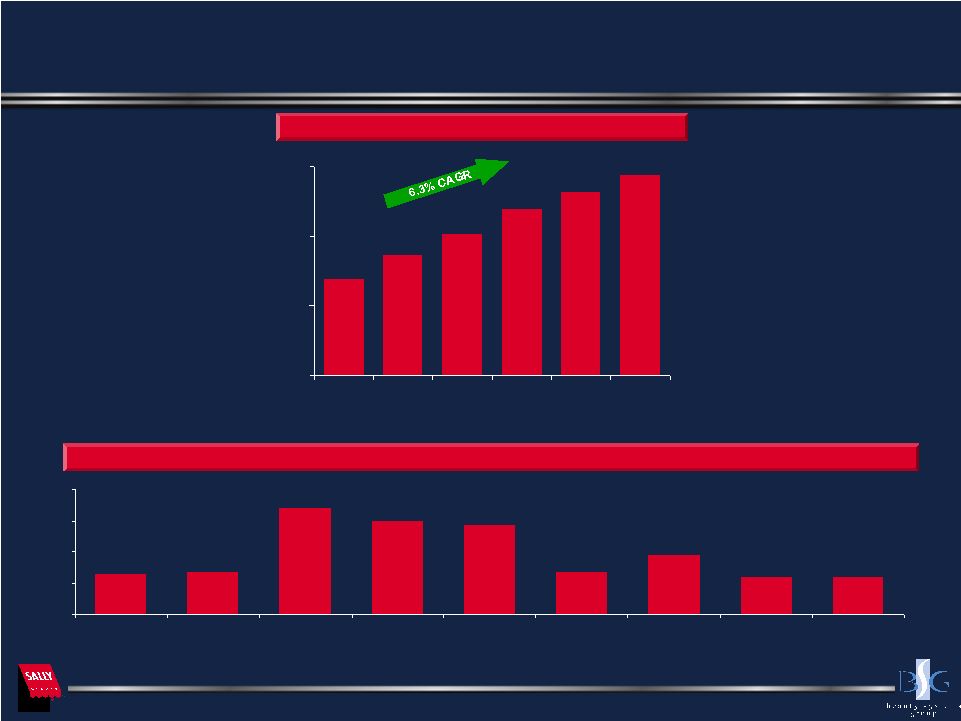

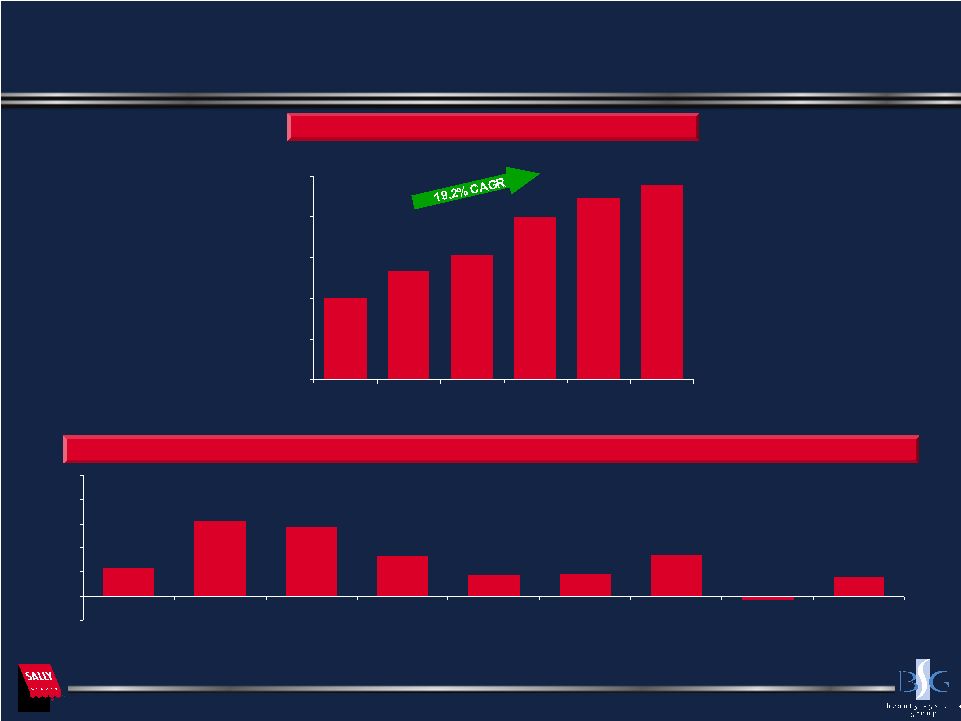

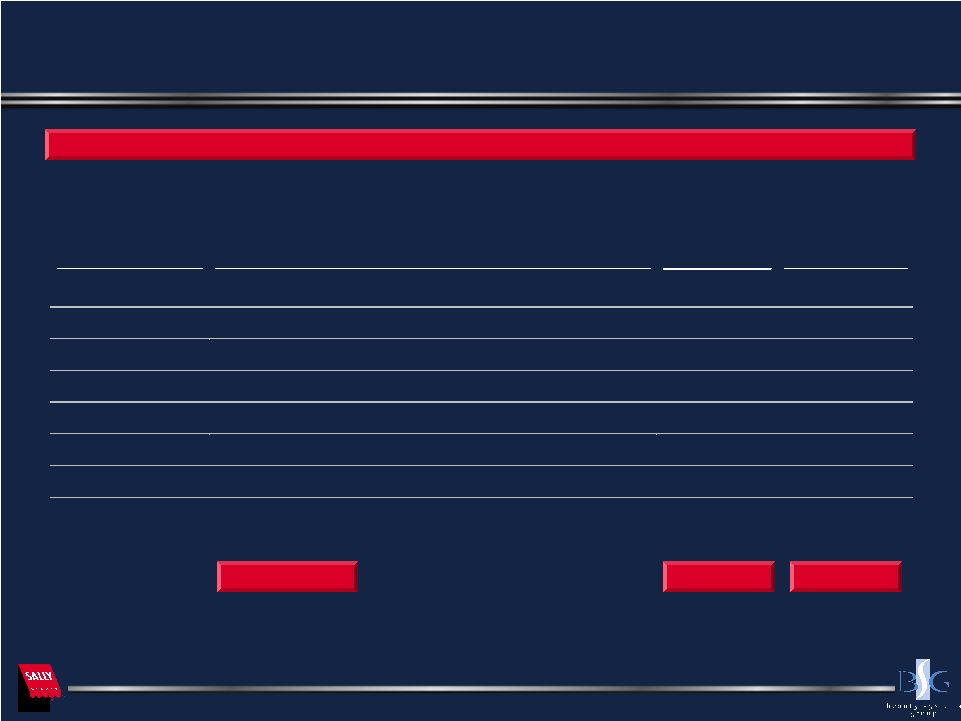

29 EBITDA Reconciliation EBITDA Reconciliation to Net Earnings _______________ (1) On October 22, 2003, Alberto-Culver converted all issued shares of its Class A common stock into Class B common stock on a one-for-one basis. The conversion required to Alberto-Culver recognize non-cash charges from the re-measurement of the intrinsic value of all Class A stock options outstanding on the conversion date that were issued to SBH employees. A portion of the charge was recognized on the date of the conversion while the remaining amount was incurred over the remaining vesting periods. (2) Alberto-Culver adopted SFAS No. 123 (R) on October 1, 2005 using the modified prospective method. Consequently, compensation expense related to Alberto-Culver stock options granted to SBH employees is recognized for new stock option grants beginning in fiscal year 2006 and for the unvested portion of outstanding stock options that were granted prior to the adoption of SFAS No. 123 (R). In accordance with the modified perspective, the financial statements for prior periods have not been restated. (3) In connection with the terminated spin/merge between Alberto-Culver and Regis, Alberto-Culver incurred fees and expenses related to the termination fee paid to Regis and legal and investment banking fees. (4) As result of the SEC’s interpretation regarding certain lease accounting issues, Alberto-Culver identified certain deviations to these interpretations which resulted in a non-cash charge in the second quarter 2005 of $1.9 million. (5) Reflects pro forma adjustments to eliminate the sales-based service fees charged by Alberto-Culver and reflected on Alberto-Culver’s historical consolidated statements of earnings associated with consulting, business development and advisory services agreements between Alberto-Culver and certain subsidiaries of SBH, less an adjustments for consulting services with Mr. Michael Renzulli, former Chairman of Sally Holdings, pursuant to his termination and consulting agreement in connection with the transaction. (6) Pro forma for the separation from Alberto-Culver, management believes that it can realize cost savings that could reduce stand-alone costs to as little as $7.5 million on an annual basis. (7) Represents a pro forma adjustment for consulting services with Mr. Renzulli pursuant to his termination and consulting arrangement. This adjustment reduces the pro forma operating earnings adjustment included in the calculation of Credit Agreement EBITDA and is included in the estimated pro forma stand-alone corporate expenses adjustment. This adjustment eliminates double-counting of the adjustment in the calculation of Adjusted EBITDA. ($ in Millions) (1) (Unaudited) Fiscal Year Ended September 30, 2001 2002 2003 2004 2005 2006 Net Earnings $89.3 $97.8 $107.5 $105.3 $116.5 $107.9 Interest expense, net of interest income 2.3 1.3 0.3 2.3 3.0 0.1 Provision for income taxes 53.1 57.0 62.2 62.1 73.2 68.7 Depreciation and amortization 22.7 22.7 22.3 24.6 33.9 38.0 Non-cash charge related to Alberto-Culver conversion to one class of common stock – – – 27.0 4.1 – Stock option expense (2) – – – – – 5.2 Expenses related to terminated spin/merge (3) – – – – – 41.5 Lease accounting adjustment (4) – – – – 1.9 – Pro forma operating earnings adjustments (5) (0.5) 16.2 22.9 25.6 27.1 28.3 Credit Agreement EBITDA $166.9 $195.0 $215.3 $246.8 $259.6 $289.7 Adjustments: Add-back of allocated corporate expenses from Alberto-Culver (6) 10.8 14.2 16.5 16.9 13.3 13.5 Estimated pro forma stand-alone corporate expenses (6) (7.5) (7.5) (7.5) (7.5) (7.5) (7.5) Adjustment to reflect double-counting of outside consulting expenses (7) 0.5 0.5 0.5 0.5 0.5 0.5 Adjusted EBITDA $170.6 $202.2 $224.7 $256.8 $265.8 $296.2 |