UNITED STATES SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

Filed by the registrant ☑

Filed by a party other than the registrant ☐

Check the appropriate box:

☐ Preliminary Proxy Statement

☐ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

☑ Definitive Proxy Statement

☐ Definitive Additional Materials

☐ Soliciting Material Pursuant to §240.14a-12

Remark Media, Inc.

Payment of Filing Fee (Check the appropriate box):

☑ No fee required.

☐ Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11

| |

| (1) | Title of each class of securities to which transaction applies: |

| |

| (2) | Aggregate number of securities to which transaction applies: |

| |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| |

| (4) | Proposed maximum aggregate value of transaction: |

☐ Fee paid previously with preliminary materials

| |

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| |

| (1) | Amount Previously Paid: |

| |

| (2) | Form, Schedule or Registration Statement No.: |

3960 Howard Hughes Parkway, Suite 900

Las Vegas, Nevada 89169

NOTICE OF SPECIAL MEETING OF STOCKHOLDERS TO BE HELD ON DECEMBER 15, 2016

Dear Stockholder:

We cordially invite you to Remark Media, Inc.’s (“we,” “our,” or “us”) special meeting of stockholders (the “Special Meeting”), which will be held on December 15, 2016 at 10:00 a.m. local time at our offices located at 3960 Howard Hughes Parkway, Suite 900, Las Vegas, Nevada 89169. We have scheduled the Special Meeting to:

| |

| 1. | approve potential issuances of our common stock in connection with our acquisition of assets of China Branding Group Limited and the related financing for purposes of Nasdaq Listing Rule 5635; and |

| |

| 2. | transact such other business as may properly come before the Special Meeting or any adjournment or postponement thereof. |

The accompanying proxy statement sets forth additional information regarding the Special Meeting, and provides you with detailed information regarding the business to be considered at the Special Meeting. We encourage you to read the proxy statement carefully and in its entirety.

Only persons or entities holding shares of our common stock at the close of business on October 27, 2016, the record date for the Special Meeting, will receive notice of the Special Meeting and be entitled to vote during the Special Meeting or any adjournments or postponements thereof.

YOUR VOTE IS VERY IMPORTANT. Regardless of whether you plan to attend the Special Meeting, we ask that you promptly sign, date and return the enclosed proxy card or voting instruction card in the envelope provided, or submit your proxy via telephone or the Internet (if those options are available to you) in accordance with the instructions on the enclosed proxy card or voting instruction card.

|

| |

| | By order of the Board of Directors, |

| | |

| | Kai-Shing Tao |

| | Chairman and Chief Executive Officer |

This Notice of Special Meeting of Stockholders, proxy statement and form of proxy are first being mailed to stockholders on or about November 4, 2016.

Important Notice Regarding the Availability of Proxy Materials for the Remark Media, Inc.

Special Meeting of Stockholders to be Held on December 15, 2016

In addition to the printed materials noted above, we have made the Notice of Special Meeting of Stockholders and the proxy statement available on the Internet at ir.remarkmedia.com/annuals.cfm.

TABLE OF CONTENTS

PROXY STATEMENT

Remark Media, Inc., a Delaware corporation (“Remark,” “we,” “us” or “our”), furnishes this proxy statement (the “Proxy Statement”) in connection with the solicitation of proxies by our board of directors (the “Board” or “Board of Directors”) for use at our special meeting of stockholders (the “Special Meeting”) which will be held on December 15, 2016 at 10:00 a.m. local time at our offices located at 3960 Howard Hughes Parkway, Suite 900, Las Vegas, Nevada 89169. We mailed the proxy solicitation materials (the “Proxy Materials”), which include the Proxy Statement and form of proxy, to holders of shares of our common stock, $0.001 par value per share (the “Common Stock”), at the close of business on the record date, October 27, 2016. The Proxy Materials contain instructions on how to vote. References in the Proxy Statement to the Special Meeting also refer to any adjournments, postponements or changes in location of the meeting, to the extent applicable.

INFORMATION ABOUT THE PROXY MATERIALS AND THE SPECIAL MEETING

Why did I receive the Proxy Statement?

The Board is soliciting your proxy to vote at the Special Meeting because you were a stockholder at the close of business on October 27, 2016, the record date, and are entitled to vote at the Special Meeting.

The Proxy Statement summarizes the information you need to know to vote at the Special Meeting. You do not need to attend the Special Meeting to vote your shares.

What information is contained in the Proxy Statement?

The Proxy Statement provides information regarding the proposals being submitted for approval at the Special Meeting, the voting process and certain other required information.

What should I do if I receive more than one set of voting materials?

You may receive more than one set of voting materials, including multiple copies of this Proxy Statement and multiple proxy cards or voting instruction cards. For example, if you hold your shares in more than one brokerage account, you may receive a separate voting instruction card for each brokerage account in which you hold shares. If you are a stockholder of record and your shares are registered in more than one name, you will receive more than one proxy card. Please complete, sign, date and return each proxy card and voting instruction card that you receive.

How may I obtain an additional set of proxy materials?

All stockholders may write to us at the following address to request an additional copy of these materials:

Remark Media, Inc.

3960 Howard Hughes Parkway, Suite 900

Las Vegas, Nevada 89169

Attention: Corporate Secretary

What is the difference between holding shares as a stockholder of record and as a beneficial owner?

If you own shares of Common Stock registered directly in your name with our transfer agent, Computershare, you are considered the “stockholder of record” with respect to such Common Stock. If you are a stockholder of record, we sent the Proxy Materials directly to you.

If you own shares of Common Stock held in a stock brokerage account or by a bank or other nominee, such Common Stock is held in “street name,” and you are considered the “beneficial owner” of such Common Stock. Your broker, bank or other nominee, which is considered the stockholder of record with respect to those shares, forwarded the Proxy Materials to

you. As the beneficial owner, you have the right to direct your broker, bank or other nominee regarding how to vote your shares by using the voting instructions included in the mailing, or by following their instructions for voting via telephone or the Internet. Since a beneficial owner is not the stockholder of record, you may not vote beneficially owned shares in person at the Special Meeting unless you obtain a “legal proxy” from the broker, bank or other nominee that holds your shares, giving you the right to vote the shares at the Special Meeting.

What am I voting on at the Special Meeting?

You are voting on the proposal to approve potential issuances of our Common Stock in connection with our acquisition of assets of China Branding Group Limited and the related financing for purposes of Nasdaq Listing Rule 5635 (“Proposal 1”); and to transact such other business as may properly come before the Special Meeting or any adjournment or postponement thereof.

The Board recommends a vote “FOR” the approval of Proposal 1.

How do I vote?

With your proxy card or voting instruction card. Following the instructions on the proxy card or voting instruction card, you may complete, sign and date the card and return it in the prepaid envelope.

Via telephone or Internet. If you are a stockholder of record, you may vote by telephone or via the Internet using the instructions in the enclosed proxy card. If you own shares held in street name, you will receive voting instructions from your bank, broker or other nominee and may vote by telephone or on the Internet if they offer that alternative.

In Person at the Special Meeting. All stockholders may vote in person at the Special Meeting. You may also be represented by another person at the Special Meeting by executing a proper proxy designating that person. If you own shares held in street name, you must obtain a legal proxy from your broker, bank or other nominee and present it to the inspector of election with your ballot when you vote at the Special Meeting. Even if you plan to attend the Special Meeting, we recommend that you also submit your proxy card or voting instruction card as described herein so your vote will be counted if you later decide not to attend the Special Meeting.

If I beneficially own Common Stock, can my broker, bank or other nominee vote my shares without my instructions?

If you do not give instructions to your broker, bank or other nominee, they can still vote your shares with respect to certain “discretionary” items, but they cannot vote your shares with respect to certain “non-discretionary” items. The proposal being submitted for approval at the Special Meeting is a “non-discretionary” item. Any shares for which you do not provide instructions to your brokerage firm regarding how to vote will be counted as “broker non-votes.” Broker non-votes are shares which are held in street name by a broker, bank or other nominee which indicates on its proxy that it does not have or did not exercise discretionary authority to vote on a particular matter. In tabulating the voting results, shares that constitute broker non-votes will have no effect on the outcome of Proposal 1, assuming that a quorum is present.

Please provide voting instructions to your broker, bank or other nominee regarding all proposals so that your vote can be counted.

What can I do if I change my mind after I vote my shares?

If you are a stockholder of record, you may revoke your proxy at any time before it is voted at the Special Meeting by:

| |

| • | sending written notice of revocation to our Corporate Secretary; |

| |

| • | submitting a new, proper proxy dated later than the date of the revoked proxy; or |

| |

| • | attending the Special Meeting and voting in person. |

If you beneficially own shares held in street name, you may submit new voting instructions by contacting your broker, bank or other nominee. You may also vote in person at the Special Meeting if you obtain a legal proxy as described above. Attendance at the Special Meeting will not, by itself, revoke a proxy.

What if I return a signed proxy card, but do not vote for some of the matters listed on the proxy card?

If you return a signed proxy card without indicating your vote, your shares will be voted in accordance with the Board’s recommendation “FOR” the approval of Proposal 1.

What are the voting requirements with respect to Proposal 1?

Proposal 1 requires the affirmative (“FOR”) vote of a majority of the votes cast on the matter. Abstentions and broker non-votes will not affect the outcome of this proposal.

How many votes do I have?

You are entitled to one vote for each share of Common Stock that you hold. As of October 27, 2016, the record date, there were 21,377,745 shares of Common Stock outstanding.

What happens if additional matters are presented at the Special Meeting?

Other than the one item of business described in the Proxy Statement, we are not aware of any other business to be acted upon at the Special Meeting. If you grant a proxy, the persons named as proxy holders, Kai-Shing Tao and Douglas M. Osrow, will have the discretion to vote your shares on any additional matters properly presented for a vote at the Special Meeting.

How many shares must be present or represented to conduct business at the Special Meeting?

A quorum will be present if at least a majority of the outstanding shares of our Common Stock entitled to vote, totaling 10,688,873 shares, is represented at the Special Meeting, either in person or by proxy.

Both abstentions and broker non-votes (described above) are counted for the purpose of determining the presence of a quorum.

How can I attend the Special Meeting?

You may attend the Special Meeting only if you were a stockholder as of the close of business on October 27, 2016, the record date, or if you hold a valid proxy for the Special Meeting. You should be prepared to present photo identification for admittance. If you are a stockholder of record, your name will be verified against the list of stockholders of record on the record date prior to your admission to the Special Meeting. If you are not a stockholder of record, but hold shares through a broker, bank or other nominee (i.e., in street name), you should provide proof of beneficial ownership on the record date, such as your most recent account statement prior to October 27, 2016, a copy of the voting instruction card provided by your broker, bank or other nominee, or other similar evidence of ownership. If you do not provide photo identification or comply with the other procedures outlined above, you will not be admitted to the Special Meeting.

The Special Meeting will begin promptly on December 15, 2016, at 10:00 a.m. local time. You should allow adequate time for check-in procedures.

What is the deadline for voting my shares?

If you hold shares as a stockholder of record, we must receive your vote by proxy before the polls close at the Special Meeting, except that proxies submitted via the Internet or telephone must be received by 1:00 a.m., Eastern Time, on December 15, 2016.

If you hold shares in street name, please follow the voting instructions provided by your broker, bank or other nominee. You may vote these shares in person at the Special Meeting only if at the Special Meeting you provide a legal proxy obtained from your broker, bank or other nominee.

Is my vote confidential?

Proxy instructions, ballots and voting tabulations that identify individual stockholders are handled in a manner that protects your voting privacy. Your vote will not be disclosed either within Remark or to third parties, except: (1) as necessary to meet applicable legal requirements; (2) to allow for the tabulation of votes and certification of the vote; and (3) to facilitate a successful proxy solicitation. Occasionally, stockholders provide written comments on their proxy card, which we then forward to our management.

How are votes counted?

For all items of business, you may vote “FOR,” “AGAINST” or “ABSTAIN.” If you elect to “ABSTAIN,” the abstention will be counted for the purpose of establishing a quorum; however, with regard to the outcome of voting, an abstention will have no effect on the outcome of Proposal 1.

Where can I find the voting results of the Special Meeting?

We intend to announce preliminary voting results at the Special Meeting and publish final voting results in a Current Report on Form 8-K to be filed with the Securities and Exchange Commission (“SEC”) within four business days after the Special Meeting.

Who will bear the cost of soliciting votes for the Special Meeting?

Remark is making this solicitation and will pay the entire cost of preparing, assembling, printing, mailing and distributing these proxy materials and soliciting votes. In addition to the mailing of these proxy materials, the solicitation of proxies or votes may be made in person, by telephone or by electronic communication by our directors, officers and employees, who will not receive any additional compensation for such solicitation activities. Upon request, we will also reimburse brokerage houses and other custodians, nominees and fiduciaries for forwarding proxy and solicitation materials to stockholders.

How can I obtain Remark corporate governance information?

The following information is available in print to any stockholder who requests it:

| |

| • | Amended and Restated Certificate of Incorporation of Remark, as amended (the “Certificate of Incorporation”) |

| |

| • | Amended and Restated Bylaws of Remark, as amended (the “Bylaws”) |

| |

| • | The charters of the following committees of the Board: the Audit Committee, the Nominating and Governance Committee and the Compensation Committee |

| |

| • | Code of Business Conduct and Ethics |

| |

| • | Policy regarding stockholder communications with the Board |

What if I have questions for Remark’s transfer agent?

Please contact our transfer agent at the telephone number or address listed below with any questions concerning stock certificates, transfer of ownership or other matters pertaining to your stock account.

Computershare

PO Box 30170

College Station, TX 77842

Overnight deliveries:

211 Quality Circle, Suite 210

College Station, TX, 77845

Toll free for US and Canada: 800-522-6645

Outside of US and Canada: 1 (201) 680 6578

Who can help answer my questions?

If you have any questions about the Special Meeting or how to vote or revoke your proxy, please contact us at the address provided earlier in the answer to the question How may I obtain an additional set of proxy materials?

PROPOSAL TO BE SUBMITTED FOR VOTING

Proposal 1: Approval of Potential Issuances of our Common Stock in Connection with Our Acquisition of

Assets of China Branding Group Limited and the Related Financing for Purposes of Nasdaq Listing Rule 5635

Acquisition of Assets of China Branding Group Limited

On September 20, 2016, we, together with our wholly-owned subsidiary KanKan Limited, completed the acquisition (the “CBG Acquisition”) of assets of China Branding Group Limited (“CBG”), pursuant to the terms of the Second Amended and Restated Asset and Securities Purchase Agreement, dated as of the same date (the “Purchase Agreement”), with CBG and the other parties specified therein. The Purchase Agreement amended and restated the Amended and Restated Asset and Securities Purchase Agreement, dated as of July 6, 2016, previously described in our Current Report on Form 8-K filed with the SEC on July 12, 2016, which had amended and restated the Asset and Securities Purchase Agreement, dated as of May 16, 2016, previously described in our Current Report on Form 8-K filed with the SEC on May 18, 2016.

The aggregate consideration for the CBG Acquisition included (i) approximately $7.4 million of cash and (ii) the future issuance of seven-year warrants (the “CBG Acquisition Warrants”) to purchase up to 6,250,000 shares of Common Stock at an exercise price of $10.00 per share, subject to certain anti-dilution adjustments (collectively, the “Purchase Price”). At closing, the parties deposited $375,000 of the cash portion of the Purchase Price into escrow for 15 months to secure certain obligations of CBG under the Purchase Agreement.

The CBG Acquisition Warrants are not exercisable unless we obtain the approval of our stockholders for issuances under the Purchase Agreement and in related transactions, including under the CBG Acquisition Warrants and the CBG Financing Warrants (as defined below), in excess of 19.9% of our shares outstanding in accordance with Nasdaq Listing Rule 5635(a). Additionally, subject to our obtaining stockholder approval in accordance with Nasdaq Listing Rule 5635(a), if the closing price of our Common Stock does not exceed the sum of $10.00 per share plus the fair value of the CBG Acquisition Warrants at the time of issuance (the “Assumed Warrant Value”) for any 15 individual trading days in any consecutive 30-trading-day period between the closing date and September 20, 2020, we will issue on September 20, 2020, in exchange for the CBG Acquisition Warrants, such number of shares of Common Stock equal to (x) the number of shares issuable upon exercise of the CBG Acquisition Warrants, multiplied by (y) 50% of the Assumed Warrant Value, divided by (z) the volume weighted average price of our Common Stock during the 30 trading days ending on September 20, 2020. Stockholder approval of Proposal 1 would constitute approval in accordance with Nasdaq Listing Rule 5635(a). We also agreed to provide resale registration rights for the shares of our Common Stock issuable upon exercise of the CBG Acquisition Warrants.

Acquisition Financing

On September 20, 2016, concurrently with the closing of the CBG Acquisition, we entered into the Amendment No. 1 to Financing Agreement, dated as of the same date (the “Amendment”), to amend the Financing Agreement, dated as of September 24, 2015 (as amended, the “Financing Agreement”), between certain of our subsidiaries as borrowers (together with us, the “Borrowers”), certain of our subsidiaries as guarantors (the “Guarantors”), the lenders from time to time party thereto (the “Lenders”) and MGG Investment Group LP, in its capacity as collateral agent and administrative agent for the Lenders (“MGG”). Pursuant to the Amendment, the Lenders agreed, among other things, (i) to extend additional credit to the Borrowers under the Financing Agreement in the additional principal amount of $8,000,000 and (ii) to modify certain of the financial covenants in the Financing Agreement, including financial covenants with respect to quarterly EBITDA levels, in a manner beneficial to us. The amount outstanding under the Financing Agreement will accrue interest at three month LIBOR plus 10.0% per annum, payable monthly, and has a maturity date of September 24, 2018. The Amendment and related documents also provide for certain fees payable to the Lenders and for the issuance of the CBG Financing Warrants.

As a condition to closing the Financing Amendment, we issued to affiliates of MGG warrants to purchase up to 2,670,736 shares of our common stock at an exercise price of $5.50 per share, subject to certain anti-dilution adjustments (the “CBG Financing Warrants”). The CBG Financing Warrants also provide as follows: (i) the CBG Financing Warrants expire on September 24, 2020; (ii) the CBG Financing Warrants are exercisable on a cashless basis only; (iii) the number of shares of our common stock issuable upon exercise of the CBG Financing Warrants and the exercise price thereof are subject to anti-dilution protection; and (iv) the CBG Financing Warrants may not be exercised if a holder, together with its affiliates, collectively would beneficially own in excess of 9.99% of our common stock after giving effect to such exercise. Also, we are not permitted to issue any shares under the CBG Financing Warrants to the extent that the issuance of such shares, when aggregated together with issuances in related transactions in accordance with Nasdaq rules, would exceed 19.9% of the shares outstanding, unless we obtain stockholder approval in accordance with Nasdaq Listing Rule 5635(a). Stockholder approval of Proposal 1 would constitute approval in accordance with Nasdaq Listing Rule 5635(a).

On September 20, 2016, we entered into a Registration Rights Agreement (the “Registration Rights Agreement”) to provide the holders of the CBG Financing Warrants with registration rights for the shares of our common stock issuable under such warrants.

Why We Need Stockholder Approval

Our Common Stock is listed on the Nasdaq Capital Market and, as such, we are subject to the Nasdaq Listing Rules. Nasdaq Listing Rule 5635(a) requires that an issuer obtain stockholder approval prior to the issuance of securities in connection with the acquisition of another company if such securities are not issued in a public offering and such issuance equals 20% or more of the common stock or voting power of the issuer outstanding before the acquisition (the “Nasdaq Cap”). We had 20,710,534 shares outstanding as of immediately prior to the transactions described above, 20% of which is 4,142,106 shares. Potential issuances of shares as a result of the exercise of the CBG Acquisition Warrants and the CBG Financing Warrants (collectively, the “Issuable Shares”) are limited, in accordance with the terms of the CBG Acquisition Warrants and the CBG Financing Warrants, such that the aggregate number of shares issued thereunder must remain below the Nasdaq Cap, which is fewer than the number of Issuable Shares.

In connection with the CBG Acquisition and our entry into the Amendment, we agreed to use our reasonable best efforts to seek stockholder approval for the issuance of Issuable Shares without regard to the Nasdaq Cap at a stockholder meeting to be held no later than 120 days after the date of the closing of the CBG Acquisition and 90 days after our entry into the Amendment. Further, as a condition to closing the Purchase Agreement and the Amendment, we entered into Voting Agreements with stockholders who together hold at least 37% of our voting securities outstanding immediately prior to closing, providing for their agreement to vote in favor of this proposal.

Effect of Proposal 1 on Current Stockholders

If stockholders approve Proposal 1, we will be able to issue Issuable Shares without regard to the Nasdaq Cap. If stockholders do not approve Proposal 1, our issuance of Issuable Shares will remain subject to limitation under the Nasdaq Cap and the CBG Acquisition Warrants will not be exercisable or exchangeable for Common Stock in accordance with their terms. The issuance of Issuable Shares may result in significant dilution to our stockholders and afford our stockholders a smaller percentage interest in the voting power, liquidation value and aggregate book value of Remark. Additionally, the issuance and subsequent resale of Issuable Shares may cause the market price of our Common Stock to decline.

Vote Required

Proposal 1 requires the affirmative (“FOR”) vote of a majority of the votes cast on the matter.

Recommendation of the Board

The Board unanimously recommends a vote “FOR” the approval of Proposal 1.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table presents information with respect to the beneficial ownership of our Common Stock as of November 1, 2016, by:

| |

| • | each person, or group of affiliated persons, known to us to beneficially own more than 5% of the outstanding Common Stock; |

| |

| • | each of our directors and named executive officers (“NEOs”); and |

| |

| • | all of our directors and executive officers as a group. |

The amounts and percentages of beneficially-owned Common Stock are reported based upon SEC rules governing the determination of beneficial ownership of securities. The SEC rules:

| |

| • | deem a person a “beneficial owner” of a security if that person has or shares voting power, which includes the power to vote or direct the voting of a security, or if that person has or shares investment power, which includes the power to dispose of or to direct the disposition of a security; |

| |

| • | deem a person a beneficial owner of any securities of which that person has a right to acquire beneficial ownership within 60 days, and securities that can be so acquired are deemed to be outstanding for purposes of computing such person’s ownership percentage, but not for purposes of computing any other person’s ownership percentage; and |

| |

| • | may deem more than one person a beneficial owner of the same securities, and may deem a person a beneficial owner of securities as to which such person has no economic interest. |

Except as otherwise indicated in these footnotes, each of the beneficial owners listed has, to our knowledge, sole voting and investment power with respect to the indicated shares of Common Stock. The information relating to our 5% beneficial owners is based on information we received from such holders. The percentage of beneficial ownership is based on 21,377,745 shares of Common Stock outstanding as of November 1, 2016.

Except as otherwise noted below, the address of persons listed below is:

c/o Remark Media, Inc.

3960 Howard Hughes Parkway, Suite 900

Las Vegas, Nevada 89169

|

| | | | | |

| | Number of Common Stock Shares | | Percentage of Outstanding Common Stock Shares |

| Persons known to beneficially own more than 5% | | | |

Digipac LLC 1 | 5,246,314 |

| | 24.5 | % |

Ashford Capital Management, Inc. 2 | 1,919,416 |

| | 9.0 | % |

Ernest T. Lee 3 | 1,981,932 |

| | 9.3 | % |

| Directors and NEOs | | | |

Kai-Shing Tao 4 | 7,130,634 |

| | 31.2 | % |

Douglas M. Osrow 5 | 479,000 |

| | 2.2 | % |

Theodore P. Botts 6 | 200,434 |

| | * |

|

Robert G. Goldstein 7 | 174,206 |

| | * |

|

William W. Grounds 7 | 168,250 |

| | * |

|

Jason E. Strauss 8 | 150,000 |

| | * |

|

All executive officers and directors as a group (6 persons) 9 | 8,302,524 |

| | 34.7 | % |

* Represents holdings of less than 1% of shares outstanding.

| |

| 1. | Consists of shares of Common Stock. Mr. Tao, as the manager and a member of Digipac, LLC (“Digipac”), may be deemed to beneficially own the shares of Common Stock beneficially owned by Digipac. Mr. Tao disclaims beneficial ownership of such shares, except to the extent of his pecuniary interest therein. The address of Digipac is One Hughes Center Drive, Unit 1601, Las Vegas, Nevada 89169. |

| |

| 2. | Consists of shares of Common Stock held by Ashford Capital Partners, L.P., of which Ashford Capital Management, Inc. (“ACM”) is the investment manager. The address of ACM is One Walker’s Mill Road, Wilmington, DE 19807. This disclosure is based on information contained in a Schedule 13G filed by ACM with the SEC on February 12, 2016. |

| |

| 3. | Consists of 1,093,044 shares of Common Stock held by Mr. Lee and 888,888 shares of Common Stock held by Urban Casinos. As the President of Urban Casinos, Mr. Lee may be deemed to beneficially own the shares of Common Stock held by Urban Casinos. The address of Mr. Lee is 3271 South Highland Drive #704, Las Vegas, NV 89109. This disclosure is based on information contained in a Schedule 13G filed by Mr. Lee and Urban Casinos with the SEC on October 26, 2016. |

| |

| 4. | Consists of (i) 144,749 shares of Common Stock held by Mr. Tao, (ii) 1,442,750 shares of Common Stock issuable upon exercise of options held by Mr. Tao, (iii) 5,246,314 shares of Common Stock held by Digipac, (iv) 275,000 shares of Common Stock held by Pacific Star Capital and (v) 21,821 shares of Common Stock held by Pacific Star HSW LLC (“Pacific Star HSW”). Mr. Tao, as the manager and a member of Digipac, the Chief Investment Officer and sole owner of Pacific Star Capital, and the control person of Pacific Star HSW, may be deemed to beneficially own the shares of Common Stock beneficially owned by Digipac, Pacific Star Capital and Pacific Star HSW. Mr. Tao disclaims beneficial ownership of the shares of Common Stock beneficially owned by Digipac and Pacific Star HSW, except to the extent of his pecuniary interest therein. |

| |

| 5. | This amount includes 475,000 shares issuable upon exercise of options. |

| |

| 6. | This amount includes 159,107 shares issuable upon exercise of options. |

| |

| 7. | This amount includes 156,250 shares issuable upon exercise of options. |

| |

| 8. | This amount represents 150,000 shares issuable upon exercise of options. |

| |

| 9. | This amount represents 5,763,167 shares and 2,539,357 shares issuable upon exercise of options. |

STOCKHOLDER PROPOSALS

We must receive proposals of stockholders intended to be presented at the 2017 Annual Meeting of Stockholders (the “2017 Annual Meeting”) no later than December 30, 2016, so we may include such proposals in our proxy statement and form of proxy relating to the 2017 Annual Meeting.

Under SEC rules, if we do not receive notice of a stockholder proposal at least 45 days prior to the first anniversary of the date of mailing of the prior year’s proxy statement, then we will be permitted to use our discretionary voting authority when the proposal is raised at the annual meeting, without any discussion of the matter in the proxy statement. In connection with the 2017 Annual Meeting, if we do not receive notice of a stockholder proposal on or before March 15, 2017, we will be permitted to use our discretionary voting authority as outlined above.

Our Bylaws establish procedures for stockholder nominations related to director elections and bringing business before any annual meeting or special meeting of our stockholders. For nominations or other business to be properly brought before a stockholder meeting by a stockholder, the stockholder must have given timely notice thereof in writing to Remark’s Secretary, and such other business must otherwise be a proper matter for stockholder action. To be timely, a stockholder’s notice shall be delivered to the Secretary at our principal executive offices not less than 60 days nor more than 90 days prior to the first anniversary of the preceding year’s annual meeting; provided, however, that in the event that the date of the annual meeting is advanced by more than 30 days or delayed by more than 60 days from such anniversary date, notice by the stockholder to be timely must be delivered not earlier than the 90th day prior to such annual meeting and not later than the close of business on the later of the 60th day prior to such annual meeting or the 10th day following the day on which public announcement of the date of such meeting is first made.

With respect to nominations, to be in proper written form, a stockholder’s notice to our Secretary must set forth (a) as to each person whom the stockholder proposes to nominate for election as a director (i) the name, age, business address and residence address of the person, (ii) the principal occupation or employment of the person, (iii) the class or series and number of shares of our capital stock, if any, which the person owns beneficially or of record, and (iv) any other information relating to the person that would be required to be disclosed in a proxy statement or other filings required to be made in connection with solicitations of proxies for election of directors pursuant to Section 14 of the Exchange Act and the rules and regulations promulgated thereunder; and (b) as to the stockholder giving notice (i) the name and record address of such stockholder, (ii) the class or series and number of shares of our capital stock which such stockholder owns beneficially or of record, (iii) a description of all arrangements or understandings between such stockholder and each proposed nominee and any other person or persons (including their names) pursuant to which the nomination(s) are to be made by such stockholder, (iv) a representation that such stockholder intends to appear in person or by proxy at the annual meeting to nominate the person(s) named in its notice, and (v) any other information relating to such stockholder that would be required to be disclosed in a proxy statement or other filings required to be made in connection with solicitations of proxies for election of directors pursuant to Section 14 of the Exchange Act and the rules and regulations promulgated thereunder. Such notice must be accompanied by a written consent of each proposed nominee to being named as a nominee and to serve as a director if elected.

With respect to other business, to be in proper written form, a stockholder’s notice to our Secretary must set forth as to each matter such stockholder proposes to bring before the annual meeting (a) a brief description of the business desired to be brought before the annual meeting and the reasons for conducting such business at the annual meeting, (b) the name and record address of such stockholder, (c) the class or series and number of shares of our capital stock which such stockholder owns beneficially or of record, (d) a description of all arrangements or understandings between such stockholder and any other person or persons (including their names) in connection with the proposal of such business by such stockholder and any material interest of such stockholder in such business, and (e) a representation that such stockholder intends to appear in person or by proxy at the annual meeting to bring such business before the meeting.

PROXY SOLICITATION

We are making this solicitation of proxies on behalf of the Board and we will bear the cost of soliciting proxies. Proxies may be solicited through the mail and through telephonic or telegraphic communications to, or by meetings with, stockholders or their representatives by directors, officers and other of our employees who will receive no additional compensation therefor.

We request persons such as brokers, nominees and fiduciaries holding stock in their names for others, or holding stock for others who have the right to give voting instructions, to forward proxy material to their principals and to request authority for the execution of the proxy. We will reimburse such persons for their reasonable expenses.

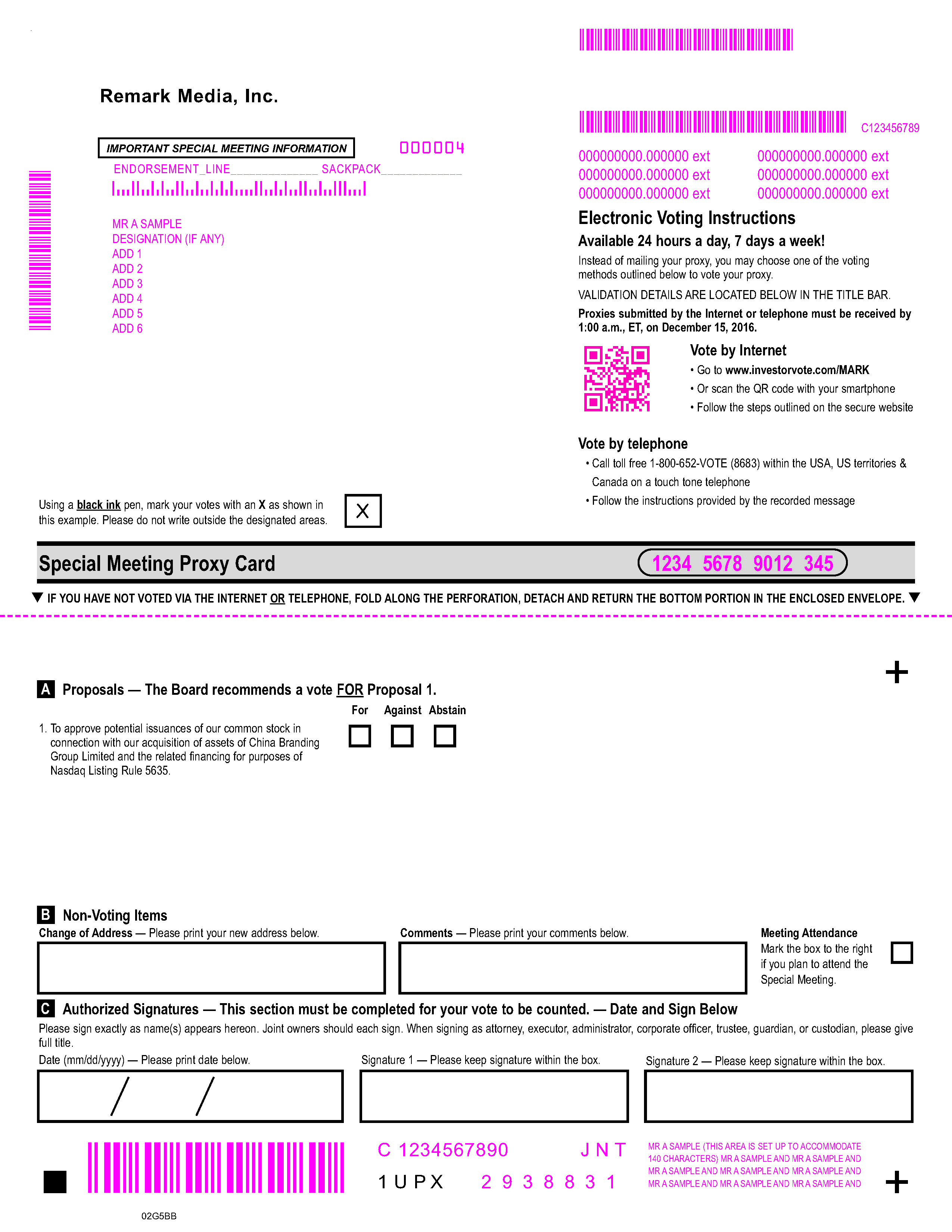

Remark Media, Inc. IMPORTANT SPECIAL MEETING INFORMATION Electronic Voting Instructions Available 24 hours a day, 7 days a week! Instead of mailing your proxy, you may choose one of the voting methods outlined below to vote your proxy. VALIDATION DETAILS ARE LOCATED BELOW IN THE TITLE BAR. Proxies submitted by the Internet or telephone must be received by 1:00 a.m., ET, on December 15, 2016. Vote by Internet Go to www.investorvote.com/MARK Or scan the QR code with your smartphone Follow the steps outlined on the secure website Vote by telephone Call toll free 1-800-652-VOTE (8683) within the USA, US territories & Canada on a touch tone telephone Follow the instructions provided by the recorded message Using a black ink pen, mark your votes with an X as shown in this example. Please do not write outside the designated areas Special Meeting Proxy Card IF YOU HAVE NOT VOTED VIA THE INTERNET OR TELEPHONE, FOLD ALONG THE PERFORATION, DETACH AND RETURN THE BOTTOM PORTION IN THE ENCLOSED ENVELOPE. Proposals — The Board recommends a vote FOR Proposal 1. For Against Abstain 1. To approve potential issuances of our common stock in connection with our acquisition of assets of China Branding Group Limited and the related financing for purposes of Nasdaq Listing Rule 5635. Non-Voting Items Change of Address — Please print your new address below. Comments — Please print your comments below. Meeting Attendance Mark the box to the right if you plan to attend the Special Meeting. Authorized Signatures — This section must be completed for your vote to be counted. — Date and Sign Below Please sign exactly as name(s) appears hereon. Joint owners should each sign. When signing as attorney, executor, administrator, corporate officer, trustee, guardian, or custodian, please give full title. Date (mm/dd/yyyy) — Please print date below. Signature 1 — Please keep signature within the box. Signature 2 — Please keep signature within the box. 1UPX

IF YOU HAVE NOT VOTED VIA THE INTERNET OR TELEPHONE, FOLD ALONG THE PERFORATION, DETACH AND RETURN THE BOTTOM PORTION IN THE ENCLOSED ENVELOPE. Proxy — Remark Media, Inc. Notice of Special Meeting of Stockholders 3960 Howard Hughes Parkway, Suite 900 Las Vegas, Nevada 89169 Proxy Solicited by Board of Directors for Special Meeting - December 15, 2016 The undersigned stockholder of Remark Media, Inc., a Delaware corporation, hereby acknowledges receipt of the Notice of Special Meeting of Stockholders and Proxy Statement, each dated November 4, 2016, and hereby appoints Kai-Shing Tao and Douglas Osrow each as proxy and attorney-in-fact, with full power of substitution, on behalf and in the name of the undersigned, to represent the undersigned at the Special Meeting of Stockholders of Remark Media, Inc., to be held on December 15, 2016 at 10:00 a.m., Pacific time, at the offices of Remark Media, Inc. located at 3960 Howard Hughes Parkway, Suite 900, Las Vegas, Nevada 89169 and any adjournment(s) thereof, and to vote all common stock which the undersigned would be entitled to vote if then and there personally present, on the matters set forth on the reverse side. The undersigned stockholder hereby revokes any proxy or proxies heretofore given by the undersigned for the Special Meeting of Stockholders. Shares represented by this proxy will be voted by the stockholder. If no such directions are indicated, the Proxies will have authority to vote FOR Proposal 1. In their discretion, the Proxies are authorized to vote upon such other business as may properly come before the meeting. (Items to be voted appear on reverse side.)

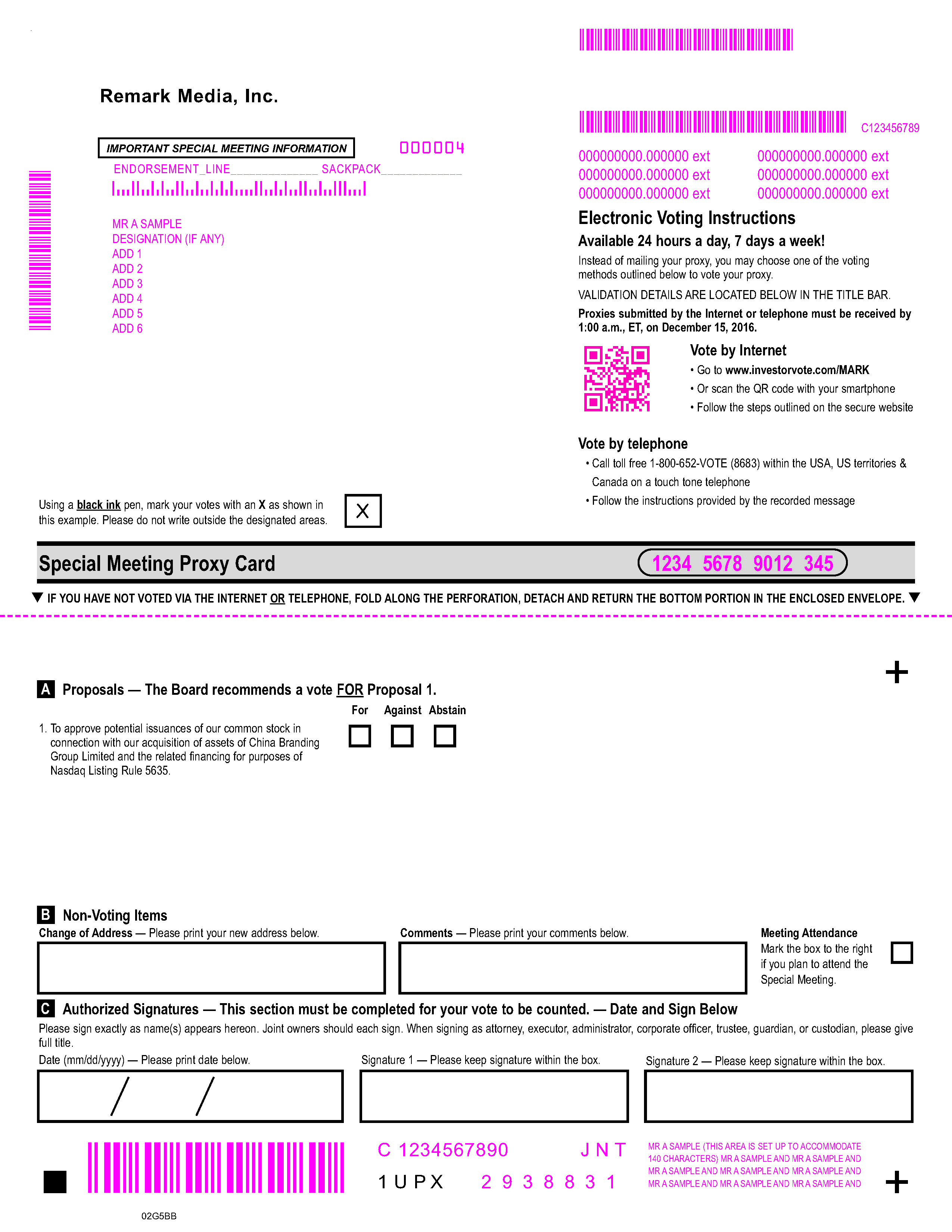

IF YOU HAVE NOT VOTED VIA THE INTERNET OR TELEPHONE, FOLD ALONG THE PERFORATION, DETACH AND RETURN THE BOTTOM PORTION IN THE ENCLOSED ENVELOPE. Proxy — Remark Media, Inc. Notice of Special Meeting of Stockholders 3960 Howard Hughes Parkway, Suite 900 Las Vegas, Nevada 89169 Proxy Solicited by Board of Directors for Special Meeting - December 15, 2016 The undersigned stockholder of Remark Media, Inc., a Delaware corporation, hereby acknowledges receipt of the Notice of Special Meeting of Stockholders and Proxy Statement, each dated November 4, 2016, and hereby appoints Kai-Shing Tao and Douglas Osrow each as proxy and attorney-in-fact, with full power of substitution, on behalf and in the name of the undersigned, to represent the undersigned at the Special Meeting of Stockholders of Remark Media, Inc., to be held on December 15, 2016 at 10:00 a.m., Pacific time, at the offices of Remark Media, Inc. located at 3960 Howard Hughes Parkway, Suite 900, Las Vegas, Nevada 89169 and any adjournment(s) thereof, and to vote all common stock which the undersigned would be entitled to vote if then and there personally present, on the matters set forth on the reverse side. The undersigned stockholder hereby revokes any proxy or proxies heretofore given by the undersigned for the Special Meeting of Stockholders. Shares represented by this proxy will be voted by the stockholder. If no such directions are indicated, the Proxies will have authority to vote FOR Proposal 1. In their discretion, the Proxies are authorized to vote upon such other business as may properly come before the meeting. (Items to be voted appear on reverse side.)

IF YOU HAVE NOT VOTED VIA THE INTERNET OR TELEPHONE, FOLD ALONG THE PERFORATION, DETACH AND RETURN THE BOTTOM PORTION IN THE ENCLOSED ENVELOPE. Proxy — Remark Media, Inc. Notice of Special Meeting of Stockholders 3960 Howard Hughes Parkway, Suite 900 Las Vegas, Nevada 89169 Proxy Solicited by Board of Directors for Special Meeting - December 15, 2016 The undersigned stockholder of Remark Media, Inc., a Delaware corporation, hereby acknowledges receipt of the Notice of Special Meeting of Stockholders and Proxy Statement, each dated November 4, 2016, and hereby appoints Kai-Shing Tao and Douglas Osrow each as proxy and attorney-in-fact, with full power of substitution, on behalf and in the name of the undersigned, to represent the undersigned at the Special Meeting of Stockholders of Remark Media, Inc., to be held on December 15, 2016 at 10:00 a.m., Pacific time, at the offices of Remark Media, Inc. located at 3960 Howard Hughes Parkway, Suite 900, Las Vegas, Nevada 89169 and any adjournment(s) thereof, and to vote all common stock which the undersigned would be entitled to vote if then and there personally present, on the matters set forth on the reverse side. The undersigned stockholder hereby revokes any proxy or proxies heretofore given by the undersigned for the Special Meeting of Stockholders. Shares represented by this proxy will be voted by the stockholder. If no such directions are indicated, the Proxies will have authority to vote FOR Proposal 1. In their discretion, the Proxies are authorized to vote upon such other business as may properly come before the meeting. (Items to be voted appear on reverse side.)

IF YOU HAVE NOT VOTED VIA THE INTERNET OR TELEPHONE, FOLD ALONG THE PERFORATION, DETACH AND RETURN THE BOTTOM PORTION IN THE ENCLOSED ENVELOPE. Proxy — Remark Media, Inc. Notice of Special Meeting of Stockholders 3960 Howard Hughes Parkway, Suite 900 Las Vegas, Nevada 89169 Proxy Solicited by Board of Directors for Special Meeting - December 15, 2016 The undersigned stockholder of Remark Media, Inc., a Delaware corporation, hereby acknowledges receipt of the Notice of Special Meeting of Stockholders and Proxy Statement, each dated November 4, 2016, and hereby appoints Kai-Shing Tao and Douglas Osrow each as proxy and attorney-in-fact, with full power of substitution, on behalf and in the name of the undersigned, to represent the undersigned at the Special Meeting of Stockholders of Remark Media, Inc., to be held on December 15, 2016 at 10:00 a.m., Pacific time, at the offices of Remark Media, Inc. located at 3960 Howard Hughes Parkway, Suite 900, Las Vegas, Nevada 89169 and any adjournment(s) thereof, and to vote all common stock which the undersigned would be entitled to vote if then and there personally present, on the matters set forth on the reverse side. The undersigned stockholder hereby revokes any proxy or proxies heretofore given by the undersigned for the Special Meeting of Stockholders. Shares represented by this proxy will be voted by the stockholder. If no such directions are indicated, the Proxies will have authority to vote FOR Proposal 1. In their discretion, the Proxies are authorized to vote upon such other business as may properly come before the meeting. (Items to be voted appear on reverse side.)