vote FOR proposals to ratify Ernst & Young as our independent auditors and to approve the amendment and restatement of the 2019 Equity and Incentive Compensation Plan. Lastly, we are asking you to vote FOR, on an advisory basis, the approval of executive officer compensation. This allows us to retain the talent that achieved important, impactful milestones this past year and will guide our strategic plan going forward. We are particularly proud of our work in rapidly implementing a restructuring plan that reduced monthly operating expenses to below $2.5 million, focused our efforts on advancing the MASTERS-2 clinical trial – our highest-value program – and improved the prospects for a successful trial outcome through a Type B Meeting with the FDA. The FDA supported our recommendations to modify the trial’s primary endpoint and enrollment criteria to better reflect the full potential of MultiStem® in treating acute ischemic stroke. The FDA also approved our request to conduct an unblinded interim analysis for the purpose of evaluating whether the study size is sufficiently powered to achieve statistical significance and we expect to receive the results of this interim analysis in early October. Alongside key developments in MASTERS-2, the MultiStem development pipeline continues to advance across other indications. With encouraging data in acute respiratory distress syndrome (ARDS), we have been exploring new opportunities to research MultiStem in this indication with government organizations. We have also begun enrollment in the third and final cohort of the Phase 2 MATRICS-1 trial evaluating MultiStem in patients following resuscitation from hemorrhagic trauma, for which we have partnered with the Department of Defense and received funding from Memorial Hermann Foundation. We negotiated an agreement with our contract manufacturing partner to address our outstanding debt, which more appropriately reflects our post-restructuring development timeline and future manufacturing needs. This achievement reopened access to MultiStem supply that is now accelerating enrollment in ongoing clinical trials including MATRICS-1 and MASTERS-2. Additionally, by closing the ReGenesys facility and strengthening our patent portfolio in animal health and our SIFU® cryogenic storage system, we are working to realize value from de-prioritized assets through licensing or other partnership arrangements. The progress we’ve made over the past year better positions Athersys for success with key clinical milestones in the second half of 2023 and throughout 2024. Our focus remains on advancing MultiStem clinical programs to build value for our stockholders and ultimately for patients. Once again, please vote FOR proposals 1-4 on the enclosed proxy card and join us at our 2023 Annual Meeting of Stockholders at www.virtualshareholdermeeting.com/ATHX2023. Thank you for your support and commitment to Athersys. | |||||||

Daniel Camardo, MBA Chief Executive Officer and Director | ||||||||

| /s/ Daniel Camardo | ||||||||

| Daniel Camardo | ||||||||

| Chief Executive Officer and Director | ||||||||

| August 15, 2023 | ||||||||

NOTICE OF ANNUAL MEETING OF

STOCKHOLDERS ON

September 27, 2023

STOCKHOLDERS ON

September 27, 2023

The 2023 Annual Meeting will be a virtual meeting to enable all stockholders the opportunity to attend and not have to travel to an in-person event. The Company is holding a virtual Annual Meeting only and stockholders can participate online at www.virtualshareholdermeeting.com/ATHX2023 at the appointed date and time. To vote during the Annual Meeting, you will need the 16-digit control number located on your proxy card. Please keep your control number in a safe place so it is available to you for the meeting. Using this control number, you will be able to participate in the live meeting. Please allow ample time for online check-in, which will begin at 8:15 a.m., Eastern Daylight Time, on September 27, 2023.

| ANNUAL MEETING OF STOCKHOLDERS | |||||

| DATE | September 27, 2023 at 8:30 AM EDT | ||||

| WEBSITE URL | www.virtualshareholdermeeting.com/ATHX2023 | ||||

| RECORD DATE | August 14, 2023 | ||||

| VOTING | Holders of outstanding shares of Common Stock as of the record date are entitled to vote | ||||

| STOCK SYMBOL | ATHX | ||||

| EXCHANGE | The Nasdaq Capital Market | ||||

| TRANSFER AGENT | Computershare | ||||

| The 2023 Annual Meeting of Stockholders, or Annual Meeting, of Athersys, Inc., a Delaware corporation, will be held for the following purposes: | |||||

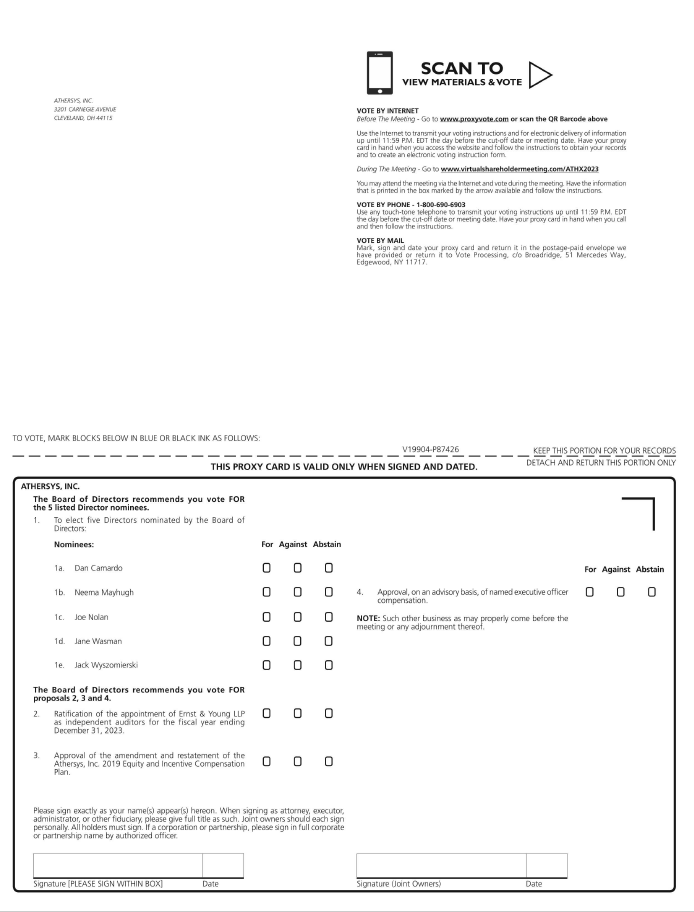

| 1 | To elect the five Directors nominated by the Board of Directors; | ||||

| 2 | To ratify the appointment of Ernst & Young LLP as independent auditors for the fiscal year ending December 31, 2023; | ||||

| 3 | To approve the amendment and restatement of the Athersys, Inc. 2019 Equity and Incentive Compensation Plan; | ||||

| 4 | To approve, on an advisory basis, named executive officer compensation; and | ||||

| 5 | To consider other business as may properly come before the Annual Meeting or any adjournment thereof. | ||||

Your vote is very important to us. Whether or not you plan to attend the Annual Meeting, we hope you will vote as soon as possible. Stockholders of record at the close of business on Monday, August 14, 2023 are entitled to vote at the Annual Meeting.

Your Board of Directors unanimously recommends that you vote: “FOR” the following:

| P | FOR | Each of the five Directors nominated by the Board of Directors; | ||||||

| P | FOR | The ratification of the appointment of Ernst & Young LLP as independent auditors for the fiscal year ending December 31, 2023; | ||||||

| P | FOR | The approval of the amendment and restatement of the Athersys, Inc. 2019 Equity and Incentive Compensation Plan; | ||||||

| P | FOR | The approval, on an advisory basis, of named executive officer compensation. | ||||||

| MANY WAYS TO VOTE | ||||||||||||||

|  |  |  |  | ||||||||||

| BY INTERNET | BY PHONE | BY MAIL | IN PERSON | SCAN QR CODE | ||||||||||

| Visit www.proxyvote.com | Dial 1-800-690-6903 | Sign, date and return your proxy card or voting instruction form | Vote in person at the virtual meeting | Scan the QR code on your Proxy Card to vote. | ||||||||||

Even if you expect to attend the virtual Annual Meeting, please promptly complete, sign, date and mail the enclosed proxy. A self-addressed envelope is enclosed for your convenience. No postage is required if mailed in the United States. You may vote online during the Annual Meeting by following the instructions on the meeting website and if you have the 16-digit control number on your proxy card in the box marked by the arrow. Stockholders who attend the Annual Meeting may revoke their proxies and vote online during the meeting if they so desire. You may also vote electronically at www.proxyvote.com or telephonically at 1-800-690-6903 within the United States and Canada.

| By Order of the Board of Directors, | |||||||||||

| /s/ Daniel Camardo | |||||||||||

| Daniel Camardo | |||||||||||

| Secretary | |||||||||||

| August 17, 2023 | |||||||||||

CAUTIONARY NOTE ON FORWARD-LOOKING STATEMENTS

This proxy statement contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 that involve risks and uncertainties. These forward-looking statements relate to, among other things, the timing of initiation of new clinical sites and patient enrollment in our clinical trials, the expected timetable for development of our product candidates, our growth strategy, and our future financial performance, including our operations, economic performance, financial condition, prospects, and other future events. We have attempted to identify forward-looking statements by using such words as “anticipates,” “believes,” “can,” “continue,” “could,” “estimates,” “expects,” “intends,” “may,” “plans,” “potential,” “should,” “suggest,” “will,” or other similar expressions. These forward-looking statements are only predictions and are largely based on our current expectations.

In addition, a number of known and unknown risks, uncertainties, and other factors could affect the accuracy of these statements. Some of the more significant known risks that we face are the risks and uncertainties inherent in the process of discovering, developing, and commercializing products that are safe and effective for use as therapeutics, including the uncertainty regarding market acceptance of our product candidates and our ability to generate revenues. The following risks and uncertainties may cause our actual results, levels of activity, performance, or achievements to differ materially from any future results, levels of activity, performance, or achievements expressed or implied by these forward-looking statements:

•our ability to raise capital to fund our operations in the near term and long term, including our ability to obtain funding through public or private equity offerings, debt financings, collaborations and licensing arrangements or other sources, on terms acceptable to us or at all, and to continue as a going concern;

•our collaborators’ ability and willingness to continue to fulfill their obligations under the terms of our collaboration agreements and generate sales related to our technologies;

•the possibility of unfavorable results from ongoing and additional clinical trials involving MultiStem®;

•the risk that positive results in a clinical trial may not be replicated in subsequent or confirmatory trials or success in an early stage clinical trial may not be predictive of results in later stage or large scale clinical trials;

•our ability to regain compliance with the requirement to maintain a minimum market value of listed securities of $35 million as set forth in Nasdaq Listing Rule 5550(b)(2);

•the timing and nature of results from MultiStem clinical trials, including the MASTERS-2 Phase 3 clinical trial evaluating the administration of MultiStem for the treatment of ischemic stroke;

•our ability to meet milestones and earn royalties under our collaboration agreements, including the success of our collaboration with Healios;

•the success of our MATRICS-1 clinical trial being conducted with UT Health evaluating the treatment of patients with serious traumatic injuries;

•the availability of product sufficient to meet our clinical needs and potential commercial demand following any approval;

•the possibility of delays in, adverse results of, and excessive costs of the development process;

•our ability to successfully initiate and complete clinical trials of our product candidates;

•the possibility of delays, work stoppages or interruptions in manufacturing by third parties or us, such as due to material supply constraints, contamination, operational restrictions due to COVID-19 or other public health emergencies, labor constraints, regulatory issues or other factors that could negatively impact our trials and the trials of our collaborators;

•uncertainty regarding market acceptance of our product candidates and our ability to generate revenues, including MultiStem cell therapy for neurological, inflammatory and immune, cardiovascular and other critical care indications;

•changes in external market factors;

•changes in our industry’s overall performance;

•changes in our business strategy;

•our ability to protect and defend our intellectual property and related business operations, including the successful prosecution of our patent applications and enforcement of our patent rights, and operate our business in an environment of rapid technology and intellectual property development;

•our possible inability to realize commercially valuable discoveries in our collaborations with pharmaceutical and other biotechnology companies;

•the success of our efforts to enter into new strategic partnerships and advance our programs;

•our possible inability to execute our strategy due to changes in our industry or the economy generally;

•changes in productivity and reliability of suppliers;

•the success of our competitors and the emergence of new competitors; and

•the risks mentioned elsewhere in this Annual Report on Form 10-K under Item 1A, “Risk Factors.” and our other filings with the SEC.

Although we currently believe that the expectations reflected in these forward-looking statements are reasonable, we cannot guarantee our future results, levels of activity or performance. We undertake no obligation to publicly update forward-looking statements, whether as a result of new information, future events or otherwise, except as otherwise required by law. You are advised, however, to consult any further disclosures we make on related subjects in our reports on Forms 10-Q, 8-K and 10-K furnished to the SEC. You should understand that it is not possible to predict or identify all risk factors. Consequently, you should not consider any such list to be a complete set of all potential risks or uncertainties.

INFORMATION REFERENCED IN THIS PROXY STATEMENT

The content of the websites referred to in this proxy statement are not deemed to be part of, and are not incorporated by reference into, this proxy statement.

TABLE OF CONTENTS

Page

| BOARD DIVERSITY MATRIX | ||||||||||||||

| As of August 14, 2023 | ||||||||||||||

| Total Number of Directors | 6 | |||||||||||||

| # Female | # Male | # Non-Binary | # Did not disclose gender | |||||||||||

| Part 1: Gender Identity | ||||||||||||||

| Directors | 2 | 4 | 0 | 0 | ||||||||||

| Part 2: Demographic Background | ||||||||||||||

| African American or Black | 0 | 0 | 0 | 0 | ||||||||||

| Alaska Native or Native American | 0 | 0 | 0 | 0 | ||||||||||

| Asian | 1 | 0 | 0 | 0 | ||||||||||

| Hispanic or Latinx | 0 | 0 | 0 | 0 | ||||||||||

| Native Hawaiian or Pacific Islander | 0 | 0 | 0 | 0 | ||||||||||

| White | 1 | 3 | 0 | 0 | ||||||||||

| Two or More Races or Ethnicities | 0 | 1 | 0 | 0 | ||||||||||

| LGBTQ+ | 0 | 0 | 0 | 0 | ||||||||||

| Did not disclose demographic background | 0 | 0 | 0 | 0 | ||||||||||

Our Investors and Engagement

Our investors are very important to us. Together we are all working towards developing new medicines to help people. We value and are deeply thankful for all our investors, especially those investors that have held our stock for many years and have been with us through the journey of developing MultiStem.

We engage our investors regularly, and members of the Company makes themselves available on a weekly basis via phone and email. Athersys does not limit correspondence based on the amount of stock ownership, and any investor may request a phone call with the investor relations department. Any stockholder inquiry or comment can be sent to Investor Relations at ir@athersys.com.

In addition to answering incoming inquiries, we engage in proactive outreach to both retail and institutional investors at minimum on a quarterly on a basis to ask for feedback on company matters or other concerns and suggestions. We value these conversations and

have learned which issues are important to our stockholders, as we strive for continuous improvement.

Over the last four annual meetings of stockholders, the stockholder advisory votes on say on pay have ranged from 57.7% to 86.5%, with an approval percentage of 57.7% in 2021 and an increase to 61.8% in 2022. The Company’s stock is held overwhelmingly by small stockholders holding in street name, which makes identification of individual stockholders difficult. Due to our large retail base, it is difficult to conduct outreach to all shareholders, however, on a regular basis we hold one-on-one meetings with retail and institutional investors to discuss company matters, answer questions and gather feedback. We gained valuable feedback from these meetings with our investors, such as perspectives on partnership models and clinical trial execution, and in response, we have taken action to address this feedback.

In an attempt to gather more specific feedback, in June of 2023, we distributed a Shareholder Feedback Survey to our top 50 institutional and large investors. These investors’ holdings represent approximately 20% of our total shares. Many investors had no feedback, and those that did provide input we have taken into account for 2023 and going forward. Following the survey, no investors requested additional meetings to discuss survey questions, ESG, or say-on-pay. It is our belief that some of the original concerns expressed by stockholders have been addressed by the recent actions we’ve taken, namely tying executive variable compensation more closely to performance, and that these topics are no longer the highest priority for our shareholders.

Since our last Annual Shareholder’s Meeting, we have engaged with shareholders frequently and in a variety of ways. Throughout 2023, we increased communication with all shareholders, switching from hosting quarterly earnings conference calls to more frequent business update calls. On these calls, we provide updates to all shareholders on company business matters, finances, goals, and progress made on important milestones. At the end of each business update call, the executive team answers questions that have been submitted by shareholders in advance. Additionally, an email address is provided for individuals to ask follow up questions directly to a member of the Company's management team.

During these one-on-one meetings and quarterly business update calls, a variety of questions and concerns were brought up related to company performance and executive compensation. As a result of this feedback, we put in place a more defined performance management process with all employees and tied executive variable compensation to specific performance goals. In 2022, the Executive Team and Compensation Committee decided not to award annual bonuses based on a failure to achieve specified performance goals. We will continue to seek feedback on this topic in future one-on-one meetings and all shareholders are invited to email our Senior Manager of Corporate Communications and Investor Relations via the Investor Relations general inbox (IR@athersys.com). All inquiries or questions are replied to within three business days, and emails are forwarded to management when appropriate and necessary.

Partially in response to our low approval vote in 2021, the Board of Directors and Compensation Committee initiated several new processes and procedures regarding personnel evaluation and compensation. In April 2021, our Board adopted a clawback policy that permits us to recoup incentive compensation paid to our current or former officers in certain circumstances. In June 2021, our Board adopted stock ownership guidelines that

| -iii- | ||||||||

align the interests of certain of our executive officers and our non-employee Directors with our stockholders by requiring that such executive officers and non-employee Directors acquire, over time, a meaningful personal investment in the Common Stock for which they are making managerial and oversight decisions.

Additionally, effective December 31, 2021, we entered into updated employment agreements with our executive officers that include a “double trigger” vesting requirement (which requires a qualifying termination of employment following a change in control) in order for any severance payments to become payable under such agreements. For information regarding these actions, please see “Executive Compensation — Compensation Discussion and Analysis” below.

In addition, over the last year, we have launched a transformation of the company, including adding new board members, making changes to the leadership of the company, and continuing to evolve our approach to performance evaluations and compensation. Our Board, in conjunction with our Compensation Committee, has evaluated several improvements to our executive compensation program. In response to feedback we’ve received on “pay for performance” we made the decision to not pay short term incentive compensation for the calendar year 2022. We will be applying rigorous judgment in determining whether to pay short term incentive compensation based on future years’ performance as compared to annual corporate goals. Further, we will be incorporating performance criteria when considering our executive officers’ equity grant in part as “performance-contingent” awards, deepening the alignment between eventual rewards and shareholder value creation. Looking ahead to the short-term cash incentive program for 2023, our executives’ paid annual incentives will be tied to the achievement of corporate goals.

We will continue to evolve our compensation philosophy, in order to attract and retain the best talent for our mission while setting clear goals and connecting performance to rewards. The Company seeks to attract and retain employees through salary levels that are competitive with the local market and similarly situated companies but generally, we aim to follow the market rather than lead the market, particularly with respect to cash compensation. We aim to offer attractive equity and cash-based incentive components to align longer term compensation with Company performance objectives. The Company believes this approach allows it to attract and retain candidates that support the Company culture of being motivated by aggressive goals and optimism about the future while permitting the Company to reduce its use of cash for executive compensation.

| -iv- | ||||||||

Athersys, Inc.

3201 Carnegie Avenue

Cleveland, Ohio 44115-2634

3201 Carnegie Avenue

Cleveland, Ohio 44115-2634

ANNUAL MEETING OF STOCKHOLDERS TO BE HELD ON SEPTEMBER 27, 2023

The 2023 Annual Meeting of Stockholders, or Annual Meeting, of Athersys, Inc., a Delaware corporation, which we refer to as the “Company,” “Athersys,” “we” and “us,” will be held on Wednesday, September 27, 2023, at 8:30 a.m., Eastern Daylight Time, at www.virtualshareholdermeeting.com/ATHX2023.

This proxy statement is furnished in connection with the solicitation by the Board of Directors of the Company, which we refer to as the Board, of proxies to be used at the Annual Meeting. This proxy statement and the related proxy are being mailed to stockholders commencing on or about August 17, 2023.

Stockholders of record of the Company at the close of business on Monday, August 14, 2023, or the Record Date, will be entitled to vote at the Annual Meeting. As of August 14, 2023, 22,501,410 shares of common stock, par value $0.001 per share, of the Company, which we refer to as Common Stock, were outstanding and entitled to vote. Stockholders have no right to cumulative voting as to any matter, including the election of Directors. Each share of Common Stock is entitled to one vote. At the Annual Meeting, inspectors of election shall determine the presence of a quorum and shall tabulate the results of the vote of the stockholders. The holders of a majority of the total number of outstanding shares of Common Stock entitled to vote must be present in person online or by proxy to constitute the necessary quorum for any business to be transacted at the Annual Meeting. Properly executed proxies marked “abstain,” as well as “broker non-votes,” as described below, will be considered “present” for purposes of determining whether a quorum has been achieved at the Annual Meeting.

VIRTUAL ANNUAL MEETING

As permitted by Delaware law and our bylaws, we have implemented the virtual annual meeting format to enable all stockholders the opportunity to attend and not have to travel to an in-person event.

We remain sensitive to concerns regarding virtual meetings generally from investor advisory groups and other stockholder rights advocates who have voiced concerns that virtual meetings may diminish stockholder voice or reduce accountability. In preparation for the virtual Annual Meeting, (i) we will implement reasonable measures to verify that each person deemed present and permitted to vote at the meeting is a stockholder or proxy holder, (ii) we will implement reasonable measures to provide stockholders and proxy holders a reasonable opportunity to participate in the meeting and to vote on matters submitted to stockholders, including an opportunity to read or hear the proceedings of the meeting substantially concurrently with such proceedings, and (iii) we will maintain a record of any votes or other action taken by stockholders or proxy holders at the meeting. Additionally, the online format allows stockholders to communicate with us during the meeting so they can ask appropriate questions of the Board or management in accordance

1

with the rules of conduct for the meeting. During the live Q&A session of the meeting, we will answer relevant questions as time permits.

Information regarding the ability of stockholders to ask questions during the Annual Meeting, related rules of conduct at the Annual Meeting, and procedures for posting appropriate questions received during the Annual Meeting, will be posted on our investor relations page in advance of the Annual Meeting. Similarly, matters addressing technical and logistical issues, including technical support during the Annual Meeting and related to accessing the Annual Meeting’s virtual meeting platform, will be available at: www.virtualshareholdermeeting.com/ATHX2023

ATTENDANCE AND PARTICIPATION

Our completely virtual Annual Meeting will be conducted on the Internet via live webcast. You will be able to participate in the Annual Meeting online and submit your questions during the meeting; however, we encourage the submission of questions in advance by emailing ir@athersys.com. You also will be able to vote your shares electronically at the Annual Meeting; however, we encourage stockholders to submit their votes electronically in advance.

All stockholders of record as of the Record Date, or their duly appointed proxies, may participate in the Annual Meeting. To participate in the Annual Meeting, you will need the 16-digit control number included on your proxy card that accompanied your proxy materials, and may also be required to provide your full name to help us validate that you are a stockholder of record. The Annual Meeting webcast will begin promptly at 8:30 a.m., Eastern Daylight Time. We encourage you to access the meeting prior to the start time. Online access will begin at 8:15 a.m., Eastern Daylight Time.

The virtual meeting platform is fully supported across all browsers and devices (desktops, laptops, tablets, and cell phones) running the most updated version of applicable software and plugins. Participants should ensure that they have a strong internet connection wherever they intend to participate in the meeting. Participants should also give themselves plenty of time to log in and ensure that they can hear streaming audio prior to the start of the meeting.

QUESTIONS

Stockholders may submit questions prior to or during the Annual Meeting. If you wish to submit a question during the meeting, you must first provide your full name, then type your question into the “Ask a Question” field, and click “Submit.” Questions pertinent to meeting matters will be answered during the meeting, subject to time constraints.

TECHNICAL DIFFICULTIES

When you access the website at www.virtualshareholdermeeting.com/ATHX2023, we will have technicians ready to assist you with any technical difficulties you may have. If you encounter any difficulties accessing the virtual Annual Meeting during the check-in or during the meeting time, you will have access to technical support. Technical support will be available beginning at 8:15 a.m., Eastern Daylight Time, on September 27, 2023 through the conclusion of the Annual Meeting.

2

REQUIRED VOTE, ABSTENTIONS, BROKER NON-VOTES AND RELATED MATTERS

Brokers or other nominees who hold shares of Common Stock in “street name” for a beneficial owner of those shares typically have the authority to vote in their discretion on “routine” proposals when they have not received instructions from beneficial owners. However, brokers are not allowed to exercise their voting discretion with respect to the election of Directors or for the approval of other matters that are “non-routine,” without specific instructions from the beneficial owner. The vote required and the treatment of abstentions and broker non-votes for each proposal are described below.

PROPOSAL ONE— Election of Directors is considered a non-routine matter, and without your instruction, your broker cannot vote your shares with respect to this proposal. The nominees for Director shall be elected by a majority of the votes cast in person or by proxy for the Director at the Annual Meeting. For this purpose, a majority of the votes cast shall mean that the number of shares voted “for” a Director’s election exceeds 50% of the number of votes cast, and votes cast shall exclude abstentions and broker non-votes. In any uncontested election of Directors, any incumbent director nominee who does not receive a majority of the votes cast shall promptly tender his or her resignation to the Board. The Board shall decide, taking into account the recommendation of the Nominations, Governance and Compliance Committee of the Board, whether to accept or reject the tendered resignation, or whether other action should be taken.

PROPOSAL TWO— Ratification of the Appointment of Ernst & Young LLP as the Company’s Independent Auditors for the Fiscal Year Ending December 31, 2023 is considered to be a routine matter. Accordingly, we do not expect broker non-votes on this proposal. The affirmative vote of the holders of a majority of the shares cast for or against, in person or by proxy and entitled to vote, is necessary for the ratification of the appointment of Ernst & Young LLP as the Company’s independent auditors for the fiscal year ending December 31, 2023. Under the Company’s bylaws, abstentions will have no effect on this proposal. As an advisory vote, the ratification of the appointment of Ernst & Young LLP as independent auditors for the fiscal year ending December 31, 2023 is not binding on the Company.

PROPOSAL THREE— Approval of the amendment and restatement of the Athersys, Inc. 2019 Equity and Incentive Compensation Plan is considered a non-routine matter, and without your instruction, your broker cannot vote your shares with respect to this proposal. Approval of this proposal requires the affirmative vote of the majority of the votes cast for or against, in person or by proxy and entitled to vote, on such proposal at the Annual Meeting. Under the Company’s bylaws, abstentions and broker non-votes will have no effect on this proposal as they will not be counted in determining the number of votes cast for or against such proposal.

3

PROPOSAL FOUR — Approval, on an advisory basis, of named executive officer compensation is considered a non-routine matter, and without your instruction, your broker cannot vote your shares with respect to this proposal. Approval of this proposal requires the affirmative vote of a majority of the votes cast for or against, in person or by proxy and entitled to vote, on such proposal at the Annual Meeting. Under the Company’s bylaws, abstentions and broker non-votes will have no effect on this proposal as they will not be counted in determining the number of votes cast. As an advisory vote, the approval of named executive officer compensation is not binding on the Company.

The shares of Common Stock represented by all valid proxies received will be voted in the manner specified on the proxies. Where specific choices are not indicated on a valid proxy, the shares of Common Stock represented by such proxies received will be voted: (i) for the election of each of the five Director nominees named in this proxy statement; (ii) for the ratification of the appointment of Ernst & Young LLP as independent auditors for the fiscal year ending December 31, 2023; (iii) for the approval of the amendment and restatement of the Athersys, Inc. 2019 Equity and Incentive Compensation Plan; (iv) for the approval, on an advisory basis, of named executive officer compensation; and (v) in accordance with the best judgment of the persons named in the enclosed proxy, or their substitutes, for other business as may properly come before the Annual Meeting or any adjournment thereof. adjournment thereof.

Returning your completed proxy will not prevent you from voting in person at the Annual Meeting should you be present and desire to do so. In addition, you may revoke the proxy at any time prior to its exercise either by giving written notice to the Company or by submission of a later-dated proxy.

4

PROPOSAL ONE

ELECTION OF DIRECTORS

ELECTION OF DIRECTORS

The Board currently consists of the following six Directors: Daniel Camardo, Ismail Kola, Neema Mayhugh, Joseph Nolan, Jane Wasman and Jack L. Wyszomierski, and their current term of office will expire at the Annual Meeting.

At each annual stockholders’ meeting, Directors are elected for a one-year term and hold office until their successors are elected and qualified or until their earlier removal or resignation. Newly created directorships resulting from an increase in the authorized number of Directors or any vacancies on the Board resulting from death, resignation, disqualification, removal or other cause may be filled by a majority vote of the remaining Directors then in office.

At the Annual Meeting, five Directors are to be elected to hold office for a term of one year and until their successors are elected and qualified. The Board recommends that its nominees for Director be elected at the Annual Meeting. The nominees are Daniel Camardo, Neema Mayhugh, Joseph Nolan, Jane Wasman and Jack L. Wyszomierski.

The composition of our Board is intentional and reflects the qualifications, skills and experience that are relevant to a biotechnology business. Our Board members have experience in the pharmaceutical and biotechnology sector and have expertise in business, science and medicine, and finance. In addition to the qualifications, skills and experience listed below, our Board members are committed to the Athersys mission and the core values of our Company - cooperation, excellence and innovation, responsibility to humanity and the environment, and honesty and integrity. Our Board also is committed to devoting the necessary time to the governance of our Company.

Pursuant to an investor rights agreement, referred to herein as the Investor Rights Agreement, entered into on March 14, 2018, as amended on August 5, 2021, between the Company and HEALIOS K.K., referred to herein as Healios, Healios has the right to nominate one Director to the Board, if Healios owns more than 5.0% of our outstanding Common Stock. At August 14, 2023, Healios owned under 5.0% of our outstanding Common Stock, so they do not have the right to nominate a Director of the Board.

If any nominee becomes unavailable for any reason or should a vacancy occur before the election, which events are not anticipated, the proxies will be voted for the election of such other person as a Director as the Board may recommend. Information, including the qualifications, skills and experience each nominee for Director brings to the Board is outlined below.

5

| Daniel Camardo, MBA | Age: 55 | |||||||||||||

| Chief Executive Officer | ||||||||||||||

| DIRECTOR SINCE: | 2022 | ||||||||||||

| BOARD COMMITTEES: | N/A | |||||||||||||

| KEY SKILLS: | Healthcare & Pharma, Medicine & Science, Business Leadership & Operations, Partnerships & Business Development, Regulatory and Commercial Launch | |||||||||||||

Mr. Camardo joined Athersys in February 2022 as our Chief Executive Officer. Previously, Mr. Camardo served as the President, U.S., and the Executive Vice President of Horizon Therapeutics plc, a global biotechnology company, overseeing the Rare Disease and Inflammation Business Units from August 2020 to February 2022, and served as Group Vice President from September 2015 to August 2020. Before joining Horizon Therapeutics, Mr. Camardo was Vice President of Sales and Operations at Clarus Therapeutics, a start-up company focused on men’s health, from July 2014 to September 2015. Prior to joining Clarus Therapeutics, Mr. Camardo held various commercial leadership roles, including Senior Director, U.S. Commercial Operations and Senior Director, Market Intelligence and Analytics from 2003 to 2014 at Astellas Pharma US, an affiliate of Astellas Pharma Inc., a Japanese global pharmaceutical company. Mr. Camardo became an Adjunct Lecturer in Healthcare at Kellogg School of Management (HCAK), in February 2022 and serves on the Board of CommunityHealth, the largest volunteer-based health center in the nation providing health care at no charge to low-income, uninsured adults, in Chicago. Mr. Camardo holds a Bachelor of Arts degree in Economics and Mathematics from the University of Rochester and a Masters of Business Administration from Kellogg School of Management.

Qualifications, Skills and Experience: We believe that as our Chief Executive Officer, Mr. Camardo is particularly well qualified to serve on the Board. His extensive experience in the biotechnology industry and leadership skills position him well to serve on the Board.

6

| Neema Mayhugh, PhD | Age: 47 | Independent | ||||||||||||

| DIRECTOR SINCE: | 2023 | ||||||||||||

| BOARD COMMITTEES: | Audit Committee; Compensation Committee; Nominations, Governance and Compliance Committee | |||||||||||||

| KEY SKILLS: | Healthcare & BioTech; Corporate Strategy; Commercial Launch; Intellectual Property Strategy and Execution | |||||||||||||

Dr. Mayhugh became a Director on Athersys’ board in August of 2023. She is an executive with more than 20 years of experience in healthcare consulting, industry, academic, and hospital settings. Dr. Mayhugh has served as the Founder and Managing Partner of Wave Strategy, a consultancy focused on the rapid commercialization of healthcare innovations, since 2016. Under her leadership, Wave Strategy has bridged early-stage technologies from renowned medical institutions with investors and industry experts, propelling them into the market. Notable partnerships include collaborations with Mass General Bringham, The Cleveland Clinic, and BioEnterprise Corporation, among others. Prior to Wave Strategy, Dr. Mayhugh served as Chief Operating Officer at Mobile Hyperbaric Centers from 2015-2016, where she instituted transformative changes that increased patient volumes and compliance rates while enhancing organizational efficiency. Earlier in her career, she held leadership positions at The Cleveland Clinic and Pfizer, with a focus on commercialization and market analytics. Dr. Mayhugh holds a PhD in Pharmacology & Toxicology from Dartmouth College and a BS in Human Physiology from Boston University.

Qualifications, Skills and Experience: Dr. Mayhugh is a dynamic visionary. Her vast experience and achievements in healthcare innovation will bring valuable insight as we pursue our growth objectives. Furthermore, Dr. Mayhugh, brings ethnic and gender diversity to the Board, which we believe will lead to more enriched thinking, creative innovation, and better governance.

7

| Joseph Nolan, MS | Age: 60 | Independent | ||||||||||||

| DIRECTOR SINCE: | 2023 | ||||||||||||

| BOARD COMMITTEES: | Compensation Committee (Chair); Audit Committee; Nominations, Governance and Compliance | |||||||||||||

| KEY SKILLS: | Healthcare & Pharma, Business Leadership & Operations, and Partnerships & Business Development | |||||||||||||

Mr. Nolan has served as our Director since January 2023. He is a results-focused pharma growth leader with more than 30 years of proven experience building high-performance teams, driving operational efficiency, and growing products in competitive spaces. In his career, Mr. Nolan helped launch several products in the central nervous system space, with the majority in orphan and specialty settings. Mr. Nolan is currently Chief Executive Officer of Jaguar Gene Therapy. Prior to Jaguar, Mr. Nolan was General Manager of AveXis, where he launched Zolgensma for the treatment of spinal muscular atrophy, one of two recently approved gene therapies in the U.S. Mr. Nolan holds a B.S. in Management from Tulane University and M.B.A from the University of Notre Dame.

Qualifications, Skills and Experience: We believe that Mr. Nolan’s extensive experience provides unique business development and marketing expertise to the Board, including an understanding of specialty pharma marketing and sales, acquisitions, product launches, recruiting, training, and developing teams, and market access strategy.

8

| Jane Wasman, JD | Age: 67 | Independent | ||||||||||||

| Chairperson of the Board | ||||||||||||||

| DIRECTOR SINCE: | 2020 | ||||||||||||

| BOARD COMMITTEES: | Audit Committee (Chair); Compensation Committee; Nominations, Governance and Compliance Committee | |||||||||||||

| KEY SKILLS: | Healthcare & Pharma, Business Leadership & Operations; International Business; Partnerships & Business Development; Law | |||||||||||||

Ms. Wasman has served as Director since November 2020. Ms. Wasman was President, International & General Counsel and Corporate Secretary of Acorda Therapeutics, Inc., a publicly traded biopharmaceutical company, from 2012 through December 2019, managing its international, legal, quality, intellectual property and compliance functions, after serving in other executive roles at Acorda starting in 2004. Before joining Acorda, Ms. Wasman was employed with Schering-Plough Corporation, a global pharmaceutical company, for over eight years, holding various U.S. and international leadership positions, including Staff Vice President and Associate General Counsel. She currently chairs the board of directors of Sellas Life Sciences (NASDAQ: SLS), is a member of the board of directors of Rigel Pharmaceuticals (NASDAQ: RIGL). Additionally, Ms. Wasman was a member of the board of directors of Cytovia Therapeutics and of the board of directors and a member of the executive committee of the New York Biotechnology Association from 2007-2022. She is co-founder of the NY Hub of BioDirector, an organization supporting board effectiveness and diversity. Ms. Wasman earned a J.D. from Harvard Law School and her undergraduate degree from Princeton University.

Qualifications, Skills and Experience: Ms. Wasman is a strategic leader with almost 25 years in the biopharma industry, with extensive U.S. and international experience. Her knowledge and expertise in M&A, strategic development, corporate governance, international, litigation, commercial, compliance and government affairs and operational implementation make her an important addition to our Board. Furthermore, we believe that Ms. Wasman enhances gender diversity of the Board and that having a more diverse Board leads to greater innovation, unique thinking and better governance.

9

| Jack Wyszomierski, MS | Age: 67 | Independent | ||||||||||||

| DIRECTOR SINCE: | 2010 | ||||||||||||

| BOARD COMMITTEES: | Nominations, Governance and Compliance Committee (Chair); Audit Committee; Compensation Committee | |||||||||||||

| KEY SKILLS: | Healthcare & Pharma, Business Leadership & Operations; Financing & Accounting | |||||||||||||

Mr. Wyszomierski has served as a Director since June 2010. From 2004 until June 2009, Mr. Wyszomierski served as the Executive Vice President and Chief Financial Officer of VWR International, LLC, a supplier and distributor of laboratory supplies, equipment and supply chain solutions to the global research laboratory industry. From 1982 to 2004 Mr. Wyszomierski held positions of increasing responsibility at Schering-Plough Corporation, culminating with his appointment as Executive Vice President and Chief Financial Officer in 1996. Mr. Wyszomierski currently serves on the board of directors of SiteOne Landscape Supply, Inc. (NYSE: SITE) since 2016, Xoma Corporation (NASDAQ: XOMA) since 2010 and Exelixis, Inc. (NASDAQ: EXEL) since 2004. Mr. Wyszomierski was also a member of the board of directors at Unigene Laboratories, Inc. (OTC: UGNE). Mr. Wyszomierski holds a M.S. in Industrial Administration and a B.S. in Administration, Management Science and Economics from Carnegie Mellon University.

Qualifications, Skills and Experience: We believe Mr. Wyszomierski’s years of experience as a Chief Financial Officer in the healthcare, life sciences and pharmaceutical industries and service as a director of multiple other public companies, well-qualifies him as a Director and a member of the Company’s Audit Committee.

The Board unanimously recommends that stockholders vote FOR the election of each of the five Director nominees named in this proxy statement.

10

THE BOARD OF DIRECTORS AND ITS COMMITTEES

Director Independence

The Board reviews the independence of each Director at least annually. During these reviews, the Board will consider transactions and relationships between each Director (and his or her immediate family and affiliates) and the Company and our management to determine whether any such transactions or relationships are inconsistent with a determination that the Director was independent. The Board conducted its annual review of Director independence to determine if any transactions or relationships exist that would disqualify any of the individuals who serve as a Director under the rules of The Nasdaq Capital Market, or Nasdaq, or require disclosure under Securities and Exchange Commission, or SEC, rules. Based upon the foregoing review, the Board determined that the following individuals who served as Directors during fiscal year 2022 were independent under the rules of NASDAQ: Dr. Kola, Ms. Wasman and Mr. Wyszomierski. The Board also determined that Mr. Nolan, who served as a Director since January 3, 2023, and Dr. Mayhugh, who served as a Director since August 17, 2023, are independent under the rules of NASDAQ. Mr. Camardo, who is our Chief Executive Officer, is not considered independent under the independence rules of NASDAQ.

Our Board’s tenure, diversity and independence provide a balance of new perspectives, innovation and Company-specific knowledge needed to function effectively. Currently, Directors having a tenure of less than 5 years represent 67% of the members of the Board. Our Board is currently 33% diverse by ethnicity and 33% diverse by gender, and 83% of our current Directors are independent.

The Board held twenty-eight meetings during fiscal year 2022. All of the Directors attended at least 75% of the total meetings held by the Board and by all committees on which they served during fiscal year 2022.

Attendance at Annual Meeting

Although the Company does not have a policy with respect to attendance by the Directors at the Annual Meeting, Directors are encouraged to attend. The Company held an annual meeting of stockholders last year, which was attended by all then-current Directors.

Committees

The Board has three standing committees: the Audit Committee, the Compensation Committee and the Nominations, Governance and Compliance Committee. All members of these committees are independent directors. The Board has adopted a written charter for each of these committees. From time to time, the Board also conducts business through other duly appointed committees, such as the Pricing Committee. The charters for the three standing committees, as well as our Directors’ Code of Conduct and our Code of Business Conduct and Ethics for Employees and Officers, are posted and available under the Investor page on our website at www.athersys.com. Stockholders may request copies of these corporate governance documents, free of charge, by writing to Athersys, Inc., 3201 Carnegie Avenue, Cleveland, Ohio 44115, Attention: Corporate Secretary.

11

BOARD COMMITTEE COMPOSITION

| Director | Title | Age | Director Since | Audit | Compensation | Nominations, Governance & Compliance | |||||||||||||||||

| Daniel Camardo, MBA | CEO/Director | 55 | February 2022 | |||||||||||||||||||

| Ismail Kola, PhD | Chairman/Independent Director | 66 | October 2010 |  |  |  | ||||||||||||||||

| Neema Mayhugh, PhD | Independent Director | 47 | August 2023 |  |  |  | ||||||||||||||||

| Joseph Nolan, MS | Independent Director | 60 | January 2023 |  |  |  | ||||||||||||||||

| Jane Wasman, JD | Independent Director | 67 | November 2020 |  |  |  | ||||||||||||||||

| Jack Wyszomierski, MS | Independent Director | 67 | June 2010 |  |  |  | ||||||||||||||||

| Chairperson | ||||||||||||||||||||||

AUDIT COMMITTEE

The Audit Committee is responsible for overseeing the accounting and financial reporting processes of the Company and the audits of the financial statements of the Company. The Audit Committee is also directly responsible for the appointment, compensation, retention and oversight of the work of the Company’s independent auditors, including the resolution of any disagreements between management and the auditors regarding financial reporting. The Audit Committee oversees policies with respect to risk assessment and risk management regarding the Company’s financial and accounting systems and accounting policies, including related regulatory compliance, information security and technology (including cybersecurity). Additionally, the Audit Committee approves all related-party transactions that are required to be disclosed pursuant to Item 404 of Regulation S-K. The current members of the Audit Committee are Dr. Mayhugh, Ms. Wasman, Mr. Nolan and Mr. Wyszomierski. The Board has determined that Mr. Wyszomierski is an “audit committee financial expert,” as defined in Item 407(d)(5)(ii) of Regulation S-K. The Audit Committee held four meetings during fiscal year 2022.

12

COMPENSATION COMMITTEE

The Compensation Committee is responsible for, among other things, annually reviewing and approving, or recommending to the Board for approval, the salaries and other compensation, including stock incentives, of our executive officers, including our Chief Executive Officer. The Compensation Committee is also responsible for reviewing and recommending to the Board, with guidance from independent compensation consultants and industry benchmarks, as appropriate, the compensation of our non-employee Directors, engaging and determining the fees of compensation consultants, if any, and overseeing regulatory compliance with respect to compensation matters. The Compensation Committee reviews, or recommends to the Board for approval, corporate goals and objectives relevant to the compensation of the executive officers and evaluates the performance of the executive officers in light of those corporate goals and objectives. The Compensation Committee also considers the duties and responsibilities of the executive officers and approves, or recommends to the Board for approval, the compensation levels for those executive officers based on those evaluations and any other factors as it deems appropriate. In determining or recommending, as applicable, incentive compensation, the Compensation Committee also considers the Company’s performance and relative stockholder return, the value of similar awards to executive officers of comparable companies, and the awards given to the Company’s executive officers in past years. The Compensation Committee may, in its discretion, delegate all or a portion of its duties and responsibilities to a subcommittee of the Compensation Committee. For more information regarding the role of our Chief Executive Officer and compensation consultants in determining or recommending executive and director compensation, please see “Executive Compensation – Role of the Chief Executive Officer” and “Role of the Independent Compensation Consultant” below. The current members of the Compensation Committee are Dr. Mayhugh, Ms. Wasman, Mr. Nolan and Mr. Wyszomierski. The Compensation Committee held ten meetings during fiscal year 2022.

NOMINATIONS, GOVERNANCE AND COMPLIANCE COMMITTEE

The Nominations, Governance and Compliance Committee held three meetings during fiscal year 2022. The Nominations, Governance and Compliance Committee is responsible for, among other things, evaluating and recommending to the Board qualified nominees for election as Directors and qualified Directors for committee membership, as well as developing and recommending to the Board corporate governance principles applicable to the Board and the Company and overseeing the evaluation of the Board.

The Nominations, Governance and Compliance Committee identifies individuals qualified to become members of the Board and recommends candidates to the Board to fill new or vacant positions. Except as may be required by rules promulgated by NASDAQ or the SEC, there are currently no specific, minimum qualifications that must be met by each candidate for the Board, nor are there specific qualities or skills that are necessary for one or more of the members of the Board to possess. In recommending candidates, the Nominations, Governance and Compliance Committee considers such factors as it deems appropriate, consistent with criteria approved by the Board. These factors may include judgment, skill, diversity, integrity, experience with businesses and other organizations of

13

comparable size, experience in corporate governance, experience in business and human resource management, the interplay of the candidate’s experience with the experience of other members of the Board and the extent to which the candidate would be a desirable addition to the Board and any committees of the Board. The Nominations, Governance and Compliance Committee considers the breadth and diversity of experience brought by the various nominees for Director in functional areas including pharmaceutical, capital markets, biotechnology, commercialization, clinical and finance. The Nominations, Governance and Compliance Committee recommends candidates to the Board based on these factors and also considers possible conflicts of interest when making its recommendations to the Board.

The Nominations, Governance and Compliance Committee will give appropriate consideration to qualified persons recommended by stockholders for nomination as our Directors, provided that the stockholder delivers written notice to the Secretary of the Company, which contains the following information:

•the name and address of the stockholder and each Director nominee;

•a representation that the stockholder is entitled to vote and intends to appear in person or by proxy at the meeting;

•a description of any and all arrangements or understandings between the stockholder and each nominee;

•such other information regarding the nominee that would have been required to be included by the SEC in a proxy statement had the nominee been named in a proxy statement;

•a brief description of the nominee’s qualifications to be a Director; and

•the written consent of the nominee to serve as a Director if so elected.

The Nominations, Governance and Compliance Committee evaluates candidates proposed by stockholders, if any, using the same criteria as for other candidates not nominated by stockholders.

Additionally, the Nominations, Governance and Compliance Committee oversees environmental, social, and governance, or ESG, matters significant to the Company. This includes seeking diverse candidates, including women and minorities, in the pool of candidates from which it recommends director nominees. In 2021, the Nominations, Governance and Compliance Committee also added compliance responsibilities to its charter, and it now oversees legal and regulatory requirements related to compliance matters, including product safety and quality, and the development, manufacturing, marketing, distribution and sale of the Company’s products, as well as other related Company matters, excluding matters regarding financial compliance, which are subject to the oversight of the Audit Committee.

THE BOARD’S ROLE IN RISK OVERSIGHT

The Board oversees the risk management of the Company. The full Board of Directors, as supplemented by the appropriate Board committee in the case of risks that are overseen by a particular committee, reviews information provided by management for the Board to oversee its risk identification, risk management and risk mitigation strategies. The

14

Board committees assist the full Board’s oversight of our material risks by focusing on risks related to the particular area of concentration of the relevant committee. For example, our Compensation Committee oversees risks related to our executive compensation plans and arrangements, and our Audit Committee oversees the financial reporting and control risks. Our Nominations, Governance and Compliance Committee oversees risks associated with the independence of the Board and potential conflicts of interest and oversight of management’s identification of non-financial risks relating to the Company and compliance. Each committee reports on these discussions of the applicable relevant risks to the full Board during the committee reports portion of each Board meeting, as appropriate. The full Board incorporates the insight provided by these reports into its overall risk management analysis. We believe that the Board leadership structure complements our risk management structure because it allows our independent directors, through independent committees, to exercise effective oversight of the actions of management in identifying risks and implementing effective risk management policies and controls.

CERTAIN RELATIONSHIPS AND RELATED PERSON TRANSACTIONS

We give careful attention to related person transactions because they may present the potential for conflicts of interest. We refer to “related person transactions” as those transactions, arrangements, or relationships in which:

•we were, are or are to be a participant;

•the amount involved exceeds $120,000; and

•any of our Directors, executive officers, nominees for Director or greater-than five percent stockholders (or any of their immediate family members) had or will have a direct or indirect material interest.

To identify related person transactions in advance, we rely on information supplied by our executive officers, Directors and certain significant stockholders. We maintain a comprehensive written policy for the review, approval or ratification of related person transactions, and our Audit Committee reviews all related person transactions identified by us. The Audit Committee approves or ratifies only those related person transactions that are determined by it to be, under all of the circumstances, in the best interest of the Company and its stockholders. Other than our arrangement with Healios as described below, the only other related person transaction that occurred in the fiscal year 2022, was related to the professional and interim CFO services provided by Ankura, which was reviewed and approved by the Audit Committee. See “2022 Summary Compensation Table” below for further details on the transaction.

Since 2016, we have had a collaboration with Healios to develop and commercialize MultiStem for the treatment of certain indications in Japan pursuant to the terms of a license agreement. In 2018, the collaboration was significantly expanded to include, among other things, an exclusive license to our technology for the development and commercialization of additional indications, for which we received additional license fees.

On February 16, 2021, we, Healios and Dr. Kagimoto entered into the Cooperation Agreement. The Cooperation Agreement provided for the parties’ cooperation on certain commercial matters, including a commitment to work in good faith to finalize negotiations

15

on all aspects of their supply, manufacturing, information provision and regulatory support relationship. The Cooperation Agreement also provided for, among related matters, the dismissal with prejudice of the complaint filed by Dr. Kagimoto against us seeking the inspection of our books and records in the Court of Chancery of Delaware on November 21, 2020, or the Section 220 Litigation. Pursuant to the Cooperation Agreement, the Company reimbursed Healios and Dr. Kagimoto for reasonable out-of-pocket fees and expenses, including legal expenses, incurred in connection with the Section 220 Litigation, which were not to exceed $500,000 in the aggregate, and $500,000 was paid in April 2021.

In August 2021, we entered into a Comprehensive Framework Agreement for Commercial Manufacturing and Ongoing Support, or the Framework Agreement, with Healios, which better aligns the collaboration structure for potential commercial success in Japan. The Framework Agreement provides Healios, among other things, access to our manufacturing technology to enable Healios to manufacture MultiStem products using a qualified manufacturer, clarifies our role in providing support services to Healios necessary for regulatory approval, manufacturing readiness and commercial launch in Japan, provides for the deferral of certain milestones and royalties to enable Healios to invest in certain manufacturing activities, and expands Healios’ license in Japan to include two new unspecified additional indications under certain conditions. To increase alignment between the companies and create incentives for accelerated execution and investment, the agreement provides for up to $8.0 million in new milestone payments available to us that are tied to certain Japanese commercial manufacturing activities and the establishment of large-scale manufacturing relevant to Japan, and warrants issued to Healios to purchase up to a total of 400,000 shares of Common Stock, which we refer to as the 2021 Warrants. One of the 2021 Warrants is for the purchase of up to 120,000 shares at an exercise price of $45.00 per share, subject to specified increases, and generally is only exercisable within 60 days of receipt of either conditional or full marketing approval from the Pharmaceuticals and Medical Devices Agency in Japan, or the PMDA, for the intravenous administration of MultiStem to treat patients who are suffering from ARDS. The other 2021 Warrant is for the purchase of up to 280,000 shares at an exercise price of $60.00 per share, subject to specified increases, and generally is only exercisable within 60 days of receipt of either conditional or full marketing approval from the PMDA for the intravenous administration of MultiStem to treat patients who are suffering from ischemic stroke. The 2021 Warrants may be terminated by us under certain conditions and have an exercise cap triggered at Healios’ ownership of 19.9% of our Common Stock.

In 2022, we received payments from Healios of approximately $4.3 million, primarily related to services performed under the Framework Agreement.

We began 2023, working closely with Healios to support their phase 3 clinical trial for ARDS, which was approved by PMDA in 1Q 2023. PMDA also approved the use of 3D bioreactor clinical product in this trial, which is the same clinical product already being used in cohort 3 of our MATRICS-1 phase 2 trauma trial. In addition, we are working closely with Healios to explore the feasibility of Healios joining our phase 3 MASTERS-2 trial in ischemic stroke to build on the TREASURE trial results and eventually seek approval in Japan under a Sakigake designation.

16

COMMUNICATIONS WITH DIRECTORS

Information regarding how our stockholders and other interested parties may communicate with the Board of Directors as a group, with the non-management Directors as a group, or with any individual Director is included on the Contact Us page under “Our Company” on our website at www.athersys.com.

17

PROPOSAL TWO

RATIFICATION OF THE APPOINTMENT OF ERNST & YOUNG LLP AS INDEPENDENT AUDITORS FOR

THE FISCAL YEAR ENDING December 31, 2023

The Audit Committee of the Board has appointed Ernst & Young LLP as the independent auditors of the Company to examine the financial statements of the Company and its subsidiaries for the fiscal year ending December 31, 2023. During fiscal year 2022, Ernst & Young LLP examined the financial statements of the Company and its subsidiaries, including those set forth in our Annual Report on Form 10-K for the fiscal year ended December 31, 2022.

Although stockholder approval of this appointment is not required by law or binding on the Audit Committee, the Board believes that stockholders should be given the opportunity to express their views on this matter. If the stockholders do not ratify the appointment of Ernst & Young LLP as the Company’s independent auditors, the Audit Committee will consider this vote in determining whether or not to continue the engagement of Ernst & Young LLP.

It is expected that representatives of Ernst & Young LLP will attend the Annual Meeting, with the opportunity to make a statement if so desired and will be available to answer appropriate questions.

REQUIRED VOTE

The affirmative vote of the holders of a majority of the votes cast for or against, in person or by proxy and entitled to vote, is necessary for the ratification of the appointment of Ernst & Young LLP as independent auditors for the fiscal year ending December 31, 2023. Under the Company’s bylaws, abstentions will have no effect on this proposal. As this proposal is considered to be a routine matter, we do not expect broker non-votes on this proposal. As an advisory vote, the ratification of the appointment of Ernst & Young LLP as independent auditors for the fiscal year ending December 31, 2023 is not binding on the Company.

The Board unanimously recommends that stockholders vote FOR the ratification of the appointment of Ernst & Young LLP as independent auditors for the fiscal year ending December 31, 2023.

18

AUDIT COMMITTEE PRE-APPROVAL POLICY AND PRINCIPAL ACCOUNTANT FEES AND SERVICES

The Audit Committee has adopted a formal policy on auditor independence requiring the pre-approval by the Audit Committee of all professional services rendered by the Company’s independent auditor prior to the commencement of the specified services. Additionally, the Audit Committee is directly involved in the selection of Ernst & Young LLP’s lead engagement partner, which occurs every five years. The year ended December 31, 2021 was the first year for the current lead engagement partner.

For the fiscal year ended December 31, 2022, 100% of the services described below were pre-approved by the Audit Committee in accordance with the Company’s formal policy on auditor independence.

Audit Fees. Fees paid to Ernst & Young LLP for the audit of the annual consolidated financial statements included in the Company’s Annual Reports on Form 10-K, for the reviews of the consolidated financial statements included in the Company’s Forms 10-Q and for services related to registration statements were $696,000 for the fiscal year ended December 31, 2022 and $661,000 for the fiscal year ended December 31, 2021.

Audit-Related Fees. There were no fees paid to Ernst & Young LLP for audit-related services in 2022 or 2021.

Tax Fees. Fees paid to Ernst & Young LLP associated with tax compliance and tax consultation were $55,093 and $72,00 for the fiscal years ended December 31, 2022 and 2021, respectively.

All Other Fees. There were no other fees paid to Ernst & Young LLP in 2022 or 2021.

19

AUDIT COMMITTEE REPORT

The Audit Committee of the Board is composed of at least three Directors who are independent and operates under a written Audit Committee charter adopted and approved by the Board. The Audit Committee annually selects the Company’s independent auditors. The written charter of the Audit Committee is posted and available under the Investor page under “Corporate Governance” on our website at www.athersys.com.

Management is responsible for the Company’s internal controls and financial reporting process. Ernst & Young LLP, the Company’s independent auditor, is responsible for performing an independent audit of the Company’s consolidated financial statements in accordance with generally accepted auditing standards and issuing a report thereon. The Audit Committee’s responsibility is to provide oversight to these processes.

In fulfilling its oversight responsibility, the Audit Committee relies on the accuracy of financial and other information, opinions, reports and statements provided to the Audit Committee. Accordingly, the Audit Committee’s oversight does not provide an independent basis to determine that management has maintained appropriate accounting and financial reporting principles, or appropriate internal controls and procedures designed to assure compliance with accounting standards and applicable laws and regulations. Nor does the Audit Committee’s oversight assure that the audit of the Company’s financial statements has been carried out in accordance with generally accepted auditing standards or the audited financial statements are presented in accordance with generally accepted accounting principles.

The Audit Committee has reviewed and discussed with the Company’s management and Ernst & Young LLP the audited financial statements of the Company for the year ended December 31, 2022. The Audit Committee has also discussed with Ernst & Young LLP the matters required to be discussed by the applicable requirements of the Public Company Accounting Oversight Board and the SEC.

The Audit Committee has also received and reviewed the written disclosures and the letter from Ernst & Young LLP required by applicable requirements of the Public Company Accounting Oversight Board regarding Ernst & Young LLP’s communications with the Audit Committee concerning independence and has discussed with Ernst & Young LLP such independent auditors’ independence. The Audit Committee has also considered whether Ernst & Young LLP’s provision of services to the Company beyond those rendered in connection with their audit and review of the Company’s financial statements is compatible with maintaining their independence.

20

Based on the review and discussions referred to above, the Audit Committee recommended to the Board that the audited financial statements be included in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2022.

Audit Committee

Board of Directors

Board of Directors

Jane Wasman (Chair)

Ismail Kola

Joseph Nolan

Jack L. Wyszomierski

Ismail Kola

Joseph Nolan

Jack L. Wyszomierski

21

PROPOSAL THREE

APPROVAL OF THE AMENDMENT AND RESTATEMENT OF THE ATHERSYS, INC. 2019 EQUITY AND INCENTIVE COMPENSATION PLAN

GENERAL

On August 14, 2023, upon recommendation by the Compensation Committee, the Board approved and adopted, subject to the approval of the Company’s stockholders at the Annual Meeting, the amendment and restatement of the Athersys, Inc. 2019 Equity and Incentive Compensation Plan. In this proposal, we refer to the original Athersys, Inc. 2019 Equity and Incentive Compensation Plan as the “2019 Plan,” and we refer to the amended and restated Athersys, Inc. 2019 Equity and Incentive Compensation Plan as the “Amended 2019 Plan.”

The Company’s stockholders previously approved the 2019 Plan, which affords the Compensation Committee the ability to design compensatory awards that are responsive to the Company’s needs and includes authorization for a variety of awards designed to advance the interests and long-term success of the Company by encouraging stock ownership among officers and other employees of the Company and its subsidiaries, certain consultants and other service providers to the Company and its subsidiaries, and non-employee directors of the Company. You are being asked to approve the Amended 2019 Plan.

Stockholder approval of the Amended 2019 Plan would primarily make available for awards under the Amended 2019 Plan an additional 2,000,000 shares of common stock, par value $0.001 per share, of the Company (“Common Stock”), as described below and in the Amended 2019 Plan, with such amount subject to adjustment, including under the share counting rules.

The Board recommends that you vote to approve the Amended 2019 Plan. If the Amended 2019 Plan is approved by stockholders at the Annual Meeting, it will be effective as of the day of the Annual Meeting, and future grants will be made on or after such date under the Amended 2019 Plan. If the Amended 2019 Plan is not approved by our stockholders, then it will not become effective, no awards will be granted under the Amended 2019 Plan, and the 2019 Plan will continue in accordance with its terms as previously approved by our stockholders. The Company has also granted certain awards as “inducement” awards outside of its stockholder-approved plans pursuant to The Nasdaq Stock Market Listing Rules (“Inducement Awards”), as further described below.

The actual text of the Amended 2019 Plan is attached to this proxy statement as Appendix A. The following description of the Amended 2019 Plan is only a summary of its principal terms and provisions and is qualified by reference to the actual text as set forth in Appendix A.

22

WHY WE BELIEVE YOU SHOULD VOTE FOR THIS PROPOSAL

The Amended 2019 Plan continues to authorize the Compensation Committee to provide cash awards and equity-based compensation in the form of stock options, stock appreciation rights (“SARs”), restricted stock, restricted stock units (“RSUs”), performance shares, performance units, dividend equivalents, and certain other awards, including those denominated or payable in, or otherwise based on, Common Stock, for the purpose of providing our non-employee directors and officers and other employees of the Company and its subsidiaries, and certain consultants and other service providers of the Company and its subsidiaries, incentives and rewards for service and/or performance. Some of the key features of the Amended 2019 Plan that reflect our commitment to effective management of equity and incentive compensation are set forth below.

We believe our future success continues to depend in part on our ability to attract, motivate and retain high quality employees and directors and that the ability to provide equity-based and incentive-based awards under the Amended 2019 Plan is critical to achieving this success. We would be at a severe competitive disadvantage if we could not use stock-based awards to recruit and compensate our employees and directors. The use of Common Stock as part of our compensation program is also important because equity-based awards continue to be an essential component of our compensation program for all employees, as they help link compensation with long-term stockholder value creation and reward participants based on their contributions to the company’s success.

In 2022, Company stockholders approved 840,000 shares of Common Stock under the 2019 plan to be used for awards following the announced restructuring reducing our number of employees by 70%. As of August 14, 2023, 84,103 shares of Common Stock remained available for issuance under the 2019 Plan. If the Amended 2019 Plan is not approved, we may be compelled to increase significantly the cash component of our employee and director compensation, which approach may not necessarily align employee and director compensation interests with the investment interests of our stockholders. Replacing equity awards with cash also would increase cash compensation expense and use cash that could be better utilized.

The following includes aggregated information regarding our view of the overhang and dilution associated with the predecessor Athersys, Inc. Amended and Restated 2007 Long-Term Incentive Plan, including as amended or amended and restated (the “2007 Plan”) and the 2019 Plan, and the potential dilution associated with the Amended 2019 Plan. This information is as of August 14, 2023. In addition, as of August 14, 2023, 429,500 shares were subject to outstanding Inducement Awards, including 400,000 shares subject to a non-qualified stock option Inducement Award granted to Mr. Camardo as of February 14,2022, which consisted of 160,000 shares that vest over a 48-month period, and the remaining 240,000 shares are eligible to vest based on the achievement of four company-based goals. 80,000 shares will vest upon marketing approval for MultiStem for ischemic stroke in the U.S., 80,000 shares will vest upon cumulative net revenues of $1 billion for sales of MutliStem in all markets, 40,000 shares will vest upon cumulative $150 million financing from all sources, including non-dilutive financing, and 40,000 shares will vest upon approval by the FDA of the “3D” manufacturing process allowing commercial use. As of

23