Table of Contents

Exhibit 99.1

NORTH AMERICAN CONSTRUCTION GROUP LTD.

NOTICE OF ANNUAL MEETING AND MANAGEMENT INFORMATION CIRCULAR

ANNUAL MEETING OF SHAREHOLDERS TO BE

HELD ON MAY 3, 2023

March 21, 2023

Table of Contents

NORTH AMERICAN CONSTRUCTION GROUP LTD.

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD ON MAY 3, 2023

NOTICE IS HEREBY GIVEN that the annual meeting of holders of voting common shares (the “NACG Shareholders”) of North American Construction Group Ltd. (the “Corporation”) will be held at the head office of the Corporation at 27287 – 100 Avenue, Acheson, Alberta on the 3rd day of May, 2023, at 3:00 p.m. (Mountain Time) (the “Meeting”), for the following purposes:

| • | to receive the audited comparative consolidated financial statements of the Corporation for the year ended December 31, 2022, and the auditor’s report thereon; |

| • | to elect the directors of the Corporation for the ensuing year; |

| • | to consider and, if deemed advisable, approve the advisory resolution to accept the approach to executive compensation disclosed herein; |

| • | to reappoint the auditors of the Corporation for the ensuing year and to authorize the directors to fix the remuneration of the auditors; and |

| • | to transact such other business as may properly come before the Meeting or any adjournments thereof. |

The specific details of the foregoing matters to be put before the Meeting are set forth in the management information circular (the “Circular”). Capitalized terms used in this notice of annual and special meeting and not otherwise defined herein shall have the meanings ascribed to such terms in the Circular.

The Circular and a form of proxy accompany this notice.

NACG Shareholders who are unable to attend the Meeting are requested to complete, sign, date and return the enclosed form of proxy in accordance with the instructions set out in the form of proxy and in the Circular accompanying this notice. A proxy will not be valid unless it is deposited with our transfer agent Computershare Investor Services Inc., (i) by mail using the enclosed return envelope or one addressed to Computershare Investor Services Inc., Proxy Department, 8th Floor, 100 University Avenue, Toronto, Ontario, M5J 2Y1, or (ii) by hand delivery to Computershare Investor Services Inc., Proxy Department, 8th Floor, 100 University Avenue, Toronto, Ontario, M5J 2Y1. Alternatively, you may vote electronically by telephone (1-866-732-8683) or internet (www.investorvote.com) by following the instructions on the enclosed form of proxy. Your proxy or voting instructions must be received in each case no later than 3:00 p.m. (Mountain Time), on May 1, 2023, and if the Meeting is adjourned, no later than 48 hours (excluding Saturdays and holidays) prior to the commencement of any adjournment thereof.

DATED at Acheson, Alberta, this 21st day of March, 2023.

BY ORDER OF THE BOARD OF DIRECTORS OF NORTH AMERICAN CONSTRUCTION GROUP LTD. |

| /S/ Joseph Lambert |

President & Chief Executive Officer |

Table of Contents

MANAGEMENT INFORMATION CIRCULAR | ||||

| 1 | ||||

| 1 | ||||

| 1 | ||||

| 2 | ||||

| 2 | ||||

| 2 | ||||

| 3 | ||||

| 3 | ||||

| 3 | ||||

| 3 | ||||

| 4 | ||||

| 14 | ||||

| 14 | ||||

| 14 | ||||

| 15 | ||||

| 22 | ||||

| 23 | ||||

| 35 | ||||

| 36 | ||||

| 36 | ||||

| 37 | ||||

| 38 | ||||

| 39 | ||||

| 40 | ||||

| 40 | ||||

| 43 | ||||

| 47 | ||||

| 47 | ||||

Incentive Plan Awards - Value Vested or Earned During the Year | 50 | |||

| 50 | ||||

| 50 | ||||

| 50 | ||||

| 57 | ||||

| 57 | ||||

| 57 | ||||

| 58 | ||||

| 63 | ||||

| 64 | ||||

| 66 | ||||

| 67 | ||||

Table of Contents

This management information circular (the “Circular”) and accompanying form of proxy (the “Proxy”) are furnished in connection with the solicitation of proxies by or on behalf of management of North American Construction Group Ltd. (the “Corporation”, “NACG”, “our” or “we”) for use at the annual meeting (the “Meeting”) of holders of voting common shares of the Corporation (the “NACG Shareholders”) to be held at the head office of the Corporation at 27287 – 100 Avenue, Acheson, Alberta on the 3rd day of May, 2023, at 3:00 p.m. (Mountain Time), and at any adjournments thereof, for the purposes set forth in the accompanying notice of meeting dated March 21, 2023 (the “Notice of Meeting”).

It is expected that the solicitation will be primarily by mail. Proxies may also be solicited personally by officers of the Corporation at nominal cost. The cost of this solicitation will be borne by the Corporation. The Corporation may pay the reasonable costs incurred by persons who are the registered but not beneficial owners of voting shares of the Corporation (such as brokers, dealers, other registrants under applicable securities laws, nominees and/or custodians) in sending or delivering copies of this Circular, the Notice of Meeting and Proxy to the beneficial owners of such shares. The Corporation will provide, without cost to such persons, upon request to the Secretary of the Corporation, additional copies of the foregoing documents required for this purpose.

For the purposes of the Meeting, the Corporation is not: (a) relying on the “notice and access” rules to allow it to make certain proxy-related materials available on the internet rather than mailing such materials directly to registered shareholders and indirectly to non-registered shareholders; or (b) mailing proxy-related materials directly to non-registered shareholders who have not waived the right to receive them. The Corporation intends to pay for “proximate intermediaries” (as defined in National Instrument 54-101 – Communication with Beneficial Owners of Securities of a Reporting Issuer) to send proxy-related materials and Form 54-101F7 – Request for Voting Instructions Made by Intermediary to non-registered shareholders who have waived the right to receive them.

The Notice of Meeting, Proxy and this Circular will be mailed to NACG Shareholders commencing on or about April 5, 2023. In this Circular, except where otherwise indicated, all dollar amounts are expressed in Canadian currency.

No person has been authorized by the Corporation to give any information or make any representations in connection with the matters contained herein other than those contained in this Circular and, if given or made, any such information or representation must not be relied upon as having been authorized by the Corporation.

This Circular does not constitute an offer or a solicitation to any person in any jurisdiction in which such offer or solicitation is unlawful.

The record date (the “Record Date”) for determining which NACG Shareholders shall be entitled to receive notice of and to vote at the Meeting is March 23, 2023. Only NACG Shareholders of record as of the Record Date are entitled to receive notice of and to vote at the Meeting, unless after the Record Date such shareholder of record transfers its shares and the transferee (the “Transferee”), upon establishing that the Transferee owns such shares, requests in writing at least 10 days prior to the Meeting or any adjournments thereof that the Transferee may have his, her or its name included on the list of NACG Shareholders entitled to vote at the Meeting, in which case the Transferee is entitled to vote such shares at the Meeting. Such written request by the Transferee shall be filed with Computershare Investor Services Inc., 8th Floor, 100 University Avenue, Toronto, Ontario, M5J 2Y1, together with a copy to the Secretary of the Corporation at 27287 – 100 Avenue, Acheson, Alberta, T7X 6H8.

Under normal conditions, confidentiality of voting is maintained by virtue of the fact that the Corporation’s transfer agent tabulates proxies and votes. However, such confidentiality may be lost as to any proxy or ballot if a question arises as to its validity or revocation or any other like matter. Loss of confidentiality may also occur if the Board of Directors decides that disclosure is in the interest of the Corporation or its shareholders.

The persons named in the accompanying Proxy as proxyholders are representatives of management of NACG. Every NACG Shareholder has the right to appoint a person or company to represent them at the Meeting other than the persons named in the accompanying Proxy. A NACG Shareholder desiring to appoint some other person (who need not be a shareholder of NACG) to represent him, her or it at the Meeting, may do so either by striking out the printed names and inserting the desired person’s name in the blank space provided in the

Management Information Circular March 21, 2023 | 1 | North American Construction Group Ltd. |

Table of Contents

Proxy or by completing another proper proxy and, in either case, delivering the completed proxy to our transfer agent Computershare Investor Services Inc., (i) by mail using the enclosed return envelope or one addressed to Computershare Investor Services Inc., Proxy Department, 8th Floor, 100 University Avenue, Toronto, Ontario, M5J 2Y1, or (ii) by hand delivery to Computershare Investor Services Inc., 8th Floor, 100 University Avenue, Toronto, Ontario, M5J 2Y1. Alternatively, you may vote electronically by telephone (1-866-732-8683) or internet (www.investorvote.com) by following the instructions on the enclosed form of proxy. Your proxy or voting instructions must be received in each case no later than 3:00 p.m. (Mountain Time), on May 1, 2023 and if the Meeting is adjourned, no later than 48 hours (excluding Saturdays and holidays) prior to the commencement of any adjournment thereof. A Proxy must be signed by a NACG Shareholder or its attorney duly authorized in writing or, if a NACG Shareholder is a corporation, by a duly authorized officer, attorney or other authorized signatory of the NACG Shareholder. If a proxy is given by joint shareholders, it must be executed by all such joint shareholders.

If a Proxy is completed, signed and delivered to the Corporation in the manner specified above, the persons named as proxyholders therein shall vote or withhold from voting the shares in respect of which they are appointed as proxyholders at the Meeting, in accordance with the instructions of the NACG Shareholder appointing them, on any show of hands or any ballot that may be called for and, if the NACG Shareholder specifies a choice with respect to any matter to be acted upon at the Meeting, the persons appointed as proxyholders shall vote in accordance with the specification so made. In the absence of such specification, or if the specification is not certain, the shares represented by such Proxy will be voted in favour of the matters to be acted upon as specified in the Notice of Meeting.

A Proxy confers discretionary authority upon the persons named therein with respect to amendments or variations to matters identified in the Notice of Meeting and all other matters which may properly come before the Meeting or any adjournments thereof. As of the date of this Circular, the Board of Directors of the Corporation knows of no such amendments, variations or other matters to come before the Meeting, other than matters referred to in the Notice of Meeting. However, if amendments, variations or other matters should properly arise before the Meeting, the Proxy will be voted on such amendments, variations and other matters in accordance with the best judgment of the person or persons voting such Proxy.

Any NACG Shareholder returning an enclosed Proxy may revoke the same at any time insofar as it has not been exercised. In addition to revocation in any other manner permitted by law, a Proxy may be revoked by instrument in writing executed by the NACG Shareholder or by his, her or its attorney authorized in writing or, if the NACG Shareholder is a corporation, by an officer or attorney thereof duly authorized, and deposited at the registered office of the Corporation to the attention of the Secretary of the Corporation, at any time up to and including the last business day preceding the day of the Meeting, or any adjournment thereof, or with the chairperson of the Meeting, prior to the commencement of the Meeting. A NACG Shareholder attending the Meeting has the right to vote in person and, if he, she or it does so, his, her or its proxy is nullified with respect to the matters such person votes upon and any subsequent matters thereafter to be voted upon at the Meeting or any adjournment thereof.

ADVICE TO BENEFICIAL HOLDERS OF COMMON SHARES

The information set forth in this section is of significant importance to many NACG Shareholders, as a substantial number of NACG Shareholders do not hold voting common shares of the Corporation (“NACG Common Shares”) in their own name, and thus are considered non-registered shareholders. NACG Shareholders who do not hold their NACG Common Shares in their own name (“Beneficial Shareholders”) should note that only Proxies deposited by NACG Shareholders whose names appear on the records of the Corporation as the registered holders of NACG Common Shares can be recognized and acted upon at the Meeting. If NACG Common Shares are listed in an account statement provided to a NACG Shareholder by a broker, then, in almost all cases, those NACG Common Shares will not be registered in the NACG Shareholder’s name on the records of the Corporation. Such NACG Common Shares will more likely be registered under the name of the NACG Shareholder’s broker or an agent of that broker or another similar entity (called an “Intermediary”). NACG Common Shares held by an Intermediary can only be voted by the Intermediary (for, withheld or against resolutions) upon the instructions of the Beneficial Shareholder. Without specific instructions, Intermediaries are prohibited from voting NACG Common Shares.

Management Information Circular March 21, 2023 | 2 | North American Construction Group Ltd. |

Table of Contents

Beneficial Shareholders should ensure that instructions respecting the voting of their NACG Common Shares are communicated in a timely manner and in accordance with the instructions provided by their Intermediary. Applicable regulatory rules require Intermediaries to seek voting instructions from Beneficial Shareholders in advance of shareholders’ meetings. Every Intermediary has its own mailing procedures and provides its own return instructions to clients, which should be carefully followed by Beneficial Shareholders in order to ensure that their NACG Common Shares are voted at the Meeting.

Although a Beneficial Shareholder may not be recognized directly at the Meeting for the purposes of voting NACG Common Shares registered in the name of their Intermediary, a Beneficial Shareholder may attend at the Meeting as proxyholder for the Intermediary and vote the NACG Common Shares in that capacity. Beneficial Shareholders who wish to attend the Meeting and indirectly vote their NACG Common Shares as a proxyholder, should enter their own names in the blank space on the form of proxy provided to them by their Intermediary and timely return the same to their Intermediary in accordance with the instructions provided by their Intermediary, well in advance of the Meeting.

NOTICE TO UNITED STATES SHAREHOLDERS

The solicitation of proxies by the Corporation is not subject to the requirements of Section 14(a) of the United States Securities Exchange Act of 1934, as amended (the “US Exchange Act”), by virtue of an exemption applicable to proxy solicitations by “foreign private issuers” as defined in Rule 3b-4 under the US Exchange Act. Accordingly, this Circular has been prepared in accordance with the applicable disclosure requirements in Canada. Residents of the United States should be aware that such requirements may be different than those applicable to proxy statements subject to Section 14(a) of the US Exchange Act.

VOTING SHARES AND PRINCIPAL HOLDERS THEREOF

The Corporation’s authorized capital consists of an unlimited number of NACG Common Shares and an unlimited number of non-voting common shares. None of the Corporation’s shares have par value. As at March 15, 2023, there were a total of 27,828,282 NACG Common Shares outstanding and no non-voting common shares outstanding. Each NACG Common Share entitles the holder thereof to one vote in respect of each of the matters to be voted upon at the Meeting. To the knowledge of the Corporation’s directors and executive officers, as of March 15, 2023, the following individuals or entities beneficially own, control or direct, directly or indirectly, securities carrying more than 10.0% of the voting rights attached to the NACG Common Shares:

| Name of Beneficial Owner | Number of NACG Common Shares | Percentage of Outstanding NACG common shares | ||

| Mawer Investment Management Ltd. | 4,094,593 | 14.7% | ||

A quorum for the transaction of business at the Meeting shall consist of at least two persons holding or representing by proxy not less than twenty percent (20%) of the outstanding shares of the Corporation entitled to vote at the meeting.

If a quorum is not present at the opening of the Meeting, the NACG Shareholders present may adjourn the meeting to a fixed time and place but may not transact any other business. If a meeting of shareholders is adjourned by one or more adjournments for an aggregate of less than 30 days it is not necessary to give notice of the adjourned meeting other than by announcement at the time of an adjournment. If a meeting of NACG Shareholders is adjourned by one or more adjournments for an aggregate of more than 29 days and not more than 90 days, notice of the adjourned meeting shall be given as for an original meeting but the management of the Corporation shall not be required to send a form of proxy in the form prescribed by applicable law to each NACG Shareholder who is entitled to receive notice of the meeting. Those shareholders present at any duly adjourned meeting shall constitute a quorum.

The Corporation’s list of NACG Shareholders as of the Record Date has been used to deliver to NACG Shareholders the Notice of Meeting and this Circular as well as to determine the NACG Shareholders who are eligible to vote.

PRESENTATION OF FINANCIAL STATEMENTS

The audited consolidated financial statements of the Corporation for the fiscal year ended December 31, 2022, together with the auditor’s report thereon, copies of which are contained in the Corporation’s annual report, will be presented to the NACG Shareholders at the Meeting. Receipt at the Meeting of the auditor’s report and the

Management Information Circular March 21, 2023 | 3 | North American Construction Group Ltd. |

Table of Contents

Corporation’s financial statements for its last completed fiscal period will not constitute approval or disapproval of any matters referred to therein.

BUSINESS TO BE TRANSACTED AT THE MEETING

| 1. | Election of Directors |

The Board of Directors of the Corporation presently consists of seven directors. All current directors have indicated that they wish to stand for re-election. Management proposes to set the total number of directors to be elected at the Meeting at seven.

All of the nominees below are now directors of the Corporation and have been directors since the dates indicated. Management does not contemplate that any of the following nominees will be unable or unwilling to serve as a director but if that should occur for any reason prior to the Meeting, the persons named in the enclosed Proxy will have the right to vote for another nominee at their discretion. Each director elected at the Meeting will hold office until the next annual meeting or until his or her successor is duly elected or appointed.

The Board adopted a “Board Policy on Majority Voting for Director Nominees” (the “Policy”) on August 8, 2013, which was most recently revised on June 8, 2022. The current Policy confirms that the majority voting requirements set out in the Canada Business Corporations Act apply to election of the Corporation’s directors. In particular: (a) separate votes of shareholders shall be taken with respect to each candidate nominated for director; (b) shareholders shall be entitled to vote “for” or “against” each candidate nominated for director; and (c) each candidate nominated for director shall be elected only if the number of votes cast “for” that person represents a majority of the votes collectively cast “for” and “against” that person by the shareholders who are present in person or represented by proxy.

The following table and the notes thereto state, as of March 15, 2023, the: (i) name, municipality, province or state of residence and country of residence of each nominee; (ii) the age of each nominee; (iii) the date each nominee first became a director of the Corporation (with the current term of each incumbent nominee expiring as of the holding of the Meeting); (iv) where applicable, the current position of each nominee with the Corporation (other than that of director); (v) the present status of each nominee as an independent or non-independent director; (vi) the committees upon which each nominee presently serves; (vii) the present principal occupation, business or employment of each nominee; (viii) the number of NACG Common Shares, securities and options beneficially owned, or controlled or directed, directly or indirectly, by each nominee; and (ix) the Board and committee meeting attendance record for each nominee in the fiscal year ended December 31, 2022.

Management Information Circular March 21, 2023 | 4 | North American Construction Group Ltd. |

Table of Contents

Martin R. Ferron

Houston, TX, USA

66 Years Old

| Martin R. Ferron is presently the Chair of the Board, was, until December 31, 2021, the Executive Chair of the Board, and was, until December 31, 2020, the Chief Executive Officer of the Corporation. He originally joined the Corporation as President and Chief Executive Officer and as a member of the Board on June 7, 2012. He was appointed Chairman of the Board on October 31, 2017. Previously, Mr. Ferron was Director, President and Chief Executive Officer of Helix Energy Solutions Inc., a NYSE-listed international energy services company. Prior to joining Helix, Mr. Ferron held a variety of senior executive positions for several oil service and construction companies in Europe and Africa. He holds a B.Sc. in Civil Engineering from City University, London, a M.Sc. in Marine Technology from Strathclyde University, Glasgow and an MBA from Aberdeen University. | |||||

Director Since: June 7, 2012 | Number of Securities Held1 | |||||

Chair of the Board | Common Shares | DSUs | Value at Risk2 | |||

Non-Independent Director | 2,196,787 | 226,975 | $52,571,398 | |||

Meets share ownership guidelines | ||||||

Committee Membership and Meeting Attendance Record | ||||||

Board | 10 of 10 | |||||

Operations | 3 of 3 | |||||

1 Martin Ferron’s securities holdings listed above do not include restricted stock units (RSUs) and performance share units (PSUs), which are discussed in detail in the Compensation Discussion and Analysis section.

2 Calculated as the aggregate number of common shares and DSUs held, multiplied by the closing price of the Corporation’s shares on the TSX on March 15, 2023, in Canadian Dollars.

Management Information Circular March 21, 2023 | 5 | North American Construction Group Ltd. |

Table of Contents

Joseph C. Lambert

Edmonton, AB, Canada

58 Years Old

| Joseph C. Lambert became Chief Executive Officer of the Corporation on January 1, 2021. He had previously been appointed President on October 31, 2017, while also retaining his role as Chief Operating Officer which role he had held since June 1, 2013. Mr. Lambert originally joined us as General Manager of Mining in April 2008 after an extensive career in the mining industry. He was promoted to Vice President, Oil Sands Operations in September of 2010 and accepted the position of Vice President, Operations Support in January 2012. Mr. Lambert has over three decades of North American and Australian experience in mining and heavy civil construction industries as both producer/owner and contract service provider. He holds a B. Sc. in Mining Engineering from the South Dakota School of Mines and Technology, a First Class Mine Manager’s Certificate of Competency from the Department of Minerals and Energy Western Australia and completed the Director Education Program through the University of Toronto - Rotman School of Management.

| |||||

Director Since: January 1, 2021 | Number of Securities Held1 | |||||

President & CEO | Common Shares | DSUs | Value at Risk2 | |||

Non-Independent Director | 280,465 | 87,504 | $7,981,248 | |||

Meets share ownership guidelines | ||||||

Committee Membership and Meeting Attendance Record | ||||||

Board | 10 of 10 | |||||

1 Joseph Lambert’s securities holdings listed above do not include restricted stock units (RSUs) and performance share units (PSUs), which are discussed in detail in the Compensation Discussion and Analysis section.

2 Calculated as the aggregate number of common shares and DSUs held, multiplied by the closing price of the Corporation’s shares on the TSX on March 15, 2023, in Canadian Dollars.

Management Information Circular March 21, 2023 | 6 | North American Construction Group Ltd. |

Table of Contents

Bryan D. Pinney

Calgary, AB, Canada

70 Years Old

| Bryan D. Pinney was appointed as the Corporation’s lead independent director on October 31, 2017. He is the principal of Bryan D. Pinney Professional Corporation, which provides financial advisory and consulting services. Mr. Pinney has over 30 years of experience serving many of Canada’s largest corporations, primarily in energy and resources and construction. He served as Calgary Managing Partner of Deloitte LLP from 2002 through 2007, as National Managing Partner of Audit & Assurance from 2007 to 2011, and as Vice Chair until June 2015. Mr. Pinney was a past member of Deloitte’s Board of Directors and chair of its Finance and Audit Committee. Prior to joining Deloitte, Mr. Pinney was a partner with Andersen LLP and served as Calgary Managing Partner from 1991 through May of 2002. Mr. Pinney is the past Chair of the Board of Governors of Mount Royal University and has previously served on a number of non-profit boards. He currently serves on the board of TransAlta Corporation, where he is chair of the Audit, Finance & Risk Committee and a member of the Human Resources and Compensation Committee, and on the board of SNDL, Inc., where he is Chair of the audit committee and a member of the governance and compensation committees. He is also a director of a private residential construction company. He is a Fellow of the Institute of Chartered Accountants, a Chartered Business Valuator and is a graduate of the Ivey Business School at the University of Western Ontario with an honours degree in Business Administration. He is also a graduate of the Canadian Institute of Corporate Directors.

| |||||

Director Since: May 13, 2015 | Number of Securities Held | |||||

Lead Director | Common Shares | DSUs | Value at Risk1 | |||

Independent Director | 40,495 | 166,441 | $4,488,442 | |||

Meets Share ownership guidelines | ||||||

Committee Membership and Meeting Attendance Record | ||||||

Board | 9 of 10 | |||||

Audit (Chair) | 6 of 6 | |||||

Governance and Sustainability | 5 of 5 | |||||

Human Resources and Compensation | 6 of 6 | |||||

1 Calculated as the aggregate number of common shares and DSUs held, multiplied by the closing price of the Corporation’s shares on the TSX on March 15, 2023, in Canadian Dollars.

Management Information Circular March 21, 2023 | 7 | North American Construction Group Ltd. |

Table of Contents

John J. Pollesel

Sudbury, ON, Canada

59 Years Old | John J. Pollesel is currently the Chief Executive Officer of Boreal Agrominerals Inc., a private company that explores for, tests, develops and produces organic approved agromineral fertilizers and soil amendment products. Mr. Pollesel has more than 30 years of experience in the mining industry. Until November of 2017, Mr. Pollesel was Senior Vice President, Mining for Finning (Canada). Prior to Finning was Chief Executive officer for the Morris Group of Companies. In his previous role as Chief Operating Officer for Vale’s North Atlantic Operations, Mr. Pollesel was responsible for one of the largest mining and metallurgical operations in Canada. Prior to Vale, he was the Chief Financial Officer for Compania Minera Antamina in Peru, one of the largest copper/zinc mining and milling operations in the world. He has chaired Finance, Audit, HSE, Compensation and Advisory Committees in addition to holding director positions at Northern Superior Resources, Calico Resources Corporation and numerous not-for-profit organizations. He presently chairs the board of Electra Battery Materials Corporation, which is listed on the TSX-V, OTC exchanges, and formerly served on the board of Noront Resources Ltd., a TSX-V listed company, until its sale in 2022. He also serves on the audit, governance and EHS committees of Electra and formerly served on the same committees for Noront. He holds an Honours BA in Accounting and an MBA from the University of Waterloo and Laurentian University respectively. He is a Chartered Professional Accountant and a Fellow of CPA Ontario.

| |||||

Director Since: November 23, 2017 | Number of Securities Held | |||||

Independent Director | Common Shares | DSUs | Value at Risk1 | |||

Meets Share ownership guidelines | Nil | 51,368 | $1,114,172 | |||

Committee Membership and Meeting Attendance Record | ||||||

Board | 10 of 10 | |||||

Audit | 6 of 6 | |||||

Operations (Chair) | 6 of 6 | |||||

1 Calculated as the aggregate number of common shares and DSUs held, multiplied by the closing price of the Corporation’s shares on the TSX on March 15, 2023, in Canadian Dollars.

Management Information Circular March 21, 2023 | 8 | North American Construction Group Ltd. |

Table of Contents

Maryse C. Saint-Laurent

Calgary, AB, Canada

63 Years Old

Director Since: August 6, 2019

Independent Director | Maryse C. Saint-Laurent is an accomplished executive and corporate director with over 25 years’ experience as a business-oriented corporate, transactional and securities lawyer in the energy, power, and mining sectors. She has led several M&A and multi-faceted financing transactions and has a strong governance background. Ms. Saint-Laurent also possesses several years’ experience in human resources, compensation and benefits/pension management. Ms. Saint-Laurent is a member of the board of Turquoise Hill Resources Ltd., where she serves as Chair of the Compensation Committee, Chair of the Governance and Sustainability Committee as well as a member of the Audit Committee. Until most recently, Ms. Saint-Laurent served on the board of Pretivm Resources Inc. where she served as a member of both the Human Resources Committee and the Governance and Nominating Committee and also served on the board of the Alberta Securities Commission, where she served as Chair of the Compensation Committee. Ms. Saint-Laurent holds a Master of Laws (securities and finance), from York University, Osgoode Hall Law School, an LL.B., BA and Certification in Human Resources from the University of Alberta as well as her ICD.D designation.

| |||||

Number of Securities Held | ||||||

Common Shares | DSUs | Value at Risk1 | ||||

Nil | 24,309 | $527,262 | ||||

On track to meet share ownership | ||||||

guidelines | Committee Membership and Meeting Attendance Record | |||||

Board | 10 of 10 | |||||

Human Resources and Compensation | 6 of 6 | |||||

Governance and Sustainability (Chair) | 5 of 5 | |||||

1 Calculated as the aggregate number of common shares and DSUs held, multiplied by the closing price of the Corporation’s shares on the TSX on March 15, 2023, in Canadian Dollars.

Management Information Circular March 21, 2023 | 9 | North American Construction Group Ltd. |

Table of Contents

| Thomas P. Stan has served as a board member on a number of public and private corporations. Until September of 2019 he was the President and CEO of Corval Energy Ltd., a Calgary, Alberta based oil company focused on exploration and production in Manitoba and Saskatchewan. Previously, Mr. Stan has held positions as Managing Director of Investment Banking at Desjardins Capital Markets and Blackmont Capital Markets, President and CEO of Phoenix Energy Ltd. and Sound Energy Trust, and Chair and CEO of Total Energy Services Ltd. Mr. Stan began his career at Suncor and spent 16 years at Hess Corporation as Vice President, Corporate Planning. After Petro Canada acquired Hess Canada he became Vice President of Corporate Development of Petro Canada. Mr. Stan received his Bachelor of Commerce degree in Finance and Economics from the University of Saskatchewan.

| |||||

Thomas P. Stan

Calgary, AB, Canada

65 Years Old

| ||||||

Director Since: July 14, 2016 | Number of Securities Held | |||||

Independent Director | Common Shares | DSUs | Value at Risk1 | |||

Meets share ownership guidelines | Nil | 56,841 | $1,232,881 | |||

Committee Membership and Meeting Attendance Record | ||||||

Board | 10 of 10 | |||||

Human Resources and Compensation (Chair) | 6 of 6 | |||||

Operations | 6 of 6 | |||||

1 Calculated as the aggregate number of common shares and DSUs held, multiplied by the closing price of the Corporation’s shares on the TSX on March 15, 2023, in Canadian Dollars.

Management Information Circular March 21, 2023 | 10 | North American Construction Group Ltd. |

Table of Contents

Kristina E. Williams

Edmonton, AB, Canada

46 Years Old

| Kristina E. Williams is currently the President and CEO of Alberta Enterprise Corporation, which is responsible for overseeing management of the Alberta Enterprise Fund, a fund established by the government of Alberta in 2009 to attract venture capital to Alberta and to invest in venture capital funds that invest in Alberta technology. The fund currently has thirty investments with an underlying portfolio of more than 600 technology companies. Previously, Ms. Williams held the position of Vice President of Marketing and Sales for Natraceutical Canada Inc. and the position of Administrative Director with Xenerate AB, a Swedish biotechnology company. Ms. Williams was born in Sweden and received a Master of Laws from Uppsala University, where she also served as COO and Vice Chair of the Board of Norrlands Nation, the largest student society at Uppsala. She is currently on the board of governors of the Northern Alberta Institute of Technology (NAIT), serving as chair of the audit and finance committees as well as chair of the NAIT Foundation, and she is a board member of Alcanna Inc. She is also on the Alberta Securities Commission New Economy Advisory Committee and serves as Swedish honorary Consul for Edmonton and Northern Alberta. In addition to her LL.M., Ms. Williams holds an MBA from the University of Alberta as well as her ICD.D designation.

| |||||

Director Since: August 6, 2019 | Number of Securities Held | |||||

Independent Director | Common Shares | DSUs | Value at Risk1 | |||

Nil | 23,055 | $500,063 | ||||

On track to meet share ownership guidelines | ||||||

Committee Membership and Meeting Attendance Record | ||||||

Board | 10 of 10 | |||||

Audit | 6 of 6 | |||||

Governance and Sustainability | 2 of 2 | |||||

Operations | 3 of 3 | |||||

1 Calculated as the aggregate number of common shares and DSUs held, multiplied by the closing price of the Corporation’s shares on the TSX on March 15, 2023, in Canadian Dollars.

Management Information Circular March 21, 2023 | 11 | North American Construction Group Ltd. |

Table of Contents

Corporate Cease Trade Orders, Bankruptcies, Penalties or Sanctions

John Pollesel is a director of First Cobalt Corporation (“First Cobalt”). First Cobalt announced on June 21, 2017, that it had proposed a friendly merger with Cobalt One Ltd. (“Cobalt One”) and CobalTech Mining Inc. (“CobalTech”). At that time, First Cobalt signed letters of intent with each of Cobalt One and CobalTech and requested the TSX Venture Exchange to temporarily halt trading of its shares. The TSX Venture Exchange approved the resumption of trading as of August 28, 2017.

Recommendation of the Board of Directors

The Board of Directors recommends a vote “FOR” the election of each of the above nominees to serve as a director of the Corporation.

Unless a NACG Shareholder otherwise directs, or directs that his or her NACG Common Shares are to be voted “AGAINST” the election of any particular nominee specified above, the persons named in the enclosed form of Proxy intend to vote “FOR” the election of each of the nominees specified above, such directors to hold office until the next annual meeting or until his or her successor is appointed.

2. Advisory Vote on Executive Compensation

The Corporation’s compensation policies and procedures are based on the principle of pay for performance. The Board of Directors believes they align the interests of the Corporation’s executive team with the long-term interests of NACG Shareholders. The Board also believes that NACG Shareholders should have the opportunity to fully understand the objectives, philosophy and principles used in its approach to executive compensation decisions and to have an advisory vote on the Board’s approach to executive compensation. This non-binding advisory vote, commonly known as “Say-on-Pay”, gives each NACG Shareholder an opportunity to either endorse or not endorse the Corporation’s approach to its executive pay program and policies through the following resolution:

“Resolved, on an advisory basis and not to diminish the role and responsibilities of the board of directors, that the shareholders of North American Construction Group Ltd. (the “Corporation”) accept the approach to executive compensation disclosed in the management information circular delivered in advance of the 2023 annual meeting of shareholders of the Corporation.”

Approval of the above resolution will require an affirmative vote of a majority of the votes cast at the Meeting.

The purpose of the Say-on-Pay advisory vote is to provide appropriate director accountability to the NACG Shareholders for the Board’s compensation decisions by giving NACG Shareholders a formal opportunity to provide their views on the disclosed objectives of the executive compensation plans, and on the plans themselves, for the past, current and future fiscal years. While NACG Shareholders will provide their collective advisory vote, the directors of the Corporation remain fully responsible for their compensation decisions and are not relieved of these responsibilities by a positive advisory vote by NACG Shareholders.

As this is an advisory vote, the results will not be binding on the Board. However, the Board will take the results of the vote into account, as appropriate, when considering future compensation policies, procedures and decisions and in determining whether there is a need to significantly increase their engagement with NACG Shareholders on compensation and related matters. The Corporation will disclose the results of the Say-on-Pay vote as a part of its report on voting results for the Meeting.

In the event that a significant number of Shareholders oppose the resolution, the Chair of the Board, Chair of the Human Resources and Compensation Committee and the Lead Director will oversee a consultation process with NACG Shareholders, particularly those who are known to have voted against it, in order to better understand their concerns. The Human Resources and Compensation Committee will review the Corporation’s approach to compensation in the context of those concerns. Shareholders who have voted against the resolution will be encouraged to contact the Lead Director to discuss their specific concerns. Such discussion may be initiated by a Shareholder by sending an e-mail requesting the same to the Corporation’s Investor Relations department at IR@nacg.ca.

Following the review by the Human Resources and Compensation Committee, the Corporation will disclose to Shareholders a summary of the significant comments relating to compensation received from Shareholders in the process, a description of the process undertaken and a description of any resulting changes to executive compensation or why no changes will be made. The Corporation will provide this disclosure within six months of the Say-on-Pay vote, and no later than in the management information circular for its next annual meeting.

Management Information Circular March 21, 2023 | 12 | North American Construction Group Ltd. |

Table of Contents

The Board recognizes that Say-on-Pay is an evolving area and will review this policy annually to ensure that it is effective in achieving its objectives.

Recommendation of the Board of Directors

The Board of Directors recommends a vote “FOR” the Corporation’s approach to executive compensation as described in the “Compensation Discussion and Analysis” portion of this Circular.

Unless a NACG Shareholder otherwise directs, or directs that his or her NACG Common Shares are to be withheld from voting in connection with the above resolution with respect to approval of the Corporations’ approach to executive compensation, the persons named in the enclosed form of Proxy intend to vote for the above resolution with respect to approval of the Corporations’ approach to executive compensation.

3. Appointment of Independent Auditors and Authorization of Directors to Fix Remuneration

At the Meeting, NACG Shareholders will be requested to vote on the re-appointment of KPMG LLP (“KPMG”) as the independent auditors of the Corporation to hold office until the next annual meeting of shareholders or until a successor is appointed, and to authorize the Board of Directors to fix the auditor’s remuneration. KPMG have been the auditors of the Corporation, or its predecessor NACG Holdings Inc., since October 31, 2003.

Recommendation of the Board of Directors

The Board of Directors recommends a vote “FOR” the re-appointment of KPMG as independent auditors of the Corporation for the fiscal year ending December 31, 2023, and authorizing the Board of Directors to fix the auditor’s remuneration.

Unless an NACG Shareholder otherwise directs, or directs that his or her NACG Common Shares are to be withheld from voting in connection with the appointment of auditors, the persons named in the enclosed form of Proxy intend to vote for the re-appointment of KPMG as auditors of the Corporation until the next annual meeting of shareholders and to authorize the directors to fix their remuneration.

4. Other Matters

Management of the Corporation know of no matters to come before the Meeting other than as set forth in the Notice of Meeting. However, if other matters which are not currently known to management should properly come before the Meeting, the accompanying proxy will be voted on such matters in accordance with the best judgment of the persons voting the proxy.

Management Information Circular March 21, 2023 | 13 | North American Construction Group Ltd. |

Table of Contents

COMPENSATION DISCUSSION AND ANALYSIS

The below discussion of executive compensation focuses on the compensation of the following executive team members for the year ended December 31, 2022, who are our “named executive officers” or “NEOs” for purposes of this compensation disclosure:

Named Executive Officer | Position in 2022 | |||

Joseph C. Lambert | President and Chief Executive Officer | |||

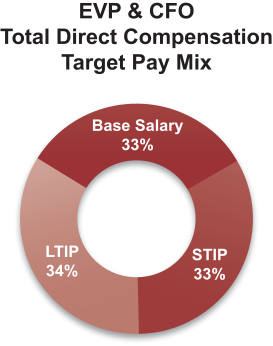

Jason W. Veenstra | Executive Vice President and Chief Financial Officer | |||

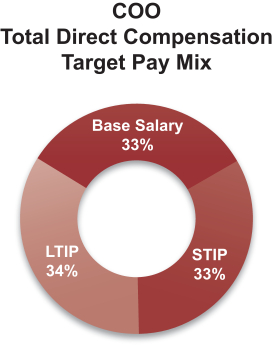

Barry W. Palmer | Chief Operating Officer | |||

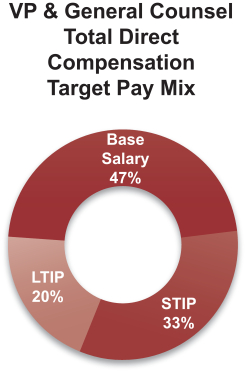

Jordan A. Slator | Vice President and General Counsel | |||

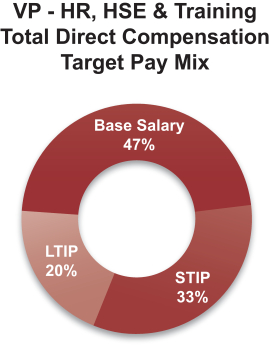

David G. Kallay | Vice President - HR, HSE and Training | |||

Executive Compensation Philosophy

Our executive compensation philosophy is guided by five fundamental principles – alignment with shareholder interests, pay for performance, transparent disclosure, shareholder say on pay and market competitive compensation:

| Alignment with Shareholder Interests | It is in the Corporation’s best interest to meet or exceed shareholder expectations and to ensure continued access to capital on favorable terms. Accordingly, the pay “at-risk” or variable pay plans (Short-Term Incentive Plan (“STIP”) and Long-Term Incentive Plan (“LTIP”)) were designed to align the interests of the Corporation’s executives with shareholder interests. | |||

| Pay for Performance | The Corporation believes that executive compensation should be strongly correlated to the financial and safety performance of the Corporation, and that the executives, as the key decision makers of the Corporation, should be held accountable for that performance. To that end, the Board has adopted the annual STIP, which rewards executives for the achievement of key financial, safety and other individual objectives in the more immediate term, as well as the LTIP, which rewards executives for the overall financial success of the Corporation over the longer term. | |||

| Transparent Disclosure | The Corporation is committed to providing transparent disclosure of executive compensation. It is our intent to follow best practices, comply with all regulatory requirements and communicate our executive pay in plain language. | |||

| Shareholder Say on Pay | The Human Resources and Compensation Committee (“HRCC”) and the Board review and consider all shareholder feedback related to compensation matters and will continue existing practices regarding shareholder discussion and engagement. Our first shareholder “Say on Pay” vote was conducted in May 2020 and established the framework for conducting an annual non-binding advisory vote by shareholders on executive compensation. | |||

| Market Competitive Compensation | The Corporation has adopted a market-competitive executive total compensation package. It is the goal of the Corporation to attract and retain talented executives who are capable and motivated to execute the financial and business objectives of the Corporation. It is important to ensure executive compensation is competitive within the market where the Corporation competes for talent. |

Management Information Circular March 21, 2023 | 14 | North American Construction Group Ltd. |

Table of Contents

Components of 2022 Executive Compensation

The following table summarizes the various components of compensation that NEOs were eligible to receive for 2022:

| Component | Description | Time Frame | ||||||

| Base Salary | Salaries are based on the executive’s level of responsibility, skills and experience and the current market value of the position. Base salary adjustments are considered annually. | Annual market reviews and adjustments | ||||||

| Short-Term Incentive Plan (“STIP”) | STIP compensation is linked to the Corporation’s achievement of financial and safety performance in the fiscal year as compared to targets set by the Board. While the CEO’s STIP is based entirely on the Corporation’s achievement of targets, STIP for the other NEO’s includes an element of individual achievement. The value of each STIP target payout to an NEO is a fixed percentage of that NEO’s annual base salary, which percentage varies by position. | Annual performance | ||||||

Payouts range from zero to a maximum of 1.5 times an NEO’s | ||||||||

The NEOs are given the opportunity to take up to 50% of their annual | ||||||||

| Long-Term Incentive Plan (“LTIP”) | LTIP grants are made through two vehicles: (1) performance share units (PSUs) and (2) restricted share units (RSUs). Each LTIP grant is awarded 60% as PSUs and 40% as RSUs. The value of each LTIP grant to an NEO is a fixed percentage of that NEO’s annual base salary, which percentage varies by position. | Three-year performance cycle | ||||||

Awards are equity-settled by the transfer of shares purchased by an | ||||||||

| Retirement Arrangements | The Corporation matches contributions of executives to registered retirement savings plans (“RRSPs”) to a maximum of 5% of base salary. If or when the executive reaches his or her annual RRSP contribution limits, the remaining contributions for the calendar year are made to a non-registered savings plan (“Group Investment Account”). | Paid semi-monthly with base salary | ||||||

| Benefit Plans | Executive benefit plans, paid for by the Corporation, provide extended health, dental, disability and insurance coverage. | Monthly premiums | ||||||

| Perquisites | Limited perquisites are provided including a vehicle allowance, and reimbursement of fuel purchases, reimbursement for annual dues to a local sport or health club, an optional annual medical examination and a discretionary health care spending account. | Monthly, as incurred |

Base Salary

Base salaries for the NEOs are reviewed each year by the HRCC. The HRCC may make adjustments to an NEO’s salary as a result of a change in the NEO’s duties and responsibilities and based on the performance and contribution of the executive, both on an individual basis and on the performance of the executive’s department(s), during the previous year. In reviewing the base salaries of the NEO’s, the HRCC also considers comparator group compensation studies provided by third party compensation consultants, internal pay relationships, total direct target compensation, total employee cost and the pay position of each executive in the market. Any changes to CEO base salary must be approved by the Board. Changes to base salaries for other NEO’s must be approved by the HRCC.

Management Information Circular March 21, 2023 | 15 | North American Construction Group Ltd. |

Table of Contents

The following table sets out the base salaries of the NEO’s as at December 31, 2022:

| NEO | December 31, 2022 Base Salary ($) | December 31, 2021 Base Salary ($) | % change | |||||||||||||||

Joseph C. Lambert | 570,000 | 570,000 | nil | |||||||||||||||

Jason W. Veenstra | 320,000 | 320,000 | nil | |||||||||||||||

Barry W. Palmer | 350,000 | 350,000 | nil | |||||||||||||||

Jordan A. Slator | 265,000 | 265,000 | nil | |||||||||||||||

David G. Kallay | 265,000 | 265,000 | nil | |||||||||||||||

Short-Term Incentive Plan (“STIP”)

STIP is the primary performance-based pay vehicle the Corporation uses to reward executives for their contributions to strong financial and safety performance in a fiscal year. Its purpose is to motivate executives to meet or exceed the Corporation’s annual financial and safety targets and to reward them to the extent that goals are achieved. All senior managers, including the NEOs, participate in the STIP.

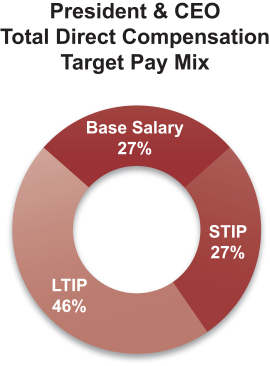

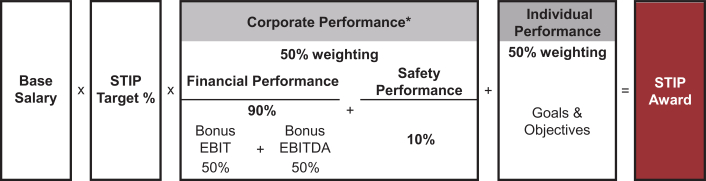

The graphic below displays the method by which STIP is calculated for NEO’s other than the CEO. The method for the CEO does not include an Individual Performance factor, as the CEO’s individual performance is seen as 100% correlated to corporate performance.

| • | DEFINITIONS: “Adjusted EBIT” is defined as adjusted consolidated net earnings before the effects of interest expense, income taxes and equity earnings in affiliates and joint ventures. “Adjusted EBITDA” is defined as adjusted EBIT before the effects of depreciation, amortization and equity investment depreciation and amortization. Both Adjusted EBIT and Adjusted EBITDA are Non-GAAP financial measures. The terms “Bonus EBIT” and “Bonus EBITDA” refer to Adjusted EBIT and Adjusted EBITDA subject to adjustments approved by the HRCC that remove elements of those metrics that do not relate to management performance. |

Management Information Circular March 21, 2023 | 16 | North American Construction Group Ltd. |

Table of Contents

The following describes the basic terms of the STIP:

Participants | Salaried employees active on the payment date. | |||

Vesting | The participant must be employed by the Corporation at the time of payout or award is forfeited. | |||

Performance Cycle | 12 months | |||

Performance Threshold | 75% of the financial goals must be achieved to trigger any STIP payment. | |||

Performance Measures | CORPORATE PERFORMANCE (50% weight) (100% for the CEO) | |||

Financial (90% weight of Corporate Performance) | ||||

The Corporation’s financial targets for the business are determined by the Board | ||||

Safety (10% weight of Corporate Performance) | ||||

The Corporation’s safety targets for the business are approved annually by the | ||||

INDIVIDUAL PERFORMANCE (50% weight) (0% for the CEO) | ||||

Individual goals in alignment with the Corporate strategy are cascaded to the | ||||

Payout Timing | Paid in the following year once performance measures have been assessed. | |||

Payout Range | Payment range for the CEO is 0 - 2.0x, based on a STIP payout curve approved by the Board. | |||

Payment range for each of the other NEOs is 0 - 1.5x, based on a STIP payout | ||||

There is no STIP payout if financial performance is below 75% of target. Maximum | ||||

Payout | Paid following the end of the fiscal year based on audited financial statements and determination of final safety metrics. | |||

The NEOs may elect to take up to 50% of their annual STIP in the form of DSUs, | ||||

Change of Control | CEO: 2.0 x 90% of STIP target for fiscal year in which the Termination Date occurs. Other NEOs: No payment triggered. See below for details. | |||

Termination Without Cause | CEO: 1.0 x 90% of STIP target for fiscal year in which the Termination Date occurs. Other NEOs: Receive 90% of their pro-rated STIP. See below for details. | |||

Management Information Circular March 21, 2023 | 17 | North American Construction Group Ltd. |

Table of Contents

Financial Weighting

For 2022, the Corporation used Adjusted EBIT and Adjusted EBITDA as the financial metrics under the STIP because the Corporation considers them good indicators of overall corporate performance. Under the STIP, the HRCC may make recommendations to the Board regarding adjustments to Adjusted EBIT and Adjusted EBITDA, thus defining “Bonus EBIT” and “Bonus EBITDA”, to eliminate factors not considered to be related to the performance of management. |

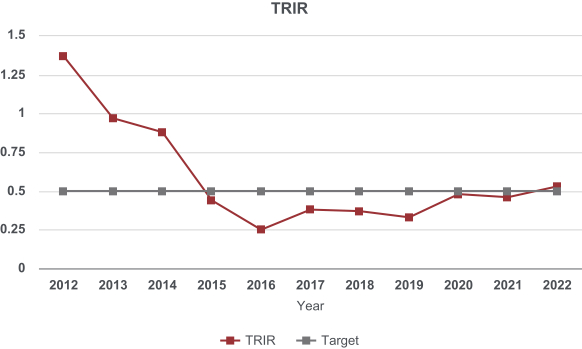

Safety Weighting

The Corporation places a high degree of focus on health and safety and so has incorporated a safety metric into the STIP. For 2022, the Corporation used Total Recordable Injury Rate (“TRIR”) as that safety metric. The TRIR is an industry and nationally-recognized standard safety measure that is in line with our clients’ measurement standards for safety on mining construction sites. It is based on the total number of work-related injury and illness cases reported that require more than standard first aid treatment, as it relates to the total number of employee hours worked. The calculation for TRIR is the number of recordable cases multiplied by 200,000, divided by the total number of hours worked by all employees during the year. |

STIP Targets

The Board approves both the financial and safety targets annually. These targets are intended to be stretch targets. The Board approved the Bonus EBIT and Bonus EBITDA targets for the year ending December 31, 2022, after taking into account the results from 2021, as well as the budget and business strategy for 2022. The Board also approved the TRIR target for the year ending December 31, 2022, considering the results from 2021 and the areas of focus and business plans for 2022 and onward.

STIP Awards

The HRCC makes an annual recommendation to the Board regarding the STIP award for the CEO on the basis of the Corporation’s Bonus EBIT, Bonus EBITDA and safety performance. The Board makes the final determination of the CEO’s STIP award based on the HRCC’s recommendation. The CEO makes an annual recommendation to the HRCC with respect to the STIP award for the other NEO’s after consideration and assessment of the individual achievements of the other NEO’s. The HRCC makes the final determination of the STIP awards for the other NEOs, based upon the CEO’s recommendation and the same corporate performance criteria as are applied to the CEO.

The following table sets out the STIP target, maximum STIP award and actual STIP award for the year ended December 31, 2022:

| NEO | CY2022 STIP Target as Percentage of Base Salary (%) | STIP Target(a) | Maximum STIP Award(b) | Actual CY2022 STIP Award | ||||||||||||||||||||||||||||||

Joseph C. Lambert | 100% | $ | 570,000 | 2.0x | $ | 1,140,000 | $ | 534,789 | ||||||||||||||||||||||||||

Jason W. Veenstra | 100% | $ | 320,000 | 1.5x | $ | 480,000 | $ | 300,232 | ||||||||||||||||||||||||||

Barry W. Palmer | 100% | $ | 350,000 | 1.5x | $ | 525,000 | $ | 328,379 | ||||||||||||||||||||||||||

Jordan A. Slator | 70% | $ | 185,500 | 1.5x | $ | 278,250 | $ | 174,041 | ||||||||||||||||||||||||||

David G. Kallay | 70% | $ | 185,500 | 1.5x | $ | 278,250 | $ | 174,041 | ||||||||||||||||||||||||||

(a)STIP Target is determined as follows: Base Salary from January 1, 2022 to December 31, 2022, multiplied by CY2022 STIP Target Percentage. This calculation takes into consideration base salary changes made part way through the calendar year and the number of eligible calendar days in the period.

(b)The Maximum STIP Award is based on two times (2x) the base salary earned for the period for Mr. Lambert, and one and one-half times (1.5x) the base salary earned for the period for all other NEOs.

STIP Settlement

STIP is paid in cash following the end of the fiscal year based on audited financial statements and determination of final safety metrics. The NEOs may, however, elect to take up to 50% of their annual STIP in the form of DSUs.

Management Information Circular March 21, 2023 | 18 | North American Construction Group Ltd. |

Table of Contents

Long-Term Incentive Plan (“LTIP”)

The purpose of the Corporation’s equity-based LTIP is to motivate NEOs to achieve and increase mid and long-term Corporate performance, which will grow the value of the Corporation over the long term and generate greater returns for shareholders. Under the LTIP, incentives are awarded to NEOs 60% in the form of Performance Share Units (“PSUs”) and 40% in the form of Restricted Share Units (“RSUs”).

The following describes the basic terms of RSUs and PSUs:

Participants | Management Employees active on the grant date. | |||

Vesting/Maturity | “Cliff-vest” or mature three years from the date of grant. Subject to limited exceptions, the participant must be employed by the Corporation at the time of vesting or award is forfeited. | |||

Performance Cycle | Three years from the grant date. | |||

Performance Measure | RSU settlement is based on the market value of a common share as of the maturity date. | |||

PSU settlement is based on the market value of a common share as of the maturity date as modified by a performance factor determined by the Board as at the time of original issuance of the PSU. | ||||

PSU participants may receive 0% to 200% of their target grant, based on the applicable performance factor. | ||||

Performance factor for PSU grants prior to 2022 was total shareholder return (“TSR”) as compared to a peer comparator group approved by the Board. Beginning in 2022, performance factor for PSU grants is based equally on four criteria: (a) TSR as compared to a peer comparator group approved by the Board; (b) adjusted earnings before interest and taxes; (c) free cash flow; and (d) adjusted return on invested capital. The first criterion is calculated based on market values, including dividends. The other criteria are based on 3-year targets approved by the Board. | ||||

Settlement Timing | Settled within 90 days following Maturity Date and in any event no later than December 31 of the year in which the Maturity Date occurs. | |||

Equity Settlement | Settled with shares purchased on the open market by an arm’s length trust established for such purpose. | |||

Change of Control | Become earned. See below for details. | |||

Termination | Become forfeited. See below for details. | |||

Under the RSU Plan, an RSU and/or a PSU is a right granted to a participant to receive, at the Corporation’s option, either a Common Share of the Corporation or a cash payment equivalent to the fair market value of a Common Share of the Corporation. RSUs mature on the third anniversary of the grant date. Subject to performance criteria, all PSUs also mature on the third anniversary of their grant date. If any dividends are paid on the NACG Common shares, additional RSUs or PSUs are credited to the participant to reflect such dividends.

The RSU plan provides that, in the event of termination of a participant (with or without cause), all RSUs and PSUs that are not determined to be “earned RSUs” are immediately forfeited unless otherwise permitted under a participant’s employment agreement. In the event of the disability of a participant, or the retirement of a participant that is approved by the Compensation Committee as a “qualified retirement”, all earned RSUs will be redeemed within 30 days of the maturity date and any RSUs which have not completed their prescribed term (credited RSUs) will continue to be eligible to become earned RSUs as if the participant was still employed by the Corporation. On the death of a participant, all credited RSUs or PSUs will be deemed earned and will be redeemed within 90 days of the date of the participant’s death, or in the case of PSUs, will be settled following receipt of the results required to measure the performance criteria. Rights respecting RSUs and PSUs are not transferable or assignable other than by will or the laws of descent and distribution.

Management Information Circular March 21, 2023 | 19 | North American Construction Group Ltd. |

Table of Contents

Upon a Change of Control, all outstanding RSUs that are not earned RSUs held in the participant’s RSU Account on the date the Change of Control transaction is completed will be deemed to be earned RSUs. The value of the earned RSUs will be fixed at the date of the Change in Control and final payment deferred until the end of the maximum term (3 years) of the RSU or PSU. Termination provisions in the amendments provide that within 24 months following the Change of Control, if the participant’s employment is terminated by the Participant for any reason other than death, disability, qualified retirement or good reason as defined in the plan, all earned RSUs will be immediately forfeited, unless otherwise permitted under a participant’s employment agreement (Refer to Termination Chart herein). In the case of a termination without cause, within 36 months following a Change of Control, all earned RSUs will be paid out.

LTIP Targets

While the non-binding “say on pay” resolution put forward to shareholders at the Corporation’s 2022 Annual General Meeting received majority support, the Board was concerned that the support was not higher. In response, the board undertook a formal process of engaging shareholders with respect to its approach to executive compensation. In particular, the Chair of the Board and the Chair of the HRCC engaged in conversations with several shareholders who had indicated that they had not supported the “say on pay” resolution. The Corporation received feedback from those shareholders in relation to the Board’s decision to approve PSU’s with a performance factor consisting entirely of TSR as compared to a group of peers. The general consensus was that a blend of relative TSR performance and target absolute metrics would be a preferable approach. The Board obtained advice from Mercer (Canada) Limited, the Corporation’s independent compensation consultant, with respect to such feedback. In response to the shareholder feedback and upon the advice of its consultant, the Board adopted PSU performance metrics for 2022 grants that are based equally on four criteria: (a) TSR as compared to a peer comparator group approved by the Board (consisting of Canadian and US public companies and relevant S&P/TSX small-cap subset indexes); (b) adjusted earnings before interest and taxes; (c) free cash flow; and (d) adjusted return on invested capital. The Board’s current intent is to follow this general approach for future PSU grants.

As with prior grants, the TSR performance metric continues to be calculated based on market values over the three-year term of the PSU’s, including dividends, relative to a benchmark group. The Board made changes to the benchmark group for the 2022 PSU grants in an effort to have the group be a truer performance comparator for the Corporation’s business, thereby making the Corporation’s relative performance against the group a more meaningful measure of shareholder value. For the 2022 grants, the benchmark group was as follows:

2022 NACG TSR Comparator Group |

Aecon Group Inc. |

Badger Infrastructure Solutions Ltd. |

Bird Construction Inc. |

Granite Construction Incorporated |

Mullen Group Ltd. |

Sterling Construction Company, Inc. |

S&P/TSX Small Cap Index: Materials subset |

S&P/TSX Small Cap Index: Industrials subset |

S&P/TSX Small Cap Index: Energy subset |

For 2022 grants, the performance targets and payouts for TSR in relation to the comparator group, to be determined over their three-year term, are as follows:

NACG TSR Percentile Rank relative to the Group | % of PSU Target Earned | |||

At or above 90th Percentile (Maximum) | 200% | |||

75th Percentile (Stretch) | 150% | |||

50th Percentile (Target) | 100% | |||

25th Percentile (Threshold) | 25% | |||

The three absolute PSU performance metrics are based on 3-year targets approved by the Board. All three of these metrics (adjusted earnings before interest and taxes “Adjusted EBIT”, free cash flow and adjusted return on invested capital) are non-GAAP financial measures. Adjusted EBIT is defined as adjusted net earnings before the effects of

Management Information Circular March 21, 2023 | 20 | North American Construction Group Ltd. |

Table of Contents

interest expense and income taxes. Free cash flow is defined as cash from operations less cash used in investing activities including purchases funded by equipment leases but excluding cash used for acquisitions and growth capital. Adjusted return on invested capital is defined as Adjusted EBIT less tax divided by average invested capital (net debt + shareholder’s equity). See the discussion of non-GAAP financial measures in our most recent MD&A for further details.

Revised PSU Performance Metrics for 2022 Awards

2021 | 2022 | |||||||||||||

Metric | Weight | Performance Period | Metric | Weight | Performance Period | |||||||||

| Relative TSR | 25% | Measured 3-year point-to-point (from July to June) against TSR comparator group | ||||||||||||

Relative TSR | 100% | Measured 3-year point-to-point (from July to June) against peer comparator group | Adjusted EBIT | 25% | Measured 3-year performance vest date (e.g., FY2022-FY2024 for July 2022 grant)

| |||||||||

| Free Cash Flow | 25% | |||||||||||||

| Return On Invested Capital | 25% | |||||||||||||

LTIP Awards

The following tables outline the LTIP target values and actual LTIP awards for the NEOs for the year ended December 31, 2022:

NEO | Annual LTIP Value at Target (% of base salary) | % as RSUs | RSUs Granted July 1, 2022 | % as PSUs | PSUs Granted July 1, 2022 | |||||||||||||||

Joseph C. Lambert | 175 % | 40 % | 25,742 | 60 % | 38,613 | |||||||||||||||

Jason W. Veenstra | 100 % | 40 % | 8,259 | 60 % | 12,388 | |||||||||||||||

Barry W. Palmer | 100 % | 40 % | 9,033 | 60 % | 13,549 | |||||||||||||||

Jordan A. Slator | 45 % | 40 % | 3,078 | 60 % | 4,617 | |||||||||||||||

David G. Kallay | 45 % | 40 % | 3,078 | 60 % | 4,617 | |||||||||||||||

LTIP Settlement

Since 2014, the Corporation has elected to settle both RSUs and PSUs in shares. Such shares have been acquired in open-market purchases by an arm’s-length trust established by the Corporation in June of 2014 for such purpose. As at January 1, 2023, the trust held 1,406,461 shares. Shares held by the trust are accounted for as treasury shares in the Corporation’s financial statements.

Retirement Arrangements

The Corporation does not have a pension plan. For the year ended December 31, 2022, the Corporation remitted a total of $179,003 for retirement and Non-Registered Savings Plans (Group Investment Accounts) for the NEOs.

Benefit Plans

The Corporation provides NEOs with health, dental, disability and insurance coverage through benefit plans paid for by the Corporation.

Perquisites

NEOs receive a limited number of perquisites that are consistent with market practice for individuals at this level. These include a vehicle allowance and reimbursement for fuel purchases, reimbursement for annual dues at a local health or sports club, an annual medical examination, a discretionary health care spending account and smart phone allowance.

Management Information Circular March 21, 2023 | 21 | North American Construction Group Ltd. |

Table of Contents

The HRCC reviews and approves a core comparator group as a reference in establishing the NEOs’ target pay. This group differs somewhat from the TSR comparator group discussed above, as the factors used in assessing competitive compensation for the NEO’s are somewhat different than the factors used in assessing Corporate financial performance. For the compensation comparator group, the Board chooses companies that meet the following criteria:

| (a) | compete with NACG for customers and revenue; |

| (b) | compete with NACG for executive talent, particularly in the Alberta labour market; |

| (c) | compete with NACG for equity or other capital; |

| (d) | are in the same or similar industry, such as construction and engineering or oil and gas equipment and energy services; |

| (e) | are of comparable size, in terms of revenue, assets, EBITDA, market capitalization and enterprise value; and |

| (f) | have reliable benchmark compensation information available. |

Certain direct competitors are not included in our comparator group because they are private corporations or partnerships (i.e. KMC Mining, Thompson Bros.) or smaller divisions of larger corporations with insufficient compensation information available for them. The use of comparative market data is just one of the factors used in setting compensation for NEOs. NEO compensation could be higher or lower than the comparator data as a result of individual performance, industry knowledge base, professional degrees and certifications, relevant skills, abilities, years of service, executive experience and market conditions.

The following table sets out NACG’s current compensation comparator group, showing that NACG is positioned between the 34th and 42nd percentiles on revenue, market capitalization and assets and above the 50th percentile on EBITDA (84th percentile) and net income (66th percentile):

Company Name (dollars in millions) (i) | Revenue(ii) | Market Cap. | Total Assets | EBITDA | Net Income | City, Province | ||||||||||||||||||

SECURE ENERGY SERVICES INC. | $ | 7,317 | $ | 2,179 | $ | 2,935 | $ | 497 | $ | (14) | Calgary, AB | |||||||||||||

AECON GROUP INC. | $ | 4,696 | $ | 556 | $ | 3,567 | $ | 174 | $ | 30 | Toronto, ON | |||||||||||||

BIRD CONSTRUCTION INC. | $ | 2,318 | $ | 436 | $ | 1,218 | $ | 110 | $ | 45 | Mississauga, ON | |||||||||||||

WAJAX CORPORATION | $ | 1,824 | $ | 424 | $ | 1,211 | $ | 107 | $ | 64 | Mississauga, ON | |||||||||||||

CES ENERGY SOLUTIONS CORP. | $ | 1,727 | $ | 704 | $ | 1,393 | $ | 175 | $ | 80 | Calgary, AB | |||||||||||||

CALFRAC WELL SERVICES LTD. | $ | 1,403 | $ | 490 | $ | 1,033 | $ | 155 | $ | (36) | Calgary, AB | |||||||||||||

TRICAN WELL SERVICE LTD. | $ | 866 | $ | 845 | $ | 671 | $ | 187 | $ | 79 | Calgary, AB | |||||||||||||

TOTAL ENERGY SERVICES INC. | $ | 683 | $ | 359 | $ | 897 | $ | 127 | $ | 27 | Calgary, AB | |||||||||||||

BADGER INFRASTRUCTURE SOLUTIONS LTD. | $ | 504 | $ | 919 | $ | 539 | $ | 61 | $ | 10 | Calgary, AB | |||||||||||||

PASON SYSTEMS INC. | $ | 303 | $ | 1,300 | $ | 463 | $ | 117 | $ | 83 | Calgary, AB | |||||||||||||

North American Construction Group Ltd. | $ | 1,054 | $ | 478 | $ | 980 | $ | 245 | $ | 67 | Acheson, AB | |||||||||||||

|

|

|

|

|

|

|

|

|

|

| ||||||||||||||

Percentile Positioning | 40 % | 34 % | 42 % | 84 % | 66 % | |||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

| ||||||||||||||

(i) Source: Mercer (Canada) Limited

(ii) Information is from public filings for the most recently reported four quarters, available as at March 1, 2023. The revenue of the Corporation in the above chart is “Total Combined Revenue”, which is a non-GAAP measure that includes revenue from certain equity-accounted joint ventures that would otherwise not be included. The Corporation feels that “Total Combined Revenue” provides a more accurate reflection of the size of the Corporation than revenue determined strictly in accordance with GAAP. See the Corporation’s most recently filed Management Discussion & Analysis for the year ended December 31, 2022, for further details on “Total Combined Revenue” and non-GAAP measures generally.

Management Information Circular March 21, 2023 | 22 | North American Construction Group Ltd. |

Table of Contents

2022 Compensation Decisions Regarding NEOs

STIP Program Objectives and Results

For the year ended December 31, 2022, the following Corporate STIP targets were recommended by the HRCC and approved by the Board under the STIP program, with achievement as indicated:

| Metric | 2022 Target and Achievement | Actual STIP Score | ||||

|

|

|

| |||

Financial Performance (90% weighting) | ||||||

Bonus EBIT

(50% weighting) | The Corporation achieved $117.1M Bonus EBIT from continuing operations, which was 102.6% of the target of $114.2M. |

| 104.2% |

| ||

Bonus EBITDA

(50% weighting) | The Corporation achieved $248.4M Bonus EBITDA from continuing operations, which was 101.7% of the target of $244.3M. | |||||

|

|

|

| |||

Safety Performance (10% weighting) | ||||||

Total Recordable Injury Rate (“TRIR”) | In 2022, there were a total of 13 reportable injury cases, resulting | 0% | ||||

|

|

|

| |||

For the fiscal year 2022, the financial metrics used in the STIP performance metrics were Bonus EBIT and Bonus EBITDA, equally weighted and comprising 90% of the overall Corporate performance measures. With respect to each of the Bonus EBITDA and Bonus EBIT targets, the Board approved a STIP payout curve that provides for payout of 0% of target payout if less than 75% of target performance is achieved, 25% of target payout if 75% of target performance is achieved, 75% of target payout if 87.5% of target performance is achieved, 100% of target payout if 100% of target performance is achieved and a maximum payout of 150% of target payout if 125% or more of target performance is achieved (with intermediate achievement being interpolated on a linear basis) and with maximum payout for the CEO being 200% of target payout, as per the CEO’s written employment agreement. This payout curve, as applied to achievement, determines the actual STIP score stated above.

For the fiscal year 2022, the Corporation achieved $117.1 million in Bonus EBIT, amounting to 102.6% of the target, and $248.4 million in Bonus EBITDA, amounting to 101.7% of the target. These achievements resulted in a STIP payout on financial metrics equal to 104.2% of target payout.

We continue to strive for zero workplace injuries. For that reason, safety performance continues to be an important factor to achieving our STIP goals. In 2022, the Total Recordable Injury Rate (“TRIR”), which is an industry and nationally-recognized standard safety measure, was used as the safety metric. It is based on the total number of work-related injury and illness cases reported that require more than standard first aid treatment, as it relates to the total number of employee hours worked (refer also to the EXECUTIVE COMPENSATION—Short-Term Incentive Plan in this document for the calculation for TRIR).

In 2022, there were 13 recordable injuries, resulting in a TRIR of 0.53. We recorded 4.9 million exposure hours, and the reportable injury count increased by two from the year prior. With a 0.50 TRIR or less target for 2022, the safety performance measure was deemed not achieved and 0% of the safety portion of the STIP was paid out.

While the safety target was not achieved in 2022, the TRIR has consistently been under the 0.50 frequency since 2015, which is a commendable achievement considering the safety-sensitive nature of the work in the mining and heavy construction industry and the large number of exposure hours recorded.

Management Information Circular March 21, 2023 | 23 | North American Construction Group Ltd. |

Table of Contents

Combined financial and safety performance, once weighted, resulted in an overall STIP score of 93.8%.

Executive Team Achievement Highlights and Awards – 2022

The Executive team continued its focus on the Corporation’s’ strategies throughout 2022. The achievements of overall Corporate performance and each NEO’s goals are aligned with the elements of the Corporation’s strategies, as summarized below.

| Corporate Business Strategy |

| Execution Excellence |