UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 20-F

| ¨ | REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) or (g) OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended: 31 December 2014

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR

| ¨ | SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Date of event requiring this shell company report

For the transition period from to

Commission file number 001-35265

CSR plc

(Exact name of Registrant as specified in its charter)

ENGLAND

(Jurisdiction of incorporation or organization)

Churchill House, Cambridge Business Park, Cowley Road, Cambridge, CB4 0WZ, England,

Tel: +44 (0) 1223 692 000

(Address of principal executive offices)

Adam R. Dolinko, General Counsel – Tel: +44 (0) 1223 692 000, Fax: +44 (0) 1223 692 001

Churchill House, Cambridge Business Park, Cowley Road, Cambridge CB4 0WZ, England

(Name, Telephone, E-mail and/or Facsimile number and Address of Company Contact Person)

Securities registered or to be registered pursuant to Section 12(b) of the Act:

| | |

Title of Each Class | | Name of Each Exchange on which Registered |

| Ordinary shares, par value £0.001 per share | | NASDAQ Global Select Market* |

* Listed, not for trading, but only in connection with the registration of the American Depositary Shares, each representing four (4) ordinary shares.

Securities registered or to be registered pursuant to Section 12(g) of the Act:None

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act:None

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report.

| | |

| Ordinary Shares, par value £0.001 | | 187,494,513 |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yesx No¨

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934. Yes ¨ Nox

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yesx No¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes¨ No¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act. (Check one):

| | | | |

| Large accelerated filer x | | Accelerated filer ¨ | | Non-accelerated filer ¨ |

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

| | | | |

| U.S. GAAP ¨ | | International Financial Reporting Standards as issued by the International Accounting Standards Board x | | Other ¨ |

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow. Item 17¨ Item 18 ¨

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes¨ Nox

(APPLICABLE ONLY TO ISSUERS INVOLVED IN BANKRUPTCY PROCEEDINGS DURING THE PAST FIVE YEARS.)

Indicate by check mark whether the registrant has filed all documents and reports required to be filed by Sections 12, 13 or 15(d) of the Securities Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by a court. Yes¨ No¨

CSR annual report

| | | | |

| | who we are | | |

| | | We are a leading provider of multifunction semiconductor platforms and technologies for the Auto, Consumer and Voice & Music markets. | | |

| | what we do Page 2 | | |

| | | Our business structure and key facts for 2014 | | |

| | how we’re doing Page4 | | |

| | | Our performance for the year | | |

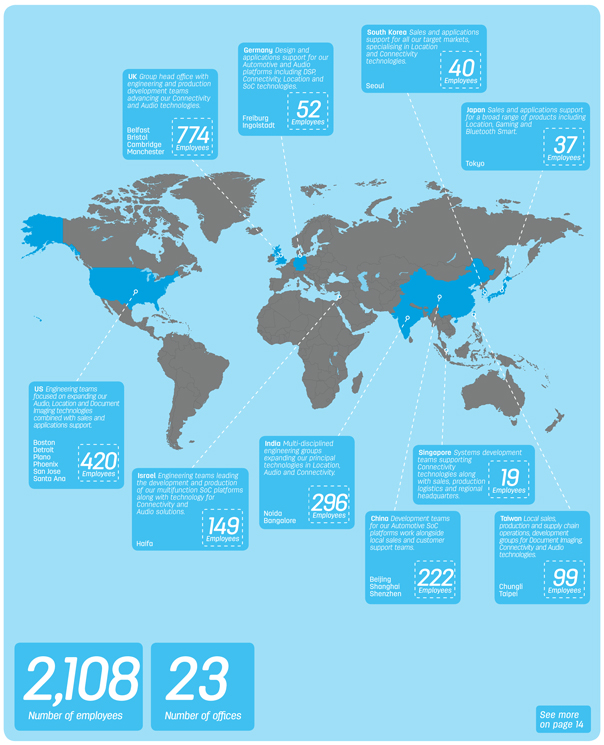

| | where we operate Page5 | | |

| | | Our office locations worldwide | | |

| | our five strategic areas of focus Page9 | | |

| | | Our strategy to focus on five end markets with our platforms | | |

| | our platform positions Page11 | | |

| | | Our aim is to develop higher margin platforms | | |

| | our technologies Page13 | | |

| | | Our aim is to use our technologies to deliver integrated and differentiated platforms | | |

| | our performancePage 14 | | |

| | | Our progress in our platforms during 2014 | | |

CSR at a glance

| | | | |

what we do | | | | Auto |

CSR has two business groups: Core comprises Auto, Consumer and Voice & Music, and is the area of the business to which we commit research & development resources. In recent years, as part of our strategic transformation towards platforms, non-Core business from discontinued home entertainment and handset business lines has formed our Legacy business. | | | |

|

| | | Auto comprises: Automotive Infotainment and Portable Navigation Devices (‘PND’). 2014 saw revenue in Auto decrease to $201.0 million from $228.8 million in 2013. We saw increasing demand from Tier One customers for our factory-fit connectivity products and systems-on-a-chip (‘SoC’), while we saw weakness in our PND and aftermarket business. |

| | | | |

| | | | Key facts |

| | | | — Good growth in autograde Wi-Fi®. |

| | | | — Our aptX® audio codec adopted by Alps and Clarion for deployment in automobiles. |

| | | | — Continued revenue growth in Auto factory-fit business and good interest in new generation Auto SoC. — The majority of our revenue is now derived from factory-fit customers. |

| | | | |

| | | | | | |

| | | | | | | $201.0m Revenue |

For more on our products visit: www.csr.com/products | | | | | |

| | | | | |

| | | | | | |

To find out more from our CEO: See page 8 | | | | | | 26% of revenue |

| | | | | |

To see our Strategic report: See page 8 | | | | | |

| | |

| 2 | | CSR plc Annual Report and Financial Statements 2014 |

| | | | | | | | |

Consumer | | | | Voice & Music | | | | Legacy |

| | | |  | | | |  |

Consumer comprises: Bluetooth Smart, Cameras, Document Imaging, Gaming, Indoor Location and Other Consumer. The year has seen a decline in Consumer revenue from $181.5 million in 2013 to $155.4 million in 2014. We have continued to see weakness in Cameras as people switch to next generation technologies of alternative suppliers. Gaming revenue has remained under pressure due to weakness in some areas of the console market and declining revenues from a single customer. We have seen strong growth in Bluetooth Smart, albeit from a small base. | | | | Voice & Music comprises: Mono headsets and stereo products for wireless audio streaming. We saw revenue in Voice & Music increase to $346.6 million from $312.0 million in 2013. We continue to see growth for streaming audio via Bluetooth, with a strong pipeline of product releases for devices such as wireless headphones, soundboxes and soundbars. Our aptX audio codec had a good year for signing new licences. The proliferation of applications for our leading audio solutions continues, for example with Wi-Fi wireless connectivity for home-based entertainment systems. | | | | Digital television, set-top box, tuners and digital video disk product lines which were acquired at the time of the acquisition of Zoran Corporation, a provider of image and video technology in 2011, in addition to the handset connectivity and handset location business lines we retained following the transaction with Samsung Electronics Co., Ltd. (‘Samsung’) which completed in 2012. |

| | | | | | | | |

| Key facts | | | | Key facts | | | | Key facts |

— In February 2014 we introduced CSRmesh®, which enables almost unlimited Bluetooth Smart devices to be networked together. — Our Bluetooth® and Bluetooth Smart solutions are gaining traction in the home entertainment ecosystem. — We are making good progress with the commercial development of our indoor location platform. | | | | — Our VibeHub™ platform, which allows device manufacturers to deliver multi-room audio over Wi-Fi, generated its first revenue in 2014. — aptX added more than 80 licensees and was featured in around 180 new products during 2014. — CSR acquired capabilities in internet radio services enabling multi-streaming to internet enabled devices. | | | | — We expect Legacy revenue in 2015 to be minimal as products reach end-of-life. |

| | | | | | | | |

$155.4m | | | | $346.6m | | | | $71.8m |

Revenue | | | | Revenue | | | | Revenue |

20% | | | | 45% | | | | 9% |

of revenue | | | | of revenue | | | | of revenue |

CSR at a glance

| | | | |

| | our performance for the year | | |

| | Our goal is to deliver growing shareholder returns by generating revenue growth and increasing profitability. We seek to do this by focusing our investment on markets that are fast growing and where we aim to deliver differentiated platforms with a leading market position. | | |

| | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | |

| | Revenue | | | | | | Gross margin | | | | | | Underlying gross margin | | | | |

| | 2014 | | | | | | 2014 | | | | | | 2014 | | | | |

| | $774.8m | | | | | | 58.1% | | | | | | 58.5% | | | | |

| | 2013 | | | | | | 2013 | | | | | | 2013 | | | | |

| | $960.7m | | | | | | 51.6% | | | | | | 52.4% | | | | |

| | | | | | | | | | | | | | | | | | |

| | Core revenue | | | | | | Operating profit (loss) | | | | | | Underlying operating profit | | | | |

| | 2014 | | | | | | 2014 | | | | | | 2014 | | | | |

| | $703.0m | | | | | | $97.0m | | | | | | $109.9m | | | | |

| | 2013 | | | | | | 2013 | | | | | | 2013 | | | | |

| | $722.3m | | | | | | $(48.4)m | | | | | | $104.3m | | | | |

| | | | | | | | | | | | | | | | | | |

| | Cash, cash equivalents and treasury deposits | | | | | | Diluted earnings (loss) per share | | | | | | Underlying diluted earnings per share | | | | |

| | 2014 | | | | | | 2014 | | | | | | 2014 | | | | |

| | $283.2m | | | | | | $0.55 | | | | | | $0.51 | | | | |

| | 2013 | | | | | | 2013 | | | | | | 2013 | | | | |

| | $306.2m | | | | | | $(0.28) | | | | | | $0.46 | | | | |

| | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | |

| | |

| 4 | | CSR plc Annual Report and Financial Statements 2014 |

| | | | |

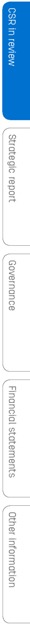

| | where we operate | | |

| | We have offices in 10 countries worldwide in order to support our global business. | | |

| | | | |

Chairman’s statement

| | | | |

| | Our goal is to deliver growing shareholder returns by generating revenue growth and increasing profitability. Ron Mackintosh,Chairman | | |

CSR is an innovator in the development of multifunction semiconductor platforms across five strategic areas: Auto, Voice & Music, Document Imaging, Bluetooth Smart and the nascent market of Indoor Location. Our platforms are adopted by many of the world’s leading technology companies in a wide range of consumer devices and automobiles. Together, these five strategic areas represent our areas of focus and we believe that they position us to deliver growth and sustainable returns in the medium and longer term.

Summary of 2014

The most significant event of 2014 was the proposed acquisition of your Company by Qualcomm Incorporated (‘Qualcomm’). On 15 October 2014, we announced that the Board of directors had reached agreement with Qualcomm regarding the terms of a recommended cash offer for CSR by Qualcomm Global Trading Pte. Ltd. (‘QGT’), an indirect wholly owned subsidiary of Qualcomm, by way of a scheme of arrangement (the ‘Qualcomm Transaction’).

The Qualcomm Transaction, which was recommended by the Board, followed an intense period beginning with the announcement on 28 August 2014 that your Board had rejected an offer from Microchip Technology Incorporated to acquire the Company.

The Qualcomm Transaction (900 pence per ordinary share) values CSR at £1,560 million and as we stated at the time of announcing the terms of the offer, the Board believes that the Qualcomm Transaction provides CSR shareholders with an immediate and certain value which is highly attractive. The decision to recommend the transaction was reached after taking into account the advice of the Board’s advisers.

On 4 December 2014, shareholders approved the scheme of arrangement and certain related matters in connection with the Qualcomm Transaction. Subject to the receipt of certain antitrust clearances, the acquisition is expected to become effective by late summer 2015.

I should like to state the appreciation of the Board for the dedication, professionalism and strength of our people and use this opportunity to express that directly to them. Without their commitment and capabilities, their inventiveness and capacity to create new ideas, CSR would not have achieved the success that it has experienced.

Strategy and financial objectives

During 2014, we continued to extend our platform strategy on which Joep van Beurden, the CEO, will comment in more detail in his report. We have focused on building and maintaining leading positions in our target markets and technologies, while also showing continued financial progress.

Underlying diluted earnings per ordinary share showed good growth on the prior year from $0.46 in 2013 to $0.51 in 2014. Although Core revenue fell 3% from $722.3 million in 2013 to $703.0 million in 2014, the Group underlying gross margin has continued to improve, rising to 58.5% for 2014, from 52.4% in 2013, as Core becomes a higher proportion of the Group revenue.

Our IFRS diluted profit per ordinary share was $0.55 compared with diluted loss per ordinary share of $0.28 in 2013. This swing mainly reflects the profitability movement between 2014 and 2013, including the gain arising from the sale of certain Imaging IP and the connected impairment reversal during 2014, and the non-cash impairment charge on our Cameras business in 2013. All these factors are explained in more detail in the financial report on pages 18 to 31.

| | |

| 6 | | CSR plc Annual Report and Financial Statements 2014 |

Returns to shareholders

CSR’s performance enables us to continue investing in new products and technologies, which underpins our strategy, and to sustain the return of capital to our shareholders. During 2014, we returned $61.9 million to shareholders through the buyback of shares, paid an interim dividend of $0.052 per ordinary share and the Employee Benefit Trust purchased shares of $7.6 million.

In view of the Qualcomm Transaction, the Board does not intend to pay or recommend for payment any further dividends at this time. The Board also does not intend to undertake any further share buybacks prior to the completion of the Qualcomm Transaction.

Our markets

The markets in which CSR operates continue to provide good prospects for growth. We recognise that in maintaining our objective of having market-leading positions in our target markets, we are up against strong competitors, as well as a rapidly changing landscape for consumer electronics. Your Board is mindful of these challenges and accordingly we continue to evaluate the potential risks that could impact the Group as pertaining to the continued conduct of its business. We address these matters in more detail on pages 32 to 35 and pages 43 to 51.

CSR is a ‘fabless’ semiconductor company and we rely on the support of our supply chain partners in providing the necessary resources and capacity that enables us to manufacture, test and supply our products to our customers. I would like to express our thanks in particular to both TSMC, whom we have worked with from our first chip to the present day, and ASE, who provide us with testing, packaging and logistics services.

Board changes

In December 2014, Anthony (Tony) Carlisle stood down from the Board, as previously announced. Tony had been on the Board since July 2005, acted as the Senior Independent Director and was a member of each of our Audit, Remuneration and Nomination Committees. His experience and abilities have been of enormous value to the Board and the committees on which he has served. I would like to thank him on behalf of the Board and wish him well.

Our people

2014 was a year of significant change for the Company. I would like to once again thank our people, who have shown great professionalism throughout this time.

Ron Mackintosh

Chairman

4 March 2015

| | | | | | |

| | how we’re doing | | |

| | | | |

| | — | | We saw strong revenue growth in our Voice & Music business, supported by growth in our stereo audio products and licencees for our aptX technology. | | |

| | — | | In Auto, we have a good pipeline of design wins and saw growth in the automotive factory-fit markets, while we saw weakness in automotive PND and the aftermarket in China. | | |

| | — | | We saw weakness in Cameras as customers switched to next generation technologies of alternative suppliers. | | |

| | — | | The potential for Bluetooth Smart remains strong as we see increasing demand in areas such as Human Interface Devices, remote controls and wearables. | | |

Chief Executive’s review

| | | | |

| | We are well positioned to capitalise on opportunities to seamlessly connect people, devices and information, as well as benefitting from the growing interest in the Internet of Things. Joep van Beurden,Chief Executive Officer | | |

Financial review of the year

2014 saw CSR continue to make progress in line with our Business Model, which is summarised in this report. Overall though, our Core revenue was $703.0m (2013: $722.3m). This decline against the prior year reflected lower revenues from the automotive aftermarket and PND sectors in our Auto business, weaker performance in Consumer (primarily Gaming and Cameras segments), and specific non-recurring demand from customers in China for the Voice & Music segments mono-headset technology, which we experienced in the first half of 2013 and which did not recur in 2014. However, Voice & Music business achieved year on year growth in revenue when compared with 2013 as a result of the increasing demand for our leading-edge technologies in this segment. We also saw growth in the proportion of our Auto revenues derived from the supply of our products to the factory-fit market. Each of these is discussed in more detail on the following pages.

As a result, we saw good year on year growth in Core revenue for the second half of 2014. For the whole of 2014, we also saw

increased overall profitability and underlying earnings per ordinary share compared to 2013.

Driven by the growth in stereo wireless audio devices such as soundbars, headphones and remote speakers,Voice & Music achieved revenue of $346.6 million, an increase of 11% against 2013.

We saw a decline inAuto, with revenue of $201.0 million, a decrease of 12% against 2013. Within Auto, we experienced growth in the Auto factory-fit market. Factory-fit now represents the majority of our Auto business and we consider this market offers good future growth opportunities. This is due primarily to the increased adoption of connectivity and infotainment solutions by automotive OEMs in their new vehicles. We continue to work with some of the largest companies in the automotive market to develop a broadening range of solutions that support consumer demands for in-dash GPS functionality, audio and connectivity products.

| | | | | | | | | | | | | | | | |

| | STRATEGIC REPORT – OUR BUSINESS MODEL | | |

| | Business Model Our goal is to deliver growing shareholder returns by generating revenue growth and increasing profitability. We seek to do this by focusing our investment on markets that are fast growing and where we can deliver differentiated platforms with a leading market position. We aim to build a strong portfolio of innovative multifunction platforms using our connectivity, location, audio and document imaging technologies for the market segments as described on pages 14 and 15. The delivery of this strategy has been supported by a combination of acquisitions and organic growth, which has allowed us to broaden the technologies we have under development. It has also widened our market presence and customer base. As a result, we have moved beyond the design and supply of single technology semiconductor products and related software solutions (predominantly using the Bluetooth standard for the mobile handset) that characterised our focus following our IPO in 2004. | | | | Fabless We are a ‘fabless’ semiconductor company. We design and develop semiconductor integrated circuits and software, and subcontract the manufacture (wafer fabrication, packaging and test) of our products to independent third parties. Our manufacturing is mostly subcontracted to TSMC, a world-class foundry, and ASE, a leading provider of semiconductor manufacturing services, and is predominantly undertaken in Taiwan (other locations include South Korea, China and Singapore). Our solutions increasingly include software, both on our chips and as part of broader system solutions. We sell directly to the producers of consumer electronic equipment, as well as to original design manufacturers and distributors, and therefore our technologies and their lifecycles are impacted by the product cycle of many consumer end-products. | | | | Five markets We focus on our chosen end markets, and aim to use our integrated and differentiated technology platforms, with the goal of achieving sustainable growth with higher margins and returns. We currently develop enhanced and connected platforms in our Voice & Music, Auto and Consumer business areas, where we believe we can achieve a strong position. We focus on five strategic end markets in our Core business group – Automotive Infotainment, Bluetooth Smart, Document Imaging, Voice & Music and the nascent market of Indoor Location – which we believe will enable us to generate sustainable revenue growth with good margins over the medium and longer term. Our objective is to develop higher margin platforms in markets that we expect will outgrow the overall semiconductor market. We expect our total serviceable addressable market to grow from approximately $4.0 billion in 2014 to $6.6 billion in 2019, (excluding revenue from the yet to be commercially introduced market of Indoor Location), representing a compound annual growth rate of 11%. | | | | R&D In order to be at the forefront of our chosen markets, we make significant investment in research and development (‘R&D’). During 2014, we spent $240.9 million on R&D. The majority of our products under design are to be manufactured on the 40nm node, as moving to a smaller lithography can enable a lower bill-of-materials cost to the customer. We continue to have dedicated processes which underpin the evaluation of new ideas from their conception through their development to market launch. We also remain focused on maintaining control of our underlying operating expenses, which include underlying R&D costs. | | |

| | | | | | | | | | | | | | | | |

| | |

| 8 | | CSR plc Annual Report and Financial Statements 2014 |

CSR at a glance

| | | | |

| | our five strategic areas of focus | | |

| | Following the transfer of handset connectivity and handset location development operations to Samsung in 2012, our platform strategy has accelerated and we have focused our energies on five markets which we believe provide growth potential. | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | Our strategy focuses on targeting our chosen end markets with our integrated and differentiated technology platforms, with a goal to achieve sustainable growth with higher margins and returns. | | | | We are developing enhanced and connected platforms in five end markets, including Automotive Infotainment, Bluetooth Smart, Document Imaging, Voice & Music and the nascent market of Indoor Location. We also develop a range of products for other markets including gaming and PC. | | | | We take a disciplined approach to capital allocation, investing in higher margin platforms and markets where we see the best prospects for profitable revenue growth. | | |

| | | | | | |

| | | | | | | | | | | | |

|

Chief Executive’s reviewcontinued

The growth in factory-fit was offset, however, by revenue declines in PND and the automotive aftermarket, predominantly in China, due to competitive pressures as well as an overall decline in demand from end customers for these products.

OurConsumer segment revenue declined 14% to $155.4 million, primarily due to declining revenue in Cameras and Gaming.

During 2014, the digital still camera marketplace continued to experience a sharp drop in demand with the move by consumers away from digital cameras, towards smartphones and tablets with video and still shot capabilities.

Our revenue inCameras was lower in 2014, due to customers switching to next generation products offered by competitors, following our decision in 2013 to cease investment in our COACH® platform. Revenue from ourGaming business was also lower as a result of weakness in some areas of the console market and declining revenues from a single customer. See page 21 for more information.

We continue to invest in emerging technologies and markets which we believe offer potential for significant growth. Particular focus has been given toBluetooth Smart, driven by the general interest in the Internet of Things, and we are making good progress with ourIndoor Location technology. In each of these, we believe we have differentiating technologies that position us well to compete. Revenues from these technologies are recorded within Consumer, and, as expected, did not contribute meaningful revenue in 2014.

Revenue in ourLegacy business, which comprises the discontinued home entertainment, handset connectivity and handset location businesses, was $71.8 million, a decline of 70% on the prior year. Performance in this area was in line with our expectations, and we continue to believe Legacy revenue in 2015 will be minimal.

As we have previously reported, we continue to see competition in our markets from existing and new entrants and we see increasing investment by these companies in emerging, as well as more established, markets.

We prepare our financial statements in accordance with IFRS, but also report ‘underlying measures’, which are non-GAAP measures. Underlying measures are supplemental measures that management uses in assessing the financial performance of the Group (see pages 130 to 133).

Underlying gross margin increased from 52.4% in 2013 to 58.5% in 2014, as we increased the proportion of revenue derived from our higher margin Core business. Importantly, we saw Core underlying gross margin increase to 60.8%, compared to 59.7% in 2013, which we believe reflects well on our strategy of moving towards differentiated, higher margin platforms.

|

| TRENDS IN OUR MARKETPLACE |

We operate in a fast moving marketplace. The results of our operations during 2012-2014 were materially affected by the following trends within the semiconductor industry in which we operate, several of which are likely to continue and which we expect are likely to affect our performance in 2015.

These include:

| | — | | consumer taste for electronic devices, which can show rapid change and so impact on the size of the markets to which we supply our products and technologies; | |

| | — | | changes in the semiconductor industry, which can affect the availability of sufficient capacity to meet our demands for integrated circuits; | |

| | — | | economic uncertainty, (particularly in China), which affects the level of demand for consumer-related products; | |

| | — | | intense competition from third parties, particularly from Asia, including for example, alternative features offered in competing products, pricing strategies to attract customers and release of new products by competitors; | |

| | — | | the recognised and ongoing trend in the semiconductor industry for declining average selling prices of integrated circuits through the period of their market lifecycle; | |

| | — | | customers ordering products with short lead times between the date of the order and required delivery, creating uncertainty in both our future revenues and whether our suppliers are able to meet our requirements; | |

| | — | | cyclical trends in the semiconductor industry generally; | |

| | — | | the reduction in the lithographic dimensions of semiconductors which can now be measured almost in individual atoms and which continue to reduce, allowing improved throughput and functionality, but increasing our development costs; | |

| | — | | unexpected changes in consumer demand for particular applications, for example, the integration of standalone functions into devices like smartphones, such as taking photographs; | |

| | — | | fluctuations in currency exchange rates which can affect our costs in light of the global nature of our business; and | |

| | — | | litigation associated with alleged infringement of proprietary rights, which is commonplace in the industry. | |

In addition, the majority of the technologies which we supply to our customers are installed into devices that are sold to consumer markets. Demand for consumer products, and therefore for our own products, is subject to seasonal variation. This in turn affects our results, which typically are stronger in the second and third quarters of a financial year, as our customers order in anticipation of demand for their own products.

We rely on our suppliers to provide the volumes of integrated circuits sufficient to meet the demands for our products from our customers. Our largest suppliers have continued to expand their capacities in the face of increasing demand. In most instances the strength of CSR’s relationship with its primary suppliers has enabled us to respond to the needs of our customers. We work to maintain a strong relationship with our suppliers and the Company has benefited from the commitment of a number of key partners who have supported our business.

| | |

| 10 | | CSR plc Annual Report and Financial Statements 2014 |

CSR at a glance

| | | | |

| | our platform positions | | |

| | Our aim is to develop higher margin platforms in markets that we expect will outgrow the overall semiconductor market. We expect our total serviceable addressable market (‘SAM’) to grow from approximately $4.0 billion in 2014 to $6.6 billion in 2019 (excluding revenue from the yet to be commercially introduced market of Indoor Location), representing a compound annual growth rate of 11%. | | |

| | | | | | | | | | | | |

| | | | | | Why is it important? | | | | What are we doing? | | |

| | | | | | |

| | | | | | | | | | | | |

| | | |

| | | | | | |

| |  | | | | The adoption of integrated information and entertainment systems in vehicles continues to grow, whether it is GPS to guide the journey, video and music systems for passengers’ entertainment, or diagnostic systems which are used to maintain and repair the vehicles we drive. We work with many of the world’s leading automotive manufacturers, providing integrated solutions that combine our existing strengths in audio, connectivity, and location. | | | | The SiRFprimaII™ integrates an ARM Cortex A9 CPU core, up to 1GHz and targets mid-end and high-range products while the SiRFatlasVI™ integrates an ARM Cortex 9 CPU core, up to 1GHz and targets low-end and mid-range products. The CSR1010™ auto is a fully Bluetooth v4.0 qualified embedded device for automotive applications. We have increased our volume production for our auto infotainment system-on-a-chip (‘SoC’) with previously reported design wins with Tier One factory-fit OEMs. We continue to see good interest from Tier One factory-fit OEMs in our upcoming new generation automotive SoC. | | |

| | | | |

| | | | | | | | |

| | | | | | |

| | | | | | | | | | | | |

| | | | |

| | | | | | | | |

| |  | | | | Enterprise workforces are becoming increasingly mobile and reliant on smartphones and tablets. Mobile workers want to take attachments and other documents that are too complex to read on a small screen and conveniently print them on a nearby printer. We call this ‘walk-up printing’. CSR enables this with a complete printer controller platform that includes the system processor, wireless connectivity and document imaging software. | | | | Our Quatro system processors are highly integrated system processors that cover a broad product range including single-function printers, multi-function printers and scanners, from entry level to high performance. CSR’s DirectOffice® Mobile Print software application directly renders Microsoft documents into high-fidelity output without the need for a PC. | | |

| | | | |

| | | | | | | | |

| | | | | | |

| | | | | | | | | | | | |

| | | | |

| | | | | | | | |

| |  | | | | This market has experienced significant growth, driven by the demand from consumers to carry their music in digital form on their smartphone, tablet, or other mobile digital music players and stream their music to stereo headsets, soundbars or speaker docks. We continue to expect long-term growth for streaming audio via Bluetooth as the proliferation of Bluetooth-enabled wireless audio devices increases. An example of where such growth is anticipated is in the soundbar market, which enhances the audio quality for flat-panel TVs. | | | | In 2014, we received our first revenue for our VibeHub networked solution. VibeHub delivers powerful versatility for sourcing audio from home networked PCs, Bluetooth enabled devices, and even cloud-based sources, routing audio throughout the home to one or many speakers. As the opportunities within this market expand, the level of competition continues to intensify, in particular in China, for low cost entry level audio products. | | |

| | | | |

| | | | | | | | |

| | | | | | |

| | | | | | | | | | | | |

| | | | |

| | | | | | | | |

| |  | | | | Bluetooth Smart is an evolution of the Bluetooth standard which uses significantly lower power levels compared to ‘classic’ Bluetooth. It enables wireless connectivity between a broad range of devices including the latest smartphones, TVs and tablets. We have seen increased interest in Bluetooth Smart, with a growing pipeline of design wins. This has been driven, in part, by the use of Bluetooth Smart Ready smartphones, or tablets, as a gateway to the Internet of Things. | | | | We expect that there will be an increasing demand in the wireless home entertainment ecosystem for products utilising Bluetooth, Bluetooth Smart and Wi-Fi, combined with our technologies such as aptX and aptX Low Latency, DDFA® power amplification, MAPX™ audio DSP and the Reciva® internet radio service. In 2014, we announced CSRmesh, a disruptive Bluetooth Smart technology designed to place the smartphone at the centre of the Internet of Things (‘IoT’). | | |

| | | | |

| | | | | | | | |

| | | | | | |

| | | | | | | | | | | | |

| | | | |

| | | | | | | | |

| |  | | | | Building on the success of GPS for location and navigation, there is a growing interest among consumers and business for similar capabilities within heavily built-up areas, in places like shopping malls and even in subways and train stations. | | | | The SiRFusion™ Software Development Kit enables indoor positioning for Android developers looking to create next-generation apps. Developers can now leverage the SiRFusion library to rapidly integrate new location-based capabilities and services such as indoor location tagging and analytics for social networking applications, indoor navigation, lone worker efficiency and safety capabilities, as well as indoor asset tracking. | | |

| | | | |

| | | | | | | | |

| | | | | | | | | | | | |

Chief Executive’s reviewcontinued

IFRS gross margin mirrored the performance of underlying gross margin and increased to 58.1% in 2014, from 51.6% in the prior year.

Underlying operating profit increased to $109.9 million from $104.3 million in 2013, reflecting the increase in both underlying gross margin, and our focus on reducing our cost base. The IFRS operating profit for the year was $97.0 million, compared with a loss of $48.4 million in 2013. The swing mainly reflects the profitability movement between 2014 and 2013, including the gain arising from the sale of certain Imaging IP and the connected impairment reversal during 2014 and the non-cash impairment charge on our cameras business in 2013. All these factors are explained in more detail in the financial report on pages 18 to 31.

Our operating costs for the year were in line with our expectations at $391.1 million and were lower than our 2013 costs of $466.8 million.

Diluted underlying earnings per ordinary share increased to $0.51 from $0.46 in 2013. Our IFRS diluted profit per ordinary share was $0.55, versus a diluted loss per ordinary share of $0.28 in 2013.

Capital allocation

We take a disciplined approach to capital allocation, investing in higher margin platforms and markets where we see the best prospects for profitable revenue growth.

We continue to retain a strong and healthy cash balance with cash, cash equivalents and treasury deposits of $283.2 million, at the end of 2014. This gives us the necessary flexibility when assessing whether to acquire additional technological capabilities.

As part of executing on our strategy, we regularly evaluate the most effective means by which to enhance our capabilities, including the development and delivery of new products and technologies. Where appropriate, we enhance our in-house capabilities with targeted acquisitions.

Our most recent acquisition, which we completed in 2014, was that of people and assets from Reciva Limited, a private company based in Cambridge, UK. This acquisition provides capabilities enabling us to aggregate internet radio and streaming music services in the cloud and provide a common interface which can stream multiple services to internet connected audio products.

Overall, we expect that there will be an increasing demand in the wireless home entertainment ecosystem for products utilising technologies such as Bluetooth, Bluetooth Smart and Wi-Fi, combined with our technologies such as aptX and aptX Low Latency, DDFA power amplification, MAPX audio DSP and the internet radio service capabilities from the Reciva transaction. Some of our initiatives in this market are reported on page 14.

Technical innovation

We continue to develop and deepen our range of technical capabilities. In May, we announced that our SiRFstarV™ architecture had established a position fix using Galileo satellites. Galileo support is required to implement the European Commission’s recently mandated eCall emergency response system for light vehicles, which will automatically send emergency notification messages from these vehicles when they are involved in an accident.

Looking ahead

Our products are used in a wide variety of consumer devices and, as a result, we are heavily exposed to consumer sentiment. The macro-economic environment has a significant impact on consumer sentiment, and in 2014, we saw somewhat improved economic conditions, especially in the US, but ongoing caution as a result of economic uncertainty in regions such as Asia. Overall therefore, the global outlook for 2015 remains unclear.

In Auto, we are experiencing strong design win momentum for our automotive factory-fit infotainment SoC platforms and we continue to see good growth in Voice & Music. As I have mentioned, we have a strong presence in each of these markets, with established products, as well as a track record for delivering innovative and leading ideas which are attractive to both our customers and end-users. At the same time, we are experiencing declines in our PND, Auto aftermarket, Cameras and Gaming business lines.

Pending satisfaction of certain conditions and the scheme of arrangement associated with the Qualcomm Transaction becoming effective, our focus remains on supporting our customers by the continued delivery of our products and services, while maintaining our current operating cost structures. We expect that demand for our products and services will be driven by wider market and economic conditions in both developed and emerging markets, as well as changes in the requirements and the implementation plans of our customers.

Qualcomm

Finally, I wish to mention the Qualcomm Transaction to acquire CSR which was approved by shareholders in December 2014 and which is a major landmark for the Company. I would like to echo our Chairman and say that the transaction is testimony to the value created by the work and dedication of CSR people.

Joep van Beurden

Chief Executive Officer

| | |

| 12 | | CSR plc Annual Report and Financial Statements 2014 |

CSR at a glance

| | | | | | |

| | | | | | |

| | our technologies | | See more on page 14 | | |

| | | | | |

| | We aim to use our range of technologies – including connectivity (such as Bluetooth and Wi-Fi), audio, document imaging and location – to deliver integrated and differentiated technology platforms in order to achieve sustainable growth with higher margins and returns. | | |

| | Below we show the key technologies that go to make up our platforms in our five strategic areas of focus. | | |

| | | | | | |

Chief Executive’s reviewcontinued

| | | | |

| | our performance in platforms | | |

| | We continued our market leadership in the area of Bluetooth stereo audio, within Voice & Music. In Auto, we are seeing growth in factory-fit, but continued weakness in PND and aftermarket. Consumer had a challenging year due to lower sales in Cameras and Gaming. | | |

| | | | | | |

STRATEGIC REPORT – PROGRESS IN PLATFORMS DURING 2014 |

| | | | | | |

| | | | | | | | | | |

Looking at our product areas in more detail, we continued our market leadership in the area of Bluetooth stereo audio, which forms part of ourVoice & Music segment. This market is growing rapidly, as more and more people carry their music in digital form on their smartphone, or other mobile digital music players, and want to wirelessly stream their music to listen on stereo headsets, soundbars or speaker docks. At the same time as this growth in demand, consumers are also seeking a high quality audio experience which emulates the sound quality available from traditional wired music systems. CSR has proven strengths in delivering high performance wireless audio. As a result of these capabilities, we continued to experience good customer traction with customers including Beats, BOSE, Sony, Vizio and Xiaomi releasing new audio products based on our solutions during 2014. Our aptX audio codec technology, which we acquired in 2010, is an important contributor to our success in this area. At the end of 2014 we had 320 licencees, a strong increase from 236 at the end of 2013. aptX is a good example of an incremental acquisition which complements our platform technologies, enabling us to further extend our competitive advantage. During 2014, there were around 180 products launched which featured aptX from companies such as Sony, Asus, Samsung, LG and HTC along with Vizio and Denon. We are making good progress with our Wi-Fi audio product, VibeHub. CSR’s multi-user networked audio platform for the home is specifically designed to allow original design manufacturers (‘ODMs’) to quickly develop and easily | | | | integrate networked audio capabilities into their products. Audio speaker designer and manufacturer BRAVEN also announced the first portable Bluetooth and Wi-Fi distributed audio system based on our VibeHub product in Q3 2014. InAuto, we are seeing the increasing use of wireless connectivity and infotainment in new build cars. While audio and navigation systems are now well established, the use of video and Wi-Fi is becoming more widespread, resulting in increasing demand for our Automotive Infotainment products and platforms, including SiRFprimaII and SiRFatlasVI. We also saw increasing demand from Tier One customers for our connectivity products, with our autograde Wi-Fi ramping into volume production with a number of customers. During 2014, the proportion of our Auto revenues derived from business with Tier One customers grew significantly as a result of the adoption of our new technologies. We believe we are well placed to continue to grow our business in this area. At the same time, we have experienced increasing competition in the automotive aftermarket, primarily in China. This sector is based on the sale to consumers of automotive infotainment systems that are installed after the purchase of a vehicle from an auto dealer. As a result of this increased competition, our revenue in this area has declined. We also saw a continued decline in the market for standalone personal navigation devices (‘PND’). During 2014, our aptX codec was adopted in automobiles for the first time by Alps for | | | | their automotive connectivity modules. This enables OEM customers to offer CD-like audio quality for Bluetooth stereo streaming in automobiles to the head unit, or to rear-seat entertainment applications for watching movies or gaming. In Q2 2014, together with Abalta Technologies, we announced a partnership to integrate Abalta’s connected car solution, WEBLINK, with our SiRFprimaII In-Vehicle Infotainment (‘IVI’) location, connectivity and multimedia system-on-a-chip. In Q4 2014, we announced the channel availability of the CSR1010 auto, a Grade 2 AEC-Q100 Bluetooth Smart chip for | | automotive applications qualified for mass production. The solution equips automotive manufacturers with the tools they need to add exciting new features to existing infotainment systems and to design innovative future Bluetooth Smart applications for both inside and outside the car. Consumer experienced a challenging year with a decline in revenues in both Cameras and Gaming. Cameras declined during 2014 in light of our decision in 2013 to cease investment in technologies for this market, (with the result that customers have switched to alternative suppliers able to offer next |

| | | |

|

| | | | | | | | | | | |

| | |

| 14 | | CSR plc Annual Report and Financial Statements 2014 |

| | | | | | |

|

generation technologies), in addition to the move by consumers away from digital cameras towards smartphones and tablets with video and still shot capabilities. Within Gaming, we continue to see weakness in some areas of the console market and declining revenues from a single customer. We continue to believe that our capabilities in indoor location offer opportunities for growth and we made encouraging progress during 2014. In April 2014, CSR and OriginGPS announced a series of high-performance GNSS modules using our SiRFstarIV™ and SiRFstarV™ product lines. The new modules are smaller than current solutions and deliver a reduction in Time-To-First-Fix (‘TTFF’), providing benefits for applications such as health and fitness trackers, sports watches, medical devices, wearable action cameras and digital still cameras. During the fourth quarter, we also announced software releases for the SiRFstarV 5ea automotive-grade quad-GNSS location platform, whereby support was added for concurrent use of GPS and BeiDou (‘BDS’) satellite constellations. Each of these end applications were a focus of much attention at the Consumer Electronics Show in Las Vegas which was held in January 2015. In Q3 2014, we launched a new series of dual mode Bluetooth 4.1 compliant platforms, designed to give greater fiexibility to developers looking to create low latency and low-power wireless gaming controllers. The CSRB5341® and the CSRB5342® provide developers with turnkey solutions for wireless gaming controllers and HID applications from a single device. We see good growth and are experiencing increased engagement with customers for | | our capabilities in the area of Bluetooth Smart, which is a low power connectivity technology. We believe there are multiple potential use cases for Bluetooth Smart in devices which are either handheld or worn by the user and which will be able to function using significantly lower power. While revenue in 2014 from Bluetooth Smart was small compared to our overall revenue, we continue to see the potential for strong medium and long-term growth in this market. Our pipeline of design wins for Bluetooth Smart continues to grow. For example, during 2014, we collaborated with Universal Electronics Inc. to add Infra-Red (‘IR’) setup and control functionality to remote controls based on our CSR µEnergy® Bluetooth Smart platforms, which will enable both IR and Bluetooth Smart capability on a single device. We believe that the application of our Bluetooth Smart in such devices, combined with our position in the Voice & Music market, will enable us to extend our presence in the developing wireless home entertainment ecosystem. This ecosystem comprises wirelessly connected products such as Smart TVs, set-top boxes, remote controls, soundbars, sub-woofers, 3D glasses, stereo headsets, game controllers and keyboards. In 2014, we saw increasing customer traction for our CSR1010 and CSR1011™ Bluetooth Smart products. Design wins for our CSR1010 during 2014 included Lenovo for its new S9 and S52 Smart TVs, which have fully featured Bluetooth Smart remote controls, Incipio with its offGRID Smart Portable Backup Batteries, and Tanita with its new smart weight scales. Our Bluetooth Smart remote platform has also been integrated into Philips’ uWand | | reference design, a complete firmware and hardware solution for developing pointing and gesture-based remote controls. The CSR Smart remote platform is an end-to-end solution utilising CSR1010 and the CSR8510™, enabling seamless data transfer between a remote control and TV or set-top box. In February 2014, we announced CSRmesh, a disruptive Bluetooth Smart technology designed to place the smartphone at the centre of the Internet of Things (‘IoT’). CSRmesh enables an almost unlimited number of Bluetooth Smart enabled devices to be networked together and controlled directly from a single smartphone, tablet or PC. We are experiencing a high level of interest for this technology from a wide range of manufacturers including those in the area of IoT. We have secured wins for CSRmesh for consumer lighting and see increasing customer interest for a range of IoT applications. During 2013 and 2014, we saw increased interest in using Bluetooth Smart for wireless beacons to enable positioning fixes to be taken using mobile devices within buildings. We expect this infrastructure based model will combine well with our own Indoor Location technology. Our Indoor Location solution utilises infrastructure such as Wi-Fi and/or Bluetooth Smart to determine a user’s location indoors, in addition to motion and pressure sensors, to build up a picture of a person’s positioning within a building such as a shopping mall. We believe that such developments and the ease of use by consumers on devices such as a tablet or smartphone will encourage the development of indoor maps, plus apps based on indoor location, to locate people or places of interest when indoors. | | In addition to adoption by consumers of our Location technologies for their leisure time, we believe that, while there is still work to be done to refine our solution for commercial use, there is good potential for our technology in areas such as asset tracking and support for logistics companies for just in time delivery and scheduling. We continue to make progress toward a commercial deployment. We are making good progress with the commercial development of our Indoor Location platform. This solution utilises existing infrastructure such as Wi-Fi as well as utilising motion and pressure sensors in the device. The solution is currently in customer trials in multiple geographies around the world. The ongoing investment into the creation of indoor maps will continue to fuel the requirement for more accurate indoor location technology to better utilise this development. In Q4 2014, we launched the SiRFusion Software Development Kit (‘SDK’) for Android application developers. The solution enables indoor positioning for Android developers looking to create next-generation apps. Developers can now leverage the SiRFusion library to rapidly integrate new location-based capabilities and services such as indoor location tagging and analytics for social networking applications, indoor navigation, lone worker efficiency and safety capabilities, as well as indoor asset tracking and targeted e-commerce services. Although we see Bluetooth Smart and indoor location as key areas of our future growth potential, we do not expect them to be a significant contributor to our revenue in 2015. |

| | |

Key performance indicators

| | | | | | | | | | | | | | | | |

| | Measuring our performance | | |

| | Our strategy is to deliver growing shareholder returns by generating revenue growth and increasing profitability. We do this by focusing our investment on markets that are fast growing and where we can deliver differentiated platforms with a leading market position. We use the following KPIs to monitor performance against this strategy. | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | Increased profitability | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | Underlying Operating Margin | | |

| | | We deliver increasing | | | | | 2014 | | | | 2013 | | | Target | | |

| | | profit margins | | | | | 14.2% | | | | 10.9% | | | We target underlying operating margins in the mid-teens | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | Headcount | | |

| | | We match our workforce to the | | | | | 2014 | | | | 2013 | | | Target | | |

| | | locations of our customer and supply base | | Europe | | | 39% | | | | 34% | | | We aim to have 40% or more of our workforce in Asia | | |

| | | | USA | | | 20% | | | | 21% | | | | | |

| | | | | Asia | | | 41% | | | | 45% | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | Target fast growing markets | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | Movements in revenue | | |

| | | We focus on growing our | | | | | 2014 | | | | 2013 | | | Target | | |

| | | strategic business | | Total Revenue | | | -19% | | | | -6% | | | We target continued growth in Core revenue, and in 2014 expected our Legacy revenue to fall by 70% | | |

| | | | | Core Revenue | | | -3% | | | | 9% | | | | |

| | | | | Legacy Revenue | | | -70% | | | | -35% | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | Delivery of platforms | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | Gross Margin | | |

| | | Our platform products | | | | | 2014 | | | | 2013 | | | Target | | |

| | | generate higher gross margins | | IFRS | | | 58.1% | | | | 51.6% | | | We target both IFRS and underlying gross margins at 55-60% | | |

| | | | Underlying | | | 58.5% | | | | 52.4% | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | Investment in R&D | | |

| | | We invest strongly to deliver | | | | | 2014 | | | | 2013 | | | Target | | |

| | | new products | | | | | 31% | | | | 28% | | | We aim to invest at least 25% of revenue in product development and technology research | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | Grow shareholder returns | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | Underlying EPS growth | | |

| | | We show growth in returns | | | | | 2014 | | | | 2013 | | | Target | | |

| | | | | | | | 11% | | | | 70% | | | We target year on year growth in underlying EPS | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | Working Capital days | | |

| | | We maximise funds available | | | | | 2014 | | | | 2013 | | | Target | | |

| | | for distribution | | | | | 58 | | | | 59 | | | We aim to hold working capital for less than 65 days | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | |

| 16 | | CSR plc Annual Report and Financial Statements 2014 |

Using KPIs to measure our performance

We use the KPIs shown on the preceding page to track business performance over time and to consider whether we are meeting our strategic objectives. We review these annually and adapt them, in response to how our business structure and strategy evolves. For 2014 we include a KPI showing investment in R&D activity to support our strategic objective to deliver differentiated platforms to delivering platform products.

Underlying Operating Margin

We review underlying operating profit as a proportion of revenue (underlying operating margin), so we can measure and compare year on year profitability trends. The full calculation of this measure is described on page 131. In 2014 we achieved our target for underlying operating margin in the mid-teens, due to the combination of increased operating profit, which is discussed on page 23, and lower revenue, discussed on pages 21 and 22. For the purposes of executive remuneration we measure the underlying operating profit against the budgeted value as described on page 71.

Headcount

The majority of our operational expenses arise from the number and location of our employees. We monitor the profile of our employees by region to ensure we have an appropriate presence to support our business, suppliers and customers and we aim to maintain over 40% of our workforce in Asia where many of our key growth markets are located.

In 2014, the percentage of employees based in Asia declined as we continued to withdraw from Legacy and Camera markets, both of which had a high Asian customer and development base. UK-based resource increased over the same period as we recruited specialists in Bluetooth low energy.

Movements in Revenue

We monitor movements in revenue to see whether we are targeting fast moving markets. We pay particular attention to movements in our Core business, being an aggregate of our Voice & Music, Auto, and Consumer segments, as this represents the businesses in which we continue to invest. We target year on year Core revenue growth.

In 2014, total revenue fell as expected due to declining volumes of the discontinued product lines in our Legacy segment. Core revenue also fell year on year, mostly due to lower volumes in our Cameras and Gaming business, but also due to the impact of a non-recurring increase in revenue in the first half of 2013 from the enforcement of hands-free driving legislation in China. However when we compare revenue from the second half of 2014, to the same period in 2013 we see an 8% year on year growth since 2013 comparative reflected business as usual activity. Further information on our revenue movements can be found on pages 20 to 22.

Gross Margin

We track movements in our gross margin (gross profit as a proportion of revenue) to see whether we are increasing the proportion of business derived from platforms and whether our strategy to increase business in this area is successful. We review both IFRS and underlying gross margin, the latter being defined on page 131.

In 2014, we achieved our targets due to a shift in mix towards our higher margin Voice and Music business because of reduced volumes from our Legacy products. More information on the drivers of gross profit and gross margin can be found on page 22.

Investment in R&D

We consistently invest in R&D to ensure we continue to develop and deliver differentiated platforms. See page 22 to understand movements in R&D expenses during the year.

Underlying Earnings per Share ‘EPS’

We monitor underlying profit after tax divided by our dilutive shares because we believe it best represents the ongoing performance and profitability of the Group. Underlying profit after tax and underlying EPS are defined on page 131.

In 2014, our volume of dilutive shares was largely unchanged and so we met our target due to the increased profitability of the Group, as described on pages 23 and 24.

Working capital days

We monitor how the business generates and utilises cash by reviewing working capital days. This represents the aggregate of: a) the number of days it takes to collect cash from customers (debtor days), b) the number of days we hold finished goods and raw materials as inventory (inventory days), and c) the credit terms we have arranged with our suppliers (creditor days). We target working capital days of 65 days or less.

In 2014, we met our target and our total working capital days remaining broadly consistent with 2013. Inventory days increased due to products held in stock for a longer period than usual under special customer arrangements but this was offset by an increase in creditor days caused by the timing of our year-end date.

| | | | | | | | | | | | | | | | | | |

| | | Introduction | | | | Review of 2014 | | | | Review of 2013 | | |

| | Overview | | | | 20 | | Segmental performance | | | | 26 | | Segmental performance | | |

| | | | | 21 | | Income statement | | | | 27 | | Income statement | | |

| | | | | | | | | |

| | 18 | | Highlights of 2014 | | | | 24 | | Balance sheet | | | | 30 | | Cash flow | | |

| | | | | | | | | |

| | 19 | | Highlights of 2013 | | | | 25 | | Cash flow | | | | | | | | |

| | | | | | | | | | | | | | 31 Finance policies | | |

| | | | | | | | | |

| | | | | | | | | | | | | | | | | | |

Introduction

This section is a discussion and analysis of our results for the 52 week period ended 26 December 2014 and the 52 week period ended 27 December 2013. It also provides information on our finance policies, including tax and treasury, and should be read in conjunction with our financial statements that begin on page 84. References in this report and elsewhere to ‘2012’, ‘2013’ and ‘2014’ are to the 52 week periods ended 28 December 2012, 27 December 2013 and 26 December 2014, respectively. References to note numbers are to the notes to the consolidated financial statements on pages 88 to 128.

|

Non-IFRS measures Although we prepare our financial statements in accordance with IFRS, we also report and discuss additional measures that we call ‘underlying’. These underlying measures are not IFRS measures. Management believes that these underlying measures provide investors with useful information regarding our ongoing performance by excluding certain amounts that are included in the comparable IFRS numbers. You can find a description of these underlying measures and their limitations, an explanation of why management believes they are useful to investors and a reconciliation to the most directly comparable IFRS measure on pages 130 to 133. |

|

|

|

Overview

Highlights of 2014

| | | | | | | | |

| | | IFRS | | Underlying |

| | | | |

| | | 2014 | | 2013 | | 2014 | | 2013 |

|

| | | | |

Revenue | | $774.8m | | $960.7m | | $774.8m | | $960.7m |

| | | | |

Gross margin | | 58.1% | | 51.6% | | 58.5% | | 52.4% |

| | | | |

Non-current asset impairment reversal (charge) | | $23.3m | | ($76.9m) | | – | | – |

| | | | |

Gain on disposal of Imaging IP | | $14.9m | | – | | – | | – |

| | | | |

Operating profit (loss) | | $97.0m | | ($48.4m) | | $109.9m | | $104.3m |

| | | | |

Profit (loss) for the period | | $96.8m | | ($46.4m) | | $90.0m | | $81.1m |

| | | | |

Diluted earnings (loss) per share | | $0.55 | | ($0.28) | | $0.51 | | $0.46 |

| | | | |

Net cash from operating activities | | $69.1m | | $82.3m | | $69.1m | | $82.3m |

| | | | |

Treasury deposits, cash and cash equivalents | | $283.2m | | $306.2m | | $283.2m | | $306.2m |

|

Trading Summary

We summarise below our performance in 2014 in comparison to 2013. For a more detailed explanation, please see the analysis on pages 20 to 27.

Revenue fell 19% in 2014 to $774.8 million from $960.7 million in 2013. This was mainly due to a 70% reduction in revenue from our Legacy segment, in line with our expectations as these discontinued products progressed to the end of their product life cycle; a reduction in volumes from our aftermarket business within our Auto segment; lower sales in cameras following our decision, announced in December 2013, to cease development of next generation camera-on-a chip (‘COACH’) products and a decline in Gaming chip volumes. These decreases were partially offset by an 11% increase in revenue from the Voice & Music segment, reflecting growth in high-end stereo speakers and headsets.

In 2014, our IFRS gross margins increased to 58.1% (2013: 51.6%) primarily due to a shift in product mix from our lower margin Legacy segment to the higher margin Voice & Music business. These factors also accounted for the increase in 2014 of underlying gross margin to 58.5% (2013: 52.4%). The increases in gross margin percentages were not enough to offset the effect of declining revenues and, so in absolute terms gross profit decreased to $449.9 million in 2014 (2013: $495.3 million) whilst underlying gross profit decreased to $453.2 million in 2014 (2013: $503.4 million) for the same reasons.

Total operational costs, which comprise Research & Development (R&D) expenses and Sales, General and Administration (SG&A) expenses, decreased 16% to $391.1 million in 2014 (2013: $466.8 million). This decrease was primarily driven by reduced variable employee expenses, lower restructuring costs and litigation activity and a reduction in external development costs.

Underlying operational costs decreased by 14% to $343.3 million in 2014 (2013: $399.1 million). This was mainly due to the combined effect of a reduction in variable employee benefit costs and external development costs as well as lower costs due to reduced litigation activity.

| | |

| 18 | | CSR plc Annual Report and Financial Statements 2014 |

Operating profit for 2014 was $97.0 million (2013: Operating loss $48.4 million). Underlying operating profit increased to $109.9 million in 2014 (2013: $104.3 million) as the lower revenue was more than offset by the strong underlying gross margin and lower operational costs.

Qualcomm Transaction

On 15 October 2014, the boards of CSR and Qualcomm Incorporated (‘Qualcomm’) announced that agreement had been reached regarding the terms of a recommended cash offer for the Company, whereby Qualcomm Global Trading Pte. Ltd. (‘QGT’), an indirect wholly owned subsidiary of Qualcomm, will acquire the entire issued and to be issued share capital of CSR (the ‘Qualcomm Transaction’). More details of this transaction can be found on page 134.

In connection with the Qualcomm Transaction, we incurred $12.0 million of costs during 2014 as described on page 23.

Sale of Imaging Intellectual Property (‘IP’) Assets & Impairment Reversal

In December 2013, we announced our decision to discontinue further investment in the development of next generation COACH platform products. This decision lead to an impairment of assets associated with the COACH business and the redundancy of 152 employees as explained in the ‘Cameras’ section on page 20.

In early June 2014, due to the progress of negotiations to sell certain Imaging IP associated with the COACH business, we determined that the IP previously impaired had a market value and we therefore re-assessed the carrying value of these assets. This lead to a reversal of some of the impairment charges made against these assets in 2013, resulting in a credit to operating profit of $23.3 million in 2014.

On 8 June 2014, we completed the sale of this Imaging IP associated with the COACH business, together with the transfer of 28 employees allocated to the COACH business, for a total consideration of $44.0 million. The gain on disposal of Imaging IP was $14.9 million. No assets or employees remain allocated to the COACH business.

Returns to Shareholders

During 2014, we bought back 6.4 million of our own ordinary shares in the open market for an aggregate of $61.9 million, the details of which are disclosed on pages 78 and 79. In addition, during 2014 the CSR Employee Benefit Trust (‘EBT’) purchased 0.8 million of CSR ordinary shares in the open market for an aggregate of $7.6 million.

On 5 September 2014, the Company paid an interim dividend of $0.052 per ordinary share. In view of the proposed Qualcomm Transaction, the Board does not intend to recommend a final dividend in respect of the 2014 financial year.

Highlights of 2013

| | | | | | | | |

| | | IFRS | | Underlying |

| | | | |

| | | 2013 | | 2012 | | 2013 | | 2012 |

|

| | | | |

Revenue | | $960.7m | | $1,025.4m | | $960.7m | | $1,025.4m |

| | | | |

Gross margin | | 51.6% | | 49.6% | | 52.4% | | 50.8% |

| | | | |

Goodwill and non-current asset impairment | | ($76.9m) | | – | | – | | – |

| | | | |

Profit on disposal of development operations | | – | | $127.2m | | – | | – |

| | | | |

Operating (loss) profit | | ($48.4m) | | $107.9m | | $104.3m | | $74.0m |

| | | | |

(Loss) profit for the period | | ($46.4m) | | $51.2m | | $81.1m | | $55.4m |

| | | | |

Diluted (loss) earnings per share | | ($0.28) | | $0.25 | | $0.46 | | $0.27 |

| | | | |

Net cash from operating activities | | $82.3m | | $73.9m | | $82.3m | | $73.9m |

| | | | |

Treasury deposits, cash and cash equivalents | | $306.2m | | $333.3m | | $306.2m | | $333.3m |

|

Trading Summary

We summarise below our performance in 2013 in comparison to 2012. For a more detailed explanation, please see analysis on pages 26 to 30.

Revenue fell 6% in 2013 to $960.7 million from $1,025.4 million in 2012. This was mainly due to an expected fall in sales of Legacy products, particularly the revenue from handset connectivity and handset location products after these transferred to Samsung in Q4 2012. We also saw a significant decline in digital still camera products within our Consumer segment reflecting the shift in the market towards smartphones and tablets. These decreases were partially offset by higher volumes of higher priced products in the Voice & Music and Auto segments.

Our IFRS gross margins increased to 51.6% in 2013 (2012: 49.6%) primarily due to a shift in product mix away from lower margin handset products, combined with the strong growth in the higher margin Voice & Music business. Underlying gross margin increased to 52.4% for the same reasons (2012: 50.8%).

Total operational costs decreased by 12% to $466.8 million in 2013 (2012: $528.4 million). This reduction in costs was primarily driven by a reduction in underlying operational costs, a $10.9 million reduction in litigation costs and the release of a $9.8 million litigation provision. This was offset by a $10.4 million increase in share based payment costs driven by the increase in share price and the higher volume of shares issued to employees.

Underlying operational costs fell by 11% to $399.1 million in 2013 (2012: $446.4 million). This was mainly due to the full year benefit of lower headcount following restructuring programmes which completed in 2012 and included the transfer of 311 employees as part of the transaction with Samsung Electronics Co., Ltd for the disposal of our handset connectivity and handset location development operations (the ‘Samsung Transaction’) that completed in 2012.

|

Financial reportcontinued |

The operating loss for 2013 was $48.4 million after the impact of the non-cash $76.9 million impairment charge in connection with the discontinuation of development of COACH products, and other non-underlying items. Underlying operating profit grew to $104.3 million in 2013 (2012: $74.0 million) due to the strong underlying gross margin and lower operational costs, as mentioned above.

Cameras

On 10 December 2013, we announced our decision to discontinue development of next generation COACH platform products, in order to focus investment on higher growth markets. This decision resulted in a non-cash impairment to goodwill, intangible assets and tangible assets allocated to the Cameras cash generating unit (‘CGU’) of $76.9 million. This charge comprised $50.5 million impairment on goodwill, $26.2 million on intangible assets and $0.2 million on tangible assets.

In connection with this action, we incurred restructuring costs of $6.5 million which were mainly due to the redundancies of 152 employees in the Camera business who were not redeployed within the Group, and which completed during 2014.

Returns to Shareholders

During 2013, we bought back 8.45 million of our own ordinary shares in the open market for an aggregate of $67.8 million. In addition during 2013, the Employee Benefit Trust purchased 0.5 million CSR ordinary shares in the open market for an aggregate of $4.8 million.

We paid a dividend of $0.136 per ordinary share, of which $0.091 was paid as a final dividend in May 2014, and $0.045 was paid as an interim dividend in September 2013.

Litigation

During 2013 we paid $12.0 million to settle outstanding lawsuits of which $7.5 million had been accrued in 2012. In March 2013, the US Supreme Court dismissed the case brought by the US Securities and Exchange Commission against two former officers of Microtune, Inc. in respect of which CSR assumed certain indemnification obligations as a result of the acquisition of Zoran Corporation in 2011. As a consequence of the court’s decision, we released a litigation provision of $9.8 million.

Review of 2014

2014 Segmental Performance

We divide our operations into four reporting segments, Voice & Music, Auto, and Consumer which form our “Core business”, and Legacy. These segments are described on pages 2 and 3.

Results for the four segments are regularly reviewed by senior management (including the CEO who is the Chief Operating Decision Maker), to understand how each area has impacted the results of our Group and inform decisions on resource allocation. Therefore, we report the results of these business areas as operational and reporting segments as defined by IFRS 8. There were no changes to these segments during 2014.

The table below shows our segmental performance in 2014 and 2013.

| | | | | | | | | | |

| | | 2014 | | 2014 | | 2013 | | 2013 | | 2014 vs 2013 |

Revenue | | $ million | | % Revenue | | $ million | | % Revenue | | % change |

| | | | | |

Auto segment | | 201.0 | | 25.9 | | 228.8 | | 23.8 | | (12) |

| | | | | |

Consumer segment | | 155.4 | | 20.1 | | 181.5 | | 18.9 | | (14) |

| | | | | |

Voice & Music segment | | 346.6 | | 44.7 | | 312.0 | | 32.5 | | 11 |

| | | | | |

Core business group | | 703.0 | | 90.7 | | 722.3 | | 75.2 | | (3) |

| | | | | |

Legacy segment | | 71.8 | | 9.3 | | 238.4 | | 24.8 | | (70) |

| | | | | |

Total | | 774.8 | | 100.0 | | 960.7 | | 100.0 | | (19) |

| | | | | |

Underlying operating result* | | | | | | | | | | |

| | | | | |

Auto segment | | (20.2) | | – | | (7.4) | | – | | (173) |

| | | | | |

Consumer segment | | (18.1) | | – | | (70.4) | | – | | 74 |

| | | | | |

Voice & Music segment | | 124.5 | | – | | 123.1 | | – | | 1 |

| | | | | |

Core business group | | 86.2 | | – | | 45.3 | | – | | 90 |

| | | | | |

Legacy segment | | 23.7 | | – | | 59.0 | | – | | (60) |

| | | | | |

Total | | 109.9 | | – | | 104.3 | | – | | 5 |

* Operating result means the underlying operating profit or (loss) in the year

Auto

In 2014, revenue from our Auto segment decreased 12% to $201.0 million, from $228.8 million in 2013.