- MARK Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

-

ETFs

- Insider

- Institutional

- Shorts

-

424B3 Filing

Remark (MARK) 424B3Prospectus supplement

Filed: 12 Jul 07, 12:00am

Use these links to rapidly review the document

PROXY STATEMENT/PROSPECTUS TABLE OF CONTENTS

Filed Pursuant to Rule 424(b)(3)

Registration No. 333-141286

To the stockholders of INTAC:

I am pleased to report that on April 20, 2006, INTAC International, Inc. ("INTAC") entered into a merger agreement with HowStuffWorks, Inc., an online publishing company ("HSW"), HSW International, Inc., a new company formed by HSW ("HSW International") and HSW International Merger Corporation, a wholly owned subsidiary of HSW International, which was amended on January 29, 2007, pursuant to which INTAC will become a wholly owned subsidiary of HSW International (the "merger") and, in related transactions contemplated by the merger agreement, (i) HSW will contribute to HSW International, in exchange for common stock of HSW International, principally exclusive digital publishing rights to HSW's content for the countries of China and Brazil (the "contribution") and (ii) certain investors have agreed to purchase shares of HSW International having an aggregate value of approximately $50 million (the "equity financing," and together with the contribution, the "related transactions"). Upon consummation of the merger and the related transactions, HSW International intends to launch an Internet business based on HSW's content, including advertising, search, e-commerce and sponsorships, in China and Brazil.

On January 29, 2007, INTAC, INTAC International Holdings Limited ("INTAC Holdings"), a wholly-owned subsidiary of INTAC, and INTAC (Tianjin) International Trading Company, a wholly owned subsidiary of INTAC Holdings ("INTAC Trading"), entered into a share purchase agreement with Wei Zhou, INTAC's Chief Executive Officer and President, and Cyber Proof Investments Ltd. ("Cyber"), a corporation controlled by Wei Zhou, pursuant to which INTAC Holdings will sell all the issued and outstanding shares of Global Creative International Limited, INTAC Telecommunications Limited, INTAC Deutschland GmbH and FUTAC Group Limited, each a wholly owned subsidiary of INTAC Holdings ("distribution companies"), to Cyber in exchange for 3 million shares of INTAC common stock held by Mr. Zhou (the "distribution business sale"). The distribution/telecommunications segment of INTAC's business, which consists of the distribution of wireless handset products and the sale of prepaid calling cards, is conducted in whole by these four subsidiaries of INTAC Holdings. In addition, INTAC Trading has agreed to transfer its rights and control with respect to Beijing INTAC Meidi Technology Development Co., Ltd. to Cyber.

You are cordially invited to attend the special meeting of INTAC stockholders to be held on August 13, 2007 at 10:00 a.m. eastern time to consider and vote on the adoption of the merger agreement and the share purchase agreement and approval of the merger, the related transactions and the distribution business sale.

Only stockholders who owned shares of INTAC common stock at the close of business on July 10, 2007, the record date for the special meeting, are entitled to notice of and to vote at the special meeting and any adjournments or postponements of the special meeting.

The merger and related transactions cannot be completed unless the stockholders of INTAC holding a majority of the outstanding shares on the record date for the special meeting adopt the merger agreement and approve the merger and related transactions. In addition, the completion of the merger and related transactions is conditioned upon the adoption of the share purchase agreement and the completion of the distribution business sale. The completion of the merger and the related transactions is also subject to the satisfaction of other conditions, including approval of HSW International's application to list its common stock on either the Nasdaq National Market or Nasdaq Capital Market.

The distribution business sale cannot be completed unless the stockholders of INTAC (other than Mr. Zhou, his affiliates and associates) holding a majority of the outstanding shares (other than those shares held by Mr. Zhou, his affiliates and associates) on the record date for the special meeting adopt the share purchase agreement and approve the distribution business sale.

If the merger and related transactions are completed, INTAC stockholders will be entitled to receive in exchange for each of their shares of INTAC common stock one share of HSW International common stock. If the merger and related transactions are completed, HSW will receive that number of shares of HSW International common stock equal to the number of issued and outstanding shares of INTAC common stock immediately prior to the merger, including the shares held by INTAC Holdings

as a result of the distribution business sale. Based on the number of issued and outstanding shares of INTAC common stock as of July 10, 2007, HSW will receive 22,940,727 shares of HSW International common stock, and INTAC stockholders will receive 22,940,727 shares of HSW International common stock. The total number of shares of HSW International common stock to be issued to INTAC stockholders and HSW is 45,881,454.

HSW International plans to list its common stock on either the Nasdaq National Market or Nasdaq Capital Market under the symbol "HSWI." You should obtain current market quotations for INTAC common stock from the Nasdaq Capital Market under the symbol "INTN."

After careful consideration, the INTAC board of directors adopted the merger agreement and the share purchase agreement and determined that the merger agreement, the share purchase agreement, the merger, the related transactions and the distribution business sale are fair to and in the best interests of INTAC and its stockholders. The INTAC board of directors unanimously recommends that you vote "FOR" adoption of the merger agreement and the share purchase agreement and approval of the merger, related transactions and the distribution business sale.

Our President and Chief Executive Officer, who owns approximately 52.1% of our outstanding shares of common stock as of the record date, has entered into a voting agreement in which he has agreed to vote his shares in favor of adoption of the merger agreement and approval of the merger and related transactions. Therefore, the merger agreement will be adopted and the merger and related transactions will be approved regardless of how our other stockholders vote their shares. Because the shares of INTAC common stock held by Mr. Zhou, his affiliates and associates will not participate in the vote to adopt the share purchase agreement and approve the distribution business sale, your vote is extremely important in determining whether the share purchase agreement will be adopted and the distribution business sale approved, and, ultimately determining whether INTAC will be able to complete the merger and related transactions.

Whether or not you plan to be present at the special meeting, please complete, sign, date and return the enclosed proxy card or submit your proxy by telephone or on the Internet as soon as possible. If you hold your shares in "street name," you should instruct your broker how to vote in accordance with your voting instruction form. If you fail to submit a proxy, fail to vote in person, abstain from voting or do not instruct your broker how to vote your shares, it will have the same effect as a vote against adoption of the merger agreement and the share purchase agreement.

This proxy statement/prospectus provides detailed information concerning the merger, the other transactions contemplated by the merger, the distribution business sale and the INTAC special meeting. Additional information regarding INTAC and HSW International, Inc., has been filed with the Securities and Exchange Commission and is publicly available.We encourage you to read carefully this entire document, including all of its annexes, and we especially encourage you to read the section entitled "Risk Factors" beginning on page 25.

On behalf of the INTAC board of directors, I thank you for your support and appreciate your consideration of this matter.

Wei Zhou

Secretary, President and Chief Executive Officer

INTAC International, Inc.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved the HSW International common stock to be issued by HSW International under this document or passed upon the adequacy or accuracy of this document. Any representation to the contrary is a criminal offense.

This proxy statement/prospectus is dated July 11, 2007 and is first being mailed

to INTAC stockholders on or about July 12, 2007.

REFERENCES TO ADDITIONAL INFORMATION

This proxy statement/prospectus incorporates by reference important business and financial information about INTAC from documents that are not included in or delivered with this proxy statement/prospectus. This information is available to you without charge upon your written or oral request. You can obtain the documents incorporated by reference in this proxy statement/prospectus by requesting them in writing or by telephone from INTAC at the following address and telephone number:

INTAC International, Inc.

12221 Merit Drive, Suite 600

Dallas, TX 75251-2248

Attention: J. David Darnell

Telephone: (469) 916-9891

If you would like to request documents, please do so by August 6, 2007 in order to receive them before the INTAC special meeting.

See "Where You Can Find More Information" on page 195.

INTAC INTERNATIONAL, INC.

NOTICE OF SPECIAL MEETING OF SHAREHOLDERS

TO BE HELD ON AUGUST 13, 2007

To the stockholders of INTAC International, Inc.:

A special meeting of stockholders of INTAC International, Inc. ("INTAC") will be held on August 13, 2007, at 10:00 a.m., eastern time, at the offices of Greenberg Traurig, LLP, 3290 Northside Parkway, N.W., Suite 400, Atlanta, Georgia 30327, for the following purpose:

We will transact no other business at the INTAC special meeting, except such business as may properly be brought before the INTAC special meeting and any adjournment or postponement of it.

Only stockholders who owned shares of INTAC common stock at the close of business on July 10, 2007, the record date for the INTAC special meeting, are entitled to notice of, and to vote at, the INTAC special meeting and any adjournment or postponement of it. A stockholders' list will be available for inspection by any stockholder entitled to vote at the special meeting beginning no later than ten days before the date of the INTAC special meeting and continuing through the INTAC special meeting.

We cannot complete the merger and the related transactions unless the stockholders of INTAC holding a majority of the outstanding shares on the record date for the special meeting adopt the merger agreement and approve the merger and the related transactions. We cannot complete the distribution business sale unless the stockholders of INTAC (other than Mr. Zhou, his affiliates and associates) holding a majority of the outstanding shares (other than those shares held by Mr. Zhou, his affiliates and associates) on the record date for the special meeting adopt the share purchase agreement and approve the distribution business sale.

Our President and Chief Executive Officer, who owns approximately 52.1% of our outstanding shares of common stock as of the record date, has entered into a voting agreement in which he has agreed to vote his shares in favor of adoption of the merger agreement and approval of the merger and the related transactions. Therefore, the merger agreement will be adopted and the merger and the related transactions will be approved regardless of how our other stockholders vote their shares. However, the completion of the merger and related transactions is conditioned upon the adoption of the share purchase agreement and the completion of the distribution business sale. Because the shares of INTAC common stock held by Mr. Zhou, his affiliates and associates will not participate in the vote to adopt the share purchase agreement and approve the distribution business sale, your vote is extremely important in determining whether the share purchase agreement will be adopted and the distribution business sale approved, and, ultimately, determining whether INTAC will be able to complete the merger and related transactions.

INTAC stockholders have no dissenters' rights under Nevada law in connection with the merger. The proxy statement/prospectus accompanying this notice explains the merger and the related transactions, as well as the merger agreement, and provides specific information concerning the INTAC special meeting. Please review the proxy statement/prospectus carefully.

After careful consideration, the INTAC board of directors adopted the merger agreement and the share purchase agreement and determined that the merger agreement, the share purchase agreement, the merger, the related transactions and the distribution business sale are fair to and in the best interests of INTAC and its stockholders. The INTAC board of directors unanimously recommends that you vote "FOR" adoption of the merger agreement AND the share purchase agreement and approval of the merger, the related transactions and the distribution business sale.

Whether or not you plan to attend the INTAC special meeting, please complete, sign and date the enclosed proxy card and return it promptly in the enclosed postage-paid return envelope or submit your proxy by telephone or on the Internet as soon as possible. You may revoke the proxy at any time prior to its exercise in the manner described in the proxy statement/prospectus. Any stockholder of record present at the INTAC special meeting, including any adjournment or postponement of it, may revoke his or her proxy and vote personally on the merger agreement. Executed proxies with no instructions indicated thereon will be voted "FOR" adoption of the merger agreement AND the share purchase agreement and approval of the merger, the related transactions and the distribution business sale.

Please do not send any stock certificates at this time.

By order of the board of directors,

Wei Zhou

Secretary, President and Chief Executive Officer

Dallas, Texas

July 11, 2007

TABLE OF CONTENTS

i

Annexes | |

| Annex A — Agreement and Plan of Merger | |

| Annex B — First Amendment to Agreement and Plan of Merger | |

| Annex C — Form of Contribution Agreement (PRC Territories) | |

| Annex D — Form of Contribution Agreement (Brazil) | |

| Annex E — Form of Services Agreement | |

| Annex F — Form of Update Agreement | |

| Annex G — Letter Agreement | |

| Annex H — Amended and Restated Stockholders Agreement | |

| Annex I — Stock Purchase Agreements with American Investors | |

| Annex J — Stock Purchase Agreements with European Investors | |

| Annex K — DWS Stock Purchase Agreement | |

| Annex L — First Amendment to DWS Stock Purchase Agreement | |

| Annex M — Voting Agreement | |

| Annex N — Opinion of Savvian LLC dated January 28, 2007 | |

| Annex O — Opinion of Savvian LLC dated January 28, 2007 | |

| Annex P — Form of Amended and Restated Certificate of Incorporation of HSW International, Inc. | |

| Annex Q — Form of Amended and Restated Bylaws of HSW International, Inc. | |

| Annex R — Share Purchase Agreement |

ii

QUESTIONS AND ANSWERS ABOUT THE MERGER

| Q: | Why am I receiving this proxy statement/prospectus? | |||

A. | HowStuffWorks, Inc. (referred to in this proxy statement/prospectus as HSW), HSW International, Inc. (referred to in this proxy statement/prospectus as HSW International), HSW International Merger Corporation, a wholly-owned subsidiary of HSW International (referred to in this proxy statement/prospectus as merger sub) and INTAC International, Inc. (referred to in this proxy statement/prospectus as INTAC) have entered into the Agreement and Plan of Merger, dated as of April 20, 2006, as amended (referred to in this proxy statement/prospectus as the merger agreement) by First Amendment to Agreement and Plan of Merger (referred to in this proxy statement/prospectus as the amendment to merger agreement), among HSW, HSW International, merger sub and INTAC, that is described in this proxy statement/prospectus. Additionally, INTAC, INTAC Holdings, INTAC Trading, Cyber and Wei Zhou, INTAC's Chief Executive Officer and President, have entered into a Share Purchase Agreement, dated as of January 29, 2007 (referred to in this proxy statement/prospectus as the share purchase agreement). See "The Merger Agreement" beginning on page 91 of this proxy statement/prospectus and "The Share Purchase Agreement" beginning on page 109 of this proxy statement/prospectus. Copies of the merger agreement, the amendment to merger agreement and the share purchase agreement are attached to this proxy statement/prospectus as Annexes A, B and R, respectively. | |||

In order to complete the merger, INTAC stockholders must adopt the merger agreement and approve the merger (as defined below) and the related transactions (as defined below), all necessary governmental approvals must be received and all other conditions to the merger must be satisfied or waived, including the distribution business sale. In order to complete the distribution business sale (as defined below), the INTAC stockholders (other than Mr. Zhou, his affiliates and associates) must adopt the share purchase agreement and approve the distribution business sale (as defined below), all necessary governmental approvals must be received and all other conditions to the distribution business sale must be satisfied or waived. INTAC will hold a special meeting of its stockholders (referred to in this proxy statement/prospectus as the INTAC special meeting) to obtain the required approvals of its stockholders. | ||||

This proxy statement/prospectus contains important information about the merger agreement, the share purchase agreement, the merger, the other transactions contemplated by the merger agreement, the distribution business sale and the INTAC special meeting. You should read it carefully. | ||||

Q: | What will happen in the distribution business sale? | |||

A. | Under the terms of the share purchase agreement, INTAC Holdings will sell all the issued and outstanding shares of Global Creative International Limited, INTAC Telecommunications Limited, INTAC Deutschland GmbH and FUTAC Group Limited, each a wholly owned subsidiary of INTAC Holdings, and INTAC Trading will transfer its right and control with respect to Beijing INTAC Meidi Technology Development Co., Ltd. ("Meidi Technology") to Cyber in exchange for 3 million shares of INTAC common stock held by Wei Zhou (the "distribution business sale"). The distribution/telecommunications segment of INTAC's business, which consists of the distribution of wireless handset products and the sale of prepaid calling cards, is conducted by the four subsidiaries of INTAC Holdings. The distribution business sale will be consummated immediately prior to the consummation of the merger. | |||

Q: | What will happen in the merger and the related transactions and what will be HSW International's resulting lines of businesses? | |||

A. | Merger | |||

Under the terms of the merger agreement, merger sub will be merged with INTAC (referred to in this proxy statement/prospectus as the merger), with INTAC surviving as a wholly owned subsidiary of HSW International. | ||||

Related Transactions | ||||

The Asset Contribution | ||||

In connection with the merger, and as contemplated by the merger agreement, HSW will contribute certain assets, properties and rights to HSW International in exchange for shares of HSW International common stock (referred to in this proxy statement/prospectus as the asset contribution) pursuant to two contribution agreements, which will result in HSW International having exclusive digital publishing rights to HSW's content that is posted or has been posted on the HSW website on or before the merger as translated in the language of the respective territories in both China and Brazil (referred to in this proxy statement/prospectus as the contributed assets). Copies of the contribution agreements are attached to this proxy statement/prospectus as Annexes C and D. | ||||

The Other Rights | ||||

HSW will also grant HSW International the right to exclusively license for a fee the digital publishing rights in the territories to new and modified HSW content pursuant to an update agreement. Additionally, HSW will provide certain transitional services to HSW International for the purposes of developing, supporting, translating and facilitating the digital transmission of the contributed assets pursuant to a services agreement. HSW will also grant HSW International an 18 month option to acquire from HSW the exclusive digital publishing rights for HSW content in India and Russia on the same terms and conditions as those in respect of China and Brazil. Finally, HSW will agree to make an irrevocable offer to HSW International to participate in any transaction involving an investment or acquisition of an interest in any entity, business, assets, properties or securities in connection with a sale, transfer, assignment or license of HSW's rights in the licensed content or sublicensed content in any geographical area outside the United States or the territories. Copies of the Services Agreement, Update Agreement and Letter Agreement are attached to this proxy statement/prospectus as Annexes E, F and G, respectively. See "Agreements Related to the Merger—The Contribution Agreements, Services Agreement, Update Agreement and Letter Agreement" beginning on page 103. | ||||

The Equity Financing | ||||

Ashford Capital Partners, L.P., Harvest 2004, LLC, American Funds Insurance Series—Global Small Capitalization Fund, SMALLCAP World Fund, Inc., Chilton Investment Partners, L.P., Chilton QP Investment Partners, L.P., Chilton International, L.P., Chilton New Era Partners, L.P., Chilton New Era International, L.P., Chilton Small Cap Partners, L.P., Chilton Small Cap International, L.P. and Zeke, LP (collectively, "American investors") have agreed to purchase $22.5 million of shares of HSW International common stock (referred to in this proxy statement/prospectus as the American investors stock purchase) pursuant to stock purchase agreements (referred to in this proxy statement/prospectus as the American investors stock purchase agreements). | ||||

2

Additionally, DWS Finanz-Service GmbH (referred to in this proxy statement/prospectus as DWS), an affiliate of INTAC's largest institutional investor, Nordinvest, Deka Investment GmbH and Brompton Cross Master Fund, Ltd. (collectively, "European investors") have agreed to purchase approximately $27 million of shares of HSW International common stock (referred to in this proxy statement/prospectus as the European investors stock purchase, and together with the American investors stock purchase, the equity financing) pursuant to stock purchase agreements (referred to in this proxy statement/prospectus as the European investors stock purchase agreements, and together with the American investors stock purchase agreements, the stock purchase agreements). A copy of the stock purchase agreements, including amendment to the stock purchase agreement with DWS, are attached to this proxy statement/prospectus as Annexes I, J, K and L. See "Agreements Related to the Merger—The Stock Purchase Agreements" beginning on page 104. | ||||

The asset contribution and the equity financing are referred to in this proxy statement/prospectus as the "related transactions." | ||||

HSW International's Resulting Lines of Businesses | ||||

Upon consummation of the merger and the related transactions, HSW International intends to launch an Internet business based on HSW's content, including advertising, search, e-commerce and sponsorships, in China and Brazil. HSW International will also continue to operate INTAC's career development and training services business segment. | ||||

Q: | Why is INTAC proposing the distribution business sale? | |||

A. | INTAC and HSW International intend to focus their post-merger operations on content acquisition, creation, and dissemination, including online publishing, career development and training and education markets. INTAC does not believe that the distribution/telecommunications segment of INTAC's current business is a complementary fit to the post-merger business plans of the combined company, as it involves the purchase and sale of physical inventory and has historically generated low profit margins. Also, due to an influx of both local and foreign competitors in the Chinese wireless handset distribution market, the distribution/telecommunications segment of INTAC's business has become increasing competitive and its future business prospects have become increasingly uncertain. | |||

Q: | Why are HSW, HSW International and INTAC proposing the merger and the related transactions? | |||

A. | HSW, HSW International and INTAC believe that a combination of HSW International and INTAC will provide substantial strategic and financial benefits to the stockholders of both companies by integrating the contributed assets with INTAC's expertise and relationships in China, thereby creating an interactive media and service platform for Chinese Internet users that has the potential to create greater stockholder value than either HSW or INTAC could create separately. INTAC will be able to utilize its international experience and leverage an interactive media and service platform to launch an online business in Brazil. In addition, the companies believe that the equity financing will prove beneficial to HSW International's future plans and operations. The success of the merger and HSW International are, however, subject to substantial risks. Please see the sections entitled "Risk Factors" on page 25. Additionally, to review INTAC's reasons for the merger, including specific risks considered by the INTAC board of directors, in greater detail, please see the section entitled "The Merger and the Distribution Business Sale—INTAC's Reasons for the Merger and Distribution Business Sale and Recommendation of the INTAC Board of Directors" beginning on page 62. | |||

3

Q: | Have any executive officers or directors of INTAC agreed to vote in favor of the adoption of the merger agreement and approval of the merger and the related transactions? | |||

A. | Yes. Mr. Wei Zhou, INTAC's President and Chief Executive Officer, who owns approximately 52.1% of the outstanding shares of INTAC common stock as of the record date, has entered into a voting agreement pursuant to which he has agreed to vote his shares in favor of the adoption of the merger agreement and approval of the merger and the related transactions. Therefore, the merger agreement will be adopted and the merger and the related transactions approved regardless of how INTAC's other stockholders vote their shares. Because the shares of INTAC common stock held by Mr. Zhou, his affiliates and associates will not participate in the vote to adopt the share purchase agreement or approve the distribution business sale, your vote is extremely important in determining whether the share purchase agreement will be adopted and the distribution business sale approved. If the share purchase agreement is not adopted and the distribution sale is not approved, the parties do not intend to consummate the merger and related transactions, and, ultimately, determining whether INTAC will be able to complete the merger and related transactions. Other officers and directors of INTAC who are eligible to participate in the vote to adopt the share purchase agreement and approve the distribution business sale own approximately 4.4% of the outstanding shares of INTAC common stock as of the record date. Such persons have expressed their intent to vote their shares in favor of the adoption of the merger agreement and approval of the merger and related transactions. | |||

Q: | What will INTAC stockholders receive in the merger? | |||

A. | Upon completion of the merger, for each share of INTAC common stock that they own, INTAC stockholders will receive one share of HSW International common stock. | |||

Q: | What will HSW receive in connection with the merger and related transactions? | |||

A. | If the merger and related transactions are completed, HSW will receive that number of shares of HSW International common stock equal to the number of issued and outstanding shares of INTAC common stock immediately prior to the merger, including the shares held by INTAC Holdings as a result of the distribution business sale. Based on the number of issued and outstanding shares of INTAC common stock as of July 10, 2007, HSW will receive 22,940,727 shares of HSW International common stock as a result of the merger and related transactions. | |||

Q: | What will INTAC stockholders receive in the distribution business sale? | |||

A. | Nothing. However, INTAC Holdings will receive the 3 million shares of INTAC common stock tendered by Wei Zhou as payment for the distribution business sale. | |||

Q: | What will HSW International stockholders receive in the merger and the distribution business sale? | |||

A. | Nothing. Each share of HSW International common stock outstanding immediately prior to the merger will remain outstanding as a share of HSW International common stock immediately following the merger. HSW will, however, receive shares of the common stock of HSW International in connection with the asset contribution. | |||

Q: | How much of HSW International will INTAC stockholders own if the merger is completed? | |||

A. | Upon the consummation of the merger and the asset contribution but without giving effect to the equity financing, | |||

4

INTAC stockholders will own approximately 46.5% of the outstanding shares of HSW International. After giving effect to the equity financing, INTAC stockholders will own a percentage of the outstanding shares of HSW International that will vary depending upon the HSW International stock price. The maximum percentage of outstanding HSW International common stock that current INTAC stockholders may own upon consummation of the merger and the related transactions is approximately 39.6%. Please see the section entitled "The Merger and the Distribution Business Sale—Ownership of HSW International Following the Merger" beginning on page 85 for more information. | ||||

Q: | Where will the shares of HSW International common stock to be received by INTAC stockholders be listed? | |||

A. | HSW International will apply to have the HSW International common stock listed on either the Nasdaq National Market or the Nasdaq Capital Market under the symbol "HSWI" and will use its best efforts to obtain Nasdaq approval for the quotation of HSW International common stock prior to the closing of the merger. | |||

Q: | Does the INTAC board of directors support the merger and the distribution business sale? | |||

A. | Yes. After careful consideration, the INTAC board of directors adopted the merger agreement and the share purchase agreement and determined that the merger agreement, the merger, the related transactions, the share purchase agreement and the distribution business sale are fair to and in the best interests of INTAC and its stockholders. The INTAC board of directors recommends that INTAC stockholders vote "FOR" adoption of the merger agreement and the share purchase agreement and approval of the merger, the related transactions and the distribution business sale. | |||

In reaching its decision to adopt the merger agreement and the share purchase agreement and to recommend the adoption of the merger agreement, approval of the merger, the related transactions, the share purchase agreement and the distribution business sale by INTAC's stockholders, the INTAC board of directors consulted with INTAC's management, as well as its legal and financial advisors, and considered the terms of the proposed merger agreement and the transactions contemplated by the merger agreement. INTAC's board of directors also considered each of the items set forth on pages 62 through 65 under"The Merger and the Distribution Business Sale—INTAC'S Reasons for the Merger and Distribution Business Sale and Recommendation of the INTAC Board of Directors." | ||||

Q: | Are there risks involved in undertaking the merger and distribution business sale? | |||

A. | Yes. In evaluating the merger and the distribution business sale, INTAC stockholders should carefully consider the factors discussed in the section of this proxy statement/prospectus entitled "Risk Factors" beginning on page 25 and other information about HSW International and INTAC included in the documents incorporated by reference in the proxy statement/prospectus. | |||

Q: | Where and when is the special meeting of INTAC stockholders? | |||

A. | The INTAC special meeting will be held on August 13, 2007 at 10:00 a.m., eastern time, at the offices of Greenberg Traurig, LLP, 3290 Northside Parkway, N.W., Suite 400, Atlanta, Georgia 30327. INTAC stockholders may attend the INTAC special meeting and vote their shares in person, in addition to completing, signing, dating and returning the enclosed proxy or submitting a proxy on the Internet. | |||

Q: | Who can vote at the INTAC special meeting? | |||

A. | INTAC stockholders can vote at the INTAC special meeting if they owned shares of INTAC common stock at the close of business on July 10, 2007 | |||

5

(referred to in this proxy statement/prospectus as the INTAC record date), the record date for the INTAC special meeting. | ||||

Q: | What vote is required by INTAC stockholders to adopt the merger agreement? | |||

A. | The affirmative vote of the holders of a majority of the outstanding shares of INTAC common stock entitled to vote at the INTAC special meeting (as determined on the record date of the INTAC special meeting) is required to adopt the merger agreement. | |||

As of the close of business on July 10, 2007, the record date, 22,940,727 shares of INTAC common stock were outstanding. | ||||

Q: | What vote is required by INTAC stockholders to adopt the share purchase agreement? | |||

A. | The affirmative vote of the holders of a majority of the outstanding shares of INTAC common stock (other than those shares held by Mr. Zhou, his affiliates and associates) entitled to vote at the INTAC special meeting (as determined on the record date of the special meeting) is required to adopt the distribution business sale. | |||

Q: | What will happen if the share purchase agreement and distribution business sale are not approved? | |||

A. | Because the completion of the merger and related transactions is conditioned upon the adoption of the share purchase agreement and the completion of the distribution business sale, if the share purchase agreement is not adopted and the distribution business sale is not approved, it is unlikely that the merger and related transactions will be completed. The INTAC Board may seek to sell the distribution business to a third party if the distribution business sale to Cyber is not approved, however, it is unlikely that such an agreement could be reached prior to the termination date for the merger agreement, which is August 31, 2007. | |||

Q: | As of the record date, what percentage of outstanding INTAC common stock was owned by INTAC's executive officers and directors as a group? | |||

A. | As of the record date, INTAC's executive officers and directors as a group beneficially owned and were entitled to vote in the aggregate 12,950,668 shares of INTAC common stock, which represented approximately 55.9% of the shares of INTAC common stock outstanding on the record date. Officers and directors of INTAC who are eligible to participate in the vote to adopt the share purchase agreement and approve the distribution business sale own approximately 4.4% of the outstanding shares of INTAC common stock as of the record date. Such persons have expressesd their intent to vote their shares in favor of the adoption of the share purchase agreement and approval of the distribution business sale. | |||

Q: | What do INTAC stockholders need to do now? | |||

A. | After carefully reading and considering the information contained in this proxy statement/prospectus, please complete, sign and date your proxy and return it in the enclosed postage-paid return envelope or vote your shares on the Internet as soon as possible, so that your shares may be represented at the INTAC special meeting. If you sign and send in your proxy and do not indicate your vote for the merger agreement and/or the share purchase agreement, INTAC will count your proxy as a vote in favor of approval of the merger agreement, the share purchase agreement or both agreements, as applicable. | |||

Because the required vote of INTAC stockholders for the merger is based upon the number of outstanding shares of INTAC common stock entitled to vote, and the required vote of INTAC stockholders for the distribution business sale is based upon the number of outstanding shares of INTAC common stock (other than those shares held by | ||||

6

Mr. Zhou, his affiliates and associates) entitled to vote, failure to submit a proxy or to vote in person, abstentions and broker non-votes will have the same effect as a vote against approval of the merger agreement and the share purchase agreement. | ||||

Q: | Can I change my vote after I have mailed my signed proxy? | |||

A. | Yes. You can change your vote at any time before your proxy is voted at the INTAC special meeting. You can do this in one of two ways. First, you can send a written notice stating that you would like to revoke your proxy. Second, you can complete and submit a new valid proxy bearing a later date by mail or on the Internet. Attendance at the INTAC special meeting will not in and of itself constitute revocation of a proxy. | |||

If you are an INTAC stockholder and you choose to send a written notice or to mail a new proxy, you must submit your notice of revocation or your new proxy to INTAC International, Inc. at 12221 Merit Drive, Suite 600, Dallas, Texas 75251-2248, Attention: Secretary, and it must be received by 10:00 a.m. eastern time on August 13, 2007. | ||||

Q: | If my shares are held in "street name" by my broker, will my broker vote my shares for me? | |||

A. | Your broker will vote your shares only if you provide instructions on how to vote. You should follow the directions provided by your broker regarding how to instruct your broker to vote your shares. Without instructions, your shares will not be voted, which will have the effect of a vote against the approval of the merger agreement and the share purchase agreement at the INTAC special meeting. | |||

Q. | Should I send in my INTAC stock certificates now? | |||

A. | No. After the merger is completed, you will receive a transmittal form with instructions for the surrender of INTAC common stock certificates.Please do not send in your stock certificates with your proxy. | |||

Q: | Is the merger expected to be taxable to INTAC stockholders? | |||

A. | Based upon current law and certain covenants, assumptions and representations as to factual matters made by, among others, HSW, HSW International and INTAC, all of which must continue to be true and accurate as of the closing of the merger, it is the opinion of Shearman & Sterling LLP (referred to in this proxy statement/prospectus as Shearman & Sterling), counsel to INTAC, that the merger and the asset contribution together will qualify as a transaction pursuant to Section 351 of the Internal Revenue Code of 1986, as amended (referred to in this proxy statement/prospectus as the Internal Revenue Code). Therefore, a U.S. holder who exchanges INTAC common stock for HSW International common stock will not recognize any gain or loss on the exchange. The opinion does not address state, local or foreign tax consequences of the merger which may be applicable to INTAC and its stockholders. | |||

You should read "The Merger and the Distribution Business Sale—Material United States Federal Income Tax Consequences of the Merger" beginning on page 87 for a more complete discussion of the United States federal income tax consequences of the merger. Tax matters can be complicated and the tax consequences of the merger to you will depend on your particular tax situation.You should consult your tax advisor to determine the tax consequences of the merger to you. | ||||

Q: | If I also hold options to purchase shares of INTAC common stock, how will my stock options be treated in the merger? | |||

A. | All outstanding stock options to purchase shares of INTAC common stock will be assumed by HSW International. The terms and conditions of the assumed options will remain unchanged as a result of the | |||

7

assumption except that, upon exercise, the optionholder shall receive one share of HSW International common stock for every one share of INTAC common stock that the optionholder otherwise would have been entitled to receive. | ||||

Q: | When do you expect the distribution business sale and the merger to be completed? | |||

A. | INTAC, HSW and HSW International are working to complete the distribution business sale and the merger as quickly as possible. If the INTAC stockholders approve the share purchase agreement and the merger agreement and the parties receive the necessary governmental approvals, INTAC, HSW and HSW International anticipate that the merger will be completed in the third quarter of 2007, prior to the merger termination date of August 31, 2007. However, it is possible that factors outside the control of the parties could require them to complete the merger at a later time or not complete it at all. | |||

Q: | Can I dissent and require appraisal of my shares? | |||

A. | No. INTAC stockholders have no dissenters' rights under Nevada law in connection with the merger. | |||

Q: | Where can I find more information about the companies? | |||

A: | You can obtain more information about HSW International and INTAC from the various sources described under "Where You Can Find More Information" on page 196. | |||

Q: | Who can help answer my questions? | |||

A: | If you have any questions about the merger or if you need additional copies of this proxy statement/prospectus or the relevant proxy card, you should contact: |

| | For HSW International | For INTAC | ||

|---|---|---|---|---|

| HSW International, Inc. One Capital City Plaza 3350 Peachtree Road, Suite 1500 Atlanta, GA 30326-1039 Telephone: (404) 364-5823 | INTAC International, Inc. 12221 Merit Drive Suite 600 Dallas, TX 75251-2248 Telephone: (469) 916-9891 |

8

This summary highlights selected information from and incorporated by reference into this proxy statement/prospectus. This summary may not contain all of the information that is important to you. To understand the merger and the distribution business sale fully and for a more complete description of the legal terms of the merger and the distribution business sale, you should carefully read this entire proxy statement/prospectus and the other documents to which we refer you, including in particular the copies of the merger agreement, the share purchase agreement, the voting agreement,the contribution agreements, the services agreement, the update agreement, the letter agreement, the stock purchase agreements, the stockholders agreement, the HSW International Amended and Restated Certificate of Incorporation, the HSW International Amended and Restated Bylaws and the opinions of Savvian, LLC (referred to in this proxy statement/prospectus as Savvian) that are attached as annexes to this proxy statement/prospectus or as exhibits to the registration statement on Form S-4, of which this proxy statement/prospectus forms a part, filed by HSW International with the Securities and Exchange Commission (referred to in this proxy statement/prospectus as the SEC). See also "Where You Can Find More Information" on page 196. We have included page references parenthetically to direct you to a more complete description of the topics presented in this summary.

The Companies (page 47)

INTAC International, Inc.

Unit 6-7, 32/F.

Laws Commercial Plaza

788 Cheung Sha Wan Road

Kowloon, Hong Kong

(852) 2385-8789

INTAC is a U.S. holding company focused on the development of strategic business opportunities available in China and the Asia-Pacific Rim. The Company currently maintains offices in China (Hong Kong, Beijing and Tianjin), Germany (Frankfurt) and the United States (Dallas, Texas). INTAC services the education and career development markets in China with software for school administration and consumer-focused websites, and distributes wireless handsets to equipment wholesalers, agents, retailers and other distributors, mainly in Hong Kong.

HowStuffWorks, Inc.

One Capital City Plaza

3350 Peachtree Road, Suite 1500

Atlanta, GA 30326-1039

Telephone: (404) 760-4729

HSW is a privately-held online publishing company that provides objective, credible, and useful information for people to learn about the world around them. The company's website attracts millions of unique visitors each month and is a source for in-depth, easy-to-understand explanations on hundreds of topics ranging from science and technology to health and electronics. In 2005, HSW became the exclusive online publisher for Publications International, Ltd. and its Consumer Guide and Mobil Travel Guide brands.

HSW International, Inc.

One Capital City Plaza

3350 Peachtree Road, Suite 1500

Atlanta, GA 30326-1039

Telephone: (404) 364-5823

9

HSW International was formed on March 14, 2006 as a wholly owned subsidiary of HSW in order to effect the merger. Prior to the consummation of the merger, HSW International will have no assets or operations other than incident to its formation and in preparation for the merger and subsequent business. After the merger, INTAC will be a wholly owned subsidiary of HSW International, and the current stockholders of INTAC will become stockholders of HSW International. Upon consummation of the merger and the related transactions, HSW International will launch an Internet business based on translated and localized versions of the HowStuffWorks website, including advertising, search, e-commerce and sponsorships, in China and Brazil, leveraging the appropriate elements of INTAC's business.

HSW International Merger Corporation

One Capital City Plaza

3350 Peachtree Road, Suite 1500

Atlanta, GA 30326-1039

Telephone: (404) 760-5823

HSW International Merger Corporation was formed on February 27, 2006, and became a wholly owned subsidiary of HSW International on March 14, 2006. This subsidiary was formed as a Nevada corporation solely to effect the merger, and this subsidiary has not conducted and will not conduct any business during any period of its existence. We refer to this subsidiary throughout this proxy statement/prospectus as the merger sub.

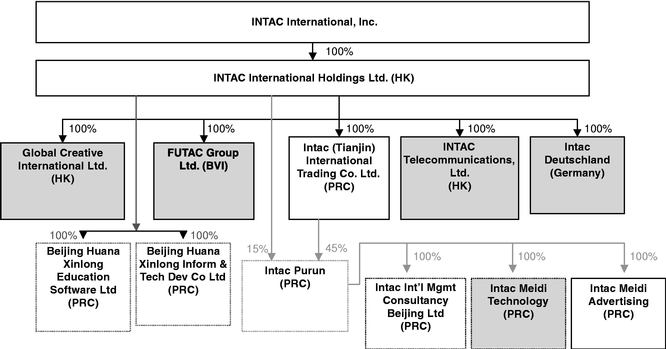

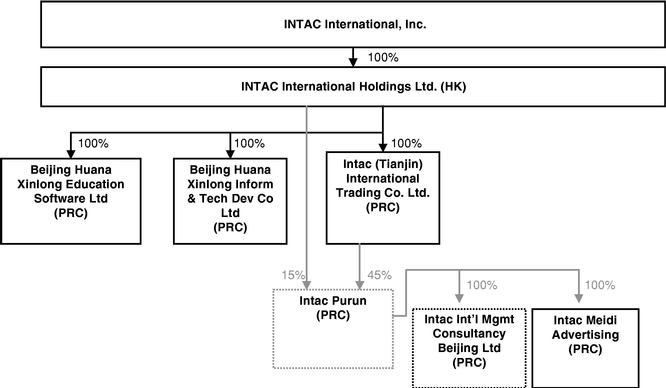

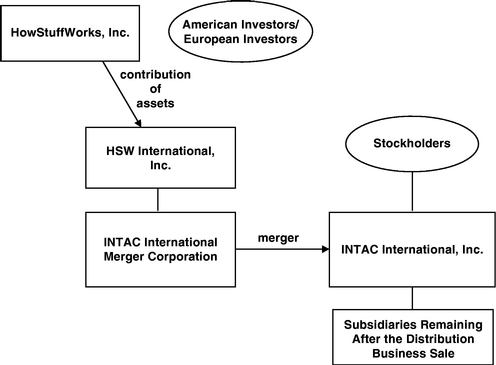

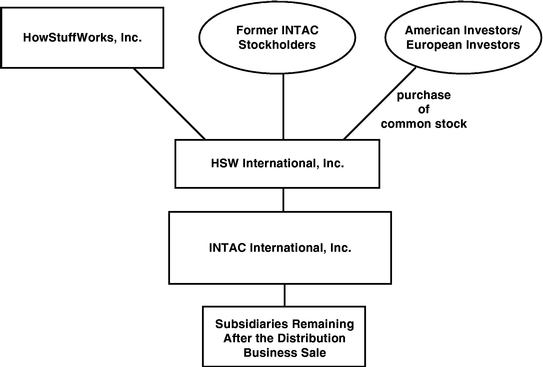

The following charts reflect the corporate structure of INTAC before and after the distribution business sale and the corporate structure of HSW International before and after the merger and related transactions. The distribution business sale and merger and related transactions are summarized below.

INTAC International, Inc. and Subsidiaries

Prior to the Distribution Business Sale

10

INTAC International, Inc. and Subsidiaries

After the Distribution Business Sale

HSW International Corporate Structure After the Distribution Business Sale

But Prior to the Merger and Related Transactions

11

HSW International Corporate Structure After the Distribution Business Sale,

Merger and Related Transactions

The Merger (page 54)

On April 20, 2006, HSW, HSW International, INTAC and merger sub, a wholly owned subsidiary of HSW International, entered into the merger agreement which was amended by the amendment to merger agreement dated January 29, 2007, which is the legal document governing the proposed merger. Under the terms of the merger agreement, merger sub will be merged with INTAC, with INTAC continuing as the surviving corporation. Upon the consummation of the merger, INTAC will be a wholly owned subsidiary of HSW International and INTAC common stock will no longer be publicly traded. HSW International will apply to have the HSW International common stock listed for trading on either the Nasdaq National Market or the Nasdaq Capital Market under the symbol "HSWI" and will use its best efforts to obtain Nasdaq approval for the quotation of HSW International common stock prior to the closing of the merger.

The Distribution Business Sale (page 54)

On January 29, 2007, INTAC, INTAC International Holdings Limited ("INTAC Holdings"), a wholly owned subsidiary of INTAC, INTAC (Tianjin) International Trading Company ("INTAC Trading"), a wholly owned subsidiary of INTAC Holdings, Cyber Proof Investments Ltd. ("Cyber"), an entity controlled by Mr. Zhou, and Mr. Zhou entered into the share purchase agreement, which is the legal document governing the proposed distribution business sale. Pursuant to the share purchase agreement, INTAC Holdings will sell all the issued and outstanding shares of Global Creative International Limited, INTAC Telecommunications Limited, INTAC Deutschland GmbH and FUTAC Group Limited, each a wholly owned subsidiary of INTAC Holdings ("distribution companies"), and INTAC Trading will transfer its rights and control with respect to Meidi Technology, to Cyber in exchange for 3 million shares of INTAC common stock held by Mr. Zhou. The distribution/telecommunications segment of INTAC's business, which consists of the distribution of wireless handset products and the sale of prepaid calling cards, is conducted in whole by the distribution companies.

12

What INTAC Stockholders Will Receive in the Merger (page 85)

At the closing of the merger and the related transactions, each outstanding share of INTAC common stock will be converted into the right to receive one share of HSW International common stock, and HSW will receive that number of shares of HSW International common stock equal to the number of issued and outstanding shares of INTAC common stock immediately prior to the merger, including the shares held by INTAC Holdings as a result of the distribution business sale. Upon the consummation of the merger and the asset contribution but without giving effect to the equity financing, INTAC stockholders will own approximately 46.5% of the outstanding shares of HSW International. After giving effect to the equity financing, INTAC stockholders will own a percentage of the outstanding shares of HSW International that will vary depending upon the HSW International stock price.

Set forth below is a table showing a range of hypothetical values representing 90% of the 10 trading day volume weighted average price of HSW International common stock commencing on the first trading day following the date on which the shelf registration statement to be filed by HSW International in connection with the equity financing is declared effective by the SEC (referred to in this proxy statement/prospectus as the shelf purchase price), the approximate number of shares of HSW International common stock to be issued pursuant to the equity financing based on the applicable hypothetical shelf purchase price and the aggregate percentage ownership of HSW International common stock to be held by current INTAC stockholders given these hypothetical values. If the shelf purchase price is lower than $6.57, equal to 90% of the 10 trading day volume weighted average price of the common stock of INTAC on the Nasdaq Capital Market ending on the trading day prior to the public announcement of the amendment to merger agreement (referred to in this proxy statement/prospectus as the public announcement price), then the investors in connection with the equity financing (other than the one European investor as described below) will ultimately receive an aggregate amount of shares equal to the value of their combined investment, or $43.5 million, divided by the shelf purchase price. However, if the public announcement price is lower than the shelf purchase price, then such investors will ultimately receive an aggregate amount of shares equal to the value of their combined investment, or $43.5 million, divided by the public announcement price. Instead of a defined purchase amount, one of the European investors has agreed to purchase 900,000 shares of HSW International common stock at the lower of the public announcement price, the shelf purchase price or highest trading price of HSW International common stock on the closing date of the purchase. There is no cap on the number of HSW International shares that may be issued in the equity financing and the percentage ownership of current INTAC stockholders in the combined company may be significantly diluted. The stock purchase agreements with the European investors allow HSW International to terminate the agreements if the shelf purchase price is less than $5.00, however, HSW International has not determined at this time if it would terminate the agreements in such event. The

13

table below does not take into account any stock options to be assumed or issued by HSW International.

| Hypothetical shelf purchase price | Approximate number of shares of HSW International common stock issuable pursuant to equity financing | Approximate aggregate ownership of HSW International common stock by current INTAC stockholders* | ||

|---|---|---|---|---|

| >= $6.57 | 7,500,000 | 39.6% | ||

$6.00 | 8,200,000 | 39.0% | ||

$5.00 | 9,600,000 | 38.0% | ||

$4.00 | 11,800,000 | 36.5% |

* HSW International outstanding shares based on 19,940,727 shares of HSW International common stock to be issued to current INTAC stockholders (other than the 3 million shares to be delivered to INTAC Holdings under the share purchase agreement for the distribution business sale), 22,940,727 shares of HSW International common stock to be issued to HSW and the variable number of shares of HSW International common stock issuable pursuant to the equity financing.

See also "The Merger and the Distribution Business Sale—Ownership of HSW International Following the Merger" beginning on page 85.

Asset Contribution Between HSW and HSW International (page 54)

In connection with the merger, HSW and HSW International will enter into two contribution agreements, through which HSW will contribute the contributed assets to HSW International in exchange for that number of shares of HSW International common stock equal to the number of issued and outstanding shares of INTAC common stock immediately prior to the merger, including the shares held by INTAC Holdings as a result of the distribution business sale. Based on the number of issued and outstanding shares of INTAC common stock on July 10, 2007, HSW will receive 22,940,727 shares of HSW International common stock. HSW International will have exclusive digital publishing rights to HSW's content in China and Brazil. In addition to the contributed assets, HSW will grant HSW International the right to exclusively license for a fee the digital publishing rights in China and Brazil to new and modified content developed by HSW after the merger is consummated (subject to the rights of third parties to such new and modified content), pursuant to an update agreement. HSW will also provide certain transitional services to HSW International for the purposes of developing, supporting, translating, and facilitating the digital transmission of the contributed assets pursuant to a services agreement. Finally, HSW will grant HSW International an 18 month option to acquire from HSW the exclusive digital publishing rights for HSW content in India and Russia. The China and Brazil contribution agreements, services agreement, update agreement and letter agreement are attached to this proxy statement/prospectus as Annexes C, D, E, F and G, respectively.

See also "Agreements Related to the Merger—The Contribution Agreements, Services Agreement, Update Agreement and Letter Agreement" beginning on page 103.

Stock Purchase Agreements (page 104)

American investors have agreed to purchase $22.5 million of HSW International common stock pursuant to the American investors stock purchase agreements, and European investors have agreed to purchase approximately $27 million of HSW International common stock pursuant to the European investors stock purchase agreements. The American investors stock purchase is conditioned upon the consummation of the merger and the European investors stock purchase is conditioned upon consummation of the merger and the effectiveness of a resale registration statement. The stock

14

purchase agreements and the First Amendment to the DWS Stock Purchase Agreement are attached to this proxy statement/prospectus as Annexes I, J, K and L, respectively.

For a more complete description, see "Agreements Related to the Merger—The Stock Purchase Agreements" beginning on page 104.

Treatment of INTAC Stock Options (page 90)

Outstanding INTAC stock options at the closing date of the merger will be assumed by HSW International and converted into options to purchase HSW International common stock on the same terms and conditions existing prior to the merger; provided, however, that outstanding options held by non-employee directors will vest as to all of the covered shares. For a more complete description of the treatment of INTAC stock options, see "The Merger and the Distribution Business Sale—Effect on Awards Outstanding Under INTAC Stock Incentive Plans" beginning on page 90.

Dissenters' Rights (page 90)

Under Nevada law, INTAC stockholders will not have dissenters' rights in connection with the merger.

Material United States Federal Income Tax Consequences of the Merger (page 87)

The merger is conditioned upon INTAC's receipt of an opinion of Shearman & Sterling, counsel to INTAC, to the effect that either (i) the merger and the asset contribution together will qualify as a transaction under Section 351 of the Internal Revenue Code, or (ii) the merger will qualify as a reorganization within the meaning of Section 368(a) of the Internal Revenue Code. This opinion of counsel to INTAC will be based on, among other things, current law and certain covenants, assumptions and representations as to factual matters made by, among others, HSW, HSW International and INTAC, which, if incorrect, could jeopardize the conclusions reached by such counsel in their opinions. So long as the merger and the asset contribution together constitutes a transaction under Section 351 of the Internal Revenue Code, the receipt by INTAC stockholders of the merger consideration in exchange for INTAC common stock pursuant to the merger will not be a taxable transaction for United States federal income tax purposes.

You should read "The Merger and the Distribution Business Sale—Material United States Federal Income Tax Consequences of the Merger" beginning on page 87 for a more complete discussion of the United States federal income tax consequences of the merger.Tax matters can be complicated, and the tax consequences of the merger to you will depend on your particular tax situation. We urge you to consult your tax advisor to determine the tax consequences of the merger to you.

Recommendation of the INTAC Board of Directors (page 62)

After careful consideration, the INTAC board of directors adopted the merger agreement and the share purchase agreement and determined that the merger agreement, the share purchase agreement, the merger, the related transactions and the distribution business sale are fair to and in the best interests of INTAC and its stockholders. The INTAC board of directors unanimously recommends that you vote "FOR" adoption of the merger agreement and the share purchase agreement and approval of the merger, the related transactions and the distribution business sale.

In reaching its decision to adopt the merger agreement and the share purchase agreement and to recommend the adoption of the merger agreement and the share purchase agreement and approval of the merger, the related transactions, the share purchase agreement by INTAC's stockholders, the INTAC board of directors consulted with INTAC's management, as well as its legal and financial

15

advisors, and considered the terms of the merger agreement, the share purchase agreement and the transactions contemplated by the merger agreement.

To review the background of, and INTAC's reasons for, the merger and the distribution business sale, as well as certain risks related to the merger and the combined company, see "The Merger and the Distribution Business Sale—Background of the Merger and Distribution Business Sale, "The Merger and the Distribution Business Sale—INTAC's Reasons for the Merger and Distribution Business Sale and Recommendation of the INTAC Board of Directors" and "Risk Factors" beginning on page 55, 62 and 25, respectively. In considering the opinions of Savvian described below, the INTAC board of directors was aware that certain fees in the amount of $2,225,000 payable to Savvian are contingent upon the consummation of the transactions, which fees are more fully described in the section entitled "Opinions of INTAC's Financial Advisor—Miscellaneous"beginning on page 65.

Opinions of INTAC's Financial Advisor (page 65)

On January 28, 2007, Savvian Advisors, LLC, or Savvian, financial advisor to INTAC, delivered to the INTAC board of directors its oral opinion, which was subsequently confirmed in writing, that, as of that date and based upon and subject to the assumptions, factors, qualifications and limitations set forth in the written opinion, the consideration to be received by the holders of shares of INTAC common stock, other than Mr. Zhou and his affiliates, taken in the aggregate pursuant to the merger agreement was fair from a financial point of view to such holders.

In addition, on January 28, 2007, Savvian delivered to the INTAC board of directors its oral opinion, which was subsequently confirmed in writing, that, as of that date and based upon and subject to the assumptions, factors, qualifications and limitations set forth in the written opinion, the consideration to be received by INTAC for all of the issued and outstanding shares of the distribution companies pursuant to the share purchase agreement was fair from a financial point of view to INTAC.

The full text of the written opinions of Savvian, each dated January 28, 2007, which set forth, among other things, the assumptions made, procedures followed, matters considered and limitations on the review undertaken by Savvian in connection with the opinions, are attached to this proxy statement/prospectus as Annex N and Annex O, respectively. Savvian provided its opinions for the information and assistance of the INTAC board of directors in connection with its consideration of the proposed transactions. The Savvian opinions are not a recommendation to any stockholder of INTAC as to how to vote or act with respect to the proposed transactions, and do not address the prices at which HSW International common stock will trade following the consummation of the merger and the distribution business sale. You are urged to read the opinions carefully and in their entirety.

Board of Directors and Management of HSW International After the Merger

Upon the consummation of the merger, the board of directors of HSW International will consist of seven individuals, with five persons to be named by HSW (consisting of Mr. Jeffrey Arnold, and four other directors to be named) and two persons to be named by Mr. Wei Zhou, Chief Executive Officer, President and Secretary of INTAC (consisting of Mr. Zhou and Dr. Heinz-Gerd Stein). Mr. Arnold will serve as chairman of the board of HSW International. A majority of the board of directors will be "independent" under both United States federal securities laws and the rules of the Nasdaq Stock Market.

Following the merger, Mr. Zhou will continue to serve as President, Chief Executive Officer and Chairman of INTAC. Mr. Zhou's current INTAC employment agreement will be assumed by HSW International. The terms of Mr. Zhou's employment will remain unchanged.

Following the merger, Mr. Robert C. Bicksler will serve as Executive Vice President, Chief Financial Officer and Chief Operating Officer of HSW International.

16

Following the merger, Mr. David Darnell will continue to serve as Senior Vice President and Chief Financial Officer of INTAC pursuant to the terms of his existing INTAC employment agreement.

For a more complete description, see "HSW International Management Following the Merger" and "The Merger and the Distribution Business Sale—Interests of HSW International Directors and Executive Officers in the Merger and Distribution Business Sale" beginning on page 138 and 84, respectively.

Interests of HSW International Directors and Executive Officers in the Merger and Distribution Business Sale (page 84)

Certain of HSW International's directors and/or executive officers may be deemed to have additional interests in the merger due to their control and/or ownership interest in HSW and/or its stockholders. In addition, Mr. Arnold's consulting agreement provides that HSW International shall grant him options to acquire 3,000,000 shares of HSW International's common stock and shall grant options to acquire an additional 1,000,000 shares to one or more individuals in the eligible grantee group, which includes Mr. Arnold. The consulting agreement further provides that Mr. Arnold shall recommend to HSW International a suggested manner of allocating the additional options. Mr. Bicksler's employment agreement provides that HSW International shall grant him options to acquire 500,000 shares of HSW International's common stock.

For a more complete description, see "The Merger and the Distribution Business Sale—Interests of HSW International Directors and Executive Officers in the Merger and Distribution Business Sale" beginning on page 84.

Interests of INTAC Directors and Executive Officers in the Merger and Distribution Business Sale (page 83)

None of INTAC's executive officers are entitled to any additional compensation as a result of the merger. Outstanding stock options granted to INTAC directors and executive officers will be assumed, meaning the options will become options to purchase HSW International common stock. Outstanding stock options held by non-employee directors (consisting of Mr. Theodore Botts, Mr. Kevin Jones, Dr. Heinz-Gerd Stein and Larrie Weil) will vest in full as a result of the merger. The aggregate dollar value of unvested stock options accelerated due to the merger for these four directors is $172,497, with $43,124 for each of the four directors, based on the closing price of INTAC common stock on July 9, 2007. Wei Zhou, Director, Chief Executive Officer, President and Secretary of INTAC is also the sole shareholder, Chief Executive Officer and President of Cyber, which will acquire the distribution/telecommunication segment of INTAC's business pursuant to the share purchase agreement.

For a more complete description, see "The Merger and the Distribution Business Sale—Interests of INTAC Directors and Executive Officers in the Merger and Distribution Business Sale" beginning on page 83.

Comparison of Rights of Common Stockholders of HSW International and INTAC (page 177)

INTAC stockholders, whose rights are currently governed by the INTAC Amended and Restated Articles of Incorporation, the INTAC Amended and Restated By-laws and Nevada law, will, upon completion of the merger, become stockholders of HSW International and their rights will be governed by the HSW International Amended and Restated Certificate of Incorporation, attached to this proxy statement/prospectus as Annex P, the HSW International Amended and Restated By-laws, attached to this proxy statement/prospectus as Annex Q, and Delaware law.

17

The special meeting of INTAC stockholders will be held at the offices of Greenberg Traurig, LLP, 3290 Northside Parkway, N.W., Suite 400, Atlanta, Georgia 30327, at 10:00 a.m., eastern time, on August 13, 2007. At the INTAC special meeting, INTAC stockholders will be asked to adopt the merger agreement and the share purchase agreement and approve the merger, the related transactions and the distribution business sale.

Record Date; Voting Power (page 44)

INTAC stockholders are entitled to vote at the INTAC special meeting if they owned shares of INTAC common stock as of the close of business on July 10, 2007, the INTAC record date.

On the INTAC record date, there were 22,940,727 shares of INTAC common stock entitled to vote at the INTAC special meeting. Stockholders will have one vote at the INTAC special meeting for each share of INTAC common stock that they owned on the INTAC record date.

Vote Required (page 44)

Adoption of the merger agreement and approval of the merger and the related transactions requires the affirmative vote of the holders of a majority of the outstanding shares of INTAC common stock entitled to vote on the INTAC record date.

Adoption of the share purchase agreement and approval of the distribution business sale requires the affirmative vote of the holders of a majority of the outstanding shares of INTAC common stock entitled to vote on the record date (other than shares held by Mr. Zhou, his affiliates and associates).

Shares Owned by INTAC Directors and Executive Officers (page 45)

On the INTAC record date, directors and executive officers of INTAC beneficially owned and were entitled to vote 12,950,668 shares of INTAC common stock in the aggregate, which represented approximately 55.9% of the shares of INTAC common stock outstanding on that date.

Voting Agreement (page 45)

Wei Zhou, INTAC's President and Chief Executive Officer, who owns approximately 52.1% of the outstanding shares of INTAC common stock as of the INTAC record date, has entered into a voting agreement pursuant to which he has agreed to vote his shares in favor of the adoption of the merger agreement and approval of the merger and the related transactions. Therefore, the merger agreement will be adopted and the merger and the related transactions approved regardless of how INTAC's other stockholders vote their shares. However, the completion of the merger and related transactions is conditioned upon the adoption of the share purchase agreement and the completion of the distribution business sale. Because the shares of INTAC common stock held by Mr. Zhou, his affiliates and associates will not participate in the vote to adopt the share purchase agreement and approve the distribution business sale, your vote is extremely important in determining whether the share purchase agreement will be adopted and the distribution business sale approved and, ultimately, whether INTAC will be able to complete the merger and related transactions. The voting agreement is attached to this proxy statement/prospectus as Annex M.

18

The merger agreement is attached as Annex A to this proxy statement/prospectus and the amendment to merger agreement is attached as Annex B to this proxy statement/prospectus. We strongly encourage you to read the merger agreement, as amended by the amendment to merger agreement, in its entirety because it is the principal document governing the merger.

Conditions to the Completion of the Merger (page 91)

HSW International and INTAC are obligated to complete the merger only if certain conditions are satisfied, or, in some cases, waived, including but not limited to the following:

Neither HSW International nor INTAC currently believes that any condition to closing will be waived. INTAC intends to recirculate revised proxy materials and resolicit proxies if there are any material changes in the terms of the merger, including those that result from waivers of any condition to closing.

For a more complete description of the conditions to completion of the merger, see "The Merger Agreement—Conditions to the Completion of the Merger" beginning on page 91.

Termination of the Merger Agreement; Termination Fee (pages 96 and 97)

The merger agreement contains provisions addressing the circumstances under which HSW International or INTAC may terminate the merger agreement. No termination fees are payable by either party in the event the merger agreement is terminated.

For a more complete description, see "The Merger Agreement—Termination of the Merger Agreement" and "The Merger Agreement—Fees and Expenses" beginning on pages 96 and 97, respectively.

Fees and Expenses (page 97)

Each of HSW (including HSW International) and INTAC will initially pay its own fees and expenses in connection with the merger, except that they will share equally (i) the expenses incurred in connection with the printing, filing and mailing of the registration statement on Form S-4 of which this proxy statement/prospectus is a part, (ii) the expenses incurred in connection with the printing, filing and mailing of any other registration statements required by the transactions contemplated by the merger agreement and (iii) Nasdaq listing application and other listing costs. Subject to certain exceptions, if the merger and the related transactions are consummated, the surviving corporation will be responsible for, reimburse or pay all expenses incurred by the parties to the merger agreement.

For a more complete description of INTAC's repayment obligation, see "The Merger Agreement—Fees and Expenses" beginning on page 97.

19

The share purchase agreement is attached as Annex R to this proxy statement/prospectus. We strongly encourage you to read the share purchase agreement in its entirety because it is the principal document governing the distribution business sale.

Sale of Distribution Companies (page 109)

INTAC Holdings has agreed to sell to Cyber, a corporation wholly-owned by Mr. Zhou, all shares of the INTAC Holdings subsidiaries responsible for the distribution/telecommunications segment of INTAC's business in exchange for 3,000,000 shares of INTAC common stock. In addition, INTAC Trading has agreed to transfer its rights and control with respect to Meidi Technologies to Cyber.

Closing (page 109)

The closing of the share purchase agreement, subject to the satisfaction or waiver of certain closing conditions, shall take place on the closing date of, but immediately prior to, the merger. The conditions to such closing include (i) the requisite shareholder approval for the share purchase agreement and (ii) the termination of all guaranties provided by INTAC, INTAC Holdings, and their affiliates with respect to liabilities of the distribution companies or Meidi Technologies, including, without limitation, the guarantee provided by INTAC Holdings in favor of Delta One Holland for amounts owed by INTAC Telecommunications.

For a more complete description, see "Agreements Related to the Merger—The Share Purchase Agreement" beginning on page 109.

Market Prices and Dividend Information

Shares of INTAC common stock are listed on the Nasdaq Capital Market under the symbol "INTN." Both HSW and HSW International common stock are privately held. As a result, there is no established trading market for either HSW or HSW International common stock. HSW International will apply to have its common stock listed on either the Nasdaq National Market or the Nasdaq Capital Market under the symbol "HSWI."

The following table presents the last reported sale prices of INTAC common stock, as reported by the Nasdaq Capital Market on:

| | INTAC Common Stock | ||

|---|---|---|---|

| | Close | ||

| April 19, 2006 | $ | 10.99 | |

| January 26, 2007 | $ | 7.02 | |

| July 9, 2007 | $ | 8.47 | |

These prices will fluctuate prior to the closing date of the merger and the distribution business sale, and INTAC stockholders are urged to obtain current market quotations prior to making any decision with respect to the merger and the distribution business sale.

HSW International and INTAC have not historically paid regular quarterly dividends. See "Comparative Stock Prices and Dividends" beginning on page 175.

20

Comparative Per Share Information