UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of report (Date of earliest event reported): October 3, 2007

VICTORY DIVIDE MINING COMPANY

(Exact Name of Registrant as Specified in Charter)

Nevada | 0-52127 | 20-4136884 |

| (State or Other Jurisdiction | (Commission File Number) | (IRS Employer |

| of Incorporation) | | Identification No.) |

211 West Wall Street, Midland, TX | 79701 |

| (Address of Principal Executive Offices) | (Zip Code) |

Registrant's telephone number, including area code: (432) 682-1761

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

£ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

£ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

£ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

£ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

TABLE OF CONTENTS

Item No. | Description of Item | Page No. |

| | | |

| Item 1.01 | Entry Into a Material Definitive Agreement | 5 |

| | | |

| Item 2.01 | Completion of Acquisition or Disposition of Assets | 11 |

| | | |

| Item 3.02 | Unregistered Sale of Securities | 75 |

| | | |

| Item 3.03 | Material Modification of Rights of Security Holders | |

| | | |

| Item 4.01 | Changes in Registrant’s Certifying Accountants | 76 |

| | | |

| Item 5.01 | Change In Control of Registrant | 76 |

| | | |

| Item 5.06 | Change in Shell Company Status | 77 |

| | | |

| Item 8.01 | Other Events | 77 |

| | | |

| Item 9.01 | Financial Statements and Exhibits | 77 |

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

Our disclosure and analysis in this Current Report on Form 8-K contains statements that depend upon or refer to future events or conditions or that include words such as “expects”, “anticipates”, “intends”, “plans”, “believes”, “estimates” and similar expressions. Although we believe that these statements are based upon reasonable assumptions, including projections of operating margins, earnings, cashflow, working capital, capital expenditures and other projections, they are subject to several risks and uncertainties, and therefore, we can give no assurance that such projections will be achieved. Our forward-looking statements are not guarantees of future performance, and actual results or developments may differ materially from the expectations expressed in the forward-looking statements.

As for the statements that relate to future financial results and other projections, actual results may be different due to the inherent uncertainty of estimates, forecasts and projections and may be better or worse than projected. Given these uncertainties, you should not place any undue reliance on these statements. These statements also represent our estimates and assumptions only as of the date that they were made and we expressly disclaim any duty to provide updates to them or the estimates and assumptions associated with them after the date of this filing to reflect events or changes in circumstances or changes in expectations or the occurrence of anticipated events.

Information regarding market and industry statistics contained in this report is included based on information available to us which we believe is accurate. We have not reviewed or included data from all sources, and cannot assure stockholders of the accuracy or completeness of this data. Forecasts and other forward-looking information obtained from these sources are subject to the same qualifications and the additional uncertainties accompanying any estimates of future market size, revenue and market acceptance of products and services.

We undertake no obligation to publicly update any predictive statement in this Current Report, whether as a result of new information, future events or otherwise. You are advised, however, to consult any additional disclosures we make in our Form 10-K, Form 10-Q and Form 8-K reports to the SEC.

Explanatory Note

This Current Report on Form 8-K is being filed by Victory Divide Mining Company (“we”, “us” or the “Company”) in connection with: (i) a transaction which closed on October 3, 2007 and in which we acquired Faith Winner Investments Limited ( “Faith Winner (BVI)”), a company incorporated under the laws of the British Virgin Islands, in a share exchange transaction with Winner State Investments Limited (“Winner State (BVI)”), a company incorporated in the British Virgin Islands, Fang Chen, Yang Miao and Ying Zhang for a total of 18,500,000 or 97.43% % of our issued and outstanding shares of $0.001 par value per share common stock (“Common Stock”) , resulting in Winner State (BVI), Fang Chen, Yang Miao and Ying Zhang collectively becoming our majority shareholders and (ii) a private placement financing transaction which closed on October 3, 2007 pursuant to Rule 506 of Regulation D promulgated under the Securities Act of 1933, as amended (the “Act”), in which we sold $21.5 million of our Series A Convertible Preferred Stock, par value $0.001 per share with five classes of attached warrants to certain accredited investors.

Faith Winner (BVI) owns all the equity interest of Faith Winner (Jixian) Agriculture Development Company Limited (“WFOE”), a company incorporated under the laws of the People’s Republic of China (“PRC”). WFOE has entered into a series of contractual agreements with Heilongjiang Yanglin Soybean Group Co., Ltd (“Yanglin”), a company incorporated under the laws of the PRC, which essentially gives WFOE control over Yanglin’s business and management as if Yanglin were a wholly-owned subsidiary of WFOE. Yanglin cannot be a wholly-owned subsidiary of WFOE at this time because of (i) substantial uncertainty with respect to new laws which became effective on September 8, 2006 governing share exchanges with a foreign entity and (ii) other than by share exchange, PRC law requires that Yanglin be acquired for cash and WFOE was not able to raise sufficient financing at a valuation acceptable to it to pay the full value for Yanglin’s shares.

The contractual agreements were utilized instead of a direct acquisition of Yanglin’s assets because current PRC law does not specifically establish the approval procedures and detailed implementation regulations for a non-PRC entity's equity to be used as consideration to acquire a PRC entity's equity or assets. This makes it highly uncertain, if not impossible, for a non-PRC entity to use its equity to acquire a PRC entity. If acquisition of a PRC entity using foreign equity were possible, we could have acquired 100% of the stock of Yanglin in exchange for shares of our Common Stock. While PRC law does allow for the purchase of equity interests in (or assets of) a PRC entity by a non-PRC entity for cash, the purchase price must be based on the appraised value of such equity (or assets). Because we presently do not have sufficient cash to pay the estimated full value of all of the assets of Yanglin, we, through WFOE, purchased the maximum amount of assets possible with the net proceeds of the private placement described below, and leased from Yanglin the remainder of the assets used in Yanglin’s business. See Item 2.01 under the heading “Contractual Arrangements between WFOE and Yanglin.”

While the acquisition of the assets and business of Yanglin through the contractual agreements was effective October 3, 2007, not all of the transactions contemplated therein have been consummated, and for that reason WFOE has not yet assumed full operational control of Yanglin’s business. To complete these transactions, WFOE must complete additional steps, filings and registrations, including: (i) completing a PRC registered capital verification process; (ii) remitting to Yanglin the full purchase price for the assets to be purchased by it under the contractual agreements; (iii) obtaining an environmental report for the assets purchased from Yanglin, and (iv) obtaining a new business license from the State Administration for Industry and Commerce in Heilongjiang, PRC, to reflect WFOE’s status as an operating company. We anticipate these steps will be completed within approximately 15 days after the date of this Current Report. At their completion, WFOE will assume full operating control of the Yanglin’s business.

The funds used to consummate our acquisition of Faith Winner (BVI) and the contractual agreements were provided from the proceeds of a private placement of our Series A Preferred Shares to ten accredited investors (the “Private Placement”) that closed on October 3, 2007, simultaneously with the Yanglin acquisition and the contractual agreements.

The Private Placement resulted in gross proceeds of $21,500,000 from the sale of 10,000,000 shares of Series A Preferred Shares. For more information about the Private Placement, please see Item 1.01 - “Entry into a Material Definitive Agreement,” Item 2.01 - “Completion of Acquisition or Disposition of Assets,” and “Certain Relationships and Related Transactions” of this Current Report.

Yanglin is in the business of manufacturing, distributing and selling non-genetically modified soybean oil, soybean salad oil and soybean meal. See “Our Business” in Item 2.01 of this Current Report below for a full description of Yanglin’s business.

As a result of the above transactions, we have ceased being a shell company as such term is defined in Rule 12b-2 under the Securities Exchange Act of 1934, as amended (the "Exchange Act") and are now in the business of manufacturing, distributing and selling non-genetically modified soybean oil, soybean salad oil and soybean meal. See Item 5.06 of this Current Report below.

Our current structure, after the aforementioned transactions, is set forth in the diagram below:

Throughout this Current Report, and unless the context otherwise requires, “we," "our" and "us" refers collectively to Victory Divide Mining Company and its subsidiaries, Faith Winner (BVI) and WFOE as well as Yanglin.

Unless otherwise noted, all currency figures in this filing are in U.S. dollars. References to “yuan” or “RMB” are to the Chinese yuan (also known as “renmimbi”). According to www.xe.com, as of October 9, 2007, $1.00 = 7.52RMB.

Item 1.01. Entry into a Material Definitive Agreement.

Background

Prior to October 3, 2007, we were a shell company, or a company with only nominal operations and assets. On October 3, 2007, we consummated (i) a share exchange transaction, in which we acquired control over an operating company in the PRC and (ii) a private sale of our Series A Convertible Preferred Stock, in which we received a gross aggregate of $21.5 million of financing.

Through these transactions, we ceased to be a shell company and, through our subsidiaries and affiliates, entered into the business of manufacturing and selling non-genetically modified soybean products.

The details of the transactions, and the agreements through which they were carried out, are described below. Each of the descriptions of the agreements below is qualified, in its entirety, by the text of the agreements which are annexed as exhibits to this report.

Share Exchange Agreement

On October 3, 2007, we acquired Faith Winner (BVI) in a share exchange transaction with Winner State (BVI), Fang Chen, Yang Miao and Ying Zhang. Both Faith Winner (BVI) and Winner State (BVI) are companies incorporated in the British Virgin Islands. Winner State (BVI), Fang Chen, Yang Miao and Ying Zhang were collectively the owners of 100% of the outstanding voting stock of Faith Winner (BVI) (such shares, the “Faith Shares”; and such transaction, the “Share Exchange”).

In the Share Exchange, we received the Faith Shares from Winner State (BVI), Fang Chen, Yang Miao and Ying Zhang and in exchange we issued and delivered to them 18,500,000 of our newly -issued shares of $0.001 par value common stock.

The Share Exchange was effected pursuant to the terms of an agreement among us and Winner State (BVI), Fang Chen, Yang Miao and Ying Zhang executed on the date of the Share Exchange (the “Share Exchange Agreement”). A copy of the Share Exchange Agreement is attached as Exhibit 10.1 to this Current Report.

As a result of the consummation of the Share Exchange Agreement, (i) we ceased to be a shell company as that term is defined in Rule 12b-2 under the Exchange Act, (ii) Faith Winner (BVI) is now our wholly-owned subsidiary, and (iii) through its newly-acquired subsidiary, Faith Winner (Jixian) Agriculture Development Company or WFOE, we now indirectly control, through a series of contractual arrangements, the business of Yanglin.

These and all other details of the Share Exchange are set forth in the Share Exchange Agreement attached to this report as exhibit 10.1.

Series A Convertible Preferred Stock Purchase Agreement (the “Series A Preferred Agreement”) and Series A Preferred Convertible Stock

On October 3, 2007, we entered and consummated a Series A Convertible Preferred Stock Purchase Agreement with Vision Opportunity Master Fund, Ltd, and certain other investors listed in Exhibit A thereto (collectively, the “Purchasers”) for the sale of a total of 10,000,000 shares of our newly designated Series A Preferred Convertible Stock (our “Series A Preferred Shares”). Subject to certain conditions, each Series A Preferred Share is convertible, at the option of the holder, into one share of our Common Stock. Accordingly, in total, the Series A Preferred Shares are convertible into 10,000,000 shares of our Common Stock which represents approximately 33.3 % of our outstanding Common Stock.

Pursuant to the Series A Preferred Agreement, the Purchasers were issued (i) Series A warrants (“Series A Warrants”) to purchase an aggregate of 10,000,000 shares of Common Stock at $2.75 per share and (ii) Series B warrants (“Series B Warrants”) to purchase an aggregate of 5,000,000 shares of Common Stock at $3.50 per share .

Further, the Purchasers who purchased not less than $4 million worth of Series A Preferred were also issued an aggregate of 7,801,268 Series J Warrants, 7,801,268 Series C Warrants and 3,900,634 Series D Warrants. The Series J Warrants are exercisable for shares of our newly designated Series B Convertible Preferred Stock (our “Series B Preferred Shares”), par value $0.001 per share, at $2.37 per share. Each of the Series B Preferred Shares is convertible into one share of our Common Stock. The Series C and D Warrants are not exercisable by their holders unless and until the Series J Warrants are exercised. The exercise prices of the Series C and Series D Warrants are $ 3.03 and $3.85, respectively.

The Series A Warrants, the Series B Warrants, the Series J Warrants, the Series C Warrant and the Series D Warrant are collectively referred to herein as the “Warrants”.

The Warrants shall expire five (5) years from October 3, 2007, except for the Series J Warrant, which shall expire eighteen (18) months from October 3, 2007. Each of the Warrants shall have an exercise price per share equal to the Warrant Price (as defined in the applicable Warrant).

These and all other details of the sale of the Series A Preferred Shares are set forth in the Series A Preferred Agreement attached to this report as exhibit 10.2, and the foregoing description is qualified, in its entirety, by the text of the agreement. The respective terms of the Warrants are set forth in the Series A Warrants, the Series B Warrants, the Series J Warrants, the Series C Warrant and the Series D Warrant attached to this report as exhibits 4.1, 4.2, 4.3, 4.4 and 4.5 and the foregoing description is qualified, in its entirety, by the text of the Warrants.

Series A Preferred Shares

Each share of our Series A Preferred Shares is convertible into one share of our Common Stock, subject to standard adjustment provisions as set forth in Section 5 of the Certificate of Designations for our Series A Preferred Shares, which is annexed hereto as Exhibit 3.4. Holders of Series A Preferred Shares also have voting rights required by applicable law and the relevant number of votes shall be equal to the number of shares of Common Stock issuable upon conversion of Series A Preferred Shares.

Holders of Series A Preferred Shares shall be entitled to participate in distributions or payments in the event of any liquidation, dissolution or winding up, voluntary or involuntary, of the Company (a “Liquidation Event”). They shall rank (a) senior to the Common Stock and to any other class or series of stock issued by the Company not designated as ranking senior to or pari passu with the Series A Preferred Shares in respect of the right to participate in distributions or payments upon a Liquidation Event; and (b) pari passu with Series B Preferred Shares in respect of the right to participate in distributions or payments upon a Liquidation Event. In the event of the liquidation, dissolution or winding up of our affairs, whether voluntary or involuntary, the holders of shares of Series A Preferred Shares then outstanding shall be entitled to receive, out of our assets available for distribution to our stockholders, an amount equal to $2.15 per share before any payment shall be made or any assets distributed to the holders of the Common Stock or any other stock that ranks junior to the Series A Preferred Shares.

The Series A Preferred Shares will not be entitled to dividends unless we pay dividends, in cash or other property, to holders of outstanding shares of Common Stock, in which event each outstanding share of the Series A Preferred Shares will be entitled to receive dividends of cash or property, out of any assets legally available therefor, in an amount or value equal to the amount of dividends, per share of Series A Preferred Shares, as would have been payable on the number of shares of Common Stock into which each share of Series A Preferred Shares would be convertible, if such shares of Series A had been converted to Common Stock as of the record date for the determination of holders of Common Stock entitled to receive such dividends. Any dividend payable to the Series A Preferred Shares holders will have the same record and payment date and terms as the dividend payable on the Common Stock.

These and all other details of our Series A Preferred Shares are set forth in a Certificate of Designations, which we filed with the Secretary of State of the State of Nevada on September 21, 2007, and which forms a part of our Articles of Incorporation. The Certificate of Designations for our Series A Preferred Shares is attached to this Current Report as Exhibit 3.4.

Series B Preferred Shares

Each share of our Series B Preferred Shares is convertible into one share of our Common Stock, subject to standard adjustment provisions under Section 5 of the Certificate of Designations for our Series B Preferred Shares annexed hereto as Exhibit 3.5. Holders of Series A Preferred Shares also have voting rights required by applicable law and the relevant number of votes shall be equal to the number of shares of Common Stock issuable upon conversion of Series B Preferred Shares.

Holders of Series B Preferred Shares shall be entitled to participate in distributions or payments in the event of any liquidation, dissolution or winding up, voluntary or involuntary, of the Company (a “Liquidation Event”). They shall rank (a) senior to the Common Stock and to any other class or series of stock issued by the Company not designated as ranking senior to or pari passu with the Series B Preferred Shares in respect of the right to participate in distributions or payments upon a Liquidation Event; and (b) pari passu with Series A Preferred Shares in respect of the right to participate in distributions or payments upon a Liquidation Event. In the event of the liquidation, dissolution or winding up of our affairs, whether voluntary or involuntary, the holders of shares of Series B Preferred Shares then outstanding shall be entitled to receive, out of our assets available for distribution to our stockholders, an amount equal to $2.37 per share before any payment shall be made or any assets distributed to the holders of the Common Stock or any other stock that ranks junior to the Series B Preferred Shares.

The Series B Preferred Shares will not be entitled to dividends unless we pay dividends, in cash or other property, to holders of outstanding shares of Common Stock, in which event each outstanding share of the Series B Preferred Shares will be entitled to receive dividends of cash or property, out of any assets legally available therefor, in an amount or value equal to the amount of dividends, per share of Series B Preferred Shares, as would have been payable on the number of shares of Common Stock into which each share of Series B Preferred Shares would be convertible, if such shares of Series B had been converted to Common Stock as of the record date for the determination of holders of Common Stock entitled to receive such dividends. Any dividend payable to the Series B Preferred Shares holders will have the same record and payment date and terms as the dividend payable on the Common Stock.

After the expiration of the Series J Warrants, any unissued Series B Preferred Shares shall be cancelled and shall revert to the status of authorized but unissued preferred stock, undesignated as to series and subject to reissuance as shares of preferred stock of any one or more series as permitted by our Articles of Incorporation.

These and all other details of our Series B Preferred Shares are set forth in a Certificate of Designations, which we filed with the Secretary of State of the State of Nevada on September 21, 2007, and which forms a part of our Articles of Incorporation. The Certificate of Designations for our Series B Preferred Shares is attached to this report as Exhibit 3.5.

Securities Escrow Agreement

On October 3, 2007, we entered into a securities escrow agreement with Vision Opportunity Master Fund, Ltd as representative of the Purchasers under the Series A Preferred Agreement, Winner State (BVI) and Loeb & Loeb LLP, as escrow agent.

As an inducement to the Purchasers to enter into the Series A Preferred Agreement, Winner State (BVI) agreed to place 10,000,000 shares of Common Stock belonging to it (“Escrow Shares”) with the escrow agent for the benefit of the Purchasers in the event the Company failed to achieve certain financial performance thresholds for the 12-month periods ending December 31, 2007 (“2007”) and December 31, 2008 (“2008”), respectively.

The earnings thresholds are: for 2007, earnings per share of $0.34 and cash earnings per share of $0.27 (the “2007 performance threshold”) and for 2008, earnings per share of $0.43 and cash earnings per share of $0.37 (the “2008 performance threshold”).

If our earnings per share for 2007 are less than 50% of the 2007 performance threshold, then the Escrow Shares (the “2007 Escrow Shares”) will be forfeited to the holders of the Series A Preferred Shares and distributed to them ratably according to the number of Series A Preferred Shares that each of them holds at that time. Within five (5) business days after the release of the 2007 Escrow Shares to the holders, Winner State (BVI) shall deposit into the escrow account maintained by the escrow agent, stock certificates evidencing another 10,000,000 shares of Common Stock.

If our earnings per share for 2007 are at least 50% but less than 95% of the 2007 performance threshold, then Winner State (BVI) will forfeit to the holders of Series A Preferred Shares the number of 2007 Escrow Shares multiplied by the percentage by which the 2007 performance threshold was not achieved and multiplied by 200%. Within five (5) business days after the release of the 2007 Escrow Shares to the Purchasers, the Winner State (BVI) shall deposit into the escrow account maintained by the escrow agent, stock certificates evidencing such number of shares of Common Stock so that the number of Escrow Shares shall equal the 10,000,000 shares of Common Stock.

If we equal or exceed 95% of the 2007 performance threshold, the 2007 Escrow Shares shall continue to be held in escrow.

If our earnings per share for 2008 are less than 50% of the 2008 performance threshold, then the Escrow Shares (the “2008 Escrow Shares”) will be forfeited to the holders of the Series A Preferred Shares and distributed to them ratably according to the number of Series A Preferred Shares that each of them holds at that time. Within five (5) business days after the release of the 2007 Escrow Shares to the holders, Winner State (BVI) shall deposit into the escrow account maintained by the escrow agent, stock certificates evidencing another 10,000,000 shares of Common Stock.

If our earnings per share for 2008 are at least 50% but less than 95% of the 2008 performance threshold, then Winner State (BVI) will forfeit to the holders of Series A Preferred Shares the number of 2008 Escrow Shares multiplied by the percentage by which the 2008 performance threshold was not achieved and multiplied by 200%. The remaining 2008 Escrow Shares shall then be returned to Winner State (BVI).

Additionally under the Securities Escrow Agreement, if we fail to list and trade our shares of Common Stock on the Nasdaq Capital Market, Nasdaq Global Select Market or the Nasdaq Global Market or any successor market thereto or the New York Stock Exchange or any successor market thereto by December 31, 2008, Winner State (BVI) will forfeit 1,000,000 of the Escrow Shares to the holders of the Series A Preferred Stock to be distributed ratably according to the number of Series A Preferred Shares that each of them holds then.

These and all the other details of the escrow obligations of Winner State (BVI) are set forth in the Securities Escrow Agreement, which is attached to this report as Exhibit 10.3 and the foregoing description is qualified, in its entirety, by the text of the Securities Escrow Agreement

Investor and Public Relations Escrow Agreement

On October 3, 2007, we entered into an Investor and Public Relations Agreement with Vision Opportunity Master Fund, Ltd., as representative of the Purchasers under the Series A Preferred Agreement and Loeb & Loeb LLP, as escrow agent. Pursuant to the agreement, $500,000 of the proceeds of the Private Placement was deposited into an escrow account with Loeb & Loeb LLP for use in investor and public relations.

The Investor and Public Relations Escrow Agreement is attached to this report as Exhibit 10.4.

Registration Rights Agreement

On October 3, 2007, we entered into a Registration Rights Agreement with the Purchasers, under which we agreed to prepare and file with the Securities and Exchange Commission and maintain the effectiveness of a “resale” registration statement (“Registration Statement”) providing for the resale of all the shares of Common Stock issuable conversion of our Series A Preferred Shares and the 451,500 shares of Common Stock belonging to Glenn A. Little, Carol Blanding, Susan Reik, Benjamin Ruhlman, Mitch Ratner, Carlos Cabezas and Daniel Milot (collectively the “Conversion Shares”) on Form SB-2 or such other applicable registration form in accordance with the Act and the rules promulgated thereunder for an offering to be made on a continuous basis pursuant to Rule 415. The agreement calls for us to maintain the effectiveness of the registration statement until either all shares registered under it have been sold or all shares registered under it may be sold without restriction under Rule 144 under the Securities Act.

Such Registration Statement shall cover to the extent allowable under the Act and the rules promulgated thereunder (including Rules 415 and 416), such indeterminate number of additional shares of Common Stock resulting from stock splits, stock dividends or similar transactions with respect to the Conversion Shares.

The deadline for filing the Registration Statement is thirty (30) days after the closing of the sale of Series A Preferred Shares under the Series A Preferred Agreement, or approximately, November 2, 2007 (the “filing deadline”). The deadline for obtaining the effectiveness of the Registration Statement is either (i) 120 days after the filing deadline, or (ii) if the SEC performs a full review of the Registration Statement, 150 days after the filing deadline, or (iii) if the SEC provides comments solely on the basis of Rule 415 under the Securities Act, 180 days after the filing deadline.

In the event we are unable to register for resale under Rule 415 all of the Conversion Shares on the Registration Statement due to limits imposed by the SEC’s interpretation of Rule 415, we will file a Registration Statement covering the resale of such lesser amount of Conversion Shares as we are able to register pursuant to the SEC’s interpretation of Rule 415 and use reasonable best efforts to have such Registration Statement become effective as promptly as possible and, when permitted to do so by the SEC, to file subsequent registration statement(s) covering the resale of any Conversion Shares that were omitted from previous Registration Statement and use our reasonable best efforts to have such registration declared effective as promptly as possible.

The deadline for filing subsequent registration statement(s) shall be thirty (30) days from the date we receive a written notice from any holder of Series A Preferred Shares, delivered after the later of (i) the date which is six (6) months after the effectiveness date of the latest Registration Statement that was filed, as applicable, or (ii) the date on which all Conversion Shares registered on all of the prior Registration Statements are sold.

If a Registration State is not filed as aforesaid or is not declared effective by the Securities and Exchange Commission on or before the relevant effective date or if we fail to file with the Securities and Exchange Commission a request for acceleration in accordance with Rule 461 promulgated under the Securities Act within three (3) business days of the date we are notified that a Registration Statement will not be “reviewed” or subject to further review or if any Registration Statement is filed with and declared effective by the SEC but thereafter ceases to be effective while shares registered under it remain unsold or may only be sold with restriction under Rule 144 under the Securities Act, without being succeeded immediately by a subsequent Registration Statement filed and declared effective by the Securities and Exchange Commission or if our Common Stock is suspended or no longer quoted on or is delisted from the OTC Bulletin Board for any reason for more than three (3) business days, we shall pay an amount in cash as liquidated damages to each holder of our Series A Preferred Shares equal to one and one-half percent (1.5%) of the amount of the holder’s initial investment in the Series A Preferred Shares for each calendar month or portion thereof until the default is cured subject to a cap of fifteen percent (15%) of the amount of the holder’s initial investment.

These and all the other details of our registration obligations are set forth in the Registration Rights Agreement, which is attached to this report as Exhibit 4.8.

Series J Registration Rights Agreement

On October 3, 2007, we entered into a Series J Registration Rights Agreement with holders (“Initiating Holders”) of more than 25% of the shares of Common Stock issuable upon conversion of the Preferred Stock and the shares of common stock issuable upon exercise of the Warrants (“Registrable Securities”). Pursuant to the agreement, at any time after the date of the exercise of any or all of the Series J Warrant into Series B Preferred Shares, any such Initiating Holder may request us to file a registration statement, providing for the resale of the Registrable Securities held by the Initiating Shareholders. We shall then prepare and file with the SEC a “resale” registration statement providing for the resale of all Registrable Securities for an offering to be made on a continuous basis pursuant to Rule 415 at our own cost and expense,.

In the event that we are unable to register for resale under Rule 415 all of the registrable securities due to limits imposed by the Securities and Exchange Commission’s interpretation of Rule 415, we will file a registration statement with the SEC covering the resale by the Initiating Holders of such lesser amount of the Registrable Securities as we are able to register pursuant to the Securities and Exchange Commission’s interpretation of Rule 415 and use our reasonable best efforts to have such Registration Statement become effective as promptly as possible, and, when permitted to do so by the Securities and Exchange Commission, to file subsequent registration statement(s) under the Act with the Securities and Exchange Commission covering the resale of any Registrable Securities that were omitted from our prior registration statements filed with the Securities and Exchange Commission and use our reasonable best efforts to have such registration declared effective as promptly as possible.

In the event that any Initiating Holder shall deliver a written notice at any time after the later of (i) the date which is six months after the effectiveness date of the latest registration statement, or (ii) the date on which all Registrable Securities registered on all of the prior registration statements filed had been sold, we shall file, within 30 days following the date of receipt of such written notice, an additional Registration Statement registering any Registrable Securities that were the subject of the applicable notice that were omitted from such prior Registration Statements.

If a Registration State is not filed as aforesaid or is not declared effective by the Securities and Exchange Commission on or before the relevant effective date or if we fail to file with the Securities and Exchange Commission a request for acceleration in accordance with Rule 461 promulgated under the Securities Act within three (3) business days of the date we are notified that a Registration Statement will not be “reviewed” or subject to further review or if any Registration Statement is filed with and declared effective by the Securities and Exchange Commission but thereafter ceases to be effective while shares registered under it remain unsold or may only be sold with restriction under Rule 144 under the Securities Act, without being succeeded immediately by a subsequent Registration Statement filed and declared effective by the Securities and Exchange Commission or if our Common Stock is suspended or no longer quoted on or is delisted from the OTC Bulletin Board for any reason for more than three (3) business days, we shall pay an amount in cash as liquidated damages to each holder of our Series A Preferred Shares equal to one and one-half percent (1.5%) of the amount of the holder’s initial investment in the Series A Preferred Shares for each calendar month or portion thereof until the default is cured provided such amount shall not exceed fifteen (15%) of the amount of the aggregate consideration paid by such holder upon exercise of the Series J Warrant.

These and all the other details of our registration obligations are set forth in the Series J Registration Rights Agreement, which is attached to this Current Report as Exhibit 4.9 and the foregoing description is qualified, in its entirety, by the text of the Series J Registration Rights Agreement.

Lock-Up Agreement

On October 3, 2007, Victory Divide Mining Company entered into an agreement with Winner State (BVI) under which, in partial consideration for our entering into the Share Exchange Agreement, Winner State (BVI) agreed that (i) it will not sell or transfer any shares of its Common Stock until at least 12 months after the effective date of the initial Registration Statement to be filed to register shares of our Common Stock issuable upon conversion of the Series A Preferred Shares, and (ii) upon the expiration of such 12 month period, it will not sell or transfer more than one-twelfth of its total holdings of its Common Stock during any one month for a period of at least 24 months thereafter.

The lock-up agreement is attached to this Current Report as Exhibit 4.10.

Consulting Agreement

On October 3, 2007, we entered into a consulting agreement (“Consulting Agreement”) with our ex-President, Chief Executive Officer and Chief Financial Officer, Glenn A. Little. Pursuant to the Consulting Agreement, the services to be performed by Mr. Little include providing advice, information and true and correct copies of documents regarding our historical records and operations to our auditors, attorneys, officers and directors, and signing such documents as they may reasonably request and providing information to the extent the requested information is reasonably available to Mr. Little. In consideration thereof, Mr. Little will be paid the sum of $550,000; provided, however, that as a condition to the making of the foregoing payment, he shall have: (i) delivered a resignation from all officer positions effective upon delivery, (ii) delivered a resignation as director which shall be effective on the tenth (10th) day after we mail a Schedule 14f-1 to our shareholders of record; and (iii) appointed Mr. Shulin Liu as our director and Chief Executive Officer and Mr. Shaocheng Xu as our Chief Financial Officer. Mr. Little completed the provision of the services and was paid $550,000 as provided in the Consulting Agreement on October 4, 2007.

The Consulting Agreement is attached to this report as Exhibit 10.4.

Item 2.01 Completion of Acquisition or Disposition of Assets.

As a result of the share exchange transaction described above, we ceased being a shell company as that term is defined in Rule 12b-2 of the 1934 Act Rules, as amended and, through our newly-acquired subsidiary, WFOE and Yanglin, which it controls, entered into the business of manufacturing, distributing and selling non-geneticaly modified soybean oil, soybean salad oil and soybean meal. The business and the nature of our control over it are described in this section.

Contractual Arrangements between WFOE and Yanglin

PRC Restructuring Arrangements

In connection with the above transactions, WFOE executed a series of agreements with Yanglin, and as a result, WFOE acquired control over Yanglin’s business, personnel and finances as if it were a wholly owned subsidiary of WFOE (collectively, the "Restructuring Agreements"). The reasons that WFOE used the Restructuring Agreements to acquire control of Yanglin, instead of acquiring control by purchasing Yanglin's assets or equity to make Yanglin a wholly-owned subsidiary of WFOE, are that (i) new PRC laws governing share exchanges with foreign entities, which became effective on September 8, 2006, make the consequences of such acquisition of assets uncertain and (ii) other than by share exchange, PRC law requires that Yanglin be acquired for cash and Faith Winner (BVI) was not able to raise sufficient financing at a valuation acceptable to it to pay the full appraised value for Yanglin’s assets or shares as required under PRC law.

Certain of the transactions contemplated by the Restructuring Agreements are in the process of being completed: (i) WFOE must complete a PRC registered capital verification process, (ii) after such capital verification process, WFOE must transmit to Yanglin the full purchase price for the intellectual property to be purchased by it and the principal amount of a loan made under the Restructuring Agreements, (iii) WFOE must apply for, and obtain the approval of the trademark office for the transfer of intellectual property to it from Yanglin, and (iv) WFOE must obtain a new business license from the local branch of PRC State Administration for Industry and Commerce to reflect WFOE's status as an operating company. We anticipate that the capital verification process will be completed within approximately 15 days as of October 3 2007. Because the intellectual property transfer involves the approval of PRC governmental entities, we cannot say with certainty when they will be completed; however, we believe that the trademark portion of the intellectual property transfer is likely to be concluded within one year, after the date of this report. WFOE currently has a temporary business license, issued by the local branch of PRC State Administration for Industry and Commerce to conduct operations in the PRC. If the capital verification process is not completed within six months from the issuance of that license, approximately two months from the date of this report, the temporary business license could be cancelled.

The WFOE’s registered capital is $15 million. Pursuant to PRC laws, the WFOE can only receive funds from offshore in the form of paid-in capital at the maximum of the amount of its registered capital limitation, which is, in our case, $15 million; however, our net proceeds of the private placement are estimated to be $18 million. Therefore, the WFOE will accept $3 million in the form of a loan from Faith Winner (Jixian) Agriculture Development Company.

The WFOE is to apply for the increase of its total investment capital from its current limit of $15 million to $18 million. After that, the $3 million can be remitted to WFOE from Faith Winner (Jixian) Agriculture Development Company.

The following is a summary of the material terms of each of the Restructuring Agreements, the English translation of each of which is annexed as exhibits to this Current Report. All references to the Restructuring Agreements and other agreements in this Current Report are qualified, in their entirety, by the text of those agreements. The transactions contemplated under the Restructuring Agreements are hereinafter collectively referred to as the PRC restructuring transactions.

Consignment Agreements

Each of Yanglin’s two shareholders holding in the aggregate 100% of Yanglin’s equity interests (collectively, the “Yanglin Shareholders”), entered into a Consignment Agreement with Faith Winner (BVI) (each a “Consignment Agreement” and collectively, the “Consignment Agreements”). Pursuant to these Consignment Agreements, each such Yanglin Shareholder consigned all its rights and interests as a shareholder of Yanglin to Faith Winner (BVI), including without limitation, its right to elect directors and officers, obtain information about Yanglin, dispose of the consigned equity interests and other shareholder rights and interests. These agreements will remain effective until Faith Winner (BVI) or its designees have acquired 100% of the equity interest of Yanglin or substantially all assets of Yanglin. Prior to the termination of the Consignment Agreements, the Yanglin Shareholders are prohibited from disposing, encumbering, consigning or restructuring the consigned interests without the prior written consent of Faith Winner (BVI).

The Consignment Agreements are attached to this Current Report as Exhibit 10.7.

Exclusive Purchase Option Agreement

Under the Exclusive Purchase Option Agreement, the Yanglin Shareholders granted WFOE an exclusive option to purchase all or part of the Yanglin Shareholders’ equity interest in Yanglin and Yanglin granted WFOE an exclusive option to purchase all Yanglin’s assets, when and as permitted under PRC laws and regulations. The agreement provides that, unless otherwise required under PRC laws and regulations, the consideration for the equity transfer or the asset transfer under the agreement will be the lowest price permitted under the PRC laws and regulations.

Prior to the termination of the Exclusive Purchase Option Agreement, without the prior written consent of WFOE, Yanglin is restricted from, among other things, (i) supplementing or amending its articles of association or rules of the company in any manner, and changing its registered capital or shareholding structure in any manner, (ii) transferring, mortgaging or otherwise disposing of the lawful rights and interests to and in its assets or income, or encumbering its assets and income in any way that would affect WFOE’s security interest, (iii) incurring, assuming or guaranteeing any debts except those that are incurred during its normal business operation or agreed to by WFOE in advance, (iv) entering into any material contract (exceeding RMB5,000,000 in value), unless it is necessary for the company’s normal business operation; (v) providing any loan or guarantee to any third party; (vi) acquiring or consolidating with any third party, or investing in any third party; (vii) distributing any dividends to the shareholders in any manner, and, at WFOE’s request, shall promptly distribute all distributable dividends to the Yanglin Shareholders (collectively, the “restrictive provisions”).

The agreement will remain effective until WFOE or its designees have acquired 100% of the equity interests of Yanglin or substantially all assets of Yanglin.

The Exclusive Purchase Option Agreement is attached to this Current Report as Exhibit 10.8.

Registered Trademark Transfer Agreement

Under the Registered Trademark Transfer Agreement, Yanglin agreed to transfer to WFOE all of its rights in connection with the two trademarks, including without limitation the title of the trademarks and right to license ( the “Transferred Trademark”) for a purchase price of $1,000,000, which is subject to a purchase price adjustment based on the minimum appraised value on intellectual property (“IP”) rights allowed under PRC laws and regulations for such transfer.

The Registered Trademark Transfer Agreement is attached to this Current Report as Exhibit 10.9.

Trademark Licensing Agreement

Under the Trademark Licensing Agreement, WFOE agreed to grant an exclusive license to Yanglin, for a term of 10 years, to use the Transferred Trademark for an annual licensing fee equal to 1% of Yanglin’s revenue of that year.

The Trademark Licensing Agreement is attached to this Current Report as Exhibit 10.10.

Consigned Management Agreement

Pursuant to the Consigned Management Agreement between WFOE and Yanglin, Yanglin agreed to entrust the business operations of Yanglin and its management to WFOE until WFOE acquires all equity or substantially all the assets of Yanglin (as more fully described in the Exclusive Purchase Option Agreement description above). Under the Consigned Management Agreement, WFOE will provide financial, technical and human resources management services to Yanglin which will enable WFOE to control Yanglin's operations, assets and cash flow. In turn, it will be entitled to 5% of Yanglin’s revenue on a yearly basis.

The Consigned Management Agreement is attached to this Current Report as Exhibit 10.11.

Loan Agreement

Under the Loan Agreement, WFOE agreed to provide a loan to Yanglin in the principal amount of $17,000,000 to be used as working capital for its business operations. Repayment should be made in its entirety or in part, at WFOE’s option and upon 10 days written notice, either (i) in cash, or (ii) by a transfer of equity interests of Yanglin or all its assets (at the minimum price allowed under PRC law with any excess over such price continuing to be subjected to the repayment obligation under the Loan Agreement). The Loan Agreement also provides restrictive provisions substantially similar to those provided under the Exclusive Purchase Option Agreement as described above under “Exclusive Purchase Option Agreement” in this Section.

The source of funds for WFOE to make payment under the Intellectual Property Transfer Agreement and to fund the Loan Agreement is the proceeds of the Private Placement offering described in Section 1.01 of this Current Report.

The Loan Agreement is attached to this Current Report as Exhibit 10.12.

Our Corporate Structure

Our current corporate structure is set forth below:

Organizational History of Victory Mining Company

We were originally incorporated on May 26, 1921 under the laws of the State of Nevada. Our original Articles of Incorporation were oriented toward mining operations. Our Common Stock traded on the San Francisco Mining Exchange and on the over the counter market. We operated a number of mining properties and in 1980, we became inactive and trading in our Common Stock ceased.

We have had no operations, assets or liabilities since 1980 and accordingly, were deemed to be a "blank check" or shell company that is, a development stage company that has no specific business plan or purpose or has indicated that its business plan is to engage in a merger or other acquisition with an unidentified company or companies, or other entity or person.

Our Articles of Incorporation were restated and amended on June 29, 2006 to reflect our objective of finding a merger partner.

We filed a Registration Statement on Form 10-SB on July 12, 2006 to register our eligible issued and outstanding shares of Common Stock .

On February 28, 2007, our Board of Directors approved a reverse split of our issued and outstanding common stock on a 200,000 shares for 1 share basis, with fractional shares rounded up to the nearest whole share. Stockholders holding shares representing 84.8% of the votes entitled to be cast at a shareholders’ meeting as of the record date of February 20, 2007, consented in writing to the actions. On March 19, 2007, we filed an information statement on Schedule 14C and the effective date of the reverse split was on or around April 9, 2007, 20 days after mailing of the information statement to the shareholders.

On August 31, 2007, we amended our Articles of Incorporation to increase the number of shares of Common Stock, par value $0.001 per share, that we are authorized to issue from 100,000,000 shares of Common Stock, par value $0.001 per share, to 10,000,000,000 shares of Common Stock, par value $0.001 per share, without changing the number of shares of preferred stock authorized therein or the per share par value of such preferred stock. The amendment was effective upon the filing with the Secretary of State of the state of Nevada a Certificate of Change pursuant to Section 78.209 of the Nevada Revised Statutes.

Also on August 31, 2007, our then sole director and majority shareholder, passed a resolution to effect a forward split of our Common Stock on the basis that one share of our Common Stock became one hundred (100) shares of such Common Stock, without changing the par value of the resulting shares of Common Stock. The record date for the forward split was September 4, 2007, and the effective date for the forward split was September 14, 2007.

Organizational History of Faith Winner Investments Limited and Faith Winner (Jixian) Agriculture Development Company Limited

Faith Winner (BVI) was incorporated in the British Virgin Islands on July 6, 2006 by its sole shareholder, Winner State (BVI).

Faith Winner (BVI) incorporated WFOE on May 31, 2007 in the PRC as a PRC Wholly-Foreign Owned Enterprise. The approval certificate for the Wholly Foreign Owned Enterprise was issued on May 30, 2007 and WFOE’s business license and State Administration of Foreign Exchange (“SAFE”) registration certificate were issued on June 4, 2007.

Organizational History of Heilongjiang Yanglin Soybean Group Co., Ltd

Heilongjiang Yanglin Soybean Group Co., Ltd was originally incorporated as a limited liability company in the PRC on July 30, 2001 as “Jixian County Golden Land Oil Company Limited”. Its business license was issued by the Heilongjiang Jixian County Administrative Bureau for Industry and Commerce and its original registered capital was RMB 56 million. Its original registered capital was contributed by the following individuals on June 11, 2001 and was paid in the following amounts:

| Name | | Amount of Capital Contribution (RMB) | | Amount of Capital Contribution ($) | | Percentage of Capital | |

| Shulin Liu | | | 50,000,000 | | | approx. $6,587,615 | | | 89.3 | % |

| Huanqin Ding | | | 6,000,000 | | | approx. $790,513 | | | 10.7 | % |

Shulin Liu was appointed executive director and supervisor and Huanqin Ding was appointed a director.

On December 28, 2001, the shareholders voted to increase its registered capital from RMB 56 million to RMB 100 million. The increase was approved by the Shuangyashan Municipal Administration Bureau for Industry and Commerce.

The increase in registered capital was contributed by the following individuals on February 25, 2002, in the following amounts:

| Name | | Amount of Capital Contribution (RMB) | | Amount of Capital Contribution ($) | |

| Shulin Liu | | | 10,000,000 | | | appox. $1,317,523 | |

| Huanqin Ding | | | 24,000,000 | | | approx. $3,162,055 | |

| Guilin Liu | | | 4,000,000 | | | appox. $527,009 | |

| Dewan Liu | | | 3,000,000 | | | approx. $395,256 | |

| Chunlin Liu | | | 3,000,000 | | | approx. $395,256 | |

The total amounts contributed post-capital increase are as follows:

| Name | | Amount of Capital Contribution (RMB) | | Amount of Capital Contribution ($) | | Percentage of Capital | |

| Shulin Liu | | | 60,000,000 | | | approx. $7,905,138 | | | 60 | % |

| Huanqin Ding | | | 30,000,000 | | | approx. $3,952,569 | | | 30 | % |

| Guilin Liu | | | 4,000,000 | | | approx. $527,009 | | | 4 | % |

| Dewan Liu | | | 3,000,000 | | | approx. $395,256 | | | 3 | % |

| Chunlin Liu | | | 3,000,000 | | | approx. $395,256 | | | 3 | % |

On October 29, 2002, the shareholders voted to change the name of the company from Jixian County Golden Land Oil Company Limited to Heilongjiang Yanglin Soybean Group Co., Ltd and to change its Articles of Association accordingly. The Shuangyashan Municipal Administration of Industry and Commerce approved the name change and issued an Approval Notice of the Change of the Company Name (Ming Zi Bian He Nei Zi [2002] No. 000187) and new business license (Registration Number: 2305002100498) on August 17, 2004. The name change was effective October 31, 2002.

On December 16, 2002, the shareholders voted to change Yanglin’s business scope to: purchasing soybeans, processing soybean products, selling food and oil, packing goods, providing ground transportation, managing restaurants and hotels, provide business services, selling tickets; processing foodstuff and distilled liquor, selling self-produced products and related technological know-how, import and export, selling raw materials, mechanical equipment, apparatus, instruments and meters, parts and components and related technological know-how for research; processing imported raw materials; and be in the “three-processing-industries-one-compensation” business (processing, assembling and processing in accordance with client’s samples and foreign trade). The Shuangyashan Municipal Administration of Industry and Commerce approve the change in business scope on January 15, 2003.

Pursuant to a share transfer agreement dated July 15, 2007, the shareholders of Yanglin are presently Shulin Liu and Huanqin Ding.

Yanglin has no subsidiaries or branches.

Our Business

We believe that we are, through Yanglin, one of the largest and most integrated private enterprises engaged in growing, crushing, refining and processing non-genetically modified soybean-based products in the PRC. Only non-genetically modified soybeans are used for soy products processed for human consumption as opposed to genetically-modified soybeans which are used to feed animals.

Our affiliate, Heilongjiang Yanglin Group Seed Co. Ltd, which is owned and managed by our Chief Executive Officer, Mr, Shulin Liu, sells and provides soybean seeds to farmers and we then purchase soybeans from them (see “The Supplier of “Yanglin” Soybean Seeds” below). We crush the soybeans and refine their crushed oil and meal into processed products, including soybean meal, soybean oil and salad oil. We plan to expand our business into “deep processing”, which will enable us to extend our product line to include higher margin products, including concentrated protein, textured protein, defatted soybean powder, powered soybean oil and squeezed oil.

Our products are sold under the “Yanglin” brand name. All of our products are non-genetically modified. All soybeans grown in the PRC are non-genetically modified and therefore our suppliers of soybeans are all from the PRC, in particular, the Heilongjiang province where we are located.

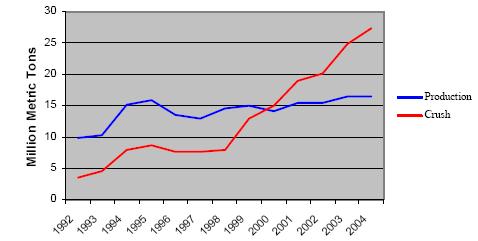

In fiscal 2006, we processed approximately 310,000 tons of soybeans and generated total revenue of approximately $88.1 million, producing a net income of $6.9 million.

We sell our products to various geographic regions of the PRC, both directly to manufacturers and through distribution channels (see “Sales and Marketing” below). We sell our soy meal output primarily to manufacturers of animal feed. Our soybean oil is distributed through wholesalers and distributors. Because the domestic demand exceeds supply, we sell all our products to our customers in the PRC although we understand that some of our products are exported internationally by certain of our customers.

Our Products

We currently manufacture and sell the following products:

(i) Soybean Oil and Soybean Salad Oil

Soybean oil is obtained from the extraction of oils from soybean seeds. Soybean oil contains various vitamins, minerals and unsaturated fatty acids which are essential to well-being of the human body. It is an important ingredient in products such as salad dressings, margarine, paint and medicines. The price, adaptability and performance of soybean oil make it appropriate for a broad range of food, chemicals as well as medical manufacturing applications. Soybean oil is a Grade IV oil as compared to the more refined soybean salad oil, which is a Grade I oil. Both these oils are for human consumption.

(ii) Soybean Meal

Soybean meal is obtained by grinding soybean flakes which remain after removal of most of the oil from soybeans by a solvent or mechanical extraction process. It is the preferred forage material for animal husbandry due to its high protein, low fat composition and edible characteristics. Soybean meal is an important raw material used in the animal feed and farming industry.

Our new products, which we plan to manufacture with proceeds from the Private Placement, will be:

(i) Powdered Soybean Oil

Powdered soybean oil is manufactured by processing soybean oil and soybean salad oil together with corn syrup and other raw materials. Powdered soybean oil not only retains the properties of liquid soybean oil, but it also has a long shelf life and can be easily packaged and transported. In addition, it can be easily dissolved or dispersed into other raw materials and water. Having a strong fragrance of milk, it is a cheap substitute for milk or powdered milk. It also contains beneficial proteins and minerals.

(ii) Textured Protein

Textured protein products are food products made from soy protein. Having been hydrated in the production process, textured protein products have a symmetrical texture and specific structure. Adding 25% to 50% of textured protein to food products can impart a taste of meat. Therefore, textured protein can be used as a substitute for beef and pork. Textured protein contains natural anti-oxygenation ingredients which can protect meat by reducing oxygenation.

(iii) Defatted Soybean Powder

This product is made from specially-extracted soy meal. Its protein content is higher than 50%, and can be added to fish, noodles, meat, dairy products and candy. It can improve the quality and taste of food, while reducing cost and prolonging shelf life.

(iv) Squeezed Oil

Squeezed oil is a kind of natural and green soy oil made from selected soybeans. A traditional technique is applied to extract crude soybean oil, and the acids usually contained in traditional squeezed oil are removed through several refining steps and hydration. Squeezed oil has a body absorption rate of 97% and contains no cholesterol. It possesses important ingredients which has been shown to help growth, improve immunity, prevent hypertension and arteriosclerosis. It also contains vitamins A, D, and E.

(v) Concentrated Soy Protein

Concentrated soy protein has a high protein content of up to 98% and no cholesterol. When used as an ingredient in food products, it can improve the texture and nutritional value of food. Concentrated soy protein is used as an ingredient in a wide range of food products, including nutritional supplements, seafood, processed meats, frozen food, nutritional beverages, cream soups, sauces and snacks.

Genetically Modified and Non-genetically Modified Soybeans

Soybeans are one of the “biotech food” crops that have been genetically modified and are used in an increasing number of products. In 1995, the Monsanto Company, a multinational agricultural biotechnology corporation, introduced "Roundup Ready" soybeans that have had a copy of a gene from the bacterium, Agrobacterium sp. strain CP4, inserted, by means of a gene gun, into its genome. “Roundup” is an herbicide glyphosate, of which the Monsato Company is a leading producer.

Glyphosate, the active ingredient in Roundup, kills conventional soybeans whereas the transgenic soybean plant is resistant to it. Genetically modified soybeans allow a farmer to spray and use the herbicide “Roundup” to reduce tillage or even to sow the soybean seed directly into an unplowed field, known as “no-till” or conservation tillage.

In 1997, about 8% of all soybeans cultivated for the commercial market in the United States were genetically modified. In 2006, the figure was 89%.

(Source: www.wikipedia.com)

Genetically modified soybean plants are widespread in the world’s leading soybean producing countries.

The United States (85%) and Argentina (98%) produce almost exclusively genetically modified soybeans. In these countries, genetically modified soybeans are approved without restrictions and are treated just like conventional soybeans. Producers and government officials in the US and Argentina do not see a reason to keep genetically modified and conventionally bred cultivars separate - whether during harvest, shipment, storage or processing. Soybean imports from these countries generally contain a high amount of genetically modified content.

It is estimated that one third of Brazil’s soybean crop is genetically modified. Most of the Brazil’s conventional soybeans are grown in the northern part of the country. European food and feed companies were able to determine that soybeans from northern Brazil contain little or no genetically modified material. Large-scale, commercial plantings of genetically modified soybeans can also be found in Paraguay, Canada, Romania and South Africa.

(Source: http://www.gmo-compass.org/eng/grocery_shopping/crops/19.genetically_modified_soybean.html)

All of our products are non-genetically modified. All soybeans grown in the PRC are non-genetically modified.

Non-genetically modified soybean products are perceived as more desirable by some consumers than genetically altered soy products, especially with respect to soy protein and other value-added soy products, and command price premiums when used as such.

Soy protein products—the vast majority of which are non-genetically modified —are an increasingly significant component of health foods and pharmaceuticals. Consumers in the European Union, Korea and Japan are especially sensitive to health issues in products using soy proteins and specifically choose to purchase non-genetically modified products. In fact, in Japan, non-genetically modified soybeans can fetch a 5-10 % price premium.

(Source: Article titled “Free Trade Threat to China’s GM-free Soybeans” by Lin Gu published by Panos Online on March 13, 2006)

Protein-based products form our market’s fastest growing segment. Some of our soy oil products are also non-trans fat—these products can help lower cholesterol levels significantly, and therefore also command premiums over normal, soy products.

Manufacturing Process for our Current Products

Soybean Oil

In processing soybeans for oil extraction and subsequent soy flour production, selection of high quality, sound, clean, dehulled yellow soybeans is very important. To produce soybean oil, the soybeans are cracked, adjusted for moisture content, rolled into flakes and solvent-extracted with commercial hexane. The oil is then refined, blended for different applications, and sometimes hydrogenated. Soybean oils, both liquid and partially hydrogenated, are exported abroad, sold as "vegetable oil," or end up in a wide variety of processed foods. The remaining soybean husks are used mainly as animal feed.

Soybean Meal

Our Facilities

We own and operate three soybean production factories in Jixian county in the Heilongjiang province. Our factories have a combined annual production crushing capacity of 520,000 tons.

Factory No.1 manufactures salad oil, Grade IV soybean oil and soybean meal. Factory No. 2 manufactures Grade IV soybean oil and soybean meal. Our newest facility, Factory No.3, which was built in 2005, is mainly designed to manufacture Grade III grade soybean oil, soybean meal, condensed phospholipids and powdered soybean oil. Our new, deep processed products like powdered soybean oil, defatted soy powder, and soy protein products, will be manufactured in Factory No. 3.

The following tables indicate the land area and annual production capacity of our production facilities:

Production Facility | Area |

| Factory No. 1 | 27,000 m2 |

| Factory No. 2 | 43,572 m2 |

| Factory No. 3 | 45,596 m2 |

Annual Production Capacity for 2005 (tons) | | Actual Output for 2005 (tons) | | Utilization Rate for 2005 | | Annual Production Capacity for 2006 (tons) | | Actual Output for 2006 (tons) | | Utilization Rate for 2006 | |

| 220,000 | | | 130,000 | | | 59% | | | 520,000 | | | 310,000 | | | 59% | |

Note: The annual production capacity is based on 3 shifts (8 hours per shift) a day for 300 days a year.

Our Suppliers of Soybeans

We purchase all of our soybean supplies from farmers in the Heilongjiang province. We have established and maintained good relationships with these suppliers.

Typically, we provide to farmers, through our affiliate company, Heilongjiang Yanglin Group Seed Co. Ltd., “Yanglin” soybean seeds. Pursuant to an annual supply contract, the farmers will sell the soybeans back to us at harvest time. This arrangement ensures us with a stable supply of soybeans meeting our quality standards, and also allows us to maintain a low rate of expenditure on raw materials.

We typically enter into one-year supply contracts with the farmers. To incentivize farmers to purchase “Yanglin” soybean seeds, cultivate and plant them and then sell the soybeans to us, we have agreed to pay 0.03 RMB (or $0.004) above the then current market rate per jin for the soybeans (one jin is the equivalent of ½ kilogram or 1.1 pounds). Also, the farmers are provided credit terms for the seeds they purchase from Heilongjiang Yanglin Group Seed Co. Ltd. This premium above market price does not apply to soybeans grown from “non-Yanglin soybean seeds”. We pay our suppliers cash upon delivery of the soybeans.

We believe the above arrangement ensures that we foster good relations with our suppliers and ensures a steady supply of quality soybeans at competitive rates. To further ensure a consistent and larger supply of soybeans, we intend to arrange to enter into more such supply agreements with the farmers.

The following is a list of our top ten major suppliers of soybeans for FY2006:

| Supplier | | Amount purchased (in RMB) | | Amount purchased (in US$) | | Percentage of Total Purchases (%) | |

| Mei Fangtao | | | 29,697,617.80 | | | 3,949,151.30 | | | 5 | |

| Wang Li | | | 22,315,170.20 | | | 2,967,442.85 | | | 4 | |

| Baoqing county North warehouse | | | 21,101,278.40 | | | 2,806,021.06 | | | 3 | |

| Li Hemiao | | | 18,199,933.75 | | | 2,420,203.96 | | | 3 | |

| Yan Wei | | | 15,818,788.20 | | | 2,103,562.26 | | | 3 | |

| Li Yajun | | | 13,212,238.52 | | | 1,756,946.61 | | | 2 | |

| Shen Liqiu | | | 10,858,177.10 | | | 1,443,906.53 | | | 2 | |

| Wang Jihua | | | 9,062,399.38 | | | 1,205,106.30 | | | 1 | |

| Duan Xufeng | | | 8,301,171.90 | | | 1,103,879.24 | | | 1 | |

| Biao Chaoli | | | 8,237,916.50 | | | 1,095,467.62 | | | 1 | |

Based on an exchange rate of 1US$ = 7.52 RMB as quoted on www.xe.com on October 9, 2007.

Our top ten suppliers together only provide an aggregate of 25% of our total supply of soybeans and our biggest supplier only supplies 5% of our total supply. We believe this decentralization of supply ensures that we can have an advantageous position in dealing with the suppliers, and that no threat of raising prices or cutting supply by any single supplier may seriously affect our operations. This situation is expected to continue in the foreseeable future.

The Supplier of “Yanglin” Soybean Seeds

Heilongjiang Yanglin Group Seed Co, Ltd. is owned and managed by Mr. Shulin Liu, our Chief Executive Officer.

Heilongjiang Yanglin Group Seed Co., Ltd has developed very desirable strains of non-genetically modified soybean seeds (collectively, “Yanglin” seeds”)- the Yanglin “East Nong 42” and the “Black Nong 44”, which boast high protein and fat content. It has also developed high oil content “Yang 02-01”, “Yang 03-02” and “Yang 03-03” soybean seeds, high protein content “Yang 03-656” soybean seeds, and high protein and high output “Yang 03-149” soybean seeds.

A brief summary of the characteristics of each strain of soybean seed is set forth below:

Soybean | Oil Content | Protein Content | Status of Development |

| “East Nong 42” | 19.33% | 45% - 46.4% | Current |

| “Black Nong 44” | 21.56% - 22.61% | 38.56% - 46.69% | Current |

| “Yang 02-01” (high oil) | 22.3%-22.6% | 37.8%-40.2% | Has been approved by the government |

| “Yang 03-02” (high oil) | 21.9%-22.7% | 37.2%-41.5% | In trial phase |

| “Yang 03-03” (high protein) | 21.7%-22.1% | 38.4%-45.9% | In trial phase |

| “Yang 03-656” (high protein) | 19.8%-20.6% | 39.7%-45.3% | In trial phase |

| “Yang 03-149” (high protein) | 20.3%-21.9% | 41.5%-44.7% | In trail phase |

The “Yanglin” seeds are cultivated, treated and then sold to farmers in the Heilongjiang area by Heilongjiang Yanglin Group Seed Co., Ltd. The farmers are then obligated to sell the soybeans to us pursuant to annual supply contracts (see “Our Suppliers of Soybean Seeds” above). In this way, we control the supply and quality of our soybean seeds.

Soybeans grown from the “Yanglin” seeds were graded “A” in 1999 by the China Green Food and Development Center, the PRC’s first agency established under the auspices of the Ministry of Agriculture to oversee organic food standards. Grade “A” means that some synthetic agricultural chemicals have been used on the product.

Sales and Marketing

We have sales offices in more than 10 cities in the PRC, and approximately 300 independent sales agents (divided evenly between sales of soybean meal and soybean oil) spread over approximately 27 provinces. These provinces include locations in the northeast, Hubei plains, southern and northwestern areas of the PRC. We will also have sales agents appointed in North America, Europe, Russia, Japan, Korea, and other countries in Southeast Asia. In order to maintain their status as agents, they are required to meet a minimum sales/order quota each year. Most of our agents have been able to meet their annual sales/order quota.

Most of our products are marketed and distributed in the PRC. The following map illustrates the geographical coverage of our sales and distribution network in the PRC:

In addition to the sale of our products to various parts of the PRC, we have also collaborated with one of our customers, China National Cereal, Oil and Foodstuff Import and Export (Group) Company to export selected soybeans overseas to Korea and Japan.

We have an in-house sales team with approximately eighteen salespersons. Their duties include monitoring the soybean industry, collecting market and price information, and providing recommendations in our marketing and sales strategy and pricing policies.

Advertising

We advertise our products through various forms of media, such as commercial magazines, popular newspapers and over the internet. We also maintain our own website (www.yanglin.com.cn) and regularly send out emails to target groups to promote our products.

We maintain a unified and consistent look to our advertisements and publicity materials. Our marketing team develops and delivers our publicity materials, including product descriptions, price lists and a description of our services. In addition, we adopt a uniquely identifiable corporate image from our employees’ uniforms to our vehicles and billboard advertisements.

Publicity

We plan to strengthen and maintain our customer relations through symposiums, receptions and direct correspondences. We will also strengthen communication with the relevant government departments to keep abreast with their policies and guidelines in order to adapt quickly to any changes, seize business opportunities and develop new markets.

Major Customers

Our customers mainly comprise distributors of soybean oil and other soybean products, as well as soybean food product and animal feed manufacturers. The following is a list of our top ten major customers for fiscal 2006. All our major customers are located in the PRC. None of our customers make up sales of more than 10% of our total sales in fiscal 2006.

Company | Product Sold | Geographical Location | Fiscal 2006 Sales (RMB) | Fiscal 2006 Sales (US$) | % of Sales |

| Yingkou Bohai Grease Co. Ltd | Soybean Oil | Liaoning | 61,122,603.67 | approx. $8,128,005.81 | 9 |

| Zhao San | Soybean Meal | Shangdong, Henan | 26,493,467.12 | approx. $3,523,067.44 | 4 |

| Yang Li | Soybean Meal | Liaoning | 25,480,801.27 | approx. $3,388,404.42 | 4 |

| Song Guoquan | Soybean Meal | Hebei | 24,746,064.40 | approx. $3,290,700 | 4 |

| Zhang Fengling | Soybean Meal | Liaoning, Zhejiang and Shanghai | 23,315,261.04 | approx. $3,100,433.65 | 3 |

| Lin Xiwu | Soybean Meal | Liaoning | 22,168,663.77 | approx. $2,947,960.61 | 3 |

| Yin Liping | Soybean Meal | Ji Lin | 20,200,208.29 | approx. $2,686,197.91 | 3 |

| Cao Zhengang | Soybean Meal | Ji Lin | 17,197,938.39 | approx. $2,286,959.89 | 2 |

| Chen Hongwei | Soybean Meal | Inner Mongolia | 16,916,189.15 | approx. $2,249,493.24 | 2 |

| Xiong Jun | Soybean Meal | Szechuan | 14,678,451.29 | approx. $1,952,921.72 | 2 |

The following table shows the breakdown of sales volume by customer type.

| Type | Soy Oil | Soy Meal |

| Volume (ton) | Number of customers | % | Volume (ton) | Number of customers | % |

| Distributor | 40,862 | 120 | 80 | 141,203 | 124 | 60 |

| Food Processor | | | | 23,534 | 5 | 10 |

| Animal Feed Processor | | | | 70,601 | 12 | 30 |

| Others | 10,216 | 9 | 20 | | | |

| Total | 51,078 | 129 | 100 | 235,338 | 141 | 100 |

Our sales are widely diversified among our customers. Our largest customer accounts for only 9% of our total sales in fiscal 2006 while our top ten customers accounted for only about 36% of our net sales in fiscal 2006. Because we are not dependent on any one customer, we have preserved our bargaining power and have more say in deciding price and payment terms. It also helps to reduce business risk and the associated impact of losing a key customers or a significant reduction in its order quantity. After we begin manufacturing and selling deep-processed and refined products, the composition of our customers may change to a combination of distributors, industrial users and retail consumers.

Sales of Products by Type and Locations

All our sales are to customers in the PRC although we understand that some of our distributor customers may have exported our products to countries such as Japan, Korea, Russia, and India. The geographical distribution of our sales in the PRC for fiscal 2006 is shown below.

| Province | Sales Revenue (Soy Oil) | Sales Revenue (Soy Meal) |

| Volume | Value (RMB)/ ($) | Volume | Value (RMB)/($) |

| Heilongjiang | 21,453 | 98,251,590.84/ 13,065,371.12 | 21,180 | 42,219,279.86/ 5,614,265.94 |

| Jilin | 15,834 | 72,517,395.67/ 9,643,270.7 | 18,827 | 37,528,248.77/ 4,990,458.62 |

| Liaoning | 13,791 | 63,160,755.57/ 8,399,036.64 | 34,124 | 68,019,950.89/ 9,045,206.24 |

| Inner Mongolia | | | 11,061 | 22,047,846.15/ 2,931,894.43 |

| Hebei | | | 32,712 | 65,205,332.23/ 8,670,921.84 |

| Beijing | | | 8,237 | 16,418,608.83/ 2,183,325.64 |

| Tianjin | | | 9,414 | 18,764,124.38/ 2,495,229.31 |

| Shanxi | | | 7,060 | 14,073,093.29/ 1,871,421.98 |

| Shandong | | | 5,177 | 10,320,268.41/ 1,372,376.12 |

| Henan | | | 8,472 | 16,887,711.94/ 2,245,706.38 |

| Shanghai | | | 8,472 | 16,887,711.94/ 2,245,706.38 |

| Anhui | | | 4,471 | 8,912,959.08/ 1,185,233.92 |

| Jiangsu | | | 7,766 | 15,480,402.62/ 2,058,564.18 |

| Zhejiang | | | 8,943 | 17,825,918.16/ 2,370,467.84 |

| Jiangxi | | | 4,707 | 9,382,062.19/ 1,247,614.65 |

| Guangdong | | | 6,589 | 13,134,887.07/ 1,746,660.51 |

| Hunan | | | 6,354 | 12,665,783.96/ 1,684,279.78 |

| Hubei | | | 3,530 | 7,036,546.64/ 935,710.89 |

| Guizhou | | | 4,236 | 8,443,855.97/ 1,122,853.19 |

| Yunnan | | | 2,824 | 5,629,237.31/ 748,568.79 |

| Sichuan | | | 10,590 | 21,109,639.93/ 2,807,132.97 |

| Shaanxi | | | 4,942 | 9,851,165.30/ 1,309,995.39 |

| Gansu | | | 3,530 | 7,036,546.64/ 935,710.99 |

| Ningxia | | | 588 | 1,172,757.77/ 155,951.83 |

| Xinjiang | | | 353 | 703,654.66/ 93,571.10 |

| Tibet | | | 471 | 938,206.22/ 124,761.47 |

| Qinghai | | | 706 | 1,407,309.33/ 187,142.20 |

Based on an exchange rate of 1US$ = 7.52 RMB as quoted on www.xe.com on October 9, 2007.

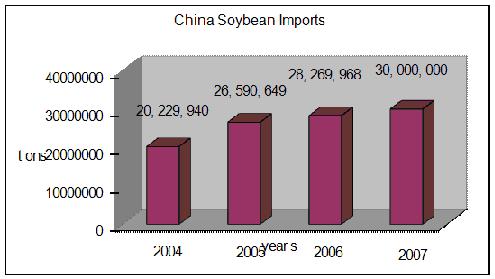

Delivery of Products